1 minute read

TAX CREDITS 101 • • •

The Inside Scoop On Tax Credits In Arizona

While we recommend confirming specific details with your financial advisor, here are some basics on how tax credits work in the Grand Canyon State.

All information here is courtesy of the Arizona Department of Revenue (ADOR). Visit azdor.gov/tax-credits for more information.

Tax credit contributions, which need to be claimed by Tax Day, allow taxpayers to receive a dollar-for-dollar credit on their state income taxes.

Arizona Qualifying Charitable Organizations (QCOs):

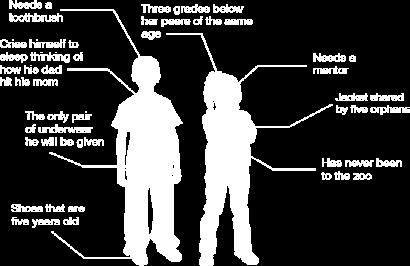

Provide basic needs to qualifying low-income individuals and families, including the chronically ill and disabled. Tax credit limits are up to $800 per married couple and $400 per individual.

Arizona Qualifying Foster Care Organizations (QFCOs):

A QFCO can receive up to $500 from an individual and $1,000 from a married couple. A QFCO provides services that meet immediate basic needs of those in the foster care system.

Public School Tax Credit:

An individual may claim a nonrefundable tax credit for making contributions or paying fees directly to a public school in this state for support of eligible activities, programs or purposes. The maximum credit allowed is $400 for married filing joint filers and $200 for single, heads of household and married filing separate filers.

Private and Certified School Tuition Organizations:

Arizona provides tax credits for contributions made to Certified School Tuition Organizations that provide scholarships to students enrolled in Arizona private schools. The maximum credit that can be claimed is $623 for single, married filing separate and head of household taxpayers, and $1,245 for married filing joint taxpayers.

ALICE COOPER'S 25TH ANNUAL ALICE COOPER'S 25TH ANNUAL

ROCK & ROLL FUNDRAISING BASH

ROCK & ROLL FUNDRAISING BASH

ED

BENEFITING ALICE COOPER'S SOLID ROCK TEEN CENTERS

BENEFITING ALICE COOPER'S SOLID ROCK TEEN CENTERS

SISTER SLEDGE SISTER SLEDGE

Sixwire Sixwire

Sponsored by:

SUNDAY, APRIL 2ND | LAS SENDAS GOLF CLUB | MESA, AZ

SUNDAY, APRIL 2ND | LAS SENDAS GOLF CLUB | MESA, AZ

Tax ID: 86-0808609