THE STATE OF CTV, DOOH

Why spending is surging in both media channels

SPECIAL REPORT

Examining the In-Store Shopping Experience (in collaboration with Great Northern Instore)

P2PI.com MARCH/APRIL 2023

MAR/APR 2023 P2PI. com

Hall of Fame 2023

Special Report: Examining the In-Store Shopping Experience

DOOH & CTV

The

P-O-P Showcase

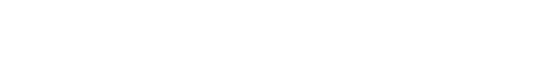

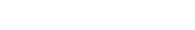

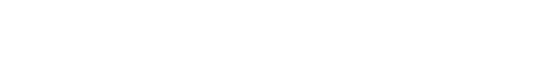

Our latest display gallery presents a sampling of eye-catching and effective in-store activations, in the BevAlc category and beyond.

Path to Purchase Institute magazine (USPS 4568, ISSN 2835-0219) is published bi-monthly by EnsembleIQ, 8550 W. Bryn Mawr Ave., Ste. 200, Chicago, IL 60631. Subscription rate for the U.S.: $80 one year; $155 two year; $14 single issue copy (pre-paid only); Canada and Mexico: $105 one year; $185 two year; $16 single issue copy (pre-paid only); Foreign: $115 one year; $215 two year; $16 single issue copy (pre-paid only); $56. Periodical postage paid at Chicago, IL 60631 Copyright 2023 by EnsembleIQ. All rights reserved. No part of this publication may be reproduced or transmitted in any form or by any means, electronic or mechanical, including photocopy, recording, or information storage and retrieval system, without permission in writing from the publisher. POSTMASTER: send address changes to Path to Purchase Institute magazine, 8550 W. Bryn Mawr Ave. Ste. 200, Chicago, IL 60631. March/April 2023 VOLUME 36 | ISSUE 2 Contents P2PI.com FEATURES 14 24 36 40

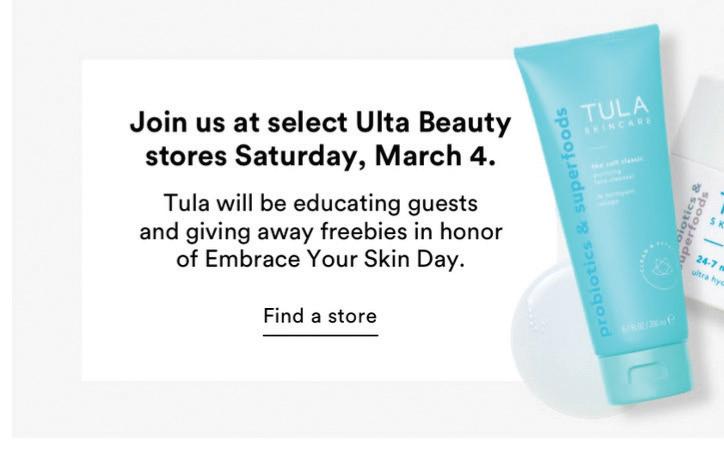

Path to Purchase Institute shines the spotlight on this year’s honorees: executives from Crayola, Ulta Beauty and Conagra Brands.

The

research provides updated insights into shopping patterns, new areas of opportunity

that could influence future

Proprietary

and the factors

behaviors.

growth of digital-out-of-home

TV

and connected

advertising tells a story about how brands are adapting in the cookie-less, multi-device world.

COVER STORY

Editorial Advisory Board

the Path to Purchase Institute

Contents 4 l March/April 2023

Follow

here:

Keith Albright Kimberly-Clark Dana Barba Coca-Cola North America

Paige

FIJI

Apple Travis Harry

Depot Brendon Lynch

Holdings José Raul Padron The Hershey Experience Jonny Rigby Amazon Jeff Sciurba Dyson Americas Kelly Sweeney The J.M. Smucker Company Rodney Waights Beiersdorf Ethelbert Williams Johnson & Johnson Consumer Health

Stephen Bettencourt CVS Health Lianna Cabrera L’Oreal Paris Cosmetics Mia Croft Native Christiana DiMattesa Under Armour Gregg Dorazio Giant Food (Ahold Delhaize)

Dunn

Water, JUSTIN Vineyards & Winery, Landmark Vineyards & JNSQ Wines Tony Fung Bob Evans Farms Patrick Hallberg

Home

Jushi

46 DEPARTMENTS 5 Editor’s Note The Vibe Shift Is Here 6 P2PI Member Spotlight 7 P2PI Member Perspective 8 Focus: Retail Media Retail Media’s Rise in Europe 10 The New Consumer Examining Health & Wellness 11 Brand Watch PepsiCo’s Snack Brands 12 In-Store Experience Meijer Grocery Debuts 23 Future Forward Sneak Peek 46 Solutions & Innovations 48 Activation Gallery Micro-Holidays 50 Insider Intel Bob Evans Turns to Mobile Sampling 8 11 23 12 50 48

The Vibe Shift Is Here

A little over a year ago, I read an article in The Cut, titled “A Vibe Shift Is Coming: Will Any of Us Survive It?” That article, which explored the cultural shift on the horizon, went viral and became the fodder of many discussions I had with brand marketers and retailers over the last year. (If you haven’t read it, I highly recommend you look it up!)

Consumer trends — and society overall — are changing in ways we can no longer anticipate, making it increasingly hard to predict the ever-moving target of shopper behavior. As we set out to develop this year’s Future Forward conference, which is dedicated to demystifying the new consumer and the next era of commerce, helping our audience navigate this “vibe shift” came to the forefront. And that’s why I am beyond excited to share that trend forecaster Sean Monahan — founder of 8Ball and the person behind the central concept of the vibe shift — will be kicking off Future Forward as our keynote speaker on day one of the event, which takes place May 16-18 in beautiful New Orleans. You can sneak a peek at what else is in store at Future Forward on page 23.

Also aligned with our efforts to help marketers better understand today’s shoppers, in this issue of P2PI Magazine we’re revealing the fi ndings of our second annual consumer study that examines the evolution of the in-store shopping experience. Our latest research — which polled more than 1,000 consumers — provides updated insights into shopping patterns, new areas of opportunity and the factors that could influence future behaviors. While e-commerce is certainly still going strong, the physical store remains the dominant channel for purchasing. In our survey, in-store trips accounted for at least two-thirds of shopping across categories.

Not only are shoppers still heading to physical retail, but they are also shopping in stores more often. Compared to a year ago, shoppers frequenting grocery stores increased 22%, while those visiting mass retailers rose 14%. While fewer in-store trips are noted for office supplies, sporting goods/outdoor activities, electronics and home improvement, the data across the majority of categories demonstrates a frequency increase from 2022. Also worth noting are the changes in shopping habits reflected in responses from younger, Gen Z and Millennial shoppers. They indicated shopping in physical stores more often compared to a year ago, and spending more time while they are there.

The research reveals some consistencies with 2022’s results, while also illuminating some interesting areas of opportunity. I encourage you to dig into the rest of the research fi ndings (the report starts on page 24) to learn how you can better connect with in-store consumers in 2023 as you set out to redefi ne the touchpoints along truly omnishopper journeys.

8550 W. Bryn Mawr Ave., Suite 200, Chicago, IL 60631 877.687.7321 www.p2pi.com

BRAND MANAGEMENT

Vice President, Brand Director Eric Savitch esavitch@ensembleiq.com

EDITORIAL

Editorial Director Jessie Dowd jdowd@ensembleiq.com

Executive Editor Tim Binder tbinder@ensembleiq.com

Managing Editor Charlie Menchaca cmenchaca@ensembleiq.com

Digital Editor Jacqueline Barba jbarba@ensembleiq.com

Director, Member Content Patrycja Malinowska pmalinowska@ensembleiq.com

Managing Editor, Member Content Cyndi Loza cloza@ensembleiq.com

Editor, Member Content Heidi Bitsoli hbitsoli@ensembleiq.com

Events Content Director Lori Pugh Marcum lpughmarcum@ensembleiq.com

Contributing Writers Michael Applebaum, Ed Finkel, Erika Flynn, Chris Gelbach, Jenny Rebholz, Bill Schober

ADVERTISING SALES & BUSINESS

Associate Director, Brand Partnerships Arlene Schusteff 847.533.2697, aschusteff@ensembleiq.com

Regional Sales Manager Orlando Llerandi 678.591.8284, ollerandi@ensembleiq.com

MEMBER DEVELOPMENT

Director, Membership Development Nicole Mitchell 203.434.5733, nmitchell@ensembleiq.com

Director, Membership Development Christopher Barry cbarry@ensembleiq.com

Membership Experience Manager Ann Estey aestey@ensembleiq.com

Manager, Membership Development Brady O’Brien bobrien@ensembleiq.com

Membership Experience Manager Heather Kurtik 724.553.0093, hkurtik@ensembleiq.com

DESIGN/PRODUCTION/MARKETING

Senior Creative Director Colette Magliaro cmagliaro@ensembleiq.com

Art Director Michael Escobedo mescobedo@ensembleiq.com

Production Director Ed Ward eward@ensembleiq.com

Marketing Director Marlene Shaffer mshaffer@ensembleiq.com

SUBSCRIPTION SERVICES

List Rental mbriganti@anteriad.com

Subscription Questions contact@pathtopurchase.com

CORPORATE OFFICERS

Chief Executive Officer Jennifer Litterick

Chief Financial Officer Jane Volland

JESSIE DOWD, Editorial Director

Chief People Officer Ann Jadown

Executive Vice President, Content & Communications Joe Territo

Executive Vice President, Operations Derek Estey

Editor’s Note P2PI.com

Not only are shoppers still heading to physical retail, but they are also shopping in stores more often.

Meet the Marketers

importantly, everything we do is highly targeted to ensure we reach shoppers with access to Sunkistgrown citrus since it supports our growers and the fruit they carefully grow and handpick.

CHRISTINA WARD Senior Director of Global Marketing Sunkist Growers

Main job responsibilities: I oversee the global brand and retail marketing strategies at Sunkist Growers, a 130-year-old fresh citrus cooperative. Since we work with a legacy brand (Sunkist is the longest-standing agricultural co-op in the nation), our team focus has been on innovation, education and celebration. In recent years, this produce brand has taken a huge leap into the shopper marketing world, extremely focused on reaching consumers where they are.

Winning with shoppers during uncertain economic times: Shopper behaviors are in constant motion, especially when it comes to fresh produce. So, we prioritize a real-time understanding of what the consumer needs and where they want to buy. We stay in lockstep with category data and shopper insights that guide relevant as well as customizable marketing programs to support our retail partners. Overall, reaching our audiences through an omnichannel approach is key to our programming.

Also, eating healthy is still a priority for citrus shoppers. In a recent study, we learned that shoppers’ No. 1 reason for buying citrus was their health and wellness. Most

New marketing tactic that you use: In the past couple of years, we’ve expanded our capabilities in e-commerce with tools to support retail partners focused on capturing the online shopper. According to a recent study, more than half of U.S. households ordered groceries online in December, up 4% versus 2021. We pair our online programming with in-store promotions to capture shoppers in a time and place that is most convenient for them.

Activating at retail: Brand partnerships are a meaningful way to create new experiences for shoppers. During the holidays, citrus is a sweet tradition in many homes across the country and the world. We have had some opportunities to promote California-grown navel oranges in November at the start of the season in conjunction with classic movie titles. We created custom 10-pound holiday cartons — the perfect tool for retailers to meet consumer demand for eating and giving health-centric holiday gifts. According to IRI data, our movie-themed promotions have historically supported a morethan-20% increase in navel orange sales at retail. Finally, Sunkist Growers is celebrating its 130th anniversary this season. We had in-store and online programming to celebrate every bite.

Associate Marketing Manager – Customer Focus

Jack Link’s Protein Snacks

Main job responsibilities: Our team handles several different duties within marketing. These range from normal marketing operations to couponing and partnerships. I was brought on in August 2022 to help revamp our shopper marketing strategy across all Link Snacks brands. I am currently focused on creating processes and baseline strategy for our core products, innovation and emerging brands across all channels.

How you win with shoppers during uncertain economic times: We invest time and resources into learning more about what our shoppers and consumers want and need from our brands, and adjust accordingly. We recently launched a rewards program for Jack Link’s and Lorissa’s Kitchen that provides much-deserved rewards for our loyal consumers.

New marketing tactic that you use: It’s not a new tactic across the board, but in the past year I gained a lot of hands-on experience in the world of experiential marketing. I was tasked with finding unique sampling opportunities at events across the country on a limited budget — a very fun challenge. I was invigorated to see what we could accomplish when we got really strategic with how we would hit our objectives and really squeeze every last drop out of our budget.

Memorable aha moment in your career: I have always had a passion for food and had always worked on food brands throughout my shopper marketing career on the agency side. I took a role with a client that was in skincare and quickly realized that food and beverage is what gets me excited. My “aha” realization was that as long as I believe in and care about the product we are marketing, it makes the hard days easier.

Member Spotlight 6 l March/April 2023

KATIE BOGGESS

HERE’S A SNAPSHOT OF INDUSTRY LEADERS FROM THE P2PI MEMBER COMMUNITY.

Next-Level Commerce

A LOOK AT THE EVOLUTION OF LIVE SELLING AND INTERACTIVE SHOPPING.

BY INDIA LOTT AND KELLY RAVESTIJN

From the door-to-door vacuum salesman of the 1950s and 1960s, to the 1980s-1990s heyday of cable shopping channels, to the live commerce happening today on social media, consumers have always been willing to engage with a sales pitch.

Although QVC and HSN are still going strong, in 2023 live and interactive selling occurs primarily on social media platforms. It is evolving in ways brands and retailers have yet to fully recognize. We defi ne the live shopping category as showcasing your product through livestreams and allowing customers to ask questions and purchase in real time. As consumers seek greater convenience, a return to in-store prominence and new ways to use technology to shop, live shopping is poised for transformative growth.

This latest iteration of interactive shopping on social media is a tactic that fi rst gained traction in 2021 in China, pulling in an estimated $300 billion in revenue. Those numbers are backed up by analysts that predict live shopping sales might make up 20% of all e-commerce sales by 2026. Additionally, the livestream e-commerce market is predicted to reach $35 billion in 2024, which is a threefold increase from 2021.

Although now is the time for U.S. brands and retailers to up their live-selling game, some of their live tactics are lagging. One reason could be that consumer shopping has evolved faster in China than in the U.S. Live selling in China is treated like an event — complete with intricate production sets, live music, sound effects and New Year’s Evetype countdowns to the start of shopping events.

The U.S. hasn’t picked up on that, which is ironic given how Americans love a spectacle. Once retailers and brands dedicate the time and resources to building an interactive shopping platform that’s exciting and fun, then we will see success in the U.S.

Live-shopping success is not simply a matter of shifting resources. It should be viewed as another platform you need to promote and drive traffic toward. In the same manner the budget is allocated across media channels, that needs to be done with interactive shopping as well.

Consumers want convenience, and brands need to shift their strategy to address it. Creating an exceptional customer experience is key.

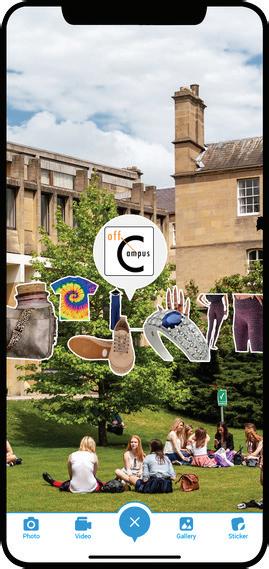

Some brands are encouraging “window shopping” with QR codes that let consumers purchase while on the go. Consider how recently shoppers in New York were able to purchase products right from store windows. TalkShopLive included a live feed and QR code that allowed shoppers to access products from the street in real time for purchase.

The rise of interactive commerce might raise concerns from retailers, but ultimately they are mostly concerned with their bottom line. The goal shouldn’t necessarily be to bring consumers back into physical stores, but to provide them with a seamless shopping experience — whether in store, online or on a livestreaming platform. This is necessary to drive brand loyalty. Having the ability to purchase via a QR code while walking down the street is simple and easy, as opposed to entering a store, searching for the product, waiting in line and fi nally completing the purchase.

Remember, that knock on the door is not coming from a traveling salesman, but from your customers who are ready to buy from their couch. It’s time to answer the door and invest in new ways to enter consumers’ homes via technology.

About the Authors

India Lott is vice president, strategic planning, at Advantage Unified Commerce (AUC). She is a senior marketing executive with more than 15 years of experience in digital marketing, with an emphasis on elevating external client and internal corporate business performance.

As senior vice president of strategic planning at AUC, Kelly Ravestijn is responsible for strategic leadership across key accounts and the development of the agency’s strategy team.

Member Perspective P2PI.com

Live-shopping success is not simply a matter of shifting resources. It should be viewed as another platform you need to promote and drive traffic toward.

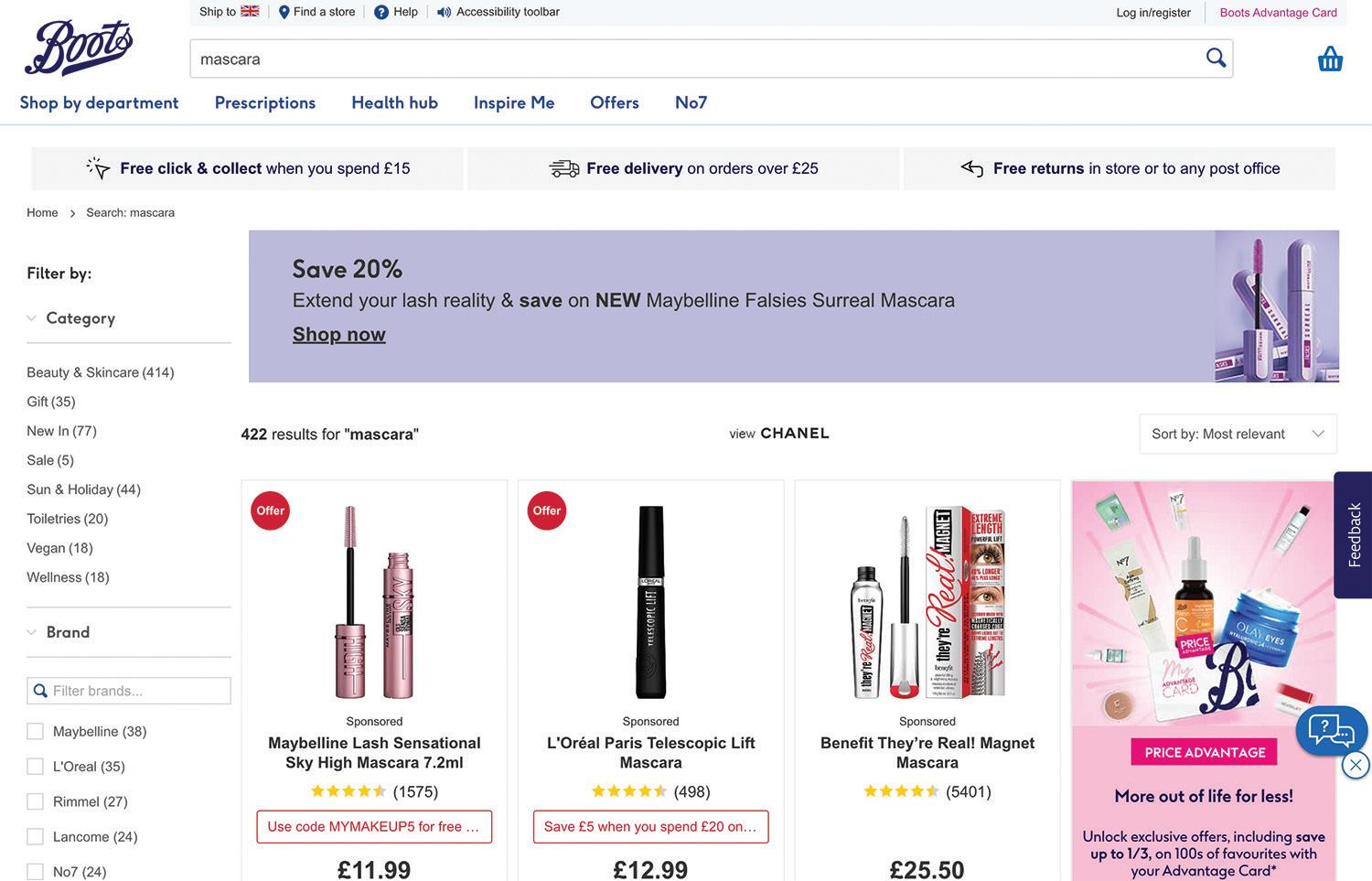

Retail Media’s Rise in Europe

BOOTS UK’S OLLIE SHAYER AND SMG’S SAM KNIGHTS DISCUSS THE RETAIL MEDIA CHALLENGES AND OPPORTUNITIES IN THE U.K. AND BEYOND.

BY CYNDI LOZA

There’s no denying the rise of retailer media networks in recent years and their cemented strategic status in the U.S. for years to come. U.S. digital retail media ad spending grew from $13.23 billion in 2019 to $40.81 billion in 2022, according to an eMarketer forecast, and will increase to $61.15 billion in 2024. Boston Consulting Group estimates the U.S. retail media market will grow to $100 billion by 2026.

The U.S. is not the only area of the world that’s witnessed retail media market growth. Retail media’s rise in the U.S. has fueled growth in Europe, where the Interactive Advertising Bureau (IAB) Europe forecasts retail media ad spend will reach 25 billion euros ($26.7 billion) by 2026 — a huge jump from 7.9 billion in 2021.

“I know the numbers are always big around the growth of retail media globally and the investment that’s moving into the space, but I think the proof is probably more in the pudding: Now we see people’s general interest in it,” says Ollie Shayer, omni-media director at Boots UK, a British health and beauty chain owned by Walgreens Boots Alliance.

As Boots has recognized the growth of retailer media networks in recent years from U.S. retailers,

such as Walmart and Kroger, there’s been a passion for retail media at his company, Shayer says. It’s the interest of the retailer’s supplier base, however, that’s significantly accelerated in the past 18 months. This is predominantly driven by the evolution of fi rst-party data, Shayer explains, as well as a desire, especially from fastmoving consumer goods companies, to use their investment effectively and efficiently.

Boots has seen positive responses and strong growth from solutions such as on-site sponsored search and sponsored products. While the toolkit is generally similar between the U.S. and the U.K., off-site advertising is still growing in Europe.

“It’s not maybe at the scale yet that the U.S. is, in the sense of driving a lot more of the off-site activity through things like Meta, through DSP partners and the utilization of data through that,” Shayer says. “I think that’s predominantly because the data regulations in Europe are obviously quite different from the U.S. When I talk to my colleagues at Walgreens, I’m always very envious of the data availability they have.”

The EU General Data Protection Regulation (GDPR) is considered the world’s toughest online privacy law, limiting how companies can collect and share data without user consent.

“We have to make sure that we can’t individually identify people,” says Sam Knights, CEO of London-based SMG (Shopper Media

FOCUS: Retail Media 8 l March/April 2023

I know the numbers are always big around the growth of retail media globally and the investment that’s moving into the space, but I think the proof is probably more in the pudding: Now we see people’s general interest in it.

— Ollie Shayer, Boots UK

is interest in it.

The sophistication of what you can do in-store in the U.K. and Europe is actually ahead of where the U.S. is, but the sophistication of what you can do digitally is way ahead in the U.S. than it is in the U.K.

— Sam Knights, SMG

Group). “They have to be anonymized, and they have to have given the right amount of consents, and you have to be able to prove at every stage that it’s done that.”

The regulation creates its own challenge in terms of being able to target shoppers off-site the way that, for example, Walmart Connect can, Knights explains. (While it presents difficulties for advertisers, Knights notes the regulation is a good thing as it centers on individual security.)

Shopper behavior in England has not only influenced how consumers there are marketed to, but it’s also shaped the general defi nition of retail media in the country. Shoppers in the U.K. are not driven by coupons or mailings — which are non-existent in England — but instead in-store promotions and presence, according to Knights.

“It’s much more in the moment, less of a plan, which makes the shopper behavior in-store easier to manipulate in a positive way for a brand,” Knights says. “So, the in-store presence is much greater in Europe than it is in the U.S.”

This difference has shaped how retail media is defi ned in the U.K., says Knights. When discussing retail media in the U.S., generally marketers are referring to e-commerce, digital and programmatic advertising, whereas in the U.K. in-store solutions come to mind fi rst, he explains.

“The sophistication of what you can do in-store in the U.K. and Europe is actually ahead of where the U.S. is, but the sophistication of what you can do digitally is way ahead in the U.S. than it is in the U.K.,” Knights says. “We’ve started from different places, I think, and that’s because of the shopper behavior [and] because the impact that you can have in a physical sense is much greater here.”

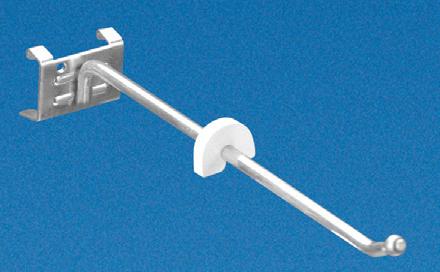

Beyond the classic point-of-sale solutions, such as floor clings, Boots is working on delivering programmatic digital radio and adding more digital screens in stores. “The idea [is] more of a digitization of the in-store environment, so things can be changed more easily centrally, but also we provide our suppliers with easier interfaces to do that. So, they can load and upload their content into it quite easily, we can approve it ... and we can push it out within 30 minutes into the store environment,” Shayer says.

Taking some learnings from the launch of Walgreens Advertising Group in 2020, Boots UK tapped SMG’s retail media agency Threefold to rapidly accelerate the retailer’s established partnership marketing group. The result

was a bespoke, joint venture: Boots Media Group. “I think the biggest thing for us was not to create an external entity that felt like it was an agency. I think that’s been an incredible piece of work from the guys at Threefold to really integrate into the Boots environment,” says Shayer, adding the team started with 10 employees two years ago and has grown to 40.

Commerce Marketing Across Borders

Want more international coverage on retail media and commerce marketing? Be on the lookout for the September/October issue of P2PI Magazine for an in-depth feature exploring how shopper marketing is evolving across the globe.

And if you are working in commerce marketing abroad and are interested in learning more about our new International Advisory Board, contact Editorial Director Jessie Dowd at jdowd@ensembleiq.com.

P2PI.com

Examining Health & Wellness

A RECENT TRENDS REPORT REVEALS HOW DIFFERENT GENERATIONS FIND GROCERY SHOPPING INSPIRATION.

BY JACQUELINE BARBA

Business journalist Dan Frommer’s new trends report, also titled “The New Consumer,” examines how different generations are fi nding grocery shopping inspiration as well as how consumers are thinking about their health and wellness. Published in collaboration with venture capital fi rm Coefficient Capital, the report leverages the results from a survey of more than 3,000 U.S. consumers as well as exclusive insights from Instacart data — including popular search terms, purchase data, basket affi nities and sales velocity.

Key fi ndings include:

• More than 70% of consumers — across Gen Z, Millennials, Gen X and Boomers — plan to prioritize their health and wellness in the next 12 months.

• Vegetables are the top items consumers want to eat and drink more of this year.

• Many of Instacart’s fastest-growing emerging brands focus on “better-for-you” or environmental values.

• Instacart search interest for “probiotic” items grew 30% last year as online shoppers prioritized gut health.

• 48% of consumers agree that small, emerging brands are looking out for Americans’ health and nutrition.

• 65% of Gen Z consumers believe online grocery stores have a responsibility to recommend healthy food.

• Consumers expect to spend more on groceries this year and less on dining.

Half of TikTok users say they’ve prepared a new recipe because of a video

Which of the following have you done because of a food-related TikTok, YouTube, or Instagram video or post?

a food or beverage recipe

Purchased a food or beverage product from a brand I did not previously know about Purchased a food or beverage product from a brand I already knew about

powered by toluna*

Top 10 Culturally Fluent Brands for Black Consumers

Black Consumer Sentiments

A 2023 study from cultural intelligence and consumer research partner Collage Group examined how Black Americans feel about top culturally fluent brands and companies, and how and where they are engaging most.

In assessing the top brands, Collage Group leveraged its Brand Cultural Fluency Quotient (B-CFQ) score to determine brand resonance across six different cultural factors: fit, relevance, memories, values, trust and advocacy.

Key fi ndings from the study indicate:

• Walmart, YouTube, Lysol, Coca-Cola’s Sprite, Visa, McCormick, Unilever’s Dove, Procter & Gamble’s Febreze, Netfl ix and Google resonate best among Black consumers (out of 320 brands examined).

• 64% percent said they fi nd joy in cooking at home versus eating out, compared to 54% of the total population.

• 63% said they seek new things to do, try and see, including new foods and meals.

• 88% said they follow influencers or content creators on social media platforms, while 42% of the segment follows food and cooking influencers/content creators.

• 72% said they are worried about their fi nances and 83% have called on brands to be involved in social issues in some respect.

• 54% said they are more likely to listen to hip-hop music (including rap), compared to 33% for the total population.

The New Consumer 10 l March/April 2023

Prepared

TikTok YouTube Instagram TikTok YouTube Instagram TikTok YouTube Instagram TikTok YouTube Instagram

TOP BRANDS RANK DIFFERENCE (vs. Non-Black) 1. Walmart 0 2. YouTube +3 3. Lysol +13 4. Sprite +33 5. Visa +1 6. McCormick +43 7. Dove +2 8. Febreze +23 9. Netflix -6 10. Google -2 50% 46% 42% 39% 30% 33% 39% 25% 29% 35% 27% 27% Data: Consumer Trends Survey,

Among

Culturally fluent brands among Black consumers by average B-CFQ score (out of 320 brands) (TikTok n=119, YouTube n=1,452, Instagram n=2,321)

Ate or drank something I otherwise would not have

users of each service. Not all responses shown.

Source: Collage Multicultural

PepsiCo Embraces Shopper Insights

THE MANUFACTURER PARTNERS WITH SYMPHONYAI RETAIL CPG TO BUILD BUSINESS ACROSS MULTIPLE CATEGORIES.

BY CHARLIE MENCHACA

A European division of PepsiCo has successfully leveraged primary shopper data in unique ways.

PepsiCo Northern Europe combined its internal advanced analytics capability with retailer data and solutions from SymphonyAI Retail CPG to bring shopper-led store clustering to more than 1,000 stores. The work resulted in a reset of the salty snacks category in 2022 at a Netherlandsbased multinational grocer, according to a written case study.

“The Netherlands is one of the highest penetration markets for snacks, at nearly 96%, so PepsiCo and our partner can’t really deepen category penetration,” said Jan Haluza, manager of data science and analytics at PepsiCo Northern Europe, in the case study. “Instead, we focus on understanding targeting shoppers very precisely to best align our assortment and category strategy with their needs. We worked with the retailer to undertake a strategic snack category overhaul including consumer insights, space management and supply chain, to drive a major strategic reset.”

PepsiCo Northern Europe and the undisclosed retailer collaborated on an end-to-end, datadriven approach centered on a four-step process:

• Integrate relevant data to create a powerful data set;

• Identify areas of highest growth potential;

• Design a solution with tailored in-store value propositions and personalized shopper engagement to unlock growth; and

• Convert opportunities to growth using continual measurement and improvement.

In this case, the large data set indexed as many as 1,000 characteristics per store. The comprehensive information meant that PepsiCo Northern Europe and the retailer could run advanced analytics models on the data, according to the case study.

After grouping the stores into three shopper-led clusters, PepsiCo had detailed discussions with the retailer about the clusters and solutions for

each. The manufacturer used SymphonyAI for assortment optimization for each cluster while analyzing incremental share of market and assortment models to generate the best scenario for each cluster. Finally, PepsiCo generated planograms for each shelf specifically for different clusters, Haluza said in the case study.

The comprehensive project met multiple goals for the retailer and PepsiCo, said Tessa Maas, senior category manager, food, at PepsiCo Northern Europe.

“The strategic approach [was] tied to overall category vision and how to grow snacks in the future — by brand, flavor, etc., including incorporating shopper decision trees,” Maas said in the study. “We took the time to learn from shoppers how they actually navigate a shelf — do [they] start with a flavor and then fi nd a brand? Or start with the brand and search for a flavor? We developed different priorities, objectives and, in the end, solutions for each cluster.”

The success of the category reset and PepsiCo Northern Europe’s collaboration with Symphony AI and the retailer yielded many benefits. It can serve as a best practice for other PepsiCo markets, Haluza said.

Brand Watch P2PI.com

We focus on understanding targeting shoppers very precisely to best align our assortment and category strategy with their needs.

— Jan Haluza, PepsiCo Northern Europe

Meijer Grocery Debuts

TWO LOCATIONS IN MICHIGAN OFFER A SIMPLIFIED AND CONVENIENT SHOPPING FORMAT AND EXPERIENCE.

BY JACQUELINE BARBA

In 2022, Grand Rapids, Michigan-based mass merchant Meijer announced its first new store format since its neighborhood grocery market debuted in August 2018. The new concept, dubbed Meijer Grocery, launched on Jan. 26, 2023, with the opening of two stores (ranging from 75,000 square feet to 90,000 square feet) in southeastern Michigan’s Orion and Macomb townships.

Meijer says the grocery format is focused on offering a simplified and convenient shopping experience for customers from start to finish. For example, the parking lot at both stores wraps around a singular corner entrance to maximize the number of parking spaces near the door.

Path to Purchase Institute recently visited one of the stores in Macomb Township. Read on to see what stood out to us.

Upon entering the store, shoppers encounter a modern design, featuring tall ceilings, wide aisles and ample lighting and shelf illumination. Each department is clearly identifiable through large, permanent installments hanging above merchandising units and aisles.

The presence of local brands is elevated across the store — most notably in the produce, meat, liquor and bakery departments — with signage communicating messages like “Michigan made” and “Grown close to home.” The store features a larger assortment of produce than other area

stores, as well as a full-service bakery, deli, ready-to-go food counter, meat and seafood counter, and a sizeable BevAlc section.

The store is also more tech-enabled to ease customers’ shopping experience. In the produce department, for example, freestanding scales with digital screens allow shoppers to weigh their produce and print and adhere a label to their item themselves for a quicker checkout.

In the beauty department, an interactive endcap display merchandised Neutrogena products under a digital screen — somewhat similar to ones seen at other Meijer stores. The footage, playing on a loop, invited shoppers to explore the brand’s skincare products showcased below by category (e.g., anti-aging, hydration and makeup remover), while also indicating which shelf they are located on.

In-Store Experience 12 l March/April 2023

Additional elements of the in-store experience that stood out include:

• Smartphone holders affi xed to shopping cart handles — to make referencing a digital grocery list easier, or for scanning product (for those who use Shop & Scan through the Meijer mobile app).

• A self-checkout area for Shop & Scan users or smaller baskets of fi ve items or less.

• An expansive “Pet Shop” department that carries 200 pet toys and more than 500 varieties of treats for dogs and cats from national brands and private labels.

• An eye-catching health and wellness wall stocking protein powders and other related products near the pharmacy.

• Recycling bins near the exit that encourage shoppers to discard plastic bags and other flexible plastic fi lms as part of Meijer’s sustainability efforts. An affi xed sign logs how many pounds of plastic Meijer and its shoppers have recycled together this year. A similar throw-away bin for expired or unwanted medications is positioned near the pharmacy counter.

P2PI.com

INTRODUCING OUR 2023 HALL OF FAME HONOREES

BY ERIKA FLYNN

Each year since 1994, the editors of the Path to Purchase Institute have selected three industry leaders for induction into the Hall of Fame. From their daily business practices to the work they produce, these honorees represent the very best of the commerce marketing industry. Collectively, these professionals have proven that they don’t just follow the path to purchase; rather, they help build it. The 2023 inductees are:

• Mimi Dixon, Crayola

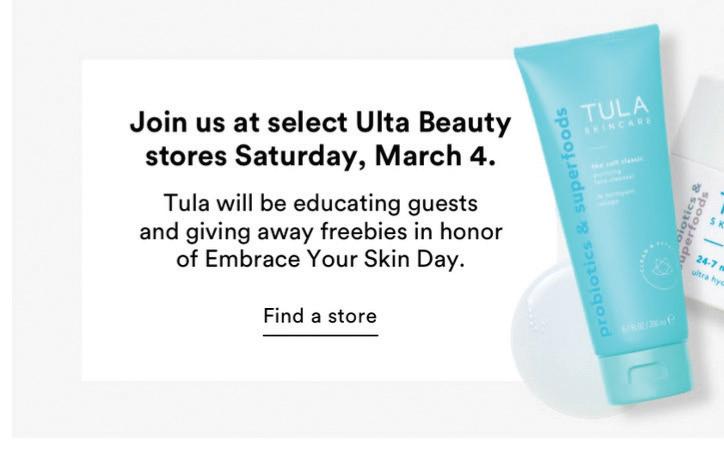

• Brent Rosso, Ulta Beauty (page 18)

• Bob Waibel, Conagra Brands (page 20)

For a complete list of Hall of Fame inductees, visit P2PI.com/HallofFame.

14 l March/April 2023

Mimi Dixon

Director,

Brand Activation and Content Crayola

Mimi Dixon thrives on connecting with consumers. That started when she worked at Barnie’s Coffee & Tea Co. in high school. It was there she got her first taste of marketing, sales and consumer interactions. And even though her first years of college took her down a different path, she never lost that passion.

Today, as director of brand activation and content at Crayola, Dixon leads a team that creates consumer connections every day, guided by four overarching principles: authenticity, transparency, credibility and inclusivity.

THE EARLY YEARS

Dixon was the oldest of four children, raised in a single-parent household in Camden, New Jersey. She came from meager beginnings and was the fi rst in her family to attend college. One of her earliest lessons was the value of always striving to be better and not being afraid to branch out.

Her early years included experiences through CHAMP (Creating Higher Aspirations & Motivations Project), a summer program out of nearby Rowan University that took inner city kids camping, taught them science, math and sociology so they could learn to network and connect, and eventually introduced them to college. This program helped her on her college endeavors, and she later gave back as a camp counselor.

Dixon also took advantage of a state-certified emergency medical technician program in high school. She was an EMT for a few years, and says it opened her eyes to the world around her. It also dimensionalized the deep roots of prejudice when she encountered racism on the job.

CAREER DEVELOPMENT

After graduating, Dixon moved back to Camden and landed as a temp at Campbell Soup Co. “I had been around Campbell’s headquarters all my life, but never thought about working there,” she says. She proved quickly that she was more than ready

for a permanent position after working on one of its signature education programs, Labels for Education, and they created a role for her.

Throughout high school, Dixon also participated in a summer program minored in political science, which led her to a masters

Throughout high school, Dixon also participated in a summer program called PRIME (Philadelphia Regional Introduction for Minorities to Engineering) and was encouraged to follow the engineering path in college. After two years, she pivoted and went on to earn a degree in sociology from Rutgers University, following her passion for understanding people and connections. She minored in political science, which led her to a masters of public administration from the University of Delaware, during which she was a legislative fellow with the Delaware House of Representatives.

P2PI.com

MIMI DIXON

Title: Director, Brand Activation and Content

Company: Crayola

Team Members: Stephanie Hudson, brand content manager; Erika Merklinger, public relations and communications manager; Pam Garrity, marketing coordinator.

Career Path:

• Crayola, director, brand activation and content (2017-present), customer development and national activation - sales (2014-2017)

• Campbell Soup Co., senior group manager, shopper marketing – Campbell North America (2013-2014); senior group manager, integrated consumer and shopper marketing (2010-2013), senior group manager/senior manager - consumer marketing (2003-2009), promotions associate/assistant manager/ manager - consumer marketing (1998-2003)

Industry Activities:

• Keynote speaker: 2021 ANA (The Association of National Advertisers) Multicultural Marketing & Diversity Conference & Awards; Disney Marketing Townhall; Dolby360 Marketing Townhall; John Deere Inclusion Summit; Kellogg’s Innovation Townhall; Pearson Inclusion Summit; Pernod Ricard Marketing Townhall; Inspira-Enthuse Marketing; NPR Marketing Townhall;

• Panelist speaker: Red Bull; SHRM (Society for Human Resource Management) Inclusion Summit; NEW (Network of Executive Women) Summit

• Judge: ANA Multicultural Awards, Effie Awards, Reggie Awards, AME Awards

Education: Rutgers University, Bachelor’s, Sociology/Political Science; University of Delaware, Master’s, Public Administration, State and Local Management.

She started as a promotions associate, and during her 16-year tenure took roles of increasing responsibility, ultimately holding the position of senior group manager – shopper marketing, Campbell North America. It was a lesson in transferable skills entering the world of CPG. “A lot of what I learned working on my master’s transferred over to Campbell Soup, almost like an MBA but for the public,” she says. “Being able to put products together, fulfilling a need for the consumer and witnessing the ambassadorship. I liked that, and I wanted more of it.”

Through her Campbell Soup years, she worked in consumer promotions and then moved into shopper marketing, working on different brands in each of her roles. She led the Chunky Soup Mama’s Boys Campaign in partnership with the National Football League for eight years, and eventually led Labels for Education as well, which was her first experience with a cause-focused program.

She counts both as some of her best work while with the company, along with what then became the label’s largest causal program with the U.S. Postal Service, Stamp Out Hunger, in collaboration with Feeding America. Giving back and helping others in need will always ring true for Dixon. “To be able to have a program that was simple and effective, but where we could really make a difference — that’s a message right after my own heart.”

Dixon says Campbell Soup’s then-CEO Doug Conant made a significant impact on her early career. He brought diversity, equity and inclusion (DEI) efforts and employee resources groups to the company, advocated for healthy lifestyles and was the biggest proponent of work/life balance — all while staying connected to employees on a regular basis and making them feel valued.

Terry Atkins, Dixon’s fi rst director of integrated marketing; Anne Pizzaro, her fi rst manager; and Angel Sasso, who created the position for Dixon when she was hired on, all played integral roles in her growth and success at the company.

l March/April 2023

Everything we did went through this lens of those four guiding principles [authenticity, transparency, credibility and inclusivity]. Even to this day, when we’re looking at partners for Colors of the World, we look through that lens. If they stand up to those guidelines, that’s what moves us forward.

MAKING HER MARK AT CRAYOLA

In 2014, Dixon decided it was time to branch out again and made a move to Crayola. She seized the opportunity to lead shopper marketing under Nancy DeBellis, director of customer leadership.

Crayola offered an entrepreneurial spirit and an organizational structure in which she was involved in more planning, discussions, pitching to senior leaders and aligning with them. “It was a whole new level of marketing, presentation skills and political savvy,” she says, adding that her involvement with retail partners increased, which was an exciting change for her.

Eventually she began overseeing the company’s merchandising efforts and, in 2017, she assumed her current position of director, brand activation and content.

Dixon has watched the practice of shopper marketing evolve. Retailers are still looking for ways to engage shoppers, she notes, but are looking to add more value. “Together we want to give more to shoppers,” she says. “We have to ask ourselves how we can do that, whether with content, exclusive product or something else. Here are the bare bones of the product, but how do we give them more?”

An added focus is on leveraging microseasons, on top of the seasons the company has historically activated against. “So think Halloween, Earth Day or Valentine’s Day,” she says. “Other moments that matter, if you will, outside of the big tent poles, when we can engage consumers and give them value add.”

Engaging with teachers and being a better resource for them, as well as new ways to drive loyalty, are also points of discussions right now at Crayola. And finally, supporting DEI. “Retailers want to partner to be more inclusive and make sure we’re not missing any key groups of consumers in our work,” she says.

When the company partnered with beauty industry expert Victor Casale for a new product launch, Dixon led the charge. Colors of the World introduced 24 newly developed colors, which represent 98% of the global population, and became the most successful launch in Crayola history.

Dixon encourages teams to learn from other industries, and to break the mold when given the opportunity. “Don’t be afraid to do things differently,” she says. Crayola had to learn how to produce paint around the Colors of the

World line, something it had never done before. She says the company culture must support the work/product and live into four key principles of authenticity, transparency, credibility and inclusivity.

“Everything we did — from R&D to reaching out to consumers, understanding packaging, crayon labeling, marketing, PR — went through this lens of those four guiding principles,” she says. “Even to this day, when we’re looking at partners for Colors of the World, we look through that lens. If they stand up to those guidelines, that’s what moves us forward.”

INTO THE FUTURE

Furthering DEI will continue to be a goal for Crayola, says Dixon, as they look at product portfolios and even marketing and content to go after those populations. She and her team are also looking at generational relevance and interconnectivity. “We have products for everyone, and we have to keep those generational congruencies in mind,” she notes. “We have our key target area of elementary school, but how do we make sure we are aging up and growing with you after that?”

Finally, there is work around furthering engagement with its brand mission — communicating to consumers that Crayola has a broader mission in addition to the products it sells.

P2PI.com

Brent Rosso Vice President of UB Media Ulta Beauty

Brent Rosso has never been one to shy away from a good startup challenge. A native of the Twin Cities in Minnesota and classically trained as a marketer, he never could have predicted his career path coming out of college. He says job prospects have come and gone that would have taken him away from his hometown, but instead he chose to stay right where he’s always been. And now, with four startups under his belt, he says being in the right place at the right time, recognizing challenges as exciting opportunities — and a stroke of luck here and there — have made for a rewarding and fun ride.

THE EARLY YEARS

Rosso, who values his childhood growing up with his parents and brother, remembers the lasting impact a sixth-grade teacher had on building his confidence. “At one point, I said I wanted to be a lawyer,” he recalls. “Her response was, ‘You got it, kiddo.’” The power of her support stayed with him, from his first jobs as a kindergarten soccer coach and lifeguard at the city municipal pool, to his current post as vice president of UB Media at Ulta Beauty.

A graduate of the University of St. Thomas with a degree in marketing, Rosso says it was his economics studies (for which he earned a minor) that landed him his first position as an e-commerce manager for online advertising at Fingerhut.

CAREER DEVELOPMENT

Fingerhut was the second-largest catalog company in the nation at the time, and Rosso learned the true disciplines of database and direct marketing. “I was a sponge,” he says. But the job lacked the innovation that he began to realize would fuel his drive going forward.

“They had been around for 100 years and it was a finely tuned machine,” he recalls. Soon after, he was “plucked up” with three others and put in a corner of the organization. “We were told there was this internet thing … go figure it out,” he says. “We did some really cool stuff after that and had a ton of fun building out our digital strategies.” That four-person digital team eventually grew to more than 200 in about 18 months.

Federated Department Stores eventually bought Fingerhut, but Rosso says it wasn’t the best marriage. The day after Fingerhut shuttered, he was in on the ground floor of a new operation: a small mom-and-pop lighting showroom that needed to build its catalog business. As the marketing director of Bellacor, Rosso helped build it from scratch to a category leader within two years.

In 2005, he moved a couple of miles down the road to work in e-commerce for the retail giant that had always been in his backyard. His work at Target would be similar: to build its media presence, starting as the manager of online advertising.

Rosso would go on to spend more than 14 years at Target, ultimately holding the post of vice president of digital media. He led all digital media channels and built teams internally and/or partnered with one of its many agencies to run those businesses, while also standing up new product teams.

“We were building capabilities, based on our data and technology, to support those channels,” he says. “That was very successful — to the point where the marketing organization asked to expand beyond just media and think more holistically for marketing.” A number of product teams stood up to support the marketing organization in that agile manner, he notes, “and that was really cool because what an unlock that became in how we operated and got stuff done.”

He also led the measurement team, which he believes truly transformed the marketing organization, considering how little measurement there was at the time. “We were meeting with the CMO and CFO and their direct reports monthly, reviewing measurement

18 l March/April 2023

and making real-time changes not just in digital, but even in our broadcast media,” he says. He also led an audience strategy team, and a programmatic strategy and activation team in Bangalore, India.

By 2010-2011, Rosso says Target executives realized this martech foundation was the basis for a new business at the retailer. More specifically, a retailer media network and a more modern approach — and Rosso was tapped to help write the business case for launching that division. “This was all about leveraging that first-party data and understanding the outcomes associated with doing that wherever you might reach customers,” he says. He then guided the launch, leading everything but the sales organization for what is now Roundel at Target.

Rosso says he’s had many great mentors over the years, but Ron Neher, who headed up e-commerce development during Rosso’s early days at Fingerhut, taught him about leading people and teams. That’s what Rosso is most proud of today: the teams he has been a part of throughout this journey. “It’s not about me at all, but about building a team,” he says. “When you come together and empower them to do and see where we want to go, they take you there.”

Rosso spent the next three years consulting for both retail media networks as well as the martech/adtech space.

IMPACT AT ULTA

When the opportunity to lead the retailer media network for Ulta Beauty (dubbed UB Media) arose, Rosso just couldn’t pass it up. It was a strategic initiative for the organization, and 95% of all transactions are tied to Ulta’s loyalty program. Working in a corporate culture that he describes as a “breath of fresh air,” he in October 2021 built another team that is tasked with reimagining and building more capabilities within UB Media’s foundation — and equipping it to handle much more scale. “That team will make or break us, so that’s where we’re spending the majority of our time right now,” he says.

RETAIL MEDIA GOING FORWARD

Rosso sees retail media’s growth as both exciting and rewarding — and views change as opportunity. He encourages his team members to embrace the ever-rapid changes in the space and to think about what might be next. Their guiding principle is to always do best by the guest. “This retail media network is not a business that sits on the side of Ulta Beauty — we are core to everything that we do.”

Rosso stresses the importance of collaboration with brand partners and especially clients to build stronger relationships. He says his team will continue to focus on building out more owned and operated inventory via the web and their app, but also in physical stores. “That’s a white space in the retail media network space,” he says, “And we believe there’s tons of opportunity there.”

As retail media networks continue to pop up and consolidation is not as likely across retailers, it’s the networks’ job to determine what that means for the retail media network space, Rosso says. “We have to figure out ways to come together and make things easier for our clients and our brand partners. That’s a challenge we’ll have to think more and more about.”

BRENT ROSSO

Title: Vice President of UB Media

Company: Ulta Beauty

Team Members: Dom Manna, director of advertising operations for UB Media; Alyson Soderberg, senior director of sales and account management for UB Media.

Career Path:

• Ulta, Vice President, UB Media (2021-present)

• Independent Consultant and Advisor (20192022)

• Target, Vice President of Digital Media (20142019), Director, Digital Media (2012-14), Senior Group Manager, Digital Media (2010-2012), Group Manager, Digital Media (2009-2010), Senior Manager, Online Media (2007-2009), Manager, Online Advertising (2005-2007)

• Bellacor, Marketing Director (2002-2005)

• Fingerhut, E-Commerce Manager, Online Advertising (1997-2002)

Industry Activities:

• Lecturer, Kellogg School of Business Northwestern University and Carlson School of Marketing University of Minnesota

• Speaker, Cannes Lions, AdWeek, Mobile Marketing Association, MediaPost, Beet.TV, LiveRamp

• Former member of: Google Retail Advisory Council, AOL Retail Advisory Council, DoubleClick Client Advisory Council, MSN Client Advisory Board, Association for Interactive Marketing: Council for Responsible Email

• Active member of: IAB Retail Media Network Committee

• Industry accolades: Best Digital Marketer, Internet Retailer; People-Based Marketing Pioneer, Digiday; Best Use of Programmatic Technology, AdExchanger; Mobile Marketer of the Year, MMA; and Media Company of the Year, MMA.

Education: University of St. Thomas, Bachelor’s, Marketing and Economics.

P2PI.com

Bob Waibel Senior Director, Commerce Marketing Conagra Brands

Bob Waibel grew up thinking he’d be a salesman. His father spent more than 30 years in sales at IBM, and although the younger Waibel wasn’t sure of his path, he was confident (in high school, anyway) that being a salesman was his end goal as well. But a marketing degree from the University of Missouri and a well-known brewery in his hometown changed all of that for him.

This year marks Waibel’s 45th year in the industry, having spent time on both the CPG and agency sides of the business. He is the senior director of commerce marketing at Conagra Brands, leading a team of 20 whom he says “day in and day out deliver great commerce marketing activations for our customers and our brands.”

THE EARLY YEARS

Waibel grew up in St. Louis in a family with four brothers and sisters. He spent weekends sailing with his dad at Carlyle Lake in central Illinois and bagging groceries at Schnucks early in his high school days. He worked there all through college when he was home, eventually becoming a part of the grocery team and stocking shelves.

His first job out of college was as a manager of promotions at Anheuser-Busch. He had come back to St. Louis, networked and found himself traveling to wholesalers weekly, doing everything from sales, merchandising and store resets to equipment audits, counting barrels in the marketplace and special events. He spent eight years with the company in total, ultimately working in consumer promotions.

20 l March/April 2023

CAREER DEVELOPMENT

Waibel’s next stop was at marketing agency The Waylon Co. At the time, agencies were springing up in St. Louis because of Anheuser-Busch (A-B) and other large CPGs. “I’d been working with agencies from the client side and this gave me an opportunity to understand how an agency operated from the inside — what the creative process to final art looked like, how an agency makes money, etc.,” he says.

Then came his chance to work at another world-class company. Waibel had lived in Atlanta while at A-B, and both the area and a job opportunity with The Coca-Cola Co. were too good to pass up. He began in the Fountain Division (now Foodservice), working with major on-premise customers that served Coca-Cola fountain drinks.

“We functioned very much like an internal agency resource to our Fountain customers, developing promotions that would drive Coca-Cola’s and our customers’ businesses,” he says. It was there he learned what great customer marketing looked like and how to make it work — for consumers, customers and its brands. He then moved into a channel marketing manager role, working on strategic planning for the casual dining channel for the Fountain division.

Waibel was at Coke for more than seven years before he moved back to the agency side, working on the bottler’s business. “The work was similar to what I was already doing inside Coke, but it was an opportunity to have a greater role in leading teams and managing the growth for a company which, on the agency side, means new business development,” he says. He held VP positions at Draftfcb, Ogilvy & Mather (BEN Marketing) and Arc Worldwide (Leo Burnett) for more than six years.

With invaluable agency-side experience under his belt, Waibel joined ConAgra Foods in 2007, realizing his passion for working for one company and that company’s goals. He moved to Tampa, Florida, to handle the east region shopper marketing efforts and, eight years later, landed in Chicago to

take over all of shopper marketing as senior director.

Waibel’s early work at Anheuser-Busch were some of his first big wins. “Competitive breweries were spending big dollars to sponsor The Rolling Stones, The Who, etc.,” he says. “We wanted to find a more economical way to do something that not only created visibility for our brands, but that our wholesalers could leverage more effectively in local markets broadly.”

His group teamed with its agency The Comedy Store in Los Angeles to identify a group of up-and-coming comedians to take out on tour, eventually securing Billy Crystal and others. “The program was less expensive than trying to sponsor a major rock group tour,” he says. “We were able to execute it in far more markets and our wholesalers could use it to drive displays and promotions in their markets.”

Waibel points to mentors who have guided him throughout his career, including Bill Schmidt, at both Anheuser-Busch and on the agency side, who helped teach him how to navigate the corporate world early on. He says a boss at Coca-Cola, Chandra Stephens-Albright, gave him sound guidance that he’s passed on many times since: “Don’t just go looking for jobs; identify what you enjoy doing first. You’ll find more enjoyment that way.” And longtime colleague Mike Buczkowski, CEO of Digitix, continues to be someone he looks to for advice and coaching.

IMPACT AT CONAGRA

When Waibel landed at ConAgra Foods (which became Conagra Brands in 2016), then-SVP of marketing Mike McMahon (a P2PI Hall of Famer himself) was just beginning to build out the shopper marketing discipline. For him, it was an opportunity to work with experienced marketers Tammy Brumfield and Tom Lisi, and build out the function. “We put together a shopper marketing team that was really at the forefront of how to structure a shopper marketing function,” he says. “We established a team structure, processes and ways of working that did not exist previously. And they were truly industry-leading.”

P2PI.com

The Conagra Brands Commerce Marketing team, from left: Shannon Staunton, Joyce Goolsby, Keisha Edgar, Andrea Knight, Lisa Matos, Stephanie Reiman, Jen Martin, Jeff Muench, Alyson Welch, Olivia Brink, Bob Waibel, Kristen Klei, Matt Pabst, Gene Karaffa, Tim Schatz and Reshma Schneider.

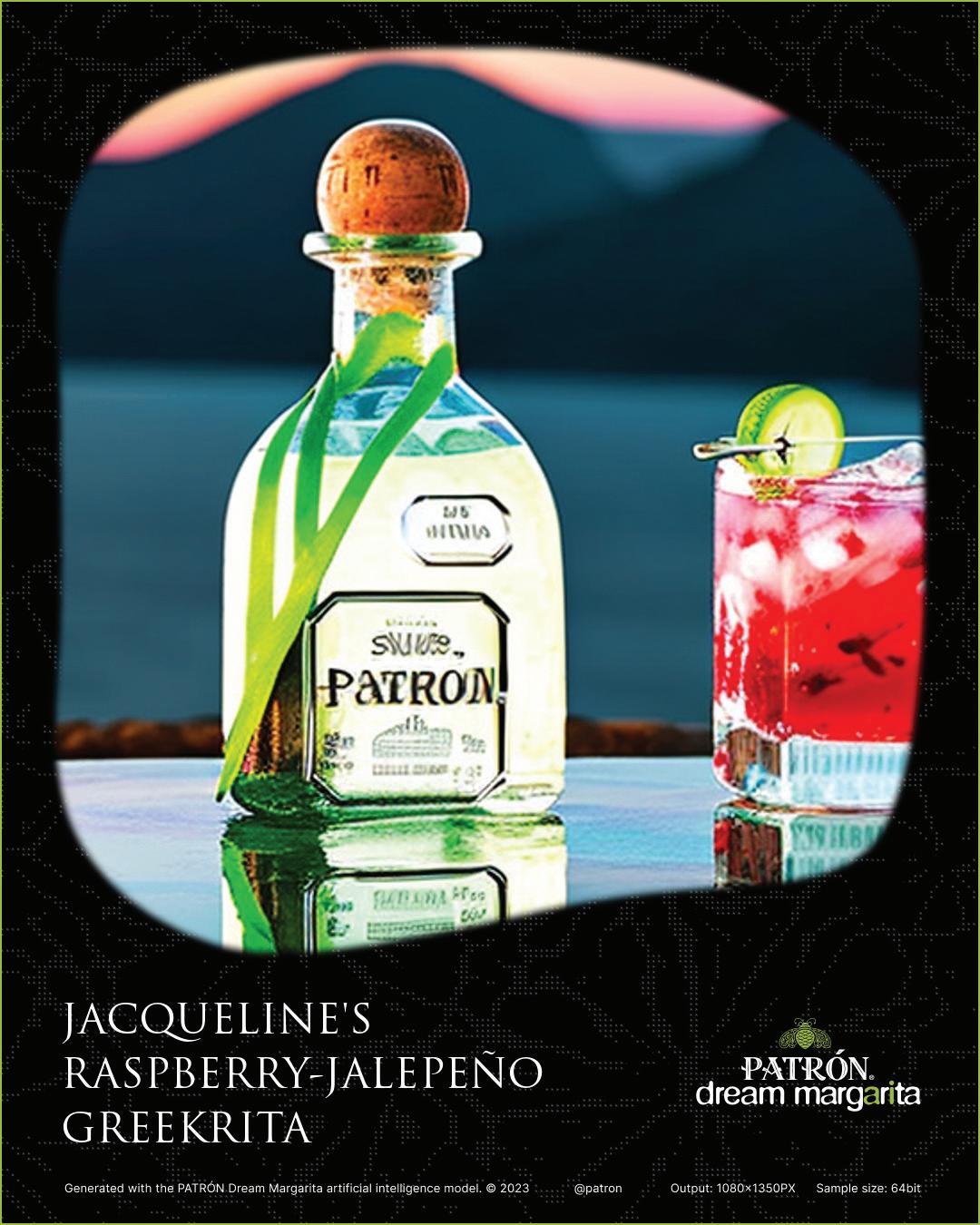

About two years ago, the team evolved from shopper marketing to commerce marketing, which was much more than just a name change, Waibel notes. “We have made it our team’s focus to ‘make every moment shoppable,’” he says. The evolution is driven by several macro trends, including a dynamic store experience, with automation/AI and external forces such as the pandemic changing how consumers shop in-store; omnichannel evolution in which physical and digital commerce have combined; and new customer platforms, such as the strong emergence of retailer media networks.

“My team has expanded our focus to continue to fi nd ways to drive our brand relevance with shoppers in every area they’re shopping — instore and online,” he says.

BOB WAIBEL

Title: Senior Director, Commerce Marketing

Company: Conagra Brands

Team Members: Matt Pabst, Director of Commerce Marketing; Tim Schatz, Director of Commerce Marketing; Reshma Schneider, Director of Commerce Marketing.

Career Path:

• Conagra Brands, Senior Director, Commerce Marketing (2016-present); Senior Director, Shopper Marketing (2007-2016)

• Arc Worldwide, Vice President, Account Director (2004-2007)

• Ogilvy & Mather (BEN Marketing) Vice President, Client Services (2002-2004)

• Draftfcb, Vice President, Group Account Director (2001-2002)

As retailer media networks continue to pop up and retailer-specific shopper data becomes more available, Waibel says his team looks to drive Conagra Brands’ sales across the whole retailer ecosystem through marketing activation by leveraging shopper and retailer expertise, which includes shopper data with its customers.

“How and where my team focuses its efforts has become much broader,” he notes. “Not only are we fi nding ways to disrupt shopper journeys in-store with incremental displays and in-store activation and communication, but we’re also making sure our brands are showing up and standing out on the retailers’ digital shelves.”

LOOKING AHEAD

Measurement will continue to be a big focus for Waibel and his team. Pinpointing accurate, reliable and meaningful measurement and ROIs that are attributable specifically to shopper marketing initiatives has always been the challenge. “Add in retailer media networks, and it gets really complicated,” he says.

While ROAS (return on ad spend) has become the default metric, he’s not convinced it’s the right metric for success in the omnichannel space. It’s a constant battle, but one his team will continue to fight with all of its partners. “We also have to get to some standardization [between the different methodologies and metrics] so we’re looking at things the same way across the universe,” he says.

• The Coca-Cola Co., Trade Channel Marketing Manager (1997-2000); Senior Program Development Manager (1996-97); Promotions Manager, National Accounts (1993-1996)

• Fruit of the Loom, Sales Promotion Manager (1992-1993)

• The Waylon Co., Account Supervisor (19891992), Senior Account Executive (1987-89)

• The Seven-Up Co., Manager, Promotion Programs (1986-1987)

• Anheuser-Busch (1978-1986)

Industry Activities:

• Guest lecturer at University of Chicago, Indiana University and University of Florida

• Multiple Path to Purchase Institute committees, most recently as part of the Commission to Standardize the Measurement of Shopper Marketing

• Final Round Judge for the Commerce & Shopper Effie Awards

Education: University of Missouri, Bachelor’s, Marketing.

22 l March/April 2023

How and where my team focuses its efforts has become much broader. Not only are we finding ways to disrupt shopper journeys in-store … but we’re also making sure our brands are showing up and standing out on the retailers’ digital shelves.

Sneak Peek

HERE’S THE INSIDE SCOOP ON WHAT TO EXPECT AT FUTURE FORWARD, MAY 16-18 IN NEW ORLEANS.

Keynote Speakers

Tuesday, May 16:

• Trend forecaster Sean Monahan, the founder of 8Ball, will explain why culture is more incomprehensible than ever before, and what brands can do to cut through the hype. His general session is titled “After the Vibe Shift: What’s Next for Consumers and Society.” The keynote/ main stage sponsor is 84.51.

Wednesday, May 17:

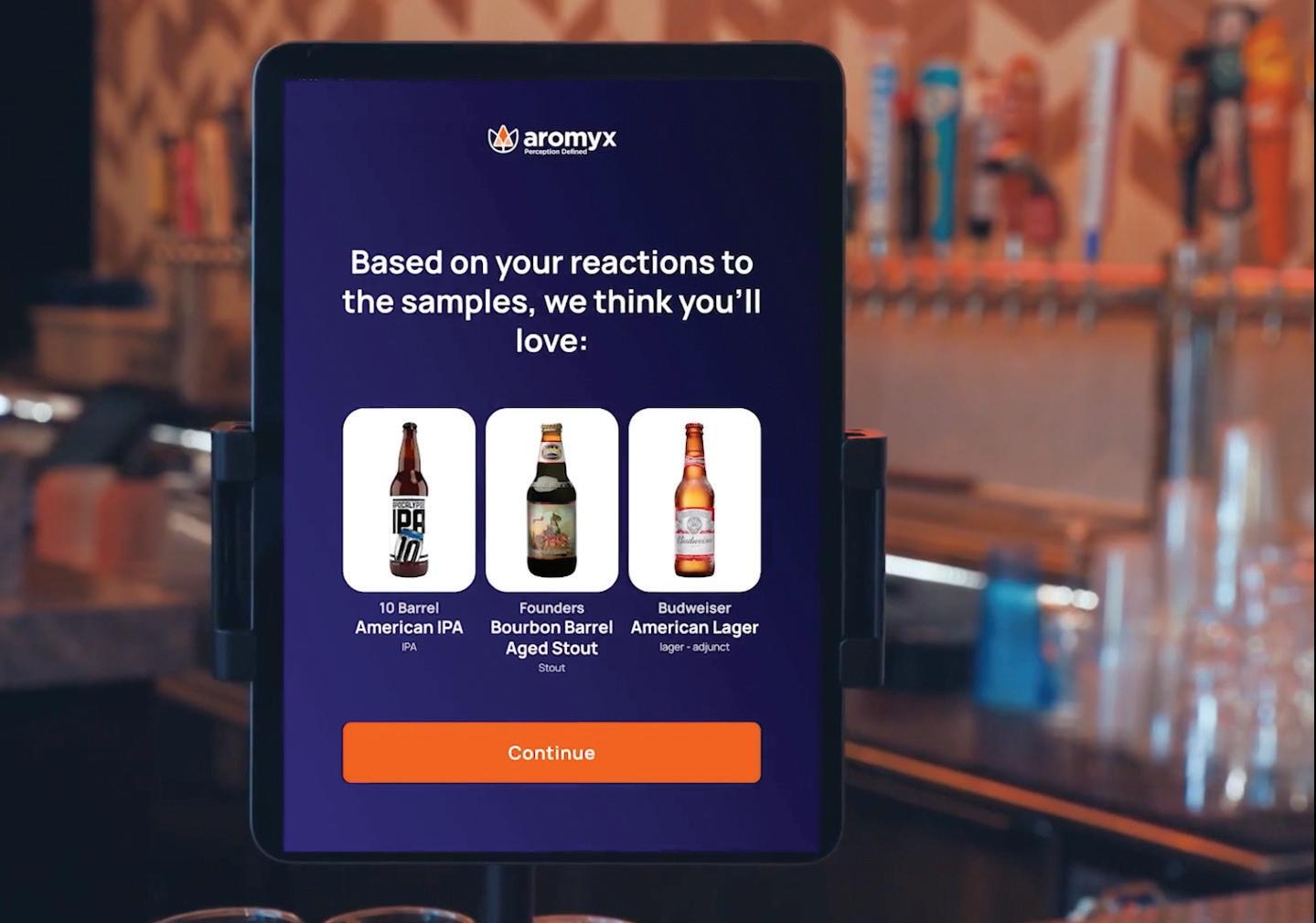

• In this general session with Ari Peralta, neuroscientist and sensory designer at Arigami, discover the evolution of sensory design and prepare for the future of commerce with the latest research insights and applied case studies. The keynote/main stage sponsor is 84.51.

Additional sessions in the conference lineup will explore:

• Retail media metrics; shopper engagement; online vs. offl ine shopping; measurement; the in-store shopping experience; and Web3.

A New Orleans Experience

Beginning at approximately 10 a.m. on Thursday, May 18 (dependent on which experience you select at registration), attendees will go on a New Orleans adventure of their choosing. (Visit P2PIFutureForward.com for more info).

• Glamorous Garden District Tour with Cemetery

• The Local’s Guide to the French Quarter Tour

• Sinister Criminal Intentions: the Original True Crime Tour

• New Orleans Bus Tour

• Breakfast at Brennan’s

Futures & Legends Roundtable and Lunch

Awards Ceremony & Cocktail Reception

From 5 p.m.-7 p.m. on Wednesday, May 17, the Path to Purchase Institute will honor the next generation of leaders (the 2023 recipients of the 40 Under 40 Awards) as well as three industry icons (the 2023 Path to Purchase Institute Hall of Fame inductees) during an awards ceremony and cocktail reception. Come network with your fellow Future Forward attendees while celebrating this year’s winners.

At noon on Tuesday, May 16, join us for this roundtable and lunch — where you’ll be seated with the Path to Purchase Institute’s prestigious Hall of Fame honorees, members of the Commerce Executive Network (CEN) and the winners of our 40 Under 40 Awards. We will explore a variety of topics at the tops of marketers’ minds during this interactive session.

EVENT REGISTRATION

For more information, including the complete agenda, and to register, scan this code.

Examining the Experience In-Store Shopping

BY JENNY REBHOLZ

Whether expected or unexpected, change is inevitable. In recent years, the highs and lows of global changes have taken consumers, brands and retailers on a roller coaster ride. From the upending experience of the COVID-19 pandemic to the pain points of inflation and the uncertain economic predictions ahead, news of consistency can provide a little comfort and relief.

When it comes to the evolution of the in-store shopping experience, consistency is exactly what our latest survey has revealed. The over 1,000 respondents from the Path to Purchase Institute’s January 2023 consumer survey are reporting similar behaviors and frustrations compared to 2022.

This data reiterates important areas for brands and retailers to focus on and again shows opportunities to garner shopper attention, gain customer loyalty and elevate the in-store experience. The 2023 report offers insights into consistent shopping patterns, new areas of opportunity, and the trends and topics on consumers’ minds that could influence future behaviors.

Shopping Behaviors

Consumer habits continue to be affected by global issues. COVID-19 and other health factors, inflation and economic struggles, war and

political upheavals, supply chain struggles and worker shortages impact shoppers in different ways. In the survey, respondents referenced inflation and shopping on fixed incomes and within tight budgets, but their responses demonstrate some consistencies in their overall shopping behaviors.

Similar to last year’s report, over half of the respondents continue to shop at least once a month in the categories of grocery, pet care, non-food household essentials, personal care items, cannabis, alcoholic beverage and medication. While 97% shop for groceries once a month or more, respondents noted shopping less than once a month for electronics, office supplies, home décor, home improvement, sporting goods and apparel.

For those who shop at least once a month per category, grocery, cannabis, sporting goods and electronics top the list for shopping frequency. The grocery and pet care categories continue to rank highest among consumers who shop less often than once a month. No matter the frequency, in-store trips

24 l March/April 2023

SPECIAL REPORT

Our latest research provides updated insights into shopping patterns, new areas of opportunity and the factors that could influence future behaviors.

In collaboration with

Shopping Frequency by Category

Typically shopped for once a month or more often

Typically shopped for less often than once per month

Q. How often do you typically shop for each of the following (including all shopping visits in a physical store and online)?

Number of Times Shopping Category per Month

Percent of Shopping Done In-Store

Q. In a typical month, about how many times do you shop for each of the following (including all shopping visits in a physical store and online)?

Q. And in a typical month, about how many times do you go to a physical store to shop for each of the following?

P2PI.com

Path to Purchase Institute Evolution of the In-Store Shopping Experience Study (January 2023)

Grocery (food & beverage) Pet care (food & supplies) Non-food household essentials Personal care items Cannabis Alcoholic beverages Medication Apparel Sporting goods Home improvement Home decor Office supplies Electronics 97% 3% 74% 26% 72% 28% 71% 29% 62% 38% 60% 40% 59% 41% 32% 68% 32% 68% 28% 72% 23% 77% 20% 80% 18% 82% At least once a month or more often Less often than once per month

Path to Purchase Institute Evolution of the In-Store Shopping Experience Study (January 2023)

(Among those who shop once per month or more often)

Grocery (food & beverage) Pet care (food & supplies) Non-food household essentials Personal care items Cannabis Alcoholic beverages Medication Apparel Sporting goods Home improvement Home decor Office supplies Electronics 6.74 4.76 3.40 3.21 4.76 4.00 3.44 3.71 4.00 3.99 3.82 2.98 4.00 3.10 2.72 2.54 3.86 3.09 2.53 2.36 2.40 3.14 3.18 2.13 3.04 2.38 All shopping In-store shopping

Grocery Pet care Non-food household essentials Personal care items Cannabis Alcoholic beverages Medication Apparel Sporting goods Home improvement Home decor Office supplies Electronics 71% 80% 79% 77% 81% 77% 74% 64% 60% 79% 83% 71% 76%

account for at least two-thirds of shopping across categories.

Cannabis, alcoholic beverages, personal care items, pet care and non-food household essentials are the overall categories most likely to be shopped for in-store. This reinforces that brands and retailers continue to have opportunities to connect with consumers and build loyalty in-store.

Changes in Shopping Habits

As society has recalibrated into a post-pandemic normal, in-store shopping has been more than an opportunity to get out of the house. Not only are shoppers still heading to physical retail, but they are also shopping in-store more often. Compared to a year ago, shoppers frequenting grocery stores increased 22%, while those visiting mass retailers rose 14%. While fewer in-store trips are noted for office supplies, sporting goods/outdoor activities, electronics and home improvement, the data across the majority of categories demonstrates a frequency increase from 2022.

When it comes to the duration of stock-up shopping trips, 50% of respondents said they are spending a similar amount of

time in the store. However, one in five shoppers noted spending more time in-store. This is a 6-point increase compared to last year’s study.

Of particular interest are the changes in shopping habits reflected in responses from younger, Gen Z and Millennial shoppers. They indicated shopping in physical stores more often compared to a year ago, and spending more time while they are there.

In terms of the number of items purchased in a given shopping trip, again approximately 50% of those surveyed said they are purchasing the same amount, while one-third reported purchasing more items during a single stock-up trip. This percentage reflects a 12-point drop from last year. In correlation with the increase in in-store shopping trip frequency, this suggests consumers may be regaining a sense of comfort in physical retail post-pandemic.

In-Store Shopping

While digital content consumption and daily screen time stats

Number of Times Shopping Category in Three-Month Period

(Among those who shop less often than once per month)

Percent of Shopping Done In-Store

Q. You said you shop for the following less often than once per month. In a typical three-month period, about how many times do you shop for the following (including all visits in a physical store and online)?

Q. And in a typical three-month period, about how many times do you go to a physical store to shop for the following?

26 l March/April 2023

*Small base size Path to Purchase Institute Evolution of the In-Store Shopping Experience Study (January 2023)

Grocery* (food & beverage) Pet care (food & supplies) Non-food household essentials Personal care items Cannabis Alcoholic beverages Medication Apparel Sporting goods Home improvement Home decor Office supplies Electronics 5.02 3.18 3.15 1.96 1.52 1.56 1.48 1.66 1.41 1.76 1.41 1.56 1.52 1.58 1.93 1.33 1.17 1.25 1.10 1.16 1.01 1.09 1.01 1.14 1.00 1.29 All

shopping In-store shopping

Grocery* Pet care Non-food household essentials Personal care items Cannabis Alcoholic beverages Medication Apparel Sporting goods Home improvement Home decor Office supplies Electronics 63% 61% 68% 82% 77% 80% 74% 70% 72% 62% 72% 73% 66% SPECIAL REPORT

continue to increase, our survey confirms that shoppers still have the desire to see and interact with products in person — 65% of respondents prefer in-store shopping for hands-on engagement with the merchandise. This ranked as a primary reason for respondents (no matter age or ethnicity). In addition to the 42% who like to avoid shipping costs, 40% of shoppers enjoy the immediate gratification of in-store purchases. These primary drivers of in-store shopping are consistent

with the 2022 report. This presents opportunities for brands and retailers to create engaging hands-on experiences with products and leverage these interactions.

When it comes to younger shoppers, they are motivated to shop in-store by factors such as wider selection, ease of returns, inspiration, the social aspect of going in-store, product samples and expertise/assistance from store associates (which were ranked higher by Gen Z and Millennials

of Shopping at Store Type

Q. Compared to a year ago, how often do you go inside the following types of physical stores?

Time Spent In-Store During Stock-Up Trip

Q. Think about going into the types of stores where you tend to pick up multiple items. On a typical shopping trip when you go into a physical store to pick up multiple items, about how much time do you spend in the store now, compared to a year ago?

P2PI.com

Frequency

Path to Purchase Institute Evolution of the In-Store Shopping Experience Study (January 2023)

Grocery/supermarket/discount/specialty Supercenter/mass merchandise Dollar store Convenience store Clothing retailer Wholesale club Craft store Health & beauty Home improvement store Drugstore Pet store Electronics store Sporting goods/outdoor activities store Office supply store 3% 9% 57% 31% 4% 28% 54% 14% 11% 23% 48% 18% 20% 21% 42% 17% 16% 26% 41% 17% 28% 15% 40% 17% 30% 18% 35% 17% 26% 18% 40% 16% 14% 24% 47% 15% 12% 19% 55% 14% 41% 12% 35% 12% 21% 23% 44% 12% 34% 26% 22% 29% 33% 37% 11% 8% Not at all Less often More often About the same

Path to Purchase Institute Evolution of the In-Store Shopping Experience Study (January 2023)

> 30 fewer minutes than I used to 1-15 minutes longer than I used to 1-15 fewer minutes than I used to > 30 minutes longer than I used to 16-30 fewer minutes than I used to 16-30 minutes longer than I used to It’s about the same 9% 6% 8% 5% 11% 11% 50% Fewer: 28% (-12 pts from 2022) Longer: 22% (+6 pts from 2022)

SPECIAL REPORT

compared to their Gen X and Baby Boomer counterparts). Elevating these aspects of the instore experience may help deepen connections with this maturing customer base.

In-store technology is another area that brands and retailers can leverage to further engage with younger shoppers. The ability to tap-to-pay at checkout (39%), create a shopping list app on a mobile device (33%) or use a mobile app to track spending as items are added to a cart (32%) were topics of interest to respondents, with younger shoppers showing significantly more interest in these technology features.

Other aspects of the in-store experience, such as store cleanliness, ease of checkout and consistently having items in stock continue to maintain relevance from a year ago. These factors rank highest for influencing shopper satisfaction with the in-store experience. Interestingly, experiential offerings, eye-catching visuals/ displays and the overall store ambience are seen as less important.

When looking for category-specific opportunities to improve the in-store experience, consider that immediacy of purchase is particularly important for grocery, medication and apparel. Brands and retailers in the cannabis and home decor categories should note that respondents rank discovering new products, enjoying the treasure hunt experience and the social aspect of going in-store as more important.

The primary in-store shopping pain points have also remained the same since the 2022 survey. Products out of stock, the ability to find what they are looking for and the checkout experience continue to be areas of frustration. Also of note, approximately one-third of shoppers said wayfinding is a challenge.

As companies continue to face labor shortages that impact some of the customer service-related pain points, brands and retailers remain tasked with addressing efficiency and service to elevate the in-store experience.

Spontaneous Purchases

According to the survey responses, brands and retailers have opportunities to entice shoppers to make spontaneous in-store purchases. Nearly half of survey respondents said they often make spontaneous purchases in-store compared to one-quarter who do so when online shopping. Price and promotions play a key role in grabbing shopper attention, with 57% being influenced to

Quantity Purchased During a Stock-Up Trip

Less: 13% (+3 pts from 2022) More: 36% (-12 pts from 2022)

51% 19% 17%

It’s 3% 10%

I buy a lot less than I used to in one store visit about the same I buy a little more than I used to in one store visit

I buy a little less than I used to in one store visit I buy a lot more products in one store visit than I used to

Reasons for Shopping In-Store

Wider range of selection Easier to navigate/find products in-store (compared to online)

Ease of making returns

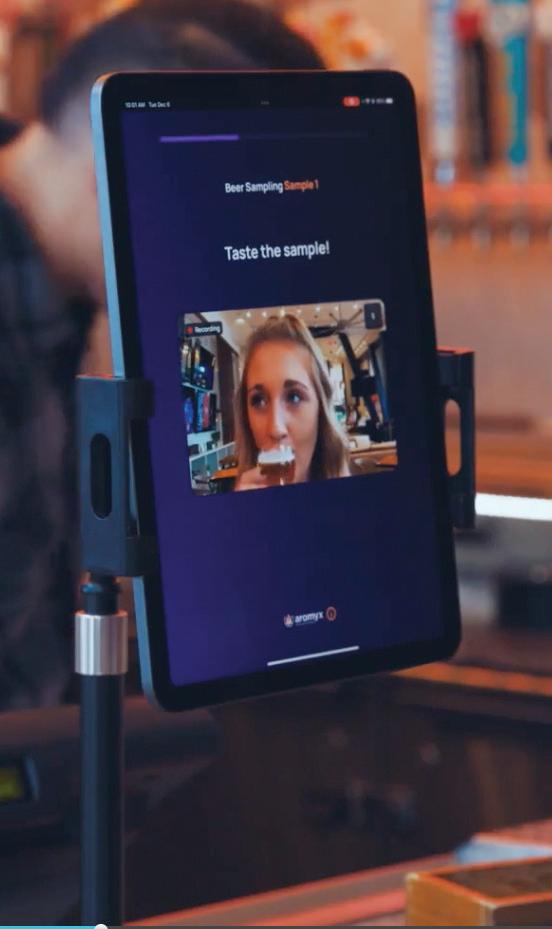

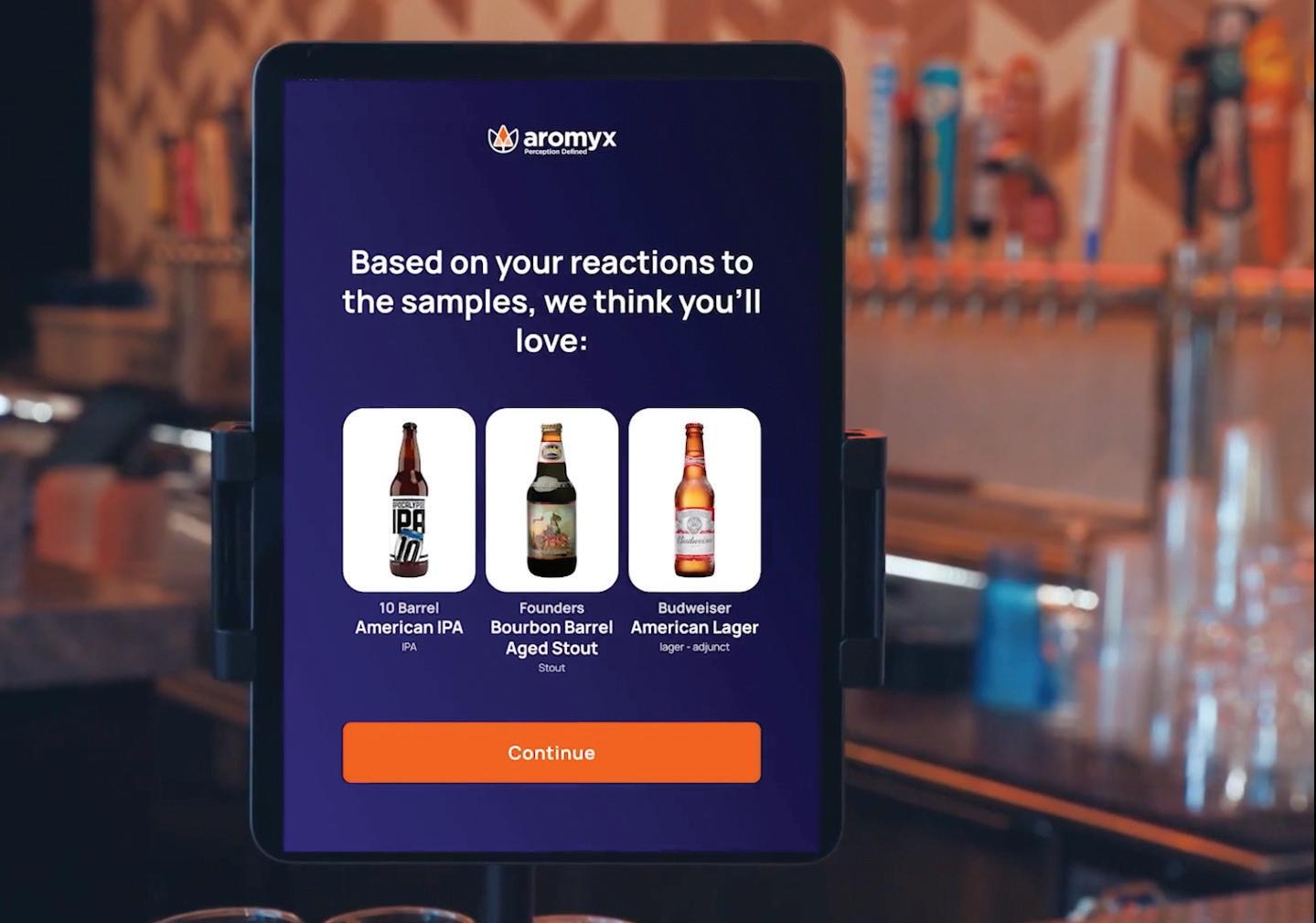

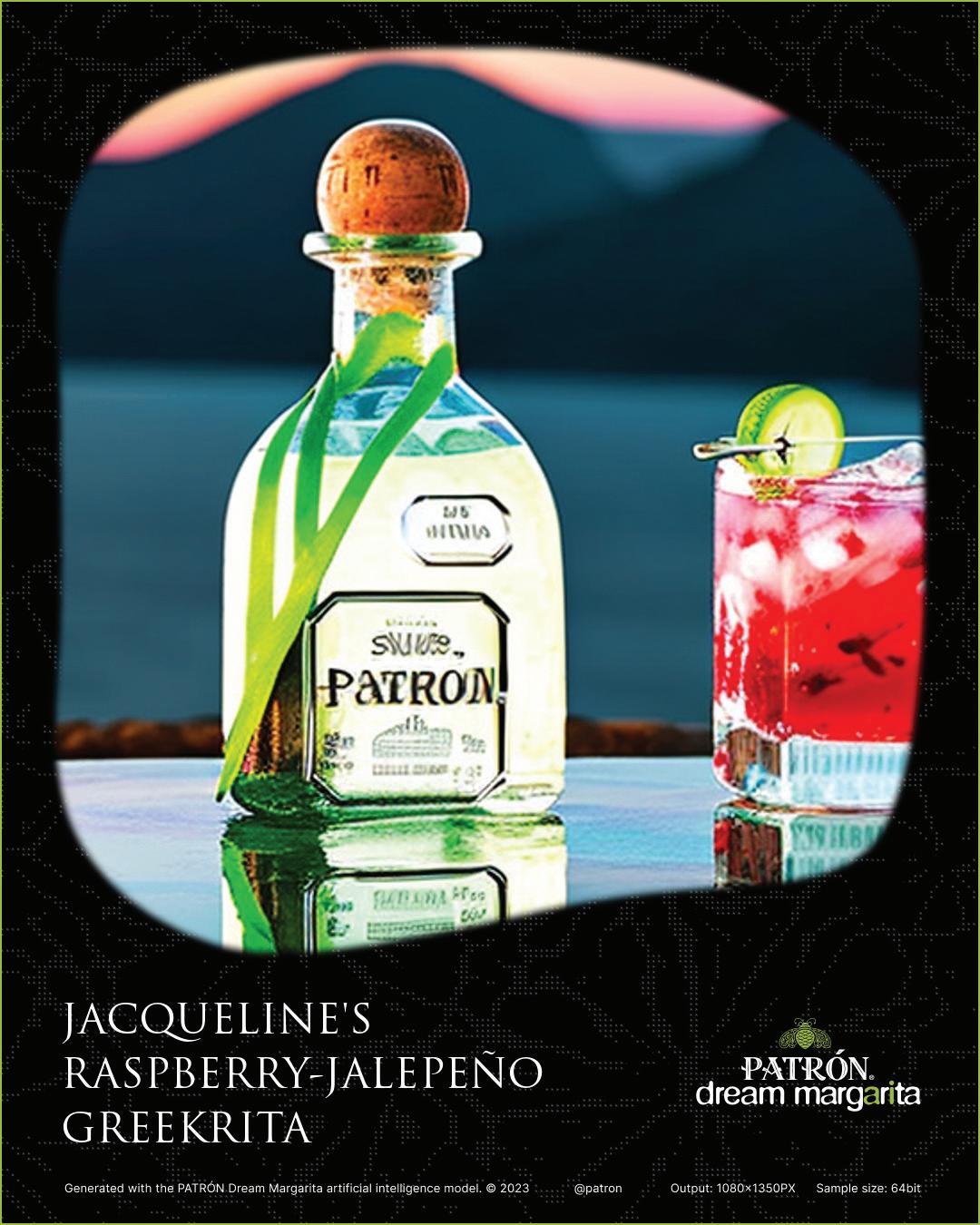

Inspiration/discovering new products