Grand Prix finalists

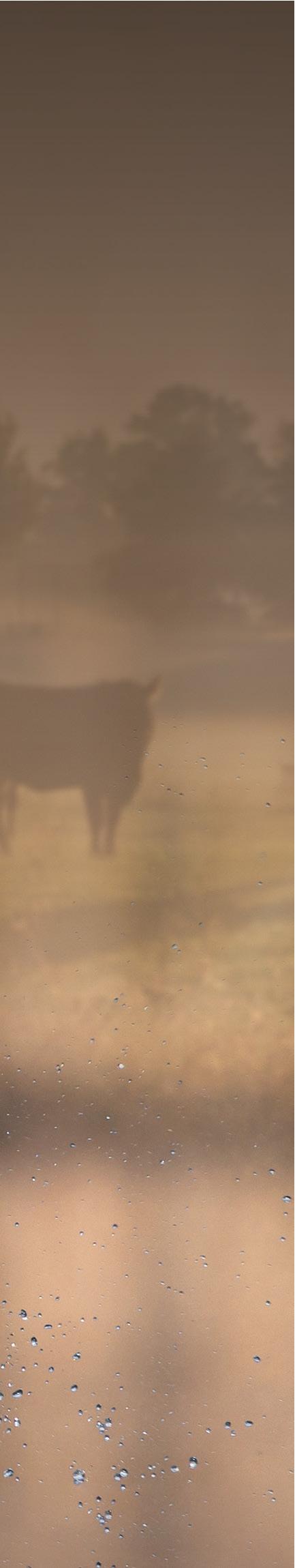

Cattle grazing brings balance to the ecosystem as many species rely on grassland habitat. Without cattle grazing, the grasslands change and can no longer sustain wildlife.

Raising cattle uses just 33% of agricultural land in Canada but provides 68% of wildlife habitat capacity. Scan QR code to learn more.

5 Front Desk

6 The Buzz

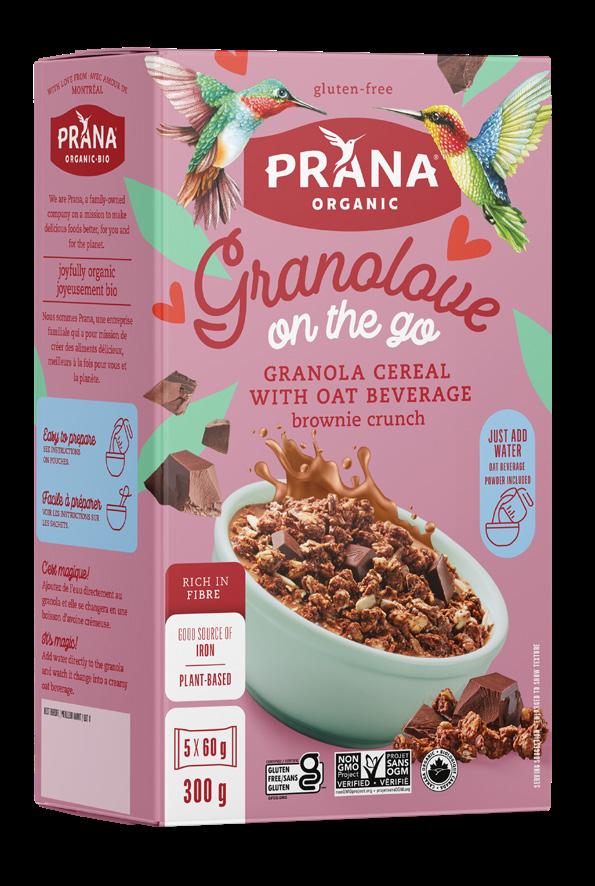

61 New on Shelf PEOPLE

8 Growing up The Rashti brothers are revolutionizing smart agriculture in Canada with their indoor farming operation, UP Vertical Farms

IDEAS

13 Leveraging loyalty Survey says: grocers can better engage customers and deliver the savings they crave

15 Circulr thinking Ontario startup is helping the grocery sector be more sustainable

17 Urban scale From clicks to bricks, Wild Fork is breaking into the Canadian retail market with a new storefront

19 The big question Leaders share their strategy when it comes to local products

21 Global Grocery News and ideas from the world of food retail

COLUMNS

27 Sizing up ai Mintel’s Joel Gregoire on how artificial intelligence might impact our relationship with food and drink

29 An appetite for cheese

Caddle’s Ransom Hawley on why budget-conscious Canadians are still adding cheese to their carts

AISLES

53 Time to ‘cue up sales

Inflation is still coming in hot, but there are opportunities beyond traditional summer fare to get sales sizzling

58 Say cheese! Consumption is down, but there are ways grocers can adapt to changing consumer habits

60 Honey: Four things to know As a condiment or a natural sweetener, we explore the versatility of honey

EXPRESS LANE

62 Art of the steal Loss prevention expert Stephen O’Keefe shares ways grocers can take aim at theft

20 Eglinton Ave. West, Suite 1800, Toronto, ON M4R 1K8 (877) 687-7321 Fax (888) 889-9522 www.canadiangrocer.com

BRAND MANAGEMENT

SVP, GROCERY & CONVENIENCE CANADA Sandra Parente (416) 271-4706 - sparente@ensembleiq.com

PUBLISHER Vanessa Peters vpeters@ensembleiq.com

EDITORIAL

EDITOR-IN-CHIEF Shellee Fitzgerald sfitzgerald@ensembleiq.com

MANAGING EDITOR Kristin Laird klaird@ensembleiq.com

DIGITAL EDITOR Jillian Morgan jmorgan@ensembleiq.com

ADVERTISING SALES & BUSINESS

NATIONAL ACCOUNT MANAGER Katherine Frederick (647) 287-3714 - kfrederick@ensembleiq.com

ACCOUNT MANAGER Karishma Rajani (437) 225-1385 - krajani@ensembleiq.com

SALES COORDINATOR Juan Chacon jchacon@ensembleiq.com

DESIGN/PRODUCTION/MARKETING

CREATIVE DIRECTOR Nancy Peterman npeterman@ensembleiq.com

ART DIRECTOR Josephine Woertman jwoertman@ensembleiq.com

SENIOR PRODUCTION DIRECTOR Michael Kimpton mkimpton@ensembleiq.com

MARKETING MANAGER Jakob Wodnicki jwodnicki@ensembleiq.com

In the world of retail, “value” is a word that’s tossed around a lot. So much so that most of us probably think we have a pretty good handle on what it means. Not so, according to Ken Wong, associate professor at Smith School of Business at Queen’s University.

In a session titled “The Value Challenge” at Grocery & Specialty Food West in Vancouver last month, Wong spoke of the disconnect between how shoppers and retailers perceive value, especially in times of high inflation. To consumers coping with rising costs, value simply comes down to low price, whereas retailers tend to think in terms of quality and added value, not the lowest price. And this difference in perception, says Wong, can create a lot of friction in the industry. “The consumer wants action,” he says, “and that action metric they’re using is ‘how low are your prices?’”

www.canadiangrocer.com/subscription

CORPORATE OFFICERS

CHIEF EXECUTIVE OFFICER Jennifer Litterick

CHIEF FINANCIAL OFFICER Jane Volland

CHIEF OPERATING OFFICER Derek Estey

CHIEF PEOPLE OFFICER Ann Jadown

CHIEF STRATEGY OFFICER Joe Territo

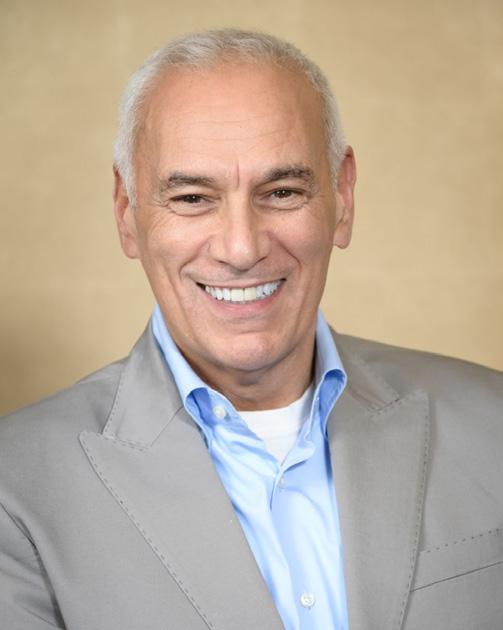

Walmart Canada is a retailer whose go-to-market strategy is Every Day Low Prices. In this issue, we speak with the retail giant’s new president and CEO Gonzalo Gebara about a wide range of subjects, among them how Walmart Canada is working to keep prices low—both in inflationary times and outside of inflationary times, “that’s the way we gain trust,” says Gebara. (Read the interview starting on page 30.)

press releases, promotional items and images) from time to time. Canadian Grocer, its affiliates and assignees may use, reproduce, publish, republish, distribute, store and archive such submissions in whole or in part in any form or medium whatsoever, without compensation of any sort. ISSN# 0008-3704 PM 42940023 Canadian Grocer is Published by Stagnito Partners Canada Inc., 20 Eglinton Avenue West, Ste. 1800, Toronto, Ontario, M4R 1K8.

Printed in Canada

In “Time to ‘cue up sales,” we look ahead to the summer and how high food prices might impact the upcoming grilling season. Though price-conscious consumers will be closely watching their budgets and gravitating to more affordable proteins to toss on the grill, the experts tell us there are still lots of opportunities to win

during this key selling period—retailers just need to follow the trends.

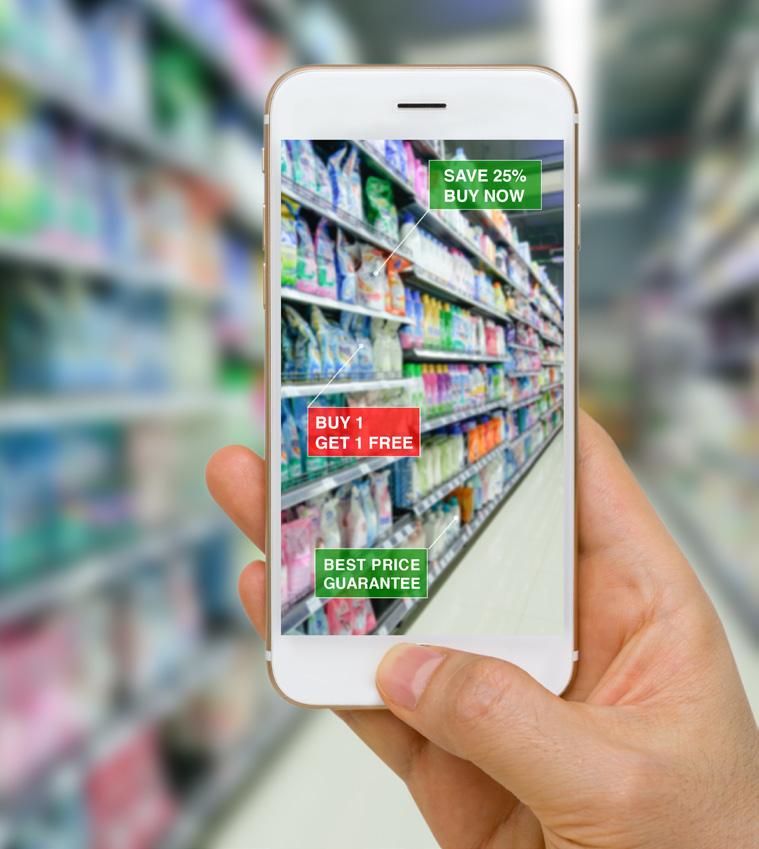

Also in this issue, the latest instalment in our Generation Next Thinking series, “Higher Tech in the Grocery Store” (page 37) looks at how technology can help meet evolving in-store expectations with solutions that create a frictionless, more engaging experience to keep customers coming back. We also look at where grocers should be investing their tech dollars right now—forget flashy innovation, the experts say it’s all about targeting customer pain points.

See you next time! CG

Shellee Fitzgerald Editor-in-Chief sfitzgerald@ensembleiq.comT&T Supermarket will open a 39,000sq.-ft. store in

T&T SUPERMARKET plans to open a 39,000-sq.-ft. store in London, Ont.—the home of Western University—in a newly renovated strip mall in summer 2024. Promising to be the largest Asian supermarket in the city, the new store will offer fresh produce, groceries, bakery, in-store prepared foods, sushi, Hong Kong barbecue pork and a Tianjin crepe station. Customers will be able to order for home delivery or click and collect via T&T’s website and app. An alumna of Western, T&T CEO Tina Lee says: “I am delighted that I finally get to bring the T&T experience back to my old school stomping grounds.”

Calgary Co-op’s COMMUNITY NATURAL FOODS banner is opening its fourth store in Alberta, and its first store outside of Calgary, this June in the Edmonton community of Old Strathcona. The 10,000-sq.-ft. store will offer an array of organic produce, meat and dairy; a selection of grocery items; a supplement and natural body care section; and a fresh juice, elixir, smoothie and grab ‘n’ go bar. The store will also host free educational events in support of whole food nutrition, sustainability and general wellness.

Canadian Grocer’s Impact Awards are back! We want to recognize the initiatives introduced by retailers, suppliers and solution providers that are making a meaningful difference in four areas: sustainability; diversity, equity & inclusion; supporting employees; community service/local impact/giving back. Please take a few minutes to tell us about the great work being done at your company. It’s free to nominate and winners will be featured in our August issue. Visit cgimpactawards.ca by May 31 to nominate.

FARM BOY is setting up shop in the Mississauga, Ont. neighbourhood of Port Credit. The new store will be the anchor tenant of the planned 72-acre Brightwater community that promises green space and trails as well as 300,000 square feet of retail, commercial and office space. The new 25,000-sq.-ft. store is scheduled to open mid-2024.

After 18 years on 744 Adelaide Street in London, Ont., SUNRIPE opened the doors to its relocated market at 1800 Adelaide Street. With 7,000 additional square feet, the new store features a popcorn station, a guacamole and salsa station, sushi station and brand-new equipment, including a smoker in its kitchen.

SAVE-ON-FOODS has opened a 20,500-sq.-ft. store in Richmond, B.C.’s Garden City shopping centre. It features a meat and seafood section; bakery; Save-On-Foods Kitchen grab ‘n’ go items including sandwiches and homestyle fried chicken; a wing and appies bar; and a variety of organic and natural products. The Western grocer celebrated the store’s grand opening in March with a gift card giveaway to the first 500 customers.

Galen Weston is stepping down from the day-to-day operations at Loblaw Companies Ltd., with European retail executive Per Bank stepping into the president and CEO role in early 2024. Bank is the outgoing CEO of Denmark’s Salling Group A/S, which owns 1,700 multi-banner supermarkets across three countries. He has been serving as CEO since 2012. Weston will remain chairman of Loblaw and chairman and CEO of holding company George Weston Ltd.

At Coca-Cola Canada Bottling Ltd., Tara Scott has been named chief commercial officer. She began her career with the company in 2018, joining as director of revenue growth management capability before moving into the vicepresident of commercial growth strategy and execution role. Scott has also worked for Maple Leaf Foods, Olivieri Foods, Henkel Consumer Goods Canada and The Kraft Heinz Company.

Traci Wildish has moved into the role of vice-president of sales for McCormick’s consumer products division Canada and North American retail operations, replacing Erin Rooney who retired in April after more than three decades in the industry. Wildish joined the company in 2020 and was most recently director of trade marketing, category management and sales operations for Canada.

Flashfood has appointed Jordan Schenck to the role of chief brand officer and Sepideh “Sepi” Burkett to the position of head of partner development. Schenck and Burkett are the first executive hires under the leadership of Nicholas Bertram, who joined Flashfood as president in February 2023.

Simon Somogyi is leaving the Arrell Food Institute at the end of the summer to join Texas A&M University. Somogyi currently serves as the Arrell chair in the Business of Food. He is also a professor at the University of Guelph’s School of Hospitality, Food and Tourism Management. Somogyi joins Texas A&M University as the Dr. Kerry Litzenberg Chair in sales and economics, and director of the school’s Weston Agrifood Sales program.

Bel Canada Group has appointed Christine Verreault as vice-president of human resources. Verreault brings more than 20 years of experience to the role. She began her career as a consultant, business partner and manager in various organizations such as Discount Auto Rental, White Birch Paper, WSP and Héroux-Devtek. Verreault most recently served as vice-president of human resources for Groupe Crevier.

Sergio Mazzuca, Fortinos’ senior director of produce, floral and bulk, passed away March 18 from cancer. Mazzuca’s professional legacy spans more than 45 years. Outside of the grocery business, his passions included fishing and hunting. He leaves behind his wife Julie, children Samantha and Victor, daughter-in-law Maria and son-in-law Peter. “Sergio was a highly valued and respected member of the Fortinos management team and will always be remembered for his tireless efforts to ensure Fortinos was the best destination for fresh produce,” the grocer said in a statement.

The Canadian Produce Marketing Association (CPMA) is recognizing Sam Silvestro with its 2023 CPMA Lifetime Achievement Award. Silvestro has worked in the industry for 40 years, having held senior roles at Sobeys and Walmart Canada, and is currently serving as an executive consultant for national brands. He has also been involved with government committees on food safety and has served on several

boards including cpma and Ontario Produce Marketing Association (OPMA).

Retail Council of Canada (rcc) and Food Health & Consumer Products of Canada (fhcp) are recognizing Serge Boulanger and John Pigott with its 2023 Canadian Grand Prix Lifetime Achievement Award. Boulanger began his career with Metro in 1996 and rose through the organization, spearheading several key initiatives until he retired as svp, national procurement and corporate brands earlier this year. Pigott, meanwhile, started at mli as a student in 1971 and worked summers through 1979. After a stint at Xerox, he returned to MLI as vice-president in July 1986 and was appointed president and ceo in 1989. He became president and ceo of Club Coffee upon its acquisition by mli in 2007.

was 2010 when Bahram Rashti, who was completing his dentistry residency at Vancouver General Hospital and The University of British Columbia, visited satellite clinics in remote northern communities in the province. “In these areas, you pay more for fresh produce, and it’s not as fresh as in the mainland,” says Rashti. That experience got him curious about fresh produce supply and distribution chains, and what effects climate change would have on those processes. He soon discovered that more than 90% of baby leaf greens sold in Canada come from the United States. “I was concerned and curious about food security,” he recalls, thinking: “Supply from the U.S. and other countries would eventually not meet Canadian demand.”

Rashti’s research brought him to a relatively new agricultural concept—indoor vertical farming. “It’s a new ecosystem to grow food indoors reliably, all year round,” he explains. “It can be a greenhouse hybrid, but it’s completely indoors, in a warehouse.”

Indoor vertical farming had already taken off in the United States, Europe and Asia, but Canada was lagging behind. Rashti not only saw a business opportunity to start an indoor vertical farming operation here, but also play a part in creating a more reliable source of produce for Canadians and help with the problem of food insecurity.

Rashti discussed the idea of starting such an operation with his brother, Shahram, who was working in IT at the time. “The more we looked at it, the more fascinated we became that indoor vertical farming didn’t exist in Canada,” says Rashti. Over the next five years, they continued working their day jobs— Bahram in dentistry and Shahram in IT, while developing their new farming concept. The brothers did market research, built a prototype in the garage of Bahram’s Vancouver home, and tested different equipment and lighting. They had to ensure the leafy greens could be grown cleanly, consistently and at a high-enough density to be profitable. “We had to manufacture our own lights and develop our own light recipe,” Rashti explains.

The Rashti brothers’ big break came in 2018 when they secured a food distribution partner—The Oppenheimer Group, a B.C.-based multinational fresh produce growing, marketing and distribution company. “Oppenheimer has some of the smartest people in produce,” Rashti says. “They understood the potential of indoor vertical farming. It was exciting when we shook hands with them.”

That partnership validated Bahram and Shahram’s decisions to quit their full-time jobs and go all-in on their vertical farming venture. Thanks to The Oppenheimer Group’s existing industry relationships, the brothers were connected with buyers at major grocers across the country. “We got their input about what they wanted in their leafy greens, like the height of the plants, the structure, taste, quality and varieties,” Rashti explains. With that knowledge, they could fine-tune their research and development to create indoor farming systems and grow exactly the types of greens that grocers would stock on their shelves.

One of the brothers’ big “aha”moments during their research and development was growing leafy green mixes together in one tray. Most baby leaf greens are grown separately and then mixed together after harvesting, which results in bruising of the leaves, shortening their shelf life. Instead, the Rashtis, under their newly-named venture UP Vertical Farms, would grow different varieties such as arugula, and red and green lettuces side-by-side on the same tray, then harvest and bag them directly afterwards. This would extend their produce shelf life from the industry average.

By late March 2023, Bahram and Shahram were ready to harvest their first batch of lettuces in their Pitt Meadows, B.C. facility, to be sold in grocery stores in British Columbia. The day their lettuces first hit supermarket shelves, the Rashti brothers participated in a panel discussion about climate-smart agriculture. “After the event, we drove to a store carrying our greens and half of our products were already gone off the shelves,” Rashti recalls. “It was a good sign.” He bought two packages of the greens to eat with his family. “It was a great moment, eating it with my family at dinner and having the same experience that Canadian consumers were having.”

Last month, UP Vertical Farms expanded beyond its home province of British Columbia to retailers in Alberta, Saskatchewan and Manitoba. “It’s a wonderful feeling to see our products that we worked so hard to build and grow be on supermarket shelves,” Rashti says.

The brothers’ next step will be expanding East. They’re currently raising equity to build a growing facility in Ontario and are also looking to expand into the United States. Looking back at his journey and career transition, from dentisty to agriculture, Rashti is humbled.

“It’s a proud moment when you change careers and can have a larger impact on society,” he says. “It’s rewarding—it’s a good feeling.” CG

30 seconds with …

What do you like best about your job?

Innovation. We’re constantly problem-solving and pushing the frontiers of indoor agriculture.

If you weren’t in the food business, what would you be doing?

Probably solving another problem out there on a larger scale. Maybe solving larger problems in healthcare or another industry and trying to have a greater impact than I could create from the dental chair.

What’s the best career advice you’ve received?

Work hard. Have integrity and always innovate. You have to innovate to evolve. Partner with strong, good people who want to work well and who believe in what you’re trying to achieve.

What’s your favourite product from your lineup?

I really like our Spring Mix, and also the 50-50 Blend. I have a lot of my salads on top of my other foods, like rice-based meals and stews, or I add it to my sandwiches. My wife is a huge salad eater, so we eat a lot of salads on their own as well.

What do you like to do when you’re not working?

I do a lot of deep-sea fishing with my brother. That is the main way we get to relax and disconnect. I also like to go hiking with my wife along the trails in North and West Vancouver.

Mouche Bamboo Facial Tissues are the sustainable premium facial tissue that works. These premiumquality, 3-ply tissues are tough on sneezes and gentle on the skin while being sustainably made from 100% FSC-certified bamboo without any whiteners, lotions or fragrances. Plus, they come in modern, neutral colour boxes that look great anywhere in the home. Stylish, sustainable tissues for any space. Mouche is proudly a Canadian, female-founded, and family-led business. Available exclusively through UNFI.

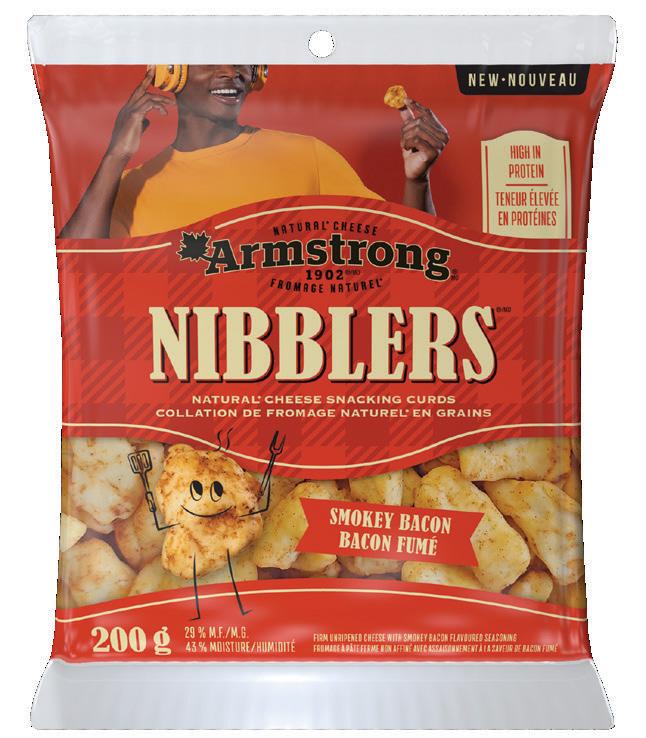

Bringing more familiar flavours to the dairy aisle, Armstrong Cheese Combos are available in two flavours: Mozzarella with Naturally Smoked Salami Sticks, and Marble Farmer’s and Naturally Smoked Ham Sausage Sticks. This perfect snacking pair is a hearty combo typically found on cheese boards—but now great for a quick, onthe-go snack. Twice the snack in just one pack!

Join the refillable revolution with Dove Refillable Deodorant. Canadians can now stop throwing away plastic deodorant packaging month after month. Each of the deodorant refills are packed in 96% recycled plastic to keep the deodorant sustainable. The caring, creamy coconut and a touch of pink jasmine scent is a soothing treat for the senses to provide a little moment of joy each morning.

The Crispers consumers know and love, but they’ve dialed up the heat. Crispers Fiery Jalapeño are spicy and cheesy –perfect to spice up the day with every crunch. They are baked in Canada and only available in Canada. Originally launched as a limited edition in 2022, Crispers Fiery Jalapeño is now back and here to stay. The heat is on!

Cadbury Caramilk chocolatey goodness combined with soft-flowing caramel, now with a hint of sea salt! An indulgence with the perfect combination of sweet and salty, available in two sizes: 50g and 100g. They are prepared in Canada with 100% sustainably sourced cocoa. Cocoa Life is Cadbury’s sustainable cocoa sourcing program that does good by encouraging responsible farming, and by helping fight deforestation and supporting cocoa farming communities. Winner of the Chocolate category.

Go Pure Soft Baked Oatmeal Bars are available in three delicious flavours: Chocolate Chip, Brownies and Carrot Cake. They are made with 100% Canadian oat, contain between 11g and 13g of whole grain and they are a source of fibre. Go Pure bars are certified peanutfree, it’s pure goodness.

Babybel®, the snack Canadians love, is now available in a dairyfree, certified plant-based, nonGMO and ‘Vegan Society’ version. The 5-portion pouch is made with 100% recyclable paper, and the cellophane is compostable at home. Perfect for the lunchbox or to grab on the go, it is a great option for adults and kids alike.

Following a gluten-free lifestyle can be challenging with limited options and not wanting to compromise delicious taste. Introducing the first ever gluten free OREO cookies! The distinctive OREO chocolate cookie made with rich, sustainable cocoa and the signature smooth crème, now gluten free! Canadians can enjoy the iconic cookie like never before.

Armstrong has unlocked the perfect combination with its new and delicious Armstrong Cheese Mmmm…Bacon Natural Shredded Cheese made with real bacon. This flavourful, time-saving, shredded cheese is perfect for omelettes, loaded baked potatoes, casseroles or as a salad topper.

This isn’t your average chocolate chip cookie. Chips Ahoy! and Cadbury have teamed up on two new flavours to delight the taste buds: Crunchy Chips Ahoy!

Cadbury Mini Eggs cookie with coloured egg inclusions; Chewy Chips Ahoy! Cadbury Caramilk with delightful chocolatey caramel chips. The taste of Cadbury chocolate, now packed in irresistibly delicious chocolate chip cookies.

This well-deserved award represents his passion for his work and significant contributions to METRO and the industry.

Serge, the METRO family is proud to see you recognized for your lifetime of achievement.

Congratulations!

ON RECEIVING THE 2023 CANADIAN

FROM RETAIL COUNCIL OF CANADA

Serge Boulanger

Serge Boulanger

the rIsIng cost of food is undoubtedly affecting shoppers’ behaviours, whether they’re switching to private-label brands or cutting back on pricey meats. A new report from Eagle Eye, a global digital marketing firm, suggests grocers can leverage loyalty programs to better engage customers—and deliver the savings they crave.

The report, Grocery’s Great Loyalty Opportunity, is based on a survey of more than 1,300 consumers and nearly 200 loyalty program managers in North America, Asia, Australia and the United Kingdom. The survey found saving at the shelf is a top priority for consumers. Nearly two-thirds of grocery shoppers (64%) are buying more items on sale or special; 57% are using loyalty program points, discounts or savings, and 48% are finding and using coupons more often. Other ways consumers are trying to save money are shopping among different retailers to find the best price on certain items (46%), shopping more at discount stores (46%), buying more private-label items (42%),

and finding ways to make meals that eliminate food waste (31%).

On the loyalty front, the survey found more than two-thirds of all global respondents (68%) belong to at least one grocery loyalty program. The top benefit members want from a loyalty program is value (69%) followed by discounts (60%).

“This is an uncertain environment for retailers, but consumers are also primed to appreciate the value of loyalty,” said Tim Mason, CEO of Eagle Eye, in a press release. “Grocery retailers are uniquely positioned to use their loyalty programs to deliver the savings their customers demand and the experiences they’ve come to expect.”

In many cases, grocers are responding. More than half of loyalty program managers (54%) report that in the next three to six months, they plan to make it easier to earn and redeem points. In addition, 48% plan to deliver relevant offers, coupons and discounts when customers are shopping; and 41% plan to make discounts and specials easier to find online and in stores.

—Rebecca Harris

Canadians are craving alternatives to meat and dairy, but price is a sticking point when it comes to consumers purchasing plant-based foods, finds a new survey from Dalhousie University’s Agri-Food and Analytics Lab. In fact, of the 5,507 consumers surveyed, just 22% think plant-based alternatives are affordable. Here’s what else the survey reveals about how Canadians consume and perceive plant-based foods:

34% of respondents consumed a plant-based meat alternative over the last 12 months

42.2% have consumed a dairy alternative over the same period

30.7% said they chose plantbased items for health benefits, while 12.6% do so for personal taste and 12.1% for the environment

39.8% believe plant-based alternatives offer high nutritional value

“Our data suggests the plantbased market is real in Canada,” says Sylvain Charlebois, senior director of the Lab. “But the market and plant-based products clearly remain a work in progress, but price is unsurprisingly the biggest hurdle for the category.” SOURCE:

CIRCULR IS A REUSE program that helps CPG brands recapture and reuse packaging to reduce waste, while rewarding consumers for returning packaging and keeping it in circulation longer. Founded in 2020 by university graduates Tyler De Sousa and Charles Binks-Collier, Kitchener, Ont.-based Circulr works with a growing roster of brands including Funky Ferments, Beck’s Broth and Alchemy Pickle Company, and offers private-label reuse programs for grocery retailers. Here, De Sousa explains how Circulr works and what’s next for the company.

What attracted you to the idea of a circular economy?

It’s a solution I think a lot of people have been waiting for … To me, a circular economy is an environmental solution that is more holistic, rather than a Band-Aid solution. It’s less about taking garbage out of the ocean and more about making sure it doesn’t end up there in the first place.

How does Circulr work?

Circulr runs the back-end infrastructure for the reuse of product packaging in grocery. We currently work with brands that have products in glass jars such as pickles, peanut butter, pasta sauces, soups, spreads and soaps. So, customers can purchase a brand’s products like they normally would. When the consumer is done with the product, they just rinse out any residue in the jar and drop it off in a Circulr bin at one of 23 collection sites [located in grocery stores] across Toronto and the Waterloo-Wellington region. They can track their return through the Circulr mobile app and get their deposit back. [Deposits range from 10 cents to $1.25.] On the retailer front, we help grocers reuse packaging for some of their private-label products. The Stone Store in Guelph, for example, has their own private-label jarred products and we provide the infrastructure for the store to collect jars and reuse them.

We’ve heard from many brands that reuse

By Rebecca Harrisis something they have always wanted to do or have been more interested in doing in recent years, but the back-end operations are too cumbersome. They don’t want to take their focus off doing what they love and what they’re good at. And so, we come in and make it easy for them. One of the biggest positives is the brand boost. People are starting to view reuse and the circular economy as an important environmental initiative, so being a part of Circulr reflects positively on the brand. On top of that, most customers who come into a store to return an empty jar leave with a full one. If I have a Funky Ferments pickle jar in my hand when I walk back into the grocery store, I’m going to remember Funky Ferments and buy another one.

Glass jars were the first step in this process But [we] can expand to a lot of other products, from cleaning products to bathroom products to cosmetics. In terms of scaling, reuse is quite local inherently and that makes sense environmentally and logistically. You need to do it on a hub basis. That’s why we have a Waterloo-Wellington hub that covers four cities and a Toronto hub that covers Etobicoke to Whitby. Our focus over the next year or so is to get more customer density in our existing hubs, then expand outwards into the wider Greater Toronto Area. After that, I think we’ll add our third hub sometime in late 2024 or early 2025. Right now, we just want to build a strong movement in these cities that could one day grow across the country.

By Kristin Laird

By Kristin Laird

AFTER INTRODUCING Canadians to its brand of frozen, premiumcut meats and seafood through e-commerce and home delivery earlier this year, Wild Fork is setting up shop in Whitby, Ont. —a suburb an hour east of Toronto.

The company, which also has omnichannel operations in Brazil, Mexico and the United States, will open the doors to a 4,000-sq.-ft. space (including a 500 to 600sq.-ft. back-of-house freezer) later this spring.

An opening date has yet to be confirmed, but Sherryl Woodward, head of brand experience at Wild Fork, says the store’s product assortment will mirror what’s currently sold on its e-commerce site. The offer will include affordable, premium cuts of beef, Berkshire pork, chicken, turkey, lamb, fish, specialty meats such as bison, elk, boar, duck and

venison as well as ready-made sides such as truffle mashed potatoes, lemon orzo salad and roasted acorn squash. Wild Fork also offers spices and sauces as well as frozen fruits, vegetables and desserts.

Wild Fork blast freezes its protein at prime freshness, which the company says seals in vitamins and minerals to keep the product fresher for longer. In-house chefs test each product to ensure the grade and cut meets company standards.

“All of our products are frozen and that’s to maintain that product integrity so it locks in freshness in a super-fast amount of time,” explains Woodward. “The first time something is defrosted is when you are going to have it for dinner.”

At its core, Wild Fork is a “protein company,” says Woodward,

with a product offering that is “complementary” to what a grocery store sells.

“We don’t offer all the same selections that your standard supermarket does,” says Woodward. “We see ourselves as complementary. We have a great protein selection. We don’t think of ourselves as purely just a frozen food company.”

Visually, the store will be an extension of Wild Fork’s e-commerce site. The space will have a clean, modern feel with natural light, soft paint colours and food photography will play a particularly important role in the physical store.

“We’re selling food. It’s different than selling fashion,” says Woodward. “You want people to say, ‘Oh man, I want to eat that.’ So, we do great photography of all our products, whether that’s

showcased on the website or on the walls of our store to drive that.”

Max Izen, head of real estate and construction at Wild Fork, says Whitby is an ideal market to open its first store in Canada. The store is located along Taunton Road, which is an arterial road running east and west through Whitby and the surrounding cities of Ajax, Pickering and Oshawa.

“We like the demographic there and we believe that it’s a good foray into the Canadian market,” he says. “We like the co-tenants and we liked that opportunity. I felt that was a good one to start with.”

In terms of expansion, Wild Fork will focus on growing its physical presence in the Greater Toronto Area over the next couple of years and hopes to introduce e-commerce in Western Canada in 2024 with bricks-and-mortar locations to follow.

“Our business strategy has always been to buy local first, when available. When we buy and sell local products, it helps to stimulate the local economy and promote sustainability. By sourcing products from local vendors, we can support small businesses and local farmers, who, in turn, can reinvest in the community. Additionally, local products often have a smaller carbon footprint as they require less transportation. By promoting local products, we are also able to connect with customers who prioritize buying local and sustainable products, helping to build brand loyalty and community support for our business.”

Kelly Herdin

“Local is weaved into our DNA and how we show up for Western Canadians. We serve our members in several business lines from food to fuel to agriculture, and we build community at each level of the value chain. As a result, we are positioned to support local growers, producers and ranchers with their operations in terms of advice and inputs, and on the manufacturing side with our store brands. We support local producers with our food and convenience stores to bring local products to our members. And, as a co-operative, the profits from these products go back to the communities we serve.”

“At Goodness Me! we believe in buying local. Why? It’s all about people. Getting to know and work and socialize within our community, getting to know our neighbours and, yes, developing friendships with wonderful people we can journey with through life. It’s easier to develop great relationships with people who live and work in proximity to us, which is why we reach out from each of our stores into our communities to include the healthy and delicious products that are often available from local folks. Our customers are delighted to know they are helping others in their local community.”

“First and foremost, we’re looking for products that are free from the ingredients that are banned in our stores. Also, we’re looking to partner with suppliers that lead with innovation in flavours and trending ingredients, raise the bar on the transparency of ingredient sourcing, as well as brands that are exploring [sustainable] packaging options. We also prioritize missionforward brands that give back to local and global communities.”

“Longo’s has a ‘you can’t beat local’ approach so our guests get the best that Ontario has to offer. We have built long-standing, generational relationships with farmers and producers. In season, 75% of our produce is local and many items travel from farm to Longo’s within 24 hours. And, 100% of Longo’s chicken, turkey and pork is locally raised. We seek out and support local providers for items throughout our stores, including Longo’s-branded products. Additionally, our team members are very committed to the communities we serve, which is why we consistently contribute through charitable giving and volunteering.”

U.K. retailer ASDA has teamed up with financial well-being app Wagestream to help its 140,000 employees better manage their finances and deal with the rising cost of living. The app allows employees to see how much they’ve earned throughout a pay period and gives them instant access of up to 50% of their earned contracted pay. The app also features tools to improve financial education and allows employees to set aside money automatically as a “rainy day pot.” And, each month, employees are entered into a prize draw for a chance to double their pot. “We understand that from time to time our colleagues may need a bit more financial help, something which would be made worse by the current cost of living crisis,” said the company’s chief people and corporate affairs officer, Hayley Tatum, in a press release. The partnership with Wagestream follows Asda’s decision to up hourly pay for its retail employees by 10% this year.

To celebrate the coronation of King Charles III, U.K. grocery giant Tesco opened a pop-up pub for two days in early May. “The King in the Castle” pop-up was a temporary takeover of the Castle pub located in Farringdon, London. The pub served up an “affordable” Coronation-themed menu that included items such as Camilla’s King Prawn Curry and The Prince’s Crust Pie, along with standard pub bevvies. Tesco said proceeds from the two-day pop-up would be directed to The Prince’s Trust, a charity founded by the King in 1976 to help vulnerable young people get their lives on track.

Sainsbury’s has stepped up efforts in recent months to reduce plastic in its private-label packaging. In March, the U.K. supermarket chain launched its liquid laundry detergent in cardboard cartons, a move it says will save 22 tons of plastic annually. The cartons are also 35% lighter than the original plastic packaging, and Sainsbury’s estimates that will remove 13 delivery trucks off the road each year, reducing carbon emissions. The grocer also set its sights on chicken and removed single-use plastic trays from its By Sainsbury’s whole chicken range. The company says the move to trayless chicken packaging is expected to save 10 million pieces of plastic a year. The grocer also announced it would be removing single-use plastic lids across its ownbrand dip containers.

Woolworths in Australia has launched an Art Bag range to “celebrate and support Australian communities.” The reusable bags feature designs from some of the country’s up-andcoming artists. The first Art Bag was created in collaboration with Jessica Johnson, founder of Nungala Creative, a First Nations owned and operated agency. To launch Art Bag, the grocer donated the equivalent of C$90,000 to support indigenous education in Australia’s Northern Territory.

To raise awareness of the social and environmental costs of products in its stores, Dutch grocer Albert Heijn has embarked on a price experiment. In three of its stores, customers are presented with two prices when paying for a cup of coffee—the price they’d normally pay and the “true” price (a slightly higher one), which considers other production costs such as harmful CO2 emissions, water consumption and working conditions. Albert Heijn says the purpose of the experiment is to provide customers with insight into hidden costs, stimulate sustainable choices and study customer reactions. The grocer says proceeds from the extra amount customers are willing to pay for the true price coffee will be directed to Rainforest Alliance improvement projects. CG

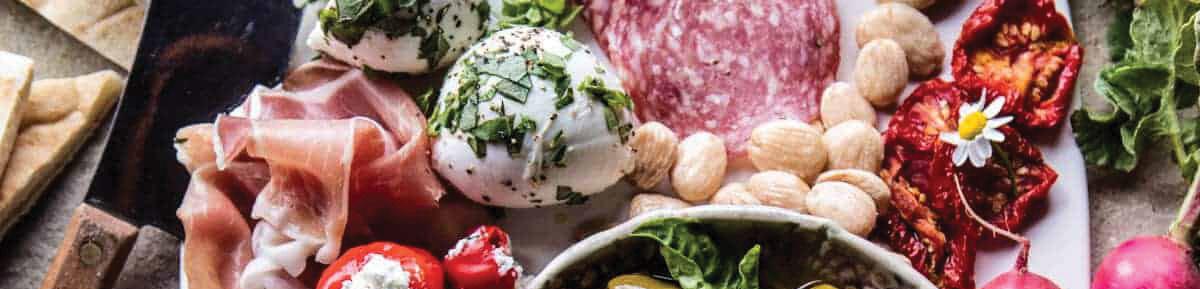

It takes a stellar instinct and solid business sense to determine what food innovations will appeal to consumers time and time again—and fortunately Finica Food Specialties Ltd. has plenty of both. In fact, the company’s foresight around gourmet fare has enabled Canadians to access some of the best cheeses, spreads, sauces, oils and specialty foods from around the world, right in their local grocery stores.

As an importer and distributor of specialty and gourmet items for the past 55 years, the company has nurtured partnerships with suppliers across continents who are passionate about their craft and committment to producing quality products. In turn, Finica’s mission is to provide Canadians with the best possible products at the best possible price. “It’s a hallmark of our success and the reason we’ve thrived this long,” says President Joe Dal Ferro who likens the company’s long-standing success to a three-legged stool. “You need the right product at the right price and the ability to get it there, and if any of those three things are frail, the stool collapses.”

Paramount to the company’s longstanding success has been its ability to introduce novel flavours and food innovations to the Canadian market. A prime example is when Finica supplied goat cheese logs to Canadian retailers via the Celebrity Goat brand 20 years ago. “It has now become a segment in the cheese category and every major grocery retailer has a goat cheese in their own brand assortment,” says Dal Ferro. “Finica put goat cheese on the map in Canada.”

1968 German expats launch Finica in Canada, focusing on German food specialties and Finnish cheese.

1995 Atalanta Corporation (of the Gellert Global Group) acquires Finica, helping expand the company’s cheese imports and premium exclusives to include products from across Europe and the U.S.

2003 Finica brings flavoured goat cheese logs to the Canadian market through Celebrity Goat products.

2011 With its partner Mariposa Dairy in Canada, Finica introduces Lindsay Bandaged Goat Cheddar and wins top prize in the category.

2013 Finica finds a new home for its flourishing business by setting up shop in its current head office, a state-of-the-art facility in Mississauga, ON, that feature a boardroom that opens into a test kitchen.

2022 Finica introduces Fresh sheep’s log as a new segment into the Canadian cheese market under the Celebrity brand.

Finica put goat cheese on the map in Canada.

– President Joe Dal Ferro

Fresh, sliced mozzarella logs are another cheese innovation Finica brought to Canadian retailers through the Zerto brand. “This mozzarella is so unique because portions are equally sliced, making it very convenient and attractive in presentation,” he says.

Dal Ferro expects this year’s introduction of Celebrity sheep’s milk cheese to be another favourite with shoppers. “We traditionally think of sheep’s cheese as hard and heavily brined, but this one is silky smooth, with a creamy flavour,” he says. “Already these products are a hit, particularly the one with honey and lavender.”

Staying on top of food trends means Finica’s team is often travelling to the best gourmet trade shows around the world and meeting with key suppliers to learn about the latest and greatest in top-quality fine foods. “We are also in alignment with our parent company, the Gellert Global company, who have resources committed to finding products that consumers are looking for,” says Dal Ferro. Evolving to meet customer demand since 1968, when Finica’s founders Gunther Mueller and Henning Strait launched the business from a humble home basement, the company has been steadily growing and meeting the needs of Canadian consumers. Initially the exclusive importer for Finland-branded cheeses, Finica was able to expand its offerings when it was acquired by Atalanta Corporation (of the Gellert Global Group) in the U.S. in 1995. “They’re a family organization and importers of fine foods

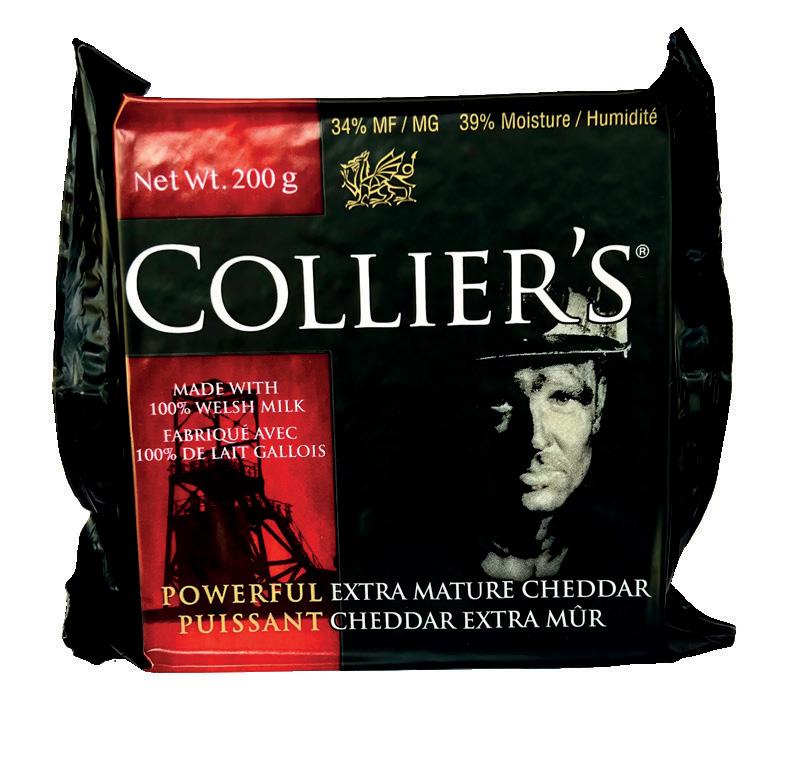

and we have a great synergy between us to be able to drive our mission forward,” says Dal Ferro. “That acquisition helped give us resources and the introductions to so many suppliers around the world.” Today Finica imports and distributes cheeses from the UK, Greece, Germany, Austria, Italy, Spain, Netherlands, Wales and the United States, including Beemster Cheese since 2008, Sartori since 2008 and Collier’s Cheddar since 2010.

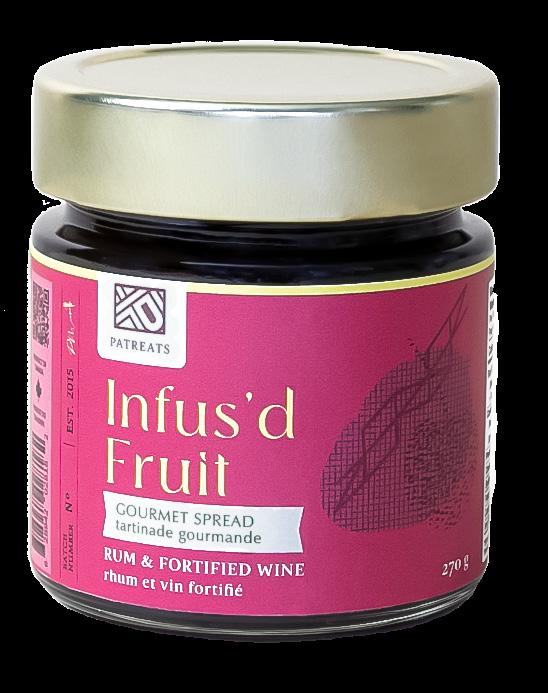

Beyond cheese, the company continues to spearhead other innovative specialty items too. In 2004 it was the first to bring Dalmatia Fig Spread from Croatia to deli cheese counters in Canada— pushing it to a leading brand in the the category—and recently expanded the line with a new chili version this year. “We cover the gamut for what can be found in the deli and on charcuterie boards,” says Dal Ferro, noting that Finica carries 2,300 SKUs across all brands. In addition to “tierone products” through brands like MENU™ that are prepared by chefs for chefs, he says there are also options for consumers looking for more value. “It’s important for us to be able to offer quality products for any budget,” says Dal Ferro.

Going forward he says grocery patrons can expect to see more innovation and unique flavour profiles coming. “We’re working on that right now with our suppliers and have outstanding relationships with our Canadian grocers to be able to bring these great tastes and great value to consumers,” says Dal Ferro.

Finica continues to bring new flavour profiles to the market by zoning in on the latest tastes through its partners with the goal of becoming charcuterie board mainstays.

Here are highlights of Finica’s very latest innovations in cheese and spreads.

September 2022

Celebrity Sheep’s Milk Cheese—Original and Lavender Honey

January 2023

Bellavitano Garlic and Herb & Dalmatia Fig Chili

March 2023

So Irish Mature Aged Cheddar & So British Double Gloucester

Refreshingly sweet and juicy when ripe, the subtle sweetness of green Anjou pears hints at a crisp lemon-lime flavour. Consumers love their dense flesh because it holds up well in heated applications like baking, poaching, roasting, or grilling and they are delicious when sliced fresh in salads or eaten as an on-the-go.

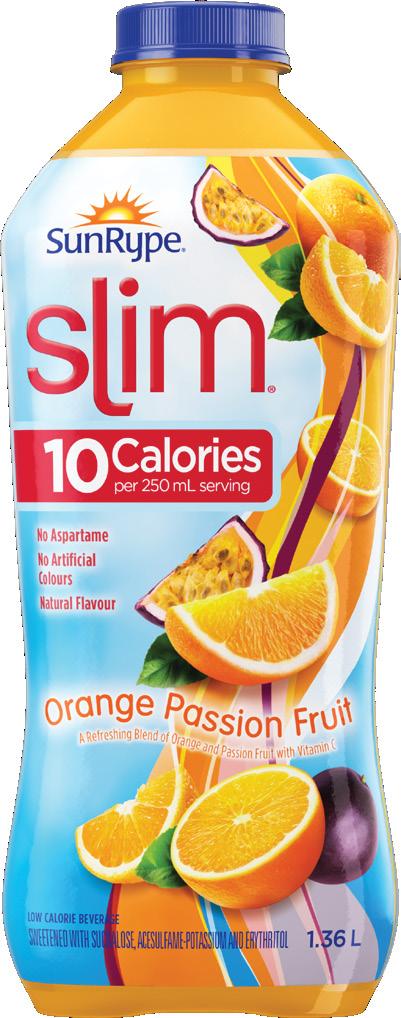

Sugar and calorie reduction remain top of mind for consumers today, and SunRype is making it easier with a delicious new Slim flavour. Slim Orange Passionfruit brings more tasty variety to the popular 5-flavour lineup, with no aspartame, and only 10 calories and 1 gram of sugar per 250mL serving.

Heat up your summer sales with Shahir’s new All Beef Halal Franks. Mildly seasoned with a taste your consumers will love, these fully cooked franks are naturally wood smoked, gluten free, and certified Zabeeha by hand. Perfect for this grilling season.

WHEN WE LOOK back at 2022, it may be remembered as a turning point for AI (artificial intelligence). At this point, you’ve likely heard of Open AI’s ChatGPT. In case you haven’t, ChatGPT is a natural language processor developed by Open AI that can respond to queries using human language. In other words, you can ask it a question or give it a task and it will respond in a way that’s, mostly, understandable and accurate.

AI will, undoubtedly, impact the grocery and food and drink industries in ways that are difficult to fathom. The real promise, or threat, of AI is the rate at which it’s developing. For instance, just a few months after the introduction of GPT3, a newer version, GPT-4, was released in early 2023. By all accounts, this enhanced version represents a step change in processing power and reflects the rapid pace at which AI is evolving.

AI’s swift development brings with it many questions related to how it will affect our lives, which many experts predict will be profound.

In terms of how food and drink brands relate to consumers, there are a couple of areas where AI can have a nearer-term impact around how individuals plan and prepare meals, and how brands engage with consumers.

Coca-Cola offers a prime example of how brands can leverage AI to form deeper connections with consumers. Using GPT-4 and DALL-E, Coca-Cola created a platform called “Create Real Magic.”

As noted, GPT-4 produces human-like text from queries and DALL-E produces images from text. Leveraging these platforms, digital artists in select countries were invited to visit CreateRealMagic. com where they could generate creative content related to Coca-Cola with AI that incorporated content from Coke’s advertising archives.

Creators were also invited to submit their work for the opportunity to be featured on Coca-Cola’s digital billboards in London’s Piccadilly Circus and New York’s Times Square.

This campaign can be viewed as a test case for how companies can use AI to engage consumers and deepen their connection with brands. With most advertising campaigns, customers are passive recipients of messaging. In this case, AI allowed individuals to be active participants, providing them with tools to create brand-related content that also offers a sense of ownership.

Some days, deciding what to make for dinner is one of the toughest questions consumers have to answer. In this respect, AI has the potential to be a co-pilot, suggesting meal ideas based on different criteria such as diet, budget, preferred ingredients or occasion. Microsoft’s search engine Bing, for instance, utilizes AI from OpenAI and uses meal planning as an example for how to use its AI capabilities. Upon opening Bing’s chat mode, a suggested question is: “I need to throw a dinner party for six people who don’t eat nuts or seafood. Can you suggest a three-course menu?”

It’s easy to envision a situation in which AI will increasingly be the source of meal recommendations, particularly for younger adults who are already more likely to rely on online recommendations from social media sites including TikTok and YouTube. One has to wonder, however, if advances in AI will encourage consumers to prepare a wider variety of dishes. It’s difficult to say, but as AI becomes better at supplying recommendations on what to cook and eat, predicting what Canadians want for dinner may become more challenging for grocers as options become more expansive.

The future impact of AI on the food industry remains uncertain and we’re likely at the beginning of this journey. What can be said with greater certainty is AI will impact nearly every area of our lives, and brands that leverage its potential to connect with consumers on both emotional and practical levels will be better positioned in the near and long term. CG

AI will, undoubtedly, impact the grocery and food and drink industries in ways that are difficult to fathom

Mutti introduces Mutti Organic Passata made from 100% organic Italian tomatoes. Mutti Organic Passata retains the bright red colour of tomatoes and has a velvety composition with an intense but sweet taste. And like all products signed Mutti, the fruits are picked at peak ripeness and packaged within 24 hours of harvest to maintain the freshness and flavour that consumers expect from Italy’s #1 tomato brand.

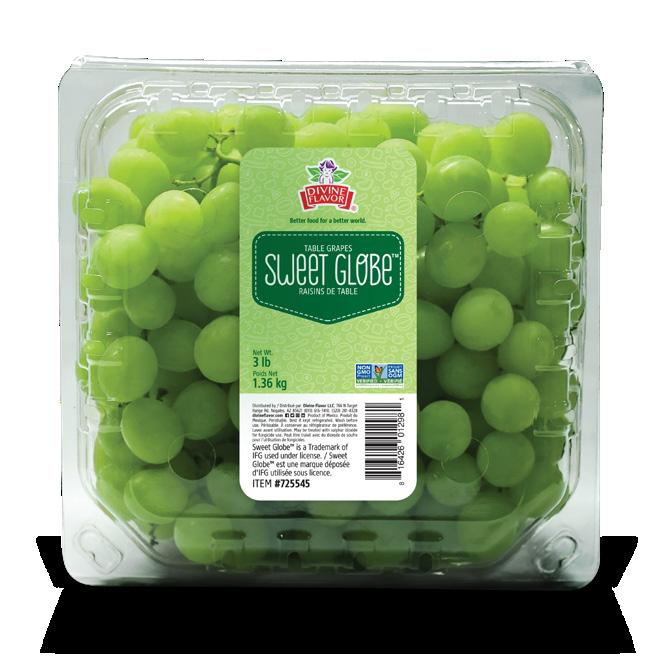

For those looking for the perfect treat this spring, Divine Flavor has got it covered with their delicious Sweet Globe™ green seedless table grapes. This variety has a unique combination of crunch and size, but grape lovers go wild for this fruit because of its juicy, sweet flavour.

New from Cracker Barrel, his naturally smoked cheddar has a mild and unique smoky flavour that brings a delicious taste to favourite dishes for Canadians. It is available in block, slices, and individual snack formats to satisfy every cooking, snacking and entertaining occasion.

SKY-HIGH INFLATION and hefty food prices have many Canadians tightening their belts on their grocery budgets. But while sticker shock is causing some consumers to think twice about adding certain luxuries to their carts, when it comes to cheese, shoppers are staying steady with their purchase behaviour.

Although it’s not seen as a luxury, some consumers have changed where they shop for cheese. In fact, cash-strapped millennials are the most likely to have switched stores for their cheese purchases

According to Caddle’s Daily Survey Panel (March 2023) of 9,928 Canadians across provinces and generations, 83.7% of consumers say they plan to continue buying the same amount or more cheese and just 16.3% say they plan to buy less.

Indeed, no matter if it’s cheddar, mozzarella, gouda, havarti or parmesan, the dairy product remains a clear staple for most Canadians. While 23.9% of respondents say they consume cheese daily, 45.1% say it’s something they consume a few times a week. Overwhelmingly, it’s a planned purchase rather than an impulse item. By and large, it’s consumed by the whole family, any day of the week, and it shows up most frequently at the dinner table, though it’s also a common choice for lunch, snacking and breakfast.

To keep their fridges stocked, about one-third (34.4%) of Canadians say they purchase cheese a few times a month, with 31% buying it monthly and 16.5% weekly or more often. Geographically speaking, Ontario has the highest percentage of weekly cheese shoppers, followed by Quebec. A much smaller percentage of prairie populations and people living in Atlantic Canada buy the product that often.

Although it’s not seen as a luxury, some consumers have changed where they shop for cheese. In fact, cash-strapped millennials are the most likely to have switched stores for their cheese purchases. More people of that generation are now buying from discount grocery stores versus traditional grocers. Costco is the cheese purveyor of choice for 32.8% of shoppers and 31.2% make their purchases at Walmart.

It’s clear that Canadian consumers are brand loyal when it comes to cheese. If their pick is not available, 41.9% of respondents say they’ll wait until their next shopping trip and hope it’s back in stock, compared to just over 37% who say they’ll try another product. Compare that to the budget-conscious millennial shopper and the numbers tell a different story. More than 46% of that generation say if their preferred brand of cheese is not available they’ll look for it at another store. But not every generation is so loyal— gen X is most likely to switch to a different brand if their go-to isn’t in stock.

Although online shopping saw a surge in popularity during the pandemic, only 1.8% of those surveyed buy their cheese online. In fact, most shoppers—a whopping 85%—say they don’t shop for cheese online. Of those who do, convenience is key. Just over 38% buy online to collect in the store and 34.6% purchase for curbside pickup.

Whether they’re buying in-store or online, when selecting a product, most shoppers do not take reviews and ratings under consideration. When they do read other people’s opinions, however, they’re more likely to be swayed by better quality reviews and higher star ratings.

There’s a generational caveat though: those who say reviews and ratings are a very important part of their decision-making process when buying cheese are all millennials. They’re more likely to consult with ratings, whether online or in-store. Perhaps, unsurprisingly, it’s mostly younger demographics who are taking to their screens to buy cheese. Millennials are most likely to buy cheese online, followed by gen X and gen Z.

Those differences continue when it comes to which generations are choosing to buy less cheese— for financial or other reasons. Millennials were most likely to say they were planning on buying less of the product, followed by gen-Xers.

While they’re in the minority, just over 11% of respondents say they rarely buy cheese and 7.5% say they never buy it. There’s a generational trend to those who abstain from the product altogether—the social justice savvy gen Z is leading the charge for the plant-based market, and it’s no coincidence they were most likely to say they never buy cheese, with millennials trailing close behind.

In the current market, shoppers are taking steps to stretch their dollars. But, cheese still plays a big role in Canadians’ diets and, as such, is considered a priority for purchase. CG

THERE’S A LARGE crowd gathered outside the main hall doors like an army of sports fans waiting to enter an arena. Some are armed with mini pom-poms; others are blowing into noise makers and one man has even brought a cow bell. The excitement helps take the chill off the early March morning.

Beyond the doors are enough seats to accommodate the 1,500 associates attending Walmart Canada’s annual company meeting, and a stage that is about to house an impromptu dance session and a boisterous rendition of the big-box retailer’s corporate cheer.

Employees from across Canada are in attendance— some even opted to make their own T-shirts with their store numbers proudly on display—and they’re all waiting to hear from their new president and CEO Gonzalo Gebara.

Gebara has an impressive 23-year career at Walmart. He joined the company in 2000 and has held roles in

finance, strategy, e-commerce, marketing and operations across multiple markets including the United States, Argentina and, most recently, Chile.

He joins Walmart Canada at an interesting time. Over the past few years, successive changes have rocked the grocery industry, from supply chain disruptions and labour shortages to skyrocketing inflation and general cost-of-living challenges.

During his 10-minute speech at the annual meeting, which also includes a video call from his wife and kids, who at the time were still living abroad, Gebara shares areas of opportunity for the company and his optimism for its future success.

Canadian Grocer chatted with Gebara a few weeks after that meeting in Toronto to discuss some of those topics and to find out what, if anything, keeps him up at night. This interview has been edited for length and clarity. »

You’ve been on the job two and a half months. How’s it going so far?

Very well. I’m excited by everything I’m seeing. Walmart Canada is a powerhouse. It’s not only a big business, but we’re doing very well with the community and with sustainability, regeneration, talent development and diversity. So many things are going on. It’s exciting to be here.

What surprises you about the Canadian market?

A few things, I’d say. I had visited Canada a couple of times, but never lived here, of course, and I just think it’s an interesting country not only because of the diversity of the people, but also how big it is and how diverse its geography is. You have metro areas and you have remote areas. And the thing that I like is, as Walmart, we’ve found a way to connect very well with communities across all of Canada. And the other thing I enjoy about Canada is the culture of embracing diversity and being interested in how anyone can contribute based on their histories. I come from a Latin American market, I was born and raised there, and the differences and nuances are quite interesting to see.

You recently told a parliamentary committee that Walmart Canada is not trying to profit from inflation. How are you communicating this to your consumers?

Well, the first thing is to highlight our EDLP [Every Day Low Prices] strategy. Our EDLP strategy is not just a commercial strategy, it’s basically the way we go to market: by keeping our costs low and by investing all the savings into prices so that we can pass along the savings to our customers. That’s the way we have been doing business forever, not only in Canada but around the world. The way I like to describe ourselves is that we are agents for our customers. We try to go as slow as we can so that we can keep prices low. We do that in inflationary times, and we do that outside of inflationary times—that’s the way we gain trust. And, unfortunately, inflation is one factor we’ve had to deal with over the last several years—there’s the pandemic, war in a certain part of the world affecting supply chain networks and production capabilities as well as supply shortages. So, it’s a combination of many things. And, as we evolve into the next stages of the post-pandemic era, we’re going to continue to work on developing processes and staying close to our customers so that we can keep prices low and continue to execute our EDLP strategy in Canada.

As inflation continues, food retailers are ramping up their private-label offering.

What is Walmart’s strategy in this area?

Yes, our private label is a key component of our customer value proposition. I think it builds trust with our customers as we develop products that are high quality. We follow the highest standards together with the suppliers that produce our private-label brands. We have developed sourcing capabilities around the world to make sure we source from the right places in the right

way, and we will continue to grow our private-label program. We have great brands that provide “great value.” [Great Value is the name of Walmart Canada’s private-label grocery brand.] I’m playing with words there, but it’s true. Also, we have brands that bring a lot of innovation and I think that’s the right way to connect with customers, by giving them options and giving them choices.

When calls for a grocery code of conduct were renewed in 2021, Walmart made it clear it wasn’t interested in participating. Where does the company stand today?

Well, I’m sure you’ve read or heard my comments during my participation at the committee a few weeks ago. I said there, and I’ll continue to say, we’re happy to participate in the discussions around the grocery code of conduct. We think if it’s the right thing for our customers, it’s great for the business. We recently got access to [a draft code] because we want to be engaged, so it’s a little bit premature to reach some conclusions. The other thing I would say is that we have a strict internal code of conduct, and integrity is one of the key pillars of our culture. We engage with customers and we drive value through this whole chain in a very good way, in a very transparent way. Our associates are committed to doing the right things across the whole chain all the time. What I’ve seen in Canada is that we have a good scenario where we can compete fairly across all the different components of the industry.

Have you read the draft? What are your initial thoughts?

The team has seen it. I haven’t been engaged yet, but I’m going to be briefed shortly. Our first impression is that it’s going in the right direction.

Jumping to e-commerce. In 2020, Walmart Canada announced plans to invest $3.5 billion over five years to improve service in stores and online, renovate 150 stores and build two distribution centres. Where are you on this journey?

We’re in the middle, not in the middle mathematically, but rhetorically in the middle of the journey. We’ve done quite a few of the things we said we would. We have invested in upgrading our supply chain network, we have opened distribution centres of different capacities, fulfilment centres for e-commerce, high velocity distribution centres and refrigerated supply chain networks. Our business is growing and we need to make sure our supply chain is developed to serve our customers in the way they want to shop with us. We want to be the best option for customers however they want to shop, whenever they want to shop. We’re building the network so we can support that the right way. That’s underway and we’re going to continue to invest in the supply chain network because it’s a critical component of that ability to deliver that value.

Technology is another area where we’re investing and over-indexing compared to previous cycles, I would say.

And we will continue to do that. There’s a lot of value to unlock that we can deliver through additional technology and digital capabilities, not only in e-commerce, but also enhancing the experience in stores.

Store remodels are also a key component of our investment program. We think updating and upgrading our stores to fulfil our customers’ needs when they choose to visit our stores is very important.

You mentioned digital capabilities, can you provide some examples?

The options are multiple and I couldn’t even start to describe all the crazy ideas we have around this, but one thing is customers can check prices using the Walmart app without the need to use a price verifier or go to the checkout. So, making our customer’s life easier is something technology is allowing us to do. Checking prices is just one of the many examples where the technology, and the technology built into cellphones, is going to bring new options and new experiences to our customers.

Self-checkout is an in-store tech that’s growing. How do you balance modernization against alienating those customers who aren’t comfortable using this kind of technology?

It goes back to the concept of choice. We need to provide choices and options to our customers. We have our own models on how many self-checkouts we need to have versus the traditional checkouts. It’s on a storeby-store basis, and we continue to learn based on customer behaviour and customer experience. We take all of that into consideration to define how many of each we open. The whole point is it must be a seamless and frictionless experience for our customers, whether they choose to have a regular checkout or whether they choose self-checkout.

How do you combat the perception that more in-store tech means less customer service?

I think we should be very clear with the customers, again, giving them options. It’s not one way or the other. It’s one way and the other so that you can choose as a customer. I think, in current times, giving customers more freedom to do their shopping the way they want is a point of differentiation. Servicing our customers is what we are here for and we will continue to provide a friendly service, and availability of products, and cleanliness, and easy and safe environments to shop. That’s never going to change. We are just complementing that with technology to make it easier for our customers to go through our stores.

More online shopping means more consumer data. What has Walmart learned about its customers over the last couple years from the increase in online shopping?

It’s interesting because when we get into data, I always reflect on the fact that Walmart has been a pioneer on managing data going back to the ‘80s. We have been sharing our sales information with our suppliers so we

can build better networks, and sharing that information has been a big part of how we run our business together with our suppliers. Now, thanks to technology and to digital capabilities, we can take that one notch higher and better understand [shopper] behaviour so we can deliver on our customer value proposition faster and, again, get better options for our customers to solve their problems. The whole point of getting more information and data is to be able to better understand customer needs and customer expectations and adapt the way we deliver our customer value proposition so we can solve our customers’ needs.

Walmart recently launched Walmart Rewards in the U.S. as part of its paid subscription service Walmart+. Are there plans to launch these or similar initiatives in Canada?

I’ll start with the obvious, which is each market has its own nuances and even though we have lots of similarities across the markets, each market runs their business depending on what’s right for each market. The U.S. has done quite a few developments lately in that arena, and we have done a few as well with our Walmart Rewards [Mastercard credit] Card. But, we are not going to copy exactly the programs in any of the markets. We’re going to continue to try to understand customer needs, and develop the programs based on the information that we gather and the intelligence that we have behind it.

How are you approaching store remodels?

It’s a combination of different things. There are changes in the design and in the flow of how the categories are laid out and the adjacencies. There’s a lot of new technology related to equipment and making sure we have the right equipment and refrigeration so we can continue to grow the grocery business. Also, setting up a nice environment for our apparel, for our housewares and for our home products. We have great assortment in those categories and we want to continue to invest in the in-store shopping experience around those categories as well.

Last question. What keeps you up at night?

Well, I’m lucky that I can sleep very well at night. I have a very strong team, we are 100,000 [associates] strong in Canada. We wake up every morning thinking about our customers and how we can deliver value [to them] and solve their needs. But there are a few challenges. How can we deploy our ideas with speed? It’s a very intense, competitive landscape and we want to make sure that we remain as relevant, or even more so, for our customers. So, moving with speed is very important to me. Making sure we provide our teams with the right environment to continue to learn and upskill is another key priority for us. And, deploying technology to improve our customer value proposition and our customer experience in stores and online is another area that’s on my mind. [We’re] working on all those things, but I’m sleeping very well, fortunately. CG

By Rosalind Stefanac

By Rosalind Stefanac

DURING THE PANDEMIC, grocers big and small made significant strides in improving their e-commerce platforms to make online shopping a viable way to buy groceries. But now that shoppers are back in-store again, they’re looking for the same conveniences they’ve become accustomed to online. With brick-and-mortar stores still being the primary sales channel and driver of long-term loyalty in grocery, analysts say retailers who want to keep tech-savvier customers coming back will need to use technology tools that help meet evolving in-store shopping expectations. That means implementing solutions that will create a frictionless and more engaging in-store experience.

“Digital engagement is becoming really, really important to shoppers in the physical store,” says Gary Hawkins, CEO of the U.S.-based Center for Advancing Retail & Technology. Yet, he adds, many grocers aren’t yet delivering on expectations. He points to grocers’ mobile apps as a key example. If shoppers can access a store’s full inventory and get recommendations based on their preferences online, why can’t they do that while they’re standing in-store with their mobile

phone. “So, if I’m in front of the pasta section, help me identify those products that are gluten free or best for a diabetes diet,” he says. “As a shopper, give me a way to easily research and find what’s most relevant to me among the 30,000 items in the store.”

These days, not only are consumers continually connected with their smartphones when shopping, but the latest statistics from Forrester Research show that 48% use these devices with a specific research purpose. The most common categories of in-store mobile research are looking for or redeeming coupons, comparing prices or searching for product information.

Along with more intuitive mobile apps, interactive digital signage is expected to gain favour in the grocery sector to showcase product information, promote special deals and give customers a more personalized experience through touch screens. We can expect to see further innovation such as displays that provide customers with personalized maps of the store so they can find specific areas they’re looking

for. Hawkins says QR codes—introduced more than a decade ago—are also making a comeback to provide product details or promote deals. Major U.S. supermarkets like Hy-Vee have even slashed the size of paper flyers by adding codes customers can scan to access promos and coupons digitally while shopping.

Looking ahead, the analysts say we’re still a way off from truly immersive virtual reality grocery stores, but some retailers are starting to experiment in blending live and virtual worlds. “Over the next two to three years, companies like Apple and others will bring out their smart glasses and that will be game-changing,” says Hawkins. Driven by all the processing power on your smartphone, these glasses will provide a digital overlay to the physical experience, giving customers instant information on products they’re perusing or relevant coupons based on their specific food selections.

In the meantime, enhancements in computing power due to 5G networks, edge computing and the cloud are making it much more feasible for grocers to effectively push the right kinds of promotions for their customers, says Marty Weintraub, partner and national retail leader at Deloitte. “All the big grocers have been relaunching loyalty programs over the last few years and these programs and the platforms they sit on will be able to serve up personalization in-store just like online.”

Weintraub says improving the customer experience in-store through friction-free checkouts is very much a priority for the grocery sector, too. “We see self-checkout continuing to roll out, even though it comes with risks around shrink,” he says. Truly frictionless checkout options like Amazon Go and Amazon Fresh (where customers scan an app upon entering the store and receive a digital receipt when leaving), however, are still too expensive to scale, he says. “[This tech] relies on camera vision, which is getting cheaper, but you still need to outfit the store with lots of cameras and then connect them … so there is lots of expensive infrastructure at work.”

With major advancements in computing power and artificial intelligence (AI), more and more grocers are also looking to invest in technologies that improve operational efficiencies on the back-end. According to the 2023 Connected Retail Experience Study, sponsored by Verizon, the vast majority of grocery and general merchandise retailers are focusing upcoming investments on inventory accuracy and visibility (96%), store and digital integration (94%), store operations efficiencies (96%) and sales and associate productivity (88%).

While the use of robots for store associate tasks is still very niche, retailers surveyed expect that to change over the next few years. In fact, they anticipate up to 70% of routine tasks to be partially or fully automated by 2025. Respondents also said this would allow them to redeploy their associates to more

customer-facing tasks and business operation support.

“What’s changing now is a focus on smart-task management,” says Weintraub, noting that new technology applications allow store leads to get digital signals that help them more intelligently deploy labour hours. “The biggest controllable cost in a grocery store is labour, so how do we optimize that spend by deploying your talent at the highest and best use of their skills.” Grocers like Kroger (see sidebar on the next page) are actively working with technology providers to do just that.

Evolving AI capabilities are also helping grocers more rapidly harness large quantities of data (big data) to improve operational decisions. “We tend to think of AI as this science-fiction type thing, but it’s really this robust technology that can process data very, very quickly,” says Ethan Chernofsky, senior vice-president of Placer.ai, a U.S.-based, AI-driven technology solution that helps grocers (and others) determine customer trends, demographics and brand preferences by analyzing big data. One application of the technology could be to help a small chain looking to expand operations to find an ideal location. The technology analyzes the retailer’s current performance metrics and then determines where its best customer demographic would be (including the optimal co-tenants) for a new location. Chernofsky says rather than expanding based on a grocer’s perceived trade area, the technology can more accurately determine where the opportunities for growth truly are.

Once the technology assists in optimizing a retailer’s footprint from a real estate perspective, it can be used to garner competitive intelligence with real metrics to show how the chain is doing compared to its competitors. “It’s one thing to have your own data, but to be able to compare it side by side with everyone else’s is extremely valuable,” says Chernofsky. “During a certain period your chain may be down by 5%, but if everyone else in your segment is down 20% you’re doing pretty great.” (Placer.ai collects all its data by working with other app makers who collect consumer data and provide un-identifiable aggregate data.)

Whereas retailers—especially smaller chains with fewer resources—were historically forced to make decisions based on predictions and hunches, Chernofsky says AI is levelling the playing field for grocers of all sizes. “Data is how we improve decision making,” he says. “With better access to information, [retailers] can make better researched, more strategic decisions.”

As for where to focus technology investment right now, it’s about targeting “customer pain points” first rather than the latest “cool and flashy innovation,” says Brendan Witcher, vice-president and principal analyst at Forrester. “I guarantee that there is no customer waiting at their door saying that their package better come by drone or they’re not shopping with

this grocer,” he says. Instead, as consumers are more likely to avoid pain than seek pleasure, Witcher says having pain points in the customer’s journey creates a reason for them to say, “maybe I’ll shop elsewhere.”

Pain point examples such as missing labels for prices, out of stock or expired items, malfunctioning self-checkout kiosks or the lack of associates on the floor to answer customers’ questions can be improved with technology solutions, says Witcher. It’s also important to recognize that pain points differ depending on the customer. “It’s not trying to find that one silver bullet that will solve everyone’s problem, but finding the things that solve groups of customers’ pain points and applying them over time,” he says, noting that most grocers already know what these pain points are. “If you truly believe creating better customer experiences will deliver better revenue, why wait,” says Witcher.

Deloitte’s Weintraub expects the days of using technology on a use-case basis are gone as we continue to build technology platforms that can be shared (interfacing to the cloud, edge computing, etc.). “The difference now will be in looking for common denominators from a tech ecosystem perspective, to enable multiple-use cases over longer periods of time,” he says. “It’s going to be about how many things can we enable by setting up this new infrastructure so we don’t have to redo it every time we have a new idea.”

On the operational side, demand forecasting and inventory management are both areas where grocers can better utilize the power of AI and other well-established technologies right now. “If you’re able to order more accurately, the less you’ll have to

discount or throw away to end up in landfills,” says John Harmon, senior analyst at Coresight Research.

In surveying more than 200 large grocery retailers in North America, he and his team discovered most weren’t taking advantage of AI tools to better manage supply. Coresight’s report showed 68% of prepared food is discarded due to overproduction or over-ordering and 15% of unsold food is thrown away or sent to landfills. On top of environment issues associated with food waste, that translates into billions and billions lost in potential grocery revenue. Food waste, as the report notes, represents a “huge, largely avoidable drag on grocery retailers’ revenues and margins.”