BELL WEALTH

A Wealth of Experience in the Twin Cities

With decades of combined experience and a comprehensive approach to wealth planning, Bell Bank Wealth Management’s team in the Twin Cities is dedicated to serving clients’ best interests.

From business succession planning to investment management, the team provides personalized financial services to help clients navigate their complex financial journey.

Get to know Bell’s Twin Cities team and their approach to serving clients.

2024 Q2

MEET OUR TWIN CITIES TEAM

In the Twin Cities, Bell Bank Wealth Management’s team brings together a wide range of experience and expertise to the shared goal of doing what’s best for Bell clients.

“Our passion for helping our clients drives everything we do,” said Brooks Bollinger, director of Bell’s Twin Cities Wealth Management team. “Everyone on our team is committed to going above and beyond to serve our clients and help them achieve their financial goals.”

The Twin Cities team provides a full range of wealth management guidance for individuals, families and businesses, including estate planning, tax planning, retirement planning and more. Team members work closely with Bell’s personal bankers to advise on both sides of a client’s balance sheet and leverage the varied resources of Bell’s wealth management division to help clients achieve their long-term goals.

▼ Meet some of the faces of our Twin Cities team below.

Meg Martin | VP/Senior Wealth & Fiduciary Advisor

Meg specializes in helping business owners and multigenerational families navigate complex financial issues. She covers topics such as business exit and trust and estate planning, and works closely with clients to build strong, lasting relationships.

Outside of work, Meg is an avid traveler who has been to all 50 states and more than 40 countries.

Tyler Swanson | VP/Wealth Advisor

Tyler offers comprehensive financial planning services to clients, including investment strategies, tax planning, retirement income planning, charitable giving and estate planning. His approach centers around understanding each client's priorities and crafting a financial plan aligned with their long-term goals.

When he’s not working with clients, Tyler enjoys an active lifestyle with his wife and three kids.

Each individual perceives the world, money and risk through a unique lens. My passion lies in providing tailored solutions that instill confidence in my clients, ensuring they remain steadfast through market fluctuations, political uncertainties and life’s diverse challenges. I’m committed to offering insights and strategies for a secure financial journey.

Chris Haarstick | VP/Senior Portfolio Manager

Chris works with Bell’s business owner clients to help them make high-quality investment and financial decisions, treating them like family to help them achieve their wealth goals. It was family, in fact, who got Chris involved in finance – his grandfathers were business owners and active participants in the stock market, and they passed their passion on to him, which he now applies to serving his clients.

I strive to know everything about our clients – their lifestyles, careers, family dynamics, and philanthropic and wealth planning goals. It’s important that I know the whole person and not just the numbers on their balance sheet, which makes my job more helpful and meaningful.

Outside of the office, Chris and his family enjoy spending time on the lakes in Central Minnesota.

I love seeing our clients achieve their major life or wealth milestones, such as sending their kids or grandkids to college, or transitioning that treasured cabin or family farm to the next generation.

2

Brooks Bollinger SVP/Twin Cities Wealth Management Director

Brooks Bollinger SVP/Twin Cities Wealth Management Director

Shelbie Fluegel Wealth & Fiduciary Associate

Shelbie Fluegel Wealth & Fiduciary Associate

Joe Pope SVP/Client Portfolio Manager

Joe Pope SVP/Client Portfolio Manager

Miranda Seeger VP/Wealth Operations Manager

Miranda Seeger VP/Wealth Operations Manager

STRATEGIES TO CONSIDER WHEN SELLING OR TRANSFERRING A BUSINESS

For many of our Bell business owner clients, the sale or transfer of their business can be the largest wealth creation tool of their lives. In some cases, they may only get one shot at a sale or transfer, which makes it crucial to be as prepared as possible.

If you’ve been thinking about possibly stepping away from your business and looking ahead to a potential sale, it’s important to consider the different possibilities. Here are some questions to ask yourself as you begin to prepare:

• Who could be a potential buyer for your business? Would it be an employee or employees? Private equity? A competitor?

• Logistically speaking, how would you sell your business? Would you hire a broker, or has a competitor or private buyer reached out unsolicited?

• Have you calculated how much you would need to make in a sale to meet your retirement goals?

• Are your financials cleaned up? Do you have data organized to send to a prospective buyer?

• Have you reviewed how your business’s current tax structure could affect your sale price?

• When you identify a buyer, who would be responsible for keeping the sale on track?

James Dufresne | SVP/Senior Wealth Advisor

3

In our experience, the most successful sales and transfers of businesses have resulted from our clients carefully thinking through those important initial steps and then working with a team of experts to develop a comprehensive plan.

— James Dufresne

Your answers to these questions will help you begin to crystalize how and to whom you’d like to sell your business. That information can then inform the specific shape your sale ends up taking, as there are several different options and strategies that will ultimately depend on your – and your buyer’s –specific situation. Here are some basic strategies to be aware of:

1STOCK SALE: This is the simplest form of a business sale and potentially the cleanest tax burden on the seller. In this case, the buyer acquires the stock of your business, and the sale price is generally taxed at favorable capital gains rates. The challenge here is the buyer can potentially take on any prior liability in the company, which some buyers may not be comfortable acquiring.

2ASSET SALE: This can be a common type of strategy for businesses with tangible assets, such as real estate or equipment. In this case, the buyer buys the assets and takes over the running of the business. You, as the seller, retire the

stock of your company. For buyers, this strategy can be preferrable because it may depreciate the sellers’ assets upon purchase, but for sellers it may be less favorable as it can result in a higher tax rate on the sale and in retention of the company’s liabilities.

3

PARTIAL SALE: Perhaps it makes sense to sell only a portion of your business rather than the entire enterprise. In some cases, business owners may choose to sell minority or majority stakes in their business to their employees, children, private investors or private equity funds. When considering a partial sale, it’s critical to have clear and reasonable expectations, operating agreements and exit strategies in place.

4EMPLOYEE STOCK OPTION PROGRAMS

(ESOP): ESOPs have received a lot of buzz over the last decade and can be a great structure if you’d like to sell your business to your employees. ESOP sales can be complex, however, and should be considered carefully.

5THE NON-SALE OPTION:

After considering potential sale scenarios, you may decide that you don’t want to sell after all – perhaps because your business’s cashflow is too good to lose. In that case, you could consider hiring a competent management team to take over the day-to-day operations while you still retain ownership.

In our experience, the most successful sales and transfers of businesses have resulted from our clients carefully thinking through those important initial steps and then working with a team of experts to develop a comprehensive plan. Investment advisors, bankers, lawyers and accountants all play important roles in this process and will be able to help you prepare.

If you own a business and have questions on a potential sale or transfer, please don’t hesitate to give us a call.

4

Mary Locken | SVP/Wealth & Fiduciary Division Manager

Mary Locken | SVP/Wealth & Fiduciary Division Manager

WHY IT’S IMPORTANT TO PREPARE FOR THE ESTATE AND GIFT TAX SUNSET SOONER RATHER THAN LATER

As of Jan. 1, 2024, the federal gift and estate tax exemption amount as well as the generation-skipping transfer exemption amount increased to $13.61 million per person. This means that individuals can transfer up to $13.61 million tax free during their lifetimes or at death (or through a combination of life and death transfers), and married couples can transfer up to $27.22 million. It also

means that even if you already utilized your full exemption amount of $12.92 million through lifetime gifts in 2023, you have up to an additional $690,000 to transfer in 2024 (an additional $1.38 million for married couples).

However, it’s important to note that the increased federal gift, estate and generation-skipping transfer tax exemption amounts are set to sunset,

or expire, on Dec. 31, 2025, under the 2017 Tax Cuts and Jobs Act. Barring congressional action, the exemptions will revert back to approximately $6.8 million per person, adjusted for inflation, starting Jan. 1, 2026. This is a significant change that could have wide-ranging estate planning implications.

Depending on the 2024 election outcomes, there could be legislative

5

changes to the federal transfer tax exemption amounts. In the meantime, for individuals and families with large taxable estates, it would be wise to consider gifting strategies now to reduce the size of your taxable estate while the exemption amounts are higher. Additionally, gifting earlier in the year could help you get ahead of a potential inundation of estate planning attorneys and tax advisors as we approach the Dec. 31, 2025, sunset under current tax law.

If you’re concerned about whether this sunset could impact your family’s transition of assets and applicable tax consequences, we recommend conferring with your legal and tax advisors to review and perhaps update your estate plan sooner rather than later.

HOW TO PREPARE

In the event your taxable estate is likely to exceed the exemption amounts following the sunset, there are strategies your estate planning attorneys and tax advisors could consider. Annual gifting ($18,000 per person and $36,000 for

married couples is allowed in 2024) both reduces the value of your taxable estate and educates younger generations about the value of financial stewardship. Other strategies could include gifting to charitable organizations or making other types of qualified transfers, such as payments on someone’s behalf directly to an eligible academic institution or medical care provider.

More advanced methods to reduce estate taxation include Spousal Lifetime Access Trusts (SLATs), Charitable Remainder Trusts (CRTs) and Intentionally Defective Grantor Trusts (IDGTs). Estate planning professionals can help you explore strategies and options that might be best for your specific situation.

The time to begin having these discussions with your estate planning attorney and tax advisor is now. Taxpayers are limited not only by the Dec. 31, 2025, sunset deadline, but also by the practical realities of the planning process combined with the limited time and resources of legal and tax advisors and their support teams.

We encourage our clients to contact their estate planning attorneys and CPAs as soon as possible to discuss their estate situations and begin exploring potential solutions that can meet their needs and goals.

The planning process should be performed with sufficient time to ensure both effectiveness and flexibility for any future changes in the law or with family circumstances.

The time to begin having these discussions with your estate planning attorney and tax advisor is now. Taxpayers are limited not only by the Dec. 31, 2025, sunset deadline, but also by the practical realities of the planning process combined with the limited time and resources of legal and tax advisors and their support teams.

— Mary Locken

6

Mike Kobbervig | SVP/Retirement Plan Services Division Manager

Mike Kobbervig | SVP/Retirement Plan Services Division Manager

Common Detrimental Investor Behaviors

On a daily basis, we’re all faced with making a wide range of decisions as we go about our lives. From what we eat for breakfast to what we decide to do after work, decisions that may seem small in the moment have the potential to affect the outcomes of our day. The same is true of investing – at some point, we as investors will need to make decisions about our investments or our portfolio that could have longlasting implications.

While it’s easy to think we’re able to make informed, rational choices, the reality is the actions we take are often influenced by a host of behaviors and biases. Sometimes, we may not even be aware of these behaviors, which can cause us to make poor decisions that negatively impact our long-term plans.

Learn about some of the more common investor behaviors and what you can do to overcome their influence.

OVERCONFIDENCE: It’s not unusual to come across someone who thinks they’re better at something than they actually are. In fact, we’ve all probably been guilty of that at one point or another. Overconfidence is also commonly seen in investing, where investors can easily rate themselves as being above average at making investment decisions. When you feel overconfident about your investing prowess, you tend to focus only on the upside of investments, while underestimating the probability of poor outcomes. Instead of trusting your gut, take a more rational and fact-based approach to make sure your decisions are as informed as possible.

HINDSIGHT BIAS: Some psychologists refer to hindsight bias as the “I knew that was going to happen” effect. By falling victim to a hindsight bias, investors may become angry or regretful about failing to avoid what appears to have been an obvious outcome. This could cause you to make poor decisions about similar events in the future. Keeping track of your investment thoughts and processes can help you better understand how you arrived at a specific decision, minimizing the chances for hindsight bias to affect your outlook.

REGRET: Similarly, investors often react emotionally after realizing they’ve made an error in judgment, and may let that regret cloud future investment decisions. This emotional reaction can potentially cause you to become more risk averse, or perhaps take greater risks, in a way that goes against your long-term plan. As with hindsight bias, taking a more fact-based approach with your investment thoughts and decisions can help you remove emotions like regret from the equation.

SHORT-TERM FOCUS: More than ever before, technology provides us with instant access to news headlines and information, including our portfolio and investment performance. While this can make our lives more convenient, it also has downsides. For example, checking on our investments too often, in conjunction with following only headline-driven news, can lead to frequent trading and/or overreactions to volatility. It’s important to remember that investing is a marathon, not a sprint. Don’t let short-term events impact your long-term plan.

HOT-HAND FALLACY: In investing, the hot-hand fallacy is when we perceive patterns where none exist, and then take action as a result. The concept of a “hot hand” is taken from a study done by Gilovich, Vallone and Tversky on the performance of basketball players, who are often thought of as being on a “hot” or a “cold” streak of shooting. The study analyzed players’ shots in hundreds of games and concluded that the outcomes of both field goals and free throws were largely independent of the outcome of the previous attempt. When selecting a wealth advisor, looking only at a one-year return (or attractive returns for the past few years) could cause some investors to drop their current advisor in favor of the one on a “hot streak.” This can lead to dangerous assumptions and predictions, when investors should be focusing on the longterm track record instead.

These examples show that there are a number of different behaviors that can impact our investment decision-making without our even realizing it. That makes it important to be methodical and fact-based in our approach to minimize any detrimental influences and stay focused on your long-term plan.

Data sourced from Financial Fitness Group

7

Inside this issue:

s Meet the Bell Wealth Management Team in the Twin Cities

s Strategies To Consider for Selling Your Business

s Preparing for the Upcoming Estate and Gift Tax Sunset

s Understanding Detrimental Investor Behaviors

INTEREST RATES REMAIN HIGH AS MARKETS AWAIT FED RATE CUTS

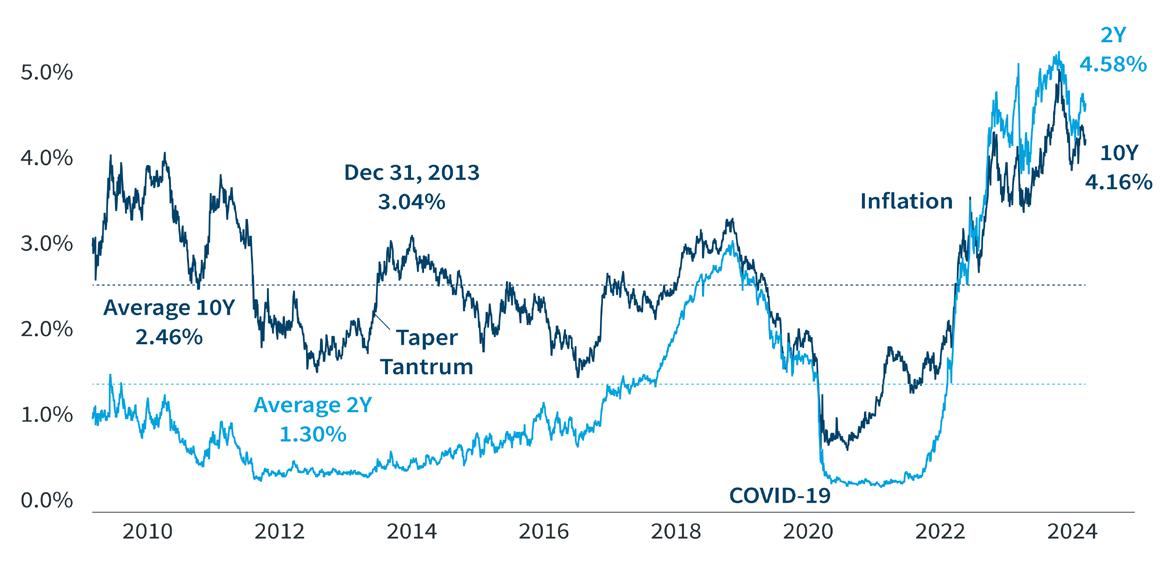

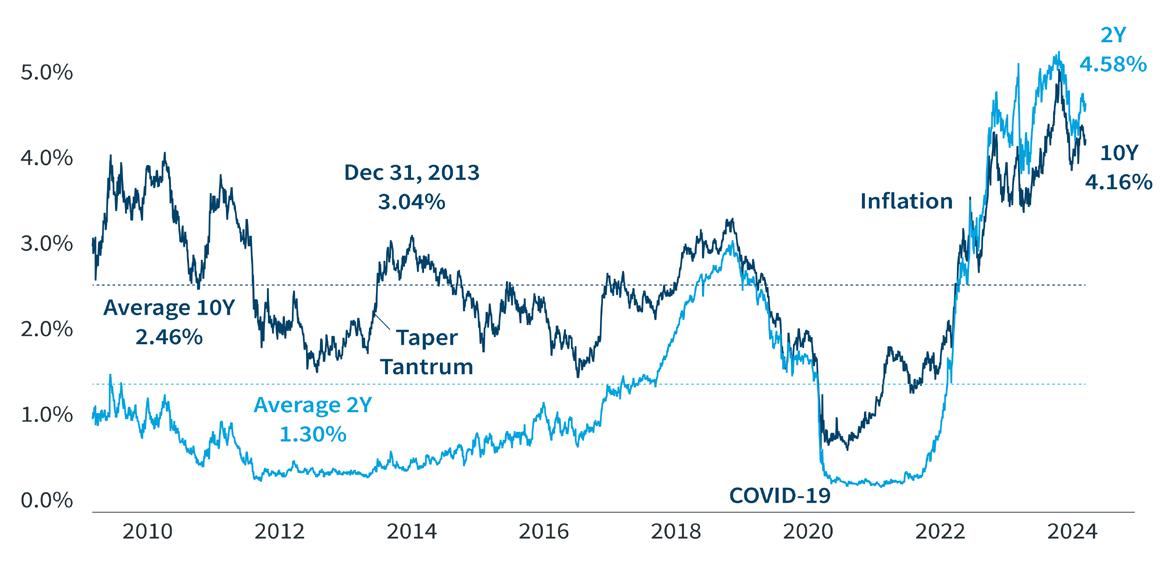

Over the past two years, interest rates have fluctuated as economic expectations have shifted. The 10-year Treasury yield briefly exceeded 5.0% for the first time since 2007 but has now settled around 4.2%. Movements in interest rates have far-reaching implications that impact everything from business loans to asset valuations. Inflationary pressures have declined significantly from the peak levels seen in mid-2022, but recent inflationary data is proving stubbornly elevated. All eyes are now focused on when we will see the Federal Reserve begin to cut short-term interest rates, with market expectations pointing to sometime in the second half of 2024.

Get LinkedIn

701.451.3000 | 800.709.5781 15 Broadway | Fargo, ND 58102 www.bell.bank Deposit and loan products are offered through Bell Bank, Member FDIC. Bell Insurance Services, LLC is a wholly owned subsidiary of Bell Bank. Products and services offered through Bell Insurance or Bell Bank Wealth Management are: Not FDIC insured | No Bank Guarantee | May lose value | Not a deposit | Not insured by any federal government agency. This newsletter has been written for the general information of clients and friends of Bell Bank. It is not intended, nor may it be relied upon, as tax or legal advice with respect to any matter. This newsletter also cannot be used by a taxpayer for the purpose of avoiding penalties that may be imposed by the Internal Revenue Service or other taxing authority.

Bell Bank on LinkedIn for regular commentary and market insights. ECONOMIC INSIGHTS

Follow

8

Brooks Bollinger SVP/Twin Cities Wealth Management Director

Brooks Bollinger SVP/Twin Cities Wealth Management Director

Shelbie Fluegel Wealth & Fiduciary Associate

Shelbie Fluegel Wealth & Fiduciary Associate

Joe Pope SVP/Client Portfolio Manager

Joe Pope SVP/Client Portfolio Manager

Miranda Seeger VP/Wealth Operations Manager

Miranda Seeger VP/Wealth Operations Manager

Mary Locken | SVP/Wealth & Fiduciary Division Manager

Mary Locken | SVP/Wealth & Fiduciary Division Manager

Mike Kobbervig | SVP/Retirement Plan Services Division Manager

Mike Kobbervig | SVP/Retirement Plan Services Division Manager