Global Renewables Market Update Q1 2023

INSIDE THIS REPORT:

• Global Renewables & Carbon Marketplace

• PPA Pricing Trends and Project Availability

• U.S. Renewable Energy Market Trends

• European Renewable Energy Marketplace Trends

INSIDE THIS REPORT:

• Global Renewables & Carbon Marketplace

• PPA Pricing Trends and Project Availability

• U.S. Renewable Energy Market Trends

• European Renewable Energy Marketplace Trends

Lauren Kielley | Boston, MA

As a Senior Clean Energy Advisor, Lauren helps navigate clients through their renewable procurement process, from early education to strategy setting, continuing to provide support and insight through competitive solicitations, negotiation, all the way to contracting.

Corina Melchor | Bucharest, RO

As a Clean Energy Advisor, Corina manages client relationships by bringing insights to life across our customer’s decarbonization journey.

Andor Savelkouls | Utrecht, NL

As Senior Director of European Energy Advisory, Andor leads his team on focusing on both the business development and operational aspects of the company’s consulting activities across Europe.

Joey Lange | Excelsior, MN

As the Managing Director of the Renewables team, Joey helps client leads with education, strategy development, analysis, and approval support for each of our engagements.

Charlotte Caldwell | Boston, MA

As a Senior Analyst, Charlotte advises clients on renewable energy strategy and economics.

Jan Cihlář | Utrecht, NLD

As a Clean Energy Advisor, Jan helps commercial and industrial energy users execute on their renewable energy procurement strategies by utilizing both on-site and off-site solutions.

Karin Corbani | Berlin, Germany

As Manager of Regulatory Intelligence in Europe, Karin leads the team responsible for tracking policy and regulatory developments on a European and national level.

Matt Donath | Milwaukee, WI

As a Senior Policy Analyst, Matt tracks relevant legislation and regulatory proceedings at the federal, state, and local level and evaluates the potential impact to client’s energy strategy and sustainability goals.

Kristi Ghosh | Utrecht, NL

As a Senior Clean Energy Analyst, Kristi is responsible for analyzing renewable energy market risks and opportunities, including policy and regulation, and administration of the project database for market evaluation and diligence.

Chelsey Harmer | Boston, MA

As a Senior Analyst on the Sustainability Strategy team, Chelsey supports clients at many stages of their decarbonization journey.

Avery Hammond | Boston, MA

As a Senior Clean Energy Analyst, Avery focuses on following key policy and market drivers impacting PPA and REC procurement in North America.

Shannon Holzer | Chicago, IL

As the Head of Policy, Shannon tracks regulatory, legislative and administrative proceedings in North America and uses this information to help our clients make better energy procurement decisions.

Henry Homer | London, UK

As European Energy Risk Manager, Henry provides market intelligence, creating and delivering bespoke energy risk management strategies to protect clients from exposure to volatile markets, with a goal to guide them towards a sustainable future.

Patrick Mingey | Boston, MA

As a Senior Clean Energy Analyst, Patrick analyzes renewable energy strategy and communicates forecasted project economics to clients.

Austin Zaelke | Lebanon, NH

As a Clean Energy Associate on both the Sourcing and Origination teams, Austin supports clients in selecting the best risk-adjusted pathway to achieving clean energy goals.

Elana Knopp | New York, NY

As a Senior Content Writer, Elana is responsible for leading content development, creating thought leadership pieces with Edison team members and industry experts, and crafting client engagement & communications strategies.

Grace Morrissey | Boston, MA

As a Manager on the Energy & Sustainability Strategy team, Grace supports clients by establishing greenhouse gas emissions inventory processes, setting science-aligned emissions reduction targets, and crafting overarching climate strategies.

Buyer demand remains high this quarter across both the U.S. and Europe, but pricing trends diverged; median PPA prices increased by almost 11% since Q4 in the U.S., while European pricing moderated. Heightened development cost and uncertainty were key price drivers in the U.S., while European markets began to stabilize following proposed regulatory guidance and a decline in electricity prices.

Following a relatively stable fourth quarter in 2022, Q1 2023 saw an uptick in PPA prices across the U.S. in almost every market and technology. High equipment and EPC costs, prolonged supply chain constraints, interconnection costs, and increased cost of borrowing have all placed upward pressure on PPA prices this quarter.

The U.S. solar market continues to face equipment import difficulties and project delays due to heightened scrutiny around forced labor practices and uncertainty around solar tariffs. These supply chain constraints have driven limited project inventory for buyers seeking to meet 2025 goals and have pushed out commercial operation dates. As solar development struggles, the Inflation Reduction Act creates more opportunity for wind, storage, and tax credit participation models, which may be of interest to some buyers.

Despite headwinds, buyers continue to set and meet stricter sustainability and renewable energy goals. Corporate buyer momentum behind renewable PPA transactions has accelerated. In 2022, corporate buyers announced a record 16.9 GW of power purchase agreements according to the Clean Energy Buyers Alliance (CEBA). Through this continued activity - particularly in a challenging market - corporations are acknowledging the importance of their sustainability efforts more broadly.

In Europe, PPA pricing declined in Q1 and is beginning to stabilize, bringing some equilibrium back to the market. Commitment to renewable goals and security of supply concerns have driven high PPA demand over the last several quarters, and the recent moderation in PPA pricing will likely lead to increased PPA activity in 2023. Europe’s renewable energy targets, along with more regulatory stability, will likely drive opportunities for renewable energy and have increased investor confidence. Buyers are eager to re-enter the market in 2023, while developers have reason to be optimistic about their renewable energy pipeline. This shared goal is expected to result in an uptick in corporate transactions this year, though local law in some regions may be in conflict.

The Greenhouse Gas Protocol (GHGP) is in the process of reviewing and refining its emissions reporting framework. Governed by a partnership between the World Resources Institute (WRI) and the World Business Council for Sustainable Development, GHGP is the most prevalent standardized framework used to measure and manage greenhouse gas emissions. In addition to providing foundational methods for measuring and tracking carbon emissions from operations and value chains, GHGP also provides methodology and best practices regarding carbon reduction practices, laying the groundwork for major corporate reporting frameworks such as RE100 and the Science Based Targets Initiative (SBTi).

Revisions to the GHGP are expected to roll out slowly. Following a stakeholder survey that closed this March, the GHGP is expected to determine the needs and scope of required updates in the coming months, with minor revisions expected to take one year and major updates expected to take two years. Edison Energy provided a response to the GHGP survey that centered around expanding access to tools and resources that would allow corporations to reduce their Scope 2

emissions via renewable energy purchases, as broader participation in renewable energy markets is critical to driving down emissions in the power sector1

With the emergence of new technologies, availability of higher resolution data, and advanced maturity of some corporate reporters, the Scope 2 guidance update is expected to address gaps and grey areas in the current guidance. It could also potentially introduce new methodologies aligned with the standard’s stated objectives of ensuring rigor and credibility in line with the latest climate science. Corporate purchasers of renewable energy should be prepared for the updated guidance to have impacts on renewable energy market factors.

While the specific impacts are difficult to ascertain at this stage in the revisions process, buyers should anticipate changes to Scope 2 guidance and should monitor the revisions process for updates.

U.S. National REC prices remain steady

National Green-e REC prices have leveled off following a near doubling from Q3 to Q4 2022, though prices have remained well below the peak pricing experienced in 2021 over the last year. At the close of Q1 2023, 2022 vintage RECs are trading at around $2.20/REC, while 2023 vintage RECs are fetching a premium, priced at ~$3.05/REC. There has been some movement in the market, driven by corporate procurement of National RECs to achieve 2022 and 2023 renewable energy goals. In line with the Green-e standard, RECs with a vintage from July 2022 – March 2024 are eligible to be retired on behalf of reporting year 2023.

Pricing of PA Tier I compliance RECs in PJM continues to climb; in Q1 2023, prices fluctuated from $28 –$30.50 for 2023 vintage, up from an average of $26 in Q4 2022. This is driven in part by project supply constraints and compliance demand of RECs in the region. Ohio REC pricing remains at a significant discount to the rest of PJM, at $5.83/REC for 2023 vintage.

European GO pricing was volatile in Q1, oscillating between €6 and €8/MWh after decreasing from their peak at the end of 2022. Nordic hydro produces a significant quantity of GOs, and reservoir levels across the Nordics are below average for the season, generating fewer GOs than ordinarily expected. High likelihood of a drought in Europe over the summer season is a concern. Most transactions have been focused around 2022 and 2023 vintage years to satisfy emissions disclosure deadlines in most geographies, but similar pricing volatility trends are present in 2024 and 2025 products, though to a lesser extent.

The GO prices tracked in Figure 1 reflect 2022 and 2023 vintage GOs. The 2022 vintage has seen the highest volume of trading activity, ending the quarter at around €6 to 7/MWh.

Voluntary carbon market faces criticism; REDD+ prices drop

Credibility and transparency have long been primary areas of focus within the voluntary carbon offset industry. In January, the Guardian2 published a highly critical article referencing two peer-reviewed studies that analyzed Reducing Emissions from Deforestation and Forest Degradation plus Conservation (REDD+)3 projects and concluded that they were falling short of achieving the intended emissions avoidance.

The key finding of the studies was that many REDD+ projects overstate their impact on avoided deforestation and climate change mitigation, stemming in large part from inaccurate baseline deforestation rate assumptions. Both studies emphasized that REDD+ projects are not inherently ineffective, and that prioritization of finance for areas at greater risk of deforestation is critical to developing successful projects.

In response to the Guardian article, project registries, developers, and other market participants published

their own analyses, questioning the methodologies of the two studies and challenging their findings and conclusions. Despite the misrepresentations in the article, there is broad agreement that REDD+ methodologies can and should be improved, and in some cases, such updates were scheduled prior to the article’s publication.

The Guardian article has had a chilling impact on REDD+ prices, which have dropped from $14 – 17/tonne to $9 – 13/tonne. REDD+ advocates have emphasized that forest conservation is essential to meeting climate goals, also citing the need to finance projects that deliver sound carbon benefits. An update to REDD+ methodologies has been underway for several years, according to Verra, with expected publication in Q3 2023.4 Recent media attention on carbon offsets, specifically REDD+ projects, emphasizes the importance for prospective buyers to perform due diligence and risk screenings on all projects under consideration before proceeding with procurement.

Prices shown reflect the median of flat, hub-settled, unit contingent offers inclusive of project RECs received over time. Markets and technologies with fewer than four distinct projects in a given quarter are not shown.

• Median PPA prices increased almost 11% ($6/ MWh) across ERCOT, MISO, PJM, and SPP wind and solar in Q1. Following a relatively stable fourth quarter, PPA price growth picked up in Q1 in almost every market and technology. High equipment and EPC costs, prolonged supply chain constraints, interconnection costs, and increased cost of borrowing – now at the highest rate since 2007 - all placed upward pressure on PPA prices this quarter. Future electricity forecasts have also decreased, which has reduced expectations for merchant PPA revenue and the merchant tail, thereby putting upward pressure on PPA prices in order to meet return requirements from those financing projects.

• ERCOT project inventory has decreased, and median solar PPA prices accounted for the largest Q1 increase, with a gain of more than 11%. After a mild drop in Q4, ERCOT solar prices have risen just over $5/MWh. ERCOT project inventory also decreased 18% in Q1, following a nearly 40% increase between Q3 and Q4 2022.

• Median solar PPA prices in MISO rose 9%, along with an 18% boost in project inventory. MISO solar prices increased by $5/MWh this quarter. MISO wind PPA prices experienced the only decrease this quarter, though the drop was very modest at 2% (or $1/MWh) between Q3 2022 and Q1 2023.5

• MISO and PJM solar PPA pricing range significantly across bids. Offers in MISO, where the average difference between the minimum and maximum bid prices has been between $20 - $25/ MWh since 2019, experienced a range of almost $40/MWh in Q1. Similarly, offers in PJM varied by $32/MWh. These broad ranges are likely driven by varying assumptions around interconnection costs and solar tariffs. PJM is undergoing interconnection queue reform and there is a gap in online dates between projects that have been fast tracked and those that have not. In MISO, most projects will become operational in 2026 or 2027, with panel procurement likely to occur after the Biden administration’s moratorium ends, which is expected to impact pricing assumptions.

PPA prices shown above reflect flat, hub-settled, unit contingent offers inclusive of project RECs received in Q1 2023. Markets and technologies with offers from fewer than four distinct projects are not shown. Some offers shown may no longer be on the market. The dotted line indicates where the median PPA price was one year ago.

Corporate buyer momentum behind renewable PPA transactions has accelerated. In 2022, corporate buyers announced a record 16.9 GW of power purchase agreements, up from 12.3 GW in 2021 and 10.5 GW in 2020 according to the Clean Energy Buyers Alliance (CEBA).6 Edison Energy’s customers executed 1.5 GW of renewable PPAs and surpassed 10.5 GW of total utilityscale renewable energy deals to date.

Despite headwinds, buyers continue to set and meet stricter sustainability and renewable energy goals, as demonstrated in Figure 6; through this continued activity, particularly in a challenging market, corporations are acknowledging the importance of their sustainability efforts more broadly.

Project inventory is more limited for buyers seeking to meet 2025 goals. While we have seen some examples of developers waiting to market new projects until they are de-risked, 22% of project inventory received this quarter is expected to become operational before 2025 (26 projects) compared to the remaining 78% slated to start operations in 2025 or 2026 (49 and 35 projects, respectively) or later. This is partially driven by supply chain constraints, which continue to push out

commercial operation dates. Some buyers are seeking alternative near-term options.

For buyers who are unable to find projects that meet required criteria such as online date or volume of offtake, utility green tariffs may be a suitable option. These utilityrun programs aim to grant access to renewable energy to corporate buyers and often consolidate the PPA onto the existing utility bill, streamlining the buyer’s renewable procurement. They can also be a good option for small and mid-sized buyers who are seeking a smaller offtake than a typical PPA requires. While program structure varies significantly by utility, green tariff programs often provide more flexibility in term length and procurement size than traditional PPA products, though they may sometimes come with tradeoffs as it relates to criteria like additionality or cost.

Utility program structures vary; some function more like an unbundled REC product, while others may be structured similarly to a PPA. Underlying projects are usually located within the same grid as the buyer’s load, which may be appealing to buyers who value local impact. However, attractive utility programs have experienced record demand; many programs, particularly in regions of significant industrial growth, are waitlisted or full. In the last year, Edison has evaluated programs covering nearly 40 utility footprints on behalf of our clients, and we are actively tracking 60 green tariff programs across the country.

Consistent with previous quarters, the U.S. solar market continues to face equipment import difficulties and project delays as Customs and Border Protection (CBP) enforces the Uyghur Forced Labor Prevention Act (UFLPA). The requirement for developers to prove their panels were not a product of forced labor practices is onerous - and in many cases beyond the control of developers or their panel suppliers - to meet the burden of proof required by the CBP. This has led to detainment at ports. The cost of storing detained cargo presents another development cost likely to be passed through to buyers. Many developers have been unable to hold project operation dates due to panel shipment delays.

A bipartisan group of lawmakers recently introduced a resolution to repeal the Biden administration’s two-year moratorium on solar tariffs, posing a potential risk to panel importers that may lead to pricing uncertainty.7 The resolution, introduced under the Congressional Review Act (CRA), would remove safe harbor for panels imported from the four Southeast Asian countries named in the Auxin petition. This would subject imports from these countries to retroactive tariffs – some as high as 254% - dating back to April 1, 2022.

Under the CRA, a resolution requires a simple majority in both chambers to pass but would likely be subject to a veto from President Biden. It is unlikely that the two-thirds majority threshold will be met to override the veto, and the risk of additional tariffs on these Southeast Asian imports over the two-year period is low. Any additional tariffs on imports from these countries would likely drive up PPA prices and reduce project supply in the near term.

According to supporting lawmakers, the CRA is intended to prevent foreign solar manufacturers from violating trade laws and support domestic manufacturers, although several renewable energy trade groups claim that the safe harbor period is needed to meet current demand while domestic suppliers ramp up production.

As a result of the Inflation Reduction Act (IRA), domestic manufacturing is growing at a rapid pace; according to NREL’s Winter 2023 Quarterly Solar Industry Update, 19 new solar plants with over 85 GW of manufacturing capacity have been announced since the IRA’s passage.8

However, panel supply is unlikely to be backfilled anytime soon via market forces, given long build times and limited domestic manufacturing capacity for ingots, wafers, and cells.

As the solar industry continues to struggle with panel procurement, development has not necessarily been easier for wind. While we anticipate that some developers will start pursuing wind development due to tax credit extensions and to diversify their project portfolios, the wind industry is facing its own challenges.

Finally, uncertainty around IRA implementation has made it very challenging for developers to determine PPA prices. At a recent Information Forecast Summit (“Infocast”), a forum for developers and the renewable finance community, frustration around lack of direction from the IRS was a pervasive theme.

IRS guidance on implementation of new tax credit structures and bonuses will trickle out through the remainder of the year. Some guidance, such as on the hydrogen tax credit, is not expected until Q3, although the IRS is prioritizing bonus adders that affect the value of the Production Tax Credit (PTC) and Investment Tax Credit (ITC).

On April 4, 2023, the IRS released proposed regulations on the 10% Energy Community bonus adder. While the ramifications of the new guidance are still under review, it generally aligns with the recommendations from the renewable industry - a positive development for renewable energy buyers. The guidance should provide some initial clarity to developers, enabling greater pricing certainty into the summer as further information is released.

Updated tax credit structure under the IRA could lead to more instances of negative power prices. The IRA increased the value of the PTC and expanded eligibility to solar assets, with some developers now pursuing the PTC rather than the ITC for solar projects in areas like Texas and the Southwestern U.S. Development costs tend to be lower on a per/ MW basis, and solar generation is most productive in these regions; given that the PTC is captured on a MWh basis, it is more economic than the ITC in some cases.

Depending on underlying contract terms and overall offtake strategy, election of the PTC for these solar projects may incentivize developers to continue selling onto the grid during periods of negative pricing until the negative floating price equals the

PTC value. In a recent survey of developers, all were either pursuing, or considering, the PTC on some of their solar projects.

Even without the potential PTC impact, increased renewables penetration will increase downward pressure on electricity market prices due to the negligible operating costs of renewable generation. The continuation of the PTC for wind projects and the potential expansion to PTC for solar will likely increase negative pricing in the market.

Over the past five years, regions with significant wind projects like ERCOT West and SPP have experienced a 200-300% increase in negatively priced hours. Negative pricing events can be mitigated via battery storage projects and transmission upgrades. Both technologies help optimize the flow of electricity across the grid, reducing pockets of congestion that ultimately result in large price differentials between nodes, and from nodes to settlement hubs (basis).

While we expect these technologies to mitigate some negative pricing and basis impacts in the mid-term, new transmission faces regulatory hurdles while battery technologies will need to be scaled.

Over the last year, volatility in natural gas prices - driven by a warm winter and higher than average levels of storage - spurred drastic swings in power prices.

In most U.S. electricity markets, natural gas power plants tend to set the marginal price of electricity, as underlying natural gas price dynamics impact power market pricing. Henry Hub spot pricing increased by over $5/MMBtu between March and September 2022, and subsequently decreased by over $7/MMBtu by March 2023.

For operating projects, these price swings have had a significant impact on project settlements over the last quarter and provide an example of the short-term volatility risks that all power projects face.

As a result of new and changing market dynamics, buyers who enter the market should expect risk sharing to be at the forefront of discussions.

Buyers are seeking more transparency, while sellers are looking for opportunities to engage with buyers on the more qualitative aspects of their bids (as it relates to project benefits and terms).

As a result of the IRA, opportunities via tax credits have increased. In addition to the tax credit extensions and bonus adders discussed in Edison’s Q4 2022 report, the IRA creates a new provision around tax credit transferability that reduces complexity and creates opportunity for smaller investments. Transferability allows the project owner to sell all or part of the renewable tax credits by transferring them to another taxpayer, thereby expanding the pool of potential investors. Some sellers have expressed a willingness to work with C&I buyers on tax credit participation models. The industry awaits more guidance from the IRS on tax credit transferability implementation, though some have already begun structuring these types of deals.

Tax credit transferability may be an appealing participation model for buyers who are able to provide upfront capital in the millions of dollars, but these transactions are not typically structured with RECs included, given that underlying projects will still need PPAs (generally bundled with project RECs) to provide a fixed revenue stream. This is a challenge for buyers pursuing a renewable energy transaction to reduce their Scope 2 emissions.

The IRA has also introduced more value for storage via additional tax credits; as a result, more buyers and developers are considering renewable generation and co-located storage models. Storage is also appealing

to manage reliability and volatility in an increasingly volatile pricing environment.

Aligning incentives for buyers and developers has been the most significant challenge around the current solar/ storage model. Storage assets are usually deployed to align with anticipated pricing events, and buyers typically are not positioned to dictate the dispatch of the asset and must rely on the developer. Without a strong economic or contractual incentive, the buyer is exposed to significant risk when it comes to the settlement of the battery. Storage assets also generate revenue across a range of markets (electricity, capacity, and ancillary services), and often much of their revenue is incurred outside of the electricity market.

Given these dynamics, sharing of revenues in all markets should be a consideration in contract terms. While storage can provide great economic value to renewable energy buyers, the market remains undeveloped and risky. In a recent survey of developers, none had been able to execute paired solar/storage deals to date, though several were pursuing options.

PPA prices for the five markets shown reflect the median of flat, unit contingent offers inclusive of project GOs, received over time. Markets and technologies with offers from fewer than three distinct projects in a given quarter are not shown. Wind PPA price trends are not shown this quarter due to fewer than three wind projects seeking offtake in each market. The EU PPA Price Index is a weighted average of all PPA prices across Europe.

• EU PPA prices moderated or fell this quarter. The EU PPA Index price, which represents a weighted average of all PPA prices across Europe, decreased by 7% following a decline in natural gas and electricity prices. In Q1, prices were at €82/MWh - down from €88/MWh in the previous quarter.

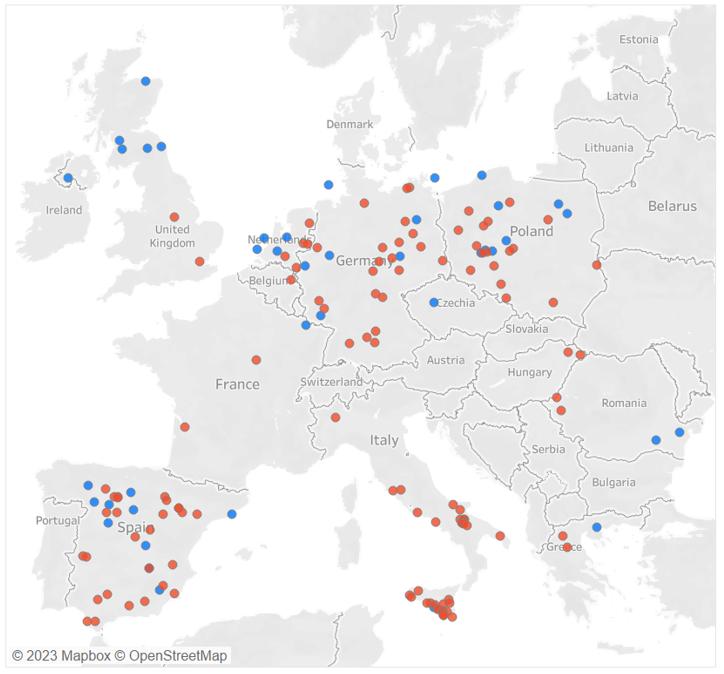

• Pricing in Spain increased from €46/ MWh to €48/MWh but is still the lowest priced PPA market, with ample options for voluntary buyers. As demonstrated in Figure 9, the Spanish market offers strong inventory in both wind and solar. A variety of PPA price structures are also available, providing buyers with optionality.

• The number of projects being marketed to voluntary buyers increased in Q1. This follows a decline in inventory over the last 2 quarters, driven in part by political uncertainty related

to protection mechanisms announced by EU Members. EU electricity market reform was announced this quarter, and while there is still ambiguity surrounding final implementation, it has provided the industry with some direction. More offers are being marketed this quarter across all EU countries.

• More projects are becoming available for PPAs in emerging markets such as Greece, Romania, Hungary, Bulgaria, and Croatia. Developers are exploring opportunities in newer markets due to more limited competition and lower project investment costs, compared to other European geographies. While there are currently not enough active offers in these markets to demonstrate pricing trends, this is a positive sign for buyers, as it creates more options in a supply-constrained PPA market.

PPA prices shown above reflect flat, unit-contingent offers inclusive of project GOs received in Q1 2023. Markets and technologies with offers from fewer than three distinct projects are not shown. Some offers shown may no longer be on the market.

Electricity pricing in Europe hit historic highs at the end of 2022, and PPA pricing followed in order to compete with the merchant electricity market. In Q1 2023, electricity prices decreased by approximately 40%, bringing some equilibrium back to the market. This was driven by mild weather across Europe this winter, which enabled healthy levels of gas storage, easing the associated pressure on electricity prices. PPA pricing has cooled off in the first quarter of 2023, partly in response to this drop in futures value.

Overall, there were competing pressures on development costs this quarter. Procuring solar components became easier, especially as geographies critical to the solar value chain phased out Covid policies, reducing the embedded risk in securing these components. However, the cost of financing assets increased due to rising interest rates, similar to the U.S.

While concerns around security of supply, compounded by a need to meet renewable energy goals, have driven high PPA demand over the last several quarters, recent moderation in PPA pricing is likely to lead to more PPA activity in 2023. Current pricing and risk are more palatable to buyers now than they were in the second half of 2022.

Regulatory certainty and sufficient incentives are key elements to attract investment into long-term renewable projects, which is critical for Europe to achieve its climate targets and stabilize prices for end customers. After many regulatory interventions in 2022 that impacted investor confidence, the industry is cautiously optimistic about proposed reforms.

The European Commission has introduced planned electricity market reform to create more stability. Unlike what many feared, the current proposal is not an overhaul of the current system, but rather a targeted reform aimed at strengthening the industrial competitiveness of member states. The proposal incentivizes investment in renewable energy and aims to keep prices manageable for industry facing competition from outside the EU. Two-way contracts for difference (CfDs) that offer guaranteed levels of revenue to generators, long-term contracts such as PPAs, and greater use of demand response mechanisms should help to achieve this.

Under the proposed amendment, most renewable projects are likely to utilize a commercial route-tomarket with PPAs. A smaller subset of projects with less favorable economics are likely to pursue “hybrid” (PPA/CfD) products9 that are both PPA and government funded, potentially opening up this pool of projects to corporate buyers.

Overall, the proposed reform should incentivize more renewable energy development. PPAs are increasingly being recognized as an important tool for long-term market design and are beginning to be incentivized accordingly.

The European Commission proposal recognizes that integrating the inframarginal revenue cap – a cap applied to technologies that bid in lower than natural gas in the price formation mechanism – as a permanent feature of the market design would lead to unnecessary risks, which could affect investment needed to decarbonize the electricity system. However, impacts of the inframarginal revenue cap are still being monitored by the European Commission, and discussions are ongoing as to whether the current regulation should be extended beyond the end of June 2023.

The European Union is also considering the Green Deal Industrial Plan, which includes several measures to accelerate the energy transition by supporting deployment of clean technologies, simplifying the regulatory environment, and speeding up access to financing. This proposal has been compared to the U.S. Inflation Reduction Act and other similar schemes across the globe.

accelerate permitting. Projects in renewable “go-to areas” would have their environmental and connection permit granting process streamlined to now take a maximum of 1 year12 (this process can take 2-3 years or more in many countries today). Electricity market reform also aims to increase renewable generation. However, jurisdictional and national laws add an additional layer of complexity that could potentially conflict with the EU’s plans to expand access for renewables, as discussed in the next section. Supply challenges vary by market, and we have seen an increase in supply of renewable energy projects in several emerging markets including Greece, Romania, Hungary, Bulgaria, and Croatia.

The anticipated phaseout of direct governmental subsidies is also expected to provide more opportunity to buyers. Direct subsidies (e.g., feed-in-tariffs) continue to be phased out and replaced by contracts for difference (CfD) structures that are selected in governmental reverse auctions. It is likely that many projects unwilling or unable to rely solely on merchant pricing and CfDs will seek direct offtake via PPAs.

Anticipated

PPA activity is expected to increase in 2023, following a significant drop in activity in 2022. On the supply side, regulatory actions should, in theory, incentivize more renewable energy development. This is driven by many regulatory actions envisioned by the EU, including ambitious renewable energy targets. Under the REPowerEU, for example, 390 GW of new solar PV10 (compared to 210 GW of installed capacity as of 2022) and 225 GW of new wind capacity11 (compared to 255 GW of installed capacity as of 2022) must be installed by 2030 to meet current goals. The EU has also taken action to reduce barriers to development, such as the Renewable Energy Directive revision, which aims to

Simultaneously, buyer demand for renewable energy is growing, driven by a combination of corporate decarbonization targets and additional demand from hydrogen-based fuels. Contracted renewable energy is falling short of proclaimed 2030 targets by member companies of RE100 due to limited project supply and challenging market conditions. Renewable hydrogen also presents another driver for PPA market growth. Recently proposed rules for renewable hydrogen production require all prospective producers to enter into PPAs with renewable energy developers.13 If the 2030 domestic production targets are met, a significant amount of renewable electricity would have to be procured.14

Buyers are eager to re-enter the market in 2023, while developers have reason to be optimistic about their renewable energy pipeline. This shared goal is expected to result in a significant uptick in corporate transactions this year.

10. Santos, Beatriz. “Europe added 41.4 GW of new solar in 2022.” PV Magazine, Dec. 2022. Europe added 41.4 GW of new solar in 2022

11. “Wind energy in Europe: 2022 Statistics and the outlook for 2023-2027.” Wind Europe, Feb. 2023. (Wind energy in Europe: 2022 Statistics and the outlook for 2023-2027 | WindEurope)

12. Note that this is the current European Commission proposal. The Parliament and Council proposed alternative timelines. The matter is currently in the negotiation process.

13. “Commission sets out rules for renewable hydrogen.” European Commission, Feb. 2023. ( https://ec.europa.eu/commission/presscorner/detail/ en/ip_23_594).

14. 10 million tons of hydrogen equals to 333 TWh (LHV). At assumed average electrolysis efficiency of 66%, this adds up to 500 TWh of renewable electricity required by 2030.

Despite efforts by the EU to simplify permitting procedures for renewable energy projects, the speed and effectiveness of local adoption varies. While expanding access is at the center of many of the most recent EU interventions, challenges in local adoption persist in most European countries. Generally, lengthy permitting processes, not-in-my-backyard (NIMBY) attitudes, and interconnection queues due to grid underinvestment significantly stall project development pipelines.

Several countries continue to face challenges around project development due to conflicting guidance between local and EU law. In the Netherlands, onshore wind is still experiencing a backstop. This is due to current environmental regulations for the operation of onshore wind projects, which are unaligned with EU law. As such, projects have been stalled.

While now resolved, similar issues had occurred in Denmark, where all new applications for offshore wind farms had been suspended due to concerns around the breach of EU law. This had endangered the offshore wind pipeline, which amounts to nearly 20 GW of capacity. Fortunately, the government has started to issue new offshore wind tenders. In Croatia, project development is challenged by permitting issues. The country enacted new renewable energy laws in 2021,15 but critical bylaws covering grid connection and extended environmental permitting have not yet been adopted, causing significant delays in renewable deployment.

In contrast, Spain continues to take steps to accelerate renewable development. Regulators have cleared hundreds of applications (amounting to over 84% of the queue) for environmental impacts assessments (EIA) for renewable projects. This is a relatively challenging step in Spain’s regulatory process and has allowed these projects to move closer to ready-to-build status. Given that project development is often delayed as a result of these hurdles, companies seeking to hedge their longerterm electricity prices and reach their decarbonization goals should act swiftly to engage in the PPA sourcing process. Project development constraints in many countries can put corporate procurement ambitions at risk.

Installed Renewable Capacity (2022): 20GW

Poland

The generation mix in Poland has been shifting rapidly. Poland’s power grid has the highest greenhouse gas emission intensity in the EU, with 66% of domestic consumption fueled by hard coal and lignite. Both coal and EU ETS (Emissions Trading System) prices have increased significantly in recent years, with Polish consumers experiencing high power prices due to the region’s reliance on coal. However, the country is experiencing a surge in renewable capacity additions; nearly 20 GW of solar and wind have been installed to date, while the government has announced its target of adding 13+ GW of renewable energy before 2027. Due to the significant presence of international companies in Poland, corporate PPAs are also experiencing a surge, with almost 600 MW of deals signed between 2021 and 2022.

Despite amendments, Poland’s distance rule continues to serve as a barrier to renewable energy procurement and development. Until recently, onshore wind project development was restricted by the 10H rule, which barred wind turbines from being built closer to nearby settlements than a specific distance (10

RE Goals: 32% RE by 2023 (up from 16% currently)

Corporate PPA signed16: 800-900 MW

times the height of the turbine).17 A recently introduced proposal sought to reduce this distance by 500 meters, in alignment with the EU‘s standard recommendation. This proposal had been heavily debated by lawmakers until mid-March, when an agreement was brokered to amend the distance to 700 meters.

While this shift represents a positive change, the amendment does not unlock the full potential for onshore wind development in Poland, as the new requirement is expected to reduce the available area for onshore wind by over 40% compared to the previous 500-meter proposal. Additionally, many developers and investors had begun permitting applications based on an anticipated 500-meter amendment to the 10H rule. Plans will now have to be revised accordingly.

Beyond providing more siting opportunities for wind, further amendments to the 10H rule would also enable Poland to access a National Recovery Plan fund18, which was previously approved by the European Commission. However, Poland can only gain access to the fund if the Commission finds the recent amendment sufficient, which is yet to be determined.

Outdated grid infrastructure has caused project delays across Poland. Aging grid infrastructure, coupled with limited capacity for new interconnection requests, have served as barriers to bringing renewable energy projects online. Due to these challenges, some developers are only offering projects with an operational date in the following year to avoid interconnection risks. While Poland has developed more transmission around major industries in its Southwestern region, this continues to remain a risk for projects in other parts of the country.

Corporate PPA market is slowly expanding. Poland is a unique geography from a corporate buyer’s perspective. Because Poland is not an AIB-member country, energy buyers must purchase renewables

in-country, as transferring GOs from other countries to cover local energy consumption is not permitted. This has driven demand for corporate PPAs within Polish borders, creating an imbalance in the market due to limited supply.

However, the revised 10H distance law and recently announced renewable energy targets are expected to reduce these impacts and accelerate the PPA market, though material effects will not be immediate. Buyers seeking to procure renewable energy in Poland should continue to be flexible, build in extra time for procurement, and consider the long-term value of PPAs to support decarbonization efforts.

Hannah Badrei Vice President, Energy Supply Advisory +1-206-718-6828

Hannah.Badrei@EdisonEnergy.com

Andor Savelkouls

Senior Director, European Energy Advisory, Altenex Energy, BV +31-30-800-9276

Andor.Savelkouls@AltenexEnergy.com

Shannon Holzer Head of Policy +1-773-897-3907

Shannon.Holzer@EdisonEnergy.com

Emily Williams Vice President, Strategy & Sustainability +1-617-681-4208

Emily.Williams@EdisonEnergy.com

Global Reach. Local Impact. Edison Energy LLC (DBA in Europe as Altenex Energy and Alfa Energy) is a global energy and sustainability advisory that provides strategy and implementation services to help large corporate, industrial, and institutional clients navigate the transition to a net-zero future.

With the recent integration of Edison, Altenex, and Alfa into one global company, we bring the strength of combined expertise across energy procurement, optimization, renewables, and sustainability solutions. With advanced technological capabilities and expanded international reach, we enable our clients to achieve more positive, measurable impact. Edison by the numbers: 45 Global Fortune 500 clients; 10+GW of offsite renewable procurement; $7BN+ in energy spend managed; 30+ countries served; 20+ languages spoken. For more information about visit www.edisonenergy.com.

Our global team has locations across Bosnia and Herzegovina, Germany, The Netherlands, Romania, Spain, and the UK. We specialize in delivering integrated strategies that best meet the needs, goals, and objectives of our global clients in an evolving energy market.

Edison Energy, LLC and its affiliate, Altenex, LLC, are registered as Commodity Trading Advisors (“CTA”) with the Commodity Future Trading Commission (“CFTC”) and additional information on Edison Energy and Altenex is available at https://www.nfa.futures.org.

April 2023

© 2023 Edison Energy Exchange Place, 53 State Street, Suite 3802 | Boston, MA 02109 Central Park, Stadsplateau 19-40, 3521 AZ | Utrecht, NL

Global presence in: North & South America, Europe and Asia-Pacific