SPECIAL REPORTS:

AI in Content Creation (in collaboration with Vizit)

Engaging Shoppers In-Store (in collaboration with Mood Media)

AI in Content Creation (in collaboration with Vizit)

Engaging Shoppers In-Store (in collaboration with Mood Media)

Marketers from around the world provide perspective on the path to purchase

Our proprietary research examines the potential of AI, showing how marketers plan to move from test-and-learn to full adoption. In collaboration with Vizit.

Our proprietary research provides insights on in-store shopping habits and drivers, as well as the overall in-store experience. In collaboration with Mood Media.

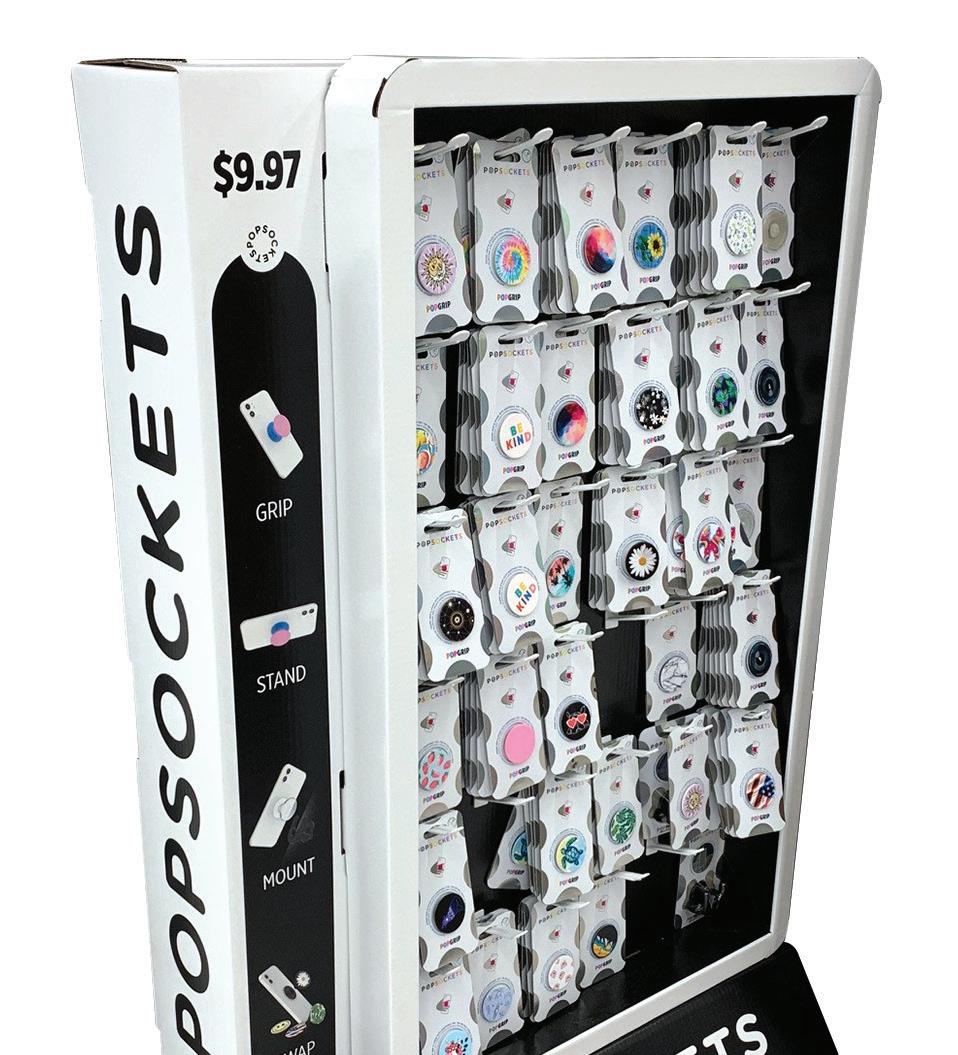

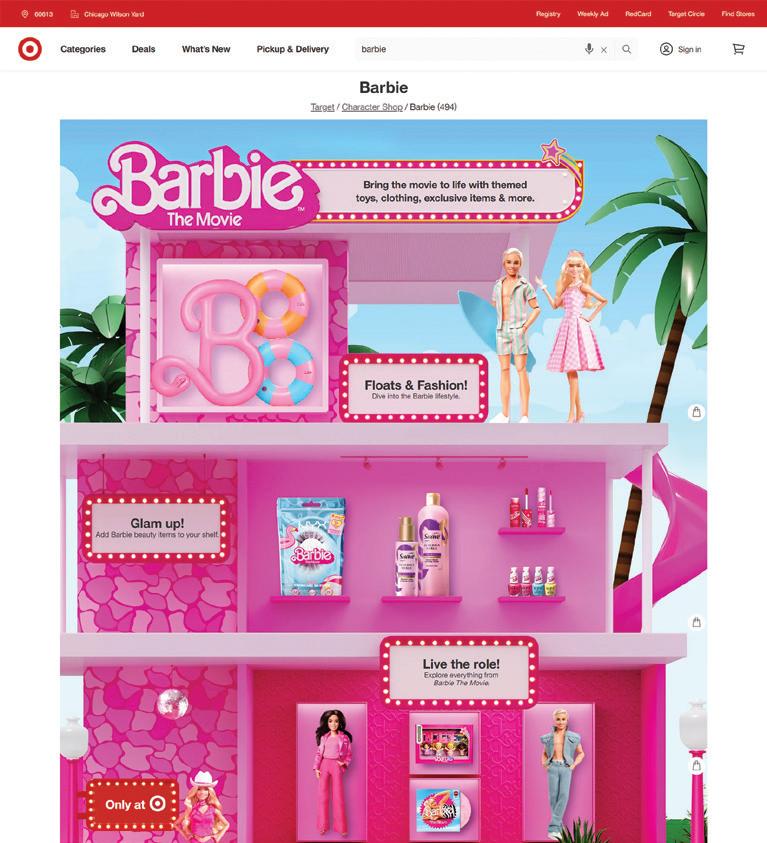

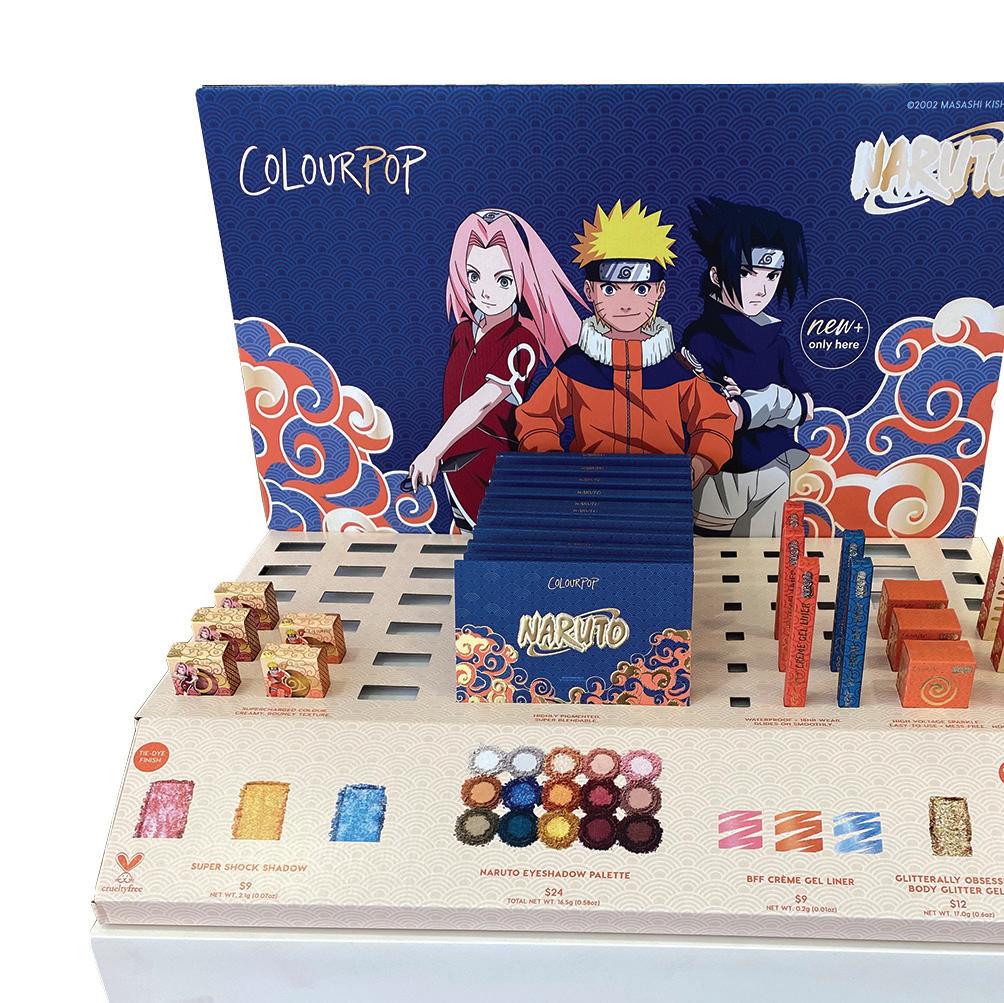

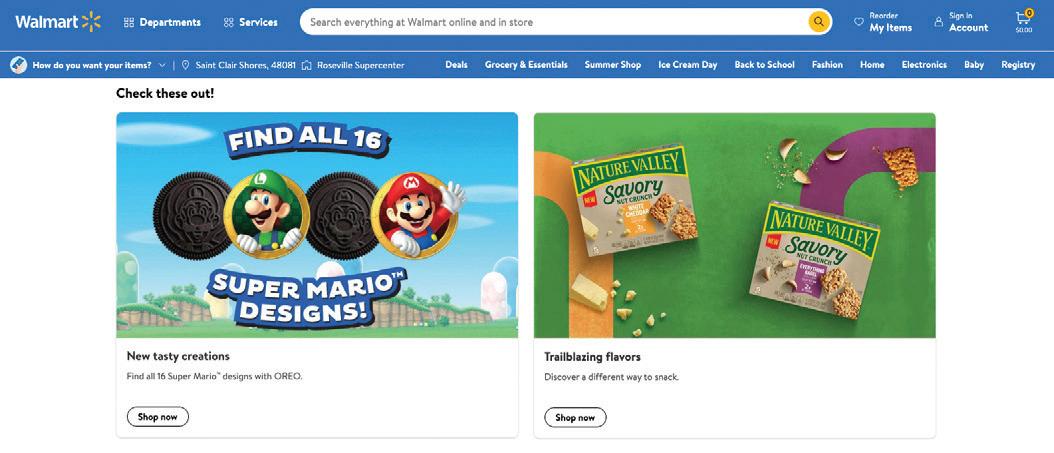

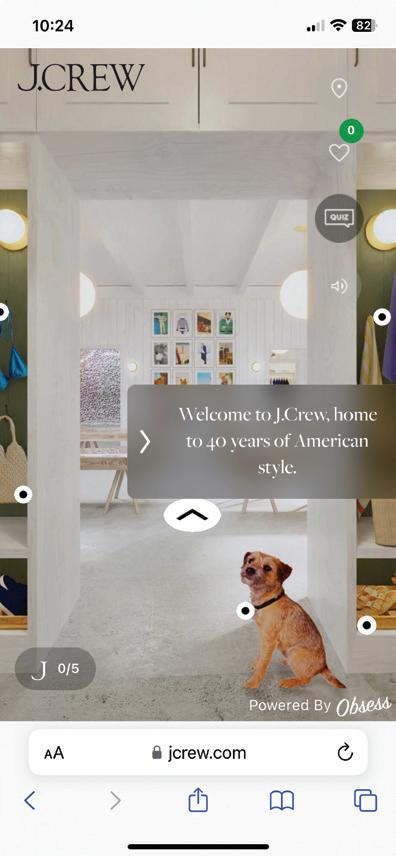

Our latest gallery presents a sampling of eye-catching and effective in-store activations, from grocery and department stores to optometrist offices.

Keith Albright Kimberly-Clark Dana Barba The Lemon Perfect Co.

Stephen Bettencourt CVS Health

Lianna Cabrera L’Oreal Paris Cosmetics

Mia Croft

Native Christiana DiMattesa Under Armour

Gregg Dorazio

Giant Food (Ahold Delhaize)

Paige Dunn FIJI Water, JUSTIN Vineyards & Winery, Landmark Vineyards & JNSQ Wines

Tony Fung Bob Evans Farms

Patrick Hallberg Apple Travis Harry Home Depot Carter Jensen General Mills

Here at P2PI, we like to think of ourselves as the OG when it comes to publications covering retail media. We’ve always been at the forefront of helping our industry navigate this field —even back when the questions our members had were quite elementary (as in, “What even IS retail media?”).

So as the proliferation of retail media continues across the globe, we too are bringing our expertise to marketers around the world, starting with a big leap across the pond. This October, we’re beyond excited to co-host our very fi rst international event — Retail Media Summit UK — in London along with our partner SMG.

There’s no doubt retail media has been a hot topic for our industry these last few years, but it seems we are fi nally hitting full stride now. And while there is a plethora of information out there available, it can also be quite challenging for commerce marketers to sort through it all.

Retail Media Summit UK has been carefully designed to help brands and retailers cut through that noise. We get it, there are a lot of events. There’s a lot of confl icting advice. So, it’s our mission to help attendees separate fact from fiction with a content program that is going to outline best practices and do a little myth busting, dig into some data and, most importantly, provide marketers with the knowledge to strategize a clear path forward in this ever-changing landscape.

Our international coverage doesn’t just stop at retail media though. As brands and retailers encounter an increasingly complex matrix of consumer trends and shopper behavior along the path to purchase, P2PI is working to make sure our readers and members are informed, inspired and interconnected. Part of this process includes covering more international stories so that our audience has access to the most innovative ideas, best practices and tactics — regardless of borders. From expanding our member-exclusive retailer profiles online to include new countries like Canada and the U.K. this year (plus more countries and retailers coming in 2024) to interviewing commerce marketers across the world to share their experiences (see page 24) to covering the latest campaigns, in-store experiences and more, P2PI will keep you ahead of the game by offering a holistic view of shopper journeys across the globe.

Today’s consumers aren’t just hybrid shoppers who move fluidly between online and in-store, they’re truly engaging in omnichannel journeys where moments of inspiration and consideration meld into one. That traditional marketing funnel — forget it, it’s gone, dissolved. Consumers are engaging with brands all across that path to purchase, and it’s our goal to help commerce marketers seize each and every new opportunity.

Whether it be retail media, AI or some new, unimagined path that’s yet to reveal itself, we hope you fi nd the fuel on these pages to confidently forge ahead in these unchartered waters. The new world of commerce marketing requires bold ambitions, out-of-the-box ideas and a little bit of bravery to test and learn new ways of thinking. When it comes to disrupting the status quo, retail media has forced our industry to rewrite the rules and reinvent the game. We may still be building the plane while flying it, but what an amazing ride it will be.

BRAND MANAGEMENT

Vice President, Brand Director Eric Savitch esavitch@ensembleiq.com

EDITORIAL

Editorial Director Jessie Dowd jdowd@ensembleiq.com

Executive Editor Tim Binder tbinder@ensembleiq.com

Managing Editor Charlie Menchaca cmenchaca@ensembleiq.com

Digital Editor Jacqueline Barba jbarba@ensembleiq.com

Managing Editor, Member Content Cyndi Loza cloza@ensembleiq.com

Editor, Member Content Heidi Bitsoli hbitsoli@ensembleiq.com

Director, Events Content and Strategic Engagement Lori Pugh lpugh@ensembleiq.com

Contributing Writers Michael Applebaum, Ed Finkel, Erika Flynn, Jenny Rebholz, Bill Schober

ADVERTISING SALES & BUSINESS

Associate Director, Brand Partnerships Arlene Schusteff 847.533.2697, aschusteff@ensembleiq.com

Regional Sales Manager Orlando Llerandi 678.591.8284, ollerandi@ensembleiq.com

MEMBER DEVELOPMENT

Director of Retail Patrycja Malinowska pmalinowska@ensembleiq.com

Sr. Director, Membership Development Nicole Mitchell 203.434.5733, nmitchell@ensembleiq.com

Membership Experience Manager Ann Estey aestey@ensembleiq.com

Manager, Membership Development Brady O’Brien bobrien@ensembleiq.com

Membership Experience Manager Heather Kurtik 724.553.0093, hkurtik@ensembleiq.com

DESIGN/PRODUCTION/MARKETING

Art Director Michael Escobedo mescobedo@ensembleiq.com

Production Director Michael Kimpton mkimpton@ensembleiq.com

Marketing Director Marlene Shaffer mshaffer@ensembleiq.com

SUBSCRIPTION SERVICES

List Rental mbriganti@anteriad.com

Subscription Questions contact@pathtopurchase.com

CORPORATE OFFICERS

Chief Executive Officer Jennifer Litterick

Chief Financial Officer Jane Volland

Chief People Officer Ann Jadown

Chief Strategy Officer Joe Territo

Chief Operating Officer Derek Estey

JESSIE DOWD, Editorial DirectorHERE’S A SNAPSHOT OF INDUSTRY LEADERS FROM THE P2PI MEMBER COMMUNITY.

LINDSAY DEFALCO Shopper Marketing and E-Commerce Sales Manager Eagle Family Foods

Main job responsibilities: Shopper marketing and retail media across all brands and all retailers, plus Amazon sales management.

How you win with shoppers during uncertain economic times: We lean into stacking our shopper marketing and retail media plans with our trade promotions to amplify those offers to our shoppers. In key activation windows where there are not trade promotions, we look to supplement with shopper tactics like digital coupons or rebates to continue driving velocity with our shoppers.

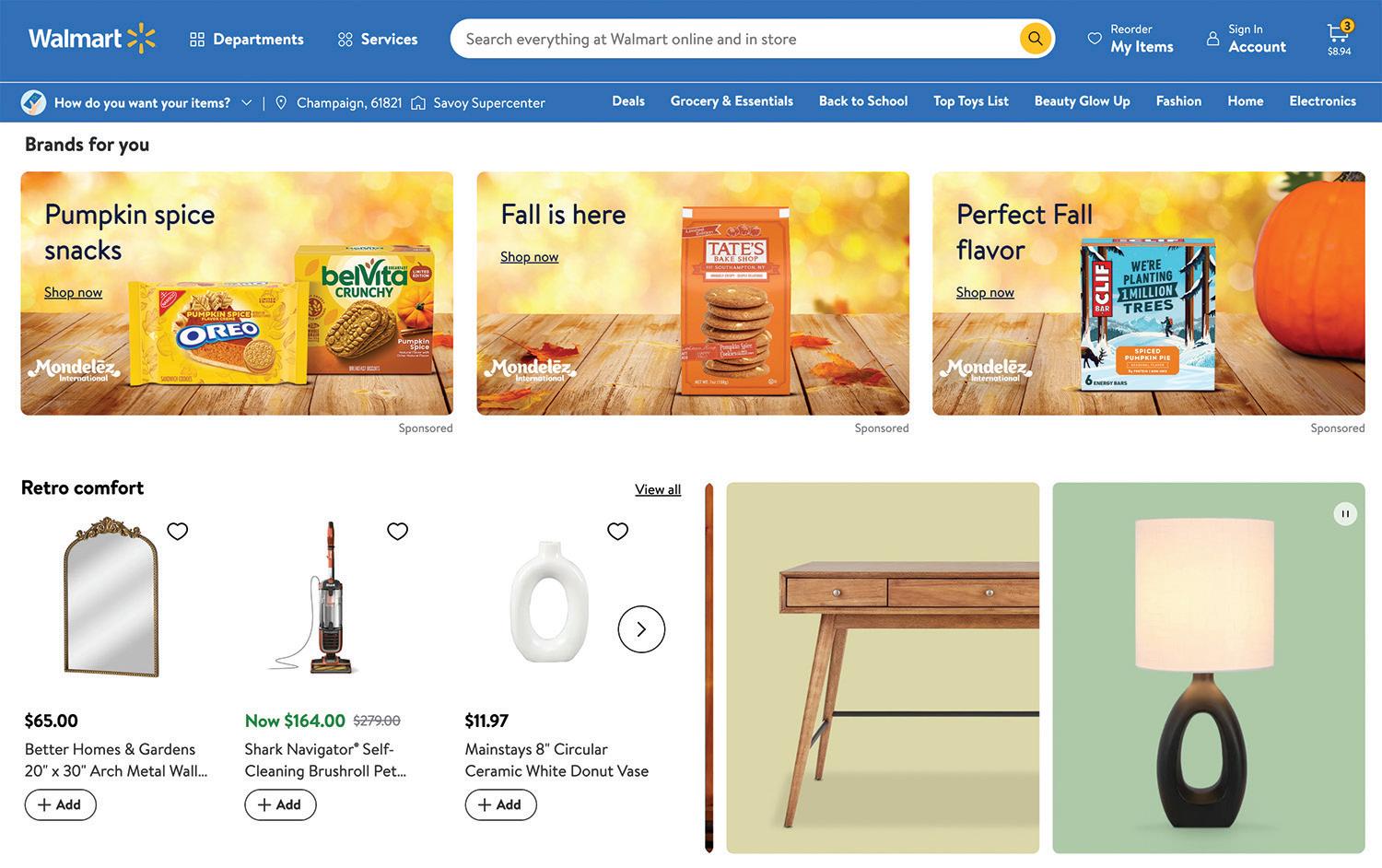

New marketing tactic that you use: Retail media multi-vendorthemed event programs are a new tactic we’ve leaned in on with many of our brands and retailers. They have driven strong ROAS for us. These programs are great, because they center around events or occasions that are relevant to that retailer’s shoppers, such as summer grilling with Suddenly Salad or holiday baking recipes with Eagle sweetened condensed milk.

Best career advice you’ve received: Keep the consumer or shopper at the center of every marketing decision. Then build out from there to also incorporate brand, sales and retailer strategic growth objectives.

Memorable aha moment in your career: Back in 2021, I had an aha moment that retail media was beginning to significantly develop and change how to approach shopper marketing strategy and execution, as well as the overall marketing mix. This epiphany drove me to transition from my past experience as a brand manager into the shopper marketing manager role. I wanted to dig in to learn more about retail media and then guide how, when and where our brands should leverage it to reach the right shoppers, measure return and drive growth.

Fall plans: I have two young boys, so our schedule includes apple picking, pumpkin farms, T-ball games and Halloween costumes.

RICHARD PACE Chief Client Officer and Co-Founder Channel AgencyMain job responsibilities: We have a great team and we wear many hats at Channel. At the core, I manage the client relationships and strategy work along with my partner, Chris Stanton.

How you win with shoppers during uncertain economic times: It has been a challenge. The ever-changing shopper dynamics, the shrinkage of the front end and price increases have really forced us to think about things differently, while at the same time getting back to basics. We’ve been laser-focused on the data, finding the right time, place and route to get our brands into the consideration set along the funnel.

Best career advice you’ve received: Clients come to our agency with a challenge, and we aspire to address the challenge and deliver results. Instinctively we want to solve that problem immediately, often before the client even finishes asking for help. The best advice I received was from my father years ago: Listen. Not just to what the client is saying, but how they are saying it. There is so much you can uncover by not jumping in with a solution.

Memorable aha moment in your career: We do a lot of experiential and other kinds of events for clients. We have worked with brands large and small with the budgets to match. It obviously depends on the objectives, but you see a lot of brands spending significant dollars at events with little benefit for the consumers themselves. To make a connection with the consumer in a meaningful way, you need to speak to them on their level and enhance their experience over that of your brands.

Recent travels: I don’t sit still well, so I’m on the go a bunch. Over the past several months, I had a family reunion in Florida, saw friends in the Outer Banks and flew to Ireland with my father to play golf.

BY MARGO KAHNROSE

BY MARGO KAHNROSE

Right now, there’s a great deal of hype around generative AI within the advertising and marketing technology industries. Imagining new possibilities with near-limitless potential, while predicting just when and how much things will change, is the feat. But it’s clear that advancements in AI will be an enormous boon in the effort to take marketing omnichannel.

While going omni might be necessary for marketers, this evolution needs some technological tailwinds. The dynamics of commerce have changed dramatically. Control of the digital ecosystem by marketers, media giants and retailers has reversed. Consumers hold most of the power today and their needs have evolved.

Today’s consumers are:

• Entirely omnichannel in their behaviors, migrating seamlessly between media and distribution channels. Marketers typically expected specific behavioral outcomes from specific channels, but consumers don’t care. They expect to be able to do it all, anywhere they are.

• Protective of their privacy. New boundaries for data collection and usage have been established. It’s not the consumers’ problem when marketers lose. They will easily disengage from brands that don’t protect their data.

• Hanging out in walled gardens. Open web advertising can be a poor experience in the consumer purchase journey. Consumers seek curated experiences in social media, search engines and retailer websites. Recent Skai research shows 77% start research within a walled garden and 65% fi nd advertising more useful in walled gardens than the open web due to data protection. For marketers, communication with consumers must be omnichannel and concentrated within walled garden media, while taking full advantage of intelligence and the safe handling of consumer data. Going omnichannel is less a technology constraint and more an issue of time — freeing up resources for cross-channel analytics,

establishing new KPIs outside of channels, and creating new ways that teams work together will map to winning customers over channels. With AI giving gains to marketers, brands can save time and overhead. This leverage helps brands to better prioritize, recognize the pockets of opportunity in audience segments and keyword terms, and make use of competitive intelligence to eliminate wasted cycles.

AI can’t simply be unleashed without checks and balances in its early days. To become an omnichannel marketer, first consider whether you have the tools to thrive within each of the walled gardens, as well as privacy-safe data connectivity between them. Most ad platforms focus on the open web, so this is a short list. Next ask yourself: Are you set up to leverage the latest in AI capability in order to reduce overhead and drive efficiencies that help you prioritize? In order to move fast, you will need to be able to rely on your platform’s expertise in data handling, governance and quality control against AI-generated output and insight. Independent platforms give you an early adopter advantage in leveraging AI without the risk.

Omnichannel marketing is the only way to keep pace with customers who are increasingly omnichannel. The tenets are clear: Go where consumers are, and respect their privacy at every touchpoint.

Margo Kahnrose has more than 15 years of experience in marketing, branding, communications and lead generation across various enterprise and consumer goods industries with an emphasis on technology. With roots in consumer brand e-commerce, she previously led the development and management of Skai’s brand marketing for more than four years before doing the same for marketplace app SpotHero. Kahnrose rejoined Skai in 2018, where she leads marketing for the company globally.

AI can’t simply be unleashed without checks and balances in its early days.

Marie Stafford of Wunderman Thompson Intelligence takes the stage on the morning of Nov. 8 for a session on “The Age of Re-enchantment.”

On Nov. 8, we cap off a full day with a 5 p.m. cocktail reception and ceremony honoring our 2023 Women of Excellence winners.

• P2PI and Chicory will share insights from a new consumer report that highlights how shoppers are inspired by relevant content.

• P2PI and Mood Media will discuss results of a new study examining what draws shoppers into stores, how they respond to media activations, and what motivates them to go from passive to active engagements.

The OmniShopper Awards cocktail reception and ceremony take place at 4 p.m. on Nov. 9. This awards program honors excellence in shopper engagement across the path to purchase.

Discover the latest and most innovative solution providers in commerce marketing. Exhibitors will showcase the tools and technologies that can elevate your marketing efforts to new heights.

We offer specialized tracks dedicated to these important topic areas, identifying new tactics, winning strategies and best practices.

BACi, Commerce Executive Network and Retail Media Guild provide just some of the additional opportunities to connect with key players in the industry over three days.

For more information, including the complete agenda, and to register, scan this code.

BY CYNDI LOZA

BY CYNDI LOZA

Technology, including mobile phones, smart TVs and a growing list of streaming services, is driving a rapid and dramatic shift in the television ecosystem. Today’s audiences are in control of what they watch, when they watch it and by what medium they watch it — and they have an abundance of content choices. We recently caught up with Nielsen’s Jeff rey Schmidt, senior vice president, client solutions; Wendy McClintock, vice president, client solutions; and Jenny Park, senior director client solutions, on what role the 100-year-old company plays in this rapidly evolving media landscape. Additionally, they discussed how Nielsen is measuring what programming audiences engage in (and where), so that the makers of content, distributors of content, advertisers and sponsors of content all have a truth set on which to conduct business with each other.

Schmidt: Although retail media has exploded within the past five years, the truth is that Nielsen has been supporting retail media since inception starting in 2014. Nielsen fits into retail media as a source of audience measurement, planning and analytic comparability. Over the last few years, Nielsen has been building out a cross-media audience measurement solution (Nielsen ONE Ads) that helps provide a comprehensive reach and frequency of computer, mobile, linear TV and CTV media. Nielsen ONE Ads covers 100% of linear TV, 90% of computer mobile and 85% of CTV media spending, inclusive of walled garden coverage of Meta and Google properties. Nielsen ONE will also aid advertisers to understand the benefits of investing in retail media partners, through the comparable independent lens they have already been using to evaluate the rest of their media plan for reach and frequency optimization.

Retail media is growing, in part, by increasing its allocation of media spending from other marketing channels, including TV. It is only by understanding the impact of media spend across all platforms that brand advertisers can intelligently allocate their cross-channel spend, for the maximum incremental gain within and across the retail media channel. Clients can take advantage of their retail media-based targets, to either measure audience performance within those targets, or pull those segments through to planning as the advertiser or agency builds out plans for optimization period to period.

What are Nielsen’s retail media solutions and offerings?

Park: Our solution suite is geared toward audience measurement (reach and frequency optimization), media planning and sales impact analytics. Retail media is moving up the marketing and sales funnel into new formats, including open web, social and streaming TV formats, even taking them into the store experience as part of the omnichannel journey. We believe retail media will disrupt traditional TV advertising with its ability to use first-party data for targeting and measurement, and it will need partners like Nielsen that can uniquely match to first-party identifiers and bring in both big data and panels, as well as measure CTV, streaming, podcasts and brand engagement at the shopper and household level.

What is the company’s approach to retail media measurement?

McClintock: Inclusive coverage of the media landscape for retail media is consistent with Nielsen’s vision to capture all audience exposure to media within the cross-media landscape. It is not new, but it is set up to serve with this additional focused reporting.

We are exploring unique partnerships within key retail media partners to offer audience measurement in Nielsen ONE directly through the retail media partner, instead of through Nielsen as a third party, and we are also seeking similar arrangements to use our industry-leading analytic practices as a bridge in comparability for those same retail media partners.

Today’s retail media networks fall into a few distinct categories: digital marketplaces or platforms, mass merchandise or department stores, category specialists, commerce intermediaries and other commerce verticals. Grocery and grocery e-commerce still leads the sector growth. These high-growth verticals are areas where Nielsen has held particularly deep relationships within the industry, as we sit at the nexus of partnerships with advertisers, their agencies and the complex landscape of sell-side providers and supporting tech company enablers. More broadly, we look at our central role in the industry as a helpful asset to the retail media landscape that can bring synergistic partnerships together for mutual gains within the total media landscape.

Johnsonville Sausage had another strong summer this year with the return of a campaign during the key grilling season.

For the third straight year, the brand turned to longtime collaborator Bush Brothers & Co. for the “Best of the Backyard” program, which ran from May 15 through July 7.

“(These are) two products that are No. 1 in their categories working together to create an easy meal solution — protein and side,” says Fiona Redhair, marketing communications manager at Johnsonville.

At the center of the campaign was a sweepstakes with 100 high-value prizes all relevant to backyard grilling. One change Johnsonville implemented to the program this year was optimizing spending by removing the upload receipt purchase incentive. “We saw large drop-off s from prior years on shoppers uploading receipts as an entry mechanism — that tactic also complicated the rules and alternate method of entry,” Redhair says.

The program had increased exposure in-store through secondary merchandising. Display signage touted a URL for the sweepstakes. At all Albertsons Cos. divisions, in-store ads from Vestcom attached to shelf labels for Bush’s SKUs directed shoppers to scan a QR code and enter the sweepstakes. Co-branded creator content supported the effort on Instagram and TikTok. Pit Boss and the American Cornhole League also promoted the sweepstakes, which was administered by Los Angeles-based Sync Marketing.

Four retailer media networks were involved with the campaign this year — AD (Ahold Delhaize)

Retail Media, Albertsons Media Collective, Kroger

Precision Marketing and Walmart Connect. The retail media assets directed consumers to Johnsonville and Bush’s items on the retailers’ respective websites. They did not promote the actual sweepstakes but the overall “backyard grilling occasion,” Redhair says.

“We take a look at each retailer individually

and which tactics are approved to use and/or work well for that particular shopper,” Redhair says. In retailers where traditional in-store activations weren’t accepted, Johnsonville and Bush’s staged co-branded promotions. They executed meal solution offers for either savings off Bush’s items or receiving free Bush’s items with purchase of Johnsonville products.

“Johnsonville had two main measures — percent of sales on display and share of dinner links,” Redhair says. From Memorial Day through Fourth of July, dinner links figures were 3% higher than prior year. Sales also increased 0.5% versus last year, she says.

Marketing agency and Bush Brothers partner Pinckney Hugo Group also worked on the campaign.

From Memorial Day through Fourth of July, dinner links figures were 3% higher than prior year.

If you’re competing in B2B you need a strategic creative partner that knows your industry inside and out. Only EnsembleIQ’s BrandLab offers full-service marketing capabilities and deep experience across retail, CPG, and technology, infused with industry knowledge and marketing intelligence.

The Path to Purchase Institute partnered with global brand consultancy and market research firm Provoke Insights to study socially conscious consumers and their shopping habits for Provoke’s bi-annual consumer trends study. Most American consumers (74%) are socially conscious when making purchases, but they are not consistently buying product from socially responsible brands. (Only one-tenth of respondents said they always do.) To understand these shoppers, the research determined that:

• “Made with clean ingredients” is the No. 1 attribute that consumers (mostly Gen Z and Democrats) consider when buying socially conscious products.

• Companies focusing on charitable donations, minority-owned and B Corp certified were not highly considered factors.

• A third (32%) of respondents will switch brands if the company does not align with their values. (Democrats, wealthier

Made with clean ingredients is the top attribute considered when buying socially conscious. Gen Z and Democrats are most likely to be looking for these types of items.

While most Americans purchase socially resposible items, the cadence is not consistent.

Americans, Millennials, parents and males are more likely to have this sentiment.)

• Those who are purchasing sustainably sourced items say they are more budget conscious than six months ago.

Amid current economic uncertainty, shoppers are divided on what promotions they prefer most, according to July research from Kroger’s 84.51 data analytics subsidiary.

• 17% of shoppers ranked digital coupons lowest on their list.

• Digital coupons are leveraged most when shopping perimeter categories (e.g., produce, dairy, meat/seafood), while threshold events and endcaps are used most often when shopping center store (e.g., shelf-stable, drinks & snacks/candy).

• Lower-income shoppers cited digital promotions as the top way to save money, while higher-income shoppers gravitate toward threshold events.

• When it comes to threshold events (e.g., BOGO/spend x, save x), the most popular is “Spend $15, Save $5,” particularly for younger shoppers.

Other trends highlighted from the last quarter include:

• Store pickup is popular. While the majority of shoppers plan to shop in-store in the upcoming months, grocery pickup showed notable growth over the past quarter.

• Fewer shoppers report noticing price increases in dairy and meat/fish compared to the past year average.

• More shoppers notice price increases in drinks, while produce, frozen foods and paper products trended flat.

Research from Bazaarvoice explored where, what, when and how shoppers will make purchases this holiday season, especially during Black Friday and Cyber Monday weekend (BFCM).

• Shoppers prefer holiday shopping in-store (81%), but not by much: 72% said online and 22% said social media.

• Consumers want to learn about deals in certain places: Ads (64%) are where consumers want to hear about Black Friday deals most, but social media (46%), marketing emails from brands (46%) and news articles and gift guides (42%) are not far behind.

• Social media is a big discovery tool for BFCM: 49% of consumers said they follow brands on social media to discover Black Friday deals, 45% are more likely to discover a product via social media than any other channel over Black Friday, and 25% of shoppers prefer to shop via social media over BFCM. Sixty-three percent said they expect to discover new products on social media over BFCM.

• Reviews are a top priority across channels: Three quarters (74%) of shoppers agree that reviews impact their purchasing decisions, while more than half (59%) say the same about social media.

• Brands should be holiday-ready now: 11% already holiday shopped in July and 14% in August, while 19% will in September, 35% in October, 57% in November and 48% in December.

• Hot-ticket items this holiday season: 70% said they’re gifting apparel, 51% said games and toys, 47% said electronics, 40% said food and beverages, 37% said health and beauty and 36% said jewelry.

Where consumers are shopping for groceries and household items:

THE SPECIALTY GROCER HAS OPENED SMALLER STORES THAT FOCUS EVEN MORE ON THE EXPERIENCE FOR HEALTH-MINDED AND FOOD-CENTRIC SHOPPERS.

BY JACQUELINE BARBASpecialty grocery retailer Sprouts Farmers Market has opened a slew of smaller format stores in 2023 as it grows its physical footprint along the East Coast and focuses its store experience even more on health-minded and food-centric shoppers.

The retailer opened its first small-format store in 2021 in Smyrna, Georgia, and has continued to mold and expand the concept since then, particularly this year. Sprouts plans to have opened more than 30 of these stores in 2023 alone.

The Path to Purchase Institute visited one store that opened in May in Manassas, Virginia, and here is what stood out: Not only is this new format smaller in size, spanning about 23,000 square feet (compared to its 30,000-square-foot traditional locations), but it also features an updated Sprouts logo and decor, revamped signage, rotating displays and some expanded departments.

The stores offer a clean and spacious layout to make it easier for shoppers to discover “betterfor-you” products and convenient prepared food options. The stores’ smaller size may not be very noticeable to shoppers, however, because the space eliminated from its traditional store layout came mostly from the backroom.

At the center of the store, Sprouts’ selection of

fresh produce includes more than 200 organic offerings, many merchandised in wooden (or designed to look like wood) displays, promoting the fresh/ farmers market theme.

Particularly notable is an in-line display — or “Innovation Center,” as Sprouts calls it — located near the front of the store in between the produce and bakery sections. The area features “New for You” signage and highlights new-to-market, attribute-driven products, many of which are exclusive to Sprouts as part of its “Find a New Favorite” program (which rotates monthly).

Dedicated account-specific endcap signage on each end of the display spotlights the merchandised brand(s) and calls out attributes — at the time of our visit, “low-sugar vegan snacks” and other nutritious benefits. The section is a space for Sprouts and vendor partners to test new or local products. Four-way displays near this section also provide brands with shared merchandising space, especially newer, seasonal and healthier products.

Sprouts expanded and redesigned the frozen food section, which features wider aisles and is more intertwined with other aisles. It also particularly highlights innovative meal solutions, including keto, plant-based and paleo options. Additionally, at the time of our visit, in-store sampling was also conducted near the plant-based food freezers.

Other notable elements include:

• A relocated deli counter and conjoined “heatand-eat” meals display, which is now located closer to the entrance.

• A “Plant-Powered” refrigerated section high-lighting the latest plant-based meat alternatives.

• Sustainable and socially responsible offerings are highlighted throughout the store.

• The self-serve nuts and coffee sections are a staple and feature wooden bins and displays. Reusable branded Sprouts bags are also affi xed to the nuts displays, encouraging shoppers to “buy in bulk and save … a bag.”

• Branded displays are still sporadically located throughout the perishable aisles.

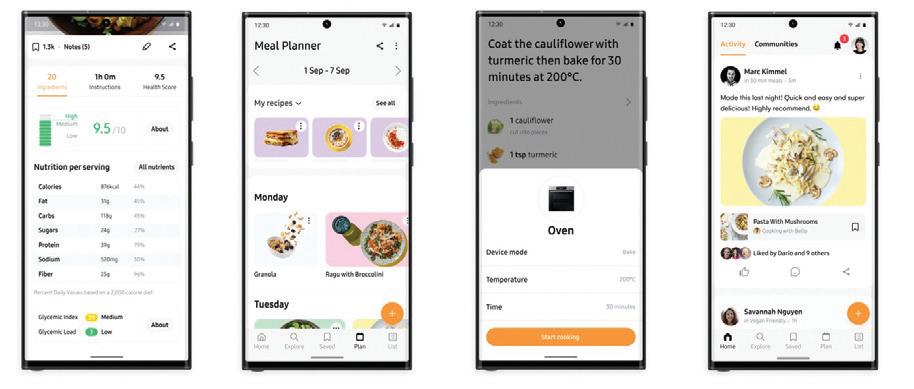

Artificial intelligence (AI) has been around and evolving for decades — but within the last year it has hit a fever pitch as it has begun unavoidably touching our daily lives with new tools and platforms. Consumers and professionals across numerous industries can’t seem to escape this hot topic of conversation.

For commerce marketing professionals, there are a plethora of questions regarding how AI will transform everything from processes and hiring to campaign execution, measurement and content creation.

This special report — based on a Path to Purchase Institute survey (conducted in July in partnership with Vizit) — begins to uncover the potential of AI when it comes to visual content creation. The respondents comprised 35 professionals who indicated that they lead or work in a role that includes visual content strategy, image creation, content syndication or measurement.

From the familiarity and adoption of different tools/services to AI budget allocations and the relevance of applications, this report reveals how AI is currently making a mark in CPG content creation. What does the future hold? Highlights include the perceived benefits and risks of using AI and how professionals see work habits changing in the year ahead.

OUR PROPRIETARY RESEARCH EXAMINES THE POTENTIAL OF AI FROM A MARKETER’S PERSPECTIVE, SHOWING HOW THEY PLAN TO MOVE FROM TEST-ANDLEARN TO FULL ADOPTION.In collaboration with

When OpenAI released an early demo of ChatGPT in November 2022, AI began to dominate social media and news headlines and took the content marketing world by storm. In our survey, familiarity with the concept of using AI for visual content creation and measurement was expressed by the majority of the survey respondents, with 46% saying they were very or extremely familiar. This demonstrates a cautiousness that is reiterated by the rate of adoption of AI tools and services. Three out of five respondents said they have at least experimented with using AI tools to support visual content creation and measurement. However, none of the professionals surveyed have fully integrated the available tools into their internal processes. The feedback on familiarity and adoption shows the industry has a big learning curve ahead.

Q. How familiar are you with the concept of using AI in the visual content creation and measurement process?

it.

we have experimented with AI tools but very much in the initial stages.

we have begun to use AI tools in some cases but have not fully integrated them.

we have fully integrated AI tools into our visual content creation and measurement process.

Q. Has your organization adopted any AI tools or services to support its visual content creation and measurement process?

effective

Q. Overall, how would you rate the effectiveness of the AI tool(s) or service(s) you have recently used to support the visual content creation and measurement process?

From tools that generate copy to platforms that measure and optimize images, there are opportunities to use AI to help with words, graphics, music, video and more. There are AI applications to support every step of the content creation process from ideation to creation to measurement.

Of the collection of AI tools and services available on the market, respondents identified the following as tools they are using or experimenting with: ChatGPT, Proprietary Tool, Vizit, Google BARD AI, OpenAI Dall-E, Midjourney, Stable Diff usion and Adobe Firefly.

The majority of respondents who have used one or more AI tools have found them to be effective — 62% of respondents said they are moderately effective while 10% found them highly effective.

With professionals recognizing the need to learn AI tools or be left behind, the creative world seems to be in an experimentation mode. This means teams need to invest time, energy and funds to explore AI with a trial-and-error mentality. While current budget allocations for AI-based tools or solutions are at a minimum (currently 5%), respondents expect a 15% average allocation in one year.

Based on their current familiarity with AI, respondents were asked to consider the relevant ways the technology may enhance or support visual content creation and management. Advanced analytics (80%), content testing and optimization (75%), content personalization and customization (74%), and content syndication selection (72%) were considered the most relevant.

When contemplating current versus future uses, respondents demonstrated a level of confidence in further exploration. Those who are currently using AI are most often utilizing tools to generate images, videos, and/or music (52%). Looking to the year ahead, there is a desire to use AI to support ongoing content performance measurement (66%), SEO recommendations (60%), advanced analytics (60%), and content personalization and optimization (60%). In addition to these areas of growth, all uses referenced in the survey — from image generation and editing to content testing and optimization, and curation of user-generated content — showed a projected 34% or greater usage. Only 6% of respondents said they don’t expect to use any AI tools or services.

According to respondents, the most compelling

Q. Which AI tools or services have you used or are you currently using to support visual content creation and measurement? (Respondents who indicated having used AI tools and services.)

Q. Which AI tools or services are you considering using to support visual content creation and measurement? (Respondents who indicated not having used AI tools and services.)

Q. What proportion of your marketing budget would you estimate is currently allocated to AI-based tools or solutions for visual content creation and measurement? What do you expect the allocation will be one year from now?

potential benefit of AI for visual content creation and measurement is the ability to improve campaign performance (52%). This was followed by the ability to leverage data-driven insights to optimize marketing efforts (40%) and expediting processes and enabling faster turnaround times (39%).

While there are perceived benefits to adopting AI, respondents are treading carefully due to potential risks and the numerous unknown variables. Seventy-one percent of respondents question the quality and authenticity of AI-generated content. This is followed by fears of potential liability concerns (63%), such as copyright infringement, as well as ethical

Q. Below are various aspects of the visual content creation and measurement process that AI tools may enhance or support. How would you rate the relevance of each of the following to your role and/or organization?

considerations (54%), data privacy and misuse of customer data (46%). With the emphasis on developing an authentic brand over the last decade, 63% are concerned about the misalignment of AI-generated content with brand voice, values and objectives.

Other concerns include the complexity of integrating these

tools into existing systems and processes, staff training and fi nding the right balance between human and AI collaboration. It is clear that the industry is in a phase of uncharted territory, which requires a commitment to exploring, learning, growing and adapting.

Respondents believe, like with all new technology, there

of images, videos and/or music

Image editing and enhancement

Creative ideation and concept development

Content testing and optimization

Content personalization and customization

Video editing and production

Advanced analytics to optimize content performance

Content syndication selection

SEO recommendations

Curation of user-generated content

Ongoing content performance measurement

Q. In which of the following areas are you currently utilizing AI tools or services to support? Which are you not using today but hope to be using by this time next year?

With all of the hype surrounding generative AI programs like ChatGPT, DALL-E, Midjourney and others, you’d be forgiven for wondering how AI fits into your content creation and execution workflows. But the recent survey from the Path to Purchase Institute and Vizit backs up what I hear in conversations with agency and consumer brand leaders: Professionals have high hopes for AI’s potential, especially as a tool to optimize the content creation and execution processes — and they’re ready to implement it in 2024.

The survey responses include a number of professionals who are hopeful that AI can help them be more efficient with their team’s time, so creatives and strategists can do what they do best. While some teams are experimenting with generative AI, many are more curious to find how AI can complement existing staff and structures. Several respondents call out the opportunity for AI to reduce costs and allow team members to focus more on creativity in e-commerce imagery, packaging and advertising.

We saw this reflected in the tasks and functions that professionals are hopeful AI can assist with in the visual content creation process. When thinking about how AI can enhance or support visual content creation and measurement, respondents saw most relevance in advanced analytics (80%), content testing & optimization (75%), content personalization & customization (74%), and content syndication selection (72%).

Applying AI to the measuring and testing side of content creation to free up time for employees is a far cry from the widely held belief that generative AI is coming for all writing and designing jobs. What’s driving the different opinions? Professionals may be wary of the quality of AI-generated content or could struggle matching generative AI outputs with brand guidelines. But an underrated factor may be the creativity and brand alignment that comes from your employees.

“AI is great, but trained creatives, writers and marketers bring unique, human ideas to the table that are valuable and personable,” one respondent said. Another respondent pointed out that younger generations today want authentic experiences

from the brands they frequent, and teams aren’t yet convinced that generative AI can deliver in that way.

This matches the conversations I’ve had with peers and Vizit customers, many of whom are intrigued by AI, but are fi rst and foremost focused on creating the best possible branded experience for consumers. They don’t need AI that will attempt to replicate their jobs. What they need is technology that gives them time and resources to focus on building and maintaining customer relationships.

We’ve seen this at Vizit for years. With AI providing the backbone of content analysis, e-commerce and design teams are free to spend their time doing what they love: creating, strategizing, designing and building out big ideas. If this is the future of AI — and it seems like a number of industry leaders want it to be — then weaving predictive AI into the fabric of your teams now is the best way to get ahead of the competition, win in an image-infused retail landscape, and retain and maximize your talent.

AI’s potential can only be fully realized when combined with the strengths of human staff. Bringing together AI’s efficiency and your employees’ creativity and emotional intelligence gives e-commerce teams a competitive edge by leveraging cuttingedge technology while ensuring customer-centricity, brand differentiation and ethical conduct. The future of e-commerce isn’t a battle between humans and AI — it’s about harnessing the strengths of both to drive success in the digital age.

Jehan Hamedi is the founder and CEO of Vizit. With more than a decade of experience in computational social science and artificial intelligence, Hamedi’s innovations have led to important advances in AI and computer vision, consumer insights and e-commerce, resulting in eight patents and an award-winning software platform.

Improve campaign performance

Leverage data-driven insights to optimize marketing efforts

Expedite our processes and enable faster turnaround times

Increase efficiency and productivity

Optimize our content strategy for better results

Create more visually compelling content

Improve targeting efforts

Create personalized content at scale

Reduce our outsourcing costs

Foster creativity, allowing for innovation and experimentation

Q. Below are some potential benefits organizations may realize from the use of AI for visual content creation and measurement. Which of the following are most compelling to you and your organization? Rank up to the top three most compelling benefits or write in your own.

will be an initial wave of fi rst adopters who will pave the way. Some believe these organizations will have an advantage. “There are many challenges in these beginning stages that may cause organizations to shy away from innovating with AI tools. Organizations that are able to effectively use AI tools will hold a tremendous advantage over those who are not,” said one respondent. “Early adopters who get effective results out of the tools will have more high-quality output with fewer resources.”

Another respondent believes a slow and steady adoption process is the best course of action, including a meticulous analysis of the integration into the organization. “I think overall it will be a slow adoption process following a crawl/ walk/run approach. There will be early adopters, but ultimately slow and steady wins the race. Organizations will need to methodically track and measure the accuracy of the content and data generated to ensure it is on par with the level of human-generated content. A rigorous evaluation process will be needed to ensure accuracy.”

Survey respondents indicated that CPG organizations will embrace AI tools at varying levels, while figuring out the best uses to support visual content creation. Respondents believe many companies will start utilizing AI more frequently in the next year.

“I see the next 12-18 months as a test-and-learn phase where we’ll begin to see the potential impact,” said one respondent. Others in agreement believe there will still be some apprehension on full adoption.

From automating menial creation tasks to reformatting base

creative to different specs and offer messaging, respondents see the potential of AI to improve team efficiencies. Rather than a fear of AI taking human jobs, a more positive outlook sees AI freeing the team up to focus on creativity.

On a broader scale, one respondent said: “More companies in the industry will adopt AI for a wider variety of applications, so content creation and personalization will be streamlined and become more efficient. AI will also become involved more robustly in the development of strategy and help drive direction, making its fi ngerprint ubiquitous across all content consumers engage with.”

Striking the right balance between human creative talent and AI tools and services will be a focus in order to authentically connect with consumers and maintain the integrity of a brand. “I think AI will be used by a majority of brands/agencies to drive efficiencies and ideation; however, there will have to be a balance between human and AI content development. The industry will learn what that right balance is to leverage AI most effectively. If they do not, the risk is coming across as inauthentic to the consumer, which could be detrimental to the brand.”

The industry will learn what that right balance is to leverage AI most effectively. If they do not, the risk is coming across as inauthentic to the consumer, which could be detrimental to the brand.

— Survey respondent

Marketers from around the world provide perspective on the path to purchase. Our report includes interviews with marketers from Brazil, Mexico, Panama, Spain, Switzerland and the U.K.

BY ERIKA FLYNNLocation: Zurich, Switzerland

Advisor, Independent Consultant, Athoria Consulting; NonExecutive Board Director, Clas Ohlson, Viva Wine Group. She works globally, with a focus on Europe and the Nordic region, Swedish/Norwegian National.

Shopper behavior: “Since the [Russia-Ukraine] war started, I’ve observed a number of changes in people’s behaviors and I would say these are typical across multiple markets. Shoppers have become more price-sensitive and less impulsive in purchases. The downtrading is clear, and there is a reluctance in spending. Shoppers think and behave differently depending on the category: small-ticket items are less impacted; larger ticket items are more impacted and purchases are put off. Consumers continue to need ways to balance their mental state and be happy. As an example, wine consumption is shifting to slightly less expensive wines or, in the Nordic region, bag in box, while volume is staying pretty much the same.”

T he path to purchase: “The shape of the consumer journey

has not changed, but the importance of a step might have. An example from consumer durables is that more research and investigation is done up front, and planned purchases are postponed, whereas distress purchases (when an appliance has broken) will still take place. It’s very important to adjust actions and, for instance, offer different payment terms (often happens via retailer) or offer guarantees. Consumers and shoppers want to a greater extent to be heard and understood, and there is less tolerance for friction in the consumer journey. We need to know their pain points and address them immediately, or we risk losing a shopper or consumer who has been loyal previously.”

Brick-and-mortar stores: “Campaign intensity is high in Sweden right now. Some stores are incredibly cluttered and difficult to maneuver for shoppers. The risk is that shoppers stop to engage with anything when campaign intensity is high. The store and many activities become wallpaper, and shoppers become task-oriented and de-select the many messages. The retailers who know their shopper base well — and can adjust and ensure they focus on what is most important to their most important and loyal shoppers as they enter the store — will win.”

Internal/external technologies: “Machine learning and AI are at the forefront of technological breakthroughs transforming the insight and analytics industry. When companies are analyzing huge amounts of data and consumer feedback, they can gain a lot of efficiencies from automation.”

FELIPE BRAGA

Global Director, Category Commercial Strategy, The Coca-Cola Co.

Shopper behavior: “The primary variable in recent years was inflation. In many countries, it was the first time a generation faced rising prices. The differences between low-income and high-income consumers becomes more pronounced, and shoppers may switch to cheaper alternatives, delay purchases or focus on essential goods. The industry must think of solutions in product, service and communication for those distinct audiences, eventually bringing more complexity to their business.”

E-commerce: “Artificial intelligence (AI) and machine learning, in particular, are increasingly pivotal in offering tailored experiences, product recommendations and customer service. The growth of mobile commerce is also critical. Businesses are optimizing their websites for mobile use and launching dedicated apps to enhance product discovery

and ease of purchase. Instagram’s Shop Tab and Pinterest’s Shopping Feature have revolutionized how consumers discover and buy products, which has placed greater emphasis on the importance of engaging, authentic content that caters to a diverse and informed audience.”

Brick-and-mortar stores: “Retailers are embracing technology to enhance in-store experiences and facilitate seamless transactions, and use data analytics and inventory management systems to optimize store layouts and offerings. The integration of online and offline retail, or ‘omnichannel retail,’ has emerged as a vital strategy, enabling businesses to sync their online and in-store inventories and allow customers to buy online and pick up items at a nearby store, thus leveraging the advantages of both platforms. The future of brick-and-mortar retail lies in the successful adaptation to and integration of modern technologies, consumer preferences and sustainable practices.”

Retail media/retailer media networks: “Retail media networks have been experiencing global growth as they increasingly become essential players in the future of commerce and marketing. We should expect a greater prominence of formats such as video and native ad placements, better sales attribution models to measure return on investment and engagement, and integration of more advanced technology to optimize ad targeting and improve campaign performance.”

Location: London, England

Head of Shopper, pladis

Shopper behavior: “There are so many different ways in how we shop, buy and behave today because there’s so much more opportunity than ever before. Shoppers have become fickle, and while they may have been brand loyal before, they aren’t any longer. Since COVID-19, people are more demanding and choosy because of the opportunities available to engage with products. The cost of living crisis has defi nitely impacted shopper behavior as well, but demand would have happened regardless in the U.K., with shoppers now having more time to think about their purchase behaviors.”

The path to purchase: “It is so squiggly right now in the U.K. in terms of how customers interact with products and brands. There are so many different interactions before you physically pick up an item, or have it delivered to your door. It has morphed into a whole digital experience and is getting more sophisticated than a traditionally simple shopping experience.”

In-store shopping: “Customers want to have more of an experience that is convenient for their lifestyle. Because the world has shrunk in terms of what is available, variety is crucial in-store and customers want to see interaction. Experiences received online or digitally need to be replicated.”

E-commerce: “There will be a saturation point. During the pandemic, e-commerce saw a huge spike but has plateaued since. While quick commerce is a great idea, it’s consolidating and doesn’t drive much business. It’s shown that it’s not for everyone. There is a fi nite amount of people who are prepared to shop through e-commerce, and it may not grow any more than it is today as generations weave in and out of life stages.”

Retail media: “This is absolutely bonkers at the moment and we expect it to only get bigger as the cookie dies. We’re working more and more with agencies and retail media networks that have been collecting data for a long time. It helps retailers make money, and we know that it delivers. While it can be pricey, retail media networks have done a great job — so much so, that more people across the business are realizing how powerful it is. We’ve been doing some great things with partners so far, but there’s so many more opportunities for us to target shoppers, and it’s really exciting.”

Web3/the metaverse: “It’s in the early stages for us and we work closely with agencies and teams to be guided in how best to use it, demonstrating what it can return for us and why it’s the right thing to do. With so much happening across the industry, it feels big and scary, but we’re here to learn.”

in driving better value and brand choice.”

Location:

Head of Insights & Analytics, MENAP, Mondelez International

Shopper behavior: “Middle East, North Africa and Pakistan (MENAP) is a cluster of markets with diverse retail structures. We have Egypt and Pakistan with high traditional trade presence and then markets like KSA and UAE with sizable modern trade presence. The challenge across markets is quite diverse for us. However, one thing that binds across markets is the pressure of inflation on shoppers, and the choices they are making depends on the role of category/brands in their daily lives. Hence, when we think of in-store, interrupting shoppers and reminding them of the moment of consumption, bringing to life the occasion becomes critical, be it via POS material or via adjacent category placement. Shoppers are also increasingly prioritizing convenience in MENAP markets, leading to growth of online shopping platforms. With the context of high inflation, dialing up some of these aspects automatically helps

The path to purchase: “With shoppers actively looking for deals/value, pre-store touchpoints do influence shoppers, and being present on retailers’ online platforms and fl yers is becoming as important as presence in the promotion area. Also, with the clutter increasing in the promotion area, it is more important than ever to stand out with the POS that brings to life the consumer occasion. Magic price points alone are not enough. Given that shoppers are spending a lot of time in the promotion area, they might also skip some of the aisles. Identifying cross-category placement based on high shopper basket incidence and synergy with our brands also plays a key role to drive multiple touchpoints for the shoppers in-store.”

E-commerce: “E-commerce is one of the fastest growing channels in MENAP, where we see new players coming up across markets and the established players (retailers) consolidating their position by investing more to give an omnichannel experience for shoppers. It’s important that we don’t try to make it one size fits all. For us, UAE is the biggest market in terms of e-commerce penetration, and we have built our strategy focused on individual channels: omnichannel, pureplay and last-milers. We have seen shoppers going for distinct needs in each of these channels, so it is important to replicate the same from an assortment/activation/pricing point of view.

Location: Santa Fe/Mexico City, Mexico

Manager Shopper Insights, Mondelez Snacking Mexico

Shopper behavior: “Due to an inflation of approximately 5.5% and price increases of 12% within the market, shoppers are pushed to look for more options to distribute their spending. They are losing loyalty in modern trade formats and looking for more retail environment options, where discounters are the only format having a growth in number of stores. In that way shoppers make their shopping basket more efficient, looking at larger sizes or private-label options even in food products, which is a new behavior versus previous years.”

The path to purchase: “Shoppers are prioritizing categories to keep the basic supplies at home and are becoming more savvy about value per money, even adding more trips to fi nd the best options for their baskets.”

In-store shopping: “Secondary displays are more relevant to select than main aisle by 20% more, where they know the

E-commerce: “Grocery shopping is gaining relevance year by year, and where last-milers took the lead during the pandemic, in recent years brick-and-click, pure players are now more relevant due to safety in their shopping experience, better prices and promotions, and better navigation within their platforms.”

Brick-and-mortar stores: “Physical stores are still the most important channel to do shopping, but we are seeing a reduction in hypermarkets in store space with the leasing of extra spaces to other businesses like gyms, cafeterias, etc. Also, we are seeing a growth in discounters. These stores are evolving into brick-andclick to become more digital, adding spaces for pickup parking, and jumping into the trend to become more frictionless shopping.”

Successful activity: “With insights around the globe and taking a step forward in payment seamless trends, we track the best way to place our products in the self-checkout area, understanding the shopping trip in the hot zones, and thinking about ergonomics that all products should fit in our arms without bags.”

Web3/the metaverse: “Defi nitively we have to pay special attention to younger generations that can connect and socialize in different manners with our brands and people. Digital transformation is pointing to metaverse actions in the near future.”

Shopper behavior: “It has changed more in the past three years than in the last 10, driven by cost of living, the pandemic and changes of weather. It is much more volatile and dynamic because of our ability to learn and relearn, which can only make us succeed and not take anything for granted. Where consumers shop and how they make decisions is changing more often than before.”

The path to purchase: “We would previously run massive campaigns with a single media touchpoint doing the job to get customers to a supermarket, but that’s just not true anymore. How consumers interact with media changes over time, throughout the week, based on the weather, etc. It’s way more complex than before so we need to be working more cross-functionally with the consumer at the forefront of our minds.”

In-store shopping: “This is an interesting one with HFSS (regulations in the U.K. regarding foods high in fat, salt and

sugar), the rise of discounters and the pandemic, which has encouraged us to invest more in in-store theater to create excitement for customers. We expect to see entertainment instore coming back. The touchpoints today are more effective, impactful and digitized, and there’s been a greater investment from retailers, along with brands that want to inspire more at shelf. Haagen-Dazs used to invest in creating huge experiences but at a lower return. We’re now clear on what our bread and butter is to fi nd the next key moment and then go above and beyond. This became even more important than before with HFSS, and it’s the same for every brand.”

E-commerce: “It will no doubt continue to be the future and there will still be growth, but there may not be the same level of over-investment that we saw previously. We have seen retailers get more agile and flexible in what they can do on e-commerce as a test-and-learn, inspiring grocers on their instore approach via meal deal opportunities, for example. Ondemand grocery channels are exciting, but they don’t have the scale yet, and the proposition needs more time.”

Retail media: “We’re talking about it more than we ever did before, and know that there are a lot of new opportunities available. While we think the U.K. is ahead of many other countries, there’s still a lot to learn from the U.S. We’ve partnered with retailers here, especially after COVID-19 to get closer to shopper behaviors, but we could still do more to continue to learn and test opportunities. Each retailer is at a different stage in their journey with retail media networks.”

Location:

Shopper behavior: “The big thing in the U.K. at the moment is the cost-of-living crisis, which is driving a massive awareness of value and price among shoppers. Retailers are responding by offering special discounts through member pricing and loyalty cards. ... Of course, in turn, retailers are using that data to drive their retail media networks and protect or grow their margin.”

The path to purchase: “We see the path to purchase as continual movement between different mindsets. As a result, we’re combining media to drive brand awareness, while also having embedded calls to action. The measurement of that provides the way forward. Customers are bouncing around what we call the ‘messy middle,’ becoming aware of new brands and purchasing them very quickly. The brands that do really well are the kings of that messy middle; they’re able to reach customers at those specific points and drive a purchase in a seamless way.”

E-commerce: “E-commerce growth has returned to the natural curve that we saw pre-COVID-19, but it differs by category. We expect its share of sales to grow to between 25% to 30% in the next five years as its capabilities grow. Those new capabilities will play a really important role in the future of retail and those companies that are investing heavily behind it are winning.”

Retail media/retailer media networks: “All the major players in the U.K. are now starting retail media networks. Retail media is now able to go further up the funnel and through that messy middle, so we’re starting to see more value in utilizing some of the traditional budget in retail media or retail media influence channels. Brands are starting to consider retail media as an integral part of their overall communication strategy, beyond just how they deal with the store. Those that provide a full omnichannel experience that’s driven through fi rst-party data and ties the awareness channels in with the conversion channels in a seamless way will win.”

Keeps you up at night: “The lack of transparency in retail media in general, and the impact that could have on the future of the business. Unless we can create the right standardization of measurement, and the right transparency and truth in activation, we’re not going to see the full potential of the industry realized as quickly as we should, because brands will become despondent with the results they’re seeing and question the investments they’re making.”

Shopper behavior: “In my journey within the FMCG and pharmaceutical sectors, I’ve maintained a laser focus on shopper behavior. This isn’t just about data collection; it’s about actively listening to the shoppers and putting ourselves in the shoppers’ shoes, grasping their motivations, aspirations and pain points. Only then can we design strategies that not only catch their attention, but also genuinely address their needs.”

The path to purchase: “It has evolved from a linear process to a multifaceted and complex journey. Consumers interact with diverse touchpoints across various channels before making their fi nal decision. Mapping people’s journeys transcends the surface level. It involves pinpointing the critical ‘aha’ moments— those instances where consumers experience a significant shift in perspective or make pivotal decisions. These moments of insight often hold the key to crafting strategies that truly resonate.”

In-store shopping: “In-store shopping has demonstrated remarkable resilience. The essence of physical shopping experiences — the tactile engagement with products, the sensory exploration and the immediate gratification — remains irreplaceable. It’s not just about purchasing products, but about creating memorable interactions. It’s evolving, and companies are embracing technology to enhance the experience rather than being overshadowed by it.”

Brick-and-mortar stores: “They possess a distinct advantage in providing tangible interactions that digital platforms cannot replicate. The natural market sector places strong emphasis on merging physical presence with exceptional service, accentuating this advantage. By crafting immersive environments that stimulate the senses, these stores forge meaningful connections and enduring relationships between customers, products and brands.”

Keeps you up at night: “Navigating constant change. New technologies emerge, consumer preferences shift, and market dynamics transform. Staying ahead of these changes requires perpetual adaptation and innovation. The ever-changing landscape is both a challenge and an opportunity.”

Current AI work: “From analyzing vast amounts of shopper data to gaining insights into consumer behavior, AI has become an integral tool in my toolkit. By harnessing AI-driven analytics, we’re able to uncover valuable trends, patterns and predictive insights that shape effective strategies.”

Location: Panama City, Panama

DAMIEN RINJONNEAU

CMI (Consumer Marketing Insights) Manager, Nestle

Shopper behavior: “In Central America, price increase is the population’s No. 1 concern, and shopping decisions are more than ever driven by prices. When inflation started, shoppers began to organize themselves to control their spendings and purchase in a smarter way, but the second wave of price increases pushed them to shift toward value for money and promotions. They are visiting more channels and spending more

time at the point of sale in order to analyze, compare and find the best deals. Households facing double-digit inflation in lowincome countries made sustainability and health claims slightly less important. These shopping behaviors vary among income groups, with higher socioeconomic levels opting for bigger packs while lower levels shift even more toward lower out-of-pocket.”

E-commerce: “Even though e-commerce sales have exploded during the pandemic, they remain a marginal percentage of food and beverage sales. The main barriers are higher perceived prices, on top of the delivery fee, and overall experience with a lack of physical interaction with the products and problems with the delivery (errors, damaged products or about to expire, etc.). E-commerce remains an interesting touchpoint that some shoppers use to compare prices and fi nd the best deals before shopping offl ine. Interestingly in this region, sales through WhatsApp and phones remain higher and are the preferred option for lower socio-economic levels.”

understand better what’s happening across the entire path.”

In-store shopping: “It is getting relevant again in Europe, and shoppers are requiring omnichannel experiences.”

Brick-and-mortar stores: “This is the biggest channel with a lower growth trend, but the most relevant in Europe in customer mix.”

Location: Madrid, Spain

E-Commerce Digital Content and PPA lead Europe, Mondelez International

Shopper behavior: “Consumers have much more info online than in traditional channels.”

The path to purchase: “We are now able to measure and

Retail media: “It is getting more relevant for retailers as a new source of profit compensating extra delivery costs.”

Keeps you up at night: “A new end-to-end digital shelf project that I am leading globally.”

Successful activity: “We have seen great improvements in search due to titles improvement in relevant customers.”

Internal/external technologies: “Mainly AI, as well as content management tools such as DAM, PIM.”

media capabilities and use them as important touchpoints for omnichannel experiences. Retailers are also looking at how they can creatively improve the shopper experience in stores. They are leveraging key categories to make them more impactful at stores, giving more space, improving merchandising, assortment, P-O-P, etc. ”

Location: Mexico City, Mexico

Senior Director, Digital Commerce Mexico & Latin America Capabilities, Colgate-Palmolive

The path to purchase: “After the pandemic, Latin America increased not only the number of smartphones, but also the number of apps/social media used by consumers. Therefore, it is becoming more nonlinear, as the consumer journey starts and ends everywhere.”

In-store shopping: “It continues to be the strongest habit among Latin American shoppers. However, more and more they use digital tools while they are shopping. Some retailers are also leveraging technology in-store to strengthen their retail

E-commerce: “It’s still one of the fastest growing channels in Latin America. Growth is coming not only from more mature digital commerce categories (e.g., electronics) but also from FMCG categories. Omnichannel experiences need to be a priority for both retailers and suppliers since, as mentioned before, the consumer journey starts and fi nishes everywhere.”

Retail media: “With the retail landscape in Latin America — pure players such as Amazon and Mercado Libre, omniretailers such as Walmart, Carrefour and Cassino, strong local ones, and last-milers such as Rappi, iFood and Uber that exploded during the pandemic — we see that almost all types of retailers are trying to do something on retail media. Currently, there are different stages of maturity in terms of retail media capabilities across the region.”

BY JENNY REBHOLZ

BY JENNY REBHOLZ

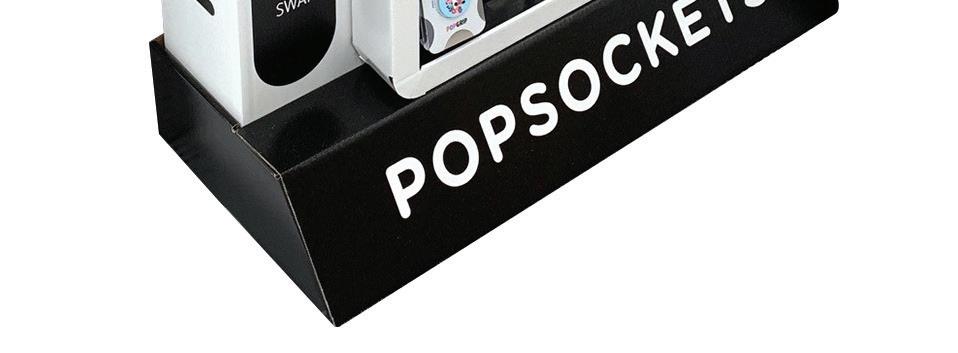

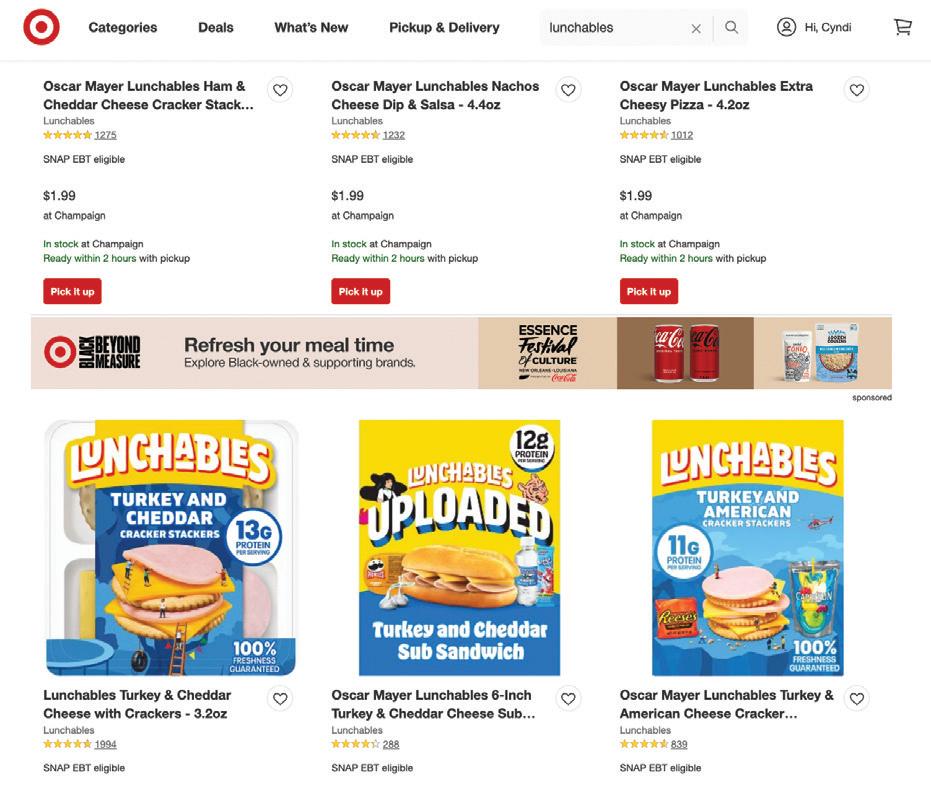

s the end of 2023 draws near, brands and retailers are addressing strategic plans and 2024 marketing initiatives.

Shopper insights provide valuable information for these planning efforts, reinforcing successful strategies and shedding light on areas for innovation and improvement. How has the in-store shopping experience evolved over the past year? What challenges and opportunities lie ahead?

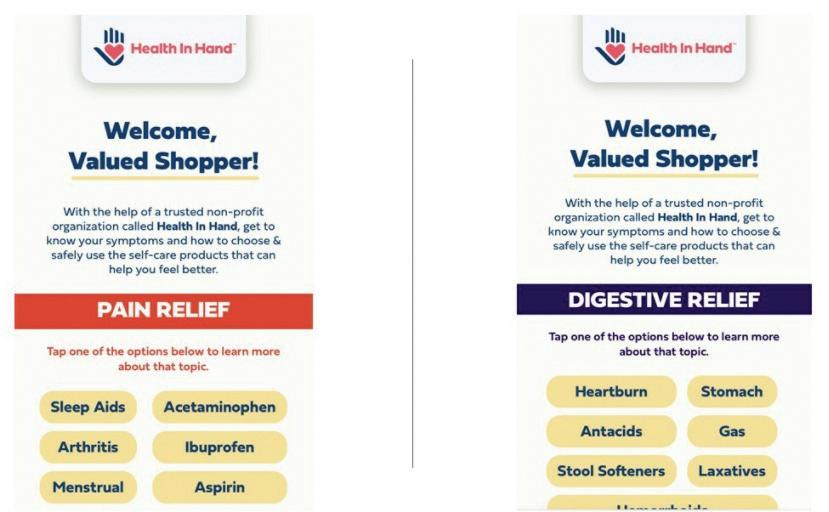

The Path to Purchase Institute’s July 2023 “Engaging Shoppers In-Store” survey, conducted in collaboration with Mood Media, gathered responses from 1,000 shoppers varying in age from 18 to 56 and income levels from less than $35,000 to $150,000 or higher. The qualifying participants reported shopping in-store in one or more categories of interest, ranging from grocery, health and beauty and department stores to fashion/clothing stores, luxury, quick service/fast food, specialty stores and automotive dealerships.

This report shares insights on in-store shopping habits and drivers, including in-store physical and digital details influencing shopper satisfaction. The report also highlights opportunities for brands and retailers to capitalize on consumer shopping habits and expectations to increase in-store shopper engagement.

Similar to shopping patterns recorded over the past few years, the survey respondents reflect a combination of in-store and online habits. Instore-only shopping accounts for more than 32%

I know exactly what I’m looking for and try to spend as little time as possible inside the store.

I have a shopping list but often enjoy browsing as well.

I have a vague sense of what I need but usually spend time browsing the store.

Q. When shopping in-store at each of the following, which typically best describes you?

of shopping practices across categories, with 52% of respondents saying they shop in-store only at grocery stores. This is closely followed by quick-service/ fast-food restaurants at 47% in-store only. Despite the evolution of shopping options in the automotive industry, it is interesting to note that 69% of shoppers say they have visited a car dealership within the last year.

Consumers shopping in-store seem to be organized, focused and timeconscious. Forty-four percent or higher across categories said they know exactly what they are looking for and try to spend as little time as possible inside the store. This suggests brands need to grab shoppers’ attention before

Q. In a typical month, do you shop at any of the following stores, either in person or online?

Q. Which of these stores do you shop at in person in a typical month?

Ability to see products in person/interact hands-on

Discovering new products

Being able to go shopping with friends, my significant other and/or family Immediacy of purchase/instant gratification

Easier to navigate/find products in-store than online

Wider selection of products

The overall atmosphere and experience

Learn more about the brands available Interaction with/assistance from the shop staff

A stronger sense of, and ties to, the local community Tech-enabled experiential offerings/interactivity

Q. What are the most important reasons why you may choose to shop in a physical store rather than online, if any? Select all that apply from the list below or write in your own response.

they head in-store, so consumers are confidently looking for their products. In fact, three out of five shoppers say they often seek out brands in-store after seeing their ads online.

While a higher percentage of shoppers seem to take the focused approach, other respondents admit to taking time to browse while in-store no matter their intended purpose, and some approach shopping with a vague sense of a list and time allotted for browsing. It is relevant to note that male shoppers are significantly more likely than their female counterparts

to say they try to spend as little time as possible inside stores, across nearly all categories.

Despite the tech-driven state of the world, there is still a desire to see and touch products in person. According to 52% of respondents, the ability to see products in person and engage in hands-on interactions is the most common reason for in-store shopping. Other motivations for consumers to visit physical

Has a pleasant scent

Interactive digital screens or tablets where you can customize, personalize and/or configure products

Supporting sustainable practices in-store

Interactive digital screens or tablets providing in-store access to all the same search and discovery tools that are available online

Hosts brand-relevant and/or community events

video walls to bring products to life

and/or virtual reality

Digital screens which provide inspirational content, information about products and/or atmospheric images

Incorporates branded music playlists and sound

Q. How important would the following factors and/or characteristics be to you if choosing to visit a physical store?

Connecting consumers with brands to shape perceptions, activate behaviors, and drive business results through on-premise media solutions.

Learn More about Mood Media, the world’s leading experiential media company, as we redefine the on-premise customer experience and deliver unparalleled value to businesses and brands globally. moodmedia.com

stores are to discover new products (37%), to enjoy shopping with friends and family (36%) or for a sense of instant gratification (35%). Some respondents also consider it easier to navigate and fi nd products in-store vs. online (35%).

Male shoppers and those with higher household incomes were more likely to reference ease of navigation, the overall in-store atmosphere, the ability to learn about available brands and interactions with shop staff as driving factors for in-store shopping.

These connections to the physical store reinforce the need for brands and retailers to continue to invest in in-store enhancements. From refi ning floor plans to support ease of navigation and intuitive wayfi nding to enhancing the sense of discovery, amping up the overall experience for learning, entertainment and enjoyment remains valuable for capturing consumer attention.

Other important drivers influencing the decision to visit physical retail include everything from the scents and sounds within a store to technology integration. Consumers are also interested in the sustainable practices of retailers and the scheduling of brand-relevant or community events. All of these factors were considered very or extremely important by at least 50% of respondents. Sixty-five percent identified the pleasant scent of the retail environment as impacting their decision to visit a physical store.

Likewise, an overpowering or unpleasant scent was cited by 39% of respondents as a cause for avoiding or leaving a shop. A lack of product information, the visual appeal of the store and the noise levels, both too loud and too quiet, were also referenced as reasons to avoid or leave a retail setting.

Video content that doesn’t seem fitting for the store or is unpleasant to watch Music too loud

Too many screens with video content

Too quiet in the store

Don’t like the music being played

Q. When thinking about shopping inside stores, which of the following cause you to avoid or leave a shop, if any? Select all that apply.

I enjoy seeing or hearing about the products available at retailers and am open to considering purchasing them during my shopping trip

I enjoy seeing or hearing about the products available at retailers and may consider purchasing them during future trips, either in-store or online

I don’t usually pay much attention or notice the product information or messaging when shopping in-store

I find in-store product information or messaging intrusive, and it takes away from my shopping experience

Q. When thinking generally about the information or messaging you might see or hear inside stores, which of the following best describes you?

I like when retailers’ in-store information or messaging suggests new products that I haven’t heard of before. I am often reminded of products I have considered purchasing by information or messaging inside stores.

I often make purchases based on seeing a sign, display, video, etc. in a retailer’s store.