OUTLOOK

What are the expectations for the commercial real estate market in 2026?

What are the expectations for the commercial real estate market in 2026?

Every year since 2015, EDC Erhverv Poul Erik Bech has conducted a major market survey on the expectations for the commercial real estate market in the coming year. The survey stands out as the industry’s largest and most comprehensive. Therefore, some elements of the survey are also based on results from previous years.

This year, more than 1,800 respondents have completed the survey. The questionnaire has primarily been shared through EDC Erhverv Poul Erik Bech’s extensive database of Danish companies, real estate investors and tenants. In addition, the data collection has also been conducted via networks and social media campaigns, targeted at business professionals with an interest in real estate investment. The responses were collected during the period 22 September - 16 October 2025.

The respondents come from professional investment firms, law firms, banks, logistics companies and retail stores, etc. An investor is defined as someone who invests in properties not intended for their own use and with the aim of obtaining a return on the investment. The survey is solely about the respondents’ expectations for the market and EDC Erhverv Poul Erik Bech’s own opinion is not part of the survey. To a certain extent, the report comments on the results of the survey with quotes.

Sustainability and ESG continue to remain a major focus in the real estate market, which is why sustainability and ESG are part of the questionnaire in the survey for the sixth year in a row. Read more on p. 25. This year’s survey includes a special focus on future housing needs. The housing market is developing rapidly and as Denmark’s largest real estate company with more than 650 employees, 20 commercial branches, 75 residential branches and three project departments, we have our finger on the pulse throughout the country and follow developments closely. Not all results in the survey total 100%, as some of the questions allowed multiple responses.

years in a row, EDC Erhverv Poul Erik Bech has carried out the survey.

respondents have answered the survey.

of respondents invest in properties that are not for their own use.

We are pleased to publish our annual expectations survey for the 11th consecutive year.

It began with an ambition to provide our clients, ourselves and the wider industry with insight into the expectations of the various stakeholders in the real estate sector for the year ahead.

Fortunately, that ambition remains relevant today, and we greatly appreciate the support we have received over the years. Our sincere thanks go to the more than 1,800 respondents who have taken the time to participate in this year’s survey. It is always insightful to follow developments from year to year – and this year is no exception. According to the respondents, we can look towards 2026 with considerable optimism.

2025 has brought a clear improvement in the commercial real estate market, and the positive trend looks set to continue in 2026. This is shown by EDC Erhverv Poul Erik Bech’s expectations survey, where more than 1,800 industry respondents share their outlook. This is the eleventh consecutive year the survey has been conducted, and expectations for the coming year have rarely been as optimistic as they are for 2026.

For the 11th year in a row, EDC Erhverv Poul Erik Bech has conducted an annual survey that delves into the expectations for the coming year in the commercial real estate market. The survey is the industry’s largest and most comprehensive and this year, more than 1,800 players from the real estate industry have given their opinion. The survey covers market prices, economic development, sustainability and this year, the housing needs of the future. Joseph Alberti, Head of Research at EDC Erhverv Poul Erik Bech, says:

“Already last year, there was great optimism in our expectations survey, but the optimism seems to continue in 2026. In fact, the responses this year are among the most positive in the 11 years that the survey has been conducted. In this year’s survey, 55% intend to spend more money on property investments in the coming year, so investors are looking forward to 2026 with confidence.”

Market prices trending upwards

Joseph Alberti says: “This year’s survey shows that 97% expect rising or unchanged market prices for residential rental properties, and this is the highest share in the survey’s 11-year history. For office properties and industrial and logistics properties, a majority also expect rising or unchanged market prices. It is only within retail properties that a majority still expect falling prices, although there has been a slight increase in the share who expect rising prices. “

“The same applies to market rent expectations. Here, too, there is a majority who expect that rents for residential rental properties, office properties and industrial and logistics properties will increase rather than fall. Retail properties have gone from 8% expecting rising market rents in last year’s survey to 14% in this year’s survey, indicating a positive trend.”

Inflation and interest rates stabilised

In the last few years, there has been considerable focus on inflation and interest rate developments,

and it was a major theme in last year’s expectations survey for the 2025 report, where 68% pointed to interest rates as one of the most significant challenges. At that time, 87% expected interest rates to fall, but the outlook for 2026 is different, says Joseph Alberti:

“The majority expect inflation and interest rates to remain unchanged in 2026. As respondents anticipated in last year’s survey, interest rates declined during 2025. This year, the majority expect interest rates to have stabilised at a balanced level and to remain unchanged in 2026, with 61% expecting inflation to remain unchanged in 2026, while 28% expect inflation to rise, which is significantly above the 11% from last year’s survey, making it particularly relevant to monitor developments in 2026.”

One of the conclusions this year is that the prices for residential rental properties are expected to increase in 2026. This year, there has been an additional focus on housing and the housing needs of the future in the expectations survey.

“Urban migration continues. The dual urbanization is in full swing, as many people prefer to live in the largest cities, or at least in the largest urban areas within the municipality. Therefore, it is not surprising that 83% expect housing demand to increase the most in the largest cities. In fact, it is somewhat surprising that the figure is not even higher. In addition, there is an expectation that small flats will experience the greatest demand over the next five years. A trend we see in many major cities in Europe,” says Joseph Alberti and continues:

“The high demand for housing in the largest cities is squeezing an already limited supply. This pushes up market prices and market rents, and therefore the expectation is that the prices for residential rental properties will continue to increase in 2026. That is precisely why residential rental properties continue to overshadow other property types in this year’s survey.”

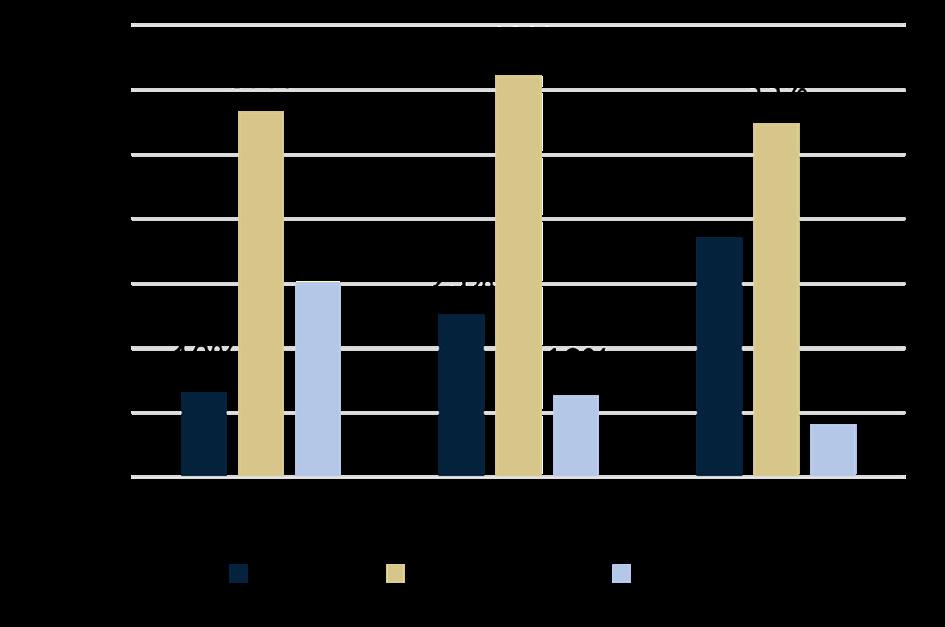

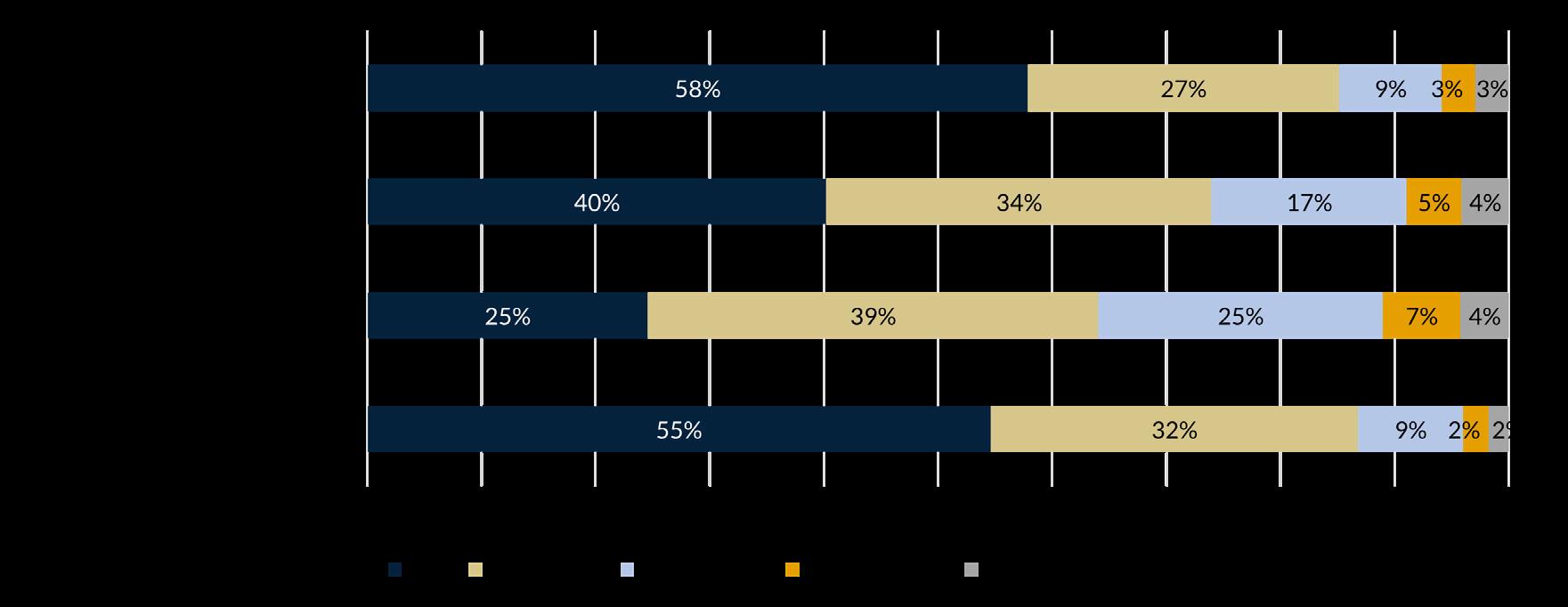

What are your expectations for the development of market prices in the coming year for...

RESIDENTIAL RENTAL PROPERTIES

INDUSTRIAL AND LOGISTICS PROPERTIES

OFFICE PROPERTIES

RETAIL PROPERTIES

The fact that residential rental properties are the property segment with the most positive expectations is not surprising. Historically, residential rental properties have been the most in-demand asset class, and when the market is performing well, they often drive overall activity. Looking at the transaction volume so far in 2025, residential rental properties account for more than half of all activity.

68%

expect rising market prices for residential rental properties.

Residential rental properties are the property type that has the most positive expectations. Expectations have shifted dramatically, with the share expecting rising market prices for residential rental properties having increased by sixty-one percentage points, from seven per cent in 2023 to sixty-eight per cent in 2026.

In the 2025 outlook, 33% expect rising market prices for industrial and logistics properties. However, the proportion expecting unchanged market prices has increased slightly and now represents more than half of all respondents.

Market price expectations for office properties have not changed significantly compared with last year’s survey, and the majority expect office property prices to remain broadly unchanged.

23%

expect rising market prices for office properties. This is an increase of 19 percentage points compared with expectations in 2023.

Retail properties stand out from the other property types, as a majority expect market prices to fall. However, expectations have improved: the share expecting falling prices has decreased by 30 percentage points, from 82% in the 2023 outlook to 52% in the 2026 outlook. At the same time, more respondents now expect market prices to remain unchanged, indicating a more positive trend.

What are your expectations for the development of market prices for commercial land in the coming year...

PARCELS FOR RESIDENTIAL DEVELOPMENT

PARCELS FOR INDUSTRIAL AND LOGISTICS DEVELOPMENT

PARCELS FOR OFFICE DEVELOPMENT

PARCELS FOR RETAIL DEVELOPMENT

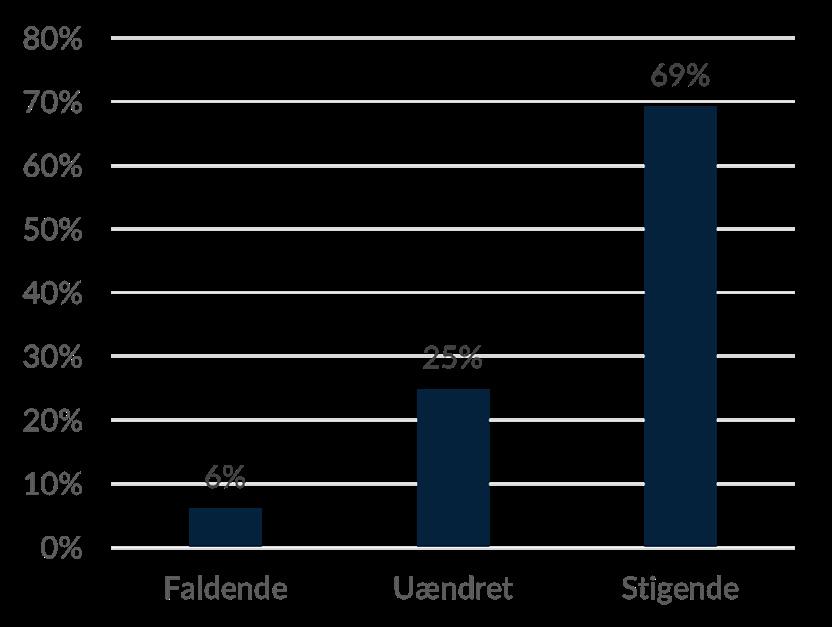

Parcels for residential rental properties stand out positively, with the share expecting rising market prices increasing from 45% to 69% in the 2026 outlook.

For parcels intended for office buildings, eight percentage points fewer now expect falling market prices compared with last year’s survey.

Expectations for parcels intended for industrial and logistics properties are largely unchanged from the 2025 outlook, although a slightly smaller proportion now expect rising market prices for commercial land.

Although only 12% expect rising market prices for commercial parcels in retail real estate, it is a slight improvement compared with expectations for last year.

In general, there are more positive expectations for market prices for commercial parcels compared with last year. With a continued limited supply of attractive parcels, increasing requirements for logistics capacity and sustainability standards, and strong corporate demand, most respondents expect that market prices for commercial parcels will increase or remain stable.

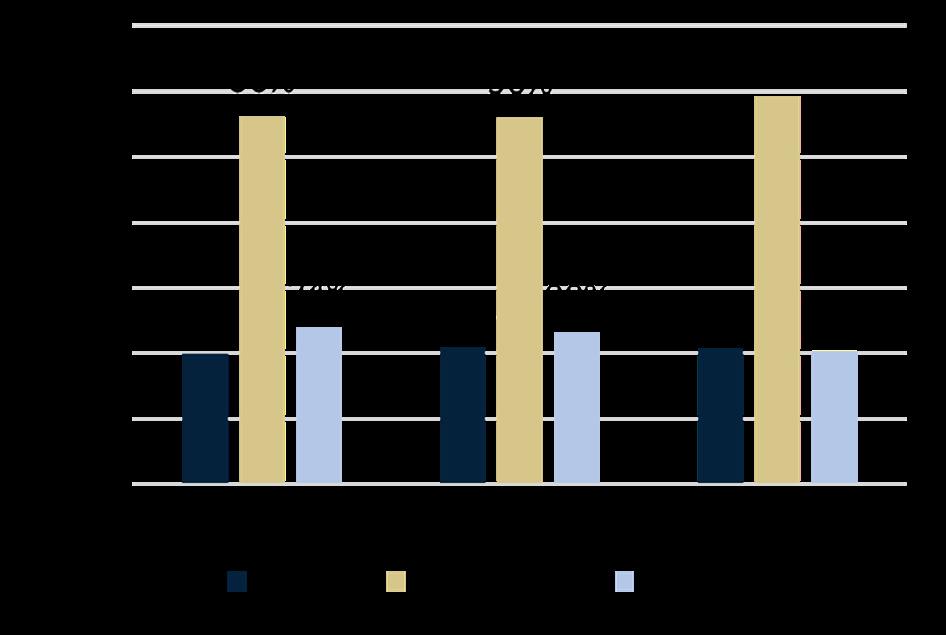

What are your expectations for the development of the market rent for the coming year...

RESIDENTIAL RENTAL PROPERTIES

INDUSTRIAL AND LOGISTICS PROPERTIES

OFFICE PROPERTIES

RETAIL PROPERTIES

As many as 98% expect rising or unchanged market rents for residential rental properties, reflecting the persistently high demand for housing, especially in the largest cities. At the same time, there is a limited supply, as new construction has been limited in recent years, partly due to rising interest rates, high material costs, and general market uncertainty.

56%

expect unchanged market rent in industrial and logistics properties.

73% expect that the market rent for residential rental properties will increase in 2026. This is an increase of 16 percentage points from last year’s survey and 33 percentage points compared with expectations for 2024.

Industrial and logistics properties are the property type with results most comparable to last year’s survey. Expectations for rising market rents have increased from 31% to 32%.

Market rent expectations for office properties point in a positive direction over a three-year period.

29%

expect the market rent for office properties to increase in 2026.

Although a clear majority of respondents expect falling or unchanged market rents for retail properties, there are six percentage points more than last year who expect rising market rents.

What are your expectations for the development of the vacancy rate in the coming year...

RESIDENTIAL RENTAL PROPERTIES

INDUSTRIAL AND LOGISTICS PROPERTIES

OFFICE PROPERTIES

RETAIL PROPERTIES

Although many expect a rising vacancy rate in retail, the retail market is developing rapidly. New trends and concepts are emerging quickly and the demand for attractive, experience-driven stores is solid. In general, the outlook for the retail market is not as negative as many believe, and this year’s survey results also show a slight improvement compared with the last few years.

37% expect that the vacancy rate for residential rental properties will fall in 2026. This is the highest percentage in the six years for which data are available.

8%

expect increasing vacancy rates for residential rental properties. This is 22 percentage points fewer than the expectations for 2024.

There is uncertainty about how vacancy rates for industrial and logistics properties will develop. 21% expect a decline in vacancy, while 20% expect a rise.

More respondents expect vacancy rates on office properties to increase (23%) than expect them to decrease (18%). There may be several reasons for this, but hybrid work, demands for higher quality offices and limited supply of newer office space are part of the explanation.

59%

expect unchanged vacancy rates for both office properties and industrial and logistics properties.

20% expect a decline in vacancy rates for retail properties in 2026. This is an improvement from the last three years’ surveys, where 17-18% have expected a decrease in vacancy. 45% expect an increase in vacancy, and this shows an improving trend compared to recent years’ surveys, where more than 50% have believed in increasing vacancy.

What are your expectations for the development of inflation in the coming year?

61% of respondents expect inflation to remain unchanged in the coming year. This is an increase of ten percentage points from last year, when 51% expected the same. Over the course of 2025, inflation has been around 2%, which is also the ECB’s (European Central Bank) medium-term target. It is therefore not surprising that the majority expect inflation to remain unchanged in 2026.

After several years of price volatility, expectations are now more subdued. The fact that six out of ten expect inflation to remain unchanged suggests that the economy is entering a more stable and balanced phase, which is also reflected in activity in the commercial real estate market.

What are your expectations for interest rate developments in the coming year?

There has been a significant shift from last year, when 87% expected falling interest rates and 10% expected them to remain unchanged. However, last year’s survey was conducted in the autumn of 2024, when interest rates were high. Since then, interest rates have fallen steadily, and it is therefore natural that there is greater uncertainty about how they will develop in 2026.

The interest rate outlook is characterised by cautious optimism. While only 10% expect interest rates to rise, almost half expect them to remain unchanged, and 41% see the possibility of a decline. This indicates an expectation of stabilisation and gradual normalisation of the interest rate market.

In which areas do you currently invest?

What types of properties are you investing in?

What is your total investment capacity?

Do you expect to allocate more or less capital to property investments in the coming year?

“55% expect to spend more on property investments in the coming year. This is the highest share in the eleven years we have conducted the expectations survey. At the same time, only 8% expect to reduce their spending, which is the lowest share recorded in the survey’s history. This represents a further significant increase compared with the expectations for 2023 and 2024, when only 24% and 32% expected to increase their investment levels. It also indicates that the market has regained momentum and that investors are prepared to increase their investments in 2026.”

What types of properties are potential investments for you in the coming year?

Almost nine out of ten respondents identify residential rental properties as their preferred investment, and the segment already accounts for more than half of this year’s transaction volume. This underlines that the belief in housing as a stable asset remains strong.

After several years of stagnation in construction, more than 30% now see potential in developing new housing as an investment opportunity in 2026. It is encouraging that interest in residential development is rising again, especially given the significant housing shortage across the country. Vacancy rates for residential rentals in 2025 were at their lowest level in a decade, leading to rising rent levels — a factor that naturally contributes to the renewed interest.

During 2025, hotels have become an established part of the transaction market, accounting for 10% of total transactions in the first three quarters of the year. It is therefore not surprising that the share of respondents who consider hotels a potential investment has increased from 7% in last year’s survey to 10% in the 2026 outlook. At EDC Erhverv Poul Erik Bech, we also clearly notice that the interest in hotels has intensified, and this trend applies across hotels of all sizes.

Which areas do you expect to invest in during the coming year? (Multiple selections are permitted)

How do you see the possibilities of getting financing for property investments in the coming year?

“67% expect that the ability to obtain financing for property investments in 2026 will remain unchanged from 2025. This reflects that almost half expect interest rates to remain stable and that there is renewed confidence in the capital and credit markets — in contrast with expectations for 2023 and 2024, when the majority expected financing conditions to become more difficult.

Do you own or rent the main premises you occupy?

Would you consider selling your premises in favour of renting instead?

Would you consider buying premises instead of renting?

Between 2020 and 2025, most respondents indicated that they were considering buying rather than renting. This year, however, sentiment has shifted, with more than half stating that they would not consider purchasing instead of renting.

“There has been an interesting development in buying/renting. Previously, a majority indicated that they were considering buying premises rather than renting, but this sentiment now appears to have shifted. For many companies, supply is very limited. Several commercial areas are being converted into new residential projects without any new areas being designated for commercial use. This results in both rising property prices and higher rents, making it more difficult for businesses to transition from renting to owning.

Do you expect to spend more or less money on commercial premises?

Do you expect changes in your need for premises?

What are the reasons for the change in your need for premises?

expect changes in their need for premises during 2026.

answer that the reason for the change in the need for premises is that they lack space.

What is most important to you when choosing premises?

“67% expect their expenditure on commercial premises to remain unchanged in 2026, which is the highest percentage in the 11 years we have conducted the survey. This record-high share indicates a more stable market, where companies have got a handle on their needs – and are not planning major changes in the short term.”

Investors are beginning to identify where ESG initiatives provide tangible returns. This is especially in the office segment, where energy consumption and image have a direct impact on the tenants. The development points to a market where the demand for modern, energy-efficient and certified office properties will continue to increase, while older properties lacking sustainable features risk falling behind in both rental and capital value, and investors must ensure they do not end up with “stranded assets”.

Sustainability is playing an increasingly important role in investment decisions, but in 2026 the approach is characterised by greater realism. Most investors recognise this when incorporating ESG into their strategy, while also closely evaluating where such efforts yield measurable financial results.

After several years of large fluctuations in investors’ views on sustainability, this year’s results paint a picture of a market that is more mature and balanced. ESG is no longer a niche topic, but a concrete parameter in decisions about investment, premises and renovation.

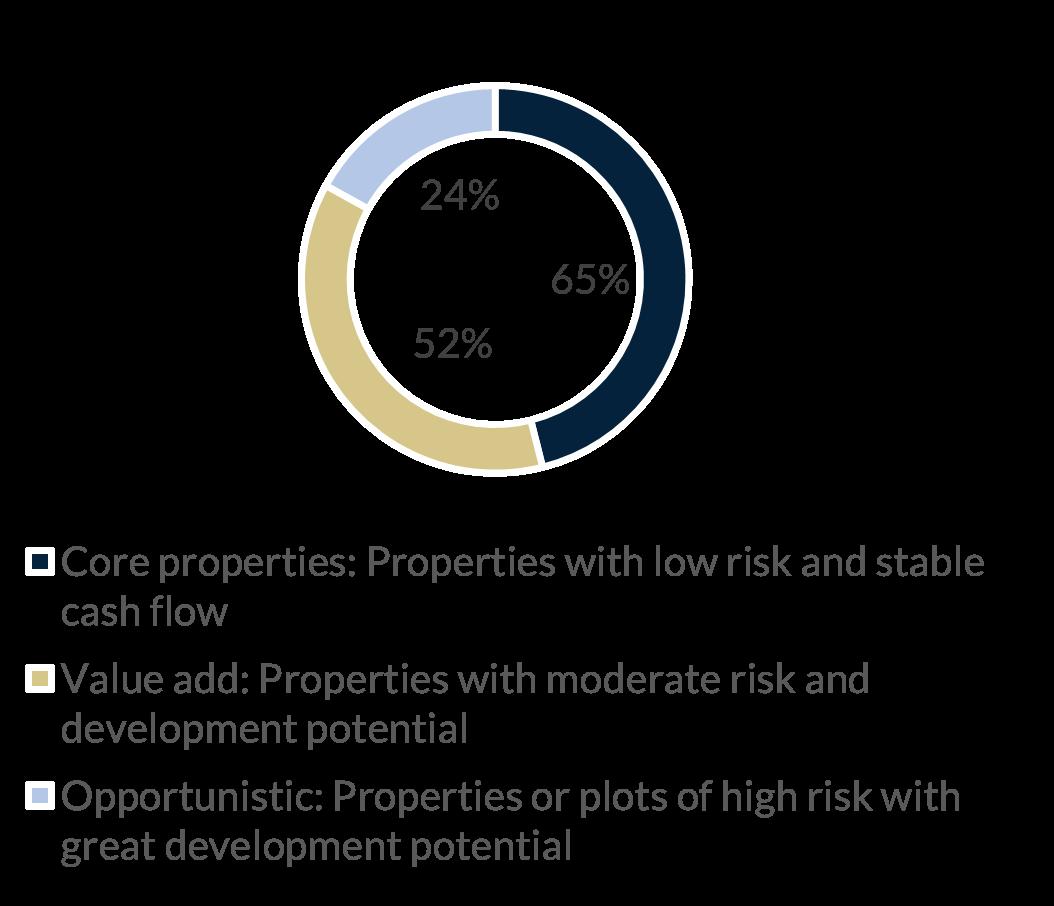

The proportion that actively integrates sustainability into their investment strategy for both ideological and economic reasons stands at 24%, roughly the same level as in recent years. At the same time, 22% say that they only do so because it is financially viable, which is an expression of a more rational and business-driven approach. On the other hand, 23% believe that sustainability is still not financially worthwhile, and this shows that costs and returns continue to play a key role.

Helle Nielsen Ziersen, Head of EDC International Poul Erik Bech, who holds a mini-MBA in sustainability, says: “The share of respondents who do not consider sustainability at all has fallen from 30% in 2022 to just 17% this year, which demonstrates that ESG has become a standard element in most strategic considerations. Sustainability has shifted from being a value-driven ideal to becoming a competitive factor, where both risk and return can be assessed from an ESG perspective.”

Progress remains to be made

In the survey for 2026, 24% of companies state that they have a formal sustainability policy for choosing premises, compared to only 18% in 2022. A further 31% have considered it but have not yet implemented such a policy. Although the proportion with formal policies has increased significantly, the figures show that more than half still have not integrated sustainability in practice. Around 36% have already optimised one or more properties to improve sustainability performance, while 21% have considered it but have not found it profitable.

“This indicates a shift towards assessing sustainable initiatives on the basis of realistic business cases, but also to the fact that many are still waiting for better financial incentives. 41% are willing to pay a premium of 1–5%, while only 16% would be willing to pay a premium of 5–10%. 40% believe that sustainability does not affect property prices, which is a sign that the ESG value has not yet been fully factored into the market,” says Helle Nielsen Ziersen.

The office segment leads the way Sustainability is high on the agenda in the office segment, where tenants in particular are willing to pay a premium. As many as 75% of investors expect tenants to be willing to pay more for sustainable office leases, making the segment the most optimistic in terms of willingness to pay.

The strong interest is linked to the fact that energy efficiency, indoor climate and corporate image play a central role for office tenants who want to attract and retain employees and live up to their own ESG goals. For investors, this means: sustainable office properties are increasingly seen as less risky assets with better rental potential.

Helle Nielsen Ziersen says: ”Investors are beginning to identify where ESG initiatives provide tangible returns. This is especially in the office segment, where energy consumption and image have a direct impact on the tenants. The development points to a market where the demand for modern, energy-efficient and certified office properties will continue to increase, while older properties lacking sustainable features risk falling behind in both rental and capital value, and investors must ensure they do not end up with “stranded assets”.

Do you or your company have a policy requiring sustainability to play a role in your choice of premises?

Does sustainability play a role in your current investment strategy?

Have you considered optimising your property or properties to improve sustainability performance?

Are you willing to pay more for a sustainable property, assuming location, condition and cash flow are the same?

To what extent do you believe tenants are willing to pay more for sustainable leases in...?

To what extent do you believe that property tax or other property-related taxes will be affected by a property’s sustainability in the future including, for example, its energy performance certificate (EPC)?

To what extent do you think properties will become less marketable due to poor ESG performance?

To what extent are you or your company willing to pay more for sustainable leases compared with leases of the same location, size and condition?

What do you suspect are the most significant challenges for the property market in the coming year?

“Movements in interest rates and lending terms top the list of challenges — but it is noteworthy that building material costs, regulation and valuation issues now rank higher than climate and ESG. This shows that the market is currently far more concerned with the economic framework conditions than with the long-term green challenges.”

Respondents also highlight the following challenges:

“Increasing vacancy”

“Realism among sellers”

“Volume of new construction”

“Demographic development”

“Political and regulatory conditions”

“Inflation and interest rates”

Which types of housing do you expect to experience the greatest demand in the next 5 years?

Where do you expect housing demand to grow the most over the next three to five years?

What do you consider to be the most important factors in future housing construction?

How do you expect the development to be in relation to whether Danes will prefer rental or owner-occupied housing in the future?

What do you do as an investor to develop or invest in housing projects that meet the needs of the future?

“Renovation and modernization”

“Focus on special target groups, e.g. seniors“

“Flexibility in use and interior design”

“Focus on location and attractive location”

“Energy optimization and sustainability”

“Focus on community and social framework”

38% expect that more people will prefer rental housing in the future. This is 13 percentage points more than those who answer that more people will prefer owner-occupied housing in the future.

83%

expects the demand for housing to increase the most in Copenhagen, Aarhus, Odense and Aalborg.

The assessment is that low operating costs (35%), flexible interior design (21%) and climate adaptation (20%) are the three most important criteria for future housing construction.

9% expect community-oriented design to be most important in future housing construction.

71% expects that small flats (studios and one-bedroom units) will see the strongest demand over the next five years.

49%

expect senior housing to experience the greatest demand in the next 5 years. This is linked to demographic developments in Denmark, where the average age is rising, the proportion of people aged 80+ is increasing, and there is a shortage of senior housing in many cities.

People continue to move to the cities. The dual urbanization is in full swing, as many people want to live in the largest cities in Denmark, or at least live in the largest or second largest city in the municipality.

The 53% who stated that they invest in properties they do not occupy themselves answered the questions relating to investment and financing..

The 47% who answered ‘no’ were directed to the subsequent questions from a user perspective, for example those concerning space requirements. Do you invest in properties that are not intended for your own occupation?

What is the size of your company?

Where is your company located today?

1%

0%

Are you curious about how the commercial property market is developing locally, or are you looking for concrete data on turnover, rent levels, yield requirements or demographic conditions in connection with a construction project or your next property investment?

CityFact gathers all relevant market data in a single analysis product, covering more than 20 geographical areas. Choose the areas that interest you, and we will make sure to keep you informed about developments in the area.

EDC Erhverv Poul Erik Bech’s Research & Analysis Department prepares tailored analyses for major institutional investors as well as private investors. We have, among others, carried out assignments for PFA, PensionDanmark, PenSam, Coop, COPI Group and Salling Group, including due diligence in relation to investments in, for example, property projects. The assignments include, among other things:

• Commercial Due Diligence

• All relevant aspects of project development

• Acquisition and operation of investment and owner-occupied properties

• Analyses for, for example, solicitors who require data for a housing court case

• Analyses of rent levels and achieved transaction prices

• Analyses of the relationship between supply and demand in larger cities as well as smaller provincial towns

• Analysis of the development of the housing stock by ownership type in specific, clearly defined geographic areas

Joseph Alberti Head of Research

joal@edc.dk +45 5858 7467

Niclas Holm Research Manager

niho@edc.dk +45 5858 8784

EDC Erhverv Poul Erik Bech

Zealand/Funen

Copenhagen +45 5858 8378

Herlev +45 5858 8376

Taastrup +45 5858 8472

Hillerød +45 5858 8377

Roskilde +45 5858 8395

Køge +45 5858 8379

Næstved +45 5858 8380

Slagelse +45 5858 8396

Odense +45 5858 8397

Jutland

Kolding +45 5858 8399

Aabenraa +45 5858 8425

Sønderborg +45 5858 8422

Esbjerg +45 5858 8398

Vejle +45 5858 8423

Aarhus +45 5858 8670

Silkeborg +45 5858 8427

Herning +45 5858 8567

Viborg +45 5858 8424

Aalborg +45 5858 8449

Vendsyssel +45 5858 8487

International +45 5858 8563

Research +45 5858 8564

Agriculture East +45 5858 8574

Agriculture West +45 5858 8683

Project +45 5858 8487

Capital Markets +45 5858 8572

Be the first to be notified when new properties are for sale

We have Denmark’s largest buyer/tenant directory. If you haven’t found the right property yet, let us help you!

Create your personal wish in our nationwide buyer/tenant directory and only get notified when new properties come up for sale or for rent. We screen all properties for you and show you only the properties that match your wishes.