Welcome!

Speakers

Tamboer – The Cromford Report

– Freddie Mac

Panel – Bell Bank Mortgage

Tamboer – The Cromford Report

– Freddie Mac

Panel – Bell Bank Mortgage

Senior Residential Housing Analyst

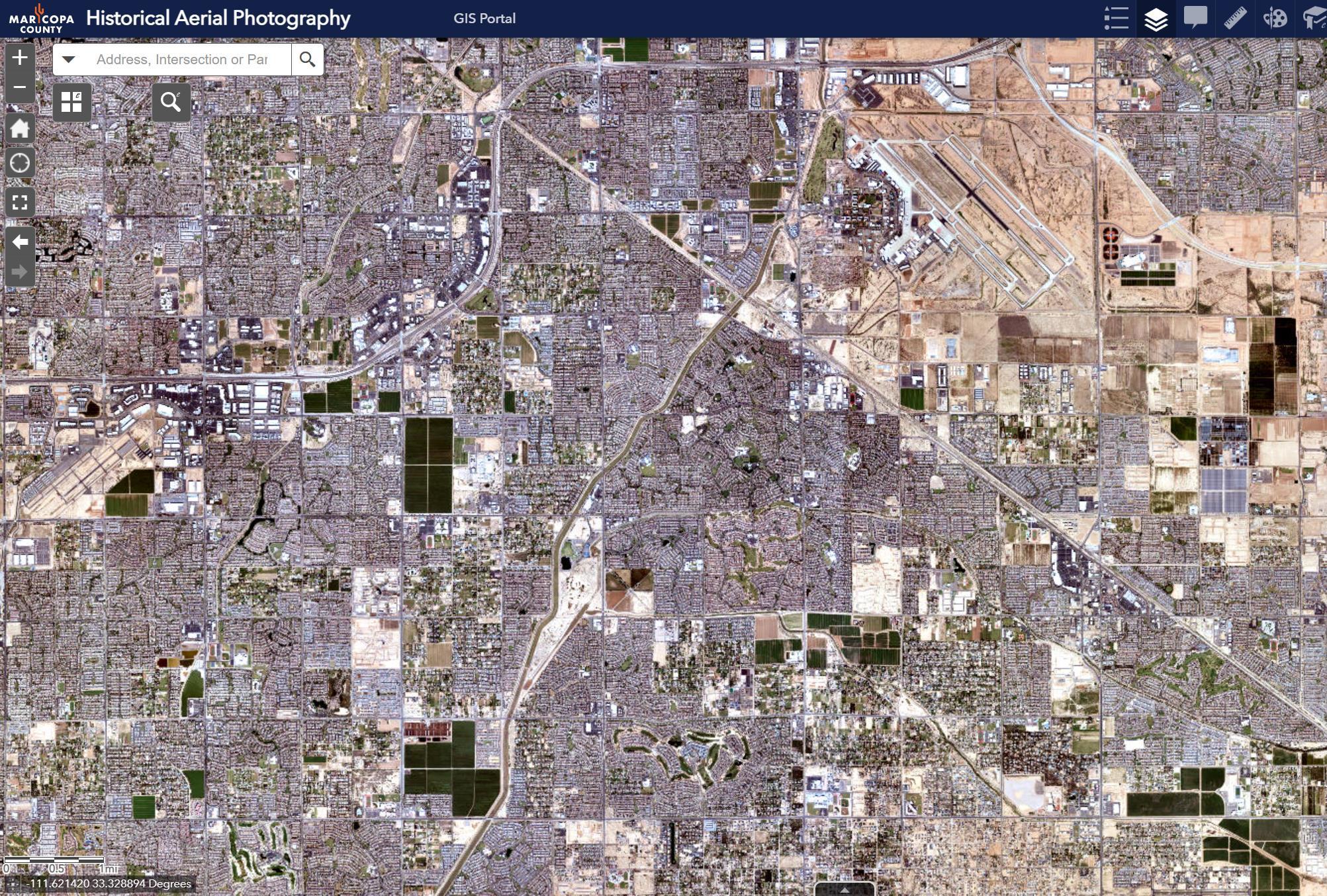

https://azmag.gov/Programs/Maps-andData/Socioeconomic-Projections

https://azmag.gov/Prop479

9/23/2024

9/23/2024

9/23/2024

Home values only declined in 1 recession, out of 8 recessions, in the past 50 years

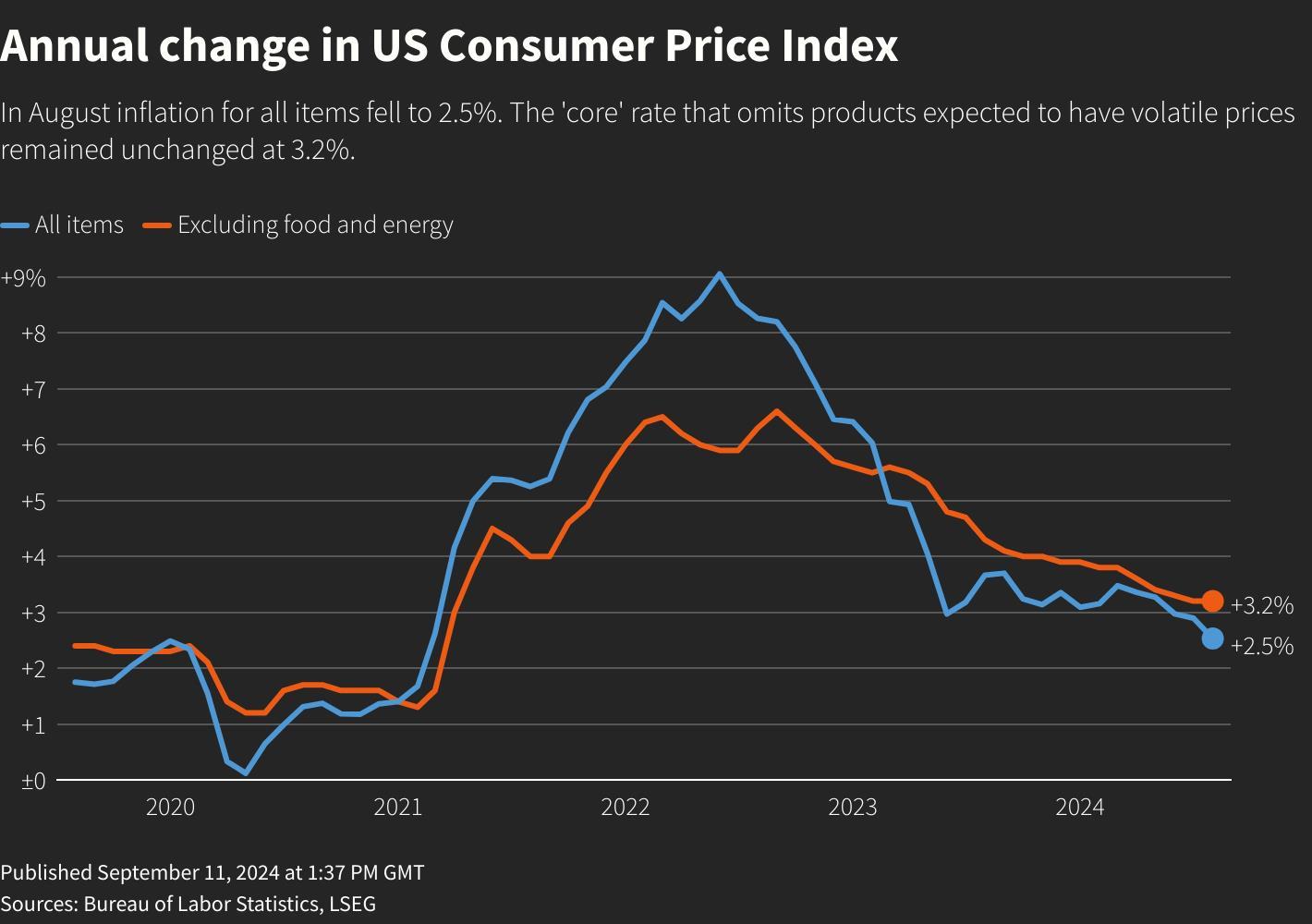

9/11/2024

9/11/2024

9/10/2024

9/9/2024

9/10/2024

9/9/2024

9/7/2024

9/7/2024

https://www.mortgagenewsdaily.com/mortgage-rates/mnd

The cost of renting vs. buying

On average, renting a studio cost $1,460—down $14 annually. A one-bedroom rented for $1,615 (down $23), and a two-bedroom rented for $1,933 (down $12).

In July, the median price of a home was $439,950. This means that the average cost to buy a starter home comes in at $2,808 per month—factoring in monthly mortgage payments, HOA fees, taxes, and homeowners insurance averaged at metro levels.

Median-priced homes are generally not considered “starter homes”

0-2BR apartments under 1,000sqft are not comparable to a 1,900sqft single family home with 3-4 bedrooms, private parking, and a yard.

https://www.realtor.com/news/trends/renting-vs-buying-first-home-saves-over-1000-per-month/

https://www.realtor.com/news/trends/renting-vs-buying-firsthome-saves-over-1000-per-month/

https://azmag.gov/Programs/Maps-and-Data/Land-Use-andHousing/Housing-Data-Explorer

*Does not include taxes, insurance, and PMI

Mkts

Mkts

Markets

Markets

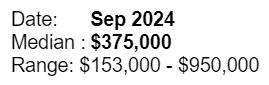

Sep = 14 of 20 Closing Days

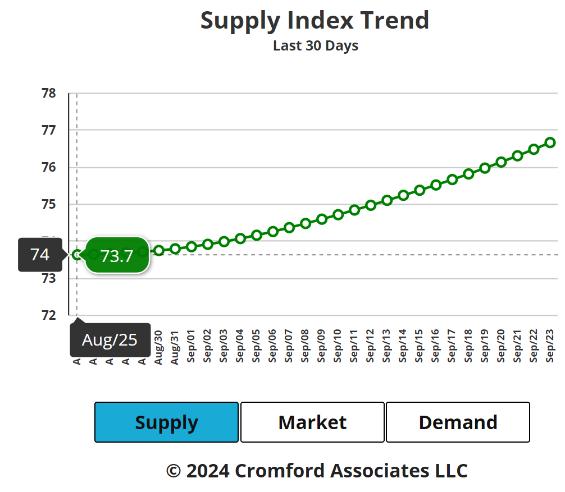

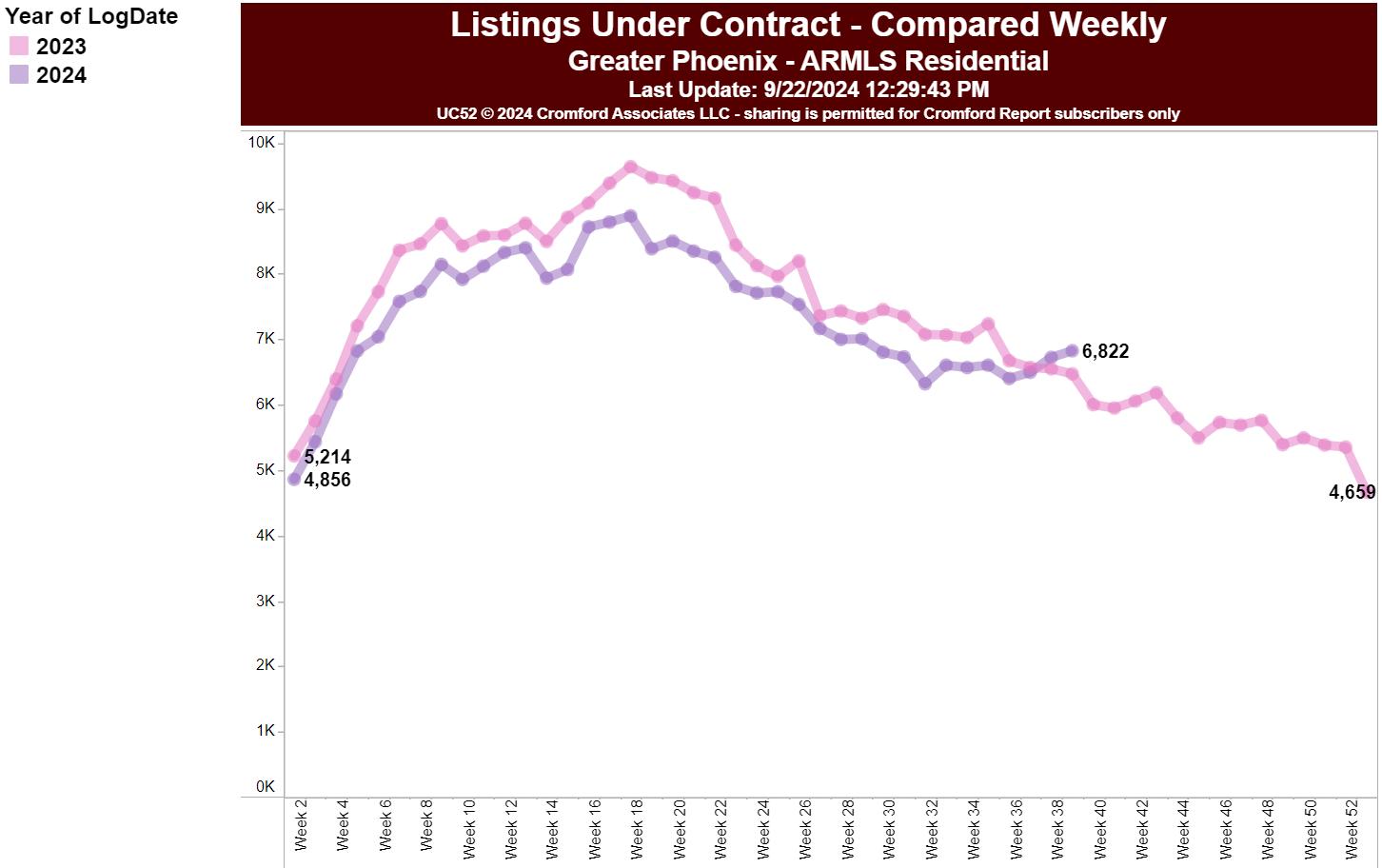

Sales measures don’t tell us where we ARE, they tell us where we’ve ALREADY BEEN. They reflect contracts written at least 4-6 weeks ago.

Sale prices are a trailing result, not a forecasting indicator.

measures don’t

Sales measures don’t tell us where we ARE, they tell us where we’ve ALREADY BEEN. They reflect contracts written at least 4-6 weeks ago.

Sale prices are a trailing result, not a forecasting indicator.

Sales measures don’t tell us where we ARE, they tell us where we’ve ALREADY BEEN. They reflect contracts written at least 4-6 weeks ago.

Sale prices are a trailing result, not a forecasting indicator.

DOM at contract is always lower than DOM at close due to the UCB/CCBS statuses that are still considered “active” during the escrow period despite being under contract. Therefore, they continue to accumulate days on market until they’re placed in Pending status.

DOM at contract is always lower than DOM at close due to the UCB/CCBS statuses that are still considered “active” during the escrow period despite being under contract. Therefore, they continue to accumulate days on market until they’re placed in Pending status.

$10,000 Sep Sep = 14 of 20 Closing Days

$8,100 Aug 2023

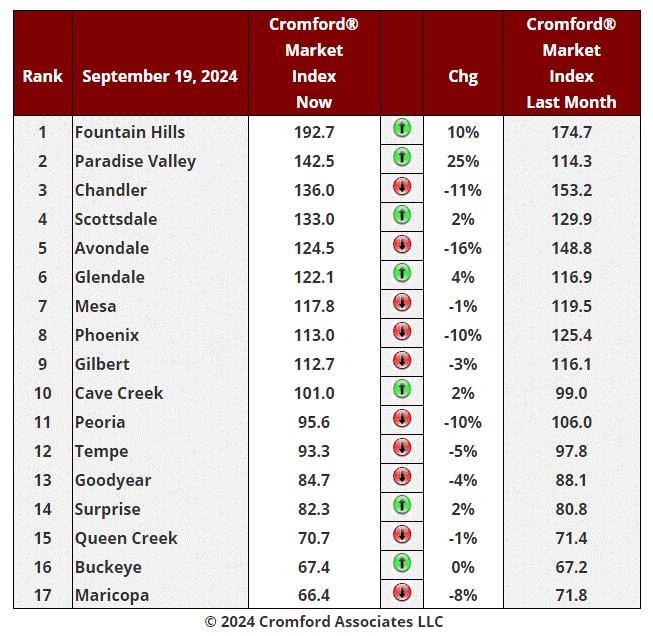

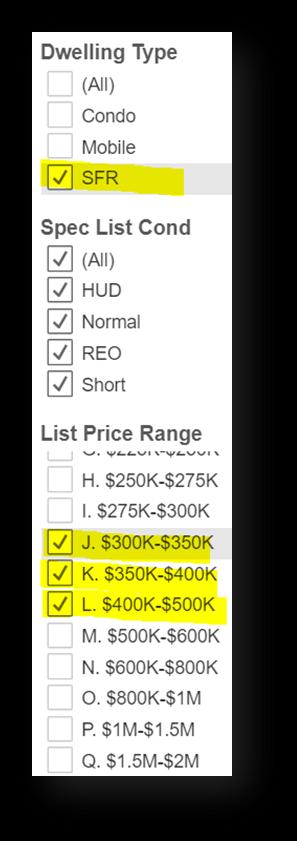

$275K-$500K 62-67%

Sep = 14 of 20 Closing Days Sep 2024

Sep = 14 of 20

Closing Days

Sep = 14 of 20 Closing Days

2023 vs August 2024 – 22 out of 22 Closing Days

For a copy of this PowerPoint and to customize any of these charts for your area, subscribe to The Cromford® Report online:

To subscribe go to www.CromfordReport.com or email us at Accounts@CromfordReport.com and we will send you a link.

• Sign Up – select ARMLS Subscription

• Monthly - $35

• Quarterly - $90 (save $60/year)

• Annually - $300 (save $120/year)

Cromford® Public - $240/Year ($150 with Cromford Report Subscription)

September 24, 2024

Monica La Crue

Affordable

Mission and Community Engagement

Monica is an Affordable Lending Manager at Freddie Mac and She joined Freddie Mac in 2019 as part of the Real Estate Engagement outreach team. She works closely with industry diverse trade associations, real estate companies and local and State REALTOR® associations.

• Freddie Mac was chartered by Congress in 1970 and operates in the Secondary Mortgage Market

• Mission to promote liquidity, stability, affordability and equality in housing – nationwide, in all economic conditions

• Community mission

o Stabilize communities

o Prevent foreclosures

o Expand credit responsibly

o Educate future homebuyers and counsel homeowners

o Support affordable rental housing

• Three main business lines

o Single-Family (1- to 4-unit for-sale properties)

o Multifamily (5+-unit for-rent properties)

o Capital Markets

Insights through research studies, thought leadership, speaking opportunities, expert contributions and data to position our clients and partners for success.

Education

Events, training and financial literacy curricula to help better prepare borrowers for homeownership and to promote responsible and sustainable behaviors.

Mortgage offerings that meet borrower needs and scenarios to include: low down payments, refinances, first-time homebuyer, energy-efficient properties, factory-built housing and renovation mortgages.

Services, resources, tools and technologies that enable housing professionals to serve as trusted advisors and to select the best solutions for their borrower.

Percentage Population Married when aged 26-41

Source: CPS Annual Social and Economic (March) Supplement 202203

Percentage of Population with Children when aged 26-41

2022 Year-over-Year Change in Household Formation by Generation (# in M)

Bachelors Degree +

Associates Degree & Some College

High school or less

Gen X Baby Boomer

Source: CPS Annual Social and Economic (March) Supplement 202203

% of Millennials with Bachelors Degree +

$39K

Source: U.S. Census-Current Population Survey (CPS) 2021; FAFSA, JP Morgan, Federal Reserve, Freddie Mac

• Along with greater college degree attainment, Millennials show higher income earnings compared to previous generations.

• Higher female wages

Median Household Income when aged 26-41 (adjusted for 2021 Dollars)

*Digital Nomads-people who embrace a location-independent, technology-enabled lifestyle

Total 65M

Source:MBOPartnersStateofIndependenceinAmericaReport2022-MBOPartners Gig Economy Workers in 2022

Source: MBO Partners State of Independence in America Report 2022 - MBO Partners

worry about having enough money to pay my bills each month

I/We have enough money to go beyond each payday (e.g., money for things I/we want, money for savings)

I/We live payday to payday, with just enough money to get by

I/We sometimes don’t have enough money for basics, like food and housing, until the next payday

*Source: Consumer Inflation Poll, June 2022 Base: All Respondents (Total: n=2,000, Gen X: n=453 ; Baby Boomers: n=441) Q. Which of the following statements best describes your household’s general financial situation. Base: All Respondents (Millennials: n=1,504)

Emergency fund of unexpected expenses

Retirement (e.g., 401k, IRA) A down payment on a home My child(ren)/ future child(ren)'s education A vacation or trip A major purchase (e.g., car, appliances, furniture) My education/ professional development A luxury purchase (e.g., electronics, jewelry)

Q. Thinking about saving for the future, which of the following are you currently saving for?

Millennials: n=1,504

Parents' or older relatives' living or medical expenses I am not saving for anything

% of Millennial renters who say they haven’t had conversations with their parents about how to manage finances or budgeting

47% of potential FTHBs (ages 25-45)

perceive lack of knowledge regarding the homebuying process as a barrier

My parents have NOT talked to me about managing my finances

My parents did NOT teach me how to set a budget

My parents have NOT involved me in family financial decisions

My parents NOT have explained to me how to invest money

Millennial Homeownership Rate

Source: CPS Annual Social and Economic (March) Supplement 202203

Millennial Homeownership Rate by Race and Ethnicity

Millennial Hispanic/Latino, African American/black homeownership and AAPI rates are below those of non-Hispanic Whites’ rate of 57%.

Considering the historical variation in homeownership rates by race and ethnicity combined with higher share of Hispanic/Latino and African American/Black populations among Millennials, the result could be another factor lowering the overall Millennial homeownership rate. Source: CPS Annual

Millennials who are renters want to buy a home and anticipate to move in two years or less… 54% Have not owned a home in the past 82%

would want to move to a different neighborhood within the same town/city 40%

26%

are currently saving for down payment on a home 56%

would use personal savings as a source for future down payment 47% will be 31-40 years old when purchase their first home 58%

would consider Single family home when move next 70%

are confident that they will be able to manage their finances well 82%

Q. Which one of these statements best reflects your views about why you are currently renting? Q. When, if at all, would you anticipate moving to a nefollowingw home or residence? Q. How would you describe your current living situation?; When you move next, which of the following would you consider Q. Thinking of your next move, to which of the following locations would you most want to move? Q. The life milestones/events are often associated with one's decision to buy a home. Which event(s) do you think would influence your decision the most when deciding to buy your next home/ in the future? Q. Thinking about saving for the future, which of the following are you currently saving for? What are your primary savings goal? (N=320) (Total=2,207)

Biggest barriers millennial renters face when wanting to purchase a home

Not enough money for a down payment and closing costs 55%

~ 44% of millennials who are renters believed that a 20% down payment on a home is required, or they didn't know.

2021 FTHB Millennial Downpayment % Distribution

Not earning enough money to meet a monthly mortgage payment 49%

Not having established a credit history to qualify for a loan

Q. How likely do you think it is that you will ever purchase/own a home? (n=695) Q. If you ever purchase a home, how old do you think you will be when you purchase your first home? Q. The following life milestones/events are often associated with one's decision to buy a home. Which event(s) do you think would influence your decision the most when deciding to buy your next home/ a home in the future? Q. If you were considering buying a home/a different home today, please indicate if you think the following would be a major obstacle, minor obstacle or no obstacle for you. Q.To the best of your knowledge, what is the percentage of a home’s sale price lenders require borrowers to pay as a down payment for a typical mortgage today? (Renter, n=695)

Source: American Housing Survey (AHS) 2019; Q1 2023 Freddie Mac Rising Generation Survey

Multiple down payment sources are becoming an imperative as the amount needed for a down payment rises with home prices Expected Source(s) of Down Payment

Median Down Payment on a Home ($ amount)

2020 Q1 2023 Q3

Worry other people might see them in a negative way for using homebuying assistance

Communications and Marketing

Say recommendation from loan officers or real estate professionals influenced their decision Would not have been able to purchase their home without financial assistance or it would have been difficult

SIZE OF ASSISTANCE

Less than $3,000

Incorrectly believe you cannot get down payment assistance if you’ve owned a home before

Base: All Participants (n=448) Do you agree or disagree with the statement “I worry that other people might see me in a negative way or judge me for using home buying assistance or loans from a nonprofit or government agency” Q. Do you believe the following statement is true or false?” You can't get down payment assistance if you've owned a home before.

Base: Financial Assistance Users (n=342) Q. How much of an impact did home-buying financial assistance or loans from nonprofit or government agencies have on your ability to purchase your home?; Q. Which of the following sources did you use to get information about home-buying financial assistance programs or loans from nonprofit or government agencies Q. What percent of your down payment and closing costs for your current home came from the following sources?; Q. What was the approximate size of the home buying financial assistance or loans from nonprofit or government agencies you received?

Source: Down Payment Resource as of April 7, 2023 *KY: small base size in the Housing Financial Assistance Survey

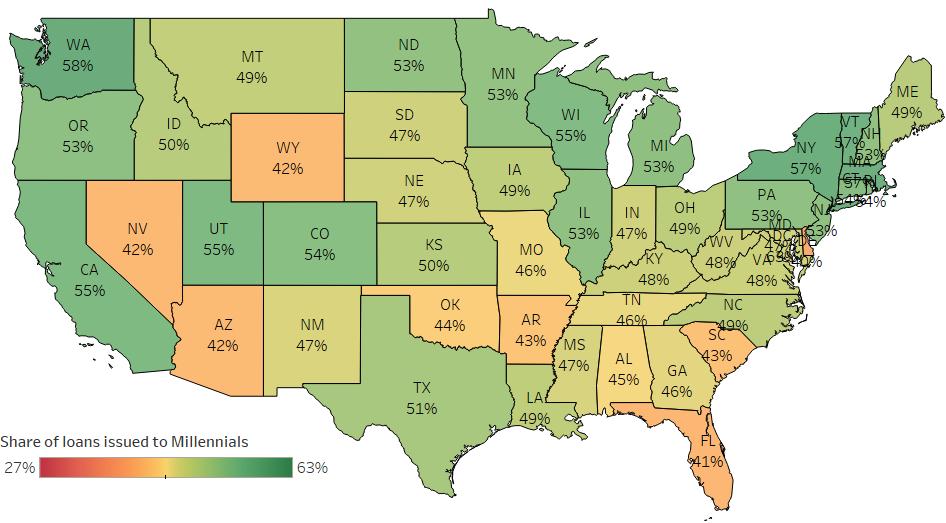

Share of Mortgages Issued to Millennial Buyers by State (2021)

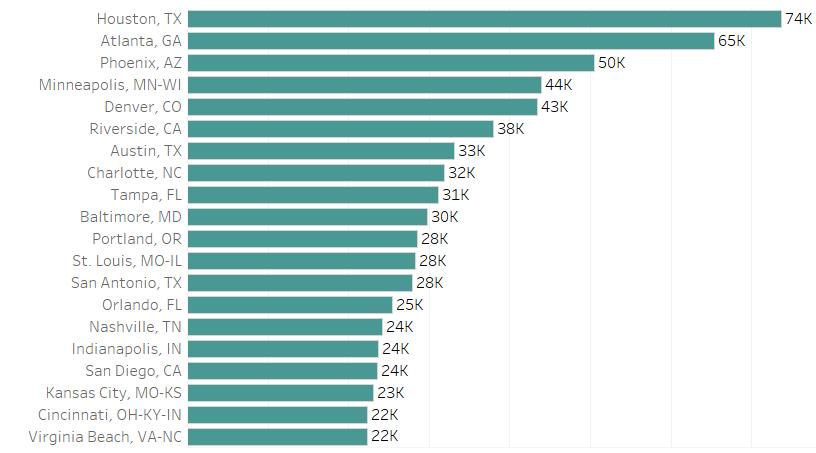

Top 20 Millennial MSAs (Count of mortgages issued to Millennials)

Home Possible®

• First-time buyers and other buyers who qualify based on area median income in the home’s location

• Down payment as low as 3%

• Flexible down payment and closing cost funding options

• Co-borrower who is not part of the household allowed

• Private mortgage insurance stops at 80% LTV

HomeOne®

• First-time buyers – no income restriction

• All borrowers must occupy

• Fixed-rate terms only

HFAAdvantage®

• Based on Home Possible underwriting requirements

• 1-4 unit primary residences; all borrowers must occupy

• State/Local HFA’s down payment assistance and guidelines

• Minimum MI coverage required

Use this tool to verify if a borrower can qualify for a Home Possible mortgage based on the property location and the borrowers' qualifying income.

SF.FreddieMac.com/working-with-us/affordable-lending/home-possible-eligibility-map

Allows you to check for available down payment assistance on the DPA One® website.

Provides Home Possible income limits based on property location.

Addressing Today’s Housing Challenges Expanding Affordable Lending

CHOICERenovation®

CHOICEReno eXPress® Manufactured Housing Shared Equity Homeownership

Financing for renovations and repairs including home resiliency

Financing for factory-built HUD Code homes affixed to permanent foundations and titled as real property

Financing for homes with lasting affordability administered by notfor-profits or state/local governments

your clients through education

CreditSmart is a suite of free financial capability and homeownership education resources designed to empower consumers with the skills and knowledge to support them through every stage of their homeownership journey.

Every person has a unique homeownership journey which is why CreditSmart offers different paths to education and financial wellness.

CreditSmart® Essentials*

CreditSmart® Multilingual

CreditSmart® Coach

*Available in English and Spanish

CreditSmart® Military

CreditSmart® Homebuyer U*

Freddie Mac developed DPA One® as a free, online tool to host down payment assistance programs and ease the matching efforts for housing professionals.

Easily enter, manage and track DPA programs

Strengthen your role as a trusted advisor with your one-stop access to:

• Industry Insights

• Enhanced Business Growth Strategies and Tools

• Resources to Share with Clients

• Connections to Expand Professional Networks

• Latest News, Market Insights and Updates

Loan Products

• Standard Conventional

• Government (FHA, USDA, VA)

• Construction, Rehab and Lot loans

• Lake and vacation homes

• HELOCs

• Portfolio Loans

• Doctor and Dentist Loans

• Refinances

• And More!

Affordable and First-time homebuyer

• Freddie Mac Home Possible/Fannie Mae HomeReady

• BorrowWise & BorrowSmart Grant

• HFA/Bond Programs

• Bell Moving Forward 140

• Bell Moving Forward +

• Bell Moving Forward DPA

• Bell Moving Forward Advantage

• Bell HomeAssist

• Local DPA Programs

• No LLPAs

• ≤80% AMI

• $2,500 grants for borrowers at or below 50% AMI

• At or below 50% AMI

• HomeReady® or Home Possible® first mortgage with $2,500 grant

• First-time & repeat buyers

• 1-2 Unit owner-occupied residences

• Homebuyer Education required if all borrowers are first-time buyers.

• Between 50.01-80% AMI

• Home Possible® first mortgage with $1,250 grant

• First-time & repeat buyers

• 1-4 owner-occupied residences

• HPF/Greenpath Homebuyer Education required for at least one borrower. Free!

• Offered through State or county agency

• First and second (DPA) mortgages

• Have their own rates

• Exclusive Fannie and Freddie Products

• Reduced MI at or below 80% AMI

NEW! BMF 140

Home Possible first mortgage with income limits at 140% AMI for borrowers who live in or move to eligible census tracts

Home Ready first mortgage with $6,000 grant for borrowers who currently live in eligible census tracts

BMF DPA LOAN

A second mortgage with monthly payment, same interest rate as first mortgage, 20 year term

BMF ADVANTAGE

First Mortgage Program for minority borrowers

*Available for borrowers identifying as a minority as defined by regulatory designations listed on the initial loan application.

97% LTV Home Possible first mortgage with 140% AMI income limit

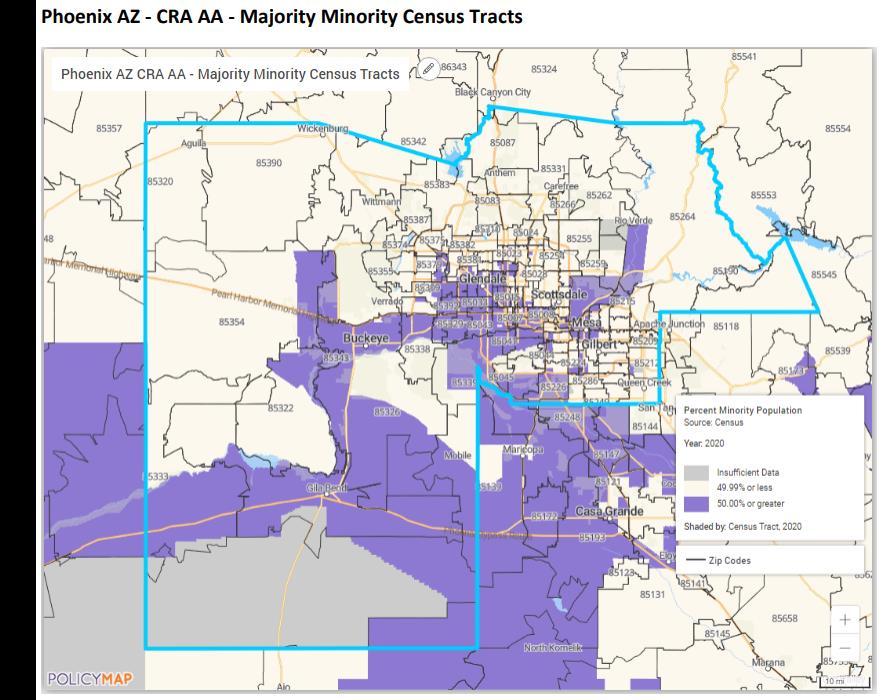

BMF 140 Home Possible first mortgage with income limits at 140% AMI for borrowers who live in or move to eligible census tracts

At least one borrower must currently live in a census tract that is 50% or more minority OR purchase a property in a census tract that is 50% or more minority

Available in AZ, FL, KS, MN, MO, ND, NM, TN, WI

$1,000 grant

Eligible properties include 1 & 2-unit SF, 1-unit PUD, 1-unit condo, and multi-width manufactured housing

Reduced MI Coverage

Exclusive to Bell Bank!

Home Possible first mortgage with income limits at 140% AMI for borrowers who live in or move to eligible census tracts

Home Ready first mortgage with $6,000 grant for borrowers who currently live in eligible census tracts

HomeReady first mortgage with a $6,000 grant and a $500 appraisal reimbursement

At least one borrower must be a first-time buyer AND currently live in an eligible census tract

NO income limits

Available for properties in eligible census tracts in these areas:

• Phoenix Metro Area

• Miami/Ft. Lauderdale Metro Area

• Memphis Metro Area

• Orlando Metro Area

• Tampa Metro Area

• St. Louis Metro Area

Loan Amount – up to 2% of the purchase price

20 year term, same rate as first mortgage

A second mortgage with monthly payment, same interest rate as first mortgage, 20 year term

Monthly Repayment

Paired with:

• HomeReady® & Home Possible®

• BorrowWise (HomeReady® & Home Possible®)

• Borrow Smart (Home Possible®)

• Bell Moving Forward Advantage

• Bell Moving Forward 140 (Home Possible®)

$200 processing fee + recording fees

First mortgage program for minority borrowers

First mortgage available to minority borrowers only

Exclusive to Bell Bank!

Lender Paid Mortgage Insurance

Provides up to 99% financing when paired with the Bell Down Payment Loan

Provides flexibilities for borrowers with limited credit or no credit scores

140% AMI Income Limits in AZ

*Available for borrowers identifying as a minority as defined by regulatory designations listed on the initial loan application.

• Requires AUS Approval

• Owner occupied primary residence

• No LLPAs qualifying income at or below 100% AMI and ONE of the following:

• First-time homebuyer (at least one borrower)

• Property in a high needs rural tract

• Manufactured home

• Fannie Homebuyer Ed: HomeView

• Freddie Homebuyer Ed: CreditSmart

• First-time buyers

• NO income limit

• Has LLPAs

• Min 97% LTV

• At least one buyer must take homebuyer ed:

• Fannie Mae – HomeView

• Freddie Mac - CreditSmart

• BorrowWise

• BorrowSmart

• Housing Finance Agency

• AZ is Home

• AZ HomePlus

• Home in 5 Advantage

• Home in 5 Platinum

• Bell Moving Forward Grants

• Bell Moving Forward DPA loan

• Other Local DPAs