Universal Tactics of Successful Trading: Finding Opportunity in Uncertainty (Wiley Trading) 1st Edition Brent Penfold Visit to download the full and correct content document: https://ebookmass.com/product/the-universal-tactics-of-successful-trend-trading-findin g-opportunity-in-uncertainty-wiley-trading-1st-edition-brent-penfold/

More products digital (pdf, epub, mobi) instant download maybe you interests ...

The Trading Mindwheel - Eight essential skills for trading mastery 1st Edition Michael Lamothe

https://ebookmass.com/product/the-trading-mindwheel-eightessential-skills-for-trading-mastery-1st-edition-michael-lamothe/

Quantitative Trading: How to Build Your Own Algorithmic Trading Business (Wiley Trading) 2nd Edition Chan

https://ebookmass.com/product/quantitative-trading-how-to-buildyour-own-algorithmic-trading-business-wiley-trading-2nd-editionchan/

The Trading Mindwheel: Eight Essential Skills for Trading Mastery Michael Lamothe

https://ebookmass.com/product/the-trading-mindwheel-eightessential-skills-for-trading-mastery-michael-lamothe/

Cryptocurrency Trading: The Ultimate Guide to Understanding the Cryptocurrency Trading Owen Hill

https://ebookmass.com/product/cryptocurrency-trading-theultimate-guide-to-understanding-the-cryptocurrency-trading-owenhill/

The Trading Mindwheel Michael Lamothe https://ebookmass.com/product/the-trading-mindwheel-michaellamothe/

The Ultimate Price Action Trading Guide https://ebookmass.com/product/the-ultimate-price-action-tradingguide/

151 Trading Strategies 1st ed. Edition Zura Kakushadze https://ebookmass.com/product/151-trading-strategies-1st-ededition-zura-kakushadze/

Make Money Trading Options 1st Edition Michael Sincere

https://ebookmass.com/product/make-money-trading-options-1stedition-michael-sincere/

Quantitative trading : how to build your own algorithmic trading business. Ernest P. Chan

https://ebookmass.com/product/quantitative-trading-how-to-buildyour-own-algorithmic-trading-business-ernest-p-chan/

TheUniversal Tacticsof SuccessfulTrend Trading FindingOpportunity inUncertainty By

Thiseditionfirstpublished2021

©2021JohnWiley&Sons,Ltd

Registeredoffice

JohnWiley&SonsLtd,TheAtrium,SouthernGate,Chichester,WestSussexPO19 8SQ,UnitedKingdom

Fordetailsofourglobaleditorialoffices,forcustomerservicesandforinformation abouthowtoapplyforpermissiontoreusethecopyrightmaterialinthisbookplease seeourwebsiteat www.wiley.com.

Allrightsreserved.Nopartofthispublicationmaybereproduced,storedinaretrieval system,ortransmitted,inanyformorbyanymeans,electronic,mechanical, photocopying,recordingorotherwise,exceptaspermittedbytheUKCopyright, DesignsandPatentsAct1988,withoutthepriorpermissionofthepublisher.

Wileypublishesinavarietyofprintandelectronicformatsandbyprint-on-demand. Somematerialincludedwithstandardprintversionsofthisbookmaynotbeincluded ine-booksorinprint-on-demand.IfthisbookreferstomediasuchasaCDorDVD thatisnotincludedintheversionyoupurchased,youmaydownloadthismaterialat http://booksupport.wiley.com.FormoreinformationaboutWileyproducts,visit www .wiley.com

Designationsusedbycompaniestodistinguishtheirproductsareoftenclaimedas trademarks.Allbrandnamesandproductnamesusedinthisbookaretradenames, servicemarks,trademarksorregisteredtrademarksoftheirrespectiveowners.The publisherisnotassociatedwithanyproductorvendormentionedinthisbook.

LimitofLiability/DisclaimerofWarranty:Whilethepublisherandauthorhaveused theirbesteffortsinpreparingthisbook,theymakenorepresentationsorwarranties withrespecttotheaccuracyorcompletenessofthecontentsofthisbookand specificallydisclaimanyimpliedwarrantiesofmerchantabilityorfitnessfora particularpurpose.Itissoldontheunderstandingthatthepublisherisnotengaged inrenderingprofessionalservicesandneitherthepublishernortheauthorshallbe liablefordamagesarisingherefrom.Ifprofessionaladviceorotherexpertassistance isrequired,theservicesofacompetentprofessionalshouldbesought.

LibraryofCongressCataloging-in-PublicationDataisavailable:

Names:Penfold,Brent,1962-author.|JohnWiley&Sons,Ltd.,publisher.

Title:Theuniversaltacticsofsuccessfultrendtrading:findingopportunity inuncertainty/BrentNormanLindsayPenfold.

Description:[Hoboken]:[Wiley],[2020]|Includesindex.

Identifiers:LCCN2020020364(print)|LCCN2020020365(ebook)| ISBN9781119734512(hardback)|ISBN9781119734550(adobepdf)| ISBN9781119734499(epub)

Subjects:LCSH:Portfoliomanagement.|Stockpriceforecasting.|Investments. Classification:LCCHG4529.5.P4442020(print)|LCCHG4529.5(ebook)| DDC332.64—dc23

LCrecordavailableathttps://lccn.loc.gov/2020020364

LCebookrecordavailableathttps://lccn.loc.gov/2020020365

CoverDesign:Wiley

CoverImage:©champc/GettyImages

Setin10/12pt,SabonLTStdbySPiGlobal,Chennai,India.

PrintedinGreatBritainbyCPIAntonyRowe,UK 10987654321

Tomybeautifulfamily, Katia,BeauandBoston, thethreebesttradesI’veevermade.

AppendixALiteratureonTrendTrading368

CowlesandJones(1933)368

Levy(1967)368

JegadeeshandTitman(1993)369

Asness,LiewandStevens(1997)369

RouwenhorstandGeert(1998)369

LeBaron(1999)370

MoskowitzandGrinblatt(1999)370

Rouwenhorst(1999)370

Griffin,JiandMartin(2003)370

HwangandGeorge(2004)370

WilcoxandCrittenden(2005)371 Faber(2006)371

Szakmary,ShenandSharma(2010)371

Liu,LiuandMa(2010)371

Hurst,OoiandPedersen(2010)372

Moskowitz,Ooi,HuaandPedersen (2011)372

Antonacci(2012)372

LuuandYu(2012)372

Hurst,OoiandPedersen(2012)373

Lempérière,Deremble,Seager,Potters andBouchard(2014)373

GreysermanandKaminski(2014)373

Clare,Seaton,SmithandThomas(2014)373

Glabadanidis(2016)374

GeorgopoulouandWang(2016)374

Hamill,RattrayandVanHemert(2016)374

D’Souza,Srichanachaichok,Wangand Yao(2016)374

GeczyandSamonov(2017)375

Hurst,OoiandPedersen(2017)375

Index377

ACKNOWLEDGEMENTS TheonlyacknowledgementI’dliketomakeistoeveryonewho boughtmyearlierbook TheUniversalPrinciplesofSuccessfulTrading (UPST)(Wiley,2010).

Ifthatisyou,thenabig,bigthankyou.

Ifit’snotyou,thenabigthankyouanywayforpickingupthis book!

Thisbookhascomeaboutonlybecauseofthesuccessof UPST Sinceitspublicationin2010 UPST hasbecomeaninternational bestsellerhavingbeentranslatedintoPolish,German,Korean, JapaneseandsimplifiedandorthodoxChinese.

Ifitwasn’tforitssuccessthiscompanionbookwouldneverhave beenwritten.

So,abigthankyoutoallthetradersouttherewhohelped UPST becomethesuccessitistoday.

PREFACE BUCKLEUP Thisbookisaboutpracticaltrendtrading.

Butwait.Beforeyoudecidetoattempttrendtrading,orcontinue trendtrading,youwillfirstneedtodoalittle‘speed’reviewand ‘speed’self-analysistodeterminewhetheryou’resuitableforit. Itwouldreallybepointlesscontinuingwiththisbookifdeepdown youweren’tsuitedtotradingwiththetrend.Hencethislittle‘heads up’beforeyoustart.

Now,ifafteryourspeedreviewyoudecidetrendtradingisnotfor youthennoworries.Welldoneonbeingtruthfultoyourself,yourrisk capitalandyourfamily.

Ifyoudodecideyou’reupforit,andifyoupersist,thenwell done—youwillberewarded.However,thekeywordis‘persist’. Althoughsimple,tradingisnoteasy,particularlytrendtrading.You willneedtolearntoendureitsunpleasantries.Itwon’tbeasmooth ridewithoutitsbumps.Butifyoupersistandaresensible,youwill berewarded.Sowhynotbuckleupandletmegiveyoualittlespeed introductiontotheworldofprofessionaltrendtrading.

THEFIRSTANDMOSTIMPORTANTFACTABOUT TRENDTRADING Letmestartwiththeunpleasantries.Trendtradingisundeniablymiserable.Yep,Isaidit.Miserable.Miserablewithacapital‘M’.

It’samiserableexistencewhereyoucanexpecttosuffer67% lossesonallyourtrades.You’llbespendingmoretimelosingthen

winning.Alotmoretimelosing.Ifyou’restillwithmethenyou’ll needtobeawareofthefollowing:

•Youwon’tbetradingtomakeimmediateprofit.No.

•Youwon’tbetradingtoproveyourmarketanalysiscorrect.No.

•Youwon’tbetradingfortheaction,orthrillofbeinginthemarket. Don’tbestupid.

•You’llonlybetradinginwhatyoubelieveisthegeneraldirectionof themarket’strend,whichquiteoftenwillbewrong.Getusedtoit.

•You’llonlybetradingfortheopportunitytoearnexpectancy,not profit.That’sright.

•Expectancycomesfrombothyourwinningandlosingtrades.Yes, itdoes.

•Expectancycanonlyaccrueoveralongperiodoftimecovering manylossesandafewwins.DidIsayitwasmiserable?

Knowandacceptthisandyou’llbeprepared. I’mnotsayingthistobeakilljoy.I’msayingittoberealistic andtotellyouhowitis.Idon’twantyoutodevelopasatisfactory trend-tradingmethodologyonlytoseeyouthrowitawayfollowinga dreadfullosingstreakof10,20or30losingtrades.Itwillhappen. Don’tthinkitwon’t.Themarket’sMrMaximumAdversitywillensure itdoes.

Remember,lifeasatrendtraderismiserable.You’llalwaysbelosing.It’srepetitiveandboring.You’llbeplacingthesameordersand enteringthesametradesoverthesameportfolioofmarketstimeand again.It’saconstantwashcycleofrinseandrepeat.It’srepetitive,it’s boringandit’spainful.You’llconstantlysufferdrawdowns.Somequite deeply.It’smoremindnumbingthenmindstimulating.

However,despiteitschallenges,itisalsoprofitable,andattimes, veryprofitable.

Butonlyifyoustickwithitduringtheturbulenttimes.Survivethe turbulenttimesandyou’llbearoundtoenjoythegoodtimes.

Youwillneedtoemployappropriatemoneymanagement.You’ll needtotradesmallrelativetoyourriskcapital.Youwillneedtoensure yourrisk-of-ruin(ROR)isat0%.Youwillneedtoensureyou’reagood loser,bothinnevermovingyourstopsandneverlettingthelossesget youangry.Youwillneedtosufferthebadtimes.Youwillneedtolearn toendurethedarknessthatwillinhibityourworldfromtimetotime. Doallthatandyouwillcomeouttheotherendwithasurprisingresult.

Ihopethatifyouembarkonthistrend-tradingjourneythatyou willrememberthesefewwords.

Ihopeyouwillrememberthemwhenyou’reinadeepdarkplace thatalltrendtradersinhabit.Whenitappearstobethedarkest,Ihope youwillrememberthatsuccessfultrendtradingisallaboutsurvival, avoidingriskofruin,beingagoodloserandfollowingagoodtrade plan.Ihopeyou’llrememberyou’reonlytradingfortheopportunity toearnexpectancy,notimmediateprofit.Thatexpectancycanonly accrueoveralongperiodoftimeexecutingmany,manytrades.It maytakeawholeyear.Itmaytakeacoupleofyears.Thisisbecause youdon’tknowwhichmarketormarketswilldecidetotrendorwhen they’lldecidetotrend.Butifyoucanlearntorideandstayonthe bumpyequitycurveyouwillberewardedwhenanewequityhighis reached.

Areyoustillupfortrendtrading?

No?Noworriesandwelldoneonbeingdecisive,andhonest. Yes?Welldoneandwelcometomypainfulworldoftrendtrading. IhopeyouenjoytheideasI’mgoingtosharewithyou.

HOWTOMAKEMONEYTRADING NowthatI’vegotyouquicklybriefedandsoberlyonboard (andremembertokeepthatbuckletight),let’scuttothechase. You’rereadingthisbookforonereasononly,andit’sthesamereason whyI’mwritingthisbook.Youwanttoknowhowtomakemoney trendtrading.

WellI’mgoingtoshowyouhow.

Butyou’llneedtostickwithmeasIprogressthroughthebook. Whenyoufinish,you’llneedtoindependentlyverifyandvalidate everythingIsay.It’snogoodmetellingyouwhatworksandwhat doesn’t.It’suptoyoutotellyourselfbydoingthework.Defyhuman natureandputtheeffortin.Dothat,executecorrectlyandyou’llbe rewarded.

Goodluck.

BrentPenfold

Sydney,Australia

INTRODUCTION Thisbookhasadualobjective.

AREALISTBOOK Firstly,Ihopeitwillbecomeapopularbookbasedonitsownmerits. Ihopeintimeitwillbecomeseenasarealisticandhonestvoiceon trendtrading.Andjustliketrendtrading,onethatwillstandthetest oftime.

ACOMPANIONBOOK Secondly,Ialsohopethisbookwillbeseenasanecessaryanddeservingcompaniontomypreviousbook, UPST.Anaturalextensionand complimenttotheuniversalprinciplesofsuccessfultradingthatI extensivelywroteaboutin UPST

THEMISSINGCHAPTER With UPST Itookaholisticapproachtodiscussingtheprocessoftradingthatfollowsanumberofimmutablecoreprinciples.Principlesthat areapplicabletoalltradersregardlessofthemarket,instrumentand timeframe,techniqueoranalysistheyfollow.Followingagoodprocess oftradingisprimarytothesecondaryissuesofmarkets,instruments, timeframes,techniquesandanalysis.

Beingaholistic-typebookIspentlittletimeonthemostinterestingpartoftrading—theanalysisanddevelopmentoftradingstrategies.Ispentlittletonotimeondissectingmarketstructure,identifying appropriatesetupsandapplyingsensibletradingplans.

Asaside-baritstillamazesmethat UPST,atradingbookthat basicallydoesn’tdiscussindetailmarketstructure,analysis,setup criterion,entry,stopandexittechniqueswassopopular.Ina nutshell,itdoesn’tdwellontheinterestingsideoftrading—the analysis,investigation,development,reviewingandfinalizationof tradingstrategies.No.Thebookconcentratesonthedryaspectsof trading,theuniversalprinciplesofsuccessfultrading.Materialthat Ipersonallycherishaboveallelse,butmaterialneverthelessIknow nottobeparticularlyexciting.Fromamaterialperspective,this bookwillbefarmoreinteresting,notmoreimportant,butfarmore interestingcomparedto UPST

Nowbacktopoint.

UPST isamoreholistic,theoreticaltypebook.Thisbookwillbea morepractical,how-toguidebookontrendtrading.Itwillbeanatural extensionandcompliementto UPST,whereIwillattempttotakethe principlesIsharedregardingmethodologyandapplytheminapracticalmannertoinvestigate,reviewanddeveloparobusttrend-trading methodology.

AlthoughIwroteextensivelyabout‘methodology’in UPST,Idid notprovideapracticalturn-keystrategyexampletodemonstratemy ideas.Thisbookwillprovidethepracticalturn-keystrategyexampleto dojustthat,todemonstratewhatIwassaying.Togiveyouanexample ofwhatIdiscussedin UPST.

Isupposeyoucouldviewthisbookasthemissing‘practical’ chapterof UPST thatwillprovideanexampleofanobjectiveand independenttradingmethodology.

MYOBJECTIVE AsI’vementioned,myobjectiveistomakethisbook:

1.Animportant,honest,informative,practicalandhelpfulbookfor theserioustrendtrader,whichcanstandonitsownmeritandbe robustenoughtolastthetestoftime.

2.Animportantandcompliementarycompanionbookto UPST,its missingchaptersotospeak.

Accordingly,itwillhaveasingular,narrowfocusonthe‘methodology’sideoftrading.Itwillnottouchupontheotheruniversal principlesofsuccessfultrading—thosearecomprehensivelycovered in UPST. Wishmeluck.

NOTENOUGHTOBESUCCESSFUL Pleaseunderstandthatthisbookisnotasilverbullet.Byitselfitwill notbeenoughtomakeyouasuccessfullong-termsustainabletrader. AlthoughIbelievethisisagoodbook,itwillnotbeenoughonits owntohelpyoulearnhowtobecomeasuccessfulandsustainable trader.Atraderwhocansurvivedespitetheinevitablelosses,inevitable drawdowns,inevitabledoubtandinevitablepainthatalltradersare intimatewith.No,thisbookwillnotbeenough.However,incombinationwithmypreviousbook UPST,Ibelieveithasthepotentialto transformalosingtraderintoalong-termsustainablewinningone.If youhaven’talreadydonesopleaseread UPST.

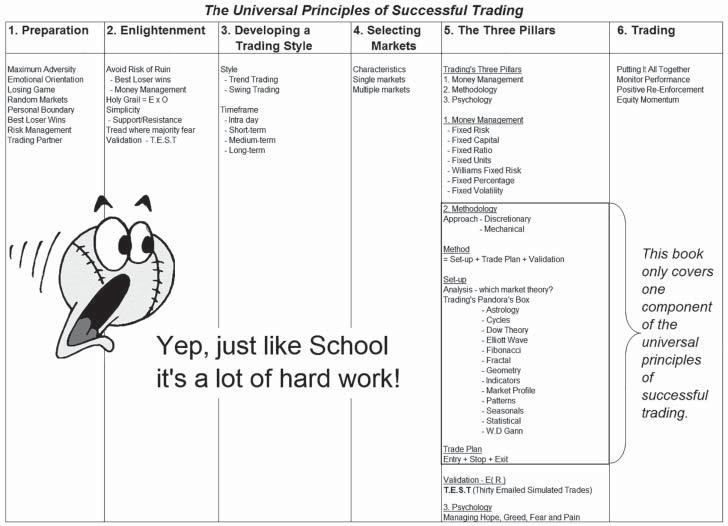

Thisbookonlycoversonecomponentoftheuniversalprinciples ofsuccessfultrading,‘methodology’,you’llneedalltheotherstohope toachievesustainabletradingsuccess.

THEREWILLBEDUPLICATION Letmeapologizenowastherewillbesomeduplicationwith UPST. Althoughthisbookhasanarrowfocus,therewillbetimeswhere I’llneedtotouchuponotherareasthataredetailedin UPST.So, therewillbesomeduplication.Myapologiesnowfortheduplication youwillcomeacrosshereandthere.However,pleaseunderstandthat theduplicationisnecessarytohelpexplain,emphasiseandresonate apointI’mtryingtomake.Itwillnotbeduplicationforthesakeof ‘padding’.InactualfactIwantthistraders’‘handbook’toberelatively small,asit’sdesignedtocomplement UPST.

READERSOFDIFFERENTEXPERIENCE Ihopethisbookwillhavesomethingforeveryone. Forthosereadersrelativelynewtotradingthereissomegood newsandsomebadnews.ThebadnewsisthatIwillbecoveringalot

FIGUREI.1 Thisbookaloneisnotenoughtomakeyousuccessful;youwillalsoneedtoknowtheuniversal principlesofsuccessfultrading,whichIextensivelywroteaboutin UPST

ofinformation.AndIsayalot.So,you’llneedtoconcentrate.That’s thebadnews.Thegoodnewsisthatit’sallgoodinformation!

Forthemoreexperiencedreader,IhopetheideasIsharehere willresonatewithyouandeitherreinforcewhatyoualreadyknowtobe trueorencourageyoutorevisitandreinvestigateandthenreconsider theideasIsharehere.

EVIDENCE,NOTOPINIONORMYTH It’smypreferenceheretodealonlywithevidence.Notopinions.Not myths.Muchofwhatiswritten,spokenoranimatedabouttrading isbasedontheauthor’s,presenter’soreditor’sopinionwithafew well-chosenchartexamplesthrownin.Unfortunately,theseopinions wiltunderscrutiny.

Inthisbookit’smypreferencetodiscussonlythoseideasthatcan bedistilleddownintoclearandunambiguousobjectiverules.Rules thatcanbehardcodedinappropriatesoftwaretodeterminetheir historicalsignificance.It’smypreferencetodemonstratethehistoricalprofitability(orloss)ofallideasIsharethatIbelieveareworth discussing.

Toooftenthemostenthusiastictalkingheads,engagingwriters orcharismaticpresenterscapturetraders’attentions.Manyconfuse the‘confidence’displayedasvaluableandactionableknowledge. However,it’susuallyimpossibletomakemoneyfromthesesweeping opinionatedviews.Unfortunately,it’sthelackofgranularitythatallows theserepeatersandamplifierstocontinuetoexpresstheirviews. Lackofdetailavoidsaccountability,whichisgoodforthem.Sadly, thelackofdetailisusuallyignoredbylessexperiencedtraders, whogenerallypayfortheirignoranceintradinglosses.They usuallydecidetobuythe‘hot’sharethenextdaywithoutany considerationforwheretoplacea‘stop’orwhatexpectancythey’re tradingfor?

InthisbookIwillattempttocodemyideas,whethergoodorbad, toillustratetheirhistoricalprofitability(orloss).AndwhileI’mhere, Ishouldalsoaddanimportantwarningthathistoricalperformance ofanyideaisnoguaranteethatthesameperformancewillcontinue intothefuture.

NOTHINGNEWANDSHINY Ifyou’vepickedupmybooklookingforanewtradingideathenI’m sorrytodisappointyou,becauseIdon’thaveone.WhatI’mgoing tosharewithyouisnotnew.WhatI’mgoingtosharewithyoucan bereferencedinotherbooks.Ihavenothingnewtoshowyou.I’m simplystandingontheshouldersofotherswhohavegonebeforeme. However,whatIwillsayisthatI’llbestandingonthestrongshoulders, nottheweakones.

Sounfortunately,ifyouarelookingforanewtradingidea,then thisbookmightnotbeforyou.

However,ifyou’relookingforgoodideas,thenImaybeableto helpyou.Iwillbesharinganumberofthem.Butremembertheywon’t benew.Some,oneinparticular,isoldandsimple.Actually,it’sveryold andverysimple.Anideathatissooldandobviousthatmosttraders discountitsusefulness.Tomost‘old’and‘simple’means‘unfashionable’and‘notprofitable’andtherefore‘not’useful.

Butletmetellyou,‘old’and‘simple’isthenew‘good’and ‘robust’.Bytheendofthisbook(ifyou’restillwithme)Ihopeto convinceyouthat‘old’and‘simple’willbecomethenew‘fashionable’ andthenew‘useful’andthenew‘essential’intrading.

IwishIcouldenticeyouwithanewidea.Ashinyandmysteriousnewideathatwouldliftyourhopesforabetterandmoreprofitablefuturethatwouldactivateyourfeel-goodneurotransmitters.But Ican’t.Therewouldbenothingbetterforthisbook’ssuccessthena newideawrappedinmystery.Butunfortunately,Idon’thaveone.

IlikeoldandIlikesimpletradingideas.

SIMPLEISBEST Ilike‘simple’ideasfortheobviousreasonthattheyare‘simple’.Now, therearemanyreasonswhytraderslose.Butonereasontheyloseis thatthemajorityoftradersmistrusttheobvious,theymistrustsimple tradingsolutions.Theycan’tbelievetradingcanbesimple,sothey seekcluesandadvantagesinthenewandthecomplex.

BelievemewhenIsaysimplicityworks.Simplemeansyouhave avoidedthetrapofexcessivecurvefitting.Youhaveavoidedthe miss-stepmanymakeofeitherintentionallyorunintentionallycurve fittingtheirstrategytohistoricaldata.Simplemeansfewermoving

parts,whichmeanslesscangowrongmovingforward.Tome,simple doesnotmeanlessbut‘more’intrading.Andby‘more’Imean more‘robustness’—thesinglemostimportantattributeofanytrading strategy.Robustnesstolastthetestoftime.Robustnesstonotonly makemoneytoday,buttomorrowandintothefuture.So,whatIwillbe sharingissimple.Therefore,pleasedonotmistrustwhatyou’reabout tolearnbutembraceitforoneofitsgreateststrength—simplicity.

So,ifyou’renotnecessarilylookingforanewidea,butseeking helptobeintroducedtoorremindedaboutwhatworks,thenthis bookmayquietlysurpriseyou.

NOTPERFECT Inaddition,theideasIwillbesharingwithyouarenotperfect.They dolose.Theydoexperiencedrawdowns.Theywillhurtyou.Theywill leaveyouuncertain,disappointed,frustratedand,attimes,furious. Buttheyhaveanedge,apositiveexpectancy.Goodtraderscanmake moneyfromanedge.

KEEPINGITREAL I’mwritingthisbookfortheserioustrader.Notfortherainbow chasers.Thisbookisabouthowtochipawaytogetahead.It’snot aboutrevealingtradingsecrets.It’snotaboutsellingfalsehopesand it’snotaboutpublishingnonsense.It’snotaboutshowingyouhowto ‘hit’amythical‘homerun’intrading.No.It’saboutkeepingitrealfor theserioustrader.Yes,whatIwillsharewithyouisnotshinyandnew. Yes,whatIsharewithyouwillattimesleaveyoubatteredandbruised. Butthatispartandparceloftrading.It’snotallsunshineandhigh fives.Tradingsuccessfullyforlongperiodsoftimewillhaveitsdark anduncertaintimes.IcanpromiseyouthatwhatIwillbesharing withyoubetweenthesepageswillleaveyoushakenanddoubtfulat times,butatleastwhatIwillbesharingisrealandhasanedge.

SUCCESSWILLCOME Ifyouunderstand,respectandembracetheimportanceofmoney managementanditssignificanceinbeingoneofthechiefweapons

againstROR,thenwhatIwillsharewithyouinthisbookwillhelpyou navigatethevolatileworldofglobalmarkets.Butfirstyouwillneedto understand,respect,embraceandexecutetheuniversalprinciplesof successfultradingthatIhaveextensivelywrittenaboutin UPST.Ifyou can,andifyoucancombinethemwithwhatI’llbesharingwithyouin thefollowingchapters,thenyoumaypleasantlysurpriseyourselfwith whereyouarrive.AtadestinationthatIhopewillbesafe,andonethat willbecalledsustainabletrading.

MYBACKGROUND I’vebeeninvolvedwiththemarketsforover35years,sinceIjoined BankAmericaasatraineedealerin1983.SincemyfirsttradeI’ve probablytriedjustabouteverytechniquethereistotrading.Ifthere wasabook,aseminar,aworkshoporasoftwareprogramthatcould helpmytrading,Ieitherboughtit,attendeditorinstalledit.During the1990sinmyquesttofindanedge,IfeltlikeIwaswalkingthrough arevolvingseminardoor.Iattendedmanywell-regardedseminars.I attendedtheTurtlesseminarwithRussellSands,learntPPSwithCurtisArnold,studiedgeometrywithBryceGilmoreandattendedLarry William’sMillionDollarChallenge(MDC)seminar.IpickedupusefulbitshereandthereanditwasLarryWilliam’sMDCseminarthat reinforcedmyworkwithshort-termmechanicalpricepatterns.

AsatraderItradeaportfolioofuncorrelatedsystematic(or algorithmic)trendandcounter-trendstrategiesacrossmultipletime frames(shortterm,mediumtermandlongterm)overaportfolioof globalindex,currencyandcommodityfutures.Myportfoliocontains over30markets.ForindexfuturesItradetheSPI,Nikkei,Taiwan, HangSeng,Dax,Stoxx50,FTSE,E-MiniNasdaqandE-MiniS&P500 indexfuturescontracts.ForcurrencyfuturesItradethemaincurrency pairsagainsttheUSdollar,whichincludetheEuroCurrency,British Pound,JapaneseYenandSwissFranc.ForcommodityfuturesItrade thethreemostliquidfuturescontractsintheUSwithintheinterest rates,energies,grains,meats,metalsandsoftsmarketsegments.

Itrademyportfolioonanalmost24/7basis,whereadaydoesn’t gobywithoutoneofmymanyfuturesordersbeingtriggeredsomewherearoundtheworld.

I’mprincipallyapatterntrader.Apartfromusingtheaverage truerangeanda200-daymovingaverage,Ifocuspurelyonprice.And

pleasedonotreadtoomuchintomyuseofa200-daymovingaverage. Thereisnothingmagicalaboutmeusing200-days.It’sjustalength Ihavealwaysused.Idon’tevenknowwhetheritistheoptimal lengthtodeterminethedominanttrend,andnordoIcare.The lastthingIwouldwanttodoinmytradingisstartusing‘optimized’ variables,asitsoneofthequickestroutestothepoorhouse.And pleaseunderstandthatthosestrategiesofminethatusethe200-day movingaveragedon’tuseittofindtradesetups.Theydon’tuseit tofindentry,stoporexitlevels.Theyjustuseittodeterminethe dominanttrend.

THISBOOKISNOTABOUTFUTURESTRADING Despitemyselfbeingafuturestrader,pleasedonotthinkthisbookis aboutfuturestrading.Yes,manyoftheexamplesandportfoliosused toshareandillustrateideaswillinvolvefutures,butonlybecausethey areadeviceofconvenienceformyself.WhatIwillbesharinginthis book,similarlytowhatIdidwith UPST,isafocusprimarilyonthe processofgoodtrading.Notonsecondaryissuessuchasindividual marketsandinstruments.Thisbookisnotabouttryingtoconvertyou tofutures.Futuresisjustmypreferredinstrumenttotrade.Youwill haveyourownpreferredmarketsandinstrumentstotrade.So,please don’tthinkthisbookisdesignedtoattempttoconvertyoutothemarketsandinstrumentsItrade.No.I’mwritingthisbooktoencourage youtofocusfirstontheprocessofgoodtradingratheronanyindividualmarket,instrument,techniqueortimeframe.It’sjustthatthe majorityofexamplesinvolvefutures,andIusefuturesbecauseit’sconvenientforme.

So,pleaseunderstandthatthisbookwillbefocusedonthecorrect processofgoodtrading,regardlessofmarket,instrumentortimeframe.Themarketsandinstrumentsshownwithinthesepagesare forillustrativepurposesonly,andintheirturnbecomesecondaryin importancetofollowinggoodtradingprincipals.

PATHWAYTOSUSTAINABLETRADING Ihopethisbookcanbecomeasensiblesteppingstoneonyourpathwaytosustainabletrading.Icertainlybelieveit’spossibletoreach

yourdestinationifthisbookisusedincombinationwithmyprevious book, UPST.

Ihavealottosharewithyouoverthefollowingpages.Letmegive youabriefoutlineofwhatI’llbediscussing.

InChapter1IbeginbyoutlininghowdifficultitisforyouandIto succeedastraders.

InChapter2Iofferanumberofkeymessagescoveringknowledge,risks,applicationandexecution.

InChapter3Isharewithyoutheappealoftrendtradingandwhy youshouldseriouslyconsideritasatradingtechnique.

InChapter4Igiveabriefoutlineofwhytrendsexist.

InChapter5Isharemythoughtsonwhysomanyfailattrend trading.

InChapter6Ireviewanumberofdifferenttrendtradingstrategiestodemonstratethevarioustechniquesthatexist.

InChapter7Idiscusstheimportanceofmeasuringstrategyperformanceonarisk-adjustedbasis.

InChapter8Ishareatoolkitthattraderscanusetohelpthem review,developandselectstrategiestotrade.

InChapter9Ifinishthebookwithanexampleofusingthetoolkit todevelop,whatIbelieveis,asensibleandsustaintradingstrategy.

JUSTMYOPINION Asyoureadthroughmybookpleasealwaysrememberandunderstand thatwhatIwriteisonlyoneperson’sopinion.Mine.Ionlyrepresentonetrader’sviewandpleasedon’taccept,justbecauseIwrite something,thatit’snecessarilytrue.I’mcertainlynoguruandnor doIbelieveanyonecanclaimthatmantleintrading.I’mjustwriting whatIbelievetobetrue.So,pleasedon’ttakeoffencetoanythingI write,it’sjustwhatIthinkandit’sokforyoutodisagree.Iwon’tbe offended,Ipromise.TheonlycautionI’llmakeisthatyouwillneed toproducethenecessarysubstantiationtocountermypositionasmy ideas/positionwillbesupportedbyhistoricalevidenceandactualtradingexperience.So,ifyoudofindyourselfdisagreeingwithmyideas, thenyouwillneedtoproducethenecessaryverificationtosupport yourview.Itwon’tbeenoughforyoutorelypurelyongutfeelorpersonalopinion.Remember,ourgutfeelingsandourpersonalopinions aregenerallyheldcaptivebyourcognitivebiases,whichcananddo playhavocwithourtradingdecisions.Sobewarned!

JustaswhatIwriterepresentsonlymyopinion,pleaseacceptthat it’snotmyintentiontoconvertyoutomywayofthinkingortrading.I’monlywritingtosharewithyoumythinkingandapproachto trading.Whatyoudowithitisyourchoice.

Onceagain,pleaserememberthatjustbecauseIwritesomething itdoesn’tnecessarilymakeittrue.AlthoughIbelieveinmyheartof heartsthatwhatIwriteistrue,andIwillhavetheevidencetosupport it,itdoesn’tnecessarilymeanyoushouldacceptitastrueonfacevalue. Certainly,welcomemyideasandopinions,butremembertovalidate allideasbeforeimplementingtheminthemarket.

ALLROADSLEADTOROME Asweknow,therearemanyroadsthatleadtoRome.Similarly,in trading,youneedtorememberandunderstandthattherearemany differentwaystotrade.I’mjustshowingyouoneway,oneapproachI use.I’mnotsayingmyapproachistheonlywayandI’mnotsayingmy approachisthebestway.AllI’mdoingisshowingoneroadItravel. Itdoesn’tmeanyouhavetogothesameway.However,ifyoudofind yourselflostonyourtradingjourneyatleastyou’llknowmyapproach isoneoptionavailabletoyou.

REPETITION Mywritingstyleistoreinforceideasthroughrepetition,sopleaselet meapologizenowfortherepetitionyou’reabouttoseethroughout mybook.Andbelieveme,Iamrepetitive.I’vebeencriticizedforthe wayIwriteandteach,butIcanonlydowantmakessensetome.It’s justthewayIroll.I’mnotaprofessionaleducatororwriter.Ijust tradeandI’mhappytoputpentopapertosharemythoughts,even ifthey’realittledisjointed,circularandrepetitive.IwishIcouldsay somethingonceandbecontent(whichwouldmakeKatiahappierfor sure)—however,it’snothowI’mwired.So,ifrepetitionisgoingto annoyyouthenpleaseacceptmysincereapologiesnow.

QUESTIONANDVERIFYEVERYTHING PleasedonotacceptwhatIoranotherauthorwritesonfacevalue. Certainly,welcomeallopinionsandthoughtsyouhear,seeorread

abouttrading,butplease,pleasereserveyouropinionuntilyouhave firstquestionedandindependentlyvalidatedtheidea.

Onlyyourquestioning,reviewandindependentvalidationwill demonstratewhetheranideaofmineoranother’shastruthand,more importantly,valueinyourhands.Itwillonlybethroughyourown effortsthatyouwillbeabletodeterminewhatistruthorfiction.Do theworkandyouwillberewarded.

LET’SGETSTARTED IhopeyouwillwelcometheideasIsharewithyouinthisbookand ifyouhaveanyquestionspleasedonothesitatetocontactmeviamy websitewww.indextrader.com.au.

Tobeginyourjourney,Iwanttodiscussourlivingparadoxwhere it’sboththebestoftimesandtheworstoftimestobeatrader.Confused?Well,letmegiveyouabigwelcometomycontradictoryworld oftrading.

1 CHAPTER TheParadox NIRVANAANDDESPAIR Todaywelivewithinatradingparadoxwhereit’sboththebestand theworstoftimestobeatrader.

Todaywe’veneverhaditsogood.Withtheadventoftheinternet,developmentofhigh-speedwirelessnetworksandproliferation ofsmartphoneswithevensmarteronlinetradingapplications,traders canbuyandselljustaboutanyinstrument,inanymarket,acrossany exchange,atanytime.

WhenIcompareitbacktotheearly1980s,whenIthoughtwearing adatapagerwasanunfairadvantage,todayfeelstotallyfuturisticwith allthetechnologicalwizardryavailableatourfingertips.

Todaywehavemultipleonlinediscountbrokerswithbothwebbasedandsmartphoneapplications.Wehaveinexpensivehistorical andrealtimedatawithautomatedtradingprograms.Therearemultiplechartingprogramswithhundredsofindicators.Wehavemultiple marketstotraderangingfromforextofinancialstocommodities.We evenhavecryptocurrenciestotrade.Therearemultipleinstruments wecantradefromoptionstowarrantstofuturestosharesandCFDs.

Butitdoesnotstopattheelectronicwizardryavailable.

Tradershaveneverhaditsogoodwiththeenormousvaultofavailabletradingknowledge.Todaytherearemultipletradingtheoriesto consider,multipletradingnewsletterstosubscribeto,multipletrading authorstoread,multiplefinancialshowstotuneinto,multipletrading educatorstolistentoandmultipletradingworkshopstoattend.

Really,thereisnoreasonorexcuseforamoderntradertofail.It’s thebestoftimes.

Butunfortunately,it’salsotheworstoftimes.

Justaskthemajorityoftraders.Why?Becausedespitetheadvancementsmadeintechnologyandtradingknowledge,themajorityof traderstodaystilllose.It’sanunfortunatesituationwhereover90%of activetradersfail.Justliketheydidbackinthe1980swhenIthought wearingadatapagerwasbothhipandadvantageous.So,forthemajorityit’stheworstoftimes.

It’stheparadoxustraderslivein.

IT’SALSOACONFUSINGTIME Notonlyisittheworstoftimesbutit’salsoaconfusingtime.Itseems theworldexcelsinconfusionanduncertainty.Itthrowsupsomany questionswithfewgoodanswers.

WheneverItrytopuzzleouttheworld’sriddlesIusuallyend upwithasorehead.Whoknowstheanswertothebigmacroissues? Idon’tthinkanyonereallydoes.Imeanwhoknowsforsurewhether theEuropeanUnionwillholdtogether?Whoknowswhetherthe UnitedStateswillgetholdofitsdebtanddeficit?Whoknowswhether Chinawillreturntotrendgrowth?WhoknowswhetherJapanwillfind aresolutiontoitsdemographicstruggles?Whoknowswhetherthe worldwillreturntonormalcyfollowingtheCoronaviruspandemic? Andwhoknowsifcentralbankswillnormalizemonetarypoliciesor keepsupplyingtheiropioidcocktailofcheapandabundantmoney? Willtheycontinuetoenablethemarket’sliquidity-drug-addicted dependencyorwilltheyrestorerisktoitspreviouslyrespectedand properpedestal?Icertainlydon’tknow.

Butthequestionsdon’tstopatthemacrolevel.Theyalsomount upatthemicrolevel,wheretradingthrowsupitsownavalancheof questions.

Outofthehundredsofmarketsavailablewhichonesshouldwe trade?Shouldwetradelocalorinternationalmarkets?Shouldwe tradeconsumerdiscretionary,consumerstaple,energy,financial, healthcare,industrial,informationtechnology,materials,metals, mining,telecommunication,utilityorcommoditymarkets?Within eachmarketsegmentwhichindividualbusinessesormarketsshould weselect?

Butthequestionsdon’tstopthere.

Whichinstrumentsshouldwetrade?Shares,options,warrants, contractsfordifferenceorfutures?

Shouldweusefundamentalortechnicalanalysisoracombinationofboth?Ifit’stechnicalanalysis,shouldweusecycles,patterns, indicators,astrology,geometry,DowTheory,seasonals,MarketProfile, ElliottWaveorWDGann?Justtomentionafew.

AsIsaid,somanyquestions,andtheydon’tstop.

Arethemarketsbullishorbearish?Shouldwetradewithoragainst thetrend?Shouldwebeashort-term,medium-termorlonger-term trader?Howmuchshouldwerisk?Whereshouldweenter,placeour stopsandexit?

AsIsaid,therearesomanyquestionstoanswer.Isitanywonder thatsomanytraderstodayaresoconfused?

HOWICANHELPYOU WellI’mheretohelpyou.

ButanimportantqualifierbeforeIdo.Ineedtoletyouknowthat Idon’tknoweverythingthereistoknowaboutthemarkets.Iwish Idid,butIdon’t.WhenIwasyounger,IthoughtIkneweverything therewastoknow.AsI’vegotolder,I’vegotwiser!So,tobeupfront Ihavetotellyouthatit’sanunfortunatetruththatafter35+ years inthemarkets,andtenyearssinceIwrote TheUniversalPrinciplesof SuccessfulTrading (hereafter, UPST),Istilldon’tknoweverythingthere istoknowabouttradingandthemarkets.

However,Iknowyou’relookingforanswers. WhatIcandoissharepartofwhatIdo.AndIdomakemoney trading.So,whatIcantellyouisthis.IfIcanmakemoneytrading, socanyou.IfIcanmake20–30%annualreturnswith manageable risk, socanyou.Andthatistheimportantword, manageable.I’mnotsome amazingtraderwithuniqueandexclusiveknowledge.No.I’mjustlike you.Imayhavemoreexperienceandmoremarketscarsthenyou,but I’mstillnormal.I’mnospecialtraderwithMarvelsuperheropowers orinsights.I’mjustanordinarypersonwhohasgainedsomeknowledgewithalotofexperiencealongtheway.

Sopleasebelieve,despitewhatyourexperiencehasbeensofar, thatitispossibletotradesuccessfully.

HOWTOTRADESUCCESSFULLY I’mwritingthisbookforonereasonandonereasononly.Toshow youhowtomakemoneytradingwiththetrend.Putsimply,profitable trendtradingisdependentupontheunderstandingandacceptance oftheuniversaltruthanduniversalprinciplesofsuccessfultrading. Youwillneedtoread,comprehend,embraceandexecutetheuniversaltruthandprinciplesofsuccessfultrading.Ifyougettheuniversal truthandprinciplesrighttheprofitswillfollow.Theyhaveto.Ignore themandyou’llcontinuetostruggle.Period.Nodiscussion.Noifs. Nobuts.Noexcuses.Thisappliestoalltradersinallmarkets,across alltimeframesandallinstruments.

Fortheuniversalprinciplesofsuccessfultradingyouwillneedto readmypreviousbook, UPST.

FortheuniversaltruthyouwillneedtoreadChapter2.

SUMMARY Despiteitbeingboththebestandworstoftimestobeatrader, Ibelievethereisasafepathwayforwardtohelpyounavigateyour waytowardsasensibledestination.Apathwaythatwillgoalongway toansweringmanyoftheconfusingquestionswetradershaveto answereachday.Apathwaythatwillallowyoutofindopportunityin uncertainty.ApathwaythatIhope,evenwithmylimitedknowledge, willleadyoutoarewardingpositionofsensiblesustainabletrading. ThatpathwaywillcommenceinChapter2,whereIwanttosharewith youanumberofkeymessages.

2 CHAPTER KeyMessages IThosethatfailtolearnfromhistory,aredoomedtorepeatit. WinstonChurchill(1874–1965)

wantyoutolearnfrommyexperiences.IfIcanhelpyouavoidthe mistakesothers(andI)havemadeinthepastthenIwillcertainlyhave helpedyoualongyourpathwaytowardssustainabletrading.Ijustneed togetmythoughtsdowninacoherentorder.Wishmeluck.

It’swellacceptedknowledgethatover90%ofactivetraderslose. Toavoidthesamefate,it’simportantforyoutoknowandtoremember thepast.Knowitandyoumayjustavoidrepeatingthesamemistakes othershavemade.Andtradersareexpertsatrepeatingthesameold mistakes,overandoveragain.Tohelpyouavoidthesamefateit’s importanttopauseandtakealookbackatallthecarnagethattechnicalanalysis,tradingandthemarketshaveleftbehind.

ThebestwayIknowtosharemyexperiencesandknowledgeof thepastistopresentthemaskeymessages.

ThesekeymessagesrepresentcoreknowledgeandvaluesIbelieve in.Stronglybelievein.I’llapologizenowifsomeofthemoffendyou; however,Icanonlysharewhatholdstrueforme.Formytradingcompasstheyshowthetruenorth.Ihopetheycanalsohelpyounavigate yourjourneytowardssustainabletrading.

ThekeymessagesI’dliketosharewithyoucanbegroupedunder fourareas: •knowledge, •risk, •applicationand •execution.

Let’stakeacloserlook. 5