Welcome to issue 15 of IMPACT, our School’s platform for thought leadership and engagement. This edition presents the Business School’s distinctive strengths and how they support business, government and society in addressing real-world challenges. In line with our strategy, the features are grouped under the School’s core themes, making the link between our research and practical outcomes clear and easy to navigate.

We are, at our best, translators of complex, system-level questions into guidance that leaders can use. Our work sits where finance meets climate risk, where platforms meet people, and where policy meets place. Framed by our commitment to discover, transform and thrive, and underpinned by our themes of connect, partner and sustain, this issue spans seven cross-sectoral megatrends: green innovation and climate adaptation, digital platforms and commerce, inclusive and resilient workforces, supply-chain transformation, sustainable finance and governance, entrepreneurship and regional innovation, and shifts in trade policy and global markets. You will find this breadth reflected in the contributions. On climate and finance, Stavros Zenios examines the climate change–sovereign debt “doom loop”, explaining why adaptation is essential yet insufficient without credible fiscal frameworks – you can read more on pages 18 to 19. On the digital economy, Varqa

Shamsi Bahar explores disinformation in influencer marketing and what responsible firms and regulators can do in response, discussed on pages 10 to 12. Our inclusive work and leadership strand includes Pablo Muñoz’s article on helping neurodivergent young adults transition to self-employment, which you will find on pages 8 to 9. Olga Epitropaki and Anders Friis Marstand examines personal impact when leaders’ actions don’t match their words on pages 20 to 21, while Miriam McGowan offers fresh insight into how diversity messaging can unintentionally alienate loyal customers if it’s poorly designed on pages 22 to 23.

In sustainable finance and social infrastructure, Charmele Ayadurai addresses the breaking point many families face when unaffordable childcare traps them in poverty, which you can read on pages 13 to 15. Bill Kallinterakis reminds us through a historical lens that behavioural finance is older than we think, which is featured on pages 24 to 25. Angela Green, meanwhile, reflects on the role of dedicated residential writing retreats in creating space for educational scholarship and supporting staff to publish in teaching, learning and assessment. You can find her contribution on pages 28 to 29. On the policy front, Bernd Brandl examines wage-setting systems with live engagement in Chile, which you can learn about on pages 26

to 27, while on pages 16 to 17 Max Schroeder and Professor Danny McGowan examine how cultural diversity continues to influence Northern Ireland’s housing markets.. Our engagement features underline how we translate ideas into impact. We showcase strategic leadership support for North East SMEs through Smart and Scale, mark the official opening of Waterside by Paul Polman, and reflect on student experiences from international research forums to our Senior Leader Apprenticeship. We also celebrate milestones, including our 60th anniversary activity, the 2025 DBA Conference on sustainability and innovation, recognition in rankings and accreditations, and community events that continue to widen our reach and relevance.

Taken together, the contributions in this issue do three things’ leaders tell us they need: they reduce uncertainty by clarifying mechanisms, they improve choices by offering tested levers, and they connect actions across households, firms and policy so that change is coherent, not piecemeal. That is what we are good at, and that is why it matters. My thanks to every colleague, student, alumnus and partner who has made this edition possible. I hope you find it both useful and inspiring.

Professor Kieran Fernandes Executive Dean, Durham University Business School

Issue 15 / 2025

Credits

The IMPACT Team

Sophie Patterson

Communications Officer

Jade Gourley

Marketing Officer

Stephen Close

Marketing Officer

Paula Lane

Marketing Officer

Charlotte Wareing

Marketing Officer

BlueSky Education

Morton Ward Ltd

Thank you

Thank you to all those who have worked on this issue including faculty, other School staff, students, alumni and business connections.

Contributors

Dr Charmele Ayadurai

Dr Varqa Shamsi Bahar

Professor Bernd Brandl

Sue Boyd

Professor Olga Epitropaki

Dr Sara Eugeni

Professor Kieran Fernandes

Dr Angela Green

Dr Vasileios (Bill) Kallinterakis

Professor Jonathan Kimmitt

Katherine Kirby

Dr Anders Friis Marstand

Omar Bilgin Mawson

Professor Danny McGowan

Dr Miriam McGowan

Professor Pablo Muñoz

Max Schroeder

Marina Sonkina

Oliver Tomlinson

Jamie Weston

Professor Karena Yan

Professor Stavros Zenios

13

Breaking point: unaffordable childcare traps families in poverty and deepens emotional stress

Childcare costs are putting pressure on parents. Dr Charmele Ayadurai shares what urgently needs to change.

18

Modelling the climate changesovereign debt doom loop

Professor Stavros Zenios tests how future climate scenarios could affect the sustainability of sovereign debt.

8

From traits to trade: helping neurodivergent youth transition to self-employment

Professor Pablo Muñoz explains a traits-based tool to help young people unlock their entrepreneurial potential.

16

Housing divides? Multiculturalism and property values

Max Schroeder & Professor Danny McGowan’s research in Northern Ireland on the economic value of diversity.

22

How organisations can show real inclusion that resonates with core customers, from Dr Miriam McGowan

20

Promoting diversity can alienate loyal customers

Leaders who fail to ‘walk the talk’ face emotional and performance setbacks

Dr Anders Friis Marstand & Professor Olga Epitropaki on the toll on leaders who don’t practice what they preach.

06 What we are good at, and why it matters

The Business School’s distinctive strengths, the impact our research has, and what we will do next

08 From traits to trade: helping neurodivergent youth transition to self-employment

The traits-based approach that could support young people with ADHD

10 When disinformation meets influencer marketing: what happens? And what can we do about it?

Avoid getting intertwined with misleading content on social media

13 Breaking point: unaffordable childcare traps families in poverty and deepens emotional stress

How our broken system of social support perpetuates inequality

16 Housing divides? Multiculturalism and property values

What centuries-old patterns of cultural settlement can tell us about the diversity premium

18 Modelling the climate changesovereign debt doom loop

The models to help policymakers transition to a climate resilient future

20 Leaders who fail to ‘walk the talk’ face emotional and performance setbacks

Not aligning our words and our actions can impact us and our performance

22 Promoting diversity can alienate loyal customers

How companies can champion inclusion without pushing others away

24 Investors’ biases: not as new as you think

Why haven’t we learned from centuries of investing mistakes?

26 How research is integrated in policy decisions on labour market reforms

The global impact being made with decision makers and governments

28 Retreat to write: making space for educational scholarship

Our academic writing retreat focused on publishing in teaching and learning

30 Smart and Scale: why strategic leadership is key to SME growth in the North East

Our Smart and Scale Programme’s regional approach to helping founders and managers scale sustainably

32 Exploring new horizons through the Dissertation Abroad programme

The professional, academic and personal benefits Omar Bilgin Mawson found through international study

33 The official opening of The Waterside

Business leader Paul Polman unveils our new state-of-the-art facility in the heart of Durham City

34 Sixty years of worldclass business education, research and impact

Plus the year-long series of events, collaborations and special initiatives we’re hosting to celebrate

35 Durham’s 2025 DBA conference: advancing global research on sustainability and innovation

Our 3rd annual conference bringing together executives, researchers and faculty

36 More than a conference: what we learned in Washington, D.C. Students Marina Sonkina and Oliver Tomlinson share their research at the Carroll Round Conference

38 How Durham’s Senior Leader Apprenticeship is helping professionals lead with confidence

This might be your last chance to join our careerstrengthening SLA programme

40 Celebrating 60 years of the Business School at the House of Commons

We mark our 60th anniversary at the UK Parliament – and launch our new alumni MBA alumni network

42 Recognition round-up

The Business School continues to have a strong performance in major international league tables

Want

We are good at turning complex, systemlevel questions into practical guidance for leaders. Our strengths sit where finance meets climate risk, where platforms meet people, and where policy meets place. They matter because they change decisions, in classrooms, boardrooms and government offices.

Our strategy commits us to discover through rigorous, interdisciplinary research, transform through education that equips responsible leaders, and thrive by fostering an inclusive community. Three cross-cutting themes – connect, partner, and sustain – run through everything we do.

Our distinctive strengths

• Climate finance and risk insight. We model how climate risk transmits into sovereign and corporate finance, informing adaptation choices and financial stability.

• Trusted, human-centred digital platforms. We study disinformation and design choices, so platform markets work fairly for consumers and firms.

• Inclusive, resilient work and leadership

We build evidence on neurodivergent entrepreneurship, hybrid leadership, DEI communication, and scholarly practice that sustains performance and wellbeing.

• Policy design for competitive labour markets. We connect research to wagesetting and reform processes that shape productivity and opportunity.

• Trade, place, and regional prosperity

We analyse how culture, assets and policy interact with markets, and we help SMEs scale through leadership and strategy.

• Supply-chain resilience for turbulent times. We translate research into playbooks for visibility, multi-sourcing and supplier development.

• Sustainable finance and social infrastructure. We surface behavioural roots of markets and make the case for childcare and similar infrastructures as foundations of equitable growth.

Professor Kieran Fernandes, Executive Dean, shares the School’s research strengths, the impact of its projects, and how this issue’s articles contribute to seven crosssectoral megatrends.

Green innovation and climate adaptation

• Modelling the climate change–sovereign debt doom loop – Stavros Zenios.

Shows how climate shocks can trigger debt distress, and why adaptation is necessary yet insufficient without credible fiscal frameworks.

Why it matters: guides debt managers, investors and IFIs on pricing climate risk, sequencing adaptation and protecting fiscal space.

Digital platforms and commerce

• When disinformation meets influencer marketing – Varqa Shamsi Bahar.

Maps the mechanics of influence, misinformation and credibility loss.

Why it matters: improves consumer protection, supports ethical brands and informs proportionate regulation and platform governance.

Inclusive and resilient workforces

• From traits to trade, helping neurodivergent youth transition to self-employment – Pablo Muñoz.

Designs routes from talent to trade for neurodivergent young adults.

Why it matters: widens participation, strengthens local enterprise pipelines and reduces scarring from underemployment.

• Leaders who fail to ‘walk the talk’ face emotional and performance setbacks – Olga Epitropaki and Anders Friis Marstand.

Evidences that leaders who say one thing but do another harm not only their teams but also themselves.

Why it matters: it creates internal conflict and emotional strain, and weakens performance.

• Promoting diversity can alienate loyal customers – Miriam McGowan.

Gives a nuanced account of DEI communication effects.

Why it matters: helps firms design inclusive strategies that attract new audiences without alienating existing ones.

• Retreat to write: making space for educational scholarship – Angela Green. Show a practical model for staff scholarship on teaching, learning and assessment. Why it matters: builds pedagogic excellence, scholarly identity and student outcomes.

Supply chain transformation

• Scaling for success: why strategic leadership is key to SME growth in the North East –editorial synthesis drawing on the School’s work with North East manufacturers and Smart and Scale diagnostics. Sets out practical levers, end-to-end visibility, multi-sourcing and near-shoring where sensible, supplier development, and contractual risk sharing. Why it matters: reduces disruption and working-capital drag, improves service levels and anchors investment locally.

Sustainable finance and governance

• Breaking point: unaffordable childcare traps families in poverty and deepens emotional stress – Charmele Ayadurai. Positions childcare as economic infrastructure. Why it matters: increases labour-market participation, reduces inequality and raises long-run growth potential.

• Investors’ biases: not as new as you think – Bill Kallinterakis. Traces behavioural finance to 1688. Why it matters: strengthens market governance, product design, and risk management by recognising persistent cognitive patterns.

Entrepreneurship and regional innovation

• Scaling for success: why strategic leadership is key to SME growth in the North East –Jonathan Kimmitt and Katherine Kirby. Gives insights from the Smart and Scale programme on leadership, finance readiness, and go-to-market focus. Why it matters: improves survival, exports and quality job creation in the region.

Shifts in trade policy and global markets

• Housing divides? Multiculturalism and property values – Max Schroeder and Danny McGowan. Shows how socio-cultural context and policy shape asset values and opportunity. Why it matters: informs levelling-up choices and spatial investment strategies.

• How research is integrated in policy decisions on labour market reforms – Bernd Brandl. Identifies how evidence enters reform with live engagement in Chile. Why it matters: supports governments to design wage institutions that balance competitiveness, inclusion and stability.

Why this mix matters now

Taken together, these projects do three things that leaders need. They reduce uncertainty by clarifying mechanisms, from climate–debt feedbacks to platform misinformation. They improve choices, by offering tested levers, from supply-chain visibility to leadership behaviours and DEI communication design. They connect levels of action, linking household decisions, firm strategy and national policy, so change is coherent rather than piecemeal.

What we will do next

• Scale the playbooks, convert our strongest findings into short tools, cases and executive modules for managers and policymakers.

• Deepen co-production, extend Smart and Scale diagnostics to supply-chain transformation, and continue our evidence-to-policy work on wage setting and climate finance.

• Invest in people, and expand scholarly development, mentorship and inclusive entrepreneurship pathways, with a focus on underrepresented talent.

Our ambition is practical and measurable: to be recognised for research that informs decisions, education that advances careers, and partnerships that deliver tangible benefits locally and globally. That is what we are good at, and that is why it matters.

Professor Pablo Muñoz,

Professor in Entrepreneurship,

on how a trait-based approach can help neurodivergent young people, particularly those with ADHD, navigate the transition to self-employment.

Why self-employment makes sense for neurodiverse minds

Self-employment is often portrayed as the wild frontier of the job market: uncertain, risky and unstructured. But for many neurodivergent young people, it can feel more like a refuge. A place where the rules are written by the doers, not dictated by the norms. A space to work with your traits, not against them. That’s especially true for young people with ADHD. Traits like impulsivity, novelty-seeking, high energy, and non-linear thinking, typically penalised in school or traditional employment, can become assets in the entrepreneurial world. Research is increasingly clear: ADHD is not just compatible with entrepreneurship; it may actually increase the likelihood of entrepreneurial intention and action. But that doesn’t mean the journey is easy or properly supported.

Why we designed a trait-based tool

Most career support for neurodivergent young adults is built on diagnostic labels that often stigmatise conditions. That’s a problem for two reasons. First, diagnosis is uneven; access, privilege, and systemic bias mean many go undiagnosed. Second, labels don’t say much about how someone works, creates, or decides. ADHD, for example, encompasses a wide spectrum of traits that manifest differently across individuals and contexts.

So, we built a different kind of tool, one that profiles traits, not conditions. It helps young people understand their tendencies around risk, focus, impulsivity, autonomy and creativity. These are traits that research shows are central to entrepreneurial success. It’s not about “are you entrepreneurial?” but how might you build a working life that fits who you are.

Most interventions kick in at university level, which is too late. The focus should be at secondary school. That’s where we focused. For 14–16-year-olds, we use the tool to raise awareness: “this is how you tend to work, think, and act: here’s where that might take you.” For 17–18-year-olds, the focus shifts to planning: “what skills, training, and support do you need to make self-employment viable?”

The aim isn’t to push anyone towards entrepreneurship. It’s to offer a route that aligns with their neurological wiring, especially for those pushed out of conventional jobs, not by choice, but by a system that doesn’t accommodate their ways of being.

ADHD is often celebrated in entrepreneurship circles as a superpower. But that narrative is too simple. As the research shows, ADHD traits can both enable and derail entrepreneurial efforts, depending on the stage, context and support. Take impulsivity. It can spark bold, fast action, great for recognising and seizing opportunities in dynamic environments. But it can also lead to ill-considered ventures or poor resource planning. Hyperactivity fuels the drive to experiment, create, and keep moving, but it can clash with the repetitive, operational demands of running a business.

Researchers highlight that ADHD tends to help with starting a business but can hinder sustaining it. Inattention symptoms are linked to poorer business performance in later stages. That’s why support can’t stop at encouragement, it must include tools for follow-through, scaffolding executive function, and managing energy cycles.

Career advisors are often the first line of support, but they’re rarely equipped to understand or guide Neurodivergent Young Adults (NDYA). Many rely on standardised advice that doesn’t account for traits like hyperfocus, sensory sensitivity, or nontraditional communication styles. Worse, the default focus on qualifications over capabilities means that many NDYA are filtered out of viable options before they even start.

Our tool aims to change that. It offers advisors a common language to talk about traits, not deficits. It helps surface potential, suggest flexible options, and engage NDYA in conversations that centre their strengths and not just their challenges.

This isn’t just good practice. It’s necessary. NDYA often don’t disclose their neurodivergence, fearing stigma or misunderstanding. Whether or not someone has a formal diagnosis, a trait-based approach helps bypass that barrier, enabling more tailored, compassionate support.

What good support looks like Support that works for NDYA transitioning into self-employment needs to include:

• Personalised trait profiles that offer insight into preferred working styles, challenges and strengths.

• Strength-based guidance that reframes impulsivity, hyperfocus and noveltyseeking as strategic assets.

• Mentorship with neurodivergent entrepreneurs who model adaptive strategies and real-world success.

• Tools for structure including executive function support, visual planning tools and flexible pacing.

• Mental health integration, recognising that entrepreneurial stress intersects with neurodivergent vulnerability. ADHD’s entrepreneurial potential is best understood as a spectrum of possibilities, not a binary of gift or curse. The key is contextual fit, and that’s what our tool is designed to reveal.

We’re in the process of developing and piloting our trait-based tool in secondary schools, youth programmes, and with career advisors across the North East of England. Early feedback is promising. We believe this kind of support should be the norm, not the exception. Because if we’re serious about building an inclusive economy, we need to do more than acknowledge difference. We need to build with it in mind, from the traits up.

Scan or click the QR code for more information on Professor Pablo Muñoz and his research interests.

what can we do about it?

Dr Varqa Shamsi Bahar, Assistant Professor in Marketing, on the social media influencers disseminating misleading content and how organisations can engage in due diligence.

Advancements in information and communication technologies, such as social media and artificial intelligence, have brought numerous benefits to our communities. For example, social media can serve as a hub for gathering ‘ground reality’ information during crisis events such as hurricanes. Artificial intelligence can help enhance productivity and inform better decision-making.

However, these same technological advancements, if not used responsibly, can pose problems to our society. One problem is disinformation: a planned campaign to intentionally spread falsehoods, predominantly on social media. Disinformation misleads people and encourages them to engage in anti-social behaviours, such as posting negative or even discriminatory comments that do not align with our inclusive values. As such, disinformation triggers disunity and even riots in our communities. This was evident in the recent civil unrest in Bangladesh and the anti-migrant protests that occurred in the UK. Artificial intelligence can exacerbate the disinformation problem, as it can be used to create deepfake content that makes it challenging for people to distinguish between genuine and fake content.

But what happens when social media influencers, who are considered to be authentic and credible, become protagonists of disinformation? My research suggests that these influencers can motivate people to take risky and even life-threatening actions. For example, a health and wellness influencer orchestrated a campaign to discredit scientific procedures for curing cancer and encouraged their followers to embark on a wellness journey instead. This led some cancer patients to stop chemotherapy and switch to ayurvedic treatments and oxygen therapy, which caused their health to decline further. In another case, a startup founder used social media to mislead investors by intentionally spreading false claims about the technological capability of their products, which increased the share price of the startup. This led to investors, particularly those who weren’t professional investors, losing money. In yet another case, a popular influencer spread conspiracy theories about crisis events, such as 9/11 and Sandy Hook, which promoted public panic, polarisation and even harassment.

Social media influencers who use disinformation can also hurt organisations that collaborate with them.

Social media influencers who use disinformation can also hurt organisations that collaborate with them. The reason is that consumers start to distrust organisations for associating with these influencers. What is even more alarming is that many influencers purchase fake followers to inflate their social media popularity. This means that organisations are spending their finances to promote their brands to people who don’t exist. Thus, bringing into question the legitimacy of influencer marketing.

So, the question is: why are social media influencers using disinformation? One of the primary motives is financial gain. In other words, disinformation is a monetisation scheme. For example, by debunking vaccine information during the COVID-19 pandemic, many influencers sold books, courses and health supplements. Similarly, some influencers focus on ‘end of the world’ narratives to market products such as survival gear and branded merchandise. Importantly, social media monetisation techniques (e.g. YouTube advertisements, affiliate links) offer an important stream of revenue. This may encourage influencers to focus more on topics based on conspiracy theories and adopt an ‘anti’ narrative (e.g. anti-vaccine), as it can attract followers and foster social media engagement, which translates into financial benefits.

The next question is: what can we do about it? Here are five practices for platform owners, organisations and social media users to be more resilient to influencers engaging in disinformation.

1. Transparency in advertising spend: There needs to be more transparency from platform owners about where advertisements will be shown (e.g. specific YouTube channels or videos). This can help organisations avoid inadvertently funding the advertising budget in influencer channels where disinformation persists.

2. Conducting due diligence: Typically, organisations examine whether the brand’s target positioning aligns with the influencer’s identity. They examine the influencer’s popularity (i.e. follower count) and investigate whether the brand’s target consumers would relate to the influencer. However, managers are encouraged to take another equally important step to analyse the influencer’s background, the legitimacy of their narrative and traces of follower bots over time. Managers are also recommended to analyse past influencer posts (e.g. YouTube videos) for indications of misleading content. Such due diligence can ensure organisations aren’t engaging with influencers with questionable intent.

3. Engaging with reliable professionals: Important matters in personal life, such as health and finance, should be discussed with professionals, like doctors and investment experts, rather than relying primarily on influencer recommendations.

4. Independent investigation: Social media users are encouraged to conduct independent research on matters discussed by influencers that are polarised and contested to gain a deeper understanding of different perspectives and have an informed perspective. Fact-checking can play a valuable role in this process.

5. Online courses in disinformation detection: Social media platform owners can offer short courses for users on ways to tackle the disinformation problem and build resilience.

Scan or click the QR code for more information on Dr Varqa Shamsi Bahar and his research interests.

Assistant Professor of Finance Dr Charmele Ayadurai’s report explores how to fix a broken system of social support in the UK.

“I think the working poor is a very real thing... the working poor that are working every hour they can work and they’re still not covering their costs and they’re still not able to have the quality of life that they should be able to have been working full time...”

[childcare provider, female]

According to European data hub Statista, the living standards of UK households has declined substantially in the last five years. In January, 57% were found to have experienced a rise in their cost of living compared to the previous month. Rising prices of essential items, utility bills and rent were all cited as main causes. Similarly troubling findings by the Office of National Statistics recently revealed that overall UK household costs rose by an average of 2.6% in March 2025, compared to the year before.

While difficult for all, the impact of these hikes is felt more keenly in lower income households and communities. Families living on the breadline become trapped when the money coming in stretches less each month. This reality becomes even more difficult when such families have young, pre-school-aged children.

A new report, co-authored alongside Dr Xiaofei Qi of Durham University’s School of Education, colleagues at Newcastle University, and a collective of local social partners across the North East* has revealed that the cost of living crisis has hit this demographic the hardest. Why? It’s not due to unemployment, wilful or otherwise. Instead, a severe lack of suitable, affordable childcare options is inflicting significant strain on families not only financially, but emotionally and socially too.

Childcare Should Not Be A Luxury explores formal and informal childcare provision through the lived experiences of 31 families, carers and childcare providers across the North East, a region already experiencing higher than average levels of disadvantage. Through interviews and investigations, the report exposes how a broken system has trapped families in unsustainable circumstances.

Costs for even the most basic levels of childcare are often too much for a family to afford, regardless of whether they’re in work or not. The price tag also limits the viability of many employment opportunities for parents, many of whom already have limitations on how they could work, such as only being available during the school day.

For parents relying on benefits to help make ends meet, flaws in the system often caused more problems than they solved. Turning down unfeasible work scenarios often risked losing their only means of financial support through sanctions. As one respondent explained:

“Mam didn’t take a job that she was offered… she was offered a cleaning job, expected to go and do a cleaning job at 7:30 in the morning when she had two school-age children and one under three. By herself… She couldn’t pay for the childcare… She got sanctioned. She got her housing benefit took and went into rent arrears and then was potentially going to be evicted.”

Furthermore, the chicken-and-egg set-up of the current system – that parents must already be in work to access any financial childcare support, yet they need the childcare in place to secure employment in the first place – leaves many families in inescapable limbo.

For the families who can meet childcare costs, the report found the impact on household budgets to often be devastating. Every family interviewed reported that childcare consumed a substantial portion of their salary, not simply forcing them to cut back on lifestyle choices or luxuries, but instead to make very difficult decisions between “heating and eating”. Many families in work shared that they’d accessed food banks or made severe cutbacks even to essential spending just to afford it.

There are wider consequences to consider, too. Trapping families in poverty created a rippleeffect of financial hardship, social stagnation and emotional distress that affected not just individual households but entire communities.

Childcare providers are facing their own crisis. Unavoidably low pay (childcare practitioners often earning less than coffee shop workers) was found to drive high staff turnover and create recruitment barriers. Additionally, the report revealed that while many providers sought to support families by running on-site food banks and offering extended support, this often came at their own expense.

Costs for even the most basic levels of childcare are often too much for a family to afford.

While limited support for families is made available by the government, our report found that navigating complex funding schemes like Childcare Choices and Universal Credit caused excessive anxiety and strain. The families most in need of support – those with language barriers, special educational needs or disabilities to consider, or experiencing separation or addiction recovery – were the ones who suffered the most. Beyond financial pressures, our report uncovered a profound impact on wellbeing. Parents juggling limited work around limited care and then navigating life on limited means spoke of a loss of identity as they struggled to find time for themselves beyond work and family stresses. Mothers described experiencing loneliness, isolation and anxiety, and fathers taking on primary caregiver roles due to their partner’s mental health or because they had more flexible employment, often suffered stigma and judgment from society due to outdated gendered expectations. Children also faced significant detriments to their development. Being excluded from early childcare settings meant crucial opportunities for social development and school readiness, which have been in decline in the UK in recent years, were missed. These struggles were also felt keenly by childcare providers who commonly shared frustrations of not being able to help further.

Household costs rose by an average of 2.6% in March 2025 compared to the year before

Our report highlights an undeniable truth: quality childcare offers far more than the opportunity for parents to return to work. It provides an essential foundation for children’s educational success, a means for parents to build a solid foundation for their families’ wellbeing and stability, and the opportunity for their own professional development. In short, good childcare is the difference between families living and families thriving. Our report calls upon government policymakers and societal actors to commit to a complete reinvention of the early years childcare and benefits system, positioning childcare as vital national and regional economic infrastructure.

To accomplish this, our investigation identified four key actions:

• Integrate childcare with economic policy: Recognising that childcare is a vital national and regional economic infrastructure will allow government to better address the ‘chicken-egg’ problem of securing work and childcare, and will help to support a reformation of the benefits system to prioritise workforce participation alongside caring responsibilities. Going further, simplifying overly complex childcare support schemes and eliminating hidden ‘top-up’ costs for consumables like food, nappies and milk can avoid further funding gaps for families.

• Conduct North East-specific research and assessment: Our report is just one step. Developing a comprehensive understanding of local childcare needs, affordability, accessibility and availability will improve existing local authority assessments, build evidence and ultimately enhance provision for children across the board. A collective effort is needed. Academic research to better represent underrepresented populations can form a core part of this, as well as involving wider societal actors to share their views.

• Value childcare beyond workforce participation: The economic arguments for childcare are strong, but our report finds that the value of formal childcare for child development and school readiness is often overlooked. Increased formal childcare hours can improve later educational outcomes, which is of particular benefit to disadvantaged children. By framing childcare provision as a contribution to narrowing educational inequality, we can build a thriving future population and workforce.

• Better support the childcare sector as an employer: Addressing core challenges such as a predominantly female workforce, routinely low pay, limited career progression opportunities and the mental toll these roles can take, can help to reduce high staff turnover, improving care availability and quality as a result.

Childcare policies and programmes should be better organised to support the dual roles of parents as providers and nurturers. Without urgent systemic change, the current childcare crisis will continue perpetuating inequality, limiting opportunities for both parents and children across North East England. For the region to become a true ‘home of opportunity’, accessible, affordable, quality childcare must be recognised as essential infrastructure, not a luxury.

Scan or click the QR code for more information on Dr Charmele Ayadurai and her research interests.

*Durham University, Newcastle University, Northern Health Science Alliance’s Health Equity North, the North East Child Poverty Commission, Ways to Wellness, North East Combined Authority and Disability North.

Centuries-old patterns of cultural settlement in Northern Ireland still shape today’s housing markets. Max Schroeder, Postdoctoral Research Associate, and Professor Danny McGowan share what this reveals about the economic value of diversity.

As migration reshapes the demographics of developed nations, the impact for many families is practical: where to live, work and raise a family. In cities worldwide, neighbourhoods differ sharply in cultural make-up, but does that affect property values? Would you pay more to live in one neighbourhood over the other?

Our research focused on Northern Ireland suggests many homebuyers would. We find that properties in more multicultural areas sell for nearly 10% more than those in more segregated communities – a clear diversity premium.

The link between diversity and house prices is complex. Traditionally, research has suggested that people prefer to live among others like themselves, a concept known as homophily

Greater diversity can, in some cases, lead to lower levels of social cohesion and cooperation, which may reduce a neighbourhood’s desirability.

But there’s another side to the story. Multiculturalism can generate positive

spillovers, exposure to different viewpoints, and improved human capital accumulation and learning in multicultural environments These factors can make diverse areas more attractive to a wider pool of buyers.

To test these competing theories, we study Northern Ireland, a region shaped by centuries of cultural division along religious lines, with clearly defined historic patterns of settlement that still persist today.

Northern Ireland’s cultural geography dates to the Plantation of Ulster in the early 1600s, when Protestant settlers from Britain were placed alongside a predominantly Catholic native population. The colonisation process was uneven and often random, resulting in a patchwork of mixed and segregated areas.

Using data from the 1659 Census of Ireland, we found a striking continuity: areas with a higher share of British settlers back then still have a higher Protestant population today. This long-run cultural persistence created a natural experiment, allowing us to isolate the effect of multiculturalism itself, rather than other social or economic factors, on modern house prices.

Share British Population 1659

Share Protestant Population 2021

We used contemporary property sales data (2021–2025) alongside statistical techniques to determine the causal impact of cultural diversity on house prices. The result: homes in more multicultural neighbourhoods sell for approximately 10% more than those in culturally segregated areas. Why? Diverse neighbourhoods appeal to a broader set of potential buyers, making properties easier to sell and reducing investment risk.

Could this premium be driven by discriminatory pricing or intra-cultural buyer preferences? Many studies find that sellers are often willing to give a considerable discount to potential buyers from a similar ethnic or cultural background. To explore this, we analysed property title deeds to identify the cultural backgrounds of buyers and sellers, and looked at pricing patterns in both intra- and inter-cultural transactions. We found no evidence of discriminatory pricing. In fact, intercultural transactions are more common in diverse areas, reinforcing the idea that multicultural neighbourhoods appeal to both Protestant and Catholic buyers alike. The multicultural premium, in this case, reflects greater demand from across the cultural divide – not bias.

While the findings paint a positive picture of integration in Northern Ireland, they also raise concerns for economic and social inequality. If multicultural areas command higher prices, homeowners in these areas benefit disproportionately from rising property values, while others may be priced out. This might be particularly problematic since more affluent areas are often better connected to jobs, education and services. Exclusion from these spaces can limit social mobility and foster new forms of segregation.

There’s also a positive side. The attractiveness of multicultural areas suggests it can be a powerful policy tool. Targeted investments in promoting diversity, through schools, community projects or urban planning, could revitalise underserved areas and reduce inequality.

Scan or click the QR code for more information on Max Schroeder and his research interests.

Scan or click the QR code for more information on Professor Danny McGowan and his research interests.

ICould a move to a climate resilient future lead to financial crisis? Professor of Operations Management and Finance, Professor Stavros Zenios, explains the models that could help policymakers with a rocky transition.

magine a world where rising temperatures don’t just threaten ecosystems, but also the financial credibility of nations. For many countries, climate change is no longer a distant environmental risk; it’s a potential fiscal crisis. Slower economic growth and increased frequency of natural disasters can strain revenue and expenditure, leading to raised government borrowing costs in response to these risks, creating a doom loop where climate shocks and debt distress reinforce each other. To understand and prepare for this emerging threat, we’ve built models that combine insights from climate science, economics and public finance. Working with colleagues from climate economics, we’ve developed a model for testing how future climate scenarios could affect the sustainability of sovereign debt.

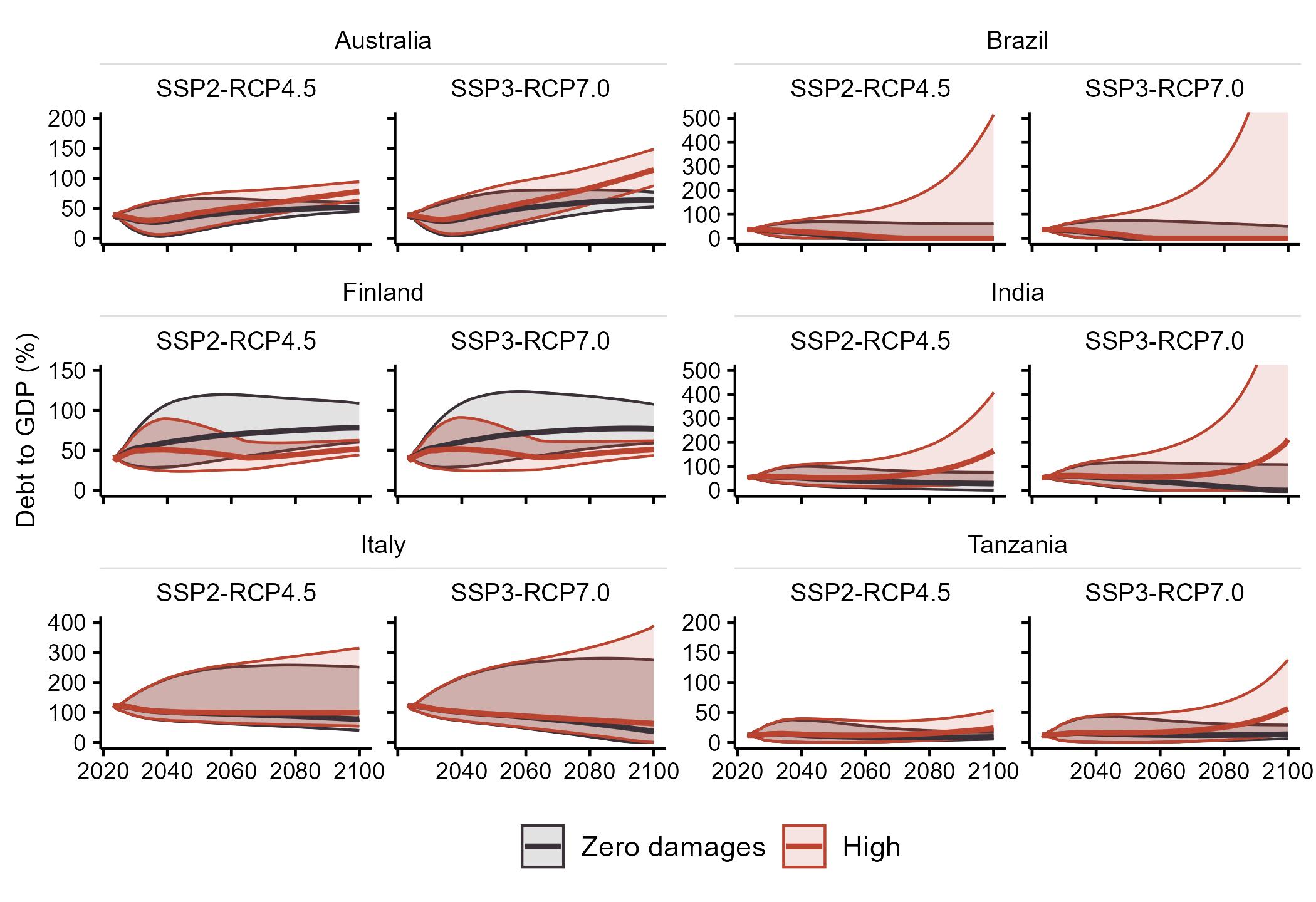

Figure 1 displays the steps of our approach. We take a model-based, data-driven multidisciplinary view to link narrative scenarios of coupled climate–economy models in the tradition of Nobel laureate William Nordhaus with debt sustainability analysis (DSA). The narrative scenarios of climate trajectories provide the basis to calibrate scenario trees of economic, fiscal and financial determinants of debt. A large-scale optimisation model trades off debt financing costs with refinancing tail risk to project future debt trajectories and assess sustainability with a high confidence level. The interlinked models translate climate science into a credible sovereign risk metric for policymakers.

The road has been challenging, but is starting to produce results.

In one project, we’ve linked a state-of-the-art climate model (RICE50+ of Gazzotti at al. 2021) with different damage functions from a large literature to study climate effects on debt and potential benefits from adaptation strategies. We stress-test sovereign debts under combinations of ‘shared socioeconomic pathways’ (SSPs) and ‘representative concentration pathways’ (RCPs), which describe future greenhouse gas emission trends, and based on different assumptions about how rising emissions will affect economic growth. Two possible future pathways from the IPCC are known as SSP2-RCP4.5 and SSP3-RCP7.0. The former assumes that socioeconomic trends will follow historical patterns and that the impact of greenhouse gas emissions will be moderate. The latter assumes that there will be international fragmentation, as observed in current geopolitical conflicts, combined with relatively high greenhouse gas emissions, leading to a median temperature rise of up to about 3.4 degrees Celsius by 2100. Coupling RICE50+ with DSA, we project debt growth for several countries. Figure 2 illustrates results for different climate narratives.

Starting from these results, we can carry out very rich analysis to answer questions with policy implications:

1. Are the projected debts sustainable? If not, what kind of fiscal adjustments are needed to avoid debt crises?

2. Can investments in adaptation mitigate the projected debt increases? If yes, how much of the investment can be publicly funded before the costs overtake the benefits?

3. Can governments maintain a constant level of public spending while maintaining sustainable debts in the long run?

The answers aren’t simple, but they are actionable. For example, we found that adaptation can have beneficial effects, but governments can only finance about 1/3 of the total cost and break even. The private sector has to carry the rest. Further detailed analysis can be found in a working paper published by the Bruegel think tank in Brussels (Calcatera et al. 2025).

This kind of integrated modelling helps policymakers grapple with a fundamental challenge: how to manage the transition to a climate resilient future without triggering a financial crisis along the way. The ice beneath sovereign finances is getting thinner. We need to move carefully and decisively before it cracks.

Scan or click the QR code for more information on Professor Stavros Zenios and his research interests.

Scan or click the QR code to read the Nature Communications article on this research.

Scan or click the QR code to download the working paper on this research.

Dr Anders Friis Marstand and Professor Olga Epitropaki explore how leaders’ failure to align words with actions not only affects their teams but also takes a profound emotional and performance toll on leaders themselves.

We’ve all heard the saying ‘practice what you preach’. It’s advice as relevant in the boardroom as in everyday life. Yet even the most well-intentioned leaders sometimes fall short. A CEO promises transparency, but withholds key information. A manager pledges flexible working, then rewards those who are always at their desks. A team leader vows to protect workloads, yet keeps adding priorities.

When these gaps between words and actions occur, attention usually turns to the fallout for employees – loss of trust, declining morale, and falling performance. Less often discussed is the toll such inconsistency takes on leaders. This was the focus of our recent research.

In our recently published work, we found that when leaders fail to live up to their stated values or commitments, what we call ‘word–action misalignment’, they often experience shame. This emotion can prompt withdrawal, avoidance of colleagues, and poorer performance, which over time can spiral into a self-reinforcing cycle of disengagement.

In the experiment, participants indicated many instances where they’d failed to deliver on promises to their staff. These included promising pay rises but not delivering, telling employees they could have time off before revoking it, and promises about recruiting new staff to alleviate workload but never doing so, resulting in higher shame.

Our other experimental tasks and field study showed the same pattern: even when misalignment was minor or inadvertent, the emotional reaction could be outsized. Together, these findings indicate the personal cost of failing to ‘walk the talk’ isn’t merely momentary embarrassment; it reshapes leaders’ daily engagement and influences performance.

Leadership research has typically examined misalignment from the outside in: how it undermines credibility, weakens team cohesion, or harms organisational reputation. We wanted to reverse that lens and explore what happens within leaders when their actions don’t match their intentions.

We carried out three studies with more than 800 managers from different sectors. These included real-world recollections, where leaders

described occasions when they’d fallen short, and experimental tasks simulating such scenarios.

Leaders told us that after recognising a misalignment, they often avoided conversations, kept a lower profile, and became less engaged. This behaviour rarely stayed confined to the original incident; it spilled into other tasks and relationships, further undermining effectiveness.

Shame differs from guilt in a crucial way. Guilt is tied to a specific action: “I did something wrong.” Shame is a judgement of the self: “I am inadequate.” For leaders, this is corrosive.

Rather than motivating corrective action, shame tends to prompt avoidance. Leaders might retreat from their teams, delay difficult conversations, or disengage from key projects. Those with low confidence in their ability to influence outcomes are particularly vulnerable; withdrawal becomes entrenched, reduced engagement lowers performance, and the cycle repeats.

This has obvious consequences. Leaders cannot inspire or guide teams if they’re mentally and emotionally pulling away.

A consistent pattern we observed was the importance of perceived control. Leaders who felt they had autonomy and influence were better able to interrupt the shame–avoidance cycle. When leaders can act decisively and take ownership, they’re likelier to address misalignments promptly and constructively.

In fast-changing environments, misalignment is often caused by factors beyond a leader’s control – shifting priorities, organisational changes, or resource limits. Without sufficient autonomy, leaders can feel powerless to fix problems, which deepens shame. Structures that give leaders meaningful decision-making authority can reduce both the frequency of misalignment and its emotional cost.

Our findings point to the need for organisations to support leaders in managing the emotional fallout of misalignment. Development programmes that build emotional intelligence, resilience and self-awareness can help.

Resilience training aids recovery from setbacks. Coaching and mentoring give space for reflection, helping leaders process shame constructively. Reviewing job design to ensure control over key decisions can prevent the powerlessness that often follows misalignment.

Equally important is a culture where acknowledging missteps isn’t seen as weakness. When leaders can speak openly about constraints, they’re more likely to confront problems rather than avoid them.

These insights should prompt leaders and organisations to rethink ‘walking the talk’. Misalignment will happen; leaders are human. The critical question is how leaders respond, and whether organisations provide the resources to help them recover.

For leaders, cultivating self-awareness matters. Recognising the signs of shame and its behavioural impact can help break the cycle before it damages performance and relationships. For organisations, the focus should be on creating structures and cultures that support rather than punish leaders in these moments.

Alignment between words and actions isn’t just about team trust or reputation – it’s central to leaders’ wellbeing and effectiveness. Leaders who receive self-awareness tools, organisational support and real decisionmaking freedom are better placed to re-engage, rebuild trust, and lead authentically.

Scan or click the QR code for more information on Dr Anders Friis Marstand and his research interests.

Scan or click the QR code for more information on Professor Olga Epitropaki and her research interests.

iversity and inclusion have become standard features of modern brand communication. From Pridethemed packaging to campaigns around gender equity or racial justice, many companies now treat social values as central to their public identity.

But as brands work to align themselves with wider cultural shifts, a difficult question has emerged: could efforts to include some audiences inadvertently push others away?

This question is especially relevant in today’s polarised climate. While some customers have always viewed certain styles of brand activism as performative rather than progressive, political shifts such as US President Donald Trump’s actions to downgrade or eradicate DEI from corporate identity has made any stance taken by brands a target for political critique. Businesses are being pulled in two directions, under pressure to demonstrate inclusive values while also trying to avoid alienating parts of their customer base.

This tension was the focus of a recent research project I conducted with Dr Louise Hassan (University of Birmingham) and Professor Edward Shiu (Bangor University). Our work sought to understand why some diversity campaigns resonate with audiences, while others provoke backlash, mistrust, or even boycotts.

When good intentions miss the mark Across ten experimental studies, we consistently found that diversity efforts can backfire when customers/audiences feel they are out of sync with a brand’s existing identity. Customers don’t necessarily object to the message itself, but rather the way it’s delivered, or who it seems to be aimed at.

When brands launch long-term diversity initiatives that don’t reflect their existing audience or established values, those campaigns can be perceived as disingenuous or opportunistic.

This perceived mismatch often leads customers to feel excluded or overlooked. For example, if a heritage lifestyle brand with a loyal, traditionally-minded audience suddenly pivots to a bold campaign without context or continuity, the change may feel jarring. Even customers who support the social issue in principle may object to the campaign.

This reaction isn’t just about the message, but what it signals about identity. Customers often view the brands they engage with as forming part of their own self-image. When those brands appear to shift direction abruptly, it can feel like a personal disconnect, almost a betrayal. Continuing to use the brand would threaten customers’ identity.

So how can companies engage meaningfully in diversity work without risking the loyalty of their core customers?

One solution is structural. Creating sub-brands or standalone product lines allows organisations to support specific communities without disrupting the identity of the parent brand. A cosmetics company, for example, might launch a gender-inclusive beauty range under a separate label. This approach can expand reach without undermining established customer relationships.

Another useful tactic is customisation. When customers can customise the product to better reflect their own identity and preferences, they tend to feel represented without others feeling excluded. Crucially, this doesn’t require bold public statements; it quietly signals that everyone is welcome.

A third strategy is consistency. Brands that demonstrate long-term commitment to a cause, rather than short bursts of activity around awareness days, are perceived as more authentic. This might mean forming partnerships with relevant organisations, setting clear goals, and tracking progress over time.

It’s also important to consider the nature of the customer relationship. In sectors where purchases are primarily functional or pricedriven, such as utilities, insurance or fast fashion, heavy social positioning may feel misplaced, and customers respond more negatively to long-term initiatives. In contrast, brands in lifestyle, beauty or fashion often trade on emotion and identity, which makes them better suited to long-term values-based marketing.

None of this suggests brands should step away from social responsibility. In fact, our research reinforces the idea that companies can and should play a role in promoting inclusion.

But to do it well requires alignment. Not every brand needs to weigh in on every issue. The most effective campaigns are those that match a brand’s history, voice and audience. Diversity messaging should grow from within the brand, rather than being tacked on for visibility, or simply enacted as a way to be seen favourably or enhance profitability. Authenticity is key, as is understanding the existing customer base.

At a time when consumer trust is fragile, the way companies engage with inclusion matters more than ever. Those who get it right, thoughtfully, sincerely, and with a clear sense of purpose, can deepen loyalty and build broader communities. Those who get it wrong risk pushing people away, not because of what they stand for, but because of how they choose to say it.

Scan or click the QR code for more information on Dr Miriam McGowan and her research interests.

Professor in Finance

‘Bill’ Kallinterakis discusses the surprising historical roots of behavioural finance and why we haven’t learned from centuries of investing mistakes.

he technological advances in investing during the past few decades have been truly phenomenal. From the early days of online trading in the 1990s to modern-day AI trading bots, the world has witnessed a growing sophistication in the tools available to investors that has rendered trading easier than ever. Easier, however, need not necessarily imply error-free. Modern-day investors project biases in their decisions, amplifying irrationality in trading dynamics, which culminates in the onset of spectacular episodes (from the cryptocurrency-hype to meme stock frenzies). Every time such an episode unfolds, the media are eager to lament it as a reflection of investors’ irrational exuberance or animal instincts; the popular finance literature further fuels this narrative with sensational stories, while the finance self-help literature aims for a more ‘popularised’ presentation of the psychological reasons prompting these trading behaviours. In the end, human irrationality is blamed and the investment losses from those episodes are viewed as a lesson to deter the repetition of such behaviour in the future. Except, financial history has little evidence to show in favour of such deterrence. Alas, from the earliest capital markets to the modernday ones, the world keeps bearing witness to financial episodes that create immense publicity and generate formidable losses. These episodes never seem to abate, therefore casting doubt over whether the losses suffered by investors ever produced a learning effect of any significance. This suggests that we repeat our mistakes not simply because of irrationality per se (after all, errors in judgement are part and parcel of human nature), but also because we don’t learn from them.

The fact that the same biased trading patterns are observed over three centuries shows that we’re not as evolved as we think.

Although failures in learning would be expected to eventually diminish over time (repetition of an error should, in theory, grant some measure of learning to those committing it), this doesn’t seem to be the case in financial history. Perhaps no other book exemplifies this better than Confusion of Confusions. Written in 1688 by the Sephardi merchant Joseph de la Vega, it provides a description of investment life in the 17th-century Amsterdam stock exchange, showcasing that investors’ trades projected behavioural biases (e.g. herding, loss-aversion, sentiment trading) that were first systemised and studied by behavioural finance researchers in the last quarter of the 20th century. Although this qualifies Confusion of Confusions as the first-ever behavioural finance treatise, a scholarly review of Vega’s book demonstrates this never really took place.

My book, Dawn of Behavioural Finance, 1688, addresses this by performing an analysis of Vega’s book based on the behavioural finance paradigm. Presenting a critical discussion of several concepts from the behavioural finance literature evident in Confusion of Confusions, I demonstrate for the first time that behavioural finance needs to be backdated to the 17th century, and that Vega constitutes its precursor. The fact that Dutch investors in the 1680s are shown by Vega to be subject to the very same biases in their trades as 21st century ones implies that behavioural forces in investment decisions are truly unremarkable; at the very least, it confirms that ‘nothing is new under the sun’. Further, the fact that the same biased trading patterns are observed over three centuries shows that we’re not as evolved as we think.

This suggests the need for educating investors on how to engage with their mistakes.

One possibility is that we fail to learn from our mistakes due to biases distorting the updating of our beliefs/self-assessment; overconfidence, for example, makes us attribute our failures to others. Sometimes, we repeat mistakes because we forget when we first made them (if they took place a very long time ago), or because we believe that ‘this time it is different’; social influence can also motivate us to repeat past mistakes (due to conformity with social norms, or fear of missing out). We’re unlikely to learn from past mistakes if they were committed by others (the pain of loss is theirs, not ours). In addition, we fail to learn because we may not be bothered to; after all, learning involves effort (e.g. in terms of time and thinking cost) – and this may lead the cost of effort to exceed the expected benefit.

The fact that the mistakes investors make in the 2020s were documented by Vega in the 1680s demonstrates the need for a shift in the behavioural finance debate. What good is it arguing that a bias exists in one’s behaviour, when the same bias was recorded over 300 years ago? To the extent that we keep reproducing the same mistakes over the centuries, this suggests the need for educating investors on how to engage with their mistakes, by demonstrating to investors that errors are normal, and help them discover/experiment with different ways to learn from them. Only by doing so can we effectively move from a culture of regret (keen on identifying judgementerrors) to a culture of change (proposing tools on how to learn from those errors).

Scan or click the QR code for more information on Dr Vasileios ‘Bill’ Kallinterakis and his research interests.

Scan or click the QR code to purchase Bill’s book, Dawn of Behavioural Finance, 1688.

Professor Bernd Brandl shares how his research is being used by decision makers in organisations and governments around the world.

The framework within which employees and employers operate is fundamental to the success of companies, industries and entire economies. Some of these framework conditions, such as the current global challenges from the economic and political crises, are largely given to companies, employees and policymakers, but others can be influenced and shaped to enable improvements. Such changeable framework conditions also include the legal and organisational regulations concerning the labour market. These include, among other things, regulations regarding wages and working conditions, as these not only strongly influence the life of workers but also have a direct impact on the success, i.e. the productivity and competitiveness, of companies, industries and economies.

Given that labour market regulations and labour market policy measures can be changed and controlled, research is needed to ensure that the right and best regulations are designed.

Rigorous academic research and advice is of fundamental importance in order to prevail in political and media discussions.

I’ve been working for more than two decades on the topic of defining and shaping labour market frameworks, such as in particular collective bargaining systems to optimise the interests of both employees and employers equally. This research includes, for example, how the interaction between management and employees should be structured and organised so that wages and working conditions can be best set. Specifically, how should wages and working conditions be regulated (or not) so that companies can prosper and increase their competitiveness, and employees are fairly compensated for their efforts and performance. My research also includes how labour market frameworks should be designed to increase the productivity of companies and make them technological innovators via vocational training and upskilling programmes. My research is therefore of practical relevance and attracts the interest of companies as well as of policymakers, including governments around the world and international organisations such as the International Labour Organization (ILO), the United Nations (UN), the European Commission (EC), and the Organisation for Economic Co-operation and Development (OECD).

I’ve been working for more than two decades on the topic of defining and shaping labour market frameworks.

For this reason, I’m frequently consulted and invited by policymakers and governments when labour market reforms are being implemented in countries around the world. Past invitations to high-level policymakers’ meetings were in context of the implementation or revocation of policies suggested by the Troika in some European countries after the economic crisis of 2008 and 2009, as well as on the design and implementation of various European Union (EU) directives and policy strategies in the past and recently on the EU Minimum Wage Directive. Recently, I participated in highly policy-relevant meetings and discussions with the ILO and representatives of the Chilean government and administration on a labour market reform that’s centred by a reform of collective bargaining and the system of how trade unions and employers are organised in Chile. With the aim to increase the competitiveness of the Chilean economy, promote more order, and create an innovationdriven economy, I based my advice not only on a research project that was targeted on the specific Chilean context but also on my past research.

Since I’ve been involved in such highly impactful research and policymaking for two decades, I was also able to publish a paper on the relationship between academic research and how it translates into impactful reforms. Specifically, in my article ‘Everything we do know (and don’t know) about collective bargaining’, I analysed and historically described the ‘Zeitgeist’ and changes in the policy-relevant debate on reforms to collective wage systems in recent decades. In the article I describe that despite clear scientific evidence, the advice isn’t being taken up by political decision-makers. As we all know from similar debates on the role of scientific evidence, the reasons for that are manyfold and also complex.

Against this backdrop, it’s particularly interesting that the recent reform strategy of the Chilean government, as well as in other parts of the world such as recently in Australia, is guided by latest and detailed scientific evidence and advice. However, this scientific evidence suggests a change in the global trend on labour market reforms that was characteristic in the past two decades but a change in the global trend is becoming apparent. In this sense, the Chilean government is certainly doing pioneering work, but is encountering resistance that is immanent to institutional and organisational change in general. In fact, the ‘Zeitgeist’ shifts often very slowly and therefore rigorous academic research and advice is of fundamental importance in order to prevail in political and media discussions that come along.

Scan or click the QR code for more information on Professor Bernd Brandl and his research interests.

Academic writing retreats are growing in popularity and are designed to help boost publication outputs. These professional development events often take place off-campus and provide a supportive environment for focused academic writing. At the Business School, we hosted our inaugural two-day residential writing retreat, focusing on publishing in the field of teaching and learning.

The Teaching Excellence Framework (TEF) encourages educators to continually evaluate and refine their teaching practices to ensure they’re effective, while requiring academic institutions to demonstrate how teaching contributes to positive student outcomes. Quality assurance processes, such as those of the Association to Advance Collegiate Schools of Business (AACSB) and the European Quality Improvement System (EQUIS), also require institutions to demonstrate reflective practice in teaching and learning. However, pedagogical research can be marginalised compared to discipline-specific research.

Writing retreats can help by offering protected time for focused work.

Dr Angela Green, Deputy Associate

Dean,

Educational Enhancement, on the School’s inaugural writing retreat centred on publishing in the field of teaching and learning.

As a progressive business school, we wanted to create a writing retreat centred on the scholarship of teaching and learning, and to formally recognise its academic legitimacy.

The School also aims to further promote a culture of inquiry into teaching, where pedagogical decisions are grounded in systematic reflection and evidence, not just intuition or precedent. In addition, we’re committed to supporting staff with their continuous professional development, particularly those undertaking HEA Fellowships (Advance HE), where individuals must reflect on classroom delivery and demonstrate how their teaching aligns with the UK Professional Standards Framework (UKPSF). Academics lead busy lives, balancing teaching, marking, research, tutoring, and taking on administration and citizenship roles. This makes it difficult to find uninterrupted time to write. Writing retreats can help by offering protected time for focused work. Off-campus retreats, in particular, remove staff from everyday distractions and allow for deep concentration; it’s this focused time that results in greater productivity.

Being mindful of financial constraints, the School utilised the fantastic resources in the University and booked Collingwood College, which provided a comfortable and practical space for our work.

Our retreat was facilitated by Professors Sally Brown and Kay Sambell, both internationally renowned for their publications in teaching and learning, and for their experience leading writing retreats. The retreat covered a variety of topics, including writing for different formats (journals, blogs, magazines, and books); understanding the editorial process from an editor’s perspective; dealing with negative reviewer feedback; linking publications to conference presentations and posters; and crafting an effective abstract. This was naturally interspersed with periods of guided individual writing.

Participants were initially asked to write 30 words, but this incrementally progressed over the two days, with most participants leaving with a well-crafted outline for a paper, and having written at least 2,000 words. There was also time for some bespoke one-to-one tutorials. At the end of each session, participants reflected on their progress and created action plans to support this.

Some have questioned the necessity of a ‘residential’ retreat. Beyond providing staff with a break from their usual responsibilities, it played a crucial role in fostering a sense of community among staff. Engaging in shared activities, such as working, socialising and dining together, helped strengthen collegial networks and alleviate feelings of isolation. This sense of connectedness is vital for establishing support systems that continue long after the retreat. While participants were initially hesitant to share their writing, this practice had evolved into a valued and encouraging experience.

Reflecting on their experience at the retreat, one participant said, “I found the ‘hands-on’ approach really helpful – it forced me to write, rather than just contemplate writing something!”

Another participant who was relatively new to the idea of publishing in the area of teaching and learning said: “I was pleasantly surprised by how accessible and impactful publishing about teaching and learning can be. I had previously assumed it required a very formal or technical approach, but the retreat highlighted that reflective and practice-based contributions are not only welcomed but in demand.”

These reflections help to illustrate the value of writing retreats in building confidence and capacity in pedagogical scholarship.

Our plan is to meet again soon to support one another, sustain writing momentum, and measure our progress. While it’ll take time to see how many publications are ultimately generated, and their impact, early indications are very positive.

Scan or click the QR code for more information on Dr Angela Green and her research interests.

I found the ‘hands-on’ approach really helpful – it forced me to write, rather than just contemplate writing something!

Scaling a business is often seen as the logical next step after early success, but for many small and mediumsized enterprises (SMEs), it’s also where things get difficult. In the North East, where entrepreneurial resilience is strong, moving from small to scaling is a critical and often underestimated leap.

What separates the SMEs that achieve sustained growth from those that plateau?

It’s rarely effort or enthusiasm. More often, it comes down to leadership.

Why growth demands a new kind of leadership

In the startup phase, founders thrive by being hands-on and proactive. But as businesses grow, those same habits can become limiting. Scaling requires a shift: from doing everything, to building the systems, people and vision for long-term growth.

“We often see leaders caught between the urgency of today and the demands of tomorrow,” says Dr Jonathan Kimmitt, entrepreneurship expert at the Business School. “The challenge isn’t just doing more, it’s thinking differently.”

In the North East, where SMEs face added pressure around resources and market access, the need for strategic leadership support is even more urgent. Yet, much of the help available still focuses on operations, not mindset or strategic capability.

The Smart and Scale programme continues to grow its network of ambitious SME leaders across the North East.

That’s where our Smart and Scale programme comes in.

Developed by the School, the programme is tailored to help ambitious SME founders and managers strengthen their leadership and scale sustainably.

Blending academic insight with realworld relevance, the programme offers peer learning, expert-led workshops, and one-toone mentoring – all grounded in the realities of leading through growth and change.

“I thought it was really well delivered with some excellent speakers and a great chance to network across the wider North East business community,” said one participant. “It was refreshing to see a focus on the human element of business and the importance of looking after the mental health and wellbeing of yourself and your people.”

But this is just the beginning.

The most recent masterclass took place in early September at Sheepfolds in Sunderland, a venue that captures the spirit of the region’s entrepreneurial ecosystem. Over two days, participants explored topics such as:

• Navigating leadership identity and overcoming impostorism

• Leading teams with authenticity and impact

• Building resilience and recognising opportunity in uncertain environments.

Working alongside Durham faculty and experienced entrepreneurs, attendees engaged in practical sessions designed to challenge their thinking, expand their networks and build the strategic mindset needed for sustainable growth.

The Smart and Scale programme continues to grow its network of ambitious SME leaders across the North East. With each cohort, the programme strengthens the region’s leadership pipeline and supports businesses in making the leap from small to scaling.

“If we want to see long-term growth in the region, we have to invest in leadership, not just infrastructure or technology,” says Katherine Kirby, Senior Business Development Manager. “That’s why Smart and Scale matters.”

Scan or click the QR code to find out more or register interest in future masterclasses.

AMSc Management student Omar Bilgin Mawson reflects on the professional, academic and personal benefits of his international experience.

s part of my MSc Management course, I had the opportunity to complete the Dissertation Abroad programme at WHU – Otto Beisheim School of Management in Vallendar, Germany. My initial expectation was that it would be an excellent opportunity to work alongside academics at one of the world’s leading business schools. As someone pursuing an international strategy consulting career, I also saw this as a chance to try living abroad independently and challenge myself in preparation for my future goals.

I found that the Dissertation Abroad programme enhanced my overall Masters experience to an unprecedented degree. I was surrounded by people with strong research expertise, and I was able to develop my academic skills and apply them to my dissertation. The connections I established also contributed to my professional growth, as WHU has strong links to leading consulting firms and thought pioneers in several different fields. Experiencing working alongside colleagues from different cultural backgrounds was also effective at enhancing my global business perspective, essential for a career in consultancy.

There are many things I took away from the Dissertation Abroad, but the most invaluable asset has been enhancing my employability.