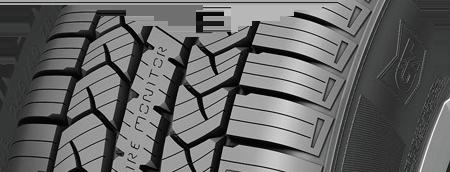

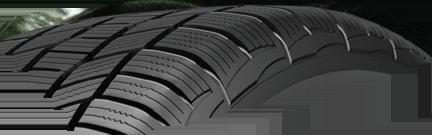

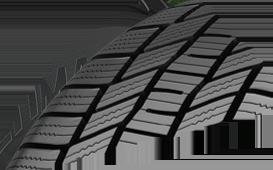

Engineered for full-size pickups and commercial vans tasked with working in the harshest conditions. 3PMSF rated, molded for optional studs and available in 28 of the most popular sizes. Contact your Yokohama sales representative for more details.

ALL-WEATHER TRACTION

LONG TREAD LIFE

OUTSTANDING ON- AND OFF-ROAD DURABILITY

SEVERE SNOW SERVICE RATED BUILT TO LAST WITH GEO-SHIELD® TECHNOLOGY

WHEN TO SELL RIDE CONTROL SERVICE

MARIJUANA IN THE WORKPLACE - WHAT YOU NEED TO KNOW

THE POWER OF ALTERNATIVE FINANCING

Dealers say consumers who are educated about winter tires make the selling easy.

You’ve worked hard to build your business into the successful enterprise it is today. You’ve scrimped, saved and sacrificed.

You’ve made countless tough decisions with the greater good of your customers, your employees and your dealership’s future in mind.

You’ve followed the rules, done it the right way and now you’re enjoying the rewards. (At least I hope you are!)

Now, let me ask you a question. Are you willing to throw all of this away — every single last piece of it — because of one employee’s lapse in judgement or moment of self-indulgence?

That’s what could very well happen if you don’t implement and enforce policies that deal with the use of recreational marijuana at your dealership.

To date, 22 states — and Washington, D.C. — have legalized the use of recreational marijuana. (Thirty-eight states — plus Washington, D.C. — have legalized the use of medical marijuana.)

In this edition of MTD, SESCO Management Consultants, a company that advises tire dealerships on human resource issues, covers the intricacies of medicinal and recreational marijuana and what you need to know and do as it pertains to both.

I urge you to read the story, clip it out and keep it handy. If you have a hiring manager or human resources person, share it with them. Share the article with your attorney, too. Make it required reading for your store managers or anybody who’s in a position of authority at your company.

You need to understand the facts about marijuana use in the workplace and how it can destroy your business.

You may have heard or read that marijuana “is harmless.” Consider these points, provided by the National Institute for Occupational Safety and Health:

• The active ingredient contained in marijuana “affects areas of the brain that control the body’s movements, balance,

coordination, memory and judgement” and marijuana use “can impair coordination and distort perception.”

• The risk of getting in a vehicle accident increases “significantly” after marijuana ingestion.

In addition, marijuana use is more common than you might think. According to SESCO, one in eight workers actively uses marijuana on a recreational basis.

Research conducted by the National Safety Council shows that marijuana “is the most frequently used illicit drug of abuse in the United States and the drug most often detected in workplace drug testing.”

You don’t want a high employee to clock into work and get behind the wheel of a delivery truck or forklift — nor do you want a spaced-out technician working on your customers’ vehicles.

Just one marijuana-related incident has the potential to ruin your business, no matter how much insurance you carry. All it takes is one lawsuit.

What can you do? The article from SESCO that I mentioned makes a number of smart recommendations that I believe you should heed and follow.

At the very minimum, you should implement a zero-tolerance policy when it comes to marijuana use at your place of business.

Let your managers and other employees know that marijuana use will not be tolerated and that anyone found in violation of your dealership’s policy will be fired.

Put this in writing, using a third-party expert, if necessary. Run it by an attorney before finalizing.

Require all employees — current and new — to read, understand and sign off on your policy as a condition of employment.

For the sake of your business’ continued existence and success, you have to say more than “no” to drug use.

You need to put policies in place and those policies must be enforced. Leaving it to chance puts you — and everything you’ve worked so hard for — at risk.

On a much lighter note, I’d like to draw your attention to MTD’s brand new website — accessible at the same address, www.moderntiredealer.com — and MTD Hotwire e-newsletters.

We launched these new platforms on March 1 and are excited about their fresh, eye-catching design and more importantly, how much more effectively they will deliver information to you. Our new website, for example, is easier to navigate and features more info than ever before.

That’s critically important as we continue to provide content to help you run your business even more efficiently and profitably. ■

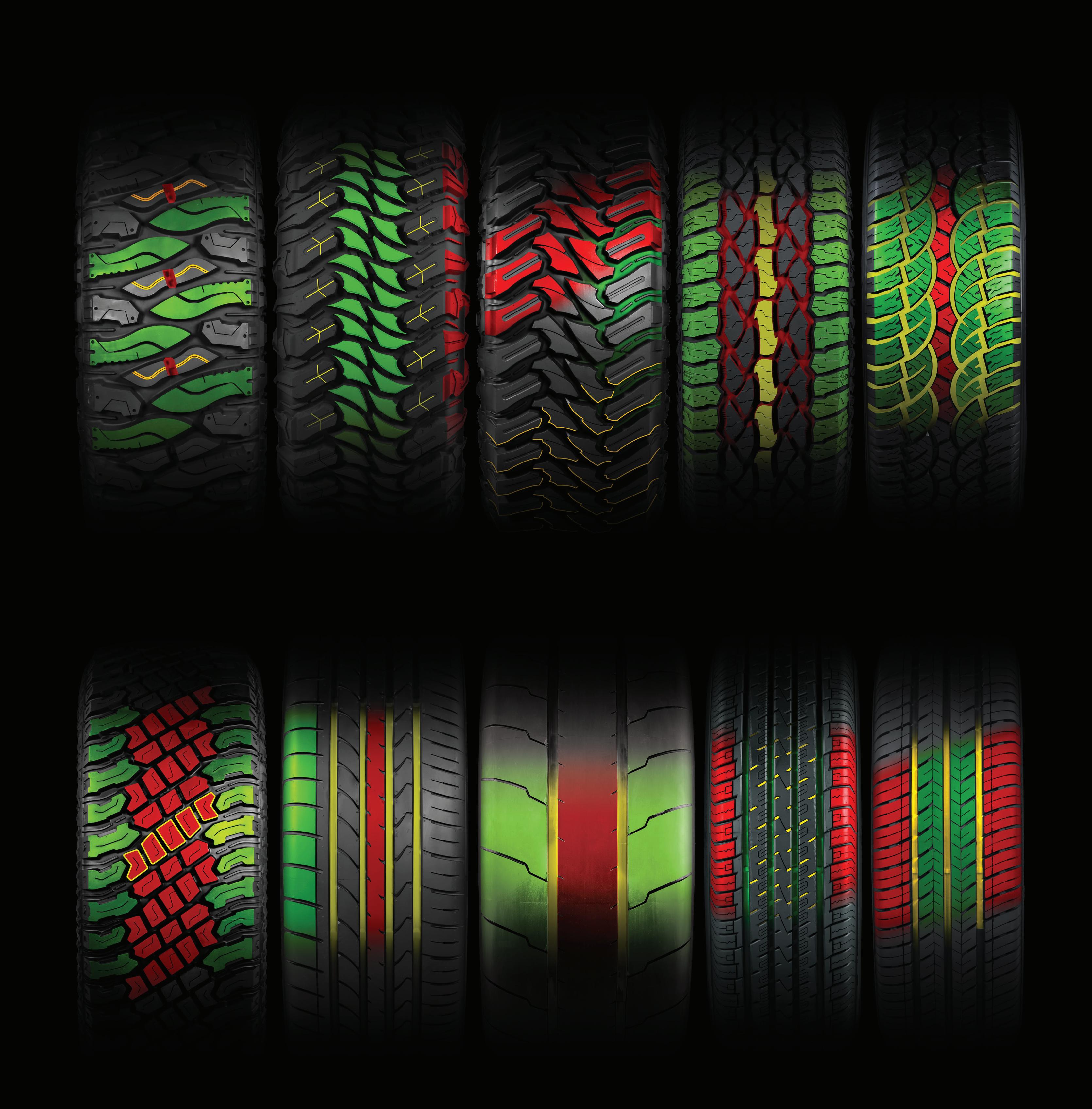

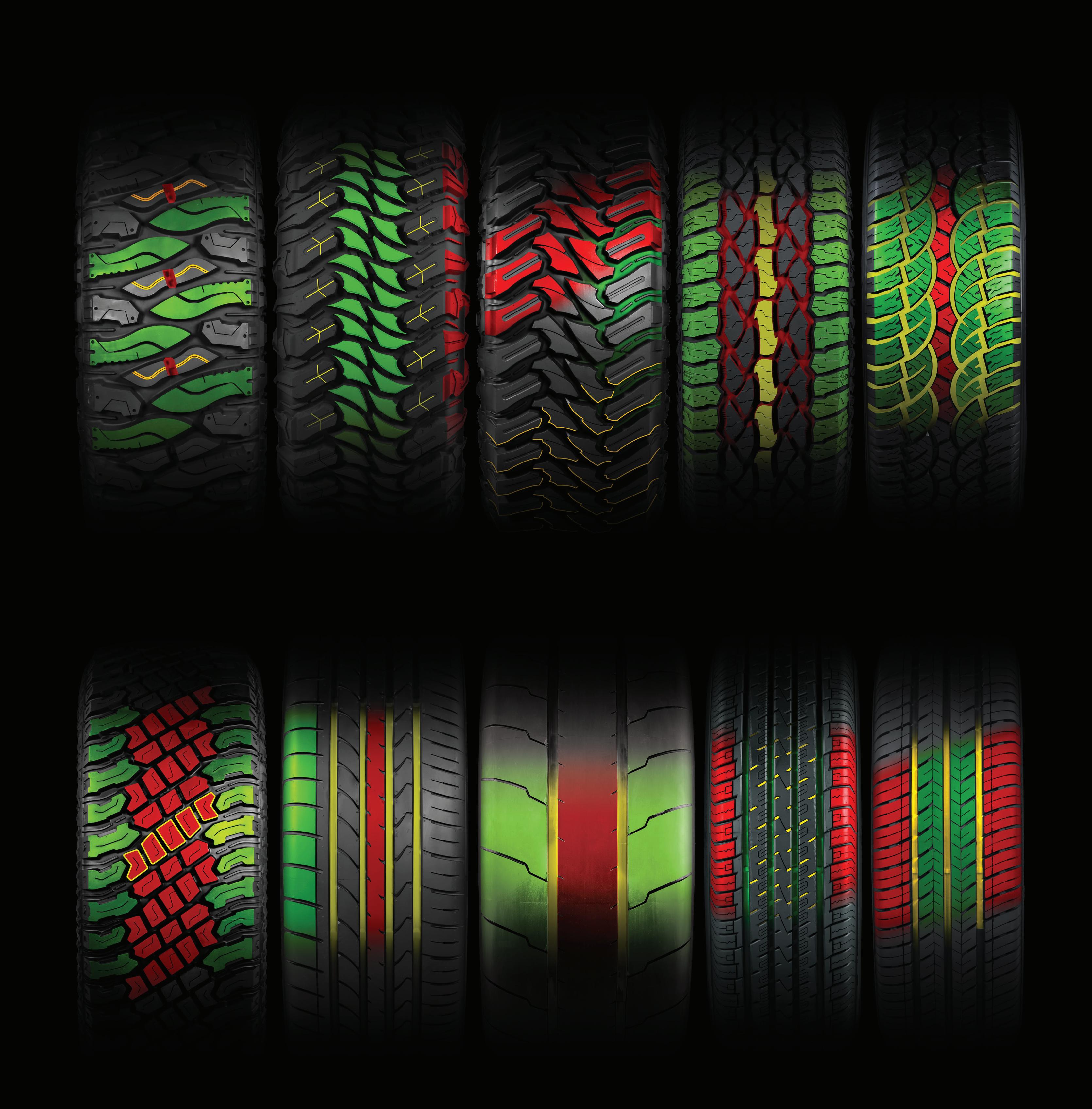

As a no-nonsense, independent tire dealer committed to providing your customers with phenomenal tires at remarkable prices, you need a no-nonsense, independent tire manufacturer that’s committed to you. At Atturo Tires, we get you. That’s why we never stop pushing the envelope with our engineering so you can offer a full range of exciting tire designs in larger sizes and more unique fitments that empower your customers to go their own way. Plus, you’ll enjoy great support and margins. Where will you go with Atturo?

The Modern Tire Dealer Show is available on Stitcher, Spotify, Apple Podcasts, Google Podcasts, iHeart Radio, Amazon Music, Audible and MTD’s website. Download it today!

Sign up now for Modern Tire Dealer’s e-Newsletters. We’ll send you the latest tire news and our most popular articles. Go to www.moderntiredealer. com and scroll down to The Modern Tire Dealer Newsletter is the Definitive Source for Tire Dealer Success.

Check out MTD’s digital edition at the top of our website’s homepage.

Like MTD on Facebook: www.facebook.com/ ModernTireDealer

Follow MTD on Twitter: www.twitter.com/MTDMagazine @MTDMagazine

3515 Massillon Rd., Suite 200 Uniontown, OH 44685

(330) 899-2200, fax (330) 899-2209

www.moderntiredealer.com

PUBLISHER

Greg Smith gsmith@endeavorb2b.com

(330) 899-2200, ext. 2212

EDITORIAL

Editor: Mike Manges, ext. 2213, mmanges@endeavorb2b.com

Managing Editor: Joy Kopcha, ext. 2215, jkopcha@endeavorb2b.com

Associate Editor: Madison Gehring, ext. 2216, mgehring@endeavorb2b.com

PRODUCTION

Art Director: Erin Brown

Production Manager: Karen Runion, ext. 2210, krunion@endeavorb2b.com

MARKETING STRATEGISTS

Bob Marinez rmarinez@endeavorb2b.com

(330) 899-2200, ext. 2217

Marianne Dyal mdyal@endeavorb2b.com

(706) 344-1388

The dynamics of supply and demand have been unpredictable over the past three years.

Photo: South Carolina Ports Authority

Pricing and supply issues from 2022 continue to impact tire dealerships in 2023. MTD readers are looking for insights on where things are headed in the year to come as economic uncertainty remains and surprises continue. For example, last year, it was expected that economic issues would put a damper on tire dealership mergers and acquisitions, but that didn’t turn out to be the case. Here’s a look at the most well-read MTD web stories of the past month.

1. Tire dealership M&A: Breaking down the big deals of 2022

2. Will there be more price increases in 2023?

3. Michelin CEO: Tire dealers will play key role in EV revolution

4. Point S plans to nearly double store total in five years

5. More big deals: Tire dealership M&A continued in 2022

6. How the founders of GCR hit on a winning formula

7. Belle Tire Golden Tire Iron contest shows appreciation for techs

8. K&M Tire dealer conference and trade show kicks off

9. Hangover from pricing, supply crisis carry over into 2023

10. Why the customer isn’t always right

Dan Thornton dthornton@endeavorb2b.com

(734) 676-9135

Sean Thornton sthornton@endeavorb2b.com

(269) 499-0257

Kyle Shaw kshaw@endeavorb2b.com

(651) 846-9490

Martha Severson mseverson@endeavorb2b.com

(651) 846-9452

Chad Hjellming chjellming@endeavorb2b.com

(651) 846-9463

MTD READER ADVISORY BOARD

Rick Benton, Black’s Tire Service Inc.

Jessica Palanjian Rankin, Grand Prix

Performance

John McCarthy Jr., McCarthy Tire Service Co. Inc.

Jamie Ward, Tire Discounters Inc.

CUSTOMER/SUBSCRIPTION SERVICE

(800) 260-0562

subscriptions@moderntiredealer.com

ENDEAVOR BUSINESS MEDIA, LLC

CEO: Chris Ferrell

President: June Griffin

CFO: Mark Zadell

COO: Patrick Rains

CRO: Reggie Lawrence

Chief Administrative and Legal Officer:

Tracy Kane

EVP Transportation: Kylie Hirko

VP Vehicle Repair: Chris Messer

As electric vehicles (EVs) continue to become more popular in North America, Michelin CEO Alexis Garcin says consumers will need to learn that tires are “the most important rangeextending feature of an electric vehicle.”

And he says independent tire dealers will play a critical role in educating consumers on that front.

Garcin, the president and CEO of Michelin North America Inc., recently spoke with reporters about three key pillars of the tiremaker’s business — its people, profit and focus on the planet through sustainability efforts.

company says is capable of extending an EV’s range, while also reducing noise levels by 20%.

“That’s a way to contribute to better mobility, but also make (the) tire an even more important piece (of) the car than it is today,” Garcin said.

He said the extra weight of EVs — along with their increased torque — puts more pressure on tires.

“We can see today that some tires might wear up to 20% faster. That’s why bringing technologies to the market and educating consumers can help the market, moving forward, while maximizing the performance of the tire (and) increasing the range of the car without sacrificing wear.

“And that’s a game-changing situation for us because that will leverage all the know-how of the last decades.”

So far, consumers are blind to the technology in those tires, according to a survey that was conducted on behalf of Michelin in the fall of 2022.

Results indicated that 83% of U.S. drivers aren’t sure what kind of tire an EV needs. The same survey showed that 52% of existing EV owners don’t know what kind of tire their vehicle needed either.

The survey also showed affordability (59%), range anxiety (43%) and how to charge the vehicle at home (37%) are the top EV-related concerns.

The tiremaker also began investing in RFID technology a decade ago and Garcin said that by 2024, “all of our tires will be equipped with RFID” so the company can further integrate its products with automakers’ platforms.

“We believe there is an opportunity that we’re already working at with several OEMs to make sure that we can provide a complete seamless tire experience … and provide consumers with much more predictive information instead of reactive information.”

That might come in the form of automated messages to alert drivers that it’s time to rotate their tires. It could also come in the form of studying a driver’s behaviors and recommending a different tire for a different kind of driving experience, said Garcin.

Even with that connected technology, Garcin said Michelin will continue to rely on its network of dealers.

“We have a very clear strategy in North America to rely on partners to service customers. That’s something that is very close to my heart and how we operate our business.”

Garcin said tire dealers will continue to be needed “to educate consumers that all tires are not the same.”

Much of the commentary focused on the company’s work tied to electric vehicles. Garcin pointed to Michelin’s role in new technologies in history, including the creation of the radial tire in 1946 and the company’s first fuel-efficiency-focused tire in 1992.

He noted that last year Michelin unveiled the Pilot Sport EV, a tire the

Garcin said Michelin believes tire technologies are inseparable from car technologies and that the tiremaker will play a role in software-defined vehicles. He says eight out of 10 EVs use Michelin tires. (In the fine print, Michelin makes that claim based on its tire sales to EV manufacturers with annual sales projections of at least 1,000 vehicles in the U.S. and Canada.)

At the same time, dealers can provide additional services to consumers and “enrich the experience for the end users.

“That’s why I mentioned connectivity. We could have those partners embedded into these connected offers. Think of all the services around tire management, tire maintenance.

“They are really part of our strategy. We don’t want to operate the service ourselves. That’s why we have those partnerships in place.” — Joy Kopcha

In April, Kumho Tire USA plans to open a distribution warehouse in Dallas, Texas. It’s the first of two facilities planned in the next three years. Another warehouse is expected to open in Franklin, La., in April 2026. Combined, they will have the capacity to hold more than one million tires.

Allen Park, Mich.-based Belle Tire Distributors Ltd. has opened a store in Huntley, Ill., the company’s 15th outlet in the state. The new store spans 10,000 square feet and has 10 service bays.

Big O Tires expects to add 10 locations during the first quarter of 2023. They will be located in North Dakota, Washington, Iowa, Arizona and Tennessee. That growth in the quarter will nearly match the 11 new stores that the TBC Corp.owned brand opened in all of 2022.

Monro Inc. has completed a five-store acquisition that includes four stores in Iowa and one in Illinois. The company bought four QC Auto Services locations, plus Muscatine Tire & Auto Center in Muscatine, Iowa. In total, they are expected to add $6 million in annualized sales.

Leeds West Groups has acquired a Midas franchise in Parker, Colo., its ninth Midas location in the Denver, Colo., metro area. Terms of the deal were not disclosed.

As part of ongoing training efforts, Lewiston, Maine-based VIP Tires & Service recently hosted three separate, handson training events to offer specialized information to more than 200 employees. The company hosted its annual Master Tech Summit, a tire forum and a day-long safety symposium.

For the first time since January 2020, Black’s Tire Service Inc. hosted an inperson sales and leadership event. More than 600 members of the Black’s Tire Service team, along with their spouses and assorted vendors, attended.

“The new warehouse will have more choices for customers and will be easily accessible via the turnpike and surrounding highways,” says Spencer Shearer, manager of the new

The Flynn’s Tire Group wholesale division, FTW, has relocated its Greensburg, Pa., warehouse to a warehouse in New Stanton, Pa., that offers more than triple the square footage and tire storage capacity than the previous location.

The new distribution center is a 150,000-square-foot facility and features 22 loading docks, as well as large training and conference rooms.

“The new warehouse will have more choices for customers and will be easily accessible via the turnpike and surrounding highways,” says Spencer Shearer, warehouse manager, FTW. It also features new technologies for FTW aimed at increasing storage density, enhancing productivity and ensuring tracking accuracy.

Flynn’s Tire Group has experienced a rapid rise in demand for tires and first responded to this growth in 2020 by opening a 150,000-square-foot warehouse in Masury, Ohio. With the new facility in New Stanton, Pa., FTW’s total warehouse space measures approximately 400,000 square feet.

In the last two years, FTW has increased its fleet of delivery trucks and tire sales by more than 50%. In 2022 alone, FTW distributed more than 1.4 million tires. The company has 450,000-plus consumer tires in stock and 70 fleet vehicles serving Pennsylvania, Ohio, New York, Maryland and West Virginia.

“This investment in building and technology allows us to serve our customers more effectively and give our customers and our associates a better overall experience,” says Joe Flynn III, president of Flynn’s Tire Group.

Goodyear Tire & Rubber Co. says it will slash 5% of its global staff “in response to a challenging industry environment and cost pressure driven by inflation.”

The Akron, Ohio-based company says around 500 jobs will be eliminated by the end of the second quarter. Some eliminations have already taken place.

“Our fourth quarter results fell short of our expectations given a significantly weaker industry backdrop, particularly in Europe,” says Rich Kramer, Goodyear’s chairman, CEO and president.

These actions “are in addition to cost synergies related to the integration of Cooper Tire. The company expects to record pre-tax charges associated with these actions of approximately $55 million, primarily relating to cash severance payments that are expected to be substantially paid during the first half of 2023.

“The rationalization and reorganization will result in a quarterly run rate benefit of approximately $15 million, beginning in the second quarter. Savings in the first quarter are expected to be $5 million.”

According to Goodyear, “global replacement tire industry demand remained weak in the fourth quarter.”

No matter how challenging your needs, BKT is with you offering a wide range of OTR tires specifically designed for the toughest operating conditions: from mining to construction sites. Sturdy and resistant, reliable and safe, able to combine comfort and high performance. BKT is with you, even when work gets tough.

VISIT US AT Las Vegas, NV

March 14th-18th 2023

Booth W41766

Virginia Tire & Auto LLC sponsored the inaugural session of the Women in Trades Lunch and Learn Series at Osbourn High School in Manassas, Va. Julie Holmes, co-CEO of the growing dealership, talked to young women about careers in the tire and auto repair industry.

Four U.S. House members reintroduced the Right to Equitable and Professional Auto Industry Repair (REPAIR) Act to Congress to ensure the “preservation of consumer choice, a fair marketplace and safe operation of vehicles.”

The Canadian government has announced plans to curtail the manufacturing and sale of lead wheel weights. Companies have until Feb. 3, 2024, to transition to alternative materials, such as steel.

BP plc plans to purchase TravelCenters of America Inc. in a deal estimated at around $1.3 billion. It includes the company’s truck stops and convenience stores, as well as the TA Truck Service business it has built since late 2016.

Balkrishna Industries Ltd. (BKT) recently unveiled its E-Ready logo, which will appear on products the company makes for electric-powered equipment. BKT says the designation represents a breakthrough in the path toward solutions for electric mobility.

Prinx Chengshan Tire North America Inc. has introduced the Fortune Tires’ Premium Tire Roadside Assistance Program for ST radial tires. The benefits include 24/7 roadside assistance, replacement of flat tires with a spare or if a spare is unavailable, a towing service is provided at no expense up to $100 for up to three years after purchase.

Tire Discounters Inc. has acquired Skip Cottrell’s Tire, a single-store location in West Somerset, Ky. The deal gives Tire Discounters 16 stores around Lexington.

The Independent Tire Dealers Group LLC (ITDG) has named Jason Rook its next president and CEO. Rook will replace Dave Marks, who is retiring this year after leading the group for the past five years.

Rook assumed his new role on Feb. 1.

Rob Slagle, chairman of ITDG’s board, says Rook “brings a wealth of experience and expertise to the position and is well-suited to lead ITDG into the future.”

Prior to joining ITDG, Rook had worked for Tube and Solid Tire since 2013 and was promoted to CEO of that company last year. Before working at Tube and Solid Tire, he worked at St. Louis Wholesale Tire.

“We believe that Jason will be an excellent leader for ITDG and will continue to build upon the strong foundation that Dave has established,” says Slagle. “We look forward to working with him as we continue to serve our members and drive the success of the independent tire dealer community.”

Rook has an extensive background in the automotive industry, with more than 20 years of experience in sales, marketing and management.

ITDG officials say he is “passionate about helping independent tire dealers succeed and is looking forward to working with the ITDG team to support and grow the organization.”

“I am honored to have the opportunity to lead ITDG as its new president/ CEO,” says Rook. “I am excited to work with the talented team at ITDG to continue providing value to our members and helping them thrive in this competitive and dynamic business environment.”

Rook and Marks will work together to ensure a smooth transition.

In a separate move, longtime ITDG associate Chris Barry was promoted to vice president of sales.

Barry joined ITDG in 1998 and since then has helped the group grow from $16 million in total purchases to more than $344 million in 2021. ITDG has 164 members who represent more than 1,000 locations throughout 45 states.

Pep Boys — Manny, Moe & Jack has named Scott Collette its new CEO. Collette has assumed day-to-day leadership of the company, which has more than 900 stores throughout the United States and Puerto Rico. Collette most recently was chief operating officer of home improvement retail chain Menards.

In his new role, Collette will “prioritize retention and recruitment efforts, while bringing a keen focus on talent development and workplace culture to Pep Boys,” say Pep Boys officials.

“Under Collette’s leadership, the company is looking to expand and grow its footprint with a focus on strategic, high-growth markets.

Canton Bandag, one of the oldest Bandag retreaders in existence, has closed after 60 years in business, Dave Richards Jr., the dealership’s president, told MTD. Over the years, Canton Bandag had expanded into manufacturing solid antique rubber tires, truck wheel polishing and other market segments.

Dick Gust, CEO of the Tire Industry Association, has been appointed for a second time to serve on the U.S. Department of Commerce’s Environmental Technologies Trade Advisory Committee. The appointment runs through August 2024.

The Virginia Automotive Association will host its annual convention and trade expo, April 21-23, at the Williamsburg Lodge in Williamsburg, Va. The event’s opening keynote speaker will be Kelley Earnhardt Miller, daughter of seven-time NASCAR champion Dale Earnhardt.

Apollo Tyres Ltd. has partnered with the Alpine World Ski Championships and the company’s Vredestein’s brand served as the official sponsor of the 2023 FIS Alpine World Ski Championships.

The Latin Tyre & Auto Parts Expo is gearing up for its 2023 show, which will take place June 14 -16 in Panama City, Panama. Organizers say the expo will host a “record-breaking” 500-plus exhibiting manufacturers.

CEAT Ltd.’s plant in Halol, India, has been awarded the Lighthouse Certification by the World Economic Forum. CEAT Ltd. is the parent company of CEAT Specialty Tires. The award recognizes companies that use technology to transform their businesses for sustainability.

Love’s Travel Stops will expand the footprint of both its truck care businesses and retreading operations. The company plans to add 15 Love’s Truck Care and Speedco locations, as well as two new retreading plants, in the year ahead.

Guest speakers and a hall of fame induction highlighted this year’s California Tire Dealers Association (CTDA)/1-800 EveryRim New Year Luncheon, which took place in late-January.

Dick Gust, CEO of the Tire Industry Association, and Steve Swanson, speaking on behalf of the Specialty Equipment Market Association’s Wheel & Tire Council, outlined the various programs and initiatives that they are providing for their members. (Swanson also is the national sales manager for styled wheels at the Carlstar Group.)

Ken Kevorkian, who owned United Vulcanizing in Los Angeles, Calif., for 50 years and was one of the first members of the CTDA, was inducted into the association’s hall of fame during the event.

Kevorkian took over the reins of United Vulcanizing in the 1950s from his father, after having served with the military in Korea.

United Vulcanizing had one location from which it sold new tires and produced retreads for passenger, light truck and truck tires. Kevorkian said the company shut down its retreading operation in the mid-1980s when he added automotive service to his retail operation.

In addition to running his business, Kevorkian participated heavily in the CTDA and served as its president in 1993 and 1994.

Approximately 80 people attended the luncheon, which was held in Santa Fe Springs, Calif. Next year’s CTDA luncheon is set for Jan. 18, 2024. ■

Introducing the Galaxy AT Grip Steel, the new skid steer radial designed from the ground up with OTR tire dealers and skid steer operators. This is exactly what the industry asked for, from the long-lasting, high-traction block tread to the sturdy, reinforced sidewalls. The AT Grip Steel minimizes bucking and bouncing, and is priced aggressively to make this the best time for customers to switch to radials.

Ask your YOHTA REP about the new Galaxy AT Grip Steel skid steer radial, visit yokohama-oht.com or call us at (800) 343-3276.

• Up to 50% longer tire life than bias-ply

• Nearly 4x more puncture resistance

• Steel radial belts

ORDERING TIRES JUST GOT EASIER! Check out our new B2B E-Commerce Portal

Relevant statistics from an industry in constant motion

31% Percentage of products or services sold by Michelin in 2022 that had been introduced to the market in the last three years.

13.7 MILLION Total number of new vehicles sold in 2022

139 Number of retread plants operated by the top 10 U.S. retreaders

15% Increase in inventory per auto parts store at the end of 2022 compared to 2021.

The

vehicles in 70+ sizes. With dual sidewall design options and a 55K Mileage Warranty, this tire has the durability drivers expect. Our most popular PLT sizes are currently available, with a 12-Ply rating in specific sizes. For factory direct and warehouse programs call 305.621.5101. For dealer inquiries visit Landsailtires.com. @landsailtires *Specific sizes only

THE LANDSAIL STORMBLAZER IS SPECIFICALLY DESIGNED FOR THESE POPULAR OE FITMENTS:

Subaru Outback

Toyota RAV4

Subaru Crosstrek

Honda CR-V

Jeep Renegade Trailhawk

Mazda CX-5

Nissan Rogue

Ford Escape

Jeep Cherokee

Recent check-ins with tire dealers leave us with the view that retail sellout trends continue to show softness on a year-over-year basis. This marks a second straight month of negative retail sellout.

Looking more closely at volume for the month of January, on a regional basis we note the Mid-Atlantic region reported the strongest year-over-year growth, up low-single digits. The Northwest region performed the weakest, falling by mid-tohigh single digits during January. Dealers indicate that less severe winter weather, as well as manufacturer price increases, were the key catalysts to unit underperformance to begin 2023.

Dealer commentary suggests consumer demand for passenger and light truck replacement tires in January was flat on a net basis compared to January of 2022. Zero respondents indicated they saw positive demand year-over-year, which compares to December’s reading of minus-25% and November’s reading of plus-43%. While trends in tire retailing are always a bit finicky and can be impacted by weather or a calendar shift, December’s trends seem to continue into 2023.

Dealers continue to struggle to obtain the right level of inventory, as 33% of respondents indicated inventory was below normal, consistent with trends from the previous month. Dealers also pointed to less severe winter weather, as well as the rising cost of tires, as factors which drove flat demand in January. One unexpected

bright spot has been the introduction of new tread patterns, which dealers say have had a positive effect on business.

Dealers had previously said they were worried 2023 would be a difficult selling environment, especially without some help from the winter weather. Thus far, this scenario appears to be playing out. Our contacts are worried about the environment going forward. And with the bulk of winter weather likely behind us, this paints a less-than-ideal picture for the consumer replacement tire industry.

While we continue to believe volumes in the long run will become more closely aligned with the current level of GDP growth, we will be closely watching macroeconomic conditions. Additional Federal Reserve interest rate hikes could spur further GDP declines.

Given volatile industry conditions, we look at several data points to assess the demand for travel by automobile, which correlates to tire usage and wear. Miles driven in January dropped 5.4% yearover-year, following a 9.7% decline in December and a 7% drop in November. Miles driven has declined each month since March 2022, when U.S. fuel prices increased following the Russian invasion of Ukraine.

Despite the price of gasoline falling for nearly six months, our index has seen no measurable increase in miles driven.

Gasoline prices acted similarly in 2010 to 2016 and we saw miles driven bottom out six months after gasoline prices reached $4 per gallon. If gas prices follow this historical track, we believe when prices reach an average of $3 per gallon, miles driven should return. This will benefit sectors related to passenger tires and aftermarket auto parts. Until then, we suspect the passenger replacement tire market will experience headwinds.

From a mix point of view, tier-two and tier-three tires were the most-in demand in January. This continues a long-term trend, as tier-two tires were the most in-demand or tied for the most in-demand in nine of twelve months in 2022. January marked the second straight month where demand for tier-three tires tied that of tier-two tires.

For the second straight month, tier-one tire brands finished last in our survey. Given rising prices for tires — and all consumer goods — January’s tier rankings are not a surprise to us. Dealers indicate the pricing spread between tier-one and tier-two brands has grown so large following recent pricing actions that they’ve seen consumers trade down.

In our view, this a current reality of the replacement tire market. Prices have simply become too high for some consumers to justify buying more expensive tires.

Looking forward, we note consumers seem to change their tier preference in line with the current economic situation. Volatility has resulted in swings in the rankings over the last three months. Over the long run, we believe consumers will opt to tier-two tires as they strike the balance between performance and value. ■

The WILDPEAK A/T TRAIL is built for adventure, delivering rugged off-road capability without compromise on the open road. Engineered to match the dynamic characteristics of modern crossovers, the A/T TRAIL strikes the perfect balance between aggressive off-road traction and dependable all-weather performance. Durable 2-ply polyester construction and rugged upper sidewall features protect the A/T TRAIL from off-road

of a modern CUV. Featuring USTMA’s Severe Snow Rating, the WILDPEAK A/T TRAIL encourages adventure-seeking crossover owners to discover true all-weather capability.

This tire is designed for severe snow conditions and meets the USTMA and TRAC snow traction performance requirements.

AVAILABLE IN 30 SIZES

• H & V SPEED RATING

• 65K LIMITED TREAD LIFE WARRANTY ON ALL SIZES

• USTMA SEVERE

SNOW RATING

• ROAD HAZARD WARRANTY includes FREE replacement for *

NOT NECESSARILY. SOME MANUFACTURERS BELIEVE IT’S JUST A STARTING POINT

Mike Manges ByMany tire dealers refer to the 3-Peak Mountain Snow ake (3PMS) designation when selling winter tires — and even all-season products — to customers. While 3PMS certi cation might help close the sale, is it the ultimate validation of winter tire performance? Or can tire dealers — and buyers — expect to see a classi cation that goes beyond 3PMS?

MTD recently posed that question to tire manufacturers, importers and marketers, whose answers varied widely. (Several tire manufacturers and marketers declined to participate.)

Brandon Stotsenberg, vice president, automotive, American Kenda Rubber Industrial Co. Ltd.: Tires stamped with

3PMS have di erent criteria to achieve the certi cation based on the United States/ Canadian standard versus the European Union (EU) standard. It is self-certi ed by the tire manufacturer to meet the minimum performance designated for 3PMS, which provides upgraded performance in colder temperatures with better medium-packed snow acceleration in the U.S. and braking in the EU.

Although end users want to also have better performance on ice, slushy conditions and potentially deeper snow, the current criteria do not account for those conditions. Many tires stamped with 3PMS will perform better in these conditions, but actual performance will vary. We believe that creating more criteria to provide better-certi ed winter performance will (enable) the consumer to have more

“The 3PMS (designation) is a good measure for acceleration traction on medium-packed snow,” says Phillip Schrader, product manager, touring and U.S. winter tires, PLT replacement business unit, Continental Tire the Americas LLC. “However, it leaves out other important winter driving performance attributes, such as braking and turning on snow-covered surfaces, as well as ice traction.”

Photo: Continental Tire the Americas

Brandon Stotsenberg, vice president, automotive, American Kenda Rubber Industrial Co.Ltd.

con dence with the tire industry and its products. Additionally, providing stronger oversight to assure that tires self-certi ed by manufacturers will consistently meet the established standards will provide the end user better con dence, as well.

Although end users want to also have better performance on ice, slushy conditions and potentially deeper snow, the current criteria do not account for those conditions.

J Downey, senior manager, product and pricing, Apollo Tyres Ltd.: Based on performance, winter tires can be (divided) into two categories — performance winter tires and ice/snow winter tires. Performance winter tires are designed to deliver a high level of snow traction with a minimum trade-o in other performance and they can satisfy the needs of drivers who will face cold, wet and snowy conditions. For this category, 3PMS is the ultimate certi cation, which indicates the tire is suitable for severe snow conditions.

Ian McKenney, senior product manager, consumer product strategy, Bridgestone Americas Inc.: A 3PMS rating requires achieving a targeted degree of acceleration in medium pack snow conditions beyond that of an all-season tire before it can be marked on the sidewall and it currently represents the highest level of winter tire performance certi cation. However, 3PMS-rated tires do not necessarily represent peak snow or winter performance.

ere is still a di erentiation in winter performance from an all-season tire with a 3-peak rating and a dedicated winter tire. At this time, there are no imminent regulations that would further di erentiate these winter characteristics.

“While 3PMS-certifi ed tires are good at lowtemperature braking and cornering and clearing slushy muck or mixed-condition snow at higher speeds, they cannot match the winter performance of traditional winter tires,” says Chris Jenkins, programs and marketing manager, automotive division, Maxxis InternationalUSA.

“To designate a tire with the 3PMS symbol, the tire must maintain standards, including a certain level of grip on a surface covered in mediumpacked snow,” says Michiel Kramer, director, product marketing, consumer, Goodyear Tire & Rubber Co.

To measure ice traction speci cally, a new test certi cation that measures ice grip performance will accompany most of our new winter tire lines in the future. Passenger tires designed for use in ice conditions that meet or exceed the ice grip index of 1.18 as compared to the 16-inch standard reference test tire will qualify for the ice grip symbol, in addition to the M+S and 3PMS.

Chris Jenkins, programs and marketing manager, automotive division, Maxxis International-USAPhillip Schrader, product manager, touring and U.S. winter tires, PLT replacement business unit, Continental Tire the Americas LLC: e 3PMS is the minimum standard for winter performance, which our winter products typically outperform by a wide margin. All-weather tires, on the other hand, perform much closer to this minimum standard, which highlights the di erences in winter performance between true winter and all-weather tires.

The 3PMS (designation) is a good measure for acceleration traction on medium-packed snow. However, it leaves out other important winter driving performance attributes, such as braking and turning on snow-covered surfaces, as well as ice traction.

Lou Monico, vice president of sales, Giti Tire Canada: 3PMS refers to a symbol on a winter tire that indicates it has been tested and meets certain performance criteria for use in severe snow conditions. Tires with the 3PMS symbol are designed to provide better traction and handling in winter conditions and they are o en required by law in areas with severe winter weather.

A new category of winter tires is the ice tire or ice performance tire, which has both the 3PMS symbol and an additional ice designation marking. is designation indicates that the tire has passed speci c tests for braking and handling on ice, in addition to meeting the winter performance criteria for snow. Ice tires are designed with special tread patterns and rubber compounds that can provide improved grip and handling on icy surfaces. If your customers frequently drive in areas with icy conditions, an ice tire may provide additional safety and peace of mind during the winter months.

It is possible that advances in tire technology and testing methods could lead to new certifications.

Michiel Kramer, director, product marketing, consumer, Goodyear Tire & Rubber Co.: The 3PMS designation is an indicator that a tire has a strong level of winter performance, per the U.S. Department of Transportation’s requirements. Several tiremakers, including Goodyear, are developing all-season tires with 3PMS designation. These are tires that carry the 3PMS symbol, but can be used year-round. These products offer more snow traction than a traditional all-season tire, and they are a great alternative for customers.

However, for someone who drives in harsh and unpredictable winter conditions, such as during a winter travel advisory, Goodyear would still highly encourage motorists to consider a dedicated set of winter tires. To designate a tire with the 3PMS symbol, the tire must maintain standards, including a certain level of grip on a surface covered in mediumpacked snow.

Moonki Cho, product manager, Hankook Tire America Corp.: 3PMS is the industry standard when it comes to grading a tire’s performance in severe snow conditions. Through a grading process known as the

“A tire that just meets the 3PMS level is a good step up in winter performance from most all-season tires, but has nowhere near the traction and control of a dedicated winter tire,” says Aaron Neumann, product development manager, Nexen Tire America Inc.

ASTM F1805-20 testing method, this procedure enables the accurate measurement of the driving traction of a tire while traveling in a straight line on snow- or icecovered surfaces. In order to obtain a 3PMS symbol and meet U.S. Tire Manufacturers Association (USTMA) requirements, a tire must achieve a traction performance index of 110 or higher. At Hankook Tire, we conduct the test through an authorized external assessment authority.

It is not clear if there will be something beyond that in terms of industry-recognized winter tire performance verification or certification in the future. However, it is possible that advances in tire technology and testing methods could lead to new certifications or performance standards.

“The 3PMS marking represents more rigorous winter tire performance certification, as it is awarded to tires that have passed specific performance tests in winter weather conditions compared to M+S, which is a more generic indicator which does not have any specific performance tests it has to pass,” says Jayden Lee, head of product marketing, U.S./Canada, Pirelli Tire North America Inc.

Chris Jenkins, programs and marketing manager, automotive division, Maxxis International-USA: 3PMS is a winter tire performance certification that measures a tire’s acceleration traction on medium-packed snow. It is expected to provide improved snow traction beyond a standard M+S-branded all-season tire, but it is not a replacement for dedicated winter tires. 3PMS-branded all-season and all-terrain tires cannot match the traction of dedicated winter/snow tires in all winter weather conditions.

While 3PMS-certified tires are good at low-temperature braking and cornering and clearing slushy muck or mixed-condition snow at higher speeds, they cannot match the winter performance of traditional winter tires — studless or studdable.

Farell Scott, product category manager, Michelin passenger and winter tires, Michelin North America Inc.: The 3PMS certifies a tire on snow traction. The 3PMS symbol indicates tires meet or exceed the minimum snow traction requirements needed to determine if a tire is fit for use in severe snow. However, we know dedicated winter tires must perform well beyond minimum traction levels and for more than just snow conditions, because winter conditions are more than just snow. So understanding how a tire performs on ice conditions is equally important, as well as considering the tire’s performance in wet (conditions and) slush and overall handling.

As tire technology continues to improve, all-season tires that meet the 3PMS requirement offer customers an additional tire choice to handle their specific winter climates. These tires do not replace true, dedicated winter tires that typically offer better cold weather, snow and ice performances. To help differentiate between all-season tires that have 3PMS and dedicated winter tires that have 3PMS,

43 SIZES UP TO 20"

70,000 MILE LIMITED WARRANTY CONFIDENT ALL-SEASON PERFORMANCE

TAKE YOUR DRIVING EXPERIENCE TO NEW HEIGHTS WITH THE ALL-NEW LAUNCHING May 202 3

a recent, industry-established ice grip symbol has been adopted. Passenger tires that meet or exceed the ice performance criteria qualify for M+S, 3PMS and an ice grip symbol, identi ed by a pictograph of a mountain with ice. e new ice grip symbol has been introduced in Europe and is expected to roll out in North America in the future.

Aaron Neumann, product development manager, Nexen Tire America Inc.: A 3PMS marking does not represent maximum winter performance. It is more a minimum. A tire that just meets the 3PMS level is a good step up in winter performance from most all-season tires, but has nowhere near the traction and control of a dedicated winter tire.

ere are many sub-categories of winter tires that qualify for the 3PMS marking, which I will list here, from best to worst: studded arctic winter tires for Scandinavian countries and far north regions; non-studded Arctic tires for those same regions where studs are banned; ice tires with semi-porous treads; alpine winter tires, which sacri ce a little snow and ice performance for more wet and dry performance for those who venture into the snow only on weekends; and nally, all-season and four-season tires that meet

minimum winter performance levels but can be used year-round.

An all-season tire that meets 3PMS is still a remarkable tire in the balance of performance it can deliver and for that reason, they represent the top 10% of the all-season tire market. But the best dedicated winter tires out there can deliver up to 50% more traction and control on snow and ice. e downside, of course, is that dedicated winter tires do not perform well outside of winter conditions and need to be taken o in the summer.

Steve Bourassa, director of products, Nokian Tyres Inc.: e 3-Peak Mountain Snow ake is not the ultimate indicator of winter tire performance. It’s a helpful tool, but an additional tool is now available — an ice grip marking that signi es strong braking on ice, too.

Nokian Tyres has recently adopted a new ice grip standard and the ice grip marking indicates that superior level of winter performance.

e 3PMS (designation) signi es a tire has met certain performance conditions in winter weather, but it’s a starting point — a helpful way to know a tire is an option for areas that experience winter conditions. However, (3PMS) does not capture all aspects of a tire’s winter performance, including braking and cornering. As a result, tires with the symbol may still vary in quality and we encourage consumers to research other factors before buying a tire with 3PMS.

Jayden Lee, head of product marketing, U.S./Canada, Pirelli Tire North America Inc.: Currently, there are two tire markings signifying snow performance — the M+S marking and the 3PMS marking. e 3PMS marking represents more rigorous winter tire performance certi cation, as it is awarded to tires that have passed speci c performance tests in winter weather conditions compared to M+S, which is a more generic indicator which does not have any specific performance tests it has to pass. e 3PMS symbol identi es that the tire has passed a minimum traction rating in the snow, but the certi cation doesn’t cover braking or other performance attributes.

Right now, there are no industry standards beyond (the) 3PMS marking and no plans in the future for introducing something beyond that level of certi cation for winter performance.

James McIntyre, vice president of sales, Canada, Sailun Tire Americas: At this time, 3PMS is the certi cation that most would look to (in order to) ensure the safety of drivers in extreme weather conditions. e mountain snow ake symbol is an easy way for a consumer to know the tire will perform at an increased level of traction.

ere are generally three types of tires that would carry the 3PMS symbol — allweather, all-terrain and winter products — with winter tires having the best traction in winter/snow conditions, based on their tread design and compounding.

“Atthis time, 3PMS is the certifi cation that most would look to (in order to) ensure the safety of drivers in extreme weather conditions,” says James McIntyre, vice president of sales, Canada, Sailun Tire Americas. Photo: Sailun Tire Americas “When a tire carries the 3PMS symbol, it communicates to the consumer that it has improved traction over the standard M+S rating,” says Nick Gutierrez, sales director, Sentury Tire USA. Photo: Sentury Tire USA

However, [3PMS] does not capture all aspects of a tire’s winter performance, including braking and cornering. Steve Bourassa, director of products, Nokian Tyres Inc.

Nick Gutierrez, sales director, Sentury Tire USA: When you are at altitude, the weather can change fast. ese changes can happen more quickly than the Department of Transportation can send out warnings or implement mandatory chains. For this reason, it is important to recommend the right snow tire for your customers. When a tire carries the 3PMS symbol, it communicates to the consumer that it has improved traction over the standard M+S rating.

Today, the industry does not o er a higher rating than 3PMS. However, drivers can attain performance beyond this certi cation by purchasing tires that also have a nano-silica compound, in addition to the 3PMS (designation.) When you combine these two features, drivers can rest assured that they have maximized performance, stability and safety in the snow. Until the USTMA identi es a higher certi cation, combining these two features is the best recommendation for drivers.

Tsuyoshi Johnson, product manager, PCR tires, Falken Tires, Sumitomo Rubber North America Inc.: Just because a tire has earned the 3PMS certi cation does not mean it’s fully capable of handling the harshest winter conditions. For a tire to earn the industry’s severe snow rating, it must perform at a rate of 112% when compared to the standard reference test tire (SRTT).

We’re seeing more and more all-weather tires starting to earn this certi cation by performing at a level above this mark. However, this does not mean all-weather tires deliver the same winter traction expected from a dedicated winter tire. Winter tires typically perform somewhere between 130% and 150% above the SRTT.

Andrew Hoit, executive vice president, brand division, Tireco: Although 3PMS proves the tire has passed an industrystandard traction test, it’s not enough to be named the ultimate in winter tire performance certi cation because the standard testing is not comprehensive and does not demonstrate the tire has a well-rounded winter performance.

It would be great to see additional testing requirements to indicate the performance levels.

“For a tire to earn the industry’s severe snow rating, it must perform at a rate of 112% when compared to the standard reference test tire,” says Tsuyoshi Johnson, product manager, PCR tires, Falken Tires, Sumitomo Rubber North America Inc.

Joaquin Gonzalez Jr., president, Tire Group International LLC: When it comes to weather-speci c applications in tires, compounding is paramount. Speci c to snow, dedicated winter tires will provide the most balanced performance across the di erent road conditions. When it comes to severe conditions, the 3PMS certi cation ensures the compounding used will maintain its qualities even at below-freezing temperatures — making it the highest-level certi cation you can currently get on a winter tire.

Chris Tolbert, director of sales, Trimax Tire: Retailers and consumers have an understanding that 3PMS represents a tire technology for winter weather conditions and safety con dence. I’m sure as vehicles keep evolving with technology and electric vehicles, there will be an even more superior advancement. With global warming in North America, the four seasons have shi ed and

“Although the 3PMS (designation) proves that the tire has passed an industry-standard traction test, it’s not enough to be named the ultimate in winter tire performance certifi cation,” says Andrew Hoit, executive vice president, brand division, Tireco.

changed. All-weather product lines with advances in technology should continue to grow.

(Alyeska Tire also carries Nokian brand winter tires.)

Providing educational materials — both online and in-person — also is important, according to Ramirez.

Photos:

By

Madison Gehring and Joy Kopcha

By

Madison Gehring and Joy Kopcha

For many, the winter tire market might seem like a world of its own. Tire dealers may think they need to use di erent techniques when selling these products to consumers.

But in reality, many dealers say that selling winter tires boils down to listening to customers’ needs and matching the right tire to their driving patterns.

Ray Ramirez, owner of Utopia Tire & Auto Repair in Frisco, Colo., says the most e ective strategy is to really understand your customers and your environment.

“We live in a mountain community and the customers who live here understand and know that winter tires work,” says Ramirez, whose dealership sells Nokian brand products.

“However, we do get a good stream of tourists coming through who don’t have a lot of faith in — or education about — winter tires.”

Don Rutherford, wholesale manager at Alyeska Tire, which is based in Anchorage, Alaska, and has eight stores, says that he promotes the stopping capability of winter tires.

“A studded tire will stop rst,” he says. “A studless winter tire will stop second. An all-weather tire will (go) beyond that studless tire. And an all-season tire will (travel) all the way across a (street) intersection before it stops.”

Ramirez says winter tires make up about 40% of Utopia Tires’ total revenue.

Rutherford says that in 2022, winter tires made up 42% of his company’s sales.

“Have education materials on your website,” he advises. “Show third-party sources that demonstrate the stopping power and braking distance of cars with winter tires versus cars with non-winter tires.

“If I quote third-party statistics, it’s better than me sitting there (stating) my opinion.”

Ramirez says it helps if salespeople are driving on winter tires, too, so they can speak from experience.

Rutherford notes that having a good point-of-sales system has been “crucial” to his company’s success because it keeps track of sales and inventory. (He bases next year’s order of winter tires on the past three years’ worth of sales data.)

“I place the order a year in advance — around February — and then by next June and July, I start getting shipments in and by September, I am starting to sell the winter tires. By Oct. 30, our inventory is almost eliminated.”

As of last month, Rutherford had plenty of winter tires le to sell — enough to get Alyeska Tire through the rest of the season.

It also helps to anticipate questions that customers will ask, says Ramirez, who adds that the best way to ensure repeat winter tire business is to educate vehicle owners.

“ e customer is going to come in here asking if winter tires actually work,” he says. “If we have a video on our website demonstrating the stopping capabilities of a winter tire, then the question is answered already.

“Once you create a market that is educated, they come back to you again and again.”

Andrew Harpole is a firm believer in consumer education.

As one of the new owners of Shervin’s Auto and Tire Care in Jackson, Wyo., Harpole says longtime customers who are familiar with the bene ts of winter tires and are accustomed to driving on them will not go a season without them.

Two generations of the Shervin family operated the dealership for more than 50 years before Harpole and two business partners, Marc and Ciara Malone, purchased it last year. Marc is the store’s manager.

The Bridgestone Blizzak and Firestone WinterForce are big sellers for Shervin’s Auto and Tire Care.

“People bought Blizzaks from the Shervin brothers for enough years that the tire has a pretty loyal following in Jackson. People understand it. They’re fine with swapping (tires) every six months.”

The Jackson market is unique in that it serves not just the local community of 10,000 people and the larger Teton County population of 23,000, but also travelers who visit Grand Teton National Park and Yellowstone National Park each year.

Harpole says there’s room in his market for all-weather tires, too.

He has a customer who lives and works in East Jackson and is “more of a procras-

tinator than proactive when it comes to taking care of her car.”

He doesn’t think the traditional seasonal tire swap is ideal for her.

“She’ll be fine in the (Bridgestone) WeatherPeak,” which is an all-weather product, he says.

“I feel very comfortable putting someone in those tires.”

Another Shervin’s Auto and Tire Care customer is a hockey mom who drives “all over creation all winter for tournaments.”

She’s a better candidate for dedicated winter tires, he explains.

Harpole says the nine-bay dealership has the capacity to store about 2,000 tires, and also relies on deliveries from warehouses in Denver, Colo., and Salt Lake City, Utah.

“We’re having one of our best snowfall years in quite a while. It is a matter of life and death in these parts” during the winter months, making it essential “that you have the best tire possible.”

Just as you are uneasy about the economy and how it might affect the customers who walk in your door, the tires you sell and the automotive repairs your technicians complete, consumers are anxious about how to pay for those service tickets. Represenatives of secondary financing companies say now is the time to offer another payment option.

MTD: It seems alternative financing is more popular in lots of categories. How is that affecting sales in tires and automotive?

Mary Jones, CEO, EasyPay Finance: Customers now expect more options and access to financing that works for them. Across categories, this translates to notably improved metrics if products can be purchased through a tailored and structured approach that matches customer need. It’s a growing trend that underscores the importance of tires and auto businesses incorporating alternative financing at the point of sale. All options are not created equal, however, so it’s essential to partner with a provider who understands the space, wants what is best for your shared customers and provides you with exceptional service.

Reid Bork, chief revenue officer, Katapult Holdings Inc.: With more individuals living paycheck to paycheck due to the current macroeconomic climate, there is greater demand for solutions that will meet consumers wherever they are on their economic journey — a demand we expect to continue to grow in 2023 and beyond.

Shawn Sieck, chief sales officer, Koalafi: Nearly one out of two U.S. consumers has a credit score below 660, unscorable credit or no credit score at all. Since these

consumers typically do not qualify for primary financing like store-branded credit cards, they need other options to pay over time. For a vast majority of tire and auto retailers, having alternative financing options increases sales and conversion rates from the get-go. Plus, dealers that advertise these financing options early and often are bringing in new customers who were previously underserved.

MTD: What’s the forecast for tires/ automotive sales via alternative financing in the next three to five years?

Jones (EasyPay Finance): We expect strong and sustained growth in this sector. Consumers have made their choice clear. They want financing options and the flexibility to pay over time. We are particularly optimistic because we work with our merchant partners to provide training and resources designed for long-term success. We speak the language of the customer and introduce a lasting solution to an otherwise perceived decline in service options.

Bork (Katapult): Lack of access to credit is not a niche issue. More than 30% of American consumers are overlooked by traditional financing options. This leaves millions of consumers unable to obtain essential durable goods when needed. As a result, big-ticket items that impact quality of life remain out of reach, including tires. When it comes to replacing or buying new tires, when there is a need, it’s typically immediate. Unfortunately, this isn’t an expense that most consumers plan for. Lease-to-own (LTO) offers consumers the additional flexibility they may need to purchase the tires that will get them to work or wherever they need to go, while keeping their monthly expenses in check.

Sieck (Koalafi): With higher interest rates and inflation, we expect more consumers to choose to pay over time for larger purchases, especially necessities like new tires or repair work. To maximize sales, tire retailers and repair shops must incorporate these alternative financing options within their sales processes and point-of-sale systems. The simpler it is for the dealer and the customer, the better it is for everyone.

MTD: For tire dealers who haven’t yet added an alternative financing option, what’s one point you’d make to urge them to sign up this year?

Jones (EasyPay Finance): You’re leaving sales on the table. It’s as simple as that. If you aren’t actively offering financing options (primary and secondary/ alternative) to your customers, they will go to your competitors that do. With the right financing partner, it is easy to learn and develop a comfort level with the well-established options that exist today. There is little to no barrier to entry and significant upside once in place.

Bork (Katapult): For retailers, LTO options are vital, helping them reach a large, loyal consumer base and enabling formerly excluded consumers to obtain the goods they need, including tires and automotive parts. According to a Katapult survey, 54% of Americans are more likely to shop with a merchant that offers flexible payment options. Flexible payment options are often the only way for non-prime consumers to obtain necessary durable goods, especially as many traditional lenders tighten their lending criteria or increase interest rates. By opening up financial opportunity through LTO, retailers can also cultivate strong customer relationships for enduring loyalty and retention. At Katapult we see 50% of our customers come back to make a repeat purchase.

Sieck (Koalafi): We surveyed over 2,000 non-prime consumers who financed a high ticket purchase with Koalafi in 2022. Sixty percent of them wouldn’t have made a purchase if there was no alternative financing option for them. Ensure every customer has a path to pay over time.

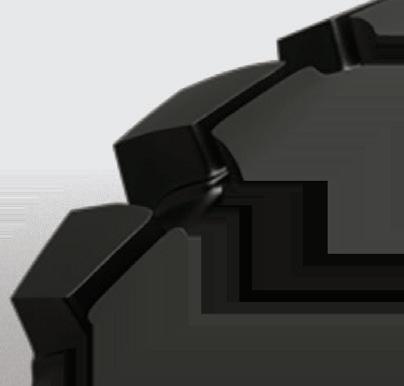

3D chamfer block

high-dispersion silica compound

Bill Ford By

Bill Ford By

Tire dealers are challenged with recruiting and retaining sta from an ever-shrinking pool of quali ed candidates.

ey also are challenged with ensuring a safe work environment, which is heavily regulated by Occupational Safety and Health Administration (OSHA) federal and state regulations.

Employees expect to work in a safe environment. Tire dealers want to ensure that their employees provide the highest quality of service. ey also want to ensure that their customers’ vehicles are not damaged while being serviced and that sta can test drive the customer’s vehicle in a safe manner on roads and highways.

As if operating a pro table business isn’t hard enough, tire dealers must now manage the legalization of medical and recreational marijuana. irty-eight states and the District of Columbia have legalized the use of medical marijuana. Additionally, 22 states and the District of Columbia have legalized the use of recreational marijuana.

Marijuana remains illegal under federal law. But it is apparent that Congress does not want to weigh in on federal regulations regarding marijuana. ey prefer that states regulate the use of marijuana, which continues to confuse employers, employees and consumers.

However, there is light on the other side of the smoke. With the right tools and policies, you can successfully navigate the challenges that the legalization of marijuana creates.

To help you understand your rights as an employer, as well as state regulations, we have provided the following de nitions and summary of regulations.

Medical marijuana is available only by prescription from a licensed medical professional and is used to treat a variety of medical conditions such as pain, anxiety, nausea, glaucoma, etc.

If you operate in a state where medical marijuana is legal, you are required to consider accommodation for registered marijuana users. Policy, however, should dictate the need of an employee to be t for duty.

Policy should require that job applicants and employees communicate to you they have any prescription to include medical marijuana.

We suggest a fit-for-duty exam be performed by the employee’s medical provider to determine if the employee can perform the essential functions of the job in a safe and productive manner. If accommodations are requested by the medical provider, then you must determine if you can reasonably accommodate those accommodations.

No state law gives any employee the right to use, possess or be impaired by marijuana on work premises or during working hours of employment. If there is reasonable suspicion to believe an employee is impaired and such individual tests positive for marijuana, adverse action may occur. In addition, a positive result for marijuana can result in adverse action if testing is required by federal or state law, you receive federal funding or an employee works in a safety-sensitive position.

In essence, you should treat medical marijuana as any other prescription medication. If a medical marijuana card is presented during the application phase or during employment, it is recommended that you ensure the employee is fit for duty by requesting the employee share with his or her medical provider the essential functions of the job. This includes physical and mental requirements. Then the medical provider will let you know whether the employee can perform essential functions with or without accommodation.

This is no different than an employee having a prescription for traditional medication that would prevent that person from performing a job in a safe manner. Just because a job applicant or an employee has a medical marijuana prescription does not mean that they are fit for duty. It behooves you to ensure that employees are, in fact, fit for duty and capable of performing their jobs in a safe manner.

Also remember that you cannot summarily not hire or separate the employee simply for having a prescription for marijuana.

Recreational marijuana simply means marijuana that is grown and sold for recreational purposes to adults over the age of 21, pursuant to applicable state laws. Recreational marijuana also means that any part of the cannabis plant, living or not, is used as an intoxicant for the reason of enjoyment or pleasure.

If you operate in California, Connecticut, Missouri, Montana, Nevada, New Jersey, New York and/or Rhode Island, you must take care before taking adverse action against applicants or employees who are recreational marijuana users. These states prohibit discrimination in hiring, termination and other employment decisions simply based on an employee’s consumption of marijuana while off the job.

Employers operating in any state where marijuana is legalized for recreational purposes are expected to simply treat marijuana the same as alcohol. Neither substance is legal to be possessed or consumed on the job or during working hours. Employees

Your managers, employees must know the rules

It is recommended that you and your managers communicate openly with applicants and employees regarding your dealership’s policy, as well as the rules and regulations regarding both medical and recreational marijuana. Your managers and employees need to know that just because marijuana is legal for either or both reasons, this does not give an employee the “license” to use and/or be under the influence while at work or during working hours.

Further, employees need to know that if they are ever tested and test positive for THC — the psychoactive found in marijuana — then disciplinary action can be taken, up to and including termination. They also need to know that certain products can contain traces of THC and although the employee may not be under the influence at the moment, a substance abuse test can result in a positive.

who are considered under the influence and intoxicated can be removed from any job, up to and including termination. You are free to test applicants and employees and if they test positive for recreational marijuana, you are free not to hire them and you are free to take disciplinary action up to and including termination.

A majority of states have updated various regulations regarding substance abuse to include medical and recreational marijuana and what employers can and cannot do. For example, in the states of Iowa, Kansas, Louisiana, Minnesota and Vermont, employees cannot be terminated simply because they tested positive for the first time. In these states, an employee must be provided the option of seeking treatment. If the employee refuses or does not complete a designated treatment program or completes the treatment program successfully and tests positive again, then the employee can be terminated.

Most states are “mixed” states, which have legalized both medical and recreational marijuana. And as stated above, many states have even more complicated rules and regulations regarding testing and the use of drugs, including marijuana.

At a minimum, one in eight workers actively uses recreational marijuana. Two-thirds of Americans favor making marijuana usage legal. These two facts create a real challenge for your business. So what can — and should — you do to navigate this?

In essence, you should treat medical marijuana as any other prescription medication.

“Fairmount Tire has chosen to partner with Fortune Tires because they produce high quality products within their segment. Fortune’s leadership team listens to our suggestions which will enable us to grow our business with them. We appreciate that they can meet the market demands for us and our customers with great programs and an in-depth product lineup that continues to grow. We look forward to strengthening our partnership with Fortune Tires for many years to come.”

- Brad

- Brad

Saunders

- PresidentFairmount Tires

Are you ready to Drive Forward with Fortune?

Prinx Chengshan Tire North America, Inc.

info@prinx.us.com

First and foremost, there isn’t a one-size-fits-all solution. Policies, procedures and practices must be customized based on many factors to include state laws, your personal beliefs regarding marijuana use, safety, customer service standards and more.

The following topics must be carefully considered when establishing policies and practices to not only comply with state marijuana regulations, but also in hiring and retaining a high-quality workforce.

To test or not test? Most employers have implemented some form of substance abuse testing policy. SESCO Management Consultants has been an advocate of substance abuse testing for as long as I can remember. I would have never thought after all these years I would say to a client, “It is recommended that you challenge your substance abuse testing policy as it relates to marijuana.”

Traditional drug testing policies happen at the pre-employment stage, the post-accident stage, at random and if there is a reasonable suspicion that justifies intervention. With the legalization of marijuana, we have recommended clients challenge their random and pre-employment testing practices, unless required by a federal or state law or Department of Transportation regulations.

I’ll never forget a few years ago, when a large client called requesting that we develop a very comprehensive substance abuse program, including random testing, for his business. He told me he vowed he was going to eradicate drugs in his workplace. After the program was implemented, the owner called me 30 days later. I asked him how the first round of random tests went. He said, “We had four employees test positive.”

He went on to say that his general manager of 30 years, his right-hand man, had tested positive for cocaine. He then asked me how he could keep him while terminating the other three who had tested positive. This created a difficult situation that potentially put the business owner at legal risk.

Pre-employment testing. As a matter of background, there are various types or different panels of drug tests to choose. These range from a five-panel test, up to a 14-panel drug test. The “panel” refers to either a drug or a family of drugs included in the test. As the panel levels increase, more types of drugs are typically screened. For example, a 13-panel drug test screens for 13 of the most frequently abused prescription drugs (Xanax, Fentanyl, Ritalin, Valium, etc.) and illicit drugs (cocaine, PCP, quaaludes, etc.).

The most common, least expensive test is a standard five-panel drug test which screens for five illicit drugs, including marijuana. (Sometimes screening for alcohol also is requested.) More and more employers are utilizing 10, 12 or even 13-panel tests.

We are finding that employers in many industries are not conducting pre-employment drug testing; are conducting preemployment drug testing, but are having marijuana dropped from the panel; or if the applicant tested positive for marijuana, are not considering it as part of the hiring consideration. More

and more employers appear to be treating marijuana use like alcohol and ignoring off-duty recreational use.

These substance abuse testing policy changes are becoming more common because of the lack of reliable testing available to determine whether an applicant or employee is under the influence of marijuana. Unlike alcohol testing, which can clearly identify whether or not an applicant or employee is under the influence, marijuana testing provides for either a positive or a negative result.

Although research is conflicting, it is widely known that an applicant or an employee can test positive for using marijuana within the last 30 to 60 days. The challenge for employers is conducting pre-employment and random testing for marijuana use. You just don’t know when the applicant or employee used the drug. And with it being legal in most states in one form or another, testing for marijuana creates a number of “hoops” and processes that an employer must consider to avoid breaking the law.

Each employer must determine whether they wish to implement a substance abuse program to include pre-employment and random testing and/or to include marijuana. We are not recommending either/or and certainly if you do elect to conduct pre-employment and/or random testing to include marijuana, we can assist you in establishing a compliant policy. Safety and workers’ comp costs are still critical issues and a comprehensive substance abuse program can go a long way in reducing these significant costs.

Reasonable suspicion. Regardless of the legalization of medical and recreational marijuana, employers do not have to tolerate on-the-job use or intoxication. Reasonable suspicion testing is critical as employees can’t come to work impaired. Additionally, you owe it to the rest of your employees, who expect a safe place to work.

Most employers want to test based on reasonable suspicion and out of concern for the health and safety of their employees. It is ideal to train managers on ways to observe and determine whether someone might be under the influence. Please note

Although research is conflicting, it is widely known that an applicant or an employee can test positive for using marijuana within the last 30 to 60 days.Photo: 1132681519 | Hailshadow | Getty Images

the words “might be.” The employee does not have to be legally impaired to be tested.

If you reasonably believe that someone may be a threat to themselves or others in the workplace and they are under the influence, it is always best and safest to conduct a substance abuse test. If they are not under the influence and know they will test negative, the employee will typically cooperate. If the employee refuses the test, your policy should state they are voluntarily resigning, effective immediately. (Of course, if they test positive, you have options which should be thoroughly discussed with your HR department or a third-party advisor.)

Testing based on reasonable suspicion could be prompted by the following:

• Suspicious odors;

• Odd employee movements, such as staggering or twitching;

• Eyes that are dilated or watering;

• Unusual facial expressions and a flushed complexion;

• Confusion and slurred speech;

• Irritability and argumentativeness;

• Drowsy, slow or unusual poor performance;

• Abnormal behavior for that individual.

Post-accident is another test that is strongly recommended. Most workers’ comp programs either recommend or require a workplace substance abuse program that includes a testing protocol. If an employee tests positive after an accident, this will go a long way in a complete denial of workers’ comp and as such, reducing significant employer liabilities and costs.

Most employers will implement a basic threshold of when to test post-accident. Basic papercuts and the like typically are not sent for post-accident testing. More serious accidents and/ or injuries are sent for tests. These can include back strains, cuts, dropping parts or tools on feet, back and body strains, slip and falls with subsequent pain, etc. You are better off taking an employee to be tested and/or taking them to the local emergency room or urgent care center than not.

In today’s litigious environment, dealerships must have effective and compliant human resource management systems to include:

• An employee handbook which, most importantly, reflects state laws;

• Job descriptions that identify the essential functions of a position, plus its physical and mental requirements in order to determine reasonable accommodations;

• A basic hiring system that includes three to five behavioral, open-ended interviewing questions, in addition to a background and reference check process;

• Safety and health policies;

• Open communications.

Dealerships are very familiar with these basic tools and systems, but many times ignore or delay their development and

implementation or allow systems to go stale and out of date. You cannot be reactive, but must be proactive in developing and maintaining these systems.

Wrongful termination lawsuits and legal intimidation are on the rise, especially among younger generations. Many believe they “know” their rights and are not afraid to contact a federal or state agency or a lawyer.

However, as stated above, compliance is attainable and affordable and an organization can attract and retain excellent employees which, frankly, removes a lot of these employment liability issues. But this must be a priority.