The supermarket’s expanding role as a hub for health

Sauce sales heat up

How food tech is transforming the dinner plate

The supermarket’s expanding role as a hub for health

Sauce sales heat up

How food tech is transforming the dinner plate

Here’s how they size up the grocery shopping experience

FEBRUARY 2023

IT’S TIME FOR YOUR ANNUAL RENEWAL Scan the QR code to confirm your subscription

7 Front Desk 9 The Buzz 53 New on Shelf PEOPLE

12 Pies in the sky After noticing a gap in the market, Francesca Galasso launched a premium frozen pizza line that’s now available in grocery stores coast-to-coast

IDEAS

From

On the cover

Our annual GroceryIQ shopper study. Illustration by Sébastien Thibault

15 Cracking the code There’s still work to be done, but Canada’s grocery industry will likely have a code of conduct in place this year

17 The big question Leaders share how they’re attracting and retaining talent amid a labour crunch

19 More than a marriage of convenience Meet KaleMart24: a self-serve, health food convenience store that is

turning the traditional c-store model on its head

19 Raising the bar Calgary Co-op has introduced carboncaptured bars of soap

AISLES

45 On the sauce More at-home eating, an increasingly diverse population, and a hankering for hot sauce pushes the category forward

51 In the cards Digital is driving consumer habits, but there is still value in traditional greeting cards

EXPRESS LANE

54 Clicks and bricks Publicis Groupe’s Jason Goldberg on why the marriage of digital and physical retail is more important than ever

Behind

We’re behind you. FCC.CA/FOOD DREAM.

We’re FCC, the only lender 100% invested in Canadian food, serving diverse people, projects and passions with financing and knowledge.

20 Eglinton Ave. West, Suite 1800, Toronto, ON M4R 1K8 (877) 687-7321 Fax (888) 889-9522 www.canadiangrocer.com

BRAND MANAGEMENT

SVP, GROCERY & CONVENIENCE CANADA Sandra Parente (416) 271-4706 - sparente@ensembleiq.com

PUBLISHER Vanessa Peters vpeters@ensembleiq.com

EDITORIAL

EDITOR-IN-CHIEF Shellee Fitzgerald fitzgerald@ensembleig.com

MANAGING EDITOR Kristin Laird klaird@ensembleiq.com

DIGITAL EDITOR Jillian Morgan jmorgan@ensembleiq.com

ADVERTISING SALES & BUSINESS

NATIONAL ACCOUNT MANAGER Katherine Frederick (647) 287-3714 - kfrederick@ensembleiq.com

ACCOUNT MANAGER Karishma Rajani (437) 225-1385 - krajani@ensembleiq.com

SALES COORDINATOR Juan Chacon jchacon@ensembleiq.com

DESIGN/PRODUCTION/MARKETING

CREATIVE DIRECTOR Nancy Peterman npeterman@ensembleiq.com

ART DIRECTOR Josephine Woertman jwoertman@ensembleiq.com

SENIOR PRODUCTION DIRECTOR Michael Kimpton mkimpton@ensembleiq.com

MARKETING MANAGER Jakob Wodnicki jwodnicki@ensembleiq.com

AgA inst A b Ackdrop of a higher cost of living, economic uncertainty and with the pandemic still hovering in the background, what kind of a mood are Canadians in? And how is this shaping the way they shop for groceries?

CORPORATE OFFICERS

CHIEF EXECUTIVE OFFICER Jennifer Litterick

CHIEF FINANCIAL OFFICER Jane Volland

CHIEF OPERATING OFFICER Derek Estey

CHIEF PEOPLE OFFICER Ann Jadown EXECUTIVE VICE PRESIDENT, CONTENT & COMMUNICATIONS Joe Territo

Avenue West, Ste. 1800, Toronto, Ontario, M4R 1K8.

Printed in Canada

To get a clearer picture of what’s going on with shoppers, we worked with the research team at Canadian Grocer parent EnsembleIQ to survey Canadians across the country and bring you our 2023 GroceryIQ Study: Taking Stock of Grocery Shopper Attitudes and Behaviours . For three years now we’ve been using this study to take the pulse of Canadian shoppers, and what have we learned? Well, among this year’s findings we know that shoppers are firmly focused on price, they have a favourable view of loyalty programs (especially those that reward them with cash or groceries), they’re loading their carts with private-label products and they’re hungry for meal solutions. (Turn to page 23 for more insights from the study.)

Canadian shoppers surveyed also told us they’re a health-conscious bunch; in fact, 73% define themselves as such. With grocery stores already brimming with nutritious foods, they’re the natural destination for the health-minded. In this issue, writer Rosalind Stefanac looks at how shoppers are increasingly turning to grocers to help them in their quest to live healthier (page 34) and the huge

opportunity this serves up for grocers who can deliver on these needs.

And in the latest instalment of our ongoing Generation Next Thinking series (page 39), we explore how food tech is taking over the dinner table, while at the same time tackling some of the planet’s big problems. For instance, advances in tech are making lab-grown meat and other foods (like coffee) a reality, while innovative firms like Germany’s Infarm have devised a way to produce wheat indoors with its vertical farm system, and innovative new solutions are taking a bite out of food waste. According to one analyst quoted in the report “It’s the golden age of food science and technology.” CG

Shellee Fitzgerald Editor-in-Chief sfitzgerald@ensembleiq.com

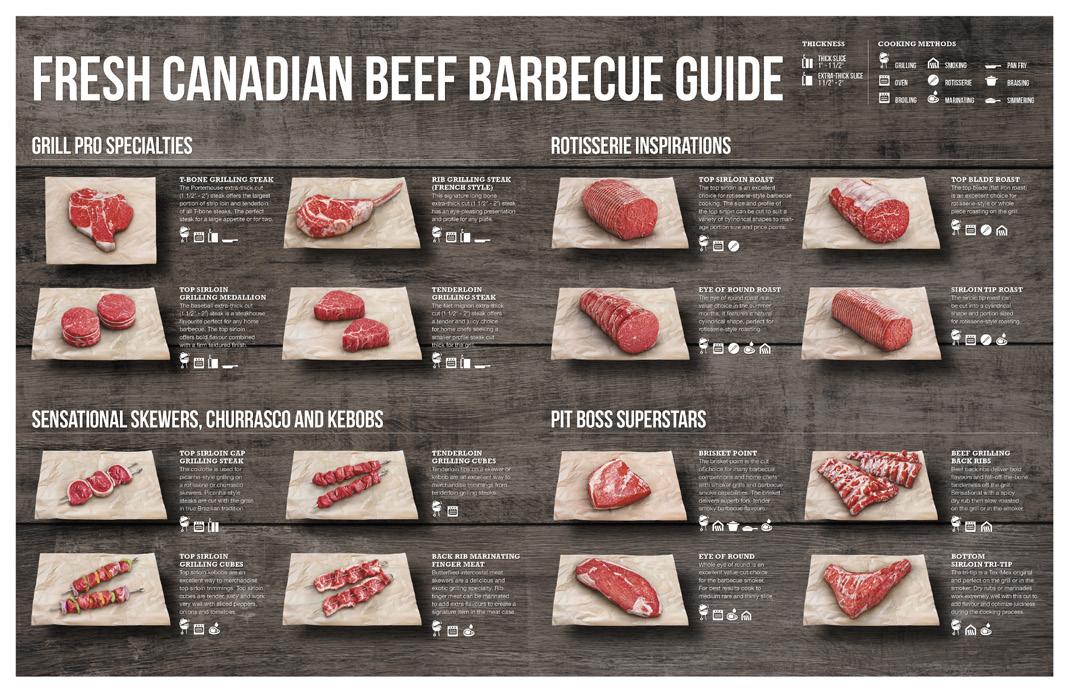

Grilling season is on the way. Fire up your sales with Canadian beef merchandising ideas for the barbecue and grill.

FREE grilling/barbecue guides featuring innovative cuts and merchandising ideas. Available to download now.

The grilling guide offers beef cut suggestions perfect for the grill including Steakhouse Superstars and Underdeveloped Performers with 16 cuts featuring something for every price range and meal opportunity.

The barbecue guide features thick cut steaks, skewers and kabobs along with roasts and ribs. Offering 16 cut options, the guide has a beef solution for every barbecue occasion.

Fortinos and Avril Supermarché top the rankings for best in-store and online experiences in Ontario and Quebec, respectively, according to Leger’s recently released 2022 WOW and WOW Digital studies. The market research firm surveyed more than 12,000 Ontarians and 12,000 Quebecers to evaluate the strengths and weaknesses of 203 retailers across 20 sectors. For Ontario supermarkets, Fortinos led the pack followed by Longo’s, Farm Boy, Whole Foods Market and Adonis. In Quebec, Avril Supermarché came out on top followed by Costco, Metro/Metro Plus, Rachelle Béry, and IGA/IGA Extra.

T&T SUPERMARKET made its much-anticipated debut in the Montreal borough of Saint-Laurent in December. The opening marks the Loblaw-owned Asian grocery chain’s first venture into the Quebec market. At 70,000-sq.-ft., and representing a $10-million investment, the store is the largest in T&T’s network of 31 stores. T&T also operates in Ontario, Alberta and British Columbia. At the store’s opening, CEO Tina Lee told Canadian Grocer: “We knew that we had to come in really strong.” Lee said the store boasts more than 20,000 products and serves up features like an Asian fruit gift section, a large selection of imported alcoholic and non-alcoholic Asian beers (the Saint-Laurent location is the first T&T to sell alcohol), large varieties of seafood, hot food bar and more. “It’s an incredible assortment. If you’re a food lover, this is a really appealing place,” said Lee.

Vancouver is home to a brand-new URBAN FARE . The upmarket grocery banner, owned by Pattison Food Group, has set up shop in the newly developed Lelǝm Village at the University of British Columbia. The 12,700-sq.-ft. space, which opened for business in early February, is

adjacent to the new Wildlight Kitchen + Bar, also owned by Pattison Food Group. Urban Fare stores can be found in Vancouver, Kelowna and Calgary.

In Toronto, RABBA FINE FOODS marked the opening of its 36th marketplace in January. Located in the city’s financial district (at Richmond and Victoria streets), the store offers the chain’s typical grocery assortment, but also features Rabba Kitchen by Paramount. The in-store kitchen offers a variety of hot and fresh meals, including specialties like shawarma and falafel. The downtown location is the fourth Rabba to offer a full meal takeout service under the Rabba Kitchen by Paramount name.

FARM BOY continues to up its store count with the addition of two new locations in the Greater Toronto Area. The Empire-owned grocery chain opened for business in Aurora, Ont. in mid-January at Wellington Street East. The grocery chain also set up shop at Toronto’s Sugar Wharf, occupying a 29,600-sq.-ft. space on the second level of 100 Queen’s Quay. One of the country’s most rapidly growing grocery chains, Farm Boy now has a network of 47 stores in Ontario.

Gonzalo Gebara is the new president and CEO of Walmart Canada. A veteran of the company, Gebara joined the retail giant in 2000 and has since held roles across finance, strategy and e-commerce, and has worked with the company’s teams in the United States, Argentina and Chile. Gebara succeeds JP Suarez who had been leading Walmart Canada on an interim basis following the departure of president and CEO Horacio Barbeito last summer.

At Sobeys, Geneviève Dugré has been promoted to the role of senior vice-president of operations for Quebec. Dugré, who joined Sobeys in 2013, has held various positions in retail operations, including management of the Rachelle Béry banner and corporate IGA stores.

The Coca-Cola Company has named Phil Cox as its new general manager, Canada. Cox joined Coca-Cola Enterprises in 1996 and most recently served as the company’s regional vice-president, Northeast U.S. Metro has added to its executive team. The grocery company appointed Pietro John Rollo to the position of senior vice-president of national procurement. Rollo, who previously held a senior role at Walmart Canada, will report to Carmen Fortino, executive vicepresident, national supply chain and procurement.

Alexander Benedet has joined Lactalis Canada as its vicepresident, customer strategy and development. Previously, Benedet was vice-president of sales strategy, capabilities and planning at General Mills.

We’re looking for the most impressive women working in the Canadian grocery industry today for our 2023 Star Women in Grocery Awards

If you know of an outstanding woman who is making a difference in grocery, please take a few minutes to tell us about her at starwomen.ca. The deadline to nominate is March 31 and winners will be revealed in our June/July issue.

known Across western Canada for its supermarkets (among them, Save-On-Foods), Pattison Food Group is now making a move into restaurants.

In January, the company offered a sneak peek of Wildlight Kitchen + Bar, its first full-service restaurant, ahead of its February grand opening.

Located at the Lelǝm Village development at the University of British Columbia in Vancouver, the concept of Wildlight Kitchen + Bar is a “celebration” of West Coast cuisine.

“The restaurant is inspired by our love of the ocean, the forests and the shoreline of beautiful British Columbia,” said Justin McGregor, general manager of restaurants at Pattison Food Group at the VIP preview event. “It is a celebration of West Coast culture and cuisine where our chef, Warren Chow, has crafted a menu with an exceptionally strong focus on local B.C. flavours and ingredients with variations from around the world.”

At Wildlight, diners can expect unique cocktails and an expansive range of local B.C. wines from the bar and tasty creations from the kitchen that include dry-aged beef burgers, duck confit and, of course, seafood ranging from Hakkaido scallops, miso-glazed sablefish and the restaurant’s seafood charcuterie (house-made salmon pastrami, marinated mussels, salt tuna tataki), all served up in a beautiful, contemporary space.

So how did Wildlight come to be?

“More than two years ago Darrell [Jones, president of Pattison Food Group] challenged us to open a restaurant and when he did, we all thought he was crazy,” said Brenda Kirk, senior vice-president of merchandising and procurement at Pattison Food Group. “We had no idea how to operate or open a restaurant, but I knew we did know a lot about food and a lot about customer experience.”

Indeed, with nearly a dozen retail banners under its umbrella, the group has figured out how to win with customers; Save-OnFoods, for instance, has earned the distinction of being one of B.C.’s “Most Loved Brands” several times over.

The way Jones sees it, moving into the restaurant business is a “natural fit” for the growing company. “Just like the Pattison Food Group’s business, our mission here is very simple, for Wildlight to deliver, always, customer-first service.”

But it’s not only a dining experience that’s being served up at the Lelǝm Village location; adjacent to the restaurant is a new Urban Fare, Pattison Food Group’s upmarket grocery banner, which also opened its doors for business in February.

The group’s first restaurant is a “celebration” of West Coast cuisineGeneviève Dugré Gonzalo Gebara Phil Cox Alexander Benedet

Connect with serious retailers, buyers, merchandisers and manufacturing executives who share a passion for food and the industry.

IDDBA 2023 retail attendees include the top 200 retail chains, top 100 wholesale chains, top 100 convenience stores, and major independents. Gain insight and engage face-to-face with industry peers.

2023, The Year of Technology and Innovation, will bring to life the latest and trending products, packaging, technology, and equipment solutions. WISL 2023 will host an array of leading experts who will provide engaging educational workshops throughout the three days.

Become an Exhibitor

WISL Sponsorship Information

For more information visit IDDBA.org

From an organization you trust, comes the resource you can depend on. Now completely digital, stay up to date on the latest industry trends and business solutions!

After noticing a gap in the market, Francesca Galasso launched a premium frozen pizza line that’s now available in grocery stores coast-to-coast

By Andrea Yu

By Andrea Yu

Who you need to know

Photography by Lucas Finlay2014, FrAncescA gAlAsso was ready for a change. She was working as a public health research assistant at the University of British Columbia but kept thinking back to her time working the front-of-house at restaurants while in school. “I kind of fell in love with restaurants that way,” she says. “It really attracted me to hospitality.”

One day, Galasso was passing by a shop that was up for lease in the North Vancouver neighbourhood where she lived. “I saw it, and it just spoke to me,” she recalls. Galasso left her job and opened a wood-fired Neapolitan-style pizzeria that she called Il Castello, which quickly became a local favourite. “It was a really cute neighbourhood pizza spot that was community-oriented,” says Galasso. “We had a ton of regulars.”

As the years went on, those regulars began asking Galasso whether they could purchase balls of dough to make their own pizzas at home. Galasso began selling frozen dough to customers from her restaurant and, shortly afterwards, a local deli asked to stock her pizza dough. That got Galasso thinking. “It wasn’t just customers buying [dough] at the restaurant now,” she says.

Galasso did some research at nearby grocery stores and noticed a gap in the market for both pizza dough and frozen pizzas. “Frozen pizzas get a bad rap,” she says. The entrepreneur envisioned creating premium, restaurant-quality frozen pizza that would be an easy dinner option, especially for millennials that were short on time. “I thought, ‘this is ripe for innovation.’”

From late 2016 to early 2017, Galasso worked on putting together a business plan. With the help of Vancouver creative agency Spring Advertising, she developed simple, modern packaging and branding for her new frozen pizza line, which she called Holy Napoli. The dough would be slow fermented in small batches using 00 flour, the crusts would be baked in a stone oven, and pizzas would be topped with premium ingredients like San Marzano tomato sauce and hand-picked basil. Holy Napoli launched with three varieties based on the bestsellers at Il Castello: a Margherita, the Calabrese and Pesto Roast Vegetable, along with the frozen pizza dough that started it all.

Early testing and trials happened at Il

Castello, but Galasso soon realized her production capacity would be limited in the restaurant. “It was a ‘chicken or the egg’ scenario,” Galasso says. “Do you get the sales first or do you get your capacity lined up first?” She took a leap of faith and took the latter option and rented out a production facility in Port Coquitlam in the spring of 2017.

That leap of faith paid off. By early 2019, Holy Napoli was in about 100 specialty and independent grocery stores, mostly in British Columbia, with a handful in Alberta. The growth of the grocery line prompted Galasso to sell her North Vancouver pizzeria and focus her efforts on growing the wholesale and CPG business.

It was around the start of the pandemic, in spring 2020, that Holy Napoli ventured beyond Western Canada, launching in about 50 independent stores in Ontario. Without in-store demos and promotions, Holy Napoli had to rely on the strength of its branding to gain customer attention. Thankfully, it worked. “People tell us all the time: ‘Your packaging is fantastic It stands out,’” Galasso says. “For a lot of people, the only indirect interaction they ever have with your brand is the packaging. I think that’s a big differentiator for us.”

Over the last two years, Holy Napoli experienced a huge period of growth. The brand launched in Thrifty Foods and Safeway stores in British Columbia, Metro stores in Quebec, Whole Foods Market stores in British Columbia and Ontario, and the market division of Loblaws nationally. Recognizing the potential to scale up her business, Galasso also brought on Toronto-based Bond Bakery Brands as an investor during this period. Holy Napoli products can now be found in more than 800 grocery stores coast-tocoast, including the Yukon.

This year, Galasso is focusing on increasing the company’s presence and sales within the stores that currently stock Holy Napoli products. “Demos are coming back to life,” she says. “There’s a real opportunity to drive more trial and get people to give our product a try.”

Looking back at her journey, Galasso feels humbled by how the business has grown. “It’s quite surreal,” says the entrepreneur, that a product she created “could be eaten by someone in front of me or by someone across the country, which is pretty cool.” CG

What do you like best about your job?

Every day is different. I like that you can interact with different aspects of the business. I have multiple touch points with business development, human resources, product sourcing, development and sales, and all that can happen in one day. It’s the variety that I love.

What inspires your work?

The prospect that you can encourage and excite people to try something new, based on the quality of our product or our packaging, and they could then tell their friends about us. I think that’s a challenge and that really excites me.

What has been your best day in business?

This is in hindsight, but it would be when I decided to get my own manufacturing facility and build that out. That was the greatest decision and the best thing I did for my business.

What is your favourite product from your lineup?

The Calabrese pizza. I eat it for lunch more times than I would like to admit.

What do you like to do when you’re not working?

I do a lot of cooking. I love to bake bread. I love to hike and hang out with my dog. Her name is Stella and she’s a very energetic eight-year-old redbone coonhound. I like to garden and knit and sew. I dabble in a lot of different creative activities. I love making and creating things.

there is still work to be done, but it’s likely the Canadian grocery industry will have a code of conduct in place this year.

The latest report from the steering committee working on the code confirms that most of the key provisions are complete, and progress is being made on how the code will be enforced.

That report was met with a joint statement from Minister of Agriculture and Agri-Food Marie-Claude Bibeau, and Quebec Minister of Agriculture, Fisheries and Food André Lamontagne, commending the industry on the progress it had made.

“By enhancing transparency, predictability and fair dealing, the code will help make Canada’s food supply chain more resilient,” the statement read, with “transparency, predictability and fair dealing” being the key watchwords for the process since the ministers called for an industry code in 2021.

“I’m really, really pleased with the progress we’ve made,” says Gary Sands, senior vice-president, public policy and advocacy, for the Canadian Federation of Independent Grocers. “Now all we’re doing is putting the final touches on it.”

While much of the work to draft the code had been led by a 10-person committee meeting monthly since mid 2021, progress to clear away the final hurdles came with the formation of an eight-person working group in August. Members of that group unilaterally understood the importance of having a code developed by the industry rather than one imposed by the government, Sands says.

Final touches to the code relate to governance and enforcement, but progress is being made there, too, says Michael Graydon, CEO of Food, Health & Consumer Products of Canada.

Wider consultations—likely to begin in February—will introduce the proposals to as many stakeholders as possible. Once the consultations are complete, the language vetted by lawyers and the final version of the code signed off, they can begin to put the formal structures in place. There will be a board of directors from representatives across the industry and an adjudicator supported by a small team (likely six staff members), which will listen to complaints and enforce the code.—David Brown

WESTERN CANADA’S LEADING GROCERY EXHIBITION AND CONFERENCE

APRIL 24-25, 2023

APRIL 24-25, 2023

VANCOUVER CONVENTION CENTRE EAST BUILDING

& APRIL 24 & 25, 2023

Attend the ONLY western-focused grocery conference & exhibition – April 24 & 25, 2023 during the GROCERY WEEK in Vancouver! Retailers, Grocers, Wholesalers, Mass and Convenience from across Canada will converge in Vancouver, BC this spring!

Network and build your business with the industry throughout the two days at industry cocktails, onsite meetings and discussions.

Take advantage of the events, sessions, and programs to maximize your leads from the New Product Showcase.

& APRIL 24 & 25, 2023

Explore new innovations and products/services at various pavilions (Ontario, High Quality BioEurope, Sustainability, First Timers).

TO EXHIBIT ROLSTER TAYLOR: RTAYLOR@CFIG.CA

EVENTS/CONFERENCE: EVENTS@CFIG.CA

“Our more than 100,000 associates are the heartbeat of our business. We want them to feel supported, valued and developed so they can live better every day. We’ve enhanced our total rewards and benefits offerings (i.e. fertility treatment, gender affirmation, mental health, 24/7 virtual care and associate assistance), leveraging associate feedback to inform decisions. And we’re doubling down on career growth within Walmart. Along with launching our first internal talent marketplace this year— connecting associates with company-wide opportunities— we’re offering thousands of part-time associates full-time positions that provide more

Leslee Wills Vice-president, people and corporate affairs BIMBO

“This is not a ‘one solution fits all’ labour environment. We are listening to what our associates have to say and we value their recommendations for improvements at our bakeries and DCs. Ensuring the safety and well-being of associates comes first. We are investing heavily in people, and we are launching initiatives focused on providing associates with a superior quality of life. Our commitment to diversity, equity, belonging and sustainability is helping engage associates in meaningful work, while driving social impact in our communities. Bottom line, we are focused on fostering a people-first culture that makes Bimbo Canada stronger for whatever comes next.”

Joe D’Addario CEO

“Shared purpose and shared vision have helped us navigate the toughest of times and have played a pivotal role in our 30-year history. We empower our team members to help educate the communities we serve about the benefits of eating well. People feel good going to work when they understand how their contributions can make an impact. Everything we do—from onboarding to ongoing development—is centred on our desire to have a positive impact on the communities we serve. Nature’s Emporium is growing, and one of the ways we retain talent is by creating opportunities for growth within the company. As we grow, we want our team members to grow alongside us.”

Teresa Spinelli President ITALIAN CENTRE SHOP

“We are blessed to have an amazing culture, which keeps our team engaged. Every decision at Italian Centre is made with the consideration of people first. We make sure our teams know they are valuable and that they make a difference—we ask for their input on many occasions. Some of the best suggestions have come from our team, and we have implemented them all.”

“Our 4000-plus team is our strongest asset. Above and beyond competitive compensation and benefits, we place great importance and investment on health and well-being programs and initiatives to meet the diverse needs of our people. We also invest in quality training and development programs to foster a learning culture, which leads to skills development and enhancement as well as internal career growth. As part of a global company, our employees in Canada are also able to build networks and gain access to international expertise, as well as unique opportunities for international career development.”

We’re proud to support

#Toonies4Tummies

By Danny Kucharsky

By Danny Kucharsky

are becoming more conscious about their health. Millennials desire a higher quality food experience with a unique narrative and authentic global flavours. KaleMart24 is geared towards those grabbing a fresh lunch or snack in time to make it back to the office or to class.

You’ve said you’re trying to become “the Whole Foods of convenience stores.” How will you achieve this?

CALGARY CO-OP has developed bars of soap made from carbon captured from its head office and converted into mineral form.

KALEMART24 wants you to forget what you know about the traditional convenience store model. Soon to launch in Montreal as a better-for-you, self-serve c-store with healthier choices like organic and plant-based foods, KaleMart24 hopes to attract convenience-minded millennials. CEO and director Oussama (Sam) Saoudi outlined the concept to Canadian Grocer and shared the company’s expansion plans. This interview has been edited for length and clarity.

Why choose the better-for-you c-store model?

I love on-the-go options and we millennials are the ones driving the trend for increased visits to c-stores and graband-go stores. We make frequent trips to grab-and-go stores to get the food we need for the same day or the next couple days. We are becoming more conscious about our health; however, the natural food and beverage options in c-stores are currently very limited or inexistent.

What consumer insights are driving the concept?

Sales in the organic food and beverage sector grew by 7.1% in 2022. Organic sales are increasing because consumers

With a nutritionist on our team, we will look for the best natural and organic foods available, maintain the highest quality standards in the industry, and have a strict commitment to sustainable food. Our secret to winning involves a balance of brand consistency, customer appreciation, innovative assortment, and ease of experience. KaleMart24 is deeply entrenched in local communities, giving customers the opportunity to support local suppliers.

What is unique about the store design compared to other c-stores?

The stores will have a modern, upscale look, while still maintaining an earthy, market-like atmosphere. Expect all the usual [convenience] categories, but with specialty brands and products in addition to personal care items and even organic pet food. Plus, you can check out with or without the help of an associate [the store leverages tech such as self-checkout and mobile payments]. There will also be a large, ready-to-eat section with warm or fresh nutritious meals made daily.

What are your expansion plans and financial projections?

By establishing a strong national brand awareness in major cities, KaleMart24 hopes to expand to five stores in its first year and grow to 30 stores by 2025. By year three, we’re projecting revenues of $55 million and profits of $6 million. CG

The all-natural, biodegradable soap hit shelves across Calgary Co-op’s 23 stores in January. It comes in six scents: spearmint, vanilla chai, sweet and spicy lemongrass, coffee honey, activated charcoal and shea butter. It is likely the first of several carbon-captured products to be released by Co-op’s private-label brand Cal & Gary. The label launched in 2000 and now boasts more than 600 products.

To make the soap, the co-op uses a device from Calgary-based CleanO2 that pulls in carbon dioxide from the building’s heating systems that are normally emitted into the air. The captured CO2 is converted into pure pearl ash (potassium carbonate) and then harvested from the unit (which is about the size of two refrigerators) and transferred to a manufacturing facility.

Chris Gruber, managing director, head of private brands at Calgary Co-op estimates the unit’s impact on removing CO2 emissions from Co-op’s head office per year is the equivalent of planting more than 300 trees.

The soap comes in recyclable packaging branded with the slogan “Friendly Soap for Friendly People,” and is sold in the “natural store” department of Co-op’s supermarkets. —Chris Daniels

It’s more than just being baked in Canada, it’s about being grown, harvested and milled right in our own backyard. It’s being loved, celebrated and even devoured by Canadians from coast to coast. For over 100 years, Dempster’s has been here, and we’re just getting started.

Our national study delves into how Canadians view the grocery shopping experience

By Shellee Fitzgerald Illustration by Sébastien Thibault

By Shellee Fitzgerald Illustration by Sébastien Thibault

To besT serve shoppers, understanding what they want is essential. While that strategy might seem like a no-brainer, shoppers can be a tricky bunch whose needs and preferences seem to be always changing. What’s a grocer to do? To help, Canadian Grocer has once again teamed up with the research team at EnsembleIQ (Canadian Grocer’s parent) to bring you the 2023 Grocery IQ Study: Taking Stock of Grocery Shopper Attitudes and Behaviours. In this, our third-annual study, we surveyed 1,000 shoppers (primary and shared decision-makers) across Canada to shed light on how they size up the grocery shopping experience today and how they plan to shop in the future. Here are some highlights from the study:

A notable shift from traditional to discount is taking place; shoppers are turning to discount retailers in the face of rising inflation.

With reports of sky-high inflation and a looming recession dominating headlines for the last several months, it’s no surprise that consumers are feeling squeezed, and this reality is influencing how they shop for groceries. The latest edition of the Grocery IQ study reveals a notable shift from traditional to discount grocery stores, with 54% of survey respondents indicating they shop at a discount chain once a week or more, up a significant 14% from last year (and up 17% from our 2021 study) as shoppers prioritize value. Meanwhile, fewer respondents said they shopped at a traditional chain store once a week or more (56% compared to 63% last year).

Against this tough economic backdrop, it’s hardly a surprise that when we asked shoppers “What is the most important factor when choosing a grocery store?” price, by far, was the most important consideration for 84% of those surveyed, up slightly from 82% last year. Other important factors for shoppers are product freshness (75%); products needed

Price has become increasingly important to shoppers in 2022; the gap has widened between price and other key factors.

are in-stock (74%); sales and promotions (73%, up from 71% last year) and product quality (73%).

While grocery stores were generally rated favourably by shoppers last year, achieving high ratings in areas like cleanliness and store organization, this year they were harder to please. The 2023 Grocery IQ study reveals that, overall, shoppers are less satisfied with their grocery shopping experience. In particular, shoppers are less impressed with store cleanliness with 61% of shoppers perceiving this to be excellent/very good compared to 70% last year. Other notable declines were the variety of products available, organization of the store, high prices and the helpfulness of employees—all things for grocers to keep an eye on.

We also asked shoppers to tell us about their biggest pet peeves or what most needs improving at the store they shop most often. While their responses were fragmented, top areas identified for improvement were the usual suspects: out-of-stocks, high prices, and not enough checkouts. On a positive note, 18% of shoppers surveyed are happy with their primary grocery store’s performance and say it needs no improvement.

Amid fierce competition in the grocery industry, the battle for customer loyalty is heating up. In recent years, retailers have launched innovative programs or tweaked existing ones to give customers a more compelling reason to choose them for their grocery shop. The question, however, is how do Canadian shoppers view loyalty programs? The good news is that loyalty program participation and satisfaction remain stable when compared to last year, with 67% of shoppers actively enrolled in their primary store’s loyalty scheme and more than 90% of those shoppers indicating some degree of satisfaction with the program. And there are interesting generational behaviours to note around loyalty programs; for instance, the study revealed that generation X (71%) and boomers (71%) are significantly more likely to be enrolled in a loyalty program than millennials (61%).

Digging a little deeper into loyalty, we asked shoppers to tell us what features of these programs they value most. By far,

Overall, shoppers are less satisfied with their grocery shopping experiences vs. last year.

Top areas for improvement include replenishing stock more frequently and easing traffic with more checkout lanes.

Most shoppers refer to flyers (digital or paper) before their shopping trip; digital flyer use has increased vs. a year ago.

1 in 3 children are ar risk of going to school on an empty stomach*.

Together, let’s feed them. Join us.

#Toonies4Tummies

70% CACAO CHOCOLATE

LINDT EXCELLENCE. SO THIN. SO INTENSE. Experience a masterfully balanced blend of the finest cocoa beans with subtle fruit and floral undertones, and a hit of natural vanilla. Lindt Maitre Chocolatier Suisse depuis 1845.

https://www.lindt.ca/en/

*Breakfast club of Canada

Reward programs that allow shoppers to redeem points on groceries are most popular.

for those shoppers enrolled and actively participating in a loyalty program, the most important feature is the ability to redeem reward points on groceries (69%). Other popular features are exclusive discounts for loyalty program members (40%) and cash back (35%). It’s worth noting that Quebec shoppers value cash back more than shoppers in the rest of Canada, with 55% deeming it the most valuable feature.

Of course, loyalty programs don’t appeal to everyone. Reasons shoppers gave for not being interested in a store’s program are: requires too many purchases to earn rewards/points (22%); the rewards/points/discounts are not valuable (20%); requires signing up for a credit card (19%); and they already belong to too many loyalty programs (16%). Bottom line: holdouts need to be persuaded there’s substantial value to be gained by the loyalty program before they’ll consider joining.

It’s no surprise that Canadians continue to rely, overwhelmingly, on physical stores to procure their groceries. In fact,

Shopping patterns remain consistent with last year with the majority of trips taking place

97% of those surveyed indicated they had shopped in the store in the past month, a figure that has not budged over the past three years of the study. Looking at the online options available, the survey revealed that curbside pickup and in-person delivery were neck-in-neck with each accounting for 4% of shopping “trips” in the past month.

When we asked shoppers how they think they’ll shop in the year ahead, most respondents (76%) said they expect to shop for groceries in-store at a similar level as they do today, with 19% saying they expect to shop in-store more often. Online shoppers also anticipate maintaining similar online behaviours in 2023. A bright spot for grocers is that satisfaction remains relatively high for online grocery shopping, with 89% of shoppers in this space claiming some level of satisfaction. For the 11% not happy with the experience, the biggest peeves are high fees (42%, up 9% from last year), outof-stocks (41%) and dissatisfaction with product substitutions (27%). On a more positive note, fewer of these shoppers (15% vs. 23% a year ago) said their order was picked incorrectly.

Looking ahead, most expect to shop for groceries in-store at a similar rate; online shoppers have increased confidence that they will maintain their online shopping habits this year.

Shoppers have shifted to more conservative shopping habits vs. last year, and expect to carry these habits forward in 2023 (more planning, less browsing, more stock-ups).

More than three-quarters of shoppers have changed their shopping behaviour in some way to cope with inflation; the most popular strategies are buying items on clearance and making fewer impulse purchases.

Buying items on reduced price/clearance

Buying fewer impulse items

Buying more private-label products

Shopping more often at discount grocery stores

Buying fewer prepared foods

Buying fewer fresh produce items

Buying cheaper animal proteins

Given the economic pressures Canadians are contending with, it stands to reason that they’re demonstrating more conservative shopping behaviours compared to last year. In fact, more shoppers report they’re planning their trips to the store, they’re stocking up, are spending less time browsing the aisles and are less inclined to add impulse items to their baskets. Shoppers also expect they’ll maintain these habits through 2023.

To cope with high costs, shoppers also appear to be leaning into home cooking and flexible meal plans to manage their food budgets. The survey revealed 57% of shoppers are cooking more from scratch, up 11% from last year, with 59% anticipating they’ll continue to do so. Perhaps another sign of the times is the growing popularity of private label; according to the survey, more shoppers (32% vs. 21% a year ago) say they’re buying store brands and predict they’ll buy them at a similar level going forward. The top reasons shoppers give for purchasing private label are to save money (76% compared to 69% last year) and they feel the quality of these items is similar to name brands.

Canadians continue to load up on fresh with 86% of shoppers purchasing dairy and fresh produce in the past month, with nearly three-quarters reporting to have added fresh meat and seafood to their carts, consistent with last year. Notable shifts were observed in frozen foods with significantly more shoppers buying them this year (63% vs. 58%) as well as confectionery (51% vs. 31%) and prepared foods (42% vs. 34%) indicating, perhaps, that shoppers are turning

to affordable luxuries in tough times. Among the non-edible products purchased at grocery stores, paper products remain the most purchased items, however, over-the-counter medications and pet supplies saw the biggest increases over last year at 32% (up 6%) and 17% (up 5%), respectively.

On average, Canadian shoppers reported spending about $112 on their most recent grocery trip, up slightly from $109 a year ago. When asked about changes they’ve

Significant growth in purchases of frozen foods, confectionery and prepared foods vs. last year.

made to cope with inflation, more than three-quarters indicated they’ve adjusted their shopping habits in some way. Among the top strategies used by shoppers: buying clearance items, fewer impulse items, more private label, and shopping more frequently at discount grocery stores. Looking at it through a generational lens, the survey revealed that boomers are significantly more likely than millennials and generation-Xers to report no changes to their shopping habits.

Two-thirds of shoppers still rely on a core shopping list, but don’t necessarily stick to it.

66%

Make a list and make additional purchases

16%

Do not make a list, but have a rough idea of what to purchase

15%

Make a list and only purchase what is on the list

3%

Do not make a list and decide what to buy while at the store

Paper

Laundry

Personal

Pet

OTC

Prescription

Beauty products

Flowers/plants

Office

Books/magazines

Toys/games

Statistically significantly higher/lower at the 95% confidence level vs. last year

Trial of grocery ordering and payment tech is up significantly vs. last year; self-checkout remains the most commonly used and has the highest satisfaction level.

Nearly three-quarters (73%) of Canadian shoppers consider themselves health-conscious, a figure that has remained unchanged from last year. As grocers seek to be a destination for shoppers’ health and wellness needs, an encouraging sign is that most shoppers indicate some level of satisfaction with their store’s healthy offerings, with just 10% expressing dissatisfaction. It’s also worth noting that of those shoppers that identified plant-based as an area of interest, 24% said they were not pleased with the plant-based food and beverages available at their store.

Two-thirds of shoppers indicate they are somewhat likely to switch to a more sustainable grocery store; however, of potential switchers, nearly half are not willing to pay more for sustainability.

The health of the planet is also a priority for many shoppers and the survey found that sentiments around sustainability are consistent with last year, with two-thirds of respondents indicating they would consider switching to a more sustainable grocery store. Of these shoppers, however, nearly half (48%) said they’re not willing to pay more for a more sustainable shop, while 41% indicated they’d be willing to pay “a bit” more.

year

Local product purchase habits remain consistent, and shoppers are more inclined to say they buy local because they perceive the quality of these items to be superior.

Almost three-quarters of shoppers consider themselves health-conscious; of these, nine in 10 are satisfied with the healthy offerings at grocery stores.

agree with the statement: “I am health-conscious”

higher/lower

Grocers have been investing heavily in prepared foods for several years, but do shoppers have an appetite for the fare being served up? It seems they do. According to the survey, 63% of shoppers purchased prepared food at the grocery store in the past month and they purchased it, on average, 2.1 times. Compared to gen-Xers and boomers, millennials have an even more robust appetite for prepared food at grocery stores, purchasing it 3.3 times a month. Among those who didn’t grab any prepared foods, the reasons given were that “it’s too expensive” (49% vs. 37% a year ago) and that they “prefer home cooking” (44%). When considering purchasing prepared food, price is the most important factor for 67% of shoppers (up from 58% a year ago).

When it comes to preferences, shoppers are equally split between prepared food types with 38% preferring graband-go refrigerated items and 37% opting for made-to-order fare. Twenty-five per cent have no preference. And while most consume prepared food at home, a notable shift is occurring with more shoppers reporting eating these meals at away-from-home locations, notably at work and in the store, reflecting a return to normal routines as Canadians move out of the pandemic era.

In their search for quick and easy ways to get meals on the table, shoppers expressed a healthy interest in meal kits. Almost half (48%) indicated they’d be extremely/very or somewhat likely to purchase meal kits if their store offered more of these solutions. However, almost one-third of shoppers aren’t aware if their primary grocery store even offers meal kits, so there’s an opportunity for grocers to up their game in this area and win more share of stomach. Food for thought! CG

Survey sample: 1,000 grocery shoppers Respondents were required to be age 18+, reside in Canada, shop at grocery stores at least once a month and are the primary or shared decision-maker for household grocery shopping

• Quotas were established by province/ territory to accurately represent the population distribution of Canada

Prepared food was purchased by nearly two-thirds of shoppers; however, barriers include cost and a preference for home cooking.

Purchased prepared food at grocery in the past month

2.1

Average prepared food purchase occasions in the past month

Too expensive

Prefer not to purchase/ prefer to cook or prepare at home

Didn’t plan to purchase prepared food

Didn’t like the selection

Didn’t look appetizing

Wasn’t

In their own words

Price has jumped in importance, while quality, freshness and taste remain the top factors (though the importance of freshness has declined vs. last year).

Statistically significantly higher/lower at the 95% confidence level vs. last year

Casual dining and fast-casual food quality perceptions vs. grocery are growing; in contrast, c-store food perceptions are declining.

THE UNCERTAINTY of the last few years has left most of us eager to regain control of our lives—and a key part of that is taking charge of our health. According to a recent survey of more than 11,000 consumers in 16 countries, including Canada, a majority of consumers consider health and fitness an “essential” part of their lives. Even though 66% of respondents to the survey—conducted by global professional services firm Accenture—said they feel financially squeezed, 80% intend to maintain or increase their

spend on health and fitness in 2023, whether that be via vitamins, supplements or exercise classes.

“For grocery, [health and wellness] used to be in that nice to have space and now it’s a need to have,” says Krystal Register, senior director, health and well-being at the Food Industry Association (FMI) That the average grocery store is already teeming with nutritious foods and beverages makes it an ideal destination for all these health and wellness-minded consumers, she says. With some grocers also having

In their quest for optimal health and wellness, Canadians are turning, increasingly, to grocers

registered dietitians available to provide nutrition advice and guidance in-store and online, she says the grocery store is the “perfect place” to spotlight the role food can play in preventing disease and improving health. “I love a good end-cap with a new health product or a combination of things I may not have put together,” says Register. “These days it’s about how retailers can be a solution for health.”

As a registered dietitian herself, Register says it’s “music to my ears” to discover that the latest trends show consumers taking a more relaxed and sustainable approach to healthy eating, which she believes is more beneficial to long-term health. Shoppers are still placing more importance on eating well, but the latest research from FMI’s 2022 report, The Power of Health and Well-Being in the Food Industry, shows they’re streamlining their approach with fewer fad diets and less focus on specific product health claims. “They’re still looking for low-sugar, low-sodium and those kinds of things, but it looks like they’re relying more on trusted brands and overall product narrative rather than strictly looking at nutrient or health claims,” she explains. “This more generalized approach opens up the whole grocery store to meal solutions that would appeal to a broader audience.”

As we continue to feel the crunch of rising inflation, Register says grocery shoppers will also be looking for affordable ways to eat more healthily at home. “That can add up to a reliance on private brands, which need to be providing meal prep options for home that translate into quality and savings,” she says.

Given rising food costs, Shelley Balanko, senior vice-president at The Hartman Group, expects consumers will stick to the tried and true. “If something is new, they will double down on research and look for guidance and assurance from their retailer or social network because they can’t afford to be disappointed,” she says. “So yes, they will be a little more cautious and conservative when it comes to health and wellness spending.”

Balanko says grocers can help provide that assurance by offering in-store product literature, vetted and curated products, and expert advice—be that from onsite dietitians, nutritionists or staff who are well-versed and able to make recommendations. She points to online retailer Thrive Market as doing an admirable job in curating a robust collection of health and wellness products, and making it easy for shoppers to make purchases based on attributes or food philosophies and diet.

“In store, it should be very clear to the consumer that a retailer has a strong stand on health and wellness that is reflected through their assortment of products … and in terms of how they train their staff or provide additional experts,” says Balanko. “Our feeling is that those retailers will fare better, especially

at this time of economic uncertainty where consumers want to continue with their health and wellness objectives but are less willing to experiment.”

At Community Natural Foods (CNF), a subsidiary of Calgary Co-op, every team member takes part in a weekly training session to ensure they are up to speed on the latest products and supplements geared to health and wellness. “We have people who come in and say, ‘this is the health issue I’m having today’ so we have a full-service department in our wellness section with great staff who are full of knowledge and passion,” says Matt Penner, CNF’s category management lead. “Our customer patterns have shown us that the more customers could engage with [staff] the more they wanted to.”

The natural and organic foods grocer offers regular webinars and in-store programs on topics such as cardiovascular care, pain management and how to improve fertility through diet and natural supplements. “We had a successful CNF Sugar Detox program this January and a record-number of signups for that,” says Penner. In addition to five virtual education sessions hosted by a functional nutrition consultant, shoppers were given downloadable food lists, recipes, planning guides and exclusive product discounts/giveaways, as well as coaching support via email. Participants could also book free personal in-store shopping tours to learn about no and lowsugar food options.

As health and wellness becomes more mainstream, the average grocery shopper is proving to be more health savvy than ever before. “Now, customers understand what artificial flavours and colours are and what organic growing means,” says Penner. “A decade ago, this certainly wasn’t the case.”

Nicole Ensoll, registered holistic nutritionist at Nature’s Emporium—a chain of health food markets in the Greater Toronto Area—says she’s also seen a marked increase post-pandemic in the number of shoppers looking to take a more active, preventative approach to health and wellness.

“They’re not just thinking about how to support their immune health with proper nutrition, they’re very cognizant of how gut health, for example, plays a role,” she says, pointing to products like bone broth and probiotics gaining favour, as well as licorice root to help repair intestinal lining. She says the same applies to customer interest in adaptogens—herbs and plants such as ashwagandha that can help rebalance the body after periods of stress. “I think people are also realizing their health is individual so they’re looking to find what makes them feel best.” Pets are no exception either, she says, noting an increasing number of pet owners who are purchasing natural supplements and healthy options for their animals.

While there are always experienced staff (including registered nurses) on hand to answer questions,

Nature’s Emporium customers are encouraged to fill out an online form to book a free one-hour store tour for a more curated experience. “That way we can be fully prepared for what they’re looking for specifically and have the handouts and takeaways available for them,” says Ensoll.

In addressing customers’ health and wellness needs post-pandemic at the grocery store, analysts say mental wellness has to be a key consideration also. According to the 2021 NielsenIQ Global Health & Wellness report, one in three consumers surveyed across the globe reported that COVID -19 had a negative impact on their mental health, so brands that were focused on improving mental health saw stronger growth than those that didn’t. “We anticipate a continued interest in aging gracefully versus anti-aging, as by 2060, 40% of the population will be age 50+,” says Sherry Frey, health & wellness industry leader at NielsenIQ. “As the boomers continue to age, they continue to redefine what wellness looks

like, bringing to the conversation previously taboo topics like menopause and increasing an emphasis on mental wellness and brain acuity.”

Consumers’ interest in “brain health and staying sharp” is certainly growing, agrees Joel Gregoire, associate director of food and drink at Mintel in Canada. Based on the findings of Mintel’s 2023 Global Food and Drink Trends report, he says consumers will be looking for food and beverages that can influence cognitive capacity, manage stress and optimize brain function. That means we can expect to see brands promoting brain boosts from energizing ingredients such as caffeine, as well as from fruit, vegetables and legumes.

Gregoire also points to growing consumer interest in small moments of indulgence to offset stressful times. “We’ve all gone through a number of health trials over the last few years, so how can grocers find new ways to promote pleasurable moments at home through food and drink,” he explains. “Consumers are now saying it’s OK to indulge from time to time and they see that as a part of being healthy.” CG

WITH GROWING EVIDENCE LINKING healthy diet to disease prevention and management—and the growing trend towards home cooking brought on by the pandemic—it’s not surprising that more and more consumers are purchasing specific fruits, vegetables and whole foods that they associate with delivering health benefits, say industry analysts. “The pandemic really shone a spotlight on comorbidities (heart disease, diabetes, obesity) and we see consumers continuing to focus on improving those ailments both through leveraging food as medicine and also through vitamins and supplementation,” says NielsenIQ’s Sherry Frey.

The benefits aren’t solely for grocery shoppers either, with 65% of supermarket retailers saying health and well-being programs and activities are key drivers in making them a one-stop healthcare resource. Almost the same (64%) also noted that shoppers’ focus on health and well-being had positively impacted their sales and profits the year prior, according to FMI’s 2022 The Power of Health report.

FMI’s research shows registered dietitians (RDs) are playing a key role in helping deliver these programs, with 65% of U.S. food retailers employing RDs in a corporate role and 31% in-store/virtual. In turn, shoppers reported that

RDs, their primary food store and grocery store pharmacists, were on their side when it came to helping them stay healthy.

A first-of-its kind clinical study released in 2022, showed that in-aisle teaching with an RD at a Kroger supermarket significantly improved shoppers’ adherence to a heart-healthy diet. When paired with education on how to use online shopping technologies and nutrition guides, adherence improved even further.

Several major Canadian grocery chains are also implementing digital tools that guide consumers in making healthier food choices— and build customer loyalty in the process.

Loblaw customers across Canada using the free PC Health app receive personalized recommendations for digital tools and support catered to their own health needs, including access to live chats with a registered nurse and dietitian. The plan is to keep expanding the app’s capabilities by adding integrated wearable devices and a digital pharmacy.

In 2021, Metro launched the My Health My Choices program in all its stores in Ontario and Quebec, which allows customers to easily locate attributes on shelf products that meet their dietary preferences or restrictions. Shoppers can also filter their preferred

attributes (among more than 50 options) within the online flyer or when building their online grocery carts. “In 2022, we launched the ‘no sugar added’ attribute, which is now the most popular one among our consumers, according to a survey of 600 users of the guide,” says Martin Turcotte, vice-president, merchandising, grocery at Metro.

This year, Metro is adding four new attributes based on customer demand geared to digestion, cardio, appetite and bones. “Comparing one product to another using nutritional information and the list of ingredients can sometimes be difficult for customers,” says Turcotte. “Our goal is to make healthy eating accessible to everyone by democratizing the analysis of this information.”

Midwest U.S. grocery chain Schnuck Markets has taken food analysis a step further with a free program called “Good For You” that tallies up the healthy products grocery patrons buy right on their receipts (based on the latest American dietary guidelines, recommedations from the American Heart Association and others), making suggestions for product swaps and offering coupons for future food discounts. Program participants also receive reports each month on whether they are making progress in buying healthier foods.

As a Canadian company, Kruger knows the importance of hockey to the families and communities in our country –not just as a game but as an opportunity for kids to make connections, grow as individuals, and pursue their dreams.

We established the Kruger Big Assist to help support these goals by offering financial assistance to hockey families in need and to help break down barriers and make the sport more inclusive, diverse and accessible for the future.

The Kruger Big Assist has committed over $600,000 to Canadian minor hockey families and we are very proud to have been recognized as a 2022 Canadian Grocer Impact Award Winner in Community Service.

Canada’s game should be for all Canadians and we will continue to assist Canadians in making this happen –so that no child’s hockey dreams have to miss a season.

KrugerBigAssist.ca

TECHNOLOGY IS taking over the dinner table, and it’s not about the kids being distracted by cellphones. As the global population rises (it could reach nearly 10 billion people by 2050) and pressure on the Earth’s resources grows, food-tech innovation is becoming more abundant. In Canada and globally, food-tech companies are developing new products, improving processing and extending the shelf life of food to help solve the world’s sustainability challenges. For those working in the sector, these are exciting times indeed.

“It’s a golden age of food science and technology,” says Dana McCauley, chief experience officer at Canadian Food Innovation Network (CFIN) . “We’re in a new industrial revolution and my prediction is that 100 years from now, this time will be viewed as an important milestone.”

For McCauley, part of what’s driving food-tech innovation are today’s digital natives who grew up with the internet and have great business ideas, an understanding of technology’s potential, and a wellspring of creativity. “The maturity and

From AI-powered food waste solutions to lab-grown meat, food-system technologies look to address some of the planet’s big problems

sophistication of this amazing workforce, along with maturing of technology and infrastructure, is driving a lot of innovation,” she says, adding “and then there are the huge societal problems people want to solve.”

Not every new food technology will make it to the table (consumer response to pulverized crickets was, well, crickets). But several developments are worth watching. Here’s a look at a few food technologies poised to shape dinner plates in the future.

A decade ago, the world’s first lab-grown beef burger grabbed headlines, not least for its US$330,000 price tag. The patty, developed by Dutch scientist Mark Post, was made by growing more than 20,000 small strips of muscle from bovine stem cells. The burger was cooked and eaten at a news conference in London, England, with mixed reviews. But the point was this: meat can be made without slaughtering animals.

Lab-grown meat (also called cell-based, cultivated or cultured meat) has come a long way since then. For starters, companies have been able to reduce production costs by 99%, according to a McKinsey & Company report titled, Cultivated meat: out of the lab, into the frying pan. On the regulatory front, Singapore was the first country to approve the product for retail sale. Last November, the U.S. Food and Drug Administration (FDA) cleared its first-ever cultivated meat product (chicken breast developed by California-based Upside Foods) as safe for human consumption. Mintel estimates cultivated meat will be a US$25 billion global market by 2030.

While eating meat born in a Petri dish may address environmental and ethical issues related to livestock production, one could argue people should just eat less meat. But, as with a lot of things, old habits die hard.

“I’ve been in food research for 15 years and the one truism is eating habits are tremendously hard to change,” says Joel Gregoire, associate director, food and drink, at Mintel. “I don’t see people globally eating less meat, so the question is how to change the way we produce meat.”

Gregoire believes cultivated meat can be “a transformative innovation in the food space,” as it helps address sustainability challenges. “Technology has the potential to have a profound impact in making sure we have a reliable food source, without changing a lot of habits people have and having less impact on the planet,” he says.

Promising as it may be, cultivated meat has big barriers to overcome before it hits the mainstream, including technical, regulatory and scale issues. But perhaps the biggest one is the ick factor consumers associate with these products. The Hartman Group’s Food & Technology 2023 report notes that cultured meat “both fascinates and repulses people,” with 45% of U.S. consumers surveyed indicating the top barrier to trying cultured meat products is they don’t taste good.

“There is nothing familiar to consumers about cellular agriculture, and there’s the question: what are these products made from?” says Shelley Balanko, senior vice-president at The Hartman Group. For companies in this space, she adds,

communicating that real animal cells are the foundation of cultivated products would be a helpful bridge.

“Consumers would understand these companies aren’t creating something out of thin air, but rather it does have roots in a real animal, in a natural entity,” Balanko says. “But [cultivated meat] is one of those further-out innovations and it will take a lot of effort on the part of those companies to communicate familiarity and underscore the lack of risk. In addition, it will likely take a lot of third-party certification and assurances around safety for this to be fully embraced.”

Lab-grown meat isn’t the only cell-based product under the microscope: lab-grown plants are another emerging alternative.

“It’s not crazy to think there is a time in the foreseeable future when we would be able to make cocoa, vanilla and coffee [in Canada] and not have to import them,” says CFIN’s McCauley. “We could reduce food miles and have a domestic supply of those kinds of foods by using cellular agriculture.”

Cult Food Science, a B.C.-based investment company focused on cellular agriculture, is an early mover in this space.

The company recently launched its Cult Food Division to develop and commercialize cell-based products in collaboration with affiliate companies. Cult Food Division is launching two products: Zero Coffee, a sparkling coffee beverage made with cell-based coffee, and Free Canada, a “performance gummy” made with cell-based collagen. Both products are meant to be sustainable alternatives without negative impacts on animals and the environment.

“Food is not just being impacted by climate change, it also adds to it,” says Lejjy Gafour, CEO of Cult Food Science. “The way we have produced food historically is now becoming fragile. Zoonotic diseases, loss of land, overuse of water— these are all impacts of increasing environmental effects on our food production. We have to work towards a more resilient food system. And cellular agriculture has the potential to produce food sustainably as we head towards an uncertain future.”

The potential isn’t limited to replicating products, but incorporating cell-based ingredients into other products. “Many products include individual ingredients that are traditionally animal derived that can now be replaced by cell-based components,” explains Gafour.

While cell-based products won’t hit the mainstream overnight—the industry, overall, is focused on scaling production—Gafour is optimistic about the future of food. “Every 1% of change we can affect by making more sustainable options available for consumers adds up,” he says.

Another area of progress in the plant world is vertical farming. This indoor farming technology grows crops in vertical layers in controlled environments—and it’s popping up in grocery stores. In 2020, for example, Empire partnered with German-based Infarm to bring in-store farming units to select stores. The partnership was later expanded, with Infarm supplying produce

“It’s not crazy to think there is a time in the foreseeable future when we would be able to make cocoa, vanilla and coffee [in Canada] and not have to import them”

from its own growing centres to more than 1,000 Sobeys stores.

Infarm’s latest development shows vertical farming’s potential beyond fresh produce. In a recent trial, Infarm says it became the first vertical farm to successfully grow wheat indoors, using no soil, no chemical pesticides and much less water than open field farming.

Guelph, Ont.-based GoodLeaf Farms recently raised $150 million in capital to fuel its vertical-farm expansion into Eastern and Western Canada. The company plans to build farms in Calgary and Montreal, in addition to its existing fully automated 50,000-sq.-ft. farm in Guelph where it produces microgreens and baby greens year-round. GoodLeaf’s farms are free of pesticides, herbicides and fungicides, and use less than 5% of the water required in open field farming, according to the company.

Jo-Ann McArthur, president of Nourish Food Marketing, believes vertical farms will be a big part of Canada’s food sovereignty. “We still import a lot of produce, especially from California, which faces droughts and floods,” McArthur says. “We need to reduce our reliance on that and vertical farming is definitely starting to fill that hole.”

And, compared to lab-grown meat, vertical farming is more accessible to consumers. “It’s something consumers can get their heads around and are behind,” McArthur says. “Consumers like the fact that it’s local, it’s year round and it’s reliable, so [vertical farms] make sense.”

The Hartman Group’s Balanko agrees. “Field and kitchen innovations, including vertical farming, tend to be a bit easier to accept because the link between ‘natural,’ conventional food production is that much closer,” she says. “Familiarity is one of the key ways in which consumers are evaluating any new food tech. If it’s familiar or has a direct link to something that is familiar, it’s easier to accept.”

That’s not to say consumers are digging into vertical farms. In The Hartman Group survey, 48% of consumers said the main barrier to trying food and beverages from vertical or hydroponic farms is that they’re too expensive. That was followed by “don’t taste good,” at 45%.

With any food technology, Balanko says, “we have to remember that this is food—and consumers want their food and beverages to taste good.” Products will have to be at least on par in taste and texture, if not superior, for consumers to adopt them. “When consumers are shelling out their hard-earned dollars [for food], it has to taste great, it has to be safe and it has to deliver a personal benefit, like health,” she says.

The irony in the conversation about feeding the growing planet is that a whopping one-third of all food produced globally is lost or wasted. That’s not lost on a number of innovative companies that are using technology to help solve the food-waste crisis.

Epic IO, a South Carolina-based tech company specializing in artificial intelligence (AI) and Internet of Things (IoT), has developed a biosecurity solution to help extend the shelf life of fresh foods and reduce spoilage. Typically, farmers and food processors rely on refrigeration to inhibit the growth of microbes

or use chemicals to kill them in cold storage and transport. Epic IO’s automated solution modifies the atmosphere with carefully timed micro-doses of FDA-approved ozone and ultraviolet irradiation. Fully autonomous, the solution transforms the air into a disinfectant that destroys bacteria, fungi and viruses.

“The benefit of killing that bacteria and fungus early in the process is that you naturally have far less food waste,” says Ken Mills, CEO of Epic IO. He says the company is looking at its solution across the food chain, from the farm to the distribution centre to the grocery store. In a test phase, for example, the company worked with hatcheries to kill harmful E. coli on eggs, as well as with fresh produce suppliers to kill pathogens during transport.

“We want to make sure that a high percentage of quality food makes it to the grocer, and once the grocer receives that food, we want to make sure the health, wellness and longevity is maintained throughout the shelf life before it hits the table,” Mills says.

Trendi is a Canadian company with an innovative approach to food waste. Based in Burnaby, B.C., the startup’s mission is to rescue “misfit” fruits and vegetables that would otherwise go to waste and upcycle them into shelf-stable products.

Trendi has developed robotic, mobile processing units that go directly to farms and food processors. The units use various processing technologies to create powders or flakes that can be used as ingredients in a range of applications, including food and beverage, pet food and cosmetics.

“We’re thinking about what’s possible and we’re thinking into the future as we work to eliminate food waste at its source,” says Christine Couvelier, president of Trendi, whose 40-year career spans roles as an executive chef, culinary executive and global culinary trendologist. According to Trendi, the powder and flakes are about one-tenth the original weight and size and retain up to 97% of their original nutrients, flavours and colours. “Tomatoes are a great example: When I’m holding the tomato powder, I’m standing in nonna’s garden, without question,” says Couvelier. “It is incredibly colourful, flavourful and vibrant.”

With the powders, manufacturers can reduce their environmental footprint and reduce costs. “You’re shipping truckloads of tomatoes—a perishable product—to your manufacturing facilities, you’re shipping water and you’re shipping weight,” explains Couvelier. In contrast, Trendi powders are lighter, so shipping costs are reduced, and the product is shelf-stable.

Manufacturers can use the powders to create products and communicate that rescued food story to customers. That story, says Couvelier, “can be told on their products, proudly stating the company makes their products from rescued fruits and vegetables that would otherwise go to landfill.”

For Couvelier, too, these are exciting times for food tech, but there’s also a sense of urgency. “We have so much food and yet we can’t feed everyone,” she says. “This is a tipping point. We must make a difference now.” CG

Generation Next Thinking is an ongoing series that explores the cutting- edge topics that are impacting grocery retail today and in the future.

“We have so much food and yet we can’t feed everyone. This is a tipping point. We must make a difference now”

In Canada, sauce consumption increased by 5% in 2022, egy and understanding at Ipsos Canada. Much of the growth came from marinades and hot sauces, which are increasingly

Increased use of sauces is driven by multiple factors that range from growing consumer demand for personalization to more at-home eating—leading people to seek affordable and effective ways to add pizzazz to their meals—as well as Canada’s

Canada welcomed a record 431,000 new permanent residents last year, many from Asia and India. According to Statistics Canada, immigrants could comprise between 29% and 34% of the population by 2041. These consumers are looking to recreate the flavours of their homelands.

“I like to think of the sauce and condiment aisle as a sort of reflection of Canadian society,” says Perrotta. “The way we were—ketchup, mustard, relish—[is markedly different] to the way the population looks today. There are more options to fit simple meal solutions and make the flavours pop.”

Enter Vancouver’s Naked & Saucy, a company that specializes in soy-free versions of teriyaki, sweet Thai chili and vegan oyster sauce. Founder and CEO Paul Gill says the steady rise of Canada’s ethnic population has been a major contributor to the company’s growth.

Created nearly 10 years ago when Gill was looking for an alternative for his nephew, who had a soy allergy, Naked & Saucy’s lineup now includes seven sauces. The company’s products are available at more than 3,000 grocery stores across the country and Gill expects sales to hit about $4 million this year, up from $1.5 million two years ago.

Naked & Saucy has plans to introduce a line of ethnic simmer sauces that will include a butterless chicken, vindaloo, and both Japanese and Thai curry sauces. Also in the works is a line of four organic dressings that will bring the company’s product roster to 15 sauces/dressings.

“We’ve grown by a ridiculous amount,” says Gill of the brand’s success. Ethnic sauces, he adds, have been “blowing up” for the past couple of years. “The continuing multicultural makeup of the country is definitely driving demand.”

Digs Dorfman, CEO of Toronto organic grocer The Sweet Potato, says sauces and condiments are selling between 10% to 12% better than they were a few years ago. He attributes the newfound popularity of natural and organic sauces, specifically, to vastly improved flavour. “I remember how terrible the organic ketchup we used to have was,” he says, not to mention how expensive it was. “Now, there are several brands on the market that taste amazing and are reasonably priced.”

In recent years there have been a

growing number of options hitting store shelves that cater to specific dietary needs—sugar-free, keto, soy-free, saltfree, gluten-free, vegan, etc. “That stuff has always been around, but there’s a lot more of it coming to market than I’ve ever seen before,” he says.

Dorfman is a huge fan of Nona Vegan, an Ontario company specializing in refrigerated authentic Italian sauces including alfredo and carbonara. “The alfredo sauce tastes so cheesy and creamy it’s hard to believe there’s no dairy in it,” he says.

Mike Longo, chief merchandising officer for Longo’s stores in Ontario, says the sauce and condiment category is “booming,” and its upward trajectory is just beginning. Customers are seeking new flavours to enhance their everyday dining, while also discovering foods from different cultures, he says.

The retailer is also seeing heightened consumer interest in cleaner labels, aligning with a broad-based interest in healthier eating. “Premium sauces are on the rise because they tend to have a cleaner list of ingredients,” says Longo, noting sauce brands such as Fody Foods and Chosen Foods that boast a roster of gut-friendly products.

Another category that Longo says is currently “on fire” is hot sauce. “The rapid increase in popularity has been staggering, and shows no signs of slowing down,” he says. At Longo’s stores, the category’s growth is being driven, in part, by artisan brands such as Mississauga, Ont.’s vegan and keto-friendly Four Fathers, and Toronto’s No Refund. The latter was developed by restaurateur Adam Brown after he grew tired of customers sending back the “suicide” wing sauces he developed for being too hot.

No Refund sauces come in flavours including No Plain Jayne (made with red Scotch bonnet and ghost peppers), 4-Alarm (Scotch bonnet, habanero and pepperoncini peppers) and Adam’s sauce (Scotch bonnet, habanero and bhut jolokia peppers). All of No Refund’s hot sauces feature a cheeky label that reads “Too hot? Too bad.”