DOWNTOWN BROOKLYN Q3 2024 MARKET REPORT

Updated quarterly, this report from the DBP Real Estate team provides insight on real estate market data, development progress and commercial leasing activity in Downtown Brooklyn.

DEVELOPMENT SNAPSHOT

COMPLETED PROJECTS (SINCE 2004 REZONING)

23,298

2.8 M

UNDER CONSTRUCTION + PIPELINE PROJECTS

2,368

Downtown Brooklyn Partnership’s (DBP) Development Matrix captures projects that have been completed since the 2004 Downtown Brooklyn rezoning, including development activity, project status and anticipated completion dates. For more detail information, please see the full Q3 2024 Development Matrix summary and map at: https://www.downtownbrooklyn.com/news/report/downtown-brooklyn-development-matrix/

8,666

700 K 103

COMMERCIAL OFFICE

COMMERCIAL OFFICE LEASES

Streaming service, Philo, has signed a five-year lease for 8,100 sq. ft. on the 18th floor of One Willoughby Square. The deal is Philo’s first office in New York City. This adds to the growing roster of tech and creative firms that have flocked to the new office tower in recent years, including Propel, Gemic, ARO, and Big Spaceship.

203 Jay Street has secured several new tenants in recent months. Software company Elevate Point has leased 9,312 sq. ft. Nonprofit legal services provider Access Justice has also signed a lease for 9,397 sq.

ft., relocating from their 5,000 sq. ft. office at 44 Court Street. Additionally, after-school tutoring company Lindamood-Bell has signed a lease for 3,253 sq. ft. in the building, moving from 185 Montague Street.

Supportive services provider, the Alex House Project, signed a lease for 7,000 sq. ft. at 9 Bond Street and Center for Justice Innovation, a community justice organization, took a 5,800 sq. ft. lease at 25 Elm Street.

COMMERCIAL OFFICE VACANCY + RENTS

In the third quarter of 2024, average office asking rents in Downtown Brooklyn declined slightly to $57.76 per sq. ft. — a 1.3% decrease quarter-over-quarter, but a 3.8% increase year-over-year. Overall vacancy rates rose to 21.6%, up 100 bps from the previous quarter, but 40 bps lower than the same period last year. The year-over-year vacancy decrease follows the removal of 175 Pearl Street from the market for residential conversion.

Downtown Brooklyn’s asking rents remain $2.40 per square foot higher than in Lower Manhattan, where rents fell to $55.39 per sq. ft. Vacancy in Lower Manhattan remained elevated at 24.4%, 280 bps higher than Downtown Brooklyn. Direct and sublet space available in Lower Manhattan is over 20 million sq. ft, almost 70% of the entire Brooklyn office inventory. Midtown and Midtown South continue to command significantly higher rents at $78.20 per sq. ft., but both submarkets maintain higher vacancy rates of 22.5% and 26.3% respectively.

Source: Cushman and Wakefield

RETAIL

NEW RETAIL LEASES ACROSS DOWNTOWN BROOKLYN

Downtown Brooklyn saw 12 new retail openings and several leasing announcements during the third quarter of 2024. Highlights include:

• Several new stores have opened or are planning to open on Fulton Street. Lids opened at 517 Fulton Street and Dollar Tree opened at 559 Fulton Street. Happy Munkey, a legal cannabis brand, anticipates opening mid-November at 453 Fulton Street. Guitar Center will open in January 2025 in its new 19,289 sq. ft. location at 540 Fulton Street.

• Two fast-casual salad spots, Chopt at 1 Boerum Place and Just Salad at 58 Court Street, debuted to meet the growing demand for healthier dining options.

• Boutique fitness studio Hot 8 Yoga opened at 57 Court Street, while Bodyrok Studios announced a new location at 397 Bridge Street.

• Three new coffee shops opened in the neighborhood: Yafa Coffee at 505 State Street in the Alloy Block, Yohevet Coffee Shop at 369 Jay Street, and a new Starbucks location at 498 Fulton Street. Additionally, two new bubble tea spots opened on Willoughby Street: HEYTEA at 52 Willoughby and Chihiro Tea at 94 Willoughby.

• Tend Dental, a full-service dental office, opened at The Guild at 308 Livingston Street.

City Point welcomed several new tenants this quarter:

• Sephora, opened its third location in the neighborhood at City Point in July.

• TwentyOneGrains, a gluten-free, healthy eatery, and Singaporean eatery Hainan Jones, joined the other vendors in Dekalb Market Hall.

• GoodVets opened a pet clinic at 1 City Point, next door to Wright & Goebel Wine & Spirits, which relocated earlier this year.

• MyGym, a children’s activity center offering birthday parties and classes, opened on the mezzanine of City Point. One Medical is set to open next door soon.

Other new businesses have announced they are coming soon to Downtown Brooklyn:

• Three new supermarkets are set to open in the neighborhood: the Fresh Grocer is slated to open at 523 Fulton Street later this year, as well as Gourmet Glatt at 625 Fulton Street, and Lidl at 485 Fulton Street.

• Gyu-Kaku Japanese BBQ has plans to open at 210 Livingston Street.

• Hot Peppers, a local Mexican chain, is set to open at 57 Willoughby Street.

• Bang Cookies will soon open on the first floor of City Point.

• Supreme Pizza will replace Hot Dog King at 472 Fulton Street.

• Blank Street Coffee will introduce its new “elevated concept” at 1 Boerum Place, with Jersey Mike’s Subs set to open around the corner.

CHOPT Opens at 1 Boerum Place

Credit: CHOPT

Starbucks Opens at 498 Fulton Street

Credit: City Point BKLN

RESIDENTIAL RENTS

The average residential rent in Downtown Brooklyn was $4,723 in September 2024, a slight 0.3% decrease yearover-year. Although two-bedrooms saw a 2.4% decrease, studios saw a 3% hike from last year and one-bedroom prices increased very slightly.

Surrounding Downtown Brooklyn, several neighborhoods saw modest year-over-year increases in rent: Brooklyn Heights (3.23%), Cobble Hill (2.32%), and Fort Greene (1.42%). Boerum Hill (0.06%) stayed constant and Dumbo (-0.90%) saw slightly lower rents.

Average Residential Rents in Downtown Brooklyn

Source: MNS

Average Residential Rents in Downtown Brooklyn by Unit Size, 2020-2024

Source: MNS

RESIDENTIAL

According to StreetEasy, the median sales price in Downtown Brooklyn for all units was $935,000, a decrease of 15% year-over-year. The median asking price per square foot (PPSF) was $1,207, a 14.5% decrease year-over-year.

• The median asking PPSF for 1-bedroom apartments in Downtown Brooklyn was $1,261 this quarter, only 1.7% less than Q3 2023.

• For 2-bedroom units, the median asking PPSF is $1,193, a 17% decrease year-over-year.

These shifts reflect typical market fluctuations influenced by seasonality and the timing of new residential developments, which can significantly impact median prices as certain buildings open for sales. This variability is a common characteristic of markets like Downtown Brooklyn, where the addition of new units periodically adjusts overall pricing metrics.

Source: StreetEasy

Median Residential Sale Price Per Square Foot, Downtown Brooklyn

Source: StreetEasy

Median Residential Sales Price Per Sq. Ft. - Downtown Brooklyn

SALES

PEDESTRIAN + VISITATION TRENDS VIA PLACER.AI TRANSPORTATION

According to Placer.ai, visits to Downtown Brooklyn in September 2024 have recovered to 90% of prepandemic levels, with an 8% year-over-year growth. Thanks to growth in the residential population, visits by local residents are now 37% above 2019 levels, with a 15% increase year-over-year. Visitor traffic (people who neither live or work in the district) has reached 89% of pre-pandemic levels, while employee foot traffic remains at 82%, reflecting the continued impact of work-fromhome trends.

Visitation data for key areas in Downtown Brooklyn from September 2019 to September 2024 shows strong recovery post-pandemic, with several areas seeing activity on par with pre-pandemic levels. Notable trends include:

• Fulton Mall saw a 10% year-over-year increase in visits, adding roughly 2,000 more daily visitors, bringing it to 94% of its pre-pandemic levels. Similarly, the area around Atlantic Terminal/Center and 300 Ashland experienced a 6% increase, also gaining about 2,000 daily visits, recovering 97% of pre-pandemic numbers.

• Other locations have experienced a more gradual recovery in visits. The Livingston/Schermerhorn corridors and Brooklyn Commons have seen steady progress, reaching 74% and 80% of their pre-pandemic numbers, respectively.Court Street is currently at 58% of its September 2019 levels, signaling impacts from the closures of Regal Cinemas and Barnes & Noble.

Downtown Brooklyn Average Daily Visits by Area, September 2019-2024

Downtown Brooklyn Visits Compared to Equivalent Month in 2019

Source: Placer.ai

Foot traffic in Downtown Brooklyn’s parks and plazas follows familiar patterns, generally seeing the strongest activity during weekdays with build-up during the morning, peaking in the afternoon, and tapering off in the evening. The data reveals some unique variations between key locations:

• Jay St + Brooklyn Commons consistently shows the highest foot traffic, starting during weekday mornings, peaking at 38,500 visitors at 1:00 PM. The Commons entrance draws the largest early crowds compared to others, with traffic starting as early as 7:00 AM.

• Albee Square sees a notable surge later in the day, with the highest traffic at 5:00 PM (almost 50,000 visitors), making it the busiest spot in the late

afternoon and evening. It maintains more steady traffic throughout the day compared to other locations.

• The Plaza at 300 Ashland has strong foot traffic throughout the day but peaks on weekends, particularly Saturday (75,000 visitors), in contrast to the more weekday-dominant trends seen at most other plazas.

• Abolitionist Place and Bridge St + Brooklyn Commons have the lowest traffic throughout the day, with both experiencing minimal peaks even during high-traffic hours, demonstrating their role as leisurely parks with less through traffic compared to plazas along main thoroughfares.

Source:

Downtown Brooklyn Average Daily Foot Traffic by Location, September 2024

Downtown Brooklyn Average Foot Traffic by Location by Time of Day, September 2024

SUBWAY RIDERSHIP TRANSPORTATION

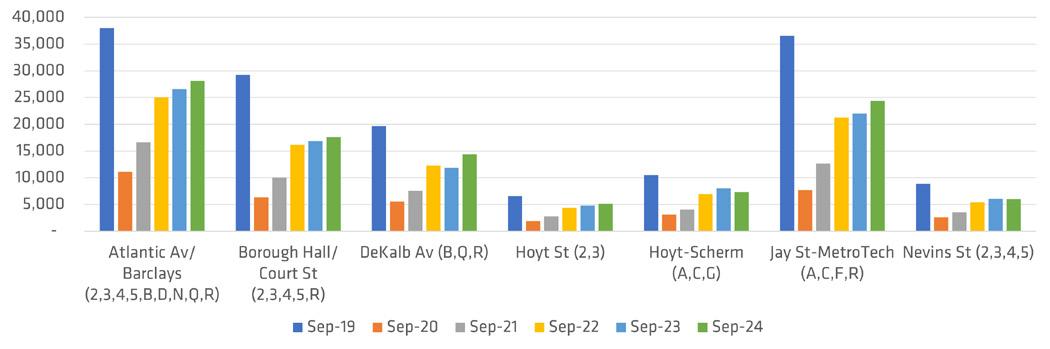

In September 2024, subway ridership across all Downtown Brooklyn Stations saw a 7% increase yearover-year, with over 6,700 more subway riders starting in Downtown Brooklyn each day. Subway ridership has recovered 69% of 2019 levels. Most stations experienced increased ridership year-over-year in September 2024, ranging between 5% and 21%.

• Dekalb Ave (B,Q,R) station experienced the largest percentage bump in ridership, with a 21% increase, equating to almost 3,000 more daily riders as compared to last year. The increase may be a reflection of the growing residential population surrounding the station, the continued success of City Point, and other new attractions such as the Brooklyn Paramount.

• Hoyt St (2/3) has experienced the greatest recovery from 2019 levels, recovering about 78% of prepandemic numbers. This recovery may be due in part to the new elevator and entrance on Fulton Street at Macy’s.

• Hoyt-Schermerhorn (A,C,G) and Nevins St (2,3,4,5) were the only stations to experience year-overyear decreases in ridership, declining 9% and 1% respectively. Hoyt-Schermerhorm (A,C,G) may have experienced a decline in ridership due to construction on the G line throughout the summer.

Downtown Brooklyn Average Daily Subway Ridership by Station, September 2019-2024

CITI BIKE RIDERSHIP

In September 2024, Downtown Brooklyn recorded over 160,000 Citi Bike rides—a 50% year-over-year increase, with 54,171 additional riders. Ridership was 116% higher than in September 2019, driven by five new docking stations and expanded bike lane infrastructure over the past five years. Key stations saw growth due to new development, including Dekalb Ave & Hudson Ave by the Brooklyn Paramount, Duffield St & Willoughby St near Abolitionist Place, and Nevins St & Schermerhorn St along the Schermerhorn bike lane.

PROPERTY SALES

• 80 Dekalb Avenue: KKR sold the 365-rental unit apartment building at 80 Dekalb Ave for $202 million to Atlas Capital Group, marking the largest transaction of the year in Brooklyn, behind Silverstein Properties’ acquisition of the Brooklyn Tower for $672 million. This comes after KKR recently purchased the residential share of the Paxton at 540 Fulton Street in July 2024 for $240 million.

• 40-50 Hoyt Street: Watermark Capital Group has signed a 99-year ground lease in 6 lots between 40-50 Hoyt Street. The site, anticipated to be a future development site, joins Watermark Capital Group’s portfolio of recently acquired development sites at 144 Saint Felix Street, 182 Duffield Street, and 175 Pearl Street.

• 57 Willoughby Street: Prosper Property Group purchased the six-story, 96,000 sq. ft. building from Meadow Partners for $48 million. The fully occupied office building recently underwent $10 million in renovations.

DEVELOPMENT OVERVIEW

As of Q3 2024, Downtown Brooklyn development includes:

• 150 projects completed since the 2004 rezoning, including 23,298 residential units (of which 4,828 are affordable), 2.8 million sq. ft. of office space and 2.5 million sq. ft. of new + repositioned retail.

• 18 projects under construction including 15 with 4,947 residential units (1,257 of which are affordable) and 108,000 sq. ft. of retail.

• 24 projects planned, including 14 projects with at least 3,719 residential units (of which 829 will be affordable).

23,298

4,947

3,719

RECENTLY COMPLETED

• 9 Chapel Street: Tankhouse Development has wrapped up construction on its 13-story, 27-condo unit building.

• 99 Fleet Place: The Jay Group has completed construction on its 21-story, residential tower and tenants have begun moving in. It has 294 rental units (including 74 affordable units), 4,500 sq. ft. of retail space and a 44-car parking garage. The retail will be occupied by The Brooklyn Montessori School.

• 17 Hanover Place: The first residents began moving into Lonicera Partners’ 34-story tower in October 2024. The project, at the corner of Hanover and Livingston, includes 314 rental units, 95 of which are affordable, and 9,000 sq. ft. of retail space.

ONGOING CONSTRUCTION

• 240 Willoughby Street: Adjacent to The Brooklyn Hospital Center campus, Rabsky Group’s 30-story, 300-unit building at 240 Willoughby Street continues interior buildout. The tower, fronting Fort Greene Park, will include 147 affordable units. Rabsky is also renovating the existing 21-story, 189-rentalunit tower at the site. The new tower is slated for completion in 2025.

• 625 Fulton Street: Facade work continues at Rabsky Group’s 35-story residential building. The building will have 1,044 rental units, with 313 affordable units, and a 250-car parking garage. Additionally, there will be 46,000 sq. ft. of commercial retail space, including a 26,000 sq. ft. grocery store. The building is anticipated to be completed in 2025.

• 55 Willoughby Street: Lonicera Partners’ 38-story, 295-rental unit residential tower is quickly ascending, and facade work has begun on lower levels. The building will include 89 affordable units and 3,500 sq. ft. of retail space. Nearly 107,000 sq. ft. of air rights were transferred from 57 Willoughby Street.

• 111 Willoughby Street: The Triangle Equities/The Michaels Organization’s tower is wrapping up interior fit-out. The 40-story tower will bring 227 rental units, 69 of which will be affordable. There will also be a 20,000 sq. ft. ministry center for the neighboring Oratory Church of St. Boniface. The site includes 16,000 sq. ft. of air rights transferred from 115 Willoughby Street. The development is slated for completion in Spring 2025.

• 98 DeKalb Avenue: Rockrose’s 49-story residential tower has topped out. Located along Ashland Place across from The Brooklyn Hospital Center, the tower will yield 569 rental units, 171 of which will be affordable, and 3,775 sq. ft. of retail space. Completion is expected in 2026.

• The Brook at 565 Fulton Street: Witkoff and Apollo’s 51-story residential tower, The Brook at 565 Fulton Street, topped out this spring and has continued façade and interior work. The building located at the corner of Fulton and Flatbush will have 591 rental units, including 178 affordable units. The project also includes 25,000 sq. ft. of retail space at the base of the tower and a jewel-box site next to Albee Square. Occupancy is anticipated in late 2025.

• 89 DeKalb Avenue: RXR’s 30-story, 324-rental unit mixed-use development has topped out in August and facade work is ongoing. The fully electric project will include 98 affordable units and 55,000 sq. ft. of academic and office space at the base that will be used by Long Island University. A late 2026 completion is expected.

• 71 Prince Street/202 Tillary Street: Madd Equities’ 31-story residential complex will yield 465 rental units, including 118 affordable units, 4,000 sq. ft. of retail space, and 40- 50 parking spaces. 71 Prince Street has topped out and is expected to be completed by 2026.

• 150 Lawrence Street: The superstructure at Twin Group Associates’ 25-story, 101-condo unit residential building has topped out. The tower will have 8,200 sq. ft. of retail space and expects a 2026 completion.

• 570 Fulton Street: Developing NY State’s project is quickly ascending. The 23-story, residential tower includes 163-rental units (including 33 units of affordable housing). The building will also have 5,200 sq. ft. of commercial space. The vacant site was sold for $24 million by Davis Companies to Developing NY State in early 2023.

• 19 Rockwell Place: Brookstone Developers’ 27-story building with 174 rental units has topped out.

• 88 Schermerhorn Street: Construction is underway at Jankos Group’s 20-story building, which comprises 58 rental units, including 14 affordable units.

• 362-370 Livingston Street: Developing NY State continues demolition work on the existing 8-story building to make way for two proposed 22-story buildings, totaling 249 units, according to DOB records. The site will include 7,162 sq. ft. of retail.

• NYU: NYU has begun its demolition of two buildings in their MetroTech campus. The Civil Engineering Building (located at 80 Johnson Street) was demolished this summer, and the Jacobs Administrative Building (located at 333 Jay Street) is in the process of being razed. No plans for the sites have been filed.

NEWLY ANNOUNCED DEVELOPMENTS

275 Flatbush Ave Ext: The Jay Group recently filed plans to construct 450 residential units (112 of which will be affordable) in 5 separate buildings at 275 Flatbush Avenue Extension. The proposed 27-story buildings, at the corner of Willoughby Street, will replace the former 1-story car wash and surrounding parking lots. By keeping each building under 100 apartments, it is speculated that the project may be avoiding the wage requirements for construction workers required by the state’s new 485x tax benefit for multifamily projects at or above that unit-count threshold.

FULTON MALL STREETSCAPE UPGRADES

Work began in September on the Fulton Mall Revitalization Project – an $8 million investment by the City that is managed by the Department of Parks and Recreation. The streetscape improvements include enlarged planting beds, new plantings, signature benches, and permeable pavers around planting beds. The transformation is another realization of DBP’s Public Realm Action Plan, a template for a more pedestrian friendly, sustainable, and welcoming downtown.

The project is being implemented in two-block phases, two phases of which have been completed on the North side of Fulton Street between Lawrence Street and Boerum Place. The full project is expected to be completed by Summer of 2025.

CITY OF YES HOUSING OPPORTUNITY

Following the City Planning Commission’s favorable vote on City of Yes for Housing Opportunity in September, the proposal now moves to the City Council for final review and approval. Downtown Brooklyn Partnership has been a strong advocate for the initiative, which aims to modernize the city’s zoning rules and improve housing affordability.

Proposed changes relevant to Downtown Brooklyn include:

• increasing height limits on corridors such as Livingston and Schermerhorn Streets and Flatbush Avenue;

• removing parking mandates;

• new provisions to facilitate office-to-residential conversions; and

• Universal Affordability Preference would also bring important changes to R10 districts.

Fulton Mall Streetscape Upgrades

City of Yes Housing Opportunity

Credit: Department of City Planning

IN THE NEWS

All eyes were on Downtown Brooklyn on Sunday, October 20th as the New York Liberty stormed to victory on their home turf in front of a sold out audience at Barclays Center. This was the franchise’s first WNBA championship. Downtown Brooklyn held a championship celebration for fans at Barclays Center to commemorate the victory.

The Liberty’s playoff run generated over $18.3 million in economic impact for New York City, according to the Mayor’s Office. Over the course of the regular season, nearly 255,000 people came to Barclays Center to attend Liberty games, an average of over 12,700 per game. In April of this year, Downtown Brooklyn hosted the WNBA Draft at the Brooklyn Academy of Music (BAM), which shattered television viewership record.

Downtown Brooklyn has also been making headlines in the cultural and arts spaces. Since debuting in late March, the Brooklyn Paramount has had over 100 shows - over 60 shows have been sold out. Recent headliners of the 2,700-person-capacity concert venue have included Sting, Halsey, Shawn Mendes, St. Vincent, Jack Harlow, and Gunna.

City Point’s Alamo Drafthouse cinema completed a major renovation this summer and dedicated the theater to Brooklyn’s iconic film director Spike Lee. The theater’s revamp also includes five new auditoriums, growing the cinema’s total capacity to nearly 980.The Downtown Brooklyn location is the theater chain’s first NYC location and its highest grossing theater.

Downtown Brooklyn Marks 20 Years of Dramatic Transformation with Interactive Map

Inside NYC’s First Public Montessori School in Downtown Brooklyn

$8M upgrade of Downtown Brooklyn’s Fulton Mall Begins

BAM continues to have a robust slate of programming led by new artistic director Amy Casello, including a larger version of its annual Next Wave Festival. BRIC held the 46th annual Celebrate Brooklyn! Festival—the longestrunning free, outdoor performing arts festival in NYC— throughout the summer. The arts organization also put on its 10th annual BRIC Jazzfest in October, among a variety of other programming.

Alamo Drafthouse Completes Major Upgrade, Expansion Of Its Top Grossing Cinema

Streaming Service Philo Takes 8K SF at One Willoughby Square

The Best Party in New York Is Only Getting Bigger

The Phone-Detox Amenity: At the allelectric 505 State Street, residents are asked to unplug.

LIU’s Roc Nation School Unveils Stateof-the-Art Dolby Atmos Studio for Students

New York Liberty Win WNBA Championship

Credit: NBC News