ON TOP OF THE WORLD

ALDI’s unlimited success with limited assortments

MEAT AND GREET

Boost beef sales to fulfill customer demands

FOR WHAT IT’S WORTH

Advanced pricing and promo tech yields results February

This year’s 25 honorees continue to prove that small(er) is not only beautiful, but also, in many cases, profitable

TOP GROCERY DELIVERY DISRUPTORS REVEAL THEIR SECRETS

2023 Volume 102, Number 2 www.progressivegrocer.com

THE INDEPENDENT DIFFERENCE 2023 OUTSTANDING INDEPENDENT: River Market Community Co-Op

ON TOP OF THE WORLD

ALDI’s unlimited success with limited assortments

MEAT AND GREET

Boost beef sales to fulfill customer demands

FOR WHAT IT’S WORTH

Advanced pricing and promo tech yields results February

This year’s 25 honorees continue to prove that small(er) is not only beautiful, but also, in many cases, profitable

TOP GROCERY DELIVERY DISRUPTORS REVEAL THEIR SECRETS

2023 Volume 102, Number 2 www.progressivegrocer.com

THE INDEPENDENT DIFFERENCE 2023 OUTSTANDING INDEPENDENT: River Market Community Co-Op

brands to beef up your meat case

Whether it’s premium Angus beef or traceable pork, shoppers’ expectations are ever-changing. Tyson Foods can help you meet their demands – and retain their business.

Select Chairman’s Reserve® Meats for premium, dual-tier options, Open Prairie® Natural* Meats for traceable beef and pork, and Star Ranch Angus® beef for delicious 100% Angus flavor. Within our brand portfolio, you’ll find solutions to meet your needs.

*Minimally processed. No artificial ingredients.

more from the Beef & Pork Experts

Beef and pork brands are just the beginning. We can help you keep your meat case stocked with case ready cuts, seasoned and marinated products and other innovative solutions.

But it’s not just our brands and products that make us the Beef & Pork Experts. We study trends, research changes in the marketplace and provide unmatched service and support to our retail customers.

Find out for yourself today. TysonFreshMeats.com/get-in-touch 1.800.416.2269

™/®/ ©2023 Tyson Foods, Inc. get

more from the Beef & Pork Experts

Beef and pork brands are just the beginning. We can help you keep your meat case stocked with case ready cuts, seasoned and marinated products and other innovative solutions.

But it’s not just our brands and products that make us the Beef & Pork Experts. We study trends, research changes in the marketplace and provide unmatched service and support to our retail customers.

Find out for yourself today. TysonFreshMeats.com/get-in-touch 1.800.416.2269

™/®/ ©2023 Tyson Foods, Inc. get

shaking up the status quo in new and exciting ways by facilitating food retailers’ omnichannel operations. Contents 02.23 Volume 102 Issue 2 12 NIELSEN’S SHELF STOPPERS Prepared Foods 13 MINTEL GLOBAL NEW PRODUCTS Natural and Organic Foods Departments 14 ALL’S WELLNESS The Food as Medicine Trend at Retail 60 EDITORS’ PICKS FOR INNOVATIVE PRODUCTS 62 AHEAD OF WHAT’S NEXT Higher Intelligence 6 EDITOR’S NOTE Navigating the ‘Never Normal’ 8 IN-STORE EVENTS CALENDAR April 2023 4 progressivegrocer.com COVER STORY The Independent Difference This year’s 25 Outstanding Independents honorees continue to prove that small(er) is not only beautiful, but also, in many cases, profitable. 16 38 OUTSTANDING INDEPENDENT: The Mildred Store

44 RETAILER DEEP DIVE Unstoppable ALDI

The fastest-growing U.S. grocer offers a value proposition shoppers can’t resist.

49 FRESH FOOD Bull Market

These strategies will boost beef sales to meet consumer demands in a changing marketplace.

8550 W. Bryn Mawr Ave. Ste. 200, Chicago, IL 60631 Phone: 773-992-4450 Fax: 773-992-4455 www.ensembleiq.com BRAND MANAGEMENT BRAND DIRECTOR John Schrei 248-613-8672 jschrei@ensembleiq.com EDITORIAL EDITOR-IN-CHIEF Gina Acosta gacosta@ensembleiq.com MANAGING EDITOR Bridget Goldschmidt bgoldschmidt@ensembleiq.com SENIOR DIGITAL & TECHNOLOGY EDITOR Marian Zboraj mzboraj@ensembleiq.com SENIOR EDITOR Lynn Petrak lpetrak@ensembleiq.com MULTIMEDIA EDITOR Emily Crowe ecrowe@ensembleiq.com CONTRIBUTING EDITOR Mike Duff ADVERTISING SALES & BUSINESS ASSOCIATE PUBLISHER, REGIONAL SALES MANAGER (INTERNATIONAL, SOUTHWEST, MI) Tammy Rokowski 248-514-9500 trokowski@ensembleiq.com REGIONAL SALE MANGER Theresa Kossack (MIDWEST, GA, FL) 214-226-6468 tkossack@ensembleiq.com BUSINESS DEVELOPMENT MANAGER Lou Meszoros 203-610-2807 lmeszoros@ensembleiq.com ACCOUNT EXECUTIVE/CLASSIFIED ADVERTISING Terry Kanganis 201-855-7615 • Fax: 201-855-7373 tkanganis@ensembleiq.com CLASSIFIED PRODUCTION MANAGER Mary Beth Medley 856-809-0050 marybeth@marybethmedley.com AUDIENCE LIST RENTAL MeritDirect Marie Briganti 914-309-3378 SUBSCRIBER SERVICES/SINGLE-COPY PURCHASES Toll Free: 1-877-687-7321 Fax: 1-888-520-3608 contact@progressivegrocer.com PROJECT MANAGEMENT/PRODUCTION/ART SENIOR CREATIVE DIRECTOR Colette Magliaro cmagliaro@ensembleiq.com ART DIRECTOR Bill Antkowiak bantkowiak@ensembleiq.com ADVERTISING/PRODUCTION MANAGER Jackie Batson 224-632-8183 jbatson@ensembleiq.com MARKETING MANAGER Rebecca Welsby rwelsby@ensembleiq.com SUBSCRIPTION SERVICES LIST RENTAL mbriganti@anteriad.com SUBSCRIPTION QUESTIONS contact@progressivegrocer.com CORPORATE OFFICERS CHIEF EXECUTIVE OFFICER Jennifer Litterick CHIEF FINANCIAL OFFICER Jane Volland CHIEF PEOPLE OFFICER Ann Jadown EXECUTIVE VICE PRESIDENT, CONTENT & COMMUNICATIONS Joe Territo EXECUTIVE VICE PRESIDENT, OPERATIONS Derek Estey PROGRESSIVE GROCER (ISSN 0033-0787, USPS 920-600) is published monthly by EnsembleIQ, 8550 W. Bryn Mawr Ave. Ste. 200, Chicago, IL 60631. Single copy price $14, except selected special issues. Foreign single copy price $16, except selected special issues. Subscription: $125 a year; $230 for a two year supscription; Canada/Mexico $150 for a one year supscription; $270 for a two year supscription (Canada Post Publications Mail Agreement No. 40031729. Foreign $170 a one year supscrption; $325 for a two year supscription (call for air mail rates). Digital Subscription: $87 one year supscription; $161 two year supscription. Periodicals postage paid at Chicago, IL 60631 and additional mailing offices. Printed in USA. POSTMASTER: Send all address changes to brand, 8550 W. Bryn Mawr Ave. Ste. 200, Chicago, IL 60631. Copyright ©2023 EnsembleIQ All rights reserved, including the rights to reproduce in whole or in part. All letters to the editors of this magazine will be treated as having been submitted for publication. The magazine reserves the right to edit and abridge them. The publication is available in microform from University Microfilms International, 300 North Zeeb Road, Ann Arbor, MI 48106. The contents of this publication may not be reproduced in whole or in part without the consent of the publisher. The publisher is not responsible for product claims and representations.

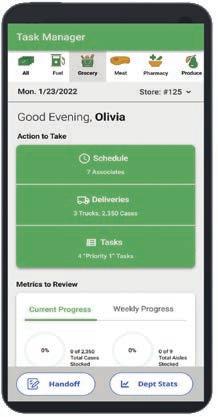

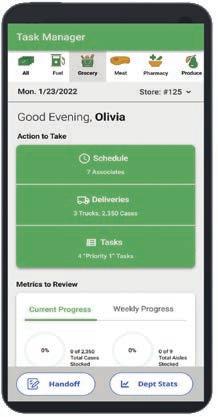

TECHNOLOGY

TECHNOLOGY

Next Grocery Tech Frontier

KUBRA Retail Cash Payments Network Grows Rite Aid has become the latest member.

The

49 56 44 IMAGE COURTESY OF ALDI

Many food retailers are reaping the benefits of using advanced technology to drive pricing decisions.

By Gina Acosta

Navigating the ‘Never Normal’

HERE ARE SIX BUSINESS IMPERATIVES FOR GROCERS IN 2023.

ow much can you cram into your brain after attending three of the retail industry’s biggest trade events in 12 days?

Quite a lot, it turns out, especially if you drink pints of coffee, walk 10 miles a day and talk to as many food retail leaders as possible.

Instead of feeling sleepy from travel, though, my time at CES in Las Vegas, NRF’s Big Show in New York City, and FMI’s Midwinter Executive Conference in Orlando, Fla., over a span of 12 days felt like an awakening. We’ve all been a little asleep since 2020, muddling through, waiting to get back to normal. Well, in-person events are decidedly back to normal, and for the grocery industry, it’s back to the “never normal,” a theme that technologist and MIT professor Peter Hinssen so eloquently introduced during his keynote at FMI Midwinter.

Top Priorities

FMI’s chief collaboration and commercial officer, Mark Baum, moderated a panel discussion at Midwinter with H-E-B President Craig Boyan, UNFI CEO Sandy Douglas, Unilever Global Chief Customer Officer/ Personal Care Terry Thomas, and Hunter Williams, partner in Oliver Wyman’s retail and consumer goods practices. The speakers outlined six business imperatives that will shape grocers’ and manufacturers’ priorities in 2023: workforce challenges, technology transformation, changing macro-economic conditions, evolving consumer behaviors, rising ESG expectations and supply chain disruption. Douglas stressed the importance of finding alternative ways to solve the labor crisis in grocery.

Despite the doom and gloom about inflation, labor shortages and slowing growth, grocery leaders have much to look forward to.

“I think there’s a public-policy opportunity for all of us to work on, which is basically workforce supply,” Douglas said. “How do we try to de-politicize the issue of immigration so that we widen the labor pool?”

Boyan expressed concerns about the American consumer “running out of fuel,” trying to absorb sticker shock at the grocery store. He mentioned that savings rates are at a 17-year low, and that credit card and household debt are growing at the fastest rate in 15 years. What happens when the consumer runs out of money?

“We know that high inflation, while it helps our sales and helps

some part of this industry, is basically a tax on households — and especially on low-income households,” he noted. “And so, when we think about the state of the U.S. household, the high inflation and spending that has drained their savings, the impact on the average household is going to be severe. We have to assume that growth and consumer spending in 2023 and beyond is going to slow. And I think it’s [incumbent] on everybody in this room, in this industry, to find ways to help the average household that’s under massive economic pressure, especially low-income” households.

Yet despite the doom and gloom about inflation, labor shortages and slowing growth, grocery leaders have much to look forward to. Food-at-home consumption keeps rising. The supermarket channel has become agile, innovative and more efficient. And opportunity abounds when it comes to automation, loyalty, private label, foodservice, retail media, data analytics, social commerce and new tech platforms.

“There are retailers positioned very effectively all over the marketplace,” Douglas concluded. “So if we pivot into this year of uncertainty, we have an opportunity to collaborate and tackle problems in a much more boundary-less way, so that the richness of the customer base continues to be strong and grows.”

Gina Acosta Editor-In-Chief gacosta@ensembleiq.com

6 progressivegrocer.com EDITOR’S NOTE

Want to fuel growth in your dairy category?

YOU’RE GONNA NEED MILK FOR THAT.

MILK IS FUELING TODAY’S CUSTOMERS AND DAIRY CATEGORY SALES!

It’s a Destination Category:

55% of consumers say it is a main reason for the trip.1

It’s a Traffic Driver:

92% of households buy fluid dairy milk at grocery stores.2

SCAN TO LEARN MORE:

It’s a Basket Builder:

Nearly 50% of stock-up trips contain milk.1

1. Kantar Shopper Journey Insights, June 2022, 2. IRI National Consumer Panel, 52 weeks ending 5-15-2022

African American Women’s Fitness Month

Alcohol Awareness Month Fresh Florida Tomato Month

National Arab American Heritage Month

National Fresh Celery Month National Pecan Month

S M T W T F S IN-STORE EVENTS

8 progressivegrocer.com 1 National Greeting Card Day April Fool’s Day 2 National Love Your Produce Manager Day National Peanut Butter and Jelly Day 3 World Party Day. Make customers aware that they can get all of their food and supplies for the big bash at your store(s). 4 National Vitamin C Day 5 National Body Care Day Passover begins. 6 National Açai Bowl Day. Provide instructions for how to make the healthiest version of this yummy dish. 7 Good Friday. Encourage associates who observe this holy day to mark it in the way that’s most meaningful to them. 8 National Catch and Release Day. Inform fishermen who abide by this practice that there’s plenty of premium seafood awaiting them at the nearest grocery store. 9 National Baked Ham with Pineapple Day Easter 10 National Cinnamon Crescent Day 11 National Barbershop Quartet Day. Hire a group to entertain your customers as they shop the store. 12 Deskfast Day. Offer ideas to make breakfast at one’s office or home desk more nutritious and delicious. 13 Passover ends. National Make Lunch Count Day 14 National Pecan Day. Yes, we know they’re popularly used in pies, but there are a range of other tasty baked goods that also feature these sweet, buttery nuts. 15 World Art Day. Put up inspiring images from local artists that your shoppers can enjoy and even purchase. 16 Day of the Mushroom. Ask customers for their favorite recipes starring these versatile fungi. 17 Go Fly a Kite Day 18 Piñata Day. Suggest that customers break one open at their next fiesta. 19 National North Dakota Day. This is the time to showcase the food traditions of the Peace Garden State. 20 International Pizza Cake Day. Be honest – who doesn’t want to make a cake out of pizza? 21 National Tea Day. Black, green, white, red or herbal, this perennial beverage, which can be enjoyed hot or iced, never goes out of style. 22 Eid al-Fitr Earth Day 23 Army Reserves Birthday. Pay tribute to all of the reservists in your area by offering a discount for those who serve. 24 National Bucket List Day 25 National Drug Take Back Day. Hold an event to encourage community members to dispose of prescription medications that they no longer need. 26 International Guide Dog Day. Profile your customers and associates who use these trained animals to generate greater awareness and understanding. 27 National Prime Rib Day. Run a special in the meat department on this great family meal option. 28 Occupational Safety & Health Day. Check with your associates that your business is complying with all regulations in this area. 29 National Supply Chain Day. Pay tribute to your partners that keep the products — both essential and fun — coming.

Day.

Calendar 04.23

30 National Raisin

This classic lunchbox snack is packed with sweetness and nutrients.

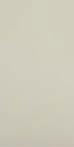

It can be easy to get caught up in trends and just focus on what’s new. Trendy and new feels fresh and can o ff e r an e xci ti ng wo rl d o f p o ssibili tie s. In the pet category, this can mean that r et ail e rs s ometime s o ve rl oo k o n e o f the largest categories in pet – premium pet food – which includes trusted, ic o nic bran d s like D o g Ch ow®, Ca t Ch ow®, Friski e s® an d Be n e ful®. In fact, Cat Chow is the number one dry cat brand in the U.S. based on dollar sales1 an d D o g Ch ow has t h e nu m b e r one SKU in the dry dog category2 These brands are true pet food powerhouses.

Th e p et ca te go ry is b ooming. Ove r t h e las t t hr ee years, th e p et p o pula tio n in t h e U.S. has als o gr own by a littl e mo r e than four percent and has added 7.5 million mouths to feed, which brings the total number of dogs and cats in the U.S. to 185 million. Consequently, t h e p et car e ca te go ry c o n ti nu e s to grow at near record highs. As of October 8, 2022 3 , the pet care category has seen a 16 percent increase in sales ve rsus t h e pr e vi o us year. This s t r o ng growth is also seen in the premium pet food category with many of Purina’s premium pet food brands showing double-digit growth with most actually e xc eed ing t h e tot al ca te go ry gr ow t h.

B u t wha t doe s t ha t mean f o r r et ail e rs? In the dog category, premium dry dog food has the second highest number of households, and the highest pound buying ra te. On ave rage, t h e pr emiu m dog food household purchases 139 pounds of dog food each year, which is 38 p o un d s mo r e t han t ha t o f t h e valu e dog buying household. That is a lot of dog food! The premium dry cat food category has the highest household

count with roughly 19.7 million households buying premium cat food in 20214 . On ave rage, th e pr emiu m d ry ca t h o us e h o l d s buy an ave rage o f 62 pounds of dry cat food a year, which is 63 percent more than super premium buyers.

Wh e n we l oo k a t gr o c e ry an d mass s to r e s, we als o kn ow t ha t t h e maj o ri t y o f puppy an d kitt e n own e rs s t ar t t h e ir p et s o ff wi t h pr emiu m d ry f ood nu t ri tio n. Puppy Ch ow® an d Kitt e n Ch ow® ar e t h e h o us e h o l d l ea de rs in puppy an d kitt e n nu t ri tio n, an d t h e s e brands are specially formulated to meet t h e uniqu e nu t ri tio n n eed s puppi e s an d kitt e ns have d uring t h e ir firs t year o f life to support their rapid growth and de ve l o p me nt . Wi t h such a large buying power, it is no wonder the premium segment has such a large impact on the total pet food category.

As we l oo k ah ea d to t h e i m pac t o f o ngo ing infla tio n, we kn ow t ha t t h e

premium pet food category will be ke y f o r c o nsu me rs an d r et ail e rs. Th e core consumers within the premium segment are the most loyal to their brand of any segment. This high degree o f l o yal t y an d c o nfi de nc e in t h e s e iconic brands means that premium pet f ood sh o pp e rs ar e n ot like ly to swi t ch. I t is i m p o r t ant t ha t r et ail e rs o ff e r a vari et y o f t h e pr emiu m f o r mulas these consumers prefer and in the sizes they want. Retailers carrying the premium dog and cat food products their consumers desire are able to turn shoppers into loyal consumers who kn ow t h e y do n’t have to l oo k b e yo n d yo ur s to r e to fin d wha t t h e ir p et s n eed . Ar e yo u all o ca ti ng th e right spac e in yo ur s to r e to valu e, pr emiu m, an d sup e r pr emiu m p et pr od uc t s? To l earn more, reach out to your Purina sales associate.

SUPPLIER PERSPECTIVES PET SPECIALTY SPONSORED CONTENT

Premium Brands Still a Powerhouse for the Pet Aisle By Joe Toscano, Vice President, Trade & Industry Development at Purina 1Niels en Dat a, AOC+PR+ECOM, lates t 52 weeks, ending 3/26/22 2Niels en AOC+PR lates t 52wks ending 3/26/22 3Niels en AOC + PR through 10/8/22 4Niels en Panel Dat a ending 1/1/22 Purina trademarks are owned by Société des Produits Nestlé S.A. Any other marks are pro p er t y of their resp e c ti ve owners.

Zip up beverage profits

With The Most Versatile System for Grab-and-Go Beverage Sales.

Zip it

Use actual product to set lane width from 2.00” to 3.75”. Slide product front-to-back to ‘ZIP’ tracks together in final position.

ZIP Track® is a cost-effective, modern merchandising system that forwards and faces its product offerings at all times. Add new facings with this easy to install and adjust system. Custom spring tensions and lane depths are available to fit any and all shelf and product needs.

Fill it

ZIP Track® maintains its width accurately for the entire depth of facing without the need for a rear anchor system.

Cross sell it

It’s not just for coolers or beverages. Use ZIP Track® in multiple categories to showcase many different types of product.

Trion Industries, Inc. | TrionOnline.com/ZipTrack | info@triononline.com | 800-444-4665 | ©2019 Trion Industries, Inc.

Zip up storewide profits

With The Most Versatile Merchandising Solution on the Market.

ZIP Track® is a cost-effective, modern merchandising system that forwards and faces product offerings at all times. Add new facings easily with this quick to install and adjust system. Custom spring tensions and lane depths are available to fit any and all shelf and product needs.

■ Zips together to fit any desired product size.

■ 2.00” to 3.75” lane widths possible.

■ Maintains accurate width for full depth of lane.

■ Custom spring tensions and lane depths easily accommodated.

Perfect for both food and non-food items Accommodates various size and shape packagesMerchandises health, beauty aids, and more

Trion Industries, Inc. | TrionOnline.com/ZipTrack | info@triononline.com | 800-444-4665 | ©2019 Trion Industries, Inc.

An economical shelf management solution for foods, non-foods, health and beauty aids, grab-and-go & single serve beverages and cooler applications.

Which cohort is spending, on average, the most per trip on breakfast sandwiches?

How much is the average American household spending per trip on various prepared food items versus the year-ago period?

12 progressivegrocer.com FRONT END

Latest 52 WksW/E 01/07/23 Latest 52 WksW/E 01/07/23 Latest 52 Wks YAW/E 01/08/22 Latest 52 Wks YAW/E 01/08/22 Latest 52 Wks YAW/E 01/09/21 Latest 52 Wks YAW/E 01/09/21 Basket Facts

Shelf Stoppers Prepared Foods

Source: Nielsen, Total U.S. (All outlets combined) — includes grocery stores, drug stores, mass merchandisers, select dollar stores, select warehouse clubs and military commissaries (DeCA) for the 52 weeks ending Jan. 7, 2023

Nielsen Homescan, Total U.S., 52 weeks ending Dec. 31, 2022 Complete Meals Sandwiches Salads Soups Appetizers Total Department Performance Top Prepared Food Categories by Dollar Sales $63,200,587,755 $55,953,959,742 $52,594,113,806 Prepared Foods Generational Snapshot

Source:

Millennials $10.23 Gen Xers $10.02 Boomers $9.66 The Greatest Generation $9.78

on all prepared food

up 10.1%

a year

$8.15 on appetizers, up 11.2%

with a year ago $8.90 on complete meals, up 13.0%

with a year ago $5.33 on mac and cheese, up 11.4%

a year ago Cross-Merch

Diapering Needs Meal Combos Toaster Pastries Fully Cooked Meat Writing Tools and Supplies Sweet Snacks Snack and Variety Packs Marshmallows Feminine Care $8,000,000,000 $7,000,000,000 6,000,000,000 5,000,000,000 4,000,000,000 3,000,000,000 2,000,000,000 1,000,000,000 0

Source: Nielsen Homescan, Total U.S., 52 weeks ending Dec. 31, 2022 $10.57

items,

compared with

ago

compared

compared

compared with

Candidates

Natural and Organic Foods

Market Insights

According to the Organic Trade Association, organic sales surpassed $63 billion in 2021, including $1.4 billion in growth from 2020. The vast majority (90%) of these sales were from food, which experienced about 2% growth.

Food and beverage accessibility complications related to inflation and supply chain perils had consumers re-evaluating necessary versus discretionary spending and challenging preferred product purchases, although consumers who can afford to do so will likely continue budgeting for natural and organic purchases.

More than half of consumers engage with natural products, and more than a third engage with organic in some capacity, indicating that natural and organic brands have their foot in the door with a significant portion of the general population — and have room to grow.

Key Issues

Half of consumers agree that natural and organic foods don’t stay fresh as long as conventional foods, compounding the financial stress that comes with natural and organic premiumization, and consequently increasing hesitation to fully engage with natural and organic.

Production methods may be what sets organic apart, but perceived personal health benefits are what move the needle: Half of consumers who engage with organic do so because they perceive it to be healthy, while about a third do so to avoid adulterants (artificial ingredients, 38%, and pesticides, 35%). Environmental friendliness resonates less, at 24%, and animal welfare lower still, at 13%.

Consumers’ blended product-type repertoires — i.e., conventional, natural, organic — according to food and beverage category indicate that their expectations and needs vary by category, and that their depth of engagement is subject to change. Natural and organic brands may have consumers’ attention in one or two categories, but not others, indicating that differentiating factors for each product need to be communicated to persuade even those already on board with natural and/or organic.

Organic sales surpassed $63 billion in 2021, including $1.4 billion in growth from 2020.

Source: Organic Trade Association

What Consumers Want, and Why

By helping consumers get creative and make the most of what they have through thoughtful leftover use, storage methods that maximize lifespan, and more, brands can align themselves with consumers’ best interests in a way that is costeffective for all parties and may alleviate some financial strain (and hesitation) on consumers’ end.

Getting more consumers on board with environmental impacts — and therefore advancing the scale and potential influence of organic — will come from marrying human health with environmental impact under one umbrella that’s “better for us.”

Brands that don’t take the time to clearly communicate their products’ benefits run the risk of being overlooked or considered not worth the price; this is especially true for organic brands, whose penetration is lower relative to natural and conventional, and whose engagement has a steeper financial barrier.

PROGRESSIVE GROCER February 2023 13 MINTEL CATEGORY INSIGHTS Global New Products Database

FOR MORE INFORMATION, VISIT WWW.MINTEL.COM OR CALL 800-932-0400

By Karen Buch, RDN, LDN

The Food as Medicine Trend at Retail

GROCERS HAVE A MASSIVE OPPORTUNITY TO PROVIDE SOLUTIONS IN THIS AREA.

“Let food be thy medicine and medicine be thy food.”

– Hippocrates, circa 400 AD

lthough there’s no evidence that the Greek physician ever uttered this fa mous quote, the notion highlights the longstanding importance of nutritious foods in the prevention and management of disease.

Over the past 25 years, supermarket-based retail programs — designed specifically to support the health and wellness of customers, associates and surrounding communities — have been established, shaped and spearheaded by innovative registered dietitian (RD) pioneers.

Retail RDs pair science-based knowledge of how food, nutrition and lifestyle can either contribute to disease development or help maintain and restore health with educational selling strategies and tactics to measurably impact consumer choice at the point of purchase. As retail RDs started to expand into full-time, consumer-facing positions, they also used multimedia communications to reach very broad audiences with food and nutrition guidance via broadcast and in-store television, broadcast and in-store radio, custom magazines, in-store point-of-purchase communications, ad messaging, live events, and retailer websites.

Momentum picked up in the early 2000s as more and more retailers recognized health and wellness as a purchase driver and sought to establish points of differentiation in the well-being space. Tactics such as in-person classes, children’s education tours, blogging and video communication gained traction in step with burgeoning social media.

Although the retail health-and-wellness landscape has expanded and contracted in pockets of the grocery industry, commonalities remain consistent, including digital and in-store path-to-purchase marketing efforts, customer engagement and personalized food and nutrition education, and use of incentives or prescriptions to purchase better-for-you foods and medically tailored meals. Historically, layered approaches tend to have the highest degree of impact.

Defining and Measuring Food as Medicine at Retail

As retail RD leadership in Food as Medicine initiatives has grown, so have the efforts to define, enhance and measure the value and effectiveness of collective Food as Medicine programming. Beginning in 2013, select retail dietitians from noncompeting retailers worked together to co-author the first edition of the Supermarket Business and Industry Skills to Thrive in Retail Dietetics Certificate of Training; it launched in 2015 as a tool for the next generation of retail RDs, covering how to navigate the retail landscape, define roles and responsibilities, expand

More than 48 million households include someone whose diagnosis can be managed in whole or in part by diet and other lifestyle choices. These households represent $268 million in annual grocery sales.

reach, and use data-driven metrics to communicate return on investment. In 2021, the Academy of Nutrition and Dietetics approved a definition of Food as Medicine: “A philosophy where food and nutrition aids individuals through interventions that support health and wellness.” In 2022, a new Certificate of Training program was launched, Excelling in the Retail Food Industry. In conjunction, Food as Medicine in the Retail Setting was developed as a resource guide. In addition, a new Nutrition in Food Retail curriculum was established for dietetic students and interns.

Food as Medicine: The Retail Opportunity

Food as Medicine bridges the gap between traditional medicine and established foodbased prevention and treatment. Health care systems, health insurers and a growing body of researchers are increasingly engaging in Food as Medicine. It is critical for food retailers to improve and expand current health-and-wellness offerings. More than 48 million households include someone whose diagnosis can be managed in whole or in part by diet and other lifestyle choices. These households represent $268 million in annual grocery sales. Food retailers have a massive opportunity to provide solutions, from prevention to management through personalized medical nutrition therapy and individually tailored meals, help at the pharmacy counter, expert guidance when navigating the food aisles, and so much more.

Karen Buch RDN, LDN, is a registered dietitian/nutritionist who specializes in retail dietetics and food and culinary nutrition communications. One of the first supermarket dietitians, she is now founder and principal consultant at Nutrition Connections LLC, providing consulting services nationwide. You can connect with her on twitter @karenbuch and at NutritionConnectionsLLC.com.

14 progressivegrocer.com

ALL’S WELLNESS

Red Hot Seafood Sales

Wild Alaska Sockeye Salmon

Wild Alaska Sockeye Salmon

Wild Alaska Sockeye Salmon

AlaskaSeafood.org

This year’s 25 honorees continue to prove that small(er) is not only beautiful, but also, in many cases, profitable.

By PG Staff

It’s often the way of things that the big guys in the industry hog much of the media attention — think of those two grocery behemoths whose impending merger set off a veritable feeding frenzy among members of the press — but independents also deserve their time in the spotlight. While they may not be able to compete with larger chains in terms of scale, many have perfected the fine art of making themselves beloved and indispensable members of their respective communities, and this approach often helps to boost their bottom lines.

As an example of this, look no further than Byron’s and Cambridge Village Markets, in upstate New York, which, when faced with supply chain woes that bedeviled even the big-box stores, found unconventional sources to keep their shelves stocked, such as restaurant suppliers that would to “a staff focused on taking care of customers from the moment they walk through the door.”

have otherwise been unable to move product during the height of the pandemic. The stores, operated by Byron Peregrim, also kept customers in the loop daily via social media on stock availability. According to Peregrim, this in itself lifted sales more than 35% over the prior year, and two years on, they’re still up 20%-25% over previous years. He proudly adds that throughout it all, the stores never raised their margins, instead growing profits via “hard work and added sales.” These added profits subsequently enabled the stores to give back even more to their local communities, completing the circle of trust between the stores and their shoppers.

In another case, when a Wegmans Food Market opened a few miles away from Harvest Market, in Hockessin, Del., in spite of predictions from a consultant of plunging sales, the single-store grocer closed out the year up 11%. The indie attributes this win

Independents’ gains aren’t just monetary, however. Gwen Christon’s store, Isom IGA, in Isom, Ky., may have been destroyed by a devastating flood, but in the aftermath, she and her business were inundated with donations and offers of help to rebuild the supermarket, which had long been a welcoming community hub and will be again.

That’s the true differentiating factor of independent grocers — their ability to bring people together through food in unique ways that reflect their local areas. Despite their many differences, that quality is one shared by each of Progressive Grocer’s 25 2023 Outstanding Independents. Read on to find out more.

16 progressivegrocer.com COVER FEATURE 2023 Outstanding Independents

2023 Outstanding Independents

Barons Market

Headquarters: San Diego

Number of Stores: 9

Local family-owned independent grocer Barons Market has always thought of its employees as part of its extended family, so in a year when labor shortages were plaguing the grocery and other industries, the food retailer put employees at the forefront of its operations.

Barons’ LEAD program not only focuses on teaching employees the ins and outs of grocery management, but also helps them find the passion in what they do. In 2022, the expansion of the program, which now has more associates participating than ever, resulted in the creation of 10 new assistant manager positions across Barons’ nine stores.

“This all stems from our core value that our employees are our No. 1 asset,” notes Barons in its Outstanding Independents submission. “The key is our culture. We’re so proud that we’ve built a company culture that encourages creativity, passion and engagement among our team. We’ve created a work

Bi-Rite Family of Businesses

Headquarters: San Francisco

Number of Stores: 2

Amid marking its 25th year under the leadership of second-generation owner Sam Mogannam and looking to open its third market in San Francisco, Bi-Rite Family of Businesses is touting its central role as an incubator. From being an early collaborator with technology partners such as Instacart and an AI-based inventory management startup, to helping local restaurants launch and scale their CPG products, the indie has offered its neighborhood stores, staff and data as resources in service to its mission of Creating Community Through Food. Through such efforts, Bi-Rite believes that it can help other independent retailers, local entrepreneurs and consumers have a better experience as part of its responsibility to create a better food system.

environment where employees feel excited to come to work every day. We want our employees to truly love what they do, and if they don’t, we beg them to find another job.”

The company points out that while it’s always had such employee benefits as health insurance, an employee discount, bonuses and matching 401(k) contributions, this past year it introduced dental insurance for all full-time

employees, increased the employee discount from 10% to 15%, and added vacation time for all employees, no matter their position.

“Barons Market will always be an employee-focused company,” the grocer asserts in its submission. “We believe that when our employees are happy, our customers are happy, and this will have a ripple effect among the communities that we are in.”

18 progressivegrocer.com

COVER FEATURE

* THE ULTIMATE LIGHTER FOR HARD-TO-REACH PLACES MAXI CLASSIC®, AMERICA’S SAFEST & LONGEST-LASTING LIGHTER1 W ® q TO ORDER, VISIT NEWREQUEST.BIC.COM LIGHT UP YOUR SALES WITH QUALITY AND SAFETY. © 2022 USA S T 06484 1 fix -fl - fi b b z ; *S : R N -MULO 52 k 06/05/22

Bi-Rite’s most important incubator activities, however, are the ones that happen behind the scenes in collaboration with its community partners. An example of this is nonprofit cooking school 18 Reasons’ Nourishing Pregnancy Program.

In early 2021, Bi-Rite wanted to develop a small food-box program to increase food security for local families. At the same time, 18 Reasons was designing its Nourishing Pregnancy program, working within the BIPOC community to boost food access, health and well-being. The program is a free four-month pregnancy and postpartum cohort series featuring online cooking classes, weekly grocery deliveries, and support classes taught through a cultural lens by Black- and Latinx-identifying facilitators.

Bi-Rite and 18 Reasons serendipitously joined forces to launch the first cohort in June 2021, with 22 participants. The grocer’s role in the program included offering recipe consultation and grocery guidance to the Nourishing Pregnancy program director, food sourcing and procurement, providing space for dry good storage and weekly food-box packing, and identifying a delivery/logistics partner to ensure that food boxes were delivered directly to participants, thereby helping to eliminate common barriers to accessing healthy food. Bi-Rite also held a point-of-sale fundraiser for the program.

Last year, Nourishing Pregnancy hosted three cohorts and served 96 participants. Despite inflation and supply chain issues that challenged the entire industry, Bi-Rite’s team continued to source ingredients for the weekly food boxes and evolve operations to increase efficiency.

The company’s work in the past year has helped create capacity within the program for 18 Reasons to further expand it in 2023. As the program grows to accommodate four cohorts of 60 participants each, the physical space needed for the weekly grocery boxes has exceeded Bi-Rite’s footprint, so Nourishing Pregnancy will team with a new wholesale grocery partner to handle most of the weekly grocery-box sourcing and packing. This move also allows the Nourishing Pregnancy staff to allocate more time to programming, further enhancing the program’s impact.

Rather than expressing sadness at losing a trusted collaborator, Bi-Rite notes that “there’s no greater reward for its incubator efforts than having a community partner outgrow them and be able to serve even more people within the community.”

BriarPatch Food Co-op

Headquarters: Grass Valley, Calif.

Number of Stores: 1

Things have been busy at BriarPatch Food Co-op. Long considered by its Northern California community as a trusted source for high-quality, fairly produced natural and organic local products and food information, the cooperative has striven to keep its quarterly magazine, The Vine, relevant by providing food education and tips on how to prepare and access healthy food, along with stories about the people and places tied to the origins of sustainable food.

The magazine, featuring all original content, is produced entirely in-house by a group within the store’s marketing team, despite the fact that creating a “scratch” magazine requires significant resources for an independent grocery store. In 2021, faced with the dramatic increase in the cost of paper and the store’s commitment to improve its carbon footprint, BriarPatch opted out all 5,000 of its print subscribers and invited them to opt back in via email. Now only 250 people receive The Vine via mail, and costs have halved. This gave the team the opportunity to improve the magazine’s digital version: QR codes link print readers to additional content, and the digital version is entirely reformatted on a platform that caters to mobile and tablet users.

Additionally, since BriarPatch’s volunteer program, PatchWorks, launched in 2020, it has more than doubled the number of volunteer hours donated in the local community, making a tangible difference to nonprofits struggling in the pandemic’s wake.

Currently, 16 Nonprofit Neighbor organizations benefit from the program, among them local food banks, environmental organizations, a farmers’ market, a homeless shelter, and an organization dedicated to diversity, equity and inclusion. Those who volunteer at approved nonprofits receive shopping discounts in return for their good deeds, while groups enrolled in the program submit volunteer hours to BriarPatch and pledge to promote PatchWorks through their marketing channels. This cross-networking gets the word out and connects people in the community like never before.

Collectively, volunteers have worked more than 20,000 hours since 2020 — with their labor valued at $600,000-plus — and earned more than $40,000 in shopping discounts. What’s more, at least three volunteers have been hired by the nonprofits for which they volunteered.

20 progressivegrocer.com

COVER FEATURE

2023 Outstanding Independents

www.mercatus.com

solutions@mercatus.com

Offer a seamless mobile experience that drives cart conversions, order frequency, and customer retention with the all-new Mercatus Mobile app.

Redefine Mobile Customer Convenience

2023 Outstanding Independents

Byron’s and Cambridge Village Markets

Headquarters: Schuylerville, N.Y.

Number of Stores: 2

During the height of COVID, which exacerbated lingering supply chain issues, Byron’s and Cambridge Village Markets were able to increase their business dramatically by striving to find sources to restock their shelves at a time “when the big-box stores struggled,” in the words of President Byron Peregrim.

“For instance,” explains Peregrim in his Outstanding Independents submission, “we would order any type of bathroom tissue available, and if it was in 6-packs or higher, we would open the packages and make up 4-packs that we would sell to our customers, with a limit of one per day, so all had bathroom tissue. We were fortunate to only be out of stock a day here and there until our next truck came in.” He adds that his stores were also able to get many deals from restaurant suppliers that needed to move out product, enabling the independent “to pass along a lot of great deals to our customers.”

Every day, shoppers were kept informed via social media of the status of the stores’ shelf stock. According to Peregrim, “This in itself helped increase our stores’ [sales] 35%-plus over last year, and two years later, they’re still up 20%-25% over previous years. I have no doubt that our increase is due to finding product availability, no matter who the manufacturer might be; our staff, for working through unknown times, when they could have easily opted out; and gaining trust and respect from our everyday regular customers and the hundreds, or maybe even thousands, of new customers we gained because of our honesty.”

Not once did the stores increase their margins, instead opting to grow their profits “through hard work and added sales.” Through these added profits, they were able to give back even more to their local communities and raise employee wages various times, instead of just during their reviews. They were also able to complete several capital projects, which gave back money to their local community job force.

“COVID, obviously not being a good thing, really changed our business model and gained our customers’ trust and appreciation,” notes Peregrim, adding that his stores continue to find sources for products that are still hard to find, giving their customers the best choice possible.

indie follows some unique practices that differentiate it from every other competitor around, regardless of size.

In the area of community support, for instance, during every holiday when the stores are closed – Thanksgiving, Christmas and Easter – the grocer provides free food in front of its locations. “We set up about 20 key items outside of our stores for customers to take as needed,” explains Charley in his Outstanding Independents submission. “We understand that people forget an item or two [and] not being open can be tough [for them], so we set that up outside. There is no requirement to pay a penny for anything you take. We have a sign next to the free product that describes what nonprofit we are supporting, with a QR code customers can scan to donate directly to nonprofits we think are great assets for our region.”

Another unique thing that Charley Family Shop ’N Save does is communicate regularly with its community through its social media accounts in a way “that would be impossible for a large company to match,” asserts Charley. The company discusses the professional accomplishments of individuals, posts pictures, and bonds with the community over various momentous life events. As well as sharing the good, however, the company doesn’t shy away from discuss challenging situations directly with the community. “We’ve had Facebook Live videos talking about specific challenges in the supply chain, categories we are having a hard time stocking and what the future looks like for those items,” says Charley, who adds that the social media channels also feature giveaways and product-sampling videos.

What’s more, all of these videos come from Charley himself. “These aren’t produced by a marketing firm; they are very grass-roots, and it shows,” he notes. “There is no filter between [my] mouth and what is going on in the industry. It fosters trust between our company and the community.”

This consistent activity on social media is reinforced by the daily presence of Charley and his brother Mike in the stores, where they regularly interact with customers.

22 progressivegrocer.com

COVER FEATURE

DeCicco & Sons

Headquarters: Pelham, N.Y.

Nunber of Stores: 10

What started nearly 50 years ago as a family-run storefront in the New York City borough of The Bronx has transformed into a multigenerational food retail destination in New York’s Westchester County. DeCicco & Sons now has 10 locations and prides itself on exemplary customer service, world-class food selections ranging from specialty goods to freshly prepared meals, and a commitment to the communities it serves.

Customers praise the retailer for its vast selection of fresh produce, its well-appointed cheese and deli counters, and imported Italian goods, as well as for its friendly associates and owners who frequently take the time to walk the aisles and speak with customers. The grocer has won accolades for its Italian bakery, beer selection and catering division, but today it’s focused on much more than just the

Dom’s Kitchen & Market

Headquarters: Chicago

Number of Stores: 2

After making its Windy City debut in the summer of 2021, Dom’s Kitchen & Market has made a splash as an omnichannel food emporium that focuses on food and community. The grocer has

food and beverages that it stocks.

As the company expands, renovates existing sites and opens new locations, it has consistently been at the forefront of innovative, environmentally friendly building solutions. Energy and water efficiency are top priorities for the company, and during the construction process, DeCicco & Sons uses post-consumer glass, as well as reclaimed brick and wood, along with employing other means to minimize water usage and

and an app, and also opening a much larger second location in November of last year. The new store, in Chicago’s Old Town neighborhood, features updated grocery technology like digital menu boards, electronic shelf labels, self-checkout and self-order kiosks.

Dom’s is spearheaded by Chicago grocery veterans Don Fitzgerald, Bob Mariano and Jay Owen, whose team is committed to highlighting local

offset its carbon footprint. Additionally, the company is one of the first in the country to test and use geothermal wells combined with natural refrigerant to reduce electricity use and cut emissions.

DeCicco & Sons also has three large solar panel arrays at select locations, with two more in the pipeline. The grocer is proud to extend its commitment to quality beyond its food and services, and into the realm of renewable and sustainable energy.

products and entrepreneurs. The customer-favorite bakery stocks baked goods from some of the most popular bakeries in Chicago, and the stores’ category managers seek out emerging local brands to help curate a uniquely local and global experience for shoppers.

Dom’s executive chef creates a menu of freshly prepared, globally inspired foods, including Roman-style pizza, sushi and poké bowls, as well as Italian main courses that complement the retailer’s signature sandwiches, salads and burgers. The company also partners with chefs across Chicago to bring unique experiences to its customers, and incorporates local ingredients into its menu items.

In addition to its commitment to great food and supporting local purveyors, Dom’s gives back to the communities it serves by regularly donating to and volunteering at the Greater Chicago Food Depository and Nourishing Hope. As it aims to open 15 new stores by 2025, the grocer also plans to create thousands of new jobs – in addition to the 250 jobs it created last year.

PROGRESSIVE GROCER February 2023 23

2023 Outstanding Independents

Dorothy Lane Market

Headquarters: Dayton, Ohio

Number of Stores: 3

As the Southwest Ohio specialty grocer enters its 75th year in business, Dorothy Lane Market (DLM) remains focused on its endless quest to innovate, according to CEO Norman Mayne. The executive believes that DLM’s successes wouldn’t be possible without the people who have been part of the journey, including his entire family, the stores’ associates, its vendors and especially its community of customers.

“Together, we’ve not only served up great food traditions, but we’ve had a lot of fun doing it along the way,” Mayne says. “We’ve always tried to create faster than the competition can steal. As a result, we try things that others won’t, and that leads to not only unique promotions and business practices, but items like the Killer Brownie and

Fareway Stores Inc.

Headquarters: Boone, Iowa

Number of Stores: 133

From South Dakota to Illinois and in five other states in between, Fareway Stores is on a mission to provide the highest-quality products while treating customers like family and valuing its dedicated employees. The family-owned grocer is known for its

our killer strategy to develop signature favorites in every aisle and department.”

Mayne took over day-to-day operations at DLM at just 23 years of age, and he’s been focused on selling great food ever since. The retailer credits its rich history as the core of everything it does, counting multiple generations of associ-

experts who cut, prepare and package product to customers’ specifications, as well as its farm-fresh produce and topnotch customer service.

Fareway had a busy 2022 that included the opening of three Meat Market locations throughout its footprint; these feature the grocer’s signature high-quality meat and a full-service butcher counter. The year also brought Fareway a high school registered-apprenticeship program for meat cutting in Indepen-

ates among its ranks. These elements have helped make DLM a Dayton mainstay, with loyal customers stopping in to take a cooking class, pick up a prepared meal for dinner, order a gourmet cup of coffee, or even stroll the grocery aisles with a glass of wine or beer in hand.

Introduced in recent years, the DLM Good Neighbor Program is one of the main ways that the grocer supports its local community. Loyalty program members can choose a nonprofit organization from a list provided by the grocer to have their purchases credited toward that group. Hundreds of thousands of dollars have been donated to date.

dence, Iowa, and the acquisition of the 20,000-square-foot Brick Street Market and Café near Des Moines.

After adding an e-commerce platform in 2020, the indie retailer made further tech moves last year with the addition of Venmo and PayPal as in-store payment options. Fareway has also worked with energy partners to install electric vehicle-charging stations and solar panels in key store locations, in addition to installing a 1-megawatt solar facility adjacent to its corporate campus.

Additionally, Fareway has rescued and donated more than 1.1 million pounds of food and recycled more than 400 tons of plastic shrink wrap, 12.5 tons of cardboard and 4.5 million plastic sacks. The grocer has also become a steward for smaller communities in Iowa through a partnership with the State of Iowa Economic Development Authority that allows the company to build smaller store models in communities of around 5,000 people. Further, Fareway makes monetary donations to Variety-the Children’s Charity, the Muscular Dystrophy Association, the U.S. Marine Corps Toys for Tots program and other local community initiatives.

24 progressivegrocer.com

COVER FEATURE

February 26-28, 2023

February 26-28, 2023

Caesars Forum Convention Center, Las Vegas

Caesars Forum Convention Center, Las Vegas

where grocers gather

40+ sessions led by retailers for retailers — all designed to give you actionable ideas to drive

Over 300 exhibitors representing the diverse range of product categories you need to stay updated on new products and innovations.

Innovative and exciting special events — spanning from receptions and networking functions to competitions and awards — provide valuable opportunities to engage with your peers.

TheNGAShow.com In Partnership With: CO-LOCATED WITH:

2023 Outstanding Independents

Gristedes/D’Agostino’s

Headquarters: New York

Number of Stores: 30

The names Gristedes and D’Agostino’s are synonymous with the New York City grocery landscape, and the 132-year-old combined supermarket chain prides itself on offering a wide selection of local foods and goods that support the community it serves. At the helm of Gristedes/D’Agostino’s is Joe Parisi, a seasoned food and grocery retail professional with more than 40 years of experience in the industry.

Parisi and his team have worked hard to maintain the success of the business despite recent hurdles, and they’re adamant about the safety and security of all stores, even doubling the number of security guards in the past year.

Despite its age, the grocer is highly technically savvy and innovative, having recently refreshed its enterprise point-of-sale system in an effort to drive greater efficiencies from a speed and reporting standpoint. The company has also made significant investments in its e-commerce strategy, offering a variety of channels and methods to enable New York metro-area residents to shop with Gristedes/D’Agostino’s, such

Harvest Market

Headquarters: Hockessin, Del.

Number of Stores: 1

The first thing that shoppers notice about Harvest Market is a big sign at the front of the store that reads: Your Community Grocer. This 27-year-old indie operator specializing in local, organic and specialty foods squeezes more than $9 million in annual sales out of a 6,000-square-foot storefront. The company knows that it can’t match the size, selection and buying power of the chains, but it strives for excellence in everything it does — successfully. In recognition of its efforts, Harvest Market has earned two consecutive top workplace awards from the Wilmington News Journal and Energage.

When a Wegmans Food Market opened a few miles away last October, Harvest Market worried that customers might defect. They did not. Despite predictions from a consultant that it might see as much as a 15% drop, the grocer closed out the year up 11%. According to Harvest Market, this is because it has “a staff focused on taking care of customers from the moment they walk through the door.”

Harvest Market quickly delivers on customer requests for new products and special orders. It developed a popular safety protocol during the peak of the pandemic. Harvest Market staff develops “how are the kids?” relationships with many customers, and they reward the retailer with a $55 average basket size.

Another key to the grocer’s success is its prepared food kitchen, which produces restaurant-quality offerings across categories such as soups, salads, sandwiches, sides and

as Freshop, Uber/Cornershop and Instacart.

On the corporate responsibility side, the company and its parent, Red Apple Group, have raised millions of dollars for Tunnel to Towers, a group that helps provide mortgage-free homes to Gold Star and fallen first-responder families with young children, and that builds custom-designed smart homes for catastrophically injured veterans and first responders.

baked goods. The kitchen is 3-Star Green Restaurant Association (GRA) Certified, and one of only seven kitchens ranked by the GRA that has earned more than 90 points for ingredient quality and sourcing.

Harvest Market was founded in 1995 as a high-quality community grocer, a mission it’s still fulfilling to this day.

26 progressivegrocer.com

COVER FEATURE

Healthy Living

Headquarters: South Burlington, Vt.

Number of Stores: 3

Founded by Katy Lesser in the 1980s and now co-owned by her two adult children, Healthy Living has always been — and remains — ahead of its time. The grocer, with locations in South Burlington and Williston, Vt., and Saratoga Springs, N.Y., was a pioneer early on by investing in ordering and inventory management technology. Lesser started the business without formal training, going up against conventional supermarkets before natural foods were mainstream.

The company’s three stores run on 100% renewable energy sources, and its cafés offer from-scratch prepared foods crafted by a renowned chef. The grocer offers a Core Shopper loyalty program that aims to teach customers that healthy food is accessible, affordable and “the right way to go.” E-mails, blog posts and more written by Healthy Living leadership further the company’s educational work, providing tasty recipes and facts about various grocery and wellness items. The retailer also has strict product standards, prohibiting foods that have added hormones, antibiotics, artificial and trans fats, high-fructose corn syrup, artificial sweeteners, bleached or bromated flour, or artificial colors, flavors and preservatives.

Last year, the retailer’s Together We Can Help philanthropy program resulted in donations totaling $91,146.56 — given directly to nonprofits helping neighbors in need. During the COVID-19 pandemic, Healthy Living showed tenacity, drive and innovation by managing to open a third location, in Williston, despite operational challenges.

Healthy Living employs 300 workers across Vermont and New York, consistently adding talent to its roster and furthering its mission of exemplary customer service and hospitality for an exceptional shopping experience. The company is also focused on nurturing a positive work culture by offering competitive pay, benefits and other opportunities for staff. In short, Healthy Living is a great place to work, shop, learn and engage with the community.

Isom IGA

Headquarters: Isom, Ky.

Number of Stores: 1

More than six months ago, Gwen Christon’s life changed forever. Her IGA supermarket, in Isom, Ky., was destroyed by storms, which sent more than 6 feet of floodwater into her store. Christon, who has worked in the store since 1973 and owned it since 1998, runs the only full-service supermarket in a 12-mile radius of that part of Appalachia, and she employs more than 20 people. As such, she is one of the largest employers in the town, part of an economically challenged region.

Before the flood, Christon had been continually investing in her store and her customers by installing self-checkout and energy-efficient cases, lights and solar power. Christon’s store was the heart of Isom, a community within a community, providing a place where people form connections and friendships, gather in good times and bad, and always feel welcomed.

So it comes as no surprise that immediately after the flood, the Isom community rallied behind her. Donations and volunteers came flooding in. The store’s parking lot became a hub for the Isom community. Christon’s team worked with World Central Kitchen and Mercy Chef Kitchen to feed hot food to 10,000 neighbors forced from their homes. People lined up for family meals every day for a month. Working with local groups, Gwen’s team also ensured that everyone would have their food needs met for Thanksgiving.

Christon’s inspiring story was featured in Progressive Grocer, on “Good Morning America” and NPR, and in other national media. Today, Christon’s new store is under construction, and she recently told NPR that she’s well on her way to planning her store’s reopening celebration on April 1.

“This is my family, and the people of Isom are my people,” Christon said in the NPR interview. “We work hard to make everyone’s life easier and more convenient for them. It’s what we do.”

PROGRESSIVE GROCER February 2023 27

2023 Outstanding Independents

John’s Market

Headquarters: Troy, Kan.

Number of Stores: 1

John’s Market, in Troy, Kan., is the textbook definition of a hometown, family-run, rural grocery store. Troy is located about 70 miles north of Kansas City and has a population of approximately 7,500, with a median household income of $54,792. Without John’s Market, a lot of people in this community wouldn’t have access to quality groceries or quality customer service.

John’s Market is famous for helping neighbors in need. From offering special hours after a local game to provide food to athletes, to delivering necessities to a customer whose house burned down on Thanksgiving, the retailer serves its community without hesitation.

Recently, one customer received a breast cancer diagnosis. Her family tradition for Thanksgiving was making oyster salad, but she was too sick to travel, so John’s Market brought the oysters to her. The grocer also helps

Kudrinko’s Ltd.

Headquarters: Westport, Ontario

Number of Stores: 1

churches, schools and community organizations, which all depend on John’s Market for successful events. Without them, each organization would have to travel more than 20 miles one way to shop for groceries.

During the pandemic, John’s Market was the community’s “security blanket.” The retailer adjusted its business model and began offering contactless delivery, accepting phone orders and

one of Progressive Grocer’s Outstanding Independents in 2014.

Kudrinko’s owners Neil and Martha Kudrinko have always been progressive grocers: The store received recognition for its sustainability practices as

Given the owners’ approach to business, it’s no surprise that when second-generation owner and president Neil Kudrinko decided to come out publicly as pansexual/ queer in 2021, he felt a responsibility to create a safer and more inclusive space in his community. Kudrinko’s has made diversity, equity and inclusion (DEI) efforts not just a matter of policy, but also a matter of action. The store joined the Welcoming Project and was successful in getting local affirming businesses to post All Are Welcome decals on their doors as well.

When it comes to human resources programs, the small company of 30 employees added gender affirmation coverage to the health benefits offered. While health care in Canada is covered

providing special shopping times for the most vulnerable, as well as adding online pizza ordering, pre-made sub sandwiches and much more.

John’s Market is also one of the few businesses in the area that hires teens and young adults. Over the years, hundreds of local teens have worked for John’s Market because the owners understand that school is a priority. A common comment from young employees is that John’s Market is flexible and understanding. The grocer will tailor schedules around band, athletics, studying and other school activities. Working at the grocery store also teaches these kids many valuable life skills — respect, friendliness, a strong work ethic and accountability, to name just a few.

by a public single-payer system, some surgeries are considered elective and are left to the individual to pay out of pocket. Kudrinko’s recognized that gender dysphoria is experienced differently by every trans individual, so a one-size-fitsall approach wasn’t going to provide the care needed for many people.

Yet beyond its DEI efforts, Kudrinko’s support for the trans community is deeply personal. Neil Kudrinko sees it as a matter of professional development, personal growth and leadership, especially during a time when members of the queer community are threatened by harassment and legislatures that would seek to use identity as a matter of political division. Kudrinko’s doesn’t only believe that diversity, equity and inclusion are a matter of ethical business practices, it’s also committed to celebrating all people regardless of their backgrounds. Addressing inequality in government policies, working toward a more sustainable planet and building a strong community are Kudrinko’s stock in trade.

28 progressivegrocer.com

COVER FEATURE

Little Red Box Grocery

Headquarters: Houston

Number of Stores: 1

Little Red Box Grocery is doing big things. Founded by H-E-B veteran and nonprofit leader Samuel Newman, the independent small-format grocer in Houston’s Second Ward aims to improve accessibility to affordable foods while engaging and empowering the community, which had been considered a food desert.

The store’s assortment includes a range of fresh food and everyday staples that meet customers’ many needs. LRB, as it calls itself, also partnered with a group called Cooking Matters to create meal kits that are quick and easy to serve for families.

The arrival of LRB in 2022 was much appreciated by community members. “Oftentimes, our customers are just coming in for one or two essential

items — a loaf of bread, milk or some vegetables, and if we weren’t here, they tell us they’d either need to take two buses to get to a store or they’d just go without,” the grocer notes.

Behind the scenes, this indie is

incorporating technology into its grass-roots food retailing. Last year, the business delved into the omnichannel realm through a partnership with Grocerist and launched several digital marketing initiatives. This

We are honored to be selected as one of the TOP

COVER FEATURE 2023 Outstanding Independents

INDEPENDENTS IN GROCERY Iowa Grocers Salute to Employees 2022.indd 2 2/6/23 4:23 PM

year, LRB and Grocerist, along with tech partner Forage, will roll out online SNAP EBT, something that they believe will be a game-changer for the many customers who would prefer to go online to use their benefits instead of doing so in person.

Further, LRB is widening its reach beyond its store doors as part of its overarching mission. The grocer works with local organizations to provide food relief, including partnerships with the Urban Harvest Group, El Centro de Corazon and Arena Foundation. Through these collaborations, local residents can get benefits such as half-off SNAP EBT purchases, medically tailored offerings, expanded food access, and more.

Ultimately, it’s about connections in many forms at LRB, which asserts, “Our approach is to treat each customer like you would a friend of a friend walking into your living room.”

The Mildred Store

Headquarters: Mildred, Kan.

Number of Stores: 1

It’s been said that walking into the Mildred Store is like stepping into a Norman Rockwell painting. It’s

THE SHOW FOR DAIRY, DELI, BAKERY

Register at IDDBA.org

NETWORK WITH THOUSANDS

Connect with serious retailers, buyers, merchandisers, and manufacturing executives who share a passion for food and the industry.

IDDBA 2023 retail attendees include the top 200 retail chains, top 100 wholesale chains, top 100 convenience stores, and major independents.

Gain insight and engage face-to-face with industry peers!

WHAT’S IN STORE LIVE

2023, The Year of Technology and Innovation, will bring to life the latest and trending products, packaging, technology, and equipment solutions. WISL 2023 will host an array of leading experts who will provide engaging educational workshops throughout the three days.

partly the fact that the general store in rural Mildred, Kan., opened 107 years ago, and the store’s current assortment includes nostalgic items like retro candies and regionally made Amish canned goods. It has also remained a hub of the community,

WHAT’S IN STORE

From an organization you trust, comes the resource you can depend on. Now completely digital, stay up to date on the latest industry trends and business solutions with WIS 2023!

Exhibit At IDDBA WISL Sponsorship Information WIS 2023

2023 Outstanding Independents

as team members regularly assemble locally famous deli sandwiches for customers who hail from Mildred and other parts of Southeast Kansas.

History is part and parcel of this indie grocer, which was founded by Lucille and Charlie Brown and was known as Charlie Brown’s for more than nine decades before the store was bought by the new proprietors, Regena and Loren Lance. The Lances, who changed the store name to simply the Mildred Store, report that they have continued many traditions, but are also forging new ones to meet

Oryana Community Cooperative

Headquarters:

Number of Stores:

Starting with its founding as a buying club 50 years ago, this cooperative and natural and organic retailer in Traverse City, Mich., has striven to follow a socially driven business model. Beyond supporting local food systems and working with nonprofit groups to boost food security and access, Oryana Community Coopera tive has transformed its area in other important ways.

the needs of today’s shoppers.

For example, stemming from Loren Lance’s interest in music, the Mildred Store now hosts a monthly music night in one of its spacious back rooms. The free event draws crowds of up to 200 and drives revenue as well as community engagement.

In addition to these events, the grocers frequently open up the site for local festivals, family gatherings, fundraisers and even car shows. They offer a variety of made-to-order party trays for these and other occasions, including platters with meats, cheeses, vegeta-

bles, cookies and candies. Recently, the Lances opened an RV park next door as another way to generate income for the business and interest in the store.

The grocers have also worked creatively on the supply side, especially during the pandemic. At a time when restaurants in the area were largely closed, they turned to foodservice suppliers to provide them with bulk items that could be repackaged and sold to shoppers who still felt comfortable shopping at their hometown grocer. Further, in the e-commerce era, the Mildred Store has added delivery services at no charge.

Case in point: The consum er-owned co-op was able to maintain its own business and essentially save another one during the recent trying times of the pandemic. CEO and General Manager Jim Nance led efforts to acquire a struggling competing business in the Grand Traverse area, which eventually led to the opening of Oryana West. The co-op helped preserve 62 jobs at the acquired business and, along the way, more than doubled its sales revenue from 2019 to 2022. What some might have seen as a risk turned out to be a choice that spurred growth and positively affected the area.

Today, the two-store co-op governed by Nance and an elected nine-member board has a base of more than 10,600 member-owners and is a $32 million operation. Oryana Community Cooperative received the 2022 Cooperative Excellence award from the local chamber of commerce for its achievements and local economic and community contributions.

Adhering to the values that have served it well since it was formed by volunteers in 1973 is what sets this co-op apart, according to its leader.

“We truly believe that all people have a right to high-quality food, and all are welcome in the co-op,” says Nance. “Recognition lets us know that the efforts of our forebears, staff and boards — both past and present — and the support of our owners and community have made a difference, and it motivates us to keep working hard, to be truly inclusive [and to] care for future generations of people and families in our community.”

32 progressivegrocer.com

COVER FEATURE

Rademacher Cos.

Headquarters: Andover, Minn.

Number of Stores: 20

As with many independent grocers, it’s a family affair at Rademacher Cos., launched in 1976 and based in Andover, Minn. The Rademacher family manages around 20 family-owned stores in the central part of the state.

After running successful superette convenience stores and G-Will liquor stores (short for Gee Willickers) for decades, the Rademachers went into the full-scale grocery business in 2022. They quickly got to work upon acquiring a former Food Price location in the town of Becker, Minn., updating the parking lot, sprucing up the store exterior and entrance of the building, and installing new lighting. They also invested in technology, adding self-checkout areas and an in-store pointof-sale system, and staffed up the store with new hires.

a former Deli Plus/Shell station.

Working with distribution partner SpartanNash, of Grand Rapids, Mich., the owners completed a full store reset with an expanded assortment of grocery items, deli offerings and fresh produce, among other products. They also added a beverage bar and a rotating series of weekly specials.

Rademacher Cos. expanded further into the Becker community by opening a new Bill’s Superette c-store at the site of

Redner’s Markets Inc.

Headquarters: Reading, Pa.

Number of Stores: 64

Sensing and seizing opportunities, the family that operates Redner’s Markets Inc. didn’t wait for the volatile times of the COVID-19 crisis, supply chain snafus and high inflation to settle. Instead, the grocers took all kinds of actions to grow their independent business and bring it into the next merchandising era.

“If the global pandemic brought anything to light, it was that for any business to survive and show continued growth and success, sticking to one’s core values is a must,” the company’s nominator asserts.

The leaders didn’t think small, either. This employee-owned indie expanded its new concept, Redner’s Fresh Market, focusing on full-service deli, bakery, meat, seafood and chef-prepared meal solutions. Having unveiled the first Fresh Market store, in Wyomissing, Pa., in 2019, the company recently opened its fourth Redner’s Fresh Market, in Lewes, Del. Unveiled in November 2022, the 49,000-square-

The new Bill’s Family Foods and the latest Bill’s Superette continue the company’s focus on serving customers promptly in a personal and sincere way, something that they perfected in their other retail enterprises that include car washes and fuel and propane sales. As the grocer’s Outstanding Independents submission puts it, “The main key to operating a successful store is simply stated in the company’s motto: ‘Cleanliness and Friendliness!’”

While the company has widened its retail presence, Rademacher Cos. has evolved as well. The next generation of the family business started by Karen and Bill Rademacher has taken a new leadership role, with their son, Grant Rademacher, now president.

foot store also makes its own fresh popcorn and pressed juice, and offers convenient self-checkout along with curbside pickup and delivery options via DoorDash and Shipt.

The Reading, Pa.-based retailer also rebranded its convenience store division, dubbing it Redner’s Quick Stops. From an operations standpoint, Redner’s invested in a front- and backend point-of-sale solution to bring the stores into the future.

Now in its third generation of leadership under Ryan, Gary M. and Richard Redner, and with 64 locations, the company begun in 1970 by Mary and Earl Redner continues its focus on valuing its 5,000-plus associates. Among other measures, Redner’s has increased wages,

recognizing the commitment of its workers during the pandemic. Community support remains a priority, too, as the grocer partners with nonprofit groups and provides charitable donations. At the end of 2022, Redner’s revealed that it’s providing more than 200,000 meals to area food banks through a partnership with such brands as Minute Rice and the Original Louisiana Hot Sauce.

PROGRESSIVE GROCER February 2023 33

River Market Community Co-op

Headquarters: Stillwater, Minn.

Number of Stores: 1

Not only is River Market Community Coop owned by local residents, it’s also active, integral and vital to its surrounding area.

In 2022, River Market created its very own grant fund to support and strengthen the local foodshed: the Growers, Grazers, Makers and Bakers Grant Program. This grant program weaves together local food and community, two essential ingredients of the fabric of the co-op since it was founded 45 years ago by a small group of volunteers. Local farmers, food producers and processors are eligible to apply for a grant through the program. Funds may be used for the purchase of machinery, construction or other resources necessary for increasing productivity, scaling offerings, improving efficiency or growing the applicant’s business.

program generates more than $38,000 each year, entirely from the generosity of the small grocer’s shoppers.

Contributions to the fund come primarily from shoppers rounding up their purchases to the nearest whole dollar. This

In an example of a unique event in its community, the World Snow Sculpting Championship takes place in

34 progressivegrocer.com

COVER FEATURE

2023 Outstanding Independents

January, just steps from River Market. Sculptors come from around the world and spend three days chiseling, shoveling and sculpting giant blocks of snow. The independent store is a proud sponsor of this event, with its deli providing lunches for each team of sculptors. What’s more, General Manager Sara Morrison is a member of the steering committee, helping plan and promote the event as well as working on logistics.