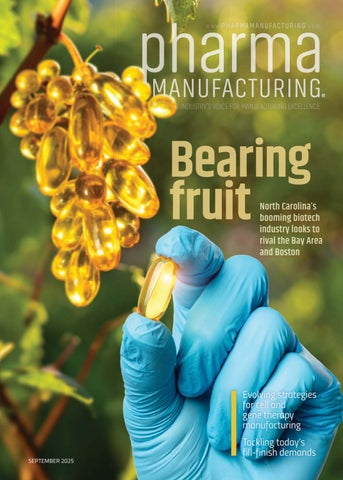

North Carolina’s booming biotech industry looks to rival the Bay Area and Boston

Evolving strategies for cell and gene therapy manufacturing

Tackling today’s fill-finish demands

North Carolina’s booming biotech industry looks to rival the Bay Area and Boston

Evolving strategies for cell and gene therapy manufacturing

Tackling today’s fill-finish demands

ROSS Ribbon Blenders meet the toughest requirements for quality materials and heavy-duty construction. Standard features include thick stainless steel troughs, low-maintenance gearmotors, strong double-helical ribbon design and much more.

Need a Ribbon Blender customized for your process? ROSS offers MANY options. Complete control systems, spray nozzles for coating, pressure feed vessels and vacuum operation, to name a few.

Used for blending pharmaceutical powders and granules, plus evenly coating particles with minor liquid ingredients, ROSS Ribbon Blenders may be customized to meet your manufacturing goals.

Sizes from ½ cu. ft. to 1000 cu. ft. A variety of standard models are in stock for faster delivery. Available worldwide.

mixers.com/ribbon-blenders

Evolving strategies for cell and gene therapy manufacturing

15 operations

How optimal biopharmaceutical processing tubing can enhance your operations

Biopharmaceutical manufacturing is a careful process that ultimately saves lives, and manufacturers

single-use technologies 20

regulatory compliance

Fill the gaps, finish strong

Tackling today’s fill-finish demands 24

Single-use instrumentation innovations propel production potential efficiency

Advances in single-use technology— including Coriolis flow, Raman spectroscopic, and capacitive level measurement—are driving more flexible, efficient, and profitable operations for both small and large-scale pharmaceutical manufacturing 28

Greg Slabodkin Editor-in-Chief

EDITORIAL TEAM

greg slabodkin Editor-in-Chief gslabodkin@endeavorb2b.com

EDITORIAL ADVISORY BOARD

BIKASH CHATTERJEE, Pharmatech Associates

EMIL CIURCZAK, Doramaxx Consulting

ROBERT DREAM, HDR Company

BARRY HOLTZ, Phylloceuticals

ERIC LANGER, BioPlan Associates

IVAN LUGO, INDUNIV, Puerto Rico

GIRISH MALHOTRA, Epcot International

RICH MYER, Tergus Pharma

GARY RITCHIE, GER Compliance

MICHAEL TOUSEY, Solid Dose Technology

DESIGN & PRODUCTION TEAM

meg fuschetti Art Director mfuschetti@endeavorb2b.com

rita fitzgerald Production Manager rfitzgerald@endeavorb2b.com

jennifer george Ad Services Manager jgeorge@endeavorb2b.com

ADMINISTRATIVE TEAM

jason desarle VP of Sales - Manufacturing and Processing Group jdesarle@endeavorb2b.com

Greg Slabodkin Editor-in-Chief

President Donald Trump in August made his most outlandish tariff threat to date, telling CNBC that levies on pharmaceutical imports could reach 250%. As of this writing, it’s the highest tariff rate Trump has threatened so far on the sector.

“We’ll be putting an initially small tariff on pharmaceuticals but in one year — one and a half years maximum — it’s gonna go to 150% and then it’s gonna go to 250%, because we want pharmaceuticals made in our country,” Trump told CNBC.

It was a significant increase from July, when Trump threatened to impose a 200% pharma-specific tariff, as part of his strategy to pressure drugmakers to increase domestic manufacturing. At the time, William Blair analyst Max Smock called it “absurd” and a much higher than expected rate. The silver lining, Smock said, was a year-anda-half grace period giving pharma companies time to “adjust” rather imposing tariffs immediately.

However, drugmakers and contract manufacturers have recently downplayed the impact of tariffs. AstraZeneca in its second-quarter financial results said it will not be significantly impacted by tariffs, while Eli Lilly said it expects a “modest” 2025 impact from currently announced tariffs.

“I can’t tell you how many texts and emails I get about tariffs and policy happening in Washington,” Paul Josephs, CEO of Minnesota-based contract manufacturer Lifecore Biomedical, told analysts in August. “Personally, I consider that just noise. I don’t think anybody in the industry really believes that we’ll have tariffs at the 250% level.”

Nonetheless, since the start of his second term, Trump has doubled, tripled, and quadrupled down on his threat to target the pharmaceutical industry with tariffs meant to secure U.S. drug supply chains by onshoring production and create manufacturing jobs.

Clearly, Big Pharma companies have responded in droves with major U.S. investment announcements, most notably Johnson & Johnson’s $55 billion commitment and respective pledges of $50 billion each from AstraZeneca and Roche. Still, it doesn’t seem like it’s enough to satisfy Trump.

Endeavor Business Media, LLC

CHRIS FERRELL, CEO

PATRICK RAINS, COO

PAUL ANDREWS, CRO

JACQUIE NIEMIEC, CDO

TRACY KANE, CALO

AMANDA LANDSAW, CMO

TRACY SMITH, EVP Manufacturing & Engineering Group

ROBERT SCHOENBERGER, VP of Content Strategy, Manufacturing & Engineering Group

1501 E. Woodfield Road, Suite 400N, Schaumburg, IL 60173

Phone: (630) 467-1300 • Fax: (630) 467-1179

Subscriptions/Customer Service

Local: (847) 559-7598 Toll free: (877) 382-9187 or PharmaManu@omeda.com

Trump’s supporters insist that there’s a method behind his policy madness when it comes to his incessant tariff threats and shifting deadlines, which they contend have forced countries to come to the negotiating table and will ultimately result in favorable trade deals — such as the 15% tariff rate imposed under a recently announced U.S.-EU agreement.

In his 1987 book, The Art of the Deal, Trump wrote that his style of dealmaking is simple and straightforward: he aims “very high” and keeps “pushing and pushing” to get what he’s after. “Sometimes I settle for less than I sought, but in most cases, I still end up with what I want.”

That seems to be Trump’s tariff playbook when it comes to pharmaceuticals. Threaten outrageously high industry-specific tariffs and drugmakers will come running back to this country. Trump in March threatened to levy a 25% across-the-board tariff on foreign-made drugs, and now it’s up to 250%. What’s next 300%? Who’s ready to make a deal?

Greg Slabodkin Editor-in-Chief

The agreement includes a 15% tariff on branded pharmaceutical products imported from the European Union to the United States.

A 15% tariff rate on pharmaceuticals imposed under a new U.S.-EU trade agreement is getting mixed responses from analysts, as the biopharma industry tries to assess the financial impacts from the levies.

While the 15% rate is half what the EU’s 27 nations were facing in a potential 30% tariff that was slated to go into effect on Aug. 1, it is still a major hit to the pharmaceutical industry. Although some analysts said they do not expect it to have a significant financial impact, others project tariffs could increase industry costs by $13 billion to $19 billion annually.

ING analyst Diederik Stadig estimates that these levies could add $13 billion to the industry’s expenses without any mitigation efforts, while Bernstein analyst Courtney Breen pegged the additional costs at $19 billion for the sector — though she noted that biopharma companies might be able to gain relief through measures such as stockpiling drug products.

However, Jefferies analysts in a note to investors said they do not expect the 15% tariff rate on

pharmaceuticals will have a significant financial impact on large biotech companies, given that a majority have manufacturing based in the U.S. and others such as Amgen have a “meaningful” amount of non-European manufacturing operations.

Jefferies analysts believe the 15% tariff rate “is (+) for biotech and provides clarity on tariffs in a major manufacturing region + should be manageable and overall looks to be ‘less bad’ than expected.”

At the same time, the analysts noted that the U.S.-EU trade deal will not take effect until the Commerce Department probe into whether pharma-specific tariffs are necessary concludes, while ensuring that tariffs will not exceed 15% on pharmaceuticals exported from Europe.

“This matters because some Pharma/Biotech companies may have meaningful manufacturing operations in Europe + tariffs are expected to be applied to the ‘transfer price’ of the good which is generally higher than cost of goods,” according to Jefferies analysts.

In a March note to investors, Jefferies analysts found that Amgen and Biogen had the most “foreign exposure” to potential tariffs due to manufacturing operations outside the U.S. and their receiving tax benefits from overseas operations. In their latest update, the analysts pointed to the fact that Amgen has European manufacturing operations in Ireland and the Netherlands.

“We estimate a potential single digit impact to [earnings per share - EPS] which assumes <50% of U.S. sales are manufactured in Europe and the tariff is otherwise applied to the U.S. price as a ‘proxy’ for the transfer price (would likely be conservative),” the analysts wrote, while noting that Amgen recently announced an approximate $2 billion manufacturing investment in Ohio and North Carolina.

Jefferies analysts called out Biogen’s manufacturing operations in North Carolina and Switzerland, with the comment that approximately 75% of the company’s 2024 U.S. product revenue is attributable to domestic manufacturing.

For advertising sales or production information, contact the following

For subscription information call Local: (847) 559-7598 Toll free: (877) 382-9187 or PharmaManu@omeda.com

amy stauffer Inside Sales Representative (352) 873-4288 aloria@endeavorb2b.com

regina dexter Strategic Account Manager (234) 201-8709 rdexter@endeavorb2b.com

roland espinosa Account Manager (201) 912-1112 respinosa@endeavorb2b.com

greg zamin Account Manager (704) 256-5433 gzamin@endeavorb2b.com

lori goldberg Advertising Coordinator lgoldberg@endeavorb2b.com

REPRINTS

To purchase custom reprints or e-prints of articles appearing in this publication contact reprints@endeavorb2b.com (574) 303-8511

According to Eurostat, medicines and pharmaceutical products were the EU’s largest export to the U.S. last year

Last year, Biogen also initiated a tech transfer process to enable the manufacture of Alzheimer’s disease medication Leqembi in the U.S., the analysts wrote, who estimate a “conservative” potential single-digit EPS impact.

However, data and analytics firm GlobalData did not mince words in its Aug. 1 assessment, concluding that the U.S.-EU trade deal puts the pharmaceutical industry at substantial fiscal risk, which threatens to elevate costs across the pharma value chain.

“Companies manufacturing pharmaceutical products in Europe will need to anticipate financial exposure when planning launches in the U.S. due to the unfavorable gross to net dynamics, weakened pricing leverage with U.S. payers, and slower commercial uptake as insurers reassess cost effectiveness due to the tariffs,” according to analysts on GlobalData’s Pharma Strategic Intelligence team.

In announcing the trade agreement, European Commission President Ursula von der Leyen in a statement said the framework with the U.S. “creates certainty in uncertain times” with a single 15% tariff rate for the vast majority of EU exports, including pharmaceuticals.

However, GlobalData warned that the U.S.-EU trade deal has increased the level of uncertainty within the pharmaceutical industry, raising concerns on the potential of tariffs increasing past 15% in the future.

While the full impact of the current 15% tariff will take time to unfold, the

analysts said it will be interesting to see the adoption of different mitigation strategies by the pharmaceutical industry.

According to Eurostat, medicines and pharmaceutical products were the EU’s largest export to the U.S. last year — totaling approximately $120 billion — with Germany as the largest extra-EU exporter of these products.

Germany’s Association of Research-Based Pharmaceutical Companies warned of “drastic” consequences for the industry, as the new tariff rate is likely to result in significant additional costs for manufacturers and for pharmaceuticals “means a break with the practice of duty-free exports, which has so far applied within the framework of the WTO and bilateral agreements.”

However, the European Federation of Pharmaceutical Industries Associations (EFPIA) was more cautious in its response, saying that it continues to review announcements on the US-EU trade deal as “key implications for the pharmaceutical sector remain uncertain.”

EFPIA Director General Nathalie Moll in a statement called tariffs on pharmaceuticals a “blunt instrument that will disrupt supply chains, impact on investment in research and development, and ultimately harm patient access to medicines on both sides of the Atlantic.”

Moll added there are more effective means than tariffs “to secure pharmaceutical investment in research, development and manufacturing, rebalance trade and ensure a fairer distribution of how global pharmaceutical innovation is financed.”

Leena Al-Kathiri Senior Business Development Specialist, Salalah Free Zone

Enterprising pharma and biotech companies in North America know that global growth, particularly into emerging markets clamoring for new products and innovations, can lead to extremely lucrative business.

Leena Al-Kathiri, senior business development specialist for Salalah Free Zone in Oman, says consumers in the Middle East and Africa continue to seek innovative, lifesaving breakthroughs for better health. And Asyad Group and Salalah Free Zone can help U.S. companies tap into those markets in a structured, supportive way, with a foundation for business already set and ready to roll.

Q: Can you briefly introduce the Salalah Free Zone and explain how it enables international investors to access regional and global markets through its integrated logistics ecosystem and investor-friendly environment?

Leena Al-Kathiri: Salalah Free Zone (SFZ) is a strategically located industrial and logistics hub on the southern coast of Oman, directly adjacent to the Port of Salalah — one of the busiest and most efficient trans-shipment ports in the region. Positioned outside the Strait of Hormuz and the Red Sea bottleneck, Salalah offers a geopolitically safe and stable location for investors seeking uninterrupted access to global markets.

As part of Asyad Group’s integrated logistics network, SFZ connects seamlessly to sea, road and air corridors, enabling efficient trade across the Middle East, East Africa and South Asia — reaching more than 2.5 billion consumers. Backed by Oman’s longstanding political neutrality and security, SFZ provides a risk-mitigated base for international businesses. Investors benefit from 100% foreign ownership, 30-year tax exemptions, duty-free operations and fast-track business services — all within a pro-business, stable regulatory environment.

Q: What are the key biopharma industry trends shaping the Middle East and Africa, and how are these driving demand for innovative production and supply solutions?

LA: The region is witnessing surging demand for transformative pharmaceuticals and biotechnology. Consumers are increasingly looking for better health care and medication options. In parallel, regional governments are prioritizing local biopharma manufacturing to reduce import dependency.

These trends, combined with the need for reliable cold-chain logistics and sustainable practices, are driving innovation across the value chain. Salalah Free Zone supports this shift by offering temperature-controlled storage, reliable utilities and a secure environment for biopharma

companies to localize production and serve regional demand quickly and efficiently.

Q: Why should North American biopharma manufacturers and suppliers consider establishing a presence in Salalah Free Zone instead of relying solely on exports?

LA: Salalah’s location offers a compelling alternative to traditional export models. Unlike hubs exposed to geopolitical flashpoints, SFZ is located along the Indian Ocean — outside the volatile Strait of Hormuz and the Red Sea — ensuring business continuity and shipping stability.

By establishing a base in SFZ, companies can eliminate long lead times, reduce tariffs through Oman’s Free Trade Agreements and benefit from lower production costs and efficient infrastructure. The zone’s proximity to high-growth markets, coupled with its secure and politically stable environment, makes it an ideal gateway for North American companies looking to scale in the region.

Q: What challenges should biopharma companies anticipate when entering this region, and how does Salalah Free Zone — through Asyad — help overcome these barriers?

LA: Companies may face challenges such as adapting to local regulatory frameworks, managing regional

Consumers are increasingly looking for better health care and medication options. In parallel, regional governments are prioritizing local biopharma manufacturing to reduce import dependency.

distribution and maintaining cold-chain integrity. Salalah Free Zone addresses these through its streamlined one-stop-shop services for company setup, licensing, customs and utility connections. In addition, Asyad’s integrated logistics platform ensures reliable multimodal connectivity and end-to-end supply chain support. Located in one of the most politically stable and neutral

countries in the region, Salalah Free Zone significantly reduces operational risks associated with regional tensions, providing investors with peace of mind and longterm predictability.

Q: For North American biopharma companies considering their first investment in the Middle East, what are the top takeaways you’d

highlight to encourage them to explore Salalah Free Zone further?

LA: First, Salalah Free Zone offers strategic and secure access to more than 2.5 billion consumers across three continents, with zero customs duties thanks to Oman’s trade agreements. Its location outside high-risk zones like the Strait of Hormuz and Red Sea ensures supply chain resilience in times of regional instability. Second, SFZ provides a highly competitive and stable investment environment with 100% foreign ownership, 30-year tax exemptions and world-class logistics infrastructure. Backed by Oman’s reputation for peace and neutrality, Salalah offers food companies a low-risk, high-opportunity entry point into the Middle East and beyond.

Greg Slabodkin Editor-in-Chief

Decades-long focus on economic development in life sciences and pharmaceutical manufacturing is bearing fruit, as it looks to rival the Bay Area and Boston.

harm

If you haven’t been to North Carolina recently, you’re missing out on seeing one of the nation’s biggest biotechnology success stories. In the U.S., the two largest life sciences clusters — Boston and the San Francisco Bay Area — often get much of the attention. However, the Tar Heel State has created a biotech hub that rivals those juggernauts.

For decades, North Carolina has been focused on economic development in the life sciences and pharmaceutical manufacturing, an investment of time, resources, partnerships, and political will

that is bearing fruit. The state is now home to 840 life sciences companies that employ 75,000 people in a business-friendly environment, according to the North Carolina Biotechnology Center (NCBiotech).

North Carolina “pretty much placed a bet 20-plus years ago on biomanufacturing,” said Bill Bullock, senior vice president for economic and statewide development at NCBiotech. “A lot of conversation is going on right now around tariffs, tax policy, and onshoring. We’ve kind of been doing that for a while.”

In the past 18 months alone, North Carolina has seen $11 billion worth of announced investments — including the creation of more than 5,000 new jobs — with 93% of this capital expenditure in life sciences manufacturing sites, according to NCBiotech. In May, Roche’s Genentech announced plans to build a $700 million, 700,000-square-foot manufacturing facility in Holly Springs, which will create more than 400 jobs and support Roche and Genentech’s future portfolio of obesity medicines.

At the center of North Carolina’s innovative life sciences community is Raleigh-Durham’s Research Triangle Park (RTP), the largest research park in

the U.S., whose 7,000 acres are home to more than 375 companies, startups, nonprofits, and academic institutions. However, the biotech boom in the state goes well beyond just RTP.

Securing top talent in R&D and manufacturing remains a challenge for life sciences companies, regardless of where they are in the U.S. However, North Carolina has made a decadeslong investment in workforce development and infrastructure.

“We have spent 20-plus years building a labor pool and a network of training facilities,” according to Bullock, who noted that the North Carolina’s community colleges are providing industry-specific workforce training to help drive growth in the state’s talent supply. “It’s a great way to connect the community colleges straight on into the needs of the companies.”

North Carolina Life Sciences Organization’s Biotech Manufacturers Forum meets regularly, bringing together companies, educational institutions, and government agencies to discuss industry-specific issues such as quality, regulatory, infrastructure, safety, and workforce training.

“That’s a group that includes all of these companies that are in manufacturing,” said Laura Gunter, president

of the North Carolina Life Sciences Organization. “We meet quarterly with them and include these partners to talk about sustainability, workforce programs, and new things that are coming online.”

Bullock added: “Everything here is about partnership.”

Just down the road from Charlotte Motor Speedway in Concord, North Carolina, is one of pharmaceutical giant Eli Lilly’s most advanced, stateof-the-art manufacturing facilities. Equipped with high-speed lines, robotics, and automated systems, the Lilly site started commercial production at the end of 2024 after completing construction in only two years — more than twice as fast as the industry average of five years, according to the company.

“At the end of 2024, we were not only making medicine, but we were able to ship medicine to patients,” said Rosa Manso, Lilly’s site head in Concord. “That was very fast,” she commented. “The site was built with unprecedented speed.”

When construction began in 2022, Lilly planned to invest $1 billion to create a new injectable products and devices manufacturing site, along with nearly 600 jobs. However, the drugmaker subsequently doubled its investment in the Concord facility to $2 billion to try and keep pace with the growing demand for its diabetes and obesity medicines — injectable GLP-1 drugs Mounjaro and Zepbound — and now has more than 750 employees.

“This is a platform that we are leveraging for existing products that Lilly has on the market right now for diabetes and obesity,” Manso said. “And it’s a platform that will be leveraged in the future to support Lilly’s robust pipeline.”

The facility, built on the 400acre site of the old Philip Morris building in Concord, covers an area of 1.3 million square feet with 10 interconnected buildings including two main manufacturing buildings: parenteral (injectable) products and device assembly.

“The site is home to wetlands so we were very intentional in how we were building on the land,” Manso said. “Only 20% of the acres that we bought are being used for buildings and the rest of it is sustained.”

The Concord site includes administrative offices, quality control laboratories, packaging and labeling, centralized utilities, waste management, a cafeteria, fitness center, as well as shipping and receiving operations. Lilly uses robotics extensively in various parts of the site’s operations, in addition to forklift-like Automated Guided Vehicles and a fully automated warehouse.

The site was selected by Lilly to leverage North Carolina’s “reliable manufacturing workforce and partner with top-tier research and medical institutions as well as community colleges with strong programs in science, technology, engineering and math (STEM),” according to the company.

The facility is Lilly’s second manufacturing site in North Carolina, following its $470 million investment in 2020 in an injectable drug and device plant at Raleigh-Durham’s Research Triangle Park.

Lilly acknowledged in its 2024 annual report, released in February 2025, that there were periods of time last year when demand for the company’s incretin medicines exceeded production and while the supply of tirzepatide — the active ingredient in Mounjaro and Zepbound — currently exceeds demand in the U.S., it’s a situation that remains fluid.

The company continues to “expand manufacturing capacity and progress efforts to bring tirzepatide to patients via different delivery presentations, such as single-use vials and multiuse pens.” Lilly said that to support anticipated demand for its current and future products, the company has undertaken “significant” investments to increase manufacturing capacity, including in North Carolina.

Lilly credited the FDA’s willingness to work together with the company to ensure the Concord facility was built to the agency’s specifications in a streamlined licensing process.

Building identical large-scale biomanufacturing facilities on two different continents is no small feat. However, that’s the goal of Fujifilm Biotechnologies — formerly Fujifilm Diosynth Biotechnologies — as it looks to begin operations later this year at its new facility in Holly Springs, North Carolina, a booming bedroom community about 20 miles from Raleigh.

As a global contract development and manufacturing organization (CDMO), Fujifilm Biotechnologies has embraced a modular model called KojoX, a harmonized design of facilities, equipment, processes, and quality systems to ensure that customers can seamlessly integrate manufacturing regardless of location.

“We have a cloning strategy with a modular design,” said Laurie Braxton, senior vice president and head of North Carolina operations at Fujifilm Biotechnologies. “We’re building them like for like — that means in the construction, in the equipment we’re using, the policies, the procedures, and the operations.”

According to Braxton, Fujifilm is not the first company to try to design, build, and operate its manufacturing

sites in the same manner but others have ultimately failed. “It’s been attempted,” she said. “It takes a lot to not only build to a standard, but to hold to it.” At Fujifilm, Braxton contends that KojoX is core to the CDMO’s values and philosophy. “Holding to it is something that we will do and will be a differentiator.”

The first KojoX node in Fujifilm’s network was built in Hillerød, Denmark, home to a large-scale facility that has been in operation for several years and is the sister site to Holly Springs. In November 2024, Fujifilm announced the completion of the first phase of its expansion at Hillerød including six mammalian cell bioreactors, bringing the total capacity at the site to twelve 20,000L bioreactors. The CDMO is leveraging Hillerød’s proven track record of success and replicating the model in Holly Springs, according to Braxton.

“We know what we’re building works — we’re not building a complete greenfield facility from the ground up without a blueprint to work off,” Braxton said. “Denmark did an expansion on to their existing facility that came online at the end of last year. We like to say that we’ve been able to learn from all their bumps and bruises along the way.”

Fujifilm is investing $3.2 billion in the Holly Springs site including the installation of eight 20,000L bioreactors for bulk drug substances, as part of its initial investment which begins operations later this year, as well as an additional second phase of eight 20,000L mammalian-cell culture bioreactors by 2028.

When it is fully operational, Fujifilm claims the Holly Springs site will be one of the largest cell culture biopharma CDMO facilities in North America, employing a workforce of approximately 1,400 people. So

far, it has added more than 500 fulltime employees.

Initially, Fujifilm only planned for a first phase at Holly Springs — drug substances, drug products, and finished goods — and “quickly after we got started, we announced a second phase and started building on further drug substance,” Braxton said.

In early 2026, Fujifilm will bring drug products online, starting with one line that has a capacity to make about 35 million units a year.

“We have the ability to expand in that area, but we want to see what clients we bring in and what they need,” Braxton said. “When you do drug product and filling, you can do vials, syringes, and cartridges — each company has their own preference, so we’d rather build what’s needed versus what we think may be needed. Once we start to produce in drug products, finished goods will then also come online.”

In April, Fujifilm announced a 10-year manufacturing supply agreement worth more than $3 billion with Regeneron Pharmaceuticals to produce the biotechnology company’s biologic medicines. Under the terms of the agreement, the CDMO will provide production services to Regeneron through current and planned expansions at the Holly Springs site.

“We’re continuing year over year to bring on capacity across the two facilities,” Braxton said. “We send teams back and forth between the two to learn, train, and support with expertise if needed. By having that phasing, it allows us to do that in a really smart way.”

The next phase of the Hillerød site’s expansion continues in 2026, which will include an additional eight 20,000L bioreactors, two downstream processing streams, and full fill-finish production.

“What it will do for customers is they will have capacity in the U.S, and Europe, depending on what they need, and to do it in a very streamlined way,” according to Braxton. “We could do dual tech transfers, where we stand up both facilities at the same time. You can fast track regulatory approvals by being able to use the same comparability between the facilities. All of that are conversations we are having with clients to make it cheaper, faster, and with a standard quality they can trust, regardless of where they are.”

Fujifilm’s Holly Springs site encompasses 150 acres, of which 90 acres have been developed, “so we have 60 acres left that we can still do some work on,” Braxton said, noting that the new facility will have the flexibility to expand beyond the planned total of sixteen 20,000L bioreactors with drug product and finished good capabilities.

Thermo Fisher Scientific’s pharma services business is strategically expanding in 2025 to support growth in its capacity and capabilities to better serve its customers. The company is investing in locations across its network, including a sprawling

1.7-million-square-foot campus on 142 acres in Greenville, North Carolina.

Currently, Thermo Fisher has more than 8,000 employees across the state of North Carolina, with the Greenville site employing a staff of roughly 2,000 people. The company took over the site in 2017 when it purchased contract development and manufacturing organization Patheon for $7.2 billion.

Michelle Logan, vice president and general manager of the Drug Product Division North America at Thermo Fisher, describes Greenville today as a large multipurpose pharmaceutical manufacturing campus and the company’s “flagship site” for sterile fill-finish, driven in part by growing demand for biologics. The company is making investments in high-speed prefilled syringe lines and sterile fill-finish lines at the location.

“We do not have another pharmaceutical sterile fill-finish facility within North America,” Logan said. “Because of sister sites in Europe, one of the things we’re focused on is leveraging the same technology and platform across our broader pharma services business. What that means is our customers might start in Greenville and need something in the European

market, or they might start in Europe and need presence in the U.S.”

While Greenville is Thermo Fisher’s only site focused on steriles, the company has also opened up sterile fill-finish capacity at its Plainville, Massachusetts site. Plainville is solely dedicated to viral vector manufacturing and recently added sterile lines at the site in response to customer demand.

At the Greenville site, the 160,000-square-foot Building 52 is the newest facility with the first sterile fill-finish line there going through its final qualifications, according to Logan. From a prefilled syringe and vial filling perspective, she noted that the company has been investing in new combination lines — Combi 1&2 in Building 52 — with not only high-speed commercial capabilities but also with more flexibility, such as providing both vial and prefilled syringe filling as well as smaller batch sizing.

In April, Thermo Fisher announced it is making a $2 billion commitment to U.S. manufacturing and R&D over the next four years. Of that amount, $1.5 billion is earmarked for capital expenditures to enhance and expand manufacturing.

“Part of the announcement for investment was around sterile fill-finish, and we have procured four additional lines which will be coming into the network,” Logan said. “It’s definitely a part of the most recent announcement.”

Greenville is Thermo Fisher’s first site to feature a fully functional continuous manufacturing line. Continuous manufacturing relies on a fully integrated process that runs uninterrupted from beginning to end, providing an alternative to traditional batch manufacturing in which drug production is segmented into a series of slow-moving steps.

“We did announce the sunset of our [traditional batch] oral solid dose business,” said Logan, who is also Greenville’s interim general manager. “We will keep continuous manufacturing, which is a new technology, for oral solid dose here. As that continues to grow, we will expand in that space.”

Despite the potential efficiencies and the FDA encouraging manufacturers to make the switch from batch processing, the pharmaceutical industry has been slow to adopt continuous manufacturing. However, Logan contends that continuous manufacturing is gaining momentum. The Greenville site is taking the plunge when it comes to oral solid dose (OSD), given that Thermo Fisher is seeing “a lot of interest” in continuous manufacturing from customers, she said.

“With continuous manufacturing, we actually load the raw materials on to the start of the line and it’s realtime feeding, granulating in a vacuum system to the line — straight into either capsules or tableting,” Logan said. “We’re in the process of adding coating as an option with real-time [process analytical technology]. So,

we’re doing all our measurements in-line instead of having to send them to the lab for testing.”

Continuous manufacturing involves material constantly being loaded, processed and unloaded without interruption through the various phases of the process. Logan called out the “robustness” of this manufacturing process, with increased efficiency when it comes to use of space, time, labor, and raw materials as well as improved product yield and quality.

“You have the real-time quality indicators, you’re not relying on a batch review 30 days afterward,” Logan said. “You have all the data there in real time that you can assess quality. The equipment actually makes adjustments for you in real time so if you start to trend out on a critical process parameter, it adjusts and fixes it.”

While Thermo Fisher has been using continuous manufacturing at Greenville on the clinical side, the first commercial product is slated for this year, according to Logan. Although the site is sunsetting its oral solid dose business, the company is serving OSD customers at additional sites throughout its global network.

Andy Campbell Senior Director, R&D at Thermo Fisher Scientific

The cell and gene therapy sector stands at a pivotal moment. Rapid growth, groundbreaking clinical advances and an influx of public attention have pushed cell and gene therapies from the fringes of experimental medicine into the center of modern medicine. Yet for every new milestone, the cell and gene therapy industry faces a host of fresh challenges that demand innovative solutions and industry collaboration.

There’s no question that cell and gene therapies have transformed treatment for diseases like cancer and autoimmune disorders. The success stories of CAR T-cell therapies and gene editing approaches have fueled optimism among patients and clinicians. Players, both big and small, across the industry continue to push forward, securing regulatory approvals and launching new therapies.

Still, the sector’s growth is not without volatility. Even the largest biopharma companies are facing operational and organizational challenges as they adapt to this rapidly changing environment. From shifting regulatory expectations to evolving scientific priorities and the logistical complexities of scaling up manufacturing, companies are navigating a landscape marked by constant change. The underlying optimism is strong, but practical hurdles remain.

What remains clear is that the scientific foundation for cell and gene therapy is stronger than ever. In addition to continued progress in cancer and autoimmune indications, the field is seeing the rise of next-generation protein therapeutics, including bispecific antibodies and T-cell engagers. These advances broaden both the scientific and commercial landscape and underscore the need for manufacturing platforms that are robust but also flexible enough to accommodate new modalities.

Despite the promise of cell and gene therapies, manufacturing remains one of the sector’s biggest bottlenecks. The challenges are well known and recognized: high cost of goods, slow production timelines and the manual, labor-intensive nature of many manufacturing workflows. Each patient batch, especially for autologous therapies, must be handled as a unique, high-value product, requiring strict process control and extensive quality assurance.

Centralized manufacturing models have helped standardize some workflows, but they remain expensive and difficult to scale. Meanwhile, efforts to move to point-of-care or decentralized production have run up against the

realities of regulatory complexity and the need for reliable, reproducible outcomes. Overall, the sector continues to grapple with how to trim costs and speed up workflow times without sacrificing quality or safety.

The need for innovation in manufacturing is clear and the sector is moving toward automation, digital transformation and process redesign in pursuit of more efficient, scalable and high-quality production.

Manufacturers are increasingly embracing automation and digital solutions to address the sector’s most pressing pain points. Investment is pouring into robotics, process analytical technologies (PAT) and artificial intelligence (AI) aimed at streamlining complex workflows, reducing manual intervention and improving consistency across batches.

AI-driven approaches are being used to optimize scheduling, monitor process parameters in real time and predict potential deviations before they impact product quality. Digital transformation is also enabling more robust data management for trend analysis, quality control and

regulatory submissions. These tools are not only reducing the burden on skilled operators but also supporting faster and more reliable release of therapies.

Yet, progress is incremental. There is no universal, ready-to-go automation solution that fits the needs of all manufacturers. Many workflows are highly specialized, requiring custom automation and significant upfront investment in validation and integration. Automating these processes is not easy and often demands a bespoke approach. The value proposition becomes more compelling as manufacturers scale up to treat larger numbers of patients, but for now, much of the industry remains in a transitional phase.

This echoes across the sector. Companies are at various stages of implementing automation and AI, with some farther along the digital journey than others. The consensus is that the sector will get there, but it will take time, collaboration and continued investment to realize the full benefits of automated, digital manufacturing.

Regulation is both a driver and a constraint for the cell and gene therapy

Despite the promise of cell and gene therapies, manufacturing remains one of the sector’s biggest bottlenecks.”

San Francisco-based instrumentation company Xcell Biosciences recently announced a strategic collaboration with Thermo Fisher Scientific to advance research in regulatory T cells (Tregs) and tumor-infiltrating lymphocytes (TILs) to combat autoimmune and solid tumor diseases.

“While significant progress has been made in the cell therapy space leveraging Chimeric Antigen Receptor T (CAR T) cells, this collaboration aims to advance Treg and TIL cell therapies,” according to the announcement. “With solid tumors representing approximately 90% of adult cancers and instances of autoimmune diseases on the rise worldwide, this collaboration looks to target a crucial area for improving global health.”

The partnership aims to streamline cell therapy workflows, while improving scalability and reproducibility in cell therapy manufacturing. According to Xcellbio, its commercial instruments and software allow researchers to discover novel insights into immune and tumor biology, enabling the translation of these insights at patient scale through the development of its cGMP cell therapy manufacturing platform.

“By leveraging our AVATAR cell therapy manufacturing platform, we aim to push the boundaries of what is possible in cell and gene therapy,” Shannon Eaker, chief technology officer at Xcell Biosciences, said in a statement. “This partnership will enable us to develop more effective treatments for patients in need.”

Xcell Biosciences’ AVATAR technology enhances T cell potency, persistence, and efficiency by recreating the tumor micro-environment in manufacturing. Thermo Fisher’s Gibco CTS portfolio of cell and gene therapy products are GMP manufactured, safety tested, and backed by regulatory documentation to support the transition from discovery through clinical and commercial manufacturing. The Gibco CTS portfolio offers cell-type and viral vector specific applications.

Andy Campbell, senior director of research and development at Thermo Fisher, said in a statement that “Xcellbio’s interest in utilizing our Gibco CTS Detachable Dynabeads platform” within Thermo Fisher’s “modular, closed and automated cell therapy manufacturing workflow is a testament to the strength of our technologies.”

Campbell added that with the teaming between the companies “in combination with our full portfolio, including the Gibco CTS DynaCellect Magnetic Separation System and the Gibco CTS Rotea Counterflow Centrifugation System, we are confident that this collaboration will significantly shorten and enhance the manufacturing workflow for cell therapies in this space, ultimately helping our customers make the world a healthier place.” — Greg Slabodkin

sector. Over the past few years, we’ve seen increased support for fast-tracking cell and gene therapy products as regulators recognize their transformative potential.

However, regulatory environments remain uneven and, in many respects, unpredictable. While there is support for innovation, greater scrutiny is also being applied to raw materials, supply chain transparency and detailed process documentation. This is a natural evolution as the sector shifts from go-to-market launches to sustained commercial production, but it also introduces complexity for manufacturers.

Uncertainty also persists around the funding environment, especially for early-stage research. Early research funding is the seed for new therapies and applications, and any constriction in capital can have longterm implications for the innovation pipeline. For now, the sector continues to attract investment, buoyed by clinical successes and growing patient demand, but vigilance is warranted as market conditions evolve.

Sustainability continues to be a central theme across the globe in cell and gene therapy manufacturing. The widespread adoption of single-use technologies has been a game changer, offering greater flexibility, reducing the risk of cross-contamination and enabling faster changeovers between production runs. These benefits have supported more agile and responsive manufacturing operations, which are essential in a sector defined by rapid innovation and diverse product pipelines.

Recognizing the environmental impact associated with increased use

of plastics, the industry is proactively developing more sustainable films and recyclable materials for bioproduction. Advances in technology are also driving greater facility output, allowing manufacturers to produce more doses from the same footprint and optimize resources. Automation further supports these goals by enabling higher throughput and operational efficiency, contributing to more sustainable practices.

As cell and gene therapy manufacturing continues to evolve, sustainability will remain a priority, with ongoing innovation aimed at minimizing environmental impact while maximizing the benefits of single-use solutions.

One of the most exciting trends in the cell and gene sector is the level of collaboration across the value chain. Partnerships between technology providers, drug developers, contract development and manufacturing organizations (CDMOs), academic centers, research arms and regulatory agencies are driving both innovation and speed to market.

Increasingly, research sharing and open collaboration between academia

and industry are breaking down traditional silos, allowing for faster validation of new technologies and streamlined development of therapies. By openly exchanging data, best practices and scientific insights, stakeholders can accelerate problem-solving and reduce duplication of effort, ultimately bringing advanced treatments to patients faster.

Beyond these research and development synergies, collaboration is also proving critical when it comes to navigating regulatory pathways and scaling up manufacturing. By leveraging the collective expertise of diverse partners, organizations are better equipped to address evolving standards, overcome production bottlenecks and ensure consistent quality. This mindset is helping the sector adapt to rapid change and deliver transformative therapies to a broader patient population.

While CAR T-cell therapies have led the way for the cell and gene therapy revolution, the pipeline is rapidly diversifying. Natural killer (NK) cells, tumor-infiltrating lymphocytes (TILs), regulatory T cells (Treg cells) and other cell types are moving into

clinical development, including a growing focus on allogeneic, or “off-theshelf,” therapies.

Unlike autologous therapies, which are tailored to individual patients, allogeneic approaches use donor cells that can be manufactured at scale and stored for immediate use. This shift has the potential to unlock economies of scale, improve access and address disease indications that are out of reach for current therapies.

Unlocking the solid tumor space is another major focus for the industry. While CAR T-cell therapies have proven effective in certain blood cancers, extending these approaches to solid tumors would represent a transformative advance for oncology. Success in this area would broaden the impact of therapies and create new opportunities for patients and manufacturers alike.

There is also growing interest in pairing cell therapies with novel protein therapeutics, such as bispecific antibodies, which may offer synergistic effects and open up new treatment possibilities. In-vivo delivery of gene therapies is another frontier, with the potential to simplify manufacturing and expand access. Some of these disruptive innovations may still be

The cell and gene therapy sector is well positioned to continue transforming patient care, provided it meets emerging challenges with agility and a willingness to collaborate.”

a few years away from widespread adoption, but they are already shaping the sector.

One of the most powerful drivers of momentum in the cell and gene therapy sector is the growing public awareness of its potential, especially as patient success stories have brought these therapeutics into everyday conversation. As more people encounter these breakthroughs – whether through a loved one’s treatment or through news stories – the level of support and investment grows.

This human element is crucial. As public understanding deepens, the sector can expect greater advocacy, more robust funding, broader support

and even patients’ willingness to receive therapies – all of which will help accelerate the journey from manufacturing to delivery.

As we look to the future, the cell and gene therapy sector’s trajectory is clear: continued growth and a drive to improve patient outcomes. However, the challenges of cost, speed and complexity remain. Through automation, digital transformation and sustainability initiatives, manufacturers are laying the groundwork for a more efficient and scalable future.

Regulatory uncertainty, supply chain scrutiny and the need for greater

sustainability will remain front and center, but the sector’s collaborative spirit and commitment to innovation offer a way forward. New cell types, modalities and delivery technologies are broadening the treatment landscape, while increased public awareness brings new energy to the field.

The cell and gene therapy sector is well positioned to continue transforming patient care, provided it meets emerging challenges with agility and a willingness to collaborate. The next era of cell and gene therapy manufacturing will be built on flexibility, resilience and a shared vision for what is possible – delivering life-changing therapies to more patients, faster and with greater impact than ever before.

Dave Krupinksi Vice President of Sales & Marketing, Kent Elastomer Products

Biopharmaceutical manufacturing is a careful process that ultimately saves lives, and manufacturers have the opportunity to optimize their outcomes by sourcing high-quality single-use technologies.

Today’s biopharmaceutical manufacturing space is an exciting one to be in. The sector is experiencing significant growth, driven by increasing demands for innovative treatments for chronic diseases, cancer(s), immune-related disorders and much more. Vaccines, gene therapies, monoclonal antibodies, cell therapies and therapeutic proteins are just some of the life-saving treatments coming to fruition within the biopharmaceutical space.

Delivering these important biologics, of course, depends on sound, reliable production strategies. It’s not an easy task—because biopharmaceuticals are produced using living organisms like cells, bacteria or yeasts, the production process can be highly sensitive and complex compared to those for more traditional pharmaceutical therapies.

It is in part for these reasons that modern biopharmaceutical production strategies have applied single-use technologies (SUTs). Such components have demonstrated a range of new benefits within the space. SUT products like bioreactors, mixing systems, filtration units and tubing have all made an impact. For example, SUTs help reduce the risk of cross contamination between different batches of individual products, which is especially important for sensitive biologics. Because traditional stainless-steel equipment requires time-consuming cleaning and sterilization processes, SUTs can bring significant time and cost savings to production environments. In turn, this benefit can lead to faster turnaround times between products, reducing downtime between runs. Elsewhere, high-quality SUTs can improve a facility’s flexibility and scalability, enabling manufacturers to deliver different products and batch sizes without major new investment in stainless steel equipment.

Importantly, however, biopharmaceutical professionals must know what qualities to look for when sourcing SUTs for their needs. Specifically, tubing presents one of the critical applications for single-use systems, but not all tubing delivers the required quality and cost-optimization benefits that can make a true impact on your operations. In this article, we’ll explore some of the common challenges faced by today’s biopharmaceutical manufacturers and how single-use tubing can help overcome them, as well as ways to evaluate your tubing options to best meet your specific needs.

Like any modern manufacturing operation, biopharmaceutical manufacturers face some broad challenges they must overcome to maintain optimal production and cost effectiveness. Some of these include: Regulatory Compliance. Because biopharmaceuticals involve living cells and complex processes, biopharmaceutical products themselves and the materials used to produce them are some of the most strictly tested and regulated products available today. Organizations like the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA) set stringent guidelines for the production, testing and quality assurance of

biopharmaceutical products. Regulatory approval can be a long and costly process, but is critical to ensure safety and is simply a requirement to conduct business in this space.

Because many SUTs are prevalidated and pre-sterilized, they can help simplify compliance with regulatory requirements in the biopharmaceutical space. This can streamline the process of regulatory approval and reduce the complexity of quality control and validation processes, which are crucial to ensuring product safety and consistency.

Labor Struggles. Because the biopharmaceutical manufacturing is heavily specialized, it requires people who have completed the necessary training to execute properly. However, due to job market trends and various geographic limitations, recruiting can be a challenge, and the reality of working with a limited number of trained professionals can hamper production capabilities of many manufacturers.

Here, some of the time-and-labor saving benefits of single-use tubing can shine through. Single-use tubing can enable faster turnaround time by eliminating the labor required to sterilize systems between batches. When single-use systems are pre-sterilized and ready to use, they reduce dependence on in-house sterilization and cleaning processes, which can be a source of delays if equipment malfunctions or doesn’t meet quality standards.

Supply Shortages. The global supply chain has no doubt seen its fair share of challenges in recent years. The COVID-19 pandemic sent shockwaves throughout supply chains everywhere, and its massively disruptive nature prompted supply chain professionals in all industries to more closely evaluate their supply strategies.

Second-sourcing critical components became more commonplace as operators sought to mitigate shortages.

SUTs are not immune to supply disruptions, of course, but it can be worth the effort for biopharmaceutical manufacturers to more closely consider supply availability in today’s market. For example, biologics producers in the United States may wish to seek the services of a domestic supplier—thus eliminating concerns with global supply chains.

TPE advantages include:

• Flexibility and Adaptability. TPE tubing offers exceptional flexibility, making it a top choice for applications where tight bends and maneuverability are required. It seamlessly integrates into complex bioprocessing systems, reducing the need for extensive customization.

• Biocompatibility. High-quality TPE tubing is formulated to meet strict biocompatibility requirements, ensuring that it does not introduce contaminants or affect the quality of biopharmaceutical products, making it an excellent option for handling sensitive biologics and pharmaceuticals.

• Enhanced Cost-Efficiency. TPE tubing is often more cost-effective than silicone, both in terms of material and production costs. This affordability makes it an attractive choice for companies looking to optimize their manufacturing processes.

• Optimal User-Friendliness. TPE tubing is connected to points throughout the system through a process called thermal welding; comparatively, silicone is joined mechanically using a barb, adhesive, tapes and sealants. Thermal welding offers some simplicity here, as thermal welds can be made quickly and consistently. This allows for easier customization on the floor, allowing technicians to make quick changes as needed without the cumbersome process of mechanical joining.

Meanwhile, silicone advantages include:

• High Temperature Resistance. Silicone is designed for operating at extreme temperatures of (-120C–177C) making it suitable for specialized applications. It maintains its integrity and flexibility in challenging temperature conditions, making it a good choice for higher-stress applications.

• Excellent Chemical Inertness. Silicone is known for its high chemical inertness. It is less likely to interact with the substances it transports, making it a reliable choice for applications involving aggressive chemicals or solvents.

• Superior Longevity. Silicone tubing tends to have a longer lifespan than TPE tubing. It is resistant to wear and degradation, making it suitable for applications where durability is a primary consideration. However, when considering silicone for single-use applications, this quality is not always necessary—the longevity of silicone may outlive a production run with no further benefit for the end user.

• Optimal Biocompatibility. While high-quality TPE maintains good biocompatibility performance, silicone tubing has demonstrated a long history of optimal biocompatibility and is often used in highly sensitive medical and pharmaceutical applications for this reason, especially in situations where temperature extremes are involved.

In the end, your choice between silicone and TPE truly depends on the specifics of your application. But rather than simply defaulting to silicone when designing your systems, it’s worth evaluating whether TPE tubing can provide some cost and performance advantages where appropriate.

Once you’ve settled upon the optimal material choice for your application, it’s important to further evaluate the specific characteristics of your tubing from your supplier.

Let’s assume you’ve determined that TPE tubing will provide advantages for your specific application. Here are a few different attributes to look for that can help contribute to optimal production in your facility:

Excellent Leachables and Extractables Performance. In biopharma production, maintaining the purity and integrity of your biopharmaceutical products is paramount. Your TPE biopharmaceutical tubing should be carefully formulated to minimize the risk of leachables and extractables, ensuring that your valuable compounds remain uncontaminated throughout the biopharmaceutical manufacturing and delivery process. It’s worth considering the stakes: tubing that leaches contaminants into a drug run can ruin it in its entirety, potentially costing the manufacturer millions.

High Burst Strength. In demanding biopharmaceutical applications, tubing integrity is crucial. Therefore, it’s important to seek out biopharmaceutical tubing that demonstrates exceptional burst strength, and is capable of withstanding the regular pressures and stresses encountered during fluid transfer and pumping operations. Durability and reliability are essential here to maintain uninterrupted processes and prevent costly downtime.

Enhanced Pump Life. Peristaltic pumps are commonly used in biopharma, and the longevity of your tubing directly impacts pump performance and maintenance costs. High-performance biopharmaceutical tubing should be formulated to resist wear, spallation and premature degradation, maximizing the life of your pumps. The right option can contribute to extended pump life and enhanced operational efficiency.

Chemical Resistance. Biopharmaceutical processes will frequently involve aggressive chemicals and solvents. That makes chemical resistance a critical quality for TPE biopharmaceutical tubing, enabling the component to provide a barrier against degradation from potent pharmaceutical compounds. High-quality TPE tubing should maintain its structural integrity to best ensure the reliability and safety of your manufacturing processes.

High Gamma Sterilization Capability. Tolerance for high gamma sterilization levels can boost your confidence in process sterility. Optimal TPE tubing may reach gamma sterilization levels of up to 60 kGy for a duration of 30 minutes. This level of performance for a wide range of sterility and eliminates pathogens and contaminants, meeting the stringent requirements of the pharmaceutical and healthcare industries.

Tommy Schornak Senior Vice President of Injectables at Kindeva

Tackling today’s fill-finish demands

The growing focus on injectable therapies, from biologics and glucagon-like peptide-1 (GLP-1) receptor agonists to messenger RNA (mRNA) vaccines and gene therapies, is placing new and varied demands on sterile drug product manufacturing. These therapies often require specialized handling, flexible batch sizes and advanced delivery formats, which are stretching the capabilities of many conventional fill-finish operations.

At the same time, regulatory standards for aseptic processing are becoming more stringent, prompting significant changes in how facilities are designed and validated. Sustainability is also gaining ground as a procurement priority, introducing new pressures around infrastructure and operational efficiency.

Meeting these challenges calls for a coordinated approach across facility design, regulatory compliance and development strategy. As the industry contends with rising technical demands, stricter sterility requirements and broader sustainability goals, manufacturers are rethinking how they build capacity, protect product quality and respond to clinical and commercial needs. These priorities are reshaping how organizations plan facilities, structure partnerships and respond to the evolving needs of both regulators and patients.

One of the most notable shifts in injectable manufacturing is the widening range of product types and delivery formats that must now be supported. At one end of the spectrum are large-volume commercial products, such as GLP-1 receptor agonists, which require high-speed,

high-throughput capacity. At the other end are targeted therapies for oncology, rare diseases or personalized applications, which depend on smaller batch sizes, highly specialized handling and accelerated production schedules.

The move toward patient-friendly formats, including prefilled syringes, cartridges, wearable injectors and microneedle array patches, adds another layer of complexity. Each configuration introduces specific requirements for filling, inspection and packaging, and places distinct demands on container closure integrity, dose accuracy and user safety.

However, many legacy fill-finish lines remain optimized for traditional vial-based production. Supporting newer formats often requires modular or combinatory line configurations that can accommodate a broader range of container types, batch sizes and fill volumes while maintaining throughput and sterility assurance.

One solution has been the use of combi lines or parallel lines that support multiple formats within a shared infrastructure. These platforms allow contract development and manufacturing organizations (CDMOs) to flex resources based on product needs without duplicating entire production suites. They also enable smoother transitions between formats as products move from early-phase development to commercial supply.

Designing for adaptability from the outset helps future-proof infrastructure and allows manufacturers to respond to the next modality shift or delivery innovation with minimal disruption.

As manufacturers adapt to a broader range of formats, they must also navigate increasingly detailed regulatory expectations for sterile facility design and contamination control. The 2022 revision of Annex 1 of the European

Union Good Manufacturing Practice (EU GMP) guidelines emphasizes technical solutions such as isolators, restricted access barrier systems (RABS) and automation [1]. These tools physically separate operators from sterile products and reduce reliance on manual procedures.

This renewed focus on contamination control stems from long-standing concerns around operator intervention and sterility breaches. As a result, engineering controls (particularly isolator-based systems) are becoming foundational to aseptic facility design.

While these technologies have been available for years, they are increasingly regarded as baseline requirements for aseptic processing rather than enhancements. For many facilities, adapting to these expectations means reevaluating both physical layout and process strategy.

In some cases, retrofitting legacy lines is technically possible but financially or operationally impractical. As a result, a growing share of industry investment is shifting toward greenfield builds designed to meet Annex 1 compliance from the outset. These

Sustainability has become a strategic imperative shaping decisions on infrastructure and partner selection.

new installations often pair isolator containment with high-speed, high-flexibility performance, reinforcing both regulatory readiness and commercial scalability.

Sustainability has become a strategic imperative shaping decisions on infrastructure and partner selection. It now touches every aspect of facility design, procurement and long-term operational planning. Drug developers face growing pressure to reduce the environmental footprint of their supply chains, and those expectations increasingly apply to their CDMO partners.

This shift is driving a more comprehensive view of sustainability. Considerations now extend beyond materials and waste to include energy efficiency,

water usage and overall facility emissions. Procurement teams are beginning to evaluate CDMOs based on these factors, prompting manufacturers to reassess how they plan and invest in infrastructure.

These expectations are also raising the bar for how sustainability is measured and reported. It is no longer enough to make one-time investments in greener equipment or facility upgrades. Stakeholders (including regulatory) are beginning to ask for ongoing visibility into resource usage, emissions data and environmental performance metrics.

Greenfield builds offer the opportunity to integrate these considerations from the ground up, aligning environmental priorities with regulatory and operational goals. CDMOs that design with this level of foresight and transparency are more likely to meet the long-term expectations of their partners.

As fill-finish operations become more complex due to the rise of varied delivery formats, stricter sterility requirements and faster timelines, drug developers are looking to manufacturing partners for more than just production capacity. CDMOs are now expected to provide technical insight early in development, supporting formulation, container selection and scalable process design.

These expanded expectations reflect both operational demands and evolving regulatory standards. Today, regulators hold CDMOs and sponsors

A new collaboration between Eli Lilly, Merck, and Purdue University is focused on sterile injectables. Purdue’s Young Institute for the Advanced Manufacturing of Pharmaceuticals is looking to advance AI-driven automation, robotics, and novel aseptic processing methods to improve efficiency, quality, and safety in the manufacture of injectable drugs.

Elizabeth Topp, director of the Young Institute, makes the case that robotics could remove human operators from sterile environments, reducing contamination risks and ensuring operator safety.

“Ideally, what we want to do is create an environment in which there are no humans present,” Topp said. “We want the fill-finish line to be completely free of humans. Humans are full of germs. We are little germ factories.”

To address the problem, Purdue is working with the pharmaceutical industry to try and create what they call a hands-off, gloveless, sterile, injectable fill-finish line. “So, we only have robots in the environment,” she said. “It’s an exciting thing to try and work on.”

In this completely robotic environment, Topp’s vision is for a fill-finish line that fixes itself. “If something falls off the line or a widget falls off of a piece of equipment, a human doesn’t have to go in and repair it,” she said.

Another contamination control-related project Purdue’s Young Institute is working involves environmental monitoring. Topp notes that “one of the most old-fashioned and common ways of monitoring” is simply putting a Petri dish next to a fill-finish line and waiting to see what lands on it.

However, it is a slow and time-consuming process that can lead to false positives, according to Topp, with incorrect information resulting in a loss of product for pharma manufacturers. “We need to switch to those other methods that involve contamination detection, using methods other than waiting for the stuff to grow,” she said.

When it comes to air monitoring of the manufacturing environment, there are cone-shaped collectors that are used to actively sample air but “they also have their problems and are ultimately limited by the same kinds of analytical challenges,” Topp lamented.

One promising area of technology involves automated visual inspection of vials coming off the line, potentially replacing a cumbersome method of manually inspecting them. Purdue and its pharma partners are working on a better way of looking for particulate or other abnormalities in products through automated visual inspection. “We have cameras. We have AI. Why can’t we have a better way of examining these?” Topp asked.

The Young Institute’s 10,000-square-foot pilot-scale manufacturing facility is under renovation in West Lafayette, Indiana — an innovation space to “monitor what’s going in fill-finish lines and develop some of these technologies,” Topp said. — Greg Slabodkin

jointly accountable for product knowledge and compliance, particularly in areas related to aseptic processing and risk mitigation. In response, many organizations are prioritizing transparency, shared data systems and collaborative problem-solving across the development lifecycle.

Whether enabling first-in-human studies or scaling established therapies in new formats, CDMOs are playing a central role in establishing robust, reproducible processes. These processes must protect product quality, satisfy global compliance requirements and support accelerated timelines for clinical and commercial supply.

The fill-finish landscape is no longer defined by a single dominant format, modality or process model. Instead, it reflects a growing mix of therapeutic innovation, evolving compliance standards and increasing operational complexity. Facilities and partnerships that succeed will be those designed with adaptability at their core.

The choices being made now, such as how lines are configured, how automation is applied and how partnerships are structured, will determine how effectively the industry can deliver the next generation of therapies.

With the right infrastructure, technical expertise and alignment across functions, sterile manufacturing partners can help ensure that growing complexity becomes a driver of progress rather than a barrier to delivery.

1 Comprehensive Overview of EU GMP Annex 1 for Sterile Manufacturing, Pharma GMP

Bethany Silva Endress+Hausery

Advances in singleuse technology— including Coriolis flow, Raman spectroscopic, and capacitive level measurement— are driving more flexible, efficient, and profitable operations for both small and largescale pharmaceutical manufacturing.

In recent years, the value of flexible manufacturing is increasingly recognized in the biopharmaceutical industry as a key way to meet variable production demands. This contributes to the development and adoption of single-use technology so production facilities can quickly scale operations and meet manufacturing needs, ranging from clinical trials and small-scale runs, all the way to conventional large batch sizes.

Single-use technology encompasses process-contact equipment designed to be replaced after each batch or manufacturing cycle. These components, assemblies, and systems can be beneficial to end-users because they do not require cleaning, sterilization, or validation. They also help reduce expenditures on chemical agents, energy, and water, and they mitigate cross-contamination risks. In addition, single-use technology helps streamline manufacturing efficiency and accelerate time to market.

As single-use technology develops, it is becoming increasingly userfriendly and efficient. Current “plug and play” modules are making the progression from batch-based operations to continuous processing more attainable for many manufacturers.

However, the use of disposable components carries challenges that must be mitigated, including the potential for certain plastic materials to interact with the process. Beyond basic construction quality standards, single-use technologies must demonstrate advancements in accuracy, durability, and robustness as required to enhance production-scale process control and reduce the chance of product losses. New and upcoming single-use devices address these challenges, delivering comparable levels of reliability and accuracy as their conventional reusable counterparts.

Single-use instrumentation emerged about a decade ago, coinciding with industry trends towards targeted medicinal products, continuous rather than batch processing, and smaller, more adaptable manufacturing systems.

While there will always be a need for large-scale production of widely used pharmaceutical products, the demand for personalized drugs is impacting the design of many modern facilities to favor flexible manufacturing over mass production. Single-use devices help facilitate this flexibility because they are modular, and they typically require far less upfront capital investment than traditional stainless-steel instrumentation.

The advantages of single-use instrumentation are most pronounced in smallscale operations, and they can provide significant benefits in larger production lines as well. While early single-use devices were fit for small-scale operations, many faced challenges in larger and more demanding production lines. Compared to standard reusable devices, single-use designs employed more plastic components, resulting in reduced reliability and the risk of material leaching.

Additionally, certain types of instrumentation are not easily adapted into single-use versions, such as many types of flowmeters. Electromagnetic flowmeters, for example, cannot be used in water for injection (WFI) applications because the electrodes used for measurement depend on liquid conductivity, and pure water is a poor conductor.

Coriolis flowmeters are a mainstay for these applications, but they rely on vibrating tubes to measure flow, and plastic is not easily excited to sustain these vibrations and provide accurate, reliable measurement. Without the ability to use electromagnetic or Coriolis flowmeters, some manufacturers resorted to ultrasonic flowmeter alternatives in single-use processes, but these sensors can be more challenging to properly calibrate, and measurement is less accurate.

This narrative has changed, however, with the advent of single-use Coriolis flowmeters, along with an increasing variety of reliable single-use instruments that are helping overcome past production challenges.

2: Many single-use bioreactors feature built-in disposable fittings for inline sensors—such as the Endress+Hauser Raman Rxn-10 probe—to prevent direct contact with the process, eliminating the need for sensor sterilization between batches.

3: Liquicap FTZ61 singleuse capacitive level patches from Endress+Hauser are ideal for accurate capacitive liquid or foam detection in non-conductive containers.

Single-use technology development is driving progress and flexibility for pharmaceutical manufacturing methods, and increasingly providing a viable alternative to conventional instrumentation.

Single-use Coriolis flowmeter measurement systems consist of a permanent transmitter and sensor, with a disposable measuring tube (Figure 1). To avoid plastic materials challenges in this precise mechanical application, single-use vibrating Coriolis tubes must be stainless steel and designed in compliance with the Current Good Manufacturing Practices (cGMP) standards and guidelines.

Each single-use tube is factory-calibrated with calibration data encoded in the tube, and upon installation in a base unit, this data is automatically uploaded. This enables an automated verification procedure to confirm validity of the original factory calibration, followed by automatic zero-point adjustment to ensure high-performance measurement under a multitude of process conditions. These automated procedures save substantial amounts of time otherwise required for technicians to conduct field calibration.

Typical mass and volumetric flow accuracy for this single-use design aligns closely with conventional Coriolis instrumentation, inside a 0.5% error range with 0.25% repeatability for flows as low as 0.12 L/min up to 75 L/min. The components are most frequently housed in a table-top casing for laboratory environments, or in smaller front-panel-mounted casings for skid builders.