High seams. Sharp seams. Open weld seams. Too often these are what you get with certain imported consignments. Insist on the quality and readily available service and support that you get from domestic manufacturers

High seams. Sharp seams. Open weld seams. Too often these are what you get with certain imported consignments. Insist on the quality and readily available service and support that you get from domestic manufacturers

As domestic conduit manufacturers we source our steel coil from domestic-only steel manufacturers that consistently produce to required specifications.

CLEAN STEEL IS BETTER STEEL. Steel made in the U.S. is the cleanest and most sustainable steel of any major market in the world. What’s good for the environment is good for business.

BE SURE OF YOUR PRODUCT.

Domestic steel comes with documentation to prove its origin and quality. You know exactly what you’re getting and where it’s from.

BUILD MORE THAN BUILDINGS. Choosing locally made products vs. imports boosts the economy, ensures local jobs and strengthens revenues for social and structural infrastructure.

Zekelman is family of companies — all proud domestic manufacturers — including Wheatland Tube, Picoma and Western Tube. Come to our booths at NECA to see our latest time-saving innovations demoed live. Even our T-shirts, swag and show gifts are all made in the U.S.

We rank this year’s top players in electrical contracting. Read more on pg. 22

IN THIS

Changes to Mediumand High-Voltage Cable Testing Specifications pg. 8 Who’s Calling the (Material) Shots on the Job Site? pg. 16

NEC Requirements for Interconnected Power Sources pg. 60

Code Quiz: Test Your NEC IQ pg. 66

Code Catastrophes Uncovered pg. 68

T106 Cable Cleat. A larger cleat for cables with outer diameters of up to 4.25″.

With its exclusive online content, ecmweb.com is a valuable source of industry insight for electrical professionals. Here’s a sample of what you can find on our site right now:

EC&M ON AIR — MEET THE 2024 EC&M PRODUCT OF THE YEAR WINNERS!

Podcast Learn more about the three products that secured the top spots for this year’s POTY competition. ecmweb.com/55135687

THE VALUE OF THE HUMBLE HARDHAT

Safety An essential piece of PPE, the hardhat is often underappreciated for what it does and sometimes thwarted in achieving its purpose. ecmweb.com/55137556

APPRENTICE’S GUIDE TO CABLE AND TUBING

E-Book Master the different NEC cable and tubing requirements with trainer Harold De Loach. ecmweb.com/55136594

Editorial

Group Editorial Director - Buildings & Construction: Michael Eby, meby@endeavorb2b.com

Editor-in-Chief: Ellen Parson, eparson@endeavorb2b.com

Managing Editor: Ellie Coggins, ecoggins@endeavorb2b.com

Editor: Michael Morris, mmorris@endeavorb2b.com

Art Director: David Eckhart, deckhart@endeavorb2b.com

Consultants and Contributors

NEC Consultant: Mike Holt, mike@mikeholt.com

NEC Consultant: Russ LeBlanc, russ@russleblanc.net

Sales and Marketing

VP/Market Leader - Buildings & Construction: Mike Hellmann, mhellmann@endeavorb2b.com

Regional/Territory Account Manager: David Sevin, dsevin@endeavorb2b.com

Regional/Territory Account Manager: Jay Thompson, jthompson@endeavorb2b.com

Regional/Territory Key Account Manager: Ellyn Fishman, efishman@endeavorb2b.com

Media Account Executive – Classifieds/Inside Sales: Steve Suarez, ssuarez@endeavorb2b.com

Production and Circulation

Production Manager: Josh Troutman, jtroutman@endeavorb2b.com

Ad Services Manager: Deanna O’Byrne, dobyrne@endeavorb2b.com

User Marketing Manager: James Marinaccio, jmarinaccio@endeavorb2b.com

Endeavor Business Media, LLC

CEO: Chris Ferrell President: June Griffin COO: Patrick Rains

CRO: Paul Andrews

Chief Digital Officer: Jacquie Niemiec

Chief Administrative and Legal Officer: Tracy Kane

EVP, Group Publisher – Buildings, Energy & Water: Mike Christian

Electrical Construction & Maintenance (USPS Permit 499-790 , ISSN 1082-295X print, ISSN 2771-6384 online) is published monthly by Endeavor Business Media, LLC. 201 N. Main St 5th Floor, Fort Atkinson, WI 53538. Periodicals postage paid at Fort Atkinson, WI, and additional mailing offices. POSTMASTER: Send address changes to Electrical Construction & Maintenance, PO Box 3257, Northbrook, IL 60065-3257. SUBSCRIPTIONS: Publisher reserves the right to reject non-qualified subscriptions. Subscription prices: U.S. ($68.75 year); Canada/Mexico ($ 112.50); All other countries ($162.50). All subscriptions are payable in U.S. funds. Send subscription inquiries to Electrical Construction & Maintenance, PO Box 3257, Northbrook, IL 60065-3257. Customer service can be reached toll-free at 877-382-9187 or at electricalconstmaint@omeda.com for magazine subscription assistance or questions.

Printed in the USA. Copyright 2024 Endeavor Business Media, LLC. All rights reserved. No part of this publication may be reproduced or transmitted in any form or by any means, electronic or mechanical, including photocopies, recordings, or any information storage or retrieval system without permission from the publisher. Endeavor Business Media, LLC does not assume and hereby disclaims any liability to any person or company for any loss or damage caused by errors or omissions in the material herein, regardless of whether such errors result from negligence, accident, or any other cause whatsoever. The views and opinions in the articles herein are not to be taken as official expressions of the publishers, unless so stated. The publishers do not warrant either expressly or by implication, the factual accuracy of the articles herein, nor do they so warrant any views or opinions by the authors of said articles.

Reprints: Contact reprints@endeavorb2b.com to purchase custom reprints or e-prints of articles appearing in this publication.

Photocopies: Authorization to photocopy articles for internal corporate, personal, or instructional use may be obtained from the Copyright Clearance Center (CCC) at (978) 750-8400. Obtain further information at www.copyright.com.

Archives and Microform: This magazine is available for research and retrieval of selected archived articles from leading electronic databases and online search services, including Factiva, LexisNexis, and ProQuest.

Privacy Policy: Your privacy is a priority to us. For a detailed policy statement about privacy and information dissemination practices related to Endeavor Business Media products, please visit our website at www.endeavorbusinessmedia.com.

Please Note: The designations “National Electrical Code,” “NE Code,” and “NEC” refer to the National Electrical Code®, which is a registered trademark of the National Fire Protection Association. Corporate Office:

By Ellen Parson, Editor-in-Chief

Like last year, electrical contractors who filled out our annual Top 50 Electrical Contractors survey acknowledged the presence of many ongoing hurdles that make it difficult to complete projects on time and within budget, including delays with material delivery/logistics, material price increases, extraordinarily long lead times on certain types of electrical equipment, difficulty finding and retaining quality employees/skilled worker shortage, inflation, elevated interest rates, and economic uncertainty.

Despite the fact that all of these challenges are still in play, this year’s Top 50 Electrical Contractors seemed to be relatively unphased by them, managing to blow past the prior year’s collective revenue total by 18% and deliver a record $51.37 billion in revenue in 2023 (up from $43.8 billion in 2022). Looking back, I had actually forgotten just how many years the Top 50 had racked in record profits — the last decline dates back to 2010! In total, almost 87% of Top 50 respondents rated the overall business climate in 2023 (the year in which 2024 rankings are based) as “strong,” which is up 13 percentage points from last year.

I recently had the privilege of sitting down with executives from a few of the electrical contracting firms featured in this year’s 2024 Top 50 in my “On Air” podcast and had a chance to pick their brains about everything electrical. We talked about the most important issues in the electrical industry right now as well as how their firms have navigated the ongoing challenges mentioned above, what new revenue streams have emerged as of late, how they’ve positioned their companies for growth going forward, analysis on hot and cold markets, and what they believe are the big things to watch as we move through 2024 and into 2025. Don’t miss my interview with Gaël Pirlot, vice president of Inglett & Stubbs, Mableton, Ga.; Tony Mann, CEO of E-J Electric Installation Co., Long Island City, N.Y.; and Chuck Goodrich, president and CEO of Gaylor Electric, Indianapolis. All agreeing now is a great time to be in the electrical business, they offered unique perspectives on the nuances they believe will make a difference in our industry going forward. Since we had such a great discussion, I’m splitting the podcast into two parts to make sure listeners can get to hear the full conversation. The first Top 50 episode will drop end of September at https://www.ecmweb.com/podcasts/ ecm-on-air and the second toward the end of October.

Can these good times continue to roll for the electrical contracting industry? According to the “United States Construction Industry Databook Series — Market Size & Forecast by Value and Volume (area and units), Q1 2024 Update” from ResearchAndMarkets.com, steady growth is on the horizon. In fact, the construction industry in the United States is expected to grow by 5.6% to reach $1,271.65 billion (U.S.) in 2024. The growth momentum is expected to continue over the forecast period, recording a CAGR of 4.7% during 2024 to 2028. The construction output in the United States is expected to reach $1,530.39 billion (U.S.) by 2028. As Tony Mann reminded us in the podcast, electrical work is now commonly one-third of the overall price of the entire project — a trend that can only mean good things for electrical contractors in the future.

Key revisions you need to know in the updated

By Chasen Tedder, Hampton Tedder Technical Services

Most of the electrical power distribution infrastructure is static, and in many facilities, the mindset for electrical equipment and devices is “set it, and forget it.” However, much of the existing equipment is made up of electromechanical devices. Most of these electrical and mechanical components — if not set, commissioned, and maintained properly by appropriately trained personnel — will fail, resulting in costly downtimes for these facilities.

The ANSI/NETA standards, much like the electrical equipment they are written for, are not static. As new technology is developed and new research emerges, the consensus shifts on which tests are considered required versus optional, and new techniques are evaluated.

Cables rarely, if ever, move. Most are not subjected to wild variations in their chemical or electrical makeup. So, for many, the expectation was that cables do not need to be routinely tested. Furthermore, misinformation has spread through the industry that routine testing — such as HIPOT testing — damages cables. Before we get to revisions in the latest standard, let’s take a quick look back at how we got to this point.

An EPRI study in the mid-1990s further complicated the issue by providing evidence of poor test practices and cable damage from DC overpotential testing of XLPE insulated cables. All these complications (and more) resulted in little or no consensus throughout the industry on mediumand high-voltage cable testing. Therefore, for a little more than a decade, the ANSI/NETA MTS, Standard for Maintenance Testing Specifications for Electrical Power Equipment and Systems, left Photo 1. Signs of degradation in a medium-voltage cable.

Electrical Testing Education articles are provided by the InterNational Electrical Testing Association (NETA), www.NETAworld.org. NETA was formed in 1972 to establish uniform testing procedures for electrical equipment and systems. Today the association accredits electrical testing companies; certifies electrical testing technicians; publishes the ANSI/NETA Standards for Acceptance Testing, Maintenance Testing, Commissioning, and the Certification of Electrical Test Technicians; and provides training through its annual conferences (PowerTest and EPIC — Electrical Power Innovations Conference) and its expansive library of educational resources.

much of the cable testing specifications open to broad interpretation.

In 2020, NETA determined it was time to revisit this section, and a subcommittee was created to review the current landscape of cable testing and make recommendations for a revised section with clear direction on the tests to perform. That subcommittee assembled cable manufacturers, test equipment manufacturers, end-users, and NETA-accredited companies to agree on the latest consensus. The subcommittee pooled the available research, standards, and test data and created recommendations. This article reviews the key changes to the cable testing section of the new MTS 2023.

The 2023 ANSI/NETA MTS revision includes a major rewrite of the mediumand high-voltage cable testing section. Some sub-sections, like the rest of the revisions in the standard, were minor changes that might not be noticed without a thorough comparison of the standards. Those minor edits included:

For more information on testing electrical power equipment and systems, refer to the following ANSI-accredited NETA standards:

1. ANSI/NETA MTS-2023, Standard for Maintenance Testing Specifications for Electrical Power Equipment and Systems

2. ANSI/NETA ETT-2022, Standard for Certification of Electrical Testing Technicians

3. ANSI/NETA ATS-2021, Standard for Acceptance Testing Specifications for Electrical Power Equipment and Systems

4. ANSI/NETA ECS-2024, Standard for Electrical Commissioning Specifications for Electrical Power Equipment and Systems

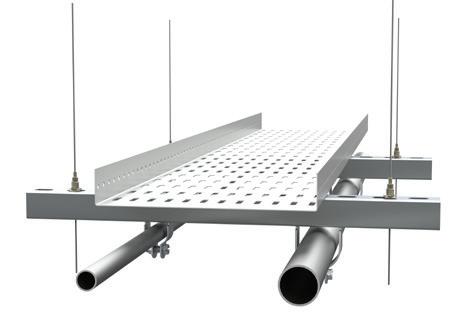

• Adding connectors of cables as part of the general cable inspection.

• Looking for all forms of degradation (Photo 1 on page 8).

• Checking supports and cable trays.

• Verifying cable routing through

window current transformers, minimum bending radii clarifications, and optionally checking cable data to drawings and specifications.

Several new and possibly different methods of testing that would impact

4

testing organizations were adopted, such as testing all phase conductors together during insulation resistance testing (Photo 2 on page 10) and optionally performing jacket integrity testing.

The most significant change was for dielectric insulation testing of medium- and high-voltage cables. The industry’s preferences for cable testing have been quite a roller coaster over the past couple of decades but have started to level out. The consensus from a cost versus benefit point of view was that very low frequency (VLF) withstand testing was the preferred method of testing the cable dielectric.

The medium- and high-voltage shielded cable subsection for dielectric testing was the most significant change in the section — if not the entire MTS-2023 standard. Previously, the section left it up to the user to determine the method of testing the cable. Now, the section guides the user toward the VLF withstand test. The section still allows the flexibility of DC withstand for laminated dielectric (see definition in the MTS appendix) or extruded cables less than five years old, but most of the cables out there do not fit into those categories. The section also allows for AC (power frequency) withstand testing of the dielectric, but the cost is significantly higher for most installations than DC or VLF. Therefore, it will likely be of little use.

Withstand testing is not the only test method for verifying the dielectric of medium- and high-voltage cables. Tandelta testing and offline/online partial discharge (PD) testing are additional diagnostic methods to evaluate the condition of a cable system. However, due to issues including the cost, availability, and usability of equipment; the lack of personnel trained to operate

the equipment; possible misdiagnosis from improper setup of the equipment; and others, those methods have not yet received wide adoption across the industry. For those reasons, these accurate test methods have been annotated as optional tests. To help standard users better understand when these optional tests should be utilized, a new appendix was added to the standard.

The electrical test subsections were not the only significant edits to the medium- and high-voltage cable sections. Since those electrical tests were updated to reflect specific tests to perform, the expected test values for those tests were also created. The offline and online PD evaluation criteria were kept in the test values section of the standards. The tan delta evaluation criteria, which were too extensive to maintain in the test values area, were moved to new tables in the back. Insulation resistance expected values and Table 100.1 (Insulation Resistance Test Values) were also updated.

The consensus was that the acceptable insulation resistance values of shielded medium- and high-voltage power cables are not easily put into a table due to differences in conductor and insulation geometry, temperature, and, most importantly, length. The correct method of verifying insulation resistance is a trigonometric formula with dielectric constants that are not easily attainable. Therefore, although the insulation resistance test is a great pre-test to determine suitability for further testing, it should not be utilized to find a discrete number for acceptability in cable testing. These changes in evaluation provided a much-needed complement to the changes in the electrical test section.

MTS-2023 saw many more changes to the tables than is typical. Most of the changes were minor or cosmetic, but some were a little more significant or may have more impact than expected, such as the note in Table 100.1 about cable insulation resistance.

• Table 100.6.1 on extruded dielectric cable (see the definition in the MTS appendix) DC withstand testing revised the table to remove the conductor sizes, added a column for 173% insulation, and revised all the notes.

• The title of Table 100.6.2 on laminated dielectric DC withstand testing was revised, and many changes were made to the notes.

• The confusing peak column was removed from Table 100.6.3 on VLF testing, and more high-voltage test levels/extra notes were added.

• The title of Table 100.6.4 on testing with damped alternating current was changed to reflect its preferred use.

• Table 100.6.5 on cable testing with power frequency was revived and updated with IEC test values. Three new tables were added to the standard. They cover VLF Tan Delta test voltages (Table 1), evaluation of Tan Delta test results for XLPE cable (Table 2 on page 14), and evaluation of Tan Delta test results for EPR cable (Table 3 on page 14).

The appendices received fewer changes than the tables. A couple of definitions were added including laminated and extruded dielectric cables, and some frequencies of maintenance were adjusted in Appendix B.

The significant change in the appendices came from the addition of a new

Table 3. The final newly added table to the standard is Table 100.6.7.2, which shows Tan Delta evaluation of EPR cable.

MV tape shield

MV concentric neutral

• 30 min VLF withstand OR

• Diagnostic TD with tip-up

• 30 min VLF withstand OR

• Diagnostic TD with tip-up

• 30 min VLF monitored withstand and

• Diagnostic TD with tip-up

• 30 min VLF monitored withstand and

• Diagnostic TD with tip-up

• 60 min VLF monitored withstand and

• Diagnostic TD with tip-up

• 60 min VLF monitored withstand and

• Diagnostic TD with tip-up and

• Offline PD

Table 4. Appendix D was created and added to the standard to help users determine when a better test method should be used. It covers factors such as cable shielding, insulation type, and the criticality of the circuit.

Appendix D. Understanding that a simple 30-minute withstand test is not always the best choice for every cable system, Appendix D (Table 4) was created to help users determine when a better test method should be chosen. The table includes cable shielding, insulation type, and the criticality of the circuit as factors to be considered.

The criticality of a circuit is a key factor in determining how much testing to perform; for example, a single-phase, parking-lot light circuit might not need as much exhaustive testing as the main incoming service to a large data center, hospital, or refinery. Appendix D includes recommended tests for each type of cable system and defines

a high-criticality circuit. This extra appendix helped round out the missing information from the cable testing section when specifying a single test for the dielectric to allow flexibility and direction for those outside the typical medium-voltage cable system.

The NETA testing standards — much like the equipment they cover — may seem to be unchanged and not need any extra inspection as the years go on, but that is far from the truth. These standards require constant refreshing, reviewing, and updating to verify they continue to provide the most relevant and up-to-date information necessary to aid skilled technicians

in their endeavor to provide an excellent, safe, and reliable electric power system for us and our communities.

If you have comments or questions about the NETA standards, please look to the end of any one of the NETA standards (Appendix E for MTS-2023), fill out the form, and send it to the NETA staff at neta@netaworld.org. NETA will examine those comments for the next update to the MTS.

Chasen Tedder started at Hampton Tedder Technical Services in 2005 and is currently vice president. He is in charge of operations, engineering, facilities, and sales. He can be reached at chasen. tedder@hamptontedder.com.

Nearly 20,000 people are injured annually in the U.S. due to improperly installed ceiling fans. Does your ceiling fan have the right box above it? The National Electrical Code (NEC) has changed to protect people, and the new UL listed Carlon Blue® fan-rated ceiling box meets this updated standard. Now there’s a better way to help make homes safer with a ceiling fan box rated for support of light fixtures up to 50 lb. and ceiling fans up to 35 lb. tnbcarlon.com Let’s write the future. Together.

Up to 40% of electricians’ time is spent on material handling — how do you reduce this unwanted time?

By Sydney Parvin and Jennifer Daneshgari, MCA, Inc.

How often do you find yourself up three flights of stairs, tools and material in tow, only to realize you are missing a part and need to make another trip? Or worse, how often do you or members of your crew realize midway through a task that someone needs to go pick up material at the shop or supply house to finish the job? If you run into this regularly, you are not alone.

A study conducted by MCA on the ideal job-site inventory levels to improve productivity showed that 40% of electricians’ time is spent on material handling (Fig. 1 on page 18). Material handling includes moving material from one location to another, ordering material, looking for material, organizing materials, and manipulating materials on the site. More time on material handling means less time on productive installation work. Your leads in the field will get the job done — and focusing on what their skill is (electrical installation) is the best for your job and company. Leave the logistics to the distributors, and move the planning upstream to the project managers (PMs) who have full responsibility for the profits on the job.

MCA’s research offers a few reasons why you may experience unwanted time spent on material handling, and it isn’t because you or your field leads are forgetful or unorganized. To understand why material handling might be happening on your job, consider:

• How does your company handle decision-making for job-related issues and topics? Who is primarily responsible for deciding, for example, where material is stored? When does this decision happen?

• How far in advance do you order material? A day? A week?

In the 2021 EC&M job-site intelligence article called “Invisible Decisions,” MCA talked about how much decision making and problem-solving happens in the field on a typical job site. The article cites Dr. Heather Moore’s 2013 thesis, “Exploring Information Generation and Propagation from the Point of Installation on Construction Jobsites,” which showed that obstacles experienced in the field are reported only about 50% of the time. Since 2021, MCA has continued its research on this topic of job decision making and what it means for

Industrialization of Construction® through regular updates to the Industrialization Index Litmus Test®. Take the test at http://bit.ly/3XhB75y.

The litmus test, which was discussed in EC&M’s “Invisible Decisions — Part 2” article, provides contractors a way to evaluate decision making across different areas in managing a job — including labor, material, tools/equipment, and subcontractor-related decisions — and the results provide insight for the industry on how contractors are transitioning from a traditional to a professional business model.

Placing work in the hands of the company that is best suited for planning, decision making, and execution will help your bottom line. MCA’s July 2024 litmus test (Fig. 2) shows that the general foreman and the on-site foreman are responsible for the highest percentage of decisions — 31% and 27%, respectively.

Looking specifically at material decisions, (including decisions about material movement, manipulation before installation, receiving, storing, and returning materials),

If you’re an engineer, commercial or industrial facility manager, or electric utility employee concerned about the quality and reliability of power delivery, this e-newsletter (sent out monthly) is for you.

Topics covered include:

• Power quality

• Voltage sags & swells

• Transients

• Harmonics

• Power factor

• Test & measurement techniques

Subscribe Today

See all of our EC&M e-newsletters at www.ecmweb.com

Electricians’ Time

Productive Time Spent Installing and Completing the Task

Material Handling Congestion Delays, Weather Delays, Lack of Tools or Information

Unproductive Time Rework

An average breakdown of an electrician’s time on a job site.

Industrialization Index Litmus Test (July 2024) Job Decision Making by Role Responsible

Fig. 2. It’s no surprise that general foreman and foreman make the most decisions overall on the job site.

field personnel are exceedingly either empowered or left responsible. Figure 3 on page 20 shows that field personnel (including technicians, foreman, and general foreman) are, on average, responsible for 73% of decisions regarding material.

Why does this matter? Your leads will order what they need (or maybe more) from whoever is closest to them or they have a relationship with — and maybe not via the channel of the deal you as the estimator or PM have negotiated pricing. The time they spend

Get more done in less time with Penn Aluminum Conduit & EMT.

At 1/3 the weight of galvanized steel, Penn Aluminum Conduit and EMT are easier to lift and carry, often requiring just one person when two or more would be needed with steel. That makes installation – including onsite fabrication, such as cutting, bending and threading – faster and easier. So projects are completed in less time. Plus, you get all these additional benefits:

• Safer to lift and carry

• Produced using recycled aluminum

• 100% recyclable

• Non-corrosive and non-sparking

• Blue Lightning® EMT is coated with our proprietary, UL-listed wire pulling compound

That’s why Penn Aluminum Conduit & EMT is The Smart Choice for electrical contractors.

ordering material reduces the time they could spend planning for the installation work and leading their crews on the job. Consider working with your distributor to have them support your material movement needs as well by giving them advance notice of what you need. Material decisions are higher than any other type of decision in terms of reliance on the technician/skilled trade, indicating that contractors’ approach to material decision making is still predominately traditional, despite the movement toward the transitional model industry-wide.

To assess if your company or project has a more traditional approach to decision making, you can complete the litmus test with your team, which will give you an idea of the current situation in your company. From there, you can use the litmus test framework to clarify who is responsible for what. This alone can reduce ambiguity, and it can ultimately reduce the potential miscommunication that leads to things like over-ordering of material, time spent looking for material, and extra trips to the vendor. Once responsibilities are defined, each assigned role can lead the charge in developing a plan for the portion they are responsible for.

Once roles are defined, the team can use tools like Work Breakdown Structure (WBS) to build out the plan for the work (including the tasks involved in getting the material to the point of installation). The WBS process consists of defining all of the work to complete a project and breaking it down into manageable scopes. This ensures that nothing is missed and everything is explicit. Some material and logistics items that your WBS should consider are:

• How often will material be ordered?

• How will inventory be managed for miscellaneous items?

• When is the material needed on the job site?

• Does it need to be stored off site during the duration of the job? Can it be stored at a distributor facility and delivered as needed?

• How will the material be labeled?

• Where will the material be delivered to the job site?

• How will it be received? Where will it be received? What tools are needed for receiving and getting it to the next location?

• How will it get to the point of installation?

• What manipulation is necessary? Can this be completed before it comes to the job site?

• If returns are needed, who is responsible for making sure they are processed?

• How much work is involved in removing packaging? Can this be done by the vendor in advance?

While material-related decisions may not be the most glamorous, they are critical to your company’s performance and your team’s ability to get their jobs done. By clearly defining decision-making responsibilities and creating a thorough plan for each element of the job-site logistics early on, you can get the material to the point of installation when, where, and how it is needed by leaning on those with the best knowledge of the overall project — and using the resources of those that are experts in logistics and material movement (i.e., the distributor).

Sydney Parvin is associate data analyst at MCA, Inc., Grand Blanc, Mich. She can be reached at sparvin@mca.net.

Jennifer Daneshgari is the vice president of financial services at MCA, Inc. She can be reached at jennifer@mca.net.

By Tom Zind, Freelance

EC&M’s 2024 Top 50 Electrical Contractors score a sizable revenue gain and expect the terrain to remain friendly this year.

Despite headwinds, crosswinds, and perennial winds of change, a happy breeze was at the electrical contracting industry’s back in 2023. That’s evident from EC&M’s latest annual survey of electrical contractors that determines the EC&M Top 50 Electrical Contractors, a ranking based on reported annual revenue. From that top-line perspective, contractors belted a wind-aided home run out of the park.

Combined, the 2024 EC&M Top 50 logged a record $51.737 billion in revenue in 2023 (the year in which 2024 rankings are based), up nearly 18% from

the $43.888 billion reported in 2022 by the 2023 EC&M Top 50 (see Rankings Table on page 24). Aside from the pandemic rebound in 2021, that was the sharpest year-over-year revenue increase on record for the cohort (see Historical Trends Chart on page 26).

Recovery from the pandemic in the form of project resumption might have padded the revenue figure, but a

strong-economy-fueled construction market was a clear contributor. Despite ongoing construction labor challenges, stubborn inflation, elevated interest rates, supply chain glitches, and ample underlying worries about what lay around the bend, 2023 was a year of continued building in a resilient and seemingly robust U.S. economy. Those benefits flowed to electrical contractors in enough volume for almost 87% of firms to rate the overall business climate in 2023 as “strong,” up 13 percentage points from last year (Fig. 1 on page 26). Those rating it as such cited a range of reasons — from solid enough underlying construction demand to continued

Quality matters. Domestic conduit is made to U.S. standards; every stick is ready to go to work for your team and your reputation.

y Proprietary ID coating, exceptional push / pull

y Superior end finish, OD to exact trade size

y Excellent corrosion protection

y Smooth seam , no risk to costly copper wiring

y Manufacturer service and technical support readily available.

Potential issues include:

• High seam, sharp seam, damage risk

• Inconsistent weld quality, split seams

• Poor end finish, burrs on end cuts

• Early corrosion, red rust and white rust

Fig. 1. The number of Top 50 respondents that characterized their business climate as “strong” increased by 15 percentage points this year — from 74% in 2022 to 89% in 2023.

evidence of electrical’s expanding profile in projects to the steady emergence of broad “electrification” of the economy as an overarching trend.

“The construction industry, including electrical contracting, is in a relatively good place right now,” says Chuck Goodrich, CEO of Gaylor Electric (No. 25), Indianapolis. “We’ve seen the essential nature of this industry over the past several years, and the business climate looks promising, especially within the manufacturing and data markets. As we progress through 2024, we are seeing exceptional growth and potential.”

Elevate indoor spaces with new ARISTA® 2-button and 4-button in-wall switches from Intermatic. These versatile switches operate within the ARISTA Advanced Lighting Control System and allow users to adjust brightness and select lighting scenes with the push of a button.

Similarly, the ALC1-P Phase Dimming Controller makes it easy to set lighting levels to maximize occupant comfort in a variety of indoor areas. From small conference rooms to shared workspaces, the ALC1-P helps enhance commercial spaces while reducing energy costs.

Connect with an Intermatic representative to learn how ARISTA controls and secure, reliable Bluetooth® mesh technology can take your commercial environment to the next level.

Learn more today at Intermatic.com/ARISTA

MMR was contracted to install six fast startup, multi-fuel, peaking load generators as a clean alternative to the capacity of a recently decommissioned power plant in downtown Colorado Springs, Colo.

For others, “strong” means a lot of opportunity knocking and latitude to sift for the gold. Greg Padalecki, CEO of Alterman, Inc., (No. 32) San Antonio, which saw revenues grow 34%, could be more selective in 2024 with cost pressures rising in a demand-driven market.

“It’s a good time for the industry,” he says. “It’s now a lot about understanding when to say no. We’re regularly approached by customers that want to give us projects, but we have to look at resources available and make a responsible decision. We don’t want to overextend ourselves when it’s a constant challenge to maintain margins.”

Strong top-line performance in 2023 — only eight of the 44 companies returning to the rankings reported lower revenues — was not wholly expected. In fact, 57% said revenues exceeded expectations (Fig. 2). Revenue surprises have steadily risen since 2021, when 24% said revenues were higher than anticipated.

The bottom-line picture was better for many, too — a likely function of strong demand and the ability to be choosy despite the disruptive impact of rising prices of inputs like labor and materials,

(N=41)

Fig. 2. The number of Top 50 companies that “exceeded” and “met” revenue expectations in 2023 both rose slightly from the previous year while those who did not meet goals decreased from 13% to 7%.

which contributed to uncertainty in bidding. The share saying they adjusted bids for higher profits shot up from 23% of last year’s top firms to 39% this year (Fig. 3). Still, nearly 60% said they kept their profit margins steady, down from 70% last year.

Fig. 3. The tables turned this year on this question. Last survey, the number of companies indicating that they would make bid adjustments for smaller profits or a loss decreased from 17% to 7%. This year, those expecting smaller profits or a plateau rose from 7% to more than 60%.

Revenue at Interstates Inc., (No. 31), Sioux Center, Iowa grew 32% to more than $375 million, partly a by-product of a wave of new investments in infrastructure

Motor City Electric Technologies and Rotor Electric of Michigan, along with strategic partner Williams Electrical and Telecommunications Co., performed more than 85% of the project’s electrical and electronic needs for the Wayne County Criminal Justice System in Detroit.

in key markets it serves. Joel Van Egdom, chief financial officer, says many industrial, food/beverage, agriculture, data center, and oil/gas sector customers upgraded, retooled, and added new facilities, yielding revenue from both capital projects as well as operational support services. The latter accounts for a small but growing share of company revenues as it seeks to serve client needs through the life cycle of their facilities.

“We’re positioned as an electrical solutions provider, doing design through to construction, and providing integration and automation services that allow operators to run their facilities and automate operations digitally,” Van Egdom says. “In addition, with our operational technology services, we’re protecting our clients and realizing more recurring revenue based on annual contract arrangements.”

Profits also grew at Interstates, as the company had more latitude to assess jobs, price appropriately, and be selective. Profits were also boosted by more effective execution of project plans, Van Egdom says, “and our ability to mitigate negative impacts from schedule extensions and compression.”

Weifield Electrical Contracting (No. 50), Centennial, Colo., saw a solid boost

Arlington’s new Furred Wall Box™ kit makes challenging outlet box installations fast and easy!

Versatile mounting options Our high strength FSB series outlet box kits are designed for use with existing 1x2 drywall furring strips – but can also be mounted directly to a concrete block wall between furring strips – so installers can place the box or outlet where it’s needed.

No cable pullout! Accommodates GFCI and USB receptacles. Convenient kits simplify ordering.

Large, pancake-style box with cover

High-strength No breakage in cold weather

Integral Mounting Flanges

Eliminates installation steps There’s NO NEED to break out concrete block. NO NEED to install separate furring strips. And NO NEED to foam around the opening and box.

in revenue to $226 million in 2023, allowing the company to stay on its 10-year growth target, says CEO Seth Anderson. Having sensed a slump in some markets, like housing, the company trained its eye on markets that were growing, such as water and distribution center projects — and the bet paid off. The strong performance was also aided by a nimbler approach to an electrical contracting market that seems to be changing.

“More projects will be smaller in size with a saturated market or will be mega project size,” he says. “The projects inbetween are likely going on the decline, so we’re going to see some changes in the competitive landscape.”

Shifting markets are a source of concern and opportunity for contractors, but there’s been little shift in the industry’s perception of where the real action lies. Once again, by a wide margin, data centers, manufacturing, and health care made more contractors’ “top three hottest 2023 markets” list than any other (Table 1). The only surprise was an uptick for renewable energy. Conversely, private office, retail, and hospitality were (like recent years) deemed the slowest (Table 2). Residential and government

1. Data Centers

2. Manufacturing

3. Health Care

4. Renewable (Wind and Solar)

5. Power (Utilities/T&D)

Table 1. For the seventh year in a row, data center/mission critical construction held its place as the top market bringing in the greatest dollar-volume of projects in 2023. The subsequent hot markets also mirrored last year’s findings with manufacturing and health care holding top positions.

1. Private Office 2. Retail 3. Hospitality 4. Residential

5. Government

Table 2. Private office retained its top spot this year as the coolest market, followed closely by retail and hospitality. Residential and government also made their debut on the cool list this year.

cracked that leader board, while oil/gas and chemical fell away.

Everus Construction Group (No. 5), Bismarck, N.D., is seeing new opportunity sprout in markets where it has cultivated strong relationships, giving it

a leg up, says Jeff Thiede, president and CEO. Data center work looks unstoppable, while established utility clients are poised for a capital spending boom as AI, cloud storage, renewables, and electrification demands grow, he says. There are

Arlington’s heavy-duty Grounding Bridges provide reliable intersystem bonding between power and communication grounding systems. And handle multiple hookups of communications systems: telephone, CATV and satellite.

Our new GB5T is THREADED for threaded conduit or another GB5T – with a SET SCREW for use on EMT or PVC.

Arlington’s zinc and bronze grounding bridges...

• Four termination points; more than required by the NEC

• Meet 2020 NEC bonding requirements for 250.94

• Fast, simple installation indoors or outside

• Textured, paintable plastic cover (except GB5NC)

• Easy access for inspections

also green shoots in Las Vegas gaming, health care, and hospitality.

“These clients expect us to be a solutions provider, be proactive and a true partner, and we have highly skilled people ready to deliver,” he says.

Alterman has been all-in on the data center market — one that now clearly qualifies as core infrastructure — Padalecki observes. But he’s keeping a wary eye on it, because “it could be ripe for disruption, and work could taper off if technological progress leads to smaller and fewer data centers someday,” says Padalecki.

So, diversification remains key, and a decision to move into the water/wastewater market that’s booming in Texas has paid off handsomely.

“It’s less commoditized and more technical, so you have to be a sophisticated contractor to get them,” Padalecki says. “They’re not as labor intensive as other mission-critical jobs; they’re longer lasting and require a different skill set.”

Broadening its geographic reach, Hunt Electric, Inc., (No. 16) Bloomington, Minn., has tapped into more

FTI (Faith Technologies Incorporated) provided systems upgrades for Waushara County, Wis., government facilities, installing approximately 1,750 Cat 6/6A cables connecting all network closets to the data center in the new government center as well as connections to existing facilities. Network cabling is utilized for wireless access points, network connections, CCTV, IP intercoms, and edge devices/controllers. FTI installed and configured an access control system with 157 doors, 185 integrated cameras, and 382 monitorable alarm points.

Arlington’s non-metallic Split Wall Plates provide a simple and effective way to accommodate pre-connectorized low voltage cable(s) of varying size and quantity or pre-existing low voltage cables.

Multiple split grommets are provided with our single- and two-gang wall plates for increased versatility in effectively sizing and covering the hole/opening. Use as shipped, or with one of the supplied bushings to alter the size of the opening.

• Single-gang CESP1 w/ 1-1/2" opening, bushings for .312" • .500" • 1" openings

• Two-gang CESP2 w/ 2" opening, bushings for .750" • 1.250" openings

Arlington’s new one-piece RETROFIT SNAP2IT® fittings are easy to use in an OLD WORK installation, and handle the widest variety of cables! They’re ideal for adding additional circuits to a load center. And you get the same labor-savings in a retrofit installation!

Easy snap-in installation - NO TOOLS. Install connector into the knockout in an existing box, pulling cable/conduit through the knockout. Slip the fitting onto the cable, then snap the assembly into the box. That’s it... a secure installation with no pullout

Widest total cable ranges 14/2 to 10/3

Widest variety of cables AC, MC, HCF, MC continuous corrugated aluminum cable, MCI-A cables (steel and aluminum), AC90,

Difficulty finding and retaining quality employees

Stagnant or retracting

Supply

Fig. 4. Again this year, “difficulty finding and retaining quality employees” was far and away the most obvious concern on the minds of Top 50 companies followed by “supply chain problems” and “stagnant or retracting market segments.” Interestingly enough, “inflation” did not rank high on respondents’ list of concerns.

hyperscale projects like battery plants and mission-critical facilities, says President and CEO John Axelson. A move away from health care has continued, and the automotive market has crept back into the mix.

“Since the pandemic, health care has been trying to find its way for what’s next, while in data centers, artificial intelligence seems to have ignited that market — where we’re involved in many 100-megawatt-plus projects,” he says.

A sluggish commercial high-rise market continues to eat into E-J Electric Installation Co.’s (No. 15) business, but the Long Island City, N.Y.-based contractor is finding replacements.

“Renewables and clean energy are a huge focus because the future is electric,” says President and CEO Anthony Mann. “We’re seeing clients consider more initiatives, like microgrids, fuel cells, solar, hydro and fully electric buildings.”

With industry growth accelerating, top contractors know that continuing to get a share of it for their firms becomes the expectation and primary goal as they scale up. But obstacles abound — the biggest one by far of which is staying fully staffed with the best workers available. More than half named finding and retaining quality employees as the single biggest growth impediment, leaving others in the dust (Fig. 4).

Fig. 5. The hiring trend continued with this year’s survey results when it came to employment metrics. Last year, 83% of companies added headcount compared to 82% in this year’s survey.

Staffing in a period of growth is critical. Therefore, hiring expectedly had the bright green light again in 2023. Eightytwo percent of firms said they added employees (Fig. 5), and 91% said they were looking at net additions in the current year (Fig. 6) — a number that’s shot up 13 percentage points since 2022. But hiring remains a slog; 86% say labor shortages are complicating the effort (Fig. 7 on page 38), up 10 percentage points from two years ago.

Fig. 6. Last year, no Top 50 companies expected to reduce headcount, as was the case again this year. In addition, 91% of respondents plan to hire employees in 2024 compared to 82% last year.

What’s the biggest hiring challenge? “Electrical foreman” once again (Fig. 8 on page 38), a position that’s made the top three the last three years. That’s partly a function, some contractors say, of older workers’ steady exit from the trades and the difficulty of moving less-experienced workers into supervisory roles.

“The skill set on the job site is not what it used to be,” says Padalecki, whose firm, like others, is battling turnover and the effects of a greener workforce in need of cultivation. “We have a history

Fully assembled, SNAP2IT® fittings handle the widest variety of MC cable AND THE NEW MC-PCS cables.

Compared to fittings with a locknut and screw, you can’t beat these snap in connectors for time-savings!

LISTED SNAP2IT ® CONNECTORS FOR NEW MC-PCS CABLE ...lighting & low voltage circuits in the same cable

• Fits widest range and variety of MC cable 14/2 to 3/3

AC, MC, HCF, MC continuous corrugated aluminum cable and MCI-A cables (steel and aluminum)...including the new MC-PCS cable that combines power and low voltage in the same MC cable

ANY Snap2It Connectors LISTED for MC cable are also LISTED for MC-PCS cable! These products offer the greatest time-savings.

• Fast, secure snap-on installation

• Easy to remove, reusable connector From cable Loosen screw on top. Remove connector from cable. From box Slip screwdriver under notch in Snap-Tite® Remove connector.

Power Design worked on Ascent South End, Charlotte’s newest residential home base, towering 24 floors over the vibrant South End neighborhood. This 587,437-square-foot high-rise houses 324 units of luxurious residential space.

(N=44)

Fig. 7. As has been the case for years, the vast majority of Top 50 companies (86% this year compared to 80% last year) indicated they continue to experience worker shortages.

in the industry of rewarding great craftsmen with supervisory roles, and now we’re losing more of those foremen and adding lower skilled people. The weakest link is the front-line field supervisor.”

Yet contractors have little choice but to play the hand that’s dealt. That means devotion to bringing a new crop of people into the labor ranks and committing to training.

Fig. 8. “Electrical foreman” moved past “electrician” into the top spot for “most difficult position to fill” for Top 50 survey respondents, followed closely by “journeyman.”

At ArchKey Solutions (No. 9), St. Louis, Ron Mortimer, senior VP, commercial strategy, says labor shortages are acute in some, but not all, areas the company works in. And it’s not limited to field workers. Vital project managers, he says, are harder to find as well. The

company’s response is to expand its field of vision.

“Our approach to mitigating the shortage is organic development of a diversified workforce,” he says. “There’s a general lack of awareness of opportunities in the industry, so we’d like to

Arlington’s steel SliderBar™ offers the easy, NEAT way to mount single or two-gang boxes between wood or metal studs with non-standard stud cavities.

No more cutting, nailing and fitting extra 2x4s to fill the space! SliderBar saves about 20 minutes per box. Designed for studs spaced 12” to 18” apart, SL18 allows positioning of one or more boxes anywhere in the stud cavity.

• Bending guides on bracket assure proper positioning on studs

• Interlocking tab stop prevents accidental disassembly

• Pre-punched pilot holes on BOTH sides of S for easy attachment of one or two boxes

make underutilized groups more aware of them. The industry has outgrown the traditional avenues for hiring for electrical roles.”

Gaylor Electric concurs and is crafting new ways to recruit. As part of its broad student outreach, it has established an on-site accredited high school where at-risk teens spend half their day learning elements of the electrical trade alongside Gaylor employees.

“This initiative has proven to be a rewarding pipeline for producing skilled electrical apprentices,” Goodrich says. “We’re confident these (and other outreach) efforts will help bridge the gap in labor availability and produce a steady supply of skilled professionals to meet our growing project demands.”

Few contractors see those demands moderating any time soon, meaning they’ll likely contend with labor issues this year and beyond.

One new wrinkle in the labor picture is the requirement that project labor agreements (PLAs) be in place on federally funded construction projects exceeding $35 million. Bidders must agree to abide by PLA rules that mimic stringent union labor agreements, which could increase their labor costs. That might have the effect of limiting

bidding opportunities for contractors likely opposed to PLAs, notably nonunion contractors. Top 50 contractors are evenly split on the potential impact on their companies and the industry: A quarter say it would be positive; 37.5% negative; and 37.5% no impact (Fig. 9).

Labor challenges notwithstanding, many firms expect to thrive in 2024. Surveying the year from a late spring vantage point, more than half think 2024 company revenue growth will exceed 6% at year-end (Fig. 10 on page 42). And 58%, compared to 41% last year, expect current-year revenues to beat expectations (Fig. 11 on page 42). On the profits front, while a majority don’t expect to adjust bids at all, 44% will aim for greater profits — up seven percentage points from last year (Fig. 12 on page 42).

Some of the strong outperformance expectations for 2024 could be tied to prospects for increased infrastructure spending. Though slow in coming, dollars from the landmark Infrastructure Investment and Jobs Act (IIJA) are beginning to flow to construction contractors.

Electrical contractors might not prove to be the biggest beneficiaries, but spending on certain projects could

Fig. 9. After the Biden Administration issued an executive order (EO) in February 2022 requiring project labor agreements (PLAs) for federally funded construction projects coming in at $35 million or more, the Federal Acquisition Regulatory Council issued a final rule implementing the EO in December 2023, which impacts all new solicitations issued after January 2024. Several industry groups favor this action; others oppose it, including those who claim that the order discriminates against non-union companies. Overall, respondents were fairly evenly split on the impact of this order.

(SEE ABOVE)

• Easy snap-in cable installation Save time over 90° 2-screw MC Connectors at same cost per connector

• Handles widest range & variety of cables: 14/2 to 10/2 AC, MC, HCF, MC continuous corrugated aluminum cable, MCI-A cables (steel & aluminum), AC90 and ACG90

• Fast, secure installation...No pullout

• Easy to remove from box...reusable

Fig 10. Last year, 80% of respondents expected their company’s revenue to either stay the same or increase. This year, that number dipped to just over 70%. The number of companies expecting more than an 11% decrease ticked up as well.

Fig. 13. The number of companies anticipating a significant impact on business from the federal infrastructure legislation funding remained relatively low at 10% compared to 14% last year; however, 75% are expecting a moderate or minor impact compared to 66% last year.

from 31% in last year’s survey (Fig. 14 on page 44). The shift is seen in lesser impact: 61% see a 0% to 5% impact, up from 48%.

Fig. 11. When it comes to making revenue projections, responses from Top 50 companies mirrored last year’s results — with the majority expecting to either meet or exceed sales goals in 2024. However, the number of companies anticipating to exceed expectations this year rose 17 percentage points — from 41% in 2022 to 58% in 2023.

pad their top lines. A plurality sees the IIJA having a moderate positive impact on their businesses in 2024, while another 10% see a significant impact,

Fig. 12. The number of Top 50 companies expecting profit margins to increase stayed the exact same at 44% followed by 54% expecting margins to stay the same.

lower than last year’s survey number (Fig. 13).

A year has also seemed to change thinking about infrastructure spending producing a new source of revenue. Slightly more than one-quarter of firms see a possible 6% to 10% increase in new project revenue tied to it, down

Those expecting an impact see it coming in a variety of forms, the largest being electric vehicle (EV) charging infrastructure, renewable energy, and electric grid updates (Table 3 on page 44). While it garnered the most mentions, EV charging work doesn’t land on most contractors’ priority list. While the vast majority have performed EV charging work in 2023 or 2024 (Fig. 15 on page 46), only a small share sees EV charging work accounting for 6% to 10% of their 2024 revenues; most see it in the 0% to 5% range. Of the few not active, 44% say they don’t plan to enter that market in 2025, while 56% do.

EV charging is a market Hunt Electric is watching and studying this year, but the jury is still out on whether it’s something to get excited about. The bigger possible source of new revenue, Axelson says, is the IIJA and the CHIPS and Science Act. The latter is bringing in some semiconductor-related construction work. Transmission and distribution work under the IIJA could

Designed for new construction, Arlington’s non-metallic FR series device and fixture boxes mount directly to a flat surface without the need to cut an opening in the substrate. They feature interchangeable backs and extension rings so ONE box works with almost any cladding system – including engineered foam/stucco systems.

Extra-wide flanges prevent water and air-intrusion, helping to meet the International Energy Conservation Code, and eliminating the need for gaskets or caulking.

• FR series boxes ship ready for use with 1-3/8” finish or cladding thickness Depth can be set for custom depth finishes or cladding materials up to 1-7/8"

• Install before or after the weather barrier house wrap - Installation of box before the house wrap at right

• 20 cu inch volume

This project, completed by Weifield Electrical Contracting Group, was part of the larger $100-million overall Empower Field at Mile High renovation of which the refurbishment of the nearly 130 suites was only a part of the whole project.

Fig. 14. The percentage of survey respondents anticipating no more than a 5% revenue increase in new project revenue tied to federal infrastructure funds rose from 48% last year to 61% this year. As was the case with last year’s results, no firms expect to experience a 30% or more boost in project activity from the recent legislation.

Table 3. Top 50 companies identified several sectors they felt would enjoy the biggest increase in new project activity in 2024 from federal infrastructure dollars earmarked in the Infrastructure Investment and Jobs Act (IIJA). Again this year, EV charging projects topped the list, but “electric grid updates” narrowly bumped “renewables” out of the No. 2 spot.

blossom, he says, but the company isn’t heavily in that market. Overall, despite rising construction costs, work with established customers and markets should drive company revenues 6% to 10% higher this year.

“The level of activity being talked about is higher than in the past, and we’re at our high in terms of revenues,”

he says. “Not too many developers are saying the cost of money is giving them pause.”

E-J Electric is predicting modest growth this year but sees the year’s better story as one of more groundwork being laid. Health care and a host of renewable energy projects — ranging from E-bus depots to EV charging to battery energy

FLBC8500 Single gang box FLBC8500

(3) FLBC8500 boxes

Cover/frame kits

in USA Plastic Cover/frame Kit

Single gang

FLBC8510BR Brown

FLBC8510BL Black

FLBC8510GY Gray

FLBC8510CA Caramel

FLBC8510LA Lt Almond

Two-gang

FLBC8520BR Brown

FLBC8520BL Black

FLBC8520GY Gray

FLBC8520CA Caramel

FLBC8520LA Lt Almond

Three-gang

FLBC8530BR Brown

FLBC8530BL Black

FLBC8530GY Gray

FLBC8530CA Caramel

FLBC8530LA Lt Almond

a two-gang box. Add another for three-gang!

Build a two- or three-gang concrete floor box by simply locking single gang boxes together!

Then buy the UL LISTED single, two- or three-gang cover/frame kit, with devices included, in PLASTIC, FIVE COLORS – or in economical diecast zinc with a brass or nickel finish. Fast, easy installation.

Cover installs with hinge on either side.

Cover/frame Kit

Two-gang FLBC8520MB

Three-gang FLBC8530MB

Three-gang FLBC8530NL

(N=42)

Fig. 15. The Infrastructure Investment and Jobs Act (IIJA) indicates that 50% of all new vehicle sales must be electric by 2030. When asked if their companies had taken on new EV charging installation work (residential, commercial, institutional, or industrial) in response to this goal, 93% of respondents said “yes” this year compared to 87% last year. Of those answering affirmatively, 82% this year (compared to 85% last year) do not expect an increase in new business revenue from this sector of more than 5%.

Fig. 16. Unlike last year, in which “distribution equipment” ran away with the top spot as the material type experiencing the greatest increase in price, “wire and cable” garnered nearly the same number of votes (16) this year.

storage systems — are contributing to 2024 revenues, Mann says. Infrastructure spending is also starting to trickle down.

“The IIJA is a positive thing for our business, affording the opportunity for many projects to move forward,” he says. “In July, the Gateway Tunnel project (in metro New York City) locked in billions in federal funding, and there are billions allocated for clean energy, grid infrastructure repair and

renovation, and manufacturing, which are key markets for us.”

A big boost in infrastructure spending will likely put pressure on materials availability and cost. Transformers, for instance, will be needed in huge numbers for transmission and distribution system upgrades — components that

Arlington’s recessed STEEL combination power/low voltage TV BOX™ is the best way to mount an LED or Hi-Def TV flush against a wall.

TV BOX provides power and/or low voltage in one or more of the openings. Plugs and connectors stay inside the box, without extending past the wall.

Designed for use in new or retrofit commercial construction where metal raceway is used, we have a STEEL TV BOX for almost any application!

• Steel box; non-metallic paintable white trim plate

• Easy, secure installation

• Optional covers

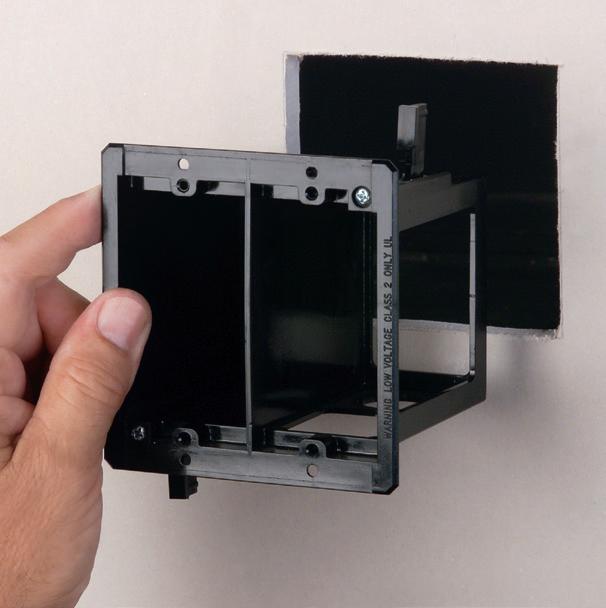

Arlington’s mounting brackets are the best way to install Class 2 wiring. They seat wall plates flush with the mounting surface and install fast!

Our new single gang, zinc mounting bracket, LV1M, for existing construction, offers extra rigidity so it won’t bend as easily as plastic. Plus, it has threaded holes for easy, fast device installation – and LABOR SAVINGS.

Fig. 17. Again this year, the most pressing issue on Top 50 company’s minds (as it relates to their ability to get a job done on time and within budget) is overwhelmingly “delays with material delivery and logistics” followed by “poor design.”

have become harder to secure and more costly due to rising demand and changes in core technology.

Many contractors continued to feel the sting of rising material costs, shortages and delays in 2023, but there are signs the pressure, for now, is easing. Whereas all 50 firms last year said they had to deal with higher materials prices in 2022, 39 this year said that was the case in 2023 (Fig. 16 on page 46). Most said distribution equipment and wire and cable led the way in price increases, but the share naming distribution equipment was halved while wire and cable mentions grew. Like last year, most contractors said the product up most in price had risen 6% to 10%.

All told, myriad supply chain issues have taken a toll on contractors. Rising costs and other supply chain problems rank high as company growth impediments, though their impact has moderated. And no factor comes close to eclipsing “delays with material delivery and logistics” as the biggest obstacle to keeping jobs on schedule (Fig. 17).

Most contractors are taking a matter-of-fact approach — unsure whether problems will continue but trying to work around them. Interstates’ Van Egdom say lead times on many commodity products are back to normal, but specialized components some customers need are in short supply, necessitating better planning.

“Electrical gear needed to run industrial facilities is still 50 to 60 weeks on

Fig. 18. Whereas AR and VR enhance real-world objects on a virtual platform to create immersive environments, artificial intelligence (AI) enables computer applications to mimic human-like intelligence and resolve problems, make predictions, and provide solutions. More than three-quarters of respondents expect AI to become a viable component of electrical design work within the next two years.

deliverables,” he says. “That requires up-front planning and coordination to get enough design done on the front end to pull the trigger early. That is the new normal that we need to plan for and work with.”

For ArchKey’s Mortimer, the situation requires adaptations on all ends. He sees bottlenecks easing and prices moderating, partly the result of the industry players adjusting expectations, improving communications and bolstering

supply infrastructure. Progress has been made, and the supply chain is “normalized and improved,” but “it’s still important to maintain clear lines of communication and set clear expectations.”

Electrical contractors and designers have turned to design workarounds, efficient planning, improved ordering processes, and reconfigured supply chains to address shortages and higher

Perfect for EV Chargers in parking garages, panels, equipment feeds and data center remote power panel feeds, Arlington’s Listed CableStop™ Transition Fittings deliver the efficient, cost-effective way to transition feeder cables to 2-1/2" EMT, IMC and RMC conduit in protective drops, risers and feeds to panels and equipment.

Our new CableStop fittings integrate our patented, versatile and SKU-reducing 8412 series cable fittings, with Arlington conduit fittings, allowing for easy transitions to larger knockout sizes.

Available with set-screw or compression connections into 2-1/2" conduit, they ship with multiple end-stop bushings that vary the size of the opening –along with a to help installers select the right bushing for the cable.

2" Trade Size • 2-1/2" Conduit size

Listed for EMT, IMC, RMC conduit 841516 Set Screw connection

Generate, analyze and optimize electrical designs/BIM (e.g., conduit groupings, raceway

Human resources/employee recruitment

Marketing/promotions

Diagnostics and troubleshooting

Optimize processes/improve efficiency

Gather intelligence data on electrical equipment (e.g., fault detection/diagnosis)

Improve profitability/cost estimating

Fig. 19. How are Top 50 electrical contractors using AI? According to this year’s results, “optimizing processes and improving efficiency” was the most common response. However, many are also already using this tool specifically for marketing and promotions, generating, analyzing and optimizing electrical design/BIM, and human resources.

the cable into the connector and rotate the connector clockwise.

YEARS

Available in 3/8" trade size, both connectors install into a 1/2" knockout, and are Listed for steel and aluminum AC, HCF, MCI and MCI-A cable.

The tinted 40STS has more room inside for easier cable insertion.

for use with AC90 and ACG90 cable.

• Tested to UL 514B and Listed to meet UL ground fault requirements

• Removable Unscrew the connector counterclockwise to remove it from the cable. Remove the connector from the box using a flat blade screw driver. Release the snap tangs from the inside of the box while pulling the connector out of the knockout.

• Packed in heavy-duty, 200-piece boxes

CATALOG NUMBER CABLE RANGES STEEL Snap2It® connectors

38STSC AC, HCF, MCI, MC!-A 14/2 w ground, 14/3, 14/2 12/2 w ground, 12/3, 12/2 • 10/2 w ground, 10/3, 10/2 .405” Dia. Minimum to .605” Dia. Maximum

40STSC AC, HCF, MCI, MC!-A Tinted 12/2 w ground, 12/3, 12/2 • 10/2 w ground, 10/3, 10/2 .480” Dia. Minimum to .605” Dia. Maximum

costs — tactics that could be aided by technology. That’s just one of many roles technology’s current heartthrob (artificial intelligence) could play in the industry’s future.

As a viable electrical design tool, contractor views vary on the timing of AI making inroads. The vast majority see that happening within just two years (Fig. 18 on page 48). That includes nearly a quarter who are already using it in design. But more are now using it for other purposes, too — primarily process optimization/efficiency improvement; marketing and promotions; and human resources (Fig. 19 on page 50).

Inglett & Stubbs (No. 33), Mableton, Ga., is assessing AI as part of a continual process of seeing where technology fits in an industry where it has long lagged. AI’s potential to speed up analysis and boost productivity is clear, says Gaël Pirlot, vice president, but essential questions remain.

“Sometimes we get caught up in getting data for data’s sake, and so maximizing our ability to sift through it better using AI is interesting,” he says. “We have made a financial commitment to looking at it, and we’re prepared to see what might stick, but also to fail quickly (if it dead ends).”

Likewise, Hunt Electric’s Axelson says the firm is studying AI but now more from a more rudimentary angle. He wants to get a feel for its security — until then, it’s limited to internal data analysis.

“We’re keeping it more in-house for use in scheduling, safety records, and education before we start projects,” he says. “There are concerns about how open you can be with inquiries. Where does the data go, and who has access to it?”

Other technologies continue to find their way into electrical contracting work. Among them, augmented reality (AR) and virtual reality (VR) tools that allow design and construction to better merge may be gaining. Almost half say they’re now using AR ( Fig. 20 ) and more than a third VR ( Fig. 21 ), but those survey numbers have tended to fluctuate. Contractors see a range of potential applications for both — chiefly collaboration, preconstruction planning, training, and design modifications (Fig. 22 and 23 on page 54).

Weifield’s Anderson said AR, VR and similar tools that improve the speed

Fig. 20. The percentage of firms already using augmented reality technologies in creased this year from 24% to 45%, suggesting that many firms are incorporating this technology as a viable component in their electrical work.

(N=41)

Fig. 21. Although it’s taken some time to catch on, nearly three-quarters of Top 50 respondents are either already using virtual reality technology or plan to in the next two years.

and accuracy of design through better visualization are valuable in managing the faster pace of projects, a growing concern. Merging AR with BIM, for instance, aids quality control, which is key because “things are happening so fast on projects that we want to make sure we don’t miss something.”

For Gaylor Electric, these technologies are gaining buy-in, Goodrich says, because they enhance communication

and collaboration while improving accuracy and efficiency. VR, for instance, helps show how manufactured electric modules will be implemented, enables site walks and immerses users in models, “ensuring all stakeholders have a clear understanding of project scope and execution.”

Information technology tools also continue to make a difference in contractors’ project field operations. With

each fitting also comes with end stop bushings that accommodate different size cable bundles. ONE trade size fits SEVERAL cable types and sizes, plus flexible metal conduit for super convenience and cost-savings! Reduces inventory and material handling too.

6/3, 6/4, 4-3, 4-4, 8/3, 8/4, 6/3

2-3, 2-4, 1-3

2-3, 2-4, 1-3, 1-4, 6/3, 6/4, 4/3, 4/4, 3/3, 1/0-3, 1/0-4, 2/0-3, 3/4, 2/3, 2/4

2/0-4, 3/0-3

2/0-4, 3/0-3, 3/0-4, 2/4, 1/3, 1/4, 1/0-3

4/0-3, 4/0-4, 250-3, 250-4 1/0-4, 2/0-3

250-4, 300-4, 350-3, 2/0-3, 2/0-4, 3/0-3, 3/0-4, 350-4, 500-3 4/0-3, 4/0-4, 250-3

500-3, 500-4, 600-3 4/0-4, 250-3, 250-4, 300-3 600-4, 750-3 300-4, 350-3, 350-4, 500-3

600-4, 750-3, 750-4 350-4, 500-3, 500-4 750-3, 750-4, 1000-4 750-3, 750-4, 1000-3

Fig. 22. These are the top six areas in which Top 50 respondents see their firms incorporating augmented reality technology into their business in the next few years. A new leader, “pre-construction planning” knocked “collaboration with clients” out of the top spot this year.

Fig. 23. These are the top six areas in which Top 50 respondents see their firms incorporating virtual reality technology into the business in the next few years. Again this year, responses were spread out fairly evenly across all of the categories. Based on the results, electrical contractors seem to be using this technology for multiple tasks, but training still tops the list.

most workers now carrying mobile devices, contractors are focused on providing software and apps that can boost efficiency and productivity.

Those continue to evolve, though, and many contractors say when it comes to training, their employees would benefit most from learning how to better understand and use field apps

and software (Table 4 on page 56). They’re helping them manage key job elements — ranging from project and time management to product specs and installation guidelines to codes and standards interpretation (Table 5 on page 56). Utilizing mobile devices for everything from product specifications and installation instructions to pricing

and product availability information, workers are getting critical data they need quickly and remotely (Table 6 on page 56).

“One of the best things we can do for workers is provide craftspeople with the information essential to performing their work,” says ArchKey’s Mortimer. “Mobile devices are helping with specs and the

Arlington’s 8X10 TV Box™ with a Plastic or Steel Box offers the ultimate in versatility for installing TVs in new and retrofit projects. There's more room in the box for wires and it installs horizontally or vertically to properly position low voltage connections behind the TV.

• Ideal for home theater systems: multiple connections for sound systems, satellite TV, CATV, DVRs

• Brackets for neater cables, with a 1-1/2" knockout for ENT and other low voltage wiring

• Box mounts to stud in new work; for retrofit, mounting wing screws secure

The SCOOP™ series of reversible, non-metallic ENTRANCE HOODS, PLATES AND DEVICES protect cable while delivering good looks and installation versatility. They also reduce labor and eliminate extra connections.

Our newest CABLE ENTRY DEVICES come with or without a wall plate for efficient cable management.

HOODS for decorator-style wall plates, single and two-gang PLATES install facing in or out...and save time!

• Low voltage cable protection

• Best way to run cable

Alterman, a San Antonio-based electrical contractor, has a new state-of-the art corporate campus. The company broke ground on the building in the suburb of Live Oak in 2022.

Table 4. Again this year, “field apps and software” overwhelmingly secured the top spot as the most common topic Top 50 employees said they need training support on followed by “NEC changes” and “lighting and control.”

accuracy of information, and that even helps build morale with team members.”

Improving the lot of workers — whether through making their jobs easier and safer via technology, improving training and advancement/growth opportunities, or offering better pay and benefits — might be close to “job one” for electrical contractors facing an array of challenges. Indeed, that was the top overarching challenge cited by contractors asked to name their biggest one over the next few years. As one put it succinctly: “Insufficient qualified labor to complete extremely large and complex projects.”

So it has been — and likely for the foreseeable future — so it shall be.

Tom Zind is a freelance writer based in Lee’s Summit, Mo. He can be reached at tomzind@att.net.

Table 5. “Time management” overtook “project management” for the top spot as the topic most employees are focused on when using apps and software in the field. Information Most Likely Accessed Via

Table 6. “Product availability” lost its top spot from last year as the task most Top 50 employees were accessing most frequently in the field via mobile devices. This year’s results revealed “product specifications,” “installation instructions,” and “Codes and standards” as standouts.

Arlington’s heavy-duty, plated steel fan/ fixture box has an adjustable bracket that mounts securely between joists spaced 16" to 24" o.c.

Flush ceiling installations

FBRS415 is designed for ceilings up to 1-1/4" thick. For 1/2" ceilings, use the pre-bent positioning tab. For other ceiling thicknesses, bend along the appropriate score line.

• 15.6 cu. inch box ships with captive screws, mud cover, installed NM cable connector