MarketMomentum

TheoryandPractice

By STEPHENSATCHELL

and ANDREWGRANT

Thiseditionfirstpublished2021

©2021StephenSatchellandAndrewGrant

Registeredoffice

JohnWiley&SonsLtd,TheAtrium,SouthernGate,Chichester,WestSussex,PO198SQ,UnitedKingdom

Fordetailsofourglobaleditorialoffices,forcustomerservicesandforinformationabouthowtoapplyfor permissiontoreusethecopyrightmaterialinthisbookpleaseseeourwebsiteatwww.wiley.com.

Allrightsreserved.Nopartofthispublicationmaybereproduced,storedinaretrievalsystem,or transmitted,inanyformorbyanymeans,electronic,mechanical,photocopying,recordingorotherwise, exceptaspermittedbytheUKCopyright,DesignsandPatentsAct1988,withoutthepriorpermissionof thepublisher.

Wileypublishesinavarietyofprintandelectronicformatsandbyprint-on-demand.Somematerial includedwithstandardprintversionsofthisbookmaynotbeincludedine-booksorinprint-on-demand.If thisbookreferstomediasuchasaCDorDVDthatisnotincludedintheversionyoupurchased,youmay downloadthismaterialathttp://booksupport.wiley.com.FormoreinformationaboutWileyproducts,visit www.wiley.com.

Designationsusedbycompaniestodistinguishtheirproductsareoftenclaimedastrademarks.Allbrand namesandproductnamesusedinthisbookaretradenames,servicemarks,trademarksorregistered trademarksoftheirrespectiveowners.Thepublisherisnotassociatedwithanyproductorvendor mentionedinthisbook.

LimitofLiability/DisclaimerofWarranty:Whilethepublisherandauthorhaveusedtheirbesteffortsin preparingthisbook,theymakenorepresentationsorwarrantieswithrespecttotheaccuracyor completenessofthecontentsofthisbookandspecificallydisclaimanyimpliedwarrantiesof merchantabilityorfitnessforaparticularpurpose.Itissoldontheunderstandingthatthepublisherisnot engagedinrenderingprofessionalservicesandneitherthepublishernortheauthorshallbeliablefor damagesarisingherefrom.Ifprofessionaladviceorotherexpertassistanceisrequired,theservicesofa competentprofessionalshouldbesought.

LibraryofCongressCataloging-in-PublicationData

Names:Grant,AndrewRobert,1982-author.|Satchell,StephenEllwood, 1949-author.

Title:Marketmomentum:theoryandpractice/AndrewRobertGrant,Stephen EllwoodSatchell.

Description:FirstEdition.|Hoboken:Wiley,2020.|Series:Thewiley financeseries|Includesindex.

Identifiers:LCCN2020020406(print)|LCCN2020020407(ebook)|ISBN 9781119599326(hardback)|ISBN9781119599470(adobepdf)|ISBN 9781119599371(epub)

Subjects:LCSH:Investmentanalysis.|Securities—Prices.| Economics—Psychologicalaspects.

Classification:LCCHG4529.G732020(print)|LCCHG4529(ebook)|DDC 332.63/2042—dc23

LCrecordavailableathttps://lccn.loc.gov/2020020406

LCebookrecordavailableathttps://lccn.loc.gov/2020020407

CoverDesign:Wiley

CoverImage:©palamatic/shutterstock

Setin10/12pt,SabonLTStdbySPiGlobal,Chennai,India.

PrintedinGreatBritainbyCPIAntonyRowe 10987654321

1AndrewGrant

Thischapterexaminesthebehaviouralfinanceargumentfortheexistenceof momentumprofits.Fromabehaviouralfinanceperspective,assetpricesmaydeviate fromfundamentalvalues,whichcanpersistifmarketfrictionspreventaprompt correctiontomispricing.Asrisk,intheformofaFama-Frenchthree-factormodel,has beenshowntoprovideapoorexplanationformomentumreturns,academicshave soughtpsychology-inspiredreasonsforthephenomenon.Wereviewtheliteratureon behaviouralfinanceandmomentum,startingwiththetheoreticalstudiesofthelate 1990s,whichhavebecomehighlyinfluential.Followingonfromthis,wediscussthe recentempiricalevidencesupportingpredictionssuchasslowinformationdiffusion, incorrectupdatingofbeliefs,tradingatthe52-weekhigh,individualinvestortrading andmarket-widesentiment.Amongthekeyinsightsisthatbehaviouralfinancecan helpprovideanexplanationforstatisticalpatternsthatgeneratemomentumportfolios (asinChapter2)andmayhelppractitionersinidentifyingthemesforenhancingtheir investmentportfolios.

2SteveSatchell

Inthischapterwelookatdifferentmomentumstrategiesandtheirproperties.Many oftheempiricalresultsofmomentumstrategiescanbeseentoresultfromthestructureofreturnprocessesandthedesignofthestrategy.Inparticular,consideringsimple cases,weinvestigatethereturndistributionsofwhatarethemajormomentumstrategies whicharecross-sectionalmomentum(CSM),time-seriesmomentum(TSM),relative strengthstrategies(RSS)andcross-assetmomentum.Forthecaseoftwoassets,wecan sayagreatdealaboutthestructureandpropertiesofreturns.Fromastatisticalperspective,behaviouralanalysiswilldeterminethemagnitudeofmodelparametersalongwith, insomecases,thespecificationofthemodelitself.Takingtheseasgiven,thestatistical analysiswilldeterminethepropertiesofthestrategyreturns.Inthisformofanalysis, weareinterestedinthepopulationmomentssuchasthemean,variance,skewnessand kurtosisbutalsothetime-seriesmomentsofthemomentumprocess.Itishopedthat therelativelysimpleanalysisinthischapterwillhelpthereaderinlaterchapters.

3NickBaltasandRobertKosowski

Motivatedbystudiesoftheimpactoffrictionsonassetprices,weexaminethe effectofkeycomponentsoftime-seriesmomentumstrategiesonturnoverandperformance.Weshowthatmoreefficientvolatilityestimationandprice-trenddetectioncan

significantlyreduceportfolioturnoverbymorethanone-third,withoutcausingastatisticallysignificantperformancedegradation.Weproposeanovelimplementationofthe strategythatincorporatesthepairwisesignedcorrelationsbymeansofadynamicleveragemechanism.Thecorrelation-adjustedvariantoutperformsthenaïveimplementation ofthestrategyandtheoutperformanceismorepronouncedinthepost-2008period. Finally,usingatransactioncostsmodelforfutures-basedstrategiesthatseparatescosts intoroll-overandrebalancingcosts,weshowthatourfindingsremainrobusttothe inclusionoftransactioncosts

4JoseMencheroandLeiJi

Inthischapter,westudytheriskandreturnofmomentumindevelopedequitymarkets.Weconstructfactorportfoliosbycross-sectionalregression.Univariateregression resultsin‘simple’factorportfoliosthatcontain‘incidental’betsonotherfactors.Multivariateregressionresultsin‘pure’factorportfoliosthatareneutraltoallfactorsexcept momentum.Wecompareperformanceofsimpleandpuremomentumfactorsacross variousdevelopedmarkets.Wefindthatsimpleandpurefactorshavevirtuallyidentical long-termperformancewithineachequitymarket.Thepurefactors,however,achieve thisperformancewithconsiderablylowervolatility,resultinginhigherrisk-adjusted performance.Wealsostudythevolatilitiesandcorrelationsofmomentumfactorsacross time.WefindthatthesequantitiespeakedduringtheInternetBubbleandtheFinancial Crisis.Finally,weshowthatformostperiods,momentumhasbeennegativelycorrelated withthemarket,thusofferingattractivediversificationopportunities.

5DandiBartolomeoandBillZieff

Pricemomentumexposureisafamiliarconcepttoanyonewhohasstudiedequity returnfactors.Lessaddressedintheliteratureishowmomentumeffectsinoneasset classmanifestinotherassetclasses.Theoriesofcorporatefinancethatlinkequityand bondreturnsthroughtheircommondependenceonthevalueofthefirmhavebeen knownforsometime,butthesetheoriesdonotaddressthedynamicsbetweendebt andequityinatime-seriescontext.Cross-Assetmomentumprovidesaparsimonious descriptionofsuchdynamics.Wedescribetheoreticalunderpinningsandempirical resultsforseveralcross-assetclassmomentumeffects.Includedisadiscussionofequity momentumimpactintofixedincome,selectedmomentumeffectsinilliquidassets,such asrealestateandprivateequity,andmomentumresultspertainingtocommodities. Implicationsforactivemanagementinassetallocationandactivemanagementwithin assetclassesareexploredandhighlighted.

6KatharinaSchwaigerandMuhammadMassood

Momentumasaninvestmentstrategyisawell-knowncomponentofsystematic strategies.Withtheriseofexchange-tradedfunds(ETFs)andsmartbeta,momentum strategiesareavailabletoabroadrangeofclientsincludingretailviaafullytransparentrules-basedindexstrategy.Theindicesarebuilttoweightandselectstocksfrom anequityuniversewithhighmomentumexposureorhighpastreturns.ThoseETFs aimtooffermomentumfactorexposureatacompetitivefee.Inthischapterweshed

lightonthemomentumETFlandscapeanddiscusshowmuchmomentumisinmomentumETFs.Wefindthatmomentumindicesexhibitmomentumcharacteristicsdespite differencesintheunderlyingindexmethodologies,lackofleverageandinfrequentrebalancing.

7OliverWilliams

Thischapterreviewstime-seriesmomentum(TSM)strategiesascommonlyusedby CommodityTradingAdvisers(CTAs).WecompareTSMwithcross-sectionalmomentum(CSM)anddescribeexamplesofvariousmethodsusedforTSMsignalgeneration, showingthattherearecertainessentialsimilaritiesinTSMapproachesalthoughthe degreeoftechnicalcomplexityvariesconsiderablyacrossmethods.WenotevariousstylizedfactsofCTAinvesting(e.g.relativelylowSharperatioandpositiveskewness)and highlightpracticallyrelevantresultsfromexistingliteratureconcerningcharacteristics ofTSMreturns.Throughoutthechapterweusesimplemarketmodelstoillustrateour pointsandwederiveanexpressionforthecorrelationbetweenTSMandCSMreturns inthissetting,whichmaybeusefulwhencontemplatingassetallocationbetweenthese strategies.

8AndersPettersonandOliverWilliams

Inthischapterweapplymomentumreturnsmodelsinanon-traditionalsetting:the valuationofcontemporaryart.Specifically,weconsiderwhetheramomentummodelis usefulatpredictingauctionoutcomesbasedonchangesinsubjectivevaluationopinions observedoverashortperiodpriortotheauction.Weuseanoveldataset(suppliedby ArtForecaster.com)thatcontainsmultiplevaluationsofthesamepieceofartprovided byindividualforecastersatapproximatelythesametime.Combinedwithauctioneers’ estimatesandhammerpricesthisdatacanbeusedtoestimateasimpledynamicmodel ofvaluationchanges.Wefailtofindsignificantevidenceoftime-seriesmomentumin thesevaluationchanges,butaforecastingstrategybasedoncross-sectionalmomentum appearstobeeffective.Thisimpliesthatsubjectiveopinionismoreinformativewhen consideredonarelativebasis(oneworkofartversusanother)ratherthanoutright, andweconjecturethismaybeduetoasub-consciousbiasonthepartofartmarket participantstowardspositiveratherthannegativesentiment.Weconcludethatmomentummodelscanprovideausefulframeworkforanalysisofinformationandbehaviour outsidetraditionalfinancialmarkets.

Thischapterexplorestheinteractionbetweenmomentumandvolatility.Theliteraturehasshownthatmomentumstrategiesusingvolatilityastheconditioningvariable stronglyoutperformplainmomentumstrategiesbyreportinghigheralphas,increased Sharperatiosandimprovedskewness.Thesevolatility-managedmomentumstrategies benefitfromtheuseofvolatility,whichhasthepotentialtobetterforecastfuturereturns. Weempiricallyreviewthevariousvolatility-managedmomentumstrategiesthatare proposedintheacademicliterature.Ourfindingsshowstrongoutperformanceofboth thetime-series(TSVM)andcross-sectionalvolatility-managedmomentumstrategies

9YangGao

(CSVM)intheUSA,EuropeandAustralia.Wedocumentinterestingevidencethatthe TSVMstrategyseemstoworkintheChineseandJapanesemarketswheretraditional momentumorCSVMdoesnotworkwell.Wefurtherdiscusstheroleofleverageconstraints,turnoverandshort-sellingconstraintsinthepracticaluseofvolatility-managed momentumstrategies.Last,weexaminehowvolatilitymanagesmomentumriskand suggestthatmomentumisnotonlyrelatedtoitsownvolatility.

10AndrewGrant,OhKangKwonandSteveSatchell

Theselectionofassetsbasedontherankingsofoneormoreoftheirattributesover apriorperiodisastandardpracticeintheconstructionofportfoliosinbothacademic andpractitionerfinance.Momentumisafamiliarexampleofthisactivity.Althoughthe propertiesofreturnsfromtheseportfolioshavebeenthesubjectofconsiderableempiricalresearch,thereisonlylimitedliteratureinvestigatingtheirtheoreticalproperties. Inthischapter,weaddressthisgapbyderivinganalyticallythedistributionalpropertiesoftheseportfolioreturnsundertheassumptionthatassetattributesandreturns arejointlymultivariatenormal.Weshowthatpriorsortingofassetattributesinduces non-normalityintheportfolioreturnsandthatthereturnsdependontheorderand natureofsortingTheanalysislooksattwofundamentaltypesofsorting,bothcommonlyusedbypractitioners,andtheauthorsshowthatthemethodofsortinginfluences thepatternofreturnsundercommonlyencounteredcircumstances.

11StefanoCavaglia,VadimMorozandLouisScott

Theresearchpresentedinthischapterextendsandcorroboratesthefindingsof ScottandCavaglia(2016)whofirstillustratedthepotentialbenefitsofafactorpremia overlaytoaninter-temporalwealthaccumulationstrategythatisfullyinvestedinequities.Weexamineapanelof5localfactorpremia(inclusiveofmomentum)ineachof21 developedequitymarketsand5regions.Innearlyallinstanceswefindthatwealthaccumulationissignificantlyenhancedbyatimeinvariant,equalweightedallocationtothese premia.Theenhancementisdriveninpartbythemeanreturnofthepremiabutmore importantlybytheirgenerallypositivepayoffinadversemarketenvironments.The qualityandmomentumfactorpremiaarethelargestcontributorstothisresult.Applyingconventionalmeasuresofriskaversionwequantifytheimportanceofdownside protectiontosupportingtheattainmentofinvestors’goals;theutility-basedevidence suggeststhatsomefactorpremiaarevaluedbyinvestorsevenwhentheirexpectedreturn iszero.

12ChristopherPolk,MoHaghbinandAlessiodeLongis

Factorcyclicalitycanbeunderstoodinthecontextoffactorsensitivitytoaggregate cash-flownews.Factorsexhibitdifferentsensitivitiestomacroeconomicrisk,andthis heterogeneitycanbeexploitedtomotivatedynamicrotationstrategiesamongestablishedfactors:size,value,quality,lowvolatilityandmomentum.Atimelyandrealistic identificationofbusinesscycleregimes,usingleadingeconomicindicatorsandglobal riskappetite,canbeusedtoconstructlong-onlyfactorrotationstrategieswithinformationratiosnearly70%higherthanstaticmultifactorstrategies.Therulesintroduced

herearesimpletoapplyandcanbeinterpretedasamacroeconomicregime-switching modelwithoutthecumbersometechnologythatsuchmodelsusuallyinvolve.Hidden regimesareabsentand,inthisframework,weknowwhatregimewearein.Resultsare statisticallyandeconomicallysignificantacrossregionsandmarketsegments,alsoafter accountingfortransactioncosts,capacityandturnover.

13RonBird,Xiaojun(Kevin)GaoandDannyYeung

Momentumisoneofnumerousmarketanomalieshighlightedoverthelast30or moreyears,bringingintoquestiontheefficiencyofmarketsaroundtheworld.However,thequestionisleftopenastowhethertheapparentprofitopportunitiesoffered bytime-seriesandcross-sectionalinvestmentstrategiesareexploitable.Withtheincorporationoftransactioncostsandrisk,the‘typical’implementationofbothmomentum strategiesyieldsprofitsinonlyahandfulofmarkets.However,wedemonstratethat theperformanceofthemomentumportfoliosisverymuchdependentontheextent towhichimplementationruleschosenareinsynchronicitywiththeperiodicityofthe market.

14ShivamGhosh,SteveSatchellandNandiniSrivastava

ArtificialIntelligence(AI)andMachineLearning(ML)hasseenunprecedented growthoverthepastdecadewithapplicationsacrosshealthcare,robotics,datasecurityandautomotiveindustriestonameafew.PenetrationofAIinfinancehasbeen slower;primarilyduetotheintrinsicnatureofmarkets–non-stationarityoffinancial processesandlackofsufficienttrainingdata.WemakeaforayintoapplyingMLto financebytrainingarangeofmodelstotradeMomentum–asystematicstrategythat benefitsfrompersistenceoftrendsinmarkets.OurfindingssuggestthataclassofML algorithmslikeRandomForestsandNeuralNetsproduceSharperatiosclosetooptimalvanillatime-seriesmomentum(TSMOM).However,correlationbetweenMLand vanillaTSMOMsignalsislowallowingustoharvestfruitsofdiversificationbycreating hybridvanilla–MLTSMOMstrategies.WefindsuchhybridportfolioSharperatiosto betwiceashighasvanillaTSMOM.

15Byoung-KyuMin

Oneoftheimportantlinkagesinfinancialeconomicsisbetweentheworldof macroeconomicsandthereturnsofindividualcompanies.Whilstthisisusually hardtoidentifyempirically,itisneverthelesspossibletofindcausalitybetween macroeconomicsandstrategyreturns.Furthermore,suchcausalrelationshipsareof greatinteresttopractitionersandconstituteakeypartofwhatisdescribedasactive quantitativefundmanagement.

Recentempiricalliteratureshowsthat timevariation intheprofitabilityof momentumstrategiesiscriticaltounderstandingthesourceofmomentum.This chapterpresentsdirectevidencethatmomentumstrategiesdeliversignificantlynegative profitsduring‘bad’economicstatesinwhichinvestorsdemandthehighestmarketrisk premium,suggestingthatmomentumstrategiesexposeinvestorstogreaterdownside risk.Italsoreviewstheliteratureinvestingwhethermomentumprofitsarerelatedto

variouseconomicstates,includingbusinesscycles,marketstateandinvestorsentiment, anddiscussesexplanationsforthesefindings.

16ChrisTinker

Momentumhasbeenconsideredamarketanomalyandtreatedasabehavioural phenomenon.Whilegenerallyregardedasastandalonetradingstrategyasaconsequence,growinginterestinfactor-basedinvestingandtheemergenceofAlternative RiskPremia(ARP),arguesforamoreintegrated,investment-basedanalysisofmomentum.Underasystematic,stocklevel,time-seriesforecastframeworkwearguethatitis possibletoidentifyaclearfundamental–andthereforerisk-basedfactorstructure.

Wetreatmomentumasafundamentalphenomenon,drivenbynews-flowrelated changestostocklevel,andexpectedreturnsoffundamentalistinvestors.Wemodeltwo investorgroups–shorttermandlongterm–sharingsimilar,butnotalwaysconsistentviewsoffundamentalvalue.Theoccasional,butsometimessignificant,variance intheirrespectiveimpliedSharperatiosprovidesthetriggerforamomentumphase, whiletheirrealignmentsignalsitsend.Athirdinvestorgroup,momentumtraders,do notparticipateintheestablishment,durationorendingofthemomentumphase.This grouparepassivebystanderswho,nonetheless,wouldbenefitfromknowledgeofthe signalsgenerated.

ResultsgeneratedfromthisanalysisontheS&P500stockuniversefrom2004to 2019confirmtheoutperformingnatureofamomentumstrategybasedonthissignal withhighhitratesandannualisedreturnsatthestocklevelandclearsignsofconvexity inthereturns,consistentwiththerequirementsofanyARP-basedmomentumportfolio.Asameansofevaluatingriskattheindividualstocklevelandasaframework forsystematicstockselectionofmomentum-basedfactorportfolios,thetreatmentof momentumasastocklevelriskfactorsuggeststhatanimpliedSharpe-ratio-basedsignal addsvaluetothedecision-makingprocessesofbothtradersandinvestors.

17StefanoCavaglia,LouisScott,KennethBlayandVincentdeMartel

Thischapterexaminestheuseofcommodityfactorsinaportfoliocontext,aimedat customisingaportfolioforspecificclients.Acriticalquestioniswhethertheinclusionof afactoroverlay,suchasmomentum,carryorvalue,oracombinationofthesefactors, canimproveoutcomesforaspiringretirees,comparedtothesimpleapproachofinvestinginaportfolioofequitiesand/orbonds.Usingabootstrapsimulationapproach, allowingforalternativescenariosfortheperformanceoftheassetsandfactors,itis foundthattheincorporationofasinglefactoroverlayenhancesthelikelihoodofan aspiringretireeachievinghergoal.Acombinationoffactorsintheoverlayprovides additionaldiversificationbenefitsforthemorerisk-averseretiree.Itisarguedthat,due totimediversificationoverthebusinesscycle,factoroverlaysenhanceaccumulated wealthnetofcosts

CHAPTER1

BehaviouralFinanceandMomentum1 1.1Introduction1

1.2Thefailureofrisk-basedexplanations3

1.3Behaviouralmodelsofmomentum3

1.4Slowinformationdiffusion5

1.5Patternsininformationarrival6

1.6The52-weekhighandcapitalgainsoverhang8

1.7Institutionaltradingandmomentumprofits10

1.8Sentimentandmomentum11 1.9Discussion12

CHAPTER2

ATaxonomyofMomentumStrategies16 2.1Introduction16

2.2Relativestrengthstrategies17

2.3Time-seriesmomentumstrategies18

2.4Cross-sectionalmomentumstrategies20

2.5Cross-assetmomentum27

CHAPTER3

DemystifyingTime-SeriesMomentumStrategies:VolatilityEstimators,Trading RulesandPairwiseCorrelations30

3.1DataDescription34 3.2Methodology39 3.3TurnoverReduction42

3.4TheRecentUnderperformanceofTime-seriesMomentum StrategiesandtheEffectofPairwiseCorrelations52

3.5TradingCostsImplications58

3.6ConcludingRemarks63

CHAPTER4

RiskandReturnofMomentuminDevelopedEquityMarkets68 4.1Introduction68

4.2Definitionofmomentum69

4.3Simplefactorportfolios71

4.4Multifactorstructure73

4.5Purefactorportfolios75

4.6Empiricalresults:momentumperformance76

4.7Empiricalresults:momentumrisk80

4.8Diversificationbenefits83

4.9Summary84

CHAPTER5 MomentumAcrossAssetClasses86

5.1Measuringmomentum87

5.2Framework:equitymomentumandcorporate creditrisk87

5.3Empiricalstudies:momentumandcreditrisk89

5.4Ourresearchonequitymomentumandbondreturns91

5.5Geographicallyboundassets92

5.6Momentuminotherilliquidassets94

5.7Cross-assetclasseffectsofcommodities95

5.8Momentumeffectsandtaxableinvestors95

5.9Activemanagementandmomentumeffects96 5.10Conclusions98

CHAPTER6 MomentuminMomentumETFs103

6.1Introduction103

6.2WhyaremomentumETFssopopular?104

6.3WhatisinamomentumETF?112

6.4WhichfactorsdriveactiveriskformomentumETFs?114

6.5Fromconstrainedtounconstrainedstrategies117

CHAPTER7 CTAMomentum120

7.1Introduction120

7.2Time-seriesmomentum(TSM)121

7.3Strategyreturnmodels127

7.4Time-seriesmomentum131

7.5TSMmeetsCSMwithtwoinstruments133 7.6Conclusions135

7.A.1AppendixA:Correlationparameterrestrictions136

7.A.2AppendixB:Proofsofvariancesandcovariance138

CHAPTER8

OverreactionandFaintPraise–Short-TermMomentuminContemporaryArt141 8.1Introduction141

8.2Contemporaryartmarketecosystem144 8.3ArtForecasterdata145

8.4Systematicforecastingstrategies149 8.5Conclusions157

CHAPTER9

Volatility-ManagedMomentum160 9.1Introduction160

9.2Dataandmomentumportfolioconstruction161

9.3Volatility-managedmomentumstrategies162

9.4Somepotentialpracticalissues166

9.5Thebestvolatilitymeasureformomentum?170 9.6Concludingremarks172

CHAPTER10

TheoreticalAnalysisoftheFama-FrenchPortfolios174 10.1Introduction174

10.2Strategies,notationandpreliminaries179 10.3DistributionofFama-Frenchfactors182

10.4Fama-Frenchfactorswithsequentialsorting189 10.5Conclusion194

10.A.1ProofofLemma1194

10.A.2ProofofTheorem3195

10.A.3ProofofTheorem4196

CHAPTER11

ExploitingtheCountercyclicalPropertiesofMomentumandotherFactor Premia–ACross-CountryPerspective199 11.1Introduction199 11.2Methodology200 11.3Alternativeinvestmentstrategies206

11.4Quantifyingtheutilityofriskpremiastrategies211 11.5Summaryandconclusions215

CHAPTER12

Time-SeriesVariationinFactorPremia:TheInfluenceoftheBusinessCycle218 12.1Introduction218

12.2Factorsandfactorrotation219 12.3Factorsandthebusinesscycle220

12.4Dataandsummarystatistics222 12.5Empiricalresults224 12.6Conclusions234

12.A.1Derivationofcash-flownewsseries234

12.A.2USleadingeconomicindicatorandglobalriskappetiteindicator236

12.A.3Dynamicmultifactorstrategy:extensiontoothermarket segmentsandregions236

CHAPTER13 WhereGoesMomentum?243 13.1Introduction243 13.2Momentumstrategies245 13.3Data246 13.4Method247 13.5Results252

13.6Risk-adjustedafter-transactioncostsperformanceoftime-series andcross-sectionalmomentumstrategies260 13.7Conclusions269

CHAPTER14

14.1Introduction273

14.2Thephilosophyofartificialintelligence274 14.3Vanillatime-seriesmomentum277 14.4Generalizedlinearmodels(GLM)–Lasso,RidgeandElasticNet280 14.5Determiningoptimalhyper-parametersviacross-validation283 14.6Results:generalizedlinearmodels284 14.7Randomforests284 14.8Neuralnetworks289 14.9Resultsandcomments291 14.10Conclusion293

CHAPTER15 MomentumandBusinessCycles297 15.1Introduction297 15.2Momentum,businesscyclesandrealisedmarketreturn298 15.3Momentumandexpectedmarketriskpremiums301 15.4Momentum,overconfidenceandsentiment309 15.5Summaryandconclusions311

CHAPTER16 MomentumasaFundamentalRiskFactor314 16.1Introduction314

16.2Definingmomentumasastrategy316 16.3Anewframework318 16.4Fromrealisedreturnstoforecastreturns319 16.5Examiningbehaviour319

16.6Themomentumtraderasabystander323 16.7Extendingthemodel325 16.8Short-termversuslong-terminvestors326

Contributors

AndrewGrant isaSydneyUniversityacademicwhoseareasofexpertisearebehavioural finance,individualinvestordecisionmakingandbettingmarkets,focusingonpreferenceandbelief-basedassetallocationandasset-pricingdecisions.Hehasalsobeen engagedwithindustry,withstudiesofalternativefinanceandmarketplacelendinginthe Asia-Pacific.Hehasappearedasaguestcommentatorinprint,radioandontelevision, discussingissuessuchasgamblingmarketandbankingregulation,personalsavingsand assetallocationmodelevaluation.

StephenSatchell isafellowofTrinityCollege;hehasconsultedtoalargenumber offinancialinstitutionsandpublishedmanypapers.Hebelievesthatfinancialresearch shouldgobeyondthenormalofferingsandheenjoyscollaboratingwithscholarsof otherdisciplinestoadvancehisunderstandingofmarkets.Hewastheeditorof Journal ofAssetManagement andistheco-founderofQuantess,anallwomenquantgroup aswellasHeadofCreditResearchatImagine,afintechstart-upofferingimaginative mortgageproducts.

NickBaltas,PhD,isamanagingdirectorandheadofR&DoftheSystematic TradingStrategiesGroupatGoldmanSachs.Heisalsoavisitingresearcherat ImperialCollegeBusinessSchoolandtheexecutiveeditorofthe JournalofSystematic Investing.Inthepast,hehasheldseveralpositionsbothinthefinanceindustryand inacademia.Hisacademicresearchhasreceivednumerousawardsandhasbeen publishedinpeer-reviewedfinancejournalsandbooks.

RonBird recentlyretiredfromboththeUniversityofTechnologySydneyand WaikatoUniversity.Hisresearchinterestshavemostrecentlyconcentratedonthe mysteriesofthefundsmanagementandretirementincomeindustries.Hehaspublished widelyinjournalssuchas ManagementScience,the JournalofPortfolioManagement andthe AustralianJournalofManagement

KennethBlay isHeadofThoughtLeadershipfortheInvescoInvestmentSolutions team.PriortojoiningInvesco,Mr.BlaywastheadvisoryresearchmanagerintheportfolioandriskresearchgroupatStateStreetAssociates.Previously,heservedasdirector ofresearchat1stGlobal.Mr.BlayearnedaBBAinfinancefromtheUniversityofTexas atSanAntonio.Hehasco-authoredandpublishedvariousworksonassetallocation withNobelLaureateHarryMarkowitz.

StefanoCavaglia holdsaPhDinFinancefromtheChicagoBoothSchoolof Business.Throughouthiscareer,hehasappliedstate-of-the-artfinancetheory.His earlyworkledtotherestructuringoftheUBSglobalequityplatformandthefounding ofa$1.3bhedgefundhemanagedatUBSO’Connor,Chicago.Presently,heis co-developing,withInvesco,novelmulti-asset,factor-basedcompletionportfolios.His researchiswidelycitedintheCFAcommunityandfinancialpress.

AlessiodeLongis isaSeniorPortfolioManagerfortheInvescoInvestmentSolutions division.Heleadsthegroup’stacticalassetallocation,includingfactorandcurrency strategies.HejoinedInvescofromOppenheimerFunds,wherehewasteamleaderand seniorportfoliomanagerofthemulti-assetteam.HeearnedanMScinfinancialeconomicsandeconometricsfromUniversityofEssex,andMA/BAineconomicsfromthe UniversityofRome.HeisaCFACharterholder.

VincentdeMartel,CFA,isSeniorSolutionsStrategistwiththeInvescoInvestment Solutionsteam.PriortojoiningInvesco,Mr.deMartelwasheadofproductstrategyfor BlackRock’smulti-assetriskparity/factorsuite.Previously,heservedasheadofEuropeanLDIstrategyatBarclaysGlobalInvestors.HeearnedanMAdegreeinaccounting andfinancialeconomicsfromtheUniversityofEssex,aswellasanMBAfromEDHEC withaconcentrationinmarketfinance.

DandiBartolomeo isPresidentandfounderofNorthfieldInformationServices, Inc.BasedinBostonsince1986,Northfielddevelopsquantitativemodelsoffinancial markets.HesitsonboardsofnumerousindustryorganizationsincludeIAQFandCQA, andispastpresidentoftheBostonEconomicClub.Hispublicationrecordincludes35 books,bookchaptersandresearchjournalarticles.InJanuaryof2018,hebecame co-editorofthe JournalofAssetManagement.DanspentnumerousyearsasaVisiting ProfessoratBrunelUniversity.In2010hewasgiventhe‘Tech40’awardby Institutional Investor magazineinrecognitionofhisroleinthediscoveryoftheMadoffhedgefund fraud.Hehasalsobeenadmittedasanexpertwitnessinlitigationmattersregarding investmentmanagementpracticesandderivativesinbothUSfederalandstatecourts.

KevinGao isanexperiencedBusinessIntelligenceConsultantwithademonstrated historyofworkingintheinformationtechnologyandservicesindustry.Hehasanalyticalskills,andskillsinquantitativeresearch,datamining,banking,accountingand teaching.HehasaPhDfocusedinAppliedFinance,anddegreesinmathematicsand computerscience.

YangGao joinedHuazhongUniversityofScienceandTechnologyasassistantprofessorinJune2019afterobtaininghisPhDfromtheUniversityofSydney.Hisresearch interestslieintheareaofempiricalassetpricingincludingtradingstrategiesandmarket anomalies.Hehasbeeninvitedtopresenthisworkinmultipleconferencesincludingthe AmericanFinanceAssociationannualmeetingandtheGoldmanSachsAsiaConference. Yangisalsointerestedincorporatefinancerelatedstudieswithafocusoncorporate governance.

ShivamGhosh completedhisPhDinTheoreticalPhysicsatCornellUniversityin 2014afterobtainingaBAandMAinNaturalSciences(Physics)attheCavendishLaboratory,UniversityofCambridge,UK.ShivamisnowaDirectorResearchatJPMorgan, Londonspecialisinginbuildingtradablesystematicriskpremiastrategiesincredit. Previously,hewasafixedincomeportfoliomanagerattheChiefInvestmentOffice, JPMorganinNewYork.Shivamhaspublishedpapersintoppeer-reviewedjournals including PhysicalReviewB and PhysicalReviewLetters.

MoHaghbin,CFA,CAIA,servesastheChiefOperatingOfficerfortheInvesco InvestmentSolutionsteam,whichdevelopsandmanagescustomizedmulti-assetinvestmentstrategies.MoHaghbinjoinedInvescoin2019whenthefirmcombinedwith OppenheimerFunds,whereheservedasseniorvicepresidentandheadofproductfor

theBetaSolutionsbusiness.AtOppenheimerFunds,heledthefirm’sentranceintofactorinvesting,havinglaunchedasuiteofequityfactorstrategiesincludingoneofthe industry’sfirstdynamicmulti-factorETFs.

LeiJi isaseniorquantitativeanalystatBloomberg.BeforejoiningBloombergin 2015,LeiwasaglobalquantitativeportfoliomanageratTudorInvestments.Priorto that,hewasafoundingmemberofthequantitativehedgefundGSBPodiumAdvisors.Beforethat,LeiservedasasystematicproprietarytraderatBankofAmerica, MerrillLynchandLehmanBrothers.LeireceivedaPhDinFinancialEconomicsfrom theUniversityofPennsylvania.

RobertKosowski isProfessorofFinanceatImperialCollegeBusinessSchooland HeadofQuantitativeResearchatUnigestion.HeisalsoaresearchfellowattheCentre forEconomicPolicyResearch(CEPR)andanassociatememberoftheOxford-Man InstituteofQuantitativeFinanceatOxfordUniversity.Robertisontheeditorialboard ofthe JournalofAlternativeInvestments andthe JournalofSystematicInvesting. RobertholdsaBA(FirstClassHonours)andMAinEconomicsfromTrinityCollege, CambridgeUniversity(UK),andaMScinEconomicsandPhDfromtheLondon SchoolofEconomics(UK).

OhKangKwon isaseniorlecturerintheDisciplineofFinanceatTheUniversity ofSydney.HeholdsaPhDinpuremathematicsfromMITandaPhDinquantitative financefromUTS.HehasheldacademicpositionsatvariousuniversitiesinAustralia, andhasalsoworkedintheroleofseniorquantitativeanalystwithallfourmajorbanks inAustralia.Hisresearchinterestsincludequantitativefinance,computationalfinance andderivativepricing.Hehasrecentlybeenworkingintheareasofcorporatefinance andstrategyanalysis

MuhammadMasood isaresearcherintheiSharesProductDevelopmentteamat BlackRock.Heisinvolvedintheresearchanddesignofsmartbeta,ESG,thematicand fixedincomeETFproducts.Hisworkonsmartbetaincludesingle-andmulti-factor strategiesthatareconstructedinasystematicmanner.Muhammadholdsamaster’s degreeinFinanceandEconomicsfromtheWarwickBusinessSchoolandanundergraduatedegreefromtheAmericanUniversityofParis.

JoseMenchero servesasHeadofPortfolioAnalyticsResearchatBloomberg.Prior tojoiningBloomberg,hewasHeadofEquityFactorModelResearchatMSCIBarra. Josehasroughly40financepublicationsinleadingpractitionerjournals.Beforeentering finance,JosewasProfessorofPhysicsattheUniversityofRiodeJaneiro,Brazil.Jose holdsaPhDintheoreticalphysicsfromtheUniversityofCaliforniaatBerkeleyandis aCFACharterholder

Byoung-KyuMin’sprimaryresearchinterestsareintheareasofassetpricingand investments.Hisresearchaimstounderstanddeterminantsofcross-sectionaldifferences instockreturns,predictabilityofstockreturnsanditsimplicationfortradingstrategies, andhowfinancialmarketsandthemacroeconomy(suchasbusinesscycles)arerelated andtheirimplicationsforassetpricing.Heproposesmultipleexplanationsforfinancial marketanomalies,includingrisk-basedexplanation,lotterypreferenceandsentiment.

VadimMoroz holdsaPhDinAppliedMathematicsfromNorthwesternUniversity. Hewasco-founderandco-PMforthe$1.3bUBSO’ConnorGlobalEquityLong/Short strategy.Subsequentlyhemanagedhigh-frequencytradingstrategiesatTudorCapital,

CitadelandJPMorgan.HeispresentlyworkingasaDataScientistsupportinginvestmentmanagementfunctions.Hewasaco-recipientoftheINQUIREEuropeprizefor bestresearchin2003.

AndersPetterson beganhiscareeratJPMorganandwentontosetupArtTactic in2001.ArtTactichasbecomeoneoftheleadingartmarketresearchcompaniesanda pioneerinusingcrowd-sourcingtechniquesforgatheringandprocessingintelligenceon theartmarket.AndersPetterssonisaregularlecturerontheartmarketforuniversities andbusinesses.HeisalsoafoundingboardmemberofProfessionalAdvisorstothe InternationalArtMarket(www.paiam.org)

ChristopherPolk isDepartmentHeadandProfessorofFinanceattheLondon SchoolofEconomics.Hehaspublishedextensivelyinleadingacademicjournals,receivingnumerousprofessionalawardsincludingpaperoftheyeartwiceatthe Journalof FinancialEconomics.Polkhasadvisedassetmanagers,centralbanksandregulatorson topicsrelatedtohisresearch.HeholdsaPhDinfinancefromtheUniversityofChicago wherehestudiedunder2013NobelLaureateEugeneFama.

KatharinaSchwaiger,PhD,isaninvestmentresearcherwithintheFactor-based StrategiesGroupatBlackRock.Herresearchresponsibilitiesincludemacroandstyle factorresearch.PriortojoiningBlackRocksheworkedasaFinancialEngineerinthe CityofLondon,asaQuantitativeResearcherataLondon-basedhedgefundandasa LecturerattheLondonSchoolofEconomics.ShereceivedaBScinFinancialMathematicsandaPhDinOperationalResearchfromBrunelUniversity.

LouisScott isthefounderofKiemaAdvisors,aresearchconsultancy.HeiscurrentlyworkingwithDrCavagliaonresearchprojectsforInvesco.Hewaspreviously HeadofFactSet’sRiskandQuantitativeResearch.LouishasmanagedaglobalequitieshedgefundatOldMutualAssetManagers,USequitiesatCitigroupandcurrencies atPanAgora–eachatover1billioninAUM.HeisamemberoftheLondonQuant Group’smanagementcommittee.

NandiniSrivastava completedherPhDattheFacultyofEconomics,Universityof Cambridgein2013isnowaDirectoratJPMorganAssetManagement,London,UK. Shefocusesonassetallocationresearchwhereherroleinvolvesquantitativelyanalysing theimpactofmacroeconomicandfinancialfactorsacrossarangeofassetclassesand developingstrategiesbasedontheseforportfolioallocation.Nandinihasbeenareferee atanumberofacademicjournalsandcontinuestopublishinacademicforums.

Christopher(Chris)Tinker isafoundingpartnerofLibraInvestmentServices,an FCAregulatedindependentequitymarketresearchcompany.Withmorethan30-years experienceintheFinancialServicesindustry,hebeganhiscareerasanEquitymarkets economistintheCityofLondonbeforemovingontoresearchrolesinfixedincome, credit,currencyandmoneymarketsandasaninternationalequitystrategistinLondon andHongKong.HehasaBAinEconomicsfromManchesterUniversity.

DannyYeung isalecturerattheUTSBusinessSchool.Danny’sresearchinterests concentrateintheareaofinvestment,withparticularemphasisontheimpactofambiguityandemotionsoninvestordecisionmaking,mutualfundperformanceandtheimpact ofinstitutionalinvestorsincapitalmarkets.Hehaspublishedwidelyininternational peer-reviewedjournalsincludingthe JournalofBankingandFinance,the Pacific-Basin FinanceJournal andthe InternationalReviewofFinancialAnalysis.

OliverJ.Williams beganhiscareeratBostonConsultingGroup,thenworkedin derivativesatJPMorganandCreditSuissebeforejoiningMarkhamRaeaspartner,portfoliomanagerandleadarchitect/developerinsystematictrading.HeholdsanMAin computerscienceandmanagementstudies,MPhilandPhDinfinancialeconomicsfrom CambridgeUniversityandMScinmathematicsfromBirkbeck.Hehasco-authored severalarticlesininvestmentmanagementandisco-inventorofasoftwarepatentin networkanalytics

WilliamE.(Bill)Zieff isDirectoratNorthfieldInformationServicesandwasManagingDirector,ChiefInvestmentOfficerandPortfolioManagerofGlobalStructured ProductsGroupatEvergreenInvestmentManagementCompany.Previously,Billwas theManagingDirectorandCo-ChiefInvestmentOfficeroftheGlobalAssetAllocationGroupatPutnamInvestments.HealsoservedasaDirectorofAssetAllocationat Grantham,Mayo,VanOtterloo.BillobtainedaBScinEconomicsandMathematics fromBrownUniversityandanMBAfromtheHarvardBusinessSchool

Therearenumerousdefinitionsofmomentum,whichasaninvestmentstrategyis likelytobeofgreatantiquity.SomeauthorscreditRichardDriehauswithpopularisingthestrategy,indeedhewasdescribedintheAmericanAssociationofIndividual Investorsasthefatherofmomentuminvesting.TheconceptofrelativestrengthinvestingmotivatedJegadeeshandTitman(1993)toanalysethemomentumeffect.Their basicfindingshowedthat‘winners’(thetopdecileofperformers)overthepastthreeto twelvemonthscontinuetooutperform‘losers’(thebottomdecile)overthesubsequent threetotwelvemonths.

Thisreturnpersistencephenomenonwasinitiallydocumentedthroughthefollowingprocess.First,stocksaresortedeachmonthintodecilesbasedonperformanceover thepast J months(the‘formation’or‘ranking’period).Wemighttypicallythinkof ‘Portfolio10’beingthatofthewinningstocks,‘Portfolio9’containingthesecond-best decileofperformers,andsoondownto‘Portfolio1’containingtheworstperforming decileofstocks,‘losers’.1

Themomentumstrategyinvolvesholdingrankedportfoliosofthechosenstocks forthenext K months(the‘holding’period).TheversionadvocatedbyJegadeeshand Titmaninvolvestakingalongpositioninthewinnersandshortingthelosingstocks. Documentedprofitsforanoverlappingversionofthestrategywereestimatedtobe about12%peryearwhen J and K rangebetween6and12months.Intheopinionof JegadeeshandTitman(2011,p.494)thesustainedandconsistentmagnitudeofreturns toamomentumstrategyaretoolargetobeexplainedbyriskfactors.

However,asthisbookwillshow,therearemanydifferentdefinitionsofmomentum, andweareattemptingtounderstandthemallwithinacommonframework.Focusing ontheabovedefinitionofmomentum,itisclearthatwecanvaryboththeformation periodandtheholdingperiod.Theremayalsobeaninterveningperiodbetweenof length M betweenthetwo.Suchastrategycouldbedefinedbythetriplet(J , M, K), wheretheusualconventionisforperiodsof J ,K and M months.However,anyunit oftimecouldbeused.Furtherimmediategeneralisationscouldmovefromdecilesto n-tiles.Onestandardconventionisthattheportfolioisself-financing.Thismeansthat ifyouweretohold$100millioninwinningstocks,youwouldshort$100millionin losers.

1 ThisistheorderingusedinKenFrench’sdata,althoughJegadeeshandTitman(1993)usereverse numberordering.

I.1.HOWHASMOMENTUMPERFORMED?

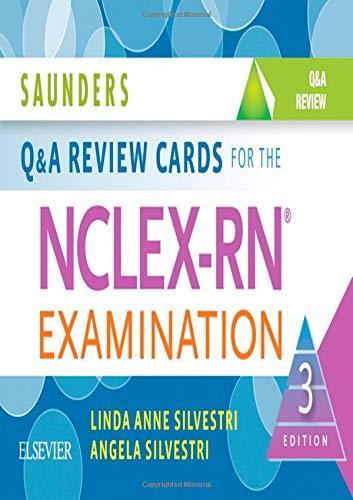

InFigureI.1,wepresentreturnsofvalue-weightedportfoliosofUSstocksusingdata fromKenFrench’swebsite.2 Thefigureplotsreturnsfortwooverlappingtimeperiods, (i)thefullsampleperiodfromJanuary1927untilNovember2019,and(ii)the30 yearperiodfromDecember1989untilNovember2019.Thelatterperiodcoincides approximatelywiththetimeframesinceearlyversionsofJegadeeshandTitman’swork becameavailable.

Toconstructportfoliosbasedonpriorreturns,stocksaresortedbasedonprior returnsfrommonth 12tomonth 2.Amonth’sreturniswithheld,andreturnsare reportedonamonthlybasis,whicharethenannualisedandaveraged.Usingtheabove notation,weconsiderthisan(11, 1, 1)strategy.WenotethataswemovefromLosers

192701 to 201911 198912 to 201911

FIGUREI.1 Annualisedmonthlyreturnsforvalue-weightedportfoliosformedbasedon priorreturns(11,1,1).Thefigurereportstheaveragereturnstoportfoliossortedonprior returns(whereportfolio1istheportfolioofworstperformingstocks,andportfolio10is theportfolioofbest-performingstocks)overtheperiodfromJanuary1927toNovember 2019(solidbars)andDecember1989toNovember2019(stripedshading).

2 https://mba.tuck.dartmouth.edu/pages/faculty/ken.french/data_library.html.WethankKen Frenchformakingthedataavailableforresearchers.Thedatausedspecificallyis‘10Portfolios FormedonMomentum’,withvalueweightedmonthlyreturns.