TOGETHER FOR ONTARIO

We would like to thank all of our partners for helping make a difference in 2022. The work we do together does so much for the people throughout Ontario by building communities, creating jobs and supporting key provincial priorities. And it simply wouldn’t happen without you.

We look forward to the year ahead and the good we can continue

SELL MORE EARN MORE

Break the Bank Retailer Incentive is your chance to earn up to 2% more in commissions on INSTANT, REGIONAL games and ENCORE products.

From January 1 to April 1, 2023, OLG retailers have the chance to earn an additional 1% to 2% in commissions for INSTANT, REGIONAL Lotto and ENCORE games. No ballots. No draws. Simply sell more to earn more.

See your sell sheet or Sales Specialist for more details.

JANUARY / FEBRUARY 2023 CCentral.ca @CSNC_Octane PM42940023 $12.00 11 HOT TOPICS SHAPING 2023 ALL FIRED UP CANNABIS AND CONVENIENCE IN CONVERSATION WITH STÉPHANE TRUDEL, CEO OF FIRE & FLOWER IT’S TIME FOR YOUR ANNUAL RENEWAL Scan the QR code to confirm your subscription EXPERT TIPS TO UNLEASH THE POWER OF YOUR POS CASH CRUNCH: ARE ATMS WORTH THE INVESTMENT? COFFEE, YOUR SECRET WEAPON FOR GROWTH

GROW CONNECT DISCOVER / / BROUGHT TO YOU BY TORONTO MARCH 7 & 8, 2023 The International Centre REGISTER NOW! FREE trade show access use PROMO CODE CNUE23 ConvenienceU.ca Canada’s LARGEST convenience, gas and car wash industry event

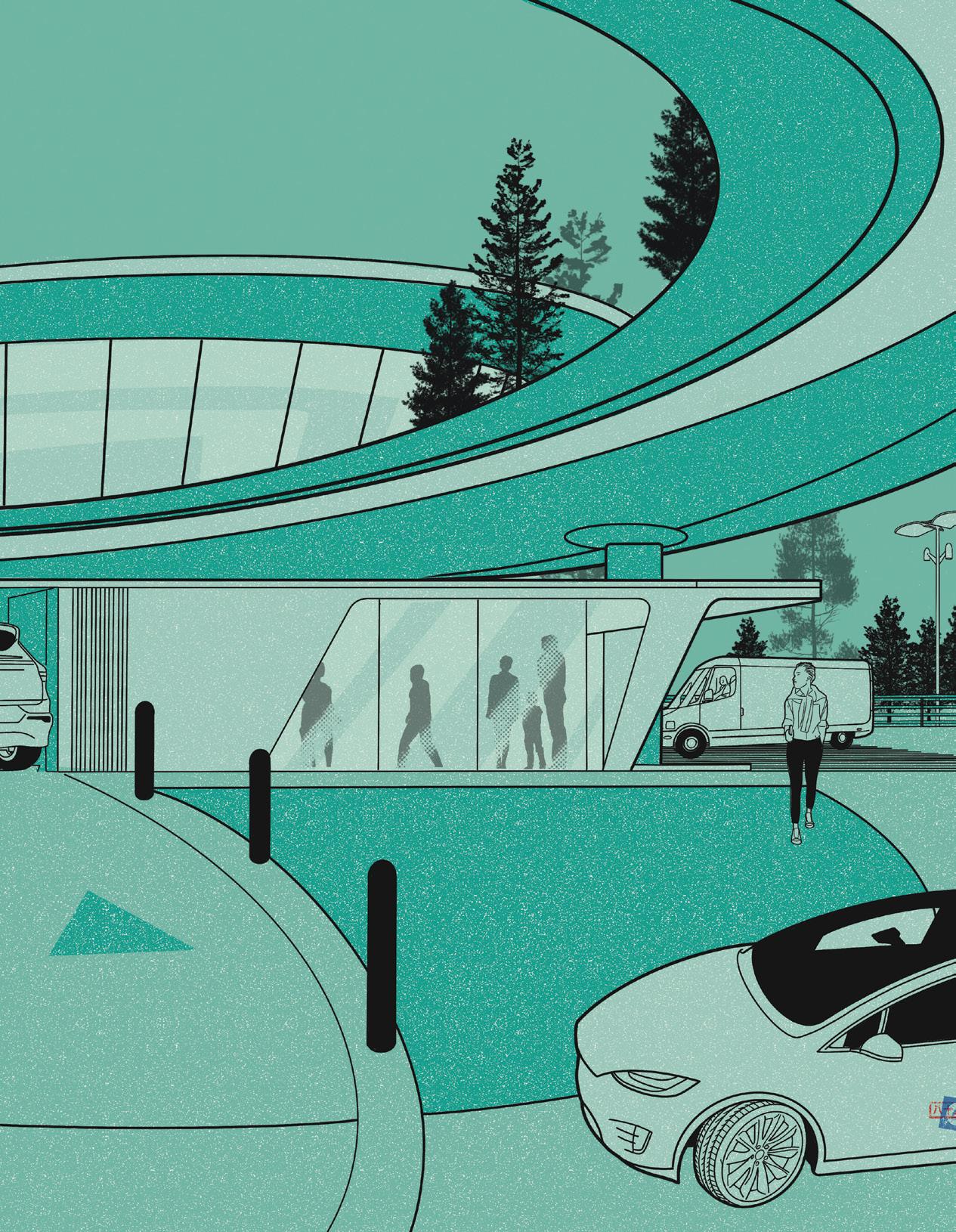

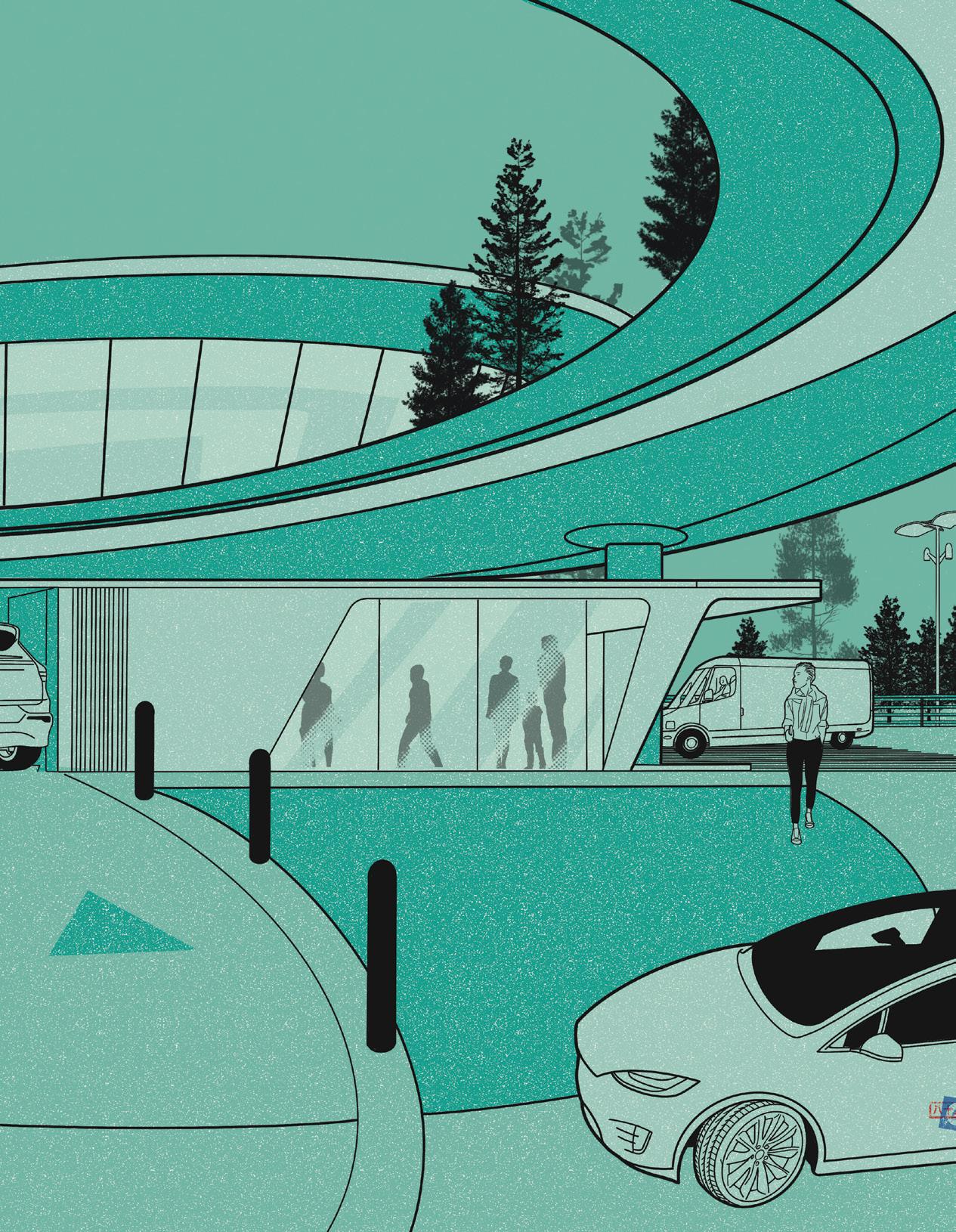

2023 TRENDS ISSUE

As products evolve and consumer demand grows, c-stores are stocking up

What’s In Store?

Banking on ATMs: Cash might not be king anymore, but in-store ATMs can still bring in a princely sum 20

2023 foodservice outlook: Kathy Perrotta of Ipsos Canada on where there’s opportunity for c-stores to grow

22 Backtalk

Cannabis and convenience: In conversation with Stéphane Trudel, CEO of Fire & Flower

CSNC EDITORIAL ADVISORY BOARD

Comprised of leading retail executives and convenience operators, this volunteer group of industry champions offer advice, key insights and on-the-ground perspectives that serve as an invaluable resource to ensure content is relevant and meets the needs of the industry.

Leslie Gordon, Circle K Marc Goodman, 7-Eleven Canada Wendy Kadlovski, Nicholby’s

Robbie Mulder, Little Short Stop Laurie & Randy Ure, Ure’s Country Kitchen Gino Vecia, Hasty Market

ALL

Delivered to your in-box every week

The latest industry news and information, plus resources, foodservice insights, store solutions, tobacco/vaping updates and more. Don’t miss out!

Sign up today at CCentral.ca/signup

Simply hover your phone’s camera over this code:

CCentral.ca Convenience Store News Canada January | February 2023 3

COVER PHOTO, DANIEL SKWARNA

CONVENIENCE E-NEWSLETTER

5 Editor’s Message Bring it on 6 The Buzz People, places, news and events 8 Top Ops Unleashing the power of POS: Experts share their best tips for making the most of your valuable technology 9 C-store IQ Resolution time: As consumers commit to a healthier year, are c-stores doing enough to support these efforts? 10 Quick Bites Perk up: Coffee is your secret weapon for foodservice recovery and growth CONTENTS JANUARY | FEBRUARY 2023 VOLUME 6 | NUMBER 1 12 Feature

hot topics and

convenience in

What’s on the horizon? Insiders share 11

trends expected to shape

2023 17 Category Check Booze control:

on non-alcoholic beverages 18

Snapshot

22

2023 Predictions & Trends

WHAT RETAIL CAN EXPECT TO SEE IN THE YEAR AHEAD...

With all of the noise surrounding the industry and consumer in 2022, where do we go from here? There have been bright spots of growth within the industry and not all categories have been similarly impacted by inflationary pressures. In 2023, my assumption is that we are in for more of the same in terms of consumer behavior and its impact on the general retail industry.

KEY TAKEAWAYS & 2023 PREDICTIONS:

The U.S. retail consumer’s wallet will continue to tighten in 2023, as student loan repayments, credit card debt and investment portfolios pull their share of attention and money away from retail.

Retailers and brands need to watch movements and behavior of high-income shoppers closely, as they may soon begin to feel the same effects that lower-income consumers felt this year.

New store concepts from retailers — both large and small — will focus on efforts to curate assortments for consumers and also provide better efficiency and in-store solutions. 2023 is certainly going to bring headwinds to the retail industry, and we will likely see new waves of consolidations, operational challenges and store closures.

2023 will prove to be the real test for both the consumer and the retail industry, which may be our indication of the shifting of the tides away from the consumerism of the pandemic into a more long-term pattern.

Elizabeth Lafontaine Chief Retail Analyst Retail Leader Pro

Visit RetailLeader.com/pro to start your 14-day, risk-free trial today and read the full report

20 Eglinton Ave. West, Suite 1800, Toronto, ON M4R 1K8

(416) 256-9908 | (877) 687-7321 | Fax (888) 889-9522 www.CCentral.ca

BRAND MANAGMENT

SENIOR VICE PRESIDENT, GROCERY AND CONVENIENCE, CANADA

Sandra Parente (416) 271-4706 sparente@ensembleiq.com

EDITORIAL

EDITOR & ASSOCIATE PUBLISHER, CSNC

Michelle Warren mwarren@ensembleiq.com

EDITOR, OCTANE

Mark Hacking mhacking@ensembleiq.com

ADVERTISING SALES AND BUSINESS

ASSOCIATE PUBLISHER

Elijah Hoffman (647) 339-9654 ehoffman@ensembleiq.com

ACCOUNT MANAGER

Jonathan Davis (705) 970-3670 jdavis@ensembleiq.com

SALES COORDINATOR

Juan Chacon jchacon@ensembleiq.com

DESIGN | PRODUCTION | MARKETING CREATIVE DIRECTOR

Nancy Peterman npeterman@ensembleiq.com

ART DIRECTOR

Jackie Shipley jshipley@ensembleiq.com

SENIOR PRODUCTION DIRECTOR

Michael Kimpton mkimpton@ensembleiq.com

MARKETING MANAGER

Jakob Wodnicki jwodnicki@ensembleiq.com

CORPORATE OFFICERS

CHIEF EXECUTIVE OFFICER Jennifer Litterick

CHIEF FINANCIAL OFFICER Jane Volland

CHIEF OPERATING OFFICER Derek Estey

CHIEF PEOPLE OFFICER Ann Jadown

EXECUTIVE VICE PRESIDENT, CONTENT & COMMUNICATIONS Joe Territo

SUBSCRIPTION SERVICES

Subscription Questions contactus@ccentral.ca

Subscriptions: Print $65.00 per year, 2 year $120.00, Digital $45.00 per year, 2 year $84.00, Outside Canada $100.00 per year, Single copy $12.00, Groups $46.00, Outside Canada Single copy $16.00.

Email: csnc@ccentral.ca

Phone: 1-877-687-7321, between 9 a.m. to 5 p.m. EST weekdays

Fax: 1-888-520-3608 | Online: www.ccentral.ca/subscribe

Convenience Store News Canada | Octane is published 6 times a year by Ensembleiq. Convenience Store News Canada | Octane is circulated to managers, buyers and professionals working in Canada’s convenience, gas and wash channel. Please direct inquiries to the editorial offices. Contributions of articles, photographs and industry information are welcome, but cannot be acknowledged or returned. ©2022 All rights reserved. No part of this publication may be reproduced in any form, including photocopying and electronic retrieval/retransmission, without the permission of the publisher.

Printed in Canada by Transcontinental Printing | PM42940023

CHANNEL ALLIANCES:

Bring it on

A year ago, I wrote about seven things convenience and gas needed to prosper in 2022 and beyond. As we move into 2023, the good news is the channel is making important strides advocating on several key issues, but the fact remains that we’re calling on regulators, policymakers and others to do more to ensure this essential industry thrives in the long term—beverage alcohol, credit card fees and contraband tobacco are top of mind.

With so much at stake and in play, operators and industry leaders tell us again and again they need information. The business—the world—is changing at such a rapid pace that it’s difficult to keep on top of it all, be it regulatory changes, macro-trends, new products, tech innovation, people on the move, evolving consumer behaviours and more.

That’s why our team’s resolution for 2023 is this: Do more to help inform and engage our readers and the convenience channel at every level.

What does that mean? Increasing timely news content at CCentral.ca, launching more e-newsletters, doubling the number of participants in the 2023 C-store IQ National Shopper Study (results in March) and providing more opportunities for the industry to come together to connect, learn and share best practices. And we’re just getting started.

First up, The Convenience U CARWACS Show March 7-8 will include a dynamic two-morning Conference designed to give attendees the big-picture information they need to make important decisions, as well as practical advice to position their businesses for success. The goal is to create a marquee event that offers value to the entire channel. Your feedback and ideas are shaping this evolution, so please reach out.

In 2023, we are also giving you more reasons to celebrate. In addition to the important Star Women in Convenience Awards, the CSNC Impact Awards will be back for a second year, shining a light on the good work being done across the industry.

Plus, I am thrilled to share plans for a new program: The Future Leaders in Convenience Awards will honour, support and inspire the next generation, while highlighting why this is an exciting industry in which to build a long and rewarding career.

Yes, 2023 will bring its own challenges, however, armed with the right information, there’s also plenty of opportunity. We’re kicking off our 2023 resolution with the annual Trends Issue, which zeroes in on 11 topics to have on your radar now (p. 12). And, speaking of long and rewarding careers, I am delighted to share my conversation with industry changemaker Stéphane Trudel (p. 22), who talks about embracing new opportunities and the convenience channel’s extraordinary resilience. CSNC

MICHELLE WARREN Editor & associate publisher

MICHELLE WARREN Editor & associate publisher

CCentral.ca Convenience Store News Canada January | February 2023 5

CCentral.ca E-newsletter CSNCOCTANE @CSNC_Octane standard no gradients watermark stacked logo (for sharing only) ConvenienceStoreNewsCanada BE A PART OF OUR COMMUNITY! EDITOR’S MESSAGE

THE BUZZ

CROSS-CANADA ROUND-UP / PEOPLE / PLACES / NEWS & EVENTS

Will you pass on a surcharge to customers who pay with a credit card?

4 5 % Yes

24% No

Do you pay most of your employees minimum wage or above?

17% Minimum wage 50% Minimum wage doesn’t cut it anymore –I pay more 33% A mixture, depending on seniority

Are you noticing an increased customer demand for cough and cold products?

Yes - items

READER POLLS NL $13.70 AB $15.00

Milking it

The Canadian Dairy Commission is increasing farm gate milk prices by about 2.2%, or just under two cents per litre, effective Feb. 1, 2023. The Crown corporation, which oversees Canada’s dairy supply management system, said the increase is based on the rising cost of production. This comes after the commission approved two price hikes in 2022: A 2.5% increase, or roughly two cents per litre, in September and an 8.4% increase, or six cents per litre, in February.

flying off the shelves FOODSERVICE FACT

NT $15.20

YT $15.70 SK $13.00 NB $13.75

PEI $13.70 BC $15.65

NU $16.00 ON $15.50

MB $13.50 NS $13.60

Between August 2021 and August 2022, a three-litre container of vegetable oil increased to $12.01 from $8.45 , a difference of $3.56, according to Statistics Canada.

Pumped for growth

BioSteel Sports Nutrition Inc. purchased Flow Beverage Corp.’s production facility in Verona, Va., while also entering into a co-manufacturing agreement. In a bid to meet growing demand, BioSteel will produce Flow’s portfolio of branded water, as well as its own BioSteelbranded sports hydration drinks. Both product lines are served in environmentally friendly Tetra Paks.

Single-use plastics update

Canada’s ban on six categories of single-used plastics is significant for c-stores. First up, as of Dec. 20, 2022, the manufacture and import for sale of bags, cutlery, foodservice ware, stir sticks and straws are prohibited. The time is now to source alternative products, as the ban will roll out in phases as part of the Government of Canada’s goal of meeting its target of zero plastic waste by 2030.

CCentral.ca January | February 2023 Convenience Store News Canada 6 SHUTTERSTOCK

31% Undecided QC $14.25

100%

are

Tania Antonas is now national account executive at The Coca-Cola Company. She joined in 2016 as a regional account manager, then moving into the role of sales analyst. Antonas has also held sales roles at Blue Buffalo Co., Naursource and Bolthouse Farms.

Larry Colatosti joins the Adapt Media team as business development executive. Colatosti has a strong retail record, having spent more than 37 years in senior management roles with OLG and Coca-Cola.

Bryan Gray is now director of network development –Western Canada at Alimentation Couche-Tard. He will oversee mergers & acquisitions, construction, facilities and franchise. Gray joined the c-store giant in 2015 as market manager and has held several increasingly senior roles, most recently as director of operations.

Ron Hyson joins MacEwen as senior vice-president operators, retail. He comes from Giant Tiger, where he spent the last seven years, most recently as SVP and chief purchasing officer grocery for the Canadian retailer. Hyson has deep experience in retail and food/ beverage, as well as HR and supply chain operations.

Ana Luiza Rangel is promoted to senior brand manager - innovation & foodservice at Conagra Brands. The 2022 Star Women in Convenience winner joined the company in 2020, as senior brand manager, snacks. In her new role, Rangel is marketing lead for innovation in the frozen and foodservice portfolio. She has held a number of marketing positions with high-profile CPG companies, including Kruger and Hershey.

Ian White is president of Parkland Canada. The industry leader takes over from Donna Sanker, who now heads Parkland USA. As SVP of strategic marketing and innovation, White oversaw the integration of several acquisitions, the launch of Journie Rewards, expansion of On the Run and the M&M Food Market business.

Star Women in Convenience 2023

NOMINATIONS OPEN JANUARY 30!

Be a part of the excitement: StarWomenConvenience.ca

New year, new venue

The Convenience U CARWACS Show is moving back to March in 2023! Note, the new venue: This year the show will take place at The International Centre, 6900 Airport Rd. in Mississauga, Ont.

WE LOOK FORWARD TO SEEING YOU MARCH 7-8

ONLINE EXCLUSIVES

10 HEADLINES YOU DON’T WANT TO MISS!

1. Is violent theft on the rise at c-stores across Canada?

2. B.C. retailers demand government take action against contraband tobacco

3. 7-Eleven kicks off plans to serve beverage alcohol in Ontario

4. CICC Connects: Full-court press on credit card fees

5. MacEwen to rebrand c-store business under Quickie banner

6. Shell Canada purchases 56 retail gas sites from Sobeys’ parent company

7. Suncor to keep Petro-Canada retail business

8. Parkland to double size of announced EV charging network in Western Canada

9. C-stores must prioritize cyber security: Here’s how

SAVE THE DATE

The Convenience U CARWACS Show

March 7-8, 2023 International Centre ConvenienceU.ca

2023 CEMA Conference

April 17-19, 2023 Toronto CEMAssociation.com

Sweets & Snacks Expo

May 22-25, 2023 Chicago

SweetsandSnacks.com

10. ‘Tis the season to highlight the cough and cold category: 7 strategies

To stay up to date on the latest news and trends, get the All Convenience e-newsletter delivered to your in-box every Wednesday: CCentral.ca/signup

CCentral.ca Convenience Store News Canada January | February 2023 7

MOVING ON UP

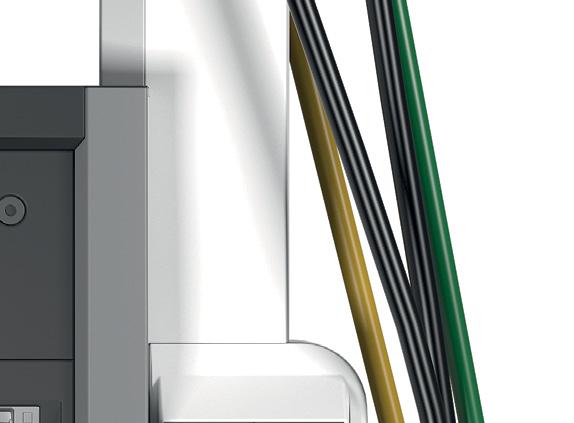

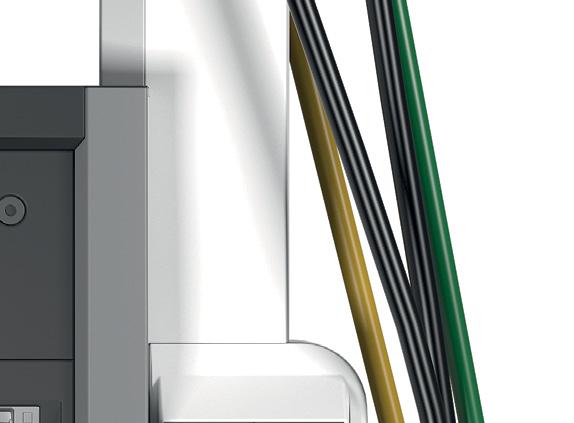

Unleash the power of POS

Experts share their best tips for making the most of your valuable technology

“Work smarter, not harder,” says Shawn Cunningham, solutions specialist & business development, SIR Solutions. “Nowhere is that more necessary than in convenience stores.” It’s a timely reminder how point-ofsale (POS) systems can do more of the heavy lifting in day-to-day c-store operations.

Unfortunately, POS technology isn’t used to its full potential. “Shortcuts are taken to save precious time instead of being invested into learning and taking advantage of the functionality and automation POS can provide,” he explains. “Doing so would eventually decrease the overall work needing to be done and lead to much tighter controls of profits and margins.”

There’s a tendency to use only the POS software features operators know or need, while overlooking others that could be useful, including entering accurate costing, linking like-items together to update prices in batches (as opposed to individually), or even tracking slow-moving stock to ensure there’s no dead weight on the shelves.

“These things are relatively easy to implement and directly impact a store’s bottom line, giving visibility on real profit margins, weeding out underperforming stock and saving time completing tedious tasks,” he says. “Reports, such as sales by shelf location or by department, can provide insights on what kinds of products are selling and how physical location can affect their movement.”

Those reports can help grow business. “The more accurate the margins are, the more you get a real idea of how well the store is performing,” says Cunningham. Replenishment and forecasting tools can also make the ordering and inventory process smoother. “Using the system’s intelligence can go a long way in streamlining many operations

and can even combat turnover since the POS can make it relatively easy to train new employees,” he adds.

Reduce operating costs

It’s useful for c-store operators to shift their mindset. “A common mistake is that retailers view the POS as an expense, rather than technology to add value and help their business,” says Kevin Wang, operations manager, Wiz-Tec Computing Technologies Inc. “When looking for a new POS system, many retailers just look for one with the lowest cost.”

Keep in mind a good POS, combined with good scheduling, can reduce operating costs substantially. Time and labour are much more expensive than a POS system.

He notes that operators may need to change their POS if they see long lineups, increased cashier errors and procedures not being followed. Or, if they’re having to create complex workflows for simple tasks and spending a lot of time on paperwork. The key is to identify and understand the tools important to your business.

Training is essential

Wang also advises retailers to make sure their staff are properly trained on procedures and use of the POS. “That should make it easier to do things the right way instead of cutting corners,” he says. “Well-trained staff will

increase throughput, reduce errors and loss, and will save time and work in the long run.”

Make the most out of each software’s different strengths. Wiz-Tec’s iPOS system prioritizes simplicity, speed and reliability. “Our industry is gas station c-stores and high-volume stores where the most consistent way to boost business and improve customer experience is to increase throughput,” explains Wang. “It isn’t a flashy feature, but a fast, accurate checkout process is tremendously valuable.”

When it comes to the data collected by POS systems, he feels an inventory movement report, which helps identify popular products, is one of the most useful. Daily balancing helps manage cash and high-risk items (like tobacco and fuel) and helps flag theft.

Experts agree operators should collaborate with POS providers to get deeper training on the software. “Some operators have an incredible understanding of the features available,” says Lee Barter, senior vice-president, InfoNet Technology Corporation. “Unfortunately, many operators have not fully embraced the capabilities their POS/back-office system offers. Much of this is due to not having proper training.”

InfoNet Technology offers online one-on-one training, 24/7 technical support and other resources to help its customers best operate their locations.

Capitalize on under-used features like inventory management, promotions management and customer account management, advises Barter. “Operators can grow their business through sales reporting, which offers details by day, time, shift, margin, department, SKU, etc. and will show the best and most profitable sellers.”

To reap the benefits, tap into the expertise of POS providers and get that tech working for you to the max. CSNC

CCentral.ca January | February 2023 Convenience Store News Canada 8 SHUTTERSTOCK.COM TOP OPS BY MICHELE SPONAGLE

RESOLUTION TIME

As consumers commit to a healthier year, are c-stores doing enough to support those efforts?

BY MICHELLE WARREN

Close to seven-in-ten (68%) convenience store shoppers consider themselves ‘healthconscious’—however most (83%), say there is definite room for improvement in the selection of healthy foods offered at convenience stores. The conundrum? Shoppers are split on willingness to pay more for better-for-you foods at convenience stores, according to the 2022 C-store IQ National Shopper Study (the 2023 study will be released in March, with an exclusive preview at The Convenience U CARWACS Show March 7, 2023).

What are health-conscious shoppers looking for? Fresh tops the list, but at least onethird are also interested in non-processed products.

52%

68% 18% Extremely/very satisfied 48% Somewhat satisfied 35% Not very/not at all satisfied No 48% Yes

Willingness to pay more for healthy / better-for-you foods at convenience stores

Satisfaction with selection of healthy / better-for-you foods at convenience stores

% Indicating concern or interest in health-related aspect concern

FRESH NON-PROCESSED ALL-NATURAL SUGAR CALORIES PROTEIN

75 % could be motivated to switch c-stores based on sustainability efforts

INGREDIENTS I CAN UNDERSTAND AND PRONOUNCE NON-GMO LOCALY SOURCED / PRODUCED SODIUM FAT CARBOHYDRATES ARTIFICIAL SWEETENERS VEGAN/PLANT-BASED ARTIFICIAL FLAVOURS FUNCTIONAL/VITAMIN-ENHANCED GROWTH HORMONES ANTIBOTIOTICS HIGH LEVELS OF CAFFEINE GLUTEN

92% of c-store shoppers purchase locallyproduced products at least sometimes

Significant increase / decrease vs. pre-pandemic

CCentral.ca Convenience Store News Canada January | February 2023 9

SHUTTERSTOCK.COM

47% 35% 31% 29% 26% 25% 23% 20% 18% 15% 13% 10% 9% 9% 9% 7% 6% 5% 4% 19% 27% 25% 21% 26% 21% 15% 12% 13% 12% 8%

Of shoppers agree with the statement, “I am health-conscious”

QUICK BITES BY

Perk up

DARREN CLIMANS

The great foodservice recovery is an unprecedented opportunity for c-stores to add customers and increase penetration of the away-from-home foodservice market.

Coffee is the key

Data of any kind reflects reality as seen through a rear-view mirror. Numbers are historical, a record of how you got to where you are. COVID health data was the exception. Its importance demanded more. Multiple provincial and international websites responded with near real-time data on daily/cumulative cases, test-positivity, vaccinations, and more.

Understanding the true impact of the pandemic on the food industry at large, however, has taken a while longer. Restaurants Canada (RC) only recently published the 2022 update of its Foodservice Facts report, which highlights shifts in consumer behaviour and details progress in the ongoing recovery.

• THE BAD: After significant contraction in 2020/2021, foodservice sales are projected to have returned to pre-pandemic levels in 2022; however, adjusted for inflation, real sales in 2022 will be 11.0% below 2019 results.

• THE LESS BAD: Retail foodservice, which includes c-stores, department stores, and other retail establishments, recovered nominally by 2021, reflecting shifting consumer behaviour, combined with sector resilience.

• THE NEW NORMAL: Remote and hybrid work continue to have an impact on consumer behaviour. Reduced commuting has translated into fewer away-from-home (AFH) meal occasions, however “Canadians’ love of coffee has resulted in a slightly quicker recovery in morning traffic.”

If history repeats itself

Beyond the psychological shock of the World Trade Centre attacks on 9/11,

the event sparked an unprecedented short-term curtailment of travel, which signaled the beginning of a significant global recession and a world forever changed.

One unexpected phenomenon was that, in Q4-01, the immediate aftermath, limited-serve restaurants (LSR) grew faster than full-serve restaurants (FSR). In fact, some of the big QSR chains reported improvement in their performance year over year. I recall that the head of a major foodservice supplier organization looked at this trend, which I had flagged at the time, and was nonplussed: “Makes sense. I’ve seen this before. Consumers will trade down, before they step away from foodservice entirely.”

RC suggests, in Foodservice Facts 2022, that a similar phenomenon may occur in 2023 as a response to the forces of inflation/recession. Rising menu prices, putting pressure on cashstarved consumers, will possibly impact spending through selective AFH meal skipping, downsizing of meals and consumers searching for a deal.

Never waste a crisis

Winston Churchill famously said, “Never let a good crisis go to waste.” The great foodservice recovery represents an unprecedented opportunity for c-stores to add customers and increase penetration of the AFH foodservice market. And coffee is the key.

Canadians love coffee. Hot coffee is by far the number one beverage purchased AFH. Add in chilled/ frozen coffee and nearly two-thirds of consumers are in play. While the foodservice industry lost about 700

reports The NPD Group, the category rebounded as consumers returned to worksites, schools, and other outside activities.

In the 12 months ending July 2022, more than 2 billion coffee servings were ordered AHF, up 13% from a year ago. However, even with the double-digit increase, restaurant coffee servings are down 15% from three years ago, before the pandemic. Hot specialty coffee, like lattes, had the most substantial growth, up 16%, traditional or regular coffee servings increased by 14%, and servings of iced, frozen or slushy coffee rose by 7% from a year ago.

“As more consumers return to their pre-pandemic routines, foodservice coffee will somewhat recover from the steep declines experienced during the lockdowns,” says Vince Sgabellone, NPD foodservice industry analyst. “Restaurants do face competition from at-home coffee appliances and the coffee-making expertise consumers learned while in lockdown, but their competitive edge is offering the convenience of a great cup of coffee when we’re on the go.”

For a channel defined by the word convenience, here lies the opportunity. Capturing drive-through coffee consumption as workers resume their commute, and/or offering a convenient source of caffeine (in-store or delivery) for them when they’re working from home, could be a significant pick-me-up for your c-store business.

Global learnings

Research provider Intouch Insight recently published results of a study of convenience store consumers across the U.S., which concluded that c-stores are well positioned to compete with both limited-serve restaurants and coffee shops.

In 2022, 88% of coffee drinkers surveyed reported having purchased

CCentral.ca January | February 2023 Convenience Store News Canada 10 SHUTTERSTOCK.COM

94 % 91% 94 % 55 %

WAS THE COFFEE AREA CLEAN?

coffee from a convenience store and, of those who purchased, 96% said they would again.

Quality content

When it comes to coffee, Canadian consumers have high expectations and c-stores are taking note: Gone are the days of a pot turning to tar as it percolates all day. New equipment and quality beans are helping c-store and c-gas operators raise the bar and meet growing demand for a premium pick-me-up.

For instance, the latest automatic machines from the likes of Bunn, Franke and Keurig, feature easyto-use touch technologies that do everything from grind beans fresh for every cup, to creating an array of gourmet offerings, including espressos, lattes, cappuccinos and more.

Commercial machines can serve a cup of premium java in as little as 30 seconds: Baristas beware.

Price point

The tipping point increasingly will be price. The assault by McDonald’s and A&W on Tim Hortons’ large morning day-part business centres on stimulating trial through dramatic and repeated $1 coffee promotions. Quality and convenience being equal, decisions come down to price. C-stores offer a favourable value-equation compared to specialty coffee shops and most QSR chains.

The lipstick effect

Lipstick, like coffee, is a consumer staple. During the Great Depression, between 1929 to 1933, U.S. industrial output was cut in half. However, over the same period, cosmetics sales increased. The phenomenon is not just true of the U.S. The same effect has been seen consistently over the last century around the globe. During different periods of economic challenge, big-ticket discretionary purchases

25 %

WAS ALL COFFEE EQUIPMENT OPERATIONAL?

WERE ALL TYPES OF COFFEE DISPLAYED AVAILABLE FOR PURCHASE?

Convenience store scorecard

WERE THERE MILK ALTERNATIVES?

Source: Intouch Insight

OF FOODSERVICE COFFEE IS CONSUMED AT HOME

33 % IS CONSUMED IN THE CAR

Source: The NPD Group

pull back. But spending on smaller indulgences tends to remain stable or even increase. True to the trend, with inflation reaching generational heights in the second quarter of 2022, “lipstick sales revenue (in the U.S.) increased by an impressive 28%.”

My advice would be to lean hard into the current economic headwinds. Respond to pervasive consumer uncertainty by executing on coffee in a way that only c-stores can—offering a place, price, and product that will draw consumer expenditures away from competitors and put wind in your sails. CSNC

43%

OF THOSE WHO WON’T PURCHASE C-STORE COFFEE AGAIN SAY POOR TASTE WAS THE #1 REASON

CCentral.ca Convenience Store News Canada January | February 2023 11 SHUTTERSTOCK.COM

Average cheque size per person in Canada 2019 2020 2021 AVERAGE JAN-APR 2022 QUICK-SERVICE RESTAURANTS $6.13 $6.43 $6.65 $6.78 MIDSCALE DINING $13.13 $13.39 $13.76 $14.57 CASUAL DINING $18.56 $18.86 $19.36 $20.01 FINE DINING $44.85 $46.06 $46.08 $52.39 RETAIL FOODSERVICE $5.15 $5.27 $5.41 $5.55 TOTAL FOODSERVICE $8.29 $8.00 $8.38 $8.78

WHAT’S ON THE HORIZON?

Insiders share 11 hot topics and trends expected to shape convenience in 2023

BY CHRIS DANIELS

BY CHRIS DANIELS

Like all retailers, the convenience store has been impacted by rapid change, from what customers expect from the experience to technological advances. Keeping a pulse on the trends, and acting on the opportunities and challenges they create, is what helps a c-store business keep relevant and moving in the right direction.

With that in mind, CSNC spoke to industry experts and consultants, c-store owners and executives, and pored over the latest research and news. Those sources helped curate our list of the top 11 topics and trends that will likely shape, impact and define convenience in 2023.

CCentral.ca January | February 2023 Convenience Store News Canada 12 FEATURE

1

‘Quick quality’ in foodservice

According to global market intelligence firm Innova Market Insights, the appetite is rising for quick better-for-you meals, snacks and beverages. Its 2023 Trends Survey found two out of three global consumers agree that they are “looking for simple and convenient ways to ensure my daily nutrients intake.” (The survey included respondents from Canada.)

“Culinary creativity blossomed during the pandemic and now needs to come with added convenience to meet busier routines,” says Innova, which has identified “Quick Quality” as one of its top 10 food trends for 2023.

Convenience chains are looking to keep their profile growing as a destination for healthier foods. Especially given partnerships, like between QSR banner Freshii and Parkland’s On the Run, 7-Eleven Canada, Suncor and Shell, have proven fruitful. Freshii reported a 33% increase in its consumer-packaged goods business (largely through the convenience channel) in Q3 2022 versus Q3 2021, led by its elixir, or superfood beverage shots. Their sales spiked 68% during the same period!

2

Heightened price-sensitivity

During the pandemic, people didn’t like the idea of going into a potentially crowded grocery store to pick up a few necessities. And c-stores jumped on the opportunity, carrying staples like milk and bread (sometimes at a higher price point than most grocers) for that convenience and peace of mind. But the economy is changing behaviours. Consumers are now more willing to jump from store to store to get the lowest price on items.

Even as inflation has led to price increases over the past few months, “I see retail getting more aggressive on price in 2023,” says Bruce Winder, retail analyst and author of Retail Before, During & After COVID-19. “People are going to cherry pick and be more reluctant to buy at regular price.”

3

Subscriptions to supercharge loyalty

“2023 will bring a host of new subscriptions from convenience stores looking to engage customers and differentiate their brands,” predicts Jeff Hoover, director of strategy and data insights at Paytronix, a software-as-a-service customer experience management solutions provider.

“Customers accustomed to paying this way for everything from groceries to pet supplies see subscriptions as a source

of value, while speeding up service,” notes Hoover. “And the convenience industry has seen the spike in recurring digital revenues that subscription offerings provide to convenience store loyalty programs.”

Couche-Tard’s Circle K expanded its car wash subscription product to Canadian loyalty app users in 2021. It also has a monthly Sip & Save beverage subscription offering.

In Alimentation Couche-Tard’s Q2 2023 earnings call on Nov. 23, 2022, Brian Hannasch, president and CEO for the global c-store giant, highlighted its subscription products amid an increasingly price-sensitive consumer mindset.

“Our Sip & Save beverage subscription program continues to drive trips, enhance basket, and attract new users while providing great value,” said Hannasch. “With the ongoing inflationary pressures, more than 420,000 subscribers are seeking deals and see the good value offer in Sip & Save.”

4Price increases, more warnings on age-restricted products

New regulations have arrived on vaping products. As of January 1, 2023, vaping products can only be sold in Canada that have paid an excise duty (and marked as such with an excise stamp). This has increased their cost.

Further changes are expected to Canada’s vaping laws and regulations, says Jeff Brownlee, vice-president communications and stakeholder relations for the Convenience Industry Council of Canada. “For 2023, Health Canada is likely to advance new regulations on vaping product manufacturers that would require more frequent sales reporting to the Government of Canada, along with the identification of ingredients in these products.”

In addition, the convenience channel is keeping a close eye on developing flavour bans and restrictions on vape products: Of Canada’s 13 provincial and territorial governments, six have adopted legislation or regulations to ban the sale of any e-cigarette liquid other than tobacco flavour, including Nova Scotia, Prince Edward Island, New Brunswick, Yukon, Northwest Territories and Nunavut. British Columbia, Ontario and Saskatchewan have adopted regulations to restrict the sale of flavoured vaping liquids to specialty vape shops where children are not permitted to enter. There are no restrictions in Manitoba, Quebec, Newfoundland and Labrador or Alberta.

In what would be a first worldwide, Canada is also proposing health warnings be printed on individual tobacco products, including cigarettes, rather than just on-package. The new regulation would likely take effect in the latter half of 2023.

“In Canada, non-illicit tobacco is seriously declining,” says Eli Mail, a retail consultant and convenience store expert who was Parkland’s VP, merchandising and store design from 2019 until March 2022. “A continued focus on growing categories outside of tobacco will be important for the industry.”

CCentral.ca Convenience Store News Canada January | February 2023 13

5

Continued experimentation at checkout

According to a recent projection from Global Payments Report, cash will account for just 3% of all point-of-sale transactions in Canada by 2025. That makes mobile and digital wallets and automated app payments a huge market.

Innovative payment solutions continue to be experimented with at retail. After being tested in Amazon Go convenience stores, the retail giant’s Amazon One quick palm-waving checkout device recently expanded to 16 Whole Foods locations in the Dallas area.

By linking their palm print on the device to their credit or debit card, customers can pay for purchases by simply hovering their hand over the device. It remains to be seen, however, if biometric payments will be adopted by consumers given their perceived privacy risks.

Labour changes amid ongoing staffing woes

According to the Labour Force Survey and the Vacancy and Wage Survey, Canada’s unemployment-to-job vacancy ratio is at an all-time low of 1.4 unemployed persons per job vacancy.

“Hiring will continue to be a challenge in 2023,” predicts Alison Manning, Parkland’s VP, people and culture, Canada. “Retailers have had to get creative on their offerings with increased wages, provide signing and retention bonuses, and provide flexible hours in order to attract and retain employees.”

And that is not just for store managers. That creativity needs to extend to junior hires. While signing bonuses are not a norm, “small retention bonuses and wage increases are what we are seeing for c-store staff,” adds Manning.

However, there is some respite for stores whose staffing pool includes international students. Canada has lifted the 20-hour per week cap on the number of hours that international students can work off-campus while class is in session “to address current labour needs.” The lift is temporary: until Dec. 31, 2023.

7

Building out a sustainability story

As c-stores with a legacy attachment to gas slowly shift to electric vehicle chargers and add more foodservice, consumers are going to be expecting to hear from them on their ESG platforms, says Marty Weintraub, national retail leader at Deloitte Canada, whose clients include c-store chains. “There had been a legacy cloud over the sector, and so they have been later to the game on ESG,” says Weintraub. “But there has been an acknowledgment within the sector that has to change.”

He notes, for instance, chains will want to communicate about what they’re doing with waste from foodservice. Its research shows 72% of Canadians prefer to shop at food retailers with strong sustainability or ethical practices. 8

A lean into localization

Single and two c-store operators typically rely on the loyalty of regular customers to keep competitive with larger players. However, the behaviour of even their most loyal customers could change because of the economy, especially if Canada enters a recession.

“Customers may go to the bigger chain stores for lower prices in order to save a few bucks,” says Jehvaughn Cente, owner

CCentral.ca

6

TOBACCO ADVERTISING IS NOT AVAILABLE IN THE DIGITAL ISSUE

at Jayy’s Cheers Convenience, which has two locations in the Greater Toronto Area.

Independents can’t—and shouldn’t try—to beat them at the pricing game. “Bigger chain stores compete by offering lower prices due to their large buying power,” he says. “To keep up, independent c-store owners will have to be resilient by maintaining the sense of community around their local area.”

One way to do that: include grab-and-go products that appeal specifically to the neighbourhood and its residents. “I think it will become even more important for stores to show the local customer that they understand them with product assortment,” says Mail.

He expects the big chains to also try and make this play. But as the consultant and former Parkland executive notes, “to localize one or two stores as an independent owner is easy. But trying to localize product assortment across 700 stores? That is very difficult.”

9

Private label boom

“Whether it’s Parkland, Couche-Tard or 7-Eleven, I expect we will see a lot more activity on private label,” says Mail.

When he left Parkland in March 2022, it had launched about 72 private label SKUs. “It was definitely something the company had been putting a lot of energy in.”

That makes sense given the success grocers have had with private label, not to mention their popularity during tougher economic times. When U.S. consumers were asked in a Statista study why they switched from a national brand to a private label brand in January 2022, almost 90% said it was because of better value.

Hannasch told investors. “And so, you are seeing—and should see—fewer promotions, but more effective promotions, which should result in both higher sales and higher margin over time.”

Managing supply issues with mindful stocking

Supply issues remain an issue for Canadian retailers. Serge Nadeau, VP projects and development, Groupe Beaudry, says c-store operators need to stock their stores with care to avoid disappointing customers if their favourite products are not available. He also notes that convenience stores will have to work harder at getting small-size items because suppliers are currently focused on regular and larger family sizes for their grocery channels. “It’s important to offer smaller sizes in some categories to provide customers with alternatives,” explains Nadeau.

Strides with data

C-store chains are gleaning tons of customer data, including from transactions and loyalty programs. But they haven’t used the data to glean insights as much as they would no doubt have liked.

In Couche-Tard’s Q3 2023 earnings call, Hannasch said the company had a tough time retaining data scientists, especially domestically, creating a headwind on its path to data-informed decision making. However, he said “we’ve set up an office in India, and we’ve been very pleased with the talent we’ve been able to source.”

One order of business: optimize promotional activity. “It’s really using data to drive our discipline to what promotions really make a difference and which ones are noise,”

The challenge for c-stores is avoiding price increases for products. It may be difficult when confronted with higher salaries, labour issues and elevated distribution costs because of fuel costs, but Nadeau points out that operators need to fight the perception that items purchased at convenience stores are more expensive. Some data shows 75% of customers hold that belief.

Nadeau is hopeful that 2023 will see an easing of supply chain issues for c-stores, but he cautions retailers will need to forecast their sales efficiently to avoid extra deliveries from providers and wholesalers. He predicts that the hot products for c-stores will be fresh food (including fruits and vegetables), beverages and foodservice items (especially ready-to-serve), while the demand for commodity products (soup, condiments and cookies, etc.) will ease. CSNC

CCentral.ca Convenience Store News Canada January | February 2023 15

10

11

Creativity needs to extend to junior hires. While signing bonuses are not a norm, “small retention bonuses and wage increases are what we are seeing for c-store staff”

-Alison Manning, Parkland

TOBACCO ADVERTISING IS NOT AVAILABLE IN THE DIGITAL ISSUE

Booze control

As products evolve and consumer demand grows, c-stores are stocking up on non-alcoholic beverages

Think mocktails, craft beer, seltzers and wine–flavourful sips without the booze. The non-alcoholic beverage category is reaching new heights with impressive growth of more than 500% since 2015, according to Nielsen data. U.S. figures peg annual growth at 7.1%. With numbers like that, convenience stores have taken notice and are stocking up.

Though the non-alcoholic beverage category isn’t new, it is having its moment now. And, with Dry January and Dry February on the horizon, it’s the perfect time to make a splash.

James Rolph, director, Canada convenience retail, Parkland, says several factors could be linked to the growing demand, including an increased focus on health, both mental and physical, among consumers. “While non-alcoholic beverages have been around for ages and historically purchased by designated drivers or pregnant consumers, we’re now seeing consumers be more critical about what they put into their bodies,” he explains. “For those who are more healthconscious but enjoy the taste of certain beverages, these products are generally low in sugar and calories, and of course, little-to-no alcohol content.”

Beverages with no/low alcohol are not a category traditionally sold in Parkland stores (including On the Run and The Corner Store), but it’s one its consumers are noticing more, thanks to significant investment in innovative products from well-known names and new entrants. “The quality of what’s being produced has also made leaps over the past few years, which makes it an even more enticing offer for our customers,” says Rolph.

To navigate the waters in nonalcoholic beverage sales, Parkland took a test-and-learn approach to gauge interest. “As with most new categories,

it was critical we launched with effectively-placed floor displayers with clear messaging and attractive price points,” he explains. “Our strategic approach encouraged trial and subsequently led to repeat purchases.”

In its stores, Parkland has noticed that many customers are very surprised at how the taste profile is nearly identical to a traditional alcoholic beverage once they sample one. “Consumers love choice and innovation, both of which the convenience industry and our stores offer, across the board,” he says.

That explains why Parkland is optimistic about the category, which “continues to evolve, and quickly.” Rolph admits options were previously very limited and rarely offered in convenience, but feels there is a high ceiling for non-alcoholic beverage sales.

David Thompson, president & cofounder, Clearsips, sees non-alcoholic choices as a good fit for c-stores as consumers look beyond pop, juice and water. The company, which started in May 2022, has become a leading distributor, importer and retailer specializing in non-alcoholic beverages. “C-stores are interested in new trends and revenue streams and they look to meet the evolving needs of their customers,” says Thompson.

He suggests that c-stores put nonalcoholic beverages together in a clearly labelled display area. “Non-alcoholic white wines, beers and ready-to-drink cocktails are best served cold, so having these items refrigerated could make them more appealing to c-store consumers as a grab-and-go option.”

He notes that the biggest consideration for non-alcoholic beverages in c-stores is the format. “We recommend looking at singleserve, ready-to-drink non-alcoholic beers, premixed cocktails and wines.

At Clearsips, we work with grocers, restaurants and retailers to wholesale a wide range of high-quality, alcoholfree products. Together we find the right NA beverages for their set-up and customers.”

Peter Neal, president, Neal Brothers, says his company launched a nonalcoholic beer last year after seeing its popularity grow rapidly in Europe. “We felt confident the same trend would continue in North America,” he explains. “We also had access to a partner who could produce a much better product than what was currently in the market. Our beer is brewed with alcohol in the same way a 5% beer would be brewed. The alcohol molecules are then removed in a patented process leaving a richer and truer full beer flavour.”

He points out that non-alcoholic beer consumption in Canada is currently less than 3% of the total beer market. Consumption rates in Europe are four to five times that amount. “With Health Canada recently labelling alcohol as a Class A carcinogen, I think this trend will rise sharply in the coming years,” Neal notes.

Though Neal Bros. Lagers are not available in convenience stores, he recognizes the suitability of products like them in c-stores “where consumers can get in and out quickly as opposed to walking a big store and digging around for a specific item.”

To maximize sales, no-alcohol beverages should be located close to other similarly consumed items— snacks is a logical move—and be offered in a standalone display, like a rotating shelving unit or cabinet with higher-end and unique beer-related snacks.

As Parkland’s Rolph says, “We’re excited to see where the no-alcohol beverage category goes.” CSNC

CCentral.ca Convenience Store News Canada January | February 2023 17 SHUTTERSTOCK.COM CATEGORY CHECK BY MICHELE SPONAGLE

Banking on ATMs

Cash might not be king anymore, but in-store ATMs still bring in a princely sum, driving revenue and foot traffic

The bank had started locking its doors after dark, but one Toronto dad needed some cash to give to the kids. Looking across at Leslieville Pumps, a unique combination of general store and barbeque joint, he spotted a sign indicating there was an ATM inside.

Sure, the transaction fee was a nuisance, and he’d probably also get dinged a couple of bucks by his bank, but sometimes there’s a price to be paid for convenience. On his way out of the store, which is based in Toronto’s Leslieville neighbourhood, he saw a sign promoting that night’s multi-million-dollar lotto jackpot, and impulsively bought a ticket.

A version of this story plays out just about every day in c-stores from coast to coast, and it’s a big reason why, despite the long-rumoured death of cash, so many operators—both national chains and mom-and-pop stores alike—continue to include an ATM among their in-store offerings.

“Cash is the simplest and fastest way to pay for something. Period,” says Bill Eaton, president of RapidCash ATM, an Edmonton company that has ATMs deployed across the country and describes its employees as “ATM geeks.”

According to the most recent C-store IQ National Shopper Study, 26% of c-store shoppers used an instore ATM in the previous month,

more than any of the other specific services offered by stores—a group that includes car washes, postal services, and self-check-out.

Debit and credit are increasingly common means of payment, however cash still plays a key role when it comes to c-stores. While down from prepandemic levels, the National Shopper Study found that nearly one-quarter of c-store shoppers (22%) used cash to pay for their most recent purchase.

And in a 2021 study aimed at disproving what it called the “sensationalism and scaremongering” about a supposed decline in cash purchases, U.K.-based ATM company PayPoint found that more than two-thirds of purchases made at convenience stores within its network were made with cash, while one in five Britons used an ATM two or three times a week.

And ATMs’ value to store operators can be significant. David Tente, executive director, USA, Canada & Americas for the ATM Industry Association in Sioux Falls, S. Dak., points to a European study conducted by HIM Research & Consulting, which found that while the typical c-store shopper spent an average of £5.64 per visit, an ATM user spent 65% more (an average of £8.99). In addition, 10% of respondents indicated that they would

shop elsewhere if an ATM was removed from their local c-store.

In a more recent study, the California retailer Wood Oil Company said that it saw about $100,000 per month in ATM withdrawals across its four stores, with approximately 25% of that spent in the stores—equating to as much as $25,000 a month or $300,000 a year in sales attributable to the presence of an in-store ATM.

“It is hard to imagine a convenience store without an ATM,” says Tente. “Consumers depend on them as a safe way to get cash late at night; on the weekend when the bank is closed; or the quickest way to get those lastminute essentials after you leave home without your cash or [credit] cards.”

Eaton, meanwhile, says he’s been hearing that cash is dead almost as long as he’s been in the ATM business. “You know, people thought that with the advent of credit cards, no one would need cash anymore,” he says. “Yet here we are, and cash is still a viable and strong payment method. It’s a secure, inclusive, and discreet way for people to pay. People want choice, and cash is a choice just like a debit or credit card is, and it needs to remain viable for a healthy payment ecosystem.”

Chains of varying sizes have agreements in place with financial institutions or ATM companies: 7-Eleven has featured Scotiabank ATMs in its stores since 2012, and Parkland recently announced that it is introducing CIBC ATMs in all of its locations as part of the Journie loyalty partnership first announced in 2019.

CCentral.ca January | February 2023 Convenience Store News Canada 18

WHAT’S IN STORE? BY CHRIS POWELL

SHUTTERSTOCK.COM

In 2021, RapidCash signed a deal with Kelowna, B.C.-based gas and convenience retailer Canco Petroleum to provide its services to the company’s more than 100 stores across the country.

The deal includes the deployment of an all-in-one kiosk offering traditional ATM services complemented by AIbased on-screen advertising, microloans and cryptocurrency transactions.

“In a time when shopping local is paramount; Canco Petroleum and One Stop Convenience are fully committed to providing products and services that allow for a ‘one stop’ shopping experience,” says Canco director of marketing, Rob Laing. “This means not only meeting our customers’ current expectations, but, more importantly, meeting the expectations of tomorrow. Over the past year we have successfully

tested Bitcoin enabled ATMs in many of our locations. Based on overwhelmingly positive customer feedback and daily usage results,

we have found an immediate need for Bitcoin services nationally. We currently offer ATM services in all of our sites, moving forward we are looking to offer Bitcoin enabled units across our network.

Eaton said that more and more merchants are considering adding in-store ATMs as they increasingly bristle at the processing fees charged by credit card and debit companies. “[Operators] are looking at ways to reduce their payment costs, and they’re something on their P&L that they can adjust quite quickly,” he says.

“So, what they’re doing is they’re getting out of their debit/credit terminals, buying an ATM and having a zero or low surcharge. Now they go to not having a cost to process payments, and that instantly impacts the bottom line.” CSNC

π OVER 3,800 RETAIL PRODUCTS IN STOCK COMPLETE CATALOG 1-800-295-5510 uline.ca ORDER BY 6 PM FOR SAME DAY SHIPPING

26%

of c-store shoppers used an in-store ATM in the previous month, more than any other extended service, according to the 2022 C-store IQ National Shopper Study

SNAPSHOT BY KATHY PERROTTA

2023 foodservice outlook

Despite economic pressures and consumers tightening purse strings, there’s an opportunity for c-stores to grow this key category

Inflation is at the highest level in decades, underscoring a difficult road ahead for many Canadians, as they navigate soaring household costs in food, fuel, utilities and many common essential and discretionary household expenses.

All of this occurs as pandemic legacy adjustments and other distressing global events cumulatively impact future economic outlook and individuals’ confidence in personal circumstances.

At the same time, food sourcing and consumption habits are ever-changing, as consumers continue to traverse a hybrid world of in-store and online grocery shopping, consider a plethora of subscription models, and dip in and out of a changing foodservice landscape.

Ipsos reports that restaurant dining and delivery services top the list of intended spending cuts as consumers navigate this new reality.

However, it is important to note that retailers and operators should not base strategy decisions solely on stated future intent, as consumers don’t always behave as they report they will or want to.

For instance, despite stated intent to cut restaurant spending, Canadian foodservice dollar spending in July 2022 outpaced spending during the same period pre-pandemic: Ipsos Foodservice Monitor (FSM) confirms that dollar expenditures in July 2022, buoyed by higher menu prices, increased 5% versus 2019.

However, while channel dollars increased, all-important traffic rates

or the share of individuals visiting the foodservice channel remained behind pre-pandemic levels (-8%), indicating a considerable growth opportunity for c-store foodservice.

According to Ipsos foodservice industry expert, Asad Amin, “there have been fundamental shifts in how we access foodservice, with dine-in slower to recover and new delivery habits gained during lockdown remaining flat that will need to be factored into growth strategies.”

The data bears out Amin’s comments, with almost three-quarters of all traffic in 2022 (70%) occurring via take-out or drive-thru channel, while on-premises dining has slowed a whopping 38% versus pre-pandemic levels. Further, the storied advent of delivery services, which doubled in size as people cocooned at home over a two-year period, remains flat.

While foodservice traffic rates at both dinner and snack occasions have improved over the past year, lunch and, to a lesser degree, breakfast visits remain soft—no doubt this is impacted, in part, by close to a third of adults (29%) continuing to work from home.

However, even in the midst of unprecedented headwinds, FSM forecasting work reveals channel upside. Several key indicators support future channel growth led by strong pent-up demand. While this demand score has slowed somewhat over the past couple of months, it remains well-ahead of 2021.

Moving into 2023, as concerns over safety in the size of gatherings and eating outside the home decrease, people want to return to restaurant quality food and dining together. As well, there’s a drive towards supporting local businesses.

The annual outlook for the QSR segment is fuelled by lower price points and demand for affordable indulgences. Conversely, the return of FSR may be stalled by higher cheque size and lower weekly visit frequency.

In this ever-changing environment, it will be key for operators in all segments, including convenience, to build foodservice strategies that target emotional and functional benefits.

• Make it easy and convenient.

• Serve quality food that is tasty.

• Provide a casual, informal environment where people can socialize.

• Position take-out or on-premises dining as an opportunity to connect or catch up with friends or colleagues.

Even during the darkest days of the pandemic lockdown when access was denied, foodservice operators held tight to a recurring theme which holds true today amid rising financial pressure—Canadians love to eat out and want to enjoy the experience again and again. CSNC

CCentral.ca January | February 2023 Convenience Store News Canada 20 SHUTTERSTOCK.COM

BUSINESS BRING IT ON. 2

Your agency. If you’re competing in B2B you need a strategic creative partner that knows your industry inside and out. Only EnsembleIQ’s BrandLab offers full-service marketing capabilities and deep experience across retail, CPG, and technology, infused with industry knowledge and marketing intelligence. ensembleiq.com/marketing | brandlab@ensembleiq.com

Your industry.

ALL FIRED

After more than 30 years as a leader in the convenience and gas business, Stéphane Trudel stepped down as senior vice-president of operations for Alimentation Couche-Tard [ACT] to take on an exciting new challenge— CEO of Fire & Flower, the cannabis consumer retail and technology platform, for which ACT is a key investor. Trudel spoke with CSNC about his career, his vision for Fire & Flower, the resiliency of the convenience channel and why he believes the two industries—cannabis and convenience—are not that different.

BY MICHELLE WARREN | PHOTOGRAPHY BY DANIEL SKWARNA

BY MICHELLE WARREN | PHOTOGRAPHY BY DANIEL SKWARNA

Convenience Store News Canada January | February 2023 30 BACKTALK

UP

You officially became CEO of Fire & Flower on June 1: What excites you about the opportunity?

ST: I’ve had this question a lot because when you’re in an industry 30 years, why exit? In a sense, I still feel I’m part of the extended family, because this business addresses a large growing market, with very similar demographics to the convenience channel. [Through ACT] I’ve been involved with Fire & Flower from legalization. I could see the opportunity to establish a very solid business leader in cannabis. The size of the market, both in Canada and the U.S., excites me because it’s there for the taking: No one really has an established position. [Former CEO] Trevor Fencott built this collection of great people and assets, so being able to take over at this time and guide the company through the next stages is exciting.

What was the impetus for ACT’s initial investment?

ST: Couche-Tard has grown through acquisitions, but the company is always looking for the next thing to invest in. Their success has been that they’ve never thought that they had the solution for everything. They’re very curious about what they could get into to expand their reach, so that was the driving force behind the investment. Early on, when they saw legalization coming and some of their own products potentially being impacted negatively by this new category, Couche-Tard wanted to see how they could get involved. It’s the same as they’ve done with other products—make an investment, focus on learning by aligning with the talent to understand how they can scale it the way they’ve scaled so many other things.

How do you see the partnership evolving over the next 12 to 18 months?

ST: Fire & Flower has been running two co-located stores with Circle K for the last couple of years in Alberta, which

proved there is a definite crossover between the two businesses. Now we have five in the GTA—they’re built right in a Circle K store, but, following regulations, there’s a dividing wall and a separate door. While you can’t go from one store to the other inside, Fire & Flower is leveraging the high traffic real estate from Circle K, as well as its loyal customer base. In turn, we are bringing our omnichannel customer experience and half a million Spark Perks loyalty customers. This isn’t just any cannabis store, Fire & Flower has a proven operating model, as well as our Hifyre digital retail platform. The businesses are very much intertwined, and we look to expand on that while we continue to consolidate the industry and become more efficient at what we do. Couche-Tard is going to leverage our best practices, we’re going to leverage theirs, but we run as two independent businesses. Having Fire & Flower as an independent entity allows Couche-Tard to learn

about the business without being themselves thrown into it. Fire & Flower is building the set of learnings independently, but with them as an investing partner.

What does your research show about how the convenience and cannabis demographics overlap?

ST: Since day one, Fire & Flower has managed the relationship with customers from end-to-end. We understand the demographics, so we bring these data insights to the relationship—we know who we are talking to; we know what we can recommend and what products they’re interested in. There is a definite crossover in the customer base. For instance, it’s the younger generation who are attracted to Fire & Flower stores and they’re also attracted to c-stores. We own our own technology from end-to-end, even up to a point where we control routing software

CCentral.ca January | February 2023 Convenience Store News Canada 24

for delivery, so for our partners and for our customers, we’re tying it all together to make a seamless experience.

Tell me about your new service— Firebird Delivery—and how that taps into the convenience customer.

ST: FirebirdDelivery.com is a virtual retail cannabis store that allows customers to get product delivered, but also, we’re piloting delivering snacks alongside as a separate transaction. Kingston, Ont. is a great test market for us. Three stores there offer rush delivery, within an hour, and when customers get to the end of their online cannabis order, we offer the opportunity to do a separate transaction [to purchase additional c-store products]. We’re fully integrated, which allows us to do tests, play with the offers, bring products in, products out.

How do you see this partnership with Couche-Tard playing out globally?

ST: About 70% of Americans live in states that have legalized cannabis and President Biden has signaled they want to do something on the federal side—it’s not a question of if, it’s a question of when. Circle K is a leader in the U.S., and they own their real estate: Fire & Flower can expand into the U.S. and scale, bringing solutions tested in Canada’s very competitive environment.

Will there be opportunities to shake up the business model in different markets? Do you see cannabis being more closely aligned with convenience in the next five years?

ST: Certainly. Right now, because of the way it’s being legalized and regulated differently in various provinces and states, players have had to adapt to the regulations and be vertically integrated. Over time this market will mature and there will be specialization at every level in the value chain. We differentiate ourselves

from the licensed producers in Canada because we don’t grow or develop product. Over time, the value chain is going to be broken up and there are going to be leaders at every step of the value chain. We intend to be the leader on the retail side.

Speaking of leadership, you were named the Convenience Industry Council of Canada’s 2022 Outstanding Industry Leader of the Year. What did this mean to you, especially considering the new role?

ST: It was a humbling experience. Over the years, I’ve had mentors and people I looked up to because they worked for the health of the entire channel, not just their own companies—if the channel is not healthy, there’s no point in trying to compete. I’ve tried to do the same and to receive this award meant that it was recognized in a larger way. Jumping into a new industry the same year is kind of ironic. This industry is very tight and there’s a ton of players who are extremely passionate about the business: I’m the new guy. The award gave me confidence and reminded me to approach it the same way I approached the convenience channel all those

years—build relationships and trust. I want to make Fire & Flower a trusted player in this industry so that it can attract solid investors and like-minded people that want to grow with us.

Drawing on your experience, what does the future of convenience look like? What needs to happen to create a vibrant channel?

ST: It’s a very resilient industry and that’s what I admire. It’s not the sexiest, but it has rolled with the punches and demonstrated that it’s essential. It’s also not the same business that it was 40 years ago when Couche-Tard was founded, and I’m amazed how much the channel has weathered the storms and adapted its offering to remain relevant. Really that’s why I’m in this new role—because Couche-Tard was looking [at cannabis] and saying, this may be another evolution and we want to be a part of it. The convenience industry listens to the market, and I believe it will remain relevant, but we need governments to understand that bringing in new categories, like beverage alcohol, is critical. Look at the number of stores that are closing in regions that don’t allow beverage alcohol. One way to keep the channel healthy is to allow it to sell different categories—it shouldn’t be taken for granted.

Final thoughts on your new position?

ST: I love talking about this industry because so many people either don’t know about it or have a negative view, especially with licensed producers bringing in a ton of retail investors during the hype at the beginning. Fire & Flower is in a different business, one that resembles convenience much more than the licensed producers, which are a mix between CPG companies and farmers.

We’re not that: We’re retailers and, like convenience retailers, we talk to our customers in a modern way, we’re evolving with them, discovering this new product and creating long-term relationships. CSNC

CCentral.ca Convenience Store News Canada January | February 2023 25

At the Fire & Flower store co-located with Circle K in Etobicoke, Ont., GM Jimmy Singh and DM Nicole McOustra review the latest product offerings

JANUARY / FEBRUARY 2023 CCentral.ca @CSNC_Octane PM42940023 $12.00 plus FUEL STATION OF THE E

F F F F U U U U U U U UT T T T R

AMERICAN CAR WASH FRANCHISE ROLLS INTO CANADA A NEW TYPE OF FUEL COMING TO YOUR LOCAL STATION THE PREVIEW INSIDE! MARCH 7-8, 2023 IT’S TIME FOR YOUR ANNUAL RENEWAL Scan the QR code to confirm your subscription

E E E

R R R

OCTANE January | February 2023 3 5 Editor’s message 6 Back in business The country’s largest convenience, gas and car wash event levels up 9 The fuel station of the future The traditional fuel station, as we’ve come to know it, is at a crossroads 15 Future fuel or false promise? A quick look at eFuels and their potential to stir the debate 18 Cross-border cleaners U.S.-based car wash franchise rolls into Canada CCentral.ca COVER ILLUSTRATION, JASON SCHNEIDER STAY CURRENT Don’t miss our e-newsletter! Car wash, petroleum, and convenience news & insights, delivered weekly. Sign up today at www.CCentral.ca/signup Simply hover your phone’s camera over this code: 9 THE INTERNATIONAL CENTRE MARCH 7-8, 2023 CONTENTS JANUARY | FEBRUARY 2023 VOLUME 28 | NUMBER 1 2023 TRENDS ISSUE

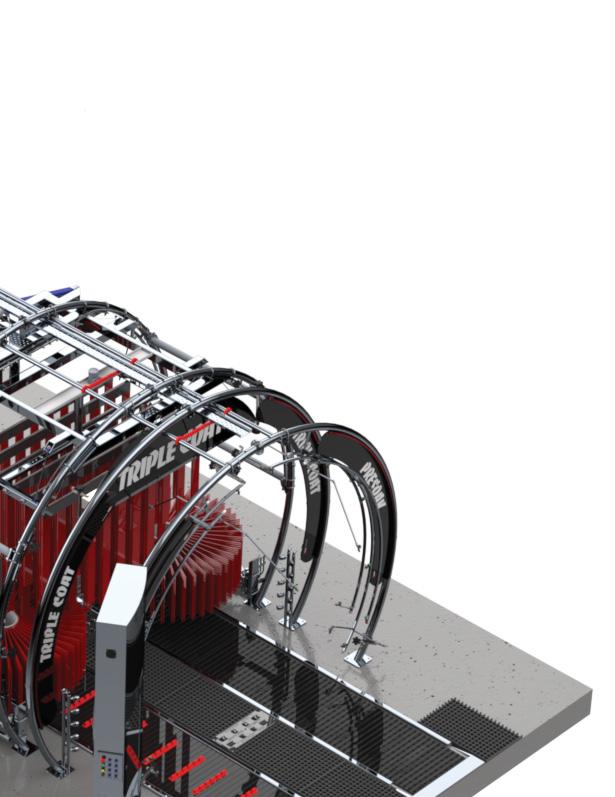

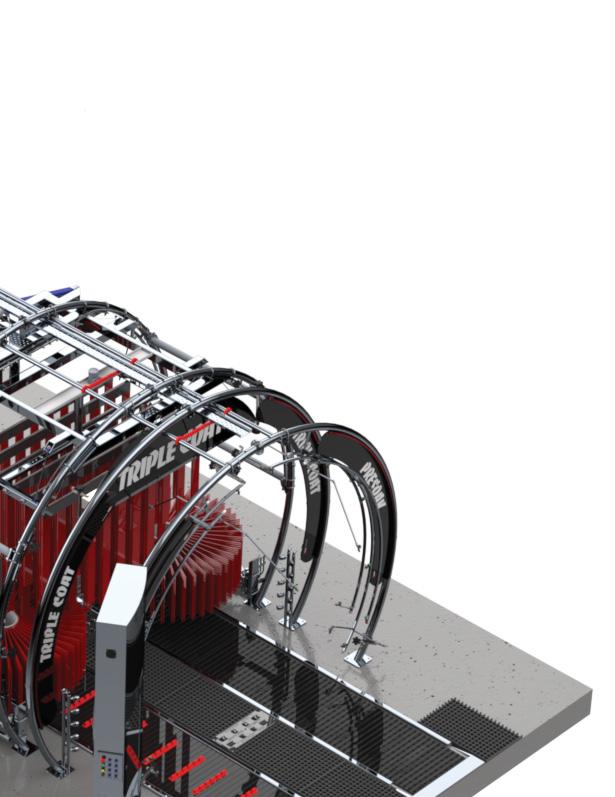

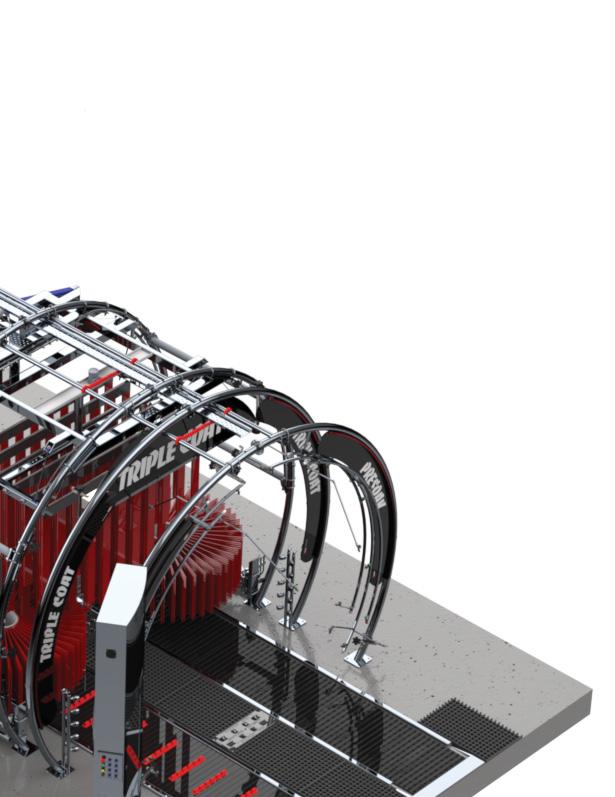

Turn the volume up Ride with us

Upgrade to new, better equipment that will pump up your processing speed and raise your bottom line. With our stainlesssteel, made-in-the-USA equipment, you can wash up to 45 cars an hour. Dazzle your customers with the best-quality wash experience.

©2022 Tommy’s Express, LLC 373G 12/22 Join one of the fastest-growing franchises in America. With over 50 years in the business, our network is expanding rapidly across the U.S. and internationally. Patented stainlesssteel parts and a templated build process will kickstart your profits early and often. Contact us to convert your in-bay Reach out now for franchise info

20 Eglinton Ave. West, Suite 1800, Toronto, ON M4R 1K8

(416) 256-9908 | (877) 687-7321 | Fax (888) 889-9522 www.CCentral.ca

BRAND MANAGMENT

SENIOR VICE PRESIDENT, GROCERY AND CONVENIENCE, CANADA Sandra Parente (416) 271-4706 sparente@ensembleiq.com

EDITORIAL EDITOR, OCTANE

Mark Hacking mhacking@ensembleiq.com

EDITOR & ASSOCIATE PUBLISHER, CSNC

Michelle Warren mwarren@ensembleiq.com

ADVERTISING SALES AND BUSINESS

ASSOCIATE PUBLISHER

Elijah Hoffman (647) 339-9654 ehoffman@ensembleiq.com

ACCOUNT MANAGER

Jonathan Davis (705) 970-3670 jdavis@ensembleiq.com

SALES COORDINATOR Juan Chacon jchacon@ensembleiq.com

DESIGN | PRODUCTION | MARKETING CREATIVE DIRECTOR

Nancy Peterman npeterman@ensembleiq.com

ART DIRECTOR Jackie Shipley jshipley@ensembleiq.com

SENIOR PRODUCTION DIRECTOR Michael Kimpton mkimpton@ensembleiq.com

MARKETING MANAGER

Jakob Wodnicki jwodnicki@ensembleiq.com

CORPORATE OFFICERS

CHIEF EXECUTIVE OFFICER Jennifer Litterick

CHIEF FINANCIAL OFFICER Jane Volland

CHIEF OPERATING OFFICER Derek Estey

CHIEF PEOPLE OFFICER Ann Jadown

EXECUTIVE VICE PRESIDENT, CONTENT & COMMUNICATIONS Joe Territo

SUBSCRIPTION SERVICES

Subscription Questions contactus@ccentral.ca

Subscriptions: Print $65.00 per year, 2 year $120.00, Digital $45.00 per year, 2 year $84.00, Outside Canada $100.00 per year, Single copy $12.00, Groups $46.00, Outside Canada Single copy $16.00.

Email: csnc@ccentral.ca

Phone: 1-877-687-7321, between 9 a.m. to 5 p.m. EST weekdays

Fax: 1-888-520-3608 | Online: www.ccentral.ca/subscribe

Convenience Store News Canada | Octane is published 6 times a year by Ensembleiq. Convenience Store News Canada | Octane is circulated to managers, buyers and professionals working in Canada’s convenience, gas and wash channel. Please direct inquiries to the editorial offices. Contributions of articles, photographs and industry information are welcome, but cannot be acknowledged or returned. ©2022 All rights reserved. No part of this publication may be reproduced in any form, including photocopying and electronic retrieval/retransmission, without the permission of the publisher.

Printed in Canada by Transcontinental Printing | PM42940023

CHANNEL ALLIANCES:

The tough (need to) get tougher

It’s not news to suggest that the last few years have been very challenging for all sorts of industries and for countless individuals. The kind of upheaval we’ve seen in the world since the early part of 2020 is not unprecedented, but it is incredibly rare—like a once-in-a-century type of rare. For example, few experts predicted that the global supply chain would have derailed so dramatically or that it would take so long for things to get back on track.

In the retail petroleum business, the supply chain is just one of the big challenges, perhaps the one that’s making day-to-day operations more difficult than ever. In the foreseeable future, though, the change that will have an even bigger impact revolves around mobility itself.

To continue with the rail travel theme, the electrification train has left the station. It’s not travelling at high speed, but there’s momentum behind it and there’s no turning back. So what does this mean for your business?

Well, as the cover of this issue suggests, it’s time to innovate. In this case, innovation does not mean ripping out all your fuel pumps and replacing them with high-speed chargers. In fact, that would likely be a disastrous course of action. But there are lessons to learn from those who have powered the electric vehicle into the spotlight including, yes, Elon Musk. Love him or hate him, the sober mind cannot deny that the Tesla figurehead has had an over-sized impact on the automotive industry over the past decade.

The first EV I drove was the original Tesla Roadster back in 2009. I was handed the keys in the middle of winter and given the chance to motor around for a few days. At the time, it seemed like a novelty—it was light and quick and entertaining. But the Roadster didn’t seem “important” enough to trigger a revolution; at the time, it struck me that the Tesla was a niche vehicle from a niche manufacturer that would never go mainstream.

Times change—and so do lasting impressions. (Sidebar: I didn’t need to recharge the Tesla Roadster when I had it over those two days. This was a good thing because, back then, there were no public charging stations anywhere—another example of how times change.)

In this issue, we share some ideas from various sources that may help you map out the future and capitalize on all this change. The landscape is still shifting and the business is arguably tougher than ever, so the tough need to get tougher, too. OCTANE

MARK HACKING Editor

CCentral.ca 5 TK OCTANE January | February 2023 EDITOR’S MESSAGE

CCentral.ca E-newsletter CSNCOCTANE @CSNC_Octane standard no gradients watermark stacked logo (for sharing only) ConvenienceStoreNewsCanada BE A PART OF OUR COMMUNITY!

BACK IN BUSINESS

Canada’s largest convenience, gas and car wash event of the year levels up

This past September, The Convenience U CARWACS Show motored back onto the calendar and into the spotlight. That show, held from September 13-14 at the Toronto Congress Centre, was the first chance for industry professionals to network face-to-face since March 2020. While it was important to get the show relaunched properly, the atypical date on the calendar proved to be a challenge for exhibitors and attendees alike.

The consensus was, last year was all about getting the chance to reconnect—this year, it’s all about putting the hammer down and getting back to business.

In 2023, The Convenience U CARWACS Show will move to a more familiar date on the calendar and to a new venue, so it’s the perfect way to kick off a fresh start to doing business. Mark your calendars now—the dates are March 7-8, 2023—and set your Google Maps to the International Centre on Airport Road in Mississauga, Ont., one of the largest trade show venues in the country.

This year’s event promises to be a bigger show and a better show. The theme for the event is “Discover. Connect. Grow.” This theme really sets the stage for what The Convenience U CARWACS Show will be all about.

Exhibitors and attendees will have the rare chance to speak with their peers and thought leaders on the future of the business, and learn how to grow their business using new strategies and the latest technology.

“With the modernization of the event, delegate experience and new exhibitor activations, in 2023 The Convenience U CARWACS Show will set a new standard and provide incredible value for all stakeholders,” says Sandra Parente, SVP, Grocery & Convenience, EnsembleIQ.