FAST TRACKING GOLD PRODUCTION IN THE ABITIBI

Positioned for significant resource growth and near-term value creation

CORPORATE PRESENTATION | November 2025

Positioned for significant resource growth and near-term value creation

CORPORATE PRESENTATION | November 2025

This presentation of McFarlane Lake Mining Incorporated (the “Company” or “McFarlane Lake”) is for information only and shall not constitute an offer to buy, sell, issue or subscribe for, or the solicitation of an offer to buy, sell or issue, or subscribe for any securities in any jurisdiction in which such offer, solicitation or sale would be unlawful The information contained herein is subject to change without notice and is based on publicly available information, internally developed data, third party information and other sources The third-party information has not been independently verified While the Company may not have verified the third-party information, nevertheless, it believes that it obtained the information from reliable sources and has no reason to believe it is not accurate in all material respects Where any opinion or belief is expressed in this presentation, it is based on the assumptions and limitations mentioned herein and is an expression of present opinionor belief only Nowarranties or representations can be made as to the origin, validity, accuracy, completeness, currency or reliability of the information The Company disclaims and excludes all liability (to the extent permitted by law), for losses, claims, damages, demands, costs and expenses of whatever nature arising in any way out of or in connection with the information in this presentation, its accuracy, completeness or by reason of reliance by any person on any of it The information contained in this presentation does not purport to contain all the information that may be necessary or desirable to fully and accurately evaluate an investment in securities of the Company and is not to be considered as a recommendation by the Company that any person make an investment in the Company The information in this presentation is not intended to be relied upon as advice to investors or potential investors and does not take into account the investment objectives, financial situation or needs of any particular investor This presentation should not be construed as legal, financial or tax advice to any individual, aseachindividual’scircumstancesare different Readers should consult with their own professional advisors regardingtheir particularcircumstances

The distribution of this presentation may be restricted by law in certain jurisdictions and persons into whose possession anydocument or other information referred to herein comes should inform themselves about and observe anysuchrestriction. Anyfailure tocomply withthese restrictions may constitute a violation of the securitieslaws of any such jurisdiction Recipients are required to inform themselves of, and comply with, all such restrictions or prohibitions andthe Companydoesnot accept liabilitytoanypersonin relation thereto

To the extent any forward-looking statement in this presentation constitutes “future-oriented financial information” or “financial outlooks” within the meaning of applicable Canadian securities laws, such information is being provided to demonstrate the anticipated market penetration and the reader is cautioned that this information may not be appropriate for any other purpose and the reader should not place undue reliance on such future-oriented financial information and financial outlooks Future-oriented financial information and financial outlooks, as with forward-looking statementsgenerally, are, withoutlimitation, basedon the assumptions andsubject tothe risksset out above under the heading “Forward-looking Statements” The Company’s actual financial position and results of operations may differ materiallyfrom management’s current expectationsand,asa result, the Company’srevenueandexpenses.

Certain information contained in this presentation concerning the Company’s industry and the markets in which it operates or seeks to operate may be based on information from third party sources, industry reports and publications, websites andother publicly available information andinformation available forpurchase, andmanagement studiesand estimates using data from marketresearch andindustryanalysis andon assumptions basedon data andknowledge of thisindustrywhichthe Company believes tobe reasonable. The Company’sinternal researchandassumptions have

not been verified by any independent source, and the Company has not independently verified any third-party information While the Company believes such third party information to be generally reliable, such information and estimates are inherently imprecise In addition, projections, assumptions and estimates of the Company’s future performance or the future performance of the industry and markets in which the Company operates are necessarily subjecttoa high degreeof uncertainty andrisk duetoa varietyof factors

This presentation may have been sent to you in an electronic form You are reminded that documents transmitted via this medium may be altered or changed during the process of electronic transmission You are responsible for protecting against viruses and other destructive items Your receipt of this electronic transmission is at your own risk and it is your responsibility to take precautions to ensure that it is free from viruses and other items of a destructive nature Asa consequence of the above, neitherthe Companynor anydirector, officer, employeeor agent of anyof them or anyaffiliate of anysuchpersonacceptsanyliabilityor responsibilitywhatsoeverin respectof anydifference between the presentationdistributed toyou in electronic format andthe hard copyversion that may be made available toyou

This news release uses the terms indicated and inferred mineral resources as a relative measure of the level of confidence in the resource estimate Readers are cautioned that mineral resources are not mineral reserves and that the economic viability of resources that are not mineral reserves has not been demonstrated The mineral resource estimates disclosed in this news release may be materially affected by geology, environmental, permitting, legal, title, socio-political, marketing or other relevant issues. It cannot be assumed that all or any part of an inferred mineral resource will ever be upgraded to an indicated or measured mineral resource category; however, it is reasonably expected that the majority of Inferred Mineral Resources could be upgraded to Indicated Mineral Resources with continued exploration The mineral resource estimate is classified in accordance with the Canadian Institute of Mining, Metallurgy and Petroleum’s “CIM Definition Standards on Mineral Resources and Mineral Reserves” incorporated by reference into NI43-101. Under NI43-101 estimates of inferred mineralresources may not form the basis of feasibility or pre-feasibility studiesor economicstudiesexcept forpreliminary economicassessments. Readers are cautioned not toassumethat further workon the statedresources willleadtomineralreserves that can be mined economically

The drill results, grades, and interceptions disclosed herein for the Juby Gold Project and Tyranite properties are from prior exploration programs and have not been verified by a qualified person under NI 43-101 These results are historical in nature, are not current, and should not be relied upon as indicative of future exploration success or as current mineral resources or reserves. Further, the grades and interceptionspresented may not reflect the potential for economic extraction and are presented for illustrative purposes only Additional exploration work, including verification drilling, sampling, andindependent analysis by a qualified person, will be requiredtoverify these results andbring them intocompliancewithNI43-101

Under NI 43-101 guidelines the technical data and information provided in this announcement is considered to be historical The data and information was taken from a report titled “Technical Report on the Update Mineral Resource Estimate on the Juby Gold Project”, co-authored by GeoVector Management and SGS Geological Services having an effectivedate of July 14 2020

To build the nextCanadian gold producer by advancing scalable, high-quality assets in Tier-1 jurisdictions–creating lasting value throughdiscovery, mine development, anddisciplined execution.

McFarlane Lake is a Canadian gold company advancing the large-scale Juby Gold Project in Ontario – a district-scale opportunity with multi-million-ouncegrowth potential and a clear path toproduction.

To drive shareholder value byexpandingresources, accelerate mine developmentwith production optionality, and executing aclearstrategy toward sustainable goldproductioninOntario.

TIER-1 JURISDICTION, TIER-1 POTENTIAL

Ontario’s Abitibi Belt offers premier infrastructure, clear permitting, and proximity to major producers.

PROVENLEADERSHIP & TRACK RECORD

Experienced mine builders and capital markets professionals with a disciplined, value-focused approach.

CLEAR PATH TO PRODUCTION

Advancingthrough drilling and technicalstudies –steadilyde-risking toward production readiness.

STRATEGIC PRODUCTION OPTIONALITY

Flexible Development Pathways to earlycash flow.

UNDERVALUED GOLD GROWTHSTORY

Scale, jurisdiction, and optionality –

Tier-1 potential trading well belowintrinsic value.

AT 0.98 G/T (31.74 Mt) INDICATED Large-scale, High-quality Gold System 1.01M oz Au

AT 0.89 G/T (109.48 Mt) INFERRED 3.17M oz Au

Mark Trevisiol

President, CEO, Chair of Board

• 30+ years ofexperience in mining and metals processing.

• Former senior executive with Falconbridgeand Xstrata Nickel.

• Operational expertise spanning mining, milling, smelting, and refining.

• Former CEO of two publicmining companies: Crowflight Minerals and Silver Bear Resources.

Brad Boland CFO, Corporate Secretary

• 25+ yearsof experience in the resource and mining industry.

• Former VP FinanceatGoldcorp and VP Controller at Kinross.

• Former CFO of Consolidated Thompson Iron Mines and numerous resourcecompanies, including operators, developers, and explorers.

• Experiencein financial accounting, treasury, risk management, internal controls, project financing, and capital markets.

Winston Whymark Manager Exploration

• 15+ yearsof exploration experience, primarily focused on gold.

• Extensive leadership background in exploration and operations.

• Former Manager of Operations atInventus Mining.

• Former Exploration Supervisor at Argonaut Gold.

Andrew McLellan

Senior Geologist

• 15 years of geologicalexperience focused on gold exploration in the Abitibi Greenstone Belt.

• Specialized expertise in structurally hosted gold deposits.

• Experiencewith Glencore, Trelawney Mining and Exploration, and Baffinland Iron Mines.

• Worked with multiple junior gold exploration companies across Ontario.

Perry Dellelce | Director

• Founder &Managing Partner,Wildeboer Dellelce LLP.

• Chair,NEOExchange &CanadianOlympic Foundation;Director,SunnybrookFoundation.

• Expert insecurities,corporate finance, and M&A.

Amanda Fullerton | Director

• VP,Legal &Corporate Secretary,GCMMining Corp. andDenarius SilverCorp.

• Former VP,Legal,Macquarie Capital Markets Canada.

• Corporate finance and M&Abackground in the mining sector.

Deborah Battiston | Director

• CPA,ICD.Dwith35+years offinancial managementexperience.

• Former CFOof QMX Gold, BuffaloCoal, Afrique Gold, andConsolidated ThompsonIron Mines.

• Deep expertise in finance,governance, and mine development.

Fergus Kerr | Director

• Mining Engineer with35+years in mine operations and safety leadership.

• Former General Manager,DenisonMines’ ElliotLake operation.

• Globalconsultant specializinginmine health and safety.

Dario Zulich | Director

• Entrepreneur andCEO ofSWSports and Entertainment(Sudbury Wolves, Five &Spartans).

• Former CEO,TESC Contracting one ofOntario’s largestindustrial firms.

• Recognized leader in business and communitydevelopment.

Roger Emdin | Director

• 30+ years in mine operations and executive leadership.

• Former VP,Harte Gold;seniorroles atSudbury Integrated Nickel.

• Chairof CEMI and Industry Chair, Ontario Mining Legislative ReviewCommittee.

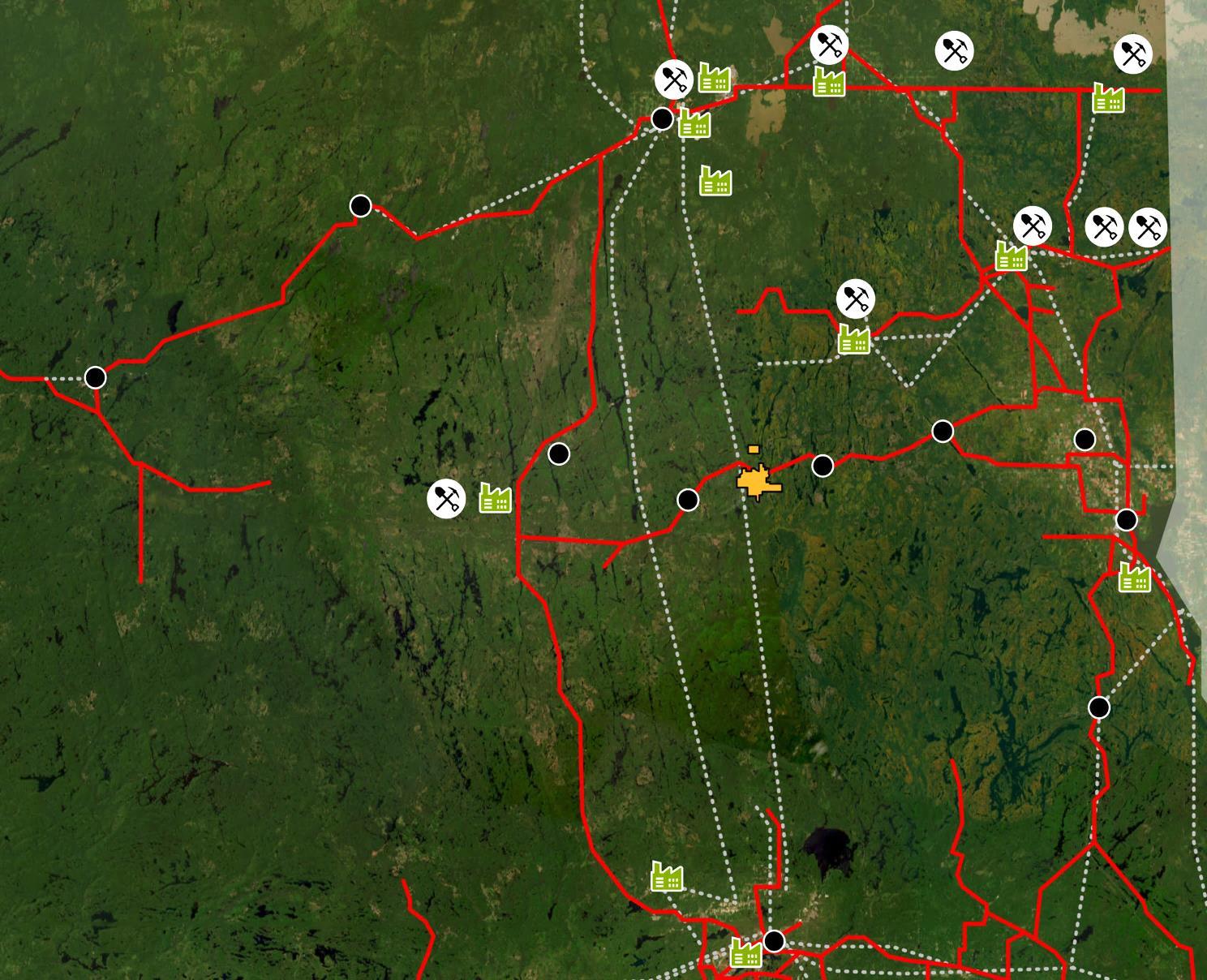

Established roads, power, and skilled labour support year-roundexploration and low-costdevelopment.

Over 200 million ounces of historicalproduction – one ofthe world’s most prolific gold regions.

Surrounded by global producers includingAgnico Eagle, IAMGOLD, Newmont,and Alamos Gold.

Allows more moneyinto the ground.

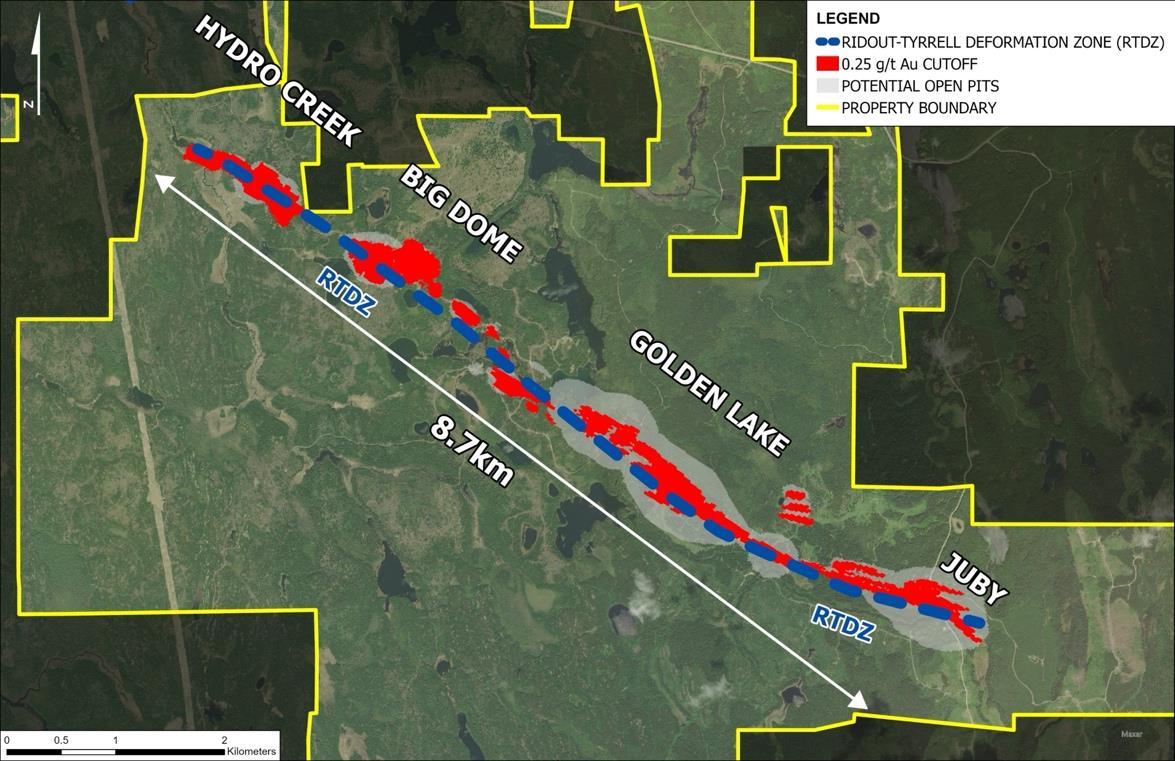

Advancing a 100%-owned portfolio of gold assets in Canada

Michaud/ Munro

FLAGSHIP ASSET

• Juby Deposit

• Golden Lake Deposit

• Big Dome Deposit

• Hydro Creek Deposit

McMIllan/ Mongowan

Additional Portfolio Assets

• McMillan/Mongowan Projects

• Michaud/Munro Projects

Toronto

JUBY PROJECT

Large-scale, near-surface gold system withflexible pathways to production

INFERRED @ 0.89 G/T 3.17Moz Au

INDICATED @ 0.98 G/T 1.01Moz Au LATEST MRE SEPT 2025 >

LOCATION

NearGowganda, Ontario, within the Abitibi Greenstone Belt

OWNERSHIP

100%McFarlane LakeMining Limited

STAGE

ResourceDefinition – CompletedMRE

GEOLOGICAL SETTING

Archean-age AbitibiBelt – world-classgoldendowment

Roadaccessible, power nearby, established miningsupportservices

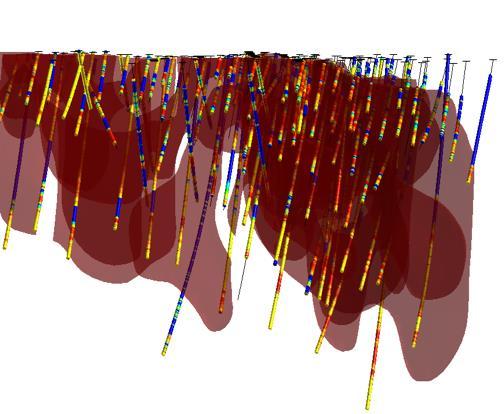

DRILLING

116,000metres drilledto date with 90% metallurgicalrecoveries

INFERRED @ 0.85 G/T 4.22Moz Au

INDICATED @ 0.94 G/T 1.20Moz Au

CONSERVATIVE @ $2,500 GOLD @ $3,750 GOLD

Provide a Strong Foundation for Growth

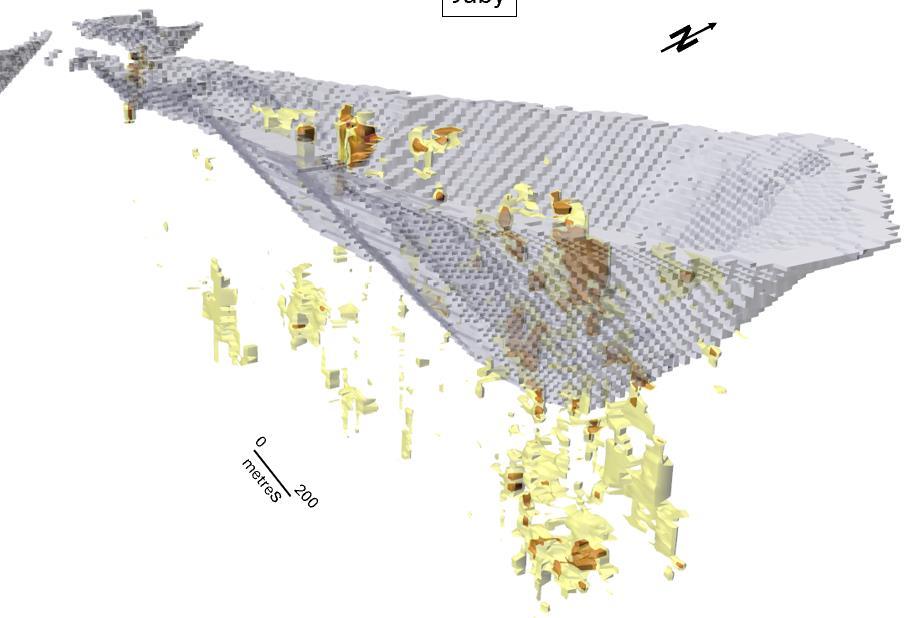

Mineral Resource Estimate within pit shell + underground shapes

(OP=OpenPit,UG=Underground,Mt=Millionstonnes,Moz=MillionsOunces,Au=Goldmetal)

RESOURCES CONSTRAINTS

Significant scale and grade underpin strong project fundamentals

Demonstrated economic potential across open-pit and underground zones

Robust, NI 43-101–compliant foundation for development and growth

(OP= Open Pit, UG= Underground,Mt= Millions tonnes, Moz= Millions Ounces, Au= Goldmetal)

Strong leverage to rising gold prices enhances returns Expanding margins deliver significant cash flow growth potential Higher prices drive asset re-rating opportunity and attract investor interest

Strategic open-pit starter option supports early production and cash flow generation

DRILLING HERE

Significant Potential to add more ounces

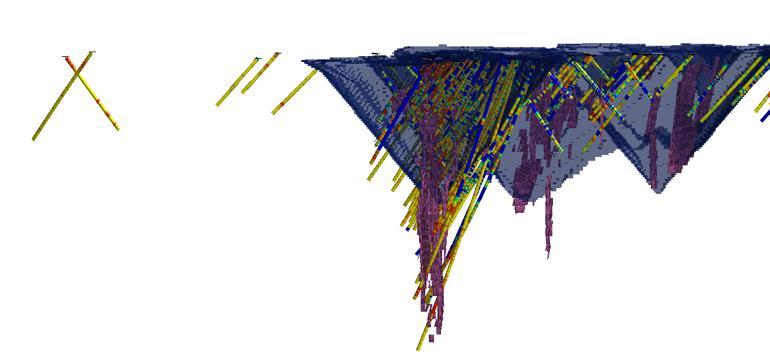

Open at depth with significant upside potential for continued resource growth. < 8.7 km > 1 km

~300 m

Open at depth & along strike | 0.25 g/t Au cutoff

Gold deposits that extend well below depths of 3,000m Our deepest known ore body 750m

0.85 g/t Au over 36.30m A | 826 Zone

PARALLELSTRUCTURES?

B | Byberg Mining Lease

Grabs up to 7.54 g/t Au

C | Juby Mining Lease

Grabs up to 17.60 g/t Au

D | What is under the glacial sand and gravel?

Systematic drilling and data-driven targeting designed to expand the Juby resource and unlock the project’s full gold potential.

STRATEGY

Process Unsampled Drill core

• Phase 1: Review and process 2,000 metres of top priority unsampled drill core

• Phase 2: Complete remaining 8,000m of unsampled core

METRES DRILLED

~10,000 metres of unsampled core from years 2000-2011*

POTENTIAL OUNCES ADDED

75,000 – 150,000 Ounces

*Footnote needed

STRATEGY

Exploration Drilling

METRES DRILLED

1,500-2,000 metres ofdrilling

STRATEGY

Infill & Expand

METRES DRILLED

Planned 23 holes for a total of 10,000-12,000 metres of drilling

POTENTIAL OUNCES ADDED

BlueSky Potential

POTENTIAL OUNCES ADDED

500,000-1,100,000 ounces

1

Juby East 2800m of strike length, under cover rocks

JUBY DEPOSIT

TARGET 2 826 zone HoleJU-13-137

0.9 gpt over 33.8m Inc (2.0 gpt over 8.8m)

JUBY DEPOSIT

Juby’s size, geology, and setting provide the foundation for a multi-million-ounce expansion story.

OZ AU

Disciplined, phased approach to development – focused on de-risking each stageand buildinglong-term value.

Acquisitionand Updated NI 43-101 Resource Estimate (Completed)

Drilling Program by Q4 2025 (Permit Application Submitted)

Sale of Non-Core Properties for $9.25Million (Completed)

• Baseline Environmental Studies

• Advanced Exploration Permit Applications in Progress

• Enhanced Investor Marketing and EngagementStrategy

• Phase 1Infill & Exploration Drilling (10–15k m)

• Historic Core Sampling Program (~8,000 m)

• Scoping Study & Updated Resource Statement

• Baseline Environmental Studies

• Marketingand Financing Initiatives

• Phase 2Infill & Expansion Drilling (~15–20k m)

• Advanced Exploration & Closure Plan Permitting

• Milling Agreement and DevelopmentPlanning

• Preparationfor Mining and Feasibility Selection

• Marketingand Financing Initiatives

• Complete Feasibility Study Finalize economic analysis and developmentplan

• Continue Shipping Ore Maintain near-term revenue potential through toll milling

• Finalize Plant Size and Production Scenario Select optimal path for full-scale operation Leveraging

• Ongoing discussions to formalize Exploration Agreements with local First Nations.

• Commitment to transparency through open communicationand regular project updates.

• Planning underway for future regulatory processes, including Environmental Assessment (EA) andImpact Assessment (IA).

• Environmental baseline studies tobe initiated toguide responsible project development.

• Prioritizing the employment of skilled First Nations talent across explorationprograms.

• Developing and implementing advanced training initiatives tosupportlong-term local employment.

• Upcoming Stage archaeological studies toensure protection and preservation of cultural heritage sites.

MLM | OTC: MLMLF

1

Recentacquisition ofthe Juby Gold Project positions McFarlane as the owner of a large-scale, NI 43-101–compliant gold resource inOntario’s Tier-1 Abitibi Belt.

4 +90%METALLURGICAL RECOVERIES

Conventional processing with high recoveries provides strong economic fundamentals and optionality.

2

Over 4 million ounces defined in Indicatedand Inferred categories – open at depth and alongstrike, with clear growth potential through drilling.

5

3

CLEAR PATH TO PRODUCTION

Multiple development options supported by excellentlocal infrastructure.

6

Leadership experienced in exploration, development, and capital markets – advancingthe projectwith technical discipline and executionfocus.

With the Juby acquisitionrecently completed, the market has yet to reflect the scale and quality of McFarlane’s portfolio, presenting a timely rerating opportunity for investors.

1. CIM definition standards were followed for the resource estimate.

2. This Mineral Resource has an effective date ofSeptember 29, 2025.

3. The 2025 resource models usedordinary kriging (OK)grade estimationwithin athree-dimensionalblock modelwith mineralized domains defined by wireframe solids.

4. Mineralresources are constrained within pit shells (OP) and Underground Shapes (UG)

5. Open pit cut-offof 0.25 g/t Aumilled is basedon the cost/tonne ($USD/t) milled for incremental mining, processing, and G&A

6. Underground cut-offof 1.85 g/t Aumilled is basedon the cost/tonne ($USD/t) milled for incrementalmining, processing, and G&A

7. The 0.25 g/tAu cut-offfor OP and the 1.85 g/t Au cut-offfor UG used for reporting is based on the following:

a. Long term Gold price of US$2,500/oz

b. Metallurgical recoveries are based on metallurgical testing recovery of 92%

c.Average Bulk density(specific gravity)was determined for each lithology and/or mineralized domain within the deposit

d. Processing costs of USD$11.00/t, G&A costs of USD$4.00/t, and Tailings Fee of USD$2.00/tmilled

e.Dilutionof 5%for OP, and 10%for UG

f. Overall Pit Slope angle of 47 degrees

8. MineralResources that are not mineralreserves do nothave economic viability. Numbers may notadd due to rounding.

9. The resource estimate was prepared byTodd McCracken, P.Geo, ofBBA E&CInc. in accordance with National Instrument 43-101 standards of Disclosure for Mineral Projects