Cultured Meat Hits ‘Pause’

One year after the first approval of cultured chicken in the U.S., no factory-grown meat product looks close to commercialization. So when? • 18

One year after the first approval of cultured chicken in the U.S., no factory-grown meat product looks close to commercialization. So when? • 18

Engineered from the ground up to provide unsurpassed performance in food processing facilities. These high performance, 100% synthetic lubricants provide extended lube intervals, multiple application capability, lubricant inventory consolidation and improved performance. All while maintaining strict H1 safety requirements.

Lubriplate’s NSF H1 Registered Products Include:

HIGH-PERFORMANCE SYNTHETIC GEAR OILS

SYNTHETIC AIR COMPRESSOR FLUIDS

SYNTHETIC HYDRAULIC FLUIDS

HIGH-PERFORMANCE SYNTHETIC GREASES

HIGH-TEMPERATURE OVEN CHAIN LUBRICANTS

NSF H1 REGISTERED SPRAY LUBRICANTS

To meet consumer demand in the better-for-you space, you need an ingredient that offers more while still tasting great. Introducing Ancient Grains Plus™ Baking Flour Blend, our new gluten-free blend of quinoa, buckwheat and chickpea flours that’s balanced for PDCAAS1 to bring more quality protein than traditional wheat flours, plus a mild flavor designed for wide consumer appeal. Harness the power of alternative grains to make better-for-you products backed by our unmatched expertise. Together, let’s move food

See how “better-for-you” can be so much better at ardentmills.com/nocompromise

Individually selectable: 256 colors

Measurement in progress

Sensor switching

Process malfunction

One year after the approval, no products look even

DEVELOPMENT

Products Expo West 2024: Mushrooms, Tinned Fish and Pickleball

The show is a reflection and precursor of food & beverage trends.

Uplifting Tales of Upcycled Foods

How companies are increasing food availability through upcycling efforts.

Cautious Toast in Beverage Processing

Optimistic signals have beverage processors hoping for better times.

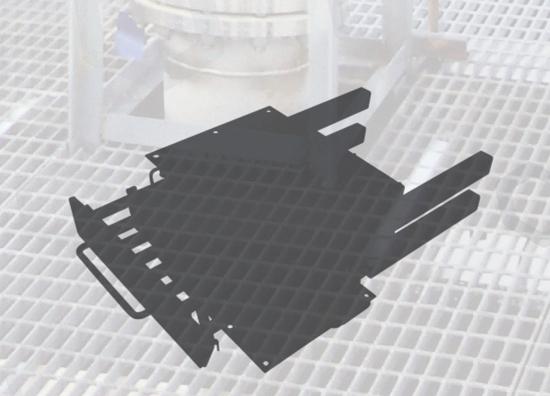

Employee-owned and operated with a legacy spanning over 180 years, ROSS is synonymous with innovation and quality in manufacturing mixing, blending, drying, and dispersion equipment.

Our commitment to excellence is evident in our five state-of-the-art manufacturing facilities across the U.S.A., complemented by an 8,000 sq. ft. Test & Development Center and three international plants, ensuring we serve customers worldwide with precision and reliability.

From standard models to custom solutions tailored to your unique processing needs, ROSS mixing equipment is engineered for decades of trouble-free operation, empowering industries and fostering economic growth.

Proudly engineered and fabricated in the USA, we’re driving the future of manufacturing, supporting American jobs, and fortifying supply chains for generations to come.

As it spreads to cows, humans and our milk, unlimited resources need to be devoted.

First it was only decimating poultry flocks. Then it spread to dairy cattle. Then one human caught it from cows. Now it’s in 20% of our pasteurized milk supply.

“It” is bird flu, highly pathogenic avian influenza (HPAI). And while all indications – so far – are that the milk supply is safe to consume and the one human and the dairy cows are getting over it quickly and easily, this sounds so much like a certain event that happened at the start of 2020.

Keep that painful, three-year lesson in mind. HPAI's impact on food prices and poultry availability is obvious (remember $5-a-dozen eggs?), but there's potentially a whole lot more at stake, now that it's appeared in other species and in humans and has (so far benignly) infected our milk supply.

In early February of 2020, I was at the Consumer Analyst Group of New York annual meeting where executives from General Mills, Mondelez, McCormick and Unilever all mentioned an unusually strong strain of flu that had forced the temporary closings of their plants in China, especially Wuhan. While all admitted the shutdowns would have some effect on financial results, they seemed to think it would blow over relatively quickly.

A week or two later, we all learned the term “coronavirus,” and the world changed.

That was a classic "zoonotic" disease – spreading from animals to humans. With the infection of that farm worker in Texas, bird flu, too, has become zoonotic and not just relegated to one species of animal.

We’ve been reporting outbreaks of avian influenza for about 10 years, although it’s been around much longer – a Centers for Disease Control and Prevention web story says the first recorded case occurred in 1878 in Italy. But it didn’t seem to make headlines till 2015. The impacts of those outbreaks have been all over the map.

The one in 2022-2023 was one of the most damaging in the U.S., with more than 58 million birds in 47 states either killed by the virus or culled as a precaution. That outbreak is estimated to have cost the government roughly $661 million and farmers a billion dollars or more. And that doesn’t factor in the cost to consumers, who were paying $5 or more for a dozen eggs.

This is not solely an American or North American problem. Past outbreaks have been all over the world; the 2020 one spread to Europe, affecting flocks in Belgium, Denmark, France, Germany, Ireland, the Netherlands, Sweden and the United Kingdom. 2023 outbreaks hit Hungary and Africa.

So it's a global problem. And there should be a global response .

As HPAI apparently originates with wild birds, it’s going to be impossible to cure it at the source. USDA’s Agricultural Research Service and Animal and Plant Health Inspection Service have been testing avian influenza vaccinations for more than a year now. And there are plenty of rules in place once an infection occurs in a flock.

There are other mitigation strategies. I just hope the USDA people are getting the support, financial and otherwise, they need. I hope FDA and CDC are involved as well. And it wouldn’t hurt to get food and animal safety agencies from across the globe on the same page about this.

Am I overreacting? I don't believe anyone thought a bat in a wet market in Wuhan could bring the world to its knees and kill 7 million people. Let's nip HPAI in the bud before it kills more chickens, spreads to more species of livestock and infects more humans. Then mutates, as viruses are wont to do, into something truly dangerous. n

Written by Dave Fusaro

EDITOR IN CHIEF

Written by Dave Fusaro

EDITOR IN CHIEF

EDITORIAL TEAM

EDITOR IN CHIEF

Dave Fusaro

dfusaro@endeavorb2b.com

SENIOR EDITOR

Andy Hanacek ahanacek@endeavorb2b.com

CONTRIBUTING EDITORS

Ed Avis, Claudia O’Donnell

EDITORIAL ADVISORY BOARD

Mohamed Z. Badaoui Najjar, Ph.D. R&D Senior Director–

Strategy & Portfolio Sector Food & Beverage, PepsiCo

Ed Ballina

Principal, Operational Excellence Consulting (retired from PepsiCo)

James Davis

Director-Global Sanitation, OSI Group LLC

Leslie Herzog

Vice President of Operations & Research Services, The Understanding & Insight Group LLC (retired from Unilever)

Steven Hill, Ph.D.

Vice President-R&D, QA, Food Safety, Sustainability, Engineering, Regulatory, T. Marzetti

Leslie Krasny Krasny Law Office

Alvaro Cuba Simons Operations & Supply Chain Consultant (formerly of Mondelez and Kraft)

Gary M. Stibel

Founder & CEO, The New England Consulting Group

Joel Warady President, Catalina Crunch

DESIGN & PRODUCTION

ART DIRECTOR Derek Chamberlain dchamberlain@endeavorb2b.com

PRODUCTION MANAGER

Rita Fitzgerald rfitzgerald@endeavorb2b.com

AD SERVICES MANAGER Jennifer George jgeorge@endeavorb2b.com

EXECUTIVE STAFF

VP/GROUP PUBLISHER Keith Larson

CIRCULATION REQUESTS Lori Books

ENDEAVOR BUSINESS MEDIA, LLC

CEO Chris Ferrell

PRESIDENT June Griffin

COO Patrick Rains

CRO Paul Andrews

CHIEF DIGITAL OFFICER Jacquie Niemiec

CHIEF ADMINISTRATIVE AND LEGAL OFFICER Tracy Kane

EVP INDUSTRIAL GROUP Mike Christian

Endeavor Business Media, LLC

30 Burton Hills Blvd, Ste. 185, Nashville, TN 37215 800-547-7377

Just as May brings more flowers, the month also brings more web-only features on FoodProcessing.com.

Take our 53rd annual R&D Survey

Help us (and your peers) identify product development priorities and issues for this year by giving this survey 5 minutes of your time. Is your team swinging for the fences or cutting costs? Removing or adding specific ingredients? Using any artificial intelligence in the lab? Your input will help make the resulting story, which will appear in June, even more enlightening. www.surveymonkey.com/r/ MH73HB9

Talking the presidential election, sustainability

We've created some interesting podcasts over the past month. Whether you want to hear talk of which presidential candidate would be best for the food industry, new thoughts on sustainability or Rich

Products' reading of trends, we have some educational and thought-provoking audio for you. Choose one (or more) from this master list: www.FoodProcessing.com/ podcasts

More on our Capital Spending Outlook

Even if you didn't miss our annual look at capex in last month's magazine, we have more numbers and more top projects on our website. See it all at: www.FoodProcessing.com/ 55001416

Help elect the best R&D teams

Help us honor the business' best product development teams by voting in our R&D Teams of the Year poll. We're pitting T. Marzetti vs. Flowers Foods in the large-company category and Egglife, Bitchin' Sauce and Tindle in the small category. Read their essays and vote at: www.surveymonkey.com/r/ 7Y9P3JV

There are numerous advantages when operational technology and information technology converge, but security vulnerabilities arise.

With the rise of digital transformation across all industries comes the convergence of operational technology (OT) and information technology (IT) in manufacturing environments. While IT/OT convergence enables greater operation efficiency, connectivity and productivity, the integration of these technologies introduces a number of cybersecurity challenges.

This is a constant learning curve for all companies regarding how to protect their infrastructure, including food & beverage. In 2020 there was an increase of 607% in cyberattacks in the agriculture/food & beverage industry from the previous year, according to Malwarebytes, proving the industry is not exempt from cybersecurity risks.

One of the main cybersecurity issues food & beverage companies face is securing legacy systems. According to Tata World, over twothirds of businesses are relying on legacy systems and mainframe applications. These legacy systems are a huge challenge to address. From an operational view, you have personnel that have been operating the equipment for many years and have come to understand the HMI graphics and all the alarms. Also, the equipment could have been running

efficiently since day one and it can be difficult to convince stakeholders to upgrade. On top of that, upgrading legacy systems is costly, as it's not a straightforward “swap.” All the equipment must be re-assessed to ensure compatibility and re-validated.

One of the main cybersecurity issues food & beverage companies face is securing legacy systems ... a huge challenge to address.

Another cybersecurity challenge for the food & beverage industry is remote access. Many vendors that supply equipment may include a service level agreement (SLA) with the end user for support. The vendor usually offers a router that includes a VPN that inherits huge risks such as unauthorised access and data access. Through the VPN, vendors can access the equipment without authorization. A similar threat to remote access is related to unauthorised remote changes.

According to Dragos, 75% of their customers had limited to no visibility into their ICS/OT environment. OT asset visibility is arguably one of the most important pieces when trying to secure your OT environment, because if you don’t know what’s existing in your environment then you can’t possibly protect your assets fully. According to a special report by Food Processing (bit.ly/3IDgABI), only 52% of respondents said they have a segmented network. Implementing a segmented network is a very challenging task that requires thorough planning and liaising with operations to get downtime for testing a cutover.

As the food & beverage industries continue their digital transformation journey, there are many cybersecurity challenges such as the convergence of OT/IT, use of legacy systems, remote access, remote changes and asset visibility. While it may seem like a daunting challenge, many of these risks can be overcome through thoughtful use of budget, as well as the opportunity for downtime to implement and test solutions. n

Written by Patrick Corbett

Written by Patrick Corbett

Natural Products Expo West has mirrored the transitions in the U.S. food industry over the past four decades.

Natural Products Expo

West has mirrored the transitions in the U.S. food industry over the four decades since it opened in 1981.

That first year, there were just 3,000 attendees. A whopping 85,540 attended the show in 2018, the most ever. After a dip because of Covid, attendance has popped back up to approximately 65,000 the past two years. This year there were more than 3,300 exhibitors, approximately 840 first timers.

The expo has always been held in Anaheim, Calif., with the convention center undergoing at least one addition resulting from a request by the organizers of the show to accommodate the ever-increasing numbers.

The complexion of those who exhibit has changed. In the early days, it was predominantly smaller companies – some referred to the exhibitors (and maybe the attendees as well) as “crunchy granola types,” shaped by cultural influences like the Whole Earth movement, Adelle Davis/Jack LaLanne personalities and the first edition of “A Diet for a Small Planet” by Frances Moore Lappe.

There has always been a mix of food, supplements and health & beauty aids. As NPEW progressed, changes occurred around definitions of “health food” and wellness. NPEW came onto the radar of both large and small CPGs in the 1990s as “fads” from the show began to be sustainable trends with year over year sales growth.

The 2000s began with an interest in health, innovation and entrepreneurship, and investment companies were looking for opportunities in food. Multiple channels of merchandising (still specialty but now more mainstream) became more common. But there was still some of the crunchy granola community at the show in the early days of the new millennium.

As the Great Recession hit (2007-2008) and investment money became cheaper, it was trendy for incubators and venture capital interests to become prevalent in this health space and at the annual NPEW event. Small start-ups were being pulled into large food companies. Mass marketers desired to be a part of the mix to satisfy both their customers and their investors.

While this led to huge excitement at NPEW, it was changing the character of the show and the community. Smaller manufacturers looking for customers (whether it be independents or large chains) found themselves elbow-to-elbow at the show with big CPG companies with large booths (including Chobani, Bolthouse, General Mills, Unilever/ Ben & Jerry’s). This was just before one heard people say “you can find our products on Amazon.”

Post-pandemic, smaller manufacturers may be in the majority again; it seemed fewer big companies were exhibiting this year. And fewer attendees came from independent “health food stores,” as this category collapsed during Covid.

One venture capitalist (who has been attending the show for more than a decade) commented after this year’s show that he spent most of his time sitting in meeting rooms as opposed to wandering the floor and “seeing what’s up and coming.” He also commented that, now more than ever, before VC firms buy a stake in companies, they want to see that the company has achieved profitability, not just has a path to profitability. Some refer to this show as the best predictor of what will be “hot” or what will be the latest innovations in the food industry, all under one roof. What we know is that NPEW has succeeded in making its point of view, natural products, mainstream. So the trends are becoming more subtle. Regenerative and organic farming have become Regenerative Organic Certified. Sustainability and mycology are huge trends. And the marketplace is omnichannel, because consumers like “one stop shopping.” And the need to go to the quirky natural food store is now a stop on Amazon or even Walmart or Target. n

Written by Jacqueline Beckley and Leslie Herzog

Written by Jacqueline Beckley and Leslie Herzog

» Consumer Reports hits the food industry

» Coca-Cola, Daisy announce big plants

» Constellation backtracks on marijuana

In the past month, it's spread to cows, humans and now milk – which appears safe.

After months of reports of bird flu decimating poultry flocks, FDA and USDA at the end of March reported the virus had infected herds of dairy cattle. At the start of April, a human caught the virus from cows. Then, at the end of April, inactivated remnants of the virus were detected in the country’s milk supply.

On April 26, FDA reported a week or more of testing found particles of highly pathogenic avian influenza (HPAI) in "one in five" samples of pasteurized milk taken randomly across the country. But the agency said the U.S. milk supply remains safe because of pasteurization.

Raw milk, on the other hand, poses a threat, the extent of which the agencies have not determined. FDA and USDA “recommend that industry does not manufacture or sell raw milk or raw milk products, including raw milk cheese, made with milk from cows showing symptoms of illness, including those infected with avian influenza viruses or exposed to those infected with avian influenza viruses.”

The FDA also tested retail powdered infant formula and powdered

milk products marketed for toddlers. “All qPCR [quantitative polymerase chain reaction] results of formula testing were negative, indicating no detection of viral fragments or virus in powdered formula products,” the agency reported.

Bird flu has caused the deaths or destruction of millions of poultry birds this year. But, according to dairy farmers and veterinarians reporting to the agencies, most infected cows recover within two to three weeks. So has the Texas man who contracted it from dairy cows. USDA is monitoring animals to detect any spread of the virus to beef cattle, but “to date, we have received no reports of symptoms in beef herds.”

“Based on the information currently available, our commercial milk supply is safe because of these two reasons: 1) the pasteurization process and 2) the diversion or destruction of milk from sick cows,” the FDA said.

“To date, the retail milk studies have shown no results that would change our assessment that the commercial milk supply is safe,” the agency continued. “Epidemiological signals from our CDC partners continue to show no uptick of human cases of flu and no cases of H5N1, specifically, beyond the one known case related to direct contact with infected cattle.”

Spun off from what was Kellogg Co., Kellanova wasted little time taking iconic Pop-Tarts in a new direction. Pop-Tarts Crunchy Poppers began hitting grocery stores last month. The little bites have a crunchy exterior, a soft filling and a layer of frosting and sprinkles. They’re $3.99 for a box of five.

USDA’s Food Safety and Inspection Service (FSIS) on April 26 announced its final determination to declare salmonella an adulterant in raw breaded stuffed chicken products, beginning in 2025.

The final determination is no different than the two years of preliminary statements the Agriculture Dept. made on the subject. The food products will be considered adulterated when they exceed a threshold of one colony forming unit per gram for salmonella contamination.

To those who understand the nuance, declaring salmonella an adulterant gives the agency the power to prohibit contaminated products from entering the market and to remove them if necessary, powers the agency did not have in the past.

And while this first declaration only involves breaded and stuffed raw chicken entrees (e.g., chicken Kiev), it’s seen as the first step for more regulation to remove all chicken products that have tested positive, even when they have a very low level of contamination.

“This final determination is part of FSIS’ broader efforts to reduce salmonella illnesses associated with the raw poultry supply in the United States,” the agency stated. “FSIS intends to address salmonella contamination in other raw poultry products later this year.”

“This final determination marks the first time that salmonella is being declared an adulterant in a class of raw poultry products,” said Agriculture Secretary Tom Vilsack. “This policy change is important because it will allow us to stop the sale of these products when we find levels of salmonella contamination that could make people sick.”

FSIS will carry out verification procedures, including sampling and testing of the raw incoming chicken component of these products prior to stuffing and breading, to ensure producing establishments control the bacterium. If the chicken component in these products does not meet this standard, the product lot represented by the sampled component would not be permitted to be used to produce the final raw breaded stuffed chicken products.

The rule will be effective 12 months after its publication in the Federal Register.

Constellation Brands has further distanced itself from its failed multi-billion dollar investment in a Canadian marijuana company by converting its shares in Canopy Growth to non-voting and non-participating exchangeable shares and removing the three directors Constellation placed on Canopy’s board.

“While we remain supportive of Canopy’s strategy, this transaction is expected to eliminate the impact to our equity in earnings and is aligned to our intent to not deploy additional investment in Canopy as we’ve previously stated in our capital allocation priorities,” said Bill Newlands, Constellation’s president/CEO.

That’s quite a reversal from 2017 or so, when cannabis legalization in the U.S. looked to become the biggest thing since the end of Prohibition –especially to alcohol companies. Over the span of the next few years, Constellation sunk at least $4 billion, maybe more, into Canopy Growth, hoping to market beverages containing CBD, and ultimately THC, in the U.S. However, national legalization in the States hasn’t happened – although it did in Canada – and the investment has annually dragged down Constellation’s financial results.

Constellation wasn’t alone. Lagunitas Brewing Co. and Harpoon Brewery launched beers with CBD and THC, and Molson Coors in 2022 ended a deal with a Canadian marijuana producer.

Nor was it just alcohol companies. Ben & Jerry’s expressed interest in CBD in mid-2019, and about the same time Mondelez’s CEO told CNBC, “We’re getting ready, but we obviously want to stay within what is legal and play it the right way.”

Constellation’s stake in Canopy Growth was at least 40% at one point, maybe more, but the U.S. supplier of Mexican beers, Mondavi wines and Svedka vodka in several steps has sold off and written-down its investment.

“Constellation has no other present plans or future intentions that relate to Canopy,” the American company wrote on its website. And it noted it may dispose of its converted shares whenever “U.S. domestic sale of marijuana could not reasonably be expected to violate the Controlled Substances Act.”

Consumer Reports continued its scrutiny of the food & beverage industry with two stories in April, one titled “The Dangerous Dyes and Other Food Additives States Want to Ban,” the other slamming lunch kits, especially Kraft Heinz's Lunchables, for lead and sodium.

“Following California’s lead, more states are trying to keep harmful additives out of our food and our schools,” the first article said. Except for its contentious tone, it mirrors an article we published on March 20: “28 Food Ingredients/Additives That May Be Banned Across the Country” (www.foodprocessing. com/33038951).

“Just a few months after California became the first state to prohibit the use of four dangerous chemicals in food, lawmakers in Illinois, New York, and Pennsylvania are considering similar bans on those and

other food additives,” the Consumer Reports article began.

“New York lawmakers are also seeking to close the so-called ‘generally recognized as safe,’ or GRAS, loophole, which many food safety experts consider a large gap in the Food and Drug Administration’s regulatory framework designed to protect Americans from dangerous food additives.

“And California is considering a bill that would expand on last year’s landmark law by banning six commonly used food dyes, plus the white pigment titanium dioxide, from food provided in the state’s public schools.”

The article did have counterpoints from the Consumer Brands Assn. and National Confectioners Assn.

Lunchables were front and center in the second story, but Armour LunchMakers and products from Target’s Good & Gather, Greenfield Natural Meat Co. and

Coca-Cola Co. has begun construction of a 745,000sq.-ft. dairy processing facility in Webster, N.Y., for its Fairlife subsidiary. The $650 million plant will be Fairlife’s first in the Northeast, and it is expected to open in the second half of 2025.

Dairy processor Daisy Brand will invest $626.5 million to build a processing facility in Boone, Iowa. The 750,000-sq.-ft. plant will be the Dallas-based company’s fourth, and is expected to create 255 jobs. Daisy’s three other processing facilities are in Garland, Texas; Casa Grande, Ariz.; and Wooster, Ohio.

Nestlé Purina PetCare Co. is expanding its Jefferson, Wis., production facility, investing $195 million in a project expected to add 35,000 sq. ft. and 100 jobs.

Oscar Mayer all had "troubling" levels of lead and sodium.

Lunchables were at the top of the list for lead and placed high in sodium content: its Turkey and Cheddar Cracker Stackers had 74% of California’s maximum allowable dose level of lead and 49% of the U.S. Dietary Guidelines recommendation for sodium; Pizza With Pepperoni had 73% lead and 45% sodium; and Extra Cheesy Pizza had 69% lead and 34% sodium.

None of the kits exceeded legal or regulatory limits, Consumer Reports noted, but five of 12 tested products would expose consumers to 50% or more of California's maximum allowable amount of lead or cadmium heavy metals, which can cause developmental and other problems in kids.

Two Lunchables kits made specifically for schools are eligible for the National School Lunch Program. Consumer Reports included a petition to USDA: “We urge you to remove Lunchables processed food kits from the National School Lunch Program and give our nation’s school children healthier food choices.”

The Choctaw Nation of Oklahoma and Three Rivers Meat Co. cut the ribbon on a new meat processing plant in Octavia/Smithville, Okla., designed to serve residents in the area who would otherwise have to drive an hour away to buy fresh meat and produce, according to Choctaw Nation. The plant will process cattle and hogs primarily, but will also take wild game, goats and lamb. The resulting meat and value-added products will be sold in a retail store within the building.

Milwaukee-based Palermo Villa Inc., manufacturer of branded and private label pizzas, will build a 200,000-sq.-ft. production facility in West Milwaukee, three miles away from the company’s corporate headquarters.

During the summer of 2024, Red’s will be rolling out a range of frozen hand-held meals designed for gourmet eating on the go. While marketed for the breakfast daypart, these protein-packed sandwiches can be enjoyed any time of day after a quick warmup in the microwave.

The ciabatta sandwiches feature either sage-flavored turkey sausage or maple syrup-infused chicken sausage, fluffy cage-free eggs and a slice of melted cheese. The English muffin range has either a seasoned pork or turkey sausage patty, a cage-free egg patty and a slice of American cheese layered on a wheat bun. There’s also a croissant with turkey sausage, cage-free eggs and cheese, as well as the gluten-free Egg’wich, where the egg patties function as the “bun” to deliver chicken maple sausage and cheese. The sandwiches are individually wrapped and come two to a box.

Fresh off the success of its popular PB2 Pantry baking mixes, PB2 Foods has created another gluten-free option: PB2 Pantry Double Chocolate Chip Cookie Mix. The mix contains only simple and recognizable ingredients, including peanuts, sugar, vegan chocolate chips, sodium bicarbonate, natural flavors, cocoa and salt.

Like all PB2 Pantry products, the new cookie mix starts with roasted peanut flour in place of wheat flour. One cookie provides 4g of plantbased protein and 100 calories, when prepared according to directions. Instructions say to use an egg and oil. For vegans, mashed banana may be substituted for the egg. PB2 Pantry comes inside a resealable jar, with a half jar yielding approximately 10 cookies. A 16-oz. jar sells for $11.99.

Else Nutrition introduces Else Kids Plant-Powered Complete Nutrition Shakes, a line of shelf-stable, ready-to-drink protein beverages designed to support healthy growth and development of children two years and older.

The dairy- and soy-free shakes contain more than 85% whole food ingredients, including almonds, buckwheat and tapioca. The product is marketed as being minimally processed for maximum nutrition –as nature intended — and is clean label certified with no corn syrup, gums, gluten or fillers. One 8-oz. drink box provides 8g of plant protein and 25 essential vitamins and minerals.

They come in chocolate and vanilla flavors. A four-pack sells for $9.99, while a 16-pack sells for $37.95. Globally patented Else Nutrition began with baby and toddler products and has since grown to include older kids. The expansion promises to provide families with kids of all ages the ability to adhere to a healthy lifestyle with a minor ecological footprint.

The bakers at Flowers Foods Inc. have been busy with numerous new products rolling out under the company’s many varied brands. Nature’s Own is introducing Keto Soft White Buns with only one net carb per serving, and Perfectly Crafted Flatbreads in white and garlic flavors. There are also new smaller loaves (12 oz.) of the brand’s ancient grain and homestyle sliced breads.

Dave’s Killer Bread is rolling out Amped-Up Protein Bars containing 10g of protein per bar. Flavors are blueberry almond butter, double chocolate coconut and peanut butter chocolate chunk. The brand also now offers dinner rolls made with its signature 21 whole grains and seeds blend.

The Wonder brand is now more than sliced bread. It can be found on bagels and English muffins. On the sweet side are gluten-free Canyon Bakehouse cinnamon raisin bread, Tastykake apple cinnamon honeybuns and Mrs. Freshley’s Hershey’s mini muffins.

Ghost, a lifestyle brand of sports nutrition products, energy drinks, dietary supplements and apparel, is entering the mainstream food sector with high-protein cereals. The line was developed in partnership with the cereal gurus at General Mills Inc.

The Marshmallow variety includes the iconic Lucky Charms marshmallows and provides 17g of protein per serving. Peanut Butter provides 18g of protein and only 6g of sugar per serving. Both cereals are also a good source of calcium and are designed to help consumers keep nutrition goals on track. The suggested price per box is $9.99.

“It’s no secret that consumers are looking for more protein choices these days, and the Ghost team has a reputation for disrupting the performance nutrition space with flavors that go beyond the basic chocolate or vanilla,” said Nicole Ayers, cereal business unit director at General Mills. "We’re excited to combine our category-leading expertise with the strength of Ghost’s brand.”

Alec’s Ice Cream, known for being made with A2/A2 dairy and sustainably sourced ingredients, debuts nine new premium craft ice creams, growing its range to 14 flavors, all of which are gluten free.

Some of the new options are Maple Cardamom Candied Pecan (with Regenerative Organic Certified maple syrup, roasted sweet and salty candied pecans with a touch of cardamom), Meyer Lemon Cookie (organic Meyer lemon ice

cream, sweet lemon curd swirl and crunchy lemon cookie) and Nutty Butter Brittle (Regenerative Organic Certified salted almond butter swirled into browned butter ice cream with pieces of crunchy almond brittle). There’s also Palm Springs Banana Chocolate Date Shake, which is an ice cream twist on Palm Springs’ famous Date Shake. It features Regenerative Organic Certified bananas with sweet dates, cinnamon and dark chocolate chips.

The new flavors come on the heels of Alec’s Ice Cream being named to Fast Company’s prestigious list of the World’s Most Innovative Companies of 2024.

One year after the first approval of cultured chicken in the U.S., no factory-grown meat product looks close to commercialization. So when?

Written by Dave Fusaro EDITOR IN CHIEF

Written by Dave Fusaro EDITOR IN CHIEF

ext month will mark the one-year anniversary of the first cultured meat products being approved for sale in the U.S. … and still there is no way for the average consumer to buy or try this novel food.

Both Upside Foods (originally known as Memphis Meats) and Eat Just (and its Good Meat subsidiary) received the last of a series of approvals from the FDA and USDA last June 21 for their chicken products, but neither appears close to getting their products on the market.

So when?

“It could be anywhere from two years to 10 years,” says Josh Tetrick, co-founder and CEO of Eat Just, parent firm of Good Meat. “We could launch tomorrow in one or two stores, if we wanted to,” he adds, but he won’t, for reasons that will become apparent in the next 2,000 or so words.

Both firms have shown they can make chicken, both claim rave reviews from the few people who have tasted it and both have proven its safety to the regulatory agencies. But the seemingly straight path from concept

to shelf has turned out to be more complicated than anyone expected. And in talking with both, it sounds like they believe they have just one shot – with no missteps allowed –to make cultured meat a success, and that will require lower pricing, at least near-national distribution and the buzz that would accompany a huge rollout.

None of those things is ready yet. It’s not like debuting a new flavor of Coke. Convincing consumers cultured meat of any type is good and safe to eat will be a formidable task.

Tetrick says that timeline shouldn’t be a surprise. “The industry is not in a place right now where it can produce at a large scale. Large scale for us is being able to produce tens of millions of pounds, and at a cost that is close to conventional animal protein. When you reach that, you can have national distribution.

“To achieve that, we have significant technology, engineering and capex [capital expenditures] barriers,” he continues. “Those are the most significant steps that the industry needs to check off. I don’t need any more data to tell me consumers really like it, are open to it.”

Tetrick admits there was some learning from nearly four years of samplings in Singapore and nearly one here in the States. “We knew the first version we launched was OK, wasn’t great. We knew what the deficiencies were in terms of flavor and texture, and there were many. So we worked to improve those deficiencies.

“Some of the insights we got from consumers that were maybe not obvious to me was that consumers were more interested in the technology than I would

have thought. Young people are particularly captivated by this idea that you can make meat without slaughtering an animal. And the older you are, the more skeptical you are. But I wouldn’t say there were any significant surprises, it was more validating what we already thought.”

A critical hurdle will be getting down the cost, and that’s another reason not to start selling cultured chicken yet. Neither would say what is the current cost per pound, but Tetrick said it’s “significantly more than regular chicken – or beef or pork.” Although he added, “We see a path to bringing it below the cost of chicken.”

A year of regression 2024 has not started well for these companies. Upside Foods in September 2023 announced with great fanfare it was building a production-quantity plant in Glenview,

Ill., just north of Chicago; but that plant was put on hold at the start of this year. Eat Just has no active plans for a large-scale facility “at this time,” and suspended production in Singapore last year, although that’s expected to resume this year.

Upside explained its pause: “We identified a more efficient and cost-effective way to achieve a similar capacity and timeline of the initial phase of Rubicon [the name of their Illinois facility] by significantly expanding our operations at EPIC [the name of their Emeryville, Calif., Engineering, Production, and Innovation Center],” a spokesperson told us.

“This approach will allow us to scale and commercialize our next generation platform and products, currently under regulatory review, while extending our runway and resources. We still plan to move forward with building our full-scale commercial facility in the future.”

Upside’s Emeryville facility, opened in November 2021, is 53,000 sq. ft., capable of producing any species of meat, poultry and seafood — in both ground and whole-cut formats — and currently can produce more than 50,000 lbs. of finished product, with a future capacity of more than 400,000 lbs. per year. “Having our first commercial production co-located with our existing team will allow us to scale, learn and iterate more effectively,” Upside said on its website.

By comparison, an average chicken plant produces 230 million lbs. per year.

Eat Just is producing “very, very small volumes” at its Alameda, Calif., headquarters and R&D center, Tetrick says. In the past, it’s used a contract manufacturer to produce some chicken.

Both firms last year were offering limited-quantity restaurant tastings with the help of supportive celebrity chefs – but that has ended. Upside sampled its product at San

Francisco’s Bar Crenn “through our partnership with three Michelin-starred chef Dominique Crenn … The feedback has been amazing!” the company says. “After an incredible run, we’ve wrapped up our dinner series and are now offering our chicken through a variety of events, both on the road and at our own facility.”

Ditto for Eat Just, whose chicken was championed by Chef José Andrés at a restaurant of his in Washington, D.C. For now, the only sampling is done at Eat Just headquarters, with road trips being planned for later this year.

Other companies in this space also had tough years. New Age Eats shut down last year, citing an inability to attract enough investment interest to fund operations. The company put its nearly completed pilot plant – also in Alameda, Calif. – up for sale.

Singapore was the first country to approve any cultured meat. In addition to Eat Just taking a pause there, two of Singapore’s own cultivated

seafood companies merged. Shiok Meats Pte. Ltd., a portfolio company of Agronomics – a capital firm with several investments in the cultured meat business – has been acquired by Umami Bioworks Pte. Ltd. Both said it was too tough going it alone.

“Most industry insiders expect a significant reduction in the number of companies working in this space over the next two years, as companies and investors face into the lengthened timelines and increased cost estimates,” says Nicole Johnson-Hoffman, a former executive with Cargill and OSI Group, who was CEO of Israeli cultured meat startup Believer Meats when it was called Future Meat Technologies. December 2023 brought one positive development. The Israeli government approved the sale of cultured beef made by Aleph Farms, making Israel just the third country to approve any cultured meat product and the first to approve beef. Aleph still faces a bureaucratic process before its products are available for purchase, the Times of Israel noted, but it hopes to roll out its Black Angus Petit Steak later this year.

Israel has been a hotbed of development on the technology; in addition to Aleph Farms, Super Meat and Believer Meats call that country home. Prime Minister Benjamin Netanyahu tasted a cultured steak from Aleph Farms in December 2020, and that company also grew meat on the International Space Station in 2019.

Other companies, other forms Eat Just and Upside Foods have their USDA and FDA approvals. There apparently are other companies in the pipeline that starts with the FDA, but a spokesperson for that agency wouldn’t name any.

But she noted, “FDA plans to issue guidance to assist firms that intend to produce human foods from cultured animal cells to prepare for pre-market consultations. The publication of this draft guidance will provide a formal opportunity for the public to comment.”

Believer Meats appears to also focus on chicken, although its current website doesn't specify the species. The company broke ground in December 2022 on what it promised would be “the largest cultivated meat production center in the world,” in Wilson, N.C. With an initial investment of $123 million, the 200,000-sq.-ft. facility will have the capacity to produce at least 10,000 metric tons of cultivated meat.

We asked if that was still on track, but no response.

Also pursuing beef, at least primarily, is Israel’s Super Meat. Fork & Good is creating pork and beef.

Blue Nalu, which has been around since 2018, is developing seafood, especially sushi-quality tuna. Although the company is based in San Diego, most of its business deals have been in Asia. It has relationships of various sorts – some involving cash investments, some relating to sales – with Thai Union, Mitsubishi Corp., Pulmuone, Sumitomo Corp. and aforementioned Agronomics.

“There will be a supply chain gap representing 28 million metric tons of seafood in 2030 – just [six] years from now,” Blue Nalu CEO Lou Cooperhouse wrote in a January 2023 letter to USDA. “While seafood can provide people with healthy and delicious protein, our seafood supply chain simply cannot keep up, and there are not enough ‘fish in the sea’ and resources to feed our growing population.”

Wildtype Foods is focusing on Pacific salmon. Tyson is among its investors. Finless Foods is developing bluefin tuna.

German startup Bluu Seafood this year inaugurated its first pilot plant in Hamburg-Altona. It’s creating Atlantic salmon and rainbow trout and predicts price parity with fish within three years.

Netherlands also is fertile ground for these companies, especially since the first cultured meat, a hamburger, was created there in 2013 (at a cost of about $300,000) by university researchers. In July of last year, the Dutch government allowed cultivated meat and seafood to be taste-tested under limited conditions.

Meatable and Mosa Meat, two Dutch companies in this sector, will follow a “code of practice” that would make tastings possible in controlled environments. That will

make the Netherlands the first country in the European Union to make pre-approval tastings of food grown from animal cells possible, even before an EU novel food approval.

A month later, Meatable said it expects to launch its pork product “in selected restaurants and retailers” in Singapore this year. The company also said it's making progress on expanding to the United States and beyond.

Australian cultivated meat company Vow just last month said it secured regulatory approval from the Singapore Food Agency to produce and sell the world’s first cultivated quail product. There are companies with at least proof of concepts in Belgium (Steakholder Foods), China (Avant and CellX) Czech Republic (Bene Meat Technologies) and India (Clear Meat). A dozen more countries have

companies that are in the preliminary stages.

Some of the biggest traditional-meat companies are making investments in many of these companies to keep informed of the technology. Tyson has investments in Upside Foods and Future Meat Technologies. Cargill has stakes in Wildtype Foods, Aleph Farms and Upside Foods.

JBS, the world’s biggest meat company, last year bought BioTech Foods, a Spanish pioneer in cultivated protein, and agreed to build a new production plant for it in Spain. BioTech expected to begin commercial production in the middle of this year. In addition, JBS announced plans to build a research and development center

of its own for cultivated protein in Brazil, where it is headquartered. It will include a pilot plant of up to 107,000 sq. ft. and will employ about 25 researchers.

As if the cultured meat category didn’t have enough problems, a number of geographies are considering banning it before the first steak or chicken nugget hits their markets.

Last year, Florida State Rep. Tyler Sirois introduced House Bill 435, which would make it illegal to manufacture, sell, hold or distribute cultivated meat in the state.

Texas did not ban these meats but did include them in a 2023

labeling law, requiring all alternative protein sources, including plant-based analogues, to clearly label what they’re made of. In the case of cultivated products, the label would need to prominently say “cell-cultured,” “lab-grown” or a similar qualifying term.

In a rare show of bipartisanship, U.S. Senators Mike Rounds (R-S.D.) and Jon Tester (D-Mont.) in January introduced legislation that would ban cultivated meat products from federally subsidized school lunches.

Italy’s parliament in November banned the production, sale or import of cultivated meat or animal feed. Ministers called it a defense of Italian tradition and its food culture. n

Natural Products Expo West is a reflection and precursor of food & beverage trends.

Written by Dave Fusaro EDITOR IN CHIEF

ushrooms are very 2024. Hemp and CBD are so last year. And at least in the Tosi booth, a miniature pickleball court replaced the putting greens you sometimes see at trade shows. Those observations show some of the trends exemplified at this year’s Natural Products Expo West, the giant and energy-filled trade show that filled the Anaheim (Calif.) Convention Center March 13-16. More than 65,000 people attended the event – even with last year’s show but below the pre-pandemic ones – with some 3,300 exhibiting companies of all sizes trying to establish themselves as leaders or breakouts in the natural products space.

For every General Mills there were a dozen or more Aussie Bubs, Jolly Llamas and Weird Beverages. But no Chobani. For the first time in my 15-year memory of the show, the Greek yogurt company did not exhibit, although Chobani nondairy coffee creamers were being poured in the booth of La Colombe, the coffee roaster Chobani bought last December.

The two companies have had a longstanding relationship, with Chobani founder Hamdi Ulukaya being the biggest investor in La Colombe even before the acquisition. Ulukaya, who has attended NPEW most years, was in the La Colombe booth at least one of the days of the show.

Maybe it's OK to talk about carbonated soft drinks again. There seemed to be more sodas this year, but with ingredients you won’t find in Coke or Pepsi. Health Ade, the kombucha maker, now has SunSip “soda with benefits” (prebiotics, vitamins and minerals). Recess drinks “calm the mind, lift the mood.” Juni had adaptogens. Culture Pop had probiotics. Wild Wonder had both probiotics and prebiotics. Vuum claimed to be the first carbonated plant-protein energy drink. Moss was made with sea moss. Trip Soda was laced with

Every year, Natural Products Expo West honors the most innovative products with Nexty Awards. This year, nearly 1,500 products entered the competition, 154 were named finalists and 35 were winners.

Here are only the food & beverage categories and winners:

Special Diet Food: Macalat Sweet Dark Chocolate (part of the sweetness and the sugar reduction comes from mushroom mycelium).

Packaged Produce: GoodSam Small Farms Crispy Crunchy Pineapple Slice (baked)

Pantry–Pasta, Grains & Rice: Jovial Foods Bionaturae Sourdough Pasta (first sourdough pasta, and it's gluten-free)

Pantry–Canned Goods, Jars & Pouches: Ya Oaxaca Mole Negro Savory or Salty Snack: Nemi Snacks Pickled Jalapeño Cactus Sticks (yes, cactus sticks)

Certified Organic Product: Artisan Tropic Tomato Herb Organic Grain-Free Crackers

Vegan Product: MyForest Foods MyBacon (a bacon made with mushroom mycelium)

Adult Non-Alcoholic Beverage: Ghia Berry Non-Alcoholic Apéritif

Certified Regenerative Product: Alec's Ice Cream Palm Springs

Banana Chocolate Date Shake (made with gut-friendly A2 dairy)

Plant Party: Lentiful Homestyle Chili Instant Lentils

Prepared Frozen Product: Ocean’s Halo Kimbap Veggie Roll

Coffee & Tea: Minor Figures Barista Chai Concentrate

Sweet Snack & Dessert: Raaka Chocolate Matcha Waffle Cone (vegan)

Planet-Forward Product: Burroughs Family Farms ROC Almond

Milk Concentrate (Regenerative Organic Certified)

Meat Alternative: Konscious Foods Plant-Based Smoked Salmon (made with carrot, pea-hull fiber and konjac root)

Gluten-Free Product: Cappello's Buttermilk Biscuits

Meat, Dairy or Animal-Based Product: Country Archer Ancestral Blend Meat Stick, Original Flavor

Functional Food or Beverage: The Coconut Cult Piña Colada Probiotic

Coconut Yogurt

Breads & Bakery: Arya Golden Curry Roti (Indian flatbread with turmeric, asafoetida and fenugreek leaf flavors)

Frozen Dessert: GoodPop Neapolitan Pops (no dairy and little sugar)

Dips & Spreads: Anne’s Toum Original Mediterranean Garlic Dip and Spread (crafted from cashews, potatoes, carrots and cultures)

Spices & Condiments: Paro Tarka

Beverage: Corpse Reviver Botanical Elixir (tea-based fusion of cardamom, anise, pomegranate, lemon and green tea)

Alcoholic Beverage: Patagonia Provisions Patagonia x Topa Topa

Brewing Co. Kernza Lager

CBD and seemed to be the only CBDbased product at the show, which in the past has had dozens.

Odyssey 222 was a mushroom-based soda and one of many mushroom-containing products at the show. Macalat somehow made dark chocolate out of the fungus. Despite the company name, MyForest Foods grows its mycelium in a factory, but its MyBacon smelled and looked like the real thing. Taste was a little lacking, however. Meati Foods featured whole-food cutlets and steaks made from mushroom root. Shroomeats makes patties, shreds and balls from shiitake.

“Tinned fish” certainly sounds trendier than canned tuna or sardines, and the product category seems to be having its day. Minnow Brand (that has to be a questionable name) had salmon, mussels, trout, garfish, sardines and cod liver in cans. Safe Catch also cans trout. Tonnino mixes its yellowfin tuna with corn, peas & carrots or tomatoes & olives in a can.

It seems every Expo West brings a new plant-based milk. This year, in addition to the macadamia, pistachio and more common nondairy milks, there was Maizly – as the name implies, a milk made from corn. With the slightest taste of corn, it came in original, chocolate, strawberry, custard and banana, and also

Dip 'n Joy was chocolate "batons" for dipping into one of three frostings: peanut butter, salted caramel or almond butter.

formed the base of an infant formula. But we didn’t see any barley milk, a common sight in the past.

New waters also appear at every Expo West. Past sources have been glaciers, Hawaiian volcanoes, even maple trees. This time, a new water came from … thin air. Actually, thick air, as Beika’s “hydropanels” suck humidity out of the air over Sonora, Mexico, to create a water that, in their words, depletes no earthly resource – not rivers, lakes, underground aquifers, etc.

Some miscellaneous novel products I noted:

Notions, a Dubai company, takes an almond, wraps it in a date, then enrobes the whole thing in chocolate. A delightful turducken of confections.

Nondairy gelatos are not new, but Doughlicious put nondairy gelato in cookie dough for a bite, a tastier version of mochi.

Yo Egg looked and tasted just like whole fried eggs but was all plant-based. When I cut into the yolk, it even squirted all over my briefcase.

There were chocolate bonbons everywhere, and Italian confectioner Venchi filled their little treat with ricotta cheese as well as candied cherries and oranges and a gluten-free biscuit crumb, all covered by a dark shell.

With both chickpea and soy proteins, Yo Egg looked, tasted and oozed just like a real fried egg. NoPigNeva's Vegetarian Plus brand created an entire turkey out of soy.Feeding the planet is a growing issue. Here’s a look at food companies increasing human food availability through upcycling efforts

Written by Claudia O’DonnellCONTRIBUTING EDITOR

Ivan Gunawan is often asked, “Why is your product made from fish skin?" His response? “Why not? Why throw them away? They are delicious!"

As co-founder and general manager of North America of Irvins (eatirvins.com), a company with snack lines based on upcycled fish skin, Gunawan is used to educating curious customers. His business of creating nutritious and tasty foods from raw materials that are a by-product of fish processing is unusual but environmentally beneficial.

The company first realized an opportunity when fried fish skins coated with salted egg were well received by patrons of the Irvins restaurant in Singapore. The company entered the U.S. market in 2021 and has since added flavored versions (Black Pepper, Smoked Cheese and Sour Cream & Onion) to obtain the right taste for its salmon skins.

Early adaptors and potential customers include Filipinos, Japanese and other Asians, as well as people with traditional foods of a similar nature. One example is Chicharrones,

and Albertsons are some of Irvins’ best customers. With certain ingredients, such as MSG, removed, these Lite products were developed for retailers attending the 2024 Natural Products Expo West.

a traditional Hispanic snack usually made of fried pig skin.

Such innovative products can create unusual hurdles. When asked what was one of Irvins’ biggest challenges, Gunawan said there was a shortage of skins a few years ago. Rich in omega-3s, protein and collagen, the skins are also purchased by European firms for their collagen content. “Our competitors were cosmetics

companies,” he laughs. Irvins solved the issue by going directly to fish farms to secure its supply.

Flock Foods (flockfoods.com) launched its product, Flock Chicken Skin Crisps, in 2019. “We put the product online and did $10 million in revenue in our first year and a half,” says Serena Xue, strategy and operations manager at Flock. “That was when we realized we had something.” The product achieved Upcycled Certification in 2023. It is now in some 6,000 stores.

Flock Foods’ primary challenge was figuring out how to keep up with the demand for the crisps. “We had to build our manufacturing process,” says Xue. “No one was doing anything like this, maybe because no one wanted to,” she said and smiled. One key was to small batch wok fry the skins.

Additional flavored versions have been added since. The product is now available at Sprouts, Albertsons and Kroger, among many other retailers.

In December 2023, Where Food Comes From (WFCF) acquired the Upcycled Certified program and trademark from the Upcycled Food Assn. All information on Upcycled Certified is housed at www.wherefoodcomesfrom.com/upcycled, including a list of companies with Upcycled Certified products and ingredients, the Upcycled Certified Standard, the Upcycled Licensing Fee Structure and Frequently Asked Questions.

A 34-page “Upcycled Certified Standard-Version 2 May 2022” document explains the percentage of upcycled foods and/or ingredients needed to be Upcycled Certified. For example, products containing Upcycled Ingredients must be composed of an aggregate of at least 10% upcycled input(s) or meet the tonnage diverted threshold.

A few 2024 statistics provided by WFCF help demonstrate the success of the Upcycled Certified program. There are 531 certified products and ingredients in the marketplace, and more than 1.25 million pounds of waste have been diverted since the program launched in 2021.

When Irvins began its business in 2014, the term “upcycled” was unknown. They’re one of many companies using formerly discarded ingredients that could be considered “upcycled” without directly promoting them as such.

“A few years ago, we used terms like ‘salvaging,’ ‘co-streams,’ ‘valorizing ingredients’ and ‘value-added surplus product,’ ” says Jonathan Deutsch, professor and director of the Drexel University Food Lab (drexel.edu/cnhp/research/centers/ Drexel-Food-Lab), also board director emeritus of the Upcycled Food Assn.(UFA).

Their website, www.upcycledfood. org, reports that “A team of experts from Harvard Law School, Drexel University, World Wildlife Fund, Natural Resources Defense Council, ReFed and others officially defined ‘upcycled food’ in 2020 for use in policy, research and more.” Specifically,

“Upcycled foods use ingredients that otherwise would not have gone to human consumption, are procured and produced using verifiable supply chains and have a positive impact on the environment.”

Deutsch says marketing people are excited about the concept, and R&D people “put their engineering hats on” to solve production issues. However, he jokes that quality and safety people start drafting their resignations in recognition of operational challenges.

A plethora of data supports the crucial promise of upcycling. For example, The World Counts website (www.theworldcounts.com) notes that from 2017 to 2050, a 70% increase in food is needed for the expected nearly 10 billion people on the planet. The website also has running clocks for estimated global food waste, time left to the end of seafood and the percentage of wild forests remaining.

The nonprofit organization ReFed (refed.org) estimates 38% of all food in the U.S. “goes unsold or uneaten.” That amount is valued at $473 billion (about 1.8% of U.S. GDP) and produces annual greenhouse gas emissions equivalent to 30% of U.S. passenger vehicle transportation.

No single step in the food chain can increase available food by 70%. However, reining in that 38% of food waste (sources range from refrigerated milk spoilage to “tons of scraps” trucked from commercial food production processes) would contribute significantly toward meeting the needs of a growing population, relays Deutsch.

In one example, Drexel Food Lab worked with Bimbo Bakeries USA to better understand consumer expectations and shelf lives. The company had some $635 million worth of baked items returned one year due to products reaching their sell-by date.

Creating language to reflect upcycling accurately and positively is ongoing. “Waste is a social construct,” Deutsch explains. “What we do with food determines whether it is ‘food’ or ‘waste.’ ” Deutsch wants to reframe what people think of as recycled food waste to create processes and products for food waste prevention.

walking the talk

Dieffenbach’s Potato Chips proudly displays the Upcycled Certificate logo on its Uglies brand of Kettle Potato Chips.

“We use Upcycled Certified potatoes from failed farm crops,”

25 million lbs. of "ugly" potatoes –misshapen, bruised or the wrong size – have been "rescued" since Diffenbach's Potato Chips started its Uglies brand in 2017.

says Bob Zender, marketing director for Dieffenbach’s. “The potatoes are misshapen, bruised or the wrong size; other manufacturers have often rejected them.”

Food waste is prevented as the produce turns into kettle chips. “They must be processed in small batches with much hands-on labor to manage the imperfect raw materials,” adds Dwight Zimmerman, the company’s sales and marketing vice president. This increases production costs; however, “Consumers want perfection,” Zimmerman adds.

Zender lists the company's difficulties they overcame moving the new product to market. The name itself, “Uglies,” was one. They had to work to educate retailers about the quality of the product. A recent change in the package created a helpful paradox between the name and upscale graphics. There also were operational challenges to support a rapidly growing brand. Nevertheless, the company claims 25 million lbs. of potatoes have been “rescued” since the company’s inception in 2017.

“Obtaining the Upcycled Certified logo was a big win,” Zimmerman says. “It helps streamline our mission statement. And it may inspire other folks in the industry.”

The whole process is a mindset. “Beauty is only peel deep,” Zender wryly adds. New consumer product categories, such as plant-based milks, create new ingredients with the potential for upcycling. “You know the wrung out oat pulp from making oat milk? That’s me, Upcycled Oaty!” explains the packaging of Seven Sundays’ Simply Honey Oat Protein Cereal (www.sevensundays.com). A character on the label adds, “Full of protein and fiber. Eat up… cycled!” The Upcycled Certified logo appears as well.

“The oat protein component has three times the protein of oats and twice the fiber,” says Emily Lafferty, director of operations at Seven Sundays. As a 2024 Nexty award finalist at the recent Natural Products Expo West, the cereal is off to a good start.

Lafferty admits there were operational questions. “How could we make the process economical? To improve ingredient stability, how could we keep production in line at our supplier’s manufacturing facility?” Seven Sundays partnered with contract manufacturer SunOpta to launch Oat Protein Cereal.

“Cereal making is complicated. Lots of R&D is required,” she says. "Our products align with consumer expectations around nutrition and product quality while adhering to our brand’s people- and planet-forward values."

AkoVeg 163-14 is a coconut oil and insoluble fiber flake offering that makes it possible for formulators to create a plant-based meat that contains less total fat and no cholesterol, yet offers similar visual

appeal and cooking attributes as traditional marbled meat products. This improves the overall functionality, taste, mouthfeel and nutrition that consumers will find appealing. The result is a product that is heat tolerant and sustainably sourced with reduced production time.

AAK; Edison, N.J.

973-344-1300; www.betterwithaak.com

Grilling is one of America’s favorite pastimes, with the Fourth of July being the No. 1 grilling holiday. Father’s Day and Memorial Day are also big holidays to fire up the grill. When polling homeowners, 80% said they own at least one grill or smoker. Because so many people

love the taste of grilled foods, food manufacturers have the opportunity to create products that taste like they came fresh off the grill. Incorporate grilled meats in breakfast applications like breakfast burritos or skillets, use grilled chicken on barbecue pizzas or pair fire-roasted vegetables with grilled sausage. Not only can you make applications with the smoky grill char that consumers love, but you can also save manufacturing time when using fully cooked meats in your products.

Hormel Ingredient Solutions; Austin, Minn. 507-434-6374

www.hormelingredientsolutions.com

Bakery manufacturers constantly adapt to supply chain complications, especially when sourcing key ingredients such as eggs. In recent years, the egg market has faced many challenges, and egg prices are on the rise again. Egg-replacement solutions not only minimize supply chain issues but also align with the shift occurring with many consumers toward a preference for sustainable, plant-based options. Tailored solutions can eliminate or minimize egg content in bakery and other formulations.

Corbion; Amsterdam 800-669-4092; www.corbion.com

Four pea protein ingredients –Nutralys Pea F853M (isolate), Nutralys H85 (hydrolysate), NutralysT Pea 700FL (textured) and NutralysT Pea 700M (textured) – have been specifically created to address challenges commonly encountered when developing foods and beverages with plant

proteins. These latest innovations present new format and formulation options, offering refined tastes, textures and high protein content for end products, such as nutritional bars, protein drinks, plant-based meat and dairy alternatives.

Roquette; La Madeleine, France www.roquette.com

OptiATP, the first reliable adenosine triphosphate for use in ready-to-drink beverages, is the only bioidentical form of ATP backed by numerous human clinical studies. It has been shown to improve muscle power output and increase strength, power and lean body mass while reducing muscle and mental fatigue. As a non-stimulant energy source, it does not result in consumers feeling jittery or experiencing a crash. Only a small dose is required, allowing for effective intake and inclusion in formulations in combination with other beneficial ingredients.

Glanbia Nutritionals; Chicago www.glanbianutritionals.com

The peach is making a comeback at the heart of trends. Lend a juicy touch to formulations with White Peach flavor. This liquid flavor will

bring a soft note to your sweet applications such as ice cream, syrups, yogurts and candy. Its organoleptic profile is characterized by notes of floral, fruity and lactonic. Also, the color Peach Fuzz, a soft peach shade reminiscent of comfort and serenity, was highlighted in this year's Pantone color trends.

Aromatech; Grasse, France 33 (0)4 9360 8444; www.aromatech.fr

European Style Chocolate

Buttercreme is crafted to meet the discerning tastes of both professional bakers and chocolate enthusiasts, combining premium ingredients with proven product features for an elevated consumer experience. Easy to use and reminiscent of scratch buttercreams, this new product is made with real cocoa and boasts a decadent, fudgy texture. It is packaged in rounded square pails for easier handling and storage efficiency Dawn Foods; Jackson, Mich. 800-292-1362; www.dawnfoods.com

Natural Rose allows the development and stabilization of color in fermented and cooked charcuterie without the addition of nitrites and nitrates, thus avoiding the production of nitrosyl compounds that have adverse health effects. It relies on the synergistic use of yeast extracts and selected cultures to provide an alternative to methods using nitrates and nitrites.

Lallemand Bio-Ingredients Blagnac, France

www.lallemand.com

Cheese Buds Simple Cheddar Cheese Concentrate makes it possible to increase overall cheddar cheese flavor with very low

inclusion levels to deliver a natural, indulgent cheddar taste without the need to declare it as a “flavor” or “natural flavor,” thus resulting in a cleaner label. This product provides manufacturers with a cost-effective way to deliver gourmet taste and cost savings in a variety of applications, including sauces, seasoning, soups and baked goods.

Butter Buds Inc.; Racine, Wis. 262-598-9900; www.bbuds.com

Fenuflakes is a formulation featuring debittered, defatted flakes of fenugreek seeds that are rich in fiber and high in protein, with the added benefit of being ultralow in fat and carbohydrates. They've been clinically proven to manage blood sugar levels, lower glycemic index of high GI foods, and improve gut health. This product has received enthusiastic consumer response in food formulations such as baked goods,

cereals, pasta and more. It is also the only fiber ingredient on the market with substantial protein benefits and contains a full suite of amino acids.

Artemis International; Ft. Wayne, Ind. 260-436-6899 www.artemis-international.com

The Lory Crumb portfolio includes a number of extrudates in various shapes and colors for breading. Variations are based on corn, rice, potato and wheat, and the portfolio includes innovative shapes such as triangles, crescents, discs and balls in an array of different colors. With a unique appearance and crunch, these functional components help create crunchy texture and visual appeal for plant-based meat alternatives, vegetable

sticks, meat and fish products. A selection of native and modified starches ensures optimum adhesion and crispness in batters, tempura coatings and dustings. Crespel & Deiters; Ibbenburen, Germany +49 5451 5000 381 www.crespeldeitersgroup.com

UNCOMPROMISING PURITY IN FOOD PRODUCTION

THANKS TO EFFICIENT SEALS

Register for our NEWSLETTER and stay informed!

Optimistic signals have beverage processors hoping for better times but still adjusting their operations to weather any future turbulent waters in the marketplace.

Written by Andy Hanacek SENIOR EDITORThe beverage category is a microcosm of the larger food & beverage industry, and it faces challenges similar to those afflicting many other segments.

“Fluctuating market demand and economic dynamics are creating inconsistent production volumes, which can present operational challenges that result in higher labor and per-unit costs,” says Greg Gutowski, Meriden, Conn., plant manager for Universal Pure (www.universalpure.com), a provider of high-pressure processing (HPP) services as well as beverage bottling and co-packing.

The beverage category slots right in with the “cautious optimism” that much of the industry has adopted for the short-term — a theme noted in numerous outlooks and reports, including our own annual outlook in January and last month's Capital Spending Outlook. There are bright spots, with functional beverages, mocktails, and plant-based and dairy-free alternatives growing, Gutowski adds. But it hasn’t been all rainbows and roses in beverages. Although a significant portion of the juice and juice drink industry may have sought replacements for controversial food additives under attack by state legislators, there is concern over what ingredients might be next on the legislative chopping block.

The beer industry has had quite the ride over the past 12 months from the very top of the market all the way down to the craft beer scene.

First, the King of Beers in the U.S. was shoved aside in a completely unexpected way. In 2023, the Dylan Mulvaney controversy and subsequent boycotts sank Bud Light as the top-selling beer in the U.S., a title the brand had held for nearly two decades. Meanwhile, beer sales and volume reflected similar tones of the larger food & beverage industry.

According to data shared in a Brewers Assn. annual craft beer report, overall beer volume (not including flavored malt beverages/flavored sugar beverages) fell 5.1% in 2023, although companies tallied 3% sales growth over 2022 numbers – a similar “sales up, volume down” story as most of the food & beverage industry.

It was “another competitive and challenging year for small and independent brewers,” said Bart Watson, vice president of strategy and chief economist of the association.

On the positive side, some companies added production capacity and are growing nationwide, as the total number of breweries increased by 82 in 2023 to 9,812 operating breweries.

Craft brewing continues to carve out share at the expense of larger companies, with the number of operating craft breweries reaching an all-time high of 9,683 in the U.S. in 2023. But the market appears to be maturing, as the number of brewery openings in 2023 decreased for the second straight year while the number of closings increased.

Production volume for small and independent brewers reflects the reckoning underway, as craft brewers produced fewer barrels of beer in 2023 versus 2022 (23.4 million, down 1% from 2022). That all said, craft still gained share within the overall beer market, rising to 13.3% from 13.1% in 2022, as overall beer volume suffered larger losses than craft beer did.

The Brewers Assn. defines small breweries as those with annual production of 6 million barrels of beer or less (approximately 3% of U.S. annual sales), while an independent brewer is one for which less than 25% of the craft brewery is owned or controlled (or equivalent economic interest) by a beverage alcohol industry member that is not itself a craft brewer.

Further, beverage operations must still battle external forces pushing on the bottom line and efficiency.

“Due to increasing costs for materials, transportation and labor, companies are implementing changes to increase profit margins, often through the use of cheaper ingredients and production automation,” Gutkowski says. “Manufacturers can combat unstable market dynamics by diversifying their capabilities, having the ability to process multiple packaging applications, along with adding automation to their processes.”

“Manufacturers can combat unstable market dynamics by diversifying their capabilities, having the ability to process multiple packaging applications, along with adding automation to their processes.”

– Greg Gutowski, Meriden, Conn., plant manager for Universal Pure

Functionality continues to gain traction. It has made its way into carbonated drinks, with numerous new soda brands putting on a full-court press to carve out market share from the mega companies by adding ingredients that boost consumers’ health.

Energy drinks continue to roll along, but consumers now demand more from beverages, to help them gain an edge in their productivity or health.

Consumers have been most attracted to beverages claiming to boost hydration — seven in 10 choose this feature in a Mintel Group Spotlight on functional beverages published in December 2023. They also seek drinks with attributes

Minimizing product waste is one small component of being more sustainable, and not surprisingly, numerous beverage that help their immune systems, reduce inflammation or enhance brain power, the report adds.

“In terms of which drinks are consumed most frequently though, two other categories emerge as prominent,” Mintel states. “Drinks that enhance weight management and sleep are among the most frequently consumed functional beverages, with almost 80% of regular consumers drinking them multiple times per week.”

Mintel also reports growing interest in natural ingredients over artificial additives — even before states like California instituted bans on some of these embattled ingredients and the FDA proposed revoking brominated vegetable oil as being safe for use in foods, especially beverages.

Many energy drink processors are looking into ingredients derived from plants, Mintel says, hoping that things like ginseng, ginger, sage and others can help them offer a perceived healthier alternative to caffeine. The tune is similar to that in the food industry overall: The cleaner the label, the better. But processors need to balance how far they go when eliminating artificial preservatives, explains Jenny Tuggle, marketing director for Universal Pure.

“Without the addition of preservatives or a kill-step for pathogens, limited product shelf-life narrows market and distribution possibilities,” she says. “Limited product shelf-life not only presents challenges entering the retail market, but can increase product waste, directly impacting the bottom line.”

processors have rolled out initiatives and projects with sustainability in mind.

PepsiCo, for example, announced it was committing

LPS® DETEX® lubricants, penetrants, electronic cleaners, and greases save time and money by extending equipment life, reducing repair time, and lowering frequency of preventative maintenance. This full line of NSF H1/3H maintenance solutions is specifically formulated for use in food processing facilities where incidental food contact may occur.

Plastic components used to package LPS® DETEX® products are both metal & X-ray detectable, helping to reduce the risk of foreign object contamination within your facility.

$300 million to build a new beverage processing plant in Vietnam that will be powered by renewable energy (it is also building a food processing plant as part of the same initiative). In

the U.S. and Canada, the company announced the rollout of paperboard wraps and clips for product multipacks for brands including Pepsi, Pepsi Zero, Starry, Gatorade and others.

Anheuser-Busch invested $13 million into its Carterville, Ga., brewery to enhance its energy systems, dry-hopping, bottling and can-packaging operations, and $22.5 million into revamping the cooling system at its Houston brewery. That project was expected to reduce electricity consumption by nearly 2.2 million kwh per year, according to reports.

Meanwhile, Coca-Cola Co. and USDA renewed a 10-year partnership to restore and improve watersheds on national forests and grasslands nationwide earlier in 2023, and global coffee companies such as Lavazza have continued to work to improve biodiversity and end deforestation in their own supply chains.

In a perfect world, foreign material contamination of food and beverage products would be a foreign concept. Packages would contain only the food or drink listed, with no surprises for the end consumer. However, a perfect world this is not.

Equipment breaks, items fall into the product stream and sometimes the most miniscule contaminant finds its way into the product. Unfortunately, this happens more frequently than anyone in the industry would prefer, as foreign material can injure consumers, force costly recalls and damage a brand’s reputation.

As food & beverage processors search for ways to eliminate foreign materials from their product streams, technology continues to offer new ways to detect contaminants.