Preface

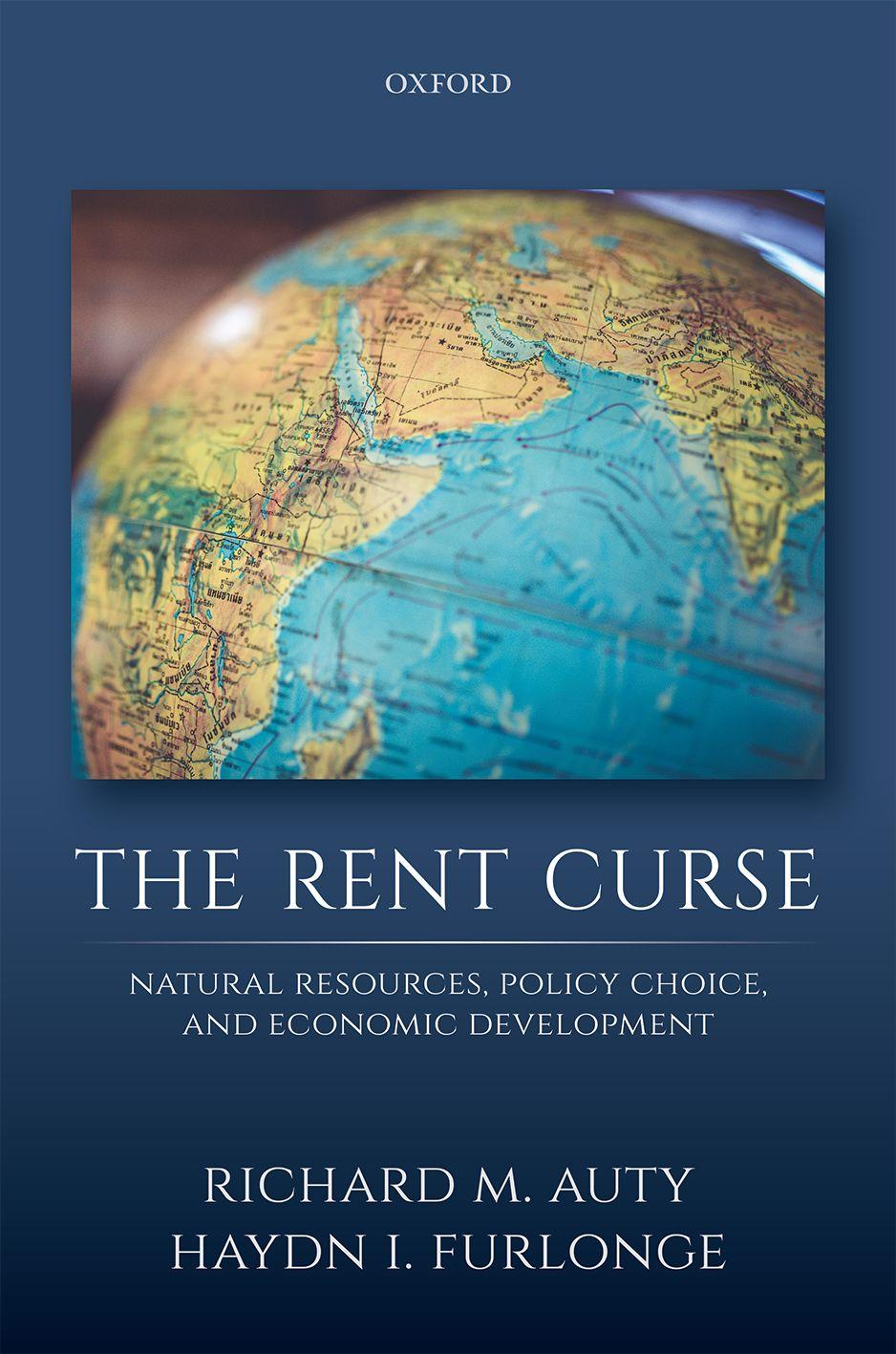

Morethantwodecadesofstatisticalanalysishavefailedtoresolvethecauses oftheresourcecurseorevendeterminewhetherthephenomenonexistsor not.Weemployrentcyclingtheorytoundertakeamoresubtleapproachto theresourcecursethanthatachievedbystatisticalstudiestodate.Wedosoby analysingthepoliticaleconomyofwindfallgainsfromnaturalresource exploitationintwocasestudycountriesandthenapplyingthe findingsto theprincipalglobaldevelopingregions.Weconstructtwostylizedfacts modelsofrent-drivengrowthtoshowthat:(i)theresourcecurseexistsbut thatitiscausedbypolicyfailure,sothatitisnotadeterministicphenomenon; (ii)theglobalincidenceoftheresourcecursevariesovertimeandbycommodity;and(iii)theresourcecurseisavariantofawiderrentcursethatcan becausedbywindfallrevenuesfromforeignaid(geopoliticalrent),worker remittances(labourrent),orgovernmentmanipulationofrelativeprices (regulatoryrent).

Thebasicpremiseofrentcyclingtheoryisthatlowrentincentivizesthe elitetogrowtheeconomyinordertobecomewealthy,whereashighrent encouragestheelitetosiphonawayrentforimmediateself-enrichmentatthe expenseoflong-termeconomicgrowth.Thecontrastingincentivestrigger systematicdivergenceinpolicythatresultsintwodistinctivetrajectoriesfor structuralchange.Morespecifically,lowrentencouragestheelitetogrowthe economybyallocatinginputsefficiently,whichalignstheeconomywithits comparativeadvantageinlabour-intensiveexportsanddrivesrapidandrelativelyegalitarianeconomicgrowthalongwithincrementaldemocratization. Incontrast,highrentelicitscontestsamongtheelitetocapturetherentfor immediatepersonalenrichmentanddiscouragesthedistributionofwealthin afairandsustainablemanner.Thiscausesthehigh-renteconomytoabsorb renttooquicklyandtoexperienceDutchdiseaseeffects,whichleadtothe expansionofasubsidizedurbansectorwhoseburgeoningdemandforrent eventuallyoutstripssupplyandcausesaprotractedgrowthcollapse,with attendantpoliticaldestabilization.Theresultinghigh-rentstapletraptrajectoryfailstoachievecompetitivediversificationandconsequentlyintensifies rentdependence.

Our findingscarrysignificantimplicationsfordevelopmentresearch.We tracerent flowsfromtheirextraction,throughtheirdeployment,totheir impactonthepoliticaleconomy.Wetherebyrespondtorecentcallsby leadingeconomistssuchasStiglitztostudythedistortingimpactsofrenton economicgrowth.Ourlow-rentmodelidentifiestheimportancetosustainable(productivity-driven)long-termdevelopmentof:rentscarcityinincentivizingtheelitetopursuegrowth-orientedpolicies;Lewis’slabourmarket turningpoint,intriggeringself-sustainingcompetitivediversificationofthe economy;andearlypassagethroughthedemographiccycle,forachieving rapidandegalitarianpercapitaGDPgrowth.Incontrast,thehigh-rentstaple traptrajectoryrisksincentivizingcontestsamongtheeliteforrentthatcause overrapiddomesticrentabsorptionandDutchdiseaseeffects.Thispostpones thelabourmarketturningpointandprecludesthebenefitsthatthelow-rent economyderivesfromitssingularpatternof competitive structuralchange. Instead,thehigh-renteconomydiversifiesintorent-subsidizedactivity,which isnotsustainable.

Ourtwobasicstylizedfactspoliticaleconomymodelsoflow-rentandhighrentgrowthusefullycomplementstatisticalstudiesoftheresourcecurse.The statisticalstudiespursuerigouratthecostofoversimplifyingthefactorsat work,whereascasestudiesallowforamorenuancedexplanationofresource curseeffects.Forexample,weidentifysignificant fluctuationsintheglobal intensityofresourcecurseeffects,linkedtohistoricalchangesindevelopment policyfashionssincethe1950s.Wealsoshowthatresource-pooreconomies canexhibit ‘resourcecursesymptoms’ dueto flowsofgeopoliticalrent,labour rent,andregulatoryrentthatcanrivalresourcerentsintheirmagnitudeand consequences.Moreover,commoditiesdifferintheirvulnerabilitytorent curseeffects.

Ourresearchidentifiesthemisallocationofinputsarisingfromthewidespreadpost-warpolicybiasinfavourofmanufacturing-drivengrowth,which invariablyoccurredattheexpenseofthepotentialcontributionstoeconomic developmentfromtheagricultureandservicesectors.Thepolicywasespeciallydisadvantageousforsmalleconomies,whichlackedsufficientdomestic demandtosustainfactoriesofminimalviablesize.Invariably,rentwas deployedtoprotectinefficientimportsubstitutionindustryratherthanthe dynamicandcompetitivemanufacturingthatlow-renteconomiesachieved. Instead,importsubstitutionpoliciesinvariablydegeneratedintoasourceof regulatoryrentthatconsolidatedrent-seekingconstituenciesthatlockedthe economyintoastapletrap.Finally,scholarsofdevelopmenthavefrequently underestimatedthe flexibilityoftheplantationasaninstitution,whichin countriesasdiverseasMalaysia,Mauritius,andGuyanahasprovedtobe adaptabletomajorchangesinthepoliticaleconomy.

WedrawuponMauritiusandTrinidadandTobagotoillustratethe argumentbecausetheyexhibitedremarkablysimilarinitialconditionsat independenceinthe1960s,apartfromtheirmineralendowments.WedemonstratethatTrinidadandTobagohasexperiencedresourcecurseeffects:its high-renteconomytracedastapletrapdevelopmenttrajectoryandexperiencedaprotractedgrowthcollapsethrough1981–93.Moreover,Trinidadand Tobagohasyettodiversifyawayfromrent-drivengrowthintoproductivitydrivengrowth,uponwhichsustainablelong-termgainsinwelfaredepend. TrinidadandTobagosharesthisunsatisfactoryoutcomewithotherrentaddictedeconomiesincludingtheGulfStates,Russia,andVenezuela.We useMauritiusasacounterfactualtoillustratethelow-renttrajectorythatis alsoassociatedwiththefourAsianDragons,aswellasChina,Bangladesh,and Vietnam,andislikelytobepursuedbysub-SaharanAfricaneconomiesas moreandmoreofthemarerenderedland-poorbypopulationgrowth.

WetracetheoriginsofTrinidadandTobago’sstrongaddictiontorenttoits earlyrelianceonsugar.WealsodemonstratetheriskstoTrinidadandTobago ofrelyinguponitscurrentstrategyofgas-basedindustrialization,whichisa minimaldiversificationfromdependenceonhydrocarbonrent.Rather,we proposereformofthepoliticaleconomytocapitalizeonrecentglobalgrowth insophisticatedserviceexportsandvaluechains,whichoffernewopportunitiestoachieveproductivity-drivendevelopmentthatissustainable.Buta preconditionforsuccessisthatpoliticiansmustbuildacoalitionofprogrowthinterestgroupstopromoteacompetitivenon-hydrocarbonsector.

The finalchaptersapplythemodelstointerpretstructuralchangein five globaldevelopingregionswithreferenceto:agriculturalinvolutioninsubSaharanAfrica;prematuredeindustrializationinLatinAmericacompared withEastAsia;andthepotentialforabsorbingsurpluslabourintoexport servicesinSouthAsiaandtheGulfstates.

WegratefullyacknowledgethehardworkofAdamSwan,KatieBishop,and CatherineOwenatOUPinguidingthisbooktofruition,andthesubsequent tirelesshelpofJulieMuskwithcopyeditingandAlameluVengatesanin shepherdingthebookthroughthepublicationprocess.Wearealsomuch indebtedtotheconstructivecommentsof fivereviewerswhooffered extremelyhelpfulsuggestionsregardingtheoverallstructureofthebookas wellassomedetails.Inparticular,thereviewersprovidedthepushthatwe neededtoshiftthe finalsectionsofthebooktowardstheimplicationsofour findingsfortheprincipalglobaldevelopingregions.

ListofTables xi

ListofAbbreviations xiii

Section1.Context

1.Aims,Approach,andStructureoftheStudy3

2.NaturalResources,CountrySize,andDevelopment: AReviewoftheLiterature16

Section2.EmergenceofRent-DependentDevelopment

3.TheRent-SeekingLegacyofthePlantationEconomy inTrinidadandTobago47

4.TheStapleTrapinHigh-RentTrinidadandTobago70

5.Low-RentMauritiusasaDevelopmentalCounterfactual forHigh-RentTrinidadandTobago94

Section3.DifferentialRent-DrivenDevelopment inGlobalRegions

6.AgriculturalNeglectandRetardedStructuralChange inSub-SaharanAfrica119

7.TheEvolvingRoleofManufacturinginEconomicDevelopment146

8.ProspectiveGrowthImpactsofExportServices174

Section4.AnalysingtheRoleofRentinEconomicDevelopment

9.ThePrincipalFindingsandsomePolicyImplications205

ListofTables

1.1PercapitaGDPgrowthbycountryresourceendowment, 1960–2015(%/year).Growthratesaresimpleaverages4

2.1Stylizedrentstreampropertiesandpredictedpoliticalandeconomic impacts,byrentsource23

2.2Principalfeaturesoftwostylizedfactsrent-driven developmentmodels26

2.3Percapitaincome,structuralchange,anddomesticabsorption, post-1973(shareofGDP)34

2.4PercapitaGDPandeconomicgrowth(Syrquinand Cheneryaggregates)35

3.1Institutionalquality,2015,comparativecasestudycountries63

3.2Selectedeconomicindicators,TrinidadandTobago,1960–201465

4.1ImpactoftheLNGboom,TrinidadandTobago,1999–200875

4.2Potentialnetbacksforthegas-basedindustry,Trinidad andTobago,1980s78

4.3Governmentrevenueandexpenditure,TrinidadandTobago, 2000–08(%GDP)83

4.4Public/privateinvestment,TrinidadandTobago,2000–08(%GDP)85

4.5GlobalCompetitivenessIndex,2015,comparatoreconomies91

5.1Selectedeconomicindicators,Mauritius,1960–2014100

5.2Populationgrowthanddependencyratio,Mauritiusand TrinidadandTobago,1960–2010116

6.1Selectedeconomicindicators,Uganda,1960–2014124

6.2StructuralchangeinAfrica,1961–2007126

6.3Economicstructure(%GDP)andproductivityratios, sub-SaharanAfrica,1990and2010127

6.4Decompositionofproductivitygrowth(%/year),bymainglobalregion, 1990–2005127

6.5Threestylizedfactstrajectoriesofstructuralchangein sub-SaharanAfrica,1990–2010(%GDP,exceptwherestated)130

6.6Comparativelabourcosts(US$)infourAfricaneconomiesandBangladesh142

7.1Selectedeconomicindicators,Chile,1960–2014(%GDP, exceptwherestated)150

7.2Selectedeconomicindicators,Brazil,1960–2014(%GDP,except wherestated)156

7.3Brazilheavyindustrybigpushes157

7.4Doingbusiness:globalranking2015162

7.5Selectedeconomicindicators,SouthKorea,1960–2014(%GDP, exceptwherestated)166

8.1Selectedeconomicindicators,India,1960–2014(%GDP,except wherestated)183

8.2Hydrocarbonrent,capital-surplusGulfeconomies, 1970–2014(%GDP)195

8.3Selectedeconomicindicators,SaudiArabia,1960–2014 (%GDP,exceptwherestated)196

8.4Hydrocarbonrentdependence,capital-surplusGulfeconomies,2012197

ListofAbbreviations

ANCAfricanNationalCongress

blbarrel

CBDcentralbusinessdistrict

CEPEPCommunity-basedEnvironmentalProtectionandEnhancement Programme

CSACommonwealthSugarAgreement

DRIdirect-reducediron

EPZexportprocessingzone

EUEuropeanUnion

FDIforeigndirectinvestment

GATEGovernmentAssistanceforTuitionExpenses

GDPgrossdomesticproduct

GNIgrossnationalincome

GNPgrossnationalproduct

IADBInter-AmericanDevelopmentBank

ICORincrementalcapitaloutputratio

ICTinformationandcomputertechnology

IFIinternational financialinstitution

ILOInternationalLabourOrganization

IMFInternationalMonetaryFund

IOCinternationaloilcompany

ISCOTTIronandSteelCompanyofTrinidadandTobago

ITinformationtechnology

LNGliquefiednaturalgas

MITMassachusettsInstituteofTechnology

MMMMauritianMilitantMovement

MNCmultinationalcorporation

MRSFmineralrevenuestabilizationfund

NARNationalAllianceforReconstruction

ListofAbbreviations

NASSCOMNationalAssociationofSoftwareandServicesCompanies

ODAoverseasdevelopmentassistance

OECDOrganizationforEconomicCo-operationandDevelopment

PMSDPartiMauricienSocialDemocrate

PNMPeople’sNationalMovement

PPPpurchasingpowerparity

REERrealeffectiveexchangerate

TCSTataConsultancyServices

UAEUnitedArabEmirates

UNCUnitedNationalCongress

WTOWorldTradeOrganization

Aims,Approach,andStructure oftheStudy

1.1AimsandApproachoftheStudy

Economistsexpectresource-richeconomiestogrowfasterthanresource-poor economiesiftheirgovernmentstakeadvantageofthenaturalresourcerent1 toraisetherateofinvestmentcomparedwithlow-renteconomiesandto increasethelevelofimportedgoodsthatarerequiredtobuildamodern infrastructure.Thisappearedtobethecaseforthedevelopingcountriesbefore the1970s:themeanpercapitagrossdomesticproduct(GDP)oftheresourcerichdevelopingeconomieswas50%higherthanthatoftheresource-poor economies(Auty2001:5).However,Table1.1showsthatduringtheperiodof heightenedcommoditypricevolatilityof1973–85andonintothelate-1990s mostresource-richeconomiesgrewslowly,ifatall,beforerecoverybelatedly commenced.Bythen,however,themeanpercapitaincomeoftheresourcepoordevelopingeconomiesexceededthatoftheresource-richones.

Table1.1alsoshowsthatattheoutsetoftheperiodanalysed(theearly1960swhentheWorldBank(2017a)begantocompilecomparativedata)most developingeconomieswereresource-richandalsosmall.Theincreasedincidenceofgrowthcollapsesinresource-richeconomiesthroughthe1970s and1980sstimulatedcasestudyresearch(GelbandAssociates1988;Auty 1993;Karl1997).Subsequently,SachsandWarner(1995,1999)triggereda surgeofstatisticalresearchintotheresourcecurse,whichafterapromising startgavewaytocontradictoryclaimandcounter-claimthathasfailedto

1 Rentisdefinedhereasthesurplusrevenueafterdeductingallproductioncostsincludingariskrelatedreturnoninvestment.PhilipCrowson(personalcommunication),formerchiefeconomistof RTZ,arguesthatrevenuesfromforeignaid(geopoliticalrent)andtheadjustmentofrelativeprices (regulatoryrent)aremoreaccuratelyconceptualizedassupernumerarygovernmentrevenues. Basically,thephenomenonisarevenuestreamwithinaneconomythatinaggregatecanbe20–30% ofGDPormore,andwhichisdetachedfromtheactivitythatgeneratesitandisupforgrabs.

Table1.1 PercapitaGDPgrowthbycountryresourceendowment,1960–2015(%/year). Growthratesaresimpleaverages

EconomicphasesPreshockglobal growth1960–73

Acutecommodity priceshocks 1973–85

IFI-backed reforms 1985–97

Post-reform recovery 1997–2015

Resource-poor1 Large2 2.43.74.73.9 Small3.51.82.42.4

Resource-rich Large2 2.70.71.92.3

Small,nonmineral1.60.70.92.1

Small,hardmineral2.20.1 –0.42.1

Small,oilexporter4.02.3 –0.71.6 Allcountries 2.71.61.52.3

1 Resource-poor=1970croplandperhead<0.3hectares.

2 Largeeconomy=1970GDP>US$7billion(proxyfordomesticmarketsize).

Source:WorldBank(2017a).

determinewhetheraresourcecurseexistsornot(LedermanandMaloney2007; Cavalcantietal.2011).Partofthereasonforthisimpasseisthat,asTable1.1 demonstrates,theintensityoftheresourcecurseeffectseasedthroughthe commodityboomofthe2000s,whichhaslimitedfurtherwideningofthe incomegapbetweenresource-pooreconomiesandresource-richones.

Thisbookarguesthattheresourcecurseismorecomplexthaninitially thought,sothattheparsimonioussilverbulletexplanationsthatcharacterize muchstatisticalanalysisneglectimportantfeatures.Therearefourkeyaspects tothisextracomplexity.First,symptomsoftheresourcecursemaybeassociatedwithstreamsofrentotherthanthatfromnaturalresources,principally foreignaid(geopoliticalrent),governmentmanipulationofprices(regulatory rent),andworkerremittances(labourrent).Theresourcecurseisthereforepart ofawiderrentcurse,whichthestatisticalstudieslargelyignore.Moreover,each rentsourcecangenerate10%ormoreofGDP,sothatinaggregatethepotential rentthatcanbeallocatedoutsidecompetitivemarketsforpoliticalgoalscanbe onascalethatissufficienttoprofoundlydistorttheeconomy.

Second,theglobalincidenceoftheresourcecurse fluctuatesovertime:it intensifiedthroughthe1970sand1980sbeforeeasinginthelate-1990sand 2000s.Thistrendreflectsinpartmajorshiftsinglobaldevelopmentpolicy wherebymanydevelopingcountriesthatgainedindependenceinthe1960s initiallyfavouredstateinterventiontoforceindustrialization.Theirgovernmentssubsequentlyrelaxedthispolicythroughthe1990sasaconditionfor receivingloansfromtheinternational financialinstitutions(IFIs)withwhich tostabilizetheireconomies.

Third,theriskposedbyrentstreamsvarieswiththeirsizerelativetoGDP, volatility,anddistribution:theriskishigherthelargerandmorevolatilethe

revenuestreamandthegreateritsconcentrationonafeweconomicagents. Forexample,resourcecursesymptomsappearstrongerinsmalleconomies thanlargeones,andespeciallyinmineral-driveneconomies,mostnotablyoil exporters(Table1.1).During1973–85themineraleconomiesgeneratedthe highestresourcerentrelativetoGDPbuttheslowestGDPgrowth,withtheoil exportershavingthehighestrentandweakestgrowthofall.

Fourth,therentcursehasnotonlyeconomiccauses(theprimeonesbeing Dutchdiseaseeffectsandvolatilerevenue)butalsoinstitutionalandpolitical ones(Acemogluetal.2001).Subsequently,attentionturnedtopolicyfailure (Glaeseretal.2004),notablytheconsequencesofthetradepolicyclosureof the1960sand1970s(LalandMyint1996).Importantly,thesecausalfactors arenotmutuallyexclusive,butinteractsystematically,aswedemonstrate throughtworent-drivenmodels.Wecontendthatthereisarentcurse,but thatitisnotdeterministicandresultsfrompoliticalcontestsoverrent,which cancausepolicyfailurethatleadstoaprotractedgrowthcollapse.

Inordertoachieveamorenuancedexplanationoftherentcursethanthe statisticalanalysesprovide,weexaminethepoliticaleconomyofrentdeployment.Wealsoadoptacasestudyapproachwithanhistoricalperspectivethat isneverthelessrootedintheory.Indoingso,wetradesomelossofrigourfor greateranalytical flexibility,whichisnecessarybecausemeasurementofcroplandrentandregulatoryrentreliesoneithercasestudyestimatesorproxy indicessuchas,respectively,exportshareanddegreeoftradepolicyclosure.2

Morespecifically,wedrawuponrentcyclingtheory(Auty2010)totracehow rentimpacts:theeconomicincentivesoftheelite;thechoiceofdevelopment strategy;andtheresultingdevelopmenttrajectorywithparticularemphasis onstructuralchange.Thebookdrawsupontwostylizedfactsmodelsofrentdrivengrowththatbetweenthemexplainthegrowthtrajectoriesofmost developingcountriessincethe1960s.Themodelsarethelow-rentcompetitivediversificationmodelandthehigh-rentstapletrapmodel.Theystartfrom thebasicassumptionthatlowrentincentivizestheelitetoimproveitswelfare byefficientlygrowingtheeconomy,whilehighrentdeflectseliteeffortinto extractinganddeployingrentforimmediateenrichmentattheexpenseof long-termeconomicgrowth.

Efficientgrowthrequiresthepursuitofcomparativeadvantage,whichin low-renteconomiesliesintheexpansionoflabour-intensiveexports.This triggersasingularpatternofstructuralchangethatisself-sustaininganddrives rapidGDPgrowthalongwithanincrementalshifttowardsaself-reliantform ofsocialcapitalandtowardspoliticalpluralism.Incontrast,high-renteconomiesabsorbwindfallrenttooquicklyinresponsetopoliticalpressures,

2 TheWorldBankisdevelopingtimeseriesforcroprentfrom1995(Langeetal.2018).

whichtriggersDutchdiseaseeffectsthatimpedecompetitivediversification andencouragesubsidizedemploymentcreation.Thislockstheeconomyinto astapletrapofincreasingrelianceonrenttosubsidizeprotectedurbanactivity.Theburgeoningrentdemandsofthesubsidizedactivityeventuallyexceed thecapacityoftherenttomeetthem,triggeringagrowthcollapsethatis protractedbecauserentrecipientsresistreform.Adependentformofsocial capitalalsoemergeswhilethepolitymayveertowardsanautocracythat isbrittle.

Weillustratethetwotrajectorieswithcasestudiesofhigh-rentTrinidadand Tobagoandlow-rentMauritius,whichprovideaninstructivecomparison becausepriortoindependenceinthe1960s,thetwosharedmuchincommon,apartfromtheirmineralendowments.TheywerebothBritishcolonies withparliamentarygovernmentselectedbyanethnicallydiversepopulation totallingnearlyonemillionineachcase,whichreliedheavilyforemployment onsugarplantationsthatwererunningshortofland.Assmallisland economies,theirdiversificationoptionsweresomewhatconstrained(Demas 1965),buttheprimedifferencewasthatTrinidadandTobagohadaccessto hydrocarbonreserves,whichMauritiuslacked.Infact,Mauritius’seconomic prospectswereviewedasMalthusian:itspercapitaincomelaggedthatof TrinidadandTobagoandcontractedthroughthelate-1950s,stokingsocial tensions(FindlayandWeitz1993).YetMauritiussubsequentlymadeasuccessfultransitionfromrent-drivengrowthtoproductivity-drivengrowththat stilleludesTrinidadandTobago.Mauritius’sdevelopmenttrajectorytherefore providesalow-rentcounterfactualtohelpexplainwhyTrinidadandTobago, likemanyhigh-renteconomies,struggledtodiversifyawayfromrentdependence(Warner2015).

TrinidadandTobagopresentsaninstructivecasestudyoftherentcurse. Commencinginthe1970s,itseconomyhasperiodicallygeneratedlarge hydrocarbonrents,driven firstbythe1974–78and1979–81oilboomsand subsequentlybylargeinflowsofforeigndirectinvestment(FDI)inliquefied naturalgas(LNG)thatexploithydrocarbonreservesthatarehighforacountryofitssize.However,theoriginofitsrelianceonrentcanbetracedback muchearlier,totheintroductionofsugarplantationsinthelate-eighteenth century.Therentfromsugarcanecanbeclassifiedasgeopoliticalrentbecause itarosefromchangesintradeconcessionsbythecolonialgovernmentin London.TherelianceofTrinidadandTobagoonrentwasstrengthenedinthe mid-twentiethcentury, firstbymuch-improvedtradepreferencesforsugar exportsandthenbythepositivehydrocarbonpriceshocksof1974–78and 1979–81.

Althoughsmallcountrysizesomewhatconstrainsdevelopmentoptions comparedwithlargeeconomies,weshowthatthedevelopmenttrajectoryof smallcountries(asopposedtomicrostates)isnotsignificantlydifferentfrom

thatoflargereconomies.Thesmallsizeofthecasestudyeconomiestherefore doesnotlimittheircapacityeithertoilluminatethetwobasicpost-1960 developmenttrajectoriesortoexplainbroaderdevelopmentthemesinthe majorglobalregions.WedemonstratethatMauritius’sdevelopmenttrajectoryisbasicallysimilartothoseofthefourAsianDragoneconomies,Hong Kong,Singapore,SouthKorea,andTaiwan.China’sdevelopmentpathhas alsoparalleledMauritius’slowrenttrajectoryinkeyrespects.3

Manufacturingplayedakeyroleintherapiddevelopmentofthelow-rent EastAsianeconomiesandMauritius,butitprovedadouble-edgedswordin mosthigh-renteconomies.Wearguethattheprioritizationofmanufacturing byhigh-rentdevelopingeconomiesthroughtheearlypost-wardecadesrepresentsamajorpolicyerror.Thisisbecausewhethergovernmentspursued industrializationbyimportsubstitutionorbyresource-basedindustry,the manufacturingsectorinvariablydegeneratedintoavehicleforrent-seeking onascalethatdistortedtheeconomyandledtoprotractedgrowthcollapses.

Thiswasnotthecaseinthelow-rentEastAsianeconomiesandMauritius, andthecompetitivediversificationmodelexplainswhy.Thesingularpattern oflowrentstructuralchangeelicitedbytheirinitialcomparativeadvantagein labour-intensivemanufacturedexportswaswhatdrovetheirrapideconomic development.Itwasnottheresultofaninterventionistindustrialpolicyas arguedbyAmsden(1992)andWade(1990).Rather,Sternetal.(2005)and NolandandPack(2003)convincinglycritiquetheefficacyofaspectsofthe EastAsianindustrialpolicies,whosevariedlevelsofinterventionalsosuggest thatindustrialpolicyplayedasecondaryroletothatofself-sustainingstructuralchange.Weidentifynumerousinstancesoftheadverseimpactsof interventionistindustrialpoliciesonrentcyclingthroughoutthisbook.

Mosthigh-renteconomiesinLatinAmerica,theGulfstates,andsubSaharanAfricaexperiencedastapletrapdevelopmenttrajectory,likeTrinidad andTobago.Thewidespreadespousalofactivistindustrialpoliciessteadily distortedtheseeconomiesthroughthe1960sand1970s,afterwhichintensifiedcommoditypricevolatilitytriggeredaseriesofgrowthcollapses.The growthcollapses firsthittheleastcredit-worthystates(mainlysub-Saharan Africanoilimporters)throughthemid-1970s.Theythenimpactedother economiesinsub-SaharanAfricaandLatinAmericaintheearly-1980sthat hadearlierbeenjudgedsufficientlycredit-worthytoborrowrecycledpetrodollarsforeconomicadjustment.Finally,growthcollapseshittheoilexportersinthemid-1980sasenergypricescollapsedwhencumulativeenergy conservationcurbedglobaloildemand.

3 LikeMauritius,Chinaeliminatedsurpluslabourviadiversificationintolabour-intensive exports,andreliedondualtrackreformtomanagethepoliticaloppositiontothereform(from stateenterprisesinChina’scase)thatwerethelikelylosersfromreform(Lauetal.2000).

AlthoughtheassistanceoftheIFIswithstabilizationeventuallyrevived economicgrowth,thehigh-renteconomiesremainvulnerabletorevenue volatilityandrent-seekingactivity.Policylapsesduringthecommodity super-cycleof2004–14suggestthatinsomecaseslessonswereonlypartially learnedandthatrent-dependentdevelopmentpersists(CherifandHasanov 2016).Hausmannetal.(2007)convincinglyarguethatrent-dependenteconomiesneedtoproducegoodsandservicesthathaveeverweakerdirectlinksto rentsandexhibitevermoresophistication.Fortunately,emergingtrendsin globaldemandforgoodsandservicesareexpandingscopeforlaggingeconomiestosupplytheseproducts(Mckinsey2012;Ghanietal.2012;Loungani etal.2017),asIndia(andMauritius)demonstrate.Lounganietal.(2017) suggestthatlaggingdevelopingcountriesmightleapfrogindustrialization.

Thedevelopmentliteraturewarnsthatrent-drivengrowthcanraise incomeswithoutestablishingthesocial,human,andcapitalresourcesto maintainthemintheabsenceofrent(CherifandHasanov2016).Thisis especiallytrueforhigh-incomeenergy-richeconomies,notablythoseofthe Gulfstates.Onevariantoftherentcurseisassociatedwitheconomiesthat becomeevermoredependentontherent.Infact,someresearchersidentify anevenmoreacutecondition(GaddyandIckes2010).Theyarguethat countrieslikeSaudiArabiaandRussiaarenotjustdependentonoilrentbut ‘addicted’ tooil,amuchmoredifficultpathologytotreat.Theireconomies requireconstantlyrisingenergypricesand/orexpandingenergyoutputjustto maintain fiscalbalanceandmeetexistingsocialentitlementslikeenergy subsidies,uponwhichgovernmentsurvivalcomestodepend.

Wearguethatdiversificationawayfromrentdependenceshouldbethe priority,especiallybyhydrocarbonexportersbecausechangesintechnology areweakeningprospectiveLNGexports,whiledeepeningconcernsabout globalpollutionposetheriskthatbothoilandnaturalgasreservesmay becomestranded.Forexample,TrinidadandTobagofacestheprospectofa steadydeclineinhydrocarbonoutputthatcouldterminateproductionwithin twodecades,unlesssignificantnewcommercialdiscoveriesaremadein deeperwatersorfromcross-border fields.Yetgasfromfrackingdiminishes theincentivetosearchforgasfromtraditional fields.Thisunexpectedaccelerationinthepaceofmaturationofthehydrocarbonsectorcallsforspeedy economicreformssoastoestablishtheproductivity-driveneconomythatis neededtosustainincomes,letalonetoenhancethem.

Rodrik(2015)arguesthatfarfromdiversifying,manydevelopingcountries areexperiencingprematuredeindustrializationastheirmanufacturingsector contractsrelativetoservices.Weargue,however,thatthistrendismore accuratelyregardedasanadjustmenttotheearlieroverexpansionofmanufacturingthatresultedfromtheprioritizationofindustrialization.Therelative declineinmanufacturingisassociatedwithIFIreformsaimedatremovingthe

cumulatedeconomicdistortionsofthe1960s,1970s,and1980sandrealigningeconomieswiththeirunderlyingcomparativeadvantage.

TwootherfactorsareatworkinmakingRodrik’sprognosislessominous. First,thelong-runningprocessofbusinessspecializationcontinues,asproductivebusinesseslikefarmsandmanufacturing firmscontractouttasks previouslyperformedin-house,oftenservices,tospecialist firms(Haig 1926).Thisimpliesthatpartofthecontractionofmanufacturingismorea book-keepingadjustmentthanasignificantlossofmanufacturingoutput (McKinsey2012):supportservicesaretransferredfromthemanufacturing columnintotheservicescolumn.Second,andmorerecently,thediffusion ofInformationandCommunicationTechnology(ICT)hasexpandedscope forproductiveserviceexportsthatexhibitsignificantpotentialtoboostlabour productivityandeconomicgrowthasmanufacturinghasdoneinthepast (Lounganietal.2017).

Thesetrendsstrengthenthecaseforpursuingsectorneutraldevelopment policiesthatfocusoncreatinganenablingenvironmentforinvestmentthatis rootedinprudentmacroeconomicpolicyandsupportiveinstitutions.Sector neutralpoliciesrecognizetheriskofpolicycapturebyrent-seekinginterests, whichthisbookargueshasseverelydamagedeconomicgrowthwithinthe developingcountriesandremainsathreat.

1.2StructureoftheStudy

1.2.1 LiteratureContext

Thebookisstructuredintofoursections.Section1explainstheobjectivesof theresearchandsetstheminthecontextoftheliteratureoneconomic developmentand,inparticular,therentcurse.Morespecifically,Chapter2 drawsupontheliteratureonnaturalresourcesandeconomicdevelopmentto explainthecircumstancesunderwhichhighrentcaneitherdrivesustained economicgrowthorbecomeacurse.Itnotesthataninitialsurgeinstatistical researchthroughthe1990sfocusedmainlyoneconomicfactorsastheexplanationfortheresourcecurse,suchasDutchdiseaseeffects(SachsandWarner 1995),commoditypricevolatility(CashinandMcDermott2002),andoverrapiddomesticrentabsorption(GelbandAssociates1988).Subsequently moreprominencewasgiventopoliticalfactors,notablythequalityofinstitutions(AcemogluandRobinson2008)andpolicies(Glaeseretal.2004).Most recently,politicalcontestsforrenthaveattractedattention(Mehlumetal. 2006;Holcombe2013).Infact,theseexplanationsarenotmutuallyexclusive andthetworent-drivenmodelsfromrentcyclingtheoryexplainhowthey systematicallyinteractinresponsetotheinitialconditionsofeitherrent abundanceorrentpaucity(Auty2010).

Chapter2thenexaminesthetworent-drivenmodelsinmoredetail.We brieflyoutlinethemhere.Thelow-rentcompetitivediversificationmodelis associatedwithsustainedrapideconomicgrowth,whereasthehigh-rent stapletrapmodelleadstoagrowthcollapse,recoveryfromwhichisprotracted.Morespecifically,thelow-rentmodelpositsthatlowrentincentivizes theelitetoenrichitselfbygrowingtheeconomy,whichrequiresthepursuitof thelow-renteconomy’scomparativeadvantageincheaplabourtoexport labour-intensivegoodsandservices.Thelow-rentmodelexplainshowrapid progressinabsorbingsurplusrurallabourspeedsboththedemographictransitionandtheonsetofLewis’s(1954)labourmarketturningpoint,which triggersasingularpatternofself-sustainingstructuralchangethatdrivesrapid economicgrowthandpoliticalmaturation.

Thelow-rentdevelopmenttrajectoryproducesself-reinforcingvirtuouseconomicandsociopoliticalcircuits.First,anearlystartoncompetitiveindustrializationacceleratesurbanization,whichadvancesthedemographiccycleso thatalowerratioofdependantsperworkerreducestheshareofconsumption inGDPandincreasesthatofsavingandinvestment,whichspurspercapita GDPgrowth.Second,therapidexpansionoflabour-intensiveexportsspeedily absorbssurpluslaboursothatthelabourmarketrapidlyreachesitsturning point,causingrealwagestorise,whichdrivesrapidstructuralchangeinto moreskill-intensiveandcapital-intensivemanufacturinginordertoboost productivityandmaintaincompetitiveness.Third,thesingularpatternof structuralchangeinlow-renteconomiesalsopromotestheformationofa self-reliantsocialcapitalandtheproliferationofsocialgroupsreadyandable tochallengepolicycapturebyanyonegroup.Togetherthesesocialforces driveanincrementalshifttowardsbothhighermeanincomesandpolitical pluralism.

Thelow-rentmodelformsausefulcounterfactualwithwhichtoexplainthe underperformanceofthehigh-rentmodel.Highrentincentivizestheeliteto competetoextractrentforimmediateself-enrichmentorpoliticalgain,which resultsinoverrapiddomesticabsorptionoftherentthatengendersDutch diseaseeffects.Theresultingstrengtheningoftherealexchangeratecauses thehigh-rentdevelopmenttrajectorytoomitlabour-intensiveindustrializationandforgotheassociatedbenefitsthat flowfromeliminatingsurplus labourandembarkingonrapidstructuralchange.Consequently,bothcompetitivediversificationandtheincrementalshifttowardspoliticalpluralism areretarded.Rather,intheabsenceofpolicyreform,whichrent-seeking interestsoftenoppose,governmentsinhigh-renteconomiesdeployrentto alleviateunemploymentbysubsidizingurbanactivityinprotectedmanufacturingandgovernmentbureaucracy.Thisistheantithesisofthecompetitive economicdiversificationthatisrequired.Thesubsidizedurbansector’sburgeoningrentrequirementseventuallyoutstripthecapacityoftheeconomyto

supplythem.Thistriggersagrowthcollapsethatisprotractedbecauserentseekersresistreform.Theessenceofthestapletraptrajectoryisthereforethe diversificationoftheeconomyintoarent-dependenturbanenclavewhose demandsforsubsidiesfromtherentoutstripthesupply.

1.2.2 Rent-DrivenDevelopmentinTrinidadandTobagoandMauritius

Section2providesdetailedcasestudyevidence,which firstevaluatesthe legacyoftheplantationeconomywithreferencetoTrinidadandTobagoin Chapter3.Thelegacyincludesestablishinganinitialrelianceonrent.In contrast,thedependencytheoristBest(1968)identifiestheprimelegacyof theplantationsystemasastrongexternaldependenceinhismodelofthe plantationeconomy.Infact,theplantationhasprovedmore flexiblethan eitherthedependencytheoristsormainstreameconomistslikeBaldwin (1956)haveassumed.Ithasexhibitedacapacitytopromotedomesticdevelopment,encouragesmallfarmexpansion,andsustainabasicstandardof livingfortheworkforce(GrahamandFloering1984).Duringthesettlement ofthesparselypopulatedislandsofTrinidadandTobagofromthelateeighteenthcentury,theplantationdominatedtheeconomy.Itestablished anethnicallymixedsocietyduetotheimportationofindenturedlabourfrom SouthAsiaaftertheabolitionofslavery.Theplantationwasalsoassociated withamarkedskewinincomedistribution,rootedindifferencesinaccessto landandthewage-depressingeffectsoftheAsianlaboursurplus(Lewis1978).

Wearguethattheemphasisplacedbydependencytheoristsontheplantation’sexternaldependenceobscuresthemorefundamentalfactorofrent dependence,whichinitiallyaroseoutofBritishcolonialtradepreferences forsugar.Paradoxically,asindependenceapproached,therentdependence intensifiedasanunintendedconsequenceofBritishreformstoraiseliving standards.Thereformsrespondedtotheunacceptablelevelsofpovertycaused bydepressedsugarpricesinthe1930s,whichledtoaRoyalCommissionof Inquirythatproposedanewtradedeal.TheresultingCommonwealthSugar Agreement(CSA)guaranteedhighersugarpricessoastoattractinvestmentby efficientinternationalcompaniesinlargemodernfactories.Theinvestment aimedtoboostproductivityandtherebyfurnishlivingstandards,equivalent tothoseoffarmworkersintheUKbutforasmallerworkforce.

Consistentwithrentcyclingtheory,thehigherrentelicitedcontestsamong plantationowners,unionizedworkers,canefarmers,andthegovernmentto capturetheextrarevenue.Consequently,althoughtheCSAsucceededin improvinglivingstandardsthroughthe1950s,theunionssubsequently blockedlabour-savingproductivityadvancesinordertomaintainemployment,whicherodedthereturnoncapitalandmotivatedtheinternational companiestowithdraw.ThegovernmentofTrinidadandTobagothen

deployedhydrocarbonrenttosubsidizetheuneconomicplantationsasan importantsourceofruralemployment.However,radicalrestructuringwas forcedontheindustryinthemid-2000swhentheWorldTradeOrganization (WTO)removedtradepreferencesliketheCSA.Butsignificantly,whereasthe eliminationofsugarrentcausedtheplantationtocollapseinTrinidadand Tobago,itthrivedinMauritius.

Chapter4analysestheimpactofhydrocarbonrentontheeconomyof TrinidadandTobago.Afterindependencein1962,TrinidadandTobago initiallypursuedcautiouseconomicpoliciesforthedeploymentofitsmodest oilrent.Thelong-serving firstindependentgovernmentmodifiedthisstance inresponsetoanextra-parliamentarychallengein1970byespousingan ambitiousstate-ledindustrializationstrategytoaccelerateeconomicgrowth andemploymentcreation(Mottley2008).Thegovernmentestablisheda consensusinfavourofgas-basedindustrializationanddrewuponthe 1974–78and1979–81oilrentwindfallstoacceleratethestrategy.

Gas-basedindustrywasexpectedtobethecatalystforprivatesectorinvestmentindownstreammaterialsfabrication,but,aselsewhere,resource-based industrializationproducedfewmanufacturingjobs,whetherdirectorindirect (Auty1990).Rather,inlinewiththestapletrapmodel,itwasassociatedwith persistentunemploymentthatwasmaskedbydeployingrenttosubsidizean expansionofthebureaucracyandextensivemake-workschemes.Therent absorptionalsoraisedconsumptionbyexpandingsubsidiestoenergyand foodaswellashousingandemployment.Theresultingincreasedrateof domesticrentabsorptionoutstrippedtheabsorptivecapacityoftheeconomy andfedDutchdiseaseeffectsthat,asthestapletrapmodelpredicts,triggered agrowthcollapsewhenoilpricesfaltered,inthiscasethrough1981–93. Thegrowthcollapsecutpercapitaincomebyone-thirdandboostedopen unemploymenttoone-fifthoftheworkforce.

Theeconomicrecoverywaslaggedduetotheoppositionofrent-seeking intereststoreform.ThereformswereeventuallyimplementedwithIFIassistanceandtheyreducedtheroleofthestateinproductiveactivity.However, wheneconomicgrowth finallyrevived,itwasduetotheexpansionofLNG ratherthantoinvestmentinnonenergyactivity,whichhasremainedmuted formorethanthreedecades.Moreover,completionoftheLNGcomplex coincidedwiththe2004–08energyboom,whichsharplyboostedtherent stream.Despiteinitialcaution,theLNGrentwasabsorbedtoorapidlyintothe domesticeconomy,therebyfurtherintensifyingrentdependenceatthe expenseofcompetitivediversification.

Section2concludesinChapter5byposingthequestion:HowmightTrinidadandTobagohavedevelopedintheabsenceoflargehydrocarbonrents?It analysesMauritiusasalow-rentcounterfactualforhigh-rentTrinidadand Tobago.Priortoindependenceinthe1960sthetwocolonieshadmuchin

common,apartfromtheirmineralendowments.Thedevelopmenttrajectory ofMauritiusfollowsthelow-rentcompetitivediversificationmodel.In1961a RoyalCommissionontheeconomyofMauritiusrecommendedrapidimplementationofbirthcontrolandindustrializationbyimportsubstitution. However,thecountry’s firstindependentgovernmentpromotedbirthcontrol but,impressedbyprogressinTaiwan,quicklydemotedimportsubstitution policiesinfavourofencouragingprivateinvestmentinanexportzone.

Despiteitspotentialdisadvantages aremote,smallmonocropeconomy runningshortofland,andwithanethnicallydiversepopulation Mauritius achievedsustainedeconomicdevelopmentanddiversification.Akeyelement initssuccess,whichisoftenneglected,istheincentivethatlowrentconferred ontheelitetobuildapoliticalcoalitiontopromoteeconomicgrowth.Butwe identifyasecondcriticalelementinMauritiansuccess,namelytheelite’s politicallysensitiveapproachtoeconomicreform.Morespecifically,Mauritius’selitebuiltapoliticalcoalitiontopromoteeconomicgrowththrough adualtrackstrategyofreform(Lauetal.2000).Thisstrategypursuedthe emergingcomparativeadvantageanddevelopedadynamiclabour-intensive marketeconomyinanexportprocessingzone(Track1).Itpostponedreform oftheresidualrent-dependentsector(Track2)untilTrack1hadgrownto dominatetheeconomy,whenitcouldabsorbandneutralizerent-seeking groupsinTrack2.Thedualtrackstrategyinitiallynurturedcompetitive industrializationviaexportsoftextilesandthenelectronics,followedby tourismand financialservices.AlthoughMauritius’smeanpercapitaincome remainsbelowthatofTrinidadandTobago,thegaphasnarrowedsince independence(WorldBank2017a).Moreover,theMauritianeconomyrelies onproductivity-drivengrowthratherthanrent,andhassignificantly improvedsocialwelfare.Mostimportantly,ithasdonesoinasustainable manner.

1.2.3 DifferentialRent-DrivenDevelopmentinGlobalDevelopingRegions

Section3appliesthetworent-drivenmodelstoexplainthedevelopment trajectoriesof fiveglobaldevelopingcountryregions,namelysub-Saharan Africa,LatinAmerica,EastAsia,SouthAsia,andtheGulf,andanalysesa systematicthemeofimportancetoeachregion.Forexample,Chapter6 focusesonsub-SaharanAfricaandtheconsequencesofagriculturalneglect. Sub-SaharanAfricaappearedinitiallytofacefavourabledevelopmentprospectsarisingfromthepredominanceofland-richpeasantfarmereconomies withdiffuselinkagesbeneficialtoeconomicgrowthandcompetitivestructuralchange(Baldwin1956).

However,ethnicdiversitysparkedpoliticalcontestsforrentamongtheelite thatdistortedmosteconomiesanddeflectedthemfromtheircomparative

advantage.Cropmarketingboardswereabusedtoextractnotonlycroprents frompeasantfarmersbutalsoreturnstocapitalandlabour.Thiswasostensiblydonetosustainapolicyofindustrializationbyimportsubstitutionthat wasill-suitedtothesmalldomesticmarketsofmostnewlyindependent countriesandquicklydegeneratedintoarent-cyclingmechanism.Eventhe resource-pooreconomiesoftheSahelespousedthepolicy,drawingupon regulatoryrentthatwasaugmentedbygeopoliticalrentfollowingthedrought oftheearly-1970s.Whatevertherentsource,theresultingmisallocationof capitalandlabourledtoprotractedgrowthcollapsesthatrequiredIFIassistance,buttressedbygeopoliticalrent,whichwasnotalwaysdirectedateconomicrecovery.

Morehomogenoussocietiesmightbeexpectedtopursueathirddevelopmentmodelofstaplediversificationthroughdiffuselinkages(Baldwin1956; North1955;Mellor1976),whichstartsfromthepremisethatsmallfarms respondtomodestincrementsofcapitalandlabourbysteadilyintensifying yields.Thisexpandsincomes.Italsoincreasestaxes,whichfarmersaccept becausetheybenefitdirectlyfrompublicservicessuchasimprovedtransportation,education,andhealthcare.Risingfarmers’ incomesalsoexpandthe domesticmarketforlocallyproducedmanufacturesofhouseholdgoodsand farmequipmentaswellasservices,therebydiversifyingtheeconomyaway fromstapledependence.Yetalthoughthestaplediversificationmodel appearedwelladaptedtopropelpeasantfarmeconomies,thefactionalpolitics insub-SaharanAfricaprecludeditsespousal.Instead,politicalcontestsand associatedrent-seekingledthestrategyofindustrializationbyimportsubstitutiontodegenerateintoamechanismforrentcyclingwithlong-lasting detrimentaleffectsforagriculture,uponwhichamajorityofthepopulation continuedtorely.

Chapter7focusesontheroleofindustrializationanddrawsuponthetwo rent-drivenmodelstoexplainhowtheEastAsianeconomiesovercameLatin America’sheadstartondevelopment.MostLatinAmericancountriesadopted industrializationbyimportsubstitutioninresponsetothedisruptionofglobal tradethrough1913–45(Lewis1978).Crucially,theirgovernmentspersisted withthestrategywhenglobaltradere-expandedfromthe1950s,despitethe failureoftheprotectedinfantindustrytomatureandbecomeinternationally competitive.Theregion’seconomicgrowthwaspunctuatedbyshortagesof foreignexchangeandpublicrevenuebecauseprotectedmanufacturingfailed togeneratesufficientexportstopurchaseimportedinputs,whilerecurring fiscaldeficitsfeddebtaccumulation,inflation,andprotractedgrowthcollapsescommencingin1979–82.

Incontrast,elitesinEastAsiafacedanexistentialthreatfromthedeteriorationoftheUSpositioninVietnamanddiminishinggeopoliticalrent.They builtonacomparativeadvantageincheaplabourtopursuecompetitive

industrialization.Theydeployedregulatoryrentthroughlow-interestloansto growtheeconomyefficientlyunderhardbudgetconstraintsbymakingfuture accesstoloansconditionalonrapidmaturation.TheEastAsianeconomies experiencedrapidgrowthinpercapitaGDPandswiftlynarrowedtheproductivitygapontheadvancedeconomies,whereasLatinAmericaneconomies fellback,leadingtofearsofprematuredeindustrialization(Rodrik2015). However,asnotedearlier,LatinAmericanstructuralchangemaybeconceptualizedmoreaccuratelyasthecorrectionofearlierpoliciesofsubsidized industrialization.

Chapters6and7bothquerythestrongbiasindevelopmentpolicytowards industrializationsincethe1950sanditscorollaryofneglectoftherural economyandexportservices.Chapter8examinesscopefordiversification intoincreasinglysophisticatedexportserviceswithreferencetothecontrastinglaboursurpluseconomiesoflow-incomeSouthAsiaandthehigh-income Gulf.Recenttrendsindemandforservicesandmanufacturedgoodsare increasingscopeformid-incomedevelopingcountriestosupplynichemarketsbyparticipatinginglobalvalue-addedchains(Economist2013).This createsnewopportunitiesfordevelopingcountriestoprovideboththeservicesthatmoderncustomer-tailoredproductsincreasinglyrequire(whichdo notincurfreightcharges)andhigh-valueindustrialcomponentscapableof bearinghighfreightcharges(McKinsey2012).

Chapter8drawsuponIndia,wheretheservicesectoroutcompetesmanufacturingindrivingeconomicdevelopment.Itcontraststhedynamismof theIndianservicesectorwiththedisappointingperformanceofIndianmanufacturing,whichwasheavilydistortedundertheLicenceRajbytheextraction anddeploymentoflargeregulatoryrentstopromoteheavyindustry. Thecorollarywasprolongedneglectoflabour-intensiveagricultureand manufacturing,inwhichIndiaheldacomparativeadvantageatindependence.Therapidriseofexportservicessince1990reflectstheexploitation byexpatriateIndianprivate firmsinNorthAmericaoflinkswithICTclusters inIndia.WedrawuponIndianexperiencetoarguethatthehydrocarbondependentGulfgovernmentscanmaketherequiredtransferofnationals fromrent-subsidizedpublicsectorjobsintomoreproductiveandsustainable privatesectoremploymentbyexportingincreasinglysophisticatedservices. AsLounganietal.(2017)argue,industrializationmaynotbeessentialfor economicdevelopment.

Finally,Section4summarizestheresearch findings.Itrestatesthecasefor conceptualizingtheresourcecurseaspartofabroaderandricherrentcurse; analysesthestrengthsandweaknessofthetwobasicrent-drivenmodels; reviewstheconsequencesofprioritizingindustrializationforeconomicdevelopment;setsouttheprincipalrequirementsfortheeffectivepursuitofasector neutraldevelopmentpolicy;andconsidersaspectsoffutureresearch.