TAKING YOUR BUSINESS TO THE NEXT LEVEL IS NOW EVEN MORE REWARDING READ MORE >

TAKING YOUR BUSINESS TO THE NEXT LEVEL IS NOW EVEN MORE REWARDING READ MORE >

CALLING ALL DEALERS. ARE YOU READY TO HYPERDRIVE YOUR BUSINESS?

Delinte Tire’s NEW HYPERDRIVE Associate Dealer Program™ is here to give independent tire dealers an opportunity to put some extra cash in their pockets.

Join the HYPERDRIVE Associate Dealer Program today and start earning up to $3 per tire.

IT’S EASY. NO OPENING ORDER REQUIRED. JUST ENROLL>SELL>START EARNING.

All Delinte PCR and LTR tire models, including the new DV3 LMD AS Last-Mile Delivery tire are eligible for the rewards.

EASY MONEY HYPERDRIVE REWARDS LEVELS:

LEVEL 1 Buy 48 units - GET $1 per tire [ $192 per year ]

ENROLL TODAY TO START RECEIVING REWARDS! S N TO ENROLL

LEVEL 2 Buy 120 units - DOUBLE your rewards to $2 per tire [ $480 per year ]

LEVEL 3 Buy 240 units - TRIPLE your rewards to $3 per tire [ $2,880+ per year ]

YES! YOU CAN EARN OVER $2,880 DOLLARS A YEAR WITH HYPERDRIVE.

DISTRIBUTORS:

IF YOU WANT TO SELL DELINTE TIRES AND OFFER HYPERDRIVE REWARDS TO YOUR DEALERS, CONTACT US TODAY ON OUR WEBSITE AT DELINTETIRES.COM/ DEALER-INQUIRIES.

“We’re still

much

into the footprint we have,” says Tony Grace, CEO of Alma Tire Companies.

Mike Manges By

couple of months ago in this column, I wrote about a tire dealer who prefers to hire people “at warp speed” — my words, not his. The editorial elicited an email from Jason Lightbody, who runs the tire division at Houska Automotive in Fort Collins, Colo.

Jason wanted to talk about the virtues of hiring slowly — and what it takes to keep employees happy after they’re on-board.

Despite operating in a hot job market where good workers are in high demand, Houska Automotive, which employs around 50 people, moves slowly and deliberately when hiring.

“For us, the goal is to not need to hire a replacement later,” Jason explained. When interviewing candidates, “we ask as many questions as we can. We do as much social media investigating as we can. We even have team members look at candidates’ vehicles” to see how well they’re maintained.

“We take our time. Everybody gets interviewed twice. We want to know how someone will fit on our team. Whether we’re hiring for a service advisor or technician role, we have a playbook” that’s followed religiously.

The company will disqualify candidates who don’t want to work out sufficient notice with their current employers. “If we interview someone — even if they look like a good fit — and they say, ‘I can start anytime. I don’t need to give a two-week notice,’ we move past them, regardless of their credentials.”

Refusing to give notice “just tells me they’re going to do that to us down the road. I don’t want to hire somebody with the hope that I’m putting my competition at a disadvantage. We don’t go to battle that way. We want to beat them based on service. And our employees see that. They know we’re trying to get the best person we can and if it takes a little longer, that’s OK.”

Our conversation shifted to the subject of employee retention. When I asked Jason to share the secret of successful employee retention, he simply replied, “It’s love. It’s us loving our people. We give them a 401(k). We give them a very robust health care package. We pay the most competitive wages. And we want to know how they’re doing” on a personal level. “We want to know what’s going on with their kids and their spouses. It’s genuine. We encourage our people to have lives outside of work. Our owners have a townhouse in a ski town and they allow employees to go there and spend time and get away from work. We also encourage (employees) to have hobbies.

“This month, we’re taking what we call ‘tenured employees’ — employees who have been with us longer than 10 years” — via shuttle to a Colorado Rockies baseball game in Denver, some 65 miles away from Fort Collins. “We’re renting a suite for them.”

The day out has become an annual tradition at Houska Automotive. “People talk about it and new employees will say, ‘I can’t wait until it’s my turn.’”

“We take our time,” said Jason Lightbody, who runs the tire division at Houska Automotive in Fort Collins, Colo. “Everybody gets interviewed twice. We want to know how someone will fit on our team.”

Management actively seeks feedback from employees. “At Houska Automotive, you can walk into the president’s office at any time. We’re never like, ‘I’m the boss. You’re going to do what I say.’ We say, ‘What are your thoughts? How can you help?’ Fifty-four people together is a pretty smart machine.”

Jason told me that new employees are sometimes surprised at the level of care and concern Houska Automotive’s management team displays. “We have some guys who come here from other shops and they’re used to ownership-down management and finger pointing. That’s not what we do.”

Rolling out the red carpet for new employees is par for the course at Houska Automotive, according to Jason. “I took the last service advisor I hired to lunch on his first day. The next day, one of the guys he was going to start working for took him to lunch. A few days later, someone else took him to lunch. It blew his mind that any one of those guys on any one of those days would take him — a new person— to lunch.

“We didn’t go to lunch so we could milk ideas from him and discuss what his previous employer did. We already knew what those guys were doing. We wanted him to understand right from the get-go who we are.”

The average tenure of a Houska Automotive employee is 10 years. “I have a lot of guys on the tire side who’ve been with us between 10 and 15 years. Three guys have been with us longer than I have.” (Jason joined the company in 2010.)

It’s evident that Houska Automotive has developed a system that works extremely well. What’s working for you? Let us know. We’d love to hear your story. ■

If you have any questions or comments, please email me at mmanges@endeavorb2b.com.

RESOURCES FOR THE INDEPENDENT TIRE

The Modern Tire Dealer Show is available on Apple Podcasts, Spotify, iHeart Radio, Amazon Music, Audible and MTD’s website.

Sign up for Modern Tire Dealer ’s eNewsletters to receive the latest tire news and our most popular articles. Go to www.moderntiredealer.com/subscribe

Telle Tire & Auto Centers has joined the list of independent tire dealerships that have added private equity support to their structure. That support is helping the dealership expand beyond its home base in the St. Louis, Mo., metro area.

We’re now well past the mid-point of 2025 and the economic picture remains uncertain. Yes, retail consumers are still holding back on purchases, but the water is choppy for those in the commercial world, too. Just look at how many of this past month’s top headlines touch commercial tire dealerships, including reports about new tires and new shops, plus a plant shutdown.

1. ATD discusses ‘reset’ in letter to industry

2. Michelin X Line Grip D offers more bene ts

3. Michelin announces Michelin X Multi Z2

4. Dealers: Tire demand and traf c on the decline

5. Yokohama launches premium drive tire

6. 2025 MTD 100 now available

7. Telle Tire brings on private equity partner

8. Bridgestone closes plant early

9. Tariffs create turbulence in the TBR tire market

10. Southern Tire Mart opens location in Idaho

Check out MTD ’s digital edition at the top of our website’s homepage.

SOCIAL MEDIA

Like us Facebook: facebook.com/ModernTireDealer

Follow us X: twitter.com/MTDMagazine

3515 Massillon Rd., Suite 200 Uniontown, OH 44685 www.moderntiredealer.com

PUBLISHER

Greg Smith gsmith@endeavorb2b.com (330) 598-0375

EDITORIAL

Editor: Mike Manges (330) 598-0368, mmanges@endeavorb2b.com

Managing Editor: Joy Kopcha (330) 598-0338, jkopcha@endeavorb2b.com

Associate Editor: Madison (Gehring) Hartline (330) 598-0308, mgehring@endeavorb2b.com

PRODUCTION

Art Director: Erin Brown

Production Manager: Karen Runion, (330) 736-1291, krunion@endeavorb2b.com

ACCOUNT EXECUTIVES

Darrell Bruggink / dbruggink@endeavorb2b.com

Marianne Dyal / mdyal@endeavorb2b.com

Mattie Gorman-Greul / mgorman@endeavorb2b.com

Cortni Jones / cjones@endeavorb2b.com

Diane Braden / dbraden@endeavorb2b.com

Sean Thornton / sthornton@endeavorb2b.com

Kyle Shaw / kshaw@endeavorb2b.com

Lisa Mend / lmend@endeavorb2b.com

Chad Hjellming / chjellming@endeavorb2b.com

Annette Planey / aplaney@endeavorb2b.com

MTD READER ADVISORY BOARD

Rick Benton, Black’s Tire Service Inc.

Jessica Palanjian Rankin, Grand Prix Performance

John McCarthy Jr., McCarthy Tire Service Co. Inc.

Jamie Ward, Tire Discounters Inc.

CUSTOMER/SUBSCRIPTION SERVICE (877) 382-9187

moderntiredealer@omeda.com

ENDEAVOR BUSINESS MEDIA, LLC

CEO: Chris Ferrell

COO: Patrick Rains

CRO: Paul Andrews

CDO: Jacquie Niemiec

CALO: Tracy Kane

CMO: Amanda Landsaw

EVP Vehicle Service/Repair Group and Fleet and Trailer Group: Chris Messer

VSRG Editorial Director: Chris Jones

Modern Tire Dealer (USPS Permit 369170), (ISSN 0026-8496 print) is published monthly by Endeavor Business Media, LLC. 201 N Main St 5th Floor, Fort Atkinson, WI 53538. Periodicals postage paid at Fort Atkinson, WI, and additional mailing offices. POSTMASTER: Send address changes to Modern Tire Dealer, PO Box 3257, Northbrook, IL 60065-3257. SUBSCRIPTIONS: Publisher reserves the right to reject non-qualified subscriptions. Subscription prices: U.S. ($81.25 per year). All subscriptions are payable in U.S. funds. Send subscription inquiries to Modern Tire Dealer, PO Box 3257, Northbrook, IL 60065-3257. Customer service can be reached toll-free at 877-382-9187 or at moderntiredealer@omeda.com for magazine subscription assistance or questions. Printed in the USA. Copyright 2025 Endeavor Business Media, LLC. All rights reserved. No part of this publication may be reproduced or transmitted in any form or by any means, electronic or mechanical, including photocopies, recordings, or any information storage or retrieval system without permission from the publisher. Endeavor Business Media, LLC does not assume and hereby disclaims any liability to any person or company for any loss or damage caused by errors or omissions in the material herein, regardless of whether such errors result from negligence, accident, or any other cause whatsoever. The views and opinions in the articles herein are not to be taken as official expressions of the publishers, unless so stated. The publishers do not warrant either expressly or by implication, the factual accuracy of the articles herein, nor do they so warrant any views or opinions by the authors of said articles.

Yokohama TWS plans to supercharge the growth of its Mitas ag tire brand by making substantial investments on several fronts.

“Our desire is to double our sales of the Mitas brand in the aftermarket and attain similar levels we enjoy in the original equipment space,” said Lawrence Harmon, regional president, North Central America, Yokohama TWS, before MTD recently toured the company’s Mitas ag tire plant in Charles City, Iowa.

“To achieve this, we will further develop our dealer network — choosing the right partners that can best articulate the brand’s value proposition. It is our responsibility to work with these dealers to equip them with the knowledge and tools to best represent this brand in the market.

“We are continuously working on new marketing programs, focusing on growing demand for Mitas products to support our dealer network,” Harmon continued. “This year, for example, we will launch our Mitas Traction Rewards dealer program, which offers incredible advantages for its members and training for our aftermarket partners. Product development is also a key part of our growth strategy, with new and exciting sizes to grow Mitas in the marketplace.”

Mitas and Trelleborg “are the two major brands” within Yokohama TWS’ ag tire portfolio. Both are “focused on performance,” with Mitas sold as “a premium ag tire” at a “competitive” price point, according to Andrea Masella, marketing director, NCA agriculture, Yokohama TWS.

The Charles City plant, now Yokohama TWS’ only manufacturing facility in North America, will be a critical component of Mitas’ growth. (The company shuttered its Trelleborg ag tire plant in South Carolina during the first quarter of 2025.)

“Since becoming part of the Yokohama group, the Mitas plant ... has seen three major capital investments, with a fourth scheduled for installation in the

Yokohama TWS’ Mitas ag tire plant in Charles City, Iowa, will play a critical role in the further growth of the Mitas brand, say Yokohama TWS officials. Pictured are first shift workers at the plant, which opened in 2012 and manufactures radial tires for a wide range of agricultural applications.

Photo: MTD

third quarter of 2025,” said Dietrich Riedemann, the facility’s manager. “We have made many upgrades and additions” to the 13-year-old facility.

“Looking ahead, we have more advancements scheduled. At the Charles City plant, we are consistently focused on increasing capacity and optimizing our product mix, with a strong emphasis on efficiency.”

The plant focuses on producing radial tires for a wide range of agricultural applications.

“While our daily output varies based on product mix and market demand, we currently have sufficient capacity to meet demand across” multiple distribution channels, Reidemann told MTD. “We’re fortunate to have a highly skilled and adaptable workforce that can operate efficiently during both high- and low-volume periods.”

While boosting output is a critical pillar of the plant’s long-term objectives, “we are equally focused on maintaining efficiency and competitiveness in all market conditions. Our goal remains the same: to deliver high-quality products, optimize resources and offer the best value to our customers — all while keeping

Mitas pricing competitive with overseas manufacturers.”

The Charles City plant’s location also provides Yokohama TWS with another strategic advantage, according to Tom Rodgers, commercial director, NCA agriculture, Yokohama TWS.

“I think if the last five years have taught us anything, it’s that supply chain disruption is both unpredictable and inevitable. It is costly and creates significant headaches for dealers, farmers and OE producers. By near-sourcing, we can significantly reduce any of the risks” associated with tariffs and supply chain disturbances.

This localized strategy also enables “faster market response and agricultural practice adaptation,” while enhancing shipping efficiency “and access to high-quality, specialty tires without international levies,” said Rodgers.

The Mitas brand’s growth plans are one component of parent firm Yokohama Rubber Co. Ltd.’s global strategy, said Harmon. “Yokohama has continued to invest heavily in the off-highway tire market. We are fully committed to the market and see wonderful opportunities in the future.” — Mike Manges

Bridgestone Americas Inc. ended operations at its LaVergne, Tenn., plant nearly a month before the factory was scheduled to close. Operations at the truck tire plant ceased July 2, ahead of the July 31 schedule. The closure affected 700 employees. LaVergne was one of two Bridgestone TBR tire plants in the U.S.

American Kenda Rubber Co. Ltd.’s newest distribution center — a facility in Henderson, Nev. — opened in April and is fully operational. It is stocking passenger, light truck and S/T radial tires and shipping to customers in the western regions of the U.S.

Sailun Group Co. Ltd. has bought a shuttered truck tire plant in China from Bridgestone Corp. for $36.9 million. Bridgestone had closed the plant after announcing in February 2024 that it was pulling out of the commercial tire business in China.

Continental Tire the Americas LLC has appointed Wyatt Hamilton Sr. as the new director of sales for the company’s truck tire replacement division in the U.S. Hamilton has been with Continental’s truck tire team for the last 20 years.

Sun Auto Tire & Service Inc. has entered the Tennessee market via the recent acquisition of Barrett’s Tire, a business established in 1951 and located in Dover, Tenn. Sun Auto also bought Miller’s OK Tire in Columbus, Miss.

TGI offers Yokohama Tire Group International LLC (TGI) has announced it will be an authorized distributor for Yokohama tires in Florida, Oregon and Washington. TGI will also offer the Yokohama Advantage Program for retailers.

On June 30, American Tire Distributors Inc. (ATD) issued an open letter to the tire industry, which reads as follows:

“ATD now operates with a clean balance sheet, sufficient liquidity and the full endorsement of our ownership group,” the company said.

Photo: ATD

“To Our Industry Partners, Customers, and the Tire Community, Over the past several months, American Tire Distributors has navigated one of the most significant transitions in our company’s history. Recent shifts in our vendor portfolio mark a significant moment in our journey. We recognize the impact these changes have had on our customers, partners, and the industry — and we meet this moment with transparency, urgency and resolve.

“Today, we stand united and forward-looking, backed by a world-class team, a resilient and fully supportive vendor network, a committed ownership group and a board of directors that believes deeply in our mission. Together, we are not simply responding — we are rebuilding, reinvesting, and redefining our role in the marketplace.

“ATD now operates with a clean balance sheet, sufficient liquidity and the full endorsement of our ownership group. This financial flexibility allows us to invest in people, infrastructure and innovation at a time when others are constrained. Our strategy includes working hand-in-hand with all of our loyal manufacturer partners to fill product voids with compelling, high-quality offerings across every segment. These partners appreciate the important role ATD plays in our industry, for customers and vendors alike.

“Our service model will remain unchanged and centers on operational precision. We are doubling down on inventory availability, service reliability and order accuracy — areas where we have and will lead. Our investments in logistics technology, automation and data analytics will enable us to continue serving customers faster and smarter than ever before. Every decision we make begins with the customer in mind. We are investing in field teams, tools and programs designed to help our customers grow their businesses — because our success is measured by theirs.

“We welcome the questions and undestand why they are being asked. We’re confident in our answers and the solutions we’re shaping, grounded in performance, strengthened by partnerships and driven by perseverance. This is not a return to business as usual. This is a reset of who we are and how we lead.

“To our loyal and valued customers: Your resilience, trust and entrepreneurial spirit define this industry. We are here to help you grow and thrive — with better service, better programs and better alignment. We will continue to earn your business each day, product by product, delivery by delivery.

“To our Tire Pros franchisees: You are a vital part of our future. We remain fully committed to supporting your businesses with a stronger platform, more integrated resources and an enhanced customer value proposition.

To our vendor-partners: We will be the distributor who delivers volume, value, growth and long-term alignment. To our team: We’ve built a culture defined not by adversity, but by how we rose from it. Stay proud. To the press and industry analysts: This is a pivotal time for ATD. What happens next will be defined not by recent events, but by the strength of our response and the power of our partnerships. We are not retreating, we are accelerating. This is a bold reset grounded in operational excellence, customer focus and financial strength. With the support of our team, partners and stakeholders, we are building something better. More focused. More flexible. More committed to helping our customers succeed than ever before.”

No matter how challenging your needs, AGRIMAX TERIS is your best ally for all harvesting operations. This radial tire actually combines extraordinary traction and high load capacity with outstanding stability. Thanks to its special compound, the reinforced shoulder and bead, AGRIMAX TERIS provides a high level of puncture resistance as well as great handling and driving comfort.

AGRIMAX TERIS is BKT’s response for combined harvesters providing best performance without damaging your crops.

Office: (+1) 330-836-1090

Southern Tire Mart at Pilot (STMP) added fi ve locations during the second quarter. They are located in Red Oak, Texas; Austinburg, Ohio; Emlenton, Pa.; Limon, Colo.; and Wichita Falls, Texas. The STMP network includes more than 80 locations, with plans to reach 100 stores by the end of 2025.

Straightaway Tire & Auto’s Victory Tire & Auto brand has acquired Pod’s Complete Care, its 19th location in the greater Minneapolis, Minn., market. The eight-bay shop in White Bear Lake has the potential to expand its footprint and team for additional business.

The Wheel Group (TWG) named Wade Kawasaki its new CEO, effective Aug. 1. Kawasaki has served as the distributor’s executive chairman since 2022, working with TWG’s leadership team and financial partners to help shape the firm’s strategy. Kawasaki previously served as president and CEO of The Coker Group.

S&S Tire Inc.’s core leadership team recently got together at the University of Kentucky’s football stadium to focus on one of the Lexington, Ky.-based dealership’s core values: developing and supporting employees. Key leaders representing the company’s wholesale, commercial, sales and operations functions spent the day reviewing metrics and creating best practices.

Grand Rapids, Mich.-based GreatWater 360 Auto Care has acquired Hubbell’s Auto Repair in Marion, Iowa, and also opened a Belden’s Automotive & Tires store in San Antonio, Texas. Hubbell’s Auto Repair will retain its name, but will have access to tools, training, technology and GreatWater’s peer network support.

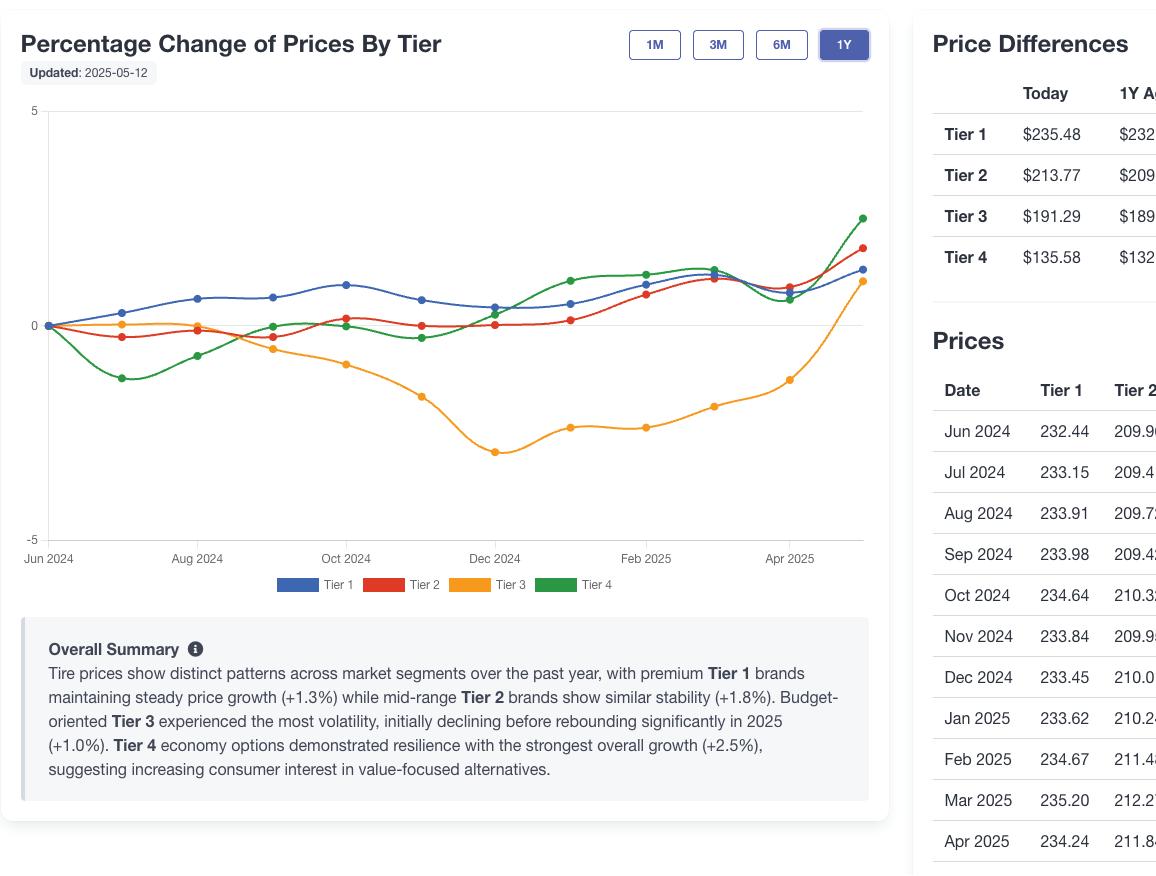

Fitment Group has launched a new, web-based tire price trend dashboard. e dashboard is available now “at no cost to industry professionals and interested users,” according to Fitment Group o cials.

“ is dynamic platform is designed to deliver insights into retail tire pricing trends across the United States, o ering a powerful data driven resource during a time of rapid market change.

“ e dashboard provides users with data-driven views of tire price uctuations over four key time intervals: the past 12 months, six months, three months, and one month. Drawing from a curated subset of more than 11 million unique online advertised price points, the platform updates weekly to ensure timely and accurate tracking.

“Users can explore pricing trends by popular tire sizes, leading brands, and tiered segments, allowing for easy comparative analysis and insights.”

To further enhance usability and interpretation, Fitment Group has integrated articial intelligence-generated summaries into the platform. “ ese summaries provide high-level overviews and key takeaways within the three main segmentation categories, helping users quickly interpret complex data patterns.”

“Fitment Group has been monitoring and analyzing retail tire prices for over a decade,” says J.P. Brooks, chief revenue o cer at Fitment Group. “In light of current economic uncertainties, we wanted to give back to the industry by o ering a resource that helps businesses stay informed and responsive to shi ing market dynamics.”

Users of the Fitment Group’s new dashboard can follow pricing trends by tire size, tire brands and/or product tiers.

Hankook Tire America Corp. announced a number of executive leadership changes across its sales and marketing organizations.

Kyuwang (Ken) Cho has been named senior vice president of North America marketing, transitioning from his dual role overseeing PC/LT sales and marketing. Previously, Cho served as vice president of global sales for Hankook Tire in Korea.

K.C. Jensen has been named vice president of U.S. PC/LT sales, expanding his responsibilities from the Western region to a national scope. Jensen joined Hankook in 2018 and “has been instrumental in leading strategic initiatives and enhancing growth strategies in the U.S. market,” according to Hankook o cials.

Mark Roe returns to Hankook as vice president of U.S. TBR sales, including supervision of the company’s replacement and OE sales team. Previously, Roe held leadership positions at American Omni Trading Co., Hankook and, most recently, was vice president of sales at Ralson Tire North America.

“ ese leadership appointments re ect Hankook’s strong momentum in North America,” says Rob Williams, president of Hankook Tire America Corp.

The new Radar Dimax All Weather tire from Omnisource will be available exclusively through www. TireRack.com. The tire’s lineup covers passenger cars, crossovers and SUVs and fits wheels ranging from 14 inches to 18 inches.

Bridgestone Retail Operations LLC plans to open its first Firestone Complete Auto Care tire and automotive service center in the state of Maine by mid-August. The new store in Biddeford is designed to offer customers a modern service, including digital displays and new automotive technologies.

Turbo Wholesale Tires LLC has launched an all-inclusive rewards program under its Lexani brand for the Lexani, Lionhart and Rolling Big Power tire lines. The rollout of the program includes LexaniShop. com, where each brand’s literature, point-of-sale materials and apparel are available and redeemable with program points.

Fountain Tire has expanded its retreading operation after acquiring the Benson Tire retread plant in London, Ontario. The facility spans 20,000 square feet and has the capacity to manufacture more than 30,000 retreads annually. It’s Fountain Tire’s fifth retread facility.

Yokohama TWS’ Interfit material handling tire and wheel services business has acquired Chicago, Ill.-based Industrial Tire Solutions (ITS). Founded in 2006 by Mike Pollini and the late Charlie Cohen, ITS provides on-site tire fitment.

Joel “Jody” Hickman, co-founder of Oak Hill, Ohio-based H&H Industries, died on July 20 at the age of 74.

Les Schwab Tire Centers Inc. has acquired Staley’s Tire & Automotive, a two-location dealership based in Billings, Mont. The acquisition gives Les Schwab three stores in Billings.

“Les Schwab Tires started in a small town in 1952 and communities like Billings have helped us get to be the company we are today,” says Matt Campbell, Les Schwab area manager.

“Our commitment to customer service is grounded in our core values of honesty and dedication to the communities where we live and work. We are excited to carry forward the 40-year legacy of Staley’s Tire & Automotive and continue serving the Billings area.”

Staley’s Tire & Automotive opened in 1985. The family-owned business ran a commercial tire center on South Frontage Road in Billings and a retail outlet located on Central Avenue. Together, the stores employ 26 people, all of whom are expected to stay with Les Schwab.

“In preparation for the official store opening today, July 28, both locations underwent light conversion updates,” say Les Schwab officials. “The Central Avenue location received a modest remodel ahead of the opening, with a full renovation planned for 2026. The South Frontage Road store also saw light upgrades, with a comprehensive remodel scheduled for September.”

“We’re thrilled to join the Les Schwab Tires family and gain the resources to better serve our customers and community,” says Harry Staley, founder of Staley’s Tire & Automotive. “That’s been our mission for more than four decades and we see a real alignment between our values and Les Schwab’s commitment to small-town service that puts the customer first.”

Houston, Texas-based Beasley Tire Service has named Michael Beasley its new president in a move that will support the dealership’s growth plans.

“Michael began his career at Beasley Tire at the age of 13, working during the summers and on weekends,” say Beasley Tire officials. “After receiving his business degree from Sam Houston State University in 2003, Michael took on the role of sales manager. For the last 15 plus years, Michael has been the vice president and COO of the company.

“As president, Michael will assume all responsibilities for the daily operation of the company, continuing to lead the company alongside his father, Bob Beasley, who will retain the position of CEO.”

Michael represents the third generation of the family business, which was founded by E.B. Beasley Sr. in 1968.

“Beasley Tire has grown from a single location in 2005 to commercial/retail locations covering central and southeast Texas.”

The dealership also is a Michelin retreader.

The Tire Industry Association (TIA) has opened voting for its 2025-2026 board of directors election. Five seats are available for this year’s board — four for a three-year term and one for a two-year term. Two incumbents are among the nine candidates on the ballot. TIA members may cast their votes by mail-in ballot or online at TIA’s website, www.tireindustry.org. Voting will close on Sept. 1, 2025.

Relevant statistics from an industry in constant motion

27.1%

Share of service shops in 2025 with posted labor rates below $100 an hour

Source: IMR monthly repair shop surveys

Photo: 15903754 © Linda Johnsonbaugh | Dreamstime.com

$435 BILLION

Forecasted amount consumers will spend to repair and maintain their vehicles this year

Source: Auto Care Association and MEMA Aftermarket Suppliers 2025 forecast Photo: 123082584 © Mbr Images | Dreamstime.com

$4,275

7,110

Number of outlets operated by the ve largest independent tire dealerships in the U.S.

Source: 2025 MTD 100

Photo: Discount Tire

e average added cost of tari s on each new vehicle sold

Source: J.D. Power July 2025 forecast Photo: 297466335 © Bill H | Dreamstime.com

172,731

Total number of automobile technicians who are ASE-certi ed

Source: National Institute for Automotive Service Excellence

Photo: AAPEX

ENROLLMENT IS NOW OPEN!

LANDSAIL TIRES IS EXCITED TO ANNOUNCE THE LAUNCH OF THE NEW ELYTE ASSOCIATE DEALER PROGRAM™.

INDEPENDENT TIRE DEALERS WHO SIGN UP NOW AND PURCHASE FROM AN AUTHORIZED LANDSAIL DISTRIBUTOR

CAN EARN UP TO $3 PER TIRE, SHOWCASING OUR COMMITMENT TO REWARDING YOUR DEDICATION AND PARTNERSHIP WITH THE LANDSAIL BRAND.

No opening order required - just sign up and start earning!

PAYOUTS ARE AS FOLLOWS

Level 1: Minimum 48 units - $1.00/tire

Level 2: Minimum 120 units - $2.00/tire

Level 3: Minimum 240 units - $3.00/tire

ANNUAL PAYOUT POTENTIAL

Level 1: $192

Level 2: $480

Level 3: $2,880+

DISTRIBUTORS

If you want to sell Landsail Tires and offer ELYTE rewards to your dealers, contact us today on our website at LANDSAILTIRES.COM/dealer-inquiries.

John Healy By

ealers indicate that retail sellout trends were up in June, which marks an unexpected improvement compared to recent months. It was a small gain — of 1.7% — but it’s an improvement nonetheless from recent declines, including a 1.4% drop that was reported in May. Trends have been flat to slightly down compared to the second quarter of 2024.

Looking closer at volume on a regional basis, the Northeast and Midwest both saw mid-single-digit volume growth, while other regions saw positive trends, too. The Mid-Atlantic region reported the weakest numbers, with a decline of 1.3% year-over-year. From our view, it appears the onset of summer drove a slight increase in consumer tire replacement.

Miles driven also took a turn into positive territory in June, with trends up by low single digits. That follows slightly negative numbers in May. But the early look at July shows the month got off to a slow start, with the first week down 1.5% against a soft comparison of 1.8% growth from July 2024. So even while demand may have firmed up a bit, we note that increases in tire pricing are also likely shifting the landscape in buyer behavior.

Dealer feedback does note that tire prices are starting to inch higher against tariffs, which are seen as the main cause of price increases. Dealers say those tariffs are further accelerating consumer

trade downs to more affordable, lowertier tire brands.

Even while dealers note increasing tire prices, the basket of raw materials needed to build a basic replacement tire dropped 3.3% during June and increased 1.3% from May levels. We note this decline follows a 2.6% year-over-year average increase during the first quarter of 2025. The results so far add up to a 4.2% year-overyear decrease for the second quarter and a sequential 3.9% drop from the first quarter.

Oil prices have shifted the most dramatically, falling 13.8% year-over-year in June. Natural rubber costs dropped 3.1%, while carbon black prices fell 6.4% year-over-year and tire fabric/cord costs dipped 6.5%. Synthetic rubber was the one input to experience a price hike, with a 1.65% increase in June.

As we’ve noted previously, given the price acceleration of 2024 and the rapid deceleration in 2023, it’s not surprising to see raw material prices moderate on a year-over-year basis. We continue to see 2025 as a year of ongoing moderation, with some potential declines in mix as the index laps year-over-year increases. The big picture points to a welcome shift toward stability for the industry.

Dealer commentary suggests consumer demand for passenger and light truck

replacement tires was up low single digits in June, compared to year-ago comparisons. Forty-four percent of our independent tire dealer contacts reported positive demand trends, an improvement from the 25% who saw increases in May. And while consumer deferment has generally persisted, June saw a modest uptick in tire replacements as favorable weather conditions encouraged some buyers to move forward rather than delay the purchase.

Of the consumers who were purchasing, we do note that buyers continued to largely prefer tier-three tires to tier-one and tier-two options.

Looking at the best and worst performers in our replacement tire survey from a mix point of view, tier-three brands were once again the most in-demand at the retail level. This marks the 13th month out of the last 14 where tier-three tire brands were the most sought after in the consumer market.

Historically, tier-two tire brands have been the most in demand in our decade of surveys. But in June, tier-two tires were in second place and tier-one products were at the bottom of our rankings. Interestingly, a year ago, we were in the same position, with both May 2024 and June 2024 shoppers picking the same mix. We continue to believe that the consumer in the market right now is looking for high-value tires at the lowest possible cost. Consumers wallets’ are stretched thin and tariffs are still weighing heavily on their minds and purchasing decisions. ■

John Healy is a managing director and research analyst with Northcoast Research Holdings LLC, based in Cleveland, Ohio. Healy covers a variety of subsectors of the automotive industry. If you would like to participate in the monthly dealer discussions, contact him at john.healy@ northcoastresearch.com.

Every tire gets balanced. What are you using? Choose the perfect weight. Choose Perfect.

By Mike Manges

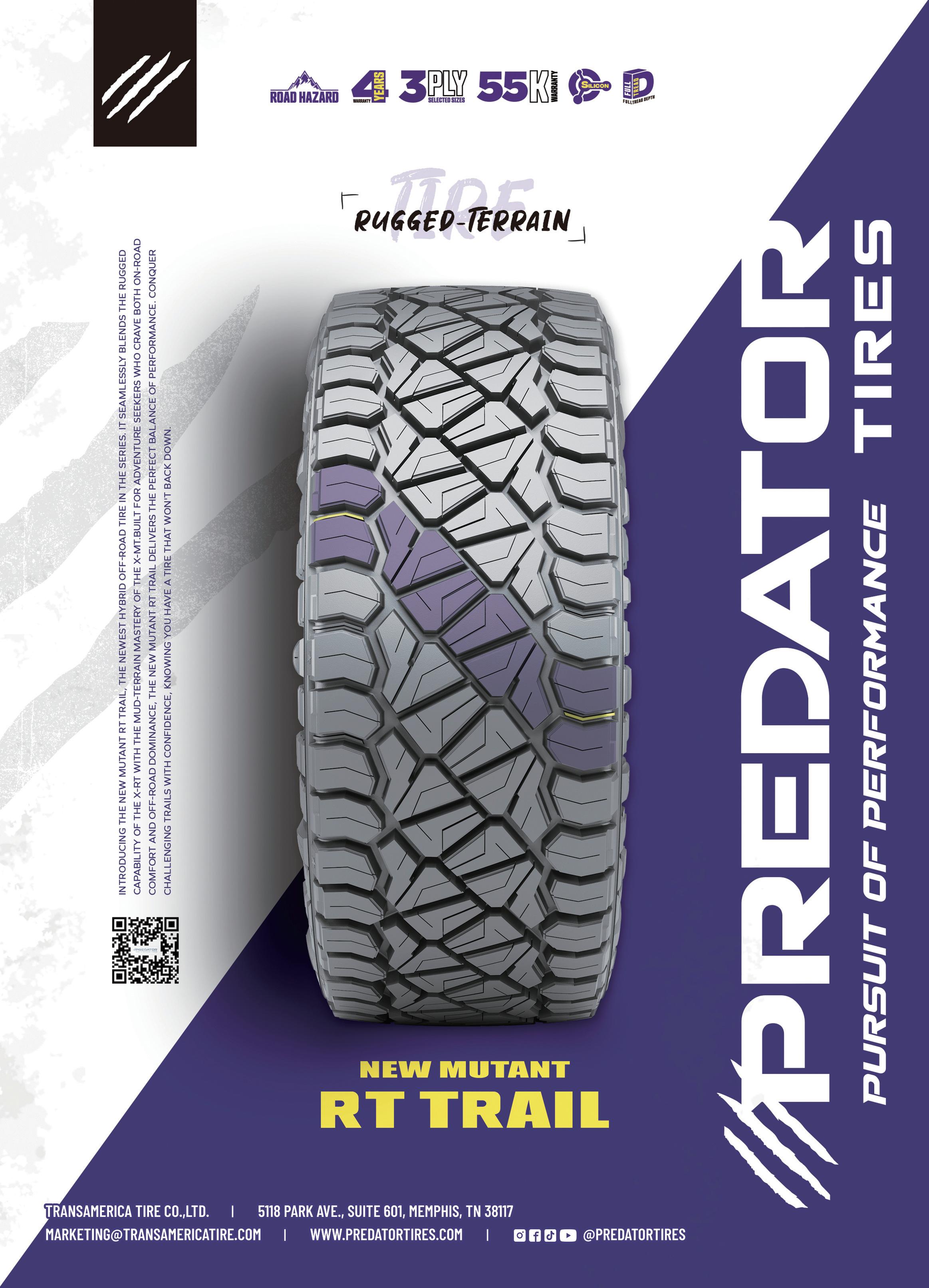

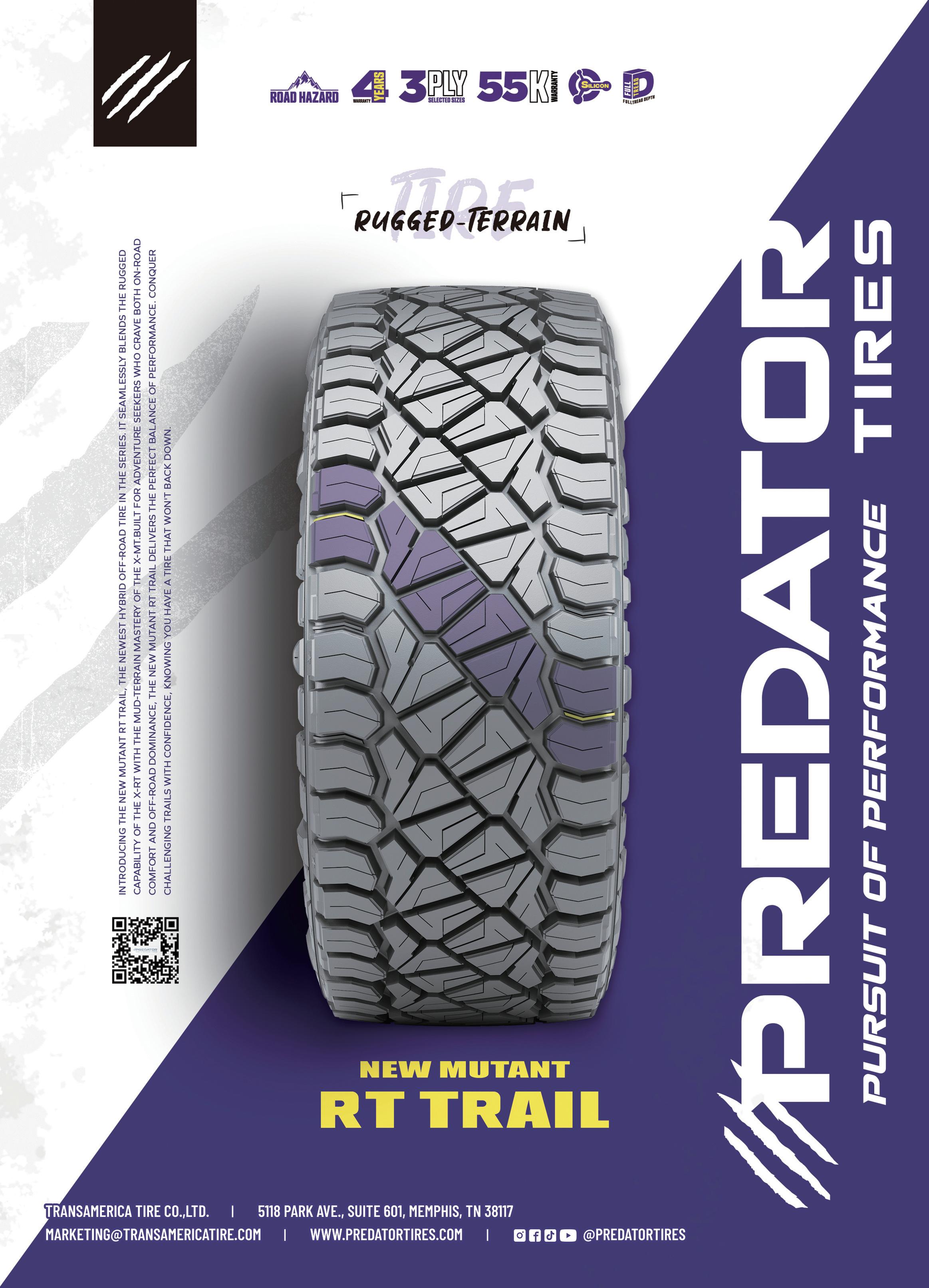

Rugged-terrain (R/T) is one of the fastest-growing segments in the light truck tire category. That trajectory is expected to continue as more consumers seek the blend of attributes that R/T tires provide, according to tire manufacturers and other suppliers.

“The rugged-terrain — or R/T — segment continues to be a distinct and growing category of the light truck tire market,” says Brandon Stotsenburg, vice president, automotive division, American Kenda Rubber Co. Ltd. “When the segment was initially developed, it represented growing hybrid light truck tire applications bridging the traditional A/T (all-terrain) segment and the more distinctive M/T (mud-terrain) segment intended for offroad use with more friendly on-road noise and ride. Many

I’ve been running the Nexen Roadian ATX on my Pro Spec truck for years, and they’ve never let me down. Whether it’s hardpack, deep ruts, or flying through the air over 150ft, the traction and reliability stays consistent lap after lap. They’re built tough and take the punishment of shortcourse racing, and that allows me to put these tires on top of the box every race weekend.”

Chris Van Den Elzen | VDE Racing

“The rugged-terrain — or R/T — segment continues to be a distinct and growing category of the light truck tire market,” says Brandon Stotsenburg, vice president, automotive division, American Kenda Rubber Co. Ltd.

drivers wanted to have plus-size otation applications o ered by traditional M/T tires, while up tting improved and distinguishing wheels covering sizes from 17 inches to 20-inch-plus diameters.”

He says the R/T segment’s total volume is only an estimate, “as USTMA (U.S. Tire Manufacturers Association) has not recognized it for unknown reasons, despite the many tires labeled R/T or X/T (extreme-terrain) available for sale.

e better R/T tires are capable in traditional M/T o -road environments and are taking share from the M/T segment due to the better ride and noise in crossover applications.”

American Pacific Industries Inc. (API) believes the R/T segment “is gaining traction within the overall LT market,” says Dan Cohen, XComp Tires director of motorsports and marketing, API. “Consumers are looking for the ultimate look, without sacri cing ride quality or mileage. Years before, end users had to choose between an all-terrain or a mud-terrain (tire). One featured the ability for light o -roading without aggressive looks, while the other enhanced the ability to go wherever you wanted, but (o ered) limited tread life.

e R/T tire has opened up a whole new segment that gives drivers the best of

both worlds. You are now seeing OE vehicles equipped with R/T tires due to consumer demand.”

While API continues to “see larger volume demand” for A/T and M/T tires, “I do believe this will change in the following calendar year,” explains Cohen.

Steven Liu, vice president, product development, American Tire Distributors Inc., says the R/T segment is growing because of the “versatility an R/T tire brings to the table. R/T tires provide optimal o -road traction and on-road comfort, taking these two highly desired elements from an A/T and M/T tire, along with the aggressive appeal many users seek. e R/T segment may have started out as a niche product, but over time the segment has grown signi cantly with the LT tire market and beyond, as we are seeing more available o erings in CUV/ SUV sizes in a R/T design.

“No o cial data shows whether or not the R/T segment is bigger than the other product segments” in the LT category “in terms of volume,” Liu notes. “However, it is important to recognize the growth rate of the R/T segment has been at a very consistent level, year-over-year, on an upward trajectory. With that being said, it is our opinion there’s been a cannibalization e ect, to a certain extent, the R/T tire is

“R/T tires offer consumers a hybrid option between the capabilities of A/T tires and the more extreme M/T tires,” says Iris Ocasio, product manager, consumer

“The hybrid category of LT tires continues to expand,” says Michael Mathis, president of Atturo Tire Corp., adding that he looks at the R/T segment “as hybrid, meaning a blend of M/T and A/T pattern designs.”

Photo: Atturo Tire Corp.

having on the A/T, H/T (highway-terrain) or M/T segments. We believe the driving factors of this growth include OE fitments and market validation over an extended period of time. Additionally, much of the branding and social media investments early on when the product segment was first introduced are now paying dividends. We’re noticing consumers who may have traditionally bought a set of tier-one A/T or M/T products are now turning to an R/T tire alternative in the value segment.”

“The hybrid category of LT tires continues to expand,” says Michael Mathis, president of Atturo Tire Corp., adding that he looks at the R/T segment “as hybrid, meaning a blend of M/T and A/T pattern designs. R/T has become a common name for models in the hybrid category and is synonymous with X/T, in our view. What was originally looked

“Consumer demand has shifted toward R/T, which offers the right combination of aggressive styling and comfort for daily driving,” Josh Benson, vice president, First Choice Sourcing Solutions.

Photo: First Choice Sourcing Solutions

“While the A/T and R/T segments are currently close in volume, the R/T market is quickly catching up and in many cases outpacing A/T growth,” says Andy Grant, marketing manager, Fury Tires.

Photo: Fury Tires

“In our product lineup, the R/T segment has been steadily growing over the past 10 years,” says Randy Tsai, senior vice president, Greenball Corp.

Photo: Greenball Corp.

at as just a milder alternative to an M/T for pickups and Jeeps has grown dramatically. In our data, hybrid sales have surpassed the M/T segment. It still lags A/T and H/T as those have far more OE replacement-type applications. e hybrid category is growing because of its versatility. Consumers love the combination of aggressive looks, performance and drivability. is is leading them to use this type of tire where they would never have considered an M/T.

“We find consumers who are wellserved with a hybrid pattern are a er a combination of these attributes: aggressive, o -road style; highway and general ride quality ... good all-season traction; actual o -road traction for mild to moderate use; (and) longer tread life,” says Mathis.

“ e R/T segment is gaining traction within the overall LT tire market,” says Iris Ocasio, product manager, consumer replacement strategy, Bridgestone Amer-

icas Inc. “R/T tires o er consumers a hybrid option between the capabilities of A/T tires and the more extreme M/T tires. is allows consumers to get robust o -road capability without the full tradeo s o en associated with an M/T tire. Additionally, there’s a growing aesthetic preference for the rugged, assertive look that R/T tires provide.

“In the hierarchy of market volume for these segments, H/T tires remain the largest segment, especially when considering the inclusion of P-metric sizes that cater to a wide range of light trucks and SUVs. Following H/T, the order is A/T, then R/T and nally, M/T tires, in terms of segment size by volume. However, we are observing a trend where the R/T segment is experiencing growth due to both changing consumer preferences and the reclassi cation of some M/T styles into the R/T category,” says Ocasio. “ is is driven by recent advancements in tire

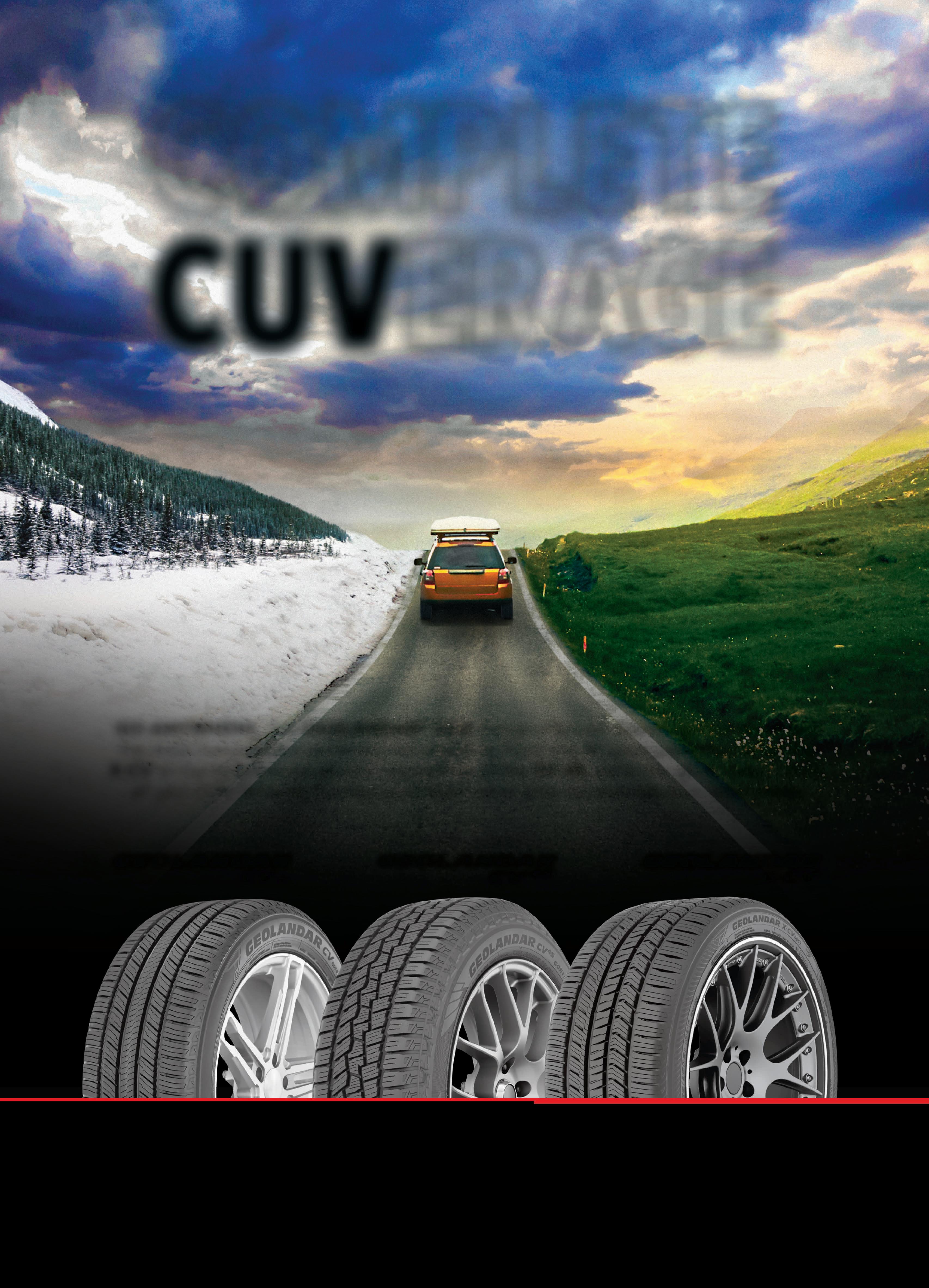

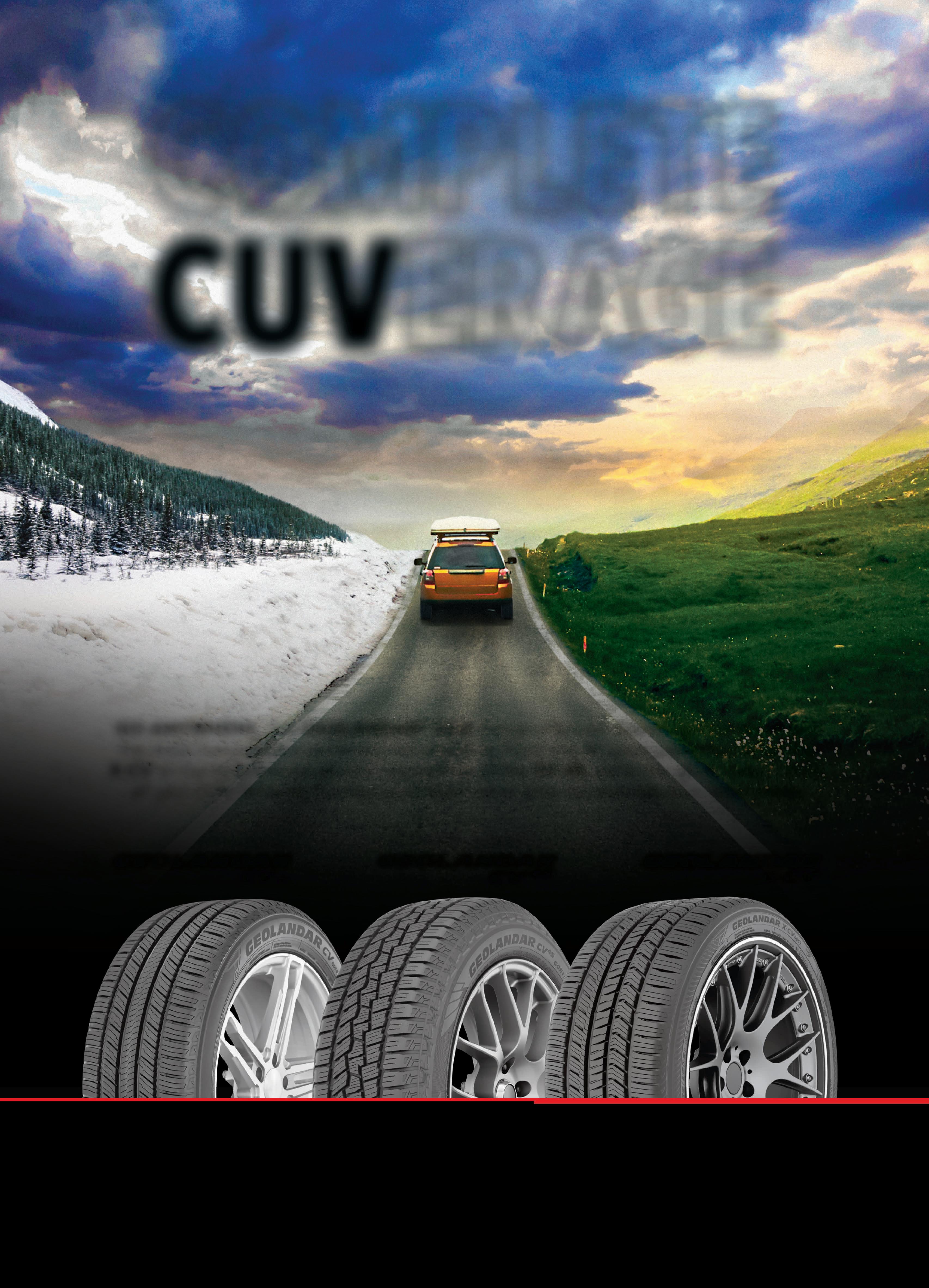

GO ANYWHERE. The GEOLANDAR® CUV lineup offers all-season performance and the most comprehensive fitment list available. From the W-rated performance of the X-CV to the severe snow service capabilities of the CV 4S, we’re the go-to resource for all your CUV fitments. Contact your Yokohama sales representative to learn more.

technology that have helped minimize the traditional trade-offs associated with aggressive off-road tires, particularly in noise reduction and ride comfort. Tire manufacturers’ commitment to meeting consumers’ expectations for both off-road performance and comfort is a key driver for the expansion of segments like R/T.”

Josh Benson, vice president, First Choice Sourcing Solutions, says the R/T segment grew last year “in sellout and continues to gain share in 2025. Consumer demand has shifted toward R/T, which offers the right combination of aggressive styling and comfort for daily driving. R/T volume remains smaller than A/T and H/T, but has overtaken the M/T category in size. Growth is being driven by new vehicle fitments and rising consumer adoption with buyers seeking real value in the R/T’s hybrid terrain versatility.”

“The R/T or hybrid-terrain tire segment has been gaining strong momentum within the LT market over the last several years,” says Andy Grant, marketing manager, Fury Tires. “Customers increasingly want the aggressive, off-road-ready look of an M/T tire, but with the comfort and quiet ride of an A/T or H/T tire. The R/T tire delivers

that perfect middle ground. We’re also seeing this trend reflected in the market. Most major brands now offer multiple R/T-style tires, signaling growing consumer demand. This hybrid design is ideal for truck owners who want capability and style without sacrificing on-road drivability.

“While the A/T and R/T segments are currently close in volume, the R/T market is quickly catching up and in many cases outpacing A/T growth. Several years ago, most brands only had one R/T offering. Now they often carry two or three. This expansion reflects a broader shift where some brands are even beginning to phase out parts of their A/T lineup in favor of R/Ts. The key drivers behind this growth include the aggressive styling and performance appeal of R/T tires, combined with better ride quality than M/Ts and more visual impact than traditional A/Ts. It’s a tire that checks more boxes for modern truck owners.”

“All indicators point to the R/T market already outpacing the M/T market by around 50%, taking share mainly from M/T, but also from the A/T segment,” says David Poling, vice president, research and development and technical,

“The consumer looking for R/T tires usually wants aggressive looks,” says Brandon Sturgis, BFGoodrich off-road product manager, Michelin North America Inc.

Consumers “seek R/T tires that combine an aggressive aesthetic with long-lasting performance,” says Ken Coltrane, vice president of product development and marketing, Prinx Chengshan Tire North America Inc.

Photo: Prinx Chengshan Tire North America Inc.

“R/T is the fastest-growing category in the LT segment,” says Jared Lynch, vice president of sales, corporate accounts, PLT, North America, Sailun Tire Americas.

Photo: Sailun Tire Americas

Giti Tire (USA) Ltd. “For the foreseeable future, the H/T and A/T (markets) will remain much larger than R/T, in part due to high volume of OE tments. We could see future o -road OE packages tted with R/T tires as the segment continues to grow in popularity. An R/T tire o ers a more aggressive appearance compared to a normal A/T tire and consumers are increasingly looking for that upgrade, but previously they didn’t want to go all the way to an M/T tire due to noise and road manners trade-o s. Conversely, the R/T tire o ers a consumer who had previously used M/T tires the opportunity to maintain the extreme appearance while o ering them improved noise and road manners. e magic behind a great R/T tire is making it look very similar to an M/T (with) excellent o -road capabilities (and) the on-road manners of an A/T.”

Jonathan omas, director, category strategy and planning, Goodyear Tire & Rubber Co., says the growth of the R/T segment is being driven “by evolving consumer demands for tires that combine the aggressive o -road capabilities and looks of M/T tires with the on-road comfort and versatility of A/T options. As more consumers use their trucks and SUVs for both work and recreation, they’re seeking tires that can con dently handle diverse conditions, from job sites and trails to highways and city streets.”

In addition, as more consumers “seek out vehicles and accessories that support an active, o -road lifestyle, the R/T segment is expected to continue its upward trajectory.

e R/T segment is also bene tting from OEM trends, with more rugged trims and o -road packages being o ered directly from the factory, increasing demand for tires that match those capabilities. As more OEMs introduce rugged trims and adventure-ready models, the demand for R/T-style tires continues to rise, creating a valuable opportunity for dealers to capture sales in both the replacement and upgrade markets.”

“We’ve seen in the past few years that the R/T segment of the market has signi cantly grown,” says Randy Tsai, senior vice president, Greenball Corp. Consumers want “the best of both worlds: a smooth, comfortable ride for everyday driving, but the style of an aggressive tire that can be taken o -road on the weekends. Essentially, an R/T tire sits right between an A/T and M/T tire.

R/T gives consumers “various options,” says Eric Zhang, product specialist, Sumitomo Rubber North America Inc., which makes Falken brand tires.

“In our product lineup, the R/T segment has been steadily growing over the past 10 years,” says Tsai. “As we have added more R/T product lines, we do see it cannibalize some sales from the M/T segment. e R/T market lls a segment of the market where M/T tires and mild, highway-oriented A/T designs didn’t quite t the bill of what consumers wanted.”

One of the “major driving forces” behind the growth of the R/T tire segment has been the popularity “of lightduty trucks among U.S. consumers,” says Jin Han, product manager, Hankook Tire America Corp. “Combine this with growing consumer interest in getting o the beaten path and taking their vehicles on greater adventures ... (and) there has been a positive in uence across all oroad-oriented tire products.

“Within the o -road segment, rugged-terrain — which some customers might refer to as extreme-terrain or X/T — products o er a nice balance between more road-tempered A/T products and the top-of-the-o -road food chain, as with M/T o erings. is has resulted in the common referral of R/T products as ‘tweeners’ that will be at home in various o -road driving environments, such as loose dirt, mud, gravel and rocks, while still retaining a considerable degree of on-road comfort and handling. is has led many consumers, especially in the overlanding community, to choose a rugged-terrain product that gives them con dence when venturing o -road, in

SIZES: 15, 17, 18, 19, 20, 21

TREAD DEPTH: 8-10

SPEED INDEX: W, Y

ASPECT RATIO: 25-50

UTQG: 200 AA A

60,000 MILE WARRANTY

SIZES: 15-20, 22, 24, 26

SPEED RATING: H, V, W, Y UTQG: 420 AA A

55,000 MILE WARRANTY (60,000 P METRIC SIZES)

SIZES: 15-20, 22

SPEED RATING: H, S, T, V LOAD RANGE: E

55,000 MILE WARRANTY (60,000 P METRIC SIZES)

SIZES: 16-18, 20, 22

SPEED RATING: H, Q, R, S, T LOAD RANGE: E, F

45,000 MILE WARRANTY

SIZES: 16-18, 20, 22, 24, 26

SPEED RATING: H, Q LOAD RANGE: E, F

M&S RATED

SIZES: 15-18, 20, 22, 24, 26

SPEED RATING: P, Q LOAD RANGE: C, D, E, F

R/T tires’ “aggressive appearance and performance make them a sought-after option,” says Shawn Denlein, president of sales and marketing, Kumho Tire U.S.A. Inc.

Mike

assistant

addition to highway travels back to civilization a er their adventure concludes.

“Despite growing interest, the R/T segment remains relatively niche compared to more well-established lines, such as A/T products,” says Han. “However, we expect the R/T segment to continue its trajectory as a fast-growing and increasingly popular subset of o -road tire o erings.”

“Market demand is continuously diversifying, according to market trends,” says Shawn Denlein, president of sales and marketing, Kumho Tire U.S.A. Inc. “New needs emerge from consumer demands and gradually gain market traction upon introduction. As R/T has not yet been categorized as a distinct segment by USTMA, most of its demand is currently categorized under all-terrain, so it’s challenging to identify the exact growth rate in demand” for R/T products. “However, as existing all-terrain products are being tailored to on-road driving performance, a consumer group that emphasizes o -road traction performance, as well as on-road driving performance, is emerging. e continuous introduction of new R/T products into the market demonstrated this growth.

“While the R/T market currently isn’t larger than the H/T and A/T segments, its growth rate surpasses both. However, due to its inherent characteristics, the R/T segment is steadily encroaching on demand for both A/T and M/T tires. R/T tires appeal to truck and SUV owners who require more o -road traction than A/T products o er. eir aggressive appearance and performance make them a sought-a er option.”

“Rugged-terrain and other, similar tire segments are expanding, as there’s greater consumer demand for aggressively styled tires with knobby shoulders and tough-looking sidewalls,” says Brandon Sturgis, BFGoodrich o -road product manager, Michelin North America Inc. “Consumers always want long (tire) life and even tread wear ... and the consumer looking for R/T tires usually wants aggressive looks, even if they don’t take their vehicle o -road.”

Jay Lee, product planning director, Nexen Tire America Inc., says that while R/T “is not yet larger in volume than A/T and H/T,” the segment “is rapidly growing and is challenging the dominance of the traditional segments. Industry

JIM FLECKNER

Tire Discounters needed a complete redesign of their top off road tire and it had to be on shelves for fall selling season. We sourced options, reviewed designs, fast-tracked engineering and even got customer performance data. In two months, the tire made it to market just in time for their fall rush.

YOUR CHALLENGE?

TBC Corp. has seen “heavy growth in the R/T segment,” says Eric Sweigart, the company’s vice president, value and proprietary brand management.

“The growth of R/T tires is primarily driven by their hybrid design, offering true, dual-purpose performance,” says Roman Racia, marketing director, Transamerica Tire Co. Ltd.

experts acknowledge that R/T remains smaller than traditional A/T, even as it gains share. e USTMA hasn’t fully recognized R/T as its own category yet, indicating that it’s still emerging in ocial volume data.”

“Demand is being fueled by the popularity of lifted trucks” and other factors, says Vahe Tchaghlassian, vice president of sales and marketing, Wholesale Tire Distributors.

However, “dealers report that R/T sales are growing at the expense of all-terrain and mud-terrain tire sales. In select tire sizes, R/T models have even begun outselling corresponding M/T models. Consumers are increasingly turning to R/T tires for their unique blend of oroad capability and on-road comfort and they have (a) clear expectation,” including aggressive looks, balanced performance, “on-road re nement,” durability, load capacity and “all-purpose versatility.

“While exact volume numbers aren’t public yet due to category ambiguity, insiders describe the (R/T) segment as experiencing double-digit, year-over-year growth and refer to ‘exponential uptake’ for key models,” says Lee. “Growth is expected to continue taking share from both the A/T and M/T segments, especially as R/T gains traction and expands availability.”

“The R/T segment continues to gain traction within the overall LT tire market,” says Todd Bergeson, senior manager, product planning and technical services, Toyo Tire U.S.A. Corp.

Toyo Tire U.S.A. Corp.

“ e R/T segment has gained signicant traction in the LT tire market,” says Ken Coltrane, vice president of product development and marketing, Prinx Chengshan Tire North America Inc.

“R/T has established itself as a strong performer in the LT segment, driven by its proven durability, balanced performance and positive consumer feedback.” He adds that consumers “seek R/T tires that combine an aggressive aesthetic with long-lasting performance.”

Jared Lynch, vice president of sales, corporate accounts, PLT, North America, Sailun Tire Americas, says the R/T segment is gaining “signi cant momentum as more truck and SUV owners seek tires that offer a blend of bold, aggressive styling and capable o -road

Revolutionize your tire and wheel service center with the ultimate pairing of precision and efficiency. Our combos redefine the standard, bringing you cutting-edge features without the hefty price tag. Elevate your services, amplify your efficiency, and see a direct impact on your profits. Don’t miss out on this opportunity to upgrade your work shop to the next level of performance. Connect with us at 1-800-253-2363 to speak with our experts or explore our combo offerings at www.bendpak.com. Discover the innovation, efficiency, and satisfaction that only Ranger can deliver – brought to you by BendPak. Tire Shop Package Includes: (1) LS45DS-220V Wheel Balancer + (1) R980DP-220V Tire Changer + (1) Tape Wheel

“The R/T segment has been growing proportionately versus other light truck tire lines for several years,” says Phillip Kane, CEO of Turbo Wholesale Tires LLC.

Photo: Turbo Wholesale Tires LLC

‘While A/T tires remain the largest in volume, R/T is the fastest-growing category in the LT segment. This growth is fueled by a shift in consumer priorities.’

Jared Lynch, vice president of sales, corporate accounts, PLT, North America, Sailun Tire Americas

performance without compromising the on-road comfort and quietness found in A/T products. e growing popularity of adventure-ready vehicles being used as daily drivers is a key factor. Consumers want all-in-one versatility and R/T tires deliver on that promise.

“While A/T tires remain the largest in volume, R/T is the fastest-growing category in the LT segment,” says Lynch. “ is growth is fueled by a shi in consumer priorities. Drivers want a tire that performs well o -road, when needed, but still delivers a smooth, quiet ride the rest of the time. R/T tires hit that sweet spot between form and function, making them especially appealing to lifestyle-focused truck and SUV buyers.”

“ e R/T segment is continuing to gain traction within the overall light truck tire market,” says Eric Zhang, product specialist, Sumitomo Rubber North America Inc. “It has clearly surpassed the market demand of the M/T segment, but not the demand of the much larger A/T segment. e R/T segment is attractive to those looking for more o -road aggressiveness and capabilities than an A/T, but who are not willing to sacri ce the on-road manners, such as tire noise and on-pavement tire life, that drivers enjoy with an A/T.

“Manufacturers can o er R/T patterns in various levels of on-road and o -road performance. ere are some R/Ts that

o er good o -road capability with better on-road manners than a traditional M/T tire and there are R/T tires that offer good on-road manners with elevated o -road capabilities when compared to A/T tires. Some manufacturers refer to these elevated o -road capable A/T tires as ‘extreme A/T’ in their product lines. So the R/T segment can provide consumers with various options, depending on how much on-road or o -road capabilities the consumer is willing to sacri ce.”

TBC Corp. reports that it has seen “heavy growth in the R/T segment,” says Eric Sweigart, vice president, value and proprietary brand management. “R/T tires are available for those weekend warriors who need tires exible enough for everyday driving during the week, but also enjoy exploring off-road on weekends. ey o er a hybrid between A/T and M/T, with the on-road comfort and stability of an A/T tire, without compromising the o -road capabilities expected from an M/T tire. With R/T tires, truck and SUV owners now have an option that looks aggressive, like an M/T, but doesn’t wear out as quickly. Truck enthusiasts who like to customize their trucks with li kits, select plus-size tments and aggressive tread designs are also utilizing R/T tires.”

Sweigart says the R/T segment “remains well-behind the A/T and H/T markets,” but adds that “versatility is a key factor (in) driving R/T tire volume past that of the M/T (segment.) R/T o ers consumers a hybrid option that combines on-road and o -road capabilities without compromising style, comfort or durability. is year, the R/T segment is showing over 9% growth.”

Mike Park, assistant director, market intelligence and pricing, Tireco Inc., says the R/T segment “has been one of the fastest-growing segments within the LT market over the past few years. It’s gaining traction because it o ers the best of both worlds: the o -road capability and aggressive styling of an M/T tire, (plus) ride comfort, road manners and longer tread life. is hybrid appeal aligns with what today’s truck and SUV owners are looking for: versatility, style and performance without compromise.

“The R/T segment is growing at a fast pace,” driven by a variety of factors, including more consumers who are “using their vehicles for both utility and

R/T tires have become “one of the fastest-growing segments in the overall LT tire market,” says Kevin Nguyen, manager of product planning, Yokohama Tire Corp.

Photo: Yokohama Tire Corp.

recreation. e aggressive R/T look has become mainstream, even for vehicles that may never see a trail. We’re seeing more factory builds pushing consumers toward li ed, o -road-capable platforms.

e rise of overlanding, o -road builds and content creation have created aspirational demands for performance both on- and o -road.

“Consumers shopping for R/T tires are looking for aggressive tread and sidewall styling that enhances their vehicles’ appearance,” says Park. Other wants include “durability and strength for oroad use; on-road comfort and quiet ride, especially for daily driving; (and) longer tread life.”

in the R/T light truck segment,” adding that TGI anticipates “tremendous growth (in the R/T segment) in the future and (will) focus our future development activities in this segment.”

“ e R/T segment continues to gain traction within the overall LT tire market,” says Todd Bergeson, senior manager, product planning and technical services, Toyo Tire U.S.A. Corp., but “the R/T segment is nowhere near the volume of the A/T segment, which is the optimal tire for more than 90% of the truck owners out there. e M/T category overall has been gradually declining in volume in recent years. Both A/T and M/T segments remain very relevant and important.”

However, Toyo “is very optimistic about the R/T category. Consumers want an aggressive- looking o -road tire that provides peak performance on and oroad. When considering an R/T category tire, consumers expect an aggressive look with a quiet and comfortable ride.”

“I think within the overall light truck tire market, the R/T segment is still smaller than the A/T segment, but may have surpassed the M/T segment in market share,” says Roman Racia, marketing director, Transamerica Tire Co. Ltd. “ e growth of R/T tires is primarily driven by their hybrid design, offering true, dual-purpose performance. ey’re suitable for comfortable daily driving and can handle challenging o -road adventures on the weekend. For many consumers, it means one tire that ts both lifestyles.”

“If a customer asks for an R/T tire, they’re probably one of two things or both: a rugged look and/or a solid off-road performance,” says Rob Montasser, vice president of Radar Tire, North America, Omnisource.

Photo: Omnisource

“ e R/T segment is the fastest growing segment in the industry,” says Mark Lindsey, chief strategy o cer, Tire Group International LLC (TGI). “Much like allweather tires in the passenger segment, R/T tires deliver superior value due to performance and longevity at a competitive price for everyday drives. And with the rugged aesthetics that were previously only available in niche M/T products, retailers can reach two distinctly di erent consumers with one product segment. While the jury is still out on all-weather for the passenger segment, it is undeniable that we will continue to see rapid growth

“ e R/T segment has been growing proportionately versus other light truck tire lines for several years,” says Phillip Kane, CEO of Turbo Wholesale Tires LLC. “R/T offers a sort of Goldilocks proposition that’s just right for those wanting something more in an A/T and a bit less in an M/T. e R/T almost perfectly bridges the gap between the two, o ering better traction, enhanced durability and a more aggressive appearance than an all-terrain tire, while providing a quieter, cheaper, more fuel-efficient and almost as tough-looking package, but with better road manners than a mud-terrain tire. is ability to have one’s cake and eat it, too, has caused those who would have formerly bought A/Ts or M/ Ts to ock to the newer R/T (segment.)

“For us, the R/T has largely supplanted both A/T and M/T volume by an order of magnitude for the simple reasons that

many A/T buyers can — for not much more money — have a tire that not only looks tougher and more capable, but actually is tougher and more capable, while those who may have been attracted to the M/T’s extreme appearance can have nearly the same look, with less noise, less fuel spend and less road walk.”

That said, “we don’t think the typical highway-tread customer is jumping all the way over A/T to get to R/T. Most H/T buyers are looking for very specific attributes found in H/T tires — like comfort, fuel economy and a quiet ride — and are not typically candidates for the more rough and tumble rugged-terrain experience.”

Growth of the R/T segment “is being driven by consumers who are looking for the versatility of an all-terrain tire with more aggressive styling and off-road capability, but without sacrificing on-road comfort,” says Vahe Tchaghlassian, vice president of sales and marketing, Wholesale Tire Distributors. “As more drivers use their trucks and SUVs for both daily

commuting and weekend adventures, R/T tires have become a go-to solution.

“While A/T tires still lead in overall volume, R/T tires are one of the fastest-growing segments. They’re effectively bridging the gap between A/T and M/T by offering a balanced mix of off-road toughness and on-road performance. This makes them especially appealing to consumers who want the aggressive look and capability of an M/T tire without the road noise or wear issues. Demand is being fueled by the popularity of lifted trucks, overlanding and the general trend toward outdoor lifestyle vehicles.”

“R/T tires have moved from a niche offering to one of the fastest-growing segments in the overall LT tire market,” says Kevin Nguyen, manager of product planning, Yokohama Tire Corp. “R/T tires offer that perfect balance for light truck and SUV customers by providing a more aggressive sidewall and tread pattern than A/T tires, while riding more quietly and smoothly than M/T tires. The R/T tire has become the go-tire for

the overlanding, off-grid camping and aggressive-styling-and-personalization customers. These consumers are looking to enhance the off-road performance and appearance of their light trucks and SUVs that were equipped with H/T or standard A/T tires from the factory.”

Omnisource offers a different take. “We are seeing the R/T segment get squeezed by the A/T segment as industry A/T designs increasingly adopt a more rugged look,” says Rob Montasser, vice president of Radar Tire, North America, Omnisource.

“Many customers want tires that look rugged, but don’t want them to ride like hardcore off-road tires on the roads, where they do most of their driving. At Radar, we are seeing the squeeze happen from both ends. Overall, we don’t expect the R/T segment growth to outpace the A/T and X/T markets.”

However, “if a customer asks for an R/T tire, they’re probably one of two things or both: a rugged look and/or a solid off-road performance.” ■

Some of the most prominent decision-makers in the North American tire industry, including the CEOs of several major tire manufacturers, look back on the rst half of the year, provide their perspective on the present state of tire demand and provide a preview of what’s to come in this MTD exclusive.

Responses are presented in alphabetical order based on company name. To read full interviews with each executive, visit www.moderntiredealer.com.

By Mike Manges

“We have had a great start to our year as several of the new initiatives that we had planned kicked in,” says Chris Brackin, president, American Omni Trading Co. (AOT). “ e biggest launch for AOT in 2025 was the introduction of our Partner Up Associate Dealer Program for our Americus and underer brands. In addition, our new marketing campaign has taken shape, which has spotlighted the value adds that AOT brings to the market for our customers. It goes without saying that the biggest challenge thus far this year has been the introduction of the Trump tari s. e uncertainty around what product is attached to which tari — along with the lack of clarity around the timing of the tari s — has been a challenge to navigate.”

“ e rst half of 2025 has seen continued success for Atturo,” says Michael Mathis, president, Atturo Tire Corp. “While the second quarter brought some headwinds, overall sales were higher than the same period last year. Obviously, there are challenges with the tari s and overall economic situation. e light truck category continues to be Atturo’s most popular. We are seeing substantial growth in the performance tire category. Our latest tire models in the all-weather category are gaining fans among dealers as they learn how versatile this type of tire can be at meeting their customers’ needs.”

“ is year appears to be a promising one for BKT, having begun on a positive note, with Q1 registering growth across our main business segments, driven by the agriculture, industrial and earthmoving industries — despite several geopolitical factors,” says Arvind Poddar, chairman and managing director, BKT. “ is progress re ects the company’s focused commercial strategy, strong distributor relationships and e cient supply chain execution. However, from the second quarter onward, new challenges emerged due to recent changes in U.S. trade policy a ecting tire imports, as well. As a company, we are aware of these current di culties and we are working closely with our partners and dealers to adapt our shipping logistics and pricing strategies to maintain our competitive advantage.”

“Our North American business is doing pretty well from a quarter-over-quarter basis,” says Scott Damon, CEO, Bridgestone West; group president, Bridgestone Americas Inc.; and Bridgestone’s global chief digital transformation o cer.

THE MR. TIRE AND BIG 3 TIRE PROGRAMS ARE DESIGNED TO HELP YOU SHAPE THE FUTURE OF YOUR INDEPENDENT TIRE DEALERSHIP WITH THE TOOLS NEEDED TO REACH YOUR MAXIMUM POTENTIAL WITHOUT SURRENDERING YOUR IDENTITY.

“Certainly, our profit is up slightly. Our revenue is comparable to what you saw in a lot of the first quarter earnings. It’s down a little bit. Our consumer and retail businesses are flattish. I think (we’re seeing) a lot of the challenges that replacement consumer (tire) dealers have probably talked to you about, where you see them trading down just because their available access to goods and services is somewhat challenging in a credit-constrained market, especially for lower- to medium-income people. But our retail business and our consumer business are weathering that and they’re flat.

“Our commercial truck business and retreading business are strong — stronger on the dealer side than even the fleet side, but both are up year-overyear and it’s certainly helping our performance,” says Damon. “Our off-road business is also quite good in North America. And our ag replacement business is good year-over-year. That business has been quite challenging and the original equipment business on that side is down almost 30%. So the ag business is definitely a headwind for us. The OE businesses themselves, year-over-year, in both truck and consumer, also are a little bit down, but we’ve forecasted them to be soft, in general.”

“In the first quarter of 2025, business was brisk as we capitalized on the growing value segment,” says Aaron Murphy, senior vice president, CMA/ Double Coin. “With economic headwinds such as tariffs and other uncertainties, our products continue to perform well as a cost-effective alternative to higher-priced tires. One of our biggest challenges lately has been the unpredictability of product costs and not knowing when those costs might change. Tariffs, in particular, have created a murky outlook. We’ve heard from many of our customers that they’re feeling the same uncertainty.”

“Our business in the Americas region has shown solid performance in the first half of 2025,” says Tansu Isik, CEO, Continental Tire the Americas LLC. “Our PLT and truck tire volumes have remained stable and we’ve maintained a consistent market share. While we’re beginning to feel some of the broader market headwinds as we approach mid-year — challenges that are impacting the entire industry — but we remain focused and committed to sustaining our momentum through the second half of the year.”

“2025 has been an exciting year for us,” says Rob Williams, president, Hankook Tire America Corp. “We started the year by launching two new products in our Dynapro line and one for our Ventus family and have since expanded our TBR line through our newly introduced Smart Brand. We continue to drive our OE partnerships both in the U.S. and globally, including a recent OE announcement with Lucid Gravity’s electric SUV. Of course, like many in the industry, we are nav-

igating some uncertainty, especially concerning potential impacts on pricing and supply chains. However, Hankook Tire America Corp. remains committed to ensuring we provide the best value for our customers — both dealers and drivers — and we are doing everything in our power to ensure strong supply lines and minimize any potential disruption. Our U.S. plant in Clarksville, Tenn., has played a major role in that.”

“2025 is off to a strong start, with solid growth compared to last year with a growth of 8.5%,” says Keiko Brockel, president and CEO, Nitto Tire U.S.A. Inc. “A key driver has been the continued strength of the Nitto brand and the loyalty it has earned in the market, which I personally view as second to none. However, we are facing the same challenges that our customers are. The news is full of reports about economic uncertainty, tariffs and changing consumer behavior — and things seem to change daily, making it harder to plan for the long term. So contingency planning and flexibility will be key. We are committed to making bold decisions that prioritize long-term growth over short-term gains.”

“We’ve had an extremely good start and when I look at official, quarterly reports of the leading players of the industry ... we are very satisfied with the development of the business both in the U.S. and Canada and also our facility in Dayton, Tenn., has been performing very well now that we’ve finally completed our first stage expansion project,” says Paolo Pompei, CEO, Nokian Tyres. “We’re achieving the daily output that we have targeted to achieve. So we are extremely satisfied with our performance. The discussion about tariffs has created some uncertainty in the market, both in Canada, as well as the U.S. But we are managing this, considering our journey is set for growth. And we still have a lot of space for growth in North America.”

“Our business is growing at a healthy pace, despite the weaknesses in the market in both the U.S. and Europe and the geopolitical situation,” says G.S. Sareen, CEO, Omnisource. “The markets are not robust. In spite of that, we are trying to grow very aggressively.”

“The first part of 2025 has been strong for Pirelli Tire North America (PTNA) as we continue reinforcing our position in the premium and high-value tire segments,” says Claudio Zanardo, CEO, PTNA. “Our recent product launches — including the Ice Friction in Canada and the Scorpion XTM AT, as well as the fifth generation of the P Zero and the DOT tire P Zero Trofeo Track — are a testament to our commitment to this market and our dedication to meeting the specific needs of North American drivers, building on the momentum of the new products introduced in 2024. These regionally developed products highlight our focus on our product offering for the market. While challenges

persist due to evolving market conditions, our business strategy centered on the high-value segment, which continues to grow at a double-digit rate, positions us well for continued success.”

“Business for PCTNA in 2025 started o very strong for both PCR and TBR segments,” says Samuel Felberbaum, president, Prinx Chengshan Tire North America (PCTNA). ”We’ve launched our tire size lineup for our all-weather products, the HiSeason 4S for Prinx and the ClimaFlex 4S for Fortune, and we will be launching our new Fortune Tormenta A/T2 and Prinx HiCountry A/ T2 in late-2Q, for arrival in Q3.”

“Despite volatility in the global and local markets, our business has stayed on track in 2025,” says Ron Dolan, president, Sailun Tire Americas. “We’ve worked closely with our partners to ensure the right product mix, while keeping our brands highly visible and relevant to value-conscious consumers looking for dependable quality.”

“I would say our rst quarter business was stable,” says Darren omas, president and CEO, Sumitomo Rubber North America Inc. (SRNA). “ at is probably an accomplishment for us because we were the only tire manufacturer who took anticipated raw material price increases early in the rst quarter to protect our global company from rising raws. We took that increase very thoughtfully and ultimately did what we thought was necessary.

“Despite those increases, our volume has remained stable because our relative price position in any given segment did not materially change,” said omas. “Maybe the index price went up a couple of percentage points, but it didn’t take us to a di erent category. I would say we’re not trying to reinvent our business model. Our goal has been a steady progression of business in the face of uncertainty and distribution challenges. notably the ATD (American Tire Distributors Inc.) bankruptcy.”