WHAT’S NEXT IN CONVENIENCE AND FUEL RETAILING

WHAT’S NEXT IN CONVENIENCE AND FUEL RETAILING

THE ABCS OF CONTACTLESS SHOPPING

WHAT’S NEXT IN CONVENIENCE AND FUEL RETAILING

THE ABCS OF CONTACTLESS SHOPPING

MILLENNIALS AND GENERATION Z ARE INCREASINGLY SHAPING THE CONVENIENCE STORE PROPOSITION.

THE YEAR I WAS BORN, the cutting-edge technology hitting the market was the Sony Walkman priced at $200. In the world of entertainment, the Bee Gees topped the charts, “Superman” flew through the theaters, and the most watched show in America was “60 Minutes.”

As a proud member of Generation X, I didn’t get my first cellphone until the summer I headed off to college. And you can be sure there wasn’t an app to be found on my Nokia flip phone.

Times have certainly changed and, as a result, so have the generations that followed mine. Generation Y, more commonly referred to as the millennials, is the first generation that grew up in the Internet Age. Labeled as “digital natives,” this generation is characterized by its familiarity and widespread usage of the Internet, mobile devices and social media. Generation Z, also known as the zoomers, is the first generation to have grown up with access to the Internet and portable digital technology from a young age. Labeled the first “social generation,” Gen Z’s purchases are heavily influenced by trends they see on social media.

Millennials, who were born between approximately 1981 and 1996, now make up the largest generational group in the United States, while Gen Z, born between approximately 1997 and 2013, is only slightly smaller than the aging baby boomers. Both of these generations are increasingly shaping the convenience store proposition. As our cover story this month (see page 34)

explains, these generations are now in the driver’s seat, so convenience store operators interested in long-term success would be wise to study up on their preferences.

The 2023 Convenience Store News Realities of the Aisle Study, being unveiled in this issue, contains some interesting insights on these influential generations. For instance:

• Compared to other generations, significantly more millennials and Gen Z report shopping at c-stores more frequently today than they did a year ago.

• Contactless shopping, mobile ordering, and social media promotions and messaging have more sway over Gen Z and millennials than other generations.

• Millennials are more likely than other generations to place importance on the quality of the prepared food offered at c-stores, while Gen Z is more likely to cite loyalty programs as important for a positive shopping experience.

• Both generations value a fun-to-shop store.

C-store operators must recognize that their customer base is undergoing a major demographic shift and react accordingly. It’s likely these shoppers are already in your stores, but you may not be fully satisfying their needs. Millennials and Gen Z hold significant buying power. And with their social media prowess, they can be compelling ambassadors for your brand.

For comments, please contact Linda Lisanti, Editor-in-Chief, at llisanti@ensembleiq.com.

Ray Johnson Speedee Mart

Ruth Ann Lilly GPM Investments LLC

Vito Maurici McLane Co. Inc.

Jonathan Polansky Plaid Pantries Inc.

Greg Scriver Kwik Trip Inc.

Roy Strasburger StrasGlobal

Chris Hartman Rutter’s

We mourn the passing of six industry greats

THE CONVENIENCE STORE INDUSTRY LOST more than a century of entrepreneurial, innovative experience with the passing of six iconic leaders since the end of last year. It’s only March as I write this, but it’s a sad time for the families and many friends of Jay Erickson, Tom Love, Don and Charlie Hunt, Bruce Bott and Bob Born, all of whom died since the closing days of 2022.

Most recently, Love, co-founder of Love’s Travel Stops & Country Stores with his wife Judy, passed away March 7 at the age of 85. With a $5,000 gift from Judy’s parents, the couple leased an abandoned gas station in Watonga, Okla., in 1964. Within a few years, the company had 40 stations and began to open convenience stores alongside its gas pumps. Named as one of the c-store industry’s 50 Most Influential People in 2019, Love’s creation today has a network of 600 locations in 42 states, along with 430 truck service centers.

Tom and Judy are renowned for their charitable giving almost as much as their business acumen. Tom’s passion for service and helping those in his community led to the Love family donating to local and national organizations such as Children’s Miracle Network Hospitals, United Way, Catholic Charities and the University of Oklahoma, which opened the Tom Love Innovation Hub in 2018 to provide a space for future entrepreneurs and other workforce development programs. Tom was a veteran of the U.S. Marine Corps.

Just before the end of last year, Charlie and Don Hunt, the last living co-founders of Hunt Brothers Pizza, died on Dec. 22 and 27, respectively. They were 78 and 88. Alongside their two other brothers, Don and Charlie formed Hunt Brothers Pizza in 1991. They teamed up to forge a company with more than 9,000 store partnerships, 550-plus team members, and the support of countless communities and charities over the years. Hunt Brothers is the largest brand of made-to-order pizza in the convenience store industry.

In late January, Ira “Bob” Born, founder of the Peeps brand of candy, passed away at the age of 98. As son of the founder of Just Born Quality Confections, Bob joined the company in 1945 after serving in the Navy during World War II. He is credited with designing a machine that deposits the Peeps marshmallow chicks; the treats were originally made by hand. Bob is also credited with inventing the Hot Tamales brand by finding a creative way to rework Mike and Ike candies. He was a true innovator in the candy industry.

Bott, founder of Advanced Digital Data Inc. (ADD Systems), passed away in February. Bruce pioneered software for the energy distribution industry, building ADD Systems from a one-person operation to a thriving corporation that employs more than 150 people across the United States and Canada. His fuel management software automated the process of predicting fuel deliveries for hundreds of clients across the industry.

Perhaps the toughest loss to take was the unexpected passing of Erickson on March 2. Jay was only 51 years old. As chief operating officer, he helped Canada-based Parkland Corp. establish a beachhead in the U.S. with an amazing 21 acquisitions in three years. Most recently, he served as interim president of Parkland USA after the departure of Doug Haugh in December 2022. The c-store industry veteran also made his mark at Kroger’s c-store division, and then EG Group.

My condolences to all the thousands of people positively touched by these inspiring spirits.

For comments, please contact Don Longo, Editorial Director Emeritus, at dlongo@ensembleiq.com.

My condolences to all the thousands of people positively touched by these inspiring spirits.

FEATURES

COVER STORY

34 In the Driver’s Seat Millennials and Generation Z are increasingly shaping the convenience store proposition.

44 Driving the Pump-to-Store Conversion

Creative marketing ideas, partnerships, mobile apps and other technologies are helping c-store retailers entice fuel customers to venture inside the store.

DEPARTMENTS

E DITOR’S NOTE

3 Understanding Your New Customer Base

It’s time to study up on the preferences of millennials and Gen Z.

VIEWPOINT

4 In Memoriam We mourn the passing of six industry greats.

10 CSNews Online

24 New Products

SMALL OPERATOR

28 A Mutually Beneficial Relationship Transparency and open communication are key in optimizing the connection between small operators and their supplier and distributor partners.

TWIC TALK

56 The Benefits of Gender-Centered Design Companies can build better work environments by prioritizing five basic principles.

STORE SPOTLIGHT

58 A Fresh Take on Convenience

Inspired by Lowcountry vernacular architecture, the new Parker’s Kitchen prototype reflects the changing needs of customers and optimizes operational efficiency.

INSIDE THE CONSUMER MIND

78 Food for Thought

Price is now the top purchase consideration for buyers of c-store prepared food.

INDUSTRY

14

14 53

8550 W. Bryn Mawr Ave., Ste. 200, Chicago, IL 60631 (773) 992-4450 Fax (773) 992-4455 WWW.CSNEWS.COM

BRAND MANAGEMENT

VICE PRESIDENT & GROUP BRAND DIRECTOR Paula Lashinsky (917) 446-4117 - plashinsky@ensembleiq.com

EDITORIAL

EDITOR-IN-CHIEF Linda Lisanti llisanti@ensembleiq.com

EXECUTIVE EDITOR Melissa Kress mkress@ensembleiq.com

SENIOR EDITOR Angela Hanson ahanson@ensembleiq.com

MANAGING EDITOR Danielle Romano dromano@ensembleiq.com

ASSOCIATE EDITOR Amanda Koprowski akoprowski@ensembleiq.com

EDITORIAL DIRECTOR EMERITUS Don Longo dlongo@ensembleiq.com

CONTRIBUTING EDITORS Renée M. Covino, Tammy Mastroberte

ADVERTISING SALES & BUSINESS

ASSOCIATE BRAND DIRECTOR & NORTHEAST SALES MANAGER Rachel McGaffigan - (774) 212-6455 rmcgaffigan@ensembleiq.com

ASSOCIATE BRAND DIRECTOR & WESTERN SALES MANAGER Ron Lowy - (330) 840-9557 - rlowy@ensembleiq.com

TOBACCO

48 Reduced Risk, Increased Opportunity?

ASSOCIATE PUBLISHER & MIDWEST SALES MANAGER Kelly Fischer - (773) 992-4464 - kfischer@ensembleiq.com

ACCOUNT EXECUTIVE & CLASSIFIED ADVERTISING Terry Kanganis - (201) 855-7615 - tkanganis@ensembleiq.com

CLASSIFIED PRODUCTION MANAGER Mary Beth Medley (856) 809-0050 - marybeth@marybethmedley.com

DESIGN/PRODUCTION/MARKETING

SENIOR CREATIVE DIRECTOR Colette Magliaro cmagliaro@ensembleiq.com

ART DIRECTOR Lauren DiMeo ldimeo@ensembleiq.com

PRODUCTION DIRECTOR Ed Ward edward@ensembleiq.com

MARKETING MANAGER Krista-Alana Travis ktravis@ensembleiq.com

SUBSCRIPTION SERVICES

LIST RENTAL mbriganti@anteriad.com

SUBSCRIPTION QUESTIONS contact@csnews.com

CORPORATE OFFICERS

CHIEF EXECUTIVE OFFICER Jennifer Litterick

CHIEF FINANCIAL OFFICER Jane Volland

CHIEF PEOPLE OFFICER Ann Jadown

EXECUTIVE VICE PRESIDENT, CONTENT & COMMUNICATIONS Joe Territo

CONVENIENCE STORE NEWS AFFILIATIONS Premier Trade Press Exhibitor

TOP VIEWED STORIES

The Texas-based travel center operator recently submitted a conditional use permit to Virginia’s New Kent County Planning and Zoning Department outlining plans to open a 74,000-squarefoot Buc-ee’s. The company is also planning its first Wisconsin site in DeForest, located approximately 16 miles north of Madison.

2

Ohio’s Liberty Township board of trustees approved plans for Unicorp National Developments Inc. to build a Wawa convenience store there. Company plans call for the opening of the c-store retailer’s first Indiana location as well, in Noblesville at State Road 32 and Hazell Dell Road.

7-Eleven Inc. and beloved video game icon PAC-MAN teamed up to reward customers in a collaboration that included giveaways, an exclusive 7Collection merchandise drop and new limited-time-only beverages inspired by PAC-MAN.

EG Group is making a change on the East Coast. The operator announced the sale-leaseback of a portfolio of 415 sites to Realty Income Corp. for gross consideration of approximately $1.5 billion. Its Westborough, Mass.-based EG America subsidiary will continue to operate and trade the portfolio.

1 3 4 5

Why the Convenience Store Industry Needs to Engage With Local Reviews

For more exclusive columns, visit the Expert Viewpoints section of csnews.com.

“Lawmakers and their staff need us so that they can understand how their policies and decisions affect their constituents,” explained NATSO President and CEO Lisa Mullings during her keynote remarks at NATSO Connect 2023.

The industry is “extraordinarily” well-positioned to navigate the transition away from one form of transportation energy to a completely different one, according to David Fialkov, executive vice president of government affairs, who pointed out that significant money is being invested in truck stops and travel centers, indicating confidence in the industry’s future.

Wayne Ovation Fuel Dispensers E40 Upgrade

Dover Fueling Solutions Austin, Texas doverfuelingsolutions.com/ovation

Tw v u u C- p dd p du m um d m d .

Exp xp u v k K m u w d v w 2023 d d. K m u pp p u u u m — m C- u . H GT

D v u d GT’ L v F d pu k u w -stores can benefit from the Kombucha boom with his Synergy brand.

Q: H w l h K m u h m k ?

A: A 2023 K m u m k v u d $3.4 w p m v u v x 10-p u . S um d k preferences are expected to benefit K m u . T K m u m k

d Fu u M k I xp $3.56 -p u w pu 2026. E m p d K mu w pp $10 2030.

Q: A h f h f l ?

A: N u w k . U K m u u d p d v v . I dd

d K m u p k d u m d u d d d ’ w m um . W

p u d u

m k w K m u um w v d v w v .

Q: Wh h um ?

A: SYNERGY’ u m u d 18-35 d u d k u p m um p du . T qu v d ju d d k . I p k k p du -v d p m w m u u .

Q: Wh um l k f wh h pp f K m u h ?

A: T pu d v qu d w u and health benefits. These consumers du d d p w pu d . T m w SYNERGY d u v 20 .

Q: Wh m d d f m x mum ROI, y u h h to serve the demand for flavors?

A: W u d u u top-selling flavors of SYNERGY that pp v um d p . W these options, consumers can find a sweet, tart, spicy, or tangy flavor u p .

Q: D u GT’ L v F d ’ w l u h d h w u ld K m u h l .

A: Ou 10 z SYNERGY w d d x u v Cit is a perfect fit for new and curious um m v d u K m u u v d m v . T m z d d p d w d w upp -um .

Q: W ll K m u h m d w h pp h du y d u ld k ?

A: A u ! H v SYNERGY 10 z w w pp u w v . R v d um w pu SYNERGY d pu p m um p du w d .

H w

Q: H w h f l ?

C-

A: Cm d SYNERGYtraffic areas of the store, displaying d m k u p du v d v .

Q: D GT’ L v F d dv d/ h v y p m l m k ?

A: W p ud d

K m u d w mm d w u POS m d m d d - p m . I year we are focusing specifically on d v um v w u 10 z x u v .

The nation’s largest convenience store operator is rolling out a proprietary electric vehicle charging network

7-ELEVEN INC. is plotting out a proprietary electric vehicle (EV) charging network called 7Charge.

The Irving, Texas-based convenience store retailer debuted the service at select stores in Florida, Texas, Colorado and California. With the launch, 7-Eleven intends to build one of the largest and most compatible EV fast-charging networks of any retailer in North America. A rollout will begin in the United States before making the jump to Canada.

The 7Charge network will offer EV drivers 7-Eleven’s trademark convenience and accessibility, the company stated. 7Charge sites allow customers to charge any EV make and model compatible with common CHAdeMO or Combined Charging System plug types.

Additionally, the 7Charge app offers a new level of convenience and coordination for customers looking for a seamless charging and payment experience. The 7Charge app can be

downloaded from the App Store or Google Play, or by visiting 7Eleven.com/7charge.

“For over 95 years, 7-Eleven has innovated to meet our customers’ needs — delivering convenience where, when and how they want it,” said Joe DePinto, the company’s president and CEO. “Now, we are innovating once again to meet our customers’ where they are by expanding our business to provide EV drivers convenience of the future ... today.”

By rolling out the 7Charge network while also continuing to utilize third-party fast-charging network options, 7-Eleven will have the ability to grow its network to match consumer demand and make EV charging available to neighborhoods that have, until now, lacked access, the company said.

7-Eleven operates, franchises and/or licenses more than 13,000 stores in the U.S. and Canada. In addition to 7-Eleven stores, the company operates and franchises Speedway, Stripes, Laredo Taco Co., and Raise the Roost Chicken & Biscuits locations.

Adding TotalEnergies’ assets will expand its European footprint by nearly 80 percent

ALIMENTATION COUCHE-TARD INC. is making good on its goal to grow. On March 16, the retailer entered into exclusive negotiations to acquire 100 percent of TotalEnergies SE’s retail assets in Germany and the Netherlands, as well as a 60 percent controlling interest in the company’s Belgium and Luxembourg entities.

The proposed acquisition would include 2,193 sites: 1,195 in Germany, 566 in Belgium, 387 in the Netherlands and 45 in Luxembourg.

“These are high-quality locations with very strong market positions in each country and in close proximity to our current footprint in Europe,” Couche-Tard President and CEO Brian Hannasch said during the company’s fiscal 2023 third-quarter earnings call, held March 16.

The Laval, Quebec-based parent company of Circle K expects to close the deal with TotalEnergies before the end of this calendar year.

“For some time, we’ve been seeking a sizable

This is the 23rd acquisition since 2013 for ARKO, parent company of GPM Investments LLC.

acquisition. This one will grow our European network by close to 80 percent, bringing value to our shareholders and being a strong geographic and strategic fit,” Hannasch said.

By expanding into Germany, Europe’s largest market, and other markets near Couche-Tard’s Scandinavian, Irish, Polish and Baltic networks, “we believe it can generate material synergies and create additional growth opportunities in some of Europe’s strongest economies,” he added.

ARKO Corp. completed a $370 million purchase of assets from Transit Energy Group and its affiliates. The deal included 135 convenience stores and fuel supply to approximately 190 independent dealers.

Yesway acquired five existing Ranglers convenience stores in the cities of Clifton, Hamilton and Hico, Texas. Each of the Ranglers locations will be remodeled and rebranded under either the Yesway or Allsup’s banner.

Street Corner is bringing two urban superette-style stores to the California market. Located in Hermosa Beach and Santa Clarita, the stores offer premade food items, including salads, sandwiches, wraps, diced fruit and soup.

FastLane parent company Warrenton Oil Co.

is acquiring Thoele Oil, a family-owned and -operated chain of 10 c-stores. The deal will expand Warrenton Oil’s footprint in St. Charles, St. Peters and O’Fallon, Mo.

Maverik — Adventure’s First Stop continued its expansion into California with a third store opening. At just more than 5,000 square feet, the Anderson site features assisted checkout registers and various in-store contactless payment technologies.

The Army & Air Force Exchange Service (AAFES) plans to open 80 micro markets throughout the continental United States in 2023. AAFES opened 46 micro markets in 2021 and 80 sites in 2022.

IT’S NOW ILLEGAL IN CALIFORNIA TO SELL MOST FLAVORED TOBACCO PRODUCTS, INCLUDING VAPES AND MENTHOL CIGARETTES. FOLLOW THE LAW TO PROTECT KIDS FROM A LIFETIME OF DEADLY ADDICTION.

MAKE SURE YOU’RE FOLLOWING THE LAW AT NOFLAVORS.ORG

$228.6B

Private label sales hit a new record last year, increasing 11.3 percent to $228.6 billion across all U.S. outlets for the 52 weeks ending Jan. 1, 2023.

— Private Label Manufacturers Association

Coffee was the most popular keyword for retail buyers in 2022, garnering 19.4 percent of all searches on product discovery platform RangeMe.

— Retail Recap 2022 Report, RangeMe

Legal U.S. cannabis sales are expected to grow 14 percent by the end of 2023 despite economic uncertainty and rising inflation.

— BDSA

Green Zebra Grocery closed all three of its stores on March 31. Founder and CEO Lisa Sedlar cited several factors for the closures, including the COVID-19 pandemic, increasing costs of goods, rising expenses, and supply chain and labor challenges.

TravelCenters of America Inc. debuted a new proprietary restaurant brand, Fork & Compass, with a ribbon-cutting ceremony on Feb. 22. The restaurant is located at the Petro Stopping Center in Perrysburg, Ohio.

Wawa Inc. kicked off hiring efforts for the 2023 summer season. The company’s goal is to bring on about 1,500 new associates to serve every Wawa store from the Jersey Shore to the beaches of Delaware, Maryland and Virginia.

Neon Marketplace tapped Mable to bring locally and regionally made specialty items to the convenience store retailer’s locations in Rhode Island and Massachusetts. Showcasing emerging better-for-you items complements Neon Marketplace’s elevated food and beverage offerings, the company stated.

Love’s Travel Stops awarded 140 Gemini Motor Transport drivers more than $2.3 million in bonuses for their commitment to safety last year. A member of the Love’s family of companies, Gemini operates a fleet that transports fuel to Love’s locations.

Quality Mart rolled out an order-ahead option at select stores in North Carolina. Through the SWIPEBY platform, customers can order ahead or while at the pump and then pick up their orders at the counter.

Parker’s debuted a refreshed Parker’s Rewards mobile app that offers an improved, user-friendly design, added security and a more personalized customer experience.

Parker’s debuted a refreshed Parker’s Rewards mobile app that offers an improved, user-friendly design, added security and a more personalized customer experience.

Altria Group Inc. is acquiring NJOY Holdings Inc. for approximately $2.75 billion in an all-cash deal. The terms include an additional $500 million in cash payments that are contingent upon regulatory outcomes with respect to certain NJOY products.

Halfon Candy Co. The purchase will increase Harbor’s market share and expand its reach into new areas.

Lula Convenience partnered with Gilbarco Veeder-Root to integrate its own platform with Gilbarco’s Passport Retail Platform. The pact will help streamline inventory management and delivery fulfillment for c-stores.

P97 Networks is partnering with Visa Inc. to deploy token technology. The collaboration is aimed at reducing friction for in-car payments and enabling electric vehicle charging payments across public networks.

Mars Inc. and Conjure Inc. are teaming up to pilot on-demand mobile ice cream stores for Mars brands. The partnership will allow customers to order ice cream from their smartphones and have it delivered to them within minutes.

Harbor Wholesale is extending its distribution capabilities into seasonal and specialty candy with the acquisition of

McLane Co. Inc. hosted its third-annual National Hiring Day on March 1. The distributor is seeking candidates for a variety of full-time and some part-time positions for driver and warehouse teammates.

SK Food Group plans to build a 525,000square-foot production facility in Cleveland, Tenn. The facility will be completed in three phases and include automation technology for sandwich assembly and food handling.

EnsembleIQ is a premier business intelligence resource that believes in Solving Big Problems and Inspiring Bold Ideas. Our brands work in harmony to inform, connect, and provide predictive analysis for retailers, consumer goods manufacturers, technology vendors, marketing agencies and service providers.

Doritos unveiled its first flavor innovation of 2023. The introduction of Doritos Sweet & Tangy BBQ chips encourages fans to see things through a different lens and try something new — including barbecue in the winter. According to the brand, the new variety delivers a bold experience that takes traditional BBQ flavor to another level with sweetness, complex spices and tanginess. Doritos Sweet & Tangy BBQ chips are now available nationwide for a suggested price of $5.59.

FRITO-LAY NORTH AMERICA • PLANO, TEXAS • DORITOS.COM

Chobani kicked off the new year with the rollout of several new yogurt offerings aimed at reducing sugar and increasing protein without sacrificing flavor. The Chobani Complete Cookies & Cream Shake is a high protein, advanced nutrition and lactose-free yogurt with 3 grams of prebiotic fiber and no added sugar. The shake is available in a 10-ounce bottle and retails for $2.79. Another new offering is Chobani with Zero Sugar Snacks, which are available in 11 single-serve flavors, six multipack formats and two multiserve tubs.

CHOBANI LLC • NEW BERLIN, N.Y. • CHOBANI.COM

Minute Maid Aguas Frescas, a Latin-American inspired juice beverage made from real fruit juices and natural flavors, is now available in a chilled 52-ounce multiserve offering. Aguas Frescas comes in three varieties: Hibiscus, Strawberry, and the new Pineapple Horchata, a twist on the traditional sweet and creamy flavor of horchata with a touch of tangy pineapple flavor. The beverages contain only 45 to 50 calories per 8-ounce serving. They have a suggested retail price of $2.99. In California and Georgia, Aguas Frescas are also available in six-packs of 12-ounce cans with a suggested price of $6.40.

THE COCA-COLA CO. • ATLANTA • MINUTEMAID.COM

The BIC EZ Reach brand debuted a new Favorites series that features fan-favorite designs. From a cold, refreshing beer to a slice of pizza to floral designs, the series is intended to have something for everyone. All EZ Reach lighters are 100 percent safety tested and have a 1.45-inch extended wand that helps keep fingers away from the flame. The BIC EZ Reach Favorites lighters have a suggested retail price of $3.50.

BIC USA INC. • SHELTON, CONN. • US.BIC.COM

Designed for retail environments where maximum flexibility is required, the DN Series Easy One from Diebold Nixdorf can be configured for assisted, semi-assisted or full self-service checkout while offering various options for peripherals and mounting. Featuring clip-on, clip-off modularity, this most compact solution in the DN Series can connect consumer and attendant screens, printers or scanners. It can also be wall-mounted, pole-mounted, used as a furniture-agnostic tabletop device or used in conjunction with a cash rack. The solution’s modular hardware design enables flexible configuration for multiple journey types and retail environments, avoiding costly customizations, the company noted.

DIEBOLD NIXDORF • HUDSON, OHIO • DIEBOLDNIXDORF.COM

Tate’s Bake Shop introduces Cookie Bark, bite-sized pieces of Tate’s chocolate chip cookies covered in chocolate and toppings. It debuts in two variations: Dark Chocolate with Sea Salt, and Milk Chocolate with White Chocolate Drizzle. According to the company, this new product reflects Tate’s ongoing focus to meet the expanding snack preferences of its fans. Tate’s Cookie Bark retails for $6.49 per 6-ounce pouch and is certified kosher by the Orthodox Union.

TATE’S BAKE SHOP • SOUTHAMPTON, N.Y. • TATESBAKESHOP.COM

Rich Products Corp. expands its menu for convenience store operators with the Gluten Free Parbaked Detroit Style Pizza Crust. The 9-by-7-inch premium, personal-sized crust meets growing consumer demand for gluten-free options and Detroit style pizzas, which layer the toppings first before adding cheese and sauce. Like other parbaked pizza crusts from Rich’s, the new option offers operators the flexibility and ease of a freezer-to-oven format. Each crust is 9 ounces and the product comes 20 per case, with a shelf life of 240 days frozen or seven days refrigerated.

RICH PRODUCTS CORP. • BUFFALO, N.Y. • RICHSFOODSERVICE.COM

Hippeas broadens its offering of chickpea tortilla chips with a new flavor, Nacho Vibes. This consumer-requested variety has the crunch and taste of mainstream nacho flavored tortilla chips, but was developed with better-for-you attributes: vegan/dairy-free, certified gluten-free and non-GMO ingredients, according to the company. The new addition rounds out Hippeas’ other chickpea tortilla chip flavors, including Straight Up Sea Salt, Rockin’ Ranch, and Sea Salt & Lime. Each 1-ounce serving has 3 grams of protein and a matching amount of fiber. HIPPEAS • NEW YORK • HIPPEAS.COM

Craft brewer Coronado Brewing Co. will bring to market several new products in the first quarter of 2023, including Nado Japanese Lager. Already available at the company’s in-house brewery, this lager is brewed with jasmine rice and a touch of Hallertau Mittlefruh hops. Nado Japanese Lager will be available for purchase outside the brewery in a six-pack of 12-ounce cans. It will become the company’s newest lager to join its core portfolio.

CORONADO BREWING CO. • SAN DIEGO • CORONADOBREWING.COM

GP PRO, a division of Georgia-Pacific, launched a product marketing campaign to build awareness of its Automated Sealing Machine, an advanced equipment solution that provides a secure, tamper-evident, spill-resistant sealed film on beverage cups. The machine applies a heatactivated plastic film seal that fits most cup sizes with a brim — paper or plastic — in just two to three seconds. The Automated Sealing Machine can empower operational efficiencies while elevating a store’s beverage business, the company stated.

GP PRO • ATLANTA • GPPRO.COM

By Danielle Romano

By Danielle Romano

WHETHER OPERATING a single store or a small chain, surviving and thriving against the larger convenience store chains is always top of mind for the industry’s small operators, and it can be challenging at times. This is especially true as of late, as the convenience channel’s single-store owners and small operators grapple with labor and staffing issues, an unpredictable economic climate and supply chain woes.

Because bigger chains have more buying power to get better deals, which they can then pass onto their customers, it is in times like this when the most important relationships a smaller retailer can leverage are the ones they have with their supplier and distributor partners.

“Our suppliers are key to everything we do. We wouldn’t have products on

our shelves if we didn’t have wonderful relationships with our suppliers, so it has to be a win-win relationship. That comes from a lot of communication and collaboration,” said Liz Williams, president and chief financial officer of Chicago-based Foxtrot, the hybrid e-commerce and physical store operator of 23 retail locations throughout the Chicago, Dallas and Washington, D.C., metro areas.

Communication is so critical for a mutually beneficial relationship that Ricky Bearden, vice president of sales for Elmwood, La.-based Imperial Trading Co., the nation’s fourth largest convenience distributor, stresses that overcommunication is necessary. This is because, in essence, distributors are the category management team for small operators.

Many small operators are limited in the staff they have, so suppliers and distributors must support them with as much information as possible, Bearden said.

“Don’t assume that the retailer is getting all of the information that you’re getting. Don’t assume that he has all of the knowledge you have,” he cautioned his

INTRODUCING THE COOL FLAVOR THAT’S HOT IN SALES

Smirnoff Ice Blue Raspberry Lemonade joins the all-star innovation lineup of successes like Smirnoff Ice Red White & Berry, Smirnoff Ice Pink Lemonade and the Smirnoff Ice Neon Lemonade. Combining the nostalgic taste of blue raspberries over sweet and refreshing-tasting lemonade, its not just for summer but a year round new favorite. A flavor that’s destined to spark taste buds and sales alike. For more information, call your Smirnoff Ice Distributor.

COMING SOON!

fellow distributors. “Any knowledge that you have as a supplier and distributor needs to be communicated to retailers frequently and aggressively, so you know that any sort of change such as new products, price changes or promotions are conveyed.”

The instability of the supply chain over the past year has put a greater significance on transparency and open lines of communication between small operators, suppliers and distributors. A supplier or distributor must be aware of an operator’s needs and ambitions, while the operator must know what to expect. This connection gives all parties the opportunity to create optimal solutions and pivot where necessary — whether that means taking advantage of better costs by opting for an alternative product, or purchasing more of a product that is in stock so that the retailer has sufficient stock on hand.

“In the convenience space, we get replenished so quickly; if we have a busy weekend or a busy couple of days. Our stores are relatively small, so we don’t have huge stock rooms, so leaning into our relationship [with our suppliers] is important to keep shelves stocked, reach consumer demand and make sales,” Williams told Convenience Store News.

Imperial Trading receives weekly reports from key manufacturers that retailers may not have access to. These reports show supply risk items, the time these issues will begin, and the time these items are no longer at risk. Often, these issues can last as long as four, five or even six months, so Bearden pointed out that it’s important to stay engaged with small retailers to ensure their planograms are current.

“This planogram process used to happen twice a year, and now we update planograms essentially in real time,” he said. “Staying in communication with retailers allows them to make quick decisions and if they’d prefer to replace these at-risk items, we can have new tags placed in a timely manner. If it’s a top-selling item, they can decide to leave the tag up and wait for recovery, or our category management team can offer a suggested item for replacement.”

Another side of the coin in a mutually beneficial relationship between small operators and their supplier and

distributor partners is letting each other know about opportunities to act on. While a supplier will inform an operator of a price increase or promotion that a manufacturer is offering, an operator can let their supplier know of any discounts or promotions that might be happening with their competitors. That way, the supplier can go back to the manufacturer and ask for the same programs, noted Roy Strasburger, CEO of StrasGlobal, a Temple, Texas-based provider of consulting, operations and management services focused on the small-format retail industry.

“The most important ‘do’ for the operator and supplier is reliability — doing what you say you are going to do. For the operator, you need to do the promotion or buy-in that is required to get the discount or rebate. For the supplier, you need to deliver the products and programs that you say you can deliver,” Strasburger emphasized.

The most important “don’t,” he believes, is don’t create an antagonistic relationship. “Operators and suppliers need to work together to maximize the business opportunity for both parties,”

“Operators and suppliers need to work together to maximize the business opportunity for both parties. Blaming each other for out-of-stocks or nickel-and-diming the supplier creates a short-term win and a toxic long-term relationship.”

— Roy Strasburger, StrasGlobal

he continued. “Blaming each other for out-of-stocks or nickel-and-diming the supplier creates a short-term win and a toxic long-term relationship. Both parties need each other to be successful and they need to work together.”

In Strasburger’s opinion, the best thing a supplier can do for an operator is introduce new products to the retailer. Suppliers have earlier knowledge as to what is being introduced and can help assess which new products would work in the operator’s market.

“An offshoot to this is sourcing and introducing local products for the operator. The more locally oriented the store is, the stronger the relationship between the operator and the customer,” Strasburger said, noting that the next retailing state will be hyperlocal.

“The more locally oriented a store is, the better it can compete with the large chains, online purchasing, and quickdelivery competitors. It’s not just about the products, but also about creating a relationship with local manufacturers that the community wants to support.”

Outside of supplying products to stores, Imperial Trading encourages its retailer partners to allow the distributor to maintain their retail pricebooks because of how frequently price changes occur.

“We try to become an extension of [a retailer’s] accounting department by allowing us to manage those retails, print tags, and get them to stores and up on the shelves as quickly as possible,” Bearden said. “We’ve also tried to work with category management teams to make larger orders and take advantage of price brackets offered to us to help keep costs down. That may require us to carry inventory for a longer period of time, but we try to do what’s needed to ensure that our retailers stay competitive in the market.”

In addition to planogram management and retail price management, Imperial Trading places importance on retailers having a point of contact with manufacturers, initiating introductions between retailers, brokers and manufacturers. A 10- to 20-store chain that has good volume may be able to take advantage of some manufacturer rebates, according to Bearden. CSN

“Any knowledge that you have as a supplier and distributor needs to be communicated to retailers frequently and aggressively, so you know that any sort of change such as new products, price changes or promotions are conveyed.”

— Ricky Bearden, Imperial Trading Co.

MILLENNIALS AND GENERATION Z ARE INCREASINGLY SHAPING THE CONVENIENCE STORE PROPOSITION

BY ANGELA HANSON

BY ANGELA HANSON

BIG CHANGES are happening for the convenience store industry. As retailers invest in foodservice, experiment with labor-saving technology and map out the future as it pertains to fuel vs. electric vehicles, the consumer base they serve is undergoing a major demographic shift.

Millennials, who were born between approximately 1981 and 1996, now make up the largest generational group in the United States, while Generation Z, born between approximately 1997 and 2013, is only slightly smaller than the aging baby boomers.

Online grocery site (e.g., Walmart.com)

Dollar

Online grocery delivery site (e.g., Amazon Fresh)

Discount supermarket

Mass/supercenter

Online food delivery site (e.g., DoorDash)

Grocery store

Club Specialty/natural store

Drug

Compared to other generations, significantly more Generation Z (33%) and Millennials (30%) report visiting c-stores more frequently today than they did a year ago.

Convenience Store News: It is mission critical for c-stores, facing encroaching competition from all channels, to be retail-ready. How can Siffron help c-store operators venture into the new categories shoppers demand while maximizing the profits in their existing footprints? CSN talked to Robb Northrup, director of marketing at Siffron at how his company is helping the industry face today’s realities.

Robb Northrup: Siffron has spent over 60 years helping all types of retailers optimize their retail space. Consumer shopping habits are constantly evolving and Siffron partners with retailers to solve these challenges, like adding merchandising solutions for fresh produce or grab-and-go meals into existing systems or maximizing the retail space for greater impulse buys. Siffron has over 6,000 retail fixture

and merchandising solutions. This includes everything from simple peg hooks and price marking rails to full display racks, sign holders, product-facing solutions, and asset protection products. This allows retailers to consolidate vendors for maximum efficiency.

CSN: Finding reliable, long-term employees has always been an obstacle. What’s Siffron’s game plan to offset the shortages?

RN: Finding reliable, long-term employees has long been an obstacle in the convenience store industry, but the current labor shortage is threatening to do even more harm. Siffron’s product-facing displays ensure products are faced automatically to the front of the shelf, keeping the merchandise organized so employees don’t have to manually update it all the time. That results in labor savings, planogram and pricing integrity, and an inviting shopping experience.

From professional smash-and-grab thefts to a simple swipe of a candy bar, theft is on the rise.

The National Retail Security Survey found shrink hit an all-time high last year, accounting for 1.62% of a retailer’s bottom line and costing the industry almost $62 billion. Convenience stores are particularly vulnerable to theft linked

to assortments with high pilferage categories such as alcohol and tobacco.

Siffron has a wideranging menu of loss prevention solutions from sweep deterrence solutions like the Invisi-Shield™ System and Spiral Anti-Sweep Hooks, to intelligent solutions like SONR anti-shoplifting devices that signal when simple

shopping activity occurs, and alarms at excessive product removal. The security devices make merchandise difficult to sweep so theft and shrink are preventable. Additionally, many of Siffron’s intelligent solutions can interact with store electronic article surveillance systems for additional layers of protection.

CSN: In addition to housekeeping, how can you maximize shelf productivity?

RN: The SKU-intensive candy category is a good example of how our fixtures can compress space and maximize the productivity of a high-traffic, impulse area. Using our NEXT™ Pusher Tray system, we can typically get 25% to 30% more facings into the space where products are typically hung on peg hooks or packed onto shelves. That means more product availability, more facings to sell, and every product is brought up to the front to make every product visible and available for customers. We have also created a pull-out version of the tray to reduce the time and effort to restock the fixture.

Another example of how we boost results and elevate the shopping experience is where we add LED lighting in high-interest, high-impulse areas. We’ve found an 18% to 20% sales lift in a category when you add our Allura LED lighting. You realize your return on investment within a few months through the sales lift of that category.

➤ To learn more about Siffron’s wide-ranging solutions to maximize store efficiency, visit siff ron.com

Loyalty program

Word of mouth

Gas price app Coupon

Mobile app offer

Availability of order ahead and pickup

Availability of drive-thru

Availability of contactless shopping

Mobile ordering

Promotion or message on social media

Email Print ad

Text message

Radio or TV ad

Billboard

These generations aren’t the sole arbiters of what’s on trend, but their collective size and growing embrace of convenience stores gives them outsized importance in the channel. Data from the 2023 Convenience Store News Realities of the Aisle Study shows that millennials and Gen Z are significantly more likely than other generations to report visiting c-stores more frequently today than they did one year ago, which means keeping track of what they want to buy and how they want to buy it is critical for long-term success.

Convenience store shoppers continue to be reliable, loyal customers, making it even more important that retailers stay aware of shoppers’ evolving preferences to keep their stores a part of their usual routines. More than two-thirds of participants in this year’s study, which surveyed 1,500 c-store shoppers across the country, report visiting a convenience store at least once a week, ahead of all other store types, including grocery stores at a close second.

While millennials and Gen Z are among c-stores’ best customers, the channel is performing well across all generations. Trip frequency is holding

steady, as 64 percent of c-store shoppers overall say they’re visiting about as often as last year, and 18 percent say they’re visiting more.

Other retail channels, however, are gaining ground in the face of rising inflation. The percentage of c-store shoppers who report visiting dollar stores and discount supermarkets more often today than they did a year ago jumped 6 points and 7 points, respectively.

To attract the younger generations, retailers would be wise to invest in contactless shopping, mobile ordering and social media messages and promotions, all of which millennials and Gen Z are significantly more likely to find influential. Gen Z also shows a preference for coupons.

C-store loyalty programs appeal across generations, with 30 percent of this year’s study participants listing it as the aspect that most influences their decision to visit a c-store — up 5 points from 2022. Word of mouth and gas price apps also have wide appeal.

Once a customer steps through the door, they are likely to do so again. Eighty-one percent of

Contactless shopping, mobile ordering, and social media promotions and messaging have more sway over Gen Z and Millennials than other generations.

Price of products

Products I need are in-stock

General convenience

Variety of products offered

Store cleanliness

Loyalty program

Speed of shopping trip

Employee friendliness

Quality of prepared food

Store organization

Employee helpfulness

Fun to shop

Store look/feel

Availability of local/sustainable products

Availability of contactless options

Employee diversity

Embraces cutting-edge technology

shoppers typically visit the same c-store brand each time they make a visit and of those shoppers, 86 percent typically visit the same specific c-store location every time.

When inside the store, it’s not just the product offerings that matter to millennials and Gen Z, it’s the overall experience. While half of all c-store shoppers rate “the shopping experience” as important or very important, an even higher 59 percent of millennials say the same.

Collectively, today’s convenience store shoppers cite product prices and the products they need being in-stock as the top factors behind a positive experience — this comes after months of rising prices and supply chain issues affecting all retail channels.

Millennials are more likely than other generations to place importance on the quality of the prepared food offered, while Gen Z is more likely to cite loyalty programs as important for a positive

Loyalty programs are most important to Gen Z, while Millennials place more importance on the quality of the prepared foods offered.

The shopping experience is particularly important to Millennials.

shopping experience. Both generations also value a fun-to-shop store.

C-stores are doing well at giving customers what they want, when they want it and doing so quickly. The channel earns its highest performance ratings (scores of either “excellent” or “very good”) for general convenience and speed of shopping.

Millennials, compared to the other generations, also give c-stores high marks for store look/feel, loyalty programs, prepared food quality, and availability of local/sustainable products.

While snags in the supply chain remain a concern for retailers, things seem to be improving from the customers’ perspective. The percentage of shoppers who report seeing more frequent out-ofstocks today than a year ago declined 6 points to 28 percent, indicating a shift to more adequately stocked c-store shelves. Six in 10 shoppers say the situation is about the same vs. a year ago.

When they can’t find the exact item they’re looking for, most c-store shoppers will still make a purchase — either a different product type (37 percent) or the same product type but a different brand (36 percent). However, 37 percent indicate they will go to a different store; a significant loss. This is especially concerning considering that Gen Z is more likely than other generations to report seeing more frequent out-of-stocks at convenience stores, and more likely to visit a different store in the event they encounter an outof-stock (47 percent).

Price increases are an even bigger problem, though. A whopping 71 percent of shoppers say they notice price increases at c-stores more now than they did one year ago. When they deem a product too expensive, shoppers are split between leaving without making a purchase (36 percent), purchasing a different product type instead (35 percent), or purchasing the product anyway because they need it (33 percent).

Three years after the COVID-19 pandemic upended shoppers’ usual routines, trip patterns are once again showing signs of change. Six in 10 shoppers say they visit c-stores while running other errands,

Seven in 10 shoppers are noticing more price increases, especially Generation X and Baby Boomers.

up 3 points from a year ago. Special trips from home are the second most common trip type, but they declined slightly vs. last year. Together, these changes may indicate a desire to consolidate trips and save gas in the face of high fuel prices and inflation.

Store visits made while traveling to or from work or school also increased 5 points year over year, bouncing back after dropping during the pandemic. By daypart, visits remain fairly consistent compared to a year ago, with foot traffic peaking during the 4 p.m. to 6:59 p.m. daypart. Millennials are the biggest driver of traffic during this period.

In-store-only visits are most common among those who make daily trips to a c-store, while gasolineonly visits are most common among those who make weekly trips. When stopping for gas, 48 percent of shoppers say they buy in-store items some of the time, so it’s worth it for convenience store operators to keep trying to draw customers from the fuel pumps to the store. These efforts appear to be working, as the percentage of shoppers who say they buy in-store items almost every time when fueling up jumped 5 points in this year’s study.

As for what influences their decision to shop for in-store products while filling up their gas tank, nearly half of shoppers (49 percent) cited feeling hungry or thirsty. Loyalty programs (21 percent) and mobile app promotions/deals (19 percent) can help compel them inside.

Convenience stores are largely on the right track

in their implementation of technology, according to shoppers who generally rate their satisfaction level in this area as high.

From the shoppers’ perspective, mobile services are among the most relevant tech advances for use today at any type of store or restaurant, with mobile coupons/discounts, mobile pay in-store and contactless payment using an app all seeing notable year-over-year usage growth.

At c-stores in particular, usage of contactless payment via an app and contactless payment via a kiosk saw the most growth within the last year. Currently, mobile pay at the pump has the highest usage at c-stores, but this technology did not show any growth year over year.

Outside of the store, home delivery is on the rise, with 53 percent of shoppers who have used this service at a c-store reporting that they’re using it more today than they did a year ago.

When asked which services they would be most likely to try at convenience stores if offered, the top responses were drive-thru, mobile pay at the pump, and mobile coupons/discounts. In fact, mobile coupons saw the largest increase in interest year over year.

Despite the uptick in usage of mobile and contactless options, c-store customers in general still prefer transacting with a real person: 57 percent say they opt for a cash register with human interaction vs. 43 percent favoring selfcheckout. Expect this to change over time, though, as Gen Z and millennials have a much higher affinity for self-checkout. CSN

Gen Z is the most open to purchasing a different product type instead.

Creative marketing ideas, partnerships, mobile apps and other technologies are helping c-store retailers entice fuel customers to venture inside the store

By Tammy MastroberteWITH THE MAJORITY of customers opting to pay at the pump for their fuel purchases rather than go into the convenience store, retailers are working harder than ever to entice them inside to purchase other higher-margin items — whether it’s food, snacks or something to drink. C-store chains with a unique offering, combined with a way to alert customers to it, are faring much better in achieving the pump-to-store conversion in today’s competitive marketplace.

“C-stores need to have a differentiated offer that is worth coming in for, and they need to do a good job at messaging that differentiation,” said Ryan Lindsley, vice president of marketing and digital strategy at Des Moines, Iowa-based Kum & Go LC, operating 390 c-stores.

It’s important to show how a store can fill multiple needs through a single stop, such as gas, milk, a beverage and dinner. “Research shows 30 percent of consumers who stop at a c-store are stopping somewhere else on the same trip for items that can be purchased at the c-store,” he noted.

Technology, which continues to evolve in the entire retail space, is helping retailers convey their in-store offerings and target customers fueling up at the pump beyond static signage and pumptoppers. Today, there is video at the pump, mobile apps, text messaging and geofencing that lets a store know when a customer is nearby or at the location.

“There have been so many tech advancements, including options available for smaller retailers with less of a budget,” said Peter Rasmussen, CEO and founder of Convenience and Energy Advisors, based in Boston. “There are platforms such as Rovertown [that] create apps for c-stores that work on top of a loyalty engine,

allowing them to create segmented and targeted offers, and knowing when a customer pulls onto the lot.”

Since before the COVID-19 pandemic, pump-to-store conversion rates for the industry have been dropping, down 8 percent in 2022 compared to 2019, according to VideoMining’s C-Store Shopper Insights enabled by CSI Tracker. The company partners with retailers across the United States to track store visits through cameras and other equipment, and releases reports every quarter.

“What is really surprising is the drop between prepandemic and now, because most behaviors have settled back to pre-pandemic levels,” said Rajeev Sharma, founder and CEO of State College, Pa.-based VideoMining. “We do think higher gas prices and inflation could be factors, as well as more people working from home and not making the commute to work.”

“With geotargeting, c-stores can target customers by store location, know when they are filling up their gas tanks at the forecourt, and push offers through to encourage them to go inside.”

— Peter Rasmussen, Convenience and Energy Advisors

With these external factors at play, and the biggest margins for c-stores being inside the store, it is more important than ever to entice customers inside. Many retailers are using foodservice and other unique offers to do this. VideoMining’s research shows that those with a robust foodservice offering have better pump-to-store conversion rates. “We see foodservice offerings drive not only pump to store, but also direct traffic in the c-store industry,” Sharma said.

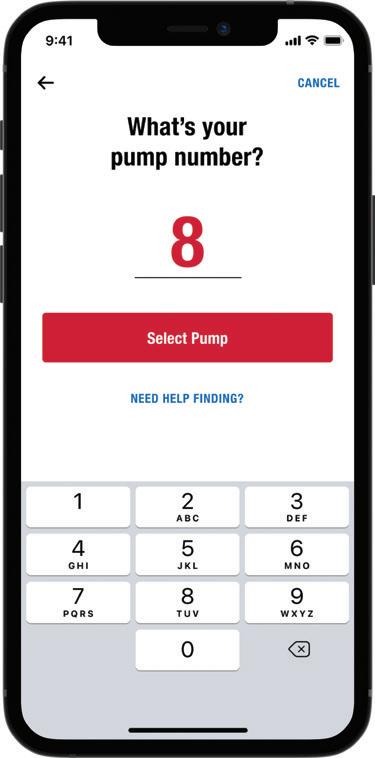

Today’s consumers are on the go, but one thing they always have with them is their mobile phone. C-store chains with a mobile app can leverage this to grab a customer’s attention, whether through geofencing or engaging them directly when they use the app to activate a pump or pay for fuel.

“With geotargeting, c-stores can target customers by store location, know when they are filling up their gas tanks at the forecourt, and push offers through to encourage them to go inside,” said Rasmussen. “It’s really magical what is in scope now and attainable for retailers.”

Kum & Go launched mobile pay at the pump through its app in May 2022. Once a customer activates the pump with the app, the app begins trying to upsell them on products in the store, according to Lindsley. The retailer offers mobile ordering capabilities as well.

“Mobile is one of the best tools available today to increase pump-to-store conversion,” he said. “Mobile ordering offers the capability for customers to buy and then pick up in the store, but they can also choose to stay at the pump and we will bring the product to them.”

While it varies from store to store, between 30 and 40 percent of the products available inside can be ordered via mobile at Kum & Go locations, along with most of the chain’s foodservice menu. The products featured for upsell on the app are usually those on promotion and ones that are easily fillable by the associates in the store, according to Lindsley.

“When we launched this part of the program, not only did it increase the sale of items on upsell, but it also increased the discovery of our mobile ordering capability for food,” he explained, noting that Kum & Go’s loyalty members are more likely to have already tried products in the store, but new fuel customers using the app represent an untapped market.

“Customers use the app for fuel pay as an entry point and then discover the ability to order other items,” Lindsley said. “We believe we captured new customers through that, and we are definitely capturing more sales than we would without it.”

Once a customer activates a fuel pump with the Kum & Go app, the app tries to upsell them on products in the store.Since before the COVID-19 pandemic, pump-to-store conversion rates for the industry have been dropping, down 8% in 2022 compared to 2019.

Currently, the offers appearing to customers on the Kum & Go app are curated by the company’s category management team; however, the company is planning to add personalization in the future to target specific offers to customers based on their past purchases, and more. Planning is underway to upgrade the app to create a more personalized experience for each customer.

“We are trying to find ways to create localized experiences, so the home screen of [the] app may change depending on the location [and] what is happening in the area,” Lindsley explained. “If someone shows up at the store around Super Bowl time and they are in Cincinnati, maybe we have a Bengals logo floating on top to grab their attention.”

Kum & Go is also in the process of overhauling its pump technology so that every store features either a full touchscreen or a screen with colored buttons that customers can interact with. These screens will feature promotions, further driving the pump-to-store conversion.

“Initially, it will just be video, sound and animationcapable media talking about the brand and promotions through storytelling. But we see the screens’ primary function [being] to get people into the store and educate them about loyalty and promotions that are relevant to them at the moment,” said Lindsley.

Another way convenience store chains are reaching new customers and getting them to their locations, where they can then entice them inside the store, is partnerships. Companies such as Mudflap for truck stops and Upside for gas stations have apps where they will list a retailer’s stores and offers in order to drive traffic and sales to those locations.

“Mudflap has taken the travel center market by storm because it allows retailers to put offers onto the platform and truck drivers will download the offer and go to the store based on what they see and like,” Rasmussen said. “People are now beginning their fueling experience based on these apps, or a Google search.”

Kum & Go recently started a partnership with Upside, whose mobile app identifies consumers not already visiting a location and uses cash-back promotions through the app to attract them there. The chain will be launching Upside at 200 of its stores.

“They have an algorithm that looks for the best prices and discounts to get customers into a new location for gas, but they are also offering c-stores the ability to pair gas or fuel promotions with in-store products, so they can also get a discount on a beverage or center-of-the-store item,” Lindsley explained.

Another creative marketing tactic that Kum & Go used last summer was tying center-store purchases with fuel discounts on its own; customers who made a purchase in-store were able to accrue cents off a gallon in their loyalty account.

“For example, a candy bar gave you 5 cents off and alkaline water offered 10 cents off,” he said. “After the purchase, the next time they filled up, they would get the total cents off per gallon. It went so well [that] we are doing it again.”

C-store retailers also have the option of partnering with other companies in their area, or larger chains outside the c-store industry, for cross rewards. Delta has offered cross rewards with Starbucks in the past, while Marriott has a partnership with Uber, Rasmussen noted.

“Pump to store also comes down to fundamentals like are your pumps clean; do you have quality digital programming to highlight the food you offer, whether it’s audio or video messaging at the forecourt; and does the store look inviting, bright, open and safe?” he said. CSN

“Research shows 30 percent of consumers who stop at a c-store are stopping somewhere else on the same trip for items that can be purchased at the c-store.”

— Ryan Lindsley, Kum & Go LC

The ongoing conversion to less harmful nicotine alternatives holds promise, especially with a revitalized PMTA process

By Renée M. CovinoCurrent industry predictions foretell a twofold change — a backbar with fewer cigarette products, and a bigger focus on harm reduction products.

The expert consensus is that convenience stores should be preparing for a future filled with reduced risk products (RRPs), which currently include modern oral nicotine, e-cigarettes/e-vapor and heatnot-burn items. Created to replicate and replace combustible cigarettes, RRPs and tobacco harm reduction refer to products that present, are likely to present, or have the potential to present less risk of harm to smokers who switch to them vs. continuing to smoke traditional cigarettes.

“Consumer choice in less harmful alternatives remains one of the greatest untapped opportunities in the nicotine category for 2023,” said Mike Wilson, vice president of trade strategy and operations for Winston-Salem, N.C.-based Reynolds Marketing Services Co. “Many adult consumers are looking for potentially less risky products and as these consumers continue to navigate away from combustible cigarettes, polyusage continues to rise.”

To meet these demands, he recommends c-store retailers strive for a more robust nicotine portfolio from reputable manufacturers. “Incorporating next-generation products into your backbar provides consumers the option to explore new ways to enjoy nicotine,” he said.

Goldman Sachs Senior Financial Analyst Bonnie Herzog agrees, and in light of advanced public health goals and industry innovation, she envisions “much more backbar space allocated to reduced risk products” in the next 10 years.

“I’m very excited about the ongoing conversion to reduced risk products,” she said, adding, “I do wish and hope it could happen at a faster pace and maybe it will, depending on the FDA [Food and Drug Administration].”

Through its extensive Premarket Tobacco Product Application (PMTA) process, the FDA must authorize a marketing granted order (MGO) for reduced risk products — and all tobacco and nicotine products — to be marketed and sold in the United States.

Even with the hurdles that have come along the PMTA pathway, Herzog is hopeful that harm reduction will be changing dramatically in the next two years. “We all need to buckle up for a wild ride because I think the innovation pipeline is going to accelerate,” she said.

Philip Morris International (PMI) reportedly has a range of RRPs in various stages of development, scientific assessment and commercialization. The company,

headquartered in Stamford, Conn., has also stated publicly that it is looking to “replace cigarettes with science-based smoke-free products as soon as possible.”

Early this year, three new tobaccoflavored heated tobacco products from Philip Morris were authorized by the FDA. The products receiving MGOs — Marlboro Sienna HeatSticks, Marlboro Bronze HeatSticks and Marlboro Amber HeatSticks — are “heated tobacco products” (HTPs) used with the company’s IQOS device, an electronic device that heats tobacco-filled sticks wrapped in paper to generate a nicotinecontaining aerosol.

In 2019, the FDA authorized the marketing and sale of IQOS and several other Marlboro HeatSticks products through its PMTA pathway. Philip Morris pursued marketing authorization for these new Marlboro HeatSticks by submitting supplemental PMTAs for modified versions and line extensions of the already-authorized product.

As a sidenote, IQOS has not been sold in the United States for over a year due to a U.S. International Trade Commission ruling that said the device infringes on two patents held by R.J. Reynolds Tobacco Co. Moreover, Altria Group Inc. is under an exclusive licensing agreement with PMI to sell IQOS in the U.S.; however, the companies announced in October they would be ending their agreement. PMI will pay $2.7 billion to Altria to have the full rights to commercialize IQOS in the U.S. beginning April 30, 2024.

This move has Herzog very optimistic. “Philip Morris clearly sees a big opportunity in the U.S. market to be willing to be paying $2.7 billion for the right to distribute it themselves,” she noted. “It’s a positive, too, for Altria. The large sum of cash increases their optionality to develop some of their own smoke-free products, two of which are in the final stage of design.”

Altria’s “Moving Beyond Smoking” mission calls for building a promising pipeline of wholly owned heated tobacco products and intellectual property consisting of heated tobacco capsule (HTC) formats and new-to-market technologies, according to CEO Billy Gifford.

“We believe capsule products can appeal to smokers who are open to novel

smoke-free products, but have not yet found a satisfying alternative to cigarettes. This audience includes the millions of U.S. smokers who tried, but ultimately rejected, e-vapor products,” he said.

Another positive development in Herzog’s view is that Altria announced a smoke-free joint venture with Japan Tobacco International late last year. The two companies will collaborate on the global development and commercialization of heated tobacco sticks. Their plan is to submit a PMTA for such innovation in late 2024, she said.

Reynolds, meanwhile, has stated that it too is committed to tobacco harm reduction and is making “significant investments in innovative tobacco products and engaging directly with stakeholders and policymakers to develop a regulatory environment that supports and promotes tobacco harm reduction.”

Last year, its R.J. Reynolds Vapor Co. subsidiary received MGOs for the Vuse Ciro e-cigarette device and accompanying tobacco-flavored closed e-liquid pod. For each device, two versions of the power units were authorized to reflect different battery manufacturers described in the company’s applications.

Additionally, E-Alternative Solutions (EAS) and its sister company Swisher are active proponents of the tobacco harm reduction movement. Their current contributions include electronic nicotine delivery system (ENDS) and modern oral nicotine products. EAS currently markets and sells Leap pod-based and Leap Go disposable products. Swisher’s Rogue pouch, gum, lozenge and tablet modern oral nicotine

“Many adult consumers are looking for potentially less risky products and as these consumers continue to navigate away from combustible cigarettes, polyusage continues to rise.”

— Mike Wilson, Reynolds Marketing Services Co.

products also have potential as harm reduction alternatives.

EAS is hopeful it will receive FDA approval. “The Leap and Leap Go products have completed scientific review and we eagerly await marketing orders as our PMTAs demonstrate that these products are appropriate for the protection of public health,” a company spokesperson stated. “The Rogue product PMTAs have been accepted and filed by FDA’s Center for Tobacco Products [CTP], but have not yet entered scientific review.”

“the action requested will better protect the public health and ensure a level playing field by discouraging illicit products and maintaining the availability of legally marketed, potentially less harmful options for current and former adult smokers who have transitioned or wish to transition from combustible cigarettes.”

A recent review of the FDA by the Reagan-Udall Foundation focused on a variety of issues, including but not limited to the way its Center for Tobacco Products handles tobacco product applications. Many consider the current process for review of both PMTAs and Modified Risk Tobacco Product applications to be unclear and/or inconsistent. The foundation’s report, which was originally commissioned by FDA Commissioner Robert Califf, indicated the need for a clearer and more predictable framework for high-quality PMTA submissions, and the need for simplification and standardization of review procedures.

Addressing these and other agency shortcomings, the FDA and its CTP issued a response to the report in late February. In the response, the CTP noted that it is committed to addressing all 15 of the Reagan-Udall report’s recommendations as quickly as possible.

To organize its efforts, the CTP convened six task forces, each focused on specific recommendations outlined in the report, according to Agustin Rodriguez, a partner specializing in tobacco with the national law firm of Troutman Pepper.

The task forces and their areas of focus are:

• Cross-Cutting: create and implement a strategic plan; obtain public input about strategic plan, objectives and metrics; and improve transparency.

• Science and Application Review: increase use of the Tobacco Products Scientific Advisory Committee; develop a clear and predictable framework for application review; and clarify the substantive review process.

At the moment, the FDA is being challenged to make changes on multiple levels.

“We continue to believe that more should be done to advance harm reduction in the U.S. and that the FDA should move more deliberately toward creating a market of authorized smoke-free products to help accelerate smoker transition away from cigarettes,” Altria’s Gifford said. “The fact remains that to date, only a small percentage of e-vapor volume has been authorized, and no oral nicotine pouch products have received market authorization.”

Collaboration and accountability from all stakeholders are required for a true market transition to take place, according to the chief executive.

Regarding the FDA’s enforcement responsibility, or lack thereof, Reynolds recently filed a Citizen Petition with the agency to take immediate action against the illicit nicotine vapor market, specifically illegally marketed disposable ENDS products. The company contends that

• Regulation and Guidance: create a more effective approach to achieve regulatory review and enforcement goals.

• Compliance and Enforcement: establish an interagency task force to make enforcement a priority; consider statutory changes to streamline the tobacco enforcement process; explore alternative approaches to compliance; enhance communication to provide greater transparency on compliance and enforcement; ensure the center’s workplan and goals reflect new priorities.

• Public Education Campaigns: solicit broad input on public education campaigns.

• Resources: improve abilities to recruit, hire and retain personnel to meet public health mandates and pursue securing user fees from each sector.

Rodriguez also noted that the CTP planned to immediately initiate the hiring process to create a new policy unit within the Office of the Center Director.

CTP Director Brian King emphasized the CTP’s commitment to transparency regarding the implementation of the report’s recommendations and promised quarterly updates online, statements from leadership and topic-specific announcements. He also promised that implementation of the recommendations would not sidetrack CTP’s current activities, which include continuing review of hundreds of PMTAs. CSN

“We all need to buckle up for a wild ride because I think the innovation pipeline is going to accelerate.”

— Bonnie Herzog, Goldman Sachs

By Melissa Kress

By Melissa Kress

FIVE YEARS AGO, a new competitor began causing a stir in the convenience channel. Amazon Inc., the company that went from online bookseller to e-commerce giant, started testing a new physical store format that took direct aim at convenience stores: Amazon Go.

The first locations debuted in January 2018 in Amazon’s hometown of Seattle and featured the company’s Just Walk Out technology, which leverages a combination of computer vision, sensor fusion and deep learning to enable shoppers to shop the store, pick out what they want, but skip the traditional checkout process.

Concerns among convenience store operators swirled. Some worried the contactless shopping experience would draw customers away from the corner store, while others raised doubts that the concept would ever catch on.

Fast forward to today, and while the e-commerce giant is reevaluating some Amazon Go locations, the company remains committed to the technology. And in what may be a case of “if you can’t beat ‘em, join ‘em,” c-store chains are now embracing contactless shopping in various forms — from self-checkout kiosks to checkout-free solutions.

Attendees of the recent NATSO Connect 2023 event in Dallas were asked to define “convenience” as part of a poll. Many said self-checkout springs to mind. It’s no surprise then that the service is currently among the top items for technology spending.

At the conference, Onvo Chief Operating Officer Gerald Danniel spoke about how the travel center operator’s location in Dorrance, Pa., embraces technology inside and outside the store. Scranton, Pa.-based Onvo has installed card readers at all the fuel dispensers and features self-checkout kiosks inside the store, as well as at its quickservice offering, Burger King. Onvo plans to invest heavily in self-checkout and mobile app pay solutions, he said.

Sean Register, president of Port Fuel Center in Savannah, Ga., told the NATSO Connect audience that the one-year-old travel center offers a mix of self-checkout and manned checkout counters. The retailer is also implementing handheld point-ofsale options — what Register referred to as the “Chick-fil-A model.”

Travel centers are not the only players in the industry embracing checkout options. Franklin, Tenn.-based MAPCO opened its first checkout-free location in December. Powered by Grabango, the checkout-free store in Brentwood, Tenn., allows shoppers to check out via the Grabango app. The experience is fully contactless; shoppers select the items they want and are billed through the app. There’s no need for barcode scanning.

BP also recently entered a partnership with Grabango and earlier this year, its Amoco brand went live with the technology at two Coen Market-owned sites in Pennsylvania. BP had previously tapped Grabango to retrofit several of its ampm stores last year.

Additionally, Laval, Quebec-based Alimentation Couche-Tard Inc.’s global Circle K brand is adding self-checkout options to locations across its network. In 2021, the retailer partnered with San Francisco-based Standard AI to roll out frictionless technology at existing stores in Arizona. In 2022, Couche-Tard announced it would deploy more than 10,000 Mashgin Touchless Checkout Systems, branded as “Smart Checkout,” at more than 7,000 of its Circle K and Couche-Tard stores over the next three years. The compact countertop device uses computer vision to recognize items presented and instantly ring them up in a single transaction.

Like other changes over the past three years, many industry players point to consumer demand for contactless shopping experiences driven by the COVID-19 pandemic as the key reason retailers are exploring new checkout options. That’s true in a way.

During the pandemic, contactless was certainly an appealing aspect of the various checkoutfree solutions emerging, but several other benefits are contributing to their staying power.

“As all of us have seen, contactless continues to be appealing because it is fast and it’s better that everyone isn’t touching our products when we are checking out and, of course, it is better that we are not waiting in line anymore, whether the pandemic is here or not,” said Andrew Radlow, chief revenue officer at Berkeley, Calif.-based Grabango.

Frank Beard, senior marketing and customer experience manager for Standard AI, agrees that the contactless attribute of these new checkout-free technologies is not what is driving adoption today. “The big picture is that we’re in the midst of a shift toward self-service at the moment of checkout,” he explained. “It began prior to the pandemic — especially with grocers and big-box retailers — and now we’re seeing it playing out in convenience stores.”

The reasons are simple, according to Beard. For retailers, rising wages and cost pressures mean it’s no longer economical to have employees scanning barcodes all day; they need to be redeployed to more productive tasks. For customers, the checkout queue was always a source of frustration, so when given options, many began gravitating toward the ones offering the most convenience.

“It’s true that convenience retailers were slow to embrace this shift,” he acknowledged. “PostCOVID, this industry experienced a ‘perfect storm’ of labor, inflationary and supply chain pressures that has forced retailers to operate more efficiently. Retailers are expected to do more, at higher wages, sometimes with less staff. They’re using technology to pull staff

away from the checkout counter and refocus them on tasks like kitchen operations, customer service and store management.”

The success or failure of contactless and selfservice technologies used by retailers ultimately hinges on their underlying motivations, according to Sam Vise, co-founder and CEO of Toronto-based Optimum Retailing, a provider of in-store experience management solutions.