Visit to download the full and correct content document: https://ebookmass.com/product/asset-liability-management-optimisation-a-practitioner s-guide-to-balance-sheet-management-and-remodelling-beata-lubinska/

More products digital (pdf, epub, mobi) instant download maybe you interests ...

Interest Rate Risk in the Banking Book: A Best Practice Guide to Management and Hedging Beata Lubinska

https://ebookmass.com/product/interest-rate-risk-in-the-bankingbook-a-best-practice-guide-to-management-and-hedging-beatalubinska/

Sedation: A Guide to Patient Management 6th Edition

https://ebookmass.com/product/sedation-a-guide-to-patientmanagement-6th-edition/

Dental Practice Transition: A Practical Guide to Management 2nd Edition

https://ebookmass.com/product/dental-practice-transition-apractical-guide-to-management-2nd-edition/

Construction Contracting: A Practical Guide to Company Management 8th Edition

https://ebookmass.com/product/construction-contracting-apractical-guide-to-company-management-8th-edition/

Quantitative Asset Management: Factor Investing and Machine Learning for Institutional Investing Michael

Robbins

https://ebookmass.com/product/quantitative-asset-managementfactor-investing-and-machine-learning-for-institutionalinvesting-michael-robbins/

SAP S/4HANA Asset Management: Configure, Equip, and Manage your Enterprise Rajesh Ojha

https://ebookmass.com/product/sap-s-4hana-asset-managementconfigure-equip-and-manage-your-enterprise-rajesh-ojha/

Conflict Management: A Practical Guide

to

Developing Negotiation Strategies Barbara A. Budjac Corvette

https://ebookmass.com/product/conflict-management-a-practicalguide-to-developing-negotiation-strategies-barbara-a-budjaccorvette/

A Comprehensive Guide to Sports Physiology and Injury Management: an Interdisciplinary Approach Stuart Porter

https://ebookmass.com/product/a-comprehensive-guide-to-sportsphysiology-and-injury-management-an-interdisciplinary-approachstuart-porter/

Sedation E Book: A Guide to Patient Management 5th Edition, (Ebook PDF)

https://ebookmass.com/product/sedation-e-book-a-guide-to-patientmanagement-5th-edition-ebook-pdf/

Foundedin1807,JohnWiley&Sonsistheoldestindependentpublishingcompany intheUnitedStates.WithofficesinNorthAmerica,Europe,AustraliaandAsia,Wiley isgloballycommittedtodevelopingandmarketingprintandelectronicproductsand servicesforourcustomers’professionalandpersonalknowledgeandunderstanding. TheWileyFinanceseriescontainsbookswrittenspecificallyforfinanceandinvestment Professionalsaswellassophisticatedindividualinvestorsandtheirfinancialadvisors.Booktopicsrangefromportfoliomanagementtoe-commerce,riskmanagement, financialengineering,valuationandfinancialinstrumentanalysis,aswellasmuchmore. Foralistofavailabletitles,visitourWebsiteatwww.WileyFinance.com.

BEATALUBINSKA

Registeredoffice

JohnWiley&SonsLtd,TheAtrium,SouthernGate,Chichester,WestSussex,PO198SQ, UnitedKingdom

Fordetailsofourglobaleditorialoffices,forcustomerservicesandforinformationabouthow toapplyforpermissiontoreusethecopyrightmaterialinthisbookpleaseseeourwebsiteat www.wiley.com.

Allrightsreserved.Nopartofthispublicationmaybereproduced,storedinaretrievalsystem, ortransmitted,inanyformorbyanymeans,electronic,mechanical,photocopying,recording orotherwise,exceptaspermittedbytheUKCopyright,DesignsandPatentsAct1988,without thepriorpermissionofthepublisher.

Wileypublishesinavarietyofprintandelectronicformatsandbyprint-on-demand.Some materialincludedwithstandardprintversionsofthisbookmaynotbeincludedine-booksor inprint-on-demand.IfthisbookreferstomediasuchasaCDorDVDthatisnotincludedin theversionyoupurchased,youmaydownloadthismaterialathttp://booksupport.wiley.com. FormoreinformationaboutWileyproducts,visitwww.wiley.com.

Designationsusedbycompaniestodistinguishtheirproductsareoftenclaimedastrademarks. Allbrandnamesandproductnamesusedinthisbookaretradenames,servicemarks, trademarksorregisteredtrademarksoftheirrespectiveowners.Thepublisherisnotassociated withanyproductorvendormentionedinthisbook.

LimitofLiability/DisclaimerofWarranty:Whilethepublisherandauthorhaveusedtheirbest effortsinpreparingthisbook,theymakenorepresentationsorwarrantieswithrespecttothe accuracyorcompletenessofthecontentsofthisbookandspecificallydisclaimanyimplied warrantiesofmerchantabilityorfitnessforaparticularpurpose.Itissoldontheunderstanding thatthepublisherisnotengagedinrenderingprofessionalservicesandneitherthepublishernor theauthorshallbeliablefordamagesarisingherefrom.Ifprofessionaladviceorotherexpert assistanceisrequired,theservicesofacompetentprofessionalshouldbesought.

LibraryofCongressCataloging-in-PublicationData

Names:Lubinska,Beata,1973-author.

Title:Assetliabilitymanagementoptimisation:apractitioner’sguideto balancesheetmanagementandremodelling/BeataLubinska.

Description:Firstedition. | Hoboken:Wiley,2020. | Series:Thewiley financeseries | Includesbibliographicalreferencesandindex.

Identifiers:LCCN2019041408(print) | LCCN2019041409(ebook) | ISBN 9781119635482(hardback) | ISBN9781119635499(adobepdf) | ISBN 9781119635512(epub)

Subjects:LCSH:Asset-liabilitymanagement. | Banksandbanking. Classification:LCCHG1615.25.L832020(print) | LCCHG1615.25(ebook) | DDC332.1068/1—dc23

LCrecordavailableathttps://lccn.loc.gov/2019041408

LCebookrecordavailableathttps://lccn.loc.gov/2019041409

CoverDesign:Wiley

CoverImages:Chartboard©golero/GettyImages, LondonTower©fotoVoyager/GettyImages

Setin10/12ptSabonLTStdbySPiGlobal,Chennai,India

PrintedinGreatBritainbyTJInternationalLtd,Padstow,Cornwall,UK 10987654321

TomyFamily.

WithspecialgratitudetoLidia,thebestdaughterIcan imagineandtoDaniele,myhusband,whohasaspecialplace inmyheart

CHAPTER1

ALMoftheBankingBook1

TheRoleofAssetLiabilityManagementinCommercialBanks1 OverviewofFinancialRisksExistingintheBankingBook7 RegulatoryRequirements–BaselIII13 CapitalRequirementsAccordingtoBaselIII/CRDIV17 SelectiveReviewoftheLiteratureRelatedtoALMandIntegrated ManagementoftheInterestRateRiskandLiquidityRiskin CommercialBanks19

CHAPTER2

MethodsofMeasurementandManagementoftheInterestRateRisk andLiquidityRisk23 InterestRateRiskintheBankingBook–Measurementand Management24 ExposuretoShort-TermInterestRateRisk–MaturityGap Analysis24 MaturityGapAnalysisfromtheEconomicValuePerspective33 LiquidityRiskintheBankingBook–Measurementand Management41 Short-TermLiquidityManagementPrinciples45 MediumLong-TermLiquidity–ThePrinciplesofStructural LiquidityManagement46 TheRoleofFundsTransferPricinginBanks50 PricingofDifferentProductsintheBankingBook54 BehaviouralisationConceptinFTP57

CHAPTER3

CustomerBehaviourandItsImpactonInterestRateandLiquidityRisk61 SignificanceandImpactofBehaviouralIssues intheBankingBook61 ModellingofCustomers’Deposits–LiabilitiesSide63 BalanceSensitivityModelling68

ModellingofLoanswithEarlyRedemptionOptionality–AssetsSide70 StatisticalPrepayments70 FinancialPrepayments71

CHAPTER4

FormulationoftheOptimisationProcessandArticulationoftheDecisionModel73

TheOptimisationMethodAppliedtotheBankingBook74 IntroductionoftheOptimisationConcept75 DefinitionoftheInitialBankingBookProfile79 BuildingtheObjectiveandConstraintFunctionsinthe OptimisationProcess81 TheImportanceofModelSensitivityAnalysis96 DefinitionoftheSensitivityParametersfortheOptimisation Model98

‘SignificantChangesinInterestRates’Scenario98 ChangesintheInitialProportionsoftheAssetBase100 ChangesintheOutputoftheDepositCharacterisation Model–BalanceVolatility,BalanceSensitivity,andAverage LifeoftheProduct100 IntroductionoftheCPRintotheModel100

CHAPTER5

PracticalExampleoftheOptimisationProcessandQuantificationoftheEconomic ImpactunderBaseandStressScenarios101

CaseStudy:EconomicImpactfromtheOptimisationModel underBaselineandSensitivityScenariosforBank1102 CaseStudy:EconomicImpactfromtheOptimisationModel underBaselineandSensitivityScenariosforBank2114 Conclusions125

APPENDIX1 DetailsoftheAnalysisPerformedforBank1129

APPENDIX2 DetailsoftheAnalysisPerformedforBank2157

Bankingisanage-oldart.Asacommercialdiscipline,modernbankingdatesfrom thefifteenthcenturybutthereisevidenceofpracticeuncannilysimilarto‘modern’ bankingdatingfromRomanandevenBabyloniantimes.Ifbybankingwemeanan independententerprisethatacceptsdepositsfromcustomers,whichitpromisestokeep safeandrepay(withinterest)ondemand,whilstatthesametimelendingfundsto borrowerswhoagreetorepay(withinterest)atasetdateinthefuture,thenbankingis indeedanancientart.

Ofcourse,thatmakesassetliabilitymanagement(ALM),asadisciplinelinked hand-in-glovewithbanking,afairlytime-honouredpracticeaswell.BecausetopractisebankingistopractiseALM.EverybankoperatesanALMfunction,forthesimple reasonthattoundertakebankingrequirestheinstitutiontomanageitsassetsandliabilitiesefficiently.AnALMdeskisasvitaltoabankastheengineandwheelsaretoa motorcar.Depositsandloanshavedifferentcashflowprofiles,theybehavedifferently atdifferenttimes,andtheyrepresentdifferentrisksonthebalancesheet.Managing thesevariousdifferencesiswhatbankingandALM,oratleastlong-termsustainable banking,areallabout.

Itseems,however,thatALMasaformaldiscipline,codifiedintoformaltext,isa rathermorerecentthing.Icanfindnotraceoftheuseofthisexpression,inthecontext ofbanking,inanyacademicorpractitionertextthatdatesbeforetheearly1970s.Thisis curious,toputitmildly,becauseitissuchavitalpartoftheartofbanking.Isurmisethat thereasonforthisistwofold:one,asaprocess,itwastraditionallypartoftheTreasury function,adeskwell-knownforits‘learnonthejob,in-at-the-deepend’approachto itsduties;andtwo,itisanareaoffinancethathasneverattractedovermuchattention fromacademia.Andifacademicsaren’twritingtechnicalpapersaboutyourart,then usuallypreciousfewTreasurypractitionersaregoingtoeither.

Nomatter,oneofthemanyimpactsofthe2008globalfinancialcrashwasthenew emphasisonALM,orIshouldsaytheimportanceofALM.Nolongerwasitthechap attheconferenceinthedullgreysuitwhostoodinthecornerlookingathis(itwas generallyahe,intheUKanyway)shoes.Nowitwastherockstar,aprimefocusfor attention.Why?Becausecapitalandliquiditywerenow,forbanks,moreconstrained, moreexpensive.Havingtoomuchofeitherwasunbearablyinefficient,whilsthaving insufficientofeitherwasnowgoingtobringthewrathoftheregulatordownonone’s head.HoweverrelaxedonemighthavebeenaboutALMbefore,overnightitbecame urgentbusiness,deservingoftheC-suite’sundividedattention.

Thus,thebuzzwordsince2008hasbeenbalancesheet optimisation, whatI’ve beencalling strategicALM foraslongasanyonehascaredtolisten.Iliketothinkof ALMoptimisationasmeaningstructuringthebalancesheet,attheloansanddeposits originationstage,inawaythatmeetsthecompetingneedsofregulator,customer,and shareholderasefficientlyandaseffectivelyaspossible.Thisis,inessence,strategic ALM.Consideringtheneedsofallthreekeystakeholdersandpractisingproactive,as opposedtoreactive,ALM.

Theauthorofthisfinebookdefinesoptimisationslightlydifferently,althoughtome herdefinitionfollowsonlogicallyfrommine.WhereasIdefinethe‘what?’,MsLubinska definesthe‘how?’;towit,optimisationis‘aprocesswhichinvolvestheapplicationof optimisationtechniques(describedinthisbook)anddefinitionoftheoptimisationcriterion(whichmetricdowewanttoprioritise),objectives(whatdowewanttooptimise), andconstraints(conditionswhichneedtobetakenintoaccountintheoptimisation process).’

Asshenotesfurther,

Oneoftheobjectivesofthisbookistowalkthereaderthroughtheoptimisationprocessindetail,fromthepracticalperspective,inordertoquantifythe economicbenefitscomingfromthisexercise.

Thisis,quitesimply,solidgold.Inthepost-crasheraofonerousbankingregulation andconstrainedcapitalandliquidity,undertakingamoredisciplined,formalapproach toALMbecomesasimportantascybersecurity,asimportantastreatingcustomers fairly,ofpursuingtherightstrategytocompete.Itisthekeytoasustainedandviable balancesheetoverthelongterm.AndasIamfondofsaying,thebalancesheetis everything.

Thisisabooktobestudiedcarefully,toreadandre-readandthentoassessfor applicationtoone’sownbank.Thetoolsdescribedherein,illustratedwithcasestudy examples,arenotnecessarilytransferableverbatimtoeverybank.Rather,itisthedisciplinethatisbeingdemonstratedthatneedstobeadopted,andthetechniquestweaked, toensurethattherightapproachistailor-madeforeachspecificcase.Thisisn’tatrivial subject.Butifonegetsitright,thesimultaneousrewardforallofabank’sstakeholders willbeplaintosee.

ProfessorMooradChoudhry Surrey,England 31October2019

Dr.BeataLubinskaisafinancialengineerwithover15yearsofpracticalexperience gainedininternationalfinancialinstitutionssuchasGECapital,Deloitte,andStandard CharteredBankbasedbothinMilanandLondon.Currently,sheleadsBLAdvisory& Consulting,asmallboutiqueconsultingcompanybasedinLondon.

Previously,shewasaHeadofMarketRiskDepartmentinMeDirectGroupin LondonwiththemainfocusonIRRBB,MarketRiskandBalanceSheetManagement. AsidefrombeingamemberofBTRMFaculty,whichwasfoundedbyProfessorMoorad ChoudhryinLondon,shealsoprovidestrainingsforprofessionalsfrombankingindustryacrosstheglobe(includingKuwait,London,USA,Oman,Qatar,andTurkey).

Hermainareasofspecialisationinclude:FundsTransferPricing,InterestRateRisk intheBankingBook,AssetLiabilityManagement,andBalanceSheetmanagement throughFTPandoptimisation.

BeataholdsaPhDfromWroclawUniversityofEconomicsinPoland.InherPhD thesis,sheintroducesthehypothesisthattheapplicationoftheoptimisationtechniques improvesthemanagementofthebankingbookintermsofquantifiableeconomic impactontheP&Lofthebankandthatthereisclearbenefitfromtheintegrated treatmentoftheinterestrateriskandliquidityriskunderoneapproach.Shestrongly promotestheproactivemanagementofthebalancesheetofabank.Theresultsof herresearcharepublishedin FinancialSciences,SpringerProceedingsinBusinessand Economics and ResearchPapersofWroclawUniversityofEconomics.Herrecent publicationsinclude:

■ ‘Reviewofthestaticmethodsusedinthemeasurementoftheexposuretotheinterestraterisk’–FinancialSciences2014.

■ ‘BalanceSheetShapingThroughDecisionModelandtheRoleoftheFundsTransfer PricingProcess’–Springer2017.

■ ‘BalanceSheetShapingthroughaDecisionmodelandFundsTransferPricing’–ResearchPapersofWroclawUniversityofEconomics,2017.

■ ‘ContemporarychallengesintheAssetLiabilityManagement’–Springer2018.

■ ‘ContemporarychallengesintheAssetLiabilityManagement’–ResearchPapersof WroclawUniversityofEconomics,2018.

■ ‘ModernAssetLiabilitymanagement(ALM)needstooperateinthemultidimensionalworld’–ALCOmagazine,August2018.

■ ‘InterestRateRiskintheBankingBook(IRRBB)–keychallengesintheimplementationoftherevisedEuropeanBankingAuthorityGuidelinesandwhyitisso important’–ALCOmagazine,November2018.

TheroleoftheAssetLiabilityManagementfunction(ALM)inthemanagementof thebankingbookofabankisconstantlygrowing.Aclearevolutioncanbeseen asALMmanagersrealisethatareactiveapproach,whichconsistsofthemanagement ofthebankingbookasapassivestructureresultingfromthecommercialandfunding strategyofabank,shouldbereplacedbyaproactiveapproachwherethebankingbook structureisdecidedinaconsciousandactivewayinordertocomeupwiththedesired targetstructureofthebankingbook.

TheintentionofthisbookistopromoteachangeintheroleofALMand,ingeneral,intheapproachtowardsfinancialriskmanagementpracticeinmodernfinance. ItwillshowthattheproactiveroleofALMthroughanintegratedapproachforthe managementoftwomainfinancialriskcategories,i.e.interestraterisk(IRR)andliquidityriskunderoneapproach,andinterrelationwiththecommercialstrategythata bankwantstoadopt,bringssignificantbenefits.Thosebenefitsaremainlyeconomical andcanbequantified.Theneedforchangeseemstobedrivenbyanumberofchallenges,suchasaheavilyregulatedlandscape,lowornegativerates(intheeurozone), andmargincompression,whichthebankingindustryhasbeenfacingsince2008.

Thisiswhytheword‘optimisation’iscommonlyusedinbanksthesedaysasan attempttoaddresstheaforementionedchallenges.However,Iquiteoftenwonderwhat thiswordmeansinpractice.Whatinrealityshouldbeoptimised,andhowitshould beoptimised.Ibelievethatoftentheword‘optimisation’justmeanstomakebetter allocationofresourcessuchasliquidityorcapitalinordertoalignabankwiththeregulatoryrequirements.Inmyview,optimisationisaprocesswhichinvolvestheapplication ofoptimisationtechniques(describedinthisbook)anddefinitionoftheoptimisation criterion(whichmetricdowewanttoprioritise?),objectives(whatdowewantto optimise?),andconstraints(conditionswhichneedtobetakenintoaccountintheoptimisationprocess).Italsoneedsapracticalimplementationtool(method).Oneofthe objectivesofthisbookistowalkthereaderthroughtheoptimisationprocessindetail, fromapracticalperspective,inordertoquantifytheeconomicbenefitscomingfrom thisexercise.Attheend,thereaderisprovidedwithtwobusinesscasesonwhichthe optimisationprocessistested.

Additionally,thebookshedslightonanotheraspect:the silo-based approach adoptedforthemanagementoffinancialrisksstillcommonlyusedasa day-by-day practiceinbanks.The silo-based approachconsistsofseparatedmanagementof financialrisks,inparticularinterestrateriskinthebankingbookandliquidityrisk. Theconsequenceofthisistakingsuboptimaldecisionsregardingthefundingstrategy (andconsequentlyliquidityandfundingrisk)andsuboptimalhedgingstrategies

(andconsequentlymitigationoftheinterestrateriskinthebankingbook).Inmy experience,Ihavealwaysseenthesetworiskcategoriestreatedseparatelyandnot interrelatedinthedailymeasurementandmanagementprocess.Forexample,inthe riskmanagementdepartmenttherewasaperson(orteam)focusedonthecalculation ofliquiditymetricsandanotherperson(team)responsibleforanalysisoftheinterest rateriskinthebankingbook(IRRBB)metrics.Thetreasurydepartment,ineachbank, haditsownset-upandtargetsdesignedforthisfunction.Assuch,insomebanks youwillseetheALMfunctionoperatingwithinthetreasurydepartment,withthe mainobjectivebeingtofocusontakinganactivepositioningontheinterestratecurve andbenefitingfromtheexpectedmovementsofthecurveinlinewiththemarket forecast.Quiteoftenthesizeandcomponentsoftheliquiditybuffer(alsowithinthe responsibilitiesofthetreasurydepartment)aredecidedseparatelyandtheimpacton IRRBBmetricsisassessedonlyafterthewholeprocessofbuildingtheliquiditybuffer isalreadyfinalised.Oneofthemostimportanttasksofabank’streasureristocome upwiththefundingstrategy.Thisistheprocesswhereallavailablefundingsources areassessed,andtheircompositionisdecided.Again,thereisstillquiteoftenlittle interactionwithIRRBB.Instead,myexperienceandacademicresearchleadtowards theconclusionthatsuchaninteractionshouldbeimperative.

Let’sanalysethisaspectindetail.

Thecrucialtaskofthetreasurydepartmentistomaintainaheathybalancebetween theprofitabilityofthebankingbookanditsexposuretofinancialrisksaltogether.There isacleartrade-offbetweentheriskinessofthebankingbookanditsprofitability.Inthis book,Icallita targetposition.Findingsuchatargetposition(ortargetprofile)isthe realchallengeofALManalysisbecauseitrequirestheanalyticaltoolsandframework tobeputinplace.Herein,thetargetprofilemeansthedefinitionofacompositionof assetsandliabilitiessothattheprofitabilityofthebankingbookreachesitsmaximum, takingintoaccountanumberofregulatoryandinternalriskconstraints.Iwillcome backtothisdefinitionlater.Fornow,mymainobjectiveistoshowthatthereisastrong interrelationbetweenthosetworiskcategories,i.e.interestrateriskinthebanking bookandliquidityrisk(thetwomainriskcategorieswhichtheALMdepartmenthas tomanage),whichbecomesveryevidentwhenlookingattheprojectionofoutstanding stocksaccordingtointerestcommitmentdates(interestrateriskview)andliquidity commitmentdates(liquidityriskview).

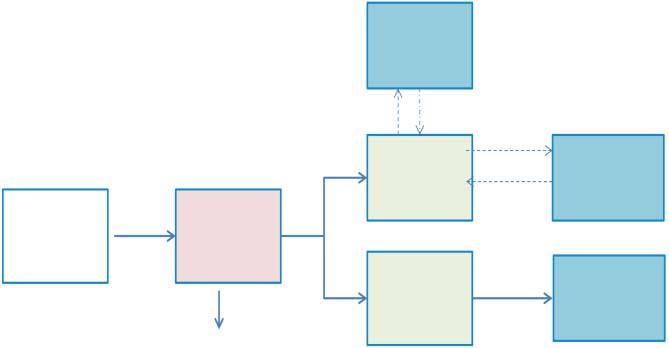

Inordertopresentthisargumentindetail,let’sanalyseaverysimplecase,inwhich thebankingbookofabankiscomposedofthefixedrateloanfundedbyafloatingrate notewitha3-monthreset.TheirfinancialcharacteristicsareshowninFigureI.1.

InanalysingtheALMprofitability,weneedtofirstdefinesometerms.Firstof all,thereisapositivemarginresultingfromtheinterestrateriskmanagementwhich isattributedtoALM(theallocationofprofitsbetweenbusinessunitsandALMis describedinthisbooklateron)ifthespreadofassetsishigherthanthespreadof liabilities.Ifthismarginisalreadycrystallisedandattributed,wecallit marginlocked in.Ifthereisuncertaintyaboutthefuturespreadbecausetheposition,atsomepoint oftime,isexposedtotheriskofchangesininterestrates,wecallit marginatrisk.The sameappliestothefundingspreadonthepositionasitfluctuatesovertime.

Inthecaseoftheanalysedexample,thebankingbookshowsexposuretotheIRRon 31March2019duetotherefixingofthefloatingrateliability.Startingfromthatdate, therefixedassetwillbefundedbytherefixingliability,causingtheinterestrategapand

Repayment type: bullet

Next (capital) payment date: 31/12/2019

Next repricing date: 31/12/2019

Customer Rate: 3.50%

FTP Base Rate: 2.00%

FTP Liquidity Spread: 0.50%

ASSET – Fixed rate loan at maturity 100 LIABILITY – Floating rate note 3m reset 100

Repayment type: bullet

Next (capital) payment date: 30/09/2019

Next repricing date: 31/03/2019

Customer Rate: 1.50%

FTP Base Rate: 1.25%

FTP Liquidity Spread: 0.25%

Liability in repricing Asset in repricing

Asset in maturity Liability in repayment

FIGUREI.1 IRRandliquidityprofileinthebankingbook. Source:ownelaboration.

theimpactonnetinterestincomeknownas NIIsensitivity.Asregardstheprofitability ofthisposition,duetotheinterestrateriskcomponent,thelocked-inALMmarginis equalto0.75%,whiletheALMmarginatriskisequalto1%undertheassumptionof adecreaseinEURIBOR3Mby25bps(from1.25%to1%).

ThissituationispresentedinFigureI.2.

Thesamesituationanalysedfromtheliquiditystandpointlooksslightlydifferent. Thebankbeginstobeexposedtotheliquidityriskon30September2019whenthe liabilityexpiresandneedstoberolledover.Startingfromthatdate,thefundinggap createstheNIIsensitivity.ItcanbeclearlyseeninFigureI.3.

TheALMlocked-inmarginderivingfromthispositionisequalto0.25%(thedifferencebetweentheliquidityspreadoftheassetandtheliability).However,theALM marginatriskdependsonthenewliquidityspreadrelatedtotheliabilitywhichneeds toberolledover.

FIGUREI.2 ExposuretoIRRinthebankingbook.

Source:ownelaboration

Arrivingatthetotalprofitabilityofthebank,inthisparticularexample,weneed tosumtheNIImarginobtainedbythepositioningofthebankintermsofbothinterest rateriskandliquidityrisk.

Consequently,thetotalnetinterestmarginintheperioduntil31March2019is equalto1%(0.75% + 0.25%)andwillbeassignedtotheALMbookwithinthetreasurydepartment.From31March2019to30September2019itgives1.25%,butdueto thefactthatthecomponentrelatedtotheIRRisuncertain,thisresultisunrealised.The samesituationappearsfrom30September2019onward.TheunrealisedALMprofit dependsonthenewliquidityspreadoftheliabilityinmaturityandthemovementof theEURIBOR3Mpillaroftheinterestratecurve.

ItisuptothetreasurertodecidehowtominimisetheNIIsensitivityderivedfrom theinterestrateriskandliquiditycomponentofthebankingbook,andwhatprofitabilityneedstobeprovidedbytheALMunittothebank.Therefore,therealchallenge consistsinunderstandingthetrade-offbetweenprofitabilityandrisk.

TherealisedprofitabilityofthebankintermsofP&Limpactisdeterminedboth bypasthedgingstrategiesconcerningtheinterestratemanagementinthebankingbook andmaturitytransformationperformedbythetreasurywithreferencetoitsfunding strategy.WhiletheunrealisedP&Lresultswillbeafunctionofthemagnitudeofthe marginatriskduetobothIRRandthefundingstrategyforthefutureaccountingperiods andthetrade-offbetweenexpectedP&Landitsvolatility(sensitivity),theriskiness

Exposuretothefundingriskinthebankingbook. Source:ownelaboration

embeddedinthebankingbookstructureisdeterminedbytherisktoleranceofabank andregulatoryrequirements.Itisobviousthatthelevelofuncertaintyandthecapability ofthebanktopredictthedirectionofthemarketintermsoftheinterestratecurveand fundingspreadarethemainimpactfactorsinthisexercise,butthisisnotsufficient.

Thereareotherimportantfactors,suchastheunpredictablebehaviourofcustomers ofabankbothfromtheassetsandliabilitiesside,whichdefinethefinalcomposition ofthebankingbook.Thebehaviouralassumptionrelatedtotheassetssideismostly definedbytheprepaymentrateofmortgagesorpersonalloanswhichcanbeprepaid beforetheircontractualmaturitydate.Thisfactorintroducessignificantuncertainty intothebankingbook,sinceitcanchangetheliquidityprofileofthebankwithinthe short-termperiod.Also,thehedgingstrategiesundertakeninthepastmightturnoutto beinefficientandmightneedtobeadjusted.

Asaconsequenceoftheabove,themainchallengeoftheALMfunctionisto findthebankingbooktargetpositionintermsoftheexposuretofinancialrisks, inordertoboostitsprofitabilityandtominimisethecostoffundingbeingsubject tothelimitsdictatedbyinternalpoliciesandregulatoryrequirements.Another challengeofALMistocooperateinaproactivewaywiththebusinessunits(BUs)

overthedefinitionofthetargetpositionofassetsinthebankingbook.Therewillbe thereturnmaximisationaspectandregulatoryrequirementswhichmayapplytothe assetside.

Theproblemrelatingtotheexistenceoftheinterrelationbetweeninterestraterisk andliquidityriskanditsconsequentimpactonthestructureofthebankingbookisnot newandhasbeendiscussedinvariouspapersandbooks,forexampleBaldan,Zen,and Rebonatoin2012,andChoudhryin2017and2018.Consequently,thisbookattempts toapproachtheintegrationproblemfromadifferentangle,i.e.formulationofmathematicalfunctionsandthereafterapplicationofoptimisationtechniquesinordertofind outthemostappropriatecompositionofthebankingbook.Thefunctionsarebuiltfor theobjectivevariableswhichneedtobeoptimised(assetprofitabilityandcostoffunding)andconstraintswhichneedtobetakenintoaccountintheoptimisationexercise (forexampletheNIIvolatility,concentrationoffunding,anddesirablelevelofliquidity buffer).Theoutputofsuchaconstructedoptimisationproblemwillleadtotheachievementofthetargetprofileofabankintermsofthecompositionofassetsandliabilities andthequantificationoftheeconomicimpactonthebank’sP&L.Finally,therecent sovereigncrises,interbankmarketilliquidity,andstrengthenedregulatoryrequirements suchasBaselIIIhaveforcedthebankingindustrytofindthemostappropriateposition inordertomaximiseprofitabilityand,atthesametime,respectlimitsdictatedbythe internalpoliciesandtheregulator.

Thestructureofthisbookhasbeensubordinatedtoitsmainpurpose,i.e.thedefinitionofthetargetstructurebothfortheassetsideandliabilitysideofthebankingbook.

Chapter1presentsthemainconceptsofassetandliabilitymanagementincommercialbanksandhighlightsthespecialroleofthetreasurydepartmentinseekinga balancebetweenmaximisingprofitability(whichislargelyderivedfromtheselection ofstrategiesforfinancingbankingoperationsinthecontextofexpectedyieldcurve andmaintainingthepreviouslydefinedlevelofmetricsdescribingtherisk).Fromthe pointofviewofliquiditymanagement,theoptimisationtaskfocusesontheissueof buildingasufficientbufferofliquidassets(HQLA)andmaintaininganappropriate long-termliquidityratio.Theinterestrateriskislimitedbysettingathresholdforthe sensitivityofinterestincome(ΔNII).Thispartofthebookpresentsthemostimportant conceptsofmanagingthebankingbookincommercialbanks,themainfinancialrisks itissubjectto,andtheconceptofthefundstransferpricingprocess.Thischapteralso containsanoverviewoftheregulatoryarchitecturebuiltaftertheglobalfinancialcrisis of2007–2009,i.e.BaselIII.

Chapter2ofthebookprovidesthereaderwithadescriptionofmethodsformeasuringandlimitingtheinterestrateriskandliquidityriskwithinthebankingbook.This chapterpresentsindetailthemethodsofriskmeasurementusingthegapmethodand quantifyingmismatchofthematuritydatesofthebankingbookitemsanditsimpact ontheeconomicvalueofcapital.Thesubjectoftheanalysisisalsothedurationmethod anditsapplicationintheprocessofmanagingthebank’sassetsandliabilities(DGAP method).Thesecondpartofthischapterpresentsdecompositionofliquidityriskand selectedmethodsofmeasurementandmanagementintheshortandlongrun.Particular attentionisgiventoanalysisofthemismatchingriskbetweenrisksensitiveassets,liabilities,andbasisrisk.Aseparatesectionisdedicatedtotheproblemoffundstransfer pricing(FTP)inthebankingsectorandthepossibilityofusingittodeterminetheprice parametersofassetsinaccordancetothelevelofliquidityriskdrivenbytheliabilities

financingthem.ThispartofthebookdescribestheconceptofFTPandtheinterestrate decompositionpaidbytheclient.TheFTPprocessplaysamajorroleinbankingbook shapingtechniques.

Chapter3focusesonthebehaviouralfactorsdeterminingthedecisionofthebank’s clients.Thisproblemispresentedbothfortheliabilitiesside(behaviourofdepositors) andforborrowerswiththeoptionofearlyrepaymentoftheirliabilitiestothebank.This chapterhighlightstheimportanceofbehaviouralfactorsforthestabilityandstructure ofthebankingbook.Oneofthekeychallenges,fromtheperspectiveofliquidityand interestrateriskmanagement,istomodelthesephenomena.Amonganumberofexistingmethods,thebookpresentstwomethodsforestimatingthelevelofdepositswithout definedthematuritydate.Thefirstofthese,classifiedasaquantitativeapproach,allows forthedeterminationofthestabilityofdepositsbasedonthegrowthmodel;thesecond isclassifiedasahybridmethod.Thesensitivityanalysiscarriedoutallowsonetopoint outfactorssignificantlyaffectingchangeinthestabilityofdeposits;forexample,the levelofinterestratesormacroeconomicfactors.Instead,theprocessofmodellingearly repaymentofloans(theassetsideofthebankingbook)ispresentedinstages.Thefirst stagedescribestheobjectiveofmodelling,thenthetypesofbehaviourregardingearly repaymentsandfactorsaffectingthedecision-makingprocess.Thispartoftheworkis descriptiveandservestopresentanapproachtomodellingtheoptionofearlyrepaymentbytheclient.Inparticular,thereisthephenomenonoffinancialprepayments, whichisdeterminedbymacroeconomicfactorsandchangesininterestrates,aswellas statisticalprepayments,whichcannotbeexplainedbytheabovementionedfactors.

Chapter4focusesonoptimisationtechniquesanddescribestheoptimisation processinthedecision-makingmodel.Thefirstsectionintroducestheconceptof optimisationandtheoptimisationalgorithmbasedontheLagrangemultipliers method.Thesecondsectionconcernsthedefinitionofthebankingbookprofileand thedescriptionoftheinitialstateofassetsandliabilitiesforwhichthedecisionmodel wasconstructed(roll-overoftimedeposits,volatilityofcurrentandsavingsaccounts, amortisationprofileofassets,prepaidrateofassets,andtypeofinterestratesand pricingpolicy).Thispartpresentsthedifferencesinthestructureofthebankingbook invariouscountriesandthesupervisoryconstraintstowhichthemodelissubject.The nextsectioncontainsadescriptionofthemodel’sstructureandconstraintsimposedon theobjectivefunctionintheoptimisationprocess.Theconstraintsaredividedfirstinto thosethatdeterminethebankingbook’sassetside,andincludeliquidityrisk(liquidity buffer,short-termliquidityratio,structuralliquidityratio,includingthebehaviour ofclientsandwithouttakingthemintoaccount),interestraterisk(income-based measuresandmeasuresofeconomicvalue),andcapitalabsorption(capitaladequacy ratio).Ontheliabilitiesside,theconstraintsadditionallyinclude(apartfromthe liquidityandinterestraterisk)theriskofexcessiverelianceonaparticularsourceof funding(concentrationrisk).Thechapteralsoincludesthederivationoftheobjective functions:maximisationofassetsincomeandminimisationoffundingcosts(costsof obtainingliabilities).Thelastsectionofthischapterpresentsthemodelriskandits sensitivityanalysis.Inparticular,itdefinesthemodelriskandprovidessomeinsighton supervisoryrequirements.Subsequently,itdefinesthenumberofscenariosonwhich thebusinesscasesarebased.

Chapter5includesapracticalcasestudyandshowstheimpactofindividualscenariosontheresultsobtainedfromtheapplicationoftheoptimisationmodel.Thecase

studyisconductedontheexampleoftwodifferentbanks.Thecasestudycanbeseen asatestofthepreviouslydesignedmodel.

InAppendices1and2,thereadercanfindthequantificationofbenefitsresulting fromtheapplicationoftheoptimisationmodel,bothfortheassetandliabilitysideof thebankingbook,underanumberofscenarios(describedinChapter4).

Thetermdecisionmodelisusedinordertoemphasisethepracticalapplication oftheoptimisationexerciseinthedecision-makingprocess.Optimisation,intheform describedthroughoutthebook,providesabenchmarkforthetreasurer,CFO,andCRO relatedtotheoptimalcompositionofthebankingbook.Thus,seniormanagementcan gainawarenessofthebankingbookcomposition,whichallowsthemtoreducethecost offundingfortheliabilitysideandincreaseincomefortheassetside.

Thebookconcludeswithanumberoftakeawaymessagesandemphasiseskey pointsdeliveredtothereader.