Robotic assembly, machine learning, data management and the digitalization of lumber.

Orgill’s commitment to getting products into your store is paramount. Our modern, private fleet of 400+ trucks are all driven by Orgill employees. Not only do our drivers keep things running smoothly, but our operational model controls our expenses and we pass these savings along to our dealers.

We’ll go the extra mile for you. Contact us today.

COVER STORY

Independents transform their yards with e-commerce, artificial Intelligence and even robots.

Plus: AI at TSCO and LOW; Dave Rush’s digital toolbox.

FROM THE EDITOR

8 Meet Alabama-based Florida transplant Robby Brumberg. He’s with us.

NEWS & ANALYSIS

10 The latest pivot in the BuildClub story 12 Ted Decker on SRS Distribution

12 Poll results: Consolidation and you TOP SHOWROOMS

15 Everything’s up to date in Kansas City’s McCray Lumber & Millwork Design Center

ORGILL REPORT

24 Hardware 101 and other programs to build sales and fuel optimism.

26 Sizable solutions: Windows, doors, fencing and more.

MARKET INSIGHTS

28 The age of empowerment

29 Inflation, and other economic highlights

30 Dunn-Edwards on the move

TOP WOMEN

32 Amy Marks is the ‘Queen of Prefab.’ And she has strong thoughts on the construction industry.

IN EVERY ISSUE 6 Here’s What’s Online

Product Knowledge

People in the News

Quikrete Industry

See more and share more when you follow us on Linkedin.

When you connect with us, you connect with the industry @HBSDealer

HBSDealer’s oneof-a-kind product demonstration video series — Ken’s New Jersey Garage — sticks to the script in the latest episode, starring a recent Golden Hammer Award winning construction adhesive. It’s just part of the growing library at HBSDealer.com/video

HBSDealer continues to celebrate the annual STIHL Hardware All Stars report, and the fi fty

hardware and building supply dealers that earned recognition in the May issue. Subscribe to HBSDealer’s daily newsletter for the stateby-state countdown, and check out the digital issue in the online library — do both at HBSDealer.com .

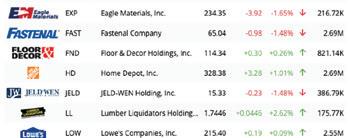

Scan the up-to-the-minute digital ticker tape of 30 publicly traded companies in the hardware and building supply area. Check it out as often as you like at HBSDealer.com/ hbsdealer-stock-watch And while you’re at it, check out the 10-Q Review, tracking the sales and earnings performance of the same 30 companies.

SPECIFICALLY, WE’RE HIRING ROBBY BRUMBERG.

It’s not often that we hire new editors at Hardware & Building Supply Dealer. So when we do, it’s a an event.

The interview questions employed during the process might shock those unfamiliar with the rigor in which we conduct business here at HBSDealer. But they serve an important step in weeding out those who might fail to rise above mediocrity.

For instance:

What’s the boiling point of propane? What are the actual dimensions of 2 x 8 dimensional lumber?

Name your favorite non-Shakespeare, Elizabethan-era playwright?

Following this strenuous process, we would like to introduce to the HBSDealer editorial team: Florida native and Birmingham, Alabama-based Robby Brumberg.

Brumberg, our new editor, brings a wealth of experience to the task. Most recently he was deputy editor of Forbes Health, distilling complex topics into clear understandable terms. He was ve-years editor of Ragan. com, covering all aspects of corporate communication. And as evidence of a golden heart, he previously served for about a decade in various communications roles for non-pro t organizations.

We asked him a few other questions:

Q: What is your most recent successful home improvement project?

A: My wife and I made a bay window bench seat in our kitchen. It's mostly been

Ken Clark Editor-in-Chief

Ken Clark Editor-in-Chief

usurped by one of our pups as a sunning area and stash location for her chew toys and other contraband from the yard, but it was fun to make.

Q Any unsuccessful efforts?

A: It's best to not dwell on failure. However, failure is also a terri c teacher. Let's say, just for a totally made-up example, that someone broke a pipe upstairs while trying to stop a drip, resulting in a cascade of water through the ceiling downstairs. Theoretically, that person will have learned a valuable lesson.

Q: That actually sounds totally real-world believable. Three kids. Strategies to mitigate distractions from working at home?

A: It takes a village, right. It also takes screens and cartoons.

We've also implemented a "Child of the Day" campaign to add an element of gami cation and hopefully inspire new heights of cooperation and self-directed play throughout the summer.

Q: Best thing about living in Alabama?

A: The cost of living is great! That was one of the big reasons we moved here from Florida.

Like any state, we have our problems (gloating Bama fans, etc.). But overall, Alabama has loads of character and lots of admirable qualities.

Q: There are actually a lot of Bama fans in our industry. Might want to adjust that tone.

A: I’ll try.

Readers, please join me in welcoming Robby Brumberg to HBSDealer. He’s at rbrumberg@ensembleiq.com.

(Answers to the above questions: negative 43.6 degrees Fahrenheit; 1.5” x 7.25”; Christopher Marlowe.)

550 W. Bryn Mawr Ave., Ste. 225, Chicago, IL 60631 (773) 992-4450 Fax (773) 992-4455 www.HBSDealer.com

BRAND MANAGEMENT

SENIOR VICE PRESIDENT John Kenlon (516) 650-2064 jkenlon@ensembleiq.com

EDITORIAL

EDITOR-IN-CHIEF Ken Clark kclark@ensembleiq.com

EDITOR Robby Brumberg rbrumberg@ensembleiq.com

ADVERTISING SALES & BUSINESS

ASSOCIATE PUBLISHER Amy Platter Grant

MIDWEST & SOUTHERN STATES (773) 294-8598 agrant@ensembleiq.com

DESIGN/PRODUCTION/MARKETING

ART DIRECTOR Bill Antkowiak bantkowiak@ensembleiq.com

PRODUCTION MANAGER Patricia Wisser pwisser@ensembleiq.com

MARKETING MANAGER Kathryn Abrahamsen kabrahamsen@ensembleiq.com

SUBSCRIPTION SERVICES

LIST RENTAL mbriganti@anteriad.com

SUBSCRIPTION QUESTIONS contact@HBSDealer.com

CORPORATE OFFICERS

CHIEF EXECUTIVE OFFICER Jennifer Litterick

CHIEF FINANCIAL OFFICER Jane Volland

CHIEF OPERATING OFFICER Derek Estey

CHIEF PEOPLE OFFICER Ann Jadown

CHIEF STRATEGY OFFICER Joe Territo

EDITORIAL ADVISORY BOARD

Levi Smith, CEO, Franklin Building Supply

Steve Sallah, CEO, LBM Advantage

Christi Powell, Women & Minority Business Enterprise Market Manager, 84 Lumber

Neal DeLowery, Store Projects and Merchandise Manager, Aubuchon Co. Brad McDaniel, Owner, McDaniel’s Do it Center

Joe Kallen, CEO, Busy Beaver Building Centers

Tom Cost, Owner, Killingworth True Value

Permissions: No part of this publication may be reproduced or transmitted in any form or by any means, electronic or mechanical, including photocopy, recording, or information storage and retrieval system, without permission in writing from the publisher.

connect with us

AUGUST 8-10

Join us at the Ace Convention and celebrate the 100-year Anniversary! The event will effectively help you and your team plan business, take advantage of margin building opportunities and experience the latest and greatest products. To register, talk to your Territory Manager today!

Palo Alto, California-based Build-

Club had big plans to disrupt the building products distribution model with an on-demand job-site building-product delivery service.

The Silicon Valley startup company last year boasted of a 258 percent in its reach, expansions into Boston, Chicago and Miami (where it promoted 2-hour delivery), and a 300 percent gain in revenue since 2021 — plus plans to launch in 15 cities in 2023.

Now comes plan “B.”

The company has a shifted to a pricing tool. It’s new website proclaims “Shop Home Depot and Lowe’s smarter with an AI copilot.”

“We’ve shifted from our original on-demand product delivery service to a model that we believe is more scal-

The California-based BuildClub made a hard pivot. It now promotes a digital pricecomparison tool.

able, pro table, and most importantly, useful to our 77,000 registered customers,” wrote BuildClub founder Stephen Forte in a May 17 update. “Our focus has turned to developing cutting-edge digital tools that are tailor-made for the

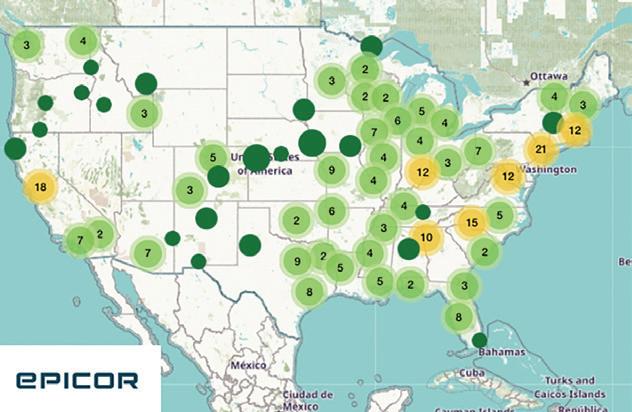

Recent updates to the HBSDealer News Map, powered by Epicor are spotted in Louisiana, with the grand re-opening of Mains Hardware Supply; and in Brooklyn, New York, where Floor & Decor's pro-oriented Brooklyn opening. There’s also spots for Ace Retail Holdings’ acquisition of 13-store Bishop Ace Hardware, including locations in Lincoln and Normal, Illinois

For more activity coast-to-coast, visit HBSDealer.com/map

building materials market.”

BuildClub did not immediately respond to HBSDealer’s questions regarding the shift.

When the company announced its expansion a year ago, there was skepticism among LBM dealers that an on-demand building products delivery startup could compete with experienced players.

“I would welcome [BuildClub] to try and come into this market to get business,” wrote Joe Marino, president of Freedom Materials in Laurel, Maryland. “What he will nd is that most of us can and have been doing same-day deliveries for years now; and at prices that are substantially lower than what he is offering. We also have boom trucks and at bed trucks with Moffetts which have far more capabilities than a small at bed truck shown in his pictures.”

Marino added that for contractors in a competitive market, in would be hard to justify a premium of 20 percent to 30 percent for same-day delivery.

Another industry veteran questioned BuildClub’s original mission of becoming “like Amazon Prime for building materials.”

“Who really wants to be the Amazon of commodity building materials,” wrote Jim Inglis, of Inglis Consulting, and a former Home Depot top merchandise executive. “There is a reason that Amazon is not a factor in commodity building materials.”

BuildClub’s new venture involves a browser extension that analyzes selected items at The Home Depot and Lowe’s stores nationwide, and alerts users if a lower-price item is found. The company’s web site also says it compares prices between Home Depot and Lowe’s.

The company’s newest pitch: “Imagine being able to nd the lowest prices on building materials city wide with just a few clicks, or uploading your blueprints to get an instant quote for the materials? That's what BuildClub is all about.”

— Ken Clark

“The partnership that we have formed with their team from the first time we met, has been something special. The hours they spent listening to our needs and creating the ideal ‘stop in shop’ of fasteners was impressive. Their packaging, presentation and selection are the best, without comparison, so the choice was easy- Midwest Fastener”.

- Randy Saunders, Owner, Provision Ace Southern Pines

Exceeding Expectations. One Fastener Destination at a Time!

* Pictured, Store Manager Alex Wiseman

What exactly does The Home Depot intend to do with Dallas-based SRS Distribution, which it agreed to acquire in an $18.25 billion deal announced earlier this year?

Home Depot CEO Ted Decker was asked that very questions during the Atlanta-based retail giant’s rst quarter earnings call with investors and analysts.

Product: Typar Construction Tape

Manufacturer: Berry Global.

Knowledge: Grip it and rip it. An An exclusive, easy-tear edge allows for quick application. Typar Construction Tape is both UV- and weather-resistant, and can be applied in cold conditions down to 0° F (-18° C). It’s a key component of the Type Weather Protection System,

North American Fun Facts: Product is made in Old Hickory, Tennessee. In Canada, the tape is approved by the Canadian Construction Materials Centre (CCMC).

The CEO described SRS as “a residential, specialty trade distributor with a leading position in three large, highly fragmented, specialty trade verticals serving the roofer, the pool contractor, and the landscape professional.”

Again and again, Home Depot has said winning with pro customers is the largest growth opportunity. Decker pointed to the $50 billion in addressable market that SRS brings to the table. The acquisition represents, he said, an opportunity to expand market, expand capabilities and better service customers.

“SRS is just a great company operating in three large highly fragmented markets,” he said.

“We've been a retailer for 45 years and we’re building wholesale capability, things like trade credit, things like much

“SRS is just a great company operating in three large highly fragmented markets.”

—Ted Decker, CEO, Home Depot

more robust, on-time and complete delivery to job sites, things like order management, things like incentivized eld sales forces. So these are all things that they've done for years and we look forward to being able to engage with them and learn from them,” he said.

“But then they can also serve our customers. I mean, our customers will bene t from their deep, broad catalogs in those verticals. And we can cross-sell their product into our residential-focused pro customer.”

By the time you nish answering the latest HBSDealer poll question, there might be a report of another example of industry consolidation. How does that make you feel. We asked. Here’s what we heard.

How do you feel about industry consolidation?

46% 35% 18%

One doesn’t simply visit the McCray Lumber & Millwork Design Gallery in Kansas City, Kansas. One experiences it.

And the experience begins on the approach, driving into an industrial (make that “industrial chic”) area of the Fairfax District where the Overland Park, Kansas-based 2021 ProDealer of the Year operates a massive door and millwork facility under the same roof.

But once through the doors of the showroom here, the feeling is one of sophistication and luxury.

“Most people are surprised at the quality and the diversity of products in it, especially given the industrial nature and area of our building,” said Luke Reeves, general manager of the facility.

By design, the showroom here greets the customer with an increasingly upscale array of products as he or she walks deeper into the gallery. “It progresses in price point from front to back, with more of the production or starter-home products toward the front. They’re concentrated in the same

area so that we don’t have to walk people by products they can’t afford or make them feel like their house isn’t their biggest investment, which it always is.”

Things get upscale pretty quickly. For instance, a display of thermally broken steel-windows-and-door system goes for about $500 per square foot, or $35,000 for the entry door on display.

And like the old show tune, everything is up to date in Kansas City. At least that’s the goal. “It’s a constant discipline to stay up-todate on products. So, we thought we were a hundred percent updated, but when we went to [the International Builders’ Show] we saw some products we needed to show.”

And so, the design ideas continue to evolve.

He added: ”What we’ve found in the estate-home products market is the clientele is very tactile. They want to touch and feel products they’re going to spend large dollars on. So, we try to show very high-end products.”

Flexibility and functionality play important roles in the showroom’s success, as well.

A kitchen display plays a central role when hosting customers or entertaining guests. And around the showroom, many displays are portable, allowing for the ability to transport off site when needed at an event or show.

Another critical feature is a conference room with seating for eight that allows the sales staff to consult with customers, develop ideas and close deals.

The conference room is equipped with High De nition Multimedia Interface at screens, and a table big enough to spread out full-size estate home plans.

“What we’ve found has happened is the design community and the builders will basically book the conference room to do their client meetings and make selections here on our turf,” he said.

Reeves is a big believer in the power of the showroom to promote sales, especially in the high-end market. He described the case of a customer who drove a couple hours all the way from Spring eld, Missouri, to be able to touch and feel a steel window product. “We were the only place in the region that had it on display.”

McCray Lumber has been serving the Kansas City building community since 1947 and is a member of both the Greater Kansas City Home Builders Association and the Kansas City National Association of Remodeling Industry (NARI). The company received the Independent ProDealer of the Year award in 2005, and the national ProDealer of the Year award in 2021.

The company builds its reputation on quality and service, and the showroom builds on that reputation.

“It has dynamically impacted the cost per transaction in a positive way for us and a lot of our clients,” Reeves said.

On day one we started with just a truck and a commitment to be the best. When the YellaWood® brand says you can trust us to deliver, those aren’t empty words; they’re actually proven words. And words we take seriously. Which is why we’ve been striving to give our very best every day for over five decades now. We can say with confidence that the Yella Tag can deliver like no other because it’s been shown to do just that. See all the other ways the YellaWood® brand has your back. Visit yellawood.com/for-dealers

Annual spending on information and communication technology (ICT) for The Home Depot, the world’s largest home improvement retailer, was estimated at $3.9 billion in 2023 by research firm GlobalData.

Most independent dealers do not have that in their budget. Check that. None of them have that in their budget.

But they’re not folding their digital cards. While independents might be outspent by giant national players, many are heavily engaged in developing the digital tools, systems and culture to bring efficiencies and advantages to the competitive landscape.

HBSDealer spoke to independent dealers who are punching above their weight in the arena of technology, operations and customer service. Below are (slightly) edited excerpts from our interviews.

John Perna, president of Hamilton Building Supply, hesitated to describe the Garden State company as an “early adopter.” But the prodealer celebrating its 100th year in business is faster than a typical “fast follower.” The company’s operations continue to adapt and adjust in a variety of ways.

The need for speed: We use tech to create speed and efficiency. So we've always believed that the faster we can respond to a customer, the more likely we are to get the sale.

If we’re the first to respond, we’re going to be that much more likely to get the order, regardless of pricing. If we are the first ones out there with the quote, customers truly appreciate it.

Recent initiatives: Our ERP system is Epicor Eagle, and it’s been a good solution for us for a very long time. We've bolted on other third-party systems around it to suit our needs as things change. One of these is our CRM and project management tool. We use a third party called Pipedrive, and it basically creates a web-based folder for any project with any parameters that you design.

So if I receive a set of plans, I can drop it into Pipedrive. I can then create quotes out of our ERP system or quotes from our Andersen or Marvin quoting tools. I can drop those into a Pipedrive project folder. I can communicate out of it. I can tag other associates in our organization who may be working on the project, and I can message them in relation to the project. We’ve been using Pipedrive as a solution for us to help manage some projects and get more of the project scope, because that’s ultimately what we’re after, achieving more of the wallet share from our customers.

Online store: We just relaunched our online store through Toolbx. And they’ve created a platform that's specifically for independent dealers, but it essentially is a web-based platform that aligns very closely with that of Home Depot and Lowe’s and their e-commerce platforms.

Customers pay their bills online very easily. Not that they couldn’t do it before, but now we’re snappier and

more efficient. It’s all integrated with Google. So if you log into Google or if you have Google credentials and your credit card saved on file and your passwords are saved, it'll tie in with that.

And it’s just a lot easier to use Hamilton’s online store now than it ever has been before. I can pay my bill now very easily or log in to see my open orders and current account statement very easily. So that’s been good for us.

AI use cases: For us, where we use AI specifically is if we're working on a report, or if we're trying to design a spreadsheet and it's going to require some special formula, we turn to ChatGPT or AI for that because it helps us create the formula right away without having to do the long math to figure it out. It's like, hey, cool, I just found a formula online, or it will tell me how to do it.

We also use it to write job descriptions. Or, if we need to write some longhand text that’s somewhat generic in nature, it's a good starting place for us, and it definitely saves our people some time.

What’s next: AI is going to continue to be a thing for us going forward. What I would love to see AI do is help with takeoffs and plan management, because that’s probably our biggest bottleneck—it’s how do we use AI to take-off plans as quickly as possible and develop material lists. What would be nice is if you basically drop the plans into some software that automatically did the take-off based on your specificity and printed out a materials list within a matter of minutes. And I think that would be a huge, huge boost for the industry just to be able to return plan designs faster to customers, and get their project started sooner. I think eventually we’re going to get there.

BURLINGTON, WASHINGTON

With four Washington locations, Louws Truss has served the Pacific Northwest as a truss manufacturer for 70 years. Third-generation owner and President B.J. Louws doesn’t claim to be a technology guy, but his company is certainly pushing at the high-tech boundaries with a fully robotic truss manufacturing system, installed in 2022.

On robots in the truss plant: We were one of the first in the country to implement the sort of line that we have. We’ve got robots placing plates onto lumber and then being assembled by an even bigger robot with lasers and automated jigging and all that kind of stuff. And we’re going to be installing a second robotic line later on this year, so we're moving forward on this technology.

ROI of robotics: Yeah, it is expensive, but a lot of things are expensive now. So I’ve been interested in advanced manufacturing, robotics, lean manufacturing for a long time.

And our company has invested in the cutting-edge technology for a long time. Obviously we’re looking at our return on investment. I’m not in business as a charity. We want to make money and we want to have a return. And we think that this technology makes us more competitive in the marketplace.

The origin story: Before we invested in robotics, we had essentially reached the end of the line of advances in equipment that was available in the truss industry. That’s when we looked at what else was available globally.

We took a trip to Australia in 2018 to see some integration of some European robotics with U.S. truss manufacturing equipment. We spent a couple weeks out there touring plants. And then the next year we met the guys from House of Design out of Boise, Idaho, who were doing robotic integration. And coming through COVID, where labor was super challenging, and then being on the West Coast just outside of Seattle in a competitive labor market, and looking at how we can stabilize our crews and stabilize our output and improve our quality and all that. It made sense for us.

The labor situation: Labor is a big deal. When you look at demographics in the United States, it seems that the labor situation isn’t going to get any better, though there will be ebbs and flows. In the 1980s and into the early 2000s, the U.S. was adding 1.5 million to 2 million people per year into the labor force. In the mid 2010s, that dropped into the 500,000 range, and we’re negative now. That situation doesn’t look like it’s going to be changing

as boomers are retiring and a smaller population is coming into the workforce. So that was a big factor.

Quality control: The plate placement that we get on the robotic system is better than we can do manually. Of course, with any wood construction, we’re dealing with a variable product. So the robot can place perfectly, but the wood varies. So any sort of technology in our industry is trying to figure out how you deal with that variability in lumber. And we thought that this was a good application.

Tech and intelligence: I think that if any company isn’t thinking about technology, they’re going to get behind very quickly. We’re thinking about AI in a big way across our organization right now. I’m not an expert in it, but I know enough about it to say that we’re in a race to figure it out with everybody else, whether we want to be or not.

The calls for artificial intelligence are growing more frequent across the hardware and building supply industry.

During a recent technology conference —Analytics Unite, hosted by HBSDealer sister publication Consumer Goods Technology—Tractor Supply and Lowe’s shared thoughts on the buzzword.

IT leaders at Tractor Supply, the largest rural retailer in the U.S., were quick to embrace AI, putting forth many use cases and “quick wins” across its business. The goal has been to enhance the customer experience — which ultimately entails enhancing the associate experience, customer service, and inventory management.

One tactic is to equip all team members with earpieces and AI communicators, known as Hey GURA, that are connected to the cloud so they can interface and get info about sales, store conditions, rewards, and more. “It’s not just about the technology; it’s about how you augment the [community/customer connection] using AI,” said Al Lettera, senior VP of IT for Tractor Supply. “That human element is still there, so if something is wrong, there’s someone there to care for it. If there’s a gap in what’s being provided [to the customer], there’s a human there to make that connection.”

During the event’s closing session, Chandhu Nair, SVP of data, analytics, computational intelligence, and marketing technology, shared how Lowe’s launched a framework for developing true personalization with AI.

Nair describe AI as a “fast race on a tightrope.” The company quickly realized the technology’s reach had shifted and, to be a frontrunner, they needed to create a roadmap.

This meant building a foundation.

“I think of digital twins and AI as Lego bricks that stack up,” said Nair, emphasizing that while the technologies lay atop their IT infrastructure, companies first must ensure their adoption is baselined with their structure.

The process must also be collaborative: “You have to bring your team along. The key is to harness all that energy but keep it objective to the path of meeting milestones and goals.”

It’s also critical that organizations don’t strangle the process. Leaving room to explore the use cases that fit is a key to success, he noted.

On competing as an independent: The advantage we have is this: we can implement technology faster than these larger companies can. Smaller businesses are just more nimble to changes in the marketplace, I think. That’s kind of like a small business’ superpower. If we have a good idea, we can start working on it today or tomorrow. We don’t have to go get approval for it. So I think that makes us nimble.

With locations on opposite sides of the San Francisco Bay in Berkeley and Concord, California, Ashby Lumber operates in the shadows of tech industry royalty. Brian Rocha, vice president of sales and marketing for the prodealer, says he can’t directly trace Ashby’s embrace of technology to the local business culture. But it certainly doesn’t hurt.

On e-commerce initiative: We switched providers recently from an iNet service to Toolbx, which is a startup company and an e-commerce platform in the building products space. And if you look at lumber yards in general (at least in our neck of the woods) the online services are pretty limited. Pricing, ability to purchase online — a lot of independent dealers can’t do that. So we felt here was an opportunity for us to have a leg up on the competition, and expand our business beyond just the local footprint. It will allow customers to shop with us outside of our radius, and keep us ahead of the curve.

We’ve already seen positive traction. Our online engagement has increased significantly. We’re getting a lot more phone calls, a lot more online quote requests. So it has had its benefits for sure. We’ve also invested in a full-fledged marketing program this year. So, we’re doing paid digital,

we’re running promotions every month. And that’s also been a big part of the increase in business online.

On choosing technology vendors: It’s an ever-changing world. We want to hear about how a vendor partner is going to improve or help our business today. But I also want to know that tomorrow is part of the thought process, too. And I feel like that’s where some of the software firms that we’ve dealt with in the past, that’s where they’ve failed. Some have built monstrous platforms, and then they abandoned them because they’re too hard to update.

On the potential of artificial intelligence: ChatGPT is the most popular AI out there, and they’ve improved their program a ton. Last year when you first started using it, it was able to help write emails and marketing copy and things like that, but it wasn’t giving you current information. Now they’ve updated the plugins. Now you have web search features. You have more data-analysis features, and that’s really what I think has made that more useful to us.

We’ve built a bot inside of ChatGPT that’s geared towards building materials search—It’s a search engine for building materials essentially. So our salespeople ideally could use this when they’re engaging with the customer. If they get a question they’re not able to answer, they can punch it into our bot. And then our bot can scrape the internet for information that would be useful to our salesperson in helping a customer.

Technology and the brain drain: In this industry right now, we’re seeing a lot of experience that has been built up over the years leave the field. And the next generation isn’t quite filling that space as effectively.

The result is a gap in information and knowledge that’s just not transitioning over to the next generation. So we’re forced to use technology to get that next generation up to speed. And that’s where I feel artificial intelligence is a good tool.

It’s still so new. I believe there's going to be an opportunity for us to really invest in it, and I feel like that’s going to come in the customer-engagement end, but I’m just not quite there yet. I haven’t found the right company or software yet that’s going to be able to provide what we want—a seamless conversation with the customer, just like a person.

At the 2024 International Builders’ Show in Las Vegas, the Builders FirstSource booth had a clear focus on digital tools. One could even say that the crowded booth would have felt right at home at a technology event or consumer electronics show.

And that’s just the way Builders FirstSource CEO Dave Rush likes it.

The company’s emphasis—and optimism—on its collection of digital tools continued in the company’s most recent quarterly earnings call with investors and analysts.

On the call, he said he was very pleased with the reaction to the program’s launch in Las Vegas in February, calling it an “exciting milestone” for the Dallas-based LBM giant. “Our customers told us the new tools address an unmet need, and they were excited to use them in their businesses.”

Rush elaborated: “At a high level, our digital tools do three things: one, solve customer pain points; two, make it even easier to partner with us and our suppliers; and three, help us gain incremental business from new and existing customers.”

He described how one of the digital tools, “Build Optimize” — a 3D modelling system — identifi es problems before they show up at the customers’ job sites. For one large customer, the tool has been used in three markets and 13 communities across 34 plans. On average, the tool identifi ed 150 confl icts per plan. “Resolving those confl icts before construction leads to job site time and cost savings,” he said.

Three other large builders have shown interest in the 3D modeling tool, as well, he said.

“With our Digital Tools, we are providing our customers with a more efficient and cost-effective way to manage the construction of their homes that will increase existing customer stickiness, win new business, and improve our operational efficiency,” he said.

A key to the company’s digital approach was its 2021 acquisition of Paradigm, a software solutions and services provider built specifically for the building products industry. Builders FirstSource promotes its Digital Tools as “powered by Paradigm.”

Rush describes Builders FirstSource as the “only provider of an end-to-end digital platform in our space.” Combined with proprietary estimating and configuration tools, he said Builders FirstSource customers will have more control over the entire building process.

Optimism to outperform the home-improvement industry abounds at Memphis-based Orgill.

The industry may be running flat, or down, but Orgill CEO Boyden Moore continues to expect growth of one or two percent at the end of the year.

“We’re excited at The opportunity to continue to grow,” Boyden Moore told HBSDealer during the company’s annual gathering of Orgill nation in Orlando.

“We’ve tended to outperform the industry over the last several years,” Moore said. “We have a lot of new business opportunities and a lot of our customers are looking to expand their assortments and grow their business, and we’re working to make that happen with them.”

Here are some of the Orgill highlights:

One way is in the area of technology. In addition to state-of-the-art robotic systems (see sidebar) at its new distribution center, Orgill is providing a building hand to its independent members on an individual basis through its growing Technology Symposium.

Earlier this year in Orlando—and livestreamed and recorded for expanded impact—Orgill’s 15th symposium was focused on providing Orgill’s customers with the latest information on technology trends impacting the industry and updates on Orgill’s tech-focused initiatives. It also allowed attendees to network with one another, as well as industry experts.

“These events started out as small gatherings for retailers utilizing our e-commerce solutions,” says Marc Hamer, Orgill’s executive VP and chief information & technology officer. “Since we initially began bringing these retailers together, the event has grown into somewhat of a conference in its own right.”

At this year’s Symposium, topics addressed ranged from “The Future of Digital” to how technology is impacting the direction of point of sale systems.

Store assortments and retail programs. Orgill’s new Core Assortments, which were heavily promoted inside model stores at the Orlando market, are all designed using Assortment Optimization Technology, according to Chris Freader, Orgill’s senior vice president of retail services.

“These assortments represent a tighter, more focused product presentation that we have vetted, tested and optimized,” Freader says.

Behind many of the category presentations is a program called the Hardware 101 report. The program helps retailers ensure they are stocking core products within assortments that consumers recognize as a requirement for their store to be considered a “viable option” in a particular category.

Orgill has developed these Hardware 101 assortment standards across every Orgill product category to ensure that, whatever categories a retailer might

In the aisles: Assortment Optimization Technology and Smart Sets are infused on retail shelves.

“These events started out as small gatherings for retailers utilizing our e-commerce solutions. Since we initially began bringing these retailers together, the event has grown into somewhat of a conference in its own right.”

—Marc Hamer, executive vice president and chief information & technology officer, Orgill

offer, Orgill can provide insights into the minimal assortments required.

The Germantown Hardware store in Orlando was full of such examples, Freader said.

Meanwhile, for retailers who are converting to Orgill’s warehouse-backed vendor programs, Orgill has a Smart Start program to grease the wheels. Smart Starts allow retailers who are converting product lines to swap out their current inventories seamlessly and receive credit to offset some of the cost of conversion.

The new Integrated Smart Starts go beyond the existing program by integrating a variety of vendors into the supported planograms.

“In the past, Smart Starts were based around removing the product from a non-supported vendor and replacing that product with warehouse-backed vendors,” Freader says. “It is very efficient and effective in most categories. The new, Integrated Smart Starts, however, address those categories where a single vendor might not be the right solution. It basically broadens what we can do for a retailer to meet the needs of their customers.”

And how are these programs playing out among the retailers?

“I am impressed by the enthusiasm of our customers, and what they’re telling us about their business,” CEO Moore said. “I think 2024 is going to be a good year.”

Orgill's newest distribution center is up and running in Tifton, Georgia.

“We are taking advantage of every opportunity to build technology and new distribution techniques into this facility that will help us create efficiencies for both our team and our customers,” said Randy Williams, Orgill’s executive vice president of distribution. “The investments we are making in this facility will ultimately help us get products to our customers more efficiently.”

New to the Orgill DC in Tifton is the Geek+ Shelf-to-Person PopPick System.

It’s described as a system that uses low-to-the-ground, disc-like P series robots to move tall stacks of shelves and pallets to a picking station. In the system, robots bring totes to the picking station and the picker selects the product according to a screen prompt.

The system is designed to be more accurate and more efficient than manual picking, while eliminating redundant back-and-forth walking down long aisles.

The facility, which replaces an older Tifton, Georgia DC, brings 25 percent more space —expanding from 650,000 sq. ft. to 800,000 sq. ft. And the distributor is making more efficient use of the space.

In addition to the new construction in Tifton, over the past two years, Orgill added 1.3 million square feet of warehouse space when it opened its new Rome, New York, distribution center in 2021 and expanded its Hurricane, Utah, distribution center in 2022.

Orgill now operates eight distribution centers in North America with 6.7 million square feet of capacity and more than 75,000 SKUs in each distribution center.

HBSDealer’s editorial team is always on the lookout for products that improve the lives of homeowners and build traffic, sales or repeat business for the hardware and building supply dealer. Lately, we’ve seen some products with heft — both in terms of physical size and what they bring to the table in terms of innovation and value.

For more along these lines, subscribe to the HBSDealer Daily newsletter, featuring Product Central every day.

Andersen retractable screen

Andersen has launched the latest addition to its product portfolio: A retractable screen for its patio doors.

“This launch of a retractable screen for Andersen patio doors helps homeowners enjoy the light, air, and views patio doors offer in an even more comfortable setting,” said Jesse Baldwin, business manager, storm door division engineering at Andersen.

The company’s retractable screen is designed to match perfectly with its 200 Series, 400 Series, and A-Series gliding patio doors.

With premium metal hardware and high-end retention performance, said the firm, “it is designed not only to blend in, but also to impress.”

The screen locks at bottom track for solid retention. It has tear-resistant screen cloth, and is engineered for durability. www.andersenwindows.com

Cornerstone Building Brands, the largest manufacturer of exterior building products in North America, announced new enhancements to its Ply Gem Perspective Multi-Slide Vinyl Patio Door.

The multi-slide patio door, crafted through an automated manufacturing process, ensures consistency and trend-setting aesthetics that new home builders and professionals can trust, the company says. Its recent upgrades include co-extruded exterior black and bronze color options with a white interior and expanded sizes of up to 10' in height or 30’ in width. www.plygem.com

DAP introduced the new HD Max Construction Adhesive, a premium hybrid formula with polyurethane strength that provides superior durability and powerful adhesion even in extreme temperatures.

Built for the toughest applications, DAP's HD Max is a hybrid construction adhesive in a 28-fluid ounce cartridge. It's described as a value hybrid formula for pros looking to accomplish larger jobs.

Whether working in scorching heat or freezing cold, the company says HD Max has an ability to bond in extreme temperatures, as it can be gunned out and bond anywhere from 0-120 degrees Fahrenheit. Its low odor formula also makes it ideal for interior use. dap.com

Digger Specialties Inc. (DSI), a manufacturer of outdoor living products, introduced Westbury Sorrento Mesh Railing.

Designed to provide a sophisticated, contemporary style that enhances the visual appeal of decks, balconies and porches, Westbury Sorrento Mesh Railing features longterm durability and resistance to the elements, the company claims.

Sorrento Railing comes in a choice of 4’, 5’ and 6’ preassembled sections in either 36” or 42” heights that combine aluminum posts and rails with 2-3/8” stainless steel mesh infill. Accessories include a variety of residential or heavy duty Commercial IRC and IBC approved posts and base plates. As an added design option, posts are available with either flat or ball caps.

Westbury Sorrento railing is available in 12 colors with the option of textured or non-textured surfaces. www.diggerspecialties.com

Westlake Royal Building Products added two colors to its Cedar Renditions aluminum siding line. The new colors include Burntwood, offering a unique stained woodgrain look, and Blonde Oak (pictured), a premium color featuring multi-tonal woodgrain designs.

“Westlake Royal Building Products is dedicated to providing our customers with a broad portfolio of product options in the latest trending shades, all while ensuring topnotch performance,” said Steve Booz, vice president, marketing, Westlake Royal Building Products. “That’s why we're excited to introduce two new colors to our award-winning Cedar Renditions aluminum siding line." www.westlakeroyalbuildingproducts.com

The Simpson Door Company has introduced its Pivot Door System.

The “monster XL-size” doors from Simpson Door Company can be custom-made to span up to 10’ tall and up to 5’ wide to create a dramatic entrance to the home.

An alternative to traditional assemblies, the company’s latest offering makes it possible to deliver the sought-after look and functionality of an oversized door on a pivot hinge.

The Pivot Door System comes complete with weatherstripping on all sides, including an integrated drop seal at the bottom of the door.

The multipoint locking system plus oversized door pulls combines both style and utility. The door’s functionality is fully incorporated into the included door, jamb and sill with no special sub-floor or job-site prep needed.

Any door from Simpson Door Company, including a Pivot door, can be customized by size, shape, wood species or glass type to accommodate a homeowner's unique vision for their home and living spaces, the company said. www.simpsondoor.com

Outdoor Living fencing

Available in smooth and textured finishes — Wood Grain Premium Fencing from Barrette Outdoor Living is made using proprietary PVC formulations. Styles within this product line include traditional solid privacy and semi-privacy to more modern options that feature decorative accents and horizontal infill boards.

Smooth Wood Grain Premium Fencing utilizes an innovative color streaking process to create a natural wood pattern that differs on each board. Featuring StayStraight material composition and StaySquare gate design to ensure the highest structural integrity. Textured Wood Grain Premium Fencing is molded from real wood and available in a variety of styles.

Barrette Outdoor Living, a division of Atlanta, Georgia-based Oldcastle APG, is a manufacturer of fencing, railing, decking, and complementary outdoor products in North America. Oldcastle APG, a CRH Company. www.barretteoutdoorliving.com

Wolf Home Products, an innovator and leader in the building products industry, added four new quartz finishes to its instock Wolf Vanity Tops with Quick Ship. These four new, natural finishes are part of the popular Bella Series and include Carrara, Frost, Laza and Terra.

“These new finishes were carefully curated to suit the design needs of today’s customers, giving them trending hues that allow them to create modern, stylish spaces,” said David Beltramea, president of Wolf Home Products Carstin Division. “We’re proud to offer these new quartz finishes as part of our Vanity Tops Quick Ship lineup to promptly deliver a variety of refined design options with enduring quality to give our customers what they need when they need it.”

LP’s

LP Building Solutions has expanded its LP NovaCore Thermal Insulated Sheathing line.

Introducing two new thickness options, R3 and R7, the company broadens the options available to builders and homeowners seeking more efficient homes with lower energy costs.

LP NovaCore sheathing’s installation mirrors traditional OSB structural sheathing and utilizes standard 2x4 spacing so that builders can seamlessly integrate these panels into their projects without the need for extensive framing adjustments. This streamlined approach enhances construction efficiency to help save time and money.

These four new hues join a variety of modern, durable finishes in the Carstin Collection ranging from soft creams and opulent grays to deep charcoals that instantly bring sophistication and style to a room, the company said. www.wolfhomeproducts.com

“Expanding our range of insulated sheathing reflects LP’s dedication to meeting the evolving needs of builders. It’s important to us to find ways to make their lives easier, and that includes helping them meet new insulation requirements without sacrificing more time for complex or additional steps,” said LP NovaCore Product Manager Billy Webb. “We strive to simplify the construction process while addressing the escalating demand for energy-efficient solutions. We’re delivering on our promise to Build a Better World, no matter the region or climate.” www.lpcorp.com

Abhi Singh, founder of LMS Strategies, is an advocate of real world concepts that LBM companies can build on.

“Empowering and trusting your people to do the right thing and make the right decisions, rather than tell them what to do, is critical,” he said.

Singh, who will deliver a keynote presentation during the upcoming ProDealer Industry Summit, hosted jointly by the National Lumber and Building Material Association and HBSDealer leans on 25 years of construction supply and LBM distribution experience. He’s learned that while the nature of products provided is broad — from plumbing to HVAC to millwork and beyond — the similarities between the different disciplines is narrow.

It comes down to some core ideas, he said: people, empowerment, execution, availability, and leadership. “Successful distributors laser focus on these inputs to create exceptional outputs and results, rather than simply focus on the bottom line,” he said.

Everyone claims that they have the best people in the industry, but they are rarely treated as such, he said.

“Some don’t share the rewards, some don’t share the praise, and some don’t provide opportunities for growth,” Singh said.

For instance, he asked: “What position do you think touches your customers the most? Hint — it’s not your sales people and it’s not your managers. It’s your drivers.”

On average 80% of all orders in the LBM industry are delivered, he said, and they are delivered by drivers.

“And if your drivers don’t feel taken care of or appreciated,” said Singh, “they won’t go the extra mile for a customer.”

He pointed to the example of the owner of a Midwest two-

step distributor who, when visiting a job site on a hot summer day, saw that one of his drivers was working in a cab with a broken air conditioner.

“With this being the last delivery of the day, the owner gave the keys to his new pickup truck to the driver and asked him to drive that home. The owner then got in the cab and drove home,” Singh said.

“Do you think that driver felt taken care of? You betcha,” said Singh.

Such thoughtfulness was in addition to providing good pay, the newest equipment and regular acts of appreciation — such as buying lunch and giving out new shirts.

“People are the most important asset we have,” Singh said. "Make sure you treat them as such.”

It’s also critical to empower and trust your people to do the right thing and make the right decisions, rather than tell them what to do.

“I was part of a larger, PE owned business that consistently managed from the top down and dictated how to do everyday tasks — think order-pulling, routing, sales calls, purchasing — yet the folks that were giving marching orders have never done any of these,” he said.

Conversely, he then joined a family owned business where the owners knew what they knew; and more importantly, he said, knew what they didn’t know.

That’s why successful distributors trust and empower their people to do their jobs rather than micromanage them.

Why hire great, highly experienced people and then tell them what to do?

Singh said the lesson is: “Hire great people on a great team. Give them a goal; then get out of their way. Be a gentle. Be a guiding hand, not a roadblock.”

Also, he said, do what you say you’re going to do when it comes to execution.

He described himself as amazed that some distributors think that their job end when they get the order, and they fail to deliver what their customer needs.

He stressed a point: “Everyone in a market has the same products, trucks, and vendors, but not everyone has the same ability to deliver the real thing a customer is buying — reliability.”

“People are the most important asset we have. Make sure you treat them as such.”

—Abhi Singh, founder, LMS Stratieges

Arecent presentation hosted by the National Lumber and Building Material Dealers Association gave a platform for a pair of seasoned industry analysts to share their observations on the state of the building supply industry. Here are some of the highlights from Matt Saunders and Chris Beard of John Burns Research and Consulting.

The analysts believe the U.S. economy is going to avoid “what we’re calling the most anticipated recession that hasn’t happened,” said Saunders, JBRC's senior VP of building products research. “We think we are going to engineer a soft landing. However, we are mindful of the macroeconomic risks to that view.”

Saunders added: “And we're watching this really carefully because the longer that inflation remains elevated, the longer

Source:

we're going to be in a higher-for-longer interest-rate environment. And that's when there’s potential for broader cracks in the economy to appear.“

April—the last month for which data was available—showed 60 percent of dealers reported orders were accelerating month-over-month, according to the analysts.

That figure is the highest April reading in two years. The category with the largest percent gain for that period was kitchen, bath cabinetry, up 13 percent, followed by Windows & doors, up 11 percent. (See chart)

What’s more, only 3 percent of dealers reported that orders were decelerating. That’s a far cry from April 2023 and April 2022, when a respective 32 percent and 31 percent of dealers reported decelerating building material orders.

Chris Beard, JBRC director of building products research, added: “What’s interesting is only 3% of dealers reported decelerating building materials orders month of the month, meaning only 3% of dealers said that they're actually seeing fewer orders coming in April versus March.”

JBRC anticipates the 30-year-fixed-rate mortgage to end 2024 with an average of 6.6%. “We do anticipate the Fed will start easing rates towards the end of this year,” Saunders said.

“Supply chain snarls have eased and this has really helped to reduce inflation,” Saunders said.

Geopolitical events are at work in the Red Sea region, causing cargo ships to be diverted from the Suez Canal to a longer route around the Horn of Africa and up the Cape of Good Hope. “We're watching this very carefully as are building product manufacturers,” Saunders said. He pointed to Masco and Fortune Brands Innovations as examples of companies that have publicly flagged the issue. FBI has announced investment in a more diversified supply chain to mitigate just such potential disruptions.

In the researchers’ survey of dealers, they were asked to describe demand as weak, normal or strong. Despite overall order strength, strong demand decreased in April across all customer types.

"But we really don't think this is necessarily a bad thing,” Beard said, “because what we see in the accelerating orders, coupled with the fact that we're seeing fewer order decelerations, dealers are really

Year-over comparison of dealer appraisal

Source: John Burns Research and Consulting

Products Dealer Survey (4/24-5/24)

reporting normalized demand across most customer types this year.”

Results from JBRC’s residential architecture design survey indicate that smaller and denser homes are on the near horizon. This squeeze on the footprint of the

home is connected to affordability.

“We're seeing that every major housing market is overpriced today, relative to what a normal share of household income would go to housing related expenses,” Saunders said. “And one of the ways builders are adapting along with those rate buy downs is by building smaller homes. Architects told us that around 40% of builders said that homes that are delivered are going to have a lower square footage.”

Beard works closely with LBM dealers from around the country in understanding demand and pricing for building products with distribution. He also leads a quarterly survey of structural component manufacturers and

monitors public building products companies’ earnings.

The webinar was presented by the National Lumber and Building Material Dealers Association, which will co-host with HBSDealer the upcoming ProDealer Industry Summit in Savannah, Georgia, Oct. 9-11. At the event, Saunders and Beard will deliver a detailed U.S. Housing Market Outlook and State

MAKES A BIG PUSH INTO

The Dunn-Edwards Corporation opened 17 stores throughout Northern California, expanding its presence in the region by over 50 percent.

The move fills a void in the market left by the sudden demise of Kelly-Moore Paints in January 2024.

The brick-and-mortar expansion also supports Dunn-Edwards Corporation’s focus on strategic growth and expansion in key markets and fulfills integral needs of new and existing customers, the company said.

The new store locations include San Francisco, Cupertino, Santa Cruz, Oakland, Chico, and more.

The expansion comes as the DunnEdwards legacy paint manufacturer approaches its 100th anniversary in 2025. Now with 174 company stores across the Southwest, Dunn-Edwards is focused on

continuing its legacy, the company said.

“For nearly a century, Dunn-Edwards has prioritized our hardworking employees, contractors, and customers. Through recent industry challenges, we believe more than ever that our people are our most valuable asset,” said Monte Lewis, Chief Operating Officer at Dunn-Edwards Corporation. “The sudden closure of Kelly-Moore

devastated hundreds of loyal employees and impacted painting professionals across the region. By moving quickly and decisively, we’re hopeful our expansion will provide relief for those who have been affected, building trust with new and existing employees and customers for years to come.”

The 17 new stores — some of which are former Kelly-Moore locations — employ approximately 125 people, almost exclusively former Kelly-Moore employees. The stores will offer expert color-matching capabilities, including an exact color match for Kelly-Moore’s popular hue, Swiss Coffee 23.

Dunn-Edwards is also prioritizing the expansion of Authorized Dealer locations across the country to serve a broader range of customers and professionals. Recent areas of development include California, Oklahoma, Texas, and Arkansas.

THE

WASHINGTON, D.C.— From the stage of the Building Innovation Conference 2024, Amy Marks told the audience about the time she attended a panel on the future of construction. The panel consisted of “five white men over the age of 55,” she recalled.

“I raised my hand and said, ‘This is not it.’”

Fast forward to the D.C. conference on building innovation, hosted by the National Institute of Building Sciences, which was celebrating its 50th year. Marks was part of a general session titled “A Look Ahead: The Next 50 Years of the Built Environment.” And Marks, the executive vice president of global strategy for Symetri, a construction technology company, and a woman who has garnered many millions of viewers through the “Queen of PreFab” YouTube channel, was part of the panel. This time, female panelists outnumbered male panelists, three to one.

Not surprisingly, there was considerable discussion of materials, techniques and codes designed to mitigate increasingly violent storms and disasters. But there was also a vision for the future that included a more diverse workforce.

Early in her remarks, Marks pointed to the disconnect between some traditional terms and the effort toward diversity.

“While we're in D.C., just a hint here, if you want more women, stop calling it the Brotherhood of the Iron Workers, or the Brotherhood of Electrical Workers. I’m just putting it out there. Because if you want us, [you should] really want us.”

Women make up less than 11% of jobs in construction and only 4% in skilled trades, according to government statistics. That’s far better than the 1970s, but still a glaring shortfall of diversity.

“You know you need outspoken challengers,” she said. “What your

Amy Marks makes a point at the recent Building Innovation 2024 Conference in Washington, D.C. Looking on is Doug Parsons of America Adapts Media.

organization needs to see next, you need to provide air cover for those agents of change.”

Changing mindsets will be a big part of the growth of construction over the next 50 years. And there’s a need for a new generation of tech savvy workers. And she used a pizza-delivery analogy to make her point.

“We also need challengers about technology,” she said. For instance: “I could order pizza right now from my Apple watch. For it to get here, there would be 70 different types of technology. But on a job site, I'm just calling somebody to call somebody to call somebody to see if my $500,000 piece of equipment is going to show up.”

To wrap up the panel, moderator Monika Serrano, resilience program manager for Turner Construction, asked panelists, “What makes you angry?”

Marks, herself a competitive rugby player, shared a personal story about her daughter’s rugby experience.

“What makes me angry is that we have a lot of people that talk about that they want diversity in the construction space,” she said. “And then every weekend I get to watch my daughter and all of her friends and the girls who are on her team. And I watch these thousands of girls on the field, where girls are wearing cleats and they know how to use the core of their body, and they're strong, and they don't need exoskeletons to be on job sites.“

“And then I look around, and there's not one sponsorship sign for Turner or Skanska or Bechtel, or any of these construction companies that say they want women. And I think to myself, they don't really want us. Because if they really wanted us, they’d stop talking. And they’d write a check.”

Also on the “Look Ahead” panel was 84 Lumber’s Christi Powell. Powell, who heads the Women Business Enterprise Division and is an HBSDealer Top Women in Hardware & Building Supply honoree, described progress on the diversity front.

Female representation at companies in the Women’s Business Enterprise National Council in the Northeast has swelled from 6 percent two years ago, to 37 percent.

“That’s just happened in 24 months,” Powell said. “And it’s really going to make a huge difference on innovation, the creativity and the forward-thinking processes and systems and policies that we're going to be putting in place for the construction industry.”

Westlake Ace named Melissa Minter as the general manager of the company’s new Simi Valley, California store. Minter was most recently the assistant manager of Ace of Porter Ranch. She joined Westlake Ace Hardware in 2019 from a leadership position at Walmart. A former competitive ice skater, Minter enjoys football, baseball, country music concerts, and Field of Dreams – her favorite movie. Passion guides her life and career, and she adheres to the mantra, “If you love what you do, you’ll never work a day in your life.”

Thomas Hudson was promoted to vice president of marketing and sales for Senco Based in Cincinnati, Hudson had been director of national accounts for nearly six years. All told, he has been with Senco for more than 21 years. Hudson’s career path also included roles in the telecommunications industry. Kyocera Senco’s manufacturing and marketing are concentrated in the U.S. and Europe, with products sold in more than 40 countries worldwide.

Bill Staley, CEO of Belco Forest Products has been named the recipient of a 2024 Lifetime Achievement Award by Vistage, a CEO coaching and peer advisory organization for small and midsize businesses.“It’s an honor to receive the Vistage Seattle area lifetime achievement award,” Staley said.

“Especially being nominated and recognized by my peers who have been such a tremendous support for me the last 10 years.”

Buildxact, a global software solutions provider for builders, remodelers and dealers, announced a leadership transition. The move brings Steve Yates, formerly Buildxact’s executive vice president of enterprise sales to the role as CEO. He will replace David Murray, who is stepping down effective May 2024. The company says the transition marks a new chapter for Buildxact as it continues to grow its capabilities and services in The United States, Australia, Canada, New Zealand and The United Kingdom.

Fort Wayne, Indiana-based Do it Best appointed Jared Hufford to director of strategic initiatives His expertise spans various areas, including sales, retail, industrial distribution, sales operations, and sales management. In his most recent position as director of e-commerce for store operations, Hufford has been responsible for managing the Epicor relationship and providing white glove services to Do it Best

members. Going forward, he will expand his responsibilities to include overseeing the Retail Performance team and spearheading the implementation of the inventory productivity analysis tool.

Roger Dankel is retiring as executive vice president, North America sales of Simpson Strong-Tie Company. He will remain in his role through Dec. 31, 2024, after which he will remain employed as an executive advisor until June 30, 2025. Dankel has served Simpson Strong-Tie as president, North America sales, branch sales manager, sales manager and sales representative. “I am honored to have been a part of the Simpson family for over three decades and am very proud of what we have achieved together,” he said.

Anaheim, California-based Ganahl Lumber’s latest digital version of its featured-products flyer includes on page 3, a special 140th anniversary “Employee Spotlight.”

The employee recognized is new CEO Brad Satterfield.

The 40-year Ganahl Lumber veteran had been chief operating officer from 2018-2023. Prior to that, Satterfield had held roles as general manager and operations and sales manager. He began in the order-pulling department in 1983.

In the promotional flyer, Satterfiled’s management style and work ethic were revealed in his response to the question: “How do you achieve success in your role?”

His answer: “Be self sacrificing! When you’re at work put Ganahl Lumber and your job first. Serve others whether they are your boss, your employee, your peer or your customer. Show gratitude to those that help you. Set a great example for others to see. Work harder than those around your and enjoy it. Be predictable and present all the time.”

He added: “Working towards being the best ever LBM operator in the business is exhilarating.”

Prior to Satterfield’s promotion, Peter Ganahl had been the company’s CEO.

Calls seeking additional comments about the leadership transfer were not immediately returned.

Since 1884, Ganahl has been a family and employee-owned business selling building supplies and hardware for professional contractors and do-it-yourself enthusiasts alike, with products that include lumber, building materials, millwork, tools, paint, doors, and windows.

The company operates 11 California locations.