1 minute read

WHAT IS A QUALIFIED CHARITABLE ORGANIZATION

While we recommend confirming specific details with your financial advisor, here are some basics on QCOs. All information here is courtesy of the Arizona Department of Revenue (ADOR). Visit azdor.gov/taxcredits for more information.

According to the ADOR:

• A QCO can receive up to $200 from an individual and $400 from a married couple.

• A QCO Is exempt from federal income taxes under Section 501(c)(3) or is a designated community action agency that receives community services block grant program monies pursuant to 42 United States Code Section 9901.

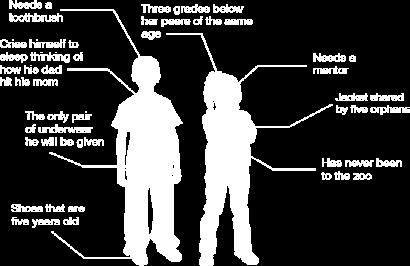

• A QCO provides services that meet immediate basic needs such as cash assistance; medical care; childcare; food; clothing; shelter; job placement; job training services; and any other reasonably necessary support to meet immediate basic needs.

• A QCO serves Arizona residents who receive temporary assistance for needy families (TANF) benefits, are low-income residents whose household income is less than 150 percent of the federal poverty level, or are chronically ill or physically disabled individuals.

• A QCO spends at least 50% of its budget on qualified services to qualified Arizona residents and affirms that it will continue spending at least 50% of its budget on qualified services to qualified Arizona residents.