LandUsePolicy

journalhomepage: www.elsevier.com/locate/landusepol

LandfinancedependenceandurbanlandmarketizationinChina:The perspectiveofstrategicchoiceoflocalgovernmentsonlandtransfer XinFana,b,SainanQiuc,YukunSund,*

a SchoolofEconomics,RenminUniversityofChina,Beijing,100872,China

b CenterforChinaPublicSectorEconomyResearch,JilinUniversity,Changchun,130012,China

c SchoolofEconomics,JilinUniversity,Changchun,130012,China

d SchoolofPublicFinanceandTaxation,ZhongnanUniversityofEconomicsandLaw,Wuhan,430073,China

ARTICLEINFO

Keywords: Urbanlandmarketization

Landfinancedependence Industrialland Commercialland Residentialland

ABSTRACT

Inthecontextoftax-sharingsystem,theissueofusingprofitsfromlandtransferstocoverlocalgovernment deficitshasattractedwidespreadattention.However,researchonhowlocalgovernmentscontingentlychoose differenttypesofurbanlandtransfermethodsandthetransfervolumesremainslimited.Thispaperutilizes China’stransferoflandparcelsdatafrom2007to2016tocalculatethemarketizationlevelofdifferenttypesof urbanland,andinvestigatesthedrivingforcesofurbanlandmarketizationinChina,payingspecialattentionto landfinancedependenceandurbanlandmarketization.Wefindthaturbanlandmarketizationlevelisincreasing.Amongdifferenturbanlandtypes,residentiallandhasthehighestmarketizationlevel,whileindustrial landhasseenthelargestincreaseinmarketization.Theresultsofaspatiallagmodelalsoshowthatwhenlocal governmentsincreasetheleveloflandmarketization,governmentsinneighboringregionsreactcorrespondingly.Judgingfromthestatusquoofeconomicdevelopmentinmostcities,localgovernmentsusuallytackle financialdeficitsbyvigorouslypromotingurbanlandmarketization,buttheytendtoprioritizeresidentialand commerciallandtransfersfortheirowninterestsgiventhedegreeoflandfinancedependence.Thisstudy broadensourunderstandingoftheheterogeneousnatureoflandmarketizationandtheroleoflocalgovernment behaviorintheurbanlandmarketinChina.

1.Introduction

UnderChina'scurrentfiscalandtaxsystems,thelocalgovernment deficitandthepoliticalpromotionsystemareprimarydrivingforcesfor landfinance.Ontheonehand,thereformofChina’stax-sharingsystem hasdecentralizedtheresponsibilityoffinancinglocalgovernment programs.Forexample,firmsthatoriginallypaidtaxestolocalgovernmentsarenowtaxedbythecentralgovernment,indicatingaplunge inlocalgovernmentrevenue:inthefirstyearunderthereform,the ratiooflocalgovernmentfiscalrevenuetothenationalfiscalrevenue droppedfrom78%to44.3%.Asthereformofthetax-sharingsystem continues,theaimofeconomicgrowthcausesincreasingpressureon localgovernments(Taoetal.,2010; Zhang,2006).Thefiscaldeficitof

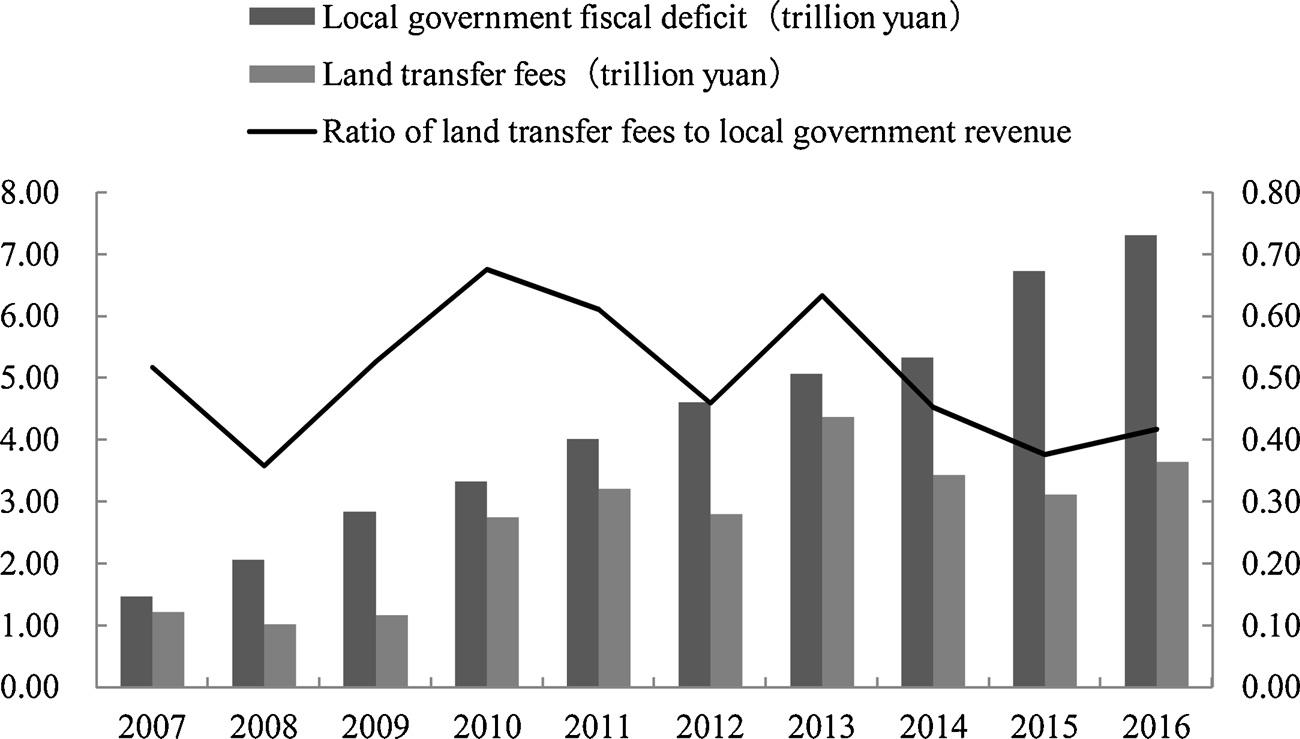

thelocalgovernmentrosefrom1.47trillionyuanin2007to7.31 trillionyuanin2016,anincreaseofnearly400%(Fig.1).Changesin deficitsincreasethedemandforgovernmentrevenueatthelocallevel (Panetal.,2015).Amongallfeasibleapproaches,landtransferfees havebecometheprimarysourceofextra-budgetaryincometocoverthe fiscaldeficitresultingfromdecreasesinfundingfromthecentralgovernment(LichtenbergandDing,2009; Lin,2007; LinandYi,2011; Fu, 2015),withamountincreasingfrom1.22trillionyuanto3.65trillion yuanduringtheperiodfrom2007to2016;althoughtheirproportion hasfluctuatedgreatly,landtransferfeeshaveprovidedupto36%of localgovernmentrevenue.1

Onetheotherhand,aslocaleconomicgrowthandgovernment revenuearethetwobasiccriteriaonwhetherthelocalgovernment

⁎ Correspondingauthorat:182NanhuAvenue,EastLakeHigh-techDevelopmentZone,Wuhan,430073,China. E-mailaddress: syk1208@gmail.com (Y.Sun).

1 Landtransferfeesareconsideredasinformalfiscalrevenue.Before2006,landtransferfeeswerelistedasnon-budgetincome;sincethepromulgationofthe ManagementMeasuresontheRevenueandExpenditureoftheTransferofState-ownedLandUseRightsin2006,theyhavebeenincludedinoneofthegovernmental fundsandarefreelycontrolledbythelocalgovernmentandrequirenosubmissiontothecentralgovernment.Itshouldbenotedthatland-relatedtaxrevenuemay alsoconstitutealargesegmentofthelocalgovernmentrevenue.However,theland-relatedtaxrevenueisincludedinthetotalbudgetofthelocalgovernment, combinedwithothertaxesandcannotbecompletelycontrolledbylocalgovernment.Therefore,localgovernmentsdonothavesufficientincentivestopursuelandrelatedtaxrevenues(Liuetal.,2016).

https://doi.org/10.1016/j.landusepol.2020.105023

Received31December2019;Receivedinrevisedform23June2020;Accepted14August2020

Availableonline02September2020

0264-8377/©2020ElsevierLtd.Allrightsreserved.

Fig.1. Landtransferfees,localgovernmentfiscaldeficitandtheratiooflandtransferfeestolocalgovernmentrevenue.

officialcanreceivepromotion,landfinancehasbeenapopulartoolof governmentsbecauseintheshorttermitcreatesanimpressiveaccomplishmentforboththejurisdictionanditsofficials(Oi,1995; Chen, 2004; Maskinetal.,2000; Chenetal.,2005).Inaddition,empirical studieshaveshownthatforeveryonepercentagepointincreasein China'sregionaleconomicgrowthrate,theprobabilityofpromotionfor provincialofficialsincreasesby15percentagepoints(LiandZhou, 2005).

Thecontinuedaccelerationofindustrializationandurbanization hasincreasedthedemandforurbanland(Liu,2018).Underthepublic landownershipsysteminChina,theprimarylandtransfermarketis monopolizedbylocalgovernments,whichcanselectivelyimplement landmanagementpoliciesauthorizedbythecentralgovernment (O’BrienandLi,1999; Ran,2013; Liuetal.,2014)aswellasmakeselfinterestorientedlandtransferdecisionsthataffectlandmarketization. AsChinacontinuesmarketizationreform,theroleofmarketmechanismsintheallocationoflandresourcesisbecomingmoreimportant. Becauselocalgovernmentscannotcreatemoreland,itseffectiveuse willbenefitChina'seconomicgrowthandurbandevelopment(Mo, 2018; Halleuxetal.,2012).

Differentfrommarket-orientedlandallocationsystemsindeveloped countries(Alonso,1964),China'surbanlandallocationsystemisboth market-orientedandgovernment-monitored(Haila,2007; XuandYeh, 2009).Duringtheplannedeconomyperiod,thegovernmentmadethe urbanlandinChinaavailableatnocost.Aftertheeconomicreformand theopeningupofthecountry,China'surbanlandavailablefordevelopmentgraduallychangedfromfreeallocationtopaidtransfer.Inthe 1990s,theinitiallandtransfermethodinChinawasprimarilybasedon closed-doornegotiationsbetweengovernmentofficialsandlandusers (xieyi),2 asystemthatincentivizedrenteduseandotherproblemsassociatedwitheconomicinefficiency(Caietal.,2013)aswellasledto inefficientusesandwasteoflandresources.Comparedwithcommercialandresidentialland,thetransferofindustriallandismorecomplex andchaotic.BecauseofChina'sregionaleconomiccompetition,local governmentshavesuccessivelytransferredindustriallandbyattracting investorswithlow,zeroorevennegative(consideringsubsidiesfor infrastructuresupport)landprices.Toachieveefficientuseofland resourcesandtobeinlinewiththereformoftheeconomicsystem,the centralgovernmentbegantovigorouslypromotelandmarketreforms. Fromthebeginningofthe21stcentury,China'slandmarketization processhasaccelerated;sincetheMinistryofLandandResourcesofthe

2 Thereisonlyoneassigneeintheclosed-doornegotiation,andtheland transferpriceisdeterminedbythegovernmentandthetransfereeinprivate.It isnotaformalmarket-basedtransfermethod.

People'sRepublicofChinaexplicitlypromotedlandmarketreformin 2002,3 China'surbanlandmarketizationlevelhasshownasteadyupwardtrend(Liuetal.,2016).

LookingbackonthedevelopmentofChina'slandmarketization,it hasbeenagradualprocesspushedforwardbythecentralgovernment fromtoptobottom.However,thedegreeofimplementationofland marketizationrequirementsvarysignificantlyamonglocalgovernments,providingarichbasisforthedifferentialanalysis,whichisthe focusofthispaper.AsChina’seconomyhasdeveloped,localgovernmentsnowfacegreaterfinancialpressure.Theymustdecideonhowto effectivelyrelievethispressureusingbothgovernmentinterventionand themarketpowerinvarioustypesoflandmarket(Yangetal.,2015; WangandHui,2017);however,therelationshipbetweentheland transferbehaviordominatedbylocalgovernmentsandurbanland marketizationisdynamic.Asanimportantsourceoffinancialrevenue forlocalgovernments,localgovernments’dependenceonlandtransfer revenuenotonlyhasapositiveimpactonlandprices(Zhangetal., 2016),especiallyonthepricesofcommercialandresidentialland(Pan etal.,2015),butalsoincreasestheamountoflandtransfers(Shuetal., 2018).Suchgrowthinlandtransfershasacleardrivingeffectonthe developmentofthelandmarket,subsequentlyacceleratingthereform oflandmarketization.However,ourdataalsodemonstratethatin economicallyunderdevelopedregions,thefiscaldeficithasinhibited thelevelofurbanlandmarketization(Liuetal.,2016),inotherwords, thedependenceonlandfinancecausedbylocalgovernmentfiscal pressurehasinhibitedthelevelofurbanlandmarketization.Withthe abovediscussioninmind,sofarscholarshavenotreachedaconsensus ontherelationshipbetweenlandfinanceandurbanlandmarketization. Ifweconsiderthedifferencesinthelandstrategiesofthelocalgovernments,theirrelationshipwillbecomemoreunclear.

3 In2002,theMinistryofLandandResourcesoftheP.R.Cissuedthe RegulationsontheTransferofState-ownedLandUseRightsbyPublicTrending, AuctioningandListingofQuotation,statingthat“Allkindsofcommercial, tourism,entertainment,andcommercialhousingmustbesoldbypublic trending(zhaobiao),auctioning(paimai),andlistingofquotation(guapai) (MLRC,2002 MinistryofLandandResourcesofChina,2002).”InAugust2006, theNoticeoftheStateCouncilonStrengtheningRelevantIssuesConcerning LandRegulationandControlclearlystated:“Industriallandmustbesoldby meansofpublictrending,auctioningandlistingofquotation,andtheselling pricemustnotbelowerthanthepublishedminimumpricestandard.”InMarch 2007,thePropertyRightfurtherstipulatedthat:“Managementlandforindustrial,commercial,tourism,entertainmentandcommercialhousing,and thosewithmorethantwointentionallanduseinthesamelandshallbeauctionedutilizingpublicbidding,publictenderingandauctioning(Ministryof LandandResourcesofChina,2007).”

Usingamulti-scale,multi-mechanismframeworktoanalyzethe strategicchoicesoflocalgovernmentsinthefaceofcentralpolicy,this researchaimstoimproveourunderstandingofChina'sindustrial, commercial,andresidentiallandmarketreforms.Weusedetailed Chineselandtransferinformationfrom2007to2016andapplya spatiallagmodeltoexaminetherelationshipbetweenlandfinance dependenceandurbanlandmarketization,payingspecialattentionto theheterogeneityoftheseeffectsamongdifferenttypesofland.

Thispapercontributestotheexistingliteratureintwoaspects.First, itappearstobethefirstpapertouseauniqueandcomprehensive databaseofurbanlandtransactionstomeasurethegeneralurbanland marketizationandthemarketizationlevelofdifferenttypesofland. Existingresearchprimarilyusesmacro-datafromtheChinaLandand ResourcesStatisticalYearbookincalculatinglandmarketization(Liu andLin,2014; Liuetal.,2016; Wuetal.,2015).However,since2008 thegovernmenthasnotreleasedthesub-itemdataof“publictendering, auctioningandlistingofquotation,”solandmarketizationcannotbe accuratelymeasured.Second,consideringthespatialspillovereffectsof landmarketization(Brueckner,2003)andthecontingencychoicesof localgovernmentsfordifferenttypesoflandtransfer,weuseaspatial econometricsmodeltoinvestigatetherelationshipbetweenlandfinancedependenceandmarketizationofdifferenttypesoflandtoprovideempiricalevidenceonthehypothesisthatpolicychoicesoflocal governmentsvaryfordifferenttypesoflandtransfer(Kongetal., 2018).

Therestofthepaperisorganizedasfollows:InSection 2,we measurethelevelofurbanlandmarketizationandthedegreeofland financedependencewhileconductingacorrespondingtrendanalysis basedontheanalysisoftheinternalmechanismoflandfinancedependenceandurbanlandmarketization.Weintroducerelevantvariablesanddatasourcesandconstructaspatialeconometricsmodelin Section 3.Section 4 considerstheimpactoflandfinancedependenceof localgovernmentsontheoverallanddifferenttypesofurbanland marketizationandSection 5 concludeswithadiscussiononimplicationsofthisstudyandsuggestionsforfutureresearch.

2.Theevolutionoflandfinancedependenceandurbanland marketization

2.1.Urbanlandmarketizationfromtheperspectiveofthestrategicchoiceof thelocalgovernmentinChina

In1994,Chinaactivelybegantoimplementthetax-sharingsystem, dividingthetaxsystemintothecentraltax,localtax,andcentral-local sharedtaxandclassifyingallconsumptiontaxesand75%ofvalueaddedtax(VAT)ascentralfiscalrevenue;thereformoftheincometax sharingsystemintroducedin2002changedthecorporateincometax andthepersonalincometaxfromlocaltaxtocentral-localsharedtax, thusreducingtheincometaxreceivedbylocalgovernmentsby40% since2003.ThechangefromabusinesstaxtoaVATfullyimplemented in2016,furtherreducedthelocalgovernment'sfinancialresourcesby reducingboththeVATandthedoubletaxation.Theimplementationof thetax-sharingsystemincreasedtheshareofcentralgovernmentrevenue,shiftedthepublicexpenditureresponsibilitytothelocalgovernmentsatthesametime(Wuetal.,2015).Localgovernmentrevenue rosefrom2.38trillionyuanto8.72trillionyuan,andfiscalexpenditure rosefrom3.83trillionyuanto16.04trillionyuanfrom2007to2016, theincreaseinfiscalexpenditurewassignificantlygreaterthanthe increaseinfiscalrevenue.Amongthe283prefecture-levelcitiesstudied,onlySuzhou,HangzhouandWuxihavesustainedfiscalsurpluses. Landtransferfeesiscontrolledbylocalgovernmentinsteadofthe centralgovernment(GuoandShi,2018).Therefore,localgovernments withlargefiscaldeficitsrequestbothtransferpaymentsfromthecentralgovernmentandlandfeestocoverdeficits,withthelatterbeingthe mostcommonwayforlocalgovernmentsinChinatoincreasetheir fiscalrevenue(Ding,2003).4 Forregionswithsmallfiscaldeficitsor

evenfiscalsurpluses,themotivationtomakeupforthefiscaldeficitsis weaker,butthesecitiesareconcentratedineconomicallydeveloped areassuchasthesoutheastcoast.Duetothepressureofofficials’promotioncompetitionandtheperformanceevaluationbysuperiorgovernments,localgovernmentsareofteninastateofrivalryandinteractionwitheachother,especiallyinregionsthataregeographically adjacentorhavesimilareconomicdevelopmentlevels.Theselocal governmentsnotonlyhavetoensuretheeconomicgrowthrate,but alsohavetoseekhigherrankingsovertheir“peers”.Consequently,they haveastrongincentivetopursuelandfinance(Oi,1995; Chen,2004; Maskinetal.,2000; Chenetal.,2005).

Chinahasformedathree-levelstructureforitslandmarket,namely theagriculturallandacquisitionmarket,theprimarylandmarket,and thesecondarylandmarket.Theprimarylandmarketismonopolizedby localgovernments,whichcanselectivelyimplementthelandmanagementpoliciesestablishedbythecentralgovernment(O’BrienandLi, 1999; Ran,2013)ordeveloplandtransferdecisionsfortheirowninterests.Bothapproachesdirectlyaffecturbanlandmarketization.To addressfinancialpressureandachievelong-termeconomicgrowthin theregion,localgovernmentshavegraduallyimplementedadevelopmentroutinethatreliesonthesaleoflandtoobtainextra-budgetary income.Landfinancehasbecometypicaloflocalgovernmentsundera decentralizationpolicy.

Chinahasexperiencedrapidurbanizationatanunprecedentedrate sincethe1978reformandtheopeningoftheeconomy(Baietal., 2014).Withthecontinuedaccelerationofindustrializationandurbanization,thedemandforurbanlandinChinahasincreasedrapidly.But thelandresourcesoflocalgovernmentsarelimited.Tomaximizetheir interests,localgovernmentsimplementlandtransferstrategiesbased onvariousdegreesoflandfinancedependence.

Localgovernmentsadoptdifferentmethodsoflandtransferand requiredifferentlandtransferincome.Atthebeginningofthemarketorientedreformofurbanlandtransfers,theonlymarket-basedmethod forlandtransfersstipulatedingovernmentdocumentswas“public tenderingandauctioning.”5 In2002,theMinistryofLandandResourcesintroducedthe“listingofquotation”transfermethod.6 Althoughthecentralgovernmentclearlystipulatedthatindustrial,commercialandresidentiallandmustbesoldthroughmarket-based methodssuchas“publictendering,auctioning,orlistingofquotation”, itiseasyforlocalgovernmentstointerveneinthe“listingofquotation” toobtainprofitsincorruption(Xuetal.,2009).Therefore,thegovernmentismoreinclinedtotransferlandthrough“listingofquotation”.

4 Transferpaymentsaredividedintogeneraltransferpaymentsandspecial transferpayments.Localgovernmentsneedtousespecialtransferpaymentsfor thepurposesspecifiedbythecentralgovernment.Specialtransferpayments stillaccountforalargeproportion.Ontheonehand,thespecialtransferpaymentdoesnotformthedisposablefinancialresourcesofthelocalgovernment; ontheotherhand,toomanylocalspecialfundpackagesrequiredinspecial transferpayments(suchasthetransferpaymentforagriculture,education, scienceandtechnology,etc.requiresthecorrespondinginfrastructureofthe localgovernment)increasetheburdenoflocalfinances,forcingmanyplacesto crowdoutnormalfiscalexpendituresandalsoaffectedtheoverallbalanceof localfiscalbudgets.

5 Auctioningreferstothattheassignorfirstsetsthefloorprice,bidderstake turnstoquoteprices,andthebidderwiththehighestpriceobtainsthelanduse right.Publictenderingreferstobiddingfortherighttouseapieceoflandina writtenbiddingwithinaprescribedperiod.Unlikethepublicpricesystemof auctions,biddersinvolvedinpublictenderingdonotknowoneanother’sbids, andthelanduserightlenderchoosesthehighestpricetotransferland.

6 Thelistingofquotationisequivalenttoatwo-stageauction.Thebiddersin thefirststagepubliclyofferpricesinasequence.Iftherearetwoormore biddersafterthefirststage,theyaretransferredtotheliveauction,whichisthe sameastheauction.Unlikeauctions,wheretherearemorethanthreebidders, thereisnorequirementforthenumberofbidderstobelisted,aslongasthe bidder'sbidisnotlowerthanthelistedbaseprice,thetransactioncanbe completed.

Aslocalgovernmentsstillhaveconsiderablemonopolypoweranda strongwillingnesstointerveneinthemarketinthetransferofindustrial land,theuseofvariousstrategiestotransferthistypeoflandatlow pricesthrough“listingofquotation”toattractcorporateinvestment stillexiststoday(Taoetal.,2010).Asaresult,thetransferpriceof industriallandissignificantlylowerthanthepriceofcommercialand residentialland,andlowerthanthemarketprice.

Localgovernmentsmakestrategicchoicesonthelandtransfertypes andonthelandtransferincome.Sellingcommercialandresidential landthrough“publictendering,auctioning,orlistingofquotation”may quicklyalleviatefinancialpressurebyobtaininglandtransferfees. Sinceindustrialzoningiscorrelatedwithlong-termemployment,populationgrowth,andincreasedbusinesstaxrevenuestreams,thereis anincentiveforlocalofficialstoofferindustriallandatalowprice (Wang,2014; Wassmer,2002; LangerandKorzhenevych,2018).Asa generalrule,localgovernmentsareincentivizedtoengageinamixed strategy,offeringdifferenttypesoflandatdifferentprices.

Thedatashowthattoeasefinancialpressure,localgovernments tendtousemorelandforcommercialandresidentialpurposes,selling itthroughthehighlymarket-oriented“publictendering,auctioning,or listingofquotation”option(Li,2014). HanandKung(2015) examined therelationshipbetweenfiscalrevenue,thelandtransferareaandthe salesincomefromcommercialandresidentialland,findingintheir samplethatevery1%decreaseinfiscalrevenueretainedbylocal governmentswastheresultofanincreaseof6.4%–11.0%inthe transferareaofcommercialandresidentialland.Suchincrementin transferareacauseslandtransferrevenuetoincreaseby10.0%–16.3 %.Inotherwords,inregionswherelandfinancedependenceishigher, localgovernmentstendtosellcommercialandresidentiallandina highlymarketablewaytocompensateforfiscaldeficitsquickly;however,itisdifficulttoprojectthelong-termeconomicdevelopment.The oppositeistrueforareaswithlowerlandfinancedependence.Dueto differencesintheeconomicdevelopmentstagesandtheadvantageous featuresofthelandresourcesincities,thestrategicchoicesoflocal governmentswiththesamelandfinancedependencearealsodifferent, indicatingheterogeneousimpactsoflandfinancedependenceonurban landmarketization.

2.2.Measurementoflandfinancialdependenceandurbanland marketization

Facedwiththepressureoffiscaldeficits,localgovernmentsurgently needtoincreaserevenuestocompensateforthem.Asaneffectiveway ofrapidlyincreasingrevenues,landtransfersareprevalentacross China.Fromtheperspectiveoftheincomesourcesoflocalgovernments,landtransferincomeprimarilyincludeslandtransferfeesand land-relatedtaxes.However,thecomplexityoflocaltaxsystemsand thedelayedstreamoflandtaxationcomplicatethemeasurementofthe truetaxrevenuebenefitoflandtransfers.Landtransferfeesareoneof themosteffectivewaystoaddresslocalgovernmentdeficitsastheyare thelargestandmosteasilycontrolledcomponentoffiscalrevenue(Shu etal.,2018).Bycontrast,land-relatedtaxrevenuestreams,whileimportant,arelesseasilyattributedtoaparticularlandtransfer.Inthis studyweusethelandtransferfeetomeasurelandfinancedependence (Mo,2018; Luetal.,2019),whichiscalculatedas

= + lfd ltf ltfgbr (1)

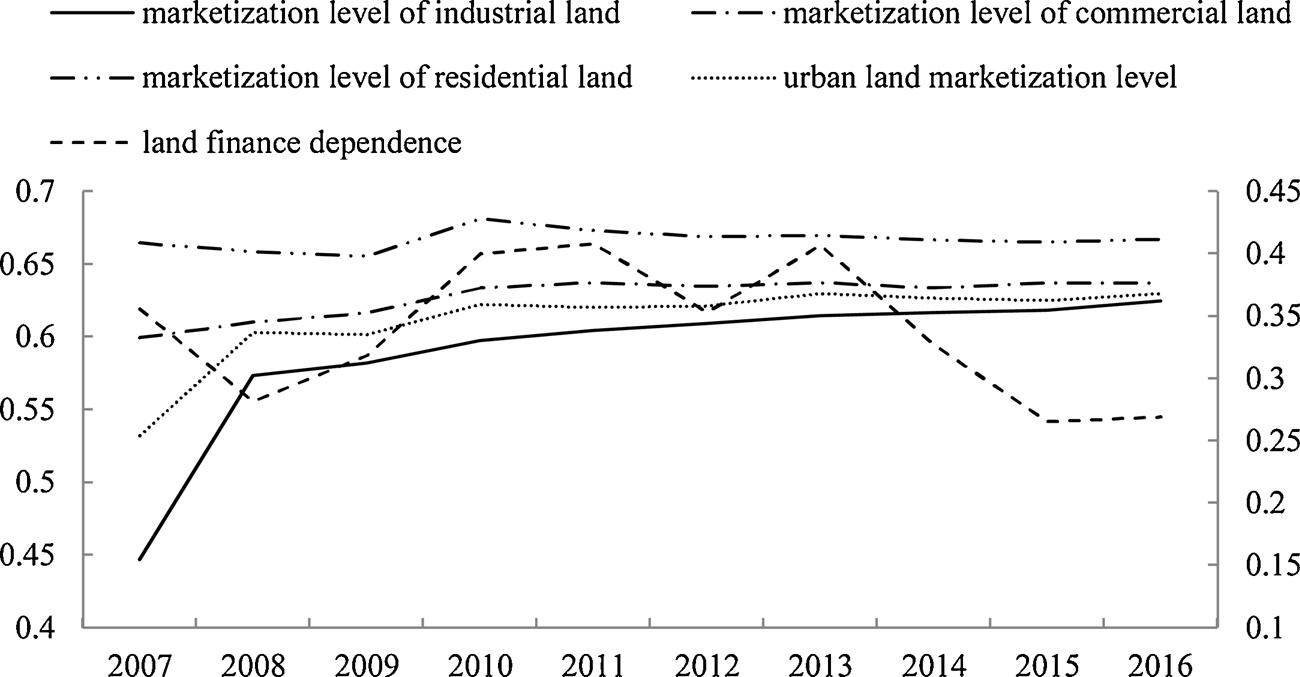

where lfd representslandfinancedependence, ltf representstheland transferfee,and gbr representsthelocalgovernment’sintra-budgetary revenue.Ascalculated,landfinancedependencefluctuates,butthe overalltrenddeclinedduringthe2007–2016sampleperiod(Fig.2).On average,thefinancialdependenceofthelocalgovernmentonlandin 2016was0.2695,around0.0692lessthantheaverageannualland financedependence.Thetrendoflandfinancedependenceiscoincident withsuchfactorsastax-sharingreformandeconomicfluctuations.

Duetothedifferencesinnaturalenvironment,populationdensity andeconomicdevelopmentlevel,therearelargegeographicdifferences inlandusepolicies(Wangetal.,2018b).Thisalsoleadstoalarge spatialdifferenceinChina’slandfinancedependence.Observingthe degreeoflandfinancedependenceofvariouscitiesin2016,itcanbe foundthatcitiesineasterndevelopedregionssuchasNanjing, Changzhou,Jinan,andJiaxinghaveahigherdegreeoflandfinance dependence,respectively0.6063,0.5944,0.5265,and0.5163,much higherthantheaveragevaluein2016(0.2695).ThelandfinancedependenceofLongnaninthewesternregionisthelowest,only0.0086. Thedevelopedregionsintheeasthavelessfinancialpressureand weakerlandresourceendowment,butthelandfinancedependenceis thehighest;theunderdevelopedregionssuchasthewesternandcentral regionshavegreaterfinancialpressuresandstrongerlandresource endowment,buttheirlandfinancedependenceisrelativelyweak.The easternregionsaredenselypopulatedwithlimitedlandarea,resulting inscarcelandresources,butbecauseoftheirbettereconomicand technologicalconditions,thedegreeoflanduseandlandpricesare relativelyhigh(Wangetal.,2018a).

Althoughtheaveragefiscaldeficitsbetween2007and2016inthe easternregionwas8.75billionyuan,whichwasmuchsmallerthan 10.63billionyuaninthecentralregionand10.54billionyuaninthe westernregion,landsalesrevenueintheeastwas13.84billionyuan, higherthanthatinthecentralregion(6.55billionyuan)andthe westernregion(5.21billionyuan).Forthecentralandwesternregions, themarketmechanismhasaweakroleinregionaldevelopment,the abundantlandresourcesarenoteffectivelyusedandthelandtransfer revenueisrelativelysmall.Despitetheheavyfinancialpressure,the centralgovernment'stransferpaymentsaremainlyinclinedtowardsthe centralandwesternregions,solandfinancedependenceisrelatively low.

InChina,therurallandmarketandtheurbanlandmarketaredivided,withthemarket-orientedtransactionssuchas“publictendering, auctioningorlistingofquotation”primarilytargetingurbanland,while thesecondarymarketoflandisclosetoacompletelycompetitive market.Therefore,weusetheleveloflandmarketizationintheprimarymarketasthemeasurementofurbanlandmarketization.The mostcommonmethodsforlandmarketizationarethedirectcalculation method(WangandTan,2020; Yuanetal.,2019)andtheweighting method(LiuandLin,2014; Liuetal.,2016; Wuetal.,2015).Thedirect calculationmethoddirectlymeasurestheleveloflandmarketization usingindicatorssuchastheprice,area,andnumberoflandtransfers; theweightingmethod,althoughbasedonthedirectcalculation method,givesdifferentpriceweightstothoseobtainedthroughcloseddoornegotiation,publictendering,auctioning,andlistingofquotation. Comparedwiththedirectcalculationmethod,theweightingmethod notonlyconsidersthelandtransfermethodbutalsotakesintoaccount thedeviationbetweentheactualsupplypriceofthelandandthe marketizationstandardandthustheweightingmethodcanbeconsideredasamorecomprehensivemeasurementtheleveloflandmarketization.

Weusetheweightingmethodinthisstudytomeasurethemarketizationleveloftheoverallandthedifferenttypesoflandusing variousadministrativelandtransectiondatainChina.Specifically,this paperusesthedetailedinformationonmorethan1.673millionland transfersinChinabetween2007and2016,7 includinglandsupply, projectlocation,area,landuse,landsupplymethod,transactionprice,

7 ChinaLandWebsite: www.landchina.com.In2006,the“Regulationsonthe TransferofState-ownedLandUseRightsforPublicTendering,Auctioningand ListingofQuotation”clearlyrequirethatthemunicipalandcounty-levelgovernmentlandauthoritiesmustpublishtheresultsofthetransferofthevarious landonthe“ResultsPublicity”columnoftheChinaLandWebsite.Theintroductionofthisspecificationprovidedabasisforustousemicro-datato measureurbanlandmarketization.

Fig.2. ThetrendofurbanlandmarketizationandlandfinancedependenceinChinesecities.

andthedateofsigningthecontract,amongothers.Wecompiledthe dataforthecitiesbasedonthe2007jurisdictioncodes.8 Considering thatdifferentlandtransfermethodshavedifferentlevelsofmarketization,accordingtotheanalysisofChina'slandmarkettransactions between2007and2016,theaveragepriceoflandtransferredbyauctionisthehighest,soitisusedasthemarket-basedbenchmarkprice, andthepriceweightissetto1.

Thepriceweightsofothertransfermethodsaredeterminedbythe relativevalueoftheaveragepriceofthelandtransferredthrough publictendering,listingofquotationandclosed-doornegotiation comparewiththeaveragepriceofthelandtransferredthroughauction. Accordingtothiscalculation,thepublictendering,listingofquotation, andclosed-doornegotiationpriceweightsare0.94,0.62,and0.3,respectively.Finally,thepriceweightdataandthetransferareaofeach transfermethodarecalculatedusingFormula(2)toobtainthemarketizationleveloftheoverallandthedifferenttypesofland.Taking intoaccountthetrendsinthelandmarketandthemarketizationofsubtypeland,thelandmarketizationlevelofindustrialland,commercial land,andresidentialland,iscalculatedasfollows:

degreegrewdramaticallyin2008,increasingbyapproximately13 percentagepointsfrom0.4471in2007to0.5733in2008.After2008, themarketizationlevelofindustriallandshowedasteadyupward trend,increasingto0.6248in2016.Fromtheperspectiveoftime,the trendandamplitudeoftheoverallandthedifferenttypesofland marketizationlevelsarecloselyrelatedtothemarket-orientedreform processofdifferenttypesofland.

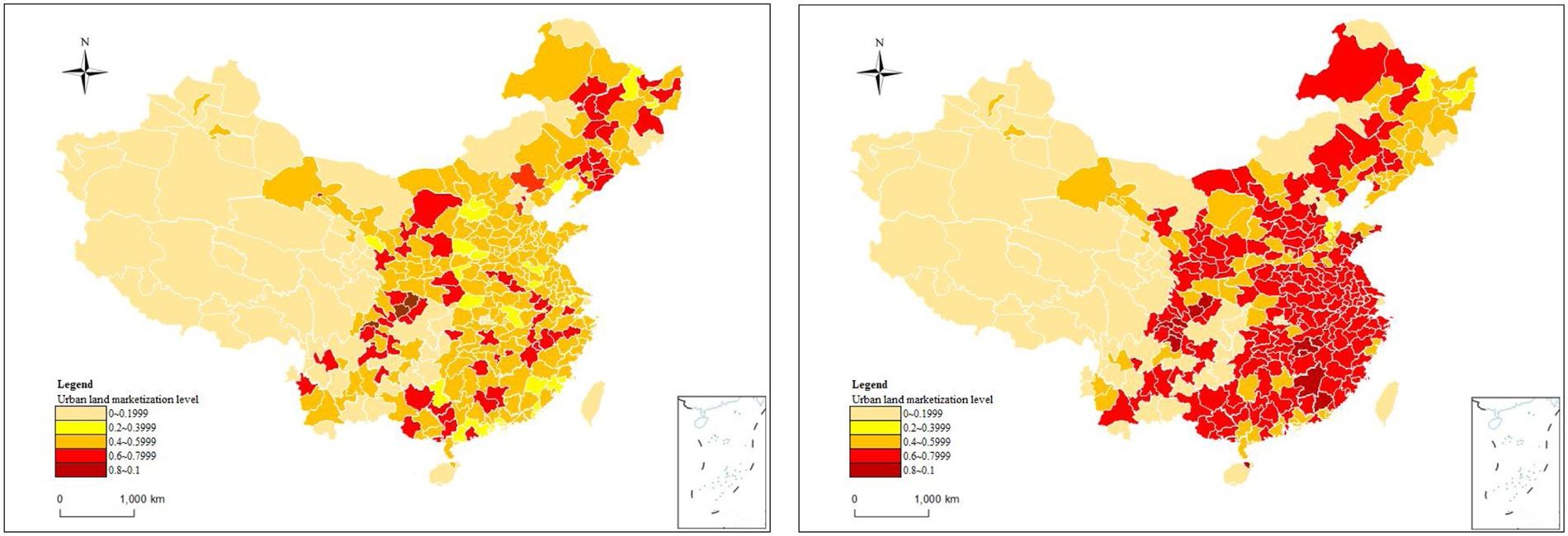

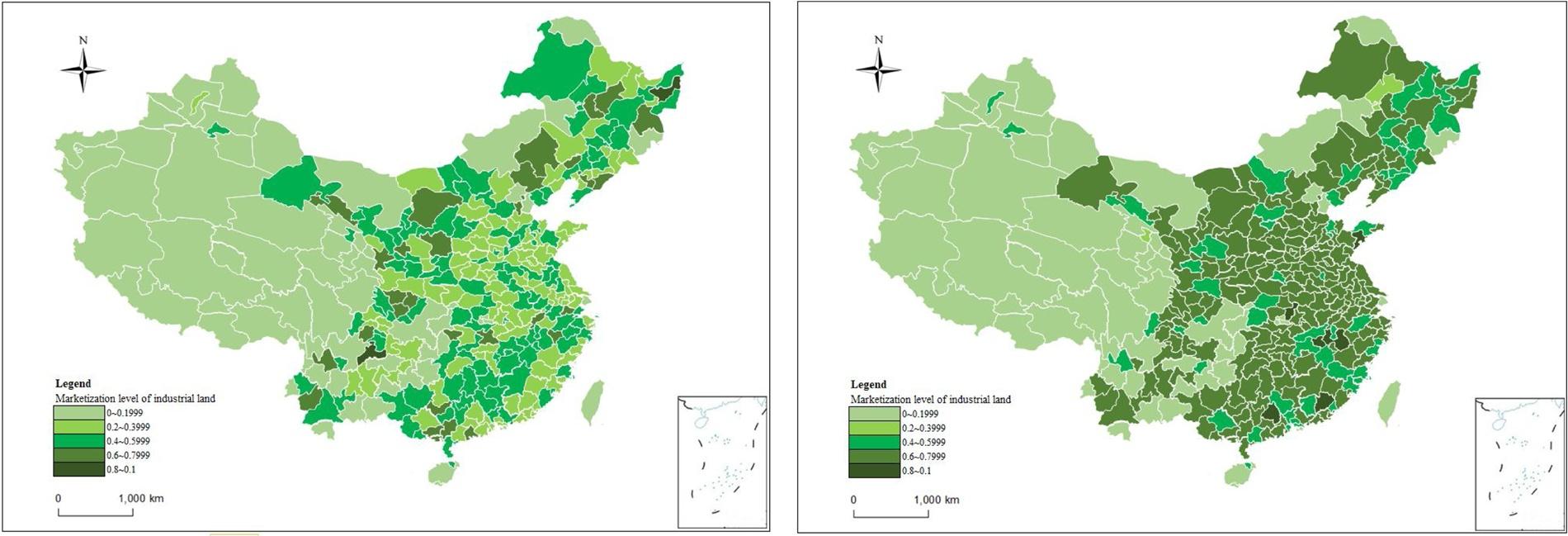

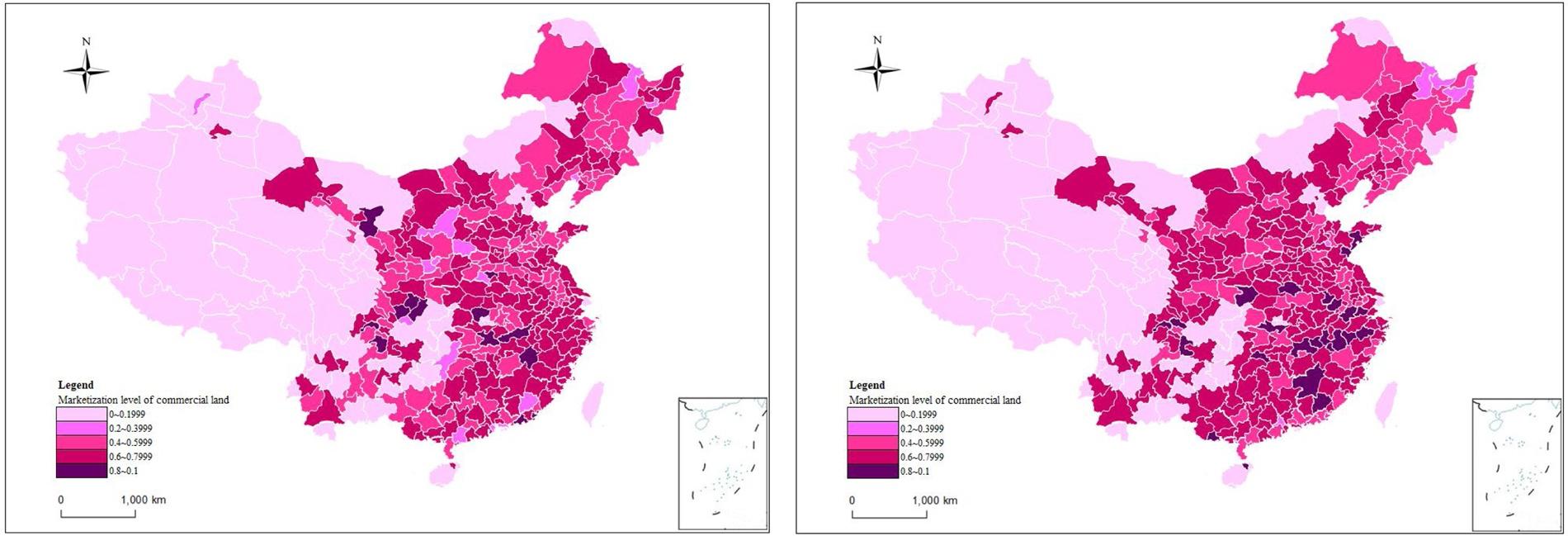

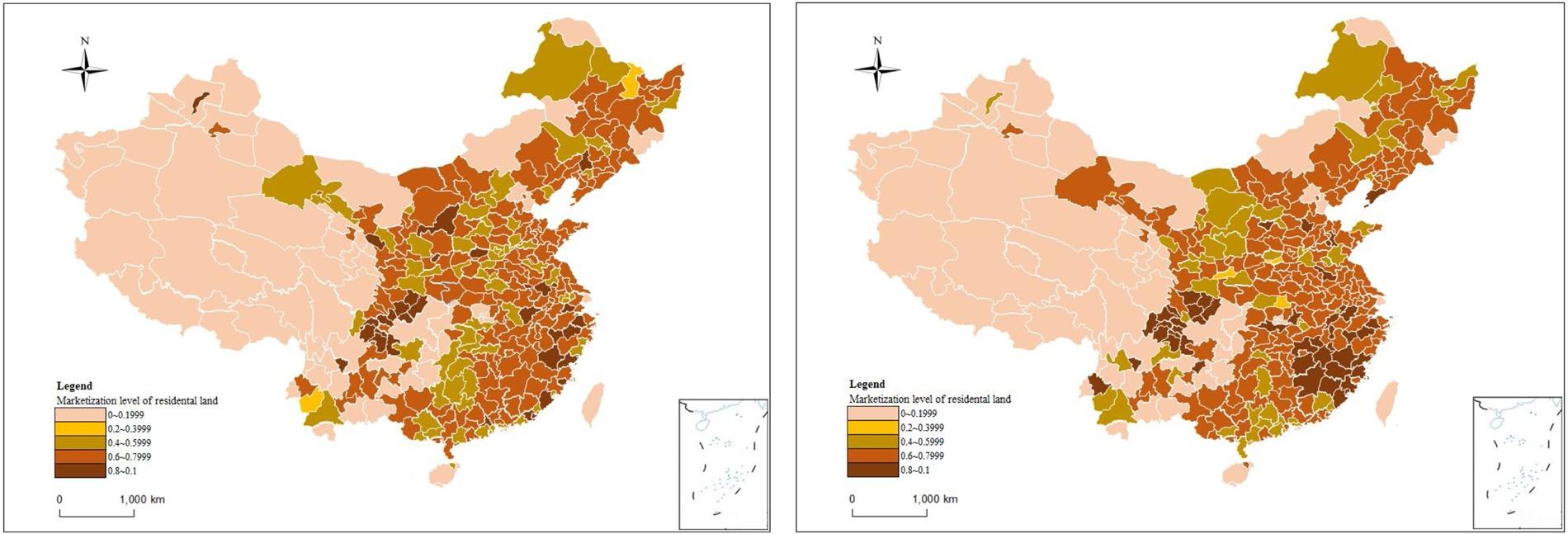

Toexplorethespatialpatternofurbanlandmarketization,wealso analyzetheoverallanddifferenttypesoflandmarketizationincitiesof differentlocations(see Figs.3–6).Forthetimeframeinvestigatedhere, theregionswithahigherleveloflandmarketizationareprimarily concentratedinkeycitiesinthesoutheasterncoastalareasandthe capitalsofprovinces,atrendconsistentwiththeeconomicdevelopmentandpopulationdistributionofthecountry.Themarketization levelofcommercialandresidentiallandexhibitssimilarurbandistribution.However,inlandcitiesgraduallybecomeregionswithahigh levelofmarketizationofindustrialland,perhapsbecauseofhigher laborcostsandfewerlandresourcesinthecoastalareas.

where lmitn isthemarketizationlevelincity i, year t andtype n; Qi isthe landareaofthecity i soldinthelandmarketbypublictendering, auctioning,listingofquotationandclosed-doornegotiation;and Wi is city i’spriceweightofthelandsoldbypublictendering,auctioning, listingofquotationandclosed-doornegotiation.

Fig.2 showsthemarketizationleveloftheoverallandthedifferent typesoflandinChinafrom2007to2016.TheoveralllandmarketizationinChinashowedanupwardtrendduringthisperiod.More specifically,totallandmarketizationgrewdramaticallyin2008,increasingfrom0.5324in2007to0.6035in2008,anincreaseofnearly7 percentagepoints.After2008,theoveralllandmarketizationlevelincreasedsteadily,reachingto0.6303in2016.Residentiallandexhibits thehighestlevelofmarketization,withlittlefluctuationduringthe periodfrom2007to2016whenthemarketizationlevelofresidential landincreasedbyonly1percentagepoint.In2007,themarketization levelofcommerciallandwas0.612,reaching0.6372in2016.Industriallandexhibitsthelowestlevelofmarketization,althoughthe

8 Sincethelanddataofthefarmer'scorpsandthecorpsarelistedseparately intheChinaLandandResourcesStatisticalYearbook,theyarenotcountedin theprefecture-levelcities.Therefore,thedataofthefarmer'scorpsandthe corpsareexcluded.Inthe283prefecture-levelcitiesbasedon2007,Sanyaand Lhasaweremissingdataduringthesampleperiod,andChaohuwasmerged withHefeiin2011.Therefore,SanyaandLhasawereexcluded,andthedataof ChaohuwasmergedwiththeHefeiforcalculation.

From2007to2016,theconstructionlandareapercapitafor33 prefecture-levelcitiesshowednegativegrowth,andmostofthesecities wereconcentratedincoastalareas.Thecoastalregionsalesthecommercialandresidentiallandathighprices,andtheurbanlandmarketizationlevelhasreachedahighlevel.Sincetheconstructionlandin coastalareasshiftedfromtheincrementalphasetothestockphase,the amountoflandthatcanbesoldbylocalgovernmentisrelativelylimited,sothemarketizationofvarioustypesoflandslowlyimprovedand thelocalgovernmentsneededtofindotherlocalrevenuesources.Areas withlowlandresourcestendedtobemoreeconomicallydeveloped withfewercentraltransferpayments.Thesegovernments’intra-budgetaryrevenuesatthistimeprimarilycamefromindirecttaxesthough landtransfers(e.g.businesstax,corporateincometax,etc.)createdby theconstructionandrealestateindustriesduetourbanexpansion,and anincreaseindirecttaxesthoughlandtransfer(e.g.stamptax,land appreciationtax,farmlandoccupationtax,housepropertytaxand urbanlandusetax,etc.)(Lianetal.,2019).Theseaccountsfor35.18% and11.01%oflocalgovernmentrevenueduringtheperiodof 2007–2016.Atthistime,theadjustmentandoptimizationofthe structureofurbanlandbecameparticularlyimportant.

3.Methodsanddata

Thelandtransferstrategyoflocalgovernmentscanbeaffectedby theactionsoflocalgovernmentsinotherregions.Thiscompetitive strategicinteractionbetweenlocalgovernmentswillhaveaspatial spillovereffectinurbanlandmarketization.Toaddressthisissue,we usethespatiallagmodeltoinvestigateiftheleveloflandmarketization isaffectedbyspatialspillovereffects.Accordingtothespatial

Fig.3. ThechangeofurbanlandmarketizationinChina,2007and2016.

Fig.4. ThechangeofmarketizationlevelofindustriallandinChina,2007and2016.

Fig.5. ThechangeofmarketizationlevelofcommerciallandinChina,2007and2016.

autocorrelationtest,theurbanlandmarketizationforeachyearandthe Moran’sIofthemarketizationlevelofdifferenttypesoflandareall significantatthe1%level,indicatingthaturbanlandmarketization hasapositivespatialspillovereffectandthespatialeconometrics modelismorereasonable.Thep-valueoftheLMerroris0.005,andthe p-valueofLMlagis0.001,indicatingthatbothpassthesignificance test;thep-valueoftheR-LMerroris0.191,meaningthatthesignificancetestisnotpassed;thep-valueofR-LMlagis0.025,passingthe significancetestatthe1%level;therefore,weusethespatiallagmodel (SLM).

Duetothetimelagoflocalgovernment'slandfinancedependence onitstransferbehavior,wechooselandfinancedependencewithone

periodlagastheexplanatoryvariable.9 Weusethefollowingmodel:

9 Onemayconcernwiththepossiblereversalcausalityrelationshipbetween landfinancedependenceandurbanlandmarketization.Theoretically,greater landfinancialdependencewillcausehigherurbanlandmarketization,witha viewtoalleviatethelocalgovernment'sdependenceonlandfinanceinthe futurebyincreasinglandsalesprices.Iftheempiricalresultsalsosupportthis theoreticalanalysis,thereversalcausalityissuetendstoweakenourestimation ofthecoefficientsconcerned,ratherthancreateafakerelationship.Thatisto say,ourestimatesofboththecausesandeffectsoftheurbanlandmarketization providesalowerboundonthetruerelationship(WangandHui,2017).Hence, lagginglandfinancialdependencebyoneyearcanalsoalleviatethepotential endogeneityissue.

4.Empiricalanalysis

where lmitn representsthemarketizationlevelofcity i intheyear t andtype n; lfd islandfinancedependence; i,j representsprefecturelevelcity, ij , N =280; wij isaspatialweightingmatrixprocessedby rowstandardization10 isthespatialweightcoefficientmeasuringthe degreeofinfluenceofthelandmarketizationlevelinneighboringregionsonthemarketizationleveloflocalland; isthecoefficientofland financedependence; Xit isthevectorofcontrolvariables; istheregressioncoefficientsofavectorofcontrolvariables; c istheconstant term;and ε isarandomdisturbanceterm.Totestwhetherthereisa nonlinearrelationshipbetweenlandfinancedependenceandurban landmarketizationlevel,weintroduceaquadratictermoflandfinance dependence,inthemodel:

Thecontrolvariablesofthisstudyincludetheaverageincome(ai), thelandresourceendowment(lrd),andthetrafficaccessibility(ta). Averageincomeismeasuredbytheaveragewageofurbanemployees. Existingresearchrevealsthattheincomelevelofemployeeswillaffect thecity’sdemandforlandandthedevelopmentofthelandmarket(Wu andHeerink,2016).Whiletheleveloflandmarketizationisrelatedto thelandresourceendowment,theincreasinglyprominentcontradiction betweenpeopleandlandshiftstheattentionoflocalgovernmentsto theeffectiveuseofland(LinandHo,2003).Inthispaper,thepercapita constructionlandareaisusedasthecontrolvariablereflectingthe regionallandresourceendowment.Asmanystudieshavehighlighted theroleoftrafficaccessibilityindrivinglandusechange(Verburg etal.,2004; Borzacchielloetal.,2010),thispaperusesthepercapita roadareatorepresenttrafficaccessibility.Inaddition,thecollinearity testisusedinthisstudytopreventmulti-variablecollinearitybetween thecontrolvariables.Theresultsshowthatthevarianceinflationfactor (VIF)ofallcontrolvariablesislessthan1.5,indicatingnosignificant collinearityinthemodel(Belsleyetal.,2005).

Dataforthesevariablescomefromthe2007–2016ChinaCity StatisticalYearbook,theChinaLandandResourcesStatistical Yearbook,theChinaLandMarketWebsiteandstatisticalyearbooksor newsreleasesfromthevariousprovincesandcitiesinChina.The outputvalueofthepercapitawageisadjustedbasedon2007price levelstoeliminateanypotentialimpactofinflationontheresults.The studysamplesetincludes2800sampleobservationsfrom280prefecture-levelcitiesinChinafrom2007to2016.Thestatisticaldescriptionofeachvariableisshownin Table1.

10 Thisstudyusedthegeographicallyadjacentspatialweightingmatrixfor analysis;ifthetworegionsaregeographicallyadjacent,thevalueis“1”; otherwisethevalueis“0”.

4.1.Impactoflandfinancedependenceonurbanlandmarketization

Table2 showstheimpactofthelandfinancedependenceoflocal governmentsonurbanlandmarketizationunderdifferentcircumstances.Specifically,Models1and2showtheinfluenceoflandfinance dependenceonurbanlandmarketizationwithouttakingthespatial spillovereffectintoconsideration,whileModels3and4showtheinfluenceoflandfinancedependenceonurbanlandmarketizationwhile includingthespatialspillovereffectinthemodel.Tofurtherverifythe robustnessofourmodels,weaddtheratioofthelandarea,indicatedby publictendering,auctioningandlistingofquotation,tothetotalland transferareabysubstitutingtheexplainedvariable.Models5and6 showtheeffectofthelocalgovernment’slandfinancedependenceon urbanlandmarketizationunderthedifferentexplainedvariable.From theempiricalresults,thecoefficientsignificanceanddirectionofthe coreexplanatoryvariablesarebasicallyconsistent,andthemodelhas strongrobustness.11

Theresultsindicateaspatialagglomerationeffectintheurbanland marketization.BasedonModels3and4,thecoefficientofρissignificantlypositiveatthe1%level,indicatingapositivespatialagglomerationeffect.Thecoefficientvaluesofρare0.3489and0.3472, respectively,indicatingthattheurbanlandmarketizationlevelin neighboringregionswillhavea34.89%or34.72%increaseassociated witha100%increaseinthelocalurbanlandmarketizationlevel. Underthedualpressureofeconomicgrowthandgovernmentdeficits, adjacentmunicipalgovernmentsoftenselecttheamountandpriceof landtransfertoattractinvestment.Thismodelsuggeststhaturbanland marketizationinoneregionwillincreasetherateofurbanlandmarketizationingeographicallyadjacentregions.

AlthoughaninvertedU-shapeisfoundintherelationshipbetween thedegreeoflandfinancedependenceandurbanlandmarketization, urbanlandmarketizationstillcanbeconsideredtohavefacilitated economicdevelopmentinmostcities.AsseeninModels1and3,the coefficientsoflandfinancedependencearebothsignificantlypositive atthe1%level,indicatingthattheincreaseoflandfinancedependence issignificantlyassociatedwithhigherlevelsofurbanlandmarketization.InModel4,thecoefficientofthelineartermoflandfinance dependenceissignificantlypositive,andthecoefficientofthequadratic termissignificantlynegative,indicatingthatlandfinancedependence andthelandmarketizationhaveaninvertedU-shapedrelationship,

11 Regardingtheheterogeneityoftheimpactoflandfinancedependenceon urbanlandmarketization,wehavealsofoundmixedeffectsundertimeand spacedifferencesandfiscalpressuredifferences.Duetospacelimitations,we willnotlistthemonebyone.Ifnecessary,itcanbeobtainedfromtheauthor.

Fig.6. ThechangeofmarketizationlevelofresidentiallandinChina,2007and2016.

Table1

Summarystatistics.

VariablesDefinition

lm Urbanlandmarketizationlevel

lmi Marketizationlevelofindustrialland

lme Marketizationlevelofcommercialland

lmr Marketizationlevelofresidentialland

lfdt-1 Landfinancedependencelaggedbyoneyear

ai Theaveragewageofemployedpersonsinurbanunits(10thousandyuan/perperson)28002.24910.51040.2214.577

lrd Percapitaconstructionlandarea (squarekilometers/10thousandpeople)

ta Percapitaroadarea (squaremeters/perperson)

Table2

Regressionresultsofthefullsample.

Note:Thetorzvaluesareinparenthesis.***,**,and*representsignificantlevelsof1%,5%,and10%respectively.

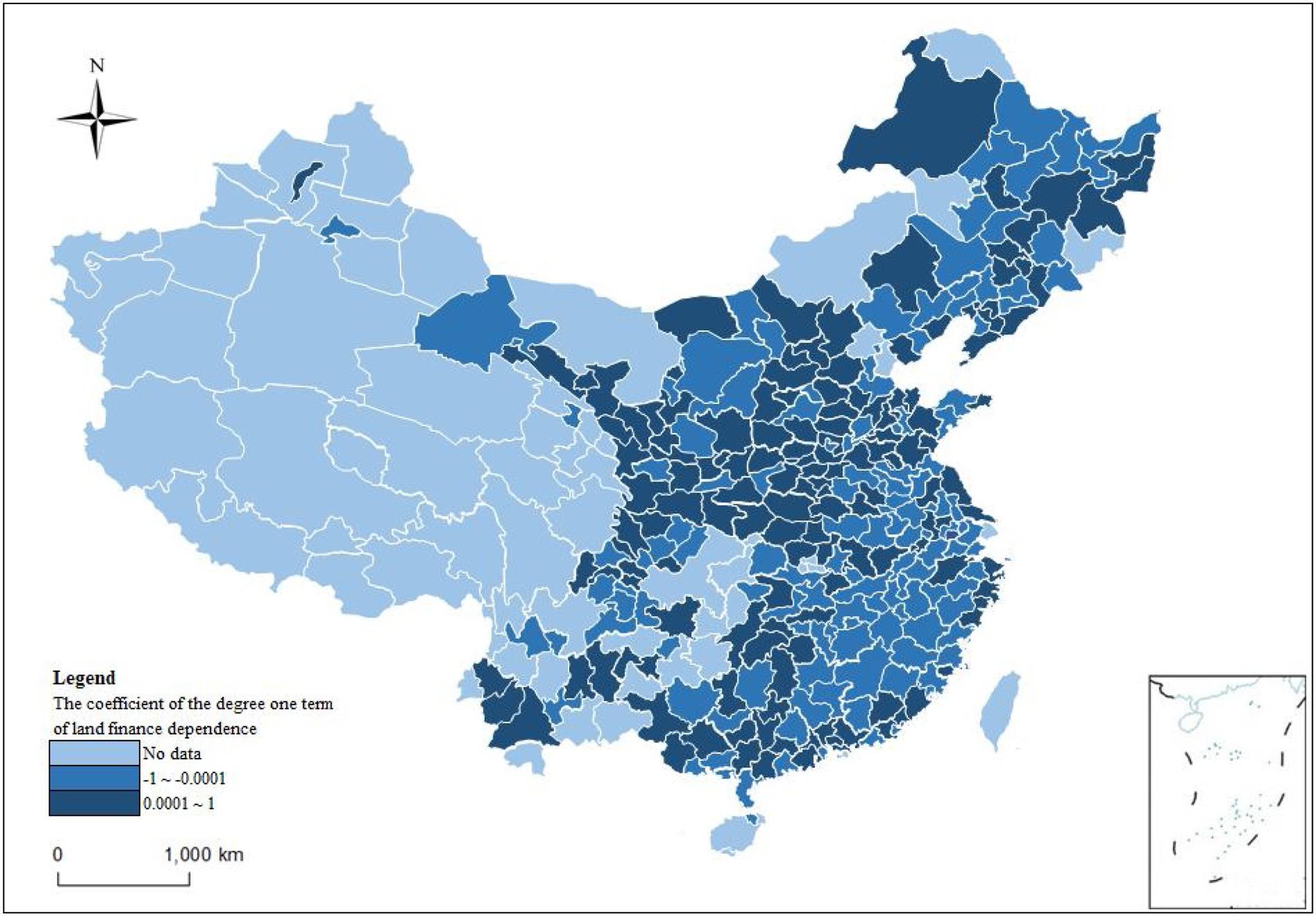

withtheinflectionpointat0.5735.Duringthisperiod,thelandfinance dependenceinmostcitiesinChinadidnotreachthisinflectionpoint, suggestingthatlandfinancedependencehasplayedaroleinpromoting theurbanlandmarketizationlevelduringthesampleperiod(Fig.7).12

Theinclusionofthespatialmatrixinthemodelconfirmsthatthe magnitudeoftheeffectoflandfinancedependenceonurbanland marketizationreliesonthepresenceofgeographicallyadjacentland. ComparingModels1and3,wemaydiscoverthattheeffectofland financedependenceonurbanlandmarketizationis0.0342and0.0296, respectively,indicatingthatifspatialspillovereffectisnotconsidered, ourcoefficientestimatesonthelandfinancedependencevariablewill bepositivelybiased.

Inaddition,inmodel4,amongotherrelevantfactors,averageincomeisassociatedwithhigherlevelsofurbanlandmarketization,indicatingthathigheraverageincomewillnotonlyincreasethedemand forresidentiallandbutalsoaffectthedemandforcommerciallandand improvetheurbanlandmarketizationlevel.Higherlandresourceendowmentisassociatedwithlowerlevelsofurbanlandmarketization. Areaswithpoorlandresourcesrequiremoreefficientmeansofallocatinglandresourcesandhencegovernmentsmayactivelycultivate anddevelopthelandmarket,whilerentinglandandwastinglandresourcesareseenmorefrequentlyinareaswithabundantlandresources. Ourresultisconsistentwiththeabovehypothesis.Thecoefficientof

12 Fromthecorrelationanalysis,thelandfinancedependenceofChina’s147 prefecture-levelcitiesstillprimarilyplaysapositiveroleinpromotingland marketization.Duetospacelimitations,thecoefficientsarenotlistedhere. Theyare,however,availableuponrequest.Inthefollowingresearch,weonly examinethelinearrelationshipbetweenlandfinancedependenceandurban landmarketization.

trafficaccessibilityissignificantlypositiveatthe5%level,indicating thattransportationaccessibilitywillacceleratetheconcentrationof factorsandincreasethelevelofurbanlandmarketization.

4.2.Analysisoftheinfluenceoflandfinancedependenceonthe marketizationlevelofdifferenttypesofland

Facedwiththeincreasingfiscaldeficit,localgovernmentsoftenuse theirowndiscretioninselectingthetypesoflandtotransfer.Asshown in Table3,allρvaluesarepositiveandsignificantatthe1%level, indicatingthatthemarketizationlevelofdifferenttypesoflandin prefecture-levelcitiesinChinaexhibitsasignificantspatialagglomerationeffect,whichisconsistentacrosstheentiresample.Compared withthemodelwithoutconsideringthespatialspillovereffect,the contributionrateoflandfinancedependencetourbanlandmarketizationdecreasedwhenconsideringthespatialspillovereffect,indicatingthattheeffectoflandfinancedependenceondifferenttypesof landmarketizationlevelmaybeoverestimatedwithoutconsideringthe spatialspillovereffect.

AscanbeseeninModel2,Model4andModel6in Table3,the coefficientsofdegreeoflandfinancedependenceareallsignificantand positive,indicatingthatlandfiscaldependenceonlandtransfersincreasesthelevelofmarketizationofalltypesofland.Theacceleration effectoflandfinancedependenceonthemarketizationlevelofindustriallandis,however,lessthanthatofcommercialandresidential land.Asaresultoffiscaldecentralization,localgovernmentspreferto reducetheproportionofindustriallandtransferredbyclosed-door negotiationsbutincreasethepriceofindustriallandbyincreasingthe amountofindustriallandtransferredby“publictendering,auctioning andlistingofquotation”.Accordingtothedata,oftheindustrialland

Table3

Fig.7. Therelationshipbetweenlandfinancialdependenceandurbanlandmarketizationin280prefecture-levelcities.

Regressionresultsforthemolecularterms.

Note:Thetorzvaluesareinparenthesis.***,**,and*representsignificantlevelsof1%,5%,and10%respectively.

transferredfrom2007to2016,theproportiontransferredbycloseddoornegotiationsdecreasedfrom67.62%to3.43%,improvingthe marketizationlevelofindustrialland.However,basedonthegoalof attractinginvestmentandlong-termregionaleconomicgrowth,the sellingpriceof“publictendering,auctioningandlistingofquotation” ofindustriallandwaslowerthanthatforcommercialandresidential land.

Duringtheperiodfrom2007to2016,theaveragesellingpricesfor industriallandforthepublictendering,auctioning,andlistingof quotationmethodswere3.3938millionyuanperhectare,2.6916millionyuanperhectareand2.1733millionyuanperhectare,respectively,whiletheaveragepricesforcommerciallandwere31.8554

millionyuanperhectare,35.0659millionyuanperhectareand 17.2209millionyuanperhectare,respectively.Forresidentialland,the priceswere39.6336millionyuanperhectare,26.854millionyuanper hectareand18.7586millionyuanperhectare,respectively,reflecting thatthelocalgovernmentsdifferintheircontingencyselectionsofthe typesoftransferredland.

5.Conclusions

Theimplementationofthetax-sharingreformin1994improvedthe centralgovernment’smacro-controlcapabilities,butduetothemismatchofthelocalgovernment’sfinancialpower,responsibilities,and

financialresources,thescaleofthelocalfiscaldeficitcontinuedto expand.Datashowthatthescaleoflocalgovernmentfiscaldeficitsin 2016wasashighas7.31trillionyuan,andthefiscaldeficitof99.65% citiescontinuedtoexpand.Thisisalsoanimportantreasonwhythe centralgovernmenthasfurtherincreasedtransferpaymentsanddeepenedtaxreforminrecentyears.Facingthewideningfiscaldeficits, Chinahasactivelypromotedthereformofurbanlandmarketization (Xieetal.,2002; Lin,2007),withthelocalgovernmentalsoplayingan importantroleinthisprocess(Lietal.,2015).Thereformofurbanland marketizationisnotonlybeneficialtolocaleconomicdevelopmentbut alsoanimportantapproachforalleviatingthefinancialpressureof localgovernments.Therefore,wemustfocusonthesocio-economic effectsofurbanlandmarketizationaswellasincludetheimportantrole playedbygovernmentactionsandinstitutionsinthereformofurban landmarketization(WeiandLin,2002; Liuetal.,2014; Lietal.,2015). However,comparedwiththepolicyresearchonthereformoftheurban landmarketization,thenatureanddynamicsoftheurbanlandmarket havereceivedlittleresearchattention(Yuanetal.,2019).

Thispaperanalyzesthespatiotemporaldynamicsofoveralland individualtypesoflandmarketizationinChinafrom2007to2016 using1.673millionpiecesoflandtransferdata.Duringthisperiod, China'surbanlandmarketizationsawrapidgrowth,withanaverage annualgrowthrateof1.89%.Theaverageannualgrowthratesofindustrial,commercialandresidentiallandwere3.79%,0.67%and0.05 %,respectively.Thelandmarketizationlevelofresidentiallandwasthe highest,whilethelandmarketizationofindustriallandwasthelowest, atrendconsistentwitheconomicdevelopmentandpolicyorientation. Atthesametime,areaswithhigherlevelsofurbanlandmarketization wereprimarilyconcentratedinkeycities,suchasthoselocatedinthe southeastcoastalareaandthecapitalsofprovinces.Thedistributionof landmarketizationlevelingeneralisthereforeconsistentwithregional economicdevelopmentlevelsandpopulationdistribution.Theurban distributioncharacteristicsofthemarketizationlevelofcommercial landandresidentiallandaresimilar,butinlandcitiesbegantohave industriallandmarketizationlevel.Thistrendimpliesthatgovernments shouldadapttolocalconditionsandimplementlandmarketreform, especiallyindustriallandmarketreformbasedonthelocation.

Theempiricalresultsusingthespatiallagmodelshowthattheland transferstrategiesadoptedbylocalgovernmentsarespatiallyinterdependent.Theincreasinglycloserelationshipbetweenurbanland marketizationandregionaldevelopmentmaysuggestthatChina's urbanlandmarketisbecomingmoremature(Liuetal.,2016)andthe strategicchoiceistheresultofregionalcompetitionbroughtaboutby decentralization.Atthecurrentstageofdevelopment,landfinance dependenceisassociatedwithhigherlevelsofurbanlandmarketization,arelationshipthatisfoundinmostcities.However,ifthefinancialpressureonthelocalgovernmentexceedsatolerablerange,it willcausenegativeeffects.Thisrelationshipexplainswhythecentral andlocalgovernmentshavefocusedonlanduseefficiencyinrecent years.Undoubtedly,duetothedifferencesinthenatureofthevarious typesofland,localgovernmentsoftenchoosethelandtype,method andamounttobetransferredbasedoncontingency,andthecontributionrateofcommercialandresidentiallandissignificantlyhigher thanthatofindustrialland.Althoughlocalgovernmentshaveincreased theproportionof“publictrending,auctioning,andlistingofquotation” inindustriallandtransfers,theirpricesarestillrelativelylowcompared tocommercialandresidentialland.Inaddition,regionalcompetition leadstouncoordinatedregionaldevelopment(Heetal.,2014),leading totheheterogeneousimpactoflandfinancedependenceonurbanland marketization.Atthistime,a“regionalcoordinateddevelopment strategy”seemsparticularlyimportant.

Thisresearchhelpsustounderstandtheroleoflocalgovernmentin themarketizationofurbanlandinChinainthecontextoffiscaldecentralization.However,itisonlyaninitialstudyintheareaofland marketization.Therearemanyissuesthatmeritfurtherexploration. First,weexpectasystematictheoreticalexplanationofhowtheactions

oflocalgovernmentsaffectlandmarketization.Althoughwehave providedtheoreticalexplanationsregardingthechoiceofdifferent typesoflandtransferredbylocalgovernmentsbasedonthecontingencyoffinancialpressure,amoresystematicdiscussionisstill neededtoenrichourunderstandingofhowthebehavioroflocalgovernmentsaffectsurbanlandmarketization.Second,furtherresearch mayexplorehowlocalgovernmentscontingentlychoosedifferent types,methodsandamountsoflandtransferbyfullyconsideringfactorssuchasgeographicallocationandthepromotionofofficials. Finally,becauselocalgovernmentshavenotdiscloseddetaileddataon extra-budgetaryincome,transferpayment,andland-relatedtaxesatthe prefecture-levelcitylevel,furtherresearchisneedtoexplorewhether localgovernmentswithscarcelandresourceshaveotherlocalsources ofincomeavailableforthemwithouttheactualtransferoflandparcels.

CRediTauthorshipcontributionstatement

XinFan: Conceptualization,Methodology,Software,Visualization. SainanQiu: Datacuration,Writing-originaldraft. YukunSun: Investigation,Validation,Writing-review&editing.

DeclarationofCompetingInterest

Theauthorsreportnodeclarationsofinterest.

Acknowledgements

Wethanktheeditorforthevaluablecommentsandsuggestions. ThisresearchwasfundedbytheNationalNaturalScienceFoundation ofChina(71703053),theChinaPostdoctoralScienceFoundation (2018T110171,2017M620080),andtheInternationalInnovationTeam ProjectofPhilosophyandSocialSciencesofJilinUniversity (2019GJTD03),andsupportedbytheFundamentalResearchFundsfor theCentralUniversities(2722020JCG020).

AppendixA.Supplementarydata

Supplementarymaterialrelatedtothisarticlecanbefound,inthe onlineversion,atdoi:https://doi.org/10.1016/j.landusepol.2020. 105023

References

Alonso,W.,1964.Locationandlanduse:towardageneraltheoryoflandrent.Econ. Geogr.42(3),277–279

Bai,X.M.,Shi,P.J.,Liu,Y.S.,2014.RealizingChina’surbandream.Nature509(7499), 158–160

Belsley,D.A.,Kuh,E.,Welsch,R.E.,2005.RegressionDiagnostics:IdentifyingInfluential DataandSourcesofCollinearity.JohnWiley&Sons,Hoboken

Borzacchiello,M.T.,Nijkamp,P.,Koomen,E.,2010.Accessibilityandurbandevelopment:agrid-basedcomparativestatisticalanalysisofDutchcities.Environ.Plan.B Plan.Des.37,148

Brueckner,J.K.,2003.Strategicinteractionamonggovernments:anoverviewofempiricalstudies.Int.RegionalSci.Rev.26(2),175–188

Cai,H.,Henderson,J.V.,Zhang,Q.,2013.China’slandmarketauctions:evidenceof corruption?RandJ.Econ.44(3),488–521

Chen,K.,2004.FiscalcentralizationandtheformofcorruptioninChina.Eur.J.Polit. Econ.20,1001–1009

Chen,Y.,Li,H.,Zhou,L.A.,2005.Relativeperformanceevaluationandtheturnoverof provincialleadersinChina.Econ.Lett.88(3),421–425 Ding,C.,2003.LandpolicyreforminChina:assessmentandprospects.LandUsePolicy 20(2),109–120

Fu,Q.,2015.Whenfiscalrecentralisationmeetsurbanreforms:prefecturallandfinance anditsassociationwithaccesstohousinginurbanChina.UrbanStud.52(10), 1791–1809

Guo,S.,Shi,Y.,2018.InfrastructureinvestmentinChina:amodeloflocalgovernment choiceunderlandfinancing.J.AsianEcon.56,24–35. Haila,A.,2007.Themarketasthenewemperor.Int.J.UrbanReg.Res.31(1),3–20 Halleux,J.M.,Marcinczak,S.,Krabben,E.,2012.Theadaptiveefficiencyoflanduse planningmeasuredbythecontrolofurbansprawl.ThecasesoftheNetherlands, BelgiumandPoland.LandUsePolicy29(4),887–898

Han,L.,Kung,J.K.S.,2015.Fiscalincentivesandpolicychoicesoflocalgovernments:

evidencefromChina.J.Dev.Econ.116,89–104

He,C.,Huang,Z.,Wang,R.,2014.LandusechangeandeconomicgrowthinurbanChina: astructuralequationanalysis.UrbanStud.51(13),2880–2898

Kong,X.,Liu,Y.,Jiang,P.,Tian,Y.,Zou,Y.,2018.AnovelframeworkforruralhomesteadlandtransferundercollectiveownershipinChina.LandUsePolicy78, 138–146

Langer,S.,Korzhenevych,A.,2018.Theeff;ectofindustrialandcommerciallandconsumptiononmunicipaltaxrevenue:evidencefromBavaria.LandUsePolicy77, 279–287

Li,J.,2014.Landsalevenueandeconomicgrowthpath:evidencefromChina’surban landmarket.HabitatInt.41,307–313

Li,H.,Wei,Y.D.,Liao,F.H.,Huang,Z.,2015.Administrativehierarchyandurbanland expansionintransitionalChina.Appl.Geogr.56,177–186

Li,H.,Zhou,L.A.,2005.Politicalturnoverandeconomicperformance:theincentiverole ofpersonnelcontrolinChina.J.PublicEcon.89(9-10),1743–1762

Lian,H.,Li,H.,Ko,K.,2019.Market-ledtransactionsandillegallanduse:evidencefrom China.LandUsePolicy84,12–20

Lichtenberg,E.,Ding,C.,2009.Localofficialsaslanddevelopers:urbanspatialexpansion inChina.J.UrbanEcon.66(1),57–64

Lin,G.C.S.,2007.ReproducingspacesofChineseurbanisation:newcity-basedandlandcentredurbantransformation.UrbanStud.44(9),1827–1855.

Lin,G.C.S.,Ho,S.P.S.,2003.China’slandresourcesandland-usechange:insightsfrom the1996landsurvey.LandUsePolicy20(2),87–107

Lin,G.C.S.,Yi,F.,2011.Urbanizationofcapitalorcapitalizationonurbanland?Land developmentandlocalpublicfinanceinurbanizingChina.UrbanGeogr.32(1), 50–79

Liu,Y.,2018.IntroductiontolanduseandruralsustainabilityinChina.LandUsePolicy 74,1–4

Liu,T.,Lin,G.C.S.,2014.NewgeographyoflandcommodificationinChinesecities: unevenlandscapeofurbanlanddevelopmentundermarketreformsandglobalization.Appl.Geogr.51,118–130

Liu,Y.,Fang,F.,Li,Y.,2014.KeyissuesoflanduseinChinaandimplicationsforpolicy making.LandUsePolicy40,6–12

Liu,T.,Cao,G.,Yan,Y.,Wang,R.Y.,2016.UrbanlandmarketizationinChina:central policy,localinitiative,andmarketmechanism.LandUsePolicy57,265–276

Lu,J.,Li,B.,Li,H.,2019.Theinfluenceoflandfinanceandpublicservicesupplyonperiurbanization:evidencefromthecountiesinChina.HabitatInt.92,1020–1039

Maskin,E.,Qian,Y.,Xu,C.,2000.Incentives,information,andorganizationalform.Rev. Econ.Stud.67(2),359–378

MinistryofLandandResourcesofChina(MLRC),2002.ChinaLandandResources StatisticalYearbook.GeologicalPublishingHouse,Beijing MinistryofLandandResourcesofChina(MLRC),2007.ChinaLandandResources StatisticalYearbook.GeologicalPublishingHouse,Beijing Mo,J.,2018.Landfinancingandeconomicgrowth:evidencefromChinesecounties. ChinaEcon.Rev.50,218–239.

O’Brien,K.J.,Li,L.,1999.SelectivepolicyimplementationinruralChina.Comp.Polit.31 (2),167–186

Oi,J.C.,1995.TheroleofthelocalstateinChina’stransitionaleconomy.ChinaQuart.

144,1132–1149

Pan,J.N.,Huang,J.T.,Chiang,T.F.,2015.Empiricalstudyofthelocalgovernmentdeficit,landfinanceandrealestatemarketsinChina.ChinaEcon.Rev.32,57–67 Ran,R.,2013.PerverseincentivestructureandpolicyimplementationgapinChina’s localenvironmentalpolitics.J.Environ.PolicyPlan.15(1),17–39

Shu,C.,Xie,H.,Jiang,J.,Chen,Q.,2018.Isurbanlanddevelopmentdrivenbyeconomic developmentorfiscalrevenuestimuliinChina?LandUsePolicy77,107–115

Tao,R.,Su,F.,Liu,M.,Cao,G.,2010.LandleasingandlocalpublicfinanceinChina’s regionaldevelopment:evidencefromprefecture-levelcities.UrbanStud.47(10), 2217–2236

Verburg,P.H.,VanEck,J.R.R.,DENijs,T.C.M.,Dijst,M.J.,Schot,P.,2004.Determinants ofland-usechangepatternsintheNetherlands.Environ.Plan.B:Plan.Des.31(1), 125–150

Wang,L.,2014.Forginggrowthbygoverningthemarketinreform-eraurbanChina. Cities41,187–193

Wang,Y.,Hui,E.C.,2017.Arelocalgovernmentsmaximizinglandrevenue?Evidence fromChina.ChinaEcon.Rev.43,196–215

Wang,R.,Tan,R.,2020.EfficiencyanddistributionofruralconstructionlandmarketizationincontemporaryChina.ChinaEcon.Rev.60,1–12

Wang,J.,Lin,Y.,Glendinning,A.,Xu,Y.,2018a.Land-usechangesandlandpolicies evolutioninChina’surbanizationprocesses.LandUsePolicy75,375–387.

Wang,J.,Lin,Y.F.,Zhai,T.L.,He,T.,Qi,Y.,Jin,Z.F.,Cai,Y.M.,2018b.Theroleofhuman activityindecreasingecologicallysoundlanduseinChina.LandDegrad.Dev.29(3), 446–460

Wassmer,R.W.,2002.Fiscalisationoflanduse,urbangrowthboundariesandnon-central retailsprawlinthewesternUnitedStates.UrbanStud.39(8),1307–1327

Wei,Y.H.D.,Lin,G.C.S.,2002.China’srestlessurbanlandscapesII:socialiststate,globalization,andurbanchange.Environ.Plan.A34(10),1721–1831

Wu,Y.,Heerink,N.,2016.Foreigndirectinvestment,fiscaldecentralizationandland conflictsinChina.ChinaEcon.Rev.38,92–107

Wu,Q.,Li,Y.,Yan,S.,2015.TheincentivesofChina’surbanlandfinance.LandUse Policy42,432–442

Xie,Q.,Parsa,A.R.G.,Redding,B.,2002.Theemergenceoftheurbanlandmarketin China:evolution,structure,constraintsandperspectives.UrbanStud.39(8), 1375–1398

Xu,J.,Yeh,A.,2009.Decodingurbanlandgovernance:statereconstructionincontemporaryChinesecities.UrbanStud.46(3),559–581

Xu,J.,Yeh,A.,Wu,F.,2009.Landcommodification:newlanddevelopmentandpolitics inChinasincethelate1990s.Int.J.UrbanReg.Res.33(4),890–913

Yang,Z.,Ren,R.,Liu,H.,Zhang,H.,2015.Landleasingandlocalgovernmentbehaviorin China:evidencefromBeijing.UrbanStud.52(5),841–856

Yuan,F.,Wei,Y.D.,Xiao,W.,2019.Landmarketization,fiscaldecentralization,andthe dynamicsofurbanlandpricesintransitionalChina.LandUsePolicy89,104208 Zhang,X.Q.,2006.Institutionaltransformationandmarketisation:thechangingpatterns ofhousinginvestmentinurbanChina.HabitatInt.30(2),327–341.

Zhang,H.,Zhang,Y.,Chen,T.,2016.LandremiseincomeandremisepriceduringChina’s transitionalperiodfromtheperspectiveoffiscaldecentralizationandeconomicassessment.LandUsePolicy50,293–300

THE FULL PROJECT GUTENBERG LICENSE

PLEASE READ THIS BEFORE YOU DISTRIBUTE OR USE THIS WORK

To protect the Project Gutenberg™ mission of promoting the free distribution of electronic works, by using or distributing this work (or any other work associated in any way with the phrase “Project Gutenberg”), you agree to comply with all the terms of the Full Project Gutenberg™ License available with this file or online at www.gutenberg.org/license.

Section 1. General Terms of Use and Redistributing Project Gutenberg™ electronic works

1.A. By reading or using any part of this Project Gutenberg™ electronic work, you indicate that you have read, understand, agree to and accept all the terms of this license and intellectual property (trademark/copyright) agreement. If you do not agree to abide by all the terms of this agreement, you must cease using and return or destroy all copies of Project Gutenberg™ electronic works in your possession. If you paid a fee for obtaining a copy of or access to a Project Gutenberg™ electronic work and you do not agree to be bound by the terms of this agreement, you may obtain a refund from the person or entity to whom you paid the fee as set forth in paragraph 1.E.8.

1.B. “Project Gutenberg” is a registered trademark. It may only be used on or associated in any way with an electronic work by people who agree to be bound by the terms of this agreement. There are a few things that you can do with most Project Gutenberg™ electronic works even without complying with the full terms of this agreement. See paragraph 1.C below. There are a lot of things you can do with Project Gutenberg™ electronic works if you follow the terms of this agreement and help preserve free future access to Project Gutenberg™ electronic works. See paragraph 1.E below.

1.C. The Project Gutenberg Literary Archive Foundation (“the Foundation” or PGLAF), owns a compilation copyright in the collection of Project Gutenberg™ electronic works. Nearly all the individual works in the collection are in the public domain in the United States. If an individual work is unprotected by copyright law in the United States and you are located in the United States, we do not claim a right to prevent you from copying, distributing, performing, displaying or creating derivative works based on the work as long as all references to Project Gutenberg are removed. Of course, we hope that you will support the Project Gutenberg™ mission of promoting free access to electronic works by freely sharing Project Gutenberg™ works in compliance with the terms of this agreement for keeping the Project Gutenberg™ name associated with the work. You can easily comply with the terms of this agreement by keeping this work in the same format with its attached full Project Gutenberg™ License when you share it without charge with others.

1.D. The copyright laws of the place where you are located also govern what you can do with this work. Copyright laws in most countries are in a constant state of change. If you are outside the United States, check the laws of your country in addition to the terms of this agreement before downloading, copying, displaying, performing, distributing or creating derivative works based on this work or any other Project Gutenberg™ work. The Foundation makes no representations concerning the copyright status of any work in any country other than the United States.

1.E. Unless you have removed all references to Project Gutenberg:

1.E.1. The following sentence, with active links to, or other immediate access to, the full Project Gutenberg™ License must appear prominently whenever any copy of a Project Gutenberg™ work (any work on which the phrase “Project Gutenberg” appears, or with which the phrase “Project

Gutenberg” is associated) is accessed, displayed, performed, viewed, copied or distributed:

This eBook is for the use of anyone anywhere in the United States and most other parts of the world at no cost and with almost no restrictions whatsoever. You may copy it, give it away or re-use it under the terms of the Project Gutenberg License included with this eBook or online at www.gutenberg.org. If you are not located in the United States, you will have to check the laws of the country where you are located before using this eBook.

1.E.2. If an individual Project Gutenberg™ electronic work is derived from texts not protected by U.S. copyright law (does not contain a notice indicating that it is posted with permission of the copyright holder), the work can be copied and distributed to anyone in the United States without paying any fees or charges. If you are redistributing or providing access to a work with the phrase “Project Gutenberg” associated with or appearing on the work, you must comply either with the requirements of paragraphs 1.E.1 through 1.E.7 or obtain permission for the use of the work and the Project Gutenberg™ trademark as set forth in paragraphs 1.E.8 or 1.E.9.

1.E.3. If an individual Project Gutenberg™ electronic work is posted with the permission of the copyright holder, your use and distribution must comply with both paragraphs 1.E.1 through 1.E.7 and any additional terms imposed by the copyright holder. Additional terms will be linked to the Project Gutenberg™ License for all works posted with the permission of the copyright holder found at the beginning of this work.

1.E.4. Do not unlink or detach or remove the full Project Gutenberg™ License terms from this work, or any files containing a part of this work or any other work associated with Project Gutenberg™.

1.E.5. Do not copy, display, perform, distribute or redistribute this electronic work, or any part of this electronic work, without prominently displaying the sentence set forth in paragraph 1.E.1 with active links or immediate access to the full terms of the Project Gutenberg™ License.

1.E.6. You may convert to and distribute this work in any binary, compressed, marked up, nonproprietary or proprietary form, including any word processing or hypertext form. However, if you provide access to or distribute copies of a Project Gutenberg™ work in a format other than “Plain Vanilla ASCII” or other format used in the official version posted on the official Project Gutenberg™ website (www.gutenberg.org), you must, at no additional cost, fee or expense to the user, provide a copy, a means of exporting a copy, or a means of obtaining a copy upon request, of the work in its original “Plain Vanilla ASCII” or other form. Any alternate format must include the full Project Gutenberg™ License as specified in paragraph 1.E.1.

1.E.7. Do not charge a fee for access to, viewing, displaying, performing, copying or distributing any Project Gutenberg™ works unless you comply with paragraph 1.E.8 or 1.E.9.

1.E.8. You may charge a reasonable fee for copies of or providing access to or distributing Project Gutenberg™ electronic works provided that:

• You pay a royalty fee of 20% of the gross profits you derive from the use of Project Gutenberg™ works calculated using the method you already use to calculate your applicable taxes. The fee is owed to the owner of the Project Gutenberg™ trademark, but he has agreed to donate royalties under this paragraph to the Project Gutenberg Literary Archive Foundation. Royalty payments must be paid within 60 days following each date on which you prepare (or are legally required to prepare) your periodic tax returns. Royalty payments should be clearly marked as such and sent to the Project Gutenberg Literary Archive Foundation at

the address specified in Section 4, “Information about donations to the Project Gutenberg Literary Archive Foundation.”

• You provide a full refund of any money paid by a user who notifies you in writing (or by e-mail) within 30 days of receipt that s/he does not agree to the terms of the full Project Gutenberg™ License. You must require such a user to return or destroy all copies of the works possessed in a physical medium and discontinue all use of and all access to other copies of Project Gutenberg™ works.

• You provide, in accordance with paragraph 1.F.3, a full refund of any money paid for a work or a replacement copy, if a defect in the electronic work is discovered and reported to you within 90 days of receipt of the work.

• You comply with all other terms of this agreement for free distribution of Project Gutenberg™ works.

1.E.9. If you wish to charge a fee or distribute a Project Gutenberg™ electronic work or group of works on different terms than are set forth in this agreement, you must obtain permission in writing from the Project Gutenberg Literary Archive Foundation, the manager of the Project Gutenberg™ trademark. Contact the Foundation as set forth in Section 3 below.

1.F.

1.F.1. Project Gutenberg volunteers and employees expend considerable effort to identify, do copyright research on, transcribe and proofread works not protected by U.S. copyright law in creating the Project Gutenberg™ collection. Despite these efforts, Project Gutenberg™ electronic works, and the medium on which they may be stored, may contain “Defects,” such as, but not limited to, incomplete, inaccurate or corrupt data, transcription errors, a copyright or other intellectual

property infringement, a defective or damaged disk or other medium, a computer virus, or computer codes that damage or cannot be read by your equipment.

1.F.2. LIMITED WARRANTY, DISCLAIMER OF DAMAGESExcept for the “Right of Replacement or Refund” described in paragraph 1.F.3, the Project Gutenberg Literary Archive Foundation, the owner of the Project Gutenberg™ trademark, and any other party distributing a Project Gutenberg™ electronic work under this agreement, disclaim all liability to you for damages, costs and expenses, including legal fees. YOU AGREE THAT YOU HAVE NO REMEDIES FOR NEGLIGENCE, STRICT LIABILITY, BREACH OF WARRANTY OR BREACH OF CONTRACT EXCEPT THOSE PROVIDED IN PARAGRAPH

1.F.3. YOU AGREE THAT THE FOUNDATION, THE TRADEMARK OWNER, AND ANY DISTRIBUTOR UNDER THIS AGREEMENT WILL NOT BE LIABLE TO YOU FOR ACTUAL, DIRECT, INDIRECT, CONSEQUENTIAL, PUNITIVE OR INCIDENTAL DAMAGES EVEN IF YOU GIVE NOTICE OF THE POSSIBILITY OF SUCH DAMAGE.

1.F.3. LIMITED RIGHT OF REPLACEMENT OR REFUND - If you discover a defect in this electronic work within 90 days of receiving it, you can receive a refund of the money (if any) you paid for it by sending a written explanation to the person you received the work from. If you received the work on a physical medium, you must return the medium with your written explanation. The person or entity that provided you with the defective work may elect to provide a replacement copy in lieu of a refund. If you received the work electronically, the person or entity providing it to you may choose to give you a second opportunity to receive the work electronically in lieu of a refund. If the second copy is also defective, you may demand a refund in writing without further opportunities to fix the problem.

1.F.4. Except for the limited right of replacement or refund set forth in paragraph 1.F.3, this work is provided to you ‘AS-IS’,

WITH NO OTHER WARRANTIES OF ANY KIND, EXPRESS OR IMPLIED, INCLUDING BUT NOT LIMITED TO WARRANTIES OF MERCHANTABILITY OR FITNESS FOR ANY PURPOSE.

1.F.5. Some states do not allow disclaimers of certain implied warranties or the exclusion or limitation of certain types of damages. If any disclaimer or limitation set forth in this agreement violates the law of the state applicable to this agreement, the agreement shall be interpreted to make the maximum disclaimer or limitation permitted by the applicable state law. The invalidity or unenforceability of any provision of this agreement shall not void the remaining provisions.

1.F.6. INDEMNITY - You agree to indemnify and hold the Foundation, the trademark owner, any agent or employee of the Foundation, anyone providing copies of Project Gutenberg™ electronic works in accordance with this agreement, and any volunteers associated with the production, promotion and distribution of Project Gutenberg™ electronic works, harmless from all liability, costs and expenses, including legal fees, that arise directly or indirectly from any of the following which you do or cause to occur: (a) distribution of this or any Project Gutenberg™ work, (b) alteration, modification, or additions or deletions to any Project Gutenberg™ work, and (c) any Defect you cause.

Section 2. Information about the Mission of Project Gutenberg™

Project Gutenberg™ is synonymous with the free distribution of electronic works in formats readable by the widest variety of computers including obsolete, old, middle-aged and new computers. It exists because of the efforts of hundreds of volunteers and donations from people in all walks of life.

Volunteers and financial support to provide volunteers with the assistance they need are critical to reaching Project Gutenberg™’s goals and ensuring that the Project Gutenberg™ collection will remain freely available for generations to come. In 2001, the Project Gutenberg Literary Archive Foundation was created to provide a secure and permanent future for Project Gutenberg™ and future generations. To learn more about the Project Gutenberg Literary Archive Foundation and how your efforts and donations can help, see Sections 3 and 4 and the Foundation information page at www.gutenberg.org.

Section 3. Information about the Project Gutenberg Literary Archive Foundation

The Project Gutenberg Literary Archive Foundation is a nonprofit 501(c)(3) educational corporation organized under the laws of the state of Mississippi and granted tax exempt status by the Internal Revenue Service. The Foundation’s EIN or federal tax identification number is 64-6221541. Contributions to the Project Gutenberg Literary Archive Foundation are tax deductible to the full extent permitted by U.S. federal laws and your state’s laws.

The Foundation’s business office is located at 809 North 1500 West, Salt Lake City, UT 84116, (801) 596-1887. Email contact links and up to date contact information can be found at the Foundation’s website and official page at www.gutenberg.org/contact

Section 4. Information about Donations to the Project Gutenberg Literary Archive Foundation

Project Gutenberg™ depends upon and cannot survive without widespread public support and donations to carry out its mission

of increasing the number of public domain and licensed works that can be freely distributed in machine-readable form accessible by the widest array of equipment including outdated equipment. Many small donations ($1 to $5,000) are particularly important to maintaining tax exempt status with the IRS.

The Foundation is committed to complying with the laws regulating charities and charitable donations in all 50 states of the United States. Compliance requirements are not uniform and it takes a considerable effort, much paperwork and many fees to meet and keep up with these requirements. We do not solicit donations in locations where we have not received written confirmation of compliance. To SEND DONATIONS or determine the status of compliance for any particular state visit www.gutenberg.org/donate.

While we cannot and do not solicit contributions from states where we have not met the solicitation requirements, we know of no prohibition against accepting unsolicited donations from donors in such states who approach us with offers to donate.

International donations are gratefully accepted, but we cannot make any statements concerning tax treatment of donations received from outside the United States. U.S. laws alone swamp our small staff.

Please check the Project Gutenberg web pages for current donation methods and addresses. Donations are accepted in a number of other ways including checks, online payments and credit card donations. To donate, please visit: www.gutenberg.org/donate.

Section 5. General Information About Project Gutenberg™ electronic works

Professor Michael S. Hart was the originator of the Project Gutenberg™ concept of a library of electronic works that could