PRESIDENT’S MESSAGE

Cooperation and the Common Good

It is my pleasure to report to our Association that the CPMA Board has been hard at work addressing the issues that affect us all. It is difficult to know what each year will bring, but the challenges that present themselves must be attacked with an end goal in mind. Win or lose, we must play the game and play hard.

I find myself and our Board in the heart of a very important time of transition for our profession. The changes that will occur in the next few years will advance our profession more than any other segment of time in our history. We have been working diligently for the past ten years building relationships with our Allopathic and Osteopathic Physician Colleagues in the hopes that one day the end result would be a better future for all. The idea of collaborating with our MD and DO counterparts was at one time considered a distant reality. It was our goal to not identify our differences but to

recognize our similarities, and we have done just that.

As the healthcare system evolves, it continually demonstrates the need for a more collaborative healthcare model. With the onset of the Affordable Care Act and the Accountable Care Organization’s requirements that we all work together to bring healthcare costs down, Podiatric medicine has evolved as one of the most cost-effective and integral parts of that system. The value a Podiatric physician brings to any organization or group is tremendous, and this will be our biggest advantage in these changing times.

DOCTORS ARE PATIENTS’ BEST

CPMA LEGISLATIVE LEADERSHIP CONFERENCE

W ednesday, M arch 4 ~ 9 a M to 5:30 PM t he c itizen h otel • 926 J s treet • s acra M ento , ca

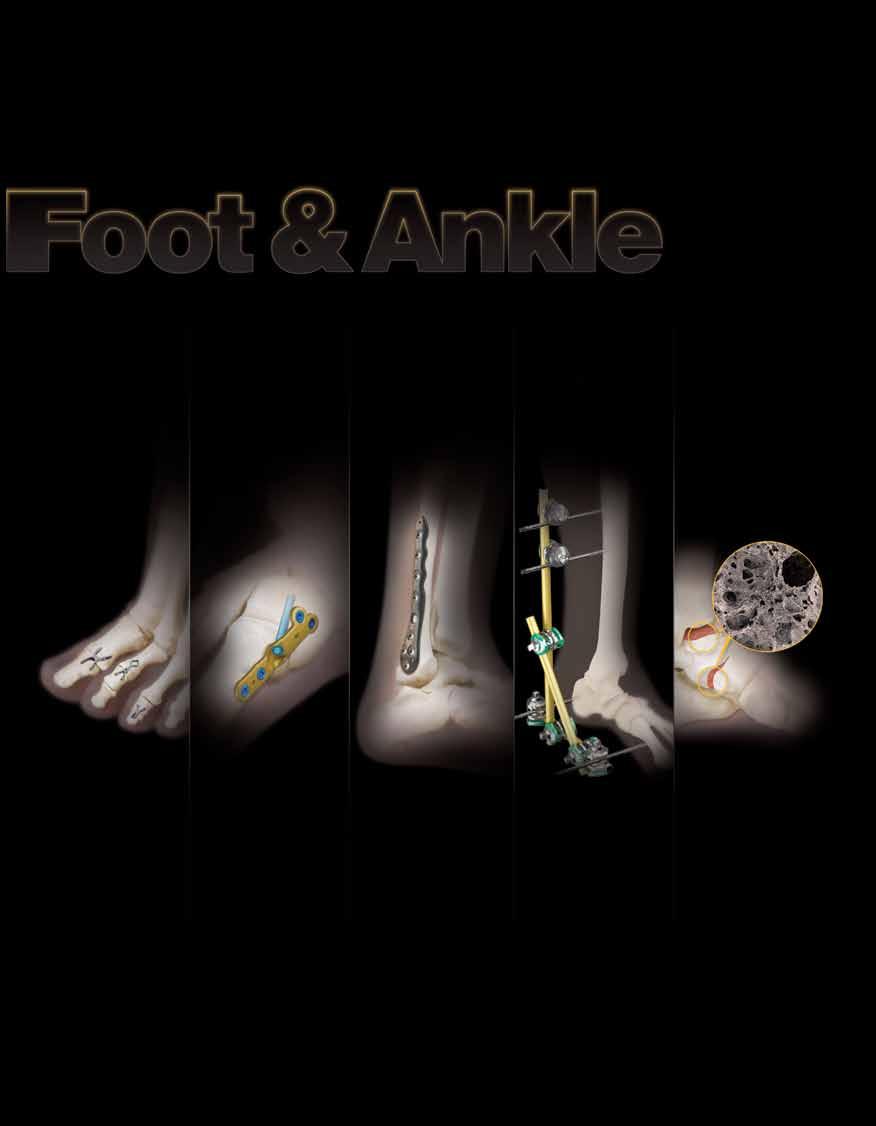

Western Foot and Ankle Conference

June 25 – 28, 2015

Disneyland Hotel & Convention Center Anaheim, California

• Economically conscious registration rates

• 25 CE contact hours

• 10 radiology CE contact hours

• Dynamic lecture tracks

• Distinguished faculty

• Innovative instructional courses

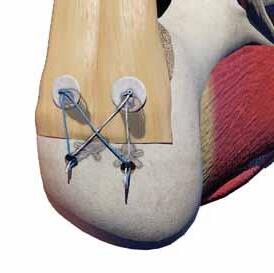

• Hands-on surgical workshops

• ICD-10 Updates

• PICA presentation

• 3-day educational seminar for podiatric medical assistants including radiology credits

• 3 days of exhibits

• Exceptional room rates at the Disneyland Hotel and Grand Californian Hotel & Spa

• Significant savings on Disneyland & California Adventure Park Passes

• Optimal location near shopping, dining, entertainment and more!

Come for the meeting; Stay for the magiC of DiSneylanD’S DiamonD Celebration

You are invited to attend the party of the year, as the Happiest Place on arth celebrates its 60th Anniversary with thrilling new rides, dazzling displays, peppy parades, and spectacular shows and surprises!

After mornings of inspired earning in innovative instructional courses, hands-on-workshops and hot topic lectures, attendees of the 2015 Western Foot and ankle Conference (one of the nation’s premier podiatric surgery, medicine, management conferences and exhibitions) will be able to enjoy evenings with families and friends as they join in the celebration. And, Western attendees receive significant savings at Disneyland Resort hotels, and on Disneyland and Disney’s California Adventure theme parks tickets.

The 2015 Western Foot and Ankle Conference (June 25-28) is your e-Ticket to education and fun!

B ECOME AN A DVOCATE f OR YO u R PATIENTS AND P RO f ESSION !

Mark your calendars now and plan to attend the California Podiatric Medical Association’s (CPMA) 2015 Legislative Leadership Conference on Wednesday, March 4. The conference will take place at the lovely Citizen Hotel, just three short blocks (a quick 10 minute walk) from California’s majestic State Capitol Building.

The morning breakfast briefing will be followed by luncheon with invited guest speakers, after which attendees will head to the Capitol Building to meet with their legislative representatives.

Following their legislative visits, attendees will return to the Citizen Hotel for refreshments and to share their experiences.

This is a unique event for podiatric physicians and is free of charge to all CPMA members. Plan to join more than 100 podiatric physicians, residents and medical students who will be coming to Sacramento to educate their legislative representatives about the critically important role podiatric medicine has in the healthcare system, and to help ensure that the people of California have access to necessary, quality podiatric medical treatment and care.

CPMA staff continues their tradition of personally donating to provide food and toys to needy families during the holiday season.

Time TO Talk Turkey

Like it or not, politics have a major impact on the podiatric medical profession. All licenses to practice podiatric medicine in California are issued by the State of California. The statutes and regulations which govern your practice are ultimately determined by our state legislators in Sacramento. These one hundred and twenty elected representatives are routinely called upon to approve or reject legislation that has a direct bearing on the nature and practice of all health professions - including podiatry.

The California Podiatric Political Action Committee (CalPPAC) is a non-profit, non-politically aligned organization run by DPMs for the betterment of DPMs . CalPPAC educates elected and appointed government officials about the critical role podiatric medicine plays in California’s healthcare delivery system. It also assists those legislators and candidates for public office who appreciate and support the podiatric medical profession.

CalPPAC opens doors for dealing with an array of legislative and regulatory issues of interest or concern to California’s DPMs, including: licensure, hospital privileges, scope of practice, insurance, professional discipline, and practice regulations … to name just a few.

Your contribution will help to ensure that the voice of podiatric medicine is heard in Sacramento, where the important decisions are made that affect your patients, practices and profession as a whole.

Remember, a single stroke of the pen can write podiatry into - or out of -the law.

Please send your contribution today to:

CalPPAC, 2430 K Street, Suite 200 Sacramento, California 95816.

To use your VISA , MasterCard or American Express call toll free (800) 794-8988 Or, donate online at CalPPAC.org

Ask yourself -

Common Good

I recently came upon a website for a nonprofit organization in Europe called “Association for the Advancement of the Economy for the Common Good”. They outline 20 principles that describe their values and guide their mission.

Their first principle states that the basis for the Economy of the Common Good are “collectively shared values that contribute to fulfilling interpersonal relationships… confidence building, cooperation, appreciation, democracy, solidarity”. These relationships are a key factor in happiness and motivation. I was so moved by this idea as I saw it consistent with what we at CPMA strive to achieve on a daily basis.

We must all cooperate and appreciate each other for what we have to offer. Degree aside, we are all on the same team: the team that provides healthcare for the state of California and the patients it serves. We win together, or we lose together. Aligning our strategies can only be accretive in the end. If we shift our strategies from competition to cooperation, the common good will prevail. And while profit and competition is still possible, it becomes less of the focus and more of the byproduct. Most of us in private practice have realized this over time by hiring an associate, consolidating offices and taking advantage of economies of scale. Those in larger HMO healthcare centers and medical groups have realized the benefit of this model for quite some time. This can also happen on a larger scale locally, statewide or even nationally.

Cooperation

Our Physician and Surgeon initiative here in California exemplifies a cooperative effort with our allies as we pursue a common good. The Task Force has had a very active year, finishing up its school and residency site visits just a few months ago. The results of our hard work have shown that we are in fact much more similar than we are different. We are all going to be affected by the inevitable outcome of this Task Force and the stakeholders therefore include all of us; for we will all benefit from the changes associated with the outcome of a Physician and Surgeon license.

Earlier this year the executive leadership of CPMA was invited to participate as fellow physicians at the Western Healthcare Alliance meeting in San Diego. The relationships we have built with CMA allowed us to participate at a level that has been unprecedented. While at that meeting we were personally invited by the Executive Director and CEO of the California Medical Association, Dustin Corcoran, to attend a private training session on MICRA, the Medical Injury Compensation Reform Act. We were privy to the ground floor discussions about how to approach the potential threat to the stability of healthcare in California. What emerged from that meeting was a CPMA strategy for aggressive fundraising

and patient education on what eventually became Prop 46. This cooperative effort initiated by CMA including our Association has paid big dividends for everyone. Thanks to all of your efforts we were able to fundraise aggressively in the first 6 months of this year followed by development and implementation of a comprehensive physician and patient education plan to defeat Prop 46.

Our Cooperative efforts did not stop there! While our Medi-Cal Bill AB 1868 was stalled in the Senate Appropriations Committee due to opposition from the Department of Finance, it was the DHCS that admitted their policies were unclear and confusing for Podiatric providers. What this did was allow us to open up discussions on the topic resulting in a change in their administrative policy allowing our services to be covered in emergency room and in-patient hospital settings. None of this would have happened without the right people in the right place looking for a common good and a common goal. Our legislative advocate Jodi Hicks has been busy behind the scenes strengthening her relationships, and this has resulted in a positive outcome for our members. CalPPAC funds have been instrumental in supporting those efforts. Please continue to donate as you have in the past so we can continue to support those legislators who support our agenda.

Let us continue to embrace the idea that we will always achieve much more together than we will apart. The Economy for the Common Good is neither the “best” economic model nor the finished product. It is simply the next possible step to a better future for all.

Your parent organization CPMA and its leaders are here to provide the tools and resources to guide you through those next steps. Please be sure to visit the www.calpma.org website often to keep up on these changes.

I wish you all a Happy and Healthy Holiday Season.

Thomas Elardo, DPM President, CPMA

2014 Norcal oNe Voice a Spectacular SucceSS!

Those attending the 3rd Annual Northern California One Voice event enjoyed an evening of big band music, comedy, casino games, camaraderie, fine food and fun. Attendees included CPMA leaders, representatives from the California Medical Association (CMA) and keynote speaker Senator Jim Beall (D), who represents CA Distinct 15, which covers the Silicon Valley area.

Event proceeds go to CalPPAC to help ensure that the voice of podiatric medicine is heard when and where it counts.

The California Podiatric m edical Association and the Santa Clara valley Podiatric m edical Society wishes to thank the following for their outstanding support of the 2014 NorCal One voice event.

• Bako Integrated Physician Solutions

• Berkshire

• BioMedical Enterprises

• Bioventus

• Dermatran Health Solutions

• Footwear, etc.

• Game Ready

• Guardian

• Health Diagnostics

• Insight Imaging

• Integra Life Sciences

• Merz Pharmaceuticals

• Organogenesis

• Osiris

• Osteomed

• Pamlab

• Qmed

• Stryker

• Tetra

• Tornier

• Valeant

T HE VA lu E O f R E l EVANT DATA

Manufacturing quality guru W. Edwards Deming has written, “In God we trust; all others must bring data.” Deming, a consultant for Toyota in the 50s, was a visionary – the first to apply raw data and statistical sampling to manufacturing processes in ways that improved quality while simultaneously lowering production costs. There are numerous ways that doctors too can utilize data and benchmarks proactively to achieve similar quality and production results within their medical practices – that is, make positive improvements and advancements in both their quality and costs. This is, in fact, something that every practitioner should be working towards now. Unfortunately, data can also be misused in ways that can negatively impact a practice when employed incorrectly by others – such as when a payer compares a doctor’s data with the “average” physician in his/her specialty to determine whether or not to initiate an audit – or when Medicare asks a practitioner to return payments because his/her coding levels have been compared with “peers” and it has been determined that this coding was “above the average.” How does one counter such an accusation when it seems out of line? This is when access to relevant data can assist the doctor.

Our future healthcare environment will be ever more driven by data. This includes the use of clinical data for measuring quality, operational data for improving practice performance, benchmark data for comparing a medical group’s performance with that of groups of equivalent size or focus, and variance data for assuring compliance with rules and regulations. Databases currently being used to compare DPMs with their peers do not accomplish these tasks well. On most, a podiatric practitioner is being compared with an “average” that includes a wide range of practitioners – from DPMs who limit their practices to palliative care to ones who perform complex, reconstructive procedures or have chosen to focus primarily in areas such as wound care or sports medicine. It is

not typically accurate to directly compare data from such diversely focused practices. The training of today’s practitioners may vary widely too. They may, or may not, be board certified, and training ranges from no residency at all to three year programs followed by fellowships. In other words, when a DPM is being compared with those in his/her “same” specialty, those with whom any individual is being compared are often not actually “peers.” Consider too comparing E/M code levels used by any one DPM with the “average.” Logically, 50% of the time, the practitioner is going to be above the average and suspected of over-billing. It is not that the data with which the doctor is being compared is incorrect, but rather, that the sample being utilized to make the comparison may not be representative for the particular doctor being monitored. Data can lead to erroneous conclusions in multiple other ways – for example, when the sample size being utilized is either too small (to few DPMs in the sample to make a broad generalization) or is not representative of the training and/or practice type of the doctor with whom s/he is being compared (yet another example in which apples are not being compared to apples).

One of the reasons that CPMA exists is to “advance and protect the profession.” I feel that an effective way of accomplishing this in the future would be to collect and analyze a large sample of relevant data from our members – data that could be used to put each practitioner on a level playing field for the purpose of comparison with his/her peers. By collecting data from its members, CPMA could create a much larger DPM sample size than that currently provided by MGMA (Medical Group Management Association) – or any other organization, for that matter. Its data could include relevant information regarding training, practice focus, patient volume, and other pertinent factors that differentiate each practitioner from the “average.” There are numerous categories of data to which access would be of value for CPMA members. Let us look at a few examples in order to understand some of the possibilities.

E/M Frequency and Distribution

Similar to the manner in which the IRS compares the type, size, and number of our deductions on income tax returns with those of peers, payers compare doctors’ billing practices with one another. When a payer compares a physician with his/her peers, it is significant just who the payer is considering to be “peers.” The sample size used might be too small to be valid as well as not even representative of the practitioner’s actual peers. When a payer sees a doctor deviating from these assumed “peers” on any particular code, or distribution of codes, to a degree considered to be statistically significant, it is likely that the payer will audit him/her. This does not mean that this doctor has actually done anything wrong, but the experience can be stressful and will necessitate that the doctor take time to review medical records in order to justify the level of codes s/he has utilized. The outcome may be that that the doctor “wins” the audit – or it may be that s/he actually is not coding correctly. In either case, access to sufficient and representative data could assist the doctor in multiple ways, that is: (1) if a doctor recognizes from examining a representative database that s/he is up-coding, it would be helpful to have relevant comparative data before being audited – thus being afforded the opportunity to make the

appropriate changes to prevent such an audit in the first place, (2) if a doctor learns that s/he is under-coding, then by adjusting to correct coding, s/he will receive appropriate reimbursement without the fear of being audited, and (3) if a doctor learns that s/ he is deviating from the norm and recognizes that a payer is likely to question his/her selection of codes, relevant data demonstrating a comparison with his/her actual peers will assist that doctor in crafting his/her defense. When a comparison shows that codes are in line with those of actual peers, this data may either help the doctor avoid an audit or, if audited “out of the blue,” it will provide him/her with an effective means of challenging the auditor’s data and ultimately “winning” the audit.

An example of the use of such data analysis can be crafted utilizing Table One, below. Herein, the E/M coding distributions of five levels of outpatient E/M visits for a fictitious Podiatric Practitioner are compared with the frequencies for these same visits as recorded in four different databases for “peers” that are in actual use today by various payers. The first column shows the number of times that our fictitious practitioner billed each code, the second shows the percentage distribution of each code for this doctor, and the remaining four columns show the distribution percentages deemed “the average” by various payers. The distribution of codes for our Podiatric Practitioner are statistically within the same range as those shown in Databases 1 and 2. A payer relying on either of these databases would be unlikely to question the practitioner’s percentages. This same distribution would, however, be likely to generate a letter from a payer using databases 3 or 4. This payer would be likely to point out that our Podiatric Practitioner has a higher percentage of levels 3, 4, and 5 codes when compared with the “average” billing behavior of other physicians within the same specialty. This letter might also let him/her know that s/he will be contacted for medical records in order to identify inaccurate coding – which, in turn, may lead to eventual recovery of associated overpayments. Have you known of cases like this? To avoid this scenario, many practitioners even intentionally under-code for fear of being audited. Obviously, this practitioner would be well-served if he/she were aware of the existence of Databases 1 and 2. Better yet would be access to a CPMA database that would compare his/her practice with peers who are actually comparable instead of simply “the average.” Regardless of the issue being raised, it is important that doctors be aware of how they line up with comparable peers long before they receive such letters.

RVU Data

Physician productivity data is but one of many statistical categories that large medical groups have shared for years. Groups have used this data for determining compensation levels for each specialty. This type of data is typically shared through an independent organization that collects and “sanitizes” data for the groups.

In past years, when physician practices were acquired by hospitals and the doctors put on salary, productivity typically dropped. The “fix” for this phenomenon was to compare Work RVUs (wRVUs) data to determine relative productivity for each specialty. Based on the findings, physicians where then categorized into percentiles – ranging from the 20th to the 90th – to determine compensation levels. Compensation was then determined by multiplying the number of wRVUs by a dollar amount that was increased as the percentile increased. For example, if a DPM were to generate 5,000 wRVUs with a dollar value of $50/RVU (the multiple), his/her resultant compensation would be $250,000 (5,100 RVUs x $50/RVU). As you might expect, there is a wide variation in actual dollar value of wRVUs amongst the various specialties within any one medical group, and there is also a large variation amongst doctors practicing the same specialty across multiple groups. The maximum size of the wRVU dollar value is ultimately limited by a group’s overhead and level of efficiency, but as often happens with capitation rates and other pay scales, it can also be enhanced, based on a physician’s negotiation skills. Access to relevant data for the purpose of arguing compensation or making any other type of decision before negotiations greatly augments these skills.

Over the years, many large medical groups have been sharing their proprietary data, and others have used MGMA data. DPMs today are increasingly becoming employed by hospitals, as well as multi-specialty, orthopedic, and podiatric groups, and their compensation levels are often determined by wRVU data. Examining a couple of databases reveals that the DPM dollar multiple on one database ranges from $30 – $44, and on another from $50 – $75. Note that the highest range for the same specialty is more than double that of the lowest! If we look at the ratio of

compensation percentage to dollars collected, the percentage on one database ranges from a low of 22% to a high of 44%. Again, one doctor is receiving twice as much for his/her productivity as the other. Given that the higher multiples are also in conjunction with the higher wRVU generation (the multiple is higher for a doctor in the 75th percentile than in the 25th), a wide range in compensation levels is created within the same specialty. A problem specific to podiatric physicians is that orthotic care has not been given an RVU number and is often not even counted in the physician’s total wRVU productivity. At the same time, orthotic care often has a high reimbursement rate – sometimes at the level of a surgical procedure. This justifies an RVU value comparable to that of a surgical procedure and should, therefore, be counted when determining podiatric productivity. The point is that it is critical for anyone running a medical group or working in one to have access to relevant data, and most doctors have access to little pertinent data. One way to fix this disadvantage is to share data through a third party – again, a role that CPMA could play to the benefit of its members.

Other Data

We have barely scratched the surface of the different types of data that could be of value to practitioners desiring to protect and advance their practices and careers. One use for relevant data that is important now and will become even more essential in the future as podiatric groups become larger and pay for performance becomes more routine is the establishment of benchmarks which can be used to evaluate practice performance – benchmarks necessary for determining where a practice is doing well and where it needs to improve. This type of data is relevant to every doctor, whether practicing solo or in a large group. Evaluating

ratios is much like doing a lab screening to determine the health of a patient; each lab result tells part of the story and needs to be viewed in the context of the entire panel. Similarly, ratios are more meaningful in the context of multiple ratios, and to be truly valuable, they should be compared with benchmarks from comparable practices. This is is another area in which the comparative data currently available to podiatric practitioners falls short. There is no real value in comparing with the “average” for all practices. Ratios such as revenue/visit, overhead/revenue, cost/ patient, CPT codes billed/visit, staff size/Dr, productivity/Dr, number of treatment rooms/Dr, and multiple other operational ratios are all useful for determining how a practice is doing and where it should focus on change. These ratios are particularly valuable when a doctor knows that s/he is comparing with data from practices or groups of similar size, focus, and patient volume, and this is what a CPMA database could offer.

This is a current and future need of DPMs, and CPMA has the capability of collecting and analyzing this important data – data similar to that which MGMA provides for its members. The advantage that our database would offer is that the sample size of the data specific to DPMs would be much larger than that contained in MGMA’s database. It would also be more relevant to the specific needs of podiatric practitioners because this information could be sorted and analyzed in ways such that all DPMs and practices would not be mixed together to achieve an “average.” Instead, key differences, such as practice size and clinical focus could be differentiated – making this a vital tool for competing in a future where access to relevant and reliable data will be essential. Do we have need for something like this? The time to get started is now. When shall we start?

N OVEMBER IS D IABETES

AwARENESS M ONTH

I NCREASE P ROD u CTIVITY w ITH P O w ER

M EETINGS AND Hu DD

l ES

One of my favorite sayings is, “None of us is as good as all of us.” I am a true believer in teamwork in the office. It is always so exciting when we sit down at a meeting, come up with a way of increasing the bottom line or improve our service quality, and everyone participates in sharing ideas. It is amazing to see what comes out of a good power meeting. You start with one thought, and in the end, come up with ideas that you never would have thought of by yourself.

It is not always like this, however; sometimes things just do not gel and nothing worthwhile comes out of the meeting.

Knowing how to run an effective power meeting is very helpful. There are many factors to consider, like location, comfort, ground rules and purpose, to name a few. Making sure that you have a good meeting facilitator is important to keep people focused and ground rules enforced. Criticism is a creativity killer and never should be allowed when brainstorming ideas together. Power meetings are not necessary to come up with good ideas, but the synergy and sense of bonding that takes place when team members all have input into the ideas is priceless.

Our team sat down for 30 minutes (setting a time limit is necessary) as we were putting together a new strategic plan for productivity and efficiency to implement in the office. The first item we needed to accomplish was to come up with our office purpose or mission statement. We all know what we do and why we do it, but putting it into words isn’t as easy as one might think. We started throwing our thoughts out there and writing them down, and with the input of all of us we were able to come up with a statement that said exactly what we all felt to be true for us - and it only took about 15 minutes. We were so excited that we were able to accomplish our goal for the meeting - and in less time than we set aside. Having a power meeting is a great and motivating way to accomplish tasks

without burnout.

In Verne Harnish’s book mastering the rockefeller Habits he states that successful businesses have daily meetings for 5-15 minutes, which he calls “huddles”. He states that by having these huddles you can actually save time because you are focusing on what is happening for that day.

There are only three questions that are covered at this meeting and they are the same each day:

1. What’s up for the day;

2. Daily measures; and

3. Where are you stuck?

Working in a medical office, the questions might translate into:

What does the schedule look like?

How can we best prepare for the patients coming in?

Is anyone having any particular work problem they need help resolving?

By just asking these three questions daily we can prepare and resolve many problems we face during the day that take more time away from being productive. It is also a good practice to have a short huddle at the end of the day to measure how the day went and gather ideas for better outcomes if there were any issues while they are still fresh in our minds.

You may think you do not have time for more meetings, but remember, this is a huddle - it is grouping those who work together to review what will be taking place that day. When everyone is on the same page and is identifying how they can resolve any issues before they arise to make for a more productive, less stressful day, how can you not take the few minutes?

2014 YEAR -E ND TAx Pl ANNING I DEAS

Whether considering your own personal tax situation or that of your business, as we near the end the year, tax considerations and planning should be on your mind. Certain decisions and actions are imperative this year to help minimize your tax situation for 2014.

Year-end tax planning for 2014 will be challenging in many respects due to tax incentives that expired at the end of the 2013 year. Although Congress could still act on some of these expired incentives and retroactively reinstate these, it is unclear as to whether the political climate will exist to support this. The end result is that there could be some truly last minute tax opportunities that open up if these tax breaks are extended.

tax breaks which expired for individuals included: opportunity to deduct state and local sales and use tax instead of state and local income taxes; an above-the-line deduction for qualified higher education expenses; tax-free IRA distributions for charitable purposes by individuals 70 ½ or older;, and the exclusion for up to $2 million of mortgage debt forgiveness on a principal residence.

tax breaks which expired for businesses included: 50% bonus first year depreciation for most new machinery, equipment and software; the $500,000 annual section 179 depreciation expensing limitation; the research tax credit; and the 15 year write-off for qualified leasehold improvement property, qualified restaurant property and

qualified retail improvement property.

2014 will also have unique consideration for higher income earners when mapping out year-end tax plans. The 3.8% surtax on certain unearned income and the additional 0.9% Medicare (hospital insurance, or HI) tax that applies to individuals receiving wages from employment in excess of $200,000 ($250,000 for married filing jointly and $125,000 for married filing separately) must be planned for.

The surtax is 3.8% of the lesser of: (1) net investment income (NII), or (2) the excess of modified adjusted gross income (MAGI)over an unindexed threshold amount ($250,000 for married filing joint or surviving spouses, $125,000 for married individual filing separate, and $200,000 for all others). Strategies to minimize this surtax depend upon the estimated NII and MAGI for the year. Taxpayers with high NII should consider ways to minimize additional NII balances for the year (possibly through income deferral). Or if high MAGI is the concern, it should be looked at how to reduce 2014 MAGI; or consider ways to reduce both NII and MAGI.

For the additional 0.9% Medicare tax (HI) year-end planning may require action. Employers must withhold the additional Medicare tax from wages in excess of $200,000 regardless of filing status or other income. However, self-employment individuals must take it into account when projecting their estimated tax for 2014. Also, there could be situations where an individual needs to have an additional amount withheld near the end of the tax year to cover this tax. This situation could occur if an employee worked at more than one employer in 2014 and cumulatively earned over $200,000 (but was under the $200,000 at each employer separately). In this case, the employee would owe the HI tax, but neither employer would have had to withhold this tax amount since neither met the thresholds.

Below is a list of many tax action items that should be considered for the 2014 tax year that may help to minimize your tax burden for the 2014 tax year if acted upon before the end of this year. Although 2014 is shaping up as a fairly hard year to plan for in many respects, there are actions that you can and should take now to help minimize your ending tax bill:

by Amanda Williams, CPA Gilbert Associates, Inc., CPAs and Advisors

Year-end tax planning actions for individuals:

• Postponing Income & Accelerating Deductions - For higher income individuals, postponing income until 2015 or accelerating deductions could lower your 2014 tax bill and help you be able to take advantage of other tax breaks that are phased out over varying levels of adjusted gross income (AGI). These include child tax credits, higher education tax credits, and deductions for student loan interest. Postponing income would be most desirable to individuals who anticipate lower income levels for the 2015 tax year. Also, for those individuals who anticipate higher income for 2015, the opposite of this strategy may make sense to help minimize the overall tax burden between the tax years.

• Traditional IRA Conversion to Roth IRA Considerations- If you converted assets held in a traditional IRA to a Roth IRA earlier in the year and the assets in the Roth IRA have declined in value, if you leave it as is you may end up paying higher tax than is necessary. You can back out of the transaction by recharacterizing the conversion (transferring the converted amount plus earnings/loss back to a traditional IRA via a trusteeto-trustee transfer). You can reconvert later to a Roth IRA if doing so proves advantageous.

• End of Year Bonus - It may be advantageous to arrange with your employer to defer a bonus that you may be receiving until 2015.

• State & Local Tax Withholding - If you anticipate owing state and local income taxes when you file your return next year, consider asking your employer to increase your withholding of state and local taxes (or make an estimated payment to the state) before year end to pull the deduction of taxes into 2014 if doing so will not create alternative minimum tax (AMT) issues.

• AMT Considerations - Talk with your tax professional to estimate the effect of any year-end planning moves on the alternative minimum tax (AMT) for 2014 – many tax breaks allowed for purposes of calculating regular taxes on your residence, state income taxes, miscellaneous itemized deductions and personal exemption deductions are not allowed for AMT purposes.

• 70 ½? Take RMD - Make sure to take required minimum distributions (RMDs) from your IRA or 401(k) plan if you have reached age 70 ½ . Failure to take the RMD can result in a penalty of 50% for the amount of the RMD not taken.

• Retirement Contributions - One of the best ways to save on taxes is to make contributions into a retirement account including 401(k), SEP or IRA. Maximizing your contribution not only saves money for retirement, but decreases your taxable income for the current tax year.

• HSA Contribution - If you are eligible to make health savings account (HSA) contributions in December of this year, you can make a full year’s worth of deductible HSA contributions for 2014. This will be the case even if you became eligible on December 1.

• Gifting Strategies - Making gifts sheltered by the annual tax exclusion before the end of the year could save taxes in the future for gift and estate taxes. You can give up to $14,000 in

2014 to each of an unlimited number of individuals ($28,000 for married couples) but you cannot carry over used exclusions from one year to the next. The transfers may also save family income taxes where income-earning property is given to family members in lower income tax brackets who are not subject to the kiddie tax.

Year-end

tax planning actions for businesses:

• Depreciation & New Capitalization Regulations - Although the expiration of the bonus 50% depreciation expense on new equipment additions and the decrease in the section 179 dollar limitation (from $500,000 limit with beginning of phase-out amount of $2 million to $25,000 limit with beginning of phaseout amount of $200,000) will be a hard hit to business taxable income, businesses could benefit from the new “de minimus” safe harbor election in the new capitalization regulations and the provisions for expensing certain regular repair or maintenance costs which in the past may have been required to be capitalized. Business controllers and managers should become familiar with the new IRS capitalization regulations and make sure they are in compliance and maximizing their business’s benefit.

Business should make sure they have adopted a capitalization policy as required by the new regulations effective as of the end of 2013 to ensure that they are able to set the capitalization threshold which applies to their business at the highest possible level. For businesses that have annual financial audits, this threshold is $5,000, however if the business did not have an audit, the maximum of this threshold is $500. If no policy is in place or adopted, however, the automatic threshold assigned under the new capitalization thresholds is only $200.

• Half-Year Depreciation Convention - If machinery and equipment is purchased before year end, the “half-year convention” should be utilized for tax purposes which secures a half-year worth of depreciation deduction for the first ownership year.

• Acceleration & Deferral of Income - A corporation should consider accelerating income from 2015 to 2014 where doing so will prevent the corporation from moving into a higher tax bracket next year. Conversely, it should be considered to defer income until 2015 when doing so will prevent the corporation from moving into a higher tax bracket this year.

• Business AMT - If income and expense deferral or acceleration options will be considered by your business for 2014, a determination for the alternative minimum tax (AMT) consequence should be considered to determine if the taxpayer would be subjected to additional AMT.

• Pay by Credit Card- Consider using a credit card to pay deductible expenses before the end of the year. Doing so will increase your 2014 deductions even if you don’t pay your credit card bill until after the end of the year.

With careful proactive and reactionary tax planning (if Congress takes action on certain tax extender legislation) and coordination with your tax advisor, you should be able to customize your tax planning to take advantage of many positive tax strategies and help minimize your tax burden for 2014.

2015 CPMA H OUSE of D ELEGATES

will convene Wednesday, June 24, 2015 Disneyland Hotel Anaheim, CA

P RESIDENT

Thomas J. Elardo, DPM

Los Gatos, CA 95032

P: (408) 358-6234

P RESIDENT -E LECT

Ami A. Sheth, DPM

Los Gatos, CA 95032

P: (408) 358-6234

V ICE P RESIDENT

Rebecca A. Moellmer, DPM Pomona, CA 91766

P: (909) 469-8413

I MMEDIATE PAST

P RESIDENT

Carolyn E. McAloon, DPM Castro Valley, CA 94546

P: (510) 581-1484

S ECRETARY -T REASURER

Devon N. Glazer, DPM Mission Viego, CA 92691 P: (949) 272-0007

D IRECTORS

John A. Chisholm, DPM

Chula Vista, CA. 91910 P: (619) 427-3481

Adam S. Howard, DPM Cupertino, CA95014 P: (408) 446-5811

Thomas J. Tanaka, DPM Ontario, CA 91761 P: (909) 724-5052

Mark A. Warford, DPM Fair Oaks, CA 91316 P: (916) 548-0218

Vladimir Zeetser, DPM Encino, CA 95628 P: (818) 907-6100

S TUDENT

R EPRESENTATIVES

Luke Hultman (CSPM) Dayna Chang (Western U)

Ex ECUTIVE D IRECTOR

Jon A. Hultman, DPM 2430 K St Ste 200 Sacramento, CA 95816

P: (916) 448-0248 (800) 794-8988

jhultman@calpma.org jonhultman@gmail.com

G ENERAL COUNSEL

C. Keith Greer, Esq. San Diego, CA 92128

G OVERNMENTAL R EPRESENTATIVE

Jodi Hicks Sacramento, CA 95814

PARLIAMENTARIAN/ R ECORDING S ECRETARY

Roderick Farley, DPM,JD/ Nedra L. Farley

2014/2015 CO m PON e NT SOCI e TY P re SID e NT S

ALAMEDA/ CONTRA COSTA

COUNTY

Michael Grimes, DPM

Pinole, CA 94564

P: (510) 724-1530

CENTRAL VALLEY

John Abordo, DPM

Merced, CA 95341

P: (209) 383-7441

COACHELLA VALLEY

Harvey Danciger, DPM

Palm Desert, CA 92260

P: (760) 568-0108

INLAND

Diane Koshimune, DPM Pomona, CA 91766

June 25-28, 2015

P: (909) 706-3778

LOS ANGELES COUNTY

Gabriel Halperin DPM Los Angeles, CA 90063

P: (323) 264-6157

MID-STATE

Richard Motos, DPM Visalia, CA 93291

P: (559) 734-1171

MONTEREY b AY AREA

Bobby Yee, DPM

Monterey, CA 93940

P: (831) 646-8242

NORTHERN CALIFORNIA KAISER

Cristian Neagu, DPM

Santa Clara, CA 95051 (408) 851-1957

ORANGE COUNTY

Thomas Rambacher, DPM

Mission Viejo, CA 92692

P: (949) 916-0077

REDWOOD EMPIRE

Paul Weiner, DPM Vallejo, CA 94590

P: (707) 643-3687

SACRAMENTO VALLEY

Daniel Lee, DPM, PhD Sacramento, CA P: (916) 688-2030

SAN DIEGO/IMPERIAL

Nicholas DeSantis, DPM

San Diego, CA 92101

P: (619) 239-3286

SAN FRANCISCO/ SAN MATEO

Bill Metaxas, DPM

San Francisco, CA 94108

P: (415) 433-3668

SAN LUIS O b ISPO/ SANTA b AR b ARA

David Sterling, DPM

Santa Maria, CA 93455

P: (805) 928-5645

SANTA CLARA VALLEY

Mehryar Amirkiai, DPM Sunnyvale, CA 94087 P: (408) 245-3230

SHASTA REGION

Gordon Shumate, DPM Redding, CA 96001 P: (530) 246-4800

SOUTHERN CALIFORNIA HMO

Diane Branks, DPM

VENTURA COUNTY

Heather McGuire, DPM

Ventura, CA 93003 P: (805) 648-2016

The California Podiatric Physician is the official publication of the California Podiatric Medical Association. CPMA and the California Podiatric Physician assume no responsibility for the statements, opinions and/or treatments appearing in the articles under an authors’s name. For editorial or business information and advertising, contact California Podiatric Medical Association, 2430 K Street, Suite 200, Sacramento, California 95816; telephone, (916) 448-0248; facsimile; (916) 448-0258; e-mail; calpma.org.

E ff ECTIVE lY COMM u NICATING w ITH THE

We frequently receive calls from members asking for guidance when interacting with deaf and hard of hearing patients. The most common question is whether the member must provide an interpreter, and if so, who is responsible for paying the interpreter. The answer to the latter question is well settled. If an interpreter is necessary, the healthcare facility is generally required to cover the costs. Unfortunately, there is no black and white answer to the question of when an interpreter is required. Rather, each case must be analyzed individually to determine whether the chosen method of communication allows the healthcare provider to “communicate effectively” with the patient.

The most common method of communication between deaf patients who are not proficient lip readers and hearing individuals who do not know sign language, is by written dialogue. This method of communication has a number of benefits. First, it is efficient. Rather than have an interpreter intervening, the doctor and patient are able to directly interact. Conversely, when using an interpreter, the doctor makes a statement to the patient and relies on the interpreter to choose the corresponding signs and words. The interpreter then signs to the patient. The patient signs to the interpreter and then the interpreter speaks to the doctor. The inherent delays between comments and thoughts, and the risk of “misinterpretation,” are not an issue when the doctor and patient are communicating in writing. If the deaf patient is competent with reading and writing, in most circumstances a written dialogue can be an effective method

of communicating information regarding podiatric care. This can be accomplished by either sitting side by side at a computer and creating a typed dialogue, or by passing a paper tablet with a hand written dialogue. Using informational pamphlets, diagrams and written instructions is also effective. The most important thing to remember is that your obligation to effectively communicate with a patient, including the obligations to explain the reason for the condition, alternative methods of treatment and provide material information necessary for the patient to make an “informed” decision on whether to undergo or forgo treatment, including surgery, is the same for all patients, regardless of their ability to hear.

If during the course of your interaction with a deaf patient you become aware that a written dialogue is not “effectively communicating” with the patient, you may be required to engage and pay for an interpreter. As discussed in more detail below, a healthcare provider can be excused from the obligation to pay for the interpreter if it would result in an “undue burden” on the healthcare provider. Although financial burden is the most pertinent factor to be considered, the mere fact that the interpreter costs more than the amount paid for the office visit is not conclusive evidence of undue burden. Rather, other factors must also be considered, including the facility’s operating income, eligibility for tax credits and the number of visits requiring interpreter services. Having reviewed the cited court decisions on this topic, I think it is unlikely that a court would find the costs of interpreter services for a single patient to be an “undue” burden for most private practices.

A review of court decisions and materials published by government agencies and various advocacy groups for the disabled reveals several topics which are particularly important, and thus more likely to warrant using an interpreter. They include explaining procedures and treatment options, obtaining informed consent and explaining medications and side effects. The vast majority of published materials on this topic also strongly encourage the use of interpreters in all circumstances. That said, it remains my opinion that for the vast majority of podiatric services, thorough written dialogues are appropriate. In fact, it would make the defense of any claim brought by a patient much easier if there was a written transcript of everything that was said. Arguably, a written dialogue is even more effective than a spoken dialogue since the doctor and the patient know exactly what was communicated, the patient can take a copy of the dialogue home with them to read again and formulate further questions, and

HEARING IMPAIRED

the doctor can read the dialogue to determine if any information was erroneously omitted or needs further discussion. Fortunately, most of the members we have spoken with have been able to communicate very effectively with deaf patients through written dialogues and supplemental written materials. In cases where an interpreter is needed, we recommend that members contact local hospitals who are generally required to have interpreters available at all times, and request the professional courtesy of allowing the member to examine the patient at the hospital with an interpreter present, or to provide the interpreter for a fee that is less than the market rate for commercial interpreting services.

The forgoing reflects my personal opinions on this topic. In order to make sure members are fully informed of the relevant law, including circumstances that warrant using an interpreter, I am providing the following excerpts and summaries of the law and other published materials.

Federal laws mandate equal access to health care services, and effective communication with individuals who are deaf or hard of hearing. These laws include the Rehabilitation Act of 1973 (the “RA”), which applies to health care providers who are also recipients of federal financial assistance, usually provided by direct funding (such as federal Medicaid funds) and the Americans with Disabilities Act (the “ADA”), which applies to all private health care providers, regardless of the number of employees. Under these laws, health care providers have a duty to provide appropriate auxiliary aids and services when necessary to ensure that communication with people who are deaf or hard of hearing is as effective as communication with patients who are not hearing impaired. Similarly, a deaf parent of a hearing child may need an auxiliary aid or service to effectively communicate with healthcare providers and give informed consent for their child’s medical treatment.

Auxiliary aids and services include the written dialogues and materials discussed above, as well as qualified interpreters, computeraided transcription services (also called CART), assistive listening devices, captioning, or other effective methods of making oral information and communication accessible. The requirement to provide auxiliary aid and services is flexible, and the healthcare provider can choose among the various alternatives, providing that the result is effective communication with the deaf or hard of hearing individual.

If the healthcare provider determines that a written dialogue and printed materials are not resulting in “effective communication,” the provider should give deference to the deaf individual’s preference for alternative methods, as they will usually have experience with certain types of auxiliary aids. The U.S. Department of Justice published a report stating that it expects health care providers to consult with the deaf patient and consider carefully his or her self-assessed communication needs before acquiring a particular auxiliary aid or service.

As discussed above, the ADA does not require healthcare providers

to use any auxiliary aid or service that would result in an undue burden or in a fundamental alteration in the nature of the goods or services provided by a health care provider.

28 C.F.R. § 36.303(a). Communicating with a deaf or hearing impaired patient is unlikely to ever result in a “fundamental alteration” of a health care service. An individualized assessment is required to determine whether a particular auxiliary aid or service would be an undue burden.

An undue burden is something that involves a significant difficulty or expense. For example, it might be a significant difficulty to obtain certain auxiliary aids or services on short notice. Factors to consider in assessing whether an auxiliary aid or service constitutes a significant expense include: the nature and cost of the auxiliary aid or service; the overall financial resources of the health care provider; the provider’s number of employees; the effect on expenses and resources; legitimate safety requirements; and the impact upon the operation of the provider. 28 C.F.R. § 36.104. Even if an undue burden can be shown for a particular auxiliary aid, the healthcare provider still has the duty to utilize an alternative that would not result in an undue burden and, to the maximum extent possible, would ensure effective communication. 28 C.F.R. § 36.303(f).

Even private healthcare providers are expected to treat the costs of providing auxiliary aids and services as part of the overhead costs of their office. So long as the provision of the auxiliary aid or service does not impose an undue burden on the provider’s business, the provider is obligated to pay for the auxiliary aid or service. This is true even if the cost of providing an auxiliary aid or service (e.g., a qualified interpreter) exceeds the charge to the patient for the healthcare service. Moreover, a healthcare provider cannot charge a deaf patient for the costs of providing auxiliary aids and services. 28 C.F.R. § 36.301(C).

A qualified interpreter is one who is able to interpret effectively, accurately, and impartially, both receptively and expressively, using any necessary specialized vocabulary. 28 C.F.R. § 36.104. There are various kinds of interpreters. The healthcare provider should determine the particular language needs of the deaf patient prior to hiring an interpreter. Some individuals need interpreters who are fluent in American Sign Language, which has grammar and syntax different from the English language. Others may use Signed English, which uses the same word order as spoken English. Although deaf patients may voluntarily bring a family member or friend to interpret for them, it is illegal to require deaf patients to bring an interpreter as a condition for providing health care services. Moreover, family members and friends may not have sufficient skills to interpret medical information effectively or may have interests that conflict See H earing im Paired on

with the patient’s and thus may not interpret “effectively, accurately, and impartially.” Using family members and friends as interpreters can also violate patient confidentiality laws. 56 Fed. Reg. at 35553.

If the healthcare provider is relying upon the patient’s ability to lip read, caution should be taken to make sure the patient truly understands what is being said. According to the National Association of the Deaf (the “NAD”): “The ability of a deaf or hard of hearing individual to speak clearly does not mean that he or she can hear well enough to understand spoken communication or to lipread effectively. Forty to sixty percent of English sounds look alike when spoken. On average, even the most skilled lip readers understand only twenty-five percent of what is said to them, and many individuals understand far less.” Thus, “because lipreading requires some guesswork, very few deaf or hard of hearing people rely on lipreading alone for exchanges of important information. Lipreading may be particularly difficult in the medical setting where complex medical terminology is often used.” Therefore, supplemental aids, such as written materials, diagrams and, in certain situations, interpreters, may be needed to insure effective communication.

Interestingly, the NAD suggests only using written dialogues for “brief and simple communication,” contending that: “Communication through the exchange of written notes is inherently truncated; information that would otherwise be spoken may not be written. Moreover, written communication can be slow and cumbersome. If a health care provider is communicating less or providing less information in writing than he or she would provide when speaking

to a patient, this is an indication that writing to communicate is not effective in that context.” I respectfully disagree with the contention that written dialogues are any more “truncated” than using an interpreter. Moreover, if the healthcare provider makes sure to provide everything in writing that would otherwise have been provided orally, the NAD’s primary concern will have been eliminated.

An important point raised by the NAD which must be considered when deciding whether to use a written dialogue, is that the effectiveness of written material also depends on the reading level or literacy skills of the patient. Reading levels of deaf and hard of hearing individuals varies as much as reading levels for the general public. More important, some deaf and hard of hearing people use American Sign Language (ASL) as their first language. Because the grammar and syntax of ASL differ from written English, using a written dialogue simply may not work. For these individuals, a qualified sign language interpreter may be the only effective way to communicate.

Although the patient cannot be charged for the cost of an interpreter, eligible small businesses can claim a tax credit of up to fifty-percent of interpreter expenses, CART services and other auxiliary aids that are more than $250, but less than $10,250. Up to $5,000 may be credited per tax year. Omnibus Budget Reconciliation Act of 1990, P.L. 101-508, § 44. To determine whether your practice qualifies, you should contact your CPA or tax advisor.

If you have further questions regarding this or other legal issues affecting your practice please call CPMA at (800) 794-8988.

(Originally printed in the 2010 October/November/December issue of The California Podiatric Physician)

Dr. Dawn Buratti (pictured left above and center below) was mistakenly identified in these two photos from the 2014 July/August/ September issue of the California Podiatric Physician. Additionally, the city in which Dr. Vladimir Zeetser resides was misidentified as Torrance, CA. Dr. Zeetser resides in Tarzana, CA.

CPMA staff goes through thousands of photos from the numerous meetings held during the CPMA House of Delegates and Western Foot and Ankle Conference meetings. Staff goes to great lengths to try to identify those pictured. But, we are not always successful, and mistakes do happen. We sincerely apologize for any inconvenience this may have caused.

w INTER HEA lTH PO l ICY REPORT

This is my last report for the year 2014. In this report, I will discuss some of the latest issues that had been developing with the private insurance world in California and we will then discuss some of the issues that we discussed at the CAC-PIAC meeting in Washington DC during the first weekend of November. The following are some of the issues in the private insurance world.

BluE SHIElD

We have gained a great deal of success with Blue Shield in the avoidance of the words on an explanation of benefits (EOB) “services are not payment when performed by providers of this classification.” For all intents and purposes, we have eliminated the majority of cases where these words occur on EOBs. However, there are still some rogue instances where this has occurred albeit much less frequently then previously noted. The reason that it has occurred, according to the principals at Blue Shield , is that they have changed their claims software and has not upgraded all services and procedures performed by Podiatrist to allow them for full reimbursement. As I stated before, in general, this is no longer an issue, but as I have told Blue Shield even one errant statement or an explanation of benefits which states that the Podiatric Physician should not be performing this service and which goes to their patient, is unacceptable. Blue Shield has taken these words to heart and is seeking to eliminate these words on ALL explanation of benefits.

Another very significant issue that has developed with Blue Shield has to do with a podiatric physician performing fungal culture tests in their office. Recently, one of our colleagues performed a fungal culture in his office and was denied by Blue Shield as not being eligible under CLIA (Clinical Laboratory Information Act), which is a provision in the federal statute that allows doctors to perform such services in their offices provided that they have a certificate from CLIA. Blue Shield stated the reason they denied this podiatric physician payment for these services, is that a podiatric physician is not allowed to perform these services without such a CLIA certificate. CPMA staff did some research at my request and determined that an MD, DO, or DPM who performs fungal cultures in their offices ALL must have CLIA certificates in order to be allowed to perform such procedures and be paid for such. I informed Blue Shield that if they discriminated against podiatric physicians and did not pay them, but proceeded to pay MDs and DOs without demonstration of them having a CLIA certificate, I would file a group dispute resolution appeal to the Appeals Department at Blue Shield. In that appeal I would state wanted this situation investigated and a formal determination made whether or not ONLY a podiatric physician was ineligible to receive payment for fungal cultures performed in their offices or was this applicable to all physicians including M.D. or D.O. dermatologists performing such procedures in their offices. What I also told Blue Shield was that if they did not handle this situation internally and proceeded to render a judgment about this situation, then they would probably have a multitude of M.D. and D.O. physicians, particularly dermatologists, who perform fungal cultures or KOH procedures in their office, up in arms. As yet, I have not heard from Blue Shield as to the direction they wish me to proceed. It is now my intention to file a group dispute resolution on behalf of our members at CPMA, which will necessitate Blue Shield to render a written decision about the performance and reimbursement

of fungal cultures in the office. This should present some very interesting future discussions.

During my trip to Washington for the CAC-PIAC on November 7th and 8th, I listened to many interesting lectures. I will discuss some of the general lectures as well as those lectures relevant to private insurance and Gabe Halperin, DPM, the CAC rep for Southern California will in a future issue of the Californian Podiatric Physician discuss those issues relevant specifically to Medicare and the changes occurring there in.

The first relevant lecture was about policy issues for DPMs by Henry Desmarais, M.D. a member of Health Policy Alternatives. Dr. Desmarais discussed the changes that will be occurring in first Medicare and then possibly in private insurance. Some of the issues that were discussed were Medicare and Accountable Care Organizations (ACO). Dr. Desmarais stated that five million Medicare beneficiaries are presently being served by more than 350 ACOs throughout the country, but only 25% of those ACOs were able to qualify for shared savings with Medicare. He stated that Medicare and Medicaid were interested in testing some new ACO concepts including transitioning ACOs to full insurance risk where the ACO would be held accountable for Medicare parts A and B and prescription drugs under Medicare part D. He also talked about the new plan to bundle payments for inpatient services. There were four models of such bundled payments and in several of them, this included physician services in and out of the hospital. He stated that approximately 68,000 organizations have expressed some level of interest in participating in the “bundle payment for care initiative”. He also stated that CMS is interested in participating in “episode-based payments” that focus on outpatient procedures and chronic conditions. These would include the diabetic patient as well as the asthmatic patient.

Of great significance to us was the idea that Medicare may eliminate the 10 day and 90 day global surgical services to zero global day services by calendar year 2017 and 2018. Of course, this would mean that we would be paid for office visits rendered after surgery, but actual surgical fees would in most likelihood decrease. Remember that when you would see the patients postoperatively, you would be able to bill for evaluation and management services, but you would still have to meet the criteria necessary to bill higher level evaluation and management services. This is going to pose a great challenge to figure out appropriate values for the actual surgery and then pay for an unspecified amount of postoperative office visits.

Also, of great significance, is the fact that with the letter writing to CMS by APMA’s President Frank Spinosa, the provisions of the Sunshine Act are now equally applicable to MDs, DOs and DPMs. That means that if there is a speaker at a program which is CME or CPME accredited, the fees generated to that speaker whether MD, DO or DPM would not be reportable under the Sunshine Act. Prior to this, podiatrists were required to have their fees for speaking at any programs subject to disclosure. Now podiatric physicians are being treated exactly like any other physician under the Sunshine Act.

Dr. Desmarais also spoke about the importance of paying attention to quality measures. He stated that there will be much more emphasis on reporting quality in doctor’s billings as payments could decline by several percentage points if a doctor did not report quality

measures. This program is applicable to all physicians including podiatric physicians. He talked about a value added modifiers where the services that are rendered by ALL physicians, MD, DO and DPM, to patients would be subject to payment increase or decrease dependent upon whether or not they satisfy the requirement of high quality and low cost services. This is a very complex issue and every body needs to pay attention as to how this plays out under Medicare. What is important to notice is that if you do not satisfactorily report a quality measure when reporting claims, then you will in future years be subject to a payment decrease for Medicare. This may in the future also apply to private insurance.

Another issue of great importance is the fact that at this present time, the conversion factor under Medicare is 35.8228. Under the conversion factor for Medicare from January to March of 2015, the conversion factor will be 35.8013, not a very big difference from 2014. However, if the sustained growth rate (SGR) is not “fixed” by congress, then from April 2015 to December 2015, we will all participate in 21.2% decrease in conversion factor to approximately 28.2239. Therefore, as it has done many times before, Congress must act to at least if not permanently, then temporarily fix the SGR so that we do not suffer a loss of revenue as compared to 2014. Also remember as goes Medicare, so goes the private sector in due time. Also please note that under Worker’s Compensation, payments will also more than likely go down if the Medicare conversion factor goes down, as Worker’s Compensation reimbursement is tied to the Medicare fee schedule. So hopefully, Congress will act to prevent any decrease in fees.

Another issue that was discussed was podiatric physicians right the pneumatic compression devices which are being challenged by Medicare in many states. The theory of many of the regional Medicare carriers is that a Podiatric Physician is not trained to deal with the complications of vascular disease including venous disease. Therefore, they should not be authorized to supervise usage of the pneumatic compression devices. This is like saying that a podiatric physician should not treat a diabetic ulcer because he/she does not manage their diabetes and is not capable of doing so. This would be a terrible precedent if passed. At the present time, in California, Podiatric Physicians are allowed to supervise the application of pneumatic compression devices.

Kelly Back an attorney and APMA consultant gave a very informative lecture on emerging issues in private insurance. Ms. Back spoke about narrow network plans, termination from provider panels, participation in Medicare Advantage Organizations, reminder of ERISA rights and the antidiscrimination provision of the Accountable Care Act.

Ms. Back spoke about narrow networks and why they developed. The primary reason was that employers were looking to decrease their expenses. As a result, 70% of plans offered through the state exchange programs generated by the ACA are offering narrow networks defined as excluding 30% of all hospitals. In a narrow network only the most “efficient” providers are invited to participate. Also fees tend to be very low so that few providers accept participation even when asked to join. These narrow network programs have resulted in tremendous scrutiny by state and

federal regulators. In California, the Department of Managed Health Care is investigating whether Anthem Blue Cross and Blue Shield violated the state law by misleading consumers into thinking their PCP’s were part of the network when in fact they had not signed up. This has created a tremendous consumer backlash.

Ms. Back also discussed the fact that there is new consumer backlash regarding states passing “any willing provider laws.” In South Dakota, an initiative for any willing provider passed by 61% of the population. This means that anyone who was willing to accept the provisions and fee schedule of an insurer would be allowed to see those patient’s at the prevailing rate.

A long discussion was held about Medicare Advantage Programs and the advantages and disadvantages of participating in such plans. To summarize, Medicare Advantage Programs are HMOs or PPOs under Medicare. They are private health plans that administer the Medicare Benefit. They are different than Medicare supplemental plans because they cover both Medicare portion of the claim and all or part of the members cost sharing. They must comply with relevant LCD’s (Local Carrier Determinations) and NCD’s (National Carrier Determinations). They are exempt from state laws including prompt payment laws, recruitment laws and external appeals laws. They may choose to cover benefits beyond Part A and Part B Medicare. If you chose to participate in such plans, there are certain benefits and disadvantages.

ADVANTAGES Of PARTICIPATING wITH MAO OR MEDICARE ADVANTAGE ORGANIZATION

1. If the Medicate Advantage participants are part of an HMO, that is the only way of furnishing services to the member.

2. You have a higher likelihood of getting referrals from physicians participating in the MAO.

3. You may negotiate a higher payment than the standard Medicare fee for service payment.

4. You may negotiate recoupment and audit provisions.

Some of the disadvantages of contracting with an MAO are:

1. They may require you to provide records for any reason at no cost.

2. You must comply with prior authorization requirement.

3. Payment may or may not be favorable.

4. They may down code at their own will.

5. The only available appeal process is the process established by the plan.

6. It may be difficult to furnish non-covered benefits to members who agree to pay out of pocket.

There are many many other benefits and disadvantages, but these are a few of the primary ones.

DOCTOR ACTING AS AGENT Of THE PATIENT

Ms. Back also discussed the issue about assigning the doctor as an agent for the patient. What this means is, is that unlike an assignment of benefits where the benefits are assigned to the doctor, the patient signs a form that indicates that the doctor is not only receiving benefits, but is actually acting as an agent for the patient. This means that even if you are not contracted with a plan and the plan has been made aware that you are an agent for the patient, they must send all communication and payment to you. If you do not have such a signed statement by the patient on file, then if you are not a contracted provider with that plan, then the insurer may send the money directly to the patient and you may have to chase down such payment. So it is a good idea to get such an “assignment as an agent” signed by the patient and send it in with your billing especially if you are a non-contracted provider with the plan. A form indicating the doctor is acting as an agent for the patient can be found on the APMA website.

ANTIDISCRIMINATION PROVISION

There is a statement in the Affordable Care Act or ACA that states that a group health plan or health insurer shall not be precluded from varying reimbursement rates based on quality or performance measures. The APMA has interpreted this, and we agree with this interpretation, to mean that this antidiscrimination provision should prevent any insurance plan from varying reimbursement to providers based solely on their degree. Therefore, as discussed many times before, the insurer, Multiplan, which clearly discriminates on the basis of licensure is in violation of the antidiscrimination provision of the ACA. To that end, the APMA is writing a letter to the attorneys at Multiplan as well as the insurance plans that contract under the umbrella of Multiplan and inform them of the fact that they are violating federal law by discriminating against Podiatric Physicians. As you may remember from my previous reports, Multiplan is the only health plan in the state of California, which clearly discriminates against Podiatric Physicians by classifying them as midlevel providers along with optometrists, psychologists, and chiropractors. Podiatric Physicians receive approximately 85% of what an MD or DO receives for the same foot and ankle services. I also want to state that the medical director at Multiplan at this time fully supports the idea that Podiatric Physicians should be placed in the category of Physician and not midlevel provider. He has written a letter to the Multiplan organization stating this. However, he has told me on multiple occasions that it is up to the network administrators whether or not they will change their policies. Thus far, they have not felt the need to abide by the Medical Director’s recommendations because they feel they have adequate Podiatric Physicians in the networks in Multiplan throughout the country.

As I stated before, I cannot tell anybody what to do in terms of signing contracts with Multiplan or any other insurer that sets out to clearly discriminate against Podiatric Physicians in their payment and provisions in their policy. However, I can tell you that if the discriminating insurer feels that they have enough providers under their plan then they do not have the incentive to change their policies and will continue to discriminate against Podiatric Physicians. Stay tuned to see what happens when APMA sends out these letters to Multiplan and their subsidiary insurers.

The last issue I am going to discuss is the break out session that we had at the CAC-PIAC meetings. During that breakout session, I facilitated the discussion between similar representatives of the Western States. Some issues that were discussed were foot orthotic coding and payment, fee discrimination, the need to develop outcome studies, and United Health Care not paying for initial evaluation and management services when procedures are performed. We had a very lively discussion and it was found that almost all states except California do not receive payment by insurance companies for foot orthotics. We are very fortunate in that we do receive payment from most health plans. It is recommended that you receive prior authorization when performing service related to foot orthotics. It is also recommended that in order to insure payment in the case of worker’s compensation, that you receive written prior authorization with fees attached to the services you are about to perform. I have learned the hard way that this is the best way to deal with the worker’s compensation world.

With regard to the need for outcomes studies, we discussed the fact that we are living in an evidence-based medicine era. The fact that many health insurance policies and payment for procedures will now and in the future will be based on good medical evidence. At this time, we have primarily anecdotal evidence for the majority of services we perform. Although we know that many such procedures work, we do not have good randomized control studies or RCTs to verify objectively that these procedures that we perform are in fact effective. We discussed the fact that it is important for the academic institutions to generate research to validate the services we perform by performing randomized control trials in such an academic setting. We are told that this will be explained to the academic institutions and hopefully we will see more evidence for what we do in good outcome studies.

We also discussed the fact that United Health Care, in some states, is not paying for initial office visits and procedures. I told the group that although we do not have this problem in California at this time, we once did. The way I dealt with it at that time was that I told the Medical Director at United Health Care that if they did not pay for initial office visit at the same time a minor procedure was performed, like an nail avulsion or a taping or cortisone injection, then I would be forced to see the patient for an initial visit, get paid, reappoint the patient for another day and then perform whatever procedure was necessary. I explained to the Medical Director that this would cause a loss of work time for the patient, general time for the patient and would probably be a greater burden on not only the patient, but the patient’s employer. With this logic in hand, United Health Care at that time rescinded their policy of only paying for initial office visit and not a procedure or vice versa. Since that time, we have not had any such problem in California. We will see if the other states adapt our strategy.

At this time, I am going to end this report. Once again, it has been a pleasure serving as the Chair of the Health Policy Committee for the California Podiatric Medical Association. Remember we are here to serve you and can only function if you inform us of problems in either reimbursement or discrimination by health plans. If we do hear from you that things are not going as well as we think they are, then we will follow through and fight to be sure our rights are preserved.

O N YO u R TOES

CPMA Members Help Defeat Proposition 46

By a 2 to 1 margin California voters rejected Proposition 46, a ballot measure that would have dramatically increased health care costs and reduced patients’ access to care by raising the payouts in lawsuits against podiatric physicians and other health care providers.

As of Nov. 5, the vote tally for Proposition 46 stood at:

Yes - 32.9%

No - 67.1%