in your details to receive.

STRAIGHT TALK HOW I WORK

8 – Making heavy weather out of climate change

NOTEBOOK

10 – Training seafarers for a decarbonised future

12 – Seafarer salaries have risen but welfare still falling short

13 – ICS launches first ‘The Master’s Practical Guide to Maritime Law’

16 – Six out of 10 investors mull divestment from maritime amid ESG concerns

19 – Rafael Fernandez elected as next ISSA President

20 – EU ETS - do you feel secure?

INTERMANAGER OUTLOOK

22 – Measuring milestones as we plan for tomorrow

– Peter Smit

– Bjørn Martin Klokkernes

P&I AND LAW DISPATCHES

– Combatting evasion of maritime sanctions

– EU ETS enters into force 38 – Europe’s road to decarbonisation will be imperfect, but crucial for global shipping

EU

Get

5 106 November/December 2023 Ship Management International 34

THE MAGAZINE FOR THE WORLD’S SHIP OWNERS & SHIP MANAGERS

Cover Story

ETS Who will benefit?

our magazine digitally. Scan QR code and fill

ISSUE 106 NOVEMBER/DECEMBER 2023

28

30

34

25

SMI WEBINAR

40 – Creating a Culture of Care Onboard for our Seafarers Navigating Wellness

MARITIME SAFETY

48 – VIKING changes shape of the lifeboat market

49 – Survitec demonstrates Seahaven advantages for cruise customers

REGIONAL FOCUS

– Year of achievement

62 – Shipyards: Expertise, experience and eco-credentials

67 – Türk Loydu begins new era as proud member of IACS

68 – Newport Shipping launches new venture at Cicek Shipyard

68 – Istanbul Marıne Turbıne welcomes Garrett partnershıp

70 – Maritime Trainer pioneers digital crew ‘learning’

CLASSIFICATION

71 – Decarbonisation Now

76 – Going with the wind

AD HOC

78 – Our regular diary section

ANALYSIS

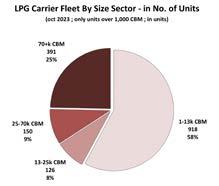

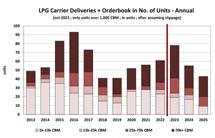

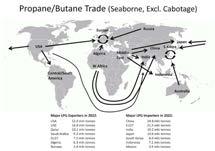

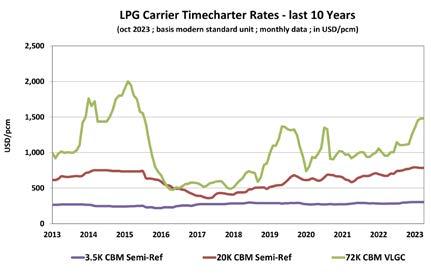

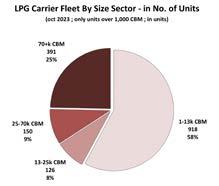

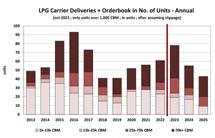

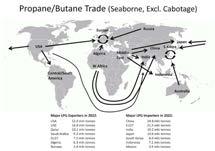

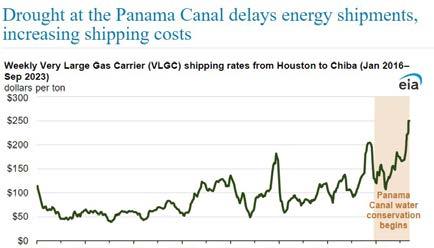

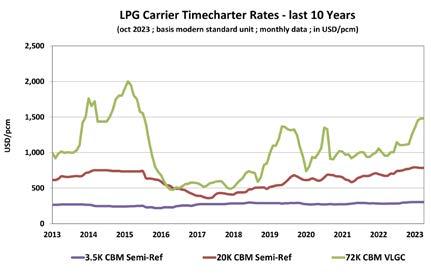

80 – LPG carriers - booming markets in all sectors

ALTERNATIVE VIEWPOINT

82 – Maritime law and the Master

TECHNICAL

83 – Russia invests in Arctic corridor

NAVIGATION

87 – Data is our new North Star

CLEAN SEAS

89 – Air lubrication can help mitigate underwater radiated noise

REVIEW OBJECTS OF DESIRE

90 – Our pick of the most coveted creations Hong Kong 51– Compelling credentials

56 – Q&A with Bjorn Hojgaard, CEO of Anglo-Eastern Univan Group

57 – Why Hong Kong will continue to thrive: Hill Dickinson

Next issue

92 – Bringing you the best in arts & culture

LIFESTYLE

94 – Road test: Toyota GR Supra 3.0 manual

SHIP MANAGEMENT INTERNATIONAL – ISSUE 106 NOVEMBER/DECEMBER 2023 THE MAGAZINE FOR THE WORLD’S SHIP OWNERS & SHIP MANAGERS

In the January/February issue of SMI we shall be looking at latest developments in Singapore, generally accepted to be the world’s leading maritime hub for some years now, as well as that small island that continues to punch above its weight in shipping terms, the Isle of Man. Also there will be a sectoral report on Ship Registries, rounding up latest developments at the world’s leading flags, as well looks at latest trends and innovation in the fields of Crew Welfare and Maritime Safety. For advertising enquiries, please contact Sales by emailing sales@elaboratecomms.com You can also keep abreast of news and subscribe to our daily newsletter at shipmanagementinternational.com 6 Ship Management International Issue 106 November/December 2023

China 58

Turkey Report 61

– Towering presence

STRAIGHT TALK

Making heavy weather out of climate change

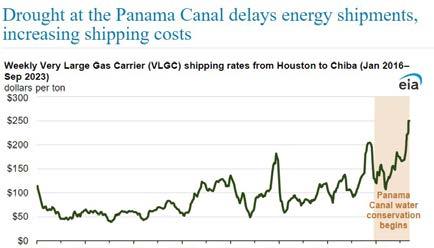

While COP28 for the first time pledged a global transition away from fossil fuels - much to the relief of smaller nations most vulnerable to climate change, environmentalists and the strong pro-decarbonisation shipping lobby alike - the effects of extreme weather are already becoming increasingly clear around the world and across its oceans.

The maritime industry is beginning to wake up to the implications of an increased likelihood of extreme weatherrelated disruptions. On the one hand, vessels have begun re-routeing to avoid the drought-induced delays being experienced by the Panama Canal – subject of last issue’s cover story – while on the other, insurers like NorthStandard have begun introducing Weather Cover into their suite of risks, covering shipowners and charterers from landside supply chain disruption, such as port closures or delays, caused solely by adverse weather conditions.

Meanwhile, there have been undeniable advances in weather forecasting capabilities, as used by ship operators

Sales Enquiries

Julian Berry

Editorial

Bob Jaques

Finance

Lorraine Kimble

Phone: +44 (0) 1296 682 051

Email:jberry@elaboratecoms.com

Phone: +44 (0) 1296 682 089

Email: editorial@elaboratecoms.com

Email: bjaques@elaboratecoms.com

Phone: +44 (0) 1296 682 051

Email: accounts@elaboratecoms.com

Wethernews’ own answer is to introduce what it calls ‘probablistic weather forecasting’ which not only offers business decision support by analysing the ETA, fuel oil consumption, CII and cost of different routes, but also includes a percentage likelihood of the predicted weather actually occurring. And AI and Machine Learning will now be added into this process to further improve calculations - a more scientific quantification of risk or attempt at ‘squaring the circle’, you might call it. l November/December 2023 |

for optimised vessel routeing. But US-based market leader Weathernews makes the point that while forecasting techniques have become more sophisticated - in its case it now uses daily weather updates from some 6,000 vessels – so the level of meteorological uncertainty has also increased.

As a result of climate change sea temperatures are rising, low pressure systems are developing more rapidly and spreading storms and swell; maximum wave heights have increased steadily year-on-year for the past 30 years, it says. And these patterns are impossible to predict with total accuracy because of the ‘chaotic’ nature of the atmosphere.

Publisher: Sean Moloney

Editor: Bob Jaques

Sales Manager: Julian Berry

Finance: Lorraine Kimble

Design and Layout: Diptesh Chohan

Regular Contributors:

Michael Grey

Felicity Landon

Ian Cochran

Margie Collins

Ema Murphy

Motoring Journalist: Rob Auchterlonie

Technical Editor: David Tinsley

Editorial contributors: The

Issue 106 The shipping business magazine for today’s global ship owners and ship managers Join the debate @ShipManInter Visit our website www.shipmanagementinternational.com Download our App Ship Management International

Printed in the UK by Warners Midlands plc. Although every effort has been made to ensure that the information contained in this publication is correct, Elaborate Communications accepts no responsibility or liability for any inaccuracies that may occur or their consequences. The opinions expressed in this publication are not necessarily those of the publishers. All rights reserved. No part of this publication may be reproduced whole, or in part, stored in a retrieval system or transmitted in any form or by any means without prior permission from Elaborate Communications.

Wingbury Courtyard Business Village, Upper Wingbury Farm, Wingrave, Bucks, HP22 4LW, United Kingdom

best and most informed writers serving the global shipmanagement and shipowning industry.

8 Ship Management International Issue 106 November/December 2023

Published by

Notebook

Training seafarers for a decarbonised future

Anew training project will prepare seafarers for zero or near-zero emission ships, helping the global shipping industry decarbonize and ensure a just transition for seafarers.

Research commissioned by the Maritime Just Transition Task Force identified that 800,000 seafarers may require additional training by the mid-2030s in order to operate vessels run on zero or near zero emission fuels.

With seafarers at the core of the shipping industry, this training is vital to ensure a successful and just transition to a new shipping landscape. The training framework, funded through the International Maritime Organization (IMO) and Lloyd’s Register Foundation, will equip seafarers with skills in decarbonization, and provide guidance for trainers and the industry.

The project is being announced at the 2023 UN Climate Change Conference (COP 28), meeting in Dubai, United Arab Emirates, from 30 November to 12 December 2023.

Preparing the entire shipping industry for the green transition is essential. The 2023 IMO Strategy on Reduction of GHG Emissions from Ships sets a common ambition to reach net-zero GHG emissions from international shipping by or around 2050 (taking into account different national circumstances); and a commitment to ensure an uptake of zero or nearzero GHG emission technologies, fuels and/or energy sources to represent at least 5%, striving for 10%, of the energy used by international shipping, by 2030.

Kitack Lim, Secretary General of the International Maritime Organization, said: “The milestone adoption by IMO of the 2023 Strategy on the Reduction of Greenhouse Gas Emissions from Shipping shows the member States’ clear commitment to transitioning the shipping industry to a decarbonized future. To do this, we need to ensure no one is left behind and we need to

commit to training the workforce so that they are ready. This collaborative project will help ensure a successful and equitable transition, harnessing the collective strength of the global maritime community.”

Ensuring a safe working environment for seafarers, as well as the effective management and operation of future technologies is at the heart of this project. The need for dedicated training has been identified by IMO and social partners. IMO is comprehensively reviewing and revising its key treaty for seafarer training, the International Convention on Standards of Training, Certification and Watchkeeping for Seafarers (STCW), with input from industry, and seafarers’ unions.

Ruth Boumphrey, CEO of Lloyd’s Register Foundation, comments: “Moving towards a lowemission future will require new green jobs and reskilling, and the global maritime industry is no different. Future alternative fuel technologies, such as hydrogen, ammonia and methanol, means there is a vital need to up-skill all seafarers. That’s why the work of the Maritime Just Transition Taskforce and its latest training framework is essential to ensuring seafarers have the right training and skills to work in a safe environment. It puts seafarers and communities at the heart of the solution as the industry works towards achieving its target for net zero emissions for shipping by 2050.”

The project will be run by IMO and the Maritime Just Transition Task Force Secretariat. Lloyd’s Register will develop the training framework for seafarers and officers, as well as an instructor handbook for maritime training institutions. The World Maritime University (WMU), an IMO global research, education and training institute based in Malmö, Sweden, will provide academic expertise. A large number of organisations are involved through a global industry peer learning group, which will provide important knowledge-sharing.

10 Ship Management International Issue 106 November/December 2023

Once developed, the Baseline Training Framework for Seafarers in Decarbonization will be first tested out in Asia through a programme led by WMU, with support from the IMO Maritime Technology Cooperation Centre (MTCC) Asia and other partners. Training materials will be developed for all seafarers and for officers. The aim is to then expand testing of the package globally with all the established MTCCs and other appropriate organisations.

Guy Platten, Secretary General of the International Chamber of Shipping, said: “2030 is just around the corner and we cannot be complacent about the needs of our seafarers and the appropriate training being in place to support them during our transitioning sector. Without our people we have no industry so seafarers should always be at the forefront of every decision.

“As we move forward into Phase II of the Maritime Just Transition programme, we must now all continue to work together and further build on the strong relationships formed in Phase I to ensure that our seafarers have the training they need.”

This package will be available to IMO Member States, for potential use by maritime education and training (MET) institutes to develop their programmes, as appropriate. A ‘train the trainer’ programme will also be developed to assist METs further.

The Maritime Just Transition Task Force was formed at COP 26 in 2021 by the International Chamber of Shipping (ICS), the International Transport Workers’ Federation (ITF), the United Nations Global Compact, IMO and the International Labour Organization (ILO). Primarily supported by funding from Lloyd’s Register Foundation, the taskforce has worked to ensure seafarers are put at the heart of shipping’s response to the climate emergency. The timeline is to develop the training materials by mid-2025. l

Notebook

11 106 November/December 2023 Ship Management International

Seafarer salaries have risen but welfare still falling short

Salaries are rising by at least 10% as the crew employment market tips in the favour of seafarers, reveals Danica Crewing Specialists as it announces the findings of its 2023 Seafarers’ Survey.

Across senior officer ranks salaries have increased some 10-15%, regardless of nationality, the Danica survey shows, compared to its 2021 results. Salary figures are particularly strong for the top four ranks on dry cargo vessels.

The wage gap is narrowing between Filipino and Eastern European officers, while Indian senior officers on dry cargo vessels are receiving salaries 10% higher than their Eastern European counterparts.

Salary rise is the most common reason for seafarers switching shipping companies, the survey indicates. Some 35% of crew who changed employer recently did so for a higher salary, although 26% moved for a more suitable joining time. And 98% or respondents said they check vacancies while on home leave.

Announcing the 2023 survey results during the Crew Connect Global Conference in Manila, Philippines – where Danica recently opened its latest crewing office – Henrik Jensen, CEO of Danica Crewing Specialists, said: “These are all indications that the crew employment market has tipped to be in the seafarers’ favour.

“We are witnessing a wage spiral like we saw leading up to the previous financial crisis. The root cause for these wage increases is the combination of a general shortage of very competent seafarers and a better financial situation for most vessel owners which is making employers more generous with remuneration,” he explained. “And, with a surplus of job offers, seafarers can afford to be picky.”

Seafarer shortages are more evident in certain ranks. The Danica survey identified bosuns, cooks and fitters as being in high demand, with salaries up 10% as a result, while Ukrainian fitters have had pay increases of up to 30% due to a huge shortage.

Seafarers remain largely satisfied with their careers at sea with 80% saying they would recommend their employer to a friend, while 50% would recommend seafaring to their children. But the lure of a shore position is also strong with 70% of respondents saying they would be interested in working ashore.

Worryingly the Danica survey revealed that as many as 36% of the respondents, drawn from the worldwide crewing marketplace, claimed their salary was not paid on time – a rise of 7% since 2021 – with 8% saying they did not receive their salary in full. Also, 23% of respondents said they had experienced a shortage of food or drinking water during their recent voyages.

Fortunately, the number of seafarers not being relieved on time has fallen to pre-pandemic levels (24%) – but that’s still almost a quarter of crew.

Other findings of the survey include that 5% of seafarers report having been bullied, 4% felt they had suffered discrimination because of race, and 1% suffered sexual harassment. Over 50% reported they had access to mental health support if needed, 70% finding this useful. Computerbased training was on the up, with 55% receiving this onboard and 60% during home periods, mainly on technical subjects. Internet connectivity at sea is now available to 96% of crew, up 6% from 2021, with 70% saying this access was free to use – a rise of 15%.

Mr Jensen commented: “Our survey revealed some interesting and surprising results which we hope will help our owners to enhance their marine crewing and HR strategies. We don’t claim this survey is representative of the whole industry or scientifically accurate but we do believe it gives a good snapshot of the seafarers’ situation in 2023.” l

Notebook 12 Ship Management International Issue 106 November/December 2023

ICS launches first ‘The Master’s Practical Guide to Maritime Law’

The International Chamber of Shipping (ICS) has launched its first edition of ‘The Master’s Practical Guide to Maritime Law’ as a simple and practical legal reference book specifically to aid seafarers with incidents at sea.

Co-authored with the International Federation of Shipmasters’ Associations (IFSMA), the guide is specifically designed to help Masters at sea identify and address common legal issues. As Masters are not qualified lawyers, the guide helps them understand how to manage legal risks and respond within the confines of the law to protect the interests of themselves, the shipowner and other crew members. With such high stakes, ICS believes it is crucial for Masters to have access to this one-stop-shop for practical legal guidance.

The detailed and practical guide bridges the gap between theory and practice by bringing real-world situations, both in port or sea, to life, helping Masters navigate common legal issues and pitfalls and assist in protecting the shipowner’s interests.

Guy Platten, Secretary-General at the International Chamber of Shipping, commented: "The current maritime operating environment is rapidly changing, and this comprehensive guide is vital to supporting seafarers with incidents at sea. This first edition specifically for seafarers is essential reading not only for seasoned Masters seeking to refresh their knowledge, but also Masters who are embarking on their very first voyage and would benefit from guidance through the legal intricacies within the maritime industry.

“Working so closely with IFSMA on this guide was crucial in ensuring that the guide addresses the key legal issues commonly facing Masters today and provides comprehensive guidance in an easy to digest way.”

‘The Master’s Practical Guide to Maritime Law’ encompasses a wide range of subjects: with

each chapter, Masters will gain a comprehensive understanding of their rights, responsibilities and obligations under maritime law from the start of a voyage until the end. It covers the legal responsibilities in areas such as ship documentation, contractual relationships and commercial responsibilities for carriage of cargo, as well as dealing with crimes on board and local legal enforcement. The guide also explains the international conventions that underpin the global maritime legal framework, for example on pollution regulations.

Serving shipmaster Martin Bjorkell, who contributed to the guide and recently presented on it at the IFSMA Biennial General Assembly in Tokyo, said: “This guide will prove invaluable for our industry and help Masters know how to approach legal issues effectively, highlighting best practices and providing expert guidance on managing legal risks, with particular emphasis on the commercial aspects that form a significant part of every Master’s responsibilities on board. We wanted Masters to feel empowered to make informed decisions on matters that might have legal consequences to ensure the safety of the crew, ship, environment and cargo.”

The guide is valuable for a wide array of individuals working across the whole industry including chief officers, shipowners, P&I clubs, officers in training and training institutions.

While the guide strives to offer a comprehensive overview on legal issues which the Master may encounter, it does not replace the need to obtain professional legal advice in the relevant jurisdiction particularly when the Master and shipowner is faced with legal challenges beyond the scope of the guide.

For more information and to pre-order ‘The Master’s Practical Guide to Maritime Law’, please visit: https:// publications.ics-shipping.org/single-product.php?id=91 l

14 Ship Management International Issue 106 November/December 2023 Notebook

Six out of 10 investors mull divestment from maritime amid ESG concerns, finds report

Sustainability and communications consultancy

Woodrow has published a report showing that 64% of senior finance professionals in the UK are contemplating reducing their investment in the maritime sector because of Environmental, Social, and Governance (ESG) risks. The study offers insights into how ESG considerations are impacting decisions in capital markets.

The report sheds light on key areas of ESG risk perceived by lenders and investors, including labour rights, climate change and regulatory compliance. It also assesses risk perceptions in specific maritime sectors such as shipping, ports and terminals, and offshore activities like drilling.

The survey engaged 100 senior finance professionals from various segments of the UK capital markets, including commercial and investment banks, asset managers, development and multilateral banks, as well as private equity firms.

ESG factors are increasingly instrumental in shaping a company’s financial future. In the maritime sector, issues like poor wastewater management affecting biodiversity, or subpar working conditions on ships, carry potential regulatory repercussions and reputational damage. These are not just ethical concerns but critical factors that investors, lenders and underwriters are incorporating into their capital allocation strategies.

Given the capital-intensive nature of maritime activities—ranging from shipbuilding to pioneering new fuel technologies—secure access to financing is crucial, heightening the need for effective ESG risk management.

Two-thirds (66%) of respondents believe that the maritime sector faces greater ESG-related financial risks compared to other industries. This perception is particularly strong among those managing debt capital (73.5%) and among large institutions with assets under management (AUM) ranging from £10 billion to £100 billion (75%).

Perceptions differ according to the type of financial institution and its exposure to maritime assets.

Investment banks were the most concerned (83.3%), whereas multilateral banks and IFIs were less aligned, with only 40% sharing this view. High maritime exposure led to higher concern (69.7%), compared to limited exposure (52.9%).

The report unveils widespread scepticism about the maritime sector’s ESG awareness and transparency, with 57% considering the sector less aware and 56% criticising its transparency. This scepticism is heightened among those handling equity capital – 66.7% questioned the sector’s awareness and 64.1% its transparency.

The type and size of institutions influenced these perceptions. Larger institutions (AUM between £10-£100 billion) generally agreed with these negative views, while smaller institutions (AUM < £1 billion) were less convinced.

Survey participants cited several areas of ESG vulnerability for maritime assets, with worker conditions and safety at 38%, technological disruptions at 34% and climate impact at 33%. Concerns varied depending on the type of capital managed and the level of maritime exposure. Equity managers prioritised climate impact (38%), while debt managers focused on biodiversity (41%). Those dealing with hybrid capital expressed most concern about technological disruptions (41%) and water management (44%).

Henry Kirby, head of Woodrow’s sustainability practice, said: “This report reveals a paradox: while capital markets consider the maritime sector to be ahead in managing ESG risks, they also find it lacking in transparency and slow to integrate sustainable practices. This inconsistency is alarming, particularly when a majority of financial institutions are mulling over divesting from or reducing exposure to maritime assets due to ESG concerns.

“The way forward involves two key shifts: maritime companies must improve their disclosure and be more forthright in engaging stakeholders, while investors and lenders should apply a more discerning lens when evaluating maritime risks and opportunities.” l

16 Ship Management International Issue 106 November/December 2023 Notebook

Rafael Fernandez elected as next ISSA President

Rafael Fernandez from Spain has been elected as the next President of the International Shipsuppliers & Services Association (ISSA), the global trade body representing the interests of 1,500 ship suppliers around the world.

The 40 National Associations of ISSA, who form the ISSA Assembly, elected Mr Fernandez during a vote prior to this year’s ISSA conference in Dubai.

Mr Fernandez has sat on the ISSA Executive Board for 12 years, and will take over as President from January 1, 2024.

Speaking after his election, he praised the work of the outgoing President Saeed Al Malik, saying he had created a strong foundation from which to grow ISSA.

“I am delighted to have been elected as the next ISSA President and I will work hard to ensure that ISSA continues to represent the interests of this very important global maritime sector.

“Global trade needs ships and ships cannot travel without being supplied so the work of our members is vital around the world, and I will continue to work with our fellow international ship owner and ship manager trade associations to ensure the voice of the ship supplier is heard.

“I am delighted to announce that the venue for next year’s ISSA Convention will be in Seville in Spain and we look forward to welcoming ship suppliers as well as owners and managers to that event,” he said. l

Notebook

EU ETS – do you feel secure?

By Robert Hodge

By Robert Hodge

ITIC wrote an article for SMI in January 2022 critiquing draft legislation coming from the EU on the upcoming EU Emission Trading Scheme (ETS). This legislation, in part, sets out which party would ultimately be responsible for the payment (or nonpayment) of emission allowances. At that time, it placed that responsibility squarely at the feet of the Document of Compliance (DOC) holder. This was a crazy proposition, considering the manager has no control over the commercial operation of the ship, and it did not follow the usual principle that the polluter pays. A failure to comply could result in fines (EUR 100 per tonne), detention or, at worst, the blacklisting of an entire fleet from EU waters.

Thankfully, the position has changed and the legislation now being considered states that the responsible entity will be the registered shipowner.

The shipowner will then be able to transfer responsibility to the DOC holder or a bareboat charterer by a written agreement.

ITIC is on the BIMCO drafting subcommittee of the new version of SHIPMAN, which is planned to be published early next year. Much of the subcommittee’s work to date has been spent on a new ETS clause (which, at the time of writing this article, had not been finished, but is hoped to be approved and released before the ETS deadline of 1st January 2024).

There are three scenarios which are envisaged. In the first, the shipowner remains the responsible entity for the surrender of the emission allowances. It is likely that

larger shipowners who have the ability and the capacity will want to keep the responsibility within their control. However, the manager will remain crucial to the owner as they have to provide the emission data to the owner so they can calculate and surrender the allowances.

In the second scenario, the owner retains responsibility but engages the ship manager on a consultancy basis to collect the emission data, arrange for it to be submitted and range for the payment of the allowances.

The third scenario is where the owner transfers the responsibility to the manager by a strict written mandate. Amongst the requirements for the mandate are that it must be an original signed by both the shipowner and the organisation assuming responsibility for compliance, or if a copy is provided, it must be certified as a true copy. This scenario is the riskiest for the manager as the credit risk will be significant. Many owners will not want to pay the manager in advance, but only on actual emissions and paid for in arrears. If this is agreed upon, the contract must be explicit on the financial security for the manager. This could be a cash deposit or issued as a number of allowances to be held on account (such as 45 days of allowances for the ship at full steaming).

ITIC’s advice at this time is that if ship managers are not totally satisfied they have adequate financial security, they should not agree to be the responsible entity and only agree to assist the owner in their compliance with the scheme. The credit risk and penalties for noncompliance are just too onerous. l

20 Ship Management International Issue 106 November/December 2023 Notebook

InterManager Outlook Measuring milestones as we plan for tomorrow

AInterManager Secretary General Kuba Szymanski looks back on an eventful 2023, and forward to 2024.

s this year draws to a close it is useful to take stock and look back on some InterManager milestones. Foremost of these is the launch of our new General Principles of Conduct and Action. These groundbreaking principles will undoubtedly raise standards in our sector and give the wider shipping industry a means by which to evaluate our services.

Ship management is evolving and today our members offer a wide range of added value and bespoke services which provide ship owners and operators with a myriad of opportunities and methods to streamline their operations in a sustainable way.

The shipping industry is moving steadily towards a more sustainable, efficient and environmentally friendly future.

This year the International Maritime Organization achieved unprecedent agreement from all its member states to adopt ambitious new decarbonisation targets. InterManager was present at these crucial debates, representing our members’ point of view and working with stakeholders and industry groups to ensure proposals are practical and workable.

InterManager continues to work closely with the IMO. We welcome the appointment of Arsenio Dominguez Velasco to the role of Secretary-General and look forward to enhancing our working relationship with him and his team. InterManager is pleased to be the record keeper for a range of industry statistics, particularly relating to lifeboat safety and deaths in enclosed spaces, and we take an active role in working groups which aim to update and improve IMO legislation to protect seafarer health and wellbeing.

The turn of the year heralds a new challenge for ship operators – that of implementing the European Union’s Emissions Trading Scheme. On behalf of its members, InterManager engaged in high-level discussions to influence

and inform decision makers, also seeking legal advice to ensure the scheme has the best chance of achieving its environmental objectives in a practical way. We will be monitoring how the scheme operates in 2024 and will provide a platform for members to raise concerns and speak out. As our President regularly reminds us, by speaking with One Voice we speak louder and have more influence!

Although small, InterManager’s secretariat is extremely active on our members’ behalf. We engage in industry dialogues, attend - and even chair - stakeholder groups, and also campaign on key issues. Our members are themselves proactively involved in sharing information and best practice and it is heartening to be part of email discussions where members raise an issue and share their experiences to identify solutions – something which happens on a regular basis.

Looking forward to 2024, we will begin the year with our Annual General Meeting which is being held at the IMO’s London headquarters on Thursday 18 January. We look forward to welcoming many members and associate members, as well as invited guests and industry colleagues to take part in our conversations. Contact me if you would like to attend or for information about how to become an InterManager member.

Meanwhile I am pleased to report that our members are already putting into action our General Principles of Conduct and Action. We have several firms currently undertaking the self-assessment process and we urge all our members to endeavour to complete their first assessment by April to enable everyone to begin this shared journey towards high standards in a sustainable, efficient, and transparent way.

I wish you a Happy Holiday Season and a successful New Year! l

22 Ship Management International Issue 106 November/December 2023

How I Work

SMI talks to industry leaders and asks the question How do you keep up with the rigours of the shipping industry?

Peter Smit

Joint CEO of BCS Group – Boers Crew Services

Growing up in Rotterdam, home to Europe’s biggest port, working in the maritime industry was always an ambition for Peter Smit, Joint CEO of BCS Group – Boers Crew Services.

Mr Smit worked for many years as an independent boardroom consultant where he advised companies on how to get the most out of their business by streamlining and improving their IT processes, many of is clients being companies within the maritime industry.

It was through this work that he met Hans Boers whose grandfather started up the company as a taxi firm for seafarers in the 1940s, for whom he first carried out some consultancy work 11 years ago. At the time the company was open to further investment to help advance it to the next level, and Peter was struck by the Boers’

work ethic, culture and passion for the shipping industry and its crews, prompting him to invest in a 50% share of the business.

“It had such a family feel and was very open and transparent which I loved,” he recalls. “It was also a ‘doing’ company in that it just got things done. I was immediately impressed with what it offered and had already achieved, and I recognised the potential growth and where it could go with two partners at its helm. Hans and I work very well together and we have both brought our family members onboard to help us grow the company.

“But it’s not just working with our family that gives it a family, welcoming feel,” he continues. “ We treat everyone the same, so if I was having a meeting with my daughter we can both be open and honest and say whatever we are thinking, we also extend that respect to all staff members. Everyone is treated with respect and integrity and they are given the opportunity to be completely open and honest with us.”

Having the right team in place in also something Boers prides itself on. “We are very strict in whether an employee is the right fit for us. If we don’t feel it is right for us and the employee then we will let them go. We are a very caring, flexible employer so we look after our team and they know they are part of the Boers family,” he adds.

As Joint CEO, Peter Smit sees his responsibility as being problem-solver and decision maker when tough calls need to be made. He is responsible for the strategy and vision for the businesses. He says no two days are the same: one day he could be facilitating a last-minute visa application, and the next he could be closing on a new business deal or speaking at top-level conferences about the importance of ensuring the journey of a maritime professional is as seamless as possible for them.

He recently participated at CrewConnect’s Fireside Side Chat panel when he joined other key players in the industry to discuss decarbonisation, crew welfare, operational efficiency and the strategic measures that are going to be needed over the next five years.

He believes it is crucial that the industry looks not only at the problem of attracting seafarers but also at their retention to try to alleviate the issues stemming from crew shortages.

25 106 November/December 2023 Ship Management International

“We should be looking at why we are not keeping people at sea for long periods of time,” he says. “It seems people are gaining their training or qualifying as a Cadet but then do not last at sea for a long time. I think we need to focus on getting the right people in the job, ensure they are well paid and treated fairly… and not only fairly, treated well. That is a combination of good wages, no delays in the journeys to and from the ship, good connectivity and entertainment onboard.”

Boers has recently held its own event in Manila for the second year running where it partnered with KLM Royal Dutch Airlines, for manning agency staff, travel agents and other interested parties to discuss and share best practice over how to ensure a smooth transition process for crews.

The company has also reaffirmed its commitment to Filipino seafarers with plans next year to open an office in Manila where it will have a direct presence for crews based in Manila and will be able to work with authorities there to facilitate visa applications, which can be a complicated and complex process for the Schengen visa.

Looking back over the last five years, Mr Smit says by far the biggest challenge the company has faced was the Covid pandemic, which saw

Boers show steal a march on some competitors by doing everything it could to ensure seafarers could still travel. This despite authorities around the world either closing ports or introducing entry measures to prevent potential coronavirus carriers from entering their country, resulting in huge challenges in facilitating crew changes.

Mr Smit says Boers certainly rose to the challenge and proved itself as a company that will always go the extra mile, whatever the obstacle. While seafarers were struggling to travel with airlines cancelling flights across the globe, Boers worked with ship owner clients who had arranged charter flights to take seafarers across Europe. The company contacted other

clients who needed to move crews and managed to fill flights, thereby reducing the cost to the original aircraft chartering company.

“Nobody could travel, and seafarers need to travel to get to the vessel and then home again, and we really had to think about what we could do,” he remembers. “We came up with the idea of working with clients to charter our own planes, so that’s what we did and we were able to move crews around. Dealing with all the different restrictions in different ports was extremely challenging, but we are specialists so by utilising our contacts, knowledge and expertise, we were able to help companies who were really struggling.”

Boers Crew Services offers an end-to-end solution when transporting shipping crew members to and from ports in The Netherlands, Belgium and Germany, dealing with everything from entry visas to medical services, hotel bookings and transport services.

During his downtime, Peter Smit is a keen sportsman enjoying regular family skiing holidays to Austria. And after playing tennis since his early childhood, in the past three years he has taken up the emerging racquet sport of padel – a cross between tennis and squash - which he now plays two or three times a week. l

How I Work 26 Ship Management International Issue 106 November/December 2023

Bjørn Martin Klokkernes CEO, Star Information Services

Bjørn Martin Klokkernes CEO, Star Information Services

Bjørn Martin Klokkernes, CEO of Norwegian-based enterprise asset management specialist Star Information Services (STAR), is a firm believer in the need for a generational shift in digital technology skills - just as the experienced heads in the industry are approaching the twilight of their careers.

There is a pressing need to retain that deep wealth of industry knowledge acquired over decades by transferring and combining it with the new generation of digitally savvy young talent that holds the keys to future technological developments and operations, he reckons.

“We are seeing a clear trend in how the future of asset management and organising maintenance will change, as the supply chain will be handled very differently from today,” says Klokkernes.

“What is important in a transitional stage is to make sure that the whole organisation is also following. It is so easy to focus only on the generational shift in technology. However, organisations need to ensure the entire company grows together with new technology. For us, we need to make sure our

knowledge and know-how change at the same speed.

“We need to make sure that people are aware of the new technology, what needs to be done when it comes to knowledge sharing, and what kind of new skills we need so the organisation grows together with the new technology,” he adds.

Star Information Systems AS was established 25 years ago in the Norwegian university city of Trondheim and with offices also now in Singapore and Rio de Janeiro it has grown globally as a provider of software systems that enable the tracking and management of assets across the maritime and energy sectors, such as equipment on vessels or rigs, machinery and property, as well as workforce scheduling.

These systems provide a range of benefits for operators, ranging from enhanced and predictive maintenance planning, optimised performance, increased efficiency, improved safety and sustainability reporting, as well as better cost control.

“Over the last two years, we have worked hard on the technical side by developing an optimised system for the longer term with our new STAR Suite platform. But we have also focused on

recruiting new people to follow these market trends,” says Klokkernes.

“When you look at the market today, particularly on the shipping side, it is mainly staffed by an older generation of people used to working in a certain way. But we are heading in a different direction, with the development of new technologies and digitalisation.

“The generational shift in skills, including on the clients’ side, is starting to change the way the industry operates. Younger people are using more digitalbased products, mobiles, apps, and different types of screen displays. We also need younger people in our organisation to develop, produce, install and maintain these systems.”

STAR’s main office in Norway’s technology capital Trondheim allows for a close connection to Scandinavia’s largest independent research organisation SINTEF and the Norwegian University of Science & Technology. This position gives the company a front-row seat when it comes to new developments, and this includes Norway’s leading role in the march towards autonomous shipping.

“When you look at the shipping industry for the next 10 to 15 years,

28 Ship Management International Issue 106 November/December 2023

How I Work

everything will change when it comes to fuel and energy sources, and the use of autonomous vessels will inevitably become more common, posing the question - how are you supposed to handle maintenance on board a ship with no people on board?” continues Klokkernes.

“How will you plan for that when the ship is coming to the harbour? Everything needs to be ready and in place regarding scheduling, suppliers, parts and equipment. That is something we are preparing for and providing with STAR Suite, to make the whole maintenance planning cycle much easier for the future,” he adds.

Today, most of the maintenance and planning is done by the crew on board. However, Klokkernes points out that some of the equipment on board will get so complex the crew will not be able to manage it, even in person. “You will need third-party suppliers looking after maintenance, for example,” he says.

STAR has designed its platforms to allow for seamless and automated updates for operators, and under Klokkernes the company itself has been moving in that very same direction.

‘We have solid expertise gained over many, many years but our knowledge is not worth anything if it is not transferred to younger people,” he says. “The person we recruit now is the person who will be part of STAR for the next 10 to 20 years and our own next generation.

“It is hard for small companies to attract students as we are competing against the giants such as Apple and other big international players, but one way we can attract young people is to offer them the chance to be part of a company that will give them the opportunity to shape it.

“There is a genuine opportunity to add something tangible to

our growth, by being part of the whole reach, directly involved in the concept, R&D, the product, the client, the market, the whole A to Z,” adds Klokkernes.

STAR is very clearly staking its claim as a key player in the generation game, with its focus on providing seamless updates to the technology and the skills required to benefit the industry far into the future. Klokkernes himself can be considered part of that generational shift since aged 42 he took over heading up the company from

58-year-old former CEO Anders Koien in December 2022, having previously served two years as COO.

Before that Bjørn Martin spent 16 years with the consultancy industry, 10 years within Global Fortune 500 Companies, and he holds a formal background as a technician within the field of automation and a double major in Management from Queensland University of Technology. He is also an entrepreneur, investor and co-owner in a Food Tech company, describing himself as: “Driven by people, business development and growth!” l

29 106 November/December 2023 Ship Management International How I Work

Connected

Star

Systems helps organisations track

manage their physical assets worldwide

Knowledge sharing - STAR is ensuring transfer of know-howacross the entire company

-

Information

and

P&I and Law Combatting evasion of maritime sanctions

A new era of sanctions compliance challenges has arisen in recent years, along with a notable increase in deceptive shipping practices (DSPs), particularly in the form of AIS spoofing and dark fleet activity. Noyonika Bhaduri, CMO at Pole Star, in conjunction with Blackstone Compliance research, explains how it is possible to comprehend, detect and mitigate these practices.

The implementation of Russia-related sanctions and a price cap on the sale of Russian oil and petroleum products has led threat actors to turn towards more sophisticated forms of sanctions evasion. Their aim is to deceive authorities and financial crime compliance programs via the creation of a shadow economy that operates outside of the confines of US, UK, EU, and G-7 law.

Sanctions targets require access to allied countries’ markets, including commodities traders, financial institutions, flag registries, and ship charterers (‘covered persons’) – all of whom have compliance obligations, including those relating to the price cap on Russian oil.

The Office of Foreign Assets Control (OFAC) and other sanctions authorities have outlined an attestation process to document that Russian oil sales are within the Price Cap. However, this is not a mere record-keeping problem. The current price cap for oil leaves very little room for margin, meaning threat actors may attempt to falsify documentation, pass goods off as being of non-Russian origin, or violate other sanctions outside the Price Cap - such as acting on behalf of a blocked party or attempting to export oil to an allied country.

30 Ship Management International Issue 106 November/December 2023

The authorities have therefore warned covered persons to be aware of evasion attempts. For instance, in April, OFAC singled out P&I clubs, ship owners, flag registries, and commodities brokers to remain vigilant for DSPs as evidence of sanctions evasion.

In addition, the UK’s National Crime Agency has warned the wider financial community that sanctions targets may use proxies and enablers to gain access to the financial system - access they would otherwise be denied. This advice is equally applicable to the maritime industry.

Dark fleet activity

There are two primary methods emerging for sanctions evasion: the ‘dark fleet’ and ‘AIS spoofing’.

The dark fleet is a fleet of tankers owned and operated by persons outside of allied jurisdictions. These tankers – estimated to number around 600 vessels globally - are acquired for trading with Russia or other sanctioned countries. Owners will go to great lengths to disguise their stakes in these vessels.

That said, dark fleet vessels are not used exclusively for sanctioned trade – and not all vessels will therefore present the same level of risk. For instance, they may be shipping oil within the confines of the Price Cap. However, they do present an increased risk to covered persons. Covered persons should therefore proceed cautiously when dealing with a dark fleet vessel and conduct enhanced due diligence on the provenance of the cargo, the buyer and the seller.

Determining whether a vessel is part of the dark fleet is a subjective process. A number of criteria and factors must be considered before a ship can be categorised:

• Ownership: A vessel’s owner may be tied directly to Russia, Iran, or Venezuela. Likewise, threat actors may attempt to obfuscate their interest by owning the vessel through shell or front companies, or by making rapid changes to a vessel’s declared owners and operators.

• Movement: Dark fleet vessels may frequent Russian or sanctioned ports with deliveries to non-allied countries, and/or conduct ship-to-ship transfers in known high-risk zones, such as those used off the coast of Greece.

• Deceptive Practices: Consideration for vessels who engage in AIS spoofing or who opportunistically turn off their AIS transponder with the intent of avoiding sanctions.

• Timing: The timing of a vessel’s ownership change may indicate an intent to evade sanctions. For instance, moving vessels to new owners directly after the Russian price cap was passed. Likewise, if a vessel makes its first voyage – or routinely makes the same voyages – to Russia or a sanctioned country, this may indicate the vessel was purchased for sanctioned trade.

• Fleet coordination: Consideration of a vessel’s changes in conjunction with other vessels owned or operated by the same person. If a fleet of vessels change their flag simultaneously or incorporate into a new high-risk jurisdiction, this may signal that the owner and operators intend to misuse the vessel.

Finally, covered persons should also be aware of the increase in pop-up P&I clubs, outside of the recognised International Group consortium. Thorough and intensified due diligence on the vessel’s owner, operator, or charterer, as well as the source of the cargo, is recommended.

AIS spoofing

Spoofing was once considered a minor part of maritime sanctions evasion, but in the past six months, the practice has surged ahead to become the predominant form of evasion – at least for vessels carrying high-value cargoes such as oil and petroleum products.

In the past, high-risk countries would simply prohibit the export of AIS data, and compliance officers denied access to AIS information. These gaps in AIS coverage were easy to spot. In reaction, there’s been a major shift toward deceptive strategies, which is the provision of false AIS information. That is, inaccurate positional and navigation data is given, making a vessel appear where it is not.

This presents a far more difficult problem for the maritime community to tackle because threat actors have access to a broader range of spoofing techniques, and maritime intelligence firms will need to keep up with those tactics to counter them. OFAC recommends insurers, flag registries, and ship managers turn to “maritime intelligence services to improve detection of AIS manipulation”.

False AIS data can be uploaded through a variety of means and can be targeted towards individual AIS ground stations and data providers, or through radio frequency broadcasts targeting satellites.

31 106 November/December 2023 Ship Management International P&I and Law

Typically, an AIS position is broadcast from a vessel’s transponder, which is then received by either a terrestrial ground station (T-AIS) or an overhead satellite (S-AIS). This information is then transmitted digitally – such as through an API – to either an AIS aggregator or directly to a maritime intelligence provider.

A threat actor can insert its false data at any point in this chain. Yet, with the right security protocols or an automated ability, receiving sources can discriminate between valid and invalid transponders.

In general, spoofing can be categorised into four typologies, each having distinct signatures:

• ‘Anchor spoofing’ simulates the vessel remaining in the same place for impractical amounts of time. The vessel may appear to be at anchor or may look like offshore storage. However, a review of the vessel’s signal activity or use of human or imagery sources allows us to confirm that it is not the transmitted location.

• ‘Circle spoofing’ describes a situation where the vessel moves in geometric circles at a set location. Circle spoofing is generally used closer to shores and ports over a few days to a week - which is enough time to visit a sanctioned port and return to the station.

• ‘Slow roll spoofing’ is when the vessel pretends to be moving in a general direction of travel at very slow speeds.

This movement will lack an economic purpose and/or be inconsistent with local traffic patterns.

• ‘Pre-programmed route spoofing’ is the most realistic technique used. The vessel is programmed to travel along feasible routes. This requires either duplicating or sourcing past AIS data to successfully mimic the vessel’s movements, or more careful planning is used to ensure that the route appears to have an economic purpose. This methodology is hardly infallible but is difficult to identify based on a visual inspection of the underlying data.

In conclusion, the threat of maritime sanctions evasion has increased tremendously over the past year. We are now seeing the wholesale creation of fleets for side-stepping allied sanctions, a drastic increase in AIS spoofing and more complex forms of maritime sanctions evasion.

With the threat environment only likely to increase; the onus is on covered persons and those involved in sanctions enforcement to conduct enhanced due diligence on all transactions involving potential dark fleet vessels and eschew – if possible – transactions involving the highest risk fleets, jurisdictions, flags, and classification societies. Working in partnership with providers of maritime intelligence services will be key to ensuring the most up-to-date data is used as part of this due diligence. l

P&I and Law

Ship Management International Issue 106 November/December 2023

Dispatches

EU ETS enters into force

There’s been a lot of scaremongering and speculating air as the European Union’s Emissions Trading System (ETS) becomes applicable to the shipping industry from January 2024. Felicity Landon navigates some of the complexities.

Exaggeration and exasperation are in plentiful supply over the entry into force of the EU Emissions Trading System (ETS) from January 2024. And while many of these dramas will not come to pass, some bizarre fallout is indeed likely to take place.

In terms of unintended consequences, there were fears of a dramatic defection by container lines from EU transhipment hubs to hubs just outside the EU bypassing the southern EU ports in the Med – or at least a reordering of port calls so the main part of the voyage would be between two non-EU ports. These concerns were addressed (or partly deflected) when the European Commission set out criteria in November which designated Tanger Med and East Port Said as official neighbouring container transhipment ports and therefore included in the ETS regime. But should we be watching (as an example) post-Brexit Felixstowe for signs of higher transhipment volumes for EU-destined cargoes? Some say so.

And then there is the money. Contrary to the suggestion that all ETS charges will pour straight into EU coffers, in fact there are random national winners here. Cyprus, Greece, Germany and the Netherlands – more of which later.

To recap, from January 2024, the EU ETS will cover CO2 emissions from vessels of 5,000 gt and above entering EU ports, regardless of flag. Emissions data must

be recorded, verified and reported for every ship calling at an EU port from 1 January; EU Allowances (EUAs), or carbon credits, must be purchased and surrendered for these. The first bills must be settled by 30 September 2025, the deadline to submit the first ETS allowances for emissions reported in 2024.

Not all emissions are equal. Shipping companies must purchase EUAs for 100% of emissions from voyages between EU ports or for ships docked at an EU port; for voyages between an EU and non-EU port, it’s 50%.

The system is being phased in: in 2025, 40% of emissions reported for 2024 must be covered by EUAs; in 2026, it’s 70% of 2025 reported emissions; and in 2027 and beyond, it’s 100%.

Shipping companies must put in place admin systems to track CO2 and other emissions, determine the volume of EUAs needed to cover these emissions, and assign the cost of the EUAs to stakeholders in order to manage their liabilities.

The uncertainty and complexity is compounded by the fact that EUAs are traded on the free market and therefore subject to price volatility.

PASSING ON THE COST

The ETS is not new. It was introduced in 2005 and already covers power stations, chemical plants, airlines

34 Ship Management International Issue 106 November/December 2023

and other sectors. It’s well established, tried and tested. Now ship owners and operators must also comply. It’s time to pay for their carbon… and the costs will be passed on.

‘Esteemed customers’ have been receiving notices from shipping lines of new charges to cover the ETS dues.

For example, Evergreen published a range of ETS surcharges according to trade route and dry/reefer box, ranging from €9 to €53 per teu, with the Asia-Europe bill being €27 (dry box) or €41 (reefer) per teu. CMA CGM has indicated a €25 per teu surcharge for Asia-Europe. Maersk has predicted as much as €70 per teu; HapagLloyd has quoted €12 per teu. Project/heavy lift carrier AAL announced it would calculate an ETS surcharge based on estimated/actual voyage emissions, quoting this separately from normal freight rates. Analyst Alphaliner has noted: “It remains to be seen if the surcharge will be used by lines as a competitive tool.”

Is the industry prepared?

Martin Crawford-Brunt, CEO at Lookout Maritime and Decarbonisation Lead at the Baltic Exchange, said: “My reflections are that the shipping industry is very unprepared in general for the ETS. There are two very distinct groups;

at one end of the spectrum, large trading companies/ cargo interests that have been doing this for some time and understand carbon pricing, who are well prepared and looking to minimise the cost of exposure; and at the other end, companies in Japan and the Middle East who haven’t heard of it, or are only scrabbling around trying to understand how it works. Between these two extremes, you have shipbrokers trying to help, you’ve got carbon specialist companies trying to offer support. I don’t think it’s going to be a very smooth entry.”

At a press day in London at end-November (2023), Albrecht Grell, managing director of OceanScore, which offers an ETS management solution, gave his views on the challenges, alongside Matthias Blöte, Director Finance, Controlling & Corporate Development at Peter Dohle Schiffahrts, which is working with OceanScore.

COMPLEX FRAMEWORK

Blöte described ETS as ‘the challenge of the day’ and pointed out: “We have a vessel starting its

Dispatches 35 106 November/December 2023 Ship Management International

voyage today which will run into next year, so we already need to think about this today. It is a relatively complex framework which you need to understand, first of all. We have the ability to understand complex structures but still it is a new kind of dimension. We need to ensure we comply with the processes in all departments, including technical and commercial, and we need to make sure we have the right data.”

However, he said, despite discussions, workshops, training and preparation, “there are still a lot of uncertainties in the regulation itself, as some member states are waiting for exemptions and some member states have not ratified the directive”.

Add that to the complexity of an international shipping company – some vessels trading in the EU, some not; different ownership structures and charterers – and the challenges are considerable. “Have we done everything we could? Yes, we have tried. And we wait for the regulators to do the rest.”

The EU regulation has to be translated into national law and that has not happened in most cases, said Grell. “It isn’t necessarily a legal issue but it feels much better if you know the laws of your country protect you. There is a complex legal structure behind it. It is all doable but how much money do you want to spend on lawyers?”

At the time of writing, how many charter parties had been agreed that take in an ETS clause? Not the majority, he said.

But overall: “It is always easy to moan that shipping isn’t ready but in this case it isn’t shipping’s fault.”

The container ship sector is the most exposed, likely to be liable for 28% of the total EUAs required by the industry, said Grell. That’s because of the vessels’ size and speed. However, the most expensive according to vessel type will be ro-pax and cruise ships. “Cruise ships have a huge consumption, €500,000 per average vessel and up to £12 million for the highest cost.”

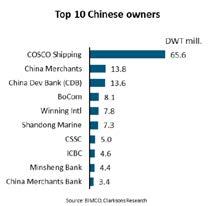

It’s estimated that 40% of EUAs will be provided by nonEuropean owners or managers, with China and Singapore both high payers, he noted.

WHERE WILL THE MONEY GO?

Whichever way you look at it, shipping companies are facing significant financial exposure from the introduction of the ETS, said Grell, and this will be further fuelled by carbon price volatility and the threat of fines for non-compliance. “The bill will be substantial,” he added, suggesting it could equate to €6.5 billion annually by the time of full implementation in 2026 based on current prices.

And so to the proceeds of the ETS. Ten per cent of the total will go to an EU fund for sustainability projects for shipping. Ten per cent goes into the EU’s social fund, for distribution. The rest – 80% – goes straight into national state coffers, based on some complex workouts. First, the money is allocated according to where the shipowner is based in the EU or where the manager responsible for ETA compliance is domiciled. Second, if the owner/manager is outside the EU, the funds go to the state according to which port the vessel has made the most port calls at in the past five years. The Netherlands looks like a strong winner here. There might be an incentive for states to attract more calls to a particular port in the hope of bringing in more money for the treasury, Grell agreed.

Meanwhile: “Cyprus wins because it is a very strong shipowning country. Also, if a shipmanager runs the scheme for you, the charterer has to surrender the EUAs where the manager is domiciled. Of the 80% of receipts, the biggest recipients will be Greece and Germany and the biggest surprise winners will be the Netherlands and Cyprus.”

Demonstrating compliance with the EU ETS is important but many people are missing an important risk factor, said Crawford-Brunt – “the reputational risk of being associated with counterparties that don’t conform”.

In addition, as pointed out by Jason Clausen, performance director at NAVTOR, the ETS is based on a cap-and-trade principle, which limits the amount of GHG emissions in the system, ensuring shipping or other companies can’t just ‘buy themselves out of trouble’ by paying for ever-increasing pollution. “Over time the cap will be reduced, with the cost of allowances rising,” he said. In other words, shipping will have to compete for EUAs even as their availability is to be reduced.

Clausen also noted: “It’s not vessel ownership that matters when it comes to paying for allowances [EUAs], but rather which party provides and pays for fuel. Owners therefore need to ensure they deliver reliable, validated vessel emissions data to charterers in a timely manner. But, to do that, we come back to the need to have a robust, reliable, real-time monitoring and management system.”

It is going to be an ‘expensive and risky environment’, said Albrecht Grell. “Every manager and owner will need to make sure they are not left to procure EUAs that the vessel’s operator should have provided. That is the number one risk to mitigate.” l

Dispatches 36 Ship Management International Issue 106 November/December 2023

Europe’s road to decarbonisation will

be imperfect,

but crucial for global shipping

By Harriet Robson, UK Director, Transparensea

As Europe’s maritime industry takes its first steps into the EU ETS era, we will see a patchwork of fuels and technologies emerge. Limited fuel availability means that the situation will be imperfect, but it doesn’t mean that companies can’t make the transition work for their fleets and operations. Their experience will be watched closely, helping set the tone and direction for shipping’s decarbonisation globally.

A fundamental truth of shipping’s decarbonisation transition, in Europe and elsewhere, is that it will inevitably not be perfect. Supplies of purely green marine fuels will remain scarce for a significant time to come, and we will need to overcome technical and supply challenges before we can get new fuels on board ships at any meaningful scale.

Recognising this shouldn’t discourage action but should spark transparent conversations in the industry to help inform the way forward. EU regulation clearly incentivises the shipping industry to reduce its greenhouse gas emissions in the short term. Following the expansion of the EU Emissions Trading System (ETS) to the maritime sector, companies will have to pay for their ships’ carbon emissions from 2024, while FuelEU Maritime will introduce requirements on the emission intensity of the energy used on board ships from 2025.

For a number of shipowners, compliance will be achieved through one-off bunkering’s, often with partial volumes, mass balancing and carbon offsets – which do not always reflect the full picture from well to wake. This will be reality for the foreseeable future. As DNV’s latest Maritime Forecast to 2050 highlights, shipping would need 30%

to 40% of the estimated global supply of carbon-neutral fuels to meet the expected demand by 2030 in line with the IMO’s current GHG strategy – and this is not counting competition with other industries for access to those fuels.

Moving away from a single-fuel era will add new levels of complexity to the process of bunkering ships, and we can expect potential compatibility issues until there is standardization. A unified approach to the development of fuel specifications will be key to compliance with emissions reporting, but there is a lot of work to be done before we have the necessary benchmarks.

With any fuel, owners and operators will need assurances that it is not only safe to handle, but also that its origin doesn’t inadvertently compromise its sustainability credentials or those of their customers. Traceability will take on a new level of significance and will be essential for accurately reporting on the well to wake emissions required by FuelEU.

As a patchwork of fuel and technology options emerge in Europe, there is an opportunity for shipowners to carve their own - albeit bumpy - pathway to decarbonization, in a way that is tailored to the individual needs of their fleets and operations. This will be a steep learning curve, putting even more importance on the capacity to get expert, independent insight as the realities of physical fuel supplies evolve constantly.

The lessons learned from their implementation will bring better understanding for the broader decarbonization transition not just in Europe, but around the globe. This will be a transition from “wait and see” to “try, learn and try again, but better”. l

Dispatches 38 Ship Management International Issue 106 November/December 2023

Creating a Culture of Care Onboard for our Seafarers Navigating Wellness

The latest in our series of industry debates, SMI teamed up with VIKAND medical group to debate the issue of ‘Seafarer Wellbeing: Creating a Culture of Care Onboard’, looking at strategies for fostering mental health awareness and ways to improve the onboard living and working environment, including how to encourage and support social interaction among crew members, methods to improve internet connectivity and communication with family and friends, and how to ensure access to comprehensive healthcare services.

Moderated by Sean Moloney, CEO of Elaborate Communications, the panellists included: Ronald Spithout – Managing Director for VIKAND’s proactive total healthcare solution, OneHealth; Johan Gustafsson – Chief Revenue Officer, Ocean Tehnologies Group (OTG); Chris Bhatt, Chief Commercial Officer, Aon; Lorraine Hager, Loss Prevention and Marketing Advisor, The Swedish Club; and Martin Hedman, Senior Consultant and Psychologist, Marine Profile.

A video recording of the full webinar debate is available on the SMI website www.shipmanagementinternational.com

Ship Management International Issue 106 November/December 2023

Sean Moloney

Hello everybody and welcome to the lates Ship Management International webinar, for which many thanks to VIKAND for their support. We’ll be talking about the issue of creating a culture of care onboard for our seafarers and it is something that’s really important so I’m sure we have a good debate ahead. So without any further ado, I’m going to ask the panellists to introduce themselves and say a few opening words on the issue of creating a culture of care onboard and what’s important in this respect, in order to set the scene for discussing how we as an industry can improve the wellbeing, safety and mental health of our seafarers.

Lorraine Hager

Thank you very much, Sean. I’m Lorraine Hager, Loss Prevention and Marketing Advisor at the Swedish Club. I’ve been with the Club for 11 years now. I’m a proud Filipina, but I’ve been living in Sweden for the past 16 years so as I said to my colleagues here, I’ve been ‘Swedified’ for a bit. Well, we all of us bear crucial responsibility in safeguarding the physical and mental health of our crews who navigate the world’s waters on our behalf, and ensuring the wellbeing of these crews requires an in-depth understanding of seafarers’ working environment, appreciation of the commercial pressures faced by operators and, of course, a knowledge of the best practice support that is available. We need to look not only the provision of adequate medical care and safe working conditions but also the need for mental health support, social integration, and access to essential amenities.

As a P&I club, we are a mutual body owned by our members, so this gives us a remit of assisting and giving guidance to our members and enabling them to give support to the crew. At the same time, we have a commitment to a wider aim of improving safety at sea for all seafarers. Our mission is twofold; firstly, we must foster a culture of prevention through rigorous training, education, and implementation of best practices. This means identifying and rectifying potential hazards before they escalate into critical situations. So we talk about loss prevention in regard to vessel casualties but the same approach must be taken with wellbeing of the most precious resource, our seafarers and secondly, and perhaps more importantly, we are committed to providing a steadfast support system that crews can rely on in times of need and this includes with access to medical

SMI Webinar

assistance and a commitment to, of course, respond to the many challenges that seafarers encounter in the course of their duties.

Just to mention, the International Group of P&I Clubs (IG) Personal Injury Committee has been discussing all of these issues and just recently gathered to discuss the subject more, also inviting charitable institutions to take part.

Sean Moloney

Thank you very much, Lorraine. Some good sort of food for thought there and good to see the industry working with the charities and with the welfare organisations. I’ve been in shipping for 40 years and still find it very strange that these important people at sea are in need of charitable assistance to the level they are. Johan, let me come on to you and ask you to introduce yourself and give your policy views on creating a culture of care.

Johan Gustafsson

Thank you, Sean and good afternoon, evening or morning, everybody. I work for a company called Ocean Technologies Group and we are providing human capital management services to our customers. In relation to what Lorraine just said, I want to come to a point where we power the people that power world trade because without the individual seafarers that are out there every day, 365 days a year, 24 hours a day navigating the sea, the world would soon see the consequence on daily living conditions.

I think that the industry is still too fragmented. There are good things happening, but not in a combined measure. There are many people taking some very

good actions, but for me, it starts from the top. If we are going to create this culture of care, it needs to start from leadership and commitment. I mean, the very top people, from the CEOs down to the captains onboard.

Then the second part of this is for me, mental health and for that you need work and life balance. Just look at ourselves, if we work too much, we will also not be satisfied with our situation. So I think that is really important onboard a ship as well, because you have vessels that has five port calls in a week and I can only imagine how they manage to get through the work and rest hours demanded today.

I also think that we need to provide a comprehensive learning situation for the people onboard because training, or repetition of training, is the mother of all knowledge for me. I come from the Navy and that’s what we did, we practiced every day for something that we wish never happened. So the same thing needs to be given to the seafarers’ health and we need to make sure that this platform or the way to get the knowledge needed is available. And it’s not only training, because training is just a tick box. Learning is what we are after and that is also important. Also, mental health for me means fair wages and living conditions, so a lot is included.

I want to finish off by saying that anyone that thinks what we are discussing here today is expensive has never had an incident or an accident because the cost of that is going to be way much more than the money that you spend on this. So for me, this is not a cost, it is an investment for the future.

42 Ship Management International Issue 106 November/December 2023 SMI Webinar

Ronald Spithout

Lorraine Hager

Johan Gustafsson

Sean Moloney

Johan, thank you very much indeed. Martin, let me come on to you. If you could introduce yourself, please, and give a little insight into your thoughts.

Martin Hedman

Sure, thank you, Sean. So my name is Martin Hedman and I’m the Head of Assessment and Organisational Management at Marine Profile. We’re a company that has conducted for more than three decades psychological solutions for the maritime industry and our focus is safety mitigation and emphasising the human factors. My background is I’m a licensed psychologist, and have been working in the maritime industry for the past 12 years, mainly conducting psychological assessment for officers and crew, for various purposes but also leadership training on a group and individual level.

Mental health is, of course, an area that’s very close to me and that I have been working on every day. In my work as a psychologist, I very often get asked the question whether or not it is possible to make changes on this level, like cultural changes.

It’s like a societal change, an industry change that we’re talking about here, and I know the first step for change is always the awareness that there is some deficit, something going that needs to be changed, and I would say the industry is at this stage on mental health at the moment. We’re having these seminars and panels and a lot of discussions now and the industry has never been more aware than it is right now, maybe because of the events we’ve been through, like the pandemic and so on. The second step of making a cultural change, as Johan was pointing out as well, is such a complex topic when

we’re changing the entire industry, it means that we have to have people aligned at all levels, not just on the ships. We should have the best tools and the services provided for the ships but they won’t be used, won’t have any impact unless we also have the entire hierarchy with us in the process. So that’s where the challenge is, as I see it, to create such an alignment and that’s what I hope this discussion today is going to be a little bit more about.

Sean Moloney

But in talking about that alignment, everybody coming into the same mode, the issue is that shipping is very fragmented and you’ve got companies that are accelerating at a fast rate and you’ve got the laggards or the slow adopters. That must create a bit of a problem when you’re trying to create this changes culture.

Martin Hedman