DOWNTOWN BROOKLYN Q2 2023 MARKET REPORT

Updated quarterly, this report provides insight on real estate market data, development progress and commercial leasing activity in Downtown Brooklyn.

DEVELOPMENT SNAPSHOT

Downtown Brooklyn Partnership’s (DBP) Development Matrix captures projects that have been completed since the 2004 Downtown Brooklyn rezoning, including development activity, project status and anticipated completion dates.

COMPLETED PROJECTS (SINCE 2004)

22,005

2.77M

UNDER CONSTRUCTION

5,954 housing units 70K

PIPELINE PROJECTS

1,763 housing units 305K

ft.

2,368

103 hotel rooms

71

rooms

For more detail information, please see the full Q2 2023 Development Matrix summary and map at: https://www.downtownbrooklyn.com/news/report/downtown-brooklyn-development-matrix/

Q3 2023 Market Report | 1 Downtown Brooklyn Partnership

office sq.

office

hotel

ft.

sq.

housing

units

hotel

office sq. ft.

rooms

COMMERCIAL OFFICE

COMMERCIAL OFFICE LEASING

One Willoughby Square (1WSQ), JEMB’s 34-story, 500,000 sq. ft. office tower, recently announced three new office leases bringing the building to 60% leased. Relocating from 141 Livingston Street, New York State’s Office of Court Administration (OCA) signed a 27,304 sq. ft. lease across two floors. Cityblock Health, a tech-driven healthcare company, is taking a 14,500 sq. ft. prebuilt office space. Additionally, Big Spaceship, a marketing firm, signed a 4,760 sq. ft. lease in a prebuilt office space in the building, moving from Dumbo. The creative agency gave up its previous office during the pandemic, but decided to move back to an in-person office.

ONE FORTY ONE COMPLETES CONSTRUCTION

Savanna completed construction of 141 Willoughby Street (One Forty One). The 24-story, 400,000 sq. ft. ground-up office tower includes 357,000 sq. ft. of office space and 24,000 sq. ft. of retail space. Floorplates are amenable to small and growing firms, ranging between 12,000 and 22,000 sq. ft.

Designed by Fogarty Finger, the building includes two tenant amenity lounges (including a bar, fitness center, and conference center) on the 2nd and 10th floors and outdoor terraces on the 10th and 20th floors.

One Forty One is located directly across from City Point and Abolitionist Place, the 1.15 acre park that will open in late 2023.

CIM Group unveiled plans for a new film production studio, Panorama Brooklyn Studios, at 25 Columbia Heights. The facility will offer 90,000 sq. ft. of studio and production space, offering Level 1 and Level 2 Qualified Production Facilities under the New York State film tax incentive program, a sought-after designation by film and television productions. The Panorama campus includes 680,000 sq. ft. across five buildings on the Brooklyn waterfront in DUMBO.

Q3 2023 Market Report | 2 Downtown Brooklyn Partnership

Credit: Savanna

COMMERCIAL OFFICE

COMMERCIAL OFFICE VACANCY + RENTS

The overall office vacancy rate in Downtown Brooklyn increased to 22% in the second quarter, up 190 basis points over the past quarter, and 170 basis points yearover-year. This was anticipated, as 141 Willoughby Street added 357,000 sq. ft. of available office space to the market in Q2. The new tower accounts for approximately 11% of all vacant office space in the district. Vacancy rates remain on par with Manhattan submarkets, all of which range from 22% to 24% vacant.

During the past quarter, Downtown Brooklyn experienced a significant increase in overall office rents, rising by over 5% year-over-year. This upward trend can be attributed primarily to the addition of the new, top-tier class A office space at 141 Willoughby Street. Asking rents at the new tower range between $68 and $80 per sq. ft.

Overall Office Vacancy by Submarket Overall Average

Interestingly, the new office inventory in Downtown Brooklyn, combined with Lower Manhattan’s declining rents and large direct and sublet vacanies, has caused a shift in market dynamics. Downtown Brooklyn is no longer considered purely a value office market, as overall asking office rents have now surpassed those of Lower Manhattan by a notable 3% margin, or $1.80 per sq. ft.

Q3 2023 Market Report | 3 Downtown Brooklyn Partnership

Asking Rent PSF

Submarket

Cushman and Wakefield -2.2% Q2 2023 Q1 2023 Q2 2022 QoQ Change (basis points) YoY Change (basis points) Downtown Brooklyn 22.0% 20.1% 20.3% +190 bps +170 bps Lower Manhattan 24.2% 22.6% 21.7% +160 bps +250 bps Midtown South 23.0% 22.5% 21.3% +50 bps +170 bps Midtown 21.7% 22.1% 21.4% -40 bps +30 bps

by

Source:

Q2 2023 Q1 2023 Q2 2022 QoQ Change YoY Change Downtown Brooklyn $58.09 $56.71 $55.18 +2.4% +5.3% Lower Manhattan $56.27 $56.33 $56.80 -0.1% -0.9% Midtown South $75.84 $75.41 $71.69 +0.6% +5.8% Midtown $77.05 $76.95 $76.84 +0.13% +0.3%

Source: Cushman and Wakefield

RETAIL

NEW RETAIL LEASES ACROSS DOWNTOWN BROOKLYN

Downtown Brooklyn saw 17 new retail openings and several new leasing announcements during the second quarter of 2023. Highlights include:

• Chelsea Piers Fitness and Field House unveiled their 103,000 sq. ft. gym at 645 Dean Street in Pacific Park. The fitness center also includes two turf fields, a basketball half-court, swimming pool, gymnastics facility and a coworking space.

• Imani Caribbean Grill opened a new location at 21 Flatbush Avenue. This is the restaurant’s third location and its second in Downtown Brooklyn.

• Other recent openings include: Dave’s Hot Chicken, at 345 Adams Street; Teriyaki One/Japanese Grill at 39 Willoughby Street; Stack’d Burger at 18 Nevins Street; Halal Munchies at 82 Livingston Street; Bora Bora at 408 Jay Street; and Uni K Wax at 326 Livingston Street.

• Kosher French bakery chain, Patis Bakery, announced a 5,100 sq. ft. full-service restaurant and bakery at 203 Jay Street, scheduled to open in late 2023.

• Wonder, a restaurant delivery service and ghost kitchen featuring menu items from over 15 restaurants, is coming to 310 Schermerhorn Street this fall.

• TATTER Textile Library, an interactive, ongoing artinstallation as well as academic research library, is expanding from Gowanus into Downtown Brooklyn’s cultural district. The new flagship space will open its doors next to BAM Strong at 230 Ashland Place in 2024.

REVIVAL OF LEGENDARY PARAMOUNT THEATRE UNDERWAY

Renovations continue for the LIU Brooklyn Paramount Theatre at the corner of Flatbush and DeKalb Avenues. This project is reviving and modernizing the 95-year-old venue and bringing new entertainment to Downtown Brooklyn. The Brooklyn Paramount operated from 1928-1962 as a live performance venue and the first theatre in the world designed to show talking movies. Artists such as Frank Sinatra, Ella Fitzgerald and Miles Davis, performed at the venue. After closing its doors, the theatre became part of LIU’s campus, serving as a multi-purpose gymnasium space.

The theater will have a flexible seating configuration to accommodate general admission events for 2,600 people or 1,200-person seated events. Live Nation has a 25-year lease and anticipates opening in spring 2024.

Q3 2023 Market Report | 4 Downtown Brooklyn Partnership

RETAIL

NEW RETAIL LEASES AT CITY POINT

City Point has announced several notable upcoming tenants in the sports and entertainment category. Court 16, a tennis and pickleball club, will open August 28 on the fourth floor. The facility will include 26,000 sq. ft. for eight courts for tennis courts or pickleball. On the horizon, The Escape Game, a popular national escape room chain, will be coming to Dekalb Market in early 2024.

City Point is also welcoming the addition of several new dining offerings, including:

• Brazilian steakhouse chain Fogo de Chao will open at full-service restaurant and bar. The steakhouse will take over 9,000 sq. ft. of the former Brooklyn Studios event space. Construction is underway and is anticipating a late 2023 opening.

• DIG, the healthy fast-casual chain, will open this September at Brooklyn Point at the corner of Willoughby Street and Albee Square West. Also coming soon to the base of the tower: Wright and Goebel wine and liquor store, One Medical and GoodVets.

• Dekalb Market Hall is nearing full occupancy after several recent openings. The market announced it will now extend its hours until 10 pm to cater to evening demand. Over 5 new eateries opened in the market this past quarter, including Italian restaurant Osteria Brooklyn, Cuban eatery Punto Cubano, Brazilian snack stand Petisco Brazuca and Asian-inspired ice cream stand Soft Swerve. In addition, Somethin’ Else, a cocktail bar offering live music, opened this past quarter, replacing Understudy.

RETAIL INVENTORY + RENTS

As of the second quarter of 2023, Downtown Brooklyn has 538 active storefronts. Of these, 38% are food and beverage establishments, 28% are dry retail stores and 34% services. However, it is worth noting that there are currently 117 vacant storefronts, resulting in a retail vacancy rate of 16.7%. There are an estimated 35 retail establishments coming soon to the neighborhood.

According to REBNY, ground floor average asking retail rents along Fulton Street (from Boerum Pl to Flatbush Ave) stood at $239 – a 22% jump year-over-year. Average asking rents are down over 33% from all-time high of $359 in Winter 2018.* Along Court Street (from Atlantic Ave to Pierrepont St), ground floor average asking retail rents stood at $192, up 9.7% from a year ago and 6% from Summer 2022. Currently, ground floor asking rents on Court Street range from $137 to $210 per sq. ft.* *Data

Q3 2023 Market Report | 5 Downtown Brooklyn Partnership

Fogo de Chao

Court 16

is based on limited availabilities

Credit: Fogo de Chao

Credit: Court 16

RESIDENTIAL

RESIDENTIAL RENTS

The average residential rent in Downtown Brooklyn was $4,638 in June 2023, up 2.9% year-over-year. Average rental prices in Downtown Brooklyn were up across all unit sizes. Rent for two-bedroom apartments rose most dramatically over the past year at over 4.4%.

Overall, average rental pricing across Brooklyn increased at a modest pace to $3,620, up 3.3% since last year. Only a few neighborhoods saw double-digit increases, including Boerum Hill, which was up 21.7% year-overyear. DUMBO saw average rents increase 2.8%, on par with Downtown Brooklyn, while Brooklyn Heights saw average rents remain unchanged from last year. Fort Greene and Cobble Hill saw a decrease in rents at -10.7% and -6.1%, respectively.

Source: MNS

Average Residential Rents in Downtown Brooklyn by Unit Size, 2020-2023

Source: MNS

Q3 2023 Market Report | 6 Downtown Brooklyn Partnership

June 2023 June 2022 Change June 2021 Change June 2020 Change Studio $3,513 +3.6% +29.6% +32.1% 1-Bedroom $4,285 +0.2% +28.4% +28.4% 2-Bedroom $6,116 +4.4% +32.6% +33.6% Average $4,638 +2.9% +30.5% +31.6%

Average Residential Rents in Downtown Brooklyn

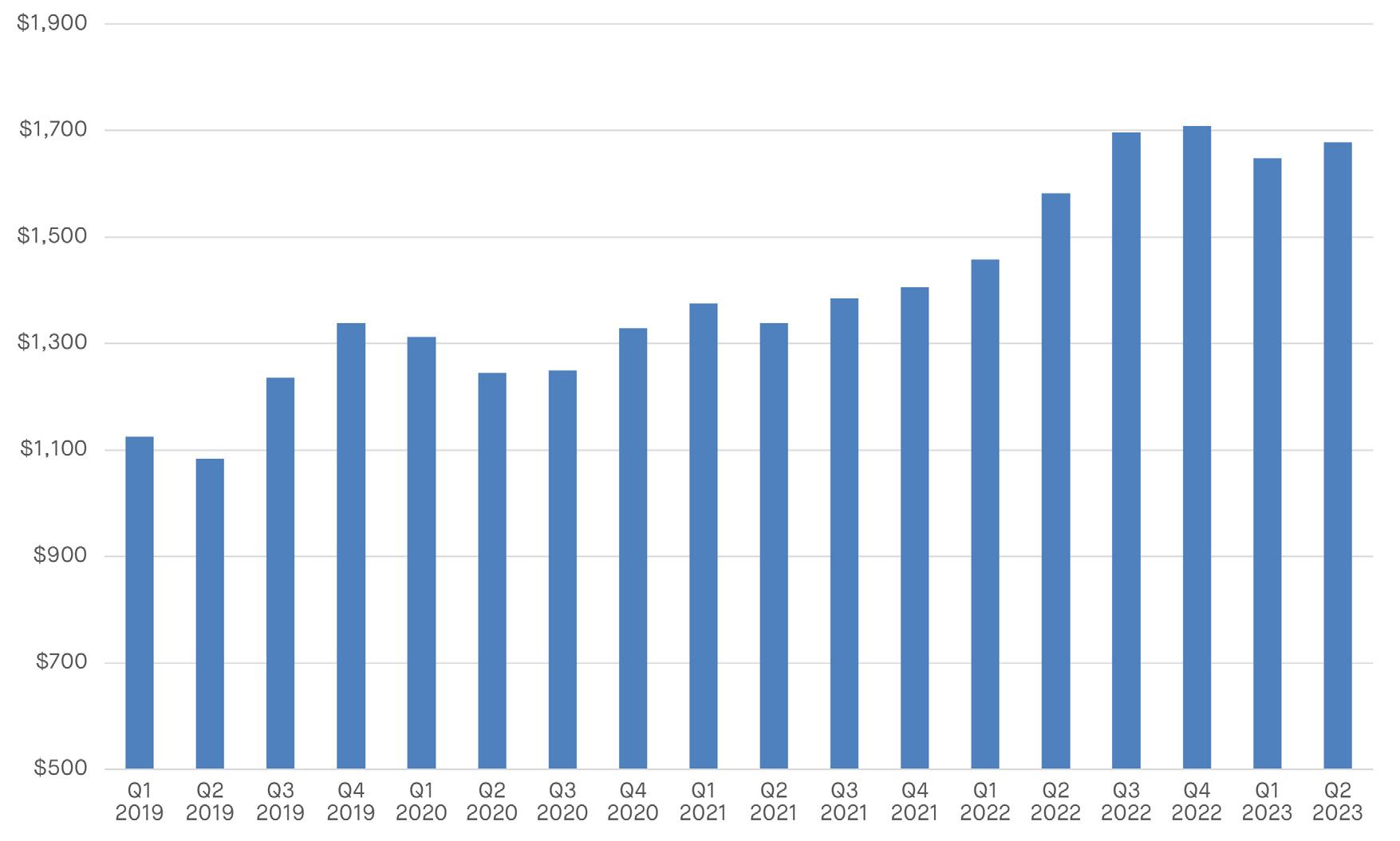

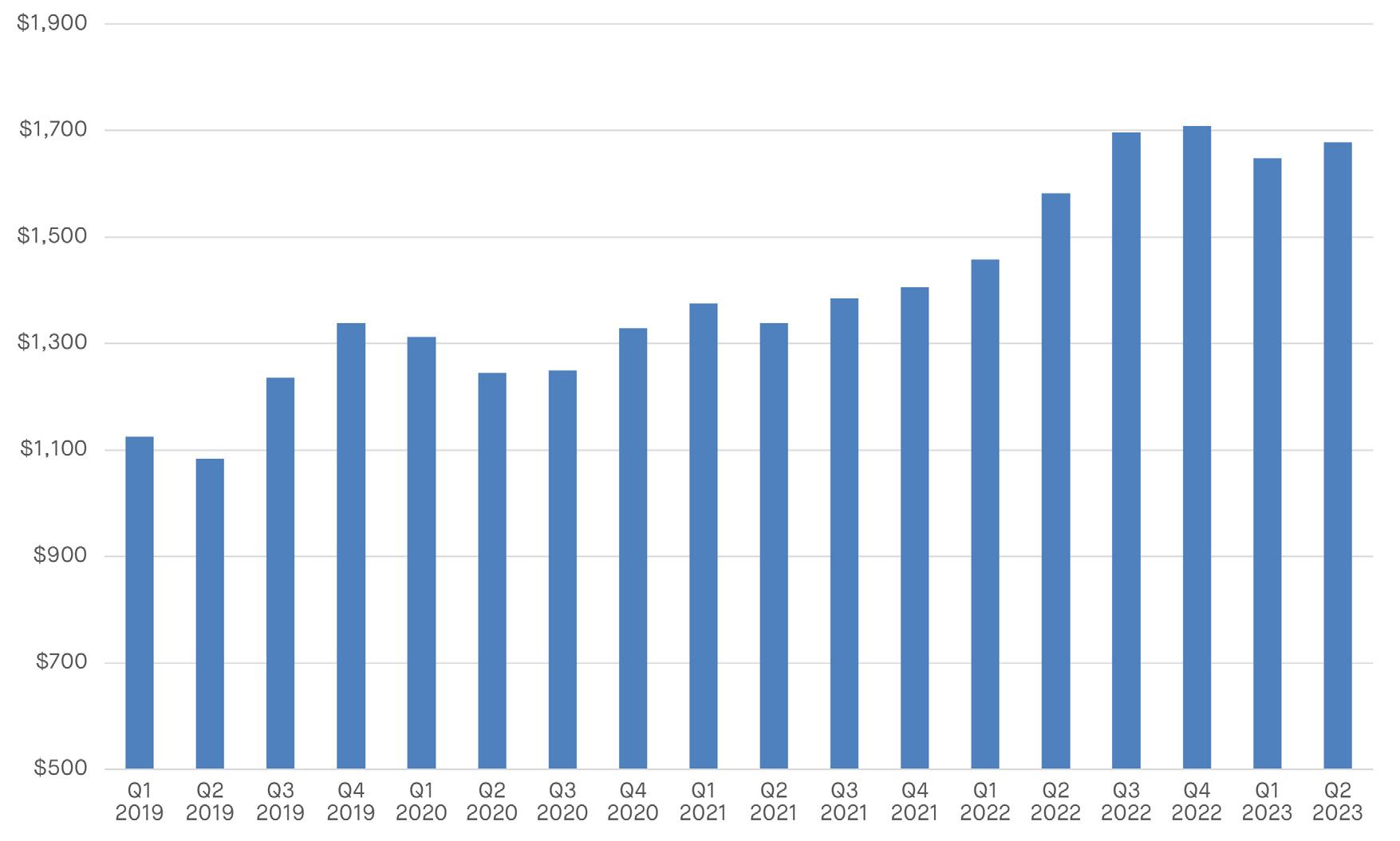

RESIDENTIAL RESIDENTIAL SALES

The median sales price in Downtown Brooklyn for new development condos was $1.95 million in Q2 2023, matching last quarter and increasing 8.4% year-overyear. The median price per square foot hit $1,678, up 6.1% year-over-year. One and two bedrooms comprised the bulk of all sales in Downtown Brooklyn at 30% and 55%, respectively.

Downtown Brooklyn sales accounted for 7.8% of Brooklyn sales volume with 33 units sold in the second quarter. Across Brooklyn, the median sales prices for new development condos decreased year-over-year by 4.3% to $998,000, while the median price per square foot decreased by 10% to $1,253.

Median Residential Sale Price Per Square Foot - Downtown Brooklyn New Development

Source: MNS (Q2 2023). Data includes first-offering sponsor sales at walk-up and elevator new development condominium buildings, as well as new conversion condominiums if the sales were applicable sponsor transactions. Cooperative sales are excluded from this data.

Source: MNS

Q3 2023 Market Report | 7 Downtown Brooklyn Partnership

Median Residential Sales Price Per Sq. Ft. - Downtown Brooklyn New Development Q4 2022 QoQ Change YoY Change Studio $1,698 -1.4% +16.1% 1-Bedroom $1,732 +2.1% +20.8% 2-Bedroom $1,462 -12.1% +6.6% 3-Bedroom+ $2,049 +20.3% +53.1% All $1,709 +0.7% +21.6%

TRANSPORTATION

PEDESTRIAN + COMMUTER ACTIVITY

During the second quarter, total monthly foot traffic across the district reached 75% of the pre-pandemic levels, with June being the best-performing month since the beginning of the pandemic. In June 2023, the monthly pedestrian activity in Downtown Brooklyn surpassed the levels observed in June 2022 by an impressive 13%, resulting in an average of almost 8,000 more pedestrians per day. Foot traffic sensors at One MetroTech Center and the corner of Smith & Livingston Streets saw large increases in foot traffic, returning 27% and 39% increases respectively year-over-year.

Downtown Brooklyn continues to experience its highest levels of activity on weekdays and has demonstrated a more pronounced recovery from the pandemic compared to weekends. Weekdays in June have reached 78% of the pre-pandemic levels, whereas weekends have only recovered 65%. Afternoons have seen the most substantial recovery from the pandemic compared to other times of day, accounting for 81% of the prepandemic levels. Thursdays were the busiest days throughout the district in June.

Q3 2023 Market Report | 8 Downtown Brooklyn Partnership

Downtown Brooklyn Monthly Foot Traffic Totals by Location, June 2022 vs. 2023

Source: Springboard

**

** The sharp YOY rise in foot traffic at Fulton + Hanover is due to construction at 565 Fulton Street diverting and funneling pedestrian traffic flows at this intersection.

TRANSPORTATION

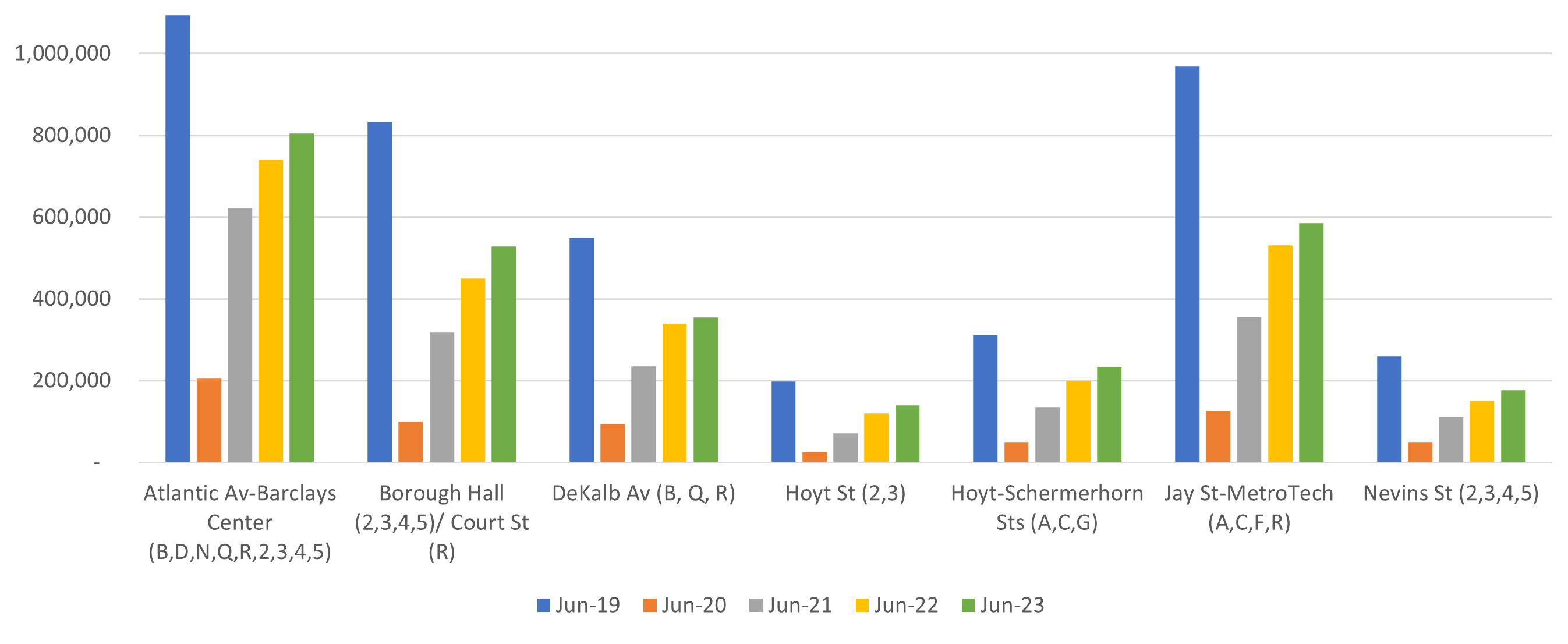

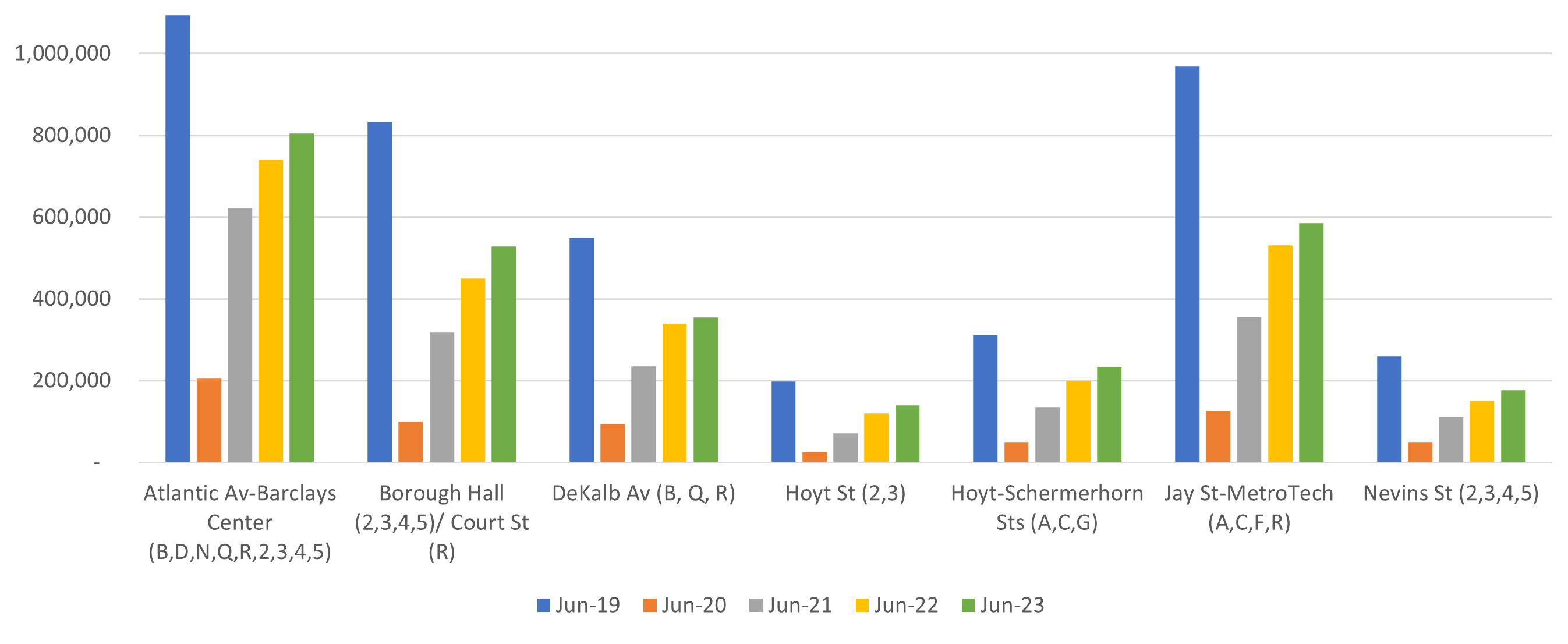

SUBWAY RIDERSHIP

In June, monthly total subway ridership in Downtown Brooklyn witnessed a significant increase of 12% compared to the same period last year. On average, there were 9,800 more daily riders in June 2023 than in June 2022. Currently, ridership has reached 67% of prepandemic levels across all Downtown Brooklyn stations.

Weekends performed stronger than weekdays, seeing a 15% increase in weekend ridership year-over-year, compared to an 11% increase in weekday ridership. Although weekday subway ridership trailed behind weekends, mornings from 8 am to 12 pm still experienced a substantial 17% increase year over year.

With the exception of the stations at Atlantic Av-Barclays Center at 9% and DeKalb Av station at 5%, all stations observed double-digit year-over-year increases. Both the Borough Hall/Court St and Nevins St stations saw the most significant spikes in ridership at 18%.

Over 104,000 Citi Bike riders began and ended at one of Downtown Brooklyn’s 19 Citi Bike stations in June 2023, representing a 2.5% increase year-over-year.

Since 2019, Citi Bike usage increased 175% in Downtown Brooklyn, with the increase correlating to the popularity of bicycle transportation citywide. Over the past year, Citi Bike has been adding capacity at existing stations and expanded further into the boroughs. DOT has also added bike infrastructure with the redesign of Schermerhorn Street.

Source: MTA

The top five Citi Bike stations in Downtown Brooklyn during June 2023 were Hanson Pl & Ashland Pl (11,186 rides); Fulton St & Adams St (8,461 rides); Schermerhorn St & Hoyt St (8,177 rides). Court St & State St (7,733 rides); and Lawrence St & Willoughby St (6,956 rides).

Q3 2023 Market Report | 9 Downtown Brooklyn Partnership

CITI BIKE RIDERSHIP

Downtown Brooklyn Monthly Subway Ridership by Station, June 2019-2022

RESIDENTIAL DEVELOPMENTRENTSOVERVIEW

As of Q2 2023, Downtown Brooklyn development includes:

• 141 projects completed since the 2004 rezoning, including over 22,005 residential units (of which 4,510 units are affordable), 2.7 million sq. ft. of office space and 2.4 million sq. ft. of retail.

• 21 projects under construction with over 5,900 residential units (1,500 of which are affordable) and 230,000 sq. ft. of retail.

• Another 19 projects planned, including nearly 1,700 residential units (of which 390 will be affordable).

22,005 residential units under construction across 141 projects

RESIDENTIAL RENTS ONGOING CONSTRUCTION

5,954 residential units under construction across 21 projects

1,763 residential units under construction across 19 projects

• The Alloy Block at 100 Flatbush Avenue: Alloy Development’s 44-story building will include 440 rental units, including 45 units of affordable housing. The first residential occupancy is expected in spring 2024 and the two schools will be operational by fall 2024. Alloy is also adding a signalized crosswalk on Flatbush Avenue at State Street. Phase two at 80 Flatbush Avenue will include a second, larger tower and will include residential, office space and a cultural center.

• 240 Willoughby Street: Adjacent to The Brooklyn Hospital Center campus, Rabsky Group’s 30-story, 300-unit building at 240 Willoughby Street topped out. The tower, fronting Fort Greene Park, will include 147 affordable unit 595 and 615 Dean Streets. Rabsky is also renovating the existing 21-story, 189-rental-unit tower at the site. The new tower is slated for completion in mid-2024.

• 625 Fulton Street: The structure of Rabsky Group’s 35-story residential building is ascending rapidly, recently surpassing the halfway mark. The building is expected to top out later this summer. The building will have 1,098 rental units, with 329 affordable units, 26,000 sq. ft. of retail space, and a 250-car parking garage. The building is anticipated to be completed in 2025.

• 15 Hanover Place: Lonicera Partners’ 34-story tower is quickly taking shape on the corner of Hanover + Livingston. The project will include 314 rental units, 95 of which are affordable, and 9,000 sq. ft. of retail space. Completion is estimated in late 2024.

• 111 Willoughby Street: Triangle Equities/The Michaels Organization’s 40-story residential tower is beginning to rise from its foundation. The project will bring 227 rental units, 69 of which will be affordable. There will also be a 20,000 sq. ft. ministry center for the neighboring Oratory Church of St. Boniface. The site also includes 16,000 sq. ft. of air rights transferred from 115 Willoughby Street. The development is slated for completion in Spring 2025.

• 180 Ashland Place/98 DeKalb: Rockrose continues foundation work on its 49-story residential tower. Located across from The Brooklyn Hospital Center, the tower will yield 569 rental units, 171 of which will be affordable. Completion is expected in 2025.

• The Brook at 565 Fulton Street: Witkoff and Apollo continue foundation work for The Brook at 565 Fulton Street. The 51-story tower at Fulton and Flatbush will have 591 rental units, including 178 affordable units. The project also includes 25,000 sq. ft. of retail space at the base of the tower and a jewel-box site next to Albee Square.

Q3 2023 Market Report | 10 Downtown Brooklyn Partnership RESIDENTIAL

RESIDENTIAL RENTS ONGOING CONSTRUCTION (continued)

• 9 Chapel Street: Tankhouse Development has topped out on its 13-story building that will include 27 market-rate condo units. Completion is estimated in late 2023.

• 131 Concord Street: Bruklyn Builders has topped out on its 13-story, 73 rental unit building. The building, located at the base of the Manhattan Bridge, will have 8 parking spaces. Completion is anticipated for late 2023.

RESIDENTIAL RENTS RECENTLY STARTED CONSTRUCTION

• 55 Willoughby Street: Foundation work continues for Lonicera Partners’ 38-story, 295-rental unit residential tower. The building will include 89 affordable units and 3,500 sq. ft. of retail space. Nearly 107,000 sq. ft. of air rights were transferred from 57 Willoughby Street.

• 356 Fulton Street: The site is being prepped for excavation at 356 Fulton Street. Extell is planning a 43-story tower with 421 residential units and 100,000 sq. ft. of commercial space.

• 89 DeKalb Avenue: RXR completed demolition of the former parking garage and has begun excavation on a 30-story, 324-unit tower (97 units will be affordable). Approximately 55,000 sq. ft. at the base will be used by Long Island University.

RESIDENTIAL RENTS NEWLY ANNOUNCED DEVELOPMENTS

• 229 Duffield Street: Webster Apartments, a 501c3 nonprofit organization that provides temporary, furnished housing to women who are in school, internships or trainings, purchased the former 130room Hotel Indigo for $40.9 million from Lam Group. The group will seek a change of occupancy from hotel to residential and plans to occupy the building in early 2025.

• 19-27 Rockwell Place: Brookstone Developers has begun construction on an 18-story building with 147 units. The previous building has been demolished and foundation work has begun.

• 101 Fleet Place: The Jay Group continues environmental cleanup at the brownfield site that began in February 2023. Remediation is expected to last seven months. A 21-story, mixed-used tower is planned at the site and will have 292 units and 205,000 sq. ft. of commercial space.

• 362-370 Livingston Street: Developing NY State has begun demolition work on the existing 4-story building to make way for a proposed 22-story, 105unit residential development. The building, located at the corner of Flatbush Avenue, will include 7,162 sq. ft. of retail space.

• 150 Lawrence Street: Twin Group Associates filed plans for a 25-story residential building. The tower will have 101 condo units and 8,200 sq. ft. of retail space. Demolition of the existing four-story building is underway.

Q3 2023 Market Report | 11 Downtown Brooklyn Partnership RESIDENTIAL

Brooklyn’s Once Opulent Paramount Theatre to Be Restored by Global Entertainment Giant

Construction Underway On Abolitionist Place Public Park In Downtown Brooklyn

Downtown Brooklyn to get $40 million pedestrian-friendly makeover

66 floors high in a New York supertall, there’s nothing but net at this open-air basketball court

Marketing Agency Big Spaceship Leaves Dumbo for One Willoughby Square

Women-only housing nonprofit snags Brooklyn hotel for $42M

Q3 2023 Market Report | 12 Downtown Brooklyn Partnership RESIDENTIAL IN THE NEWS

Kosher French Bakery Nails Down Locations in Downtown Brooklyn

Biggie Smalls sculpture unveiled in Downtown Brooklyn’s Cadman Plaza

The Tatter Blue Archives Institute (TATTER) Signs Lease at BAM’s 230 Ashland Place

A massive indoor tennis and pickleball club is opening at Brooklyn’s City Point

A ‘Top Chef’ Alum Makes a Comeback in Brooklyn

Jehovah’s Witnesses’ HQ in Dumbo to be renovated into film studio