Wide range of SnowDogg® plows for trucks 1/2-ton and up

NEW NEW BACKPACK TRUCK TOOL BOX SERIES

HIGH-CAPACITY STORAGE FOR SERVICE BODIES AND DUMP TRUCKS

Durable 14 Ga steel contruction with gloss black or gloss white finish. Access your tools from either side of the truck and organize gear with interior shelving. Featuring a brand new, alternate mounting system.

SMOOTH ALUMINUM ROLLBACK TRUCK TOOL BOX SERIES

INCREASED STORAGE FOR ROLLBACK WRECKERS

Keep chains, straps, and other gear protected from the elements. The bottomless box design uses perforated bed wells to prevent moisture buildup, while push-button locks on both sides enhance security.

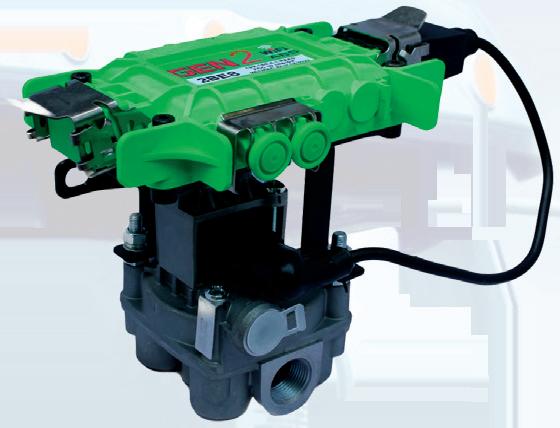

SALTDOGG® PRO-M SERIES POLY SPREADERS

WITH IN-CAB MULTIPLEX CONTROLLER

Combines the power and reliability of SaltDogg PRO Series Spreaders with the advantages of modern CAN bus architecture.

SIMPLIFIES LOADING, UNLOADING, AND STORAGE OF YOUR SALTDOGG SPREADER

Designed for use with 1.5-2.0cy SST and Poly SHPE/ PRO Spreaders in 3/4T+ truck beds. Available in black powder-coated or hot dipped galvanized finish. Patent Pending loading/unloading mechanism.

Quick plug-in setup with a 48-inch pre-wired connector. A wireless pendant control, built-in leveling gauge, and LED night light make operation easy—day or night.

LEARN MORE about the NEW SnowDogg® MXII

SnowDogg® Illuminator ™ LP Low Profile LED Plow Lights Part No. 16160900

ELECTRIC-POWERED SOLUTION FOR RAISING, LOWERING, OR LEVELING YOUR RV OR TRAILER

Engineered to prevent your plow from digging into soft, unfrozen surfaces like gravel or dirt. Helps minimize surface displacement, reduce cleanup, and avoid costly repairs. Available to ship in December 2025.

Annual NTDA convention o ered a beacon of hope for trailer dealers mired in a record-long downturn

19 Recovery postponed: Trailer market drags on

NATM 2026

17 Leer Group shows o lighter, exible truck up ts

22 Wabash Q3 sales slip; CEO eyes 2026 recovery Wabash is positioned to take advantage of 95% US-sourced supply chain as tari s kick in, Yeagy says

24 Smart trailers: Autonomous trucking can’t work without them Trailer technology panel details growing role connectivity, data analysis, AI play today, and for tomorrow’s self-driving eets

28 Taking stock at the stockyard NATM returns to Cowtown for annual gathering of light- and medium-duty trailer builders

30 Convention Exhibitors

31 Convention Schedule

32 Making things happen FABTECH 2025 highlights manufacturing’s critical role—and shows o some cool stu

34 Preparing for the boom Manufacturers manage current volatility with strategic investment for now, and later

Market Leader

Commercial Vehicle Group – Dyanna Hurley dhurley@endeavorb2b.com

Editorial Director – Kevin Jones kjones@endeavorb2b.com

Senior Editor – Jason McDaniel jmcdaniel@endeavorb2b.com

Associate Editor – Alex Keenan akeenan@endeavorb2b.com

Marketing/Advertising – Dan Elm delm@endeavorb2b.com

Art Director – Jennifer Dakas jdakas@endeavorb2b.com

Directories/Listings – Maria Singletary msingletary@endeavorb2b.com

Audience Development Manager – Laura Moulton lmoulton@endeavorb2b.com

Endeavor Business Media, LLC

CEO Chris Ferrell

COO Patrick Rains

CDO Jacquie Niemiec

CALO Tracy Kane

CMO Amanda Landsaw

EVP Transportation Group Chris Messer

VP of Content Strategy, Transportation Group Josh Fisher

TRAILER|BODY BUILDERS (USPS Permit 636660, ISSN 0041-0772 print, ISSN 2771-7542 online) Volume 67 Issue

2, is published monthly by Endeavor Business Media, LLC. 201 N Main St 5th Floor, Fort Atkinson, WI 53538. Periodicals postage paid at Fort Atkinson, WI, and additional mailing offices. POSTMASTER: Send address changes to Trailer/ Body Builders, PO Box 3257, Northbrook, IL 60065-3257. SUBSCRIPTIONS: Publisher reserves the right to reject nonqualified subscriptions. Subscription prices: U.S. ($79 per year); Canada/Mexico ($79 per year); All other countries ($157 per year). All subscriptions are payable in U.S. funds. Send subscription inquiries to Trailer/Body Builders, PO Box 3257, Northbrook, IL 60065-3257. Customer service can be reached toll-free at 877-382-9187 or at trailerbodybuilders@ omeda.com for magazine subscription assistance or questions. Printed in the USA. Copyright 2025 Endeavor Business Media, LLC. All rights reserved. No part of this publication may be reproduced or transmitted in any form or by any means, electronic or mechanical, including photocopies, recordings, or any information storage or retrieval system without permission from the publisher. Endeavor Business Media, LLC does not assume and hereby disclaims any liability to any person or company for any loss or damage caused by errors or omissions in the material herein, regardless of whether such errors result from negligence, accident, or any other cause whatsoever. The views and opinions in the articles herein are not to be taken as official expressions of the publishers, unless so stated. The publishers do not warrant either expressly or by implication, the factual accuracy of the articles herein, nor do they so warrant any views or opinions by the authors of said articles.

Corporate Office: Endeavor Business Media, LLC, 30 Burton Hills Blvd, Ste. 185, Nashville, TN 37215 USA; 800-547-7377

From ‘badass’ to belly up: Bollinger calls it quits

Another EV startup runs out of charge Trailer-BodyBuilders.com/55332622

Fleet Perspective Panel to return for HDAD 2026 Fleet leaders to tackle real-world challenges Trailer-BodyBuilders.com/55328944

Trailer industry faces soft demand despite order gains Trailer-BodyBuilders.com/ 55332476

EQUIPMENT

Workhorse expands W56 platform with Utilimaster body Trailer-BodyBuilders.com/ 55327575

Read the digital edition online at Trailer-BodyBuilders.com/magazine/78147

The Federal Motor Carrier Safety Administration officially renewed the pulsating brake lamp exemptions granted to National Tank Truck Carriers and Grote Industries following the end of the record-long government shutdown and reopening of the Office of the Federal Register.

The agency filed the notices Nov. 14 and published them on Nov. 17.

NTTC’s five-year exemption, originally granted Oct. 8, 2020, allows motor carriers operating tank trailers to install or continue to use a red or amber brake-activated pulsating lamp positioned in the upper center position or in an upper dual outboard position on the rear of the trailers. The renewal runs through Oct. 8, 2030. Grote’s exemption, originally approved Dec. 7, 2020, allows motor carriers to use Grote’s amber brake-activated auxiliary pulsating lamp on the rear of their commercial motor vehicles. The renewal is good through Dec. 2, 2030.

Both exemptions only authorize carriers to use the pulsating brake lamps in addition to the steady-burning brake lamps required by the Federal Motor Carrier Safety Regulations (FMCSRs).

FMCSA received 15 public comments on NTTC’s exemptionrenewal request—13 in support of the exemption, one opposing it, and one that misunderstood the application, the agency reported. Gemini Motor Transport, Oakley Transport, Island Transportation, and ADM Trucking all reported reductions in rear-end collisions and improved visibility after equipping their fleets

with pulsating brake lamps. ADM specifically noted that positive results from early adoption across 100 units led to fleetwide installation being considered. Industry associations such as American Trucking Associations, Growth Energy, and Clean Fuels Alliance America also supported the renewal, emphasizing the broader safety benefits of improved rear signaling.

“FMCSA and NHTSA research programs examining the ability of alternative rear-signaling systems to reduce the frequency and severity of rear-end crashes provide a sufficient basis for FMCSA to conclude that implementation of amber brake-activated auxiliary pulsating warning lamps on the rear of trailers and van body trucks, in addition to the steady-burning brake lamps required by the regulations, is likely to achieve a level of safety that is equivalent to, or greater than, the level of safety achieved without the exemption,” FMCSA stated in its decision.

“Therefore, for the reasons discussed above and in the

prior notice granting the original exemption request, FMCSA concludes that renewing the exemption on the terms and conditions set forth in this exemption renewal decision, will likely achieve a level of safety that is equivalent to, or greater than, the level of safety achieved without the exemption.”

Grote’s renewal application received eight comments—six in support and two in opposition. Amazon and Schneider National reported significant reductions in rear-end collisions after equipping their fleets with Grote’s amber auxiliary brake-activated pulsating lamps, FMCSA noted.

NTTC said FMCSA decided to renew its exemption in October but could not publish the notice until the Federal Register reopened, which finally happened Nov. 12 following a 43-day shutdown. “NTTC appreciates FMCSA’s continued recognition of this safety-enhancing technology and its support for innovative solutions that promote safer roadways for all motorists,” the association said.

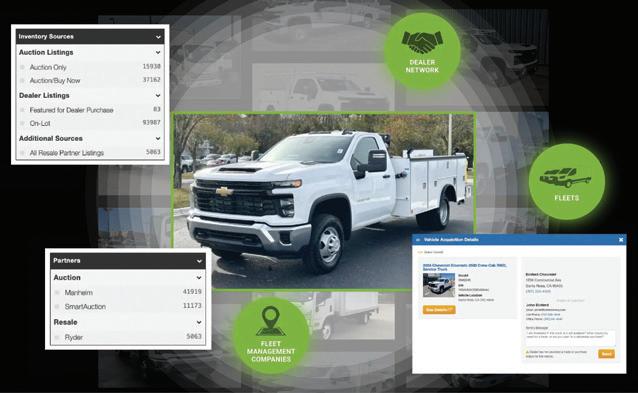

Work Truck Solutions has released its Q3 2025 Commercial Vehicle Market Analysis, revealing a market in transition. Movement (sales), pricing trends, and Days-to-Turn (DTT) metrics suggest a recalibration phase as inventory levels and buyer behavior work toward equilibrium, according to the report.

New work truck and van market

New commercial vehicle pricing softened slightly, with the average price declining 0.8% QoQ and 1.7% YoY to $58,514. Commercial vehicle inventory per dealer dipped 1.2% from Q2 but remained up 7.3% YoY.

Average DTT remained unchanged from Q2 at 202 days but surged 38.4% YoY. Sales per dealer held steady QoQ but rose 22.7% YoY. Combined, these metrics indicate sustained demand.

The data suggests the rise in DTT, an effect of elevated inventory and pricing, may finally be plateauing as prices and incoming inventory remain relatively level in 2025. However, this requires continued examination for two reasons:

• The plateau is only one quarter long. Significant, but not yet a trend.

• It is the average DTT that is flat from

Q2 to Q3. Further examination of the aggregate shows that while new box trucks and pickups experienced one flat quarter, new service trucks, and vans of all types continue to experience climbing days-to-turn.

Used work truck and van market

Used vehicle pricing continued its downward trend, falling 0.9% QoQ and 4.8% YoY, even though median mileage dropped 3.0% QoQ and 2.3% YoY.

Used inventory per dealer fell slightly, down 3.6% QoQ, and remained flat YoY.

Sales dipped 8.3% QoQ, while holding steady YoY, reflecting a continuing relationship between availability and sales.

DTT rose modestly to 54 days, up 1.9% QoQ, but unchanged YoY.

Although the QoQ data appears to show a softening of the market, long-term

trends indicate that used commercial vehicle sales mirror inventory availability and continue to be a reliable commodity.

New battery electric vehicle (BEV) prices decreased 2.6% QoQ but increased 15.3% YoY. Used commercial BEV prices showed a completely opposing trend with a 4.3% rise QoQ and 0.9% decrease YoY.

Fluctuations in vehicles on-lot, pricing, DTT, and sales numbers continue to tell the tale of a technology segment in its infancy.

As adoption accelerates and fleet dynamics shift, Work Truck Solutions will continue to monitor the BEV and hybrid commercial vehicle space.

Industry perspective

“The Q3 data tells a story of stabilization,” said Aaron Johnson, CEO of Work Truck Solutions. “Commercial dealers are seeing vehicles move, but the rise in Days-to-Turn highlights the importance of aligning production and inventory with buyer behavior.”

Johnson added, “The fundamentals haven’t changed, visibility and agility remain the cornerstones of success in any market cycle.”

Hyundai Translead will serve as the official distributor of Hyundai’s XCIENT Fuel Cell Trucks in North America. This will further simplify procurement, enhance operational efficiency, and support the evolving needs of fleet operations.

The XCIENT Fuel Cell is billed as the world’s first mass-produced hydrogen-powered heavy-duty truck, showcasing Hyundai’s commitment to zero-tailpipe emission technology and progress in commercial transportation. Since its global launch in 2020, Hyundai has delivered over 3,500 fuel cell commercial vehicles worldwide, including more than 250 heavy-duty XCIENT Fuel Cell trucks, along with a

range of transit and coach buses.

In California, Hyundai has deployed 35 XCIENT Fuel Cell trucks through two major initiatives: 30 trucks as part of the NorCAL ZERO Project and 5 additional trucks supported by the U.S. Environmental Protection Agency’s Targeted Airshed Grants (TAG) program. Hyundai also has introduced 21 XCIENT Fuel Cell trucks to assist with the launch of production at Hyundai Motor Group Metaplant America in Georgia.

“Appointing Hyundai Translead as the official distributor of our XCIENT Fuel Cell Trucks in North America is a step toward advanced sustainable logistics,” said Chul Youn Park, Hyundai Motor

Company’s SVP and head of global commercial vehicles.

“We’re not only improving operational efficiency and enabling the use of advanced technologies, but we’re also building a more cohesive approach that opens the door to future possibilities,” said Sean Kenney, CEO of Hyundai Translead.

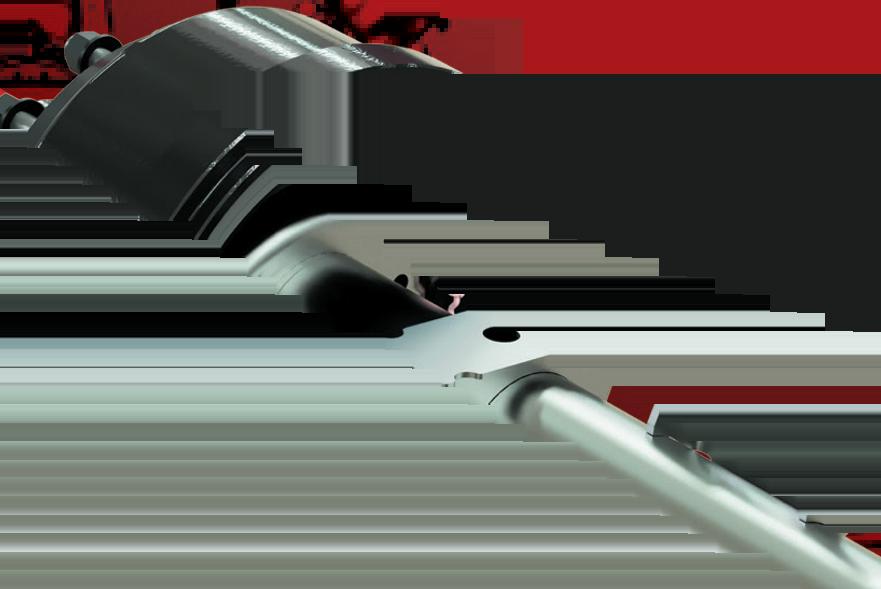

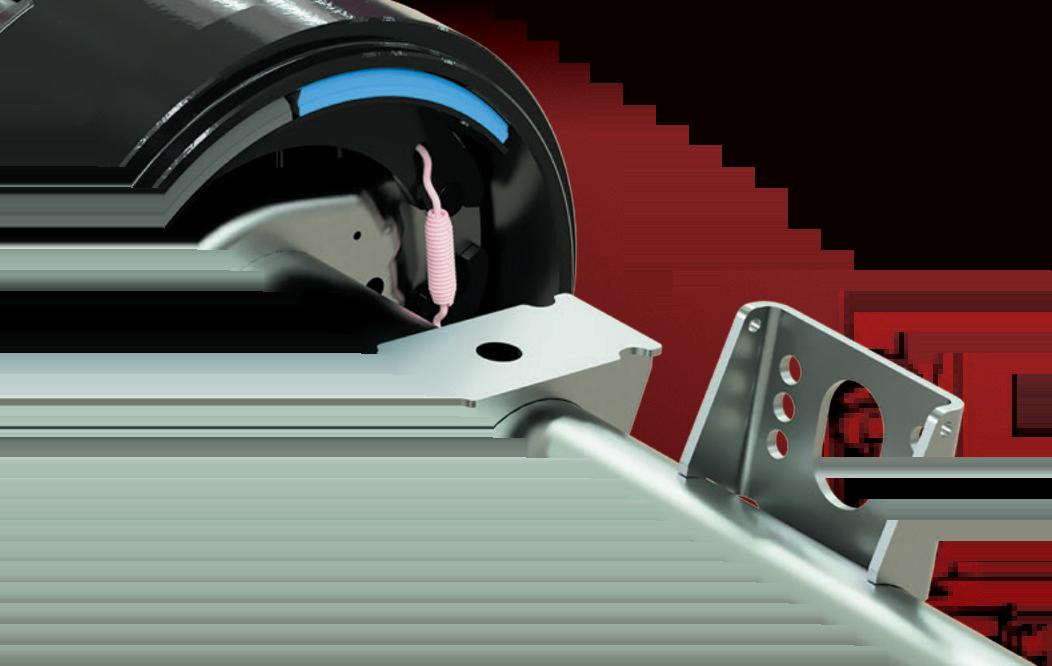

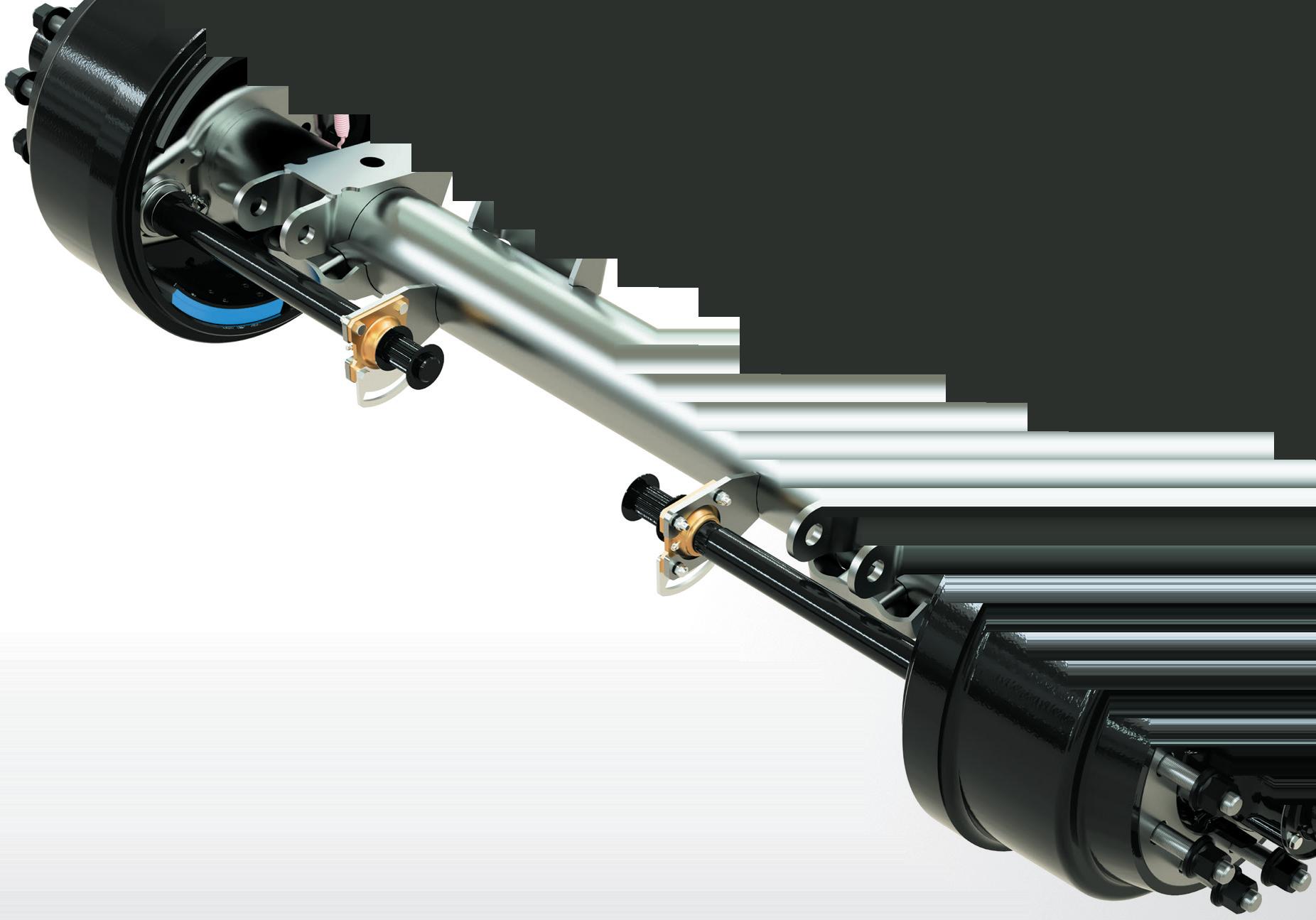

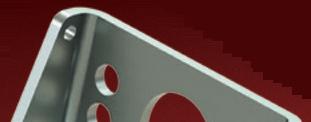

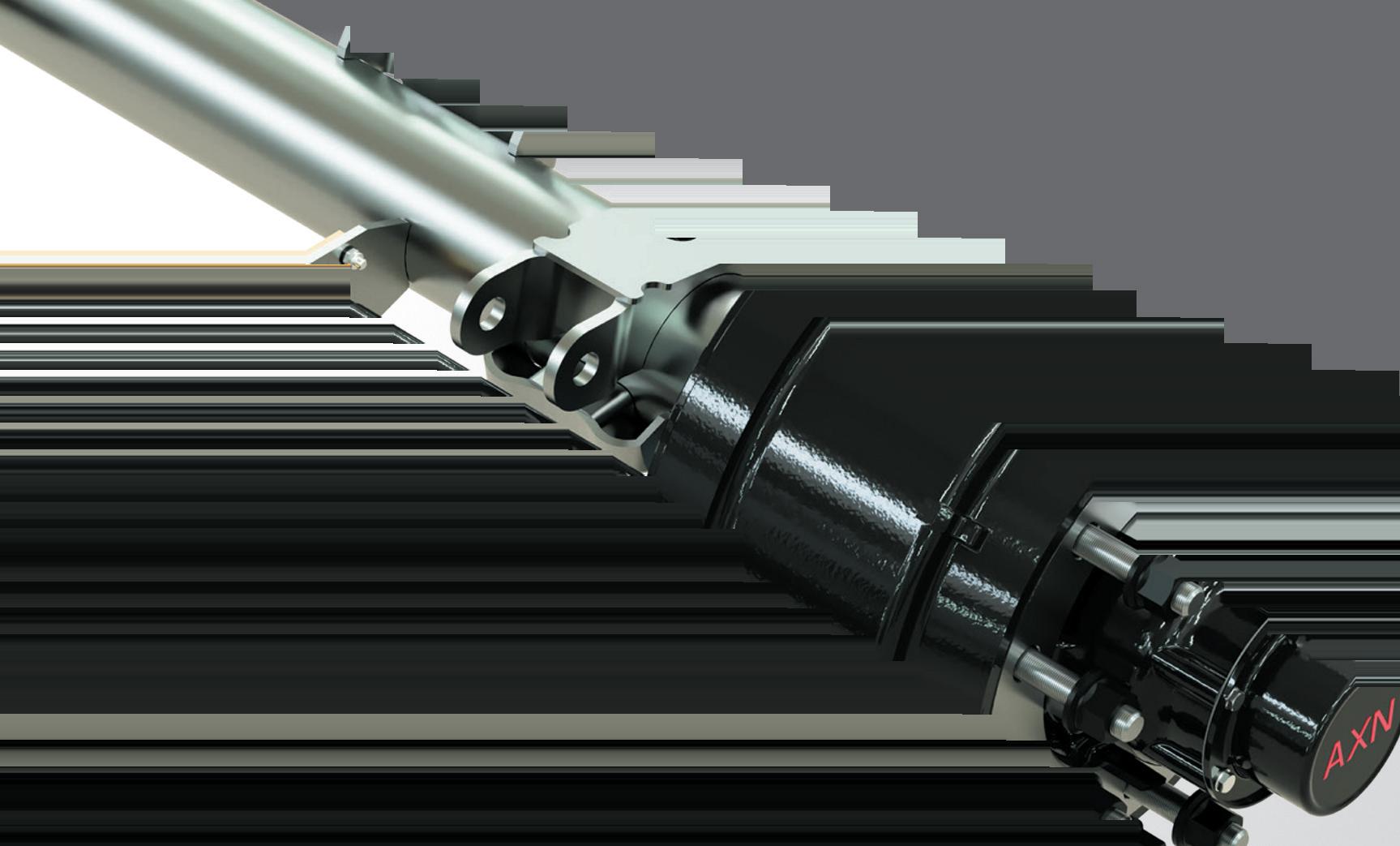

AXN’s heavy-duty trailer axles bring quality and durability to the market. Crafted by our team of industry experts, our axles and fully assembled bogies are designed to fit your hauling needs.

The imposition of tariffs on imports to the U.S. continues to cause “a great deal of uncertainty” in Europe and, as a consequence, a loss of business confidence that impacts the E.U. trailer market, according to CLEAR International’s latest forecast for the West European heavy goods trailer market.

This had a real impact on the willingness of fleets to invest in new trailers, the report noted. Nevertheless, 8.4% growth is forecast for the second half of 2025 compared to the same period in 2024.

However, this will not be enough to offset the fall in demand in the first half of 2025, meaning growth in demand for the whole year will still be very slightly negative.

“We are now sailing into slightly more benign waters,” said Gary Beecroft,

director of Clear International. “Economic growth in the region will remain moderate but positive for the next three years. Interest rates and inflation should continue to fall. Pent-up demand caused by three years of weak trailer demand will boost the recovery.”

There will be no direct effect on West European trailer production because exports of heavy goods trailers to the U.S. from Europe approximate to zero, the report added.

Two countries within Western Europe have had weak trailer demand in 2025 compared to expectations at the beginning of the year: Germany and France— the two largest trailer markets in the region. Both have suffered as a result of the knock-on effects of the war in Ukraine. Germany was in recession in 2023-24 and France has suffered ongoing political turmoil. As a result, economic investment shrank, resulting in a 25% decline in trailer registrations in both countries.

Six countries are forecast to have an increase in trailer registrations in 2025: Finland, Denmark, Norway, Italy, the Netherlands, and Spain. In some cases, this is because of weak registrations in 2023-24 creating pent-up demand.

Aurora Parts has been named a “2025 Top Company for Women to Work in Transportation” by the Women in Trucking Association.

WIT’s magazine created the award in 2018 to support an element of the organization’s mission: to promote the accomplishments of companies that are focused on the employment of women in the trucking industry, according to Jennifer Hedrick, CAE, president and CEO of WIT. Aurora was recognized during a special program on Nov. 9 at the 2025 WIT Accelerate! Conference in Dallas, TX.

Aurora Parts was recognized for its strong culture of supporting gender diversity and often promotes from within, which provides career growth opportunities for women at all levels of the organization, according to the award announcement.

Additionally, 24.3% of Aurora leaders are women, while 33% of their C-suite executives are women. Furthermore, they provide ongoing training and development opportunities to

The large numbers of West European trailers that were previously exported to Russia (and Belarus) have been severely cut back or stopped altogether due to sanctions implemented as result of Russia’s war in Ukraine, according to the report.

Instead, most of the trucks now sold in Russia are thought to be supplied from China. China also has huge capacity for the manufacture of trailers and can easily supply demand previously met from European sources. This particularly affects large exporters in Germany and elsewhere in the West European region.

But the demand for road transport in Western Europe, having fallen by 4% in 2023, was flat in 2024 with every prospect of an increase in 2025.

The OECD Composite Leading Indicators (CLIs) for May 2025, designed to anticipate turning points in economic activity relative to trend, showed that the CLIs for Germany, France, the UK, Italy and Spain are all just over the trend level, which is 100 on the index. This suggests there will be an improvement in the economic growth of these countries in the next six months. In October 2025 all of these countries except Spain were above 101 on the index.

support the professional advancement of women within the company. Overall, Aurora Parts is committed to creating an inclusive and supportive workplace environment where women can thrive and succeed in their careers, WIT noted.

“At Aurora Parts, we’re proud to champion a culture where women are encouraged to excel, innovate, and lead with confidence,” said Brad Fulkerson, president and CEO of Aurora Parts. “Our recognition as a top workplace for women underscores our ongoing commitment to inclusion, mentorship, and meaningful career growth.”

HDNABI has selected STEMCO’s Platinum Performance System Plus (PPS+) with Auto-Torq as the standard specification for all dressed air disc axles supplied to trailer OEMs, the companies reported.

HDNABI, which provides dressed air disc axles to leading trailer manufacturers including Great Dane, Hyundai, Wabash, Fruehauf, and Strick, selected the PPS+ System with Auto-Torq to enhance performance, minimize downtime, and provide

extended warranty coverage, according to the news release. STEMCO’s wheelend technology was chosen for its record of reliability and its integrated-system approach. With STEMCO products, every component is engineered to work seamlessly together to eliminate weak links and ensure consistent performance.

“The modern wheel end is a system of codependent pieces, each critical to the overall reliability of your vehicle,” said Josh Kucera, product manager at STEMCO. “Air disc axles continue to raise the bar and are naturally complemented by the PPS+ System of premium STEMCO products, ensuring that every component in your wheel end was built to perform to the highest standard.”

“With PPS+ and Auto-Torq now standard on HDNABI’s dressed axles, fleets can expect the longest warranty coverage in the industry: eight years, parts and labor, supported by two trusted names in trailer innovation,” added Tre Wright, national OEM sales manager for STEMCO. “This partnership is a win-win for our customers, and we believe it furthers our commitment to Making the Roadways Safer.”

As a result of this partnership, STEMCO and HDNABI teams will begin working jointly with fleets and OEMs to further expand adoption of PPS+ and Auto Torqequipped axles.

Douglas Dynamics has completed the acquisition of substantially all the assets of Venco Venturo Industries LLC, a provider of truck-mounted service cranes and dump hoists. Terms of the deal were not disclosed.

“This acquisition represents a meaningful first step in the execution of our Activate strategic pillar, which is focused on acquiring complex attachments to diversify and balance our portfolio,” Mark Van Genderen, president and CEO of Douglas Dynamics, said. “Led by three generations of the Collins family, the Venco Venturo team has built a tremendous reputation for its commitment to quality and reliability. When combined with Douglas Dynamics’ attachment expertise and experience at scale, we believe there is significant opportunity to drive profitable growth in the years ahead.”

Founded in 1952, Venco Venturo has been operated by the Collins family for over 70 years.

The acquisition of the Venco Venturo assets is expected to be modestly accretive to earnings per share and free cash flow positive before synergies in 2026, according to Douglas Dynamics. Venco Venturo Industries LLC will operate as a division of the Work Truck Attachments segment reporting to Chris Bernauer, president, Work Truck Attachments.

Shurco unifies flatbed business under one brand

Cargo protection and load securement specialist Shurco has begun a strategic initiative regarding its flatbed unit.

Following the company’s recent rebrand, Shurco is retiring the ShurTite brand and consolidating its offerings under the Shurco name to strengthen brand unity, simplify the customer experience, and improve operational efficiency, Shurco reported.

As part of this initiative, Rolling Tarp Systems, formerly offered under the ShurTite brand, will be positioned as a strategic product line within Shurco, falling under the strategic sales team. This realignment ensures focused attention on the product line and supports Shurco’s long-term growth strategy, while making it easier for customers to access the full range of offerings with confidence and clarity.

This transition is designed to build on Shurco’s recent efforts to optimize operations, including the closure of the Brancord, Ontario facility and consolidation of manufacturing in Yankton, South Dakota. For the customer, this means faster turnaround times and a more responsive support experience, backed by a centralized Shurco operation.

“As we transition away from the ShurTite brand and bring its offerings into the Shurco portfolio, our focus remains firmly on our customers,” said Chad Heminover, CEO. “This carefully planned shift ensures uninterrupted access to the products and support they depend on. Customers can continue to expect the same trusted quality, expertise, and responsiveness—now with the added clarity and one-stop convenience of a comprehensive offering—and reinforcing our commitment to being a single, reliable partner for every tarping and cargo control need.”

Stoughton Trailers recently expanded its dealer network through a new partnership with Northstar Trailer, which is located in the Carolinas. The trailer manufacturer aligned with Northstar to strengthen its overall support for operators in need of dry van, refrigerated,

and intermodal solutions across a highdemand territory.

Northstar Trailer, headquartered in Mount Pleasant, South Carolina, will represent Stoughton’s complete lineup in North Carolina and South Carolina. Offerings include dry vans, PureBlue

refrigerated trailers, intermodal chassis, parts, and service. To support quick availability, the dealer maintains two drop yards to store equipment for immediate customer access.

“We are excited that Northstar Trailer has come on board, providing us with a strong foothold in a dynamic market,” Derrick Washington, VP of sales at Stoughton Trailers, stated. “We are confident that Northstar will provide excellent customer service and sales support in the Carolinas.”

Stoughton also recently added TyCorra Fleet Solutions to its dealer network in Eastern Canada. The company, which supplies trailers for transportation fleets, will work directly with key customers

across Ontario, Quebec, and Atlantic Canada, providing dry vans and refrigerated trailers matched to specific operational needs.

Select Trailer Sales, Stoughton’s longtime dealer in Mississauga, Ontario, will continue managing its existing customer network and targeted account growth to ensure fleets have efficient access to the right equipment. TyCorra is also expanding into container and chassis solutions, supported by GoRight FleetCare Plus, which offers full trailer repair, maintenance services, and realtime roadside support.

“We are very excited about our new relationship with Stoughton, providing our strategic customers with dry vans and refrigerated trailers built for their specific applications,” Neil Christensen, EVP of TyCorra Fleet Solutions, stated.

This piece was created with the assistance of generative AI tools and was edited by our content team for clarity and accuracy.

Tremcar recently named Post Leasing & Sales as an official distributor in a new partnership that further strengthens Tremcar’s presence in the U.S. market, and its ability to serve clients in the Southeast.

This agreement is the latest in a series of moves this year designed to enhance the Canadian tank trailer manufacturer’s ability to serve U.S. customers. Tremcar partnered with Kentuckybased distributor Mid America Trailers in February; Californiabased equipment tanker equipment specialist BigDuty in April; dealers Elite Trailer Sales & Service in Tennessee and Universal Truck Service in Minnesota, both in May; and acquired Pacific Truck Tank in October.

Post Leasing, located in Knoxville, Tennessee, has been a trusted name in the transportation industry since 1965. The company specializes in used and pre-owned fuel trucks, tanks, and trailers, offering an extensive inventory that includes well-known brands such as International, Peterbilt, Kenworth, Sterling, and Freightliner. Their available stock ranges from newer models—such as a 2023 International with an aluminum tank—to older, reliable equipment like a 2002 Sterling with a 5300×4 aluminum tank.

“We are thrilled to welcome Post Leasing & Sales into the Tremcar family as an official distributor,” Daniel Tremblay, Tremcar

president, said in a news release. “Their longstanding history, market knowledge, and commitment to customer service make them an ideal partner for Tremcar.

“Together, we will better serve customers in Tennessee and across the Southeastern U.S.”

In addition to equipment sales, Post Leasing offers customization services tailored to customer needs. Services include plumbing, meters/registers, hoses, paint, and full branding packages, including company logos. The company also assists clients in selling fuel trucks, tanks, and trailers, while providing expertise in helping customers find or build fuel tanker trucks that best meet their operational requirements.

To streamline the process, Post Leasing operates a mobile app for inventory management and customer interaction.

Excel Truck Group, a full-service truck and trailer dealership group across Virginia and the Carolinas, recently celebrated the grand opening of its newest location in Ashland, Virginia.

The new facility provides truck sales and parts and service, offering a modern, customer-focused environment designed to meet the evolving needs of commercial truck operators throughout the region. The dealership features 36 service bays equipped with the latest diagnostic and repair technology, and a 23,000 sq.-ft. parts warehouse supporting a wide range of OEM and aftermarket components to keep fleets on the road.

“Excel Truck Group’s new Ashland location marks a significant milestone in our commitment to delivering industry-leading support to our customers and communities,” said Greg Witt, SVP of Excel Truck Group.

“This best-in-class facility strengthens our ability to provide the high-quality solutions and outstanding service our customers rely on.”

Employees currently based at Excel Truck Group’s nearby Glen Allen Dealership will relocate to the new Ashland facility, ensuring continuity and the same trusted service relationships customers have relied on for years, the company added.

Polar King recently announced that North Carolina Trailer Sales is joining its nationwide dealer network to provide over-the-road cold storage solutions. The company, which produces refrigerated and freezer trailers designed for outdoor, over-the-road use, ensures units maintain consistent internal temperatures regardless of

external conditions.

North Carolina Trailer Sales, with locations in Winston-Salem and Thomasville, brings nearly three decades of experience as a full-service trailer solutions provider. The dealership will sell, service, and support Polar King’s trailers, offering customers longterm maintenance and operational support.

These trailers are suitable for foodservice, catering, agriculture, hunting, baking, and other temperaturesensitive applications.

“As a customer-centric and familyowned business, Polar King is proud to partner with North Carolina Trailer Sales, a company that shares similar values and ideals,” said Danny Gaviria, national sales manager for the company’s trailer division. “Their team has a great reputation throughout the Carolinas, and we know this will be a great partnership.”

Jon Sievert, owner of Casper’s Truck Equipment, founding member of Fourward Upfitting, and David Scheitlin, former Holman director of operations have acquired Regional Truck Equipment, with locations in Addison and Alsip, Illinois.

Regional Truck Equipment expands the current platform to Illinois and the greater Chicagoland area—one of North America’s most important commercial truck upfitting markets. The go-forward strategy is built on strong local support, backed by the ability to scale and manage national fleet requirements when and where needed, according the news release.

“Customers deserve fast local decisions and real people who know their market,” said Sievert. “We’re deepening local capability and responsiveness—while bringing disciplined national resources to bear when customers require them. David and I are fully aligned on that approach.”

“Our strategy is to better serve everyday local working fleets and also support national requirements of those customers,” added Scheitlin. “Speed, flexibility, and throughput are the new competitive advantages—and we’re investing to deliver.”

The business will continue operating under the Regional Truck Equipment name. Sievert confirmed this decision is being made to honor the legacy and reputation built by longtime owner Brian Lutz and the entire team at Regional Truck Equipment.

The business will receive strategic investment in systems, capacity, and operational capability for the future, the statement noted. Sievert will act as president with his main focus on sales growth and strategy. Scheitlin will fill the role of vice president with a main focus on operations in both locations to continue improving quality, find efficiencies, and invest in people and systems to maximize capacity and capabilities. TBB

Commercial truck upfitting is moving away from static, heavy solutions of the past into more modular, lighter, and versatile accessories that offer fleets running light- and medium-duty equipment more efficiency and flexibility.

JBPCO subsidiary Leer Group, one of North America’s largest truck cap, cover, and truck accessory suppliers, showed off some of its latest innovations during SEMA 2025 in Las Vegas last week. A lot of Leer’s accessories attract pickup truck enthusiasts looking for different ways to trick out their rides with sharp-looking, useful upfits; the company also has a strong commercial fleet presence, Tracy Harper, Leer’s VP of marketing and ecommerce, told TBB during a visit to the Las Vegas Convention Center.

Leer’s latest accessories are designed to solve real-world problems for truck owners, Harper said. “We have a strong commercial presence,” he noted. “We work with a lot of fleets, particularly the trades like HVAC and plumbing, that like our truck caps and bed slide products.”

The shift in market preference from heavy, traditional fiberglass or aluminum shells toward flexible modular systems is most pronounced in the truck cap segment.

Harper said this is a significant area of growth for Leer Group, noting the popularity of the new modular cap (such as the Leer NexCap). These caps are often metal-constructed and feature Molly panels on the sides, allowing for endless customization and mounting options. The modular design means the cap can be easily removed by an individual, eliminating the need for a forklift—a feature that provides instant flexibility for fleet managers. “I would say that my favorite is the modular cap with the Molly panels on the sides,” Harper said.

“You can do different things, like you can mount your fishing poles on the side, or you can put… different mounts on there, you know, bike rack or whatever.”

While the caps provide a versatile shell, another significant component of modern fleet efficiency lies in how easily technicians can access their gear inside the bed.

Leer Group has expanded its BedSlide lineup to eliminate wasted time and prevent technicians from having to crawl into the cargo area.

The new Bedslide Stacked Drawer System offers secure, customizable, stackable storage for easy organization, with a quick-release feature that lets you remove elements as needed.

For straightforward access to heavy items, slide-out trays like the BedSlide 500Go (rated for 500 lbs.) and its heavier-duty counterparts (offering capacities up to 1,500 lbs.) can ease the burden on trade workers’ backs, Harper noted. These non-drill install systems are also easily transferred between trucks, making them a cost-effective solution for replacing vehicles.

Beyond organization, fleets need security and reliable weather protection for tools and inventory. Leer Group addressed this with new hard-folding tonneau covers, such as the Leer HF680. Combining the strength of a hard shell with multi-position latching for flexibility, these covers are built for security and feature an advanced rail-and-seal system for superior water management, protecting the bed’s contents without the need for drain tubes.

Leer also showed off other accessories designed to maximize truck bed utility:

• BedSlide 600Slim: A compact slide with a 600-pound capacity, featuring a slim design that allows for side-byside placement.

• Leer NexRak: A modular bed rack that integrates with the NexGen system, offering a flexible design to support a wide range of accessories.

• Leer NexStor: A drawer system sold as part of the NexGen lineup, boasting universal compatibility, secure sliding, and weather-resistant components that are easy to install and detach. TBB

By Kevin Jones

TUCSON—The desert served as an appropriate (if not exactly appreciated) location for 35th Annual NTDA Convention, an annual gathering of trailer dealers that this year coincided with the longest market lull in recent memory.

But association members understand trailer cycles, and know from experience the convention is the place to be to find new solutions to industry challenges, and maybe commiserate with some old friends and competitors.

Along with an extensive social agenda and just-for-fun activities, the traditional working program featured updates from NTDA leaders, compelling pitches from select suppliers, and a keynote that suggested, basically, anyone who is surprised hasn’t been paying attention.

To wrap it all up, the general session included a chat with ACT Research President and Senior Analyst Ken Vieth, who’d just delivered the firm’s trailer forecast, and NTDA government affairs representative Tim Lynch, senior director at Morgan, Lewis & Bockius LLP.

Moderated by TBB Editor-in-Chief Kevin Jones, the discussion touched on the economic outlook, regulatory turmoil, and the role of the trailer industry as the backbone of the U.S. supply chain.

TBB: Ken, we’ve heard commentary suggesting the economy is faring better than anticipated. What is your bottom-line assessment of the market for the trailer and trucking sectors?

Vieth: As I said in my presentation, tariffs are a drag on an otherwise good economy. Again, corporate profits were good, consumer balance sheets were good coming into this. The data center

build-out, the utility build-out—there’s a lot to like. What tariffs did was brakecheck an otherwise good economy and that caused everybody to downshift. But, once we get past the impact of tariffs, it’s still a good economy.

TBB: Tim, the political environment is defined by extreme uncertainty—

shutdowns, deregulatory pushes, and policy shifts. How does this instability impact long-term business planning?

Lynch: Coming from Washington D.C., you’re always asked, ‘So, what’s going on in Washington?’ And the cynical answer I give is ‘not much good.’ But I can report that the answer today is ‘not anything,’ with the shutdown. So when folks ask me, ‘Who really has the leverage on this shutdown?’ my answer is, ‘Well, the guy that wants to shrink the government.’ There’s no better way to do it: Just shut the government down. But there’s been a number of issues, particularly in the trucking industry. As a matter of fact, hours-of-service regulation, for example: Republican administrations generally allow for a more liberal view of that. In Democratic administrations, the FMCSA was way more restrictive. Business wants certainty—basically they say, ‘Look, I can adapt, but I just need to know what the rules are going to be.’

TBB: The possibility of regulatory change, especially regarding emissions, poses a significant threat to CV manufacturers. What is the practical concern surrounding rules like the GHG and NOx emissions regulations?

Vieth: One of the challenges, as we look at the EPA’s Low NOx regulation, is the stickiness of the regulation and the challenge of getting rid of it. One thought is that the Trump administration will say, ‘Well, we can’t get rid of the regulation as soon as we’d like, but we’re not going to enforce it.’ Well, if you’re an engine manufacturer, if you don’t sell the engine that the regulation says you have to sell, and another party comes into power in 2028, are they going to say ‘You guys have just spent the last two years violating this regulation and you’re going to have to pay colossal fines’? So if the Trump administration does something like this, truckers are going to be expecting the old engine and the engine manufacturers are going to be like, ‘No, tough luck for you.’ So, this is going to cost an extra $20,000 in tariffs on a Class 8 truck in 2026. And

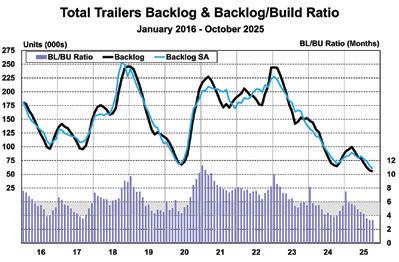

The U.S. trailer market remains stalled as 2025 concludes, with economist Ken Vieth of ACT Research indicating that the anticipated recovery has been delayed, as he explained at the NTDA convention.

“Certainly, we wish we had better news to impart,” Vieth began. “Though, with the Section 232 tariffs, the 25% on heavy duty trucks, we are at least guardedly more optimistic for trailers in 2026 than we were just a month ago.”

While the economy exited 2024 with robust “secular tailwinds,” including strong business balance sheets and massive investment in utilities and data centers, these positives have been overshadowed by tariffs, an economic “brake-check” forcing the economy to “downshi .”

The core problem for trailer demand is the weakness in freight activity, which has dragged on for more than three years. Carriers are struggling as key indicators lag: slow manufacturing, declining housing starts, and stagnant jobs growth.

Vieth noted that the market is now dealing with a significant “freight air-pocket inbound,” driven by importers pulling forward shipments into 2025’s third quarter to beat the October deadline

for new reciprocal tariffs. Because of this early capacity pull-through, a period of supply-demand imbalance, and low trucking rates, will likely extend into early to mid-2026.

Weakness in equipment demand hits across almost all vehicle types and trailer segments. Total trailer net orders have been “stuck at low levels,” and backlogs are at “as-bad-as-it-gets levels”.

Despite the grim near-term outlook, the substantial policy risks facing the tractor market are “now tilted to the upside” for trailers. The 25% tariff on imported Class 8 trucks will materially raise the price of new tractors in 2026. Coupled with cost hikes from Low NOx emission regulations in 2027, the unfriendly capex outlook for tractors may divert capital towards trailer purchases, Vieth explained

This, plus an aging trailer fleet, suggests trailer demand could see a strong rebound once truck capacity balances.

The ACT Research forecast puts total trailer production for 2025 at 188k units, rising slightly to 205k units next year. The market improves to 265k in 2027, to 295k in 2028, peaking at 309k units in 2029 and remaining strong at 299k in 2030.

then we get another $20,000 engine on Class 8 trucks in 2027.

Lynch: Particularly for the supplier community, both in the auto and truck side, it’s not like you flip a switch and say, ‘We’re going to manufacture this on Monday, then Tuesday we’ve got to manufacture something different.’ I don’t think there’s a real appreciation for the lead time, the research time, and for those research dollars. When the rug gets pulled out from under them, who do they call up and say, ‘You’ve got to compensate me for five years with R&D.’ Good luck with that.

TBB: If federal regulation is scaled back, does the industry risk replacing federal stability with a patchwork of aggressive state-level rules?

Lynch: The downside is you’re starting to see states, particularly states like California, saying, ‘We’re going to step into the breach. If you’re not going to regulate, then we’ll regulate.’ We’re even seeing this in the labor arena where the National Labor Relations Board has always been preeminent. Now California, New York, Illinois, obviously blue states, are stepping in and then we may end up with a network of things that may not be possible.

TBB: Ken, with the high costs and regulatory risks facing tractors, you expressed ‘guarded optimism’ about the trailer market. Why?

Vieth: We work on the theory that truckers hate to pay taxes. So they want to invest a certain amount of their profits back into their businesses every year. And if trucks become very expensive, you pull back your capex on trucks. After you get past tractors, one of the answers is trailers. It’s not a onefor-one, every dollar I don’t spend on tractors, I’m going to spend on trailers. But certainly some of those dollars I’m not going to spend on tractors in 2026 are going to fall into ‘Let’s upgrade our trailer fleet.’

TBB: How significantly does the Federal Excise Tax (FET) magnify the cost pressure on new equipment?

Lynch: I know that for NTDA the FET is a big deal. And now you’re going to apply a 12% excise tax on all of these cost increases. And as I understand it, you can’t finance the excise tax. So there’s a big ball coming down that hill.

Vieth: If you start with a $20,000 price increase, you’ve got about 20% between FET and state sales tax—so that’s $27,000 or $28,000 for the guy that’s taking delivery of the truck.

TBB: The downturn has been lengthy. What are current market conditions like, particularly for segments that typically thrive in a slow economy?

Vieth: This is an industry that’s, peakto-trough, 60% down in the worst downturns and 30% in an average downturn. This has just turned out longer than most. One thing I’ve heard is that the aftermarket is not doing particularly well. Typically, when the new market is in the tank, you at least get a little bit of love on the aftermarket side. But it sounds to us like a good business to have been in this year would have been in cinder blocks—because guys are jacking up their trucks and taking the tires off of the trailers that are parked against the fence, because they don’t have the money to afford new tires. The one segment performing surprisingly well is flatbed. There is decent activity in the big construction markets, the build-out of data centers. Flatbed rates, relative to dry van and reefer, are holding up reasonably well.

TBB: Tim, on Capitol Hill, what key legislative or advocacy items is the association focusing on right now?

Lynch: The underride guard issue, obviously, has been around for a very, very long time. The industry stepped up and addressed the rear underride guard. But on the side-guard issue there’s excellent arguments against it.

The industry needs to continue to argue and make the case why this is not a great idea. Another issue that the association really got behind is the dealer floor plan inventory tax deduction. [Trailer dealers] are the only entity now that is still under the 30% cap. We’ve got the legislation drafted. I look out in this audience and I have to believe that you folks are in virtually every congressional district. We just have to mobilize the grassroots. There’s an old saying in Washington that if you’re not at the table, you’re going to find yourself on the menu.

TBB: Looking ahead, how will the inevitable adoption of autonomous trucking affect equipment demand and fleet operations?

Lynch: I’ve been in this industry for 40 years, and we have killed roughly 45,000 to 50,000 Americans on the highway every year. Yet, look at what the trucking industry has done: CDLs, hours of service, roadside enforcement, all the equipment that’s going in the

vehicles—great, great things, and yet we still only marginally reduce that fatality number. But making the case [for autonomous trucks] on Capitol Hill is a tough push.

Vieth: Initially, on the tractor side, you have to have vehicles with redundant systems—so it drives some healthy demand on the front end. But then it really crushes heavy-duty vehicle demand. If you’ve got a vehicle that’s 50% more productive because it’s running 200,000 miles a year, that productivity is going to allow for lower vehicle sales. For trailers, it puts upward pressure on trailer-to-tractor ratios.

TBB: What is the most important takeaway for dealers navigating this difficult period to avoid costly errors—yet not be left behind when the market turns?

Vieth: You just have to be paying attention. Spot rates are a leading indicator. I would have said the load-to-truck ratio, but that’s kind of misfiring in 2025. If

you see a positive trend in spot rates that looks sticky and you’re reading your preferred financial source, and it’s starting to feel a little bit better. Look for used equipment prices starting to move positive, and rates starting to move positive. But you don’t want to get ahead of your skis, either.

TBB: Final thoughts on political engagement, Tim? What can NTDA members do, and does it make a difference?

Lynch: Stay engaged. If you ever do a call on Washington, you will be astounded at the number of groups that are coming into every congressional office for a half hour. There’s maybe 20 or 30 issues a day that a congressman or senator is hearing about, or their staff is hearing about, and they can’t react to everything. But if you’re not even going in there, if you’re not even talking to them, they won’t know. So when NTDA puts out a plea to contact the congressman or senator, it’s important, and it matters. It really, really does matter. TBB

Wabash is positioned to take advantage of 95% US-sourced supply chain as tari s kick in, Yeagy says

By Kevin Jones

Wabash President, CEO & Director

Brent Yeagy got the bad news out of the way right from top.

“As we look back on the third quarter, it’s clear that the softer market conditions we’ve been navigating through the year persisted and, in some cases, intensified,” Yeagy said to open the company’s Q3 earnings call with investment analysts. “Demand across the transportation industry remained below expectations as customers continue to delay capital spending decisions, creating further pressure on order activity. This environment contributed to our Q3 performance coming in below plan.”

Wabash reported net sales for the third quarter of 2025 were $381.6 million, a 17.8% decrease compared to the same quarter of the previous year. The company generated consolidated gross profit of $16 million, equivalent to 4.1% of sales. GAAP operating income amounted to $58 million as the company recognized a $81-million gain as a result of a settlement agreement related to a 2019 accident and subsequent legal verdict. Non-GAAP adjusted operating loss was $23.6 million for the quarter.

As for silver linings, Yeagy pointed to the parts and service business, which posted both sequential and year-overyear revenue growth in the quarter, “demonstrating its resilience and [the] critical role it plays in providing stability to our overall performance.”

As of Sept. 30, the Wabash backlog stood at approximately $829 million, as

customers continue to take “a wait-andsee approach,” to capital spending, the company noted.

For the full year ending Dec. 31, Wabash reduced its revenue outlook to $1.5 billion.

“As we close out the third quarter, we’ve stayed true to our values while making the prudent—but sometimes difficult—decisions needed to manage our cost base in this environment,” Yeagy said. “Our balance sheet is working, and our liquidity provides the flexibility to navigate near-term headwinds while investing in long-term growth.”

customer discussions and the most recent forecast, we remain cautiously optimistic that 2026 could mark the beginning of a gradual recovery, supported by pent-up replacement needs and improving freight conditions.”

And Wabash remains well positioned when demand “normalizes” next year, Yeagy noted.

“Based on early customer discussions and the most recent forecast, we remain cautiously optimistic that 2026 could mark the beginning of a gradual recovery, supported by pent-up replacement needs and improving freight conditions.” Brent

The fourth quarter will be the weakest of the year, both in terms of Wabash revenue and operating margins, Yeagy reported, but the 2026 order book is open and Wabash has seen “a few early wins.”

“The bulk of larger fleet orders typically comes together between now and year’s end, which will give us much better visibility into next year’s demand profile,” he continued. “Based on early

Yeagy, Wabash

“With the recent inclusion of dry van and refrigerated trailers in the Section 232 steel and aluminum derivative tariffs, we expect to see gradual effects on the competitive landscape as the industry adjusts over the coming quarters,” he said. “This development may ultimately serve as a catalyst for improved market share dynamics as the cycle strengthens through 2026. However, we recognize that these effects may take time to materialize as competitors evaluate their sourcing strategies and pricing responses. Our focus remains on maintaining cost stability and supply chain resiliency, areas where Wabash holds a clear structural advantage.”

Recent long-term agreements with major suppliers are the key to that advantage, affording Wabash a 95% domestically sourced supply chain, Yeagy added.

“We are far better positioned than our peers to manage input cost volatility. As the full impact of the 232 tariff action unfolds over the coming months, it’s important that we continue to educate our customers on the growing risk of pricing instability within the market,” Yeagy said. “Wabash’s consistent and reliable supply chain represents a distinct value differentiator, particularly as customers prepare for the next freight up cycle and look to manage profitability in the early stages of recovery.”

Also during the third quarter, Wabash finalized a settlement related to a 2019 accident involving a Wabash trailer that was fully compliant with safety regulations. The case had previously resulted in a jury verdict that included punitive damages exceeding $450 million, along with approximately $12 million in compensatory damages.

Following post-trial motions, the court substantially reduced the verdict amount prior to the settlement. Under the terms of the settlement, Wabash’s payment obligation is approximately $30 million, Yeagy reported, with the remaining amount to be covered by the company’s insurance.

Despite precedent to the contrary, the jury was prevented from hearing

critical evidence in the case, including that the driver’s blood alcohol level was over the legal limit at the time of the accident and the fact that neither the driver nor the passenger were wearing seatbelts, he noted.

“Unfortunately, this case reflects a troubling trend in America’s courts, where aggressive plaintiffs’ attorneys target reputable companies regardless of the facts,” Yeagy said. “Verdicts like this threaten not only innovation, but the stability of manufacturing and transportation companies that serve as economic anchors in communities across the country.”

Regarding the Wabash parts and services business, Mike Pettit, SVP and chief growth officer, characterized the unit’s performance as “validating,” posting Q3 revenue that was among the best on record “in a very challenging freight environment.”

“One of the clearest proof points behind the parts and services momentum sits in our upfit business,” Pettit said. “Our upfit offerings let us deliver fully tailored equipment in just a couple of weeks, combining the scale of truck body production with the deep customer intimacy that defines parts and services. This is also a business where we are introducing some of our latest cutting-edge digital tools.

“Using AI, we are now able to quote and upfit a truck body almost instantaneously, allowing our customers to make

pricing decisions in real time and place orders for their chassis and truck body together. This process has historically taken days or weeks in the truck body market. We shipped over 540 units in Q3 and about 1,500 units year-to-date.”

Wabash plans to ship more than 2,500 next year, he added.

Pettit also pointed to the expanding Trailer-as-a-Service business, which has grown to include TaaS pools.

“With pools, we continue to develop solutions that enable logistics providers to grow with flexible, scalable trailer solutions,” Pettit said. “TaaS pools provide shippers with a universal trailer pool that replaces the complexity of managing fragmented pools across different partners. … We continue to accelerate the technology road map inside TaaS and have either launched or will soon be launching predictive analytics, alerts, and automated tracking and billing, capabilities that turn raw data into actionable, measurable savings.”

For the quarter, Wabash shipped 6,940 new trailers, down from 7,585 trailers in the Q3 last year. Truck body shipments totaled 3,065 units, down from 3,630.

“Our truck body business continued to face challenging market conditions through the third quarter, reflected in softness across medium-duty chassis production. Demand eased across most end markets as freight activity, construction, and industrial sectors slowed further,” Yeagy said. TBB

Trailer tech panel details growing role connectivity, data analysis, and AI play today, and for tomorrow’s self-driving eets

By Kevin Jones

CANTON, Ohio— e roadmap to autonomous trucking is typically focused on the power unit—the self-driving tractor— but a recent panel of telematics and fleet management experts underscored a crucial truth: e future of driverless long-haul operations rests squarely on the intelligence of the trailer being pulled behind that tractor. Without the robust data and predictive capabilities provided by smart-trailer technology, autonomous trucking operations face unacceptable risks—and that’s asking for trouble.

Gathered here for a session during Hendrickson’s Beyond Suspensions media event, the smart trailer technology panel detailed how connected equipment is transforming fleet operations and maintenance—and preparing the industry for a safe, autonomous future.

Matt Wilson, who leads Hendrickson’s Vehicle Technology Group, explained that the creation of his division was

rooted in the need to provide fleets and users with sophisticated, sensor-related technology that delivers “data and actionable insights.” These will form the basis for the connected, smart trailers needed for autonomous trucking.

“There’s a real focus for us here at Hendrickson to try to make sure that we’re providing as much information as possible to fleets and users moving

we’re really focused on, what the industry is focused on, in terms of bringing better insights, better sensors to drive better decisions.”

But which data points are critical? The foundational, “table stakes” data revolves around lights, brakes, and tires, emphasized Lawrence Bader, retired UPS global fleet systems director, currently with Advanced Transportation

All the data elements are important, but when we put them into action, that’s where the meat is.”

Lawrence Bader

forward,” Wilson said. “So part of that for us is to get a little bit more sophisticated with our products.”

Indeed, smart trailer technology is a collection of sensors that keep an eye on everything from a trailer’s hardware to the freight riding in the box, explained Mark Wallin, general manager and senior vice president of product for Phillips Connect.

“The part that makes it smart is when you bring that all together and create insights for the right stakeholders,” Wallin said. “That is the collection of technologies around smart trailers that

Technology LLC. He, too, stressed that data must be actionable, meaning it can be put into the hands of the people who can use it immediately.

“All the data elements are important, but when we put them into action, that’s where the meat is,” Bader said.

For Jason Theis, fleet maintenance manager-trailers with Anderson Trucking Service (ATS), this focus on data-derived insights resulted in immediate, measurable success. After implementing the TIREMAAX PRO advanced automatic tire inflation system, ATS saw a “massive reduction” in CSA violations.

Theis noted that underinflated tires were their number-one violation, and by combating this persistent issue with technology, they were able to dramatically reduce fines and service violations.

“Getting drivers to stop and check post- and pre-trip is very, very difficult, even with the DVIR [inspection report] process,” Theis said. “So we’re combating technology with technology. When you go through a weigh station, there’s AI technology in those stations now. They check the tire tread depth and [inflation] psi just by going through it. So we had to find a way we can be a little more systematic with what we’re doing and not do a manual process.”

And the predictive capability—getting ahead of a problem before it escalates— is essential, especially given the true cost of a flat tire once roadside repairs, downtime, and missed appointments are added up. For ATS, that averages $694 above the cost of the tire itself, Theis noted.

While the promise of data is tremendous, fleets face challenges, primarily data overload. Wallin pointed out that managing the complexity and sheer

volume of data—and finding what’s important—is difficult.

“There’s new technology being added to every part of the trailer, and with all that great new technology and all the new insights, you’ve got to get it to the right place,” Wallin said. “So the challenge for a fleet is, how do you make use of all that information? How do you turn a bunch of data into something that’s actionable and really valuable?”

Fleets often struggle to build the necessary IT infrastructure themselves, leading them to seek platforms that simplify data consolidation and delivery.

“That’s really what we [Phillips Connect] have been focused on: how to help solve that challenge with technology, with the platform,” Wallin said.

The solution lies in creating “fit for purpose” applications. Dispatchers, mechanics, and drivers all require different information to act efficiently. Instead of forcing users to sift through the same detailed reports, platforms must serve up only the necessary information to the right person at the right time. As a component supplier, Wilson suggested that Hendrickson’s looking into edge computing—making certain decisions on the vehicle in real-time—is

Dustin Lancy Director, Global Branding & Comminucations, Hendrickson

Matt Wilson VP & GM — Vehicle Technology Group, Hendrickson

Mark Wallin GM & SVP of Product, Phillips Connect

Lawrence Bader

Retired UPS Global Fleet Systems Director, currently with Advanced Transportation Technology LLC

Jason Theis Fleet Maintenance Manager-Trailers, Anderson Trucking Service (ATS)

key to restricting how much non-critical information is sent to the cloud.

“Let’s try to make sure that the information that we identify are actual issues—actionable items that we can hand off to telematics systems to then communicate to the back office or the driver,” he said.

Moreover, gaining organizational buy-in requires demonstrating a comprehensive return on investment (ROI). Bader advised fleets to look beyond just the maintenance budget and consider the impact on safety, brand reputation, insurance costs, and operations.

“When you look at all of the other aspects, it’s very clear—you just can’t look at one piece of it,” Bader said.

Autonomous imperative

The convergence of smart trailers and autonomous trucking is obvious—or should be.

“The autonomous vehicle age is evolving. All of the AV developers today are looking to deploy with dumb trailers,” Bader said. “I think some of your respectable fleets who do care about their brand image are going to want to ensure that their labeled trailer going down the highway is not at risk from a simple tire blowout, to smoking brakes, to a thermal event. So they are investing in trailer telematics to give us that data. I do believe that autonomous vehicle developers are going to discover how that data can be brought into their systems, and take action on those.”

Smart trailers are crucial because they serve as the technological replacement for the human driver’s intuition and observation. They provide the autonomous system with the critical health diagnostics necessary to make safety decisions.

“I absolutely believe we need to understand the true health of that trailer that’s being pulled behind on autonomous vehicles,” Bader continued. “We need to understand when that tire is getting low. Are the wheel bearings holding up? It’s a safety issue.”

The application of this smart data extends beyond simple tire pressure alerts. Theis shared an unexpected

Mark Wallin, general manager and senior vice president of product for Phillips Connect, says the industry is focused on “bringing better insights, better sensors to drive better decisions.”

Kevin Jones | TBB

success story where the telematics data, coupled with the inflation system, allowed ATS to detect improper load distribution on an open deck trailer, preventing trailer damage and educating dispatchers on safe loading practices. Furthermore, ATS integrated Phillips Connect and Hendrickson technology to monitor the unauthorized use of complex steerable trailer systems, ensuring drivers complied with policy restrictions.

These complex insights prove the systems are customizable and essential for policy compliance and safety in specialized operations.

Looking toward 2026 and beyond, the panelists agreed that AI is the definitive trend. Wallin of Phillips Connect predicted that AI will raise the bar by enabling greater automation and allowing fleet personnel to ask smarter questions.

“We’re going to solve real problems, and that trend in AI is going to open a lot of doors for technology,” Wallin said. “It’s around people’s thinking, and what they expect in their day-to-day work. With connected equipment, like we have here at Hendrickson, and the platform that we’re working on, we’re going to make that easier, and this trend will be very helpful for the industry.”

Bader pointed to the transformative aspects of physics-based AI. This

advanced AI will be able to dig into data and predict component failure, moving the industry away from traditional time- and mileage-based maintenance schedules toward condition-based maintenance by “understanding where the problems really are.” This means replacing parts like brake pads or starters only when the prediction models indicate imminent failure, maximizing resource utilization and minimizing premature replacement.

For fleets, operational insights offer a tremendous opportunity.

“We’re in a down market right now, so asset management is important,” said Theis, from ATS. “Our ops group, they’re constantly looking at the trailer counts: Where are they? How long have they been sitting there? What’s the load status? Time is money, and every load counts right now. So we’re really looking to utilize all the resources and data that’s out there, using AI.

“Getting the right truck-to-trailer ratio, it’s always been a guessing game. We’re finding that we don’t need as many trailers in the fleet because we have so many that are underutilized. So we’re really watching that ratio, getting it as close as we can to make sure we have enough for the customers, and that they’re still turning their wheels as much as they can. I think the AI’s going to be a big portion of that analysis.”

Hendrickson’s Wilson summarized the industry’s near-term challenge: achieving clarity.

“Over the next year or two, you’re going to see a lot of users figure out what are the most important parts and what are the most important things for them to pay attention to,” Wilson said. “Because, right now, I think there’s still a little bit of confusion over what sensors are the ones that I really need to have in my trailer; there’s almost information overload in some cases. The industry as a whole is going to get some clarity over the next year or so and really figure out and dial in the specific sensors, the specific requirements that they need to monitor to make sure that their equipment is healthy and working properly.” TBB

The National Association of Trailer Manufacturers (NATM) is returning to the Fort Worth Convention Center for its annual convention and trade show, February 23-26, 2026.

As always, the NATM Trade Show is the one-stop-shop for the light- and medium-duty trailer industry to meet with suppliers and service providers on the trade show floor. Additionally, attendees will be able to connect with the industry and attend networking events, workshops, technical forums, and more.

For 2026, however, NATM has made some adjustments to the event lineup based on feedback from attendees at the 2025 show.

And it starts with brunch. NATM is unveiling a bold new Wednesday morning event: Bacon & Brilliance: Association Update and Awards Brunch, sponsored by Optronics. This opening session replaces the traditional early workshops with an NATM-focused experience that brings the community together over great food and updates on the association’s success. On the menu, along with bacon and other brunch favorites, will be the State of the Association address; annual membership awards; and video updates

on programming such as the NATM Academy, National Safe Trailering Council, and Trailer Safety Week.

This brunch will replace the “Lunch with Exhibitors” boxed lunches on the Trade Show floor, but concession stands will be available. After brunch, attendees head straight into the exhibit hall.

Also new for 2026, Tuesday’s traditional awards luncheon and keynote speaker will be replaced by the Government Affairs Lunch & Learn, featuring NATM’s government affairs representatives, K&L Gates, who will offer insight into the legislative and regulatory developments shaping trailer manufacturing, alongside food and networking.

The NATM convention is known for its roster of educational sessions, and that will not change for 2026.

Leading off will be a workshop that sets the tone with a high-energy, keynote-style session that will get attendees thinking differently about what drives business growth.

You Monetize - T.I.E. Relationships to Revenue isn’t just another motivational talk. It’s an interactive, 90-minute experience where NATM Members will explore how Time, Intention, and Experience (T.I.E.) can transform everyday interactions into business-building opportunities.

This session was voted on by NATM’s education and convention committees as one of the most impactful topics for 2026, reflecting demand for programming that goes beyond technical skills and speaks to the heart of business success, according to the association.

Dustin E. James, known as “America’s Top Corporate Energizer,” has presented to more than 500,000 people across industries, inspiring them to elevate their workplace culture and performance. What makes James unique is that he isn’t just talking about building business—he’s doing it. He still runs his own ventures, constantly testing and refining the very strategies he shares on stage. His businesses have been featured on

FOX, ABC, NBC, and CBS, and he brings fresh, real-world insights every time he steps in front of an audience. Attendees can expect laughter, energy, and maybe even a few goosebumps as James takes his audience on a journey of discovering how a little more time, intention, and experience can completely change the way you approach your business.

For those looking to innovate their manufacturing processes, at Technical Forum 1: Driving Efficiency in Trailer Manufacturing - The Case for Automation, you’ll get straight answers, backed by data and real-world examples. This 90-minute session will show how automation can solve bottlenecks, boost safety, and deliver measurable ROI, while empowering your workforce instead of replacing it.

Trailer manufacturers want to work smarter, not just harder, and the leap into automation can feel overwhelming. But automation isn’t just for massive manufacturing plants. It’s a powerful, scalable tool for companies of all sizes. This session is designed to show how automation can help reclaim lost time, eliminate bottlenecks, and raise quality standards—even in custom-shop environments. Through data-driven insights and peer-proven examples, attendees will learn exactly how to spot when the shop is ready for transformation (floor assembly, riveting, welding, or bending tasks, etc.).

The session will be led by Tim Hildebrandt and Chris Poole of Acieta. As an NATM member, Acieta understands the unique challenges trailer manufacturers face. With more than four decades of experience and more than 10,000 robotic systems successfully deployed across North America, their team has seen first-hand how automation can transform operations of every size.

For the full 2026 convention schedule, see Page 31.

For 2026, NATM has announced the New Trailer Manufacturer Promotion, an opportunity for NATM trailer manufacturer members who have not experienced the NATM Convention & Trade Show previously, or who have not

attended in the last five years. This promotion entitles eligible trailer manufacturing companies to two complimentary full registrations, two complimentary spouse/partner registrations, and the added luxury of one free hotel room night per qualifying company.

Those wanting to know if they qualify for the New Attendee Promotion should reach out to NATM Membership & Events Coordinator Catie Rutkowski, at Catie.Rutkowski@natm.com.

Otherwise, attendees can register online at www.NATM.com/convention.

The NATM Room block rates are $269.00 per night at the Omni Fort Worth Hotel. To book outside of the room block dates listed online, or ask questions about reservations, contact

The NATM Trade Show will open immediately following the Bacon and Brilliance brunch meeting on Wednesday, and will open again Thursday at 9 a.m. NATM

the Omni directly at 817-535-6664.

The NATM Group Rate Cut Off Date is January 20, 2026. Please reserve your room early, as NATM cannot guarantee the reduced group rate after that date. See www.natm.com/hotel-information. And, as always, the annual event provides an opportunity for light- and medium-duty trailer manufacturers, suppliers, and service providers to showcase their latest products. As of press time, some 10’ x 10’ booths were still available, priced at $2,100 for NATM Members and $4,200 for non-members and include two complimentary booth worker registrations. Contact NATM Events Director Aileen Valido at Aileen. Valido@natm.com.

3M

H

H.E.

Alamo

From nuts and bolts to marketing videos, workshops and technical sessions have something for everyone

Beyond the exhibit hall, the NATM convention once again is packed with valuable sessions tailored to empower trailer manufacturers and suppliers with the knowledge and tools they need to excel. Here’s a glimpse of the full schedule, including the educational workshop and technical forum lineup, as of TBB press deadlines.

Monday, February 23

• Dueling Pianos Welcome Event Reception

6 p.m. - 8 p.m.

Kick off the convention with an evening of music and fun. The night promises connection, networking, and the excitement of live dueling piano performances.

Tuesday, February 24

• Workshop Session 1: Humanize Before You Monetize - T.I.E Relationships to Revenue Presenter: Dustin E. James

9:30 a.m. - 11:00 a.m.

The workshop isn’t just another motivational talk. It’s an interactive, 90-minute experience where NATM Members will explore how Time, Intention, and Experience (T.I.E.) can transform everyday interactions into business-building opportunities.

• Technical Forum Session 1: Driving Efficiency in Trailer Manufacturing –The Case for Automation

Presenters: Tim Hildebrandt and Chris Poole, Acieta

9:30 a.m. - 11:00 a.m.

This forum will focus on providing straight answers, backed by data and real-world examples. This 90-minute session will show how automation can solve bottlenecks, boost safety, and deliver measurable ROI, while empowering your workforce instead of replacing it.

• Lunch and Legislation: Government Affairs Lunch & Learn

Presenter: K&L Gates

11:00 a.m. – 1:30 p.m.

The Government Affairs Lunch & Learn with NATM’s government affairs representatives K&L Gates will offer valuable insight into legislative and regulatory developments shaping the industry, alongside food and networking.

• Workshop Session 2: AI in Action: Make Your First Company Video While We Talk Presenters: Lucien Harriot, Steve Lance 2:00 p.m. - 3:45 p.m.

This interactive, 90-minute session will empower attendees to create a fully usable company marketing video—live, in real time—during the workshop. Whether you want to boost your website, sharpen your sales messaging, train employees, showcase products, or energize your social media presence, this hands-on program will show you how.

• Technical Forum Session 2: Fasteners 101 & Beyond

Presenter: Dan Long, FDL Components 2:00 p.m. - 3:45 p.m.

This 90-minute session will begin with a foundational look at fastener basics — the perfect refresher for those who touch these parts every day — before advancing into more complex but critical issues like fastener markings, traceability, legislation and compliance requirements, and understanding the liability chain.

• NATM PAC Reception 3:50 p.m. - 4:30 p.m.

The PAC Reception may only be attended by NATM’s “Restricted Class,” which includes certain NATM employees, individual and other

Back by popular demand, Dueling Pianos will be featured at the convention’s welcoming reception.

NATM

noncorporate NATM Members, and certain employees of corporate members with pre-approval.

• Newcomer Orientation & Reception 4 p.m. - 6 p.m.

• President’s Reception 6 p.m. - 7:30 p.m.

Wednesday, February 25

• Bacon & Brilliance: Association Update and Awards Brunch 9:00 a.m. – 11:00 a.m.

• Trade Show Open 11:30 a.m. - 5:00 p.m.

• Trade Show Reception 4:00 p.m. - 5:00 p.m.

Thursday, February 26th

• Trade Show Open 9:00 a.m. - Noon

• Coffee with Exhibitors 9:00 a.m .- 10:00 a.m.

• Trailer Trends & Tech Showcase Awards 10:00 a.m. -10:30 a.m.

• Trailer Trends & Tech Showcase Raffle 10:30 a.m. - 11:00 a.m.

• CVP Failures and Trailer Technology Workshop 11:00 a.m. - Noon

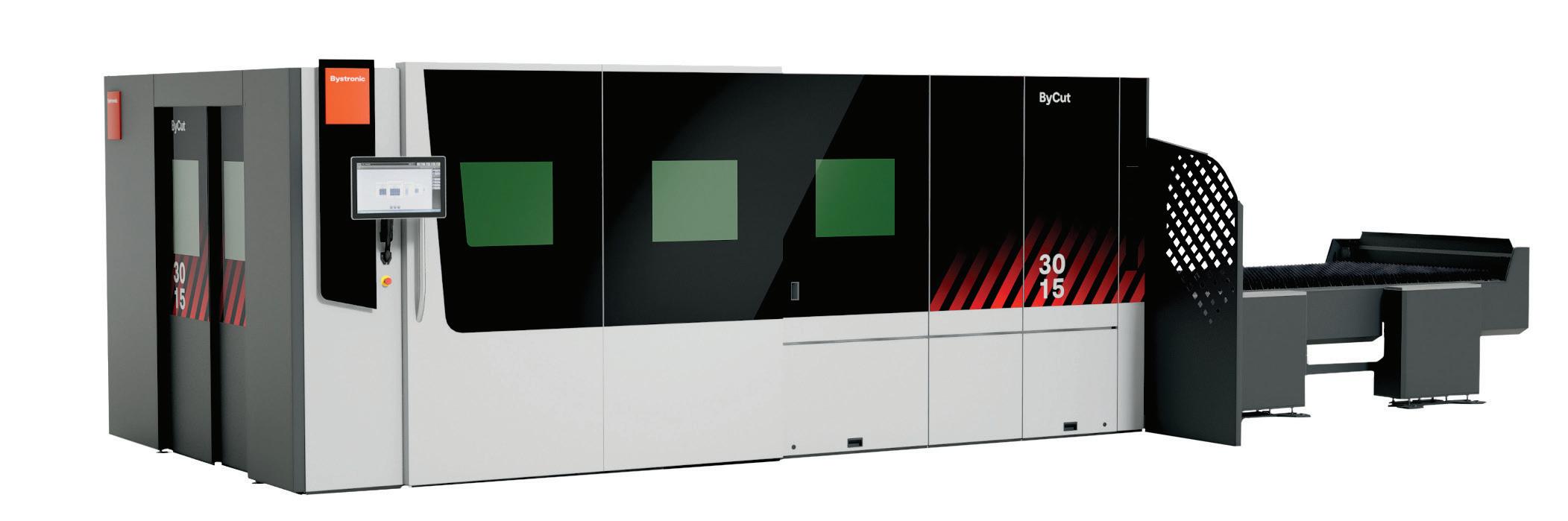

FABTECH 2025 highlights manufacturing’s critical role—and shows o some cool stu

CHICAGO—FABTECH

2025, North America’s largest metal forming, fabricating, welding and finishing event, concluded its four-day run in Chicago with the largest show floor in its history. e event, at McCormick Place in September, brought together 42,000 manufacturing professionals and more than 1,700 exhibitors to connect, explore new technologies and drive business forward.

“The energy on this year’s recordbreaking show floor was a clear reflection of the manufacturing industry’s confidence and forward momentum,” said Tracy Garcia, FABTECH group director at SME. “FABTECH is more than just a showcase for technology; it’s the critical venue where face-to-face connections are made, partnerships are

forged, and business gets done. The level of engagement we saw this year was exceptional.”

FABTECH by the numbers:

• 42,000 industry participants

• 1,700+ exhibitors covering 885,000+ square feet of exhibit space

• 300 first-time exhibitors

• 800+ new products launched

• 200+ education sessions across 13 tracks

• $80+ million estimated economic impact to Chicago

Biggest show floor to date

The expansive, record-setting show floor served as the central hub for FABTECH

2025, a bustling marketplace of discovery where attendees and exhibitors alike found measurable value. Its prominence was underscored by a visit from Illinois Governor JB Pritzker, who toured the floor with leaders from FMA and SME, to meet with Illinois-based manufacturing companies.