Guide Suhail Chandy And Weison Ding

Visit to download the full and correct content document: https://ebookmass.com/product/bank-investing-a-practitioners-field-guide-suhail-chan dy-and-weison-ding/

More products digital (pdf, epub, mobi) instant download maybe you interests ...

Salesforce Field Service: A Beginner's Guide to Creating, Managing, and Automating Field Service Saiteja Chatrati

https://ebookmass.com/product/salesforce-field-service-abeginners-guide-to-creating-managing-and-automating-fieldservice-saiteja-chatrati/

Startup Accelerators: A Field Guide 1st Edition Richard Busulwa

https://ebookmass.com/product/startup-accelerators-a-fieldguide-1st-edition-richard-busulwa/

A Field Guide to British Rivers 1st Edition George

Heritage

https://ebookmass.com/product/a-field-guide-to-britishrivers-1st-edition-george-heritage/

A Mysterious Universe: Quantum Mechanics, Relativity, and Cosmology for Everyone Suhail Zubairy

https://ebookmass.com/product/a-mysterious-universe-quantummechanics-relativity-and-cosmology-for-everyone-suhail-zubairy/

The Princeton Field Guide to Dinosaurs Third Edition (Princeton Field Guides, 69) Paul

https://ebookmass.com/product/the-princeton-field-guide-todinosaurs-third-edition-princeton-field-guides-69-paul/

Research Design and Methods: An Applied Guide for the Scholar-Practitioner (NULL)

https://ebookmass.com/product/research-design-and-methods-anapplied-guide-for-the-scholar-practitioner-null/

Field Guide to North American Flycatchers: Kingbirds and Myiarchus Lee

https://ebookmass.com/product/field-guide-to-north-americanflycatchers-kingbirds-and-myiarchus-lee/

The Experimentation Field Book: A Step-by-Step Project Guide Jeanne Liedtka

https://ebookmass.com/product/the-experimentation-field-book-astep-by-step-project-guide-jeanne-liedtka/

The Norton Field Guide to Writing (Fifth Edition)

https://ebookmass.com/product/the-norton-field-guide-to-writingfifth-edition/

“Finally,thesingular,comprehensivemanuscriptforbankinvestingI wishI’dhadatthebeginningofmycareer.SuhailandWeisonclearly chronicletheevolutionandcurrentchallengesoftheindustryforthe amateurenthusiast,whilesimultaneouslysupplyingthetechnical depth,practicalexecution,andoperationalguidanceforinstitutional investors,sell-sideanalysts,andexecutivemanagementteams.”

—TylerStafford,CFA, CEOandCo-Founder, PanaceaFinancial;FormerSell-SideBankAnalyst

“BankInvesting:APractitioner’sFieldGuide explainsanddetailsall ofthecriticalvariablesinvestorsneedtoanalyzeinordertomakethe rightdecisionsinbankstockinvesting.ChandyandDinglayoutboth themacroandmicrofactorsneededtoaccuratelydeterminethefair valueofabankstock.Thisbookwillquicklybecomethego-tobookfor bothneophyteandexperiencedbankstocksinvestors.”

—GerardS.Cassidy, ManagingDirector,HeadofBankEquity Strategy,andLargeCapBankAnalyst,RBCCapitalMarkets andcreatoroftheTexasRatio

“SuhailandWeisonhavewrittenatrulycomprehensiveguidetoinvestinginbanks.Theirapproachprovidesacomprehensiveframeworkfor analyzingthemostcriticalandoftenmostchallengingtopics,includingabank’sinterestratesensitivity,creditexposure,andliquidityand capitalposition,andprovidesvaluablecasestudiesandinsightsfrom professionalinvestorsinthisspace.Thisbookisamust-readforevery bankinvestor,fromthenovicetothemostseasoned.”

—EricWasserstrom, EquityAnalyst;FormerHedge FundPortfolioManager

“SuhailandWeisonhavecollaboratedonamust-readthatwill proveinvaluabletoallconstituentsofthebankandbroaderfinancial servicessector.Thecommentaryisinsightful,educational,entertaining, andinformative,helpingthereadertounderstandthehistoryofthe sector,itsfundamentalunderpinnings,andthetransformationand convergencewithfintechthatiscurrentlyunderway.”

—JoeFenech, CIO,GenOppCapitalManagement; formersell-sidebankanalyst

CHAPTER 1 Introduction

“Thejudiciousoperationsofbankingenablehimtoconvertthisdeadstockinto activeandproductivestock;intomaterialstoworkupon,intotoolstoworkwith,and intoprovisionandsubsistencetoworkfor;intostockwhichproducessomething bothtohimselfandtohiscountry.”

–TheWealthofNationsBookII:OftheNature,Accumulation,and EmploymentofStock, AdamSmith

WHYABOOKONBANKINVESTING?

Webelievethatbankinvestingcanbeafruitfulpursuit.Asauthorsofabook onthetopicwehaveavestedinterest,butweaskthereadertoconsiderthe following:

1. Themostsuccessfulinvestorofourtimes,WarrenBuffett,hashadasizeableinvestmentinbanksovertime(closetoathirdofhisportfolioweight usedtobeinbanks).Thisisbasedontheminorityinvestmentsinpublicly listedentities,andwedonotincludeBerkshire’soperatingsubsidiaries.

2. Banksallowyoutomakemacroeconomicbetssincetheyarehighlyleveredtobusinesscycles.

3. Bankinvestingallowsyoutoscaleyourknowledge,astheyhaverelatively homogenizedbusinessmodels.

4. Atthesametime,banksarediverseenoughtodrivemeaningfuldispersioninpriceperformance.Thisdivergenceofperformancecanbetaken advantageofbyanastuteandpreparedsecurityanalyst.

5. Banksaregreatvehiclestomakespecificinvestmentplaysongeographic regions,demographictrends(suburbantourbanmigration,aging),industries(agriculture,tech,energy),newsflow(trade/tariffs,weather),real estatesubsectors(NYCoffice,bayareaapartments),andinvestingthemes suchasESG,cryptocurrency,andventurecapital.

6. Thelargestassetonabank’sbalancesheetisitsloanbook.Thisisnot directlyanalyzable;onecannotwalkuptoabankandaskpermission

toviewtheloanbook.Therearelimitedinstanceswhenasmallbankis gettingre-capitalizedthatitsloanbookmaybemadeavailableinaselectivesamplemanner,butthoseareverylimitedinstances.

Thisinformationasymmetrymakesittougherbutalsoinsome instancesrewardsthediligentanddoggedanalyst.Thisrelativeopacity makesbanksverydifferentfromanalliedsectorsuchasREITs.Thereal estateassetsofaREITaretangibleandcanbetouredandindependently assessed.ThereisalargeCREmarketwhererealestateassetstrade,and onecanusethattovaluetheassetsofREITs.Wehighlyrecommend anexcellentbookonthetopicofREITsbyourgoodfriendStephanie Krewson-Kellyandherco-authorR.BradThomas.Thatbookis The IntelligentREITInvestor:HowtoBuildWealthwithRealEstateInvestment.

7. Fintechdisruptionisreal,buttounderstandthisphenomenononeneeds tounderstandthesectorbeingdisrupted.Itisnotacoincidencethat someofthebiggestfintechnameshaveappliedforandobtainedabank charter.Thatisavalidationthatachartercanprovidebenefitsexceeding theregulatorycost.Finally,webelievethatfintechdisruptioniscreating aninvestingopportunitytoplaythedigitaldividebetweenbanksthat embracetechnologysuccessfullyandthosethatgetleftbehind.Banks havetostartviewingthemselvesasfintechswiththeabilitytoaccept deposits.

FINTECHONSLAUGHT

Thefintechonslaughtisjustgettingstarted.Thereisnodenyingthatfintechis disruptingthebankingbusiness.Thechallengersand“potential”challengers rangeinsizefromminnowsbeingdreamtupindormroomstogiantssuch asAmazon.AstudybytheconsultingfirmBainandCompanyin2018postulatedthatAmazon’sbankingservices,iflaunched,couldgrowtomorethan70 millionUSconsumerrelationshipsoverafive-yearperiod.Seethelinkbelow: https://www.bain.com/insights/bankings-amazon-moment/ ThiswouldbethesamesizeasWellsFargo,foundedin1852,whichisthe fourthlargestbankinthecountry.WearenotprivytotheplansofAmazon, butwearenotsurprisedbythehypotheticalgrowthtrajectoryofapotential challengerwhohassignificantheftandhasconsumedentireindustries.While notsurprising,itisunsettlingthatsomeonetakes168yearstobecomethe fourthlargestbankandthenfindthemselvesrivaledbyadigitalupstartwho tookfiveyearstogettothesamesize.

Therelentlessfintechonslaughthasseenskyrocketingvaluation,aburgeoningnumberofplayers,increasinginterestintheconcept,andabarrage ofnewsflowallreinforcingeachother.

EXHIBIT1.1

Source:GoogleTrends

Fintechunicorns,ofwhichthereare58,haveanaggregatevaluationof $213.5BaccordingtoCBInsights.Nearlyeverytransactiononewouldtraditionallydowithabankcannowbedonethroughafintechusingamobileapp onyoursmartphone.ThefintechsincludeSoFi,Earnest(ownedbyNavient), Chime,Varo,MoneyLion,Stash,Square,Kabbage,OnDeck,Affirm,Klarna, Greensky,Afterpay,andalonglistofvendorscoveringresidentialmortgage loans,studentloans,onlinecheckingandsavings,SMBloans,point-of-sale financing,andmore.Thelistisendless,andthereisavirtualtapestryoffintechlogosthatcoveravarietyofareas.

InterestinfintechhasgrownimmenselyascanbeseeninExhibit1.1,a chartofGoogletrendsonthesearchterm fintech overthelast10years.

ANOPPORTUNITYTOLEVELTHEPLAYINGFIELD

Whileinnovationisexciting,itisimportanttonotgetcaughtupinthefintech narrativeandlosesightthatultimatelybankingatitscoreisaboutaccepting deposits,makingloansprofitably,acquiringcustomersefficiently,andengagingwithcustomersmeaningfullytoincreasethecross-sellofproducts.Itis alsoimportanttorememberthatseveralnewagefintechlendershavenotbeen fullycycletested.

Branchlessbanksarenotanewconcept.Telebank,adivisionofTeleBancFinancialofArlington,VA,wasfoundedin1990andoperatedwitha branchlessstrategyinitiallyusingthetelephonenetwork.SecurityFirstNetworkBank(SFNB),foundedin1995,wasapureinternetbank.

Whilebranchlessbankingisatleast30yearsold,thenewageofthechallengerbanksisfueledbypowerfulsmartphones,amobileappecosystem,and abunchofcriticaltechnologiesandAPIsthatallowtheorchestrationofbank transactionsandactivitiesinaseamlessmanner.

Banks,especiallyregionalandcommunitybanks,havealottoworry aboutgiventhisrelentlessonslaughtfromnimblestart-upsandthelevelof techspendingatthelargebanks.Thelargestsevenbanksinthecountryare collectivelyspendingupwardsof$45Bontechnology.Smallerbankswillnot beabletomatchthatlevelofspending.However,inthisDavidversusGoliath struggle,allisnotlostforDavid.

Itisaccurateandintuitivethatsmallerbankssimplydonothave theresources(bothtalentandbudget)tocompetewiththelargebanks. However,iftheypartnerwiththerighttechnologyvendors,forefficient digitalacquisitionofcustomers,frictionlessservicesprovidedviamobileand online,andreassuringlevelsofcybersecurity,Davidwillmorethanmatch Goliath.

Inordertocompetesuccessfullybanks,largeandsmall,havetoreimagine themselvesasafintechwithabankcharter.

Whiletheycan’tmatchthelargebanksinspendingbillionsontechnology ayear,thereisnoonestoppingsmallbanksfromarchitectingavisionfortheir digitaljourneyandpropellingthisjourneybyembracingtherightsetoftechnologies.Asanecdoteswecanthinkofnumerousexamplesofsmallerbanks acrossthecountrythathaveembracedtechnologyappropriatelyandhaveseen greatsuccesswiththerampofcustomersusingmobileandsignificantlybetter customerservicescores.

Thechallengetoembarkingonasuccessfuldigitaljourneyisinpartculturalandinsomewayslimitedbyimagination.Alicensetoacceptdeposits andsubmitoneselftoregulatorysupervisiondoesnotimplythatbanksneed tohandcuffthemselvestothepast.Itistimeforsmallbankstounshackle themselvesandembracetheirdigitalfuture.

Whilethedigitalfutureisexciting,wehavetoacceptthatthebankmodel isadouble-edgedswordwhenitcomestoregulation:ontheonehandit affordsprotectionandtheabilitytoacceptdeposits,butontheotherhandthe burdencanbeonerousforsmallbanks.Thus,ontheonehand,wehaveseen fintechsthathaveshowninterestinseekingbankcharters,whichvalidates theviewthatthebankmodelisasourceofstrengthalbeitonethatneedsto bereinvigoratedwithnewtechnology.Ontheotherhand,therearefintechs thatdonotwishtoseekabankcharterinpartduetotheirviewthatthe regulatoryburdenisnotworththeirwhile;whererequired,thesefintechs partnerwithbankswhitelabelingtheproduct.Theincreasingregulatory burdenisonereasonwebelievethatthenumberofde-novoapplicationshas beenwellbelowpre-GlobalFinancialCrisis(GFC)levels(Exhibit1.2).

Source:S&PGlobalMarketIntelligence Note:asof6/9/2019

WeareveryencouragedbythestepstakenbyFDICChairJelena McWilliamstoencouragenewbankformation.Herearecommentsshemade inthe2018FDICAnnualReport.

“OneofmytopprioritiesasFDICChairmanistoencourage moredenovoformation,andwearehardatworktomakethisa reality.. .

Denovobanksareakeysourceofnewcapital,talent,ideas,and waystoservecustomers,andtheFDICwilldoitsparttosupportthis segmentoftheindustry.”

“TheFDICalsotookrobuststepsthisyeartoreducetheregulatoryburdenoncommunitybanks,withoutsacrificingsafetyandsoundnessorconsumerprotections.Weeliminatedoverone-halfofthemore than800piecesofsupervisoryguidanceoutstanding.Wealsolaunched apilotprogramtousetechnologytoreducethenumberofon-sitedays neededtoconductanexamination,andtookotherstepstoreducethe costsofexaminationstoourregulatedinstitutions.”

–MessagefromtheChairman,FDIC2018AnnualReport

FINTECHTRAILBLAZERS

Wewillbeinterviewingafewmanagementteamsofbanksthathaveboth successfullyadoptedtechnologyaswellasafintechCEOwhoisakeysupplier tothefintecharmsracebetweenbanks.

PASTISPROLOGUE:THEULTIMATEFINANCIALINNOVATION

Itisagiventhatbankstodayareadeeplyintegratedcornerstoneinmodern economies.Andwhenwesay“banks,”whatwereallymeanisthefractional reservebankingsystem.Thatis,thepoolingtogetherofdepositsandthesubsequentlendingoutofmostofthosedeposits.Withoutthissystem,vastsums ofwealthwouldbestuck“dead”invaults,generatingzeroeconomicvalue andmassivelyincreasingfrictionwithintheeconomy.Indeed,aworldwithout banksisahardonetoimagine,butmodernbankingwasnotalwaysaround.

ThestorygoesthatEuropeangoldsmithsintheseventeenthcentury servedas“depositories”forpreciousmetals,chargingcustomersasmall feetostoretheirwealthwithintheirvaults.Thegoldsmithswouldissue redeemablereceipts,whichwouldrepresenttheirphysicalholdings.Atthe time,feeswereanecessity.Security,bookkeeping,andotherexpensesto maintainavaultwereallcostly.Evenso,customerswerewillingtopaythis fee,asthealternativeofprotectingyourownwealthwasevenmoreexpensive andfrankly,risky.

Soonthesegoldsmithsrealizedthevastmajorityofwealthwithinthe wallsoftheirvaultswascollectingdust,andsotheybegantolendoutand earninterestonaportionofthesedeposits.Aportionofmoneywaskeptas “reserves”toservicepotentialwithdrawals.Theseloaned-outmonieswould bespentorinvested,makingtheirwaythroughtheeconomyandeventually endingupasanotherdepositinanothervault,readytobelentoutagain, creatingavirtuousmultiplier.Thus,fractionalreservebankingwasborn.

Thoughitseemsstraightforward,atthetimethismusthavebeena groundbreakinginnovation.Imaginebeingadepositorycustomeratoneof thesegoldsmiths,andsuddenlybeingofferedinteresttohavethemprotect andbookkeepyourwealth!

Furtherdevelopments,suchasthepermanentissuanceofbanknotes,centralbanking,andtheeventualdecouplingofacurrencytoanunderlyingcommodity(i.e.,thetransitionfromthegoldstandardtofiat),soonfollowed.But thefundamentalnutsandboltsofgatheringandlendingdepositsremainin placetoday.

THEHEREANDNOW

Today,thepoolingofdepositstocreatecreditisfoundationaltotheefficient allocationofresourcesfromthosethathave(depositors)tothosethatneed (borrowers),andisanimportantmechanismfortheapplicationofmonetary policy.

IntheUnitedStates,bankshaveaccumulatedover$13trillionindeposits, andthankstothefractional-reservebankingsystem,ahugechunkofthese depositshasbeenproductivelylentoutintoeverycorneroftheeconomy.

Banksarecertainlynottheonlyfinancialintermediaryintownthough. TheFederalReserve’sZ.1Tablesshowusthatalthoughbankshaveaplurality ofthetotalloanmarket,banksonlyholdaboutathirdofthe$27trillionintotal loansthatexistintheeconomy(Exhibit1.3).BankscontendwithGovernment SponsoredEntities(likeFannieMaeandFreddieMac)andotherprivateinstitutionslikeasset-backedsecuritiesissuersandfinancecompanies.Outofall ofthese,creditunionsareperhapsthemostsimilarinformandfunction.

Banksalsohaveameaningfulphysicalpresenceandareubiquitously wovenintothebuiltenvironmentaroundusthroughextensiveATMand branchnetworks.Despitetheseemingpervasivenessofbanks,Americaas awholeremainsunderbanked.TheFederalDepositInsuranceCorporation (FDIC)recentlyreportedthat19%ofhouseholdsintheUnitedStates(a whopping24millionhouseholds)were“underbanked,”whileanadditional 8.5millionhouseholdswereunbankedaltogether(2017FDICNational SurveyofUnbankedandUnderbankedHouseholds).Werecommend The

EXHIBIT1.3

UnbankingofAmerica byLisaServonformoreonthistopic.Thatsaid,the remainingpopulationisoverbankedtoadegree.AccordingtotheWorld Bank,commercialbankbranchesper100,000adultssitinthethirtiesforthe UnitedStates,ascomparedtomid-twentiesforotherhigh-incomecountries. InacitylikeDallas,thereare74differentbankswith370branchesbetween themcompetingforcustomers.Onlythreeofthesebankshaveadeposit marketsharegreaterthan5%.

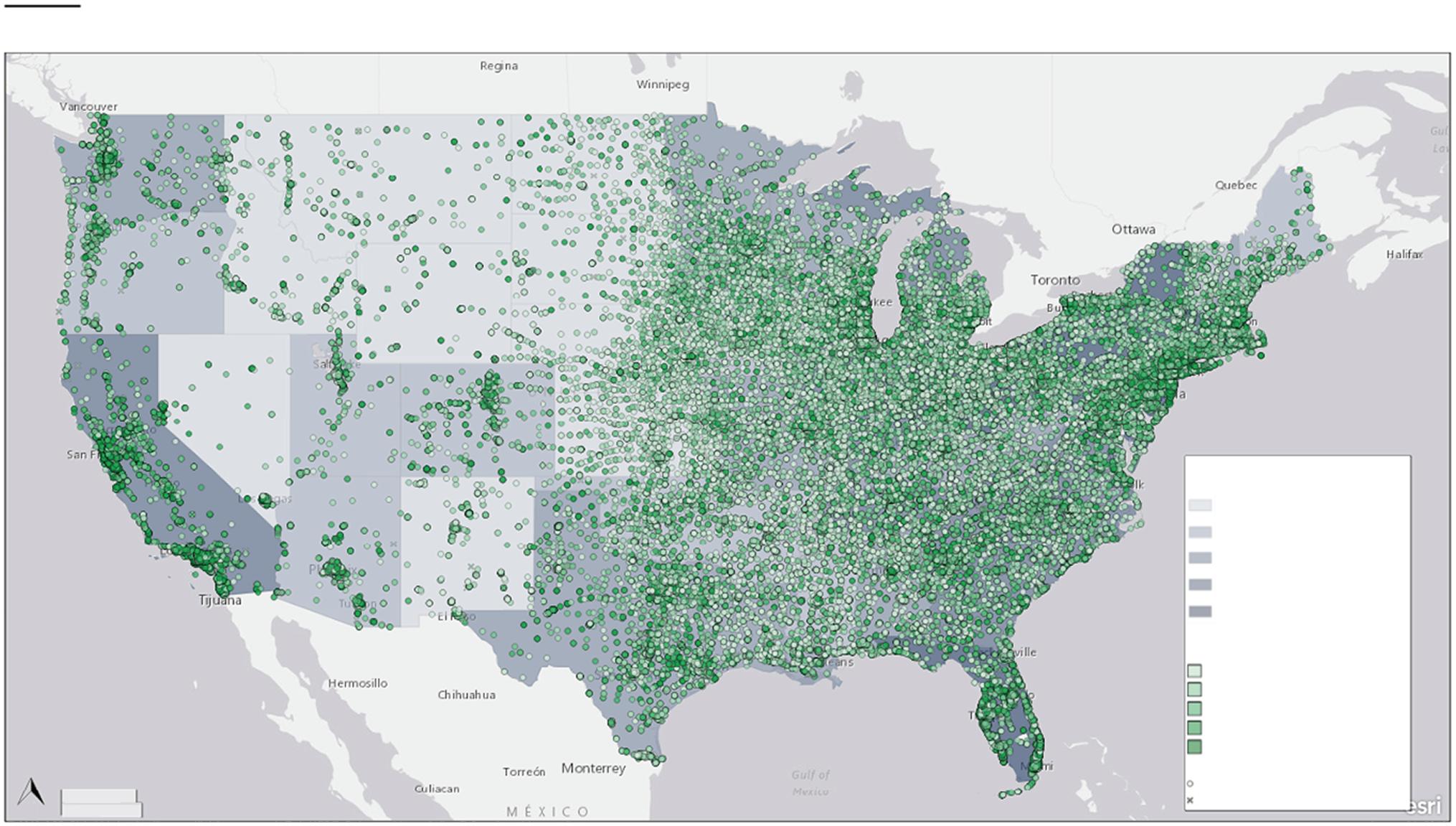

ThemapinExhibit1.4showsallUSbankbranches(exceptHawaiiand Alaska)aswellasstatelevelpopulationdensity,illustratingthenon-uniform distributionofbranches.

Thebankingindustryhasbeengoingthrougharemarkablysteady periodofconsolidation,evendespiteeconomiccycles.Thetotalnumberof FDIC-insureddepositoriespeakedin1985at18,000,andnowsitsbelow6,000 (Exhibit1.5).

Shiftingtoapublicsecuritiesmarketperspective,banksmakeupameaningfulproportionofaggregatemarketvalue.Forinstance,ifwelookatthe S&P500,financialsareabout10%oftheindex.Withinfinancials,banksare thelargest subsector at$3.0trillion,andincredibly,haveamarketvalueequal tothatofsome entire industriesintheS&P500suchasenergyandindustrials: https://eresearch.fidelity.com/eresearch/markets_sectors/sectors/ sectors_in_market.jhtml

CommunityBanks areatypeofbankthatfocusesonbankinglocalcommunities,derivingthemajorityoftheirincomefromspreadincome,thatis arbitragingthespreadbetweeninterestpaidongathereddepositsandinterestearnedonloans.Communitybanksaredeeplyembeddedwithintheir localcommunities,andasaresulttheyhaveanintegralunderstandingofthe communitiestheyoperatewithin.Thislocalexpertiseisirreplaceablewhen itcomestoefficientreallocationofcapital.WhereastheJ.P.Morgansofthe worldhavethesizeandscaletobankmultinationalcorporations,community bankshavetheabilitytodevotetheirresourcesinabespokewayfortheirlocal communities.

Theterm communitybanks hasneverhadastrictdefinition,thoughoften timesanassetcapisusedasaproxy.Mostputthisassetcapinthe$10billion range,whichwefindreasonable.However,wewillresistcommittingtoahard number,asinflationandtheregulatoryenvironmentmakethissomewhatof amovingtarget.

EXHIBIT1.5 NumberofBanks

20,000 1986Q1: 18,083

2019Q2: 5,303

Source:FDIC

WHYINVESTINCOMMUNITYBANKS?

Forstarters,therearealotofthemtochoosefrom.Nearly800publiclytraded bankshaveassetsbelow$10billion,givinganypotentialinvestorahugepool ofinvestablesecurities.Further,onceyou’vefamiliarizedyourselfwiththe peculiaritiesoftheindustry,yourknowledgewillbemostlyapplicabletothis ratherhomogeneousbusinessmodel.

That’snottosaythatreturns within thebankspacearehomogenized though.Thereisenoughspecializationwithintheindustry,whetheritbegeographicallyorinlendinganddepositgatheringstrategies,thatperformance canvarywildlybetweenbanks.Forinstance,abusinessbankbasedinTexas wouldbenefitmorefromrisingoilpricesandarisingFedFundsrate,thana mortgagebankbasedintheNortheast.

Consolidationisalsoaseculartailwindthatbenefitsbankinvestorsas well.Forinstance,in2017therewereatotalof305dealsannounced,and80 ofthetargetswerepubliclytraded,implyingnearly1in10publiclytraded banksweretakenoutinjustoneyear.

Inthisbook,youwillgetinsightsfrominterviewsconductedwithreal industryleaders,fromthosethatoperatebanks,andthosethatinvestinbank stocksandinthecreditmarkets.Further,wewillprovidetherequisiteinformationthatanyinvestorwouldwanttoknow,includingtheidiosyncrasiesin financialstatementanalysis,capitalandcredit,theregulatoryenvironment,

andvaluation.Ultimately,wehopetoleaveyouwithallthetoolsnecessaryto besuccessfulininvestinginbankstocks.

Thisbookgivesyoutheessentialtoolkittobecomeasuccessfulbank investor.Itpackagespracticallessons,theoreticalknowledge,andhistorical context,allintoonecompellingandentertainingbook.Thisisabasic101on investinginbanks,asthereisalotofmaterialthathasbeenleftonthecutting roomfloor.Wearesuretohavemadesomeerrorsaswell.Weinvitereadersto sendallcommentstobankinvesting101@gmail.com.