DOWNTOWN LA MARKET REPORT

Founded in 1998, the DTLA Alliance has been a catalyst in Downtown Los Angeles’ transformation into a vibrant 24/7 mixed-use destination for over 25 years. A coalition of more than 2,000 property owners in the Downtown Center, the DTLA Alliance is committed to enhancing the quality of life in Downtown LA.

The mission of the Economic Development team is to ensure that DTLA remains the premier choice for office, residential, hospitality, retail, and cultural investment. We provide services to support and promote investment and development in DTLA, including:

• Market & Research Reports

• Tours & Events

• Development Consulting

• Requests for Information

• Press & Media Inquiries

Whether you need information on construction and development, insights on the DTLA market, finding a location for your business, or you just want to learn more about Downtown’s market sectors and dynamics, we are your best source for information about DTLA

To learn more about the Downtown LA and the DTLA Alliance, visit DowntownLA.com

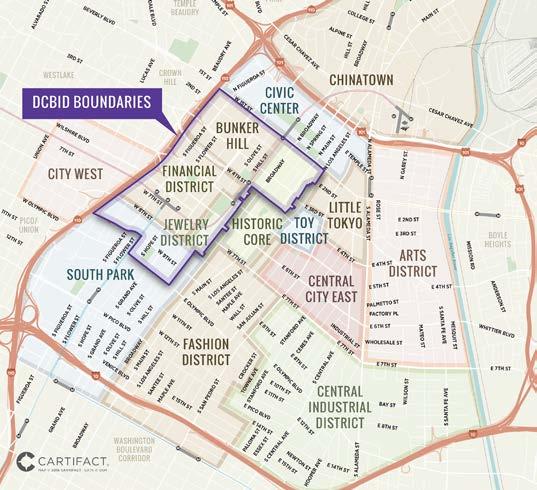

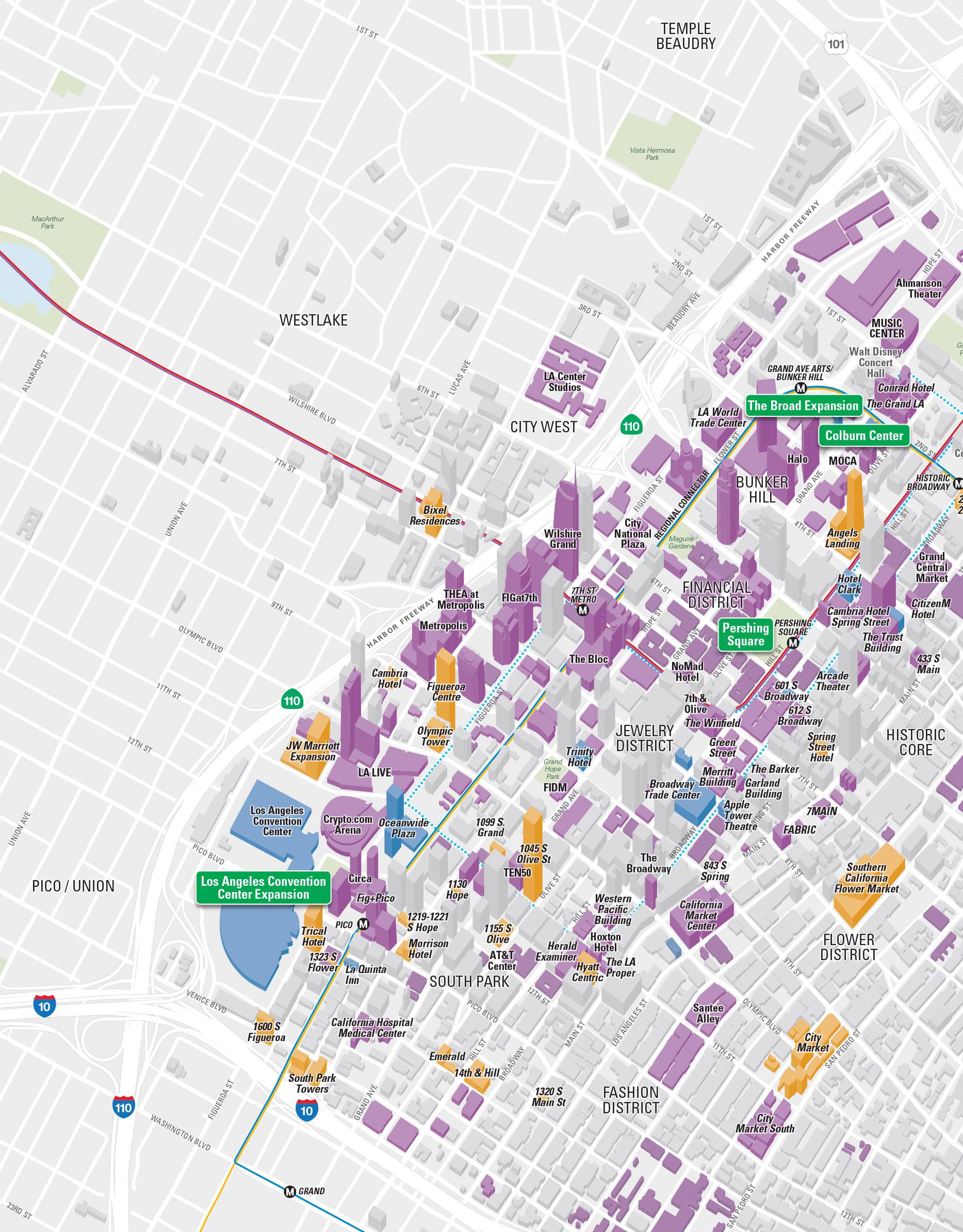

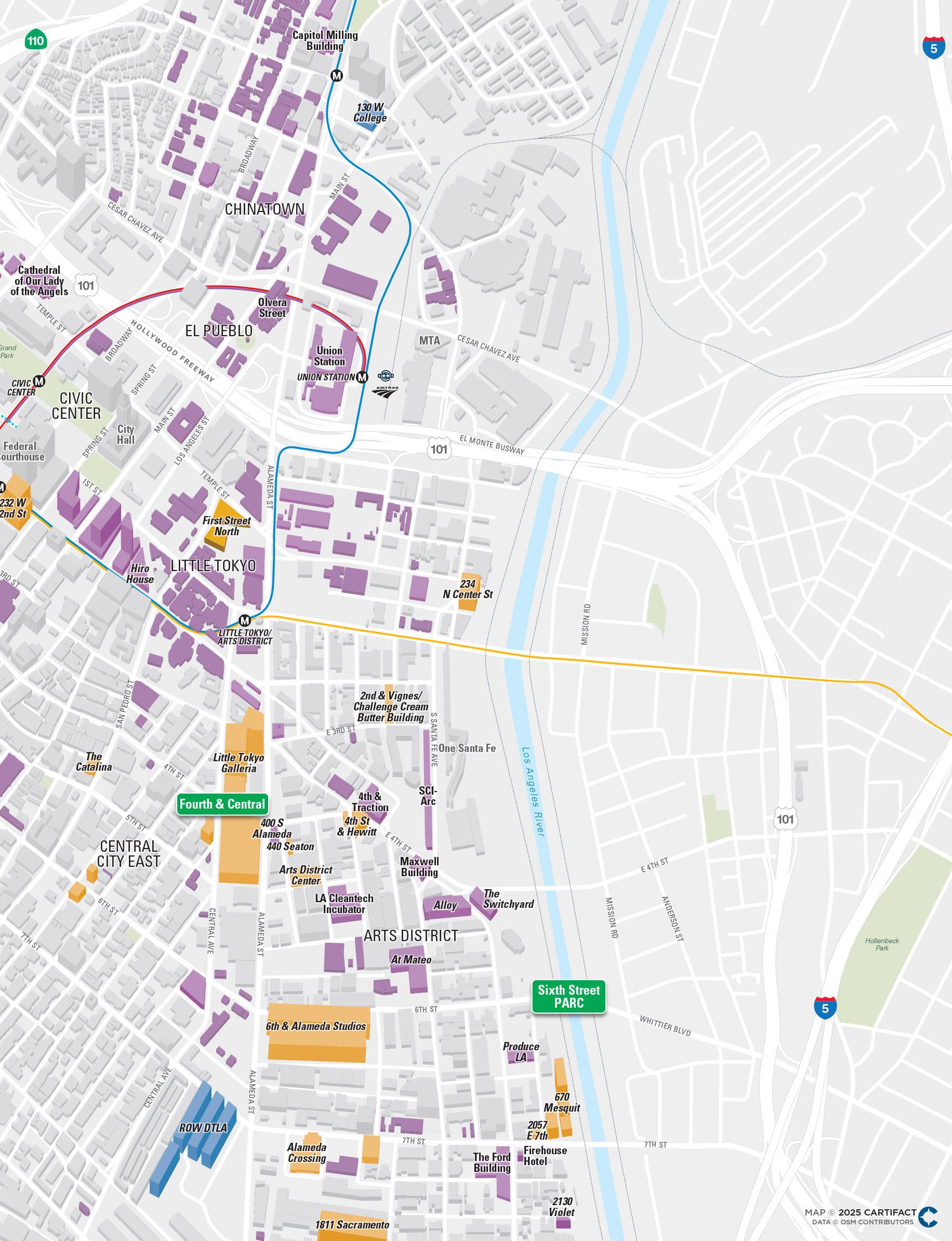

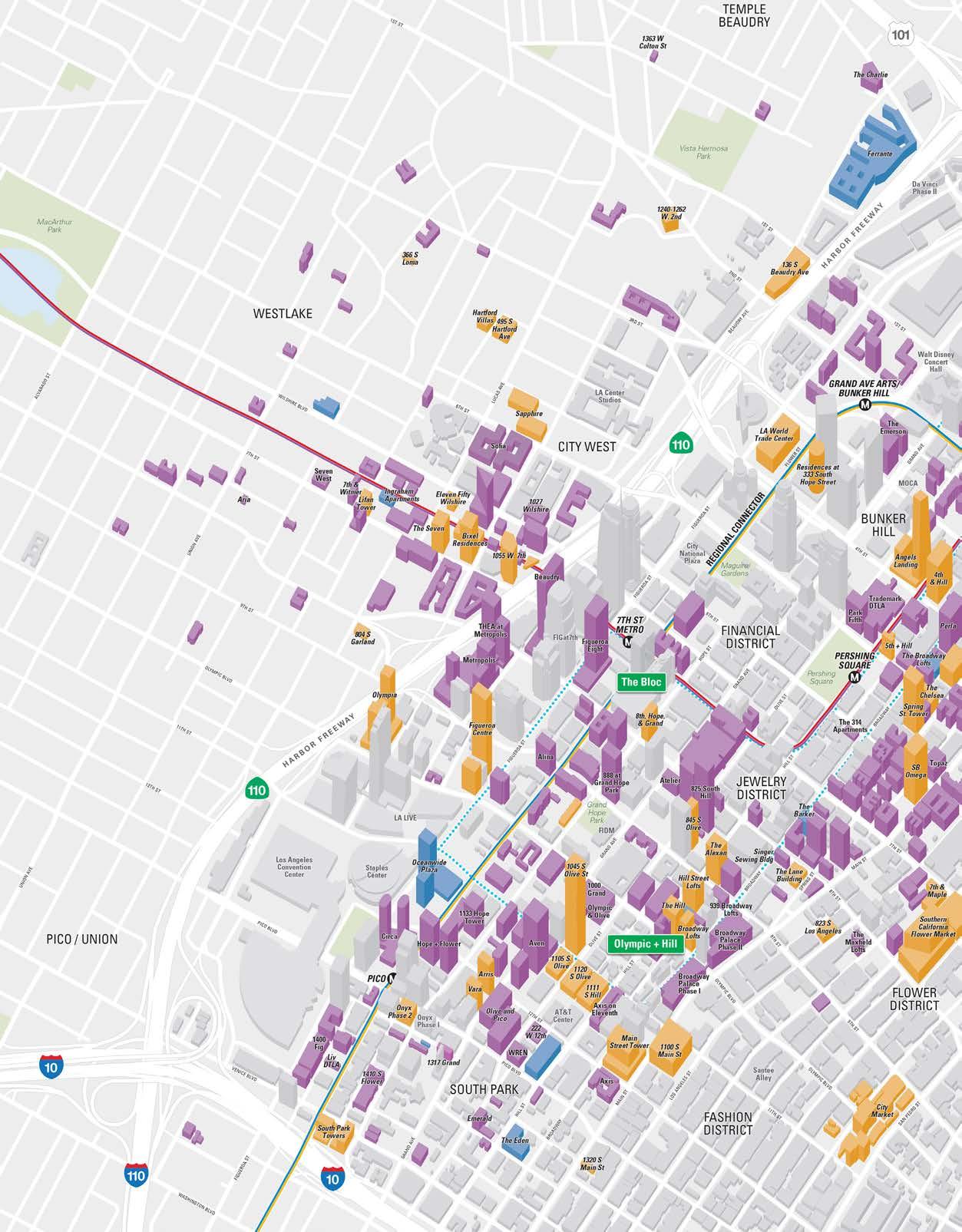

The DTLA Alliance defines Downtown Los Angeles as the area bounded by the 110, 101 and 10 freeways and the LA River, plus Chinatown, City West, and Exposition Park. The projects contained in this report are within a portion of Downtown Los Angeles, shown on the map to the left.

The third quarter of 2025 saw a major milestone on one of DTLA’s most important projects. The Los Angeles City Council approved the $2.6-billion renovation and expansion of the LA Convention Center, which will add 190,000 square feet of new exhibit space and a 98,000-square-foot rooftop ballroom. Construction is already underway, with completion expected in 2029.

Once open, the expanded convention center is expected to provide a major boost to the local hospitality market, which has delivered strong results in recent years. Adding to the positive momentum, Condé Nast’s latest survey of top Los Angeles hotels included three DTLA properties: The Moxy (7th), Hotel Figueroa (8th), and the LA Athletic Club (10th). While the convention center grabbed the headlines, the City Council also advanced the residential sector with approval of three major projects totaling more than 1,800 units. These will join a market that just celebrated the opening of two new properties, Olympic & Hill, a 54-story tower with 685 units, and The Umeya, a 175-unit affordable housing development by the Little Tokyo Service Center.

The office market remains in flux, with properties trading at steep discounts compared to pre-2020 levels. This quarter, the iconic PacMutual sold for just under $50 million. On the leasing front, Banc of California announced its move to the former TCW Tower, securing naming rights, KPMG signed for 70K SF, relocating to the US Bank Tower, and the Consulate General of India secured its first Southern California location at the AON Center.

Retail also saw noteworthy activity. Erewhon purchased a property at 940 S. Hill, where it plans to open a DTLA location that will serve the growing residential population, and likely serve as a draw for complementary retailers. In another major announcement, Ballers LA, a social club featuring 18 pickleball courts, will take 100,000 square feet of the former Macy’s space at The Bloc, with an opening planned for late 2026.

$3.86

$3.39

1, 481

RESIDENTIAL UNITS UNDER CONSTRUCTION

29, 205 PROPOSED

10 , 751

HOTEL ROOMS IN DTLA

1, 237 UNDER CONSTRUCTION

5 ,923 PROPOSED

LA Convention Center expansion was approved by LA City Council.

Olympic+Hill opened with 685 market-rate apartments.

Erewhon purchased 940 S. Hill and plans to open a DTLA location there.

After a significant recovery in 2020 and 2021, monthly visits to DTLA have remained within a range of 8-10 million per month, which is just slightly below the average experienced prior to the pandemic. However, compared to 2024, the monthly average is about 5% lower following the wildfires and civil unrest earlier this year.

12,000,000

10,000,000

8,000,000

As the heatmap below indicates, the largest concentration of visitors to DTLA lives within just a few miles, demonstrating that in addition to being a draw for tourists and people attending major events, Downtown plays a vital role in providing shopping, dining, and entertainment options for residents in the surrounding neighborhoods.

Source: Placer.ai

residents per unit X 95% occupancy

Set in the Arts District, this trattoria offers a contemporary expression of Sicilian dining in a loft-inspired space with a spacious patio. The menu features handmade pastas, fresh seafood, and woodgrilled specialties, balancing rustic flavors with a modern sensibility.

Also in the Arts District, Berenjak draws inspiration from the traditional kebab houses of Tehran while embracing a modern Los Angeles setting. Coal-grilled meats, warm breads from the oven, and vibrant mezze create a dining experience designed for sharing and lingering.

On the rooftop of AC Hotel in the Historic Core, ÜCA Terraza channels the atmosphere of the Riviera Maya with sweeping city views. A menu of Latin-inspired dishes pairs with a cocktail program rooted in agave spirits.

Located on the rooftop of The Hoxton, Downtown LA, Inanna Bar is a Mediterranean-inspired lounge that combines elevated aesthetics with skyline views. Guests can enjoy shareable mezze, wood-fired flatbreads and grill-fired dishes, alongside a refined cocktail program infused with citrus, herbs, and spice.

The residential market rebounded strongly after a short-term decline during the pandemic, with rent and occupancy returning to pre-pandemic levels. Although occupancy dipped in 2023 due to delivery of over 2,000 new units, it has remained over 90% ever since.

Source: CoStar

Lingering uncertainty about return-to-work was felt across the region, with vacancy rates reaching a historic high in 2024 and remaining at that level for Q1 2025. However, asking rents have increased for two straight quarters, suggesting the start of a possible recovery.

Retail rents have remained remarkably stable, indicating that interest in urban locations like Downtown LA has stayed strong. Although the vacancy rate has ticked up, much of that is due to the recent closure of Macy’s at The Bloc.

Both occupancy and RevPAR made significant gains in 2022, ticking up further in 2023 before flattening out at around 10% below their pre-pandemic levels through 2024 and into 2025.

n Existing

n Under Construction/Renovation

n Proposed

As of 9/30/2025

n Existing

n Under Construction/Renovation

n Proposed

As of 9/30/2025

RESIDENTIAL

OLYMPIC & HILL

Developer: Onni Group

At over 760 feet and 60 stories, this is now the city’s 4th tallest building and tallest residential highrise.

RESIDENTIAL THE UMEYA

Developer: Little Tokyo Service Center

Transit-oriented mixed use development with 175 affordable units and 13,000 SF of community space.

CIVIC

LOS ANGELES CONVENTION CENTER EXPANSION

Developer: City of Los Angeles

$2.6B expansion will modernize the facility and add over 200K SF of space, bringing the total to over 1M SF.

Developer: The Colburn School

Topping out in Q2 2025, this 100,000 SF expansion designed by Frank Gehry will include new studios, public spaces, and a 1,000-seat performance venue.

Developer: The Broad I Design: Diller Scofidio + Renfro

Breaking ground in Q2 2025, this 55,000 SF expansion will increase The Broad’s gallery space by 70%, add two top-floor open-air courtyards, and flexible ground-floor event space.

Developer: City of Los Angeles

12 acres of new park space at both ends of the Sixth Street Viaduct will feature basketball, soccer, and volleyball courts, event space, and performance facilities.

Developer: City of Los Angeles

The first phase of Pershing Square’s renovation along the Olive St. side of the park was completed in Q2 2025. Phase 2 will include similar improvements along Hill St., with existing structures being replaced with new landscaping, and a more open design.

Developer: National Real Estate Advisors Design: Handel Architects

41-story tower will sit atop the existing 12-story parking garage and create up to 466 apartments.

MAJOR MIXED USE FOURTH & CENTRAL

Developer: Continuum Partners

Design: Studio One Eleven & Adjaye Associates

10-building project to include over 1,500 residential units, 400,000 SF of office space and 100,000 SF of restaurant/retail space.

MAJOR MIXED-USE

Developer: V.E. Equities Design: Bjarke Ingels

LA City Council has given their approval to this Arts District project that would add 894 residential units, over 600K SF of commercial space, and a 271-room hotel.

The project, which received the final go-ahead from City Council last month, calls for the construction of a new structure bridging over Pico Boulevard to connect the existing West Hall and South Hall. The completed expansion will include 190,000 square feet of new exhibit space as well as a 98,000-squarefoot rooftop ballroom. —Urbanize LA, 10/02/25

Erewhon’s long-awaited downtown Los Angeles expansion is finally taking shape, with the luxury grocer revealing an unexpected location choice that marks a shift from its original plans.

—LA Business First, 9/17/25

The deal comes as tenants are increasingly prioritizing space in the newest and nicest U.S. office buildings in the wake of the pandemic. The U.S. Bank Tower was renovated in 2023 and has a roster of high-quality tenants drawn to its location and reputation as a landmark office. —CoStar, 8/27/25

CBRE arranged a full-floor lease totaling 20,459 square feet at 707 Wilshire Blvd. in Downtown Los Angeles on behalf of The Sentinel Firm, APC. The Sentinel Firm entered the Downtown Los Angeles market in 2023 with a 2,641-square-foot sublease at Union Bank Plaza. In 2024, CBRE facilitated the firm’s move into a 6,439-square-foot sublease. —Connect CRE, 8/25/25

JLL worked with architecture firm Gensler to redesign the space. Every decision was made with a longterm vision in mind to ensure that there was no wasted space in the office. The firm did away with assigned seating and created private spaces that can be utilized for confidential calls and meetings. —Los Angeles Times, 7/20/25

Chef Kian Samyani founded Berenjak in 2018, pulling inspiration from the vibrant kebab (also spelled “kabab”) houses of Tehran. The restaurant has received widespread acclaim, including garnering a Michelin Bib Gourmand in London. Currently, Berenjak operates two locations in London — one in SoHo and another in Borough — alongside outposts in the United Arab Emirates and Qatar. —Eater LA, 09/23/25

CONTACT US

SCAN HERE TO SIGN-UP FOR OUR NEWSLETTERS OR VISIT DOWNTOWNLA.COM /SUBSCRIBE

Stay plugged in on everything new and exciting in DTLA, from restaurant openings and up-coming events to arts & culture programs and family activities.

Get the latest on the Downtown market, including business news and trends, detailed data, and compelling content from our industry-leading research and reports.

Make the most of your workday in Downtown LA with a monthly guide to discovering new favorites, after-work hotspots, free lunchtime events and more, curated for the Downtown 9-to-5 crowd.

Get alerts on local street closures, construction projects, major events, or other activity that might impact you as a Downtown residents, worker, visitor, or business.

Connect with Downtown’s vibrant community of small businesses and professionals in marketing, promotion, and events, and tap into trends, opportunities, and partnerships.

Nick Griffin, Executive Vice President (213) 416-7522 I ngriffin@downtownla.com

Elan Shore, Director of Economic Development (213) 416-7518 I eshore@downtownla.com