THE HMR OPPORTUNITY Inside Metro’s Private-Label Success

SECURING THE GROCERY AISLES GET READY FOR COLD & FLU SEASON!

THE HMR OPPORTUNITY Inside Metro’s Private-Label Success

SECURING THE GROCERY AISLES GET READY FOR COLD & FLU SEASON!

Vancouver Convention Centre

West Building | Vancouver, BC

Conference: February 20, 2026

Trade Show: February 21–22, 2026

Trade Show Hours: 10:00 AM – 5:00 PM PT

membership is not required to attend. Online registration for the trade show is free for retailers and CHFA members only. Advanced online registration ends on January 29, 2026 for non-CHFA Members. On-site registration for the trade show and conference is available. Trade show fees apply for non-member health practitioners, brands and business services. Conference fees apply for all non-members.

ID and proof of industry involvement is required. Restrictions apply. Visit chfanow.ca/vancouver for full attendee policy.

COLUMNS

12 Secret sauce

How a Toronto trio turned a lockdown idea into a thriving sauce and condiment business IDEAS

15 Measuring the tariff effect NIQ Canada study gauges consumer sentiment around economic pressures

17 Preparing for the unexpected? Most small business owners have insurance, but many don’t use it when it matters most

19 Overcoming self-doubt

Star Women in Grocery winners, past and present, on building inner confidence

23 Peak retail season brings early, smart shoppers Caddle research reveals the behaviours that will drive sales this holiday season

25 Retail power shifts in Canada How Canadians shop is evolving, Kantar’s Amar Singh explains why

FRESH

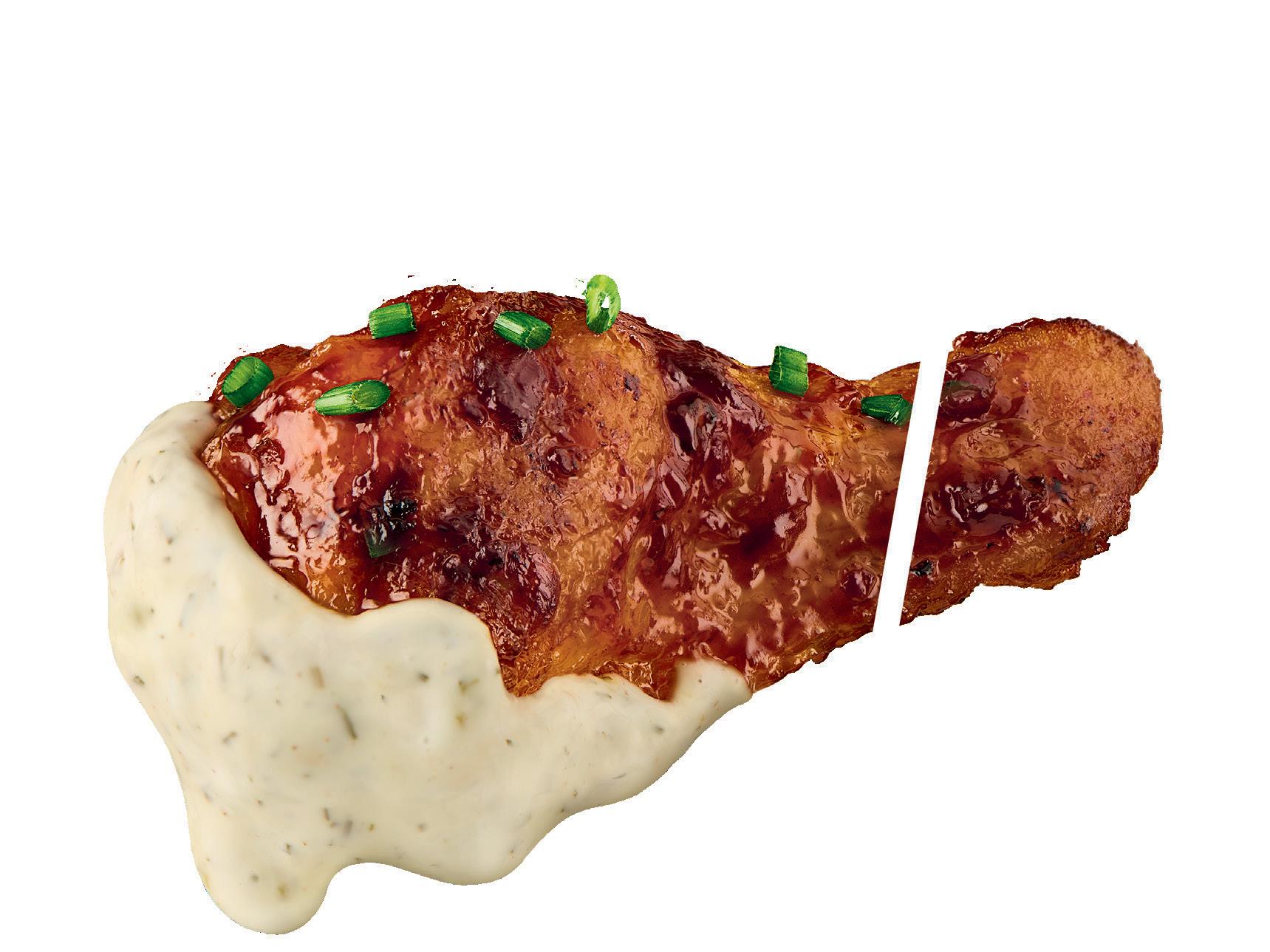

45 Consumers crave more from HMR Quality and value are on order when it comes to ready-made meals

AISLES

49 Choc-full of potential From premium to purposedriven products, here’s what’s fuelling the chocolate category

52 Cold comforts The health and wellness wave hits the medicine cabinet

20 Stars in our eyes

See photos from this year’s sold-out Star Women in Grocery Awards ceremony!

55 Alternative pastas: Four things to know Hearty, healthy and anything but ordinary EXPRESS LANE

56 Food for thought Food economist Michael von Massow unpacks food inflation, shopper habits and more

2300 Yonge Street, Suite 2900, Toronto, ON M4P 1E4

(877) 687-7321 Fax (888) 889-9522

www.canadiangrocer.com

BRAND MANAGEMENT

GROUP PUBLISHER/SVP,

GROCERY & CONVENIENCE, CANADA Sandra Parente (416) 271-4706 - sparente@ensembleiq.com

PUBLISHER Vanessa Peters vpeters@ensembleiq.com

EDITORIAL

EDITOR-IN-CHIEF Shellee Fitzgerald sfitzgerald@ensembleiq.com

MANAGING EDITOR Kristin Laird klaird@ensembleiq.com

DIGITAL EDITOR Kaitlin Secord ksecord@ensembleiq.com

ADVERTISING SALES & BUSINESS

NATIONAL ACCOUNT MANAGER Karishma Rajani (on leave) (437) 225-1385 - krajani@ensembleiq.com

NATIONAL ACCOUNT MANAGER Julia Sokolova (647) 407-8236 - jsokolova@ensembleiq.com

NATIONAL ACCOUNT MANAGER Roberta Thomson (416) 843-5534 - rthomson@ensembleiq.com

ACCOUNT MANAGER Juan Chacon jchacon@ensembleiq.com

DESIGN/PRODUCTION/MARKETING

CREATIVE DIRECTOR Nancy Peterman npeterman@ensembleiq.com

ART DIRECTOR Jackie Shipley jshipley@ensembleiq.com

SENIOR PRODUCTION DIRECTOR Michael Kimpton mkimpton@ensembleiq.com

MARKETING MANAGER Jakob Wodnicki jwodnicki@ensembleiq.com

EDITORIAL ADVISORY BOARD

RAY HEPWORTH , METRO

BRENDA KIRK , PATTISON FOOD GROUP

CHRISTY MCMULLEN , SUMMERHILL MARKET

GIANCARLO TRIMARCHI VINCE’S MARKET

SUBSCRIPTION SERVICES

Subscriptions: $102.00 per year, 2 year $163.20, Outside Canada $163.20 per year, 2 year $259.20 Single Copy $14.40, Groups $73.20, Outside Canada Single Copy $19.20.

Digital Subscriptions: $60.00 per year, 2 year $95.00

Category Captain: Single Copy $20.00, Outside Canada Single Copy $30.00

Fresh Report: Single Copy $20.00, Outside Canada Single Copy $30.00

Subscription Questions: contactus@canadiangrocer.com

Phone: 1-877-687-7321 between 9 a.m. to 5 p.m. EST weekdays Fax: 1-888-520-3608 Online: canadiangrocer.com/subscription-centre

CORPORATE OFFICERS

CHIEF EXECUTIVE OFFICER Jennifer Litterick

CHIEF FINANCIAL OFFICER Jane Volland

CHIEF OPERATING OFFICER Derek Estey

CHIEF PEOPLE OFFICER Ann Jadown

MAIL PREFERENCES: From time to time other organizations may ask Canadian Grocer if they may send information about a product or service to some Canadian Grocer subscribers, by mail or email. If you do not wish to receive these messages, contact us in any of the ways listed above.

Contents Copyright © 2025 by EnsembleIQ, may not be reprinted without permission. Canadian Grocer receives unsolicited materials (including letters to the editor, press releases, promotional items and images) from time to time. Canadian Grocer, its affiliates and assignees may use, reproduce, publish, republish, distribute, store and archive such submissions in whole or in part in any form or medium whatsoever, without compensation of any sort. ISSN# 0008-3704 PM 42940023 Canadian Grocer is Published by Stagnito Partners Canada Inc., 2300 Yonge Street, Suite 2900, Toronto, ON M4P 1E4. Printed in Canada

There are bad leaders, there are good leaders—and then there are the exceptional ones.

Bad leaders (and I’d wager most of us have had brushes with a few) can stifle innovation, erode morale and damage company culture. Good leaders, on the other hand, keep teams focused, set clear goals and communicate effectively. But exceptional leaders go further. They see beyond routine management to inspire their teams, transform their organizations and elevate their wider communities.

In this issue, we shine a light on a few of the Canadian grocery industry’s exceptional leaders—Empire’s Michael Medline, The Grocery Foundation’s Shaun McKenna and Gary Wade of Unilever Canada. They are, of course, the recipients of the 2025 Golden Pencil Award, the industry’s most prestigious honour.

Medline, McKenna and Wade’s journeys are as varied as the industry itself. One started out as a lawyer, one built his career in sales and marketing, and the other is a former Olympian. They also come from different parts of the industry. Yet what unites these leaders isn’t just their professional success—it’s their impact. Each has given back generously and have helped push both their organizations and the industry forward with passion and purpose. (Read their inspiring stories starting on page 28.) And if you have the opportunity, join the celebration on Nov. 24 in Toronto when these leaders will receive their Golden Pencil Awards.

Also in this issue, we sit down with Metro’s Annie St-Laurent, a 20-year Metro veteran who is now leading the grocer’s private brands team. St-Laurent tells us how Metro’s private-label portfolio

is evolving to meet changing consumer needs and why store brands are having a moment. (Read the interview on page 40.) And with retail theft surging in this country, “Securing the grocery aisles” ( page 35 ) explores how retailers are responding to the problem and aiming to mitigate risk through smarter store design, new technologies, enhanced staff training and collaboration with law enforcement.

See you next time!

Shellee Fitzgerald Editor-in-Chief sfitzgerald@ensembleiq.com

in downtown

STONG’S MARKET and its Stems floral shop have opened within the Health and Technology District in downtown Surrey, B.C. The opening brings Stong’s store count to four and marks its second free-standing Stems. The smaller-format store will offer national brands, local suppliers, hot meals, an Edibles deli, fresh produce and more. Next door, Stems will focus on fresh flowers, succulents and giftware.

SAVE-ON-FOODS has returned to Port Moody, B.C., with a 13,000-sq.-ft. store in a space previously occupied by Meiga Supermarket. The compact format features fresh produce, meat, dairy, grocery staples as well as sushi and bento boxes from the Save-On-Foods Kitchen. The grocery retailer last operated in the city in the ’80s under the Your Mark-It Foods banner and now has 189 stores across Western Canada and the Yukon.

Cochrane, Alta. is home to a new CALGARY CO-OP. The 41,000-sq.-ft. food centre is located in the brand-new Greystone community and offers a wide range of fresh, local and ready-to-eat options, alongside a full-service pharmacy with a walk-in clinic, a dedicated health and wellness area, and a community room for local groups. The site also features a 10-pump gas station with a touchless car wash, convenience store, and Cochrane’s second Calgary Co-op Wine Spirits Beer location, complete with a tasting bar and walk-in cooler stocked with local craft beers.

WALMART CANADA opened a 100,000-sq.-ft. supercentre in Oakville, Ont.’s South Oakville Centre in early October, in a former Target space. In addition to a full grocery department, Hot Kitchen and general merchandise selection, the new location also includes a Chatime bubble tea café and a pharmacy.

After being temporarily closed following a roof collapse, general merchandise retailer RED APPLE has reopened its location in Assiniboia, Sask. at 120 1st Ave West. The store has been fully refreshed with a new look, but continues to offer a wide range of fashion, home essentials, toys and food at reasonable prices.

Save-On-Foods marks a return to Port Moody, B.C. with a 13,000sq.-ft. compact format offering fresh produce, meat, dairy, sushi and more

An opening date has been set for T&T SUPERMARKET’S second store in Washington state. Located within the Lynnwood Crossroads shopping centre north of Seattle, the 30,000-sq.-ft. store will feature a 150-item bakery, sushi station, carving counter for Chinese barbecue, self-serve food bar and made-to-order food stall.

As part of an ongoing succession plan, Calgary Co-op has appointed current board chair Ken White as interim chief executive officer while the board continues its search for a permanent replacement. White will succeed Lisa Swartzman, who concludes her year-long term as interim CEO in mid-November. He will also remain on the board as executive chair.

Keurig Dr Pepper Canada (KDP Canada) has appointed Ryan Bahadur interim president.

Bahadur joined KDP Canada in 2018 as vicepresident, finance and helped support the expansion of the beverage company’s portfolio within Canada. He succeeds Olivier Lemire, who served as president of KDP Canada since 2021. Lemire will take on a new role, leading Keurig Dr Pepper’s U.S. coffee business unit.

Simon Small has been named executive director of The Grocery Foundation. He replaces Shaun McKenna who officially steps down in 2026. Small brings nearly 30 years of industry experience to the role. Previously, he worked as general manager of the Americas with The Jordans Dorset Ryvita Company. He has also held leadership roles at Nestlé and Aliments Ultima and has served as a board member of Food and Health Products of Canada.

Lactalis Canada has promoted Burhan Khan to general manager for its cheese & tablespreads division. In his new role, he is responsible for the overall long-term strategy, sales, marketing and retail partnerships for brands including Cracker Barrel, Black Diamond, Balderson, P’tit Québec, Cheestrings Ficello and aMOOza!. Prior to joining Lactalis Canada in 2019, Burhan held various leadership roles at McCain Foods, Unilever and Reckitt Benckiser.

Catherine Sumague has joined BCI Foods—Canada’s largest private-label canned soup maker and home to brands such as Aylmer, Primo and Baxters—as chief revenue officer. In this role, Sumague will focus on accelerating growth, expanding market presence and strengthening customer relationships. She was previously chief revenue officer at Natursource, which she joined in 2018.

UNFI has announced several executive leadership changes: Ali Davies, previously vice-president of sales, has become vice-president of market development, natural, for UNFI U.S.; Andy Hull, vice-president of finance, strategy, and revenue growth management Canada, has transitioned to vice-president of supplier services and revenue growth management Canada; Melinda Zoccoli, formerly vice-president of supplier services, marketing, and data governance, is now vicepresident of sales and customer experience; and Lisa Gilbert assumes the role of senior director, new business development, sales, and supplier strategy. Additionally, the company promoted Rachel D’Sa from director of financial planning and analysis to senior director of finance for Canada.

Walmart Canada recently opened its ambient distribution centre (ADC) in Vaughan, Ont., supported by the big box retailer’s $6.5-billion investment to grow its store network and supply chain.

Located in Vaughan, Ont., Walmart Canada’s new ADC is 550,000 square feet and 94 feet tall

Spanning 550,000 square feet and 94 feet tall, the facility—Walmart’s first ADC in Canada—uses advanced robotics and AI-driven systems to boost speed and reliability, enabling the retailer to ship up to 70 million cases a year.

The distribution centre employs more than 200 associates and currently services 131 stores and two fulfilment centres across Ontario, making it the highest-volume facility in Walmart Canada’s supply chain network.

“Every associate here from forklift drivers to team leads, from engineers to planners, everyone plays a vital role in keeping Walmart Canada moving,” said CEO and president Vanessa Yates at the centre’s grand opening in October. “When we invest in facilities like this one, we’re not just building capacity, we’re building opportunity for our people, partners and our communities.”

Canadian Grocer has won a 2025 Eddie Award. Our December 2024/January 2025 issue—featuring the 2024 Generation Next Award winners and lessons in leadership from Kruger Products CEO Dino Bianco— won an Eddie for Best Full Issue, B2B, Retail.

How these Toronto-based partners turned a lockdown idea into a zesty sauce and condiment business

By Andrea Yu • Photography by Jaime Hogge

WHEN COVID HIT, Jannine

Rane and her partner Anush Sachdeva were working busy jobs in Toronto’s tech and finance industries. “At the end of a workday, we’d look at each other and say, ‘What’s for dinner?’” Rane recalls. “That would cause friction and an argument about who’s making it and what we were going to eat that night.”

Rane and Sachdeva began thinking about how much they loved their city’s diverse food and how restaurants were able to make delicious meals quickly. They realized complex flavours were achieved in the form of seasonings and sauces to deliver a lot of flavour in little time. “The secret sauce is really the secret sauce,” says Rane.

In the summer of 2020, the duo brought their chef friend, Kiran Singh, on board to help develop “flavour shortcut” sauces and seasonings inspired by the many global communities that have made their home in Canada. First came their Hakka-ish Chili Crisp. It was inspired by Toronto’s Indo-Hakka Chinese diaspora—communities of Hakka Chinese descent who migrated to India and later to Canada—whose cuisine blends Chinese techniques with Indian spices and heat. It went through 10 different iterations before they settled on the perfect recipe. They also created a second sauce, the Mogambo Roasted Garlic Condiment, which was inspired by Indian and North African flavours. It was made using French culinary techniques and was born out of Rane’s displeasure with chopping garlic. There was also a line of three seasonings: the Zesti Jerk Seasoning, Smoki Garam Masala and Ooomami Savoury Seasoning Salt.

The company, named Zing Pantry Shortcuts, first launched in October 2020, selling direct to consumers through e-commerce. Zing quickly sold out of some products, boosted by positive press coverage. “That helped give us the confidence that it is something that people might want, and it’s worth investing in,” Rane explains.

In the spring of 2021, Rane began exploring retail partnerships with independent shops in Toronto, including the Dark Horse Espresso Bar chain and Sanagan’s Meat Locker. “We were really moving through word-of-mouth,” explains Rane. “Customers were recommending us to their local retailers.” By the end of

2021, the company had about 50 retailers on board, mostly in Ontario, with a few spots across the country and in the United States. That year, Zing also added more sauces and seasonings to its lineup, including Buzz Hot Honey, which was developed with bestselling cookbook author and executive chef Christine Flynn. It was the first in a series of sauces co-developed with Canadian chefs and food personalities.

Sachdeva and Rane’s backgrounds in tech helped inform the way the company grew; for example, the creation of their public test kitchen. “It’s a group of real consumers and tastemakers, everyone from food journalists to buyers to Michelin star chefs that will try product prototypes, so to speak, and provide feedback on what’s working and what’s not,” Rane explains. “We are very methodical—we like to make small bets, fail fast and grow from there. That iterative approach has been really the DNA of how we’ve operated from day one.”

In 2022, Zing got its first “yes” from a major grocery chain—Whole Foods Market Canada—launching in all its Ontario stores. “They really gave us our first big break and their stamp of approval,” Rane says. “That opened the door to a lot of opportunities for us.” One of those opportunities was connecting with a national food distribution company, Jonluca Neal. By the summer of 2023, Rane quit her tech job to run Zing full time. “We had enough signs and signals from sales and from the community to show me that we had done enough to take the leap,” she explains. The year continued to be a great one for Zing, with its products launching in a few more Ontario grocers including 24 Fortinos stores and nine Goodness Me! locations. Then, in June 2024, they added 48 Farm Boy locations in Ontario and 14 IGA and Fresh St. Market stores in British Columbia and Alberta. This was followed by Healthy Planet locations in Ontario in November 2024 and most Metro Ontario locations in May 2025. And there’s more to look forward to in 2026, as they’ll expand their reach with Whole Foods to 14 stores nationally, along with launching a line of Asian-style barbecue sauces. Looking back, Rane admits she never intended to start a company. “It was a pandemic project, but one thing led to another and here we are,” she says. “We were in the right place at the right time, with a little bit of the unexpected.” CG

30 seconds with …

What has been your best day in the business so far?

When we got our first order that wasn’t from friends and family. Nothing’s going to top that one. Just the idea that someone, somewhere, thought what we were building was worth buying.

What’s the best business advice you’ve received?

Just do it! Just try! A lot of the time, people have great ideas but are hesitant to execute on them. The biggest unlock for us has just been to put yourself out there and try. Don’t hesitate to take a big swing.

What has been the biggest growing pain in your business?

We come from non-CPG backgrounds, so learning the ins and outs of CPG has been something that we’ve had to do as we go.

What’s your favourite product from your lineup?

That’s like picking a favourite kid! It changes often. I have a soft spot for the original Hakka-ish Chili Crisp because that’s the first product. I put it on my eggs. But, I think the underdog in our lineup is our seasoning salt, Boom. It’s like a coming together of South Asian spice blends that are lentil-based and Mexico’s smoky chilies. I’m using that a lot these days to season chicken.

MosT Canadians believe tariffs will have negative short- and long-term impacts on the economy and continue to affect their grocery spending, according to a new study by NielsenIQ (NIQ).

The North America Tariff Sentiment Study: U.S./Canada Topline found 76% of Canadians expect tariffs will have a negative impact on the economy this year and 72% expect they will have a negative impact over the next three years.

Not surprisingly, 85% of Canadians disapprove of tariffs while only 6% favour them and 9% are unsure.

The study was the third of four NIQ fielded this year to gauge Canadian and U.S. consumer sentiment around tariffs. In Canada, 5,002 English and French speaking consumers were surveyed between Aug. 1 and 11.

Mike Ljubicic, managing director of NIQ Canada, says tariffs are just one of the factors, along with inflation, increased commodity prices and economic uncertainty, that are putting pressure on consumers’ wallets.

The study found Canadians are most concerned about the impact tariffs have on the prices of fresh produce (49%), followed by poultry (40%) and dairy and eggs (both at 39%).

Ljubicic says many cash-strapped consumers who oppose the U.S. tariffs would like to buy Canadian at the grocery store, but have to opt for lower-priced American goods. “They have to make

a decision based on how much money they have in their wallets.”

That, he says, helps explain why the percentage of Canadians who said they would avoid buying U.S. products due to the tariffs has dropped from 36% at the beginning of the year to 29% in the latest survey.

The NIQ study also found 42% of Canadians say they are not eating out as much and 32% have reduced travel, partly due to the U.S. tariffs.

“People are just a little nervous about the future” and are being more frugal, Ljubicic says.

Consumers are controlling their spending by sticking to essentials and cutting back on discretionary spending, buying on promotion, shifting to private label and shopping at discounters, he says.

Even households with incomes above $70,000 are being prudent. “They’re the ones that are driving the growth in the discount sector,” by shopping at “hard discounters” such as No Frills, FreshCo and Food Basics.

Ljubicic does not expect a bounce back from discounters to conventional grocers for the foreseeable future. “I think discount is a new norm that’s here to stay,” he says. “We will continue to see expansion and conversion into those types of outlets because that’s where the traffic is going.”— Danny Kucharsky

INDEPENDENT GROCERS KNOW better than most that the unexpected can quickly disrupt business—from a refrigeration breakdown that spoils thousands of dollars worth of inventory to a flood that forces the store to close its doors.

A recent TD Insurance survey shows that while nearly all Canadian small business owners carry insurance (94%), more than half (52%) said they would still rely first on financing, such as credit cards or loans, in an emergency.

For grocery retailers, 56% indicated they would reach for credit cards and 27% would rely on family and friends. With grocers already facing tight margins and rising costs, that gap between coverage and confidence could make recovery harder than it needs to be.

SO WHY DOES THAT GAP EXIST?

“What stood out in the survey was that grocery and convenience retailers were among the least confident that insurance would help them in a crisis,” says Tang Trang, vice-president, product and pricing, small business insurance at TD Insurance. “I think there are several misconceptions, and one is if you use your insurance, maybe my premium will go up, maybe you won’t be able to get it next year (which is untrue). So, there is a lot of fear.”

Another issue worth noting, says Trang, is that retailers sometimes buy insufficient insurance or even the wrong kind for their situation. And in some cases, they think they have the wrong kind of insurance and it won’t cover their particular situation or that it won’t cover

smaller issues. Trang compares it to buying a tablet and using it only for writing or scrolling. “It has a thousand features and you use only 1% of it.”

With 27% of surveyed grocers saying managing cash flow and finances was their biggest business challenge, Trang points out that insurance doesn’t just protect against loss—it preserves cash flow and provides critical liquidity in times of crisis when small business owners need it.

Trang gives the real-life example of an independent specialty food store that had a power outage resulting in a freezer shutout and spoiled meat. Within 30 days, insurance was able to replace the inventory, ensure the freezer was functioning and offer advice on getting a generator.

Trang recommends retailers maintain accurate inventory records and promptly and carefully document any incidents. If there is a loss, this will help expedite insurance claims and get business owners back on their feet quickly.

He also recommends that retailers don’t think of insurance as “one and done.”

“Every business changes over time, and you may be wanting to grow your business, so you may need more insurance or a different type of insurance,” he says.

By meeting with an advisor to understand their coverage and plan for both everyday risks and major disruptions, he adds, grocers can reduce reliance on costly emergency financing and focus on what matters most: keeping shelves stocked and customers satisfied.

—Louise Leger

Thirty-nine per cent of Canadian workers report feeling burnt out at work, according to a new national survey by Mental Health Research Canada, Workplace Strategies for Mental Health, and Canada Life.

The survey’s authors call the rise of burnout (up from 35% in 2023) “troubling,” noting it’s not just a wellness issue—it’s also a business issue. Burnout costs employers between $5,000 and $28,500 per employee, annually.

According to the report, companies that prioritize prevention see a 27% burnout rate versus 47% for those taking no action, resulting in potential savings of $1.7 million per year for a 500-employee company. “When organizations invest in prevention, they don’t just protect their people, they protect their bottom line,” says Mary Ann Baynton, director of collaboration and strategy, from Canada Life’s Workplace Strategies for Mental Health, in a press release.

Other findings from the survey: ONLY

42% of employees with a mental health diagnosis disclose it at work fearing career consequences

46% of employees say burnout prevention is not a priority at their workplace

3 IN 5 managers report their workplace provides them with the tools/skills to effectively manage emotionally distressed employees

Time-based supports like paid time off and flexible schedules are more effective in tackling burnout than awareness campaigns

Star Women in Grocery recognizes the incredible women shaping Canada’s grocery industry. We thank our sponsors for their support in celebrating these trailblazers.

Even at the highest levels of leadership, female executives wrestle with self-doubt. And it can creep in regardless of business results or professional track records. Resilience and strong working relationships can help counteract these feelings and enable people to embrace challenges outside their comfort zones.

At Canadian Grocer’s Star Women in Grocery Awards ceremony, this theme resonated as some of this year’s winners (and a past honouree) took to the stage to share how they’ve faced self-doubt, how collaboration helped them overcome it, and the importance of mentorship in shaping the next generation of executives.

By Kristin Laird

“People often assume that senior leaders must be perfect and have never doubted themselves, and that is not true. I think everyone has faced self-doubt at some point, but it’s how you learn to shift your mindset … Eventually, I learned to bet on myself, to trust my experiences, my higher success and my ability to grow into whatever came next.”

Cara Keating, CEO, PepsiCo Canada

“Sometimes imposter syndrome stays there, so a lot of the leaders and mentors I’ve had the fortunate opportunity to meet on my journey have helped me see my blind spots, have encouraged me to take risks that I may not have taken or didn’t think I was ready or capable of taking, and those risks have, ultimately, opened up new opportunities and have helped me grow along my journey. And that is something that is so pivotal.”

Erika DeHaas, vice-president, corporate marketing, Sobeys

“I have definitely felt imposter syndrome. Imposter syndrome is not necessarily something you get over and you’re done with [it]. You have to work through it consistently throughout your career. A few things that have helped me is reframing a lot of the discomfort and the doubting into growth. It’s like, ‘OK, I know I’m in an area that’s not as familiar—that means I’m growing. That means I’m learning.’ And the other thing is finding your people. I’ve been very fortunate in my career to have incredible leaders, bosses, peers … and I can go to them and trust they can tell me when I’m being hard on myself.”

Amanda Galante, senior category director, centre of store - super market division, Loblaw

“As leaders, we all have a role to play to help others find their path. And I think it’s important for us to always make sure that in a busy schedule, we carve out time for other people, to guide, to mentor—because for me, there’s nothing more rewarding than seeing someone you coach or guide who is thriving and succeeding. I’m super grateful for the opportunities I have, but mainly the leaders that crossed my path … it makes a huge difference.”

Marie-Eve Girard, senior director, commercial strategy and channel development, Danone Canada

“I try and remind myself that resilience isn’t new and it’s not just a skill we need to start developing at a certain stage in our career or a certain stage of life. We’ve been practicing resilience our entire lives. If you go back to making your first friend, surviving high school or figuring out life in your early 20s, we’ve been practicing that skill for a long time. It’s a good reminder to myself and to anybody else to say, ‘We’ve already been through many challenges, and you got to here today.’”

Hali Burness, senior director, finance, Conagra Brands Canada

Connections were made, stories were shared and inspiration was sparked as Canada’s grocery industry came together in Toronto on Sept. 25 to recognize Canadian Grocer’s 2025 Star Women in Grocery winners.

A sold-out crowd of more than 700 attendees was on hand to recognize this year’s 60 winners for their remarkable career achievements and contributions to the industry.

The morning kicked off with a keynote presentation from PepsiCo Canada’s chief executive officer Cara Keating—and a 2017 Star Women in Grocery winner—on leading with authenticity, owning your accomplishments and creating space for team members to succeed.

Next, as part of a panel discussion moderated by editor-in-chief Shellee Fitzgerald, four of this year’s winners—Erika DeHaas (Sobeys), Amanda Galante (Loblaw), Marie-Eve Girard (Danone Canada) and Hali Burness (Conagra Brands Canada)—shared the importance of adaptability and resilience, learning to accept feedback and maintaining a work-life balance.

The event wrapped with Empire chief executive officer Michael Medline presenting the inaugural Icon Award to Retail Council of Canada’s retiring president and CEO Diane J. Brisebois, acknowledging her impact and industry-shaping achievements. CG

This year’s Star Women Networking Lunch featured a powerful presentation from Tonia Jahshan, a trailblazing entrepreneur and advocate for women’s mental health. Tonia, recognized by Ernst & Young as one of Canada’s top entrepreneurs, grew her company Sipology into a multi-milliondollar health and wellness success. Her story is a testament to how resilience and vision can transform challenging moments into positive outcomes.

As Vanessa Peters, Publisher of Canadian Grocer, noted, “In sharing her personal journey, Tonia showed us it is okay to make mistakes, but not okay to sacrifice our health and wellbeing. Women can do great things, but we have got to look after ourselves as we build our companies and careers. That is why events like this are so important, because they help to build a supportive community.”

“The Star Women Networking Lunch capped off a wonderful day where we celebrated a deserving group of women for their hard work,” added Peters, “It is a privilege to give them a little something back.”

Caddle research reveals how deals, loyalty and shifting mindsets will shape the peak retail period

While inflationary pressures continue to influence wallets, Canadians are determined to celebrate.

Almost half (46%) say they are shopping more selectively but still want to enjoy the season

The holiday season has always been a high-stakes battleground for Canadian retailers but, in 2025, shoppers are entering with a mix of caution, creativity and resilience. According to Caddle’s latest research, conducted in August, Canadians are not opting out of holiday celebrations, but they are redefining how and where they spend. With advertising costs peaking and consumer attention fragmented, the pressure on brands to show up with the right value at the right moment has never been greater. For retailers, the insights paint a clear picture: the holiday shopper journey is earlier, more digitally influenced and more selective than ever before.

Forty-two per cent of Canadians say they begin shopping in November or earlier, while another 18% admit they wait until two weeks before the holidays to shop. That leaves retailers balancing both early planners and last-minute scramblers—a dual mindset that calls for consistent, extended promotions across the calendar. Black Friday and Cyber Monday remain the centrepieces. Nearly 1 in 3 Canadians plan their holiday spend around this window, with millennials (39%) and generation Z (38%) leaning most heavily on these tentpole events. Older generations, by contrast, are more likely to spread their purchases into December.

While inflationary pressures continue to influence wallets, Canadians are determined to celebrate. Almost half (46%) say they are shopping more selectively but still want to enjoy the season, and another 34% report they are cutting back to essentials. Only a small minority (5.5%) say they are skipping most

shopping altogether. The focus on value is strongest among younger Canadians. Generation Z (49%) and millennials (47%) are the most deal-driven, reporting that discounts matter more this year than in previous seasons. Older cohorts (baby boomers and the Greatest Generation) are less swayed by price tags alone, leaning instead on loyalty and familiar retailers to guide decisions.

Food, drinks and hosting represent a large share of seasonal spend, with baby boomers leading in grocery purchases, while generation Z and millennials allocate more toward parties and travel. This broadening of budgets underscores the need for retailers to think holistically about holiday baskets.

Despite the growth of e-commerce, big-box in-store shopping remains dominant, with 35% of Canadians saying they plan to do most of their holiday shopping at major retailers. That said, 28% will shop online through the same big retailers, and younger cohorts are increasingly turning to social platforms to discover and purchase products—with 12% of generation Z and 9% of millennials saying social commerce is their channel of choice. Inspiration also varies by generation and region. Retailer websites and apps lead overall, especially for baby boomers (41%), while in-store signage remains a powerful trigger for older shoppers. Social media is nearly 1.5 times more influential for generation Z than baby boomers, highlighting the need for multichannel strategies that adapt to shifting discovery habits.

For all the excitement, holiday shopping isn’t without frustrations. High prices top the list, discouraging 51% of Canadians. Crowded stores (32%) and out-of-stocks (17%) also rank high as barriers, reinforcing the importance of seamless in-store execution. When asked what makes for a standout in-store experience, Canadians say clearly marked promotions (48%), fast checkout (28%) and helpful staff (23%) define success. These fundamentals, while simple, are essential for building trust and keeping shoppers engaged through a hectic season.

The 2025 holiday season is less about unchecked splurging and more about balancing joy with pragmatism. Shoppers want deals, but they also want reliability. They are looking for trusted product information, convenient experiences and brands that respect both their budgets and their time. For retailers, the opportunity lies in meeting shoppers where they are—both early and late, online and offline, price-sensitive and loyalty-driven. Those who combine sharp promotions with consistent omnichannel messaging, well-stocked shelves and service that reduces friction will not only capture share of wallet this season, but set the stage for lasting loyalty well into the new year. CG

Lantic undertook an ambitious modernization of its retail pouch line in 2024. The goal for this project was to re-introduce the full line-up to the market aligning with their sustainability goals - making each pouch recycle-ready certified. This maple pouch duo is the latest to go to market. In addition to giving both a fresh new look and sustainable features, Lantic gave Maple Flakes a new nameMaple Crunch to better reflect its nature.

Activia, the pioneer in gut health and the #1 doctor-recommended probiotic food and beverage brand* in Canada, proudly unveils Activia EXPERT— its most advanced yogurt yet. Backed by Activia’s over 35 years of global research in gut health, this new product line is the first of its kind in Canada, combining an exclusive blend of probiotics with prebiotics.

*#1 Recommended brand of probiotic Food and beverage by Doctors (Family Doctors, Gastroenterologists, OBGYNs, and Internal medicine Doctors) based on a 2024 blinded survey amongst a representative sample within doctors. The results were statistically significant at 95% confidence intervals.

Introducing OÎKOS Pro™ Caramel Macchiato High Protein Drinkable Yogurt –Oikos’s first coffee flavoured drinkable yogurt! Crafted for those seeking a delicious and rewarding experience, this drink is ideal for post-workout recovery1 or a quick snack during the day, offering a delightful caramel coffee taste.

1Oîkos PRO™ drinkable yogurt 300 mL is a source of protein. Protein helps build and repair body tissues.

Yupik, a family-owned Canadian brand, is the fastest-growing name in premium snacks and ingredients. Known for innovative products like Cosmic Cashews, Maple Chipotle Almonds, and Bloody Mary Cashews, Yupik offers versatile snacks as well as family-sized formats. Yupik delivers shelf-ready solutions that meet evolving demand and maximize retail impact, helping retailers and distributors stand out. Discover more at yupik.com

The rise of value-driven formats and rapid e-commerce growth are reshaping how people shop

While Canadian retail is projected to grow at a 3.3% compound annual growth rate through 2030, value formats are expanding even faster

KANTAR’S LATEST FIVE-YEAR forecast reveals a dramatic transformation in Canada’s retail landscape. Three forces are driving this shift: the rise of Costco as a market leader, the rapid expansion of value formats and the accelerating growth of e-commerce. For brands, understanding these dynamics is essential to capturing growth in an increasingly competitive environment.

Costco is on track to surpass Loblaw in sales by 2030. This shift reflects Costco’s consistent performance and its ability to deliver both value and quality, particularly through its private-label brand, Kirkland Signature. Over the past five years, Costco’s growth rate has significantly outpaced that of Loblaw. The warehouse club has emerged as a key grocery destination, especially among new Canadians who increasingly recognize its appeal for value and product quality. Rising trip frequency and strategic club openings nationwide have further accelerated Costco’s expansion and relevance. For brands, this underscores the importance of aligning with retailers that offer affordability while maintaining a premium perception.

While Canadian retail is projected to grow at a 3.3% compound annual growth rate through 2030, value formats are expanding even faster. Discounters are no longer competing solely on price. They are evolving to meet broader consumer needs, including indulgence and convenience. Retailers such as Dollarama, Dollar Tree and Giant Tiger are driving

shopper satisfaction and loyalty by delivering value, convenience and a compelling product assortment at low-entry price points. Among shoppers of Metro’s Food Basics discount banner, 43% agree that pantry grocery delivery has improved; the figure is 41% for Giant Tiger shoppers. Chocolate and sweet snacks consistently rank among the top-performing merchandising groups at both Dollarama and Dollar Tree, reinforcing their role as key snack destinations for budget-conscious households. While rankings vary by region and season, these categories remain central to shopper missions.

Digital commerce is expected to account for roughly one-third of incremental retail dollars over the next five years. Amazon and Walmart are projected to capture nearly two-thirds of online sales among Canadian online retailers. Also, Amazon stands out as the most cross-shopped retailer, reflecting its broad appeal and robust fulfilment capabilities. While delivery remains the dominant method for online orders, remote pickup and buy-online-pick up-in-store options are gaining traction. Both French Canadians and multicultural Canadians are showing increased adoption of online retail compared to last year. For brands, the implication is clear: offering multiple fulfilment options is essential to meet diverse shopper preferences and capture share in an increasingly omnichannel environment. The baby category illustrates how digital channels are reshaping consumer behaviour. Baby food fulfilment is balanced between online and physical platforms, reflecting a decisive pivot toward embracing e-commerce. Online sales for baby food are driven by exclusivity, premium organic assortments and superior shopping experiences. Walmart and Costco remain dominant destinations for these categories, both online and in store, reinforcing the need for integrated channel strategies. Brands that fail to optimize their digital presence risk losing relevance in a category where convenience and quality are paramount.

Value and online channels will capture the majority of incremental retail dollars through 2030, outpacing traditional formats. To remain competitive, brands must prioritize partnerships with high-growth retailers such as Costco, Dollarama, Giant Tiger and hard grocery discounters. They must also invest in robust digital capabilities to capitalize on the accelerating shift toward e-commerce. Aligning strategies with key performance drivers, including value, convenience and assortment, will be critical to sustaining shopper loyalty and driving long-term growth. CG

Amar Singh is a senior director at Kantar Retail. He creates insights that inform strategic decisions about key drug, home improvement, discount, convenience, grocery and digital channels. Amar is a seasoned brand, shopper and advertising researcher.

Whether it’s a morning ritual, a moment to unwind, or a chance to connect with friends, coffee has become more than a caffeine boost. It’s an experience. In fact, Canadians’ love affair with coffee shows no signs of slowing. According to the Coffee Association of Canada (CAC), 74% of us enjoyed a coffee yesterday—more than any other beverage, including tap or bottled water and tea. Espresso-based beverages gaining favour

Espresso-based beverages (EBBs) such as cappuccinos and lattes have reached an all-time high in Canada, with 30% of Canadians enjoying at least one espresso-based drink yesterday, according to CAC data. This trend is expected to continue throughout 2025, driven largely by Gen Z and millennials who enjoy café-quality drinks at home or on the go.

Younger coffee lovers are also changing when and how they drink coffee. Cold brew and nitro options are now sought after year-round—even in winter—indicating that Canadians are expanding their appreciation for coffee beyond the traditional hot cup.

Bring on more

Another trend percolating in the category is the surge in flavoured coffees. Younger generations are leading

the charge, asking for new tastes across all formats—from roast and ground to pods. “We see classics like caramel returning season after season, alongside limited editions that invite consumers to explore,” notes Roberto D'Elia, Director of Canada Retail Sales at Lavazza. “That’s why we entered this market in 2025 with the launch of two flavoured Nespresso* compatible capsules, Caramel and Chocolate-flavoured espresso—and there’s more to come.”

Both roast-and-ground and coffee pods are gaining in popularity. The former remains a staple for everyday use, while the latter appeals to consumers who want speed, convenience and consistency. Together, they’re fuelling renewed momentum for the coffee category in 2025.

This year marks 130 years since Luigi Lavazza opened his first store in Turin, Italy, to introduce his first coffee recipe. His curiosity and ingenuity led him to blend beans from different origins, and that spirit of innovation still drives the company today. “Believing that even excellence can be improved upon is one of our core values,” says D’Elia. “We bring dedication to everything we do, ensuring impeccable quality that exceeds expectations.”

Lavazza’s latest campaign invites Canadians to “feel the real coffee pleasure” by experiencing life the Italian way—one perfectly crafted espresso at a time. For more information go to https://www.lavazza.ca/en

Lavazza Qualità Oro

First developed in 1956 and passed down through generations, Qualità Oro is a 100% Arabica blend featuring six of the finest beans from Central and South America. The result is a symphony of fruity and floral notes, an intense aroma, and a velvety golden crema that reflects Lavazza’s enduring passion for quality.

The Golden Pencil Awards will be handed out at Toronto’s Fairmont Royal York on November 24. For tickets visit groceryconnex.com

A grocery chief credited with turning around Empire’s business, a passionate leader of a foundation dedicated to combating child hunger, and a former Olympian turned CPG executive are among this year’s recipients of the Golden Pencil Award. First presented in 1957 by the Food Industry Association of Canada, the Golden Pencil is awarded annually to exceptional leaders for their contributions to the grocery industry and their communities. Read on to learn more about this year’s winners: Empire’s Michael Medline, The Grocery Foundation’s Shaun McKenna and Gary Wade of Unilever Canada, and discover why they’re worthy of this prestigious accolade.

By Shellee Fitzgerald and Kristin Laird • Photography by Mike Ford

“LONG AND WINDING,” is how Michael Medline describes his path to leading Empire and Sobeys. “I wasn’t sure really, when I was younger, what I wanted to do … I was always trying to figure out the next thing that I wanted.”

Medline’s circuitous journey began with a degree in history—“great training to read, write, communicate and think through things logically”—followed by law school then an MBA, which he pursued to better understand “the nuts and bolts of business.” Early in his career, he landed a role at McCarthy Tétrault, one of Toronto’s top law firms practising corporate securities law.

“Although I liked the law, I was always jealous of the people on the other side of the table who were doing the business side,” says Medline. So, he shifted to the business side, first as corporate counsel for Pepsi, then on to Abitibi-Consolidated where he was given opportunities to run different areas of the business, including supply chain, purchasing and strategic planning. What followed was a 16-year stretch at Canadian Tire, where he rose through the ranks to become CEO. “When I left [Canadian Tire], I had to figure out, again, what I wanted to do.” Sobeys had long been on his radar. “I’d always wanted to work at Sobeys because I really liked the culture,” he says, so when the opportunity to lead the company came up, he jumped at the chance and has been at the helm since 2017.

One lesson his journey has taught him: “You don’t have to have everything figured out, all the time … work hard and put your head down and see where your career takes you.”

Among his many achievements, Medline says he’s particularly proud of Project Sunrise, the three-year transformation initiative to turn around Empire’s business. “It was both an awesome responsibility and a thrill,” says Medline, noting the success of the project was not assured at the outset. “But pretty quickly, I thought we had a real chance to be highly successful,”

he explains, noting the stakes were high—more than 120,000 team members were counting on the project to work. “We didn’t want to let them down.”

It was also a time when tough decisions had to be made, he says, acknowledging that “many great people” were let go for “the good of the whole.” Medline’s takeaway: “Treat people like adults. Don’t try to fool them with words. Tell them what’s going on, what you’re facing, what has to happen—and then treat them with unbelievable respect.”

Medline credits his father, Alan—a doctor “who has never missed a day of work”—for instilling his strong work ethic. And when asked what he attributes to his success, he notes two things: “One is that I never give up, ever. Even when the chips are against me, I just keep on going,” he says. The second is making time to talk to people, both inside and outside the company, and learning from them. He says it’s important to be humble and acknowledge you don’t know everything—there’s always much to learn.

Earlier this year, Medline announced he’ll retire from Empire next May. What will he miss? The people, the team and the frenetic pace of grocery. “There’s nothing like retail and certainly nothing like grocery retail … you never know what the next day is going to bring and I think I’ll miss that excitement.”

The board of directors of The Grocery Foundation, along with the dedicated community of grocery retailers, food and beverage manufacturers, and our esteemed industry partners and colleagues at the Foundation, extend our heartfelt congratulations to Shaun McKenna and Michael Medline on receiving your Golden Pencil Awards. Your exceptional leadership and the significant impact you both have had on our industry and the lives of children across the nation is truly inspiring and will leave a tremendous legacy.

A GRADUATE OF Ivey Business School at Western University in London, Ont., Shaun McKenna says his “real” education came from running his own painting business while a student.

“There’s no better motivation than necessity—I needed to make the money to get back to school, otherwise I wasn’t going to be able to get back,” says McKenna. That experience, he adds, taught him responsibility and resilience at a young age.

The experience also sparked his entrepreneurial spirit. After starting his career at Coca-Cola Bottling straight out of school, six years in he was looking for a new challenge. He found it at CIM, a startup sales and marketing agency he helped build over the course of 15 years. In 2012, McKenna and his partner sold CIM to Mosaic, where he went on to lead the company’s sales business. When Mosaic was later acquired by Acosta Sales & Marketing, he became the president of the company’s Canadian business and later held an executive role on the U.S. business.

While serving as a board member of The Grocery Foundation—a non-profit organization that brings together retailers and CPG companies to combat child hunger and support youth well-being—McKenna seized the opportunity to become executive director when the role opened up in 2017. “I wanted to pursue my moral ambitions,” he says. “I wanted to give back and do something a little more rewarding.”

Under McKenna’s watch, the Foundation has achieved remarkable growth. Its Make Happy Tummies fundraising platform has expanded not only geographically—now reaching Quebec, Atlantic Canada and Western Canada, in addition to Ontario—the number of participating stores has increased from 400 to 1,700, while corporate sponsors have jumped from 14 to more than 40. “We’ve had great growth,” says McKenna. “I’m proud that we’re doing something good for kids—that I’ve played a role, have helped lead that [effort].”

Leading the Foundation, he adds, has also given him a

“unique” vantage point to see the grocery industry come together—even competitors—to support a shared cause.

“They realize that by working together, they can increase their impact,” he says. “I feel privileged to have the bird’s eye view of the best of the industry.”

Born and raised in Hamilton, Ont., McKenna humbly attributes his success not to “any special talents,” but to hard work.

“In Hamilton, we have a term for that, you’re called a grinder— you’re willing to do whatever it takes and just grind it out.”

As for career advice that’s stuck with him through his more than 35-year career, McKenna recalls something a professor once told his class in his final year of university: “‘It’s on you to make your job interesting and exciting, not your employer, it’s on you.’ I’ve always believed that.”

Last month, McKenna announced that after eight years, he will be departing The Grocery Foundation next year. “I’m passionate about what we’ve built here,” he says. “It’s been a great ride.”

We are proud to celebrate Gary Wade, President of Unilever Canada and CEO of Beauty & Wellbeing, North America, for being recognized with the prestigious 2025 Golden Pencil Award.

Over 30 years with Unilever, Gary has driven growth, expanded market share, and strengthened the brand presence in Canada, demonstrating a commitment to sustainability, innovation, and consumer well-being.

Thank you for your leadership, Gary! - Unilever Canada

WADE President and CEO

BEING A CPG executive isn’t all that different from training to be an Olympic athlete—both require relentless discipline, a desire for growth, unbridled ambition, the stamina to perform under pressure and the ability to work as part of a team.

For Gary Wade, this is more than an analogy drawing parallels between two worlds that demand a lot of its players—it’s a lived experience. At the age of 22, Wade represented his home country of South Africa as part of the national kayaking team at the 1992 Summer Olympics in Barcelona, Spain.

“I had a mindset at the time, which was my whole life revolved around making that team,” Wade said during an episode of the Own Your Potential podcast in 2022. “I went to bed at nights thinking about making the team, I woke up in the morning, I was training two or three times a day. I put everything into it.”

Wade has demonstrated that same level of dedication, drive and ambition throughout his decades-long career with Unilever, a company he joined right out of university, earning him an extensive list of accolades and industry awards along the way, including the 2025 Golden Pencil Award.

“I come from a competitive sport background,” said Wade. “I get energy from winning, however you define winning, but winning in results and delivering results. I wanted to have enough bandwidth or breadth in my career that allowed me to lead an organization—big organization or small organization—doesn’t really matter, doesn’t really matter the industry. I really wanted to have autonomy and be able to lead an organization.”

Wade began his journey with the company in South Africa and

later moved to Canada as part of what he called “a three-year plan.” More than 20 years later, Wade has held many progressive sales and marketing roles, culminating in his appointment as president of Unilever Canada in 2017. Wade was now at the helm of a very large organization.

Wade has been credited with not only achieving strong commercial results at Unilever, but also demonstrating a deep commitment to sustainability, innovation, consumer health and wellness, and equality in the workplace. He has been a champion of creating a safe, inclusive environment that embraces diversity in all its forms—including religion, sex, gender and physical ability.

“Sometime in the future, I will no longer be in this role and Unilever will have someone who is equally equipped to do the role,” said Wade. “I really want to make use of the time that I have to make change in our industry.”

In 2024, his role expanded to include CEO of Unilever’s Beauty & Wellbeing division in North America. In this dual role, Wade now leads the company’s operations across both Canada and the United States.

Wade’s career has been defined by strategic vision, leadership and impact, and his desire to continue to grow remains strong— like that of a former athlete. “You know, there’s still many things I want to do in my professional career,” said Wade. “I might not get to those goals or ambitions … But the journey is as much part of it as the destination. Knowing that every day you’re just going to get a little bit better, try a little bit harder [and] overcome setbacks is fulfilling in itself.” CG

from your friends and colleagues at Empire Company Limited on being recognized with the 2025 Golden Pencil Outstanding Service Award.

Michael Medline has played a defining role in charting a bold path forward for Empire Company Limited — strengthening our commitment to teammates, customers and communities across Canada, while also serving as one of the staunchest and most passionate advocates for the growth and progress of our country’s grocery industry.

As retail crime escalates, grocers look for new ways to fight shrink

By Rosalind Stefanac

HETHER IT’S MIS-SCANNING at the self-checkout, organized theft rings or cybercrime, loss prevention is becoming harder and harder for grocers to tackle. According to Retail Council of Canada (RCC), retailers reported an average shrink of 1.5% or $9 billion in 2024, nearly double what it was five years prior. In fact, RCC says losses for Canadian retailers are now in line with shrink levels in the United States.

Fuelled by opportunity, today’s shoplifters are also getting increasingly sophisticated, operating in co-ordinated groups and finding new vulnerabilities to exploit in grocery, be it in-store or online.

But as theft evolves and losses escalate, so do the strategies to stop them. Across the country, grocers are looking to smarter store design, new technologies, better staff training and closer collaboration with police and government to keep loss—and risks—in check.

With a greater shift towards automation, grocers and retailers across the board cite self-checkout as a top contributor to shrink. Retail loss-prevention expert Stephen O’Keefe,

from your friends at Congratulations Michael Medline, Shaun McKenna and Gary Wade on your 2025 Golden Pencil Award!

president of Bottom Line Matters based in Georgetown, Ont., says self-checkouts are a prime example of technology implemented to improve the customer experience and save labour costs, with security as an afterthought. “I did a study on a 20-store project that showed that self-checkout added 36% more shrink compared to stores without it,” he says. “It’s really about opportunity and the perception that you’ll get away with it.”

Even as technology around self-checkout security improves, O’Keefe says grocers still need to figure out their trade-off between labour cost-savings and increased loss, and if “the math makes sense.”

On top of individual theft, organized crime is another factor contributing to significant shrink for Canadian grocers, especially in major cities such as Toronto and Vancouver. Industry experts say the combination of demand for lower-priced items and the sheer access to large volumes of perishable and non-perishable foods in a grocery store make it an enticing target. Labour issues in grocery are further compounding the problem with fewer employees to monitor grocery aisles and report incidences.

“We’re not talking about posting a wheel of cheese on [Facebook] Marketplace and having somebody buy it, but a very organized group of people who allow for the supply chain of stolen goods to get to market—and everybody along the way is making money,” explains O’Keefe.

Sylvain Charlebois, a professor in food distribution policy and senior director at the Agri-Food Analytics Lab at Dalhousie University, says “middle-mile” theft (where trucks are hijacked and products stolen as they move from warehouse to store), is a particularly costly problem that is difficult to police. “There is some potential with driverless trucks to reduce risks in the middle mile, but it’s still early days,” he says.

cybersecurity is becoming more of a priority for grocers, for sure, … the level of concern is uneven across the supply chain and that concerns me,” says Charlebois, noting that in his experience, manufacturers aren’t considering cybersecurity as big an issue as it should be.

Industry experts say assessing risk in your organization is the first key step. ECR Retail Loss is a Europe-based global think tank of retailers, suppliers and academics working together to tackle loss issues. It offers a free benchmarking tool for retailers on its website, ecrloss.com, developed by one of its academic researchers Emmeline Taylor—a professor of criminology at City St George’s, University of London—to help evaluate how secure their operations really are. The tool explores seven key principles—data, people, control, offenders, guarding, monitoring and joining forces—to generate a detailed security profile, and retailers report finding the process quite “eye-opening.”

Current data shows that grocers are certainly recognizing the importance of technology in loss prevention

As retailers respond to threats by adding more locked or glass-secured goods, body cameras or security guards, Charlebois says these actions carry the risk of turning off honest customers. “Canadians aren’t as used to visible security measures like Americans … so grocers have to be careful,” he explains, adding that if you make shoppers feel watched or distrusted, it changes the way they shop.

When large grocery chains receive backlash from the public for piloting new security measures such as body cameras on cashiers (as Loblaw and Walmart have adopted) or self-checkout barriers, he says, it can make other grocers hesitant to explore these options. “I think Loblaw’s anti-theft effort is often used as a weather balloon for the entire sector,” explains Charlebois.

Concerns around e-commerce crime and cyberattacks are another security concern plaguing grocers today. This past June, a highly publicized cyberattack on major food distributor United National Foods Inc. (UNFI) left Whole Foods Market and other grocers with empty shelves, putting food supplies at risk. Last year, Western Canada’s Federated Co-Operatives experienced a ransomware attack that impacted computer systems at hundreds of its grocery stores and gas bars for weeks. “While

Colin Peacock, the think tank’s group strategic co-ordinator, says reducing shrink takes a company-wide approach that starts with good data and prioritization. “First of all, you try and gather as much data as you can to figure out what stores are riskier than others,” he says. The data can help guide grocers on where to focus their efforts, from adjusting store hours and assortment in higher-risk locations to investing in training and empowering staff.

“Self-checkout hosts are one of the most important, but also one of the toughest jobs in the store,” Peacock notes. “Investing in the right people and training them to de-escalate tension and manage abusive customers is crucial.” He also highlights how new scan-avoidance and product-recognition technologies can help reduce loss, with some retailers seeing up to an 11% improvement in shrink so far and even better technology coming.

Current data shows grocers are certainly recognizing the importance of technology in loss prevention. According to 2025 research from the Food Industry Association (FMI)’s Asset Protection in Food Retail report, nearly half of retailers (48%) are now using data analytics for loss prevention, up from 37% the year before. Artificial intelligence is also gaining ground, with usage doubling from 10% to 22%.

Doug Baker, FMI’s vice-president of industry relations, says these tools help retailers spot patterns and intervene faster. Looking ahead, he expects electronic labels and tags to see continued growth, along with technology that supports product traceability and inventory planning. “It’s clear that the industry is leaning into smart, scalable solutions to stay ahead of shrink and operational risk,” he says, adding that fraud detection tools are also on the rise.

Peacock adds that effective loss prevention depends on leadership and culture as much as tools or tech. “Thinking about shrink as a choice is important—it’s a function of the choices you make from the CEO down,” he says, citing self-checkouts as

Our nation-wide network of financing experts is helping you transform the Canadian food and beverage value chain. If you process it, produce it, pack it or move it, we can help your food and beverage business start strong or take the next step.

fcc.ca/Food

a prime example. “All the research suggests that their adoption will increase loss; however, there is a significant reduction in labour with their adoption. Across the world, retailers see this trade-off and choose higher losses.”

In the meantime, RCC is focusing on the bigger picture in reducing retail crime by working with law enforcement and government. Through its national Retail Blitz initiative, which runs four times a year in partnership with police services across the country, the organization helps co-ordinate targeted enforcement efforts that track arrests, repeat offenders and violent incidents (see sidebar). The program has resulted in more collaboration between grocers and law enforcement with some communities beginning to see results.

Rui Rodrigues, executive advisor, loss prevention and risk management at RCC, points to cities such as Winnipeg that are seeing a decrease in crime after years of double-digit increases. “This gives us the win to be able to say what we’re doing is working,” he says.

Beyond enforcement, in its latest report, RCC is also advocating for legal and policy reform to address what it calls a

As grocery theft surges across the country, so does violence against grocery employees. What was once the occasional heated confrontation between a customer and staff member has escalated into legitimate safety concerns causing grocers to rethink store design, training and technology to safeguard their staff.

Retail Council of Canada’s 2024 report, Retail Crime in Canada: The Hidden Crisis Impacting Business, Communities and Safety, provides some hard facts around what is quickly becoming a safety crisis in Canada. Survey findings showed more than 76% of retailers reporting increased violence during thefts, and last year alone there were 121 weapons seized in RCC-led retail blitz operations with police and retailers across the country. Almost 18% of those arrested were repeat offenders, too.

RCC’s Rui Rodrigues says it’s no longer just the volume of theft that is worrying retailers, but the violence often surrounding it. “Now, there are people coming in with machetes and knives and there are

“revolving door” of repeat offenders, by calling on government to strengthen bail reform and sentencing guidelines under the Criminal Code for chronic retail offenders. It’s also urging retailers of all sizes to report even minor thefts, so police can better allocate resources and build intelligence on organized networks. Without that information, Rodrigues says it’s much harder to prevent repeat offenders and protect both staff and customers.

He points to international safety models, such as those used in New Zealand, where there is a single national police service that allows for more efficient collaboration across regions.

“While Canada’s multiple jurisdictions make that model challenging to replicate, it’s an example of how centralized co-ordination can improve results,” says Rodrigues.

Despite escalating retail crime, some encouraging news is the vast majority (93%) of grocery shoppers still feel their primary store is a safe place to shop and 91% appreciate the safety measures retailers have put in place, shows research from FMI. “That tells us grocers are implementing security in ways that are visible but not intrusive, and they’re doing it with clear communication and respectful engagement,” says Baker. “It’s not just about having cameras or gates; it’s about creating an environment where customers feel protected without feeling policed.”

incidences of guns being utilized, which is concerning from a safety perspective for employees and consumers,” he says.

Along with deploying security guards on-site, large chains in Canada such as Walmart and Loblaw are piloting bodyworn cameras on employees to help reduce violent incidents in-store. This past March, Loblaw announced plans to extend its bodycam pilot—first initiated in Alberta and Saskatchewan—to select stores in Ontario, British Columbia and Manitoba.

Loblaw noted the cameras will only be worn by trained asset protection representatives, third-part security, store management and additional team members where applicable. They will also be activated only when colleagues are faced with a situation where there is a risk of escalation and fear for one’s safety and/or the safety of others.

Overall, Rodrigues says retailers have reported significant de-escalation of threatening behaviour from consumers when they see themselves on a camera screen. “They either stop their behaviour or leave because they know they’re on camera,” he says, noting it is essential that people wearing the body cameras are trained in how to de-escalate risky situations.

Meanwhile, retailers in Australia are redesigning their entire stores and front-line

practices to help reduce the risk of violence to staff. This means ensuring stores are welllit, providing dedicated staff-only access routes that allow employees to move safely around the premises without dealing with customers, along with “safe” lockable back rooms and till cages in high-risk locations. Checkout barriers and signage setting clear behavioural expectations are also in use. Even small, well-placed interventions in-store are helping reduce confrontation and give staff a better sense of control and overall safety.

To curb grocery store violence going forward, Rodrigues advises grocers to report all incidents to police. “I think there is a misconception that there is no point in submitting a police report if there is no arrest or charge being laid, but it’s so important for intelligence gathering … and helping police know where they need to deploy officers,” he explains.

For smaller grocers with less budget for additional security measures, Rodrigues also advises asking local police for help on assessing their risk areas in and around stores and advice on how best to curb them. “All the police agencies I know of will come out and do this when they have time—and even talk to employees on site about safety measures,” he says. CG

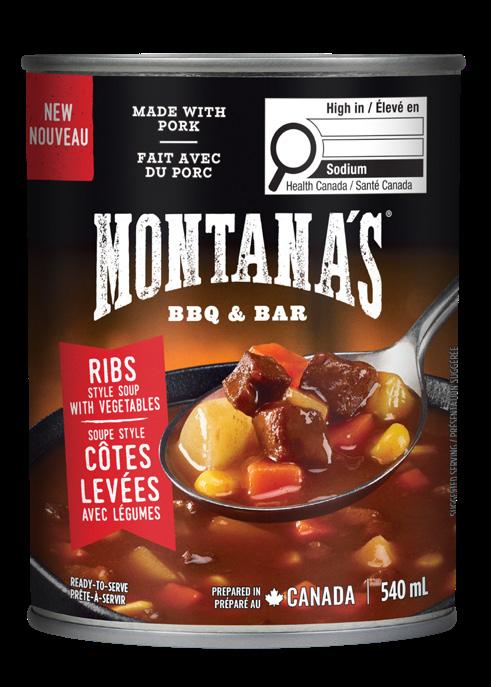

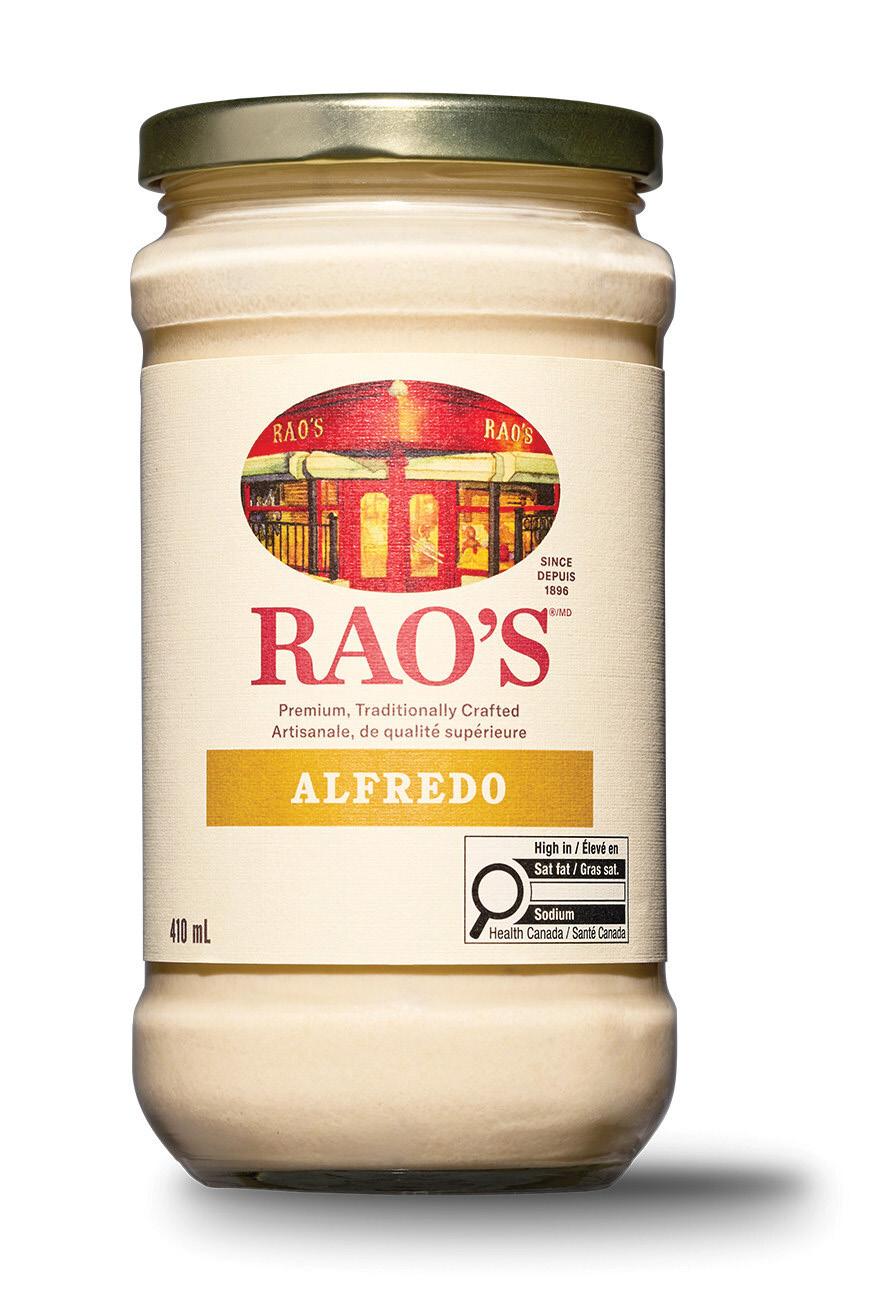

the power of private-label brands and how Metro hits the mark with consumers

By Rebecca Harris

Photography Chantale Lecours

Private label is on the rise as consumers seek value and quality—and grocers’ store brands are delivering. We spoke with Annie St-Laurent—a 20-year Metro veteran who has been leading the private brands team since May 2024—about new developments in the grocer’s portfolio and why it’s private label’s time to shine. This interview has been edited for clarity and length.

Tell us about your career path and how you came to Metro.

I started working for the grocery industry when I was a university student. Right after I finished, I was hired at Metro—and I’ve been with the company for more than 20 years now. My earlier roles were in replenishment and central procurement negotiation, but for the last 15 years, I’ve been with the private-label department. The interesting part is that it’s an area of constant innovation and learning, and one where we’re facing a lot of challenges. So, that’s what’s keeping me in that role—and I’m loving it a lot.

Just over a year into your position as vicepresident, private brands, what’s been the biggest success, and what have you learned?

There have been many successes during the last year for private label. All our banners have continued to grow their penetration rate for private label during the last year, so that’s a good success. We have built a strong plan for increasing visibility around all our private-label brands. One of the big successes that I’m really proud of is the launch of our new Irresistibles branding. It was also an interesting year in terms of challenges regarding new legislation around product [front-of-pack warning labels], but so far, that has permitted us to reposition our product and our brands. It has forced us to review our recipes, making sure they’re a little bit healthier for the customer, and making sure we have the right product and the right branding.

Private label has been growing for years, but some say private label is currently “having a moment.” Why do you think it’s private label’s time to shine?

One of the reasons why [our] private label is so popular is we’re always bringing value for customers. We have listened to their needs—and they want to have value. They want to have a great price, but the quality that we bring to our products and the variety of our assortment are key drivers. Yes, there’s always the national brands that bring familiarity, security and trust for customers, but I think private label now is also bringing excitement and innovation. This is another reason why private label is growing.

Can you share your overarching strategy for Metro’s privatelabel portfolio?

I want to bring sustainable growth to my banner. We need our brands and products to have a purpose. So, our goal in private label is always to bring a true differentiation for Metro around our family of brands. We have the Selection brand—this is a category where the customer wants to have the best value for the price. Our Irresistibles brand is for the food lover, with products like hors d’oeuvres and frozen fruit. If you’re a customer concerned with health and wellness, we have the LifeSmart brand, which is a better-for-you option— better for you and for the planet, too. In pharmacy, we have a strong brand with Personnelle, which offers health care and over-the-counter products that bring trust to customers. In terms of strategy, we need to be careful about what the customer needs and demands and play around with our product and portfolio to make sure we bring them exactly what they need. So, we’re always focusing on those priorities.

What was the thinking behind the rebrand of Irresistibles and what results have you seen so far?

Irresistibles was always a good brand for showcasing our innovation and our exciting products. Unfortunately for us, the brand was unknown on the market and was not highly visible on shelf. So, the objective behind the rebranding was to make sure customers can see, understand, recognize and repurchase the products. We did studies to see the impact of our branding on the market. I’m proud to say the parameters that we measure are positive in terms of the products being easier to recognize in the store and purchase intent has increased. The growth of that brand is stronger than the rest of our portfolio—it’s performing really well in the market and the customer knows the brand now.

What are your plans for the other private-label lines?

For our other lines, I have four initiatives. I won’t give you any secrets today about whether we’re rebranding the others. But, for sure my focus is on keeping fair pricing for all those brands, making sure each brand is still relevant for customers, and that all my products have the quality I promise in my assortment—and where there’s room to grow, adding assortment or innovation in some categories. This is where we’re going.

We haven’t communicated this much, but we also did a repositioning for LifeSmart during the last year that customers are starting to see now. We have made sure the promises of the brand are more perceptible for customers. We’ve changed the logo, we restructured the design and the brand promises are clearer. So, the organic [label] is not shy anymore in the packaging. You can see it big and bold—all the attributes of the brand.

On the product development front, what factors do you focus on to create a strong private-label product?

Because private label is only in our banners, we’re focusing on what products have a real interest for customers. We’re not going into the nitty gritty of specific trends. Our role is to make sure we focus on what the customer is really

interested in. We don’t need to be everywhere in every category. We need to be strategically well-defined in categories. For Selection, it’s everything related to family and economic essentials. For Irresistibles, it’s about excitement and festiveness but, behind it, we need to make sure it answers a customer need.

To identify those needs, we have a calendar of category reviews. So, we have identified priority categories we need to bring excitement to every year. I’ll give you the example of hors d’oeuvres. You cannot come into the Christmas season without new hors d’oeuvres—and there’s excitement around it. There’s also a growing population of new Canadians, so we need to be closer to them and make sure we answer their needs. That means looking at what ingredients are on trend—both for new Canadians and the entire population who are starting to use new ingredients and try something new.

How do you lead your team to deliver on your strategy?