P2PI.com JULY/AUG 2023 SPECIAL REPORT Retail Media: The Agency Perspective (In collaboration with CVS Media Exchange) THE AI REVOLUTION What marketers need to know now JULY/AUG 2023 P2PI. com MEET OUR 25 INAUGURAL WINNERS Retail Media Awards

media network? Or looking to take your current RMN to the next level?

Threefold have launched 10 RMN’s over the past 12 years. Work with us to understand your RMN potential, assessing your current proposition to help you build your RMN of the future.

Meet the team that can empower your RMN capabilities

Sam Knights CEO

Matt Lee Co-Founder & CGO

Sam Knights CEO

Matt Lee Co-Founder & CGO

Happy shoppers. Brilliant business results. Better brand awareness.

“

Threefold are a brilliant partner. They’ve enabled us to create our own center of excellence - a brilliant new media agency within Boots Walgreens - Boots Media Group. BMG delivers the very best of Boots Walgreens to our CPG’s - from digital to off-site to in-store.

Boots Walgreens Chief Marketing Officer

Boots Walgreens Chief Marketing Officer

Path to Purchase Institute magazine (USPS 4568, ISSN 2835-0219) is published bi-monthly by EnsembleIQ, 8550 W. Bryn Mawr Ave., Ste. 200, Chicago, IL 60631. Subscription rate for the U.S.: $80 one year; $155 two year; $14 single issue copy (pre-paid only); Canada and Mexico: $105 one year; $185 two year; $16 single issue copy (pre-paid only); Foreign: $115 one year; $215 two year; $16 single issue copy (pre-paid only); $56. Periodical postage paid at Chicago, IL 60631 Copyright 2023 by EnsembleIQ. All rights reserved. No part of this publication may be reproduced or transmitted in any form or by any means, electronic or mechanical, including photocopy, recording, or information storage and retrieval system, without permission in writing from the publisher. POSTMASTER: send address changes to Path to Purchase Institute magazine, 8550 W. Bryn Mawr Ave. Ste. 200, Chicago, IL 60631. FEATURES July/Aug 2023 VOLUME 36 | ISSUE 4 Contents P2PI.com 14 24 34 38 Introducing the 25 innovators who are forging the evolution of retail media and advancing connected commerce across the path to purchase. Retail Media: The Agency Perspective Our proprietary research digs into what agency professionals — and their CPG clients — really think about retail media. In collaboration with CVS Media Exchange. Feature: Artificial Intelligence What commerce marketers should know about artificial intelligence now — and how you can immerse yourself — while the playing field is still level. REGGIE Awards Excellence We share a roundup of mini case studies for selected winners of the ANA’s annual REGGIE Awards. COVER STORY

Editorial Advisory Board

Keith Albright

Kelly 46

Kimberly-Clark

Dana Barba

The Lemon Perfect Co.

Stephen Bettencourt

CVS Health

Lianna Cabrera

L’Oreal Paris Cosmetics

Mia Croft

Native

Christiana DiMattesa

Under Armour

Gregg Dorazio

Giant Food (Ahold Delhaize)

Paige Dunn

FIJI Water, JUSTIN Vineyards & Winery, Landmark Vineyards & JNSQ Wines

Tony Fung

The J.M. Smucker 9 50

Bob Evans Farms

Patrick Hallberg Apple

Travis Harry Home Depot

Carter Jensen General Mills

Brendon Lynch

Joseph Vizcarra The Coca-Cola 12

Jushi Holdings

José Raul Padron The Hershey

Jonny Rigby Amazon

Rodney Waights Beiersdorf Ethelbert Williams Kenvue 10

Follow the Path to Purchase Institute here: Contents 4 l July/Aug 2023

Experience

Sweeney

Company

Company

Jeff Sciurba Dyson Americas DEPARTMENTS 5 Editor’s Note Pioneering Retail Media 6 P2PI Member Spotlight 7 P2PI Member Perspective 8 Focus: Retail Media Measurement Standardization 9 Brand Watch Bed Head Celebrates Creativity 10 The New Consumer Consumption Trade-Offs & More 12 In-Store Experience Sprinter’s Experiential Store 46 Activation Gallery Social Media Marketing 48 Solutions & Innovations 50 Insider Intel Muddy Bites at Walmart 48

Pioneering Retail Media

I’ve said it before, but it bears repeating: Awards programs are one of my favorite things we do here at the Path to Purchase Institute. Showcasing excellence, celebrating the people and brilliant minds changing commerce, spotlighting impressive achievements and sharing those stories with the greater industry at large — it really doesn’t get any better than that. It’s an honor we take both seriously and delightfully.

So, it was with the utmost excitement that we launched a new awards program this year: the Retail Media Awards 2023. Our goal was simple: honor those marketers who are retail media pioneers making impactful change in their companies and in the industry. What wasn’t simple was evaluating the overwhelming onslaught of nominations that was to come. We were blown away by the quality of candidates who were nominated this fi rst year; it was a wonderful reminder of how vastly talented our community of marketers truly is.

And while we wished we could have selected far many more winners who were certainly deserving (the top 173 winners seemed like a bit of overkill), the editorial team was focused on keeping this year’s list of winners at 25. So, we meticulously reviewed entries (and re-reviewed and re-reviewed) until we narrowed it down to this year’s honorees. And wow, what a list of inspiring innovators it is.

From managers, directors and VPs to co-founders and CEOs, the winners of the Path to Purchase Institute’s inaugural Retail Media Awards represent a broad spectrum of industry expertise. Honoring the top 25 commerce marketers pioneering retail media, the awards recognize innovative leaders across brands, retailers, agencies and solutions providers who are effectively leveraging or helping others leverage retail media for successful digital and omnichannel campaigns.

P2PI celebrated this talented group of changemakers in June during our annual Retail Media Summit — at an awards ceremony and reception that gathered the industry’s top influencers and thought leaders for an evening of celebration and networking. And now, in this edition of P2PI Magazine, you can get to know these 25 winners (turn to page 14) and learn more about how each one has made an impressive impact on our industry and the evolving world of retail media.

And speaking of retail media … as we come away from our amazing Retail Media Summit in Chicago, P2PI is taking that momentum and planning some very exciting things on the retail media front for the back half of the year. From continued collaboration with IAB on retail media measurement standards and our Guide to Retail Media Networks (coming out with the September/October issue) to a retail media track of dedicated sessions at P2PI LIVE & Expo in November and more meetings of our Retail Media Guild share group, there are so many ways commerce marketers can get involved and stay ahead of the curve.

With retail media growing so rapidly around the globe and becoming table stakes across numerous market sectors, my bet is by this time next year, the words “retail media” may even become part of everyday vernacular. So, the next time someone asks what you do, and you blurt out, “Retail media!” you just might not get a blank stare.

JESSIE DOWD, Editorial Director

BRAND MANAGEMENT

Vice President, Brand Director Eric Savitch esavitch@ensembleiq.com

EDITORIAL

Editorial Director Jessie Dowd jdowd@ensembleiq.com

Executive Editor Tim Binder tbinder@ensembleiq.com

Managing Editor Charlie Menchaca cmenchaca@ensembleiq.com

Digital Editor Jacqueline Barba jbarba@ensembleiq.com

Managing Editor, Member Content Cyndi Loza cloza@ensembleiq.com

Editor, Member Content Heidi Bitsoli hbitsoli@ensembleiq.com

Events Content Director Lori Pugh Marcum lpughmarcum@ensembleiq.com

Contributing Writers Michael Applebaum, Ed Finkel, Erika Flynn, Jenny Rebholz, Bill Schober

ADVERTISING SALES & BUSINESS

Associate Director, Brand Partnerships Arlene Schusteff 847.533.2697, aschusteff@ensembleiq.com

Regional Sales Manager Orlando Llerandi 678.591.8284, ollerandi@ensembleiq.com

MEMBER DEVELOPMENT

Director of Retail Patrycja Malinowska pmalinowska@ensembleiq.com

Sr. Director, Membership Development Nicole Mitchell 203.434.5733, nmitchell@ensembleiq.com

Membership Experience Manager Ann Estey aestey@ensembleiq.com

Manager, Membership Development Brady O’Brien bobrien@ensembleiq.com

Membership Experience Manager Heather Kurtik 724.553.0093, hkurtik@ensembleiq.com

DESIGN/PRODUCTION/MARKETING

Art Director Michael Escobedo mescobedo@ensembleiq.com

Production Director Michael Kimpton mkimpton@ensembleiq.com

Marketing Director Marlene Shaffer mshaffer@ensembleiq.com

SUBSCRIPTION SERVICES

List Rental mbriganti@anteriad.com

Subscription Questions contact@pathtopurchase.com

CORPORATE OFFICERS

Chief Executive Officer Jennifer Litterick

Chief Financial Officer Jane Volland

Chief People Officer Ann Jadown

Chief Strategy Officer Joe Territo

Chief Operating Officer Derek Estey

P2PI.com

Editor’s Note

8550 W. Bryn Mawr Ave., Suite 200, Chicago, IL 60631 877.687.7321 www.p2pi.com

Meet the Marketers

HERE’S A SNAPSHOT OF INDUSTRY LEADERS FROM THE P2PI MEMBER COMMUNITY.

Promotions

Main job responsibilities: I work on the development of national, channel and key customer strategy around pricing and promotions. This also includes budgeting, forecasting and developing promotional planning tools for our sales team. I serve as the liaison between fi nance and sales, with responsibility for our total trade budget, selling, general and administrative expenses, and revenue growth management. I lead an incredible team that manages our trade systems and ensures controls are in process for audit compliance.

How you win with shoppers during uncertain economic times: You have to be able to continuously adapt to the changing environment. What worked last year or even six months ago might not work today. Staying on top of trends, willing to take calculated risks and thinking outside the box have proven to be successful tactics for driving growth during these challenging times. Leaning in with digital initiatives has also proven to be a quick and efficient lever to utilize.

New marketing tactic that you use: Using the “always on” digital strategy in regard to digital coupons and discounts, such as buy and save. This has helped to increase basket size and capitalize on the growth of pickup and delivery while providing extra value to the shopper.

Best career advice you’ve received: Control what you can control. It took me a long time to realize the value in this statement as I am a passionate person. It helps put things in perspective and allows you to focus on what actually matters.

Recent travels: I traveled to Japan this spring to celebrate my birthday with a group of friends. I am half-Japanese, so it was amazing to see where my family came from and learn more about my culture.

SCOTTY MULLINS Senior Expert Services Manager Skai

Main job responsibilities: I work in the expert services team at Skai, which provides transitional support for clients who might be, for example, bringing their media programs in-house or in the middle of changing agencies. My team also provides strategic consulting and hands-on support. I specifically focus on retail media advertising. Day to day, my responsibilities include strategic planning, client enablement, account management and optimization of campaigns for some of the biggest consumer goods brands in the world.

New marketing tactic that you use: Off-site and offl ine tactics are increasingly becoming part of the retail media landscape. In our 2023 State of Retail Media study, we discovered that 76% of advertisers use search and social media to drive traffic to retail sites. Therefore, the last 12 months for us have been about taking retail media omnichannel. I’ve been driving clients to implement comprehensive omnichannel marketing strategies in order to find new creative efficiencies of scale and unify ad programs. By integrating retail, search and social channels, I’ve been able to push brands forward and create a seamless and consistent brand experience across various shopper touchpoints. Even more tactically than that, leveraging channels like search and social to drive traffic to retailers is a great way of tapping into new customers when you’ve maxed out the reach on a particular Amazon Ads keyword. It can help overcome rising cost per clicks, and the algorithmic rewards and brand referral bonuses can have a seriously positive impact on your bottom line.

Best career advice you’ve received: Never stop learning and embrace change. In the rapidly evolving field of e-commerce and retail media, staying up to date with the latest trends, technologies and consumer behaviors is crucial.

Summer plans: I want to explore the Pacific Northwest and Canada. I also want to play as much golf as possible.

Member Spotlight 6 l July/Aug 2023

APRIL KODA Director of Trade

Simply Good Foods Co.

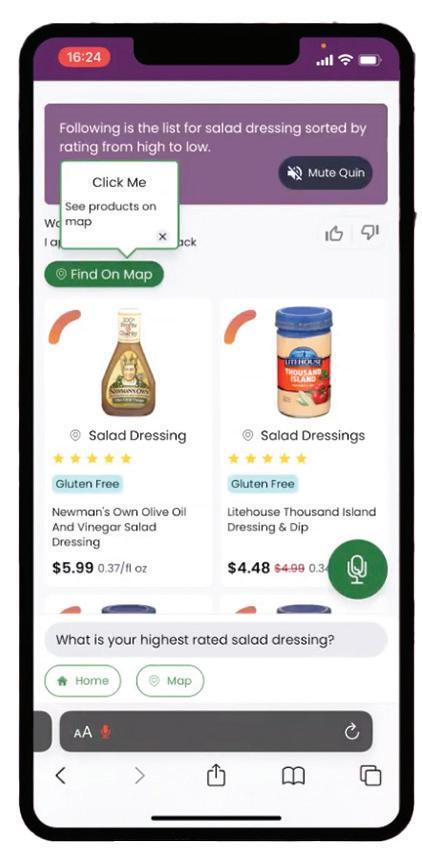

Unlocking In-Store Retail Media

HERE’S HOW BRANDS CAN LEVERAGE THIS EMERGING OPPORTUNITY AT BRICK-AND-MORTAR SITES.

BY RICK SHUMAN

At Grey, we believe there will soon be an explosion of in-store retail media tactics. Only 9% of U.S. retail media networks offer in-store digital media for brands, but 90% of sales happen in-store, according to Merkle and Statista. A new and largely untapped opportunity is becoming clear — harnessing the power of retail sales data to execute highly effective in-store activations to build fully integrated omnichannel programs.

Retailers are adding capabilities and improving measurement within their retail media networks, and we expect to see this accelerate. Let’s look at some recent examples.

Kroger announced an expanded partnership with Cooler Screens to 500 stores. This followed a three-year pilot with the goal of improving instore shopping experiences through captivating interactive screens and digital merchandising.

Walmart also added new product demos and in-store radio to its retail media capabilities. The retailer already includes digital out-of-home media in its network. Walmart is enhancing these tactics through improved sales attribution and putting screens in highly desirable locations, such as checkout and the wall of TVs in the electronics department.

Another notable move was Wakefern Food Corp. rolling out 95 Freeosk units in ShopRite and The Fresh Grocer after a successful pilot. The kiosks serve as in-store discovery destinations for product and category innovation by dispensing free samples. Digital media space is offered on large touchscreens and the kiosks provide secondary merchandising space.

Physical stores lack personalized experiences, but sales data through retail media networks and retailer data licensing may be key to enabling brands to bring personalization in-store. The reality will still be one-to-many messaging for the near term, but we can slowly add additional levels of personalization to get closer to one-to-one messaging. Although the opportunities are limitless, we can imagine some near-term possibilities. QR codes could unlock personalized content based on shopping habits, such as unique discounts or trade price reductions that can help brands reduce subsidization. Augmented reality experiences could be dynamic and personalized, not onesize-fits-all. Even SMS and push notifications could move beyond geofencing and into being personalized based on previous purchase history.

All of this has mutual benefits for brands, shoppers and retailers. One of the key outcomes of in-store integration into retail media networks is an enhanced shopping experience. It’s about helping shoppers fi nd products they need faster and facilitating product discovery that may be relevant based on purchase history. Brands also can reach shoppers with important messaging at scale with closed-loop measurement near the point of conversion to ensure success. Lastly, brands can expose new audiences to product discovery and aid in category growth during moments when shoppers are likely to act on impulse while in-store.

As we prepare to embrace these new tactics, we face the reality that brand

Physical stores lack personalized experiences, but sales data through retail media networks and retailer data licensing may be key to enabling brands to bring personalization in-store.

budgets won’t get larger. So where do we pull spend from to execute the latest tactics? Retail media spend surpassed connected TV spend and is on pace to surpass broadcast TV by next year. When you think about eyeballs in-store as a media audience, they represent nearly double the reach of a retailer’s average digital audience — this is incredibly powerful. In-store budget typically fights for only a small share of overall budget. A case can now be made to tap into TV budgets, however, given the scale, increasing ability to closed-loop measure and proximity to conversion.

There is another area that could push investment into this space — trade incentives from retailers, such as incremental displays, digital support or even shelf placement. Most retailers aren’t making merchandising or trade decisions based on retail media spend, but some are beginning to explore this space.

In-store retail media is about to have its time in the spotlight. Let’s prepare for it together.

About the Author

Rick Shuman leads shopper marketing for Grey out of the Midwest office in Cincinnati. He has more than 12 years of experience in shopper marketing, consumer promotion and marketing leadership on both the brand (L’Oreal, Kao) and also the agency (pep, Grey) side of the business.

Member Perspective P2PI.com

The Need for Measurement Standardization

ALBERTSONS EXEC TALKS MEASUREMENT IN RETAIL MEDIA — AND INCREMENTALITY’S ROLE.

BY CYNDI LOZA

BY CYNDI LOZA

Albertsons Media Collective, the retail media arm for Albertsons Cos., this summer shared a preliminary framework to standardize specifications, methodologies, terminology and disclosures across retailer media networks (RMNs). The initial version of the framework focuses on four areas: product characteristics, performance measurement, thirdparty verification and capabilities. The framework will be fi nalized after pressure-testing industry-wide priorities, according to Albertsons, and ensuring executional feasibility.

Guided by an advisory group, the framework will also expand and evolve further to support key initiatives by the Interactive Advertising Bureau (IAB). The Path to Purchase Institute recently chatted with Evan Hovorka, Albertsons’ vice president of product and innovation, to discuss the need for measurement standardization and how AI is going to be a key unlock for retail media.

P2PI: The biggest challenges we hear from brands are data sharing and transparency, measurement standardization and managing so many networks. Any advice for brands?

Hovorka: Brands should demand a standardization framework be put in place to foster better collaboration and efficiency across retail media. Standardization wouldn’t just be a win for brand advertisers and agencies. RMNs have skin in the game, too, and should help pave the way for standardization to ensure the channel’s growth for years to come. RMNs are wasting engineering calories by trying to build end-to-end channel solutions when many of the product features are not, and should not, be differentiators. Adopting common patterns for basic features would make everyone’s lives better.

P2PI: You say measurement standardization is imperative for the growth of retail media, especially as the sector grows increasingly crowded. Can you expand on this?

Hovorka: While the number of RMNs has grown at an impressive rate over the past year, the absence of industry-wide standardization poses significant challenges for advertisers, agencies and RMNs themselves. Without standards to follow, each RMN has its own ad formats and measurement protocols, essentially operating as their own walled gardens. Because of this lack of transparency, advertisers do not have the resources to transact across many

RMNs at once. The result is an unnecessarily inefficient, costly and frustrating ecosystem for ad buyers. Without overcoming these challenges, RMNs put their future success at risk.

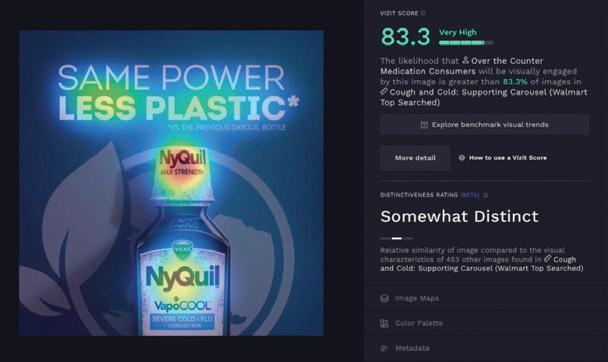

P2PI: How does Albertsons Media Collective define incrementality?

Hovorka: Incrementality is a measurement tool that calculates incremental outcomes of ad campaigns. It can be used to measure everything from conversions and sales to brand awareness. That said, not all methodologies are created equal. There is still an opportunity to muddy the numbers, especially when using synthetic hold out groups where ads are shown to the entire audience segment. At Albertsons Media Collective, we use a pre-campaign audience hold out. Before a campaign begins, the entire audience segment is randomized into test and control groups. An ad is then shown to the test group while being withheld from the control group. Having this audience control group at the start of a campaign helps to eliminate biases, providing advertisers with data-informed insights to optimize their next ad campaigns.

P2PI: How can incrementality solve retail media’s measurement problem?

Hovorka: Incrementality adds an extra layer of transparency to measurement and reporting by providing insight into sales, as well as how much of a sale can be attributed to an ad. This is especially important for advertisers who already have a large customer base of loyal customers. This level of granularity ensures retail media networks only take credit for the incremental part of sales, and not the loyalty the brand has already established with that customer.

P2PI: What role does AI play in helping marketers fully embrace retail media?

Hovorka: AI is going to be a key unlock for retail media, specifically for media buying, creative generation and audience creation. However, what many forget about AI is that it’s only as powerful as the data it sits on top of. This makes it especially powerful for retail media, but also a potential trap door. Many RMNs are built on top of unstable data foundations, and as AI only utilizes the data it has available to it, a poor data set will lead to poor results.

Editor’s Note: The full, extended version of this interview is available on P2PI.com.

FOCUS: Retail Media 8 l July/Aug 2023

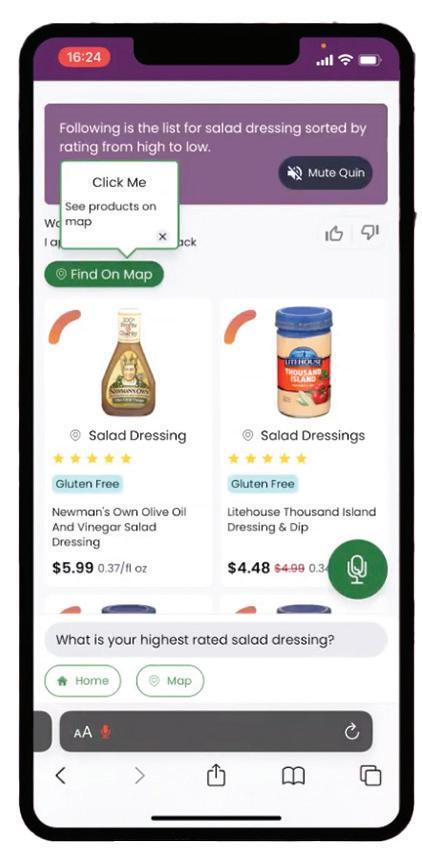

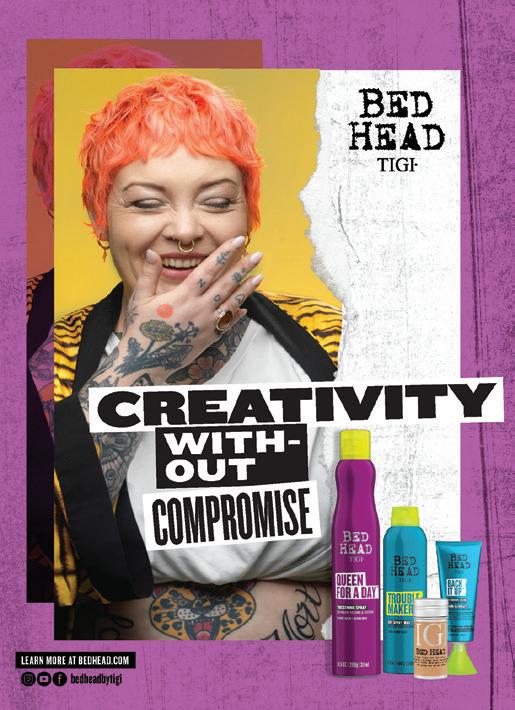

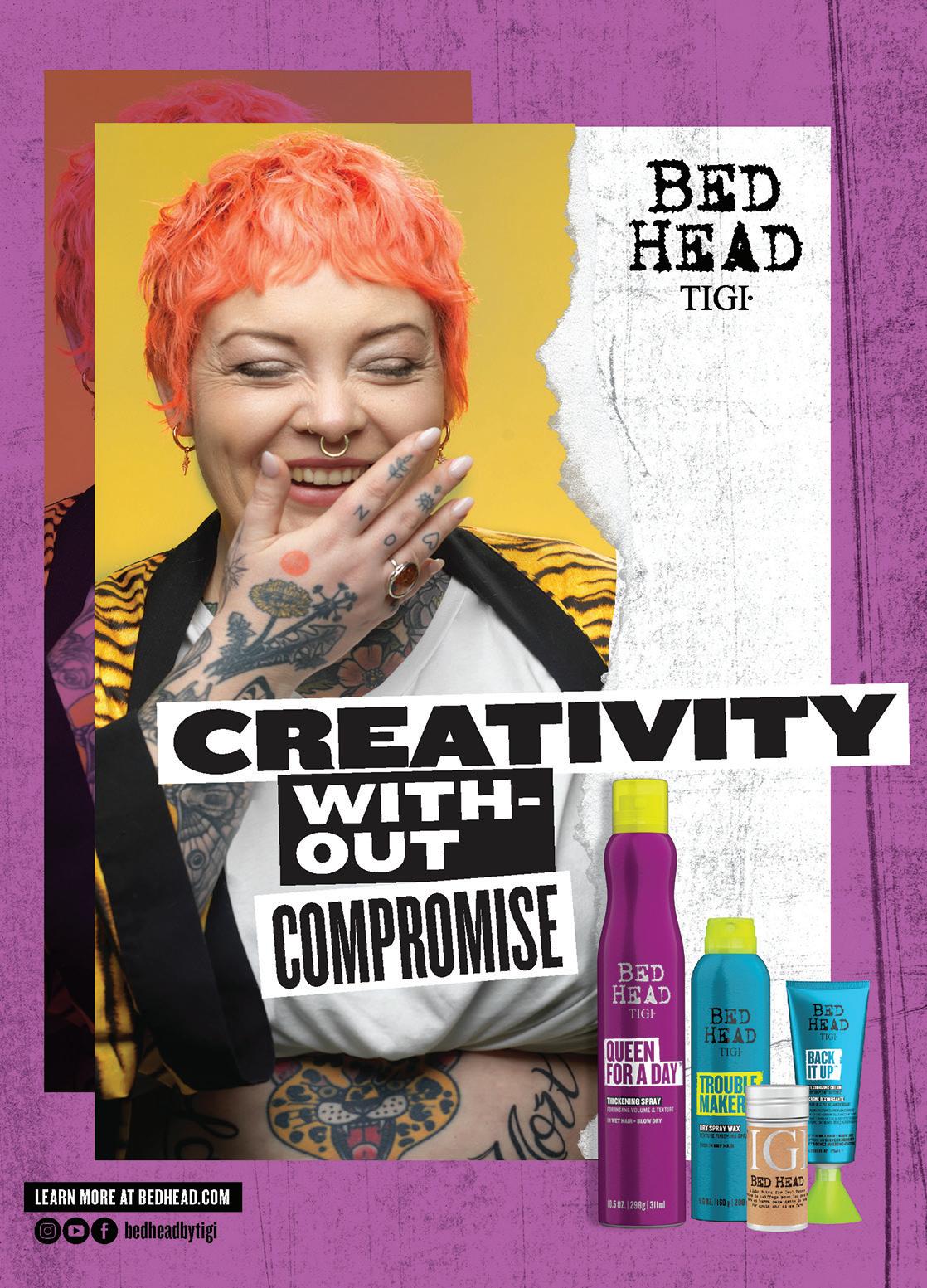

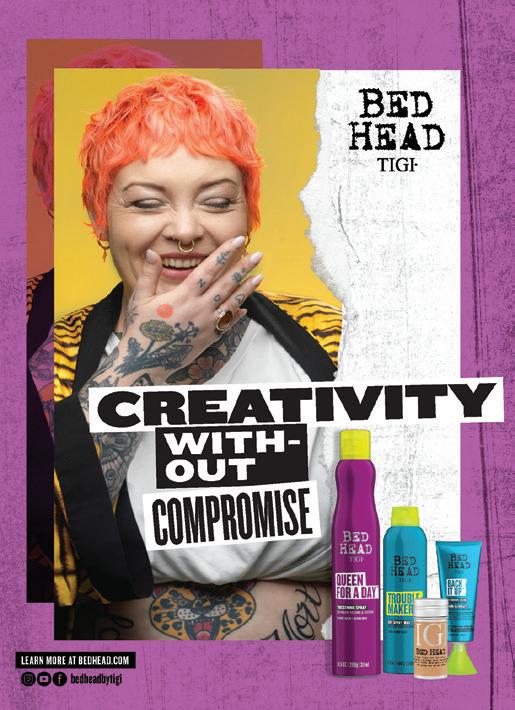

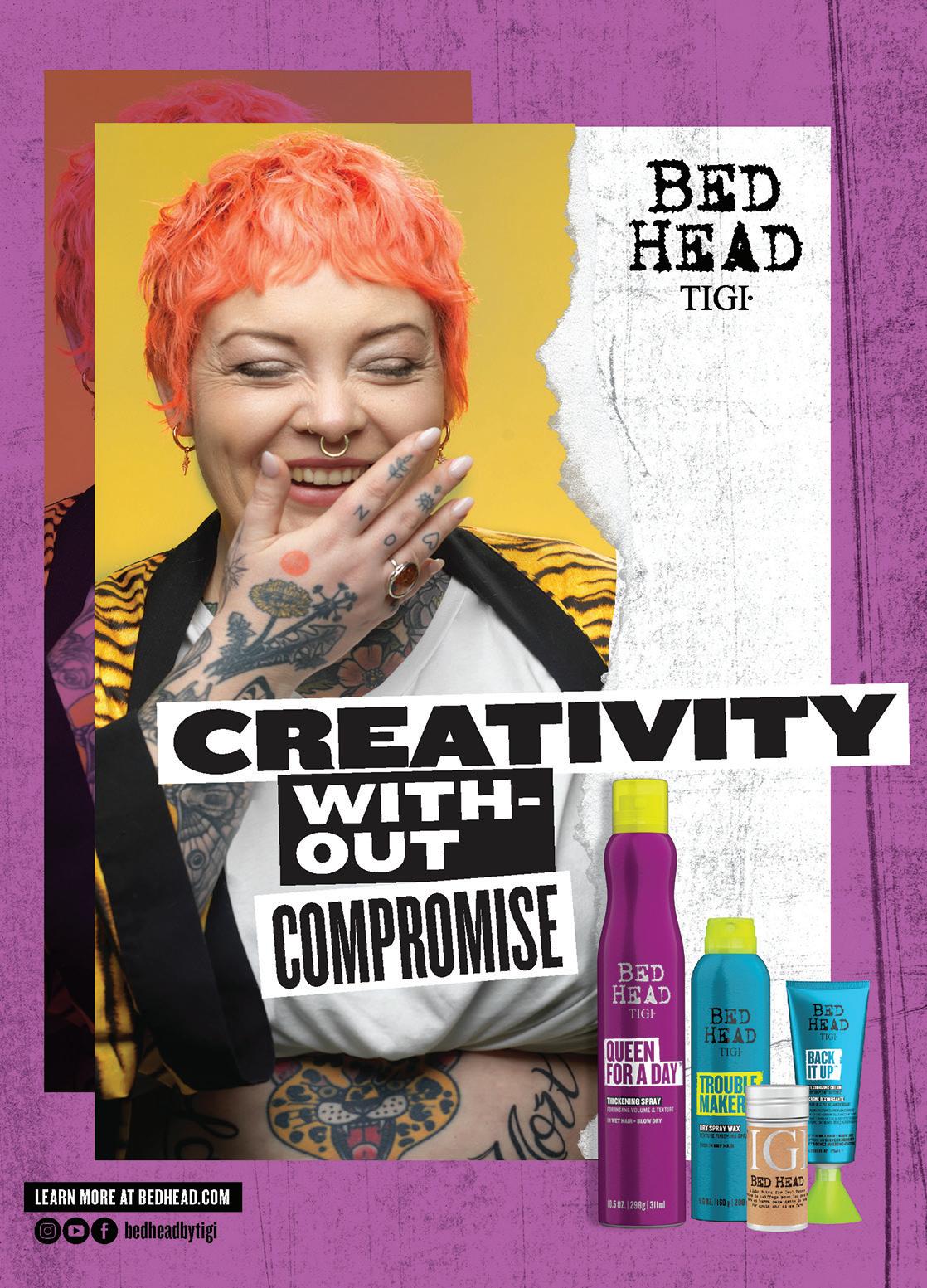

Bed Head Celebrates Creativity

THE UNILEVER BRAND TEAMS UP WITH DIVERSE CREATIVES FOR AN EXTENDED CAMPAIGN.

BY CHARLIE MENCHACA

Bed Head by Tigi is putting a spotlight on inclusivity and self expression with the help of multiple unique voices.

The Unilever hair care brand in April launched the “Creativity Without Compromise” campaign. The effort spans the rest of the year and illustrates how hair styling with various Bed Head products can be a gateway for expressing oneself for any talent or background type.

“Staying true to our mission to unleash creativity, we searched for creatives from diverse walks of life that matched our bold, unapologetic mission to challenge the status quo,” says Nataly Avila, head of Tigi Professional, Americas, Unilever. “We enlisted Colin Dougan, a Calgary, Alberta-based director, to bring this campaign to life and help source talent.”

In all, 10 creatives will be showcased during the campaign, which kicked off with U.K. artist Taynee Tinsley and celebrity yoga instructor Jonah Kest. More than 200 pieces of content have been developed for the campaign to leverage across multiple outlets, including social media, paid ads, long- and short-form videos, static assets and in-store displays.

Bed Head is utilizing assets from the campaign to create engaging store displays for Ulta Beauty, one of the brand’s largest in-store retail partners, Avila says. For its online retail partners — such as Amazon, Target and Walgreens — Bed Head will incorporate its “how to use” short-form product videos to tie back to the campaign and inspire consumers to try different hairstyles, pushing the boundary of creativity.

While developing the content and throughout the campaign, Bed Head places an emphasis on highlighting styling products best suited for curly and textured hair, such as Foxy Curls contour curl cream.

“We want to increase consumer knowledge and build a deeper education about our styling products developed specifically for curly hair and our commitment to championing creativity for all hair textures, styles and colors,” Avila says.

The brand is using a #CreativityWithoutCompromise hashtag on social media to encourage creatives worldwide to share their hairstyles and tout the availability of Bed Head products at retail.

“This was a big reason why we went the creative versus model approach for this campaign — many of the talent have been inspired to create their own content in tandem with our assets and posted to their personal social channels,” Avila says. “Generating additional organic and authentic content was important to us to illuminate the true essence of Bed Head by Tigi and the inspiration behind our campaign.”

Besides Dougan serving as the visionary and a creator for the campaign, Bed Head worked with its agency partners at Razorfish to create and amplify its paid strategy, and Edelman to develop messaging.

Brand Watch P2PI.com

Staying true to our mission to unleash creativity, we searched for creatives from diverse walks of life that matched our bold, unapologetic mission to challenge the status quo.

— Nataly Avila, Tigi Professional

Consumption Trade-Offs … and Snacking

RESEARCH EXAMINES SPENDING ON DISCRETIONARY GENERAL MERCHANDISE; PLUS, A LOOK AT SNACKING AND CANDY PURCHASING.

BY JACQUELINE BARBA

Financial Well-Being & Consumption Trade-Offs

Back in May, U.S. retail sales revenue — including both discretionary (or non-essential) general merchandise and CPGs — increased 2% compared to the same month last year as unit sales declined 3%, according to research from Circana (formerly IRI and The NPD Group).

Other takeaways include:

• The growth came primarily from food and beverage CPG spending (a 5% increase in sales revenue and a 2% unit-sales decline).

• Non-edible CPG sales revenue grew 2%, while unit sales fell 4%.

• Spending on discretionary general merchandise continued to decrease through May, with a decline of 5% in sales revenue and 8% in units.

• Sales of apparel, technology and other “traditionally high-volume”

categories declined from a year ago.

• Prestige beauty was the only category to exceed the sales growth noted in the food and beverage industry, with sales revenue up by 16%.

• Mass-market beauty sales grew by 9%.

• E-commerce gained the largest share of sales revenue so far this year, rising more than 2 share points.

• Department stores maintained a steady share of the market.

Also notable: the average number of items

The New Consumer 10 l July/Aug 2023

purchased in a shopping trip this year is smaller than it was last year. Consumers have also begun their migration to more “value-focused” retail options, a change Circana says is likely a precursor of what’s on the horizon for the rest of the retail industry.

Additionally, according to Deloitte’s fi nancial well-being index and State of the Consumer Tracker for June 2023:

• Fewer consumers are citing concerns around their level of savings, worsening fi nancial situations and delaying large purchases as infl ation eases.

• Spending intentions have mostly remained flat across 2023 as consumers prioritize summer travel and building savings back up.

• Spending on durable goods grew 1.4% in April from March after shrinking in the previous two months.

Snacking & Candy Attitudes

According to the National Confectioners Association (NCA), June’s designation as National Candy Month is gaining momentum with both retailers and consumers nationwide. Major retail activations related to National Candy Month started in 2020 with just 570 stores nationwide. By 2022, more than 50,000 stores participated in summer promotions. The trend is continuing in 2023, despite factors impacting consumer spending habits.

Economic uncertainty, self-checkout lanes, omnichannel shopping, and natural and organic trends are impacting the way consumers are purchasing and consuming snacks and candy, according to a survey from Acosta Group.

For example, the increased use of self-checkout, which is preferred by 76% of Gen Z and 73% of Millennial

shoppers, is putting candy sales at risk. More than 25% of all candy sales occur at checkout, with self-checkout reducing impulse candy conversion purchases by 50%.

Other recent insights include:

• Chocolate is preferred (82%) over nonchocolate.

• 54% of shoppers say they eat more candy than they should.

• Four in 10 consumers are eating candy at least once a day, with Millennials and higher income households eating more.

• 30% of shoppers said they’re buying less candy than last year due to high prices and health concerns.

• A majority of adults regularly replace meals with snacks, with parents much more likely to do so (eight in 10 parents versus twothirds of non-parents), per a Del Monte Foods survey.

• More than three-quarters of adults said convenience and portability are qualities they consider with snacks (per Del Monte).

• Fruit is a key component of what is currently missing from snacks (per Del Monte).

P2PI.com

% of respondents Concerned about level of savings Delaying large purchases Financial situation worse than last year 70% 65% 60% 55% 50% 45% 40% 35% 30% 25% 20% Sept. 1, 2020 Sept. 1, 2021 Sept. 22, 2022 March 1, 2021 March 30, 2022 March 23, 2023

Since summer 2022, fewer Americans are citing concerns around savings, worsening financial situations, and delaying large purchases

Sprinter’s Experiential Store

NEW CONCEPT FEATURES AN EXPANDED RANGE OF PRODUCTS, AS WELL AS IMMERSIVE AND INTERACTIVE EXPERIENCES DESIGNED TO EDUCATE AND INSPIRE CUSTOMERS.

BY JACQUELINE BARBA

In 2023, Alicante, Spain-based sports retailer Sprinter opened its largest store to date, spanning 43,000 square feet, in a former Ikea store in Alcorcon, part of Spain’s Community of Madrid.

Sprinter is part of the British sports retail giant JD Sports (or JD Group) and specializes in sporting goods and sportswear, including footwear and accessories — with a focus on running, training and football/soccer.

Sprinter spent 12 months designing the megastore concept in partnership with London-based innovation and creative studio Dalziel & Pow (D&P).

The massive store allows Sprinter to introduce an expanded range of products, as well as immersive and interactive experiences designed to educate and inspire customers. The new concept offers enhanced product trials, performance advice, hands-on test-and-learn activations, product customization, footprint analysis and three dedicated places to practice track, soccer and tennis/paddle tennis and test equipment.

The store has two distinct retail spaces. Sprinter occupies the ground level, and Deporvillage — a digital-native cycling brand within the JD group — takes 50% of the upstairs on a central mezzanine with double-height space. The store is Deporvillage’s first physical retail space.

The 32,200-square-foot space for Sprinter boasts bright colors and a fresh feel, while the 10,700-square-foot Deporvillage area is darker, more dramatic and theatrical. The latter exclusively merchandises bikes and biking equipment, and offers personalized bike fittings. D&P said the spaces are “literally the reverse palate of each other,” in a media release shared with P2PI.

In-Store Experience 12 l July/Aug 2023

Specifically, the unique store features include:

• A nearly 32-yard straight running track behind a merchandising wall to test shoes and record your time against other runners.

• A “Runners Bar” where customers can pick up their sports shoes after selecting their size, brand and model on interactive screens.

• A spiral slide that links the kids bike section in the Deporvillage level with the Sprinter kids offerings on the floor below.

• A multi-purpose, timber-lined studio offering monthly programs, such as free yoga, Pilates, training and barre classes, as well as workshops on nutrition and mental health and exclusive activities for Sprinter Club members.

• A “Sports Lab” offering high-tech footprint analysis, in collaboration with Spanish podiatrist company Podoactiva, to recommend the most suitable shoe for athletes.

• A “Custom Shop” where customers can design and personalize sports T-shirts with a live screen-printing machine service.

• Additional services such as tennis racket stringing and sports equipment rental.

The space features a slew of materials contributing to its overall look and feel, including concrete, timber, white and black enameled steel, ribbed felt and translucent acrylic. Store navigation is aided with green and red (depending on the section of the store) suspended lamps over walkways that are not demarcated on the floor, but purely overhead.

Merchandising is flexible and features mid-floor walls throughout, aiming for a sustainable and “future-proof” architecture that can accommodate change in the coming years, according to D&P.

P2PI.com

MEET THE 25 INNOVATORS WHO ARE FORGING THE EVOLUTION OF RETAIL MEDIA AND ADVANCING CONNECTED COMMERCE ACROSS THE PATH TO PURCHASE.

14 l July/Aug 2023

BY ERIKA FLYNN

After combing through a plethora of nominations, the Path to Purchase Institute (P2PI) selected 25 commerce marketers who are pioneering retail media for our inaugural Retail Media Awards program. The awards recognize innovative leaders across brands, retailers, agencies and solutions providers who are effectively leveraging or helping others leverage retail media for successful digital and omnichannel campaigns. P2PI honored the winners in June during an awards celebration and ceremony at our Retail Media Summit in Chicago. Read on to get to know the trailblazers making an impact at their companies and across the industry …

RISA ANDERSEN Head of North America Media & Data PepsiCo

Over the past six years, Risa Andersen has been an instrumental leader in driving PepsiCo’s in-house media strategy and planning team. She now leads all media and data capabilities for PepsiCo across North America, including retail media. Her team leverages PepsiCo’s proprietary measurement and scorecarding tools to collaborate with retail media networks to evolve capabilities and media performance, as well as other data-driven capabilities that serve national media, including measurement, insights and audience.

Andersen and her team have driven the standardization of ROI measurement across RMNs leveraging PepsiCo’s proprietary ROI Engine capability. They’ve also evolved its standardized RMN scorecard — a way to benchmark RMN capabilities — to include 11 distinct RMNs and 43 different criteria. By understanding each RMN across these attributes and side by side with one another, the team can better determine how it should invest while also doing their part to elevate capabilities across the industry.

The next big trend in retail media is: Adding incremental channels to RMN offerings. The future of retail media is increased flexibility. While offplatform media isn’t a new idea for RMNs, they will unlock new and optimized partnerships, execution and measurement opportunities with the likes of social and CTV platforms. Additionally, as they move to leveraging their shopper data in more ways, they will also offer increased flexibility in how advertisers can buy, optimize and measure via these off-platform channels.

The most exciting opportunity in retail media is: Full-funnel media planning, because if the RMNs can deliver on flexibility, transparency and costs, companies could connect national brand creative with retail media capabilities via a collaborative planning process. That would allow for retargeting audiences with sequential messaging for more efficient and effective campaigns.

P2PI.com

Retail Media Awards

YOLANDA ANGULO Director, Shopper Marketing Mondelez International

Yolanda Angulo leads the company’s retail media efforts as well as the integration of shopper marketing and e-commerce. She has been instrumental in building out ways of working, key learnings and processes with Mondelez’s core strategic omni-customers as well as with regional players. She developed a database of learnings, costs and returns that has been shared internally across the Mondelez organization. She also has led the company’s efforts in the digital outof-home space, and developed a retail media program at Ahold that won a North America Regional Excellence award at Mondelez.

In the past year, Angulo focused on a tech-forward, multimedia, omni-campaign driven by insights and a business opportunity for a key customer that leveraged weather patterns to promote summer activities using Mondelez cookie and cracker products. She initiated three test-and-learns with new digital media platforms/vendors across multiple retailers that garnered strong results, including sales lift and brought new buyers to the brand.

She is proud of the group’s work with its vendor partners, having opportunities to expand on and compliment current first-party retail media partnerships. She will continue to ensure there is clarity around key KPIs upfront, as well as continue to request and push for incrementality and/or clarity of measurement.

The most exciting opportunity in retail media is: The phygital world is here, but the level of technology has clearly improved and evolved over the past few years. That has resulted in the opportunity to leverage shopper data, connect with shoppers in a more 360-degree way and to deliver the content consumers are looking for, making the shopping experience easier and more enjoyable everywhere.

The future of retail media is: Hyper-personalization. Technology is enabling us to get to know our consumers and shoppers in perhaps a deeper way, to develop a relationship and build loyalty. It’s a two-way street, and hopefully we learn from each other to build our pipeline, create relevant content and stay top-of-mind/on her list all the time.

MELANIE BABCOCK

Vice President of Retail Media & Monetization

The Home Depot

The Home Depot Retail Media+ Network has experienced substantial growth in the last two years, which has led to team growth, investment in tools, processes and technology. Melanie Babcock sits at the helm of the group that has spent time this past year working on processes, role alignment and technology solutions to improve the associate experience.

When The Home Depot started its journey in retail media, there were fewer than 10 retail media networks in the market, heavily focused on grocery and mass retail. Since then, Babcock has successfully led her team to identify key strategic needs and make investments to drive tangible, revenue-generating outcomes, including growing the media business by more than two times year over year. Babcock assumed her current post in February after serving as the retailer’s vice president of integrated media for nearly four years prior.

KRISTI ARGYILAN Senior Vice President Albertsons Companies

Kristi Argyilan led the launch of Albertsons Companies’ retail media network, Albertsons Media Collective, which partners with marketers to grow their businesses through Albertsons’ ad tech platforms. Since 2021, she and her team have leveraged the retailer’s 34 million weekly customer base and first-hand knowledge of customer shopping habits to provide advertisers and agencies with a deeper understanding of their customers.

The team has seen the industry react to its push for transparency and its commitment to a co-op garden model. Its integration with The Trade Desk is a partnership that highlights the co-op garden model, featuring a focus on transparency and collaboration with its partners. While the retailer continues to invest in its own platform and solutions, it is also a priority to develop direct connections with other leading tech partners to deliver beyond its own walls. These partnerships make it easier for brands to reach the right audience across the internet and beyond, including the industry’s fastest-growing digital channels, such as connected TV.

The partnership with Omnicom Media Group (OMG) leverages multi-party clean room technology, powered by Snowflake, allowing the team to combine its near-real-time shopper data with audience data from the NBCUniversal, Paramount and Warner Bros-Discovery linear and streaming channels in a privacy-safe manner. As a result, OMG clients will be able to directly connect advertising campaigns to purchase data with a high degree of precision, delivering increased media ROI and better business outcomes.

The most exciting opportunity in retail media is: AI. It will be a key unlock for retail media, specifically for media buying, creative generation and audience creation. Many of the tasks that humans still have to touch, like optimizing campaigns, can be accelerated by AI.

The future of retail media is: Endless. And less about retail, more about media. Standardization will strengthen the retail media ecosystem, causing all boats to rise with the tide. We’ll also see more retail media networks explore partnerships with non-endemic brands to open up their platforms to a new, broad slate of advertisers and generate new revenue streams.

The next big trend in retail media is: Extending retail media into the physical store experience. The retailer’s strong customer experience connection between online, app and in-store gives it an opportunity to enhance the in-store customer shopping experiences with digital outof-home messaging.

The most exciting opportunity in retail media is: Retail media brings that “last-mile delivery” to reach the customer. Digital media ads are measurable and at the point of decision-making. That’s the last piece that’s been missing in that marketer’s toolbox.

16 l July/Aug 2023

RAY BALBERMAN Director, Strategy Loblaw Media

Ray Balberman was a pivotal member in the launch of Loblaw Media in 2019. He’s a trailblazer for learning and evolving the industry as retail media gains more traction with marketers in Canada. This past year, he supported the launch of Incremental Customer Long-Term Value (iCLTV) measurement, which uses transactional data to project the incremental sales impact of a media campaign for 12 months after the campaign ends. With this capability, Loblaw Media can help quantify retail media’s impact, providing a more holistic understanding of campaign performance. He also contributed as a key stakeholder in the launch of MediaAisle Sponsored Products Retail Media Platform, a self-serve, auction-based sponsored search platform built fully in-house by Loblaw Media. When combined with MediaAisle Demand Side Platform (DSP), Loblaw Media has made significant investments in its own technology, which will allow for maximum flexibility to build products to advertiser demand, and to reimagine new post-cookie identity solutions.

Balberman also integrated the company’s media and loyalty programs to drive holistic planning. By launching ad products and programs where media and loyalty offers are integrated seamlessly for Loblaw shoppers, the retailer is unlocking new types of digital engagement. Recent efforts that have made an impact include helping to drive the evolution of narratives surrounding retail media in Canada — from being focused on lower-funnel search and display products to a more full-funnel, omnichannel solution. Furthermore, Loblaw developed strategic planning best practices based on campaign results, custom analytics and industry meta-analyses on performance, which Balberman says drove a significant increase in clients planning for more consistent, omnichannel campaigns that resulted in overall improved effectiveness.

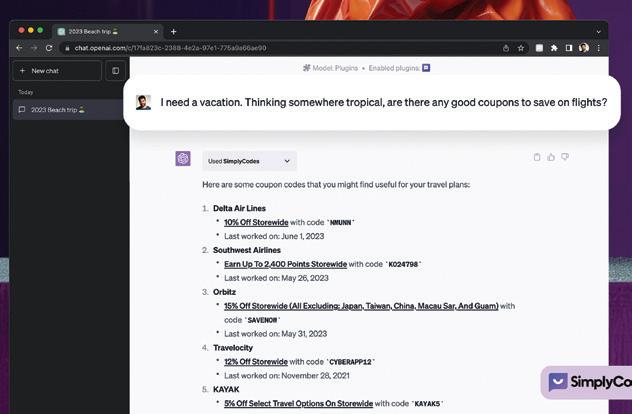

The next big trend in retail media is: AIbased shopping assistants and search algorithms.

The most exciting opportunity in retail media is: Creating new jobs and professional growth.

The future of retail media is: Integration across shopper, trade and brand dollars.

IRINA BARSKIY Director of Digital Demand Generation Danone

An eight-year veteran of Danone, Irina Barskiy assumed her current post in June 2022 and began working on an e-retailer transformation internally that centralized all retailer media/search under one team. She created an infrastructure, working with many cross-functional teams to understand objectives and priorities for each channel/platform. The strategy allows the team to capitalize on opportunities and growth and right-size investments based on where the company has the largest opportunities to win.

Barskiy also onboarded a new agency to add to Danone’s strategic capabilities in retail media and partnered with its media and shopper team to have a best-inclass approach, resulting in a more than 30% improvement in its ad returns. She believes collaborating closely with all cross-functional stakeholders was key to evolving the company’s retail media success, in addition to building a cohesive plan and stacking multiple tactics across the entire consumer funnel that ladder up to overall objectives. Working with internal and external partners, Barskiy also helped the company understand the impact of its retail media dollars by leveraging new data points, including share of voice, sales lift studies and marketing mix models, to help understand incrementality and halo impacts.

The most exciting opportunity in retail media is: Brand building versus performance marketing. As platforms beef up their advertising capabilities, retail media is a brand-building vehicle and not just another “performance marketing” channel.

The future of retail media is: Personalization and omnichannel cohesiveness. Personalization has been the name of the game for brands with first-party media. CPG brands selling through third parties can capitalize on some of these same personalization and data efforts as well. As more retailers enter this space, we can expect to see networks innovating with their offering, forced to improve tech, data/ measurement and capabilities to compete for more brand dollars.

RENEE CACERES Vice President, Retail Media Firework

Renee Caceres was one of the first internal associates at Walmart Connect. She led the development of the processes and tools that supported first its operationalization and later its migration to an in-house retail media business. Today, Caceres heads up the retail media efforts for video commerce company Firework, and this past year created its first-ever retail media network sales strategy, development and implementation for video commerce. Firework’s technology, she says, has made connecting with customers through video commerce in a meaningful and scalable way finally possible — thus evolving the media mix for brands and retailers.

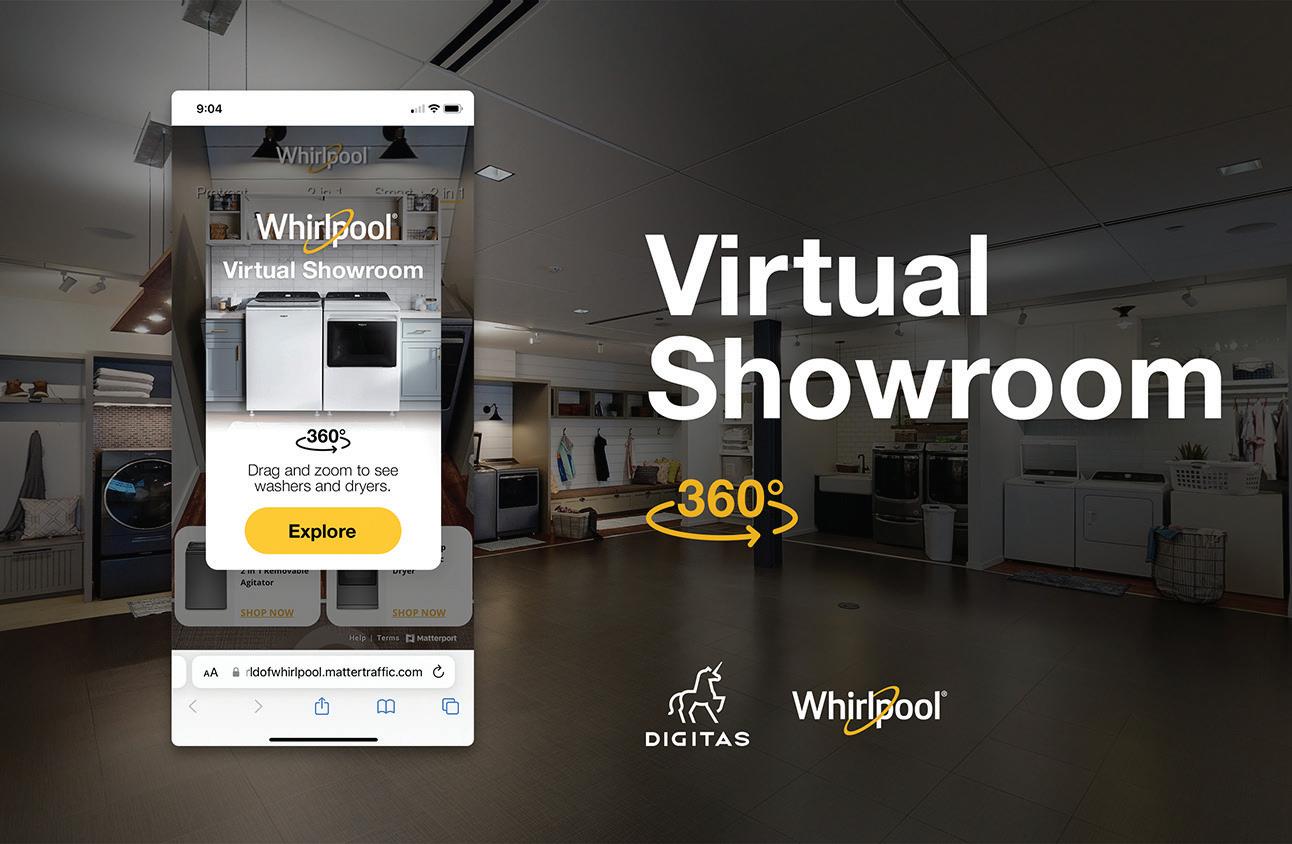

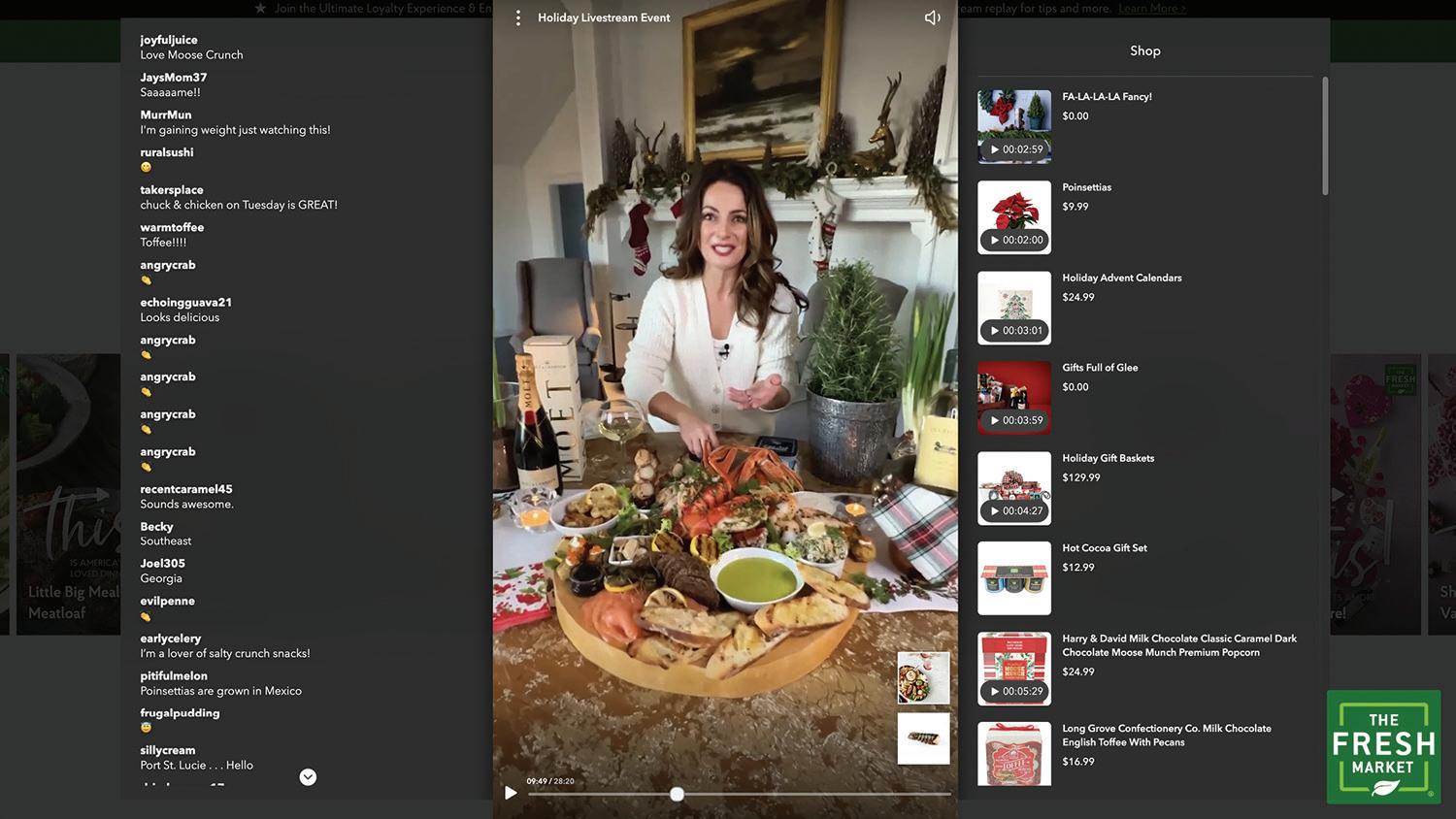

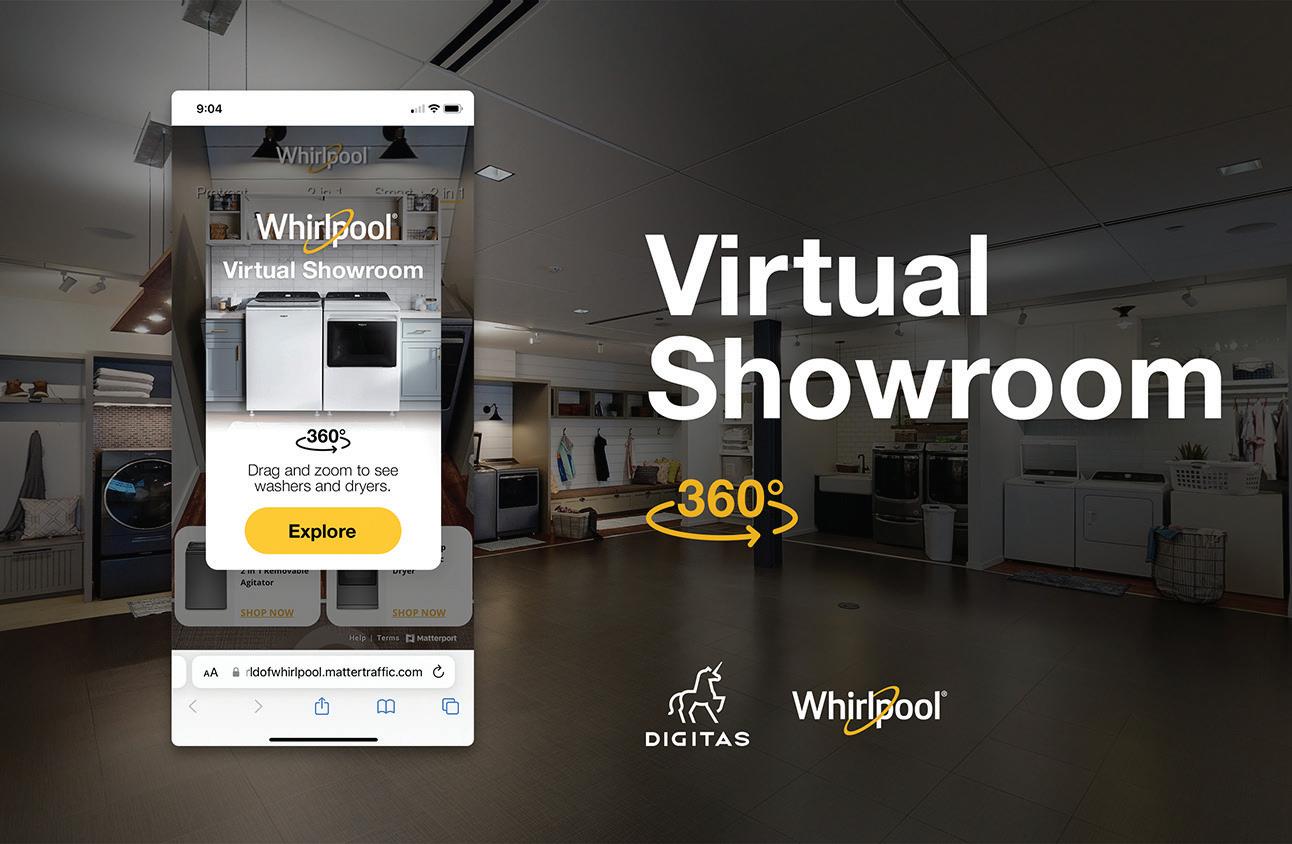

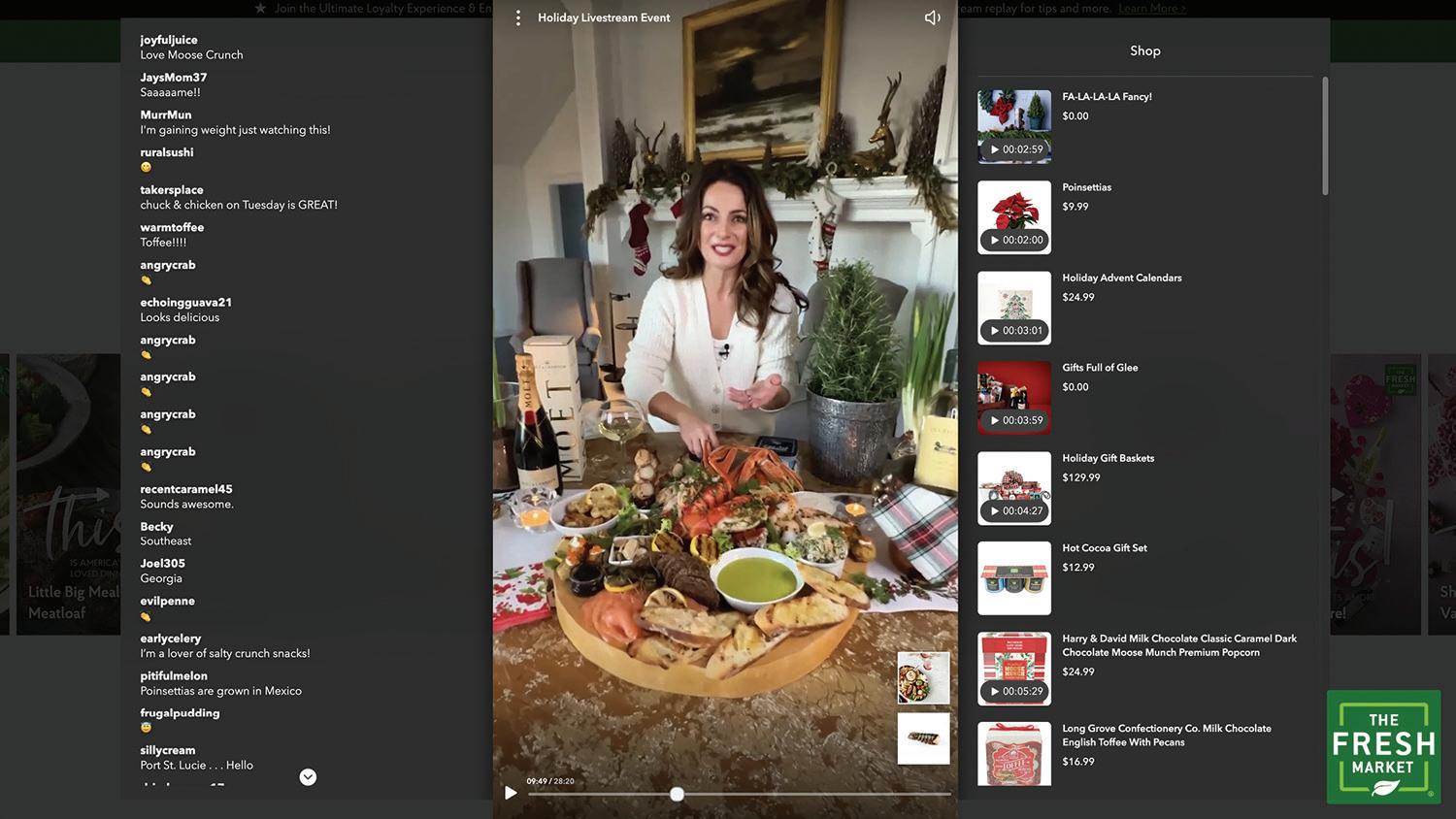

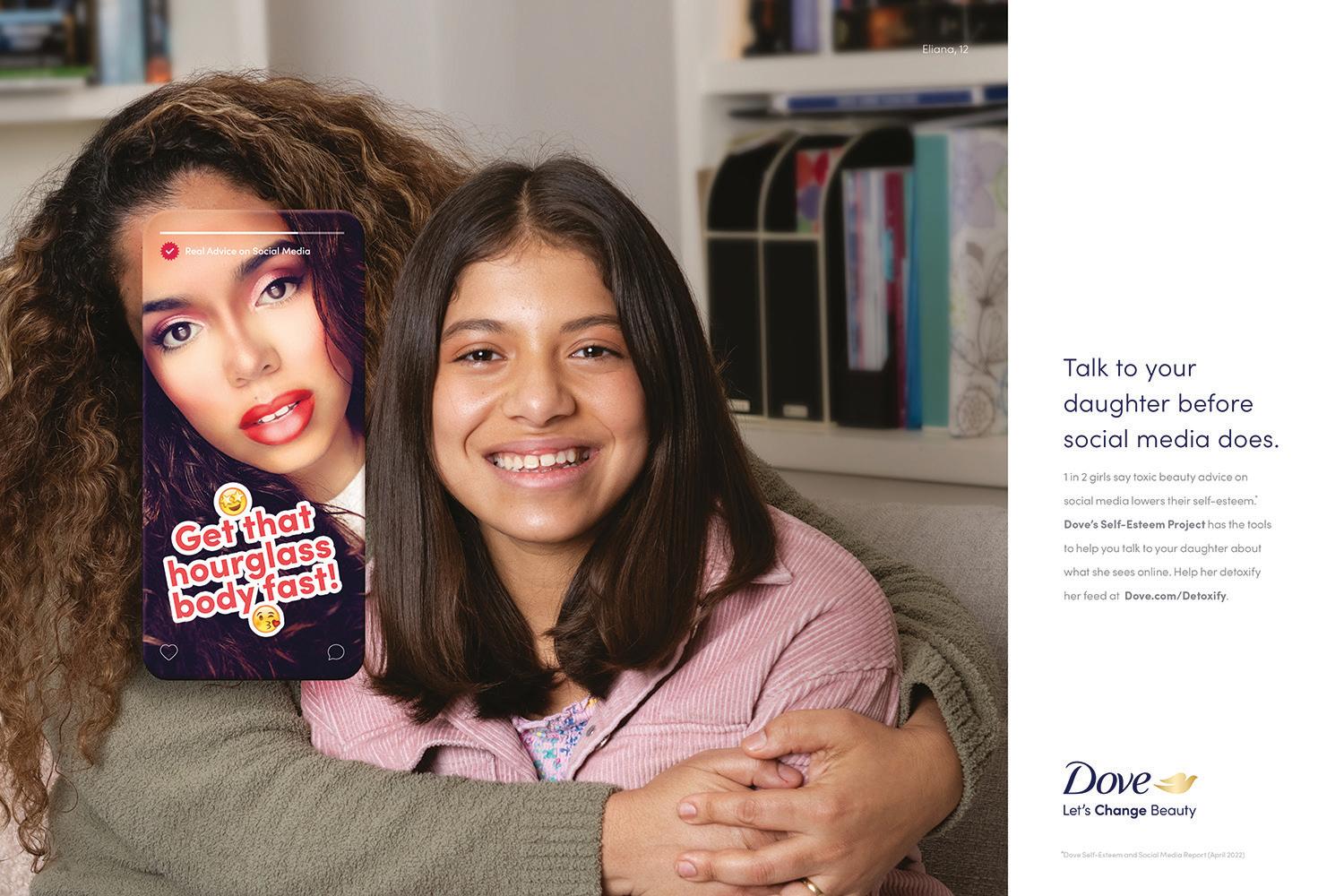

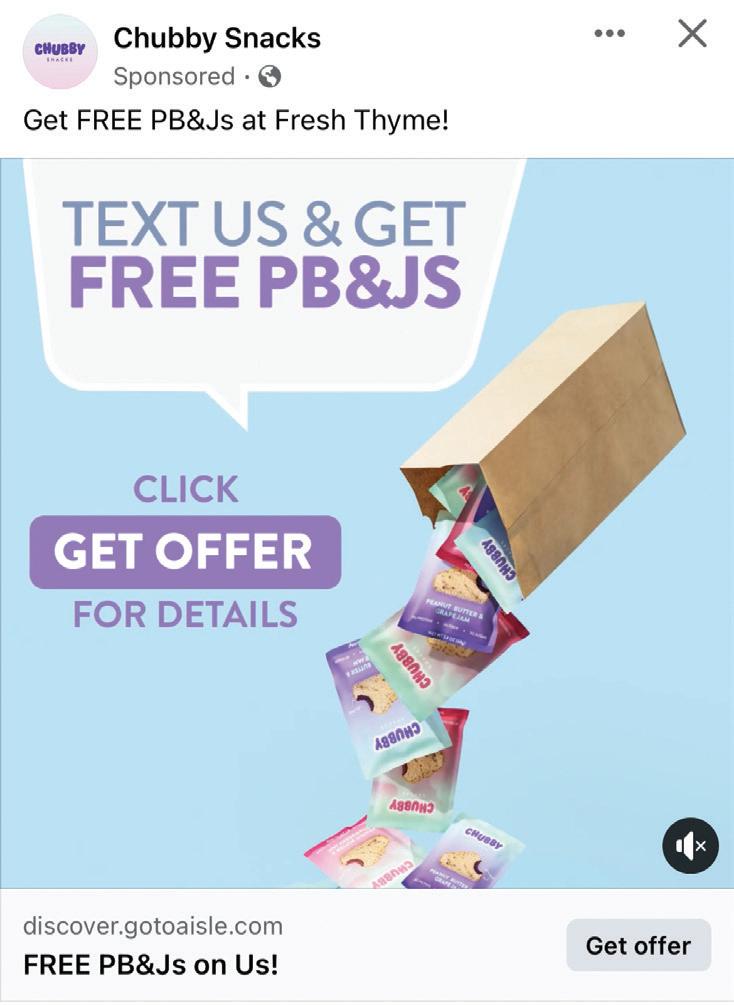

She also spearheaded the company’s debut with regional retailer The Fresh Market for their shoppable video-live commerce retail media network partnership, as well as launched long-format and live video events with Sam’s Club to kick off the holiday season for its members. Through this partnership, Sam’s Club members were able to interact with products in a new way, combining the best of the instore experience, trusted influencer reviews and real-time shopping directly on their phones and computers.

The next big trend in retail media is: Standardization versus differentiation. Fragmentation in the market is rampant and brands want to consistently understand how their dollars affect KPIs and results across all RMNs.

The most exciting opportunity in retail media is: Personalization at scale. Retailers are often data rich and insights poor, and retail media networks have the unique opportunity to be the bridge. By using data to better predict what customers want and why in real time, brands will be better equipped to deliver alternative options and personalized experiences to meet their customers’ needs wherever they may be, at scale.

P2PI.com

Retail Media Awards

JEFF CLARK Vice President of Product and Omni-Commercialization Walmart Connect

Jeff Clark was charged with kick-starting Walmart’s retail media initiative when he joined the organization in 2017 and has since created the platforms and experiences that have fueled Walmart Connect’s substantial growth over the past few years. He led the development and growth of an API-powered infrastructure that enables agency partnerships, the company’s self-serve interfaces and the Walmart DSP — all of which were developed with robust and integrated measurement and reporting capabilities. He also oversaw the integration into Walmart’s in-store network of more than 4,700 stores across the U.S.

Clark heads up the teams that have integrated retail media into Walmart’s TV wall, self-checkout screens and in-store radio, with additional integrations coming soon. Last year, the team invested heavily in improving Walmart’s sponsored search products, with advancements such as second-price auction, evolved search algorithm enhancements, introduction of new search placements and expanded self-serve capabilities that reduced average costper-click and increased average ROAS for advertisers. Furthermore, he led the release of the Walmart DSP, which has enabled advertisers to connect and measure both online and in-store performance, offering targeting, reporting and omnichannel insights down to a granular level; and also Walmart’s Display Self-Serve platform, which provides more speed, flexibility and control to launch and manage display campaigns.

A more recent focus is on expanding advertiser access to omni-touchpoints with customers. With enhancements in display advertising, the group is leaning into providing new in-store experiences for shoppers, along with an expanded suite of omni-insights to connect across channels.

The next big trend in retail media is: Omnichannel solutions with in-store connections. Pure digital advertising isn’t enough anymore. Brands tell us they want to engage with shoppers across the entire shopping journey, including in stores.

The future of retail media is: Seamless digital-to-physical customer experiences. Search and display will always be the fundamental backbone for strong retail media strategies. But retailers with brick-and-mortar stores are starting to create an essential differentiator by bridging the digital-to-physical shopping experience.

ANNIE DERRIG Marketing Director - Walgreens

Procter & Gamble

Annie Derrig has spent more than nine years at Procter & Gamble, assuming her current post as marketing director on the Walgreens Customer Team in July 2020. Since then, she has helped shape and advance Walgreens Advertising Group’s (WAG) measurement, reporting and standards in its managed service and self-serve media models. She also helped broker the first self-serve media model test with WAG, establishing the roadmap to obtain third-party measurement. Her partnership with WAG has helped to shape the requirements for ad viewability, invalid traffic, brand safety and financial stewardship. Derrig also codified learnings from WAG media campaigns throughout the past year and applied those learnings to unlock both efficiencies and effectiveness of WAG campaigns.

JILL CRUZ Executive Vice President, Commerce Strategy Publicis Groupe

Jill Cruz leads commerce strategy for Publicis Commerce, sitting at the intersection of experience, CRM and media. She provides thought leadership, commerce training and enablement services to all Publicis agencies to build best-in-class retail media network practices. She is most proud of her work during the past year that resulted in deepening retailer relationships and building value into the team’s partnership agreements to help influence the product roadmap for the agency’s clients.

She is a member of the IAB Retail Media Network Council and will also be the co-chair of the Retail Media Measurement Working Group, which is working to standardize measurement across retailers and vendors. Prior to her current post, she held a dual role within WPP, where she was on the senior leadership team at Wunderman Thompson Commerce and helped grow commerce revenues by 2.5 times, leading three key clients to become some of the organization’s most successful ones in 2021. She also led Mediacom to help build its retail media network practice and developed a dedicated retail media team to serve one of its largest CPG clients.

The most exciting opportunity in retail media is: Connected, digital in-store solutions. As RMNs add more media partners to their offerings, it is harder to measure reach and keep various messages from overlapping, causing a poor consumer experience and alienating shoppers from feeling the personalization that they expect.

The future of retail media is: Automated. We can no longer operate siloed and manually in an algorithmic world. We need an end-to-end service model that encompasses industry-leading tools and tech automation that will allow us to execute and measure flawlessly.

She led the development of P&G’s Women’s Wellness campaign aimed at women aged 45+ that kicked off in September 2022 at Walgreens in partnership with WAG. The campaign led to category growth, and Derrig and her team unlocked learnings that will strengthen future P&G/WAG partnerships as they continue to empower women throughout their ever-changing needs.

The next big trend in retail media is: Activating rich consumer insights via first-party data at scale. With more data available, there is a huge opportunity to both refine targeting and deliver personalized, relevant messaging to shoppers in a more costefficient way.

The most exciting opportunity in retail media is: Delivering the right solutions at the right time. The competitive nature of the industry will continue to push retailers in their journey to enable seamless shopping (even faster) and, ultimately, deliver better outcomes for the shopper.

18 l July/Aug 2023

ADAM FISH Director of Omnichannel Strategy Wells Enterprises

Adam Fish leverages addressable audiences to drive omnichannel campaigns for Wells Enterprises and its family of brands. He led the team’s development of addressable audience segmentation to enable more precise media targeting and deliver more relevant messages to consumers this past year. The digitalfirst media planning approach that bridges brand and retailer media allows for a more seamless omnichannel brand experience that is tailored to where consumers are in the purchase journey. Internally, the capability is referred to as Unified Media, a process that allows Fish and his team to shift investment more easily across channels and audiences, and to optimize campaigns in real-time to maximize effectiveness and increase ROI.

The initiative integrated media planning processes across brand, shopper and e-commerce objectives — and drove an increase in media effectiveness to drive sales. The company has also been an early adopter of video search ads across several platforms, as well testing CTV to directly add to cart with QR codes. By leveraging retail media programmatic buying capabilities, Fish and his team can better connect activity between brand and e-commerce initiatives by overlaying audiences exposed to awareness messages with a retailer’s category buyers to deliver a more personalized message. The result is a more relevant experience for the consumer and increasing likelihood to purchase.

The next big trend in retail media is: Increased use of data clean rooms for measurement.

The most exciting opportunity in retail media is: Connecting upper-funnel media like CTV to purchase.

The future of retail media is: Seamless integration across the purchase journey.

MARK HEITKE Director, Ad Product & Audience Strategy

MARK HEITKE Director, Ad Product & Audience Strategy

Best Buy Ads

TONY FUNG Director of Shopper Marketing and E-Commerce

Bob Evans Farms

Tony Fung joined the company in early 2020, developing and conceptualizing the brand’s shopper marketing capabilities and retail strategy. He leads its shopper marketing strategy and execution across mass and grocery channels as well as e-commerce and omnichannel capabilities. He has continued to use retail media in his campaigns, most recently for the launch of Bob Evans’ mashed cauliflower assortment, which won Product of the Year accolades. The campaign included retail-sponsored search across key retailers, on-site and off-site digital banner ads, and national immersive digital ads.

Fung believes retail media networks give brands a great opportunity to drive the future of commerce marketing, and the ability to optimize in real time as needed. By partnering with retail media teams, the company has been able to tap into retailers’ first-party data and create unique and personalized messaging to reach its targeted consumers more efficiently — and, more importantly, to understand closed-loop measurement. With the constant evolution of retail media, he believes it is crucial to adopt a test-and-learn mindset and approach to help gain insights into consumers’ preferences and needs, and to also help create a benchmark for future campaigns.

The next big trend in retail media is: Using first-party data to reach consumers via connected TV (CTV). By using retailer’s firstparty data to target shoppers via CTV, brands can understand real-time conversions on the ads and connect impressions directly to purchase.

The most exciting opportunity in retail media is: Closed-loop sales measurement and reporting. We will continue to see more brands allocating dedicated budgets for retail media advertising due to valuable first-party data, contextually relevant ad experiences and closed-loop reporting.

Charged with evolving Best Buy Ads’ retail media portfolio when he assumed his current post in January 2022, Mark Heitke has led his team and the enterprise in reimagining and relaunching an expanded and unified portfolio. He established a product hierarchy and operationalized a 360-degree portfolio across display, search, store, social and content advertising channels — with significant advancements in video, sponsored products and shoppable ads — and fostered the growth of self-service opportunities.

In partnership with Best Buy’s reporting and ad tech teams, Heitke championed a multi-year effort to launch My Ads, a platform designed for brands and agency partners looking for a more turn-key solution. My Ads is currently in pilot with seven brand partners and will be available more broadly later this year. Heitke believes that helping grow the expertise and knowledge of the industry only serves to create a more effective ecosystem. He has served as a consultative partner to other retailers who are just beginning their journey in the retail media space to ensure they are positioning themselves for success.

The next big trend in retail media is: Moving beyond e-commerce to stores. While retail media started online due to its measurement capability and standardized ad formats, leveraging the full footprint can help brands execute new and innovative experiences in the future.

The future of retail media is: The future of retail overall. Retail media investments are forcing retailers to rethink and balance their place as an advertising destination with their shopping experience, and I believe it will unlock innovation across retail categories.

P2PI.com

investments

Retail Media Awards

JENNY HOLLERAN Group Director Kroger Precision Marketing, 84.51

Jenny Holleran has been a member of the 84.51 team for nearly eight years, first in business development for omnichannel media and, since early 2018, heading up media sales and connecting brands with customers through data-driven media. She works to deepen relationships with client partners across the advertiser and agency community, helping them drive growth by balancing category business and brand priorities, while aligning their campaigns to measurable KPIs. She focuses on driving the value of effective media against brand objectives, and helping CPGs think differently about retail media as media and the power of audience targeting.

Holleran believes she has furthered the evolution of the space as she has worked to shape positions and perspectives on consumer-focused, accountable advertising across the industry, including through speaking engagements at the Path to Purchase Institute’s Retail Media Summit and Future Forward. She has also been “diving in deep” with global and U.S. media leads across the CPG community to partner during this transformational time. As CPGs restructure their brand and retail teams in an omniapproach to drive effectiveness and efficiency in the landscape, she sees it as a group effort, noting that building out joint learning agendas has been critical in the evolution.

The next big trend in retail media is: Sustainability in digital advertising, with retail media playing a key role. Insights can help direct ads to the most relevant households, reducing advertising waste and energy consumption at the same time.

The future of retail media is: A better experience for both consumers and brands. As the industry matures, we can expect to see retail media networks become easier to activate and more consistent across platforms, making it easier for brands and agencies to reach their target audiences and drive results.

JULIE KAHN Associate Director, Digital Strategy Blue Chip

Julie Kahn is a proponent of retail media network standardization, transparency and accountability — and she’s helped shape how many of Blue Chip’s clients engage with their largest retail partners since joining the company in July 2021. From key clients to the emerging brands that are newer to retail media investments, she focuses on strategy, activation and measurement, working to ensure their retail media spend is measurable and each dollar is accountable to results.

Through her work, she is also helping to evolve the industry toward more transparent and actionable measurement with the shared metrics from retail media networks. After months of conversations, she persuaded a prominent retailer to update their entire media platform to enable greater transparency and to share metrics they were not willing to share before. On behalf of several Blue Chip clients, she and her team oversee strategy and buying of retail media investments for more than 15 different teams.

The most exciting opportunity in retail media is: The emergence of omnichannel activations and media partnerships. Partnerships with media companies will enable brands to leverage retailer first-party data to reach shoppers at multiple digital touchpoints with unique and custom messaging.

The future of retail media is: Personalized and dynamic customer experiences. By customizing messaging and offers to specific audiences, brands will connect with and appeal to shoppers in ways that are more authentic, engaging and impactful. This will not only drive new customer acquisition, but also trial of new products among existing brand shoppers.

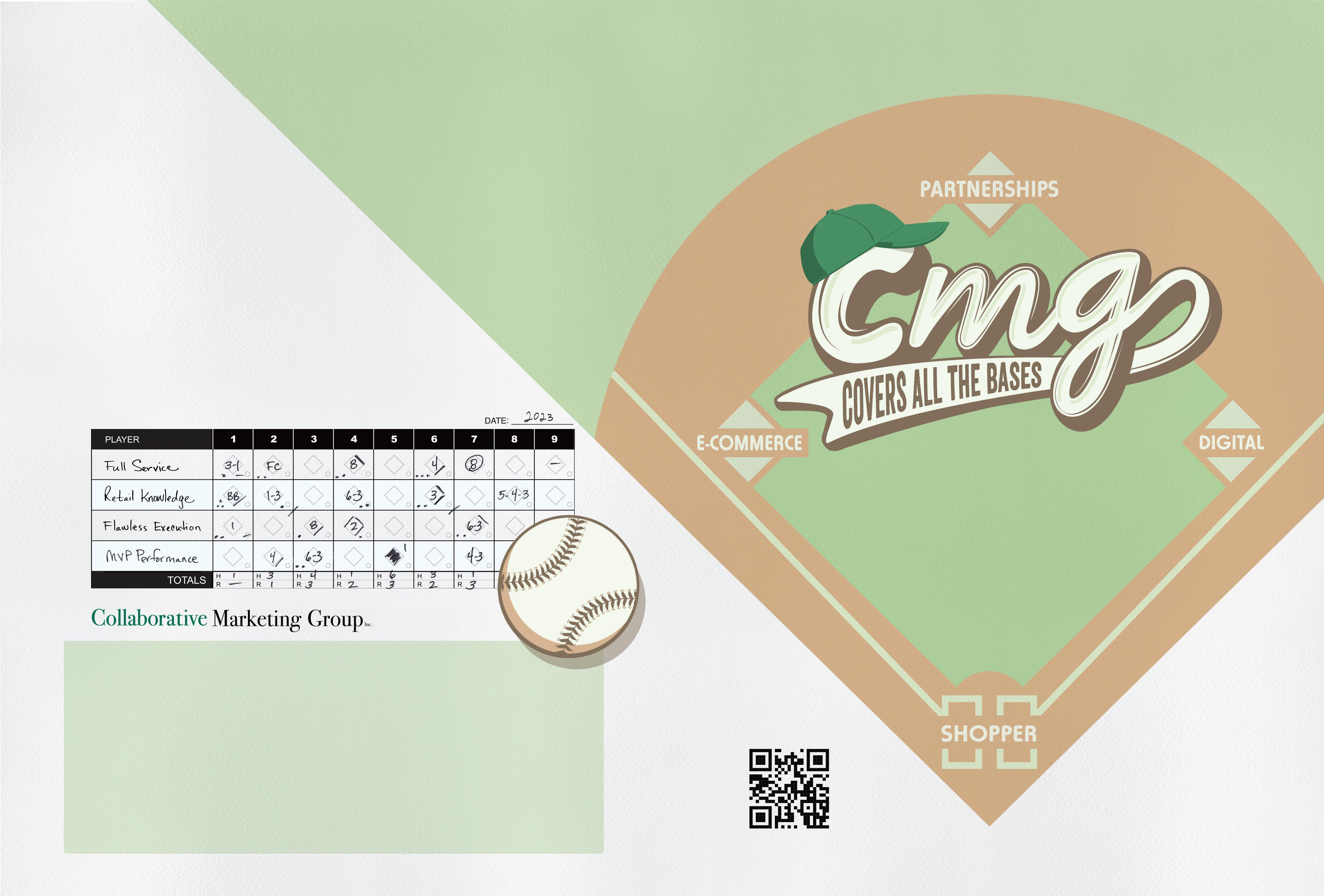

SAM KNIGHTS CEO SMG

Sam Knights leads the global SMG business, which has launched multiple omnichannel media networks for some of the largest retailers in the U.K., including Boots Walgreens, Morrisons, The Coop, The Very Group and Signet Group. These retailer media networks have seen double-digit percentage advertising revenue growth and have increased their profit contribution from this ad spend to their own retail P&Ls. In the last year alone, Knights and his team have spearheaded the launch of Boots Media Group, helping Boots monetize its first-party data via the launch of Audience360. It’s the first retail media network in the U.K. to offer CPGs the opportunity to use first-party retailer data for media targeting with closed-loop sales attribution, and other U.K. retailers are looking to follow suit and mirror Audience360’s success.

His team also launched Morrisons Media Group, a retailer media network for the fourth-largest grocer in the U.K. Knights champions efforts that will result in the retail media industry being increasingly transparent in its media performance reporting. His fundamental belief is to do retail media the right way by ensuring CPG brands see retail media through a marketing lens to drive growth for everyone. His passion lies in proving that retail media works and delivers positive results for both CPGs and retailers.

The next big trend in retail media is: Measurement. Retail media will only continue to grow if it is completely transparent and measurable. Using first-party data, SMG can now run testversus-control digital activations in order to get to incremental return on ad spend (iROAS), a significantly better measure of the incremental impact of marketing campaigns. Getting this right will be a crucial driver of future sustainable growth.

The most exciting opportunity in retail media is: Omnichannel media, and connecting digital to physical. The big unlock will be to combine the U.K. and U.S., taking learnings from both markets to enable brands and retailers to activate campaigns that reach 100% of their shoppers across physical and digital estates, linked through loyalty data.

20 l July/Aug 2023

ERIN LASTRA Vice President of Retail Partnerships Criteo

Over the past year, Erin Lastra led the onboarding and transitioning of retailer partners from a legacy platform to Criteo’s Commerce Media Platform. She also coordinated and managed a market test for the global commerce media company’s new demand-side platform, Commerce Max, hand-selecting Best Buy and a video game brand partner to execute a self-service, full-funnel campaign that is armed with the platform’s audience builder to create their own segments using Best Buy’s first-party data. The team launched on-site and off-site ads, using Criteo’s closed-loop reporting to analyze product-level sales data in real-time, allowing them to adjust their strategy as needed.

Lastra had the opportunity to engage with global counterparts to help share best-in-class learnings of the success they’ve experienced in the Americas to its EMEA and APAC markets, traveling to Europe, Tokyo and Singapore. She also served as a catalyst to help the company’s retail partners succeed as they grow their retail media programs, often realizing that they have limited space on-site and can drastically scale their programs if

AUSTIN LEONARD

Head of Sales, Member Access Platform (MAP) Sam’s Club

Austin Leonard joined Sam’s Club in March 2022. He leads the partnership and sales team that supports advertisers, agencies and ad tech partners since launching the Sam’s Club Member Access Platform (MAP) in June of last year. MAP delivers an additive ads experience for members. He has also led the building of in-club attribution measurement for search, proving that online search behaviors lead to offline sales. MAP connects all member clicks to their offline sales for Sam’s Club advertisers and has realtime, first-party omnichannel data connected back to member IDs, including in-club, in-app and web. MAP therefore delivers accurate transaction data, while advertisers can see what revenue is generated by which ads, including search and sponsored products campaigns. The team has been able to deliver higher return on ad spend and increased sales in a truly omnichannel way. Overall, ROAS has increased an average of nearly 30% since adding in-club sales to the sponsored products attribution mix.

The launch of the MAP Retargeting Platform called OmniDesk was also a focus this past year. Sam’s Club MAP uses real-time, accurate data from verified Sam’s Club members, including data on purchase history, demographics, recent purchases of similar items and basket size — data that is not available on other retail media platforms. Thus, MAP campaigns can deliver personalized ads in real time to members who have expressed interest in a product but have not yet made a purchase, as well as stop serving ads once the member makes a related purchase.

The next big trend in retail media is: Measurement outside walled retail/social gardens. As consumers shop seamlessly between online and in-store, true omnichannel measurement will become increasingly important.

The future of retail media is: Breaking down the walls between “national” and “shopper,” which will open up better experiences for members (shoppers) and better opportunities for advertisers to reach highly engaged, highly coveted audiences.

they also prioritize off-site campaigns across the open internet. Her work has made this goal a reality for Criteo’s partners by advancing the company’s off-site offerings and working closely with retailers to ensure they are maximizing the potential of their off-site campaigns — enabling self-serve buying capabilities to garner more growth for their programs.

The most exciting opportunity in retail media is: Expansion across verticals like last-mile delivery. Fast is the new slow. Consumers want things quickly, and retailers are partnering with order fulfillment and transportation companies to enable this fast delivery, providing massive opportunities for these companies to activate and enable their retail media offering to ensure they are reaching the consumer at the right time while they are shopping with relevant ads.

The future of retail media is: An overarching commerce media environment. Commerce media effectively enables both endemic and non-endemic players to access data, outside the walls of a retailer’s e-commerce site, to drive their campaigns, while also enabling retailers to expand their retail media monetization offerings.

JEFF MALMAD Global Head of Commerce Mindshare

Jeff Malmad has been leading the growth of Mindshare’s commerce capability for more than five years, first as U.S. commerce lead and, more recently, as the global lead, driving commerce media strategies and consumer engagement. He and his team have worked with leading retail media networks to improve data and measurement solutions in commerce; bring retailers’ verification and brand safety guidelines to the same standards as other digital partners; and expand clients’ access to retailers’ on-site advertising inventory, from product listing ads to shoppable video and more. Part of that collaboration has been working closely with GroupM on a commerce media scorecard that helps brands assess and evaluate retail media networks from around the world.

He also launched and grew Mindshare’s Commerce Media Bootcamp to train Mindshare teams across North America on commerce media and create new employee career paths as a result. Furthermore, he spearheaded a partnership with Kroger to create versions of Mindshare’s Inclusion PMPs that connect back to the products that brands sell through retailer sites and leveraging retailer media networks. Malmad believes that retail media is media — you can’t separate the two — and everyone working in the media and marketing industry needs to understand how to leverage it in order to better engage their consumers.

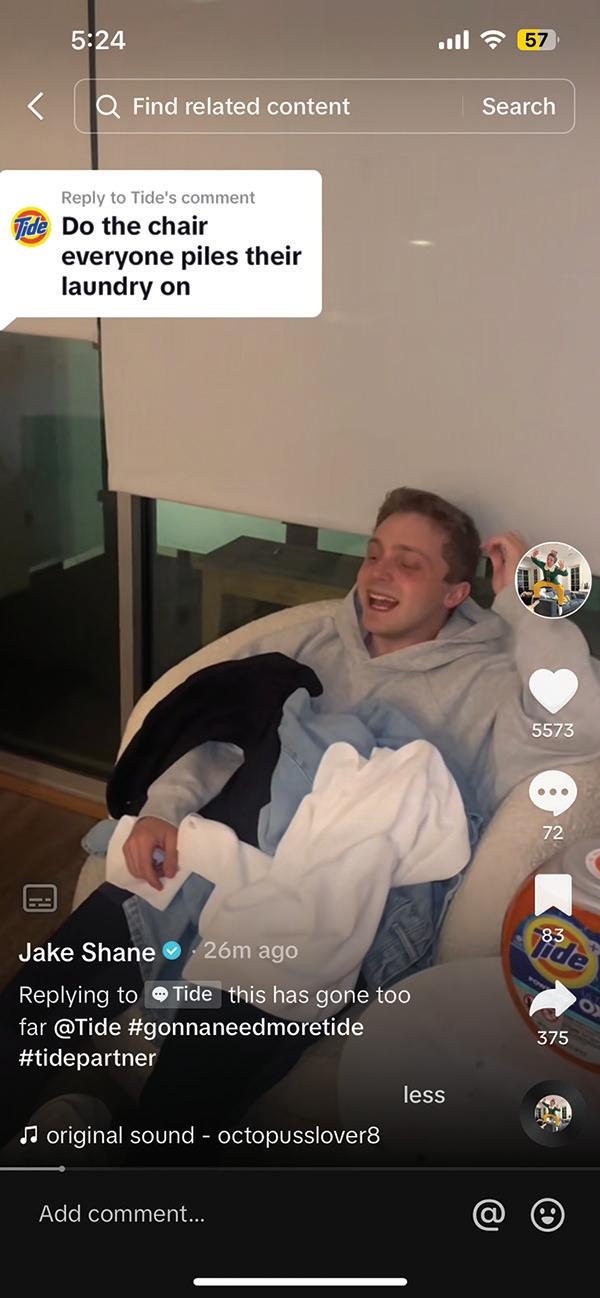

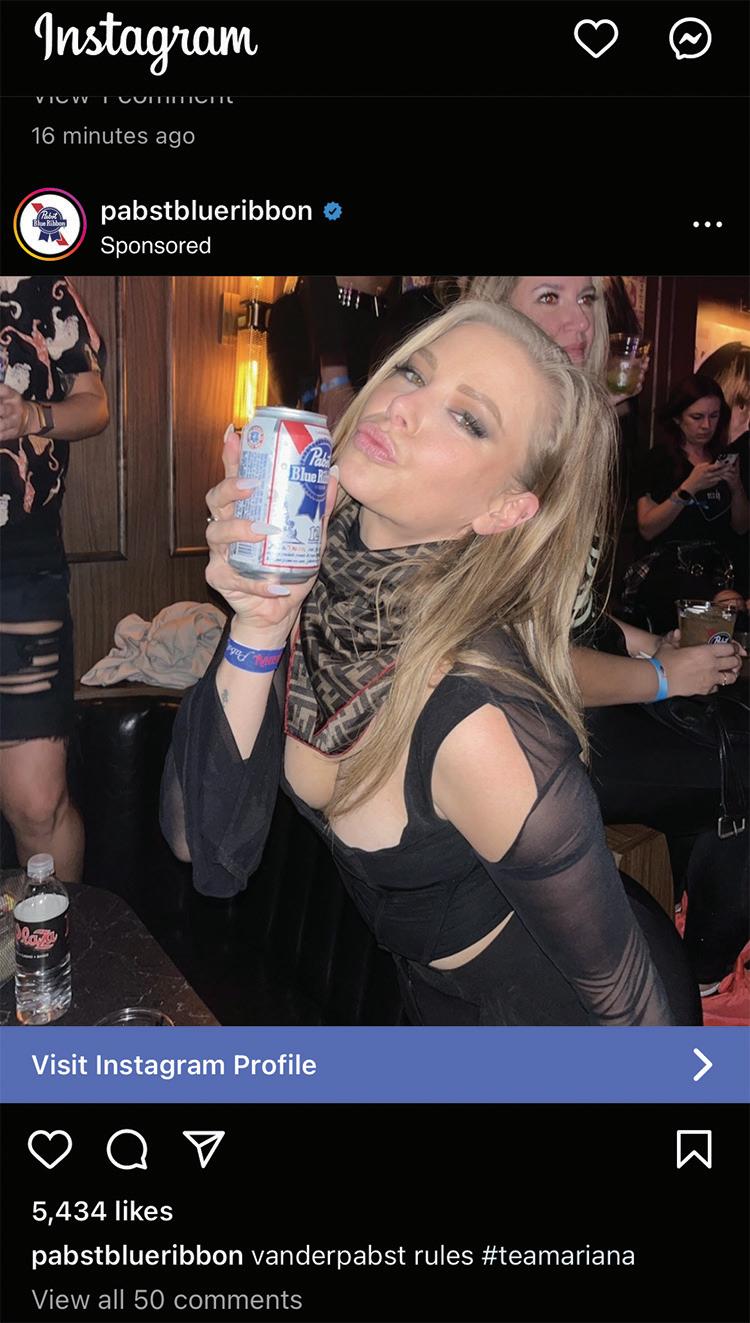

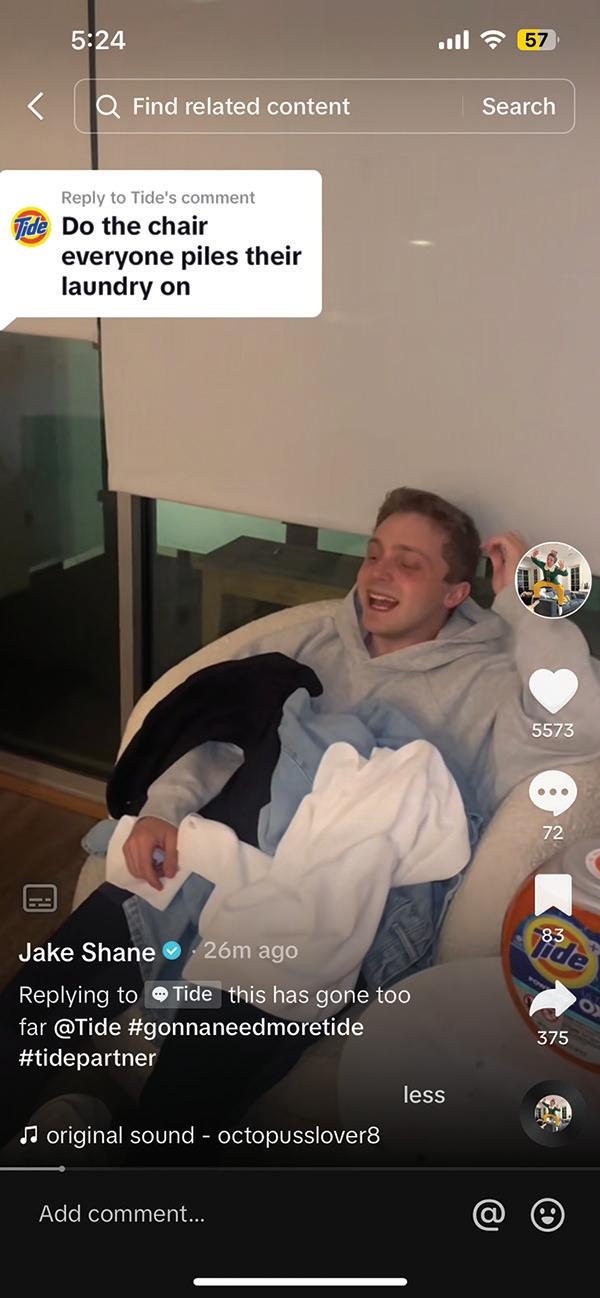

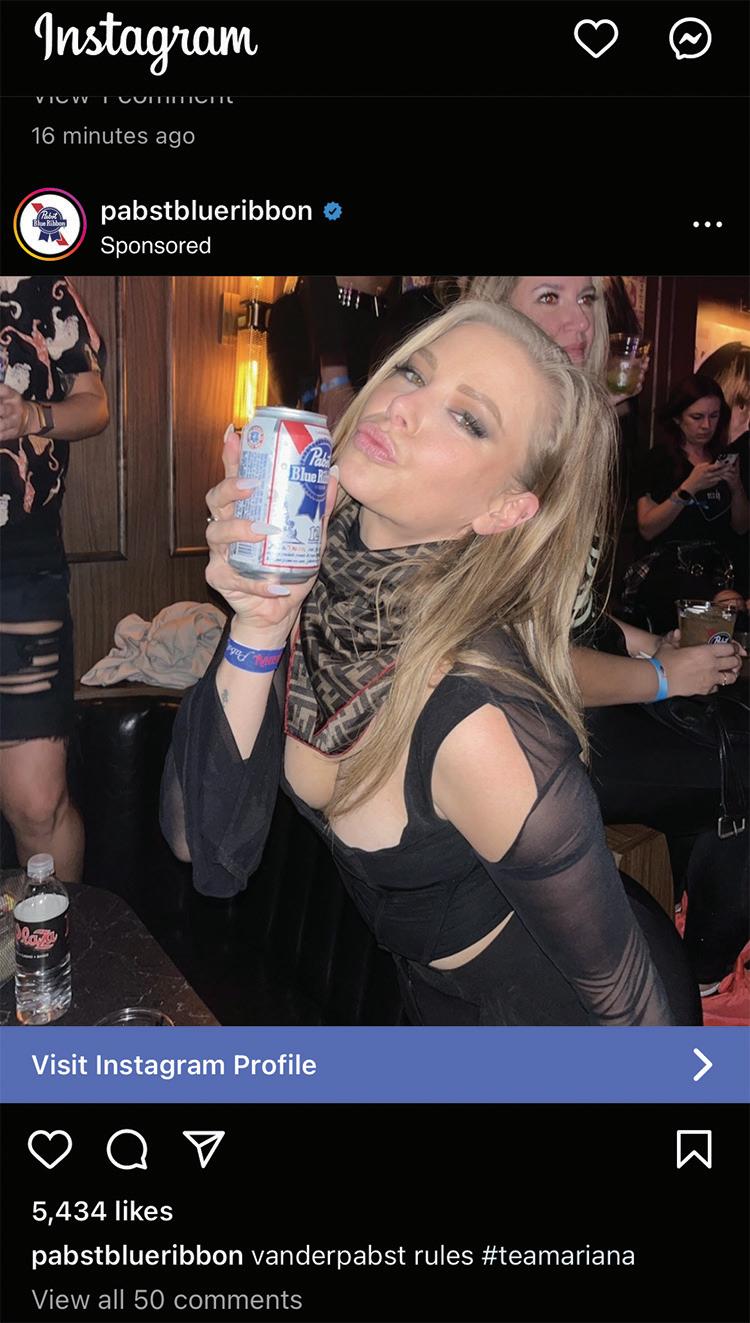

The next big trend in retail media is: Influencers working with retailers more broadly and more consistently to expand their programs and engagements.

The most exciting opportunity in retail media is: AI enhancing retailer search. Retailers should explore and leverage generative AI experiences within their destinations, because AI will allow for a more personalized search experience that will eventually evolve into a personalized retailer experience.

P2PI.com

Retail Media Awards

SARAH MARTIN Senior Manager, Commerce Marketing J.M. Smucker Co.

Sarah Martin leads the Walmart media business for J.M. Smucker’s coffee and consumer foods brands. She drives significant new buyer growth and is building incremental sales for categories, including the 2022 Coffee Scale DSP Beta Test with Walmart Connect, among others. The campaign saw ROAS of more than $26, surpassing the $2 DSP baseline, and has been shortlisted in Zenith’s 2022 ROI Excellence Awards. Martin also led the charge for the 2023 Folgers Switcher campaign, which was aimed at gaining back shoppers who were trading to other brands. The campaign featured a partnership with brand and sales on a Walmart rollback, pinpoint targeting that resulted in strong incremental sales, a $20.90 iROAS, and the highest performing audience being lapsed brand buyers.

Martin begins every project and campaign with the shopper first, since she believes the amount of retailer data gives marketers much more actionable data to build their campaigns. Starting with the retailer data, like Walmart Luminate — as well as brand insights and industry trends — has made the targeting of the shopper more successful for J.M. Smucker campaigns, yielding not only strong ROAS for its media, but driving incremental growth by reaching and converting new shoppers for its brands.

The next big trend in retail media is: Total funnel media driving conversion. Leveraging media that is building awareness of brands and products, but able to drive immediate conversion for the shopper, can help brands and marketers meet their objectives and KPIs. With the data and traceable reporting, retail media networks can help brands and CPGs reach shoppers, retarget the shoppers and drive conversion through new media channels.

The most exciting opportunity in retail media is: Staying current with growing social media channels. This is an exciting time for brands and marketers to stay relevant and authentic to our shoppers, while also developing new marketing strategies to communicate to them.

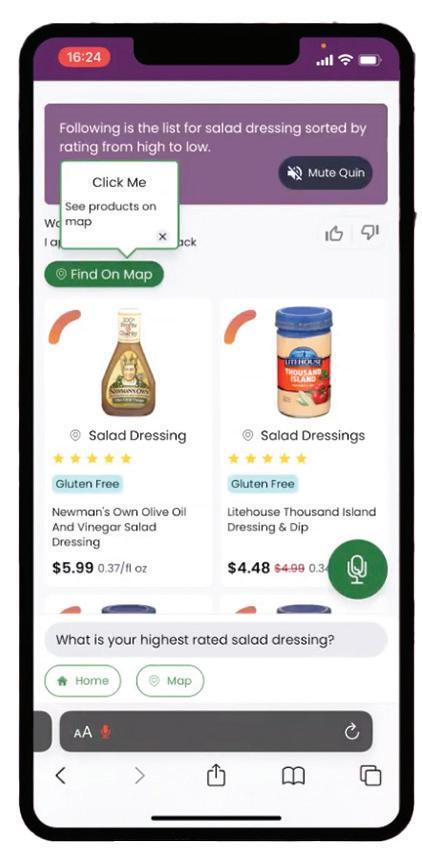

TOM MILLER CEO Sellr Technologies

Tom Miller has been at the helm of Sellr Technologies, with its in-aisle digital assistant, for nearly five years. His focus lies in the emerging retail media space, with a vision that goes beyond the online/in-app e-commerce channels — where the majority of retail media currently sits. He has a goal of securing more brick-andmortar retail media activations.

This past year, he oversaw the company’s efforts of market-testing its interactive, on-shelf Sellr digital platform with 1,000 devices in 100 physical stores, during which the team saw substantial sales lift and shopper engagement for both suppliers and retailers. Category-specific ads run on tablets placed on shelf, and still image “featured product ads with pricing” encourages shoppers to tap for additional information about the product or associated recipes. Shopper engagement is tracked, and suppliers typically realize double-digit incremental sales when advertising on Sellr, while retailers see 1%-2% total store sales revenue increases with the Sellr digital network.

Miller also led efforts as it launched ad conquesting, which enables advertised brands to market over non-advertised brands as shoppers browse, scan or search for competitor products.

The next big trend in retail media is: The incorporation of AI capabilities — for retailers to better understand shopper demand trends, for consumers to identify new products based on previous purchases, and for suppliers to personalize ad content to shoppers based on their shopping habits.

The most exciting opportunity in retail media is: Precision marketing through technology. Opt-in consumers already get highly targeted content, but technology will become more sophisticated to aim content to “likely” shopper demographic profiles. Although anonymized to protect individual privacy, it will become more precise to the audience based on a growing combination of data inputs.

JOEY PETRACCA Chief Operations Officer & Co-Founder Chicory

Joey Petracca leads the creation, development and positioning of all of Chicory’s contextual commerce advertising solutions. He and his co-founder started the company in 2012 to help people more easily cook their favorite recipes at home, but they have expanded to building shoppable technology and solutions. Over the past year, he managed the building and development of two new products: Branded Cart and Featured Retailer. Branded Cart prioritizes a particular brand’s product at the add-to-cart stage of Chicory’s Recipe Activation experience — its signature shoppable recipe button. Featured Retailer offers different retailers a special visual spotlight at the retailer selection step of the experience. Both products seamlessly integrate marketing tactics into the e-commerce experience, enhancing the shopper experience and generating incremental revenue for retailers and publishers.

In developing and advancing in-recipe, contextual advertising technologies, the company helps CPG brands and retailers more easily reach high-intent shoppers and win the basket off-site, without the use of consumer data.

The next big trend in retail media is: Contextual commerce, which seamlessly integrates high-intent contextual moments and commerce experiences to drive consumers through the purchase funnel. The combination of these elements creates a powerful tool for expanding retail media beyond a retailer’s website without relying on cookies or online identifiers.

The future of retail media is: Solutions-based advertising, which focuses on understanding and catering to the broader context and needs of consumers. In the realm of CPG and grocery, consumers rarely engage in “spearfishing,” where they seek out specific individual products. Their purchases are inherently bundled and driven by the solution they’re seeking.

22 l July/Aug 2023

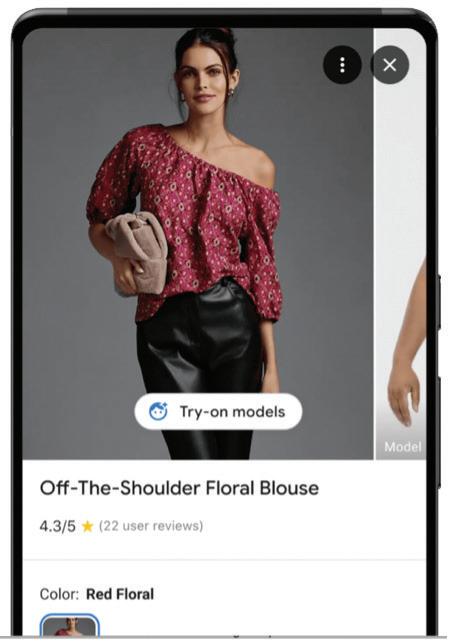

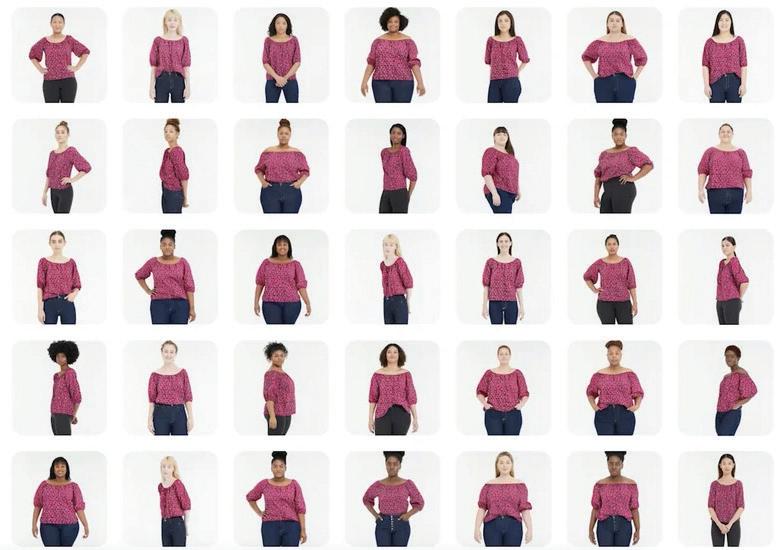

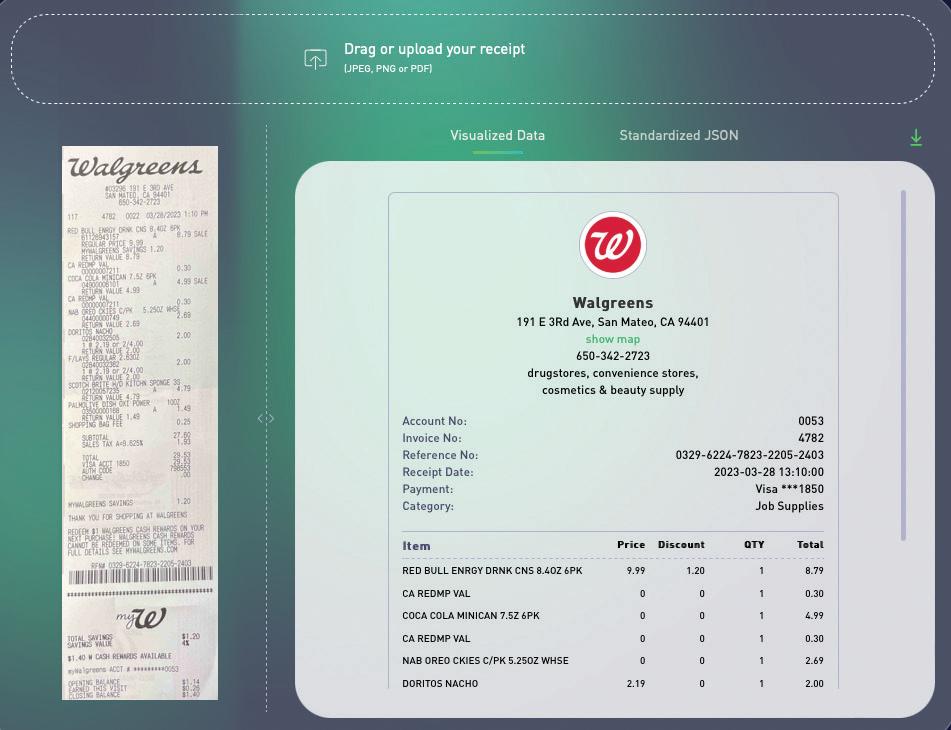

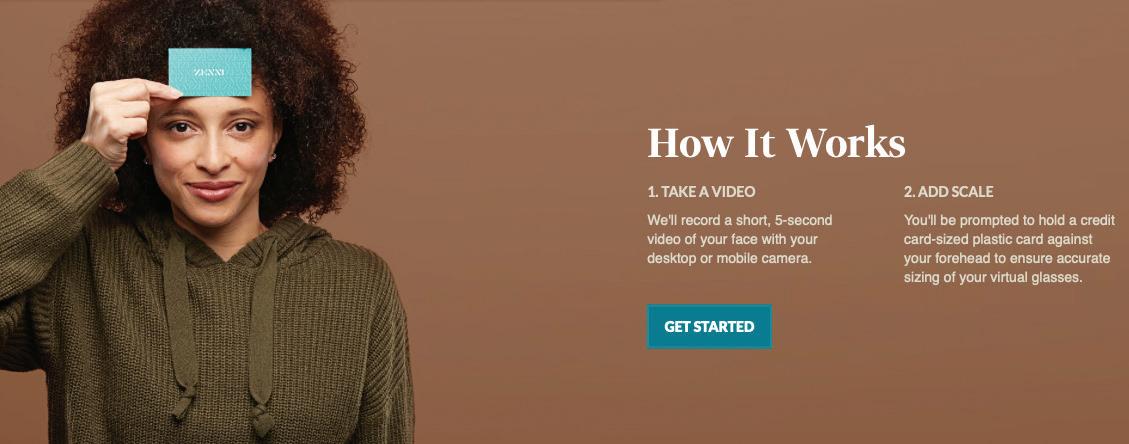

NICOLE RAINEY Senior Retail Media Manager Mars Wrigley