CFORCE

From a 23,000 year old naturally-alkaline aquifer deep underneath the Earth, CForce has what others artificially imitate - but naturally. Ready to enjoy a Roundhouse Kick of Hydration? literally natural literally natural

SEPTEMBER 2023 CSNEWS.COM WHAT’S NEXT IN CONVENIENCE AND FUEL RETAILING

MEET THE 2023 TECHNOLOGY LEADER OF THE YEAR WHAT’S NEXT IN CONVENIENCE AND FUEL RETAILING SEPTEMBER 2023 CSNEWS.COM

AROUND ELECTRIC VEHICLE CHARGING IS BUILDING IN THE C-STORE INDUSTRY. READYING FOR THE FUTURE READYING FOR THE FUTURE

MOMENTUM

• Establishes a digital foundation to optimize the ATC 21+ journey

• Enables an integrated marketing approach focused on the ATC 21+

• Provides a clear road map for development, integration, and implementation supported by AGDC

Help responsibly connect and engage with your ATC 21+ in the digital environment

Invest in digital infrastructure that responsibly optimizes and enables new channels for ATC 21+ experiences

Meet the evolving ATCs 21+ expectations to improve consumer experiences by enhancing retail digital capabilities and building a foundation of responsibility

©2023 Altria Group Distribution Company For Trade

Purposes Only

It’s a We Thing

Convenience Store News is seeking more partners for its diversity and inclusion initiative

EARLIER THIS YEAR, I had the pleasure of conducting a live Q&A session with inclusion strategist and author Amri B. Johnson, host of the Reconstructing Inclusion podcast. During our chat, Amri shared a wealth of knowledge, insights and advice on how to become “a future-fit organization” by investing in diversity, equity and inclusion (DEI) beyond just “window dressing.”

Four little words that Amri uttered during our hourlong conversation stuck with me the most: “It’s a we thing.” He spoke about how some organizations unintentionally create an us-versus-them dynamic when implementing DEI initiatives. Rather than creating belonging, companies can create “othering” for those within the organization who may feel like their identity isn’t relevant at that particular time. Instead, the goal is to identify DEI as a we thing by empowering all races, genders, orientations and ability levels to become their best selves.

“Replace us and them with we,” Amri said. “Make sure everybody understands that DEI is everyone and that we can put things in place that create the conditions for everyone. Everyone has a unique situation, but we can always create those conditions for everyone to thrive.”

Here at Convenience Store News, we also see DEI as a we thing.

Since June 2021, CSNews has been spearheading an industrywide initiative to facilitate engagement among all stakeholders in the convenience channel around diversity and inclusion. The

EDITORIAL EXCELLENCE AWARDS (2016-2023)

2021 Jesse H. Neal National Business Journalism Award Finalist, Best Infographics, June 2021

2018 Jesse H. Neal National Business Journalism Award Finalist, Best Editorial Use of Data, June 2017

2023 American Society of Business Press Editors, National Azbee Awards

Silver, Data Journalism, January/April/June 2022

2023 American Society of Business Press Editors, Upper Midwest Regional Azbee Awards Gold, Data Journalism, January/April/June 2022

Bronze, Diversity, Equity and Inclusion, March 2022

2016 American Society of Business Press Editors, National Azbee Awards

Gold, Best How-To Article, March 2015

Bronze, Best Original Research, June 2015

2016 American Society of Business Press Editors, Midwest Regional Azbee Awards Gold, Best How-To Article, March 2015 Silver, Best Original Research, June 2015

platform is designed to be a catalyst for discussion, innovation, engagement and action.

Now, in our third year, we are focused on increasing participation in the initiative and achieving industrywide engagement that reaches all corners of the convenience channel — single-store owners, small operators, large operators, distributors, suppliers and solution providers.

To accomplish this, we are establishing three new steering committees around key DEI issues:

• Membership & Communication

• Minority Owned Supplier Initiative

• Training

CSNews is currently recruiting 10 to 12 members for each steering committee. These groups will meet quarterly and help identify industry best practices, develop programming, assist c-store retailers and distributors in achieving greater supplier diversity, and more.

Anyone interested in joining one of the steering committees should contact me at llisanti@ensembleiq.com. Any companies interested in underwriting opportunities should contact CSNews Brand Director Paula Lashinsky at plashinsky@ensembleiq.com.

Together, WE can create an industry where everyone is able to thrive.

For comments, please contact Linda Lisanti, Editor-in-Chief, at llisanti@ensembleiq.com.

2022 Eddie Award, Folio: magazine

Winner, Business to Business, Retail, Single Article, March 2022

Winner, Business to Business, Food & Beverage, Series of Articles, October 2021

Honorable Mention, Business to Business, Retail, Single Article, September 2021

2020 Eddie Award, Folio: magazine

Business to Business, Retail, Series of Articles, September 2019

2018 Eddie Award Honorable Mention, Folio: magazine

Business to Business, Retail, Website

Business to Business, Retail, Full Issue, October 2017

Business to Business, Editorial Use of Data, June 2017

2017 Eddie Award, Folio: magazine

Winner, Business to Business, Retail, Single/Series of Articles, May 2017

Honorable Mention, Business to Business, Retail, Single/Series of Articles, June 2016

2016 Eddie Award Honorable Mention, Folio: magazine

Business to Business, Retail, Full Issue, October 2015

Business to Business, Retail, Single/Series of Articles, August 2015

EDITORIAL ADVISORY BOARD

Laura Aufleger OnCue Express

Billy Colemire Stinker Stores

Robert Falciani ExtraMile Convenience Stores

Jim Hachtel Core-Mark

Chris Hartman Rutter’s

Faheem Jamal CPD Energy Corp./ Chestnut Markets

Ruth Ann Lilly GPM Investments LLC

Vito Maurici McLane Co. Inc.

Jonathan Polonsky Plaid Pantries Inc.

Greg Scriver Kwik Trip Inc.

Tony Sparks Curby’s Express Market

Roy Strasburger StrasGlobal

EDITOR’S NOTE

2020 Trade Association Business Publications Intl. Tabbie Awards Honorable Mention, Best Single Issue, September 2019 2016 Trade Association Business Publications Intl. Tabbie Awards Silver, Front Cover Illustration, June 2015 SEPTEMBER 2023 Convenience Store News 3

NACS Show Reflects a Changing Industry

There’s no better place to explore the many trends impacting the c-store business

AS THE CONVENIENCE STORE industry gathers next month in Atlanta for the 2023 NACS Show, I’m thinking about how much the business has changed from a few short years ago, specifically pre-COVID.

It is true that most of the strict mandates such as mandatory masking and vaccination requirements are over and, for the c-store industry at least, sales are back to normal. The industry reached a new revenue high last year, according to the annual Convenience Store News Industry Report. However, increased operating expenses in the form of labor costs and credit card transaction fees continue to eat away at the bottom line. This is no time for complacency.

An article I read recently in the Harvard Business Review pointed out how the pandemic played havoc with the labor market. “Working under the weight of chronic stress, financial insecurity and collective grief forced people to work harder and longer to get to the same goals. We became exhausted, self-efficacy decreased, and cynicism grew. It’s no wonder that people eventually hit the wall. But it was still shocking when nearly half of the global workforce said, almost simultaneously, ‘I quit!’”

Those labor challenges continue to have adverse effects on every link in the supply chain, even as American businesses try to put COVID behind them. Another trend impacting the c-store business that appears here to stay is the work-from-home phenomenon. The shift toward more hybrid work arrangements appears to be sustainable. This trend has had a major impact on daypart sales at convenience stores. The morning rush is now a more sustained queue of customers throughout the day.

Whatever your thoughts on diversity and inclusion, there’s also no getting around the fact that employees today demand a fairer workplace environment. A recent Gartner study noted that “organizations need to go beyond policies and develop philosophies” to hold on to good employees in the years ahead.

The NACS Show is a great place to explore these and other trends affecting your business. There are too many educational sessions for me to list them all here (more than 45 in total), but some of the most important topics being covered revolve around menu development in foodservice, cultivating an employee-centric culture, engaging customers through digital innovation, and the future of fuel retailing and the impact of electric vehicles.

This will be my 18th NACS Show. I intend to sit in on as many education sessions as possible, along with taking advantage of the networking events where I can pick the brains of some of the smartest people in the convenience store business.

I hope to see you at this year’s show.

For comments, please contact Don Longo, Editorial Director Emeritus, at dlongo@ensembleiq.com.

VIEWPOINT

4 Convenience Store News CSNEWS.com

Increased operating expenses in the form of labor costs and credit card transaction fees continue to eat away at the bottom line. This is no time for complacency.

©2023 W r d s u r , ff ri g t r f rr d t g ri s d di g br ds t driv ur s s d r fit gr wt . t t ur r r s t tiv , +1 800 241 OKE, r visit www. . Visit us at the 2023 NACS Show, booth #B3115 REFRESHMENT RUNS IN THE FAMILY

FEATURES

COVER STORY

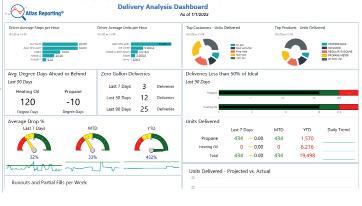

34 Readying for the Future Momentum around electric vehicle charging is building in the c-store industry.

MIDYEAR REPORT CARD

46 Ups & Downs

So far, 2023 is bringing a hodgepodge of results for key c-store product categories.

FEATURE

116 The New Convenience Imperative Delivery, pickup and drive-thru are quickly becoming necessities for the convenience channel.

DEPARTMENTS

E DITOR’S NOTE

3 It’s a We Thing Convenience Store News is seeking more partners for its diversity and inclusion initiative.

VIEWPOINT

4 NACS Show Reflects a Changing Industry

There’s no better place to explore the many trends impacting the c-store business.

10 CSNews Online

22 New Products

SMALL OPERATOR

28 But What About the Squirrels?

How to rid your business of unwanted visitors that are keeping legitimate customers away.

AN EYE ON D&I

126 Sustaining an Inclusive Workplace

Chevron’s Neurodiverse Hiring Program benefits both the employees and the company.

STORE SPOTLIGHT

130 Driving Forward

GetGo’s new drive-thru location provides a convenient option for customers on the move.

INSIDE THE CONSUMER MIND

162 Making the Most of Every Visit

C-store shoppers point to deals as a top influencer in their pump-to-store decision.

CONTENTS SEPT 23 VOLUME 59 NUMBER 9 6 Convenience Store News CSNEWS.com

28 COVER STORY PAGE 34 130 22

INDUSTRY

Reach Acquisition Deal for 63 Stores

14 FDA’s Rule Over Premium Cigars Hits Judicial Roadblock

16 Fast Facts

18 Retailer Tidbits

20 Supplier Tidbits

21 Eye on Growth

21 Murphy USA & QuickChek Reap Benefits From PostIntegration Synergies

TOBACCO

54 The Lowdown on the FDA Crackdown Convenience store operators must be in the know to avoid selling disposable e-cigarettes illegally.

FOODSERVICE

60 Putting Foodservice Center Stage Highlights from the 2023 Convenience Foodservice Exchange event in Nashville, Tenn.

HEALTH & BEAUTY CARE

84 In Recovery Mode Product shortages and inflation are impacting the high-profit HBC category at c-stores.

SERVICES

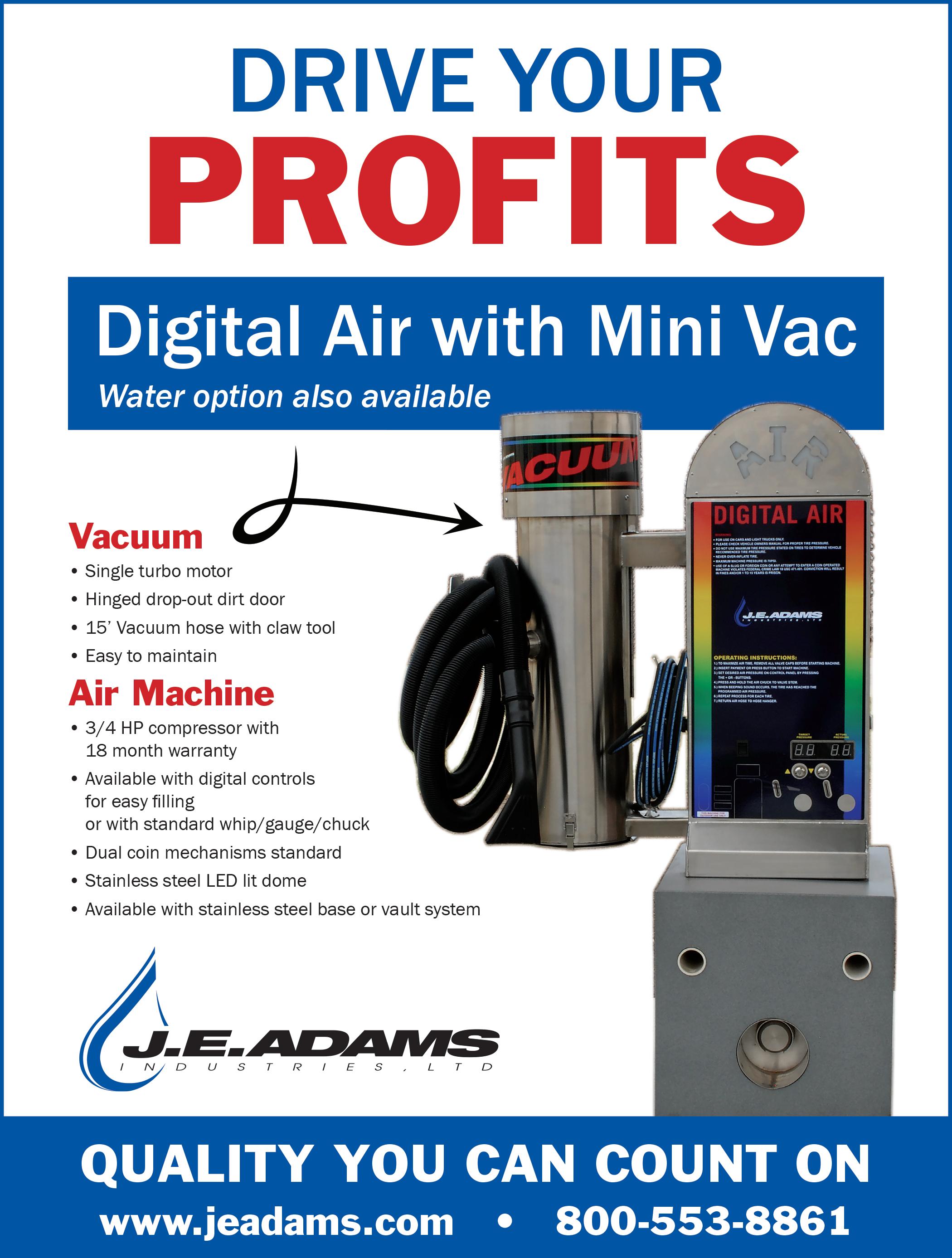

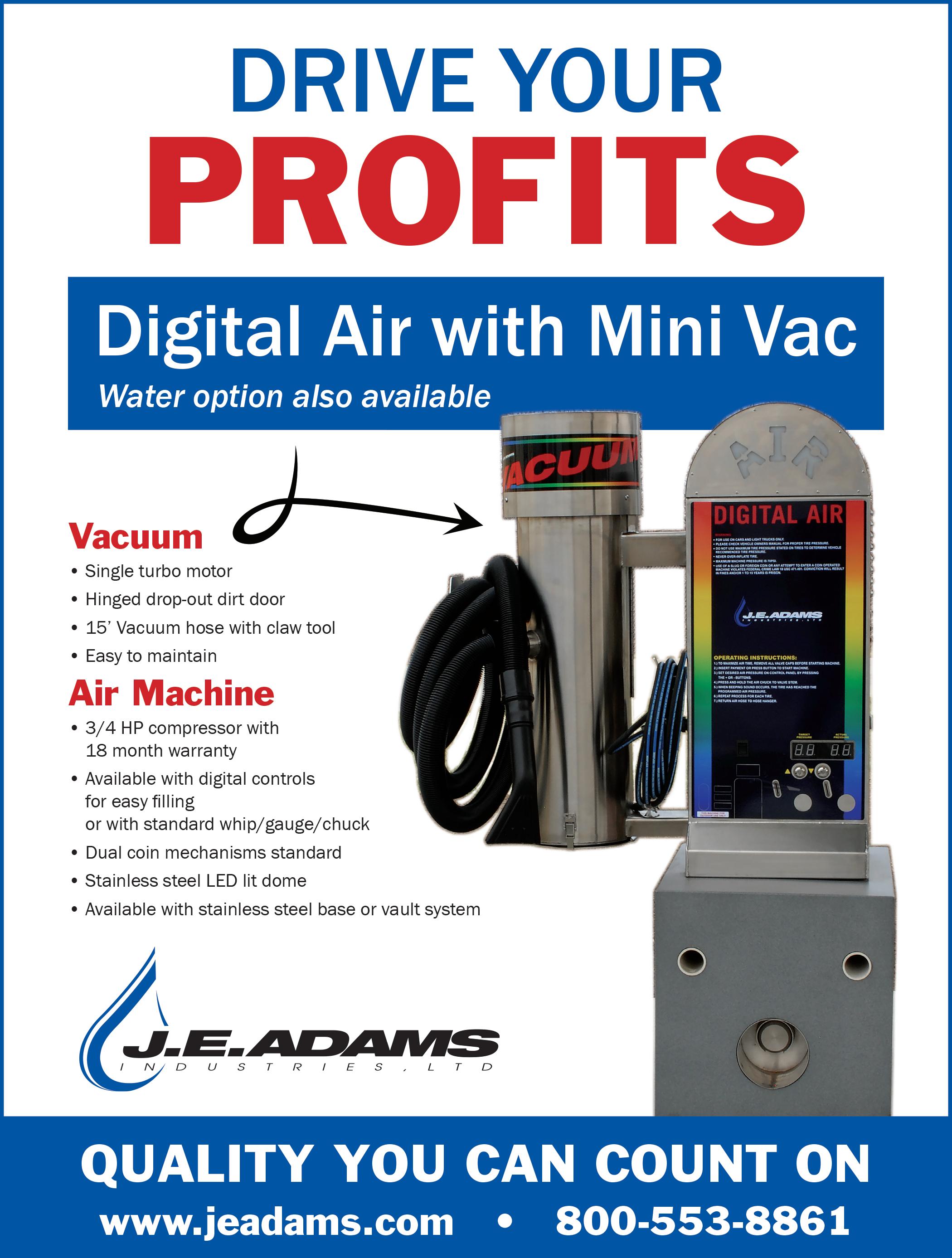

96 Innovations in Car Washing Upgraded equipment, automation, subscriptions and truck washes are creating higher-end experiences for customers.

TECHNOLOGY

106 Customer Obsessed Convenience Store News’ 2023 Technology Leader of the Year, bp, embraces innovative tech solutions to meet the changing needs of the motoring public.

8550 W. Bryn Mawr Ave., Ste. 200, Chicago, IL 60631 (773) 992-4450 Fax (773) 992-4455 WWW.CSNEWS.COM

BRAND MANAGEMENT

SENIOR VICE PRESIDENT-GROUP PUBLISHERUS GROCERY & CONVENIENCE GROUP

Paula Lashinsky (917) 446-4117 - plashinsky@ensembleiq.com

EDITORIAL

EDITOR-IN-CHIEF Linda Lisanti llisanti@ensembleiq.com

EXECUTIVE EDITOR Melissa Kress mkress@ensembleiq.com

SENIOR EDITOR Angela Hanson ahanson@ensembleiq.com

MANAGING EDITOR Danielle Romano dromano@ensembleiq.com

ASSOCIATE EDITOR Amanda Koprowski akoprowski@ensembleiq.com

EDITORIAL DIRECTOR EMERITUS Don Longo dlongo@ensembleiq.com

CONTRIBUTING EDITORS

Renée M. Covino, Tammy Mastroberte

ADVERTISING SALES & BUSINESS

ASSOCIATE BRAND DIRECTOR & NORTHEAST

SALES MANAGER Rachel McGaffigan - (774) 212-6455 rmcgaffigan@ensembleiq.com

ASSOCIATE BRAND DIRECTOR & WESTERN SALES MANAGER Ron Lowy - (330) 840-9557 - rlowy@ensembleiq.com

ACCOUNT EXECUTIVE & CLASSIFIED ADVERTISING Terry Kanganis - (201) 855-7615 - tkanganis@ensembleiq.com

CLASSIFIED PRODUCTION MANAGER Mary Beth Medley (856) 809-0050 - marybeth@marybethmedley.com

DESIGN/PRODUCTION/MARKETING

ART DIRECTOR Lauren DiMeo ldimeo@ensembleiq.com

PRODUCTION DIRECTOR Pat Wisser pwisser@ensembleiq.com

SENIOR MARKETING MANAGER Krista-Alana Travis ktravis@ensembleiq.com

SUBSCRIPTION SERVICES

LIST RENTAL mbriganti@anteriad.com

SUBSCRIPTION QUESTIONS contact@csnews.com

CORPORATE OFFICERS

CHIEF EXECUTIVE OFFICER Jennifer Litterick

CHIEF FINANCIAL OFFICER Jane Volland

CHIEF PEOPLE OFFICER Ann Jadown

CHIEF STRATEGY OFFICER Joe Territo

CHIEF OPERATING OFFICER Derek Estey

Chicago, IL 60631.

8 Convenience Store News CSNEWS.com CONTENTS SEPT 23 VOLUME 59 NUMBER 9

ROUNDUP 12 Casey’s & EG America

Convenience Store News (ISSN 0194-8733; USPS 515-950) is published 12 times per year, monthly, by EnsembleIQ, 8550 W. Bryn Mawr Ave., Ste. 200, Chicago, IL 60631. Subscription rates: Subscription rate in the United States: $125 one year; $230 two year; $14 single issue copy; Canada and Mexico: $150 one year; $270 two year; $16 single issue copy; Foreign: $170 one year; $325 two year; $16 single issue copy; Digital One year, digital $87; two year, $161. Periodical postage paid at Chicago, IL 60631, and additional mailing addresses. Copyright 2023 by EnsembleIQ. All rights reserved. No part of this publication may be reproduced or transmitted in any form or by any means, electronic or mechanical, including photocopy, recording, or information storage and retrieval system, without permission in writing from the publisher. POSTMASTER: send address changes to Convenience Store News, 8550 W. Bryn Mawr

Ste.

The contents of this publication may not be reproduced in whole or in part without the consent of the publisher. The publisher is not responsible for product claims and representations. CONVENIENCE STORE NEWS AFFILIATIONS Premier Trade Press Exhibitor

MANAGEMENT

Ave.

200,

CATEGORY

12

106

*Source: Information Resources, INC. C-MULO 52 weeks ending 01/01/23 © 2023 BIC USA Inc., Shelton, CT 06484 TO ORDER, VISIT NEWREQUEST.BIC.COM CHOOSE BIC® EZ REACH® FOR QUALITY, SAFETY & SALES! Martha Stewart, Snoop Dogg and Willie Nelson prefer the BIC EZ Reach lighter for hard-to-reach places 1.45-inch extended wand helps keep fingers away from the flame Perfect for all lighting occasions VISIT BIC® AT NACSBOOTHSHOW 2723 THE ULTIMATE LIGHTER *

TOP VIEWED STORIES

Buc-ee’s to Take Legal Action Against Apparent Imitator

The retailer announced that it would protect its brand after a photo of Buk-II’s Super Mercado in Mexico went viral this summer. The store’s logo features a variation of the famous beaver wearing a red hat against a yellow circle depicted in Buc-ee’s logo.

Buc-ee’s Plans First Ohio Location

2

A 75,000-square-foot Buc-ee’s store will be built on a 35-acre site in Huber Heights, a suburb of Dayton, according to local news reports. The location, situated at the northeast intersection of Interstate 70 and State Route 235, will also feature a diesel repair facility.

FDA Issues Warnings to Distributors for Selling Illegal Disposable Vapor Products

The illegal products listed in the letters include e-cigarette products Elf Bar/EB Design, Esco Bars and Puff Max, the former two of which have been the focus of earlier FDA actions on retailers aimed at cutting down on illegal sales of youth-appealing tobacco products.

Wawa Tests All-Digital Convenience Store

Located in the University City neighborhood of Philadelphia, the shelfless format provides touchscreens for customers to place their orders, which are then retrieved by Wawa associates from behind the counter. Customers may also place orders at the store via the Wawa app.

Kum & Go Unveils New Personalized Digital Experience

Its new mobile app and &Rewards program feature an all-new personalized interface customized to display unique information relevant to each customer. This includes the ability to designate a favorite Kum & Go store location and shopping recommendations based on past activity.

INDUSTRY REPORT 2023 DEEP DIVE: ALCOHOLIC BEVERAGES

Rising prices due to ongoing inflation are causing many consumers to socialize and celebrate at home, presenting the opportunity for convenience stores to capture a larger share of off-premise alcoholic beverage sales. In this special “Deep Dive” report, a bonus supplement to the Convenience Store News 2023 Industry Report, we present exclusive data and insights into the beer, wine and liquor categories at convenience stores. For more exclusive stories, visit the Special Features section of csnews.com.

MOST VIEWED NEW PRODUCT

Flipz State Fair Flavors

Five Tips for Creating a Successful Bakery Program

A vital component of every convenience store foodservice program is the bakery case, which offers customers an everyday treat, at any time of day — a morning pick-me-up, an afternoon snack or a late night treat, writes Alyssa Barrett, customer marketing manager, convenience channel, for Rich Products Corp. “The Future of Fresh Bakery” study from Rich Products revealed that 31 percent of consumers say they’re purchasing more baked goods for an “anytime treat” now vs. previously. To succeed with bakery, five key recommendations for retailers are: know your shopper; create ambiance; offer variety; co-locate impulse drivers; and leverage loyalty.

Pladis introduces two new flavors to its Flipz chocolate-covered pretzel brand inspired by traditional state fair snacks: Strawberry Shortcake and Churros. Strawberry Shortcake Flipz balance salty and sweet, with pretzels coated in a fresh strawberry, sweet cream and buttery cake flavored coating. Churros Flipz are covered in a cinnamon sugar churro-flavored coating and drizzled with milk chocolate. The limited-edition flavors are available through September while supplies last.

Flipz Stamford, Conn. flipz.com

CSNEWS ONLINE

ONLINE EXCLUSIVE 1 3 4 5 10 Convenience Store News CSNEWS.com

EXPERT VIEWPOINT

Contact your Tyson Foodservice Representative or visit tysonfoodservice.com for product info, resources and market-relevant solutions backed by our trusted brands.

Casey’s & EG America Reach Acquisition Deal for 63 Stores

CASEY’S GENERAL STORES INC. is adding 63 convenience stores in Kentucky and Tennessee to its network via an acquisition. The stores, which currently operate under the Minit Mart and Certified Oil banners, are owned by EG America.

The retailers expect the transaction to close later this year subject to customary regulatory approvals. No dollar amount for the deal was publicly released.

“One of the key pillars in our strategic plan is to accelerate our store growth over the next three years and bring Casey’s to more communities. This opportunity is an excellent strategic fit as we look to add locations in Kentucky and Tennessee, which are both within our existing distribution footprint,” said Casey’s President and CEO Darren Rebelez.

“We look forward to serving more guests in these markets and welcoming the team members from this transaction into the Casey’s family,” he added.

Casey’s is expected to retain the impacted employees at each store.

“We have built a strong and successful business over the years in these Certified Oil and Minit Mart stores, and we are proud of the hard work and dedication shown by our team members there,” said EG America President Nick Unkovic. “Casey’s is an excellent operator, and we believe these stores and team members will continue to thrive under their ownership.”

Westborough, Mass.-based EG America is a subsidiary of the U.K.-based EG Group.

EG Group acquired the 200-plus-store Minit Mart chain from TravelCenters of America in 2018 for $330.8 million. Six months later, the company acquired 69 Certified Oil-branded sites in Kentucky, West Virginia and Ohio.

“EG Group is pleased to have found a new home for some of our Certified Oil and Minit Mart portfolio. This divestment will enable both parties to execute their strategic plans, respectively. For EG Group, this divestment also represents another important step in executing our deleveraging strategy,” added Zuber Issa, cofounder and co-CEO of EG Group.

Ankeny, Iowa-based Casey’s operates more than 2,500 convenience stores in the United States.

INDUSTRY ROUNDUP 12 Convenience Store News CSNEWS.com

The transaction is comprised of Minit Mart and Certified Oil sites in Kentucky and Tennessee

Grow your pizza offerings and meet your customer’s tastes Furmano’s 100% plant-based pizza toppings are a delicious way to give your customers more of the meatless menu items they want. Pizza Toppers Request A FREE Chef Consultation Discover how you can grow your plant-based menu with Furmano’s Seasoned Quinoa Call 77- 77-6032 or visit furmanosfs.com/contact-us Available in 24 oz. shelf-stable pouch packaging Clean Label, Plant-Based Meat Replacement for Customers

ingredient list with foods you know Mimics the taste and texture of crumbled ground meat, adding protein and fiber Ready-to-serve – saves labor with no prep or hassle

Prepared Seasoned Quinoa Pepperoni & Italian Sausage

Simple

Fully

FDA’s Rule Over Premium Cigars Hits Judicial Roadblock

The Aug. 9 decision brings an end to a seven-year legal battle

THE U.S. FOOD AND DRUG ADMINISTRATION’s (FDA) attempt to regulate premium cigars under its 2016 deeming rule has gone up in smoke. On Aug. 9, Judge Amit Mehta of the U.S. District Court for the District of Columbia issued a ruling that vacates the agency’s deeming regulations that pertain to premium cigars.

As a result of the ruling, the regulation is cancelled or declared null and void, according to the National Association of Tobacco Outlets (NATO).

Mehta issued the decision in a lawsuit filed by the Cigar Association of America (CAA), the Premium Cigar Association and the Cigar Rights of America, bringing an end to a seven-year legal battle. Following the ruling, cigars that meet the definition of a “premium cigar” will not be regulated by the FDA.

“This is a big victory for cigar enthusiasts across America. The evidence clearly showed the public would receive little benefit resulting from FDA regulation of premium cigars.

Moreover, regulation would add burdensome costs to all premium cigar manufacturers, which cannot be justified,” said CAA President David Ozgo.

The move comes one year after Mehta issued a ruling that the FDA’s decision to include premium cigars in the deeming regulations to exert regulatory authority over these products was arbitrary and capricious. In July 2022, the judge said the FDA failed to consider data submitted to it concerning the use of premium cigars and the health effects of such use.

Based on that decision, Mehta needed to determine whether to vacate those portions of the deeming regulation that regulated premium cigars or send the issue back to the FDA to correct the deficiencies in the provisions of the deeming regulations related to premium cigars.

As a result of Mehta’s decision to vacate those portions of the rule related to premium cigars, the FDA does not have an opportunity to correct the deeming regulations. The agency has 60 days to appeal the ruling to the U.S. Circuit Court of Appeals, NATO said.

INDUSTRY

14 Convenience Store News CSNEWS.com

ROUNDUP

With Premium LINDOR Chocolates CREATED WITH PASSION

The Lindt Master Chocolatiers

Drive Incremental Sales And Basket Ring

By

Since 1845

FAST FACTS

66%

Two out of three convenience store retailers (66 percent) reported that their sales for the first seven months of 2023 were higher than their sales during the same period in 2022.

— NACS

13%

Buy some, get some and coupon deals were among the most popular retail foodservice outlet deal types, growing 13 percent and 18 percent, respectively, in the first quarter of 2023.

— Circana

45%

In a recent survey, 45 percent of Americans expressed concern over electric vehicle charging accessibility, while 41 percent cited affordability as their priority when finding a charger.

— PDI Technologies

16 Convenience Store News CSNEWS.com INDUSTRY ROUNDUP 816-813-3337 www.forteproducts.com CONVENIENCE PLUS WASTE/WINDSHIELD STATION TRUCKERS WINDSHIELD VALET GAS STATIONS, TRUCK STOPS, C-STORES FORECOURT AMENITIES OCT. 4-6 BOOTH # 6527 Products

20YEARS Energizing America for 20 years THEN Call 866-960-1700 | 5hourEnergy.com/trade Limit caffeine products to avoid nervousness, sleeplessness, and occasional rapid heartbeat. Individual results may vary. See 5-hourENERGY.com for more details. Tastes better Works better for consumers who are thirsty and prefer carbonation. ©2023 Living Essentials Marketing, LLC. All rights reserved. Launching nationally in 2024 5-hour ENERGY® drink The great-tasting energy drink made for hardworking people – available in 6 flavors

Retailer Tidbits

Casey’s General Stores Inc. hit a milestone of providing 30 million meals through its partnership with Feeding America since joining forces in 2020. The retailer’s annual roundup at the register campaign supports the nonprofit organization.

Wawa Inc. expanded its dinner menu with the introduction of Wawa Pizza. The chain started rolling out pizza to select stores in early June and, as of late July, had completed the launch at more than 900 locations across the Mid-Atlantic and Florida.

Circle K and lottery app Jackpocket expanded their partnership to Massachusetts. As part of the Bay State launch, Jackpocket offered Circle K customers their first lottery ticket on the app for free.

Love’s Travel Stops also awarded 96 diesel technicians and mechanics more than $520,000 in lifetime achievement bonuses for reaching career milestones in billed repair labor.

Love’s Truck Care and Speedco recently celebrated the landmark of having 300 diesel technicians graduate from Love’s Truck Care Academy since its launch in April 2022. Love’s plans to double the number of diesel technician graduates over the next year.

7-Eleven Inc. introduced the Convenience Tour, an array of golf-inspired merchandise for fans of the brand who want to look good and feel good when hitting the range. Items include shirts, hats, golf balls and golf tees.

The Wills Group’s Dash In stores selected GSP to provide retail marketing services to the chain’s 55 locations. The program will use GSP’s AccuStore to deliver point-ofpurchase and in store-specific shipments with marketing guides tailored to the needs of each store.

18 Convenience Store News CSNEWS.com INDUSTRY ROUNDUP

GO FROM PEGS TO PUSHERS USING YOUR PEGWALL WITH SIMPLISTOCK™ PEG The unique pusher display system mounts quickly to your existing pegboards or slat walls to –www.retailspacesolutions.com 800-279-5291 custservice@retailspacesolutions.com REDUCE labor costs IMPROVE product selection ELIMINATE package rips & tears

Supplier Tidbits

Anheuser-Busch reached an agreement to sell eight beer and beverage brands to Tilray Brands Inc. Included in the deal are Shock Top, Breckenridge Brewery, Blue Point Brewing Co., 10 Barrel Brewing Co., Redhook Brewery, Widmer Brothers Brewing, Square Mile Cider Co. and HiBall Energy.

Altria Group teamed up with Stuzo to launch the tobacco company’s Digital Trade Program (DTP) and Altria Personalization Plus (P+) offerings for retailers, which include different personalized tiers that can integrate loyalty programs with identity verification.

NCR Corp. unveiled the names for the two companies that will form after its planned separation: NCR Voyix for its digital commerce business and NCR Atleos for its ATM business. The spinoff is expected to occur during the fourth quarter of 2023.

PDI Technologies acquired Skupos, a platform that connects independent convenience stores and consumer packaged goods brands. The move gives the company access to performance and activation at more than 25,000 independent sites.

Core-Mark International is relaunching Core-Mark Curated. As a key component of its Center of Excellence, the initiative serves as a startup accelerator and incubation program.

Juul Labs Inc. submitted a premarket tobacco application for its next-generation vapor platform to the U.S. Food and Drug Administration. The updated device uses technology to restrict both underage use and counterfeit pods.

20 Convenience Store News CSNEWS.com INDUSTRY ROUNDUP

Ventless Kitchen Solutions | 800-348-2976 | MTIproducts.com MEET YOUR MOST DEPENDABLE EMPLOYEES • VENTLESS DEEP FRYERS & HIGH SPEED OVENS • EASY INSTALLATION AND OPERATION • UNPARALLELED COMMITMENT TO SAFETY • FOODSERVICE MADE SIMPLE IN ANY SPACE

The sale also includes four production facilities and eight brewpubs across the United States.

Eye on Growth

MAPCO Express Inc. welcomed customers at its second checkout-free store. Located in Nashville, Tenn., the convenience store is powered by Grabango Inc.

QuikTrip Corp. has two locations under construction in Laredo, Texas, which are expected to open during February and March 2024. Both sites will be part of the retailer’s remote travel center network.

Buc-ee’s will break ground in 2024 on its first Louisiana store and begin operations in the city of Ruston in 2025. The planning process moved forward after the state legislature earmarked money for infrastructure construction to accommodate the site development.

Royal Farms opened its third location in North Carolina in New Bern at the end of July. The first two locations opened in Grandy and Greenville earlier in the year. Lumberton, Kinston and Jacksonville, N.C., locations will be opening later this year.

GPM Investments LLC, an ARKO Corp. subsidiary, opened a new Pride convenience store in South Windsor, Conn., earlier this summer. Sitting at 4,860 square feet, the site features a Chester’s Chicken alongside proprietary food offerings.

Rusty Lantern Market opened the doors to its third New Hampshire location — the 26th store in the company’s roster and its eighth store opening within the last 12 months. The 4,200-square-foot location includes a full kitchen and indoor and outdoor seating.

Murphy USA & QuickChek Reap Benefits From Post-Integration Synergies

Product innovation and promotions are driving bigger baskets across both chains

MORE THAN TWO YEARS after acquiring Whitehouse Station, N.J.-based QuickChek Corp. for $645 million, Murphy USA Inc. is seeing significant benefits across the enterprise, President and CEO Andrew Clyde shared during the company’s earnings call in August.

Not only did QuickChek stores post record food and beverage sales during the second quarter of 2023 with record margin months in May and June, but the company is also yielding positive results from product and menu innovation along with enhanced promotional and marketing activities to help improve store performance. “The combined learnings of both companies are coalescing into sustainable and material performance drivers of the business,” Clyde said.

He noted that the QuickChek store format is the perfect test-and-learn environment to identify high-potential products that strongly overlap with Murphy USA customers. By developing products in partnership with wellknown national brands, the retailer is able to drive traffic and build baskets.

Murphy USA continues to innovate in its growing core categories, where the made-to-order

QuickChek menu is being realigned with consumer insights and fresh product preferences. This will lead to the introduction of new signature sandwiches in the second half of 2023.

El Dorado, Ark.-based Murphy USA’s total network comprises more than 1,500 stations primarily in the Southwest, Southeast, Midwest and Northeast regions of the United States.

INDUSTRY ROUNDUP

SEPTEMBER 2023 Convenience Store News 21

The store’s forecourt features six multiple product dispensers with 12 fuel pumps, two diesel dispensers with four fuel pumps, and five high-flow diesel dispensers with 10 fuel pumps.

MamaMancini’s On-The-Go Cups

MamaMancini’s On-The-Go Cups is a new line of fully cooked and microwave-ready meals. They come in five varieties that are intended to tap into the nostalgic meals made by grandma: Beef Meatballs, Turkey Meatballs, Chicken Cacciatore, Sausage & Peppers, and Beef & Rice. According to the company, the recipes are all-natural, preservative and soy free, and contain no artificial ingredients. The packaging provides a 21-day shelf life from thaw. A refrigerated Feta & Olive Salad variety is also available. The 10-ounce cups, or two servings, come with a suggested retail price of $5.99.

MAMAMANCINI’S HOLDINGS INC. • EAST RUTHERFORD, N.J. • MAMAMANCINIS.COM/RETAILER-CONTACT

Seagram’s Escapes Cocktails Margarita Variety Pack

Seagram’s Escapes introduces a 12-pack of margarita-inspired flavored malt beverages with its new Cocktails Margarita Variety Pack. The offering is intended to take advantage of the skinny margarita trend, which is up 51 percent over the last four years, according to the company. The variety pack includes Strawberry, Watermelon, Classic Lime and Prickly Pear flavors. Seagram’s Escapes Cocktails Margaritas contain just 100 calories per 12-ounce slim can.

FIFCO USA • ROCHESTER, N.Y. • SEAGRAMSESCAPES.COM

Hi-Soft Salted Caramel Chews

Morinaga America Inc., the official distributor of Hi-Chew, is bringing Hi-Soft Salted Caramel Chews to the United States. A long-time favorite in Japan, the product has a sweet, velvety texture with a rich flavor balanced by a hint of salt. Hi-Soft Salted Caramel Chews will begin to roll out to select retailers nationwide in the fall of 2023. The candy will be offered in a 3-ounce peg bag for a suggested retail price of $3.59 or a 10.59-ounce standup pouch for a suggested retail price of $7.69. Prices will vary depending upon the market.

MORINAGA AMERICA INC. • IRVINE, CALIF. • HISOFTUSA.COM

White Cheddar Harvest Snaps

Calbee’s Harvest Snaps adds a cheesy addition to its lineup of veggie snacks: White Cheddar. These new baked crisps combine the creamy, mellow taste of white cheddar with farm-picked green peas milled whole in-house, which are the first ingredient for maximum nutrition, according to the company. The plant-based snacks are packed with 5 grams of protein and 3 grams of fiber per serving. They are free of artificial flavors, preservatives and common allergens such as gluten, wheat, soy, nuts, peanuts and eggs. White Cheddar Harvest Snaps are available in a 3-ounce bag.

CALBEE AMERICA • FAIRFIELD, CALIF. • HARVESTSNAPS.COM

Heinz Remix Sauce Dispenser

Kraft Heinz Co.’s foodservice division debuts Heinz Remix, a customizable and IoT-enabled digital sauce dispenser that allows consumers to personalize their own flavor creations. Developed in six months from initial brief to the physical product, the dispenser can create more than 200 potential sauce combinations. The freestanding machine is touchscreen operated with a selection of bases that can be personalized further with one or more enhancers, such as jalapeño or mango, and set to a customer’s preferred intensity level (low, medium or high). The Heinz Remix dispenser will begin rolling out via a pilot program starting in late 2023 to early 2024.

THE KRAFT HEINZ CO. • PITTSBURGH & CHICAGO • KRAFTHEINZCOMPANY.COM

NEW PRODUCTS 22 Convenience Store News CSNEWS.com

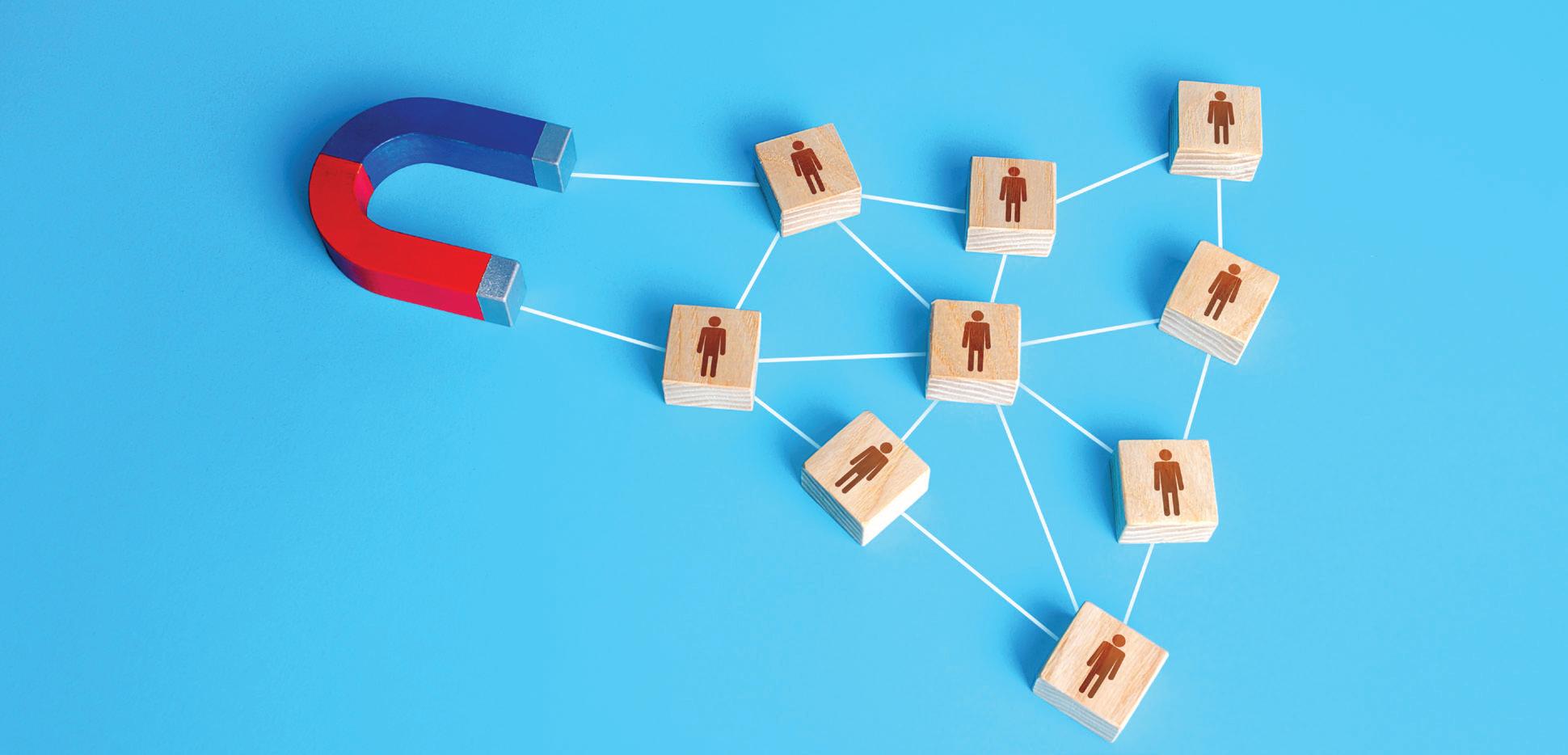

Building Long-Term Revenue Through Loyalty

C-store retailers can create personalized programs by leveraging data across the engagement ecosystem

By Kathleen Furore

DATA HAS BECOME the name of the game when it comes to competing successfully in the convenience arena. But chalking up a win won’t happen if you play that game using existing data alone. Collecting data throughout the engagement ecosystem, segmenting it and then creating personalized loyalty programs aimed at building longterm revenue are all key steps in scoring successfully.

“Twenty years ago, data capture was done by knowing your customers personally. The operator knew who came in everyday, what brand of soft drink they liked to buy, and often knew the names of their customers’ kids,” said Roy Strasburger, CEO of StrasGlobal, a provider of contract operations for gas stations and convenience stores, and cofounder of The Vision Group Network, an organization that brings together industry leaders in quarterly virtual meetings to create a knowledge base of experience and innovative ideas.

“This still holds true for owners and operators of single stores. But if you have multiple stores, more sophisticated loyalty programs have become necessary to maximize your sales and profit potential,” he noted. “The better you know your customer, the better you can meet their needs.”

Data Capture Strategies

There are several strategies convenience store retailers can use to capture data, according to Bonnie Woods, senior strategist at Paytronix, a provider of SaaS

customer experience management (CXM) solutions for c-stores and restaurants.

This includes surveys, which deliver qualitative data; loyalty programs and technology, which offer key metrics “especially when a seamless customer experience enables brands to engage through digital channels”; and social media, which Woods said many Paytronix brand partners use “to connect with guests and build a more robust data set for each customer.”

Whichever strategy retailers employ, data-gathering should be a gradual process, Strasburger stressed.

“Having a long profile data entry for someone to fill out when downloading the app is annoying and may lead to people abandoning the registration process. The best idea is a registration protocol that only asks for the information that is crucial for your method of communication — text or email, for example — and, if you are doing online payment, payment information,” he said. “As the customer uses the app, ask an additional question every two or three interactions to gain demographic and preference data. This will allow you to build a robust profile over time without creating friction with the customer.”

Insights from the January 2023 report, “CLVG Currents of Change” — the first in a series of reports from the Convenience Leaders Vision Group (CLVG) — support

SPECIAL SERIES ON FRICTIONLESS ENGAGEMENT SPECIAL SERIES: A ROADMAP FOR SUCCESS IN 2023

SEPTEMBER 2023 Convenience Store News 23 Sponsored by

that advice. The inaugural meeting of the CLVG brought together c-store industry leaders to discuss a broad range of topics impacting convenience retailing today.

“While there was no defined limit as to how much [information to ask for] is too much, everyone agreed that you have to be sensitive to overreaching,” Strasburger relayed.

Offering incentives is one approach that can enhance the data-capture process.

“With any loyalty program, it is critical that guests are incentivized to identify themselves on every transaction, so marketers can build a complete guest profile,” Woods said.

Strasburger echoed this, stating that “customers are transaction-oriented — they will give us something if we give them something in return.”

Providing rewards and recognition to loyal customers without giving away something they already planned to pay for, he added, is the challenge.

“The loyalty perks should be items that provide either intangible rewards, such as recognition or experiences which drive an ‘emotional’ loyalty; offer the opportunity to upsell the customer such as a discount on a drink that is larger than the one they normally buy; or introduce the purchase of an item that is not part of their normal buying pattern — ‘if you like this, then you will probably like this,’” Strasburger explained.

Points of Engagement

Deciding how you’ll capture information about your customers is one step in playing the data game; figuring out when to connect with customers and what to ask at various points in the engagement ecosystem is another.

“The two critical phases are registration and the first halfdozen interactions,” said Strasburger, who stressed that the initial point of engagement should be as frictionless as possible and immediately rewarding. “Any type of friction — multiple screens to navigate, multiple questions to answer, manual data to enter, security codes,

passwords at each step of the way — will reduce the likelihood that the customer will use the app, even if they are shopping with you.”

Woods said the points of engagement should depend on the retailer’s goals at any given time. “On the business side, c-store brands should look at their strategic priorities and then look to loyalty as a way to build the data they’ll need to reach these goals,” she advised.

Stores with “somewhat less mature” loyalty programs should make sure the data is mapped to communicating the core program value, Woods noted. “And if the concern is customer lifecycle management, then the program data collection should focus on those problem areas that could negatively affect retention, acquisition or engagement.”

Maintaining engagement throughout the ecosystem in ways that help retailers achieve their goals without burdening customers is another challenge, according to Strasburger.

“Promotions and benefits need to be new and fresh,” he said, noting that one solution is to create a tiered program that provides additional benefits the more the app is used. For example, convenience store chain Texas Born (TXB) uses silver, gold and platinum levels, each one with a benefit multiplier or special access to individualized deals, Strasburger explained.

Segmenting the Data

Once operators have data in hand, they must analyze and organize it in ways that will help them build out and maintain an effective loyalty program.

“It’s really about using the data to make better decisions,” Woods said. “If you’ve collected data about purchasing habits, then you can cluster by items and categories and, through that, understand what a person is likely to purchase next or what their best category is. This can help drive them to new categories and increase basket size.”

Recency/frequency/monetary value (RFM) — a datadriven segmentation technique that can reveal when a customer’s last purchase was, how often they’ve purchased in the past, and how much they’ve spent overall — is another strategy that can help c-store retailers understand shopping cadence and overall customer lifetime value, she said.

“We also can understand whether a buyer is driven by merchandise, like coffee or snacks, or if they’re coming in for gas and making a purchase as a secondary action,” she added. “Then, there is the lifecycle of the customer, so we can understand whether they’re in the nurturing phase, an active member, or lapsed … and finally, we want to know what channels they’re using, so we can drive adoption of additional channels. For example, if a person is only shopping in the store, how do we move them to the mobile app? How can that drive additional revenue?”

Demographic information such as age, gender and zip

24 Convenience Store News CSNEWS.com

SPECIAL SERIES: A ROADMAP FOR SUCCESS IN 2023

code are the segments Strasburger is most interested in. “This can be married to the purchase history when your customer gives you their loyalty number to provide insight into the customer basket and the demographics associated with the purchase,” he said. “If this is done well, it can surprise the owner as to who their real customers actually are and shed a bright light on their buying habits and patterns.”

Best-in-Class Connections

How are successful convenience store operators using data to connect with customers and build long-term loyalty — and long-term revenue — in the process?

According to Woods, the best brands marry qualitative and quantitative data sets to personalize the guest experience. “Top brands focus more on reinforcing good behavior vs. focusing too heavily on generating net new behavior,” she explained. “It’s really about engaging with guests where they are, offering them choice and value in their preferred categories, and building deep relationships that increase customer lifetime value.”

The U-Drive Plus program from United Dairy Farmers (UDF) is one example of a loyalty program that has evolved significantly and successfully since its launch as a fuel rewards program more than 10 years ago. In fact, it took the top spot for the gas stations category in Newsweek’s “America’s Best Loyalty Programs” for 2023.

Today, the core of U-Drive Plus consists of everyday cents off, fuel rewards, U-Drive Plus pricing and market basket savings for all members. Registered members who provide more personal information enjoy additional perks, such as birthday rewards, weekly app freebies, targeted offers, and a low-price lock that automatically rolls back the price they pay to the lowest fuel price of the day.

These features drive customers in from the fuel pump to the c-store because “people don’t want to leave savings on the table,” Denise Jenkins, vice president of marketing, insights and loyalty for UDF, told Convenience Store News. “Often, if you can get them to come for gas, you can get them for something else.”

Flying J — No. 1 in the convenient stores category in Newsweek’s best loyalty programs ranking — is another retailer taking a creative approach to collecting data.

“When they launched their loyalty program, they offered every new member the chance to win $10,000 in their ‘Trace Adkins Ride for Rewards’ cash giveaway as a signup bonus,” said Strasburger. He called this “a great motivator to initiate action.”

Playing the data game in a way that builds robust loyalty programs is key for c-stores that want to thrive today — something Strasburger predicts will be even more imperative as society moves into what is certain to be an increasingly technology-driven future.

“Store loyalty programs are going to become more important with the growing use of electric vehicles. No longer will customers be fuel brand centric. It will be all about the store,” he concluded. “A good loyalty program will help a retailer stand out from the competition.” CSN

Tips for Playing the Loyalty Data Game

Looking for ways to gather and use data to build a successful loyalty program? Roy Strasburger, CEO of StrasGlobal and cofounder of The Vision Group Network, and Bonnie Woods, senior strategist at Paytronix, share tips on where to start.

Make It Easy — Ensure that the interface and user experience are as frictionless and intuitive as possible. “Ease of use is key,” Strasburger said.

Avoid Common Pitfalls — Going to your favorite app store and reading reviews of other companies’ loyalty apps is one way to discover how your program measures up, Strasburger noted. “You will get great insight from user comments about the pros and cons of the different apps, the issues with the user interface, and what pitfalls you can avoid when designing or redesigning your app,” he said.

Understand Your Customers — Key questions that your data should help answer, according to Woods, include: What did they buy? How often are they visiting? How many customers are you retaining? Where are they shopping?

Listen to Your Guests — “Customers want to be heard, so you need to understand what they do and don’t like about your program,” Woods advised. “This also means knowing how [the program] fits in the competitive landscape and how much perceived value is being delivered.”

Segment the Data as Finely as You Can — “You may only be able to put the information into two or three buckets, but that can be the start of a segmented strategy,” Strasburger said.

Don’t Drown in Data — “Determine initial long- and short-term strategic objectives and focus on data points that support those key initiatives,” Woods explained. “Determine what success looks like and focus on those data sets that support those objectives.”

Have a Plan to Keep Customers Engaged Over the Long Term — Communication with customers should always be new, interesting, potentially exclusive and nonrepetitive, Strasburger stressed. Depth of customer involvement can escalate over time. A customer who has been on your app for three years should have a different experience than a customer who has been with you for three months, he said.

Encourage Members to Use Their Points — More than 50 percent of customers will leave a loyalty program if their points have expired, so Strasburger recommends retailers always keep members engaged in ways that will encourage them to use those points.

SEPTEMBER 2023 Convenience Store News 25

Sponsored by

Upping Your Game With Data

DATA LIES AT THE HEART of any major convenience store and nowhere is this truer than when it comes to building lasting guest relationships.

People have become accustomed to personalized experiences in their digital shopping and not just at digital brands like Amazon. Convenience stores also have seen a sharp increase in guests seeking personalized digital experiences. In fact, 71 percent expect companies to personalize their experience, and 76 percent get frustrated when that doesn’t happen, according to a 2021 study by McKinsey & Co.

Getting to that level of personalization means having access to the right data, and having the tools in place so that marketers can use that data to create a more relevant experience — and, through that, increase revenue.

At a minimum, a person should be able to see their last order at the top of a custom menu. But guests want more, like suggestions for an add-on item or something they are likely to purchase. To do that, you need to understand the purchasing habits of that individual, as well as those of people who have made similar purchases. Artificial intelligence (AI) plays a significant role here.

Done right, this kind of experience happens without the guest entirely knowing that something is built just for them. Behind the scenes, a digital guest engagement platform is learning that guest’s visit cadence, their preferred items, and even the dayparts they generally choose.

Then, the marketers can use the platform to spring into action so that win-back programs reach a guest at just the right time while offering up the right item. Campaigns to promote a new food offering can reach the people who are most likely to act on it and help them feel seen.

Loyalty is about keeping guests coming back. If you’re just looking at rewards and discounts, you’re missing the bigger picture. Loyalty can do so much more and help raise customer lifetime value and, through that, long-term revenue.

Loyalty should be a foundational element in a convenience store brand’s broader marketing mix. Loyalty is not a campaign or a promotion, it is a long-term commitment to the customer relationship that is the most direct route to true connection of any of the marketing tools available. It considers the journey customers want to take with you and you want them to take with you.

An effective loyalty program is part of a broader digital guest engagement strategy that keeps your guests active in that journey and coming back for more. That journey must include elements like online ordering, mobile apps, CRM tools, and messaging.

Ensuring these elements work in concert is key to meeting the brand promise. Our data finds that people who use a brand’s native mobile app return more often, tip better and spend more than those using third-party apps. What’s more, they also tend to be part of the loyalty program, which means it’s easier to understand their preferences and easier to communicate with them directly.

The ability to personalize the experience meets customer expectations and drives a higher shopping cart. All this is to say, when you engage the guest fully across the whole platform, you can build those strong relationships that are at the core of the hospitality industry.

SPECIAL SERIES: A ROADMAP FOR SUCCESS IN 2023

By Andrea Mulligan, Paytronix

SPECIAL SERIES: A ROADMAP FOR SUCCESS IN 2023 Sponsored by 26 Convenience Store News CSNEWS.com

Andrea Mulligan is chief customer officer at Paytronix. She helps customers realize the full benefits of the Paytronix Customer Experience Platform by ensuring that every customer receives world-class service.

On Top Oat Milk Toppings

Rich Products Corp. presents On Top Oat Milk Toppings, which are intended to meet consumer and convenience store operator demand for nondairy options, customization, and social media-friendly drinks and desserts. Aimed at madeto-order beverage programs, the line includes: Soft Whip Pourable Topping, the industry’s first plant-based cold foam; Whipped Topping, a plant-based, whipped topping with superior stability; and Soft Whip, a creamy, pourable foam. The company believes oat milk provides operators with a better plant-based option for its coffee selections because it has fewer allergen concerns than nut milks.

RICH PRODUCTS CORP. • BUFFALO, N.Y. • RICHSFOODSERVICE.COM

Welch’s Zero Sugar Fruity Bites

Confectioner PIM Brands Inc. adds a new fruit snack to its product lineup: Welch’s Zero Sugar Fruity Bites. The treats are chewy, fruity and 100 percent sugar-free, with 25 percent fewer calories than the original Welch’s Fruit Snacks. They are also fat-free, gluten-free, aspartame-free and contain no preservatives. Welch’s Zero Sugar Fruity Bites are available in three varieties — Mixed Fruit, Berries ‘n Cherries and Island Fruits — with a retail price of approximately $3.99 per 3-ounce peg bag. Other packaging formats will roll out later in the year into early 2024.

PIM BRANDS INC. • PARK RIDGE, N.J. • PIMBRANDS.COM

Thin Mints Milk Chocolate Malt Balls

Hilco Sweets teamed up with the Girl Scouts of the USA to create its new Thin Mints Milk Chocolate Malt Balls, inspired by the popular Girl Scout cookie. The candy has a crunchy malted milk ball center coated in Girl Scout Thin Mints milk chocolate, creating a unique and decadent confection, according to the company. Thin Mints Milk Chocolate Malt Balls started being available for purchase in late summer 2023. The suggested retail price for a 4-ounce bag is $5.99, with bags shipped in cases of 12.

HILCO SWEETS • LOUISVILLE, KY. • HILCOUSA.COM

Monaco Margaritas

Atomic Brands’ Monaco Cocktails brings a new offering to the single-serve adult beverage category: ready-to-drink margaritas. Expanding upon the brand’s tequila portfolio, the line includes two distinct flavor profiles, Lime and Watermelon, with classic and spicy varieties for each. The company believes the line will allow it to capitalize on a fast-growing category as margaritas are the No. 1 bestselling cocktail in the United States, according to Nielsen. Monaco Margaritas are currently available at convenience stores nationwide for between $2.50 and $2.99 per 12-ounce can. Each can has a 9 percent ABV, with zero carbonation, malt or gluten.

ATOMIC BRANDS • MIAMI • DRINKMONACO.COM/MONACO-COCKTAILS

Power Prep Wrap

Packaging manufacturer Novolex introduces Power Prep wrap for grab-and-go hot sandwiches and other freshly made foods. Made by Novolex brand Bagcraft, the nonfluorinated oil-and-grease-resistant paper is laminated and insulated to keep food tasting fresh as it moves from the freezer to thawing and reheating to hotplate at the point of sale. Power Prep is available as cut sheets in different sizes or as a roll, and can be custom printed to include branding and promotional messages. The wrap is ideal for convenience stores and other foodservice operators that provide prepared graband-go food options where maintaining consistent quality and food integrity is critical, the company stated.

NOVOLEX • HARTSVILLE, S.C. • NOVOLEX.COM

NEW PRODUCTS

SEPTEMBER 2023 Convenience Store News 27

But What About the Squirrels?

How to rid your business of unwanted visitors that are keeping legitimate customers away

THIS IS PART TWO of a column that ran in the June issue of Convenience Store News If you didn’t have the chance to read that column (which was excellent, IMHO), allow me to bring you up to speed. My previous column talked about unwanted visitors.

I bludgeoned the analogy of a bird feeder to death in trying to make a point about the difference between having guests that you want vs. guests that you prefer not to have. The bird feeder is your convenience store. The birds are the customers who you work very hard to attract and are the reason you’re in business. The squirrels are those who hang around the bird feeder because it is easy to get food. The end result is that the squirrels scare off the birds. Not the optimal circumstances for when you are trying to run a business.

In this column, I want to go into the specifics of what I’m advising at a site that’s having this problem and provide you with the results that we are seeing in the first three months.

This location should be a successful convenience store and fuel site. It’s on the corner of a busy intersection (on the “downstream” side of the traffic light of the busiest street) and has excellent access. There is a dense residential area

around it and while there are some other convenience stores in the area, there is not a dominant player in the local market. However, the squirrels (sorry!) seem to be keeping the legitimate customers from frequenting the site as often as they want to.

My suggestion to the business owner was to use a three-prong approach.

The first objective was to clean up the site to make it more attractive to customers, especially female shoppers. When I arrived, the store looked like many urban convenience stores: heavy security bars on the windows, dirty forecourt area, peeling paint, a trashed dumpster corral and lots of signs covering up the windows.

A business must be presented to its customers in the best possible light. If someone thinks the owner doesn’t care about how the property looks, then they are going to think the owner doesn’t care about what happens on the property. This is an open invitation for people who have nothing better to do than hang around and create mischief.

I had the operator powerwash the sidewalks, the parking lot and the brick exterior of the building; repaint the

SMALL OPERATOR

28 Convenience Store News CSNEWS.com

By Roy Strasburger, StrasGlobal

WHISKEY — MADE WITH REAL BREWED TEA

mansards and the parking poles; and restripe the parking lot. I encouraged him to take down all of the signage in the windows that was not required by local ordinance, paint the security bars on the windows and doors to match the rest of the color scheme and make them less imposing, and clean all the glass on the exterior.

Furthermore, inside the building, ceiling tiles that were stained were replaced, the interior walls repainted, the floors cleaned and signage removed from the windows of the cashier cage. The counter and backbar displays were rearranged so that the cashier had better sightlines within the store and into the parking lot (customers can see that the cashier can see them!). My goal was to enhance the appearance of the store without investing a lot of money.

The speakers create a sonic space that is uncomfortable for someone who is standing around for long periods of time. While the idea of playing the sound of a dentist drill at high volume is appealing, it’s not a practical solution, as we want our legitimate customers to continue to come into the store. Therefore, I have based the strategy on a modified definition of discomfort.

We want to create an environment that particular individuals would find uncomfortable. This is based on using music that the target audience doesn’t like to listen to, finds irritating after a while, or is music that makes them “uncool” in front of others. The music genres that I usually start with are classical opera, traditional country or smooth jazz, but sometimes you have to keep experimenting with the music to see what is effective for the specific location. The key is that the target demographic does not enjoy hearing it for an extended period of time, whereas our customers at worst will find it to be a minor disturbance and may not even notice the music as they make the short trip into and out of our store.

The final part of improving the store appearance was maximizing the lighting — making sure that the interior, exterior and the parking lot were all well-lit, and replacing bulbs in the signage frames that were burned out. The overall effect, especially at night, is a “fishbowl” where customers can see into the store before they walk in the door. We wanted high visibility into, and out of, the store.

The second objective was to install additional video cameras that are connected to an AI (artificial intelligence) enhanced software system, allowing me to analyze whether the steps that I am recommending are effective. With this system, the cameras can be monitored remotely, the videos are immediately stored in the cloud (so that someone cannot steal the DVR to remove the video), and I can track “incidents.” My goal is to provide the owner with hard data on whether the nuisance abatement measures are effective.

Objective three was to put speakers on the exterior of the building that provide a level of discomfort for those people loitering outside the business. Research has shown the effectiveness of playing music to move loiterers away from a property. We have used this method in our stores in the past and it seems to be an effective way to dissuade people from just hanging around the store.

With a sound program, there are three things to keep in mind. First, you must stay within the local noise ordinances. Second, if you’re playing music, it needs to be with a music program that pays the proper royalties and licenses for the commercial use of that music — just playing something off your phone is not legal. Third, the control of the music must not be left to the staff on duty because they are the ones that can be most heavily influenced/intimidated by the people who want to have the music turned off.

So far, the initial results are very promising. After the cleanup, the number of police incidents and calls dropped to almost zero after averaging about eight calls per month for the previous year. Anecdotal evidence from the staff is that fewer people are hanging out and when they do appear, they are loitering for a shorter amount of time. Sales seem to be increasing over the same period last year, but it’s going to take time for word to get around the community that things have changed and bring customers back into the store. The music program has been effective as well, by pushing those people who are still loitering around the area off our property and further away.

We are going to continue this program for the next six months to make sure it is sustainable. If that is the case, then we will have been able to accomplish our objectives of reducing the number of criminal nuisance instances at the site, increasing sales, and becoming a better neighbor to the community.

Hopefully, our birds will come back to the roost. CSN

Roy Strasburger is CEO of StrasGlobal, a privately held retail consulting, operations and management provider serving the small-format retail industry nationwide. StrasGlobal operates retail locations for companies that don’t have the desire, expertise or infrastructure to operate them. Learn more at strasglobal.com. Strasburger is also cofounder of Vision Group Network, whose members discuss future trends, challenges and opportunities, and then share with all retailers and suppliers, regardless of the size of their business.

Editor’s note: The opinions expressed in this article are the author’s and do not necessarily reflect the views of Convenience Store News.

STORE RESCUE SMALL OPERATOR 30 Convenience Store News CSNEWS.com

If someone thinks the owner doesn’t care about how the property looks, then they are going to think the owner doesn’t care about what happens on the property.

C

INQUIRE NOW Looking for products with more profitability? VLN® is the answer to what’s next in tobacco. Interested retailers, please contact us at SALES@XXIICENTURY.COM or 800-225-1838 Of adult smokers consistently show interest in using VLN®. Indicate they would use VLN® along with their usual brand. Of VLN® users would migrate to other higher margin in-store products. *Internal Data Sources Low nicotine is the future. Responsible retailers are seen as solutions providers, offer your adult customers VLN® today.

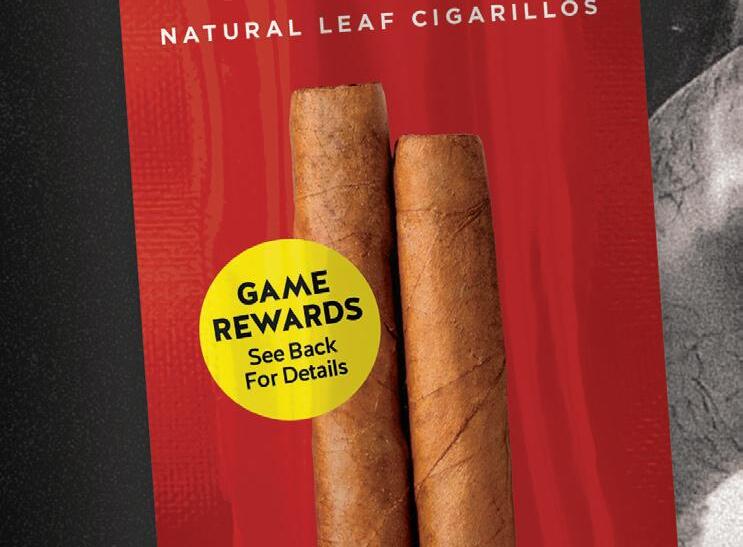

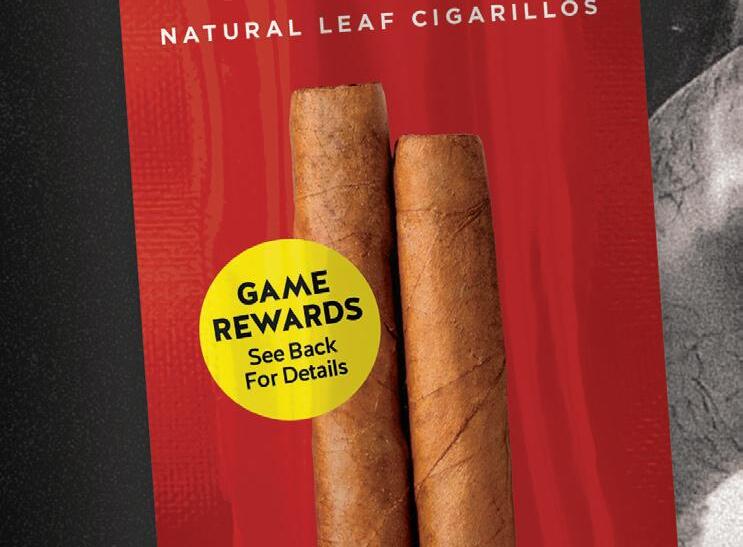

CRWNZ BRINGS THE ROYAL TREATMENT TO NATURAL LEAF

RAM SALAZAR, Senior Director of Brand Strategy at Swisher shares why the slow burning nature of Natural Leaf cigarillos appeals to adult consumers who want to take their time, relax and enjoy the experience. Salazar tells Convenience Store News how research into the changing consumer preferences was incorporated into CRWNZ. “It is everything adult consumers are looking for,” she said.

What are the major trends in the OTP category?

Where is growth coming from?

RAM: CRWNZ is hitting the shelves during an exciting time for the category. Over the past five years, we’ve seen a shift in preference by adult consumers who are choosing Traditional Natural Leaf products more than ever. While the Large Cigar category has grown at a +1.1% five-year CAGR (2017-2022), the Traditional Natural Leaf sub-category outpaced Large Cigars during that time growing at a 6.0% five-year CAGR.

Can you discuss what consumers are looking for in the category?

RAM: Adult consumers want consistent quality delivered in every pack. Going back to the trends we’re seeing in the category, one of the reasons we feel adult consumers are drawn to a Natural Leaf product is the slower burning nature of the cigarillos, which allows them to take their time, relax and enjoy the experience. Certainly taste, freshness, and overall quality are just as important. CRWNZ delivers on everything adult consumers are looking for.

What is happening in the Natural Leaf segment?

What has your research found?

RAM: Natural Leaf products are becoming more popular, both with adult consumers, and retailers looking to drive sales. Adult consumers are willing to spend more per unit for a Natural Leaf product, especially if it delivers consistent quality, taste, and freshness. On the retail side, our partners see an average of $1.57 per unit with a Traditional Natural Leaf item, versus the $1.51 per unit for an HTL item. We feel CRWNZ can capture that momentum due to its unique branding, high quality, and superior experience.

How are you filling a gap in the Natural Leaf?

RAM: We know adult consumers are choosing Natural Leaf products more than ever in markets across the country. Our research indicates that nearly 75% of adult consumers

21-34 actively purchase multiple brands within the category. CRWNZ is poised to capture that energy by injecting a level of excitement for adult consumers who desire greater variety and higher quality.

Can you tell us more about CRWNZ?

RAM: Drawing on our experience and existing portfolio of Natural Leaf products, we conducted extensive research in developing the CRWNZ brand and product line, from the name, packaging, to the blend varieties offered. As we’ve talked about already, the Natural Leaf category is experiencing real momentum among adult consumers who prefer a slower burn and more relaxing experience. The intent is for CRWNZ to become a fresh face in the Natural Leaf category. The brand’s mission is to honor those who, through grit, and determination, embrace their inner hero, break through, and crown life’s victories. The bold packaging creative drove an 80% Top Purchase Intent score. The launch is being supported through a holistic digital media and an adult premises advertising plan that we believe will drive excitement around the brand, and higher sales for retail partners.

Where and how should CRWNZ be merchandised in C-stores?

RAM: CRWNZ packaging is bold, elevated, and unlike anything else in the Natural Leaf category. When positioned next to or near existing Natural Leaf brands, we feel it will draw considerable attention from adult consumers, compared to alternatives.

Are there promotional plans in the pipeline.

RAM: We are taking a holistic approach to promoting CRWNZ. While this is a national roll out, we are taking extra care to focus on markets where we know Natural Leaf products outperform other categories. Additional promotional pieces will roll out in 2024.

How can retailers gear up for demand for CRWNZ?

RAM: We would love to meet you at NACS, at Booth #B1333 We also encourage you to engage with your Swisher Sales Representative to learn more about CRWNZ and to begin placing orders ahead of the national launch. They are your direct source for all CRWNZ related information and promotional items. Our Customer Service Team can be reached during normal weekday business hours at 1(800) 874-9720, or anytime by fax at 1(800) 628-4675, and email at customerservice@swisher.com

ADVERTORIAL

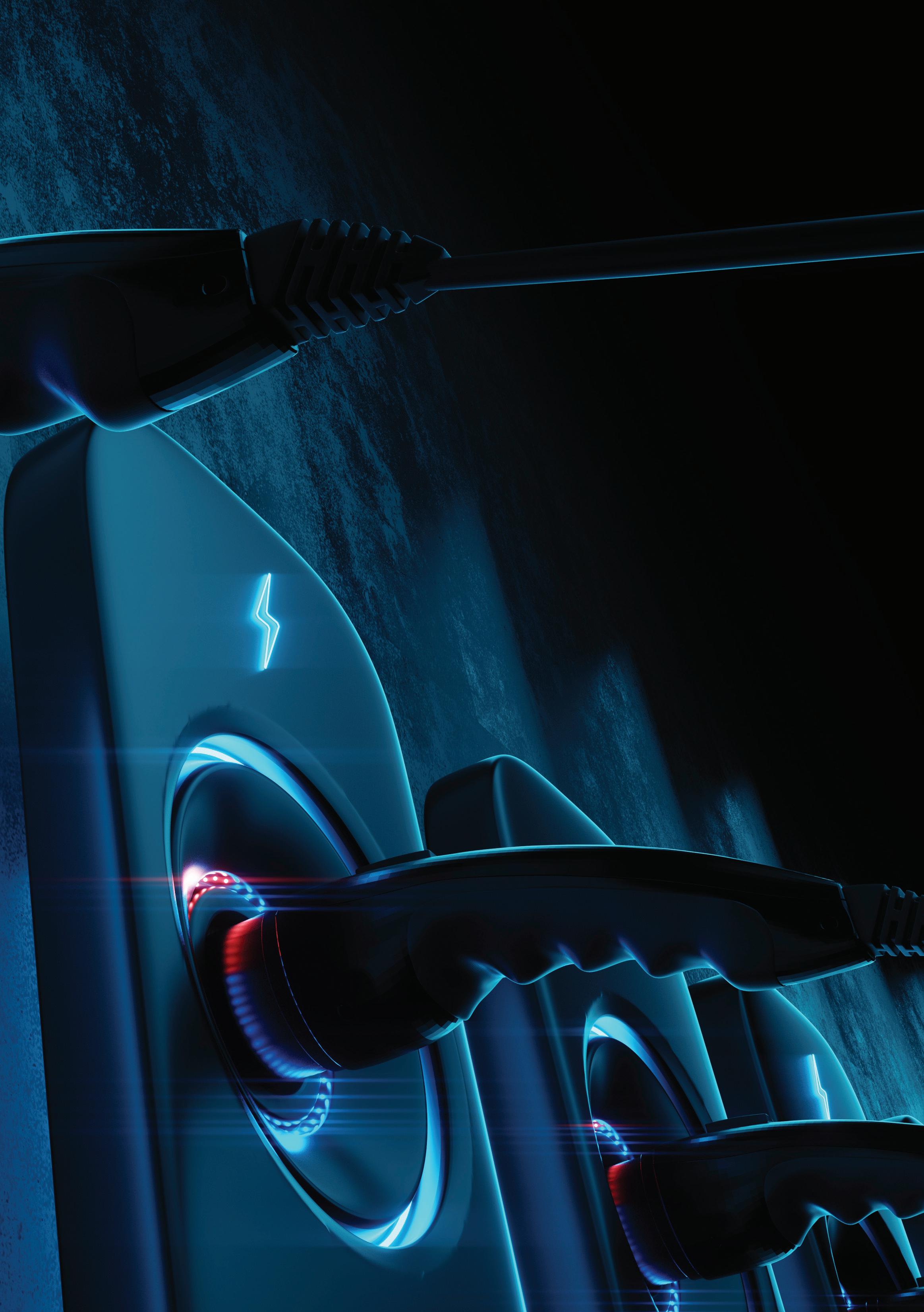

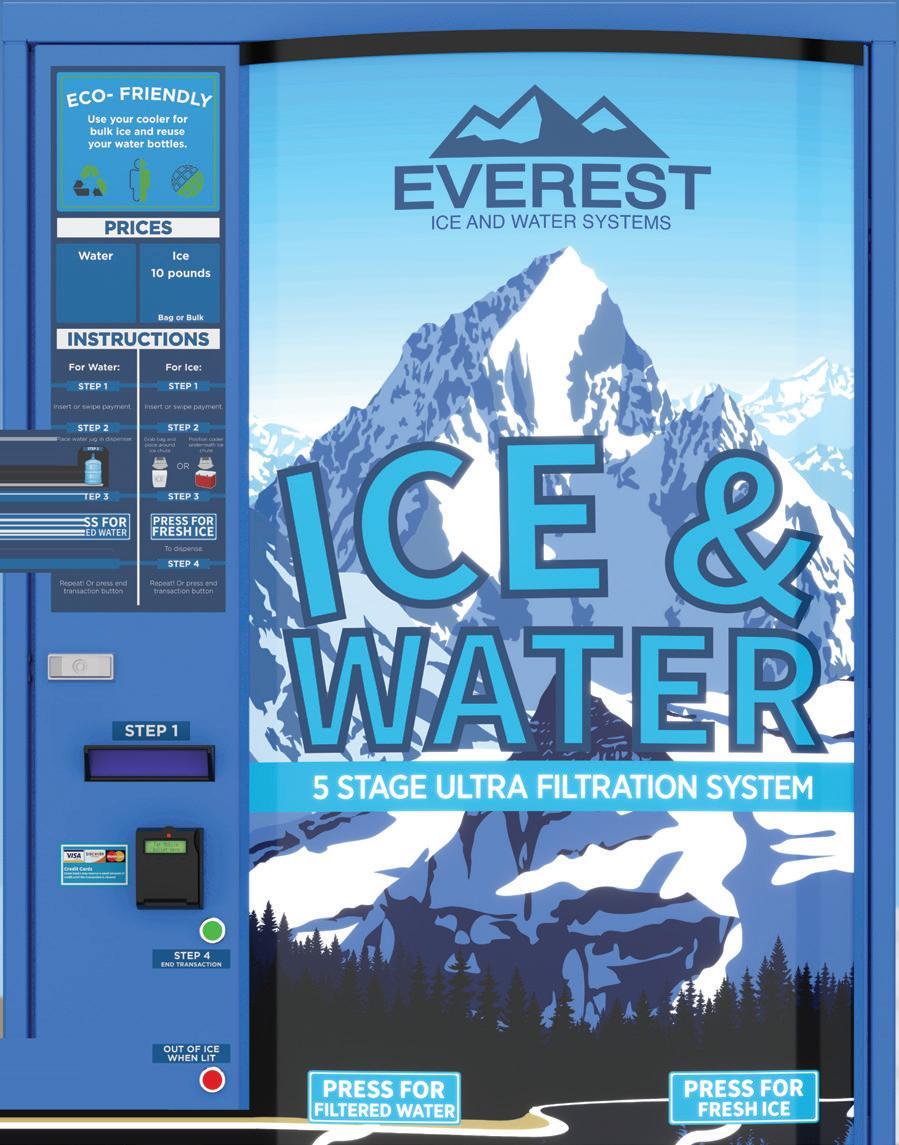

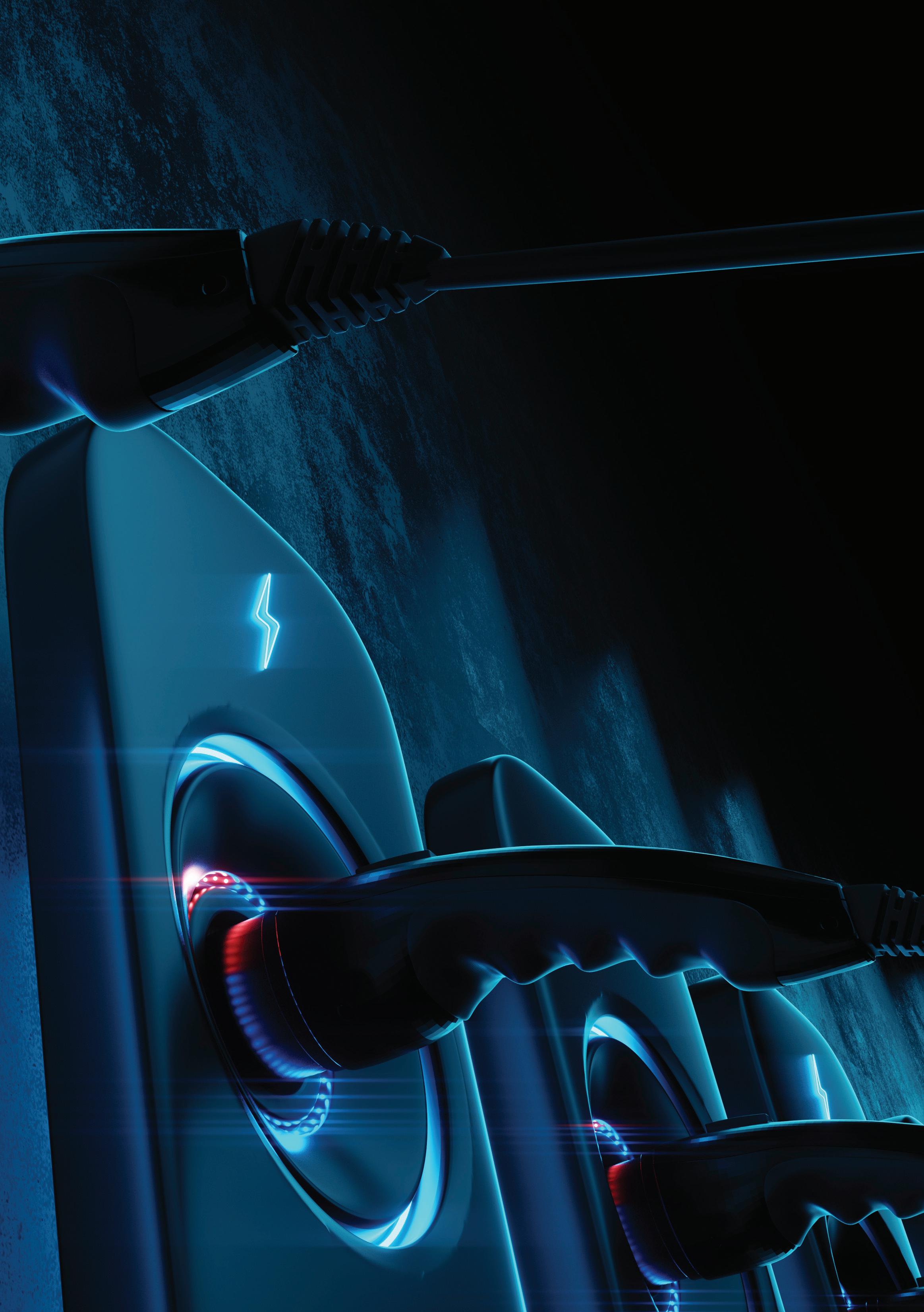

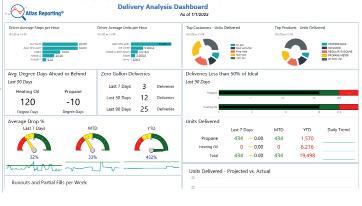

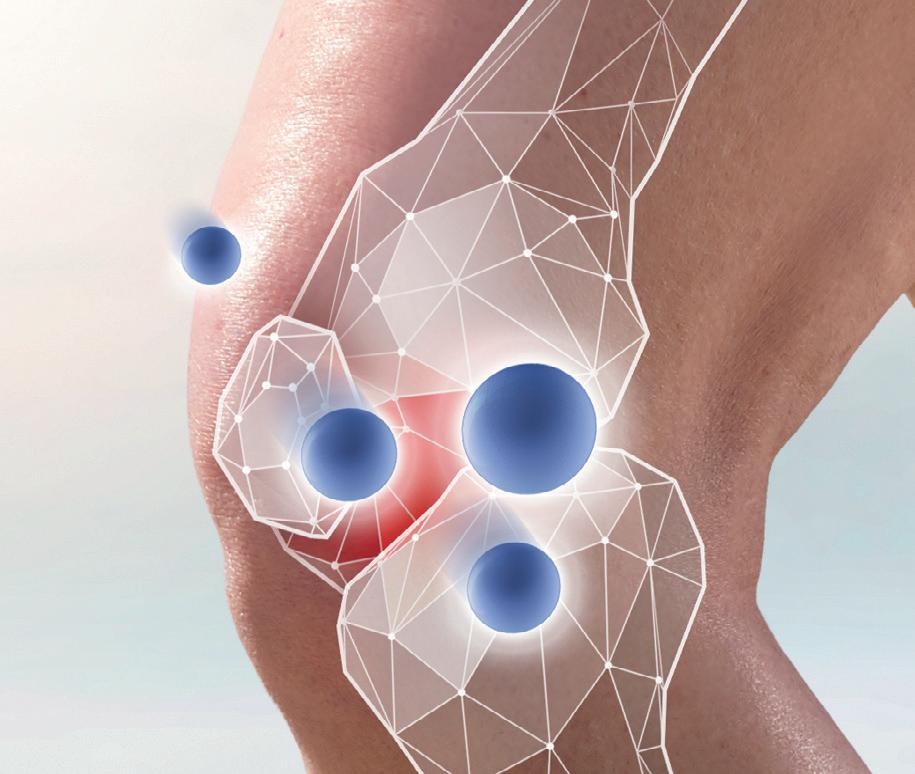

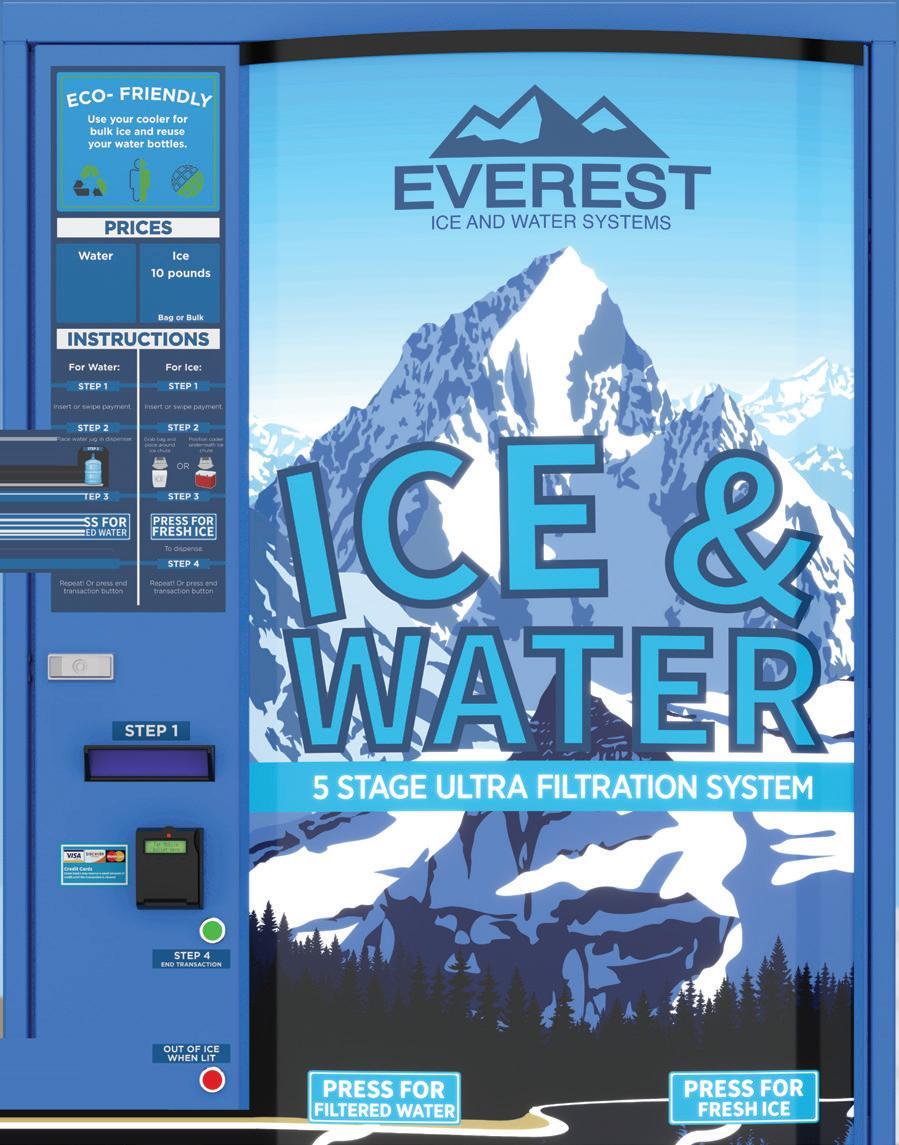

MOMENTUM AROUND ELECTRIC VEHICLE CHARGING IS BUILDING IN THE C-STORE INDUSTRY

WHILE THE UNITED STATES is at least 10 years or more away from a time when electric vehicle (EV) charging will become more popular than traditional fueling — with recent estimates stating that 45 percent of new car sales could be electric by 2035 — the EV market continues to grow.

The Alternative Fuels Data Center, which is part of the U.S. Department of Energy, listed almost 50,000 EV charging stations in operation in the U.S. as of October 2022, with 93 percent of them publicly accessible and 99 percent of them direct current (DC) fast chargers.

“We are seeing year-over-year increases in new vehicle sales transitioning over to electric,” said Tom Pocrnich, director of product management for EV charging at Dover Fueling Solutions, based in Austin, Texas. He noted that 5 percent of new vehicles purchased in 2022 were electric, up from 3 percent in 2021, and the number of EV registrations hit 7 percent in January 2023. “We are reaching a crucial inflection point and being shown in the marketplace up to 30 percent of new vehicles will be electric likely before 2030.”

34 Convenience Store News CSNEWS.com COVER STORY

SEPTEMBER 2023 Convenience Store News 35

In the convenience store industry, retailers across the nation are announcing plans to either introduce EV charging at their sites or expand upon already established networks. Travel centers are implementing EV charging, too, especially since they often cater to highway drivers.

Pilot Co. announced last year that it was building a network of 2,000 fast charging stations across its 500 travel centers. It is still in the process of doing so — in partnership with General Motors and EVgo chargers — with the aim of having 200 charging stations available by the end of 2023, said Matthew Dunn, head of mergers and acquisitions for the chain.

“The automotive industry has shifted into heavy EV production to meet its pressing goals and the national electrification infrastructure is doing its best to match that pace,” he explained. “Consumer interest is steadily increasing as more makes and models are available. However, widespread EV adoption is limited by lack of chargers nationwide in the places people travel most. Pilot is well equipped to meet the needs of American highways and offer drivers of all vehicles a safe and seamless road trip experience.”

While home and workplace represent the majority of where charging occurs, the remaining 20 to 30 percent will be shared not just by c-stores, but also by restaurants and other retailers, making for a competitive environment, according to Campbell, Calif.-based ChargePoint Inc., a provider of networked hardware and software solutions for charging electric vehicles.

“There are also a lot of companies entering the market that had nothing to do with fueling because they are looking at it as a complement to their business,” a ChargePoint spokesperson said.

One way Pilot is seeking to differentiate itself is by offering charging stations with a pull-through design and canopies that protect from the weather, similar to fuel pumps, as many charging stations that exist today at municipal buildings and parking lots do not provide the various amenities a travel center or a convenience store can offer.

“[Other] locations do not provide shelter from the elements, clean restrooms, Wi-Fi or refreshment offering,” said Dunn.

Retailers can gain access to grants and other funding to install EV charging at their locations through a number of programs that started with the passing of the Bipartisan Infrastructure Law in November 2021. This created new U.S. Department of Transportation programs, including the National Electric Vehicle Infrastructure (NEVI) Formula Program offering $5 billion in funding, and the Discretionary Grant Program for Charging and Fueling Infrastructure offering $2.5 billion in funding.

“The biggest difference between this year and last year is all the funding, which is surging right now,” said Peter Rasmussen, CEO and founder of Convenience and Energy Advisors, a strategic consulting firm based in Boston. He noted that the first year of federal funding was released to establish EV charging every 50 miles on state travel corridors.

“If a c-store doesn’t apply, one of their competitors will get the funding and it might not even be another c-store,” Rasmussen cautioned. “For Level 3 fast chargers, you are talking over $100,000 and if a chain has multiple positions and needs a new transformer from the utility company, it could be close to a million dollars to invest.”

36 Convenience Store News CSNEWS.com COVER STORY

©2023 Haleon group of companies or its licensor. All rights reserved. CONTACT YOUR LOCAL NICORETTE SALES REPRESENTATIVE ON HOW TO ORDER OR EMAIL SCOTT.X.BREISINGER@HALEON.COM CON C T OU R LOC L N ICOR TO ORDER OR EM A I L DID YOU KNOW... Nicorette 10ct is your answer! Cinnamon Surge, White Ice Mint, & Fruit Chill Gum These retailers are on board, are you? HOLIDAY STATIONSTORES ® WAWA ® CIRCLE K® 7-ELEVEN ® SPEEDWAY® AMPM ® New Jersey passed a law REQUIRING CONVENIENCE STORES that sell tobacco or vapor products TO CARRY FDA APPROVED NRT * NICORETTE IS THE ONLY FDA APPROVED SMOKING CESSATION ITEM† F * Took effect March 18, 2022. Includes Vape shops. Excludes Cigar shops. † Only national branded FDA approved smoking cessation item.

7Charge, a proprietary charging network, launched at select 7-Eleven stores in Florida, Texas, Colorado and California.

• 7-Eleven Inc. unveiled a proprietary electric vehicle charging network called 7Charge. Launched at select stores in Florida, Texas, Colorado and California, 7Charge sites allow customers to charge any EV make and model compatible with common CHAdeMO or Combined Charging System plug types, while a 7Charge app offers convenience to customers looking for a seamless charging and payment experience.

• Sheetz Inc. reached a milestone of more than 2 million electric vehicle charging sessions. The Mid-Atlantic chain installed its first EV charger in Pennsylvania in 2012. As of April, Sheetz had 650 electric vehicle chargers available at 95 of its stores, and the company said it’s still actively expanding the network across its footprint.

• Shell USA Inc. completed a $169 million acquisition of electric vehicle charging and media company Volta Inc. and now owns and operates one of the largest public EV charging networks in the United States. The company plans to scale the existing network and is shooting to have more than 500,000 charge points globally by 2025 and around 2.5 million charge points by 2030.

• BP announced plans in February to invest $1 billion by the end of 2023 on electric vehicle charge points across the United States. A cornerstone of this investment is its partnership with Hertz to bring fast charging infrastructure to Hertz locations in major cities including Atlanta, Austin, Boston, Chicago, Denver, Houston, Miami, New York, Orlando, Phoenix, San Francisco and Washington, D.C. Several of the installations will include gigahub locations that will serve rideshare and taxi drivers, car rental customers and the general public at high-demand locations, such as airports.