WALMART LOOKS TO THE FUTURE

Retailer explores alternative revenue streams

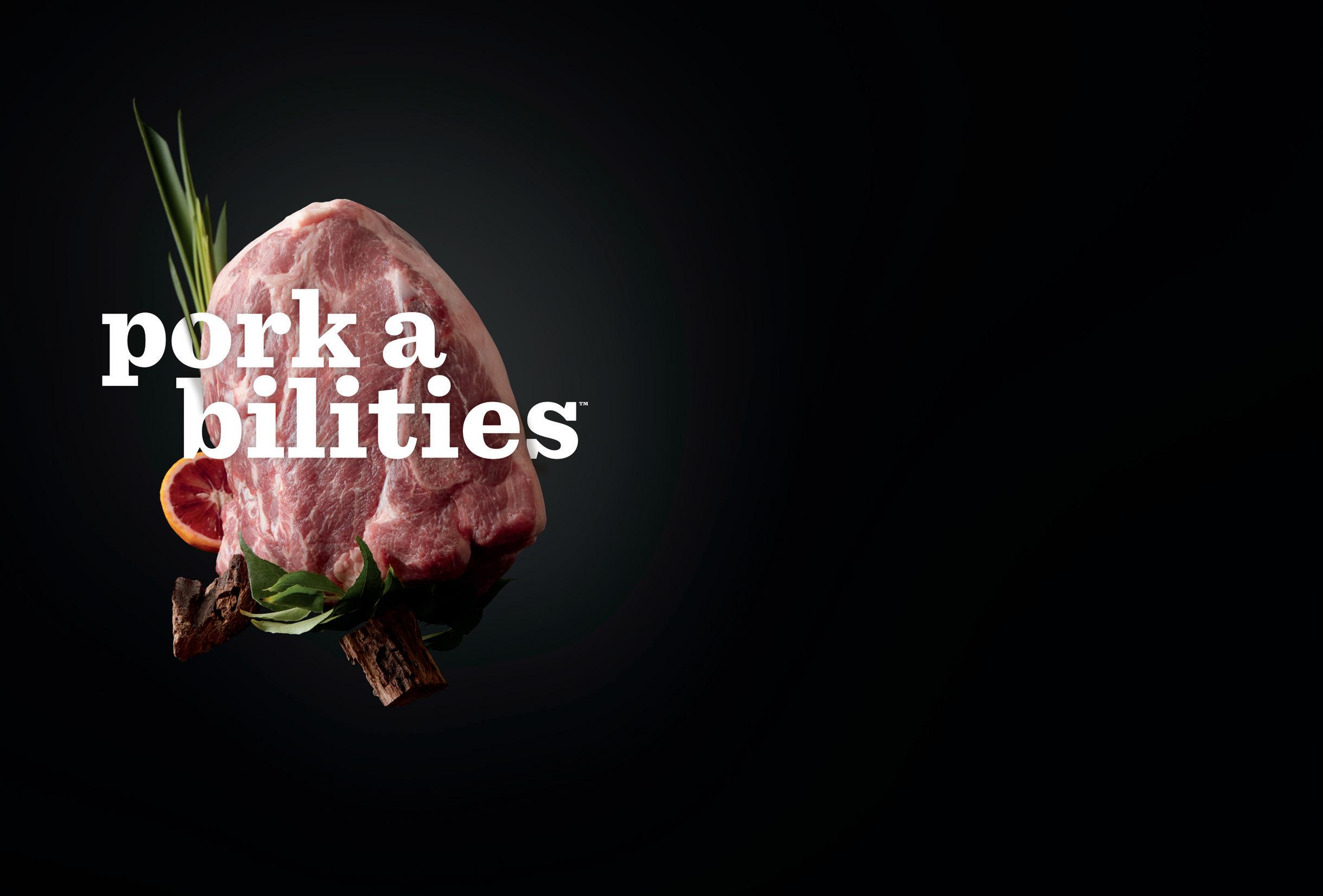

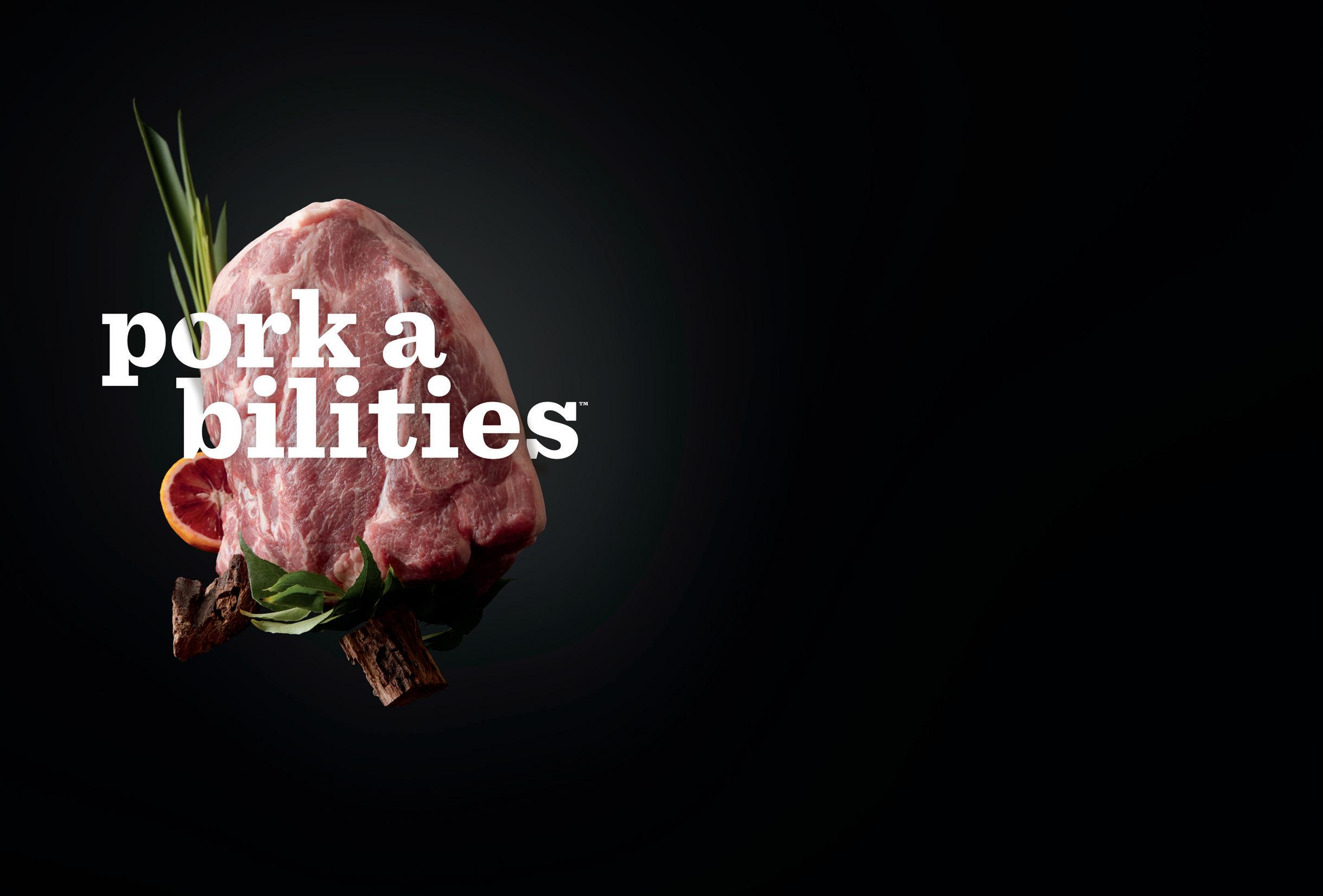

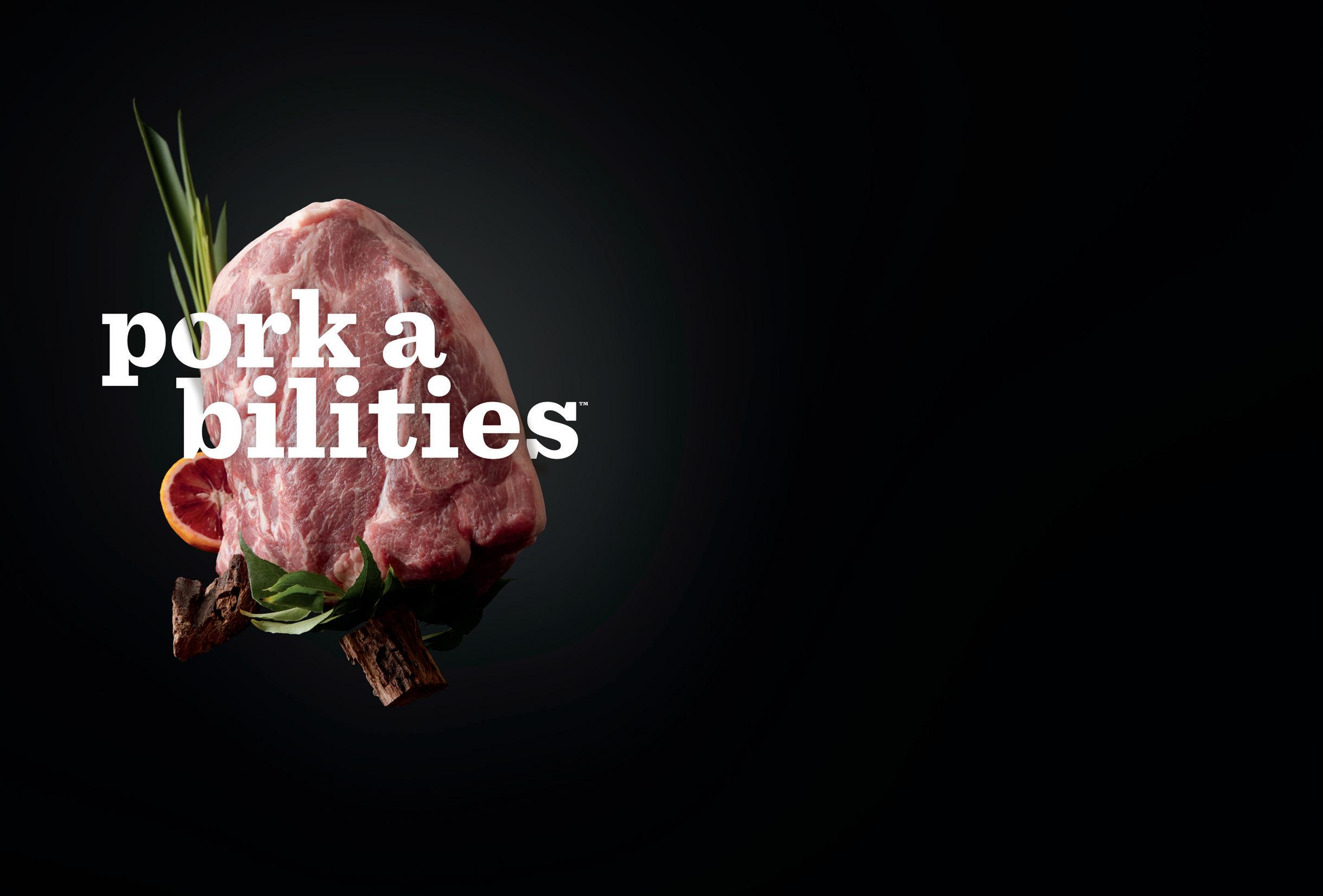

MEAT AT A PREMIUM

Demand for prime cuts steady despite in ation

GET ON BOARD WITH CHARCUTERIE

Innovative trends fueled by at-home entertaining

PROFILES IN CONSUMER PACKAGED GOODS

SUSTAINABILITY

April 2023 Volume 102, Number 4 www.progressivegrocer.com These companies

it look easy to be GREEN

make

Start your 14 Day Risk-Free Trial Today retailleader.com/pro ◆ Consumer Behavior ◆ Retail Trends ◆ Innovation ◆ Benchmarking Break through the news barrier. Guide your business decision making with Retail Leader Pro — a premium resource for retail and CPG professionals. Our analysts and experts go beyond the headlines to provide you with the data-driven insights and tools you need to accelerate business growth. CRITICAL INSIGHTS. INSIDE PERSPECTIVES.

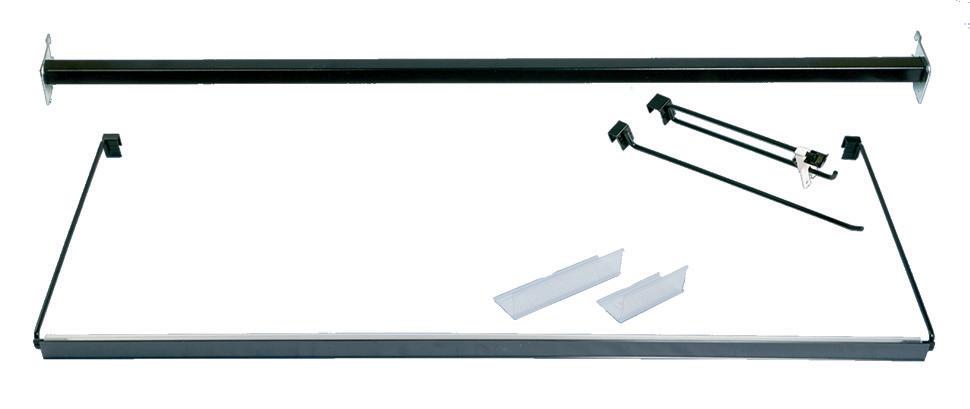

The System That Sells

Maximize Your Merchandising Space.

Our revolutionary Tray and WonderBar® Merchandising System is designed and manufactured with the most innovative accessories to increase facings, maximize visibility, enhance package billboarding, ensure product rotation, and reduce shrinkage for a full range of frozen, refrigerated and general merchandise products. Easy to install and adjust, this complete merchandising system also ensures quick restocking.

Trion will help you optimize your display space, attract customers, increase sales and cut labor costs—and our products are built to last. No wonder we’re the industry’s leading manufacturer and supplier, with more than five million trays earning high praise from retailers and shoppers every day!

™ Trion® WonderBar ® Storewide Applications Oversize Packages Vac-Pack Meat Dual Lane Merchandising Cheese and Fresh Pasta Frozen Food Proudly Made in the U.S.A. ©2013 Trion Industries, Inc. Toll-Free in U.S.A. 800-444-4665 info@triononline.com www.TrionOnline.com Note: Product photography is a simulation of a retail environment and is not meant to imply endorsement by or for any brand or manufacturer.

As part of its sustainability efforts, The Giant Co., a banner of Ahold Delhaize USA, recently added four electric vehicles to its delivery fleet in Philadelphia.

Profiles in Sustainability

These five CPG all-stars are among the best at advancing eco-friendly strategies.

Contents 04.23 Volume 102 Issue 4 14 NIELSEN’S SHELF STOPPERS Bakery 15 MINTEL GLOBAL NEW PRODUCTS Coffee and Tea 16 ALL’S WELLNESS Health-Focused Store Brands Departments 64 EDITORS’ PICKS FOR INNOVATIVE PRODUCTS 66 AHEAD OF WHAT’S NEXT A Matriarch’s Legacy in Bloom 10 EDITOR’S NOTE Sustainability Redefined 12 IN-STORE EVENTS CALENDAR June 2023 6 progressivegrocer.com COVER STORY 10 Most Sustainable Grocers These companies make it look easy to be green. 18 34

Premium. Outstanding. Authentic. Award-winning authenticity. S tock GOYA® Extra Virgin Olive Oil , winner of the ChefsBest Excellence Award * . Your shoppers will taste the exceptional quality that sets our single-origin Spanish olive oil apart from the competition. ©2023 Goya Foods, Inc. Learn More! Contact your GOYA representative or email salesinfo@goya.com | trade.goya.com * Earned by products that surpass quality standards established by professional chefs.

42 EQUIPMENT & DESIGN Smart Salad Bars

Schnucks becomes the latest retailer to deploy Picadeli’s innovative concept.

44 RETAILER DEEP DIVE Walmart Fires Up the Flywheel

The retailer doubles down on a new business model for the future.

52 FRESH FOOD Placing a Premium on Meat

Despite economic headwinds, market demand for quality eating experiences and shared-value sourcing are keeping higher-end cuts in the case.

56 FRESH FOOD Across the Board

Inventive new trends in charcuterie add zest to a revitalized home entertaining landscape.

TECHNOLOGY Taking on In-Store and Online Promotional Strategies

Data, personalization and more help grocers and brands reach customers at the right moments along their buying journey.

8550 W. Bryn Mawr Ave. Ste. 200, Chicago, IL 60631 Phone: 773-992-4450 Fax: 773-992-4455

VICE PRESIDENT & GROUP BRAND DIRECTOR 917-446-4117 plashinsky@ensembleiq.com

Bridget Goldschmidt Marian Zboraj

CONTRIBUTING EDITORS

Debby Garbato, Jenny McTaggart and Barbara Sax

ADVERTISING SALES & BUSINESS

ASSOCIATE PUBLISHER, REGIONAL SALES MANAGER (INTERNATIONAL, SOUTHWEST, MI)

Tammy Rokowski 248-514-9500 trokowski@ensembleiq.com

REGIONAL SALE MANGER Theresa Kossack (MIDWEST, GA, FL) 214-226-6468 tkossack@ensembleiq.com

REGIONAL SALES MANAGER (EAST COAST)

Dave Cappelli 312-505-3385 dcappelli@ensembleiq.com

BUSINESS DEVELOPMENT MANAGER

Lou Meszoros 203-610-2807 lmeszoros@ensembleiq.com

ACCOUNT EXECUTIVE/CLASSIFIED ADVERTISING Terry Kanganis 201-855-7615 • Fax: 201-855-7373 tkanganis@ensembleiq.com

CLASSIFIED PRODUCTION MANAGER Mary Beth Medley 856-809-0050 marybeth@marybethmedley.com

PROJECT MANAGEMENT/PRODUCTION/ART

SENIOR CREATIVE DIRECTOR Colette Magliaro cmagliaro@ensembleiq.com

ART DIRECTOR Bill Antkowiak bantkowiak@ensembleiq.com

ADVERTISING/PRODUCTION MANAGER Jackie Batson 224-632-8183 jbatson@ensembleiq.com

MARKETING MANAGER Rebecca Welsby rwelsby@ensembleiq.com

SUBSCRIPTION SERVICES

LIST RENTAL mbriganti@anteriad.com

SUBSCRIPTION QUESTIONS contact@progressivegrocer.com

CORPORATE OFFICERS

CHIEF EXECUTIVE OFFICER Jennifer Litterick

CHIEF FINANCIAL OFFICER Jane Volland

CHIEF PEOPLE OFFICER Ann Jadown

CHIEF STRATEGY OFFICER Joe Territo

EXECUTIVE VICE PRESIDENT, OPERATIONS Derek Estey

PROGRESSIVE GROCER (ISSN 0033-0787, USPS 920-600) is published monthly by EnsembleIQ, 8550 W. Bryn Mawr Ave. Ste. 200, Chicago, IL 60631. Single copy price $14, except selected special issues. Foreign single copy price $16, except selected special issues. Subscription: $125 a year; $230 for a two year supscription; Canada/Mexico $150 for a one year supscription; $270 for a two year supscription (Canada Post Publications Mail Agreement No. 40031729. Foreign $170 a one year supscrption; $325 for a two year supscription (call for air mail rates). Digital Subscription: $87 one year supscription; $161 two year supscription. Periodicals postage paid at Chicago, IL 60631 and additional mailing offices. Printed in USA.

POSTMASTER: Send all address changes to brand, 8550 W. Bryn Mawr Ave. Ste. 200, Chicago, IL 60631. Copyright ©2023 EnsembleIQ All rights reserved, including the rights to reproduce in whole or in part. All letters to the editors of this magazine will be treated as having been submitted for publication. The magazine reserves the right to edit and abridge them. The publication is available in microform from University Microfilms International, 300 North Zeeb Road, Ann Arbor, MI 48106. The contents of this publication may not be reproduced in whole or in part without the consent of the publisher. The publisher is not responsible for product claims and representations.

52 62 44 Contents 04.23 Volume 102 Issue 4 8 progressivegrocer.com

56

sellbottledwater@casupport.com | | Weekdays sellbot tledwater@casupport .com C n ac y u BlueTriton acc un ep esen a ive e in a i n c n ac us di ec ly. X Q I I ©

By Gina Acosta

Sustainability Redefined

RETAILERS SUCH AS RE_GROCERY ARE LAYING A FRAMEWORK FOR THE FUTURE.

hat does it mean to be a sustainable grocer? While many large and small grocers featured in this special “Earth Month” issue of Progressive Grocer are making big strides in sustainability, a small operator in California is trying to redefine how grocery stores think about going green.

Re_grocery, in Los Angeles, is a “refill your own container” grocery store; there’s no plastic packaging to be found. Shoppers are encouraged to bring their own containers for dry grocery, oils, vinegars, honey, and a select number of fresh dairy and other perishable products. The store offers 100% post-consumer recycled paper bags for use, and reusable glass jars/bottles and cloth produce bags for purchase.

I visited re_grocery while I was in town for Natural Products Expo West, and I was impressed not only with the assortment of dry grocery, but also with the shopping experience. Re_grocery offers more than 500 refillable bulk goods, and the company strives to source only the highest-quality organic, non-GMO and clean products, all plastic-free. The store offers items such as bulk grains, pasta, dried fruit, nuts, dried herbs, psyllium seed husk, protein powders, matcha, coffee, tea and much more. It has a wall with pour-your-own white wine and red wine vinegars, olive oil, sesame oil, coconut oil, canola oil, avocado oil, sunflower oil, manuka honey, agave, and tamari. There’s also a kombucha tap. The refrigerated case allows customers to serve themselves yogurt, tofu, butter or cream cheese out of glass jars. Re_grocery even has a beauty department featuring “closed-loop skin care” products — that is, items whose packaging can either be refilled, composted, or returned to the store for refilling and reuse. The store also stocks reusables and zero-waste accessories. At re_grocery, shoppers fill their containers — whether it’s almond flour or toothpaste or cheese — write the product code on a piece of paper, weigh their containers at the self-checkout station at the front of the store, and pay through a fast and easy process. There’s also a human cashier and other employees ready to answer questions about products or the checkout process. Re_grocery accepts SNAP and offers free next-day delivery on orders of more than $150. There’s a

$9 delivery fee on orders over $50; orders under $50 are charged a $15 fee.

Re_grocery might seem niche, but since opening its first store in April 2020 at the height of the pandemic, when fewer consumers were shopping in stores, the retailer has now grown to three locations and is attracting scores of consumers that every survey says are looking for more sustainable products and shopping options. “It feels more important than ever to reconnect with each other, with our food and with our planet. Our glass is always half-full. And refillable,” the grocer’s website says.

Re_grocery’s rapid expansion proves that grocers don’t have to choose between sustainability and revenue growth. Consumers want to see grocers innovate more on these issues, and they will reward those retailers that do with their loyalty.

Gina Acosta Editor-In-Chief gacosta@ensembleiq.com

10 progressivegrocer.com EDITOR’S NOTE

Grocers don’t have to choose between sustainability and revenue growth. Consumers want to see grocers innovate more on these issues, and they will reward those retailers that do with their loyalty.

Since opening its first store in April 2020 at the height of the pandemic, re_grocery has grown to three Los Angeles-area locations.

Scaling with Personalization

The 1st annual GroceryTech event, produced by Progressive Grocer and RIS News, brings together the combined PG/RIS community of business & technology grocery execs who are on the journey to modernize their technology infrastructure to support innovation.

The event’s theme, Scaling with Personalization, focuses on how grocery execs can build a technology infrastructure to pro tably serve shoppers now and into the future. GT will bring together the full spectrum of grocery stakeholders, including leadership and business implementation executives across IT, supply chain, marketing and store operations.

Who Attends

A cross-functional representation of IT, marketing, merchandising, store operations, supply chain, data/analytics, digital commerce, and corporate leaders across multi-channel large and mid-sized grocers

July 12-14 Cincinnati Presented by

View the full agenda and register today at: GroceryTechEvent.com Contact Gina Acosta gacosta@ensembleiq.com Jamie Goodman jgoodman@ensembleiq.com WANT TO SPEAK? Contact your sales representative or John Schrei for details! jschrei@ensembleiq.com WANT TO SPONSOR?

SPONSOR GOLD SPONSOR

THANK YOU TO OUR SPONSORS: TITLE

National Candy Month

National Dairy Month

National Dairy Alternative Month

National Fresh Fruit and Vegetable Month

1

World Milk Day. Run a discount on the popular beverage to increase traffic in your dairy department.

National Frozen Yogurt Month

National Iced Tea Month

National Rose Month

National Safety Month

2

National Donut Day. Look to the right for the perfect accompaniment to your in-store bakery assortment.

3

The Big Lunch. Already observed in the United Kingdom, this highly social occasion sees communities across the country get together for a large shared midday meal. Now it’s our turn.

4 National Cheese Day. Sample some of your more unusual varieties in the deli department.

5 Sausage Roll Day. These yummy appetizers are also known as pigs in blankets.

6 National Applesauce Cake Day. Provide a recipe to enable consumers to make this moist baked treat — no butter or oil needed — at home.

7

World Food Safety Day. Check over procedures at your store(s) to ensure that everything is up to snuff.

8 National Best Friends Day. Encourage the BFFs among your customers to do their shopping in matching outfi ts.

9 National Meal Prep Day. No time like the present to get all of the preliminary work for dinner out of the way.

10 National Iced Tea Day

11 National Corn on the Cob Day. If some kernels get stuck between our teeth, please let us know.

18

Father’s Day. Help Dad get his due by stocking stuff the old man will love, like juicy steaks to put on the grill.

25

Global Beatles Day. Any excuse to play the Fab Four’s music for hours is welcome.

12 International Falafel Day. Spotlight these delicious fritters, made with ground chickpeas, as part of a broader focus on Middle Eastern cuisine.

19 Juneteenth. Sponsor an essay contest asking students to describe the meaning of this holiday celebrating the end of slavery in the United States.

26

World Refrigeration Day. Where would we be without it?

13

National Chamoy Day. Educate those not in the know about this unique Mexican condiment, which contains fruit, dried chiles and lime juice, and its uses.

20

National West Virginia Day. Let your customers discover the unique eats enjoyed in the Mountain State.

27

Decide to Be Married Day. Promote your fl oral department’s services for all those happy couples planning to walk down the aisle.

14 Flag Day National New Mexico Day

15

World Tapas Day. Hold an in-store demonstration to show customers how they can prepare these Spanish small plates for at-home entertaining.

16 National Flip Flop Day. Have a supply on hand for beachbound shoppers.

17

National Mascot Day. If your store/ chain doesn’t already have one, what are you waiting for?

21 Summer Solstice. It’s the longest day of the year, so enjoy it while you can.

22

Positive Media Day. Make sure to post something uplifting on your digital channels today.

28

National Insurance Awareness Day. Remind associates of the importance of being insured, and if you have a retirement plan, urge them to opt in.

29

National Bacon Burnt Ends Day. Eat up!

23 National Family-Owned and -Operated Businesses Day. Celebrate by sharing your origin story — and how far you’ve come — with associates and customers.

30

National Corvette Day. Drive yours to work — if you’re lucky enough to have one.

24 Farmer Day. Salute those who grow and raise the food we eat.

S M T W T F S IN-STORE EVENTS Calendar 06.23 12 progressivegrocer.com

14 progressivegrocer.com FRONT END Shelf Stoppers Bakery Latest 52 WksW/E 03/04/23 Latest 52 WksW/E 03/04/23 Latest 52 Wks YAW/E 03/05/22 Latest 52 Wks YAW/E 03/05/22 Latest 52 Wks YAW/E 03/06/21 Latest 52 Wks YAW/E 03/06/21 Basket Facts How much is the average American household spending per trip on various bakery items versus the year-ago period? Source: Nielsen, Total U.S. (All outlets combined) – includes grocery stores, drug stores, mass merchandisers, select dollar stores, select warehouse clubs and military commissaries (DeCA) for the 52 weeks ending March 4, 2023 Source: Nielsen Homescan, Total U.S., 52 weeks ending Feb. 25, 2023 Cake Cookies Pies Cupcakes Regular Muffins Total Department Performance Top Bakery Categories by Dollar Sales $19,216,640,956 $16,689,207,249 $14,457,874,724 Bakery Generational Snapshot Which cohort is spending, on average, the most per trip on cookies? Millennials $5.65 Gen Xers $5.30 Boomers $5.22 The Greatest Generation $5.73 Source: Nielsen Homescan, Total U.S., 52 weeks ending Feb. 25, 2023 $5.78 on all bakery items, up 15.1% compared with a year ago $3.61 on artisan bread, up 5.78% compared with a year ago $6.78 on cake, up 10.9% compared with a year ago $4.21 on dinner rolls, up 23.2% compared with a year ago Cross-Merch Candidates Wine Nuts and Seeds Cheese Spirits Fruit Dips and Spreads Lunchmeat Extracts, Herbs, Spices and Seasonings $4,500,000,000 4,000,000,000 3,500,000,000 3,000,000,000 2,500,000,000 2,000,000,000 1,500,000,000 1,000,000,000 500,000,000 0

Coffee and Tea

Market Overview

Price increases, organic growth driven by consumer interest in premium home coffee experiences, the rise of remote work, and the shift away from roasted coffee toward higher-priced ready-to-drink and single-cup formats are all driving factors behind the coffee market’s overall growth.

Current economic conditions largely benefit the retail coffee market as consumers increasingly cut back on their foodservice coffee expenditures.

Tea category sales are settling back into familiar tepid growth, with 202227 sales more closely resembling pre-pandemic patterns. Inflation is behind much of the category’s projected sustained momentum in 2022 (4.3%) and 2023 (2.2%).

Tea’s relative affordability, along with strong connections to routine, suggest that the category and its brands are well positioned to maintain steady engagement with category users despite ongoing fi nancial volatility.

Key Issues

While foodservice will continue to affect retail coffee trends, social media infl uencers (particularly those on TikTok) are playing a growing role.

Tea is a multisensory experience that consumers use as a tool in wellness pursuits, whether their goals are physical (i.e., replacing less healthy beverages) or holistically oriented (i.e., creating a moment of calm).

Although tea is a logical vehicle for added functionality, consumers consistently rank functional benefits below general health interests as important attributes of tea — all of which come after price and product satisfaction.

What Consumers Want, and Why

Consumers are most interested in indulgently flavored ready-to-drink (RTD) coffees that satisfy personal treat occasions, but 35% are interested in RTD coffees that offer functional benefits in addition to energy.

PROGRESSIVE GROCER April 2023 15 MINTEL CATEGORY INSIGHTS Global New Products Database

FOR MORE INFORMATION, VISIT WWW.MINTEL.COM OR CALL 800-932-0400

Gen Z’s preference for cold coffee indicates key growth opportunities for RTD coffee brands and a need for roasted coffee brands to connect with Gen Z consumers or risk future declines.

Functional innovation can bring RTD coffee into new consumption occasions, and innovations that supplement/enhance coffee’s inherent energizing properties could position RTD coffee as a natural alternative to energy drinks.

Tea’s correlation with age means that to sustain sales volume through 2027 and beyond, brands will need to appeal to younger consumers as demographic distributions change.

ALL’S WELLNESS

By Diane Quagliani, MBA, RDN, LDN

Health-Focused Store Brands

tore-brand or private label foods and beverages have long competed on price, an edge that’s more important than ever as costs continue to rise. But unlike the plain “generics” of the past, many store brands today offer shoppers great taste, top quality, attractive packaging, and sought-after health-related attributes related to health, nutrition, ingredients and sustainability.

What Shoppers Want

When consumers were asked what they look for when shopping in person for foods and beverages, products labeled “natural” topped the list, at 39%, followed by clean ingredients (27%), raised without antibiotics, no added hormones or steroids, locally sourced, and organic (25% each), and nonGMO (23%), according to the International Food Information Council 2022 Food and Health Survey.

Also mentioned were plant-based (15%), fair wage/fair trade (14%) and small carbon footprint/carbon neutral (13%).

Many store brands deliver entire product lines with at least some of these attributes, making it easier for health-minded consumers to shop with confidence. A few examples follow:

Albertsons’ Open Nature line is free from artificial colors, flavors, sweeteners and preservatives, and includes 100% natural chicken, 100% grass-fed beef, items that are free from added hormones and antibiotics, and wild-caught seafood that’s free from preservatives. Gluten-free, high-protein, nondairy and plant-based options are also available. Additionally, Albertsons’ O Organics product line is USDA Certified Organic.

Trader Joe’s private label products contain no artificial flavors, artificial preservatives, MSG, genetically modified ingredients or partially hydrogenated oils. Colors are derived only from naturally available products.

All items sold at Whole Foods Market meet strict quality standards for ingredients, sustainability practices and more. The 365 by Whole Foods Market brand in many cases goes “above and beyond” these standards in terms of sourcing, worker and animal welfare, and supply chain transparency. Whole Foods is the first and only certifiedorganic national grocery store, with 20,000 organic offerings.

Wegmans’ Food You Feel Good

About line, which comprises nearly 90% of all Wegmans brand items, promises “great taste with no artificial colors, flavors or preservatives,” according to the grocer. Wellness Keys

16 progressivegrocer.com

THESE RETAILERS’ FOODS AND BEVERAGES DELIVER SHOPPERS’ DESIRED ATTRIBUTES.

Dietitians are trusted sources of health and nutrition information who can lend credibility to health-focused store brands.

on Wegmans brand products highlight nutrition or ingredient information like “high-fiber” or “gluten-free” to help shoppers quickly find items that support their health-and-wellness goals.

The Kroger Co.’s Simple Truth line is free from more than 101 artificial colors, flavors, preservatives and sweeteners; contains no artificial ingredients; and offers minimally processed, naturally raised meats that are fed a 100% vegetarian diet, without antibiotics or added hormones. Simple Truth also includes a line of certified-organic products.

Retail Dietitians Help Reach Shoppers

Dietitians are trusted sources of health and nutrition information who can lend credibility to health-focused store brands. For instance, they can:

Select a series of rotating “dietitian picks” to include on shelf tags and in weekly ads;

Develop programming that highlights store brands during health-related and seasonal promotions and theme months, cooking classes, samplings and store tours; and

Create web content and social media outreach to educate shoppers about the key health-related attributes of store brands.

Learn more at go.unfi.com/smallbusiness SOLUTIONS FOR SMALL BUSINESS

Diane Quagliani, MBA, RDN, LDN, specializes in nutrition communications for consumer and health professional audiences. She has assisted national retailers and CPGs with nutrition strategy, web content development, trade show exhibiting, and the creation and implementation of shelf tag programs.

“It’s great to know that I have the Professional Services team behind me as a one-man show. When we decided to build a second store, I knew exactly who to call. They immediately said,”Okay, how can we help?”

PROGRESSIVE GROCER April 2023 17

-Jason Keen, Village Beach Market

Almost every week one grocery retailer or another rolls out a new sustainability commitment.

Why?

Sustainability is still top of mind for grocery shoppers, even amid inflation and high prices. According to a March survey from Panasonic-owned software and consultancy company Blue Yonder, 48% of respondents said that their interest in shopping with an eye toward sustainability in the past year has increased, while 74% of

By Progressive Grocer Staff

consumers have shopped at a retailer promoting its products as sustainable at least once in the past six months. Additionally, 69% of shoppers said that they’d be willing to pay more for sustainable products.

Meanwhile, a January survey of grocery executives conducted by Incisiv and Wynshop revealed that 71% of grocers regard sustainability as a key priority in 2023, while 76% also regard it as a C-level issue. The survey showed that waste reduction is grocers’ primary sustainability focus (86%), followed by energy efficiency (77%) and

packaging improvement (66%).

Sustainability has certainly been a key theme over the past few years in the grocery industry, and that focus is only accelerating. That’s why Progressive Grocer’s editors decided to profile the 10 grocers doing the most innovative work on such sustainability topics as ethical sourcing, climate commitments, fair trade certifications, food waste, green buildings, and more. These sustainable grocers have woven sustainability into their DNA, and their customers are rewarding them for their efforts.

18 progressivegrocer.com

These companies make it look easy to be GREEN.

COVER STORY Operations

Imagine the

Prairie Fresh USA Prime® is the best of our best. Our industry-leading proprietary technology helps to select premium cuts based on superior marbling, color and tenderness. So you can deliver a higher level of consistency and quality to your shoppers.

That’s the Prairie Fresh® Way. prairiefreshway.com

©

AHOLD DELHAIZE

In an effort to play a leading role in driving sustainability across the food retail sector, Zandaam, Netherlands-based Ahold Delhaize revised its interim CO2 emissions reduction target for its entire value chain to at least 37% by 2030, with the aim of becoming net zero by 2050. For its own operations, the retail conglomerate remains committed to achieving net-zero status by 2040, with an interim target of a 50% reduction by 2030. Through this updated target, Ahold Delhaize intends to decarbonize its entire value chain and ensure that all of its climate targets are in accordance with the United Nations’ goal of keeping global warming below 1.5°C.

U.S. banners like The Giant Co. are also contributing to the company’s sustainability ambitions. The Carlisle, Pa.-based grocer recently added four electric vehicles to its delivery fleet

ALDI

It isn’t easy being green at a time of super-high inflation, but ALDI knows how to do it. The German-owned discount grocer, which first put down roots in the United States back in 1976, is now the third-largest grocer in the country by store count, with a current total of 2,285 stores.

One big reason that ALDI has become the fastest-growing grocer in the United States over the past year is inflation — penny-pinching shoppers love its value proposition. But another big reason for ALDI’s unstoppable rise

in Philadelphia. The electric vans will save more than 9,000 gallons of gasoline each year compared with standard delivery vehicles and can travel 108 miles per charge. According to The Giant Co., the vehicles’ zero-tailpipe emission design, coupled with their avoidance of gasoline, will prevent 171,963 pounds of greenhouse-gas emissions annually.

Then there’s the banner’s efforts with Keep Pennsylvania Beautiful. The two recently rolled out their third annual Healing the Planet grant program. This year, $300,000 will go to projects addressing food waste prevention, reduction and recovery across The Giant Co.’s market area of Pennsylvania, Maryland, West Virginia and Virginia. Since the program began, more than $800,000 has gone to 87 recipients for projects that connect people and families to green spaces, and improve or help to protect local water-

ways and water resources.

Ahold Delhaize’s Stop & Shop banner is also ramping up efforts to curb food waste by expanding the availability of the Flashfood program. In January, the retailer widened the digital marketplace to 34 more stores in Massachusetts and statewide in Rhode Island. Toronto-based Flashfood is now at nearly 70 Stop & Shop stores in those two states, as well as in New York and Connecticut. The banner estimates that it has diverted nearly 170,000 pounds of food from landfills through the program, which connects consumers with discounted food close to its best-by date.

has been the retailer’s sustainability commitments. ALDI hasn’t offered single-use plastic shopping bags for more than four decades and has always encouraged shoppers to bring their own reusable bags. Further, the company has pledged to remove all plastic shopping bags from its stores by the end of 2023, an initiative that is estimated to remove 4,400 tons of plastic from circulation every year.

ALDI has also committed to diverting 90% of operational waste by 2025, and to reduce food waste by 50% by 2030. To accomplish this, the grocer has rolled out nonfood donation programs to nearly all stores and distribution centers, expanded recycling and food recovery initiatives, and piloted and expanded composting.

The company is also remodeling and building stores and distribution centers with sustainability top of mind. It has installed rooftop solar panels on more than 155 stores and 14 distribution centers, and has plans to continue adding them to even more stores to increase its use of green energy. The U.S. Environmental

Protection Agency’s GreenChill program has recognized ALDI as a grocery industry leader for reducing harmful refrigerant emissions. Further, in its supply chain, the retailer is working with its business partners to promote sustainable sourcing.

“Shoppers shouldn’t have to choose between doing what’s right and saving money,” says Joan Kavanaugh, VP of national buying at Batavia, Ill.-based ALDI U.S. “That’s why we make sure they don’t have to. We keep sustainability in mind with everything we do, from our smaller-footprint stores to our curated selection of private label products. Our customers can feel good about their purchases without straining their budgets. As a leader in the industry, we have paved the way with aggressive goals to reduce our carbon footprint, rethink our product packaging, advocate with suppliers for ethical sourcing, and support the health and welfare of our communities. Every day, ALDI is taking actionable steps to advance our sustainability goals, and we won’t stop until we’ve achieved our vision to make sustainable shopping affordable for everyone.”

22 progressivegrocer.com COVER STORY Operations

PROFITABLE AND SUSTAINABLE:

A Winning Solution for Transforming Fresh

Speaking with...

Matt Schwartz , CEO and co-founder, Afresh

In 2017, Matt Schwartz co-founded Afresh with the goal of eliminating food waste and making fresh food accessible to all. Progressive Grocer asked Schwartz to discuss the state of Fresh today and how the company’s AI-driven platform is helping grocers move beyond traditional inventory management to optimize decisions across the fresh supply chain, driving profitability and sustainability in the process.

Progressive Grocer: Why do retailers need a technology solution specifically purpose-built to manage their fresh departments?

Matt Schwartz: Customers care about fresh more than ever. Data shows that 93 percent of grocers have seen the demand for fresh food rise since 2020.1

WHAT OUR CUSTOMERS SAY

But Fresh is fundamentally different and more complex than Center Store due to multiple factors that shift daily, making the category highly variable and hard to predict. And unfortunately, many grocers arerelying on rigid technology that cannot adapt to the complexities of fresh food.

Afresh is changing the game with a platform designed to recognize and respond to that ever-changing, often hard-to-predict world of fresh. It streamlines fresh operations, resulting in a significant reduction in food waste, fresher food, and happier customers — all while improving grocers’ bottom lines.

PG: What does all of that have to do with sustainability?

MS: The important thing we want grocers to realize is that preventing food waste doesn’t have to come at the expense of revenue goals. Afresh is driving massive results for several functions across the organization, like merchandising, operations, sustainability/ESG, finance, and IT. Bottom line goals and ESG goals are not mutually exclusive.

The Afresh platform improves order accuracy — and with more accurate ordering, inventory turns over faster, displays remain fresher, and over-ordering is

STORES HAVE TYPICALLY EXPERIENCED

3% sales increase

7% faster inventory turns

20% increase in labor efficiency

25% shrink reduction

80% stockout reduction

reduced chain-wide. With better visibility into supply and demand, grocers can also consolidate orders, which leads to efficiencies in the delivery and handling of fresh food. And finally, preventing food waste means saving water that would otherwise be used to grow that food.

PG: Is there data that shows results stores have achieved by using the Afresh platform?

MS: We have a lot of data — and perhaps one of the most impressive figures is the +3 percent sales increase stores have realized. That can translate into millions of dollars in additional annual sales depending on the size of the store. Stores also have typically experienced 7 percent faster inventory turns, 20 percent increase in labor efficiency, 25 percent shrink reduction, and 80 percent stockout reduction.

PG: What makes the Afresh platform unique in the industry?

MS: Afresh is the only technology solution that intelligently navigates incomplete and imperfect information to drive optimal decisions across fresh departments and the entire fresh supply chain. We leverage cutting-edge machine learning models and easy-to-use workflows to deliver transformational benefits in fresh ordering and inventory management.

At the end of the day, our relationships with partners like Albertsons, Cub, and Fresh Thyme always link back to our vision: to sustainably nourish the world with fresh food.

1Opportunities in Fresh: 2022 Report, Afresh

WANT TO LEARN MORE? SEE THE AFRESH PLATFORM IN ACTION AT www.afresh.com.

ADVERTORIAL

By partnering with Afresh, we are now able to improve our processes to better manage our fresh product supply and provide our store teams with a tool to better predict demand and monitor inventory.

— SUSAN MORRIS, EVP and Chief Operations Officer, Albertsons Companies

GIANT EAGLE INC.

When it comes to sustainability, Giant Eagle Inc. is laser-focused on waste, carbon emissions and plastics. The Pittsburgh-based company’s specific goals include diverting 90% of waste from landfills by 2025, achieving 50% carbon neutrality by 2030 and net-zero carbon emissions by 2040, and also eliminating all single-use plastics from its operations by 2025.

Through its Full Plates Zero Waste program, Giant Eagle aims to provide access to fresh, healthy meals for those in need, while also reducing its food waste, by donating 80 million meals between 2021 and 2025. The grocer’s partnership with Flashfood has also helped it divert more than 1 million pounds of food from landfills to date. In reaching that milestone with Giant Eagle, the Toronto-based program that connects shoppers with heavily discounted food nearing its best-by date has also saved consumers nearly $2.5 million on groceries.

Giant Eagle’s roadmap to net-zero carbon emissions has led it to reducing carbon dioxide emitted throughout its operations by 22% over the past eight years while also converting about 70% of its truck fleet to alternative energy, LED retrofitting, and more efficient heating and cooling. Sustainability is also apparent in the grocer’s brick-andmortar operations through infrastructure improvements that target carbon reduction and energy efficiency, smart lighting solutions that use automation and innovation, and investments in green energy solutions.

The grocer was also honored by the U.S. Environmental Protection Agency’s GreenChill program with both Superior and Exceptional Goal Achievement awards, which recognize partners that meet or exceed their annual and stretch GreenChill refrigerant emission goals, respectively.

As for plastics, Giant Eagle recently relaunched its effort to eliminate single-use plastic bags across its footprint, with plastic bags no longer available at checkout in stores throughout Columbus, Ohio, and Indiana. The retailer has also undertaken strategic partnerships to reduce plastics in other parts of its operations, including one with Pittsburgh-based vertical-farming pioneer Fifth Season to reduce plastic packaging for leafy greens, lettuces and salad blends by 40% per package. Giant Eagle also carries products from Ohio craft brewery The Brew Kettle, which uses biodegradable 6-pack rings made out of spent grain from the brewing process.

THE KROGER CO.

Sustainability is continually woven into The Kroger Co.’s DNA through its Zero Hunger | Zero Waste social and environmental impact plan, and the urgency for greater climate action is prompting the Cincinnati-based grocer to make even bigger bets on seafood sustainability, lowering its climate impact, creating more sustainable packaging, and more.

As it shared its updated environmental, social and governance (ESG) action plan in the fall, Kroger formally committed to setting a more aggressive greenhouse-gas reduction goal. While its current 2030 goal is aligned with a well-below 2°C climate scenario, the company has strengthened its goal to support a 1.5°C climate scenario. Kroger will also set a new Scope 3 goal for supply chain emission reduction.

Kroger’s sustainable packaging goals include 100% recyclable, reusable and/or compostable private label brand packaging by 2030. A baseline assessment focused on grocery and fresh food products, as well as health, beauty, household supplies and cleaning items, found that 40% of in-scope product packaging already meets the company’s definition of “recyclable” when measured by weight.

Among Kroger’s other major sustainability goals are eliminating food and operational waste; reducing water use, finding reuse opportunities and managing water discharge quality; and creating a truly sustainable supply chain to include responsible seafood sourcing. In 2021, 94% of wildcaught seafood sourced by Kroger met sustainability criteria, and 98% of farm-raised seafood did the same.

Additionally, Kroger had 79% waste diversion from landfill company-wide in 2021, and 48.8% food waste diversion from landfill in its retail stores. Its broader goal is to divert 95% or more of food waste from landfill company-wide in the next two years. Also in 2021, Kroger donated 94 million pounds of surplus food to Feeding America’s network of food banks and agency partners.

“We live our purpose — to feed the human spirit — through Kroger’s commitments to advance positive impacts for people and our planet and create more resilient global systems,” says CEO Rodney McMullen. “We are proud to report that Kroger continues to make progress toward key ESG goals. I am especially proud of the Kroger team’s collective effort to create communities free from hunger and food waste.”

26 progressivegrocer.com

COVER STORY Operations

MEJIER INC.

Meijer doesn’t leave many stones unturned when it comes to sustainability. Last year, the Grand Rapids, Mich.based retailer invested in beach-cleaning robots that sorted through sand and stone to find and remove garbage from beaches in the Great Lakes region.

Meijer’s priority of protecting natural resources is evident in projects in and around its physical stores. In fall 2022, the company added rain gardens to its store in Benton Harbor, Mich., with the aims of attracting environmentally important pollinators and improving water quality in a nearby creek.

Repurposing is another hallmark of Meijer’s sustainability efforts. From a building and grounds standpoint, the company teamed up with Midland, Mich.-based Dow to create a parking lot made with post-consumer recycled plastic. Taking steps to ensure that products are used and not discarded, the retailer

MISFITS MARKET

When it first began in 2018, Misfits Market aimed to offer all consumers access to quality but affordable food by minimizing food waste in the traditional food supply chain. Since that time, the Delanco, N.J.based e-grocer has more than lived up to that promise, as exemplified by its rescue of 55 million pounds of food in 2022. In fact, since it was established, Misfits has rescued 278 million-plus pounds of food, with efforts now encompassing conventional as well as “ugly” produce.

This mindset was also apparent in the company’s September 2022 acquisition of Imperfect Foods, another online food retailer dedicated to reducing food waste.

“The strengths of the Imperfect Foods organization, from its in-house delivery fleet and robust private label program to its sustainability commitments and innovation, add immediate scale and depth to what we’re building at Misfits Market,” notes Kai Selterman, Misfits’ chief strategy officer.

also doubled down on its partnership with Toronto-based Flashfood. In addition to diverting more than 1 million pounds of food waste by offering shoppers the chance to get discounted fresh and packaged products nearing their sell-by date, Meijer recently widened the Flashfood offering to SNAP beneficiaries. That earned the company a shout-out from the Biden Administration as it rolled out its White House Challenge to End Hunger and Build Healthy Communities.

Meijer’s multi-pronged sustainability commitments encompass several actions to reduce the organization’s carbon footprint. The company recently deployed two all-electric semi-trucks for deliveries, becoming the first retailer to track those energy-saving

vehicles in a cold climate. Back at its physical stores, the company opts for eco-friendlier refrigerant gases and has won awards for its refrigerant gas management from the GreenChill partnership with the U.S. Environmental Protection Agency.

Like many businesses, Meijer sees sustainability as a work in progress, gauging results while setting new goals. The retailer is currently working to meet its targets of cutting food waste in its stores by 50% by 2030; switching to 100% recyclable, reusable or compostable packaging for its private label Own Brand packaging by 2025; and halving its absolute carbon emissions by 2025.

President and CEO Rick Keyes recently commented on Meijer’s sustainability strides, noting: “Our company’s earliest beginnings were marked by doing what’s right while keeping an eye toward innovation. That philosophy still guides us today and is exemplified by our company’s commitment to lessening our carbon footprint.”

In fact, since the acquisition of Imperfect, Misfits has rolled out a packaging return program, making it, according to Selterman, “the only grocer to take back packaging for reuse, and this is a program we plan to scale in 2023.” In tandem with that initiative, the company is leveraging its delivery fleet to reduce the number of ice packs and the amount of packaging needed for cold items.

Beyond those efforts, Misfits has leaned into growing and streamlining what it calls its “value supply chain” through such methods as partnering with suppliers to bring upcycled products to market and working with vendors to rescue food that would otherwise end up in landfills.

“We’ve become a destination for emerging, sustainable brands, and that kind of treasure-hunt experience is valuable for customers and suppliers alike,” observes Selterman. “Our customers are excited to try new items and be introduced to alternative, quality products that you can’t find everywhere, and

brands get immediate visibility in front of a highly engaged customer base.”

Additionally, in regard to conservation, Misfits teamed up with a group called Watershed last year to measure and reduce its carbon footprint.

Selterman believes that the company’s greatest opportunity going forward is “[c]ementing our status as the only grocer that leverages sustainability to create affordability. By virtue of our opportunistic buying strategy, we can deliver high-quality products at a great value while fighting food waste.”

PROGRESSIVE GROCER April 2023 27

What the Environmental Connection Between Planet and People Means for GROCERY RETAILERS

Speaking with…

Leslie Simmons, Senior Director of Business Development, Fresh, Fair Trade USA

Speaking with…

Leslie Simmons, Senior Director of Business Development, Fresh, Fair Trade USA

Sustainability is at the forefront of many companies’ initiatives today. Fair Trade USA — the leading 501(c) (3) nonprofit, third party certifier of fair trade products in North America — is one of them. Progressive Grocer spoke with Leslie Simmons, Fair Trade USA’s Senior Director of Business Development, Fresh, to learn how the organization is working to foster production practices that both enhance people’s lives and ensure the health of the planet.

Progressive Grocer: Let’s talk about the interconnectedness between people and the environment.

Leslie Simmons: People and our planet are intertwined in such an intricate way that the livelihoods of individuals and entire communities are inextricably linked to the environment. The production of the food and goods that society relies on every day impacts the environment in myriad ways. Likewise, shifts in the natural environment — extreme weather, for example — impact society because they threaten the long-term viability of things like agricultural production.

PG: How does Fair Trade USA work to further sustainability and its relationship to people’s everyday lives?

LS: Fair Trade USA fosters production practices that preserve the environment, enhance resilience to climate

change, and protect the health and quality of life of farmers, fi shers, workers, their families, and their communities. Preventing and reducing direct harm to the local environment from production activities is the focus across all of our programs.

For example, Fair Trade USA’s Agricultural Production Standard starts with good practices that minimize environmental impacts on natural ecosystems and improving the resiliency of crop production to both preserve the natural environment, as well as ensure economic viability for farmers. Standards include requirements related to deforestation, land management, and proper disposal of waste, hazardous materials, and

into these funds, which can and have been used to support a wide range of projects related to the environment. In 2022, we reached a significant milestone by exceeding $1B in financial impact to farmers, fishers, workers, and communities around the world over the 25-year history of our organization.

PG: Why is this important for grocery retailers?

LS: Consumers care about the environment and are more and more willing to support companies that do, too. In our Consumer Insights Report, new research shows that consumers increasingly see fair trade as one of the easiest ways to improve lives,

SEVENTY-EIGHT PERCENT OF THE GENERAL POPULATION

TRUST THE FAIR TRADE CERTIFIED LABEL AND MORE CONSUMERS RECOGNIZE THE LABEL THAN ANY OTHER SOCIAL CERTIFICATION.

wastewater. Requirements address the importance of identifying and managing risks, such as the risk of contamination of local waterways.

We empower and build capacity with farmers, fishers, and workers to produce sustainably. Unlocking access and opportunity is at the heart of the fair trade model. We seek to ensure individuals have the capacity and knowledge to safeguard the natural environment while enhancing production.

And we provide funds to support those sustainability journeys through the Community Development Fund, which provides money that industry and brand partners pay to producers of fair trade products. In 2021, more than 75 million U.S. dollars were paid

communities, and the environment through their purchases. Seventyeight percent of the general population trust the Fair Trade Certified label and more consumers recognize the label than any other social certification. In fact, 55 percent of Millennials and 48 percent of Gen Zs — even with inflation — say they would pay 20 percent more for a Fair Trade Certified product.1

12022 Consumer Insights Report, Fair Trade USA, January 2023

TO LEARN MORE ABOUT USA’s position on the environment and how stores can benefit by carrying Fair Trade Certified products, visit go.fairtradecertified.org/progressive-grocer

Fair Trade

ADVERTORIAL

Storewide Merchandising Solutions American Ma nufacturing50 YEARS of YEARS of American Manufacturing OV ER

WonderBar ® Merchandiser For coolers, freezers and center store Clear Scan® AdjustaView ® Label System Auto-feed Tray System Pusher Hook and Display Hook Label & Sign Holder System Flip Scan® Hooks, Label Holders & Signing Accessories Glass, Wood & Solid Shelf Label Holders Glass, Wood & Solid Shelf Label Strips Wire Basket & Wire Shelf Label Strips Magnetic Pallet Rack Label Strips Electronic Ticket Label Strips & Holders Wire Basket & Wire Shelf Label Holders

WonderBar ® Trays

More ways to boost productivity

Mini Tray

n Made from U.S. steel and heavy-duty wire frames.

n Multiple-depths range from 13" to 24".

n Adjustable-widths adapt from 1 3/4" to 17 1/2".

Dual Lane Tray

Standard Tray with Finger Product Stop

n Tool-free installation.

n Bar and shelf capable.

n Auto feed any product.

Oversize Double-Wide Tray

Radius or Square Tray Sidewalls

Standard Tray with Locking, Molded Pusher

Create Exciting Cross-Sells

with Dual Lane merchandising

WonderBar® Dual Lane Trays

n Fit many more items, sell families of products in different sizes and increase impulse buying with cross-sells and adjacencies.

n Asymmetrical lanes sell different-width products.

n Each lane adjusts to fit products as small as 13/4" wide.

n Unique design features a separate paddle to push each item forward individually in its own lane.

Display Cheese & Salad

Improve rotation and reduce shrinkage

WonderBar® Trays

n Face more packages, accommodate a wider range of shapes and sizes, restock easily, and manage dated produce better.

n Air baffles maintain product temperature and extend shelf life.

n Durable cooler-capable steel construction ensures long life.

n Trays lift out for rear restocking and proper rotation.

n Versatile spring tension is gentle on delicate produce.

Cooler-Capable EWT ™

Expandable Wire Tray for refrigerated retail

n Quick drop-on, one-piece installation.

n Accommodates any style or size package adjusting from 3 3/8" to 17 1/2" lane width.

n Various built-in mounting capabilities available based on shelf component.

n Molded pusher paddle available, both locking and non-locking styles with wire- or metal-sided trays.

n Auto feed any product.

n Clear or Imprinted Front Product Stops.

n Vends oversize items like pizza.

Display & Scan Hooks

Hooks for every purpose

Right Angle Label Holder Hook

n A simple, inexpensive design.

n Use with Quick Back® to maximize product density, provide easy mounting and relocation of stocked hooks in tight places, under shelves or in fully loaded displays, and speed re-merchandising and display changeover.

Economical All Wire Hook

n Safer, rounded Ball-End Tips are available on all hooks at no extra charge and no minimum order.

n Use the Peg Hook Overlay to quickly convert All Wire Hooks to Scan Hooks.

Slatwall Hooks

Pouch Hook™ Merchandising

A new venue of product promotion

Pouch Hook™ Merchandising

n Standard and Gravity-Feed options keep items forwarded and automatically faced.

n Tool-free installation on most common gondola and cooler uprights.

n Stocked in 4 lengths compatible with all standard shelf sizes allowing mixed use in display.

Flip-front Label Holder swings up for easy access and product removal.

Protect Your Merchandise

Anti-theft security hooks

Scan Lock® Hooks

n Easy-to-use, inexpensive key-lock system.

n Prevent the removal of any stock or display 1 or 2 items unlocked to prevent sweeping.

Anti-Sweep™ Hooks

n Camel-back profile prevents sweeping while providing direct access for customers.

n Flip Scan® Label Holder swings up and out of the way.

n Use of plain-paper labels can save up to 65% on labels and up to 75% on labor.

Adjustable Merchandising Tray®

AMT ® for dairy, freezer and center store

n Molded-in openings improve refrigeration air circulation.

n Top-tier sidewall available for support and containment of tall or multi-tier products.

n Adjustable width trays, designed for yogurts, ice cream, and other difficult to organize products.

n Trays lift out with easy-grip handles to allow quick restocking or cleaning.

Clear Scan® Label Holders

The complete shelf edge labeling system

n Easy-to-use design flexes open at a touch for fast, drop-in, plain-paper labeling, then automatically springs shut to secure the label in place.

n Unsurpassed range of sizes, styles & lengths.

n Labels shielded from dirt, spills, moisture & wear so they last longer, read easier & scan more accurately.

n Long lasting PVC construction retains “memory” and shape, resists yellowing, darkening & aging.

Choice of magnetic, adhesive or clip-on mounting systems.

Choice of magnetic, adhesive or clip-on mounting systems.

Being Seen Means Being Sold® ©2022 Trion Industries, Inc. 297 Laird St., Wilkes-Barre, PA 18702 Ph 570-824-1000 | Fx 570-823-4080 Toll-Free in the U.S.A. 800-444-4665 info@triononline.com www.TrionOnline.com American Ma nufacturing50 YEARS of YEARS of American Manufacturing OV ER

NATURAL GROCERS BY VITAMIN COTTAGE

How is sustainability a cornerstone of Natural Grocers’ operations? Sustainability is the first tab on the company’s website and is a guiding principle on virtually all aspects of its food retailing business.

Shoppers who browse Natural Grocers’ aisles can know that products in the stores have been vetted for sustainability attributes. The Lakewood, Colo.-based company offers 21,000 SKUs of natural and organic products per store that meet its rigorous product standards supporting the sustainability and health of food systems and communities. Team members regularly visit farms and ranches to ensure that foods meet a high bar for practices and metrics. The grocer also goes to great lengths to share what it won’t carry, via a list posted on its website.

In addition to putting sustainability at the forefront of its assortment, Natural Grocers takes steps across its operations to lighten its environmental footprint, whether through efforts to reduce waste, investing in carbon dioxide refrigerant technology, eschewing single-use bags at checkout or pursuing other measures to maximize efficiencies.

Even the store layouts reflect a prudent use of resources. Natural Grocers locations don’t include deli, meat or seafood counters or a salad bar, to reduce the use of refrigerants, electricity and water. The store washrooms feature low-flow faucets and toilets, and the company also uses xeriscaping, a form of water-saving landscaping, on its properties.

Sustainability is an end-to-end proposition for Natural Grocers, as it also implements measures in its bulk packaging facility and distribution centers. The retailer uses corrugated boxes with 48% recycled content for bulk packaging, along with recyclable resealable bags and film. In 2022, its operations slashed the use of plastic stretch wrap by half from the previous year.

The company continues to build on its green practices, often turning to technologies to make them happen. Last year, for example, Natural Grocers added a new cooler technology that streamlines temperature tracking in its stores, and switched over to a new automated ordering process as a way to curb over-ordering and waste.

“We hope to inspire other companies to follow our lead,” assert Co-Presidents Kemper Isley and Zephyr Isley in Natural Grocers’ most recent environmental, social and governance report.

PCC COMMUNITY MARKETS

On the occasion of its 70th birthday this year PCC Community Markets, a Seattle-based grocery cooperative with 16 stores in the Puget Sound area, took the time not only to reflect on its past, but also to look forward to its future by revealing that it was hard at work on its next set of five-year environmental, social and governance goals.

As it stands, the co-op is already well known for its wide-ranging sustainability endeavors. This past year alone, PCC updated its long-standing product standards to include such changes as not selling any fresh and frozen raw seafood that’s rated an “Avoid” by Seafood Watch, and that all whole-bean and pre-ground coffee, both pre-packaged and bulk, must be certified organic and fair trade or direct trade by a third-party certifier. These reviews are carried out by the grocer’s Quality Standards Committee, an internal cross-departmental forum that discusses social and sustainability concerns regarding products and the supply chain.

“Not many grocers have publicly available standards that are focused on sustainability, and setting criteria for health, environmental benefits, animal welfare [and] toxics concerns,” noted Rebecca Robinson, PCC’s senior product sustainability specialist, in the May 2022 issue of the co-op’s Sound Consumer publication at the time that the new product standards were revealed. “The main goal and purpose was to articulate what we’re doing and what our merchandisers do.”

In its April 2022 “Co-op Purposes Report,” PCC reported a year’s worth of sustainability progress, including the achievement of carbon-negative store operations. The grocer also observed that since the implementation of its social and environmental operational goals, created in 2017 with input from co-op members, community representatives, vendors and partners to help boost its sustainability impact, the co-op has made progress every year on those goals, among them lowering its energy use and reducing water waste.

30 progressivegrocer.com

COVER STORY Operations

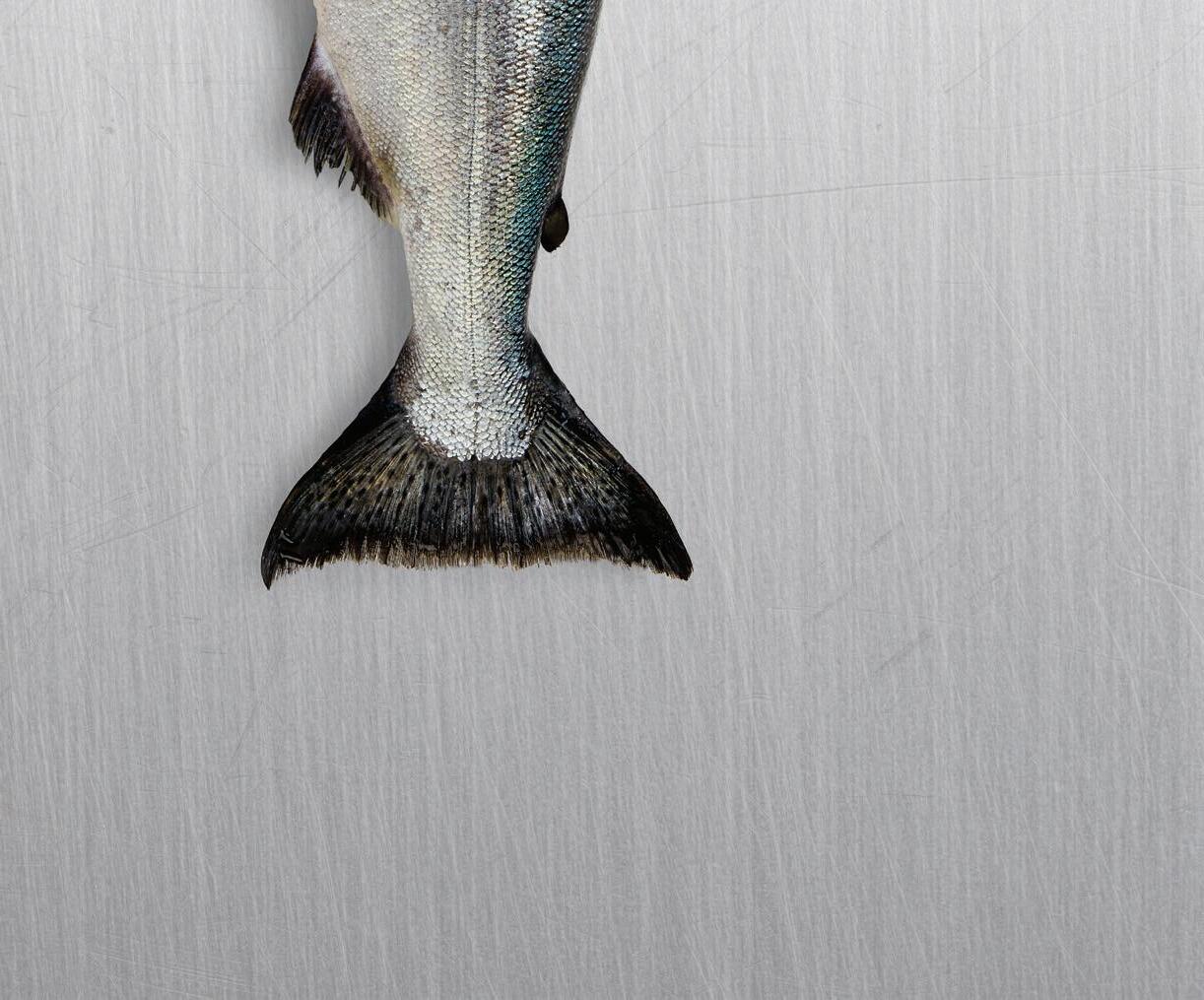

WEGMANS FOOD MARKETS

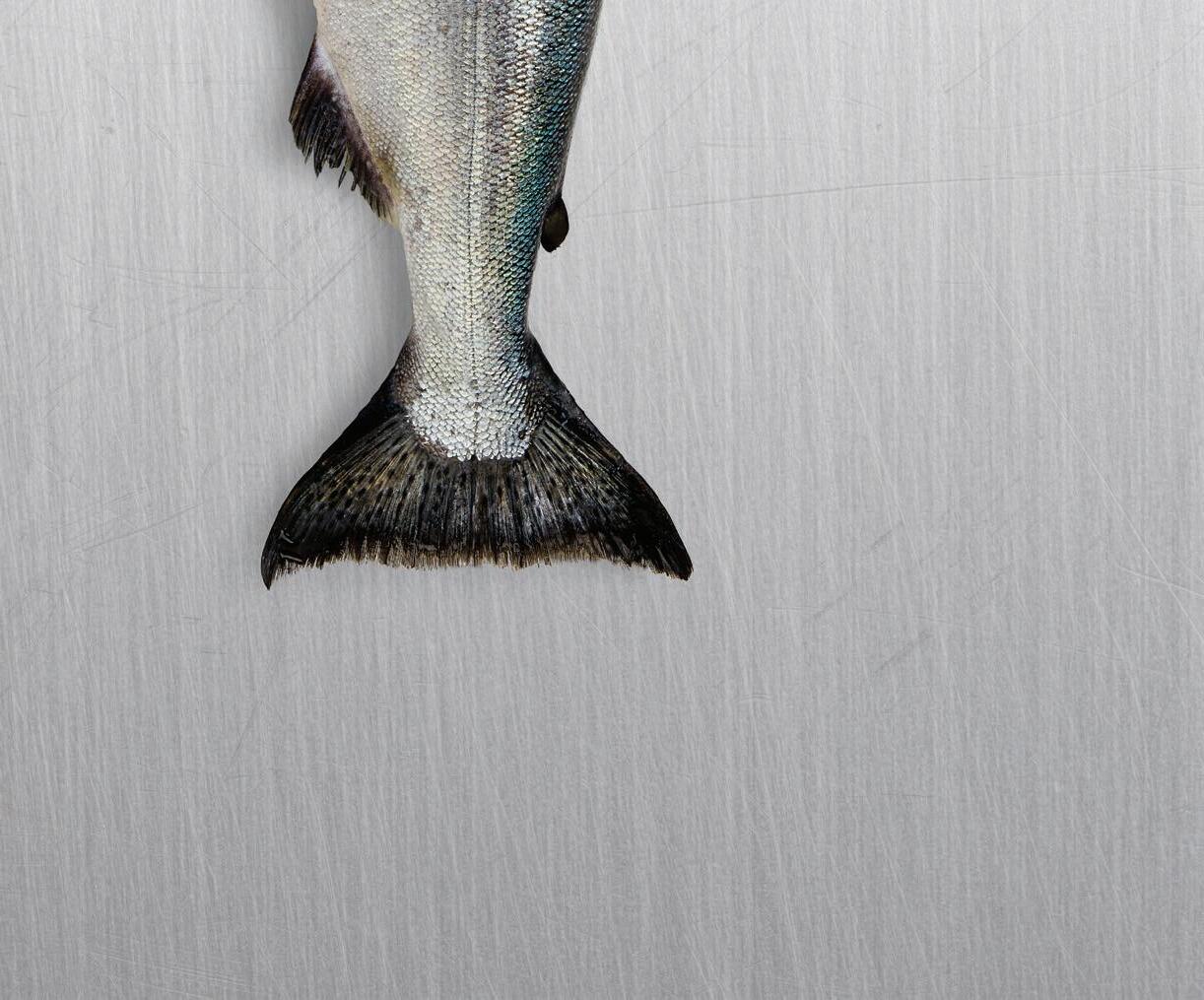

Sustainable packaging has been a focus of Wegmans Food Markets for a number of years. But the Rochester, N.Y.based retailer recently upped its game by using reusable plastic containers (RPCs) to get fresh seafood from its suppliers to its stores, eliminating the need for single-use Styrofoam coolers. The use of RPCs for transporting food instead of using single-use packaging isn’t new, but Wegmans’ application is: The grocery chain is the first retailer to launch such a program for seafood.

RPCs perform as well as foam coolers do in keeping product cold and secure during transportation. They’re also collapsible and stackable, taking up less room, and the cost of the containers is equal to or less than the cost of foam coolers.

With all of these benefits, however, there was one hurdle for Wegmans to overcome: size. The grocer thus reached out to Atlanta-based packaging provider Tosca to see about getting a smaller crate that would be more suitable for its seafood team’s needs.

Once the development of the smaller crate was completed, Tosca sent samples to local Wegmans salmon supplier JD & Sons for testing in a four-store pilot. As expected, the pilot was a success, and Wegmans has since expanded the program to additional suppliers, which are using the new half-sized totes to transport a variety of fresh seafood items. Currently, five of Wegmans’ suppliers have made the switch to RPCs, a change that resulted in more than 1.2 million pounds of Styrofoam being eliminated from its supply chain at the end of 2022.

“From the very beginning, this idea of using reusable containers that have a lifespan of at least eight to 10 years and can then be recycled, in place of single-use foam coolers, was about doing what’s right for the environment, and getting the seafood industry as a whole on board,” says Mark Fromm, Wegmans’ seafood category merchant.

The grocer also successfully eliminated single-use plastic bags in 2022 chainwide, another example of its commitment to reduce single-use plastics. In fact, the grocer is devoted to reducing its in-store plastic packaging made from fossil fuels, along with other single-use plastics, by 10 million pounds by 2024.

WHOLE FOODS MARKET

Since Whole Foods Market first opened its doors in Austin, Texas, in 1980, sustainability has been its hallmark. When shoppers walk into a Whole Foods store, they will find vibrant stacks of produce, animal welfare-rated meat, responsibly farmed and sustainable wild-caught seafood, and body care products with natural ingredients. The operator of 514 locations carefully vets products to make sure that they meet the company’s high standards for ingredients, labels and sourcing practices.

Whole Foods touts six key core values: selling the highest-quality organic and natural foods, satisfying and delighting customers, taking care of its team members, creating win-win partnerships with suppliers, generating profits and prosperity, and advancing environmental stewardship. While many grocery retailers are still in the throes of deciding whether to get rid of plastic bags, Whole Foods eliminated plastic grocery bags way back in 2008. Today, North America’s largest organic and natural food chain is focused on supply chain transparency. The company has traceability programs in place to track its more than 3,500 365 by Whole Foods Market private-brand products back to the manufacturer or farm of origin, and it requires fair and safe working conditions for the men and women who grow the food it sells — both inside and outside the United States. Whole Foods also has traceability programs for its meat and seafood departments, eggs in the dairy cases, canned tuna, and more.

The Whole Foods Sourced for Good program helps support workers, communities and environmental stewardship where products are sourced. The program relies on internationally recognized third parties such as Fair Trade USA to verify social practices, environmental practices and/or working conditions. Shoppers can find the Sourced for Good seal on hundreds of products, including bananas, bell peppers, tomatoes, tulips and roses.

Finally, Whole Foods is building greener stores that educate shoppers on its purpose to nourish people and the planet. One location, in Needham, Mass., boasts recycled steel beams, a white roof, solar panels, reclaimed water, and recycled grocery bags and receipt paper, and 80% of store waste is reused.

PROGRESSIVE GROCER April 2023 31

A TASTE OF

peaking with… atherine arry, Vice President of Marketing, National Honey Board

Sustainability is a buzz word in most every industry today — and nowhere is that word more applicable than when talking about honey! Progressive Grocer asked Catherine Barry, Vice President of Marketing of the National Honey Board, to explain why honey bees are so important to the health of people and the planet and how grocers can tap consumers’ interest in sustainability to keep honey sales buzzing.

Progressive Grocer: What role do honey bees play in the ongoing quest for environmental sustainability?

Catherine Barry: A big one! Bees pollinate 35 percent of the food we eat — which means more than one-third of the world’s food supply wouldn’t exist if it wasn’t for the work of beekeepers and honey bees. Imagine your stores’ shelves and produce departments without honey, apples, blueberries, cherries, watermelons, avocados, almonds, and broccoli! None of those products would exist without managed pollination, which is the practice of caring for hives and honey bees in order to pollinate crops.

The coexistence of beekeepers and honey bees sustains ecosystems and humanity. Beekeepers who manage pollinators are unsung heroes who have evolved their practices to protect honey bees, habitats and local economies. Together with researchers, they have discovered innovative solutions to combat threats like parasites, pathogens, poor nutrition, and pesticides. Responsible beekeeping also supports best practices to find

innovative solutions for planting healthy pollen and nectar sources, as well as effective but considerate pest control. All of those things ensure there are healthy habitats to grow the food we all rely on.

PG: How important is honey to a grocer’s bottom line?

CB: Consumers love honey — and they’re showing that love at checkout! Honey category dollar sales at retail advanced 15.4 percent in 20221 and in 2021 U.S. honey demand reached an all-time high.2 Two things are driving demand: the growing population, and the fact that consumers consider honey a delicious and nutritious sweetener. Consumers are beginning to understand when you choose honey you are getting a perfect all-natural sweetener and supporting honey bees and beekeepers who help feed the world. If you don’t have a variety of honey on your shelves, you’ll likely lose sales to retailers who do.

PG: What are some initiatives retailers should know about when it comes to the honey industry?

CB: This is the third year of Honey Saves Hives, an educational program designed to bring awareness to the importance of honey bees and their crucial role in our ecosystem and global food supply. In 2022, during September in celebration of National Honey Month, the National Honey Board partnered with food and beverage brands dedicated to protecting honey bees to educate consumers about how supporting honey bees helps the broader ecosystem. Consumers were encouraged to participate by purchasing honey and made-with-honey products from those partners at retail stores nationwide.

And this September, we’ll celebrate

National Honey Month again with print and digital advertising, public relations efforts, influencer-driven awareness and social media activities. Our Honey Saves Hives initiative will see us continuing to partner with a variety of food and beverage brands dedicated to protecting honey bees. We may be biased, but we see a big opportunity for retailers to support this initiative, educating their shoppers about the importance of honey while driving added sales throughout National Honey Month. Interested retailers should reach out to learn more and to inquire about the support we can provide.

While specifics change from year to year, the message remains the same: Use honey. Protect honey bees. Help the planet.

PG: How can retailers incorporate honey into their merchandising and marketing plans?

CB: The National Honey Board is a go-to resource for grocery retailers. We have a wealth of information, consumer research, recipes, photos, and funding to help retailers promote honey. We’re at the ready to help them communicate this message to their customers: Honey — it’s good for you and good for the planet!

1Total US xAOC, Latest 52 Weeks Ending 11/05/2022, 2Sugar and Sweeteners Outlook report published by the United States Department of Agriculture (USDA) FOR MORE INFORMATION, BUZZ ON OVER TO THE NATIONAL HONEY BOARD!

ADVERTORIAL

Y Y-- -

There’s no shortage of consumer packaged goods companies that are doing their bit to help make the planet a better place for us to live, but the five companies profiled in the following pages are doing an especially stellar job in that department.

From ambitious goals to achieve net-zero greenhouse-gas emissions to innovative consumer-facing campaigns, Hormel Foods, PepsiCo, Procter & Gamble, Stonyfield, and Unilever have all placed more earth-friendly policies at the center of what they do. Such moves by these companies and many others are in direct response to consumers’ evolving attitudes toward sustainability. According to a recent report from on-demand consumer research program Glow, a Nielsen IQ partner, shoppers

By

are increasingly “shedding the brands that don’t meet their sustainability expectations, and moving to brands that better align with their values.”

Glow adds that younger consumers in particular are switching brands at much higher rates than those of other demographics, with brands leading in environmental, social and governance perceptions benefiting the most. This propensity for switching to more sustainable brands is especially high within food and grocery. The consumer researcher uncovered rates of between 30% and 40% in food

and grocery departments. The risk of switching was greatest in health and beauty, meat, beverages, and household products, but even among lower-risk categories like bakery and dairy, Glow cautions that “no business can risk losing up to a third of its customers!”

Given these figures, it’s imperative that companies get their sustainability stories out there, and all of the CPG businesses spotlighted by Progressive Grocer have done an admirable job of this. In fact, Dawn, a brand of Procter & Gamble, was identified as the most responsible food and grocery brand by consumers, according to Glow’s research, while Dove, manufactured by Unilever, came in fifth and Quaker, one of PepsiCo’s brands, was No. 10.

To find out what PG’s five profiled companies are doing right when it comes to sustainability, read on.

34 progressivegrocer.com OPERATIONS Sustainablity

These ve CPG all-stars are among the best at advancing eco-friendly strategies.

Progressive Grocer Staff

HORMEL FOODS CORP.

Last month, in a testament to its longstanding commitment to making the planet a better place to live, Hormel Foods Corp. was named to Barron’s list of the 100 most sustainable U.S. companies for 2023, coming in at No. 23. To come up with its sixth annual list, the business publication evaluated the 1,000 largest publicly traded companies across more than 200 environmental, social and governance performance indicators. Through its award-winning Our Food Journey program, Austin, Minn.-based Hormel strives to produce food responsibly by investing in its people and partners, improving communities and the world, and creating products that enrich peoples’ lives. The company also has an ambitious

set of corporate responsibility goals that it will aim to achieve by 2030, known as the 20 by 30 Challenge. This includes initiatives related to climate leadership, regenerative and sustainable agriculture, packaging sustainability, water stewardship, food security, and human rights.

“As a Fortune 500 global branded food company, we must take a leadership position in addressing climate change,” Tom Raymond, Hormel’s director of sustainability, tells Progressive Grocer. “One of our 20 by 30 challenge goals is our commitment to set a Science Based Target for the reduction of greenhouse-gas emissions by 2023. We sub mitted our materials into the Science Based Targets Initiative for validation in mid-2022, and we are currently in the active validation period. We expect to have an aggressive goal set that will include targets for our emissions and our supply chain this year.” Adds Raymond: “We know we have a responsibility to our team members, shareholders, customers, consumers and communities.

In fact, our 20 by 30 challenge goals are some of the most robust in the industry, and we are working hard to achieve them. As a company, we remain committed to continuous improvement, and these 20 qualitative and quantitative goals and commitments will help make the world a better place for everyone.”

PROGRESSIVE GROCER April 2023 35

masonways.com | 800-837-2881

Last year, Hormel rolled out Justin’s reduced-plastic nut butter jars as part of its move toward more sustainable packaging across its product portfolio.

Sustainability? We’re Living It. Alaska Seafood aligns with the highest global sustainability standards, and Nature-of course. AlaskaSeafood.org - RFMcertification.org

RFM Certified — An Eco-Label That Can Drive Seafood Sales

Progressive Grocer: What is RFM Certification and why is it important for seafood retailers?

Megan Rider: Responsible Fisheries Management (RFM) is one of the most credible and robust wildcapture sustainable seafood certification programs in the marketplace today. RFM Certification gives the entire supply chain including grocery retailers and the customers they serve proof that any seafood that carries the RFM logo comes from responsibly managed, certified sustainable fisheries. And it does that without charging licensing fees to use the logo, which most other seafood certification programs do.

PG: Do consumers really care about certification when they’re shopping for seafood?

MR: Absolutely! 46% of consumers overall and 55% of Milennials believe seafood certification is very/extremely important when making purchasing decisions. With 50% of Americans increasing their seafood consumption, proving that you source from certified sustainable fisheries is more important than ever it really can help make your store a destination for seafood shoppers.

PG: So, shoppers want the seafood they buy to be certified. But do they know what RFM means?

MR: Yes! Research conducted by Datassential for the RFM Certification Program shows that the RFM eco-label has a significant impact on purchase. 71% of consumers are willing to pay more for seafood with the RFM eco-label and 44% would pay up to 20% more!

PG: How does Alaska Seafood fit into the picture?

MR: That same Datassential research shows that origin matters to seafood shoppers. 64% of U.S. consumers want to know the source/origin of seafood they purchase. Even more important for grocery retailers, 73% of affluent U.S. consumers and 66% of all U.S. consumers are more likely to purchase when they see the word ‘Alaska’.

44% 71%

of consumers are willing to PAY O E for seafood with the RFM eco-label would pay up to 20% O E!

RFM recognizes that origin is a key motivator for seafood purchase, so the RFM logo always includes place of origin including for Alaska’s fisheries. 85% of consumers say including origin on RFM eco-label is important and 89% say the RFM ecolabel drives purchase.

CAST OUT TO US

Contact RFM at rfm@rfmcertification.org alaskaseafood.org • rfmcertification.org

p Al Q&A p Al Q& A SPONSORED

Contact ASMI at info@alaskaseafood.org

Datassential 2022

PEPSICO

Since PepsiCo is the largest food and beverage company in North America, and the second largest globally, a resilient food system is essential to its business. In March, the Purchase, N.Y.-based company revealed a $216 million multiyear investment in long-term strategic partnership agreements with three farmer-facing organizations — Practical Farmers of Iowa, Soil and Water Outcomes Fund, and the Illinois Corn Growers Association — to drive adoption of regenerative agriculture practices nationwide. The combined impact of these three partnerships is expected to support the accelerated uptake of climate-smart regenerative practices on more than 3 million acres and deliver approximately 3 million metric tons of greenhouse-gas emission reductions and removals by 2030. Based on progress to date, these collaborative efforts are expected to deliver more than 500,000 regenerative acres by the end of 2023.

PepsiCo is also combating the nation’s water crisis with the help of its Frito-Lay subsidiary. The companies have revealed a commitment of $3.3 million in funds toward water replenishment projects across North America. These projects will advance PepsiCo’s ambitious effort to become net water positive by 2030, which includes

reducing absolute water use and replenishing the local watershed with more than 100% of the water used at company-owned and third-party sites in high water-risk areas.

The company’s efforts have been recognized with the 2023 Industrial Water Reuse Champions Award, from the WateReuse Association, the U.S. Chamber of Commerce, Veolia and the University of Pennsylvania Water Center, for best-in-class water recycling and reuse programs inside and outside its plants.

Additionally, PepsiCo is applying its reuse strategy to packaging. The company unveiled its global packaging goal to double the percentage of all beverage servings it sells delivered through reusable models from 10% to 20% by 2030. Reuse is a critical component to meet PepsiCo’s aims of reducing virgin plastic per serving by 50% by 2030 and to become net zero by 2040.

To achieve these objectives, PepsiCo will expand its SodaStream business, both at home and in workplaces through SodaStream Professional; build out its refillable plastic (PET) and glass bottle offerings in partnership with PepsiCo bottlers; grow its fountain drink business with reusable cups; and accelerate growth in powders and concentrates.

PROCTER & GAMBLE

According to a recent Procter & Gamble study of U.S. consumers, more than half — 55% — said that they don’t make environmentally conscious choices at home as often as they’d like, so the Cincinnati-based CPG powerhouse decided to lend a helping hand through the third iteration of a popular initiative.