SOURCE

Engineered from the ground up to provide unsurpassed performance in food processing facilities. These high performance, 100% synthetic lubricants provide extended lube intervals, multiple application capability, lubricant inventory consolidation and improved performance.

All while maintaining strict H1 safety requirements.

Lubriplate’s NSF H1 Registered Products Include:

HIGH-PERFORMANCE SYNTHETIC GEAR OILS

SYNTHETIC AIR COMPRESSOR FLUIDS

SYNTHETIC HYDRAULIC FLUIDS

HIGH-PERFORMANCE SYNTHETIC GREASES

HIGH-TEMPERATURE OVEN CHAIN LUBRICANTS

NSF H1 REGISTERED SPRAY LUBRICANTS

Boundless Food Cutting Solutions

Urschel designs and manufactures high capacity, precision food cutting machinery designed for rugged production environments.

Sanitary and dependable in design. Rely on Urschel cutting solutions to effectively process all types of products.

Explore more cutting solutions at urschel.com.

Pressure measurement for your process? Leave

it to us!

Our technologies offer everything you need for process, hydrostatic, and differential pressure for the food industry. Around the world, VEGA pressure solutions stand for proven reliability and trend-setting innovation. Our pressure measurement solutions go beyond just efficient, optimised processes – they provide you with peace of mind, knowing that you’ve chosen the best technology available.

Everything is possible. With VEGA.

Birds of a Feather

The 2022 merger combined complementary processors into a poultry powerhouse.

Connecting Culture and Customers

Wayne-Sanderson Farms’ product development efforts flow from its Customer Innovation Center.

Processing Partner of Choice

Wayne-Sanderson’s operations team has a customer-centric approach, with an engaged workforce and a strong company culture.

LTOs Give Small Companies a Boost

Limited-time offerings bump end-of-year sales and attract new customers year round.

Green Plant of the Year:

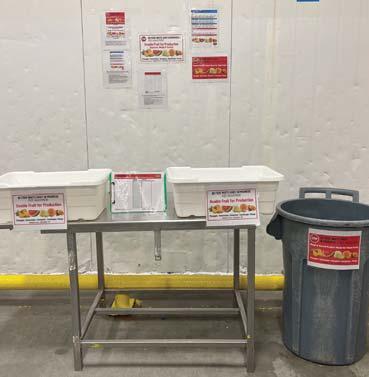

The North Portland, Ore., plant reduced food waste by altering incoming fruit inspections.

Photo: David Tadevosian / Shutterstock.com

This Marriage Is Working

The 2022 merger of Wayne Farms and Sanderson Farms defines success in the poultry industry.

erger mania has gripped the food & beverage industry the past few years. Not the politely labeled, in-name-alone mergers like General Mills buys Blue Buffalo, but marriages of titans, if not equals. Most involve the acquirer or bigger company using the smaller one to enter a new food category. That's proven to be a risky strategy, although no company seems to be satisfied with success in its home category anymore.

And like 33% of all human marriages, not all of these business relationships are working out.

Wayne-Sanderson Farms, our 2025 Processor of the Year, is one of the exceptions. When we created our Top 100© list back in August, it was apparent most poultry companies enjoyed a profitable 2024. But even among those happy chicken processors, Wayne-Sanderson Farms stood out.

Technically, it was an acquisition: Smaller Wayne Farms, with the backing of Cargill and ContiGroup, acquired larger Sanderson, and maybe because of the size differential it really looks and feels like a merger. And it’s working out beautifully. Undoubtedly, private ownership is a big part of the reason. As Wayne-Sanderson's CFO T.J. Wolfe put it, "Our owners have a long-term view over investments and growth, and Kevin [McDaniel, CEO] and I can make investments

and decisions for the longer-term versus thinking quarter to quarter."

Maybe staying focused on poultry, rather than getting into coffee or baked goods, is another reason.

Kraft Heinz is an example of a bad marriage. The new company's sales were $26.5 billion one year after the 2015 merger. In the years since, only 2023 sales eclipsed that, and only by $153 million. Last year’s sales were $25.8 billion. The stock price peaked at $92 a share in mid-2017; it was $26 in late June, just before the first story of a possible split. And split they will, the company announced, sometime next year.

So will the short-lived combo of Keurig and Dr Pepper Snapple Group.

J.M. Smucker Co. was giddy when it won the 2023 bidding for Hostess Brands. The jelly company is still trying to figure out how to make Twinkies and other snack cakes into a profitable business.

More recently, WK Kellogg Co, the cereal half of the former Battle Creek company, closed out 2024, its last year of existence, with a $55 million decline in sales, with net income down 35%. We may never know how it truly fares under new owner Ferrero Group, which completed that acquisition this September.

The other half of the former Kellogg Co., Kellanova, is still awaiting European approval of its acquisition by Mars Inc. – at least as of this writing. Until that deal closes,

Kellanova keeps publishing regressive financial reports. Through six months, sales were down $100 million; so was operating profit.

Maybe those last two will work out, although we'll never know the pain along the way. As private companies, Mars and Ferrero can play the long game, endure some hits along the way to making their acquisitions successful. They only need to satisfy their owners, mostly family members. That’s a luxury not enjoyed by publicly held companies.

Whatever the reasons, Wayne-Sanderson is working. Our three-part coverage – into the company's business, product development and manufacturing –begins on p24.

Wayne-Sanderson makes a fine Processor of the Year, our 21st (the list is on p27). Our criteria for this honor include sound financial performance, innovative product development, leading manufacturing technology, managerial excellence and service to the community. Wayne-Sanderson excelled at all of those.

Written by Dave Fusaro EDITOR

Mixing Excellence & Employee Ownership

Employee-owned and operated with a legacy spanning over 180 years, ROSS is synonymous with innovation and quality in manufacturing mixing, blending, drying, and dispersion equipment.

Our commitment to excellence is evident in our five state-of-the-art manufacturing facilities across the U.S.A., complemented by an 8,000 sq. ft. Test & Development Center and three international plants, ensuring we serve customers worldwide with precision and reliability.

From standard models to custom solutions tailored to your unique processing needs, ROSS mixing equipment is engineered for decades of trouble-free operation, empowering industries and fostering economic growth.

Proudly engineered and fabricated in the USA, we’re driving the future of manufacturing, supporting American jobs, and fortifying supply chains for generations to come.

EDITORIAL TEAM

EDITOR IN CHIEF

Dave Fusaro dfusaro@endeavorb2b.com

SENIOR EDITOR

Andy Hanacek ahanacek@endeavorb2b.com

CONTRIBUTING EDITORS

Ed Avis, Claudia O’Donnell

EDITORIAL ADVISORY BOARD

Mohamed Z. Badaoui Najjar, Ph.D. R&D Senior Director–Strategy & Portfolio Sector Food & Beverage, PepsiCo

Ed Ballina

Principal, Operational Excellence Consulting (retired from PepsiCo)

James Davis

Director-Global Sanitation, OSI Group LLC

Leslie Herzog

Vice President of Operations & Research Services, The Understanding & Insight Group LLC (retired from Unilever)

Steven Hill, Ph.D.

Vice President-R&D, QA, Food Safety, Sustainability, Engineering, Regulatory, T. Marzetti

Leslie Krasny Krasny Law Office

Jagriti Sharma

Senior Vice President of Product, Poppi

Alvaro Cuba Simons Operations & Supply Chain Consultant (formerly of Mondelez and Kraft)

Gary M. Stibel

Founder & CEO, The New England Consulting Group

DESIGN & PRODUCTION

ART DIRECTOR

Derek Chamberlain dchamberlain@endeavorb2b.com

PRODUCTION MANAGER

Rita Fitzgerald rfitzgerald@endeavorb2b.com

AD SERVICES MANAGER

Jennifer George jgeorge@endeavorb2b.com

EXECUTIVE STAFF

GROUP CONTENT DIRECTOR Keith Larson

CIRCULATION REQUESTS Lori Books

ENDEAVOR BUSINESS MEDIA, LLC

CEO Chris Ferrell

COO

Patrick Rains

CDO

Jacquie Niemiec

CALO

Tracy Kane

CMO

Amanda Landsaw

EVP MANUFACTURING & ENGINEERING GROUP

Lisa Paonessa

VP OF CONTENT STRATEGY, MANUFACTURING & ENGINEERING GROUP Robert Schoenberger

Endeavor Business Media, LLC

30 Burton Hills Blvd, Ste. 185, Nashville, TN 37215

800-547-7377

What’s New Online

Don’t miss what’s happening on FoodProcessing.com

very day, we add things to www.FoodProcessing.com. Here are few of the items launching this month.

SURVEY

How does manufacturing look in 2026?

As we near the end of 2025, look into your crystal ball for the year ahead and tell us what you foresee for your plant. More or less production, employment, automation? Are you ready for FSMA 204? There are only 12 questions in our Manufacturing Outlook Survey, and if you give us your name we’ll enter you in a drawing for one of four $50 Amazon gift cards. Results will be published in January. Take the survey at: www.surveymonkey. com/r/3FPQ9QT

NEWSLETTER

Daily

food & beverage news

We try to write a "best of" the news every month in this magazine, but all the stories you see on pp15-19 first appeared on our website and in our daily newsletter. Stay up to date and be the first at your company to know things – by signing up for our daily newsletter. bit.ly/3yHyZLZ

PLM and proteins

Two interesting webinars come up this month. On Nov. 13, Tom McGirty of Marzetti Co. will speak on his experiences with more than one product lifecycle management system. Nov. 20 we will air one on emerging protein sources featuring Becky Dheri, founder of snack company Days Out, and Abby Sewell from the Good Food Institute. In December, we'll add one on compressed air systems' efficiency. See all our webinars, including archived ones, at: www.FoodProcessing.com/ webinars

PODCASTS

Ethnic foods, tariffs, seasonal flavors

For those of you who like to listen, we continue to build our podcast library. In recent weeks, we had Kiernan Laughlin, general manager of Deep Indian Kitchen, discuss Americans’ love of ethnic foods; Rabobank experts highlight the impact of tariffs on the packaging supply; and Shannon O’Shields of Rubix Foods sharing her thoughts on the fall and winter seasonal flavors that could unseat pumpkin spice. www.FoodProcessing.com/ podcasts

Jack Payne Solution Consulting Director, Food & Beverage and Process Manufacturing, Aptean

INDUSTRY PERSPECTIVE

Sponsored Content

A Advancing Food Safety, Traceability Through Digital Tech Innovation

s food and beverage processors seek ways to operate efficiently while monitoring and maintaining food safety and a traceable supply chain, they’re looking for advanced technology to help them achieve their goals. Jack Payne, Solution Consulting Dir., Food & Beverage and Process Manufacturing, for Aptean and a longtime industry expert, shares his insights on the innovations that have driven the industry forward, and how a shared passion for serving the best quality, safest food and beverage products has shined through in nearly every partnership he’s developed with processors.

Food Processing: What first brought you into the food and beverage industry and what has kept you so engaged throughout the years?

Jack Payne: Family meals growing up were very special. Every person in the family was expected to be there on time. It was a time of sharing and learning. As I got into the industry and had been working in various roles, I got to thinking about how food is essential to everyone. I became aware of the unique challenges of managing inventory and food. So I searched and found a food and beverage company just getting started in ERP and said, “I’d like to see if I could provide some expertise and help to you.” I never even imagined I would be doing this for 30 years! I hope to keep doing it for a lot longer. It’s just been an exciting industry.

FP: What are some of the more notable developments you’ve witnessed in food safety and traceability first-hand?

JP: I have to go back and remind everyone what kind of technology we lived with 30 years ago. We didn’t have the internet, mobile devices, iPhones or iPads. In fact, not many people had cell phones either. So just think about how consumer technology has changed in the last 30 years. That same technology has changed the food and beverage industry. Thirty years ago, to do traceability, you recorded everything on a piece of paper and entered it into a system. Then you had the ability to track your inventory, your lots, and also to put the pieces together one by one in terms of tracing from ingredients to finished goods. We now have moved into the era where there are mobile devices on the factory floor, receiving your barcode scanning. That then gives us the ability to almost instantaneously see full traceability. Again, going back 30 years ago, if that information was recorded, we could typically see it step by step. Now modern systems give you that real time — almost instantaneously, you’re able to see full traceability backward and forward.

Sponsored Content

FP: The food and beverage industry, right or wrong, often gets a bad rap about being more hesitant on things like digital technology. What is your take on that over the last 30 years?

JP: There are early adopters of technology. I’ve seen certain companies that want to be on that leading edge. They want to be able to adopt that technology because they see the potential value in it. But then there are other companies that are almost a little bit hesitant. They don’t want to adopt the latest technology until it’s proven. Like any industry, there are laggards. The best way I’d describe the food and beverage industry is “cautious.” They want to adopt technology, but they want to be cautious to make sure it is proven technology before they do.

FP: I understand you’ve even written a book on this subject. Could you share a bit about it and what inspired you to write it?

JP: The motivation really goes back to that passion for food safety, traceability and sustainability. The industry has been very generous and patient with helping me learn, and every day I learn more about the industry. I decided that I wanted to be able to give back to the industry to share what I have learned. The title of the book is “Appetite for Success: Thriving with Technology in the Food and Beverage Industry.” It’s not a technology book; it’s more about how to apply technology in food and beverage to meet the regulatory requirements of traceability and food safety. How do you become more sustainable? How do you become more profitable? How do you grow?

FP: Food safety regulations are top of mind across the industry, and you’ve obviously got a lot of background there, so what advice would you give to executives out there trying to balance compliance, efficiency and longterm growth?

JP: The first thing I would tell them is, these are not competing priorities. They’re actually complementary. I’ve seen companies implement technology to help with traceability, and it also helps productivity and efficiency. I’ve been recommending companies get ahead of the game on FSMA 204. Earlier this year, the FDA delayed the compliance date by

Food For Thought

Hear the conversation by tuning in to Food Processing’s Food For Thought podcast.

30 months, and the reason they delayed it was because suppliers were not providing information to their customers, who need to provide that forward. So, there’s that 30-month extension, but don’t wait: Get started now and be ready. It’s going to make you a stronger, more efficient company.

FP: What makes Aptean such a special partner for food and beverage companies and positions it to help navigate the complexities of the industry today?

JP: We’ve always focused on providing solutions for food and beverage companies starting out on ERP, in terms of lot control, shelf-life management, traceability, costing, and other unique requirements in the food and beverage industry. We want to stay in touch with the industry; we go to conferences; and we listen to our customers; and we build those best practices back into our software. We want to stay ahead of the game and understand what’s going on, but we also want to be a partner with our customers and provide all the technology solutions they need in one place, managing everything from product development through shipping that final product out to customers. And now, with our investments in AI and automation, we’re helping those companies make smarter decisions across their entire business. That is the focus of the company. We have quite a few people that are dedicated to food and beverage, a whole team across the company, and I’m just very privileged to be here.

Parilov /

Why food & beverage manufacturers should choose flexibility over speed.

A Right-Sizing Production Lines

s SKU counts continue to rise, production schedules become more constrained. For many food & beverage manufacturers, the traditional focus on maximizing line speed has turned into a liability rather than an advantage. Legacy systems designed for long runs of core products often struggle to meet today's demands for variety and quick product changes.

For decades, "bigger and faster is better" made perfect economic sense. Manufacturers could spread fixed costs over larger volumes, lower per-unit production costs and maximize returns on costly equipment investments. When companies operated a few products for weeks at a time, high-speed lines provided exactly what operations needed: maximum throughput with minimal complexity.

Today's reality looks dramatically different. Production lines that once handled three or four SKUs now manage dozens, with changeovers happening multiple times per shift. The same high-speed equipment that once drove profitability now spends more time switching between products than actually running them, often operating at just 30-40% efficiency because constant changeovers consume production time.

When manufacturers focus on maximum throughput, they often ignore the real-world performance costs of oversized equipment. For instance, a 1,200-bottle-per-minute line may sound impressive on

paper, but that theoretical capacity is irrelevant when changeover times stretch for hours and the complexity of adjustments grows exponentially with line size.

Large, high-speed systems require extensive changeover procedures for each component, including fillers, conveyors and labeling systems – which need adjustment, calibration and verification. The inventory of changeover parts alone becomes a major expense, with specialized components needed for every product variation.

The reality of efficiency becomes clear when analyzing actual operation. A production line that operates at its maximum theoretical speed only 65-70% of the time produces less overall output than a smaller system running at 95% efficiency.

Compare the mathematics of operating two 600-unit lines versus one 1,200-unit line. While the large line faces frequent changeovers and reaches 80% efficiency, two smaller lines can each sustain 95% efficiency. This results in a total production capacity increase of 15%.

This advantage goes beyond simple math. Smaller systems enable faster changeovers with fewer parts to adjust and less complex coordination. Programmable logic controllers can store recipes for different products, enabling single-minute changeovers that allow

operators to switch from regular mashed potatoes to loaded mashed potatoes with essentially the flip of a switch. When changeover time drops from hours to minutes, manufacturers gain the flexibility to respond to changing demand patterns without losing overall productivity.

Built-in resilience

Right-sized production systems provide benefits that go well beyond quick changeovers. The most immediate advantage is inherent redundancy. When equipment problems shut down one line, production can continue on the other. This reliability is especially important in food manufacturing, where time-sensitive products cannot wait for repairs.

Delays in food manufacturing cause widespread problems across the entire operation. In dairy production, packaging is a small part of the total plant investment, but packaging failures can halt the whole process. Milk from hundreds of thousands of cows continues to arrive regardless of whether the packaging line is working. Spoiled product, batch losses and emergency disposal costs far exceed the initial equipment investment.

Right-sized dual lines eliminate these single points of failure while

Large, high-speed systems require extensive changeover procedures for each component ... which need adjustment, calibration and verification.

delivering additional operational advantages. Two lines can run different product mixes simultaneously, spreading variety across multiple systems instead of forcing everything through one chokepoint.

Overall, flexibility reduces scheduling complexity while allowing manufacturers to maintain steady-seller production and to experiment with new formulations on separate lines. This operational simplicity also extends to quality control. Operators can focus on fewer variables per line, significantly reducing errors that lead to batch disposal.

Most food manufacturers cannot afford lengthy shutdowns for major equipment overhauls. Successful right-sizing projects require careful planning that aligns with available downtime and operational constraints. The key is to break large improvements into manageable phases that can be completed during scheduled maintenance.

Manufacturing managers can begin by analyzing current line efficiency using data. Facilities with data collection systems can identify equipment that frequently underperforms, while plants lacking automated monitoring might require manual line inspections. This initial assessment helps pinpoint where right-sizing can have the greatest impact.

Once this assessment identifies priority areas, the phased approach allows manufacturers to spread costs across multiple budget cycles while gradually improving operations. Each phase should deliver standalone value instead of waiting until the project’s end to see benefits. Data-driven impact analysis helps prioritize the most cost-effective improvements first,

POWER LUNCH

often revealing that operational changes generate larger gains than equipment purchases.

Operational realities

Successful implementation depends on close collaboration between engineering teams and operations staff to set realistic timelines for each improvement phase. This collaborative approach is especially valuable when retrofits involve both equipment upgrades and operational enhancements.

For example, adding smart accumulation zones between critical processes changes line dynamics by stopping system-wide shutdowns when individual machines need attention. Modern programming enhances this idea by intelligently managing these buffers, predicting bottlenecks and automatically adjusting speeds to improve production flow.

Smaller systems adapt more readily to changing requirements driven by sustainability concerns, new regulations or material innovations. Equipment modifications cost less, implementation happens faster and the risk of extended downtime decreases significantly. Energy consumption patterns also favor smaller systems, which can shut down one line during low-demand periods without affecting overall capability.

These operational advantages extend to workforce management as well. Labor efficiency improves as operators master less-complex lines more quickly. Ideally, this will reduce errors and increase confidence.

One recent project demonstrated this principle when a facility guaranteed 91% efficiency but achieved 97.5% during commissioning. This was largely due to comprehensive

operator training on the right-sized system. Cross-training becomes more feasible when systems share similar operating principles rather than requiring specialized knowledge for massive, unique equipment configurations.

Right-sizing positions manufacturers to respond more effectively to market changes and consumer preferences. As product lifecycles shorten and seasonal variations become more pronounced, the ability to adjust production mix quickly becomes a competitive advantage. Manufacturers with flexible systems can capitalize on trending flavors, respond to supply chain disruptions and test new concepts without disrupting core production.

The approach also supports innovation by allowing manufacturers to dedicate one line to experimental products while maintaining production of established items. This accelerates product development cycles and reduces the risk associated with new product launches.

The choice between speed and flexibility is no longer just a theory for food manufacturers. Market realities have already decided the winner. Companies that stick to maximum-speed strategies will be at a disadvantage as SKU counts keep increasing and consumer demands become more unpredictable. Meanwhile, manufacturers that embrace right-sizing today position themselves to seize opportunities tomorrow that large, inflexible competitors cannot capitalize on.

Written

by

Stéphane Larivière

SME AND PROJECT MANAGER at Salas O'Brien (email foodbev@salasobrien.com)

IN THIS SECTION

» Processors pit MAGA against MAHA

» Govt. shutdown delays Magnum debut

» FDA may require GRAS notices

Nestle To Cut 16,000 Jobs, Most White Collar

After an anemic third-quarter report, the restructuring should save $1.25 billion annually.

estle SA’s new CEO will cut 16,000 jobs, three-quarters of them white collar, by the end of 2027 to save CHF 1 billion ($1.25 billion) annually by 2027, the company revealed in its third-quarter earnings report.

“Nestle needs to change faster,” said Philipp Navratil, who’s held the top job just since Sept. 1. “This will include making hard but necessary decisions to reduce headcount over the next two years… We are working to substantially reduce our costs, and today we are increasing our savings target to CHF 3.0 billion by the end of 2027.”

Nine-month sales were CHF 65.869 billion, that’s CHF 1.3 billion lower than in 2025. Zone Americas, which includes U.S., Canada, Latin

America and the Caribbean, was down an identical CHF 1.3 billion, but the Asia-Oceania-Africa business and Nestle Health Science also contributed slightly to the decline. The European and Nespresso businesses were up a tiny bit, and Waters was flat.

“Greater China continues to be a drag,” the Oct. 16 report said. “New management is now in place and executing our plan to transform this business.”

Net income or profitability for nine months was not included in the report.

“The actions we are taking will secure Nestlé’s future as a leader in our industry,” Navratil concluded. Meanwhile, Paul Bulcke, chairman of Nestle SA since 2017, has decided to resign from the board, apparently in connection with the Sept. 1 firing of CEO Laurent Freixe for “an inappropriate relationship.” Pablo Isla became chairman on Oct. 1.

European media have reported investor pressure against the world’s largest food company since Freixe was dismissed, having served just one year, for

an undisclosed relationship with a subordinate, which may have involved workplace favoritism.

Bulcke, who is or near 71 and was Nestle’s CEO 2008-2016, was scheduled to step down in April of 2026 anyway, with Isla already named chairman-elect this June.

Bulcke said, “I have full trust in Nestlé's new leadership and firmly believe this great company is well positioned for the future. This is the right moment for me to step aside and accelerate the planned transition, allowing Pablo and Philipp to advance Nestlé's strategy and guide the company with a fresh perspective. I wish the entire Nestlé family every success in the future."

Nestlé Chairman Paul Bulcke resigns following CEO scandal

Philipp Navratil

Processors Use a Republican Network To Pit MAGA Against MAHA

U.S. soft drink and snack food makers are engaging a network of Republican pollsters, strategists and political financiers in an effort to pit Donald Trump’s Make American Great Again campaign against Robert Kennedy’s Make America Healthy Again effort, according to an investigation by the British newspaper The Guardian and environmental watchdog Fieldnotes.

Their goal is to stymie the MAHA-led effort to curb Americans’ consumption of soda and ultraprocessed foods, the investigators say.

The two Trump administration campaigns have been strange bedfellows. Trump and MAGA are devoted to deregulation, less oversight and free markets, while Kennedy’s leadership of Health & Human Services and FDA has increased scrutiny of and eventually regulation of food and drug companies.

“The companies have turned to a partially formalized network of for-hire pollsters, strategists and political financiers with deep ties to the national Republican party – several of whom have taken steps that obscure their connection to the effort and to one another,” said the Guardian story. “In the process, the industry has also been aided less directly by a loose coalition of free-market ideologues who have previously worked to advance Trump’s deregulatory agenda.

“The effort features MAGA influencers hired by a firm that promotes ‘anti-woke’ movies; an obscure research group Lee Zeldin was working for when Donald Trump picked him to lead the Environmental Protection Agency; and a media outlet backed by rightwing billionaires Leonard Leo and Charles Koch, among others.”

The Guardian says the influence campaign is being spearheaded by the American Beverage Assn. with help from Consumer Brands Assn. While not directly connecting these processors to the effort, the Guardian notes Coca-Cola, PepsiCo, Keurig Dr Pepper, General Mills, Kraft Heinz, Mondelez and Nestlé “are among those that pay dues for the right to have a say in either or both of the trade groups’ strategies.”

All three soda makers identified the MAHA efforts as significant threats to their bottom lines in their most recent annual reports.

The companies’ most pressing political concerns are two related RFK Jr-backed efforts: one to ban schools from serving foods with petroleum-based dyes, and the other to bar people from using Supplemental Nutrition Assistance Program (SNAP) benefits to purchase soft drinks, the report says.

Their not-so-subtle message to conservative lawmakers, delivered directly by lobbyists and indirectly via both an industry front group and paid social media influencers: Oppose the MAHA efforts or face a MAGA backlash.

Food Companies Unite for One Federal Standard on Questionable Ingredients

In what sounds reminiscent of the 2010s fight over labeling genetically engineered foods, a handful of food & beverage companies is collaborating to lobby for national standards that cover ingredient bans – before the states impose their own. This time, however, the processors are being transparent about it and enlisting the public’s support.

Until now, food companies have been opposed to ingredient bans. But apparently seeing the writing on the wall, they’ve created Americans for Ingredient Transparency (AFIT), launched on Oct. 22 to counter the growing number of states that are creating their own, slightly varying sets of laws controlling questionable ingredients.

“These well-intentioned efforts are creating an ever-expanding patchwork of disjointed food, beverage and personal care regulations that are increasing confusion, rather than providing Americans with the clarity they deserve,” AFIT said in its inaugural announcement.

Food company backers are Coca-Cola Co., Conagra, General Mills, Hormel, Ken’s, Keurig Dr Pepper, Kraft Heinz, McCormick, Nestle, Ocean Spray, PepsiCo, Sargento and Tyson. The effort also is backed by a number of associations, including Consumer Brands Assn., American Beverage Assn., Meat Institute, National Restaurant Assn., National Milk Producers Assn., FMI-The Food Industry Assn., and others.

AFIT is lobbying for pre-emptive federal standards, “and it stands ready

to work with the Trump Administration and Congress on incorporating Generally Recognized as Safe (GRAS) reform, Front-of-Package labeling reform and QR code reform into federal law,” the group said.

“The group has committed the necessary resources to effectively advocate for federal legislation that ushers in one national standard for ingredient transparency that applies consistent, science- and risk-based principles to give Americans everywhere confidence in the safety of their foods, beverages, and personal care products.”

AFIT claim to be made up of “concerned Americans, policy experts, f armers and industry leaders,” who want the information delivered “in the most consumer-friendly way possible to help families decide what is best for them. So far, only the food companies and associations are listed on its website.

The coalition is led by Julie Gunlock, a Washington, D.C.-based conservative policy advocate focused on food and nutrition, parenting and science-based issues, and Andy Koenig, a former policy special assistant to President Trump.

“Unfortunately, states are now implementing their own patchwork of contradictory ingredient rules that have caused widespread confusion among consumers,” Koenig said. “President Trump and his administration are well-suited to make these determinations.”

Under the direction of Health & Human Services Secretary Robert Kennedy, dozens of food & beverage companies voluntarily have committed to removing seven petroleum-based color additives by the end of 2026. 11 state legislatures have passed state laws that ban those colors but some include titanium dioxide, potassium bromate, propylparaben and other ingredients. Even high-fructose corn syrup is in one proposed ban.

Back in the 2010s, when several states were considering laws to require the labeling of genetically engineered foods, a coalition of food & beverage companies was working behind the scenes to defeat those efforts or ballot referendums, with Consumer Brands Assn. at the helm. Washington state officials hit the organization – then called Grocery Manufacturers Assn. – with an $18 million fine for “concealing” the names of the food & beverage companies funding an effort to persuade a “no” vote on a 2013 ballot referendum in that state.

Breaking Up Is Hard To Do: KDP, Kraft Heinz Are Splitting

This is old news by now, but for the record: In September both Kraft Heinz and Keurig Dr Pepper announced they were splitting into two public companies each.

Ten years after its creation, Kraft Heinz Co. will split into one company focused on condiments and sauces, the other on general grocery products. Neither company has been named yet.

One, tentatively called “Global Taste Elevation Co.,” will include three billion-dollar brands: Heinz, Philadelphia and Kraft Mac & Cheese, with approximately 75% of sales coming from sauces, spreads and seasonings. It would have had approximately $15.4 billion in 2024 sales and $4.0 billion in before-tax 2024 earnings (EBITDA).

“North American Grocery Co.” will be a scaled portfolio of North America staples with about $10.4 billion in 2024 net sales and $2.3 billion in 2024 net. It also will have three billion-dollar brands: Oscar Mayer, Kraft Singles and Lunchables.

Kraft Heinz currently expects the transaction to close in the second half of 2026.

Meanwhile, the 2018 merger of Keurig Green Mountain with Dr Pepper Snapple Group will be over when Keurig Dr Pepper acquires European coffee company JDE Peet’s for €15.7 billion ($18.4 billion) and then separates into two separate companies, one focused on coffee globally and the other on soft drinks, mostly domestically. At the moment, the post-split companies simply are being called Beverage Co. and Global Coffee Co.

The merger will be a homecoming of sorts for Keurig, as prior to the merger with Dr Pepper, that company was owned by JAB Holding Co., the same investors behind JDE Peet’s. Mondelez International also was an equity holder in Keurig when Mondelez and JAB engineered the acquisition of Dr Pepper for $18.7 billion.

Unilever Delays Magnum Spinoff

Unilever is delaying the spinoff of Magnum Ice Cream Co. “as a result of the ongoing U.S. federal government shutdown.” But the parent firm still thinks it will happen this year.

“The revision of the timetable has arisen because the U.S. Securities and Exchange Commission is currently unable to declare effective the U.S. registration statement required for The Magnum Ice Cream Company N.V. shares to be admitted to listing and trading on the New York Stock Exchange,” the diversified multinational said in its filing with the SEC on Oct. 21.

Unilever has been preparing the business – which includes Magnum products around the world and Ben & Jerry’s and Klondike in the U.S. – for demerger for a year and a half and had anticipated a mid-November spinoff. The business already has been established and is working mostly independent of its parent.

FDA May Require GRAS Notices

Reliable Exhaust of Cryogenic Gases with Quickdraft

With Quickdraft Venturi based exhaust systems, no moving parts are in contact with cryogenic gas, eliminating fan failure due to freezing. Velocity Reduction Chamber component is available to capture breading and meat particles in the exhaust stream.

See 3D exhaust system animations at www.quickdraft.com or call Quickdraft for more information.

(Toll Free in U.S. and Canada) www.quickdraft.com

The FDA in September published a Notice of Proposed Rule Making that would require companies to notify the agency of new ingredients the companies claim fall under the Generally Recognized as Safe (GRAS) regulation.

Currently, submission of GRAS notices to the FDA is voluntary, and many manufacturers self-determine the GRAS status of substances without notifying the agency. Under the proposed changes, however, companies would be legally obligated to notify the FDA before marketing any food or feed substance with a GRAS designation.

The concept of food additives being "generally recognized as safe" assumes that an ingredient has been determined by recognized experts – hired by the petitioning company – to be safe for use in foods or beverages. GRAS substances include sugar, salt and citric acid –although new ingredients are being developed all the time.

The FDA itself made GRAS determinations until the volume got so large in the 1980s that the agency allowed outside scientific authorities to certify ingredients as safe. The FDA can question the validity of a GRAS substance or withdraw the safety designation, but only if it’s aware of the ingredient.

While the agency does not want to entirely take over the job of GRAS certifications, that loophole of not notifying the agency of a self-affirmed GRAS substance has become an issue with Health & Human Services Secretary Robert Kennedy.

People

Mark Smucker, CEO and chairman of J.M. Smucker Co., will serve as chair of the Consumer Brands Assn. board of directors beginning Jan. 1. Smucker has served on the Consumer Brands board since 2016, and as vice chair since 2024. He will succeed Linda Rendle, chair and CEO of Clorox Co., who will serve as vice chair of the board.

A month after the company announced its long-serving chief financial officer is retiring, Flowers Foods found his replacement. On Jan. 1, D. Anthony Scaglione will take over as CFO from Steve Kinsey. Scaglione has been

CFO at several public and private multi-billion-dollar organizations. Kinsey will retire after 36 years, including the last 18 as Flowers' chief financial officer.

Alfonso Gonzalez Loeschen, currently CEO of Nespresso North America, was to be promoted Nov. 1 to global CEO of Nespresso and member of Nestle’s Group Executive Board. He replaces Philipp Navratil, who was promoted to CEO of all of Nestlé on Sept. 1, following the dismissal of Laurent Freixe.

Boston Beer Co. made two changes to its leadership, announcing that Phil Hodges will be the new chief operating officer for the company, and Phil Savastano will be promoted to replace Hodges as chief supply chain officer.

Molson Coors Beverage Co. appointed Rahul Goyal, currently chief strategy officer, to be its new president and chief executive officer (and to join the board of directors), succeeding Gavin Hattersley in the role. Hattersley, who announced his retirement plans in April, will remain in an advisory role through the end of the calendar year.

Frankford Candy, a fourthgeneration, family-owned manufacturer of licensed confections and gifts in Philadelphia, says Stuart Selarnick, CEO of 25 years, will transition to chairman of the board. Christopher Munyan succeeds him as CEO.

Anthony Scaglione

Christopher Munyan

ROLLOUT

Freeze-Dried Instant Soups

Long Weekend premium instant soups were inspired by the popularity of freeze-dried soup in Japan. The product line is being rolled out by the West Coast Food & Lifestyle Group of Sumitomo Corporation of Americas. Made in the U.S., the soups come in four flavors with a suggested retail price of $4.99. Each soup has unique nutrient content claims. Carrot Ginger touts its 4g of fiber per serving. Vegan Minestrone delivers 20% of the RDA for dietary fiber, plus 10% iron, 10% potassium and 6% protein. Thai Coconut Curry has 5g of protein and 10% of the RDA of iron per serving. One serving of Tomato Bisque provides 15% of the RDA of both iron and potassium. Additional flavors are planned for 2026. All are gluten free and are made without artificial preservatives, colors or flavors.

Restaurant-Inspired Kettle Chips

PepsiCo Canada is growing its Miss Vickie’s brand with the Ristoranti Series. This limited-edition line of kettle cooked potato chips was inspired by signature dishes from three of the country’s beloved restaurants.

Waffles Celebrate Final ‘Stranger Things’

Kellanova is bringing breakfast to another dimension with a new waffle inspired by Netflix’s Stranger Things. Just in time for the fifth and final season, fans can enjoy Eggo Stranger Things Strawberry Waffles, its first strawberry red waffle made with colors from natural sources. The limited-edition packs have a suggested retail price of $3.59 for a 10-count box and will be merchandised next to the returning limited-edition packs of Stranger Things Homestyle Waffles.

The brand collaborated with Pizzeria Badiali in Queen West, Toronto, to create Vodka Sauce Pizza chips, which tastes like creamy tomato sauce, cheese and oregano with hints of woodfire-baked pizza crust. Ask for Luigi, a Railtown, Vancouver, hotspot, is the inspiration for the Cacio e Pepe chips. The flavor balances sharp, creamy cheese and black pepper, resembling the classic pasta dish. Last, Spicy Pepperoncini & Focaccia chips are an adaptation of Focaccia Maison from Nora Gray’s in Griffintown, Montreal. The chip delivers flavors of spicy pepperoncini, tangy sweet onion and notes of sourdough focaccia.

Building on last year’s debut of Eggo Protein Waffles, the brand adds a buttermilk vanilla flavor, joining chocolate chip brownie and strawberry. It’s also introducing Protein Waffles in blueberry and vanilla flavors. Eggo Protein Waffles and Pancakes deliver an excellent source of high-quality, complete protein, and retail for $5.99 for a 10-pack of waffles or a 12-pack of pancakes.

To ensure authenticity, the brand’s research & development and culinary teams collaborated with these renowned restaurants, conducting in-depth tastings and carefully analyzing each dish’s signature flavor and seasoning notes. PepsiCo chefs developed and refined the seasoning blends, testing various iterations to deliver a true-to-dish taste experience.

Better-for-You PB&J

ROLLOUT

J.M. Smucker Co. is giving a healthful spin to Uncrustables sandwiches, the brand known for its iconic frozen creamy peanut butter and jelly sandwiches. New Higher Protein PB&Js come in two varieties: Bright-Eyed Berry (with strawberry jam) and Up & Apple Sandwich (with apple cinnamon jelly). Each sandwich delivers 12g of protein, making them the highest protein offering in the Uncrustables portfolio and across widely distributed PB&Js, according to the company.

In addition to the protein boost, these new offerings feature more fiber and whole grains, supporting a more balanced start to the day without compromising on taste or convenience. The sandwiches are individually wrapped, with an eight-count box having a suggested retail price of $10.50. These new additions join the brand’s existing lineup of grape, strawberry, honey, raspberry, chocolate hazelnut, reduced-sugar grape and reduced-sugar strawberry.

Protein Products in Three New Formats

Protein-centric snack and beverage brand Ready introduced a range of new products at the 2025 NACS Show. The new Iced Oatmeal Cookie Protein Bar is a layered treat that provides 15g of protein from soy and whey, along with 7g of fiber from chicory root and 6g of whole grains. A box of 12 sells for $24.99.

The brand’s Protein Puffs line now includes Movie Theater Popcorn and Maple Sea Salt flavors. A 50g bag contains 25g of protein, which is flagged as milk protein on the front of the bag. These join the company’s 100% plant-based puff offerings. In the functional beverage space, Ready Clear Protein Water is growing with the addition of a Mixed Berry flavor. Each bottle delivers 20g of whey isolate protein and five key electrolytes with zero sugar and no artificial sweeteners.

Simply Crafted Oat Beverages

Dairy co-operative Organic Valley has expanded its oat beverage portfolio with the launch of Organic Valley Oat Beverages. Made with organic oats sourced from the cooperative’s family farms, the new drink comes in original and creamy varieties.

Original is crafted with three ingredients: organic oats, water and a touch of salt. For those seeking a richer texture, the Creamy variety blends in organic medium-chain triglyceride (MCT) oil. This enhances the creaminess as well as the frothiness, making it an ideal addition to lattes and specialty drinks.

“From our research, we know that many of our consumers are reaching for both dairy and plantbased beverages and looking for options that are free from gums and seed oils,” says Laurie Drake, vice president of marketing. “Our new oat beverage is crafted for those who care about knowing where the ingredients in their food come from and want something that tastes great in every sip.”

Scott Cole Senior Director of Strategic Growth, Food & Beverage, Envita Solutions

INDUSTRY PERSPECTIVE

Sponsored Content

A Finding Hidden Value in Food & Beverage Waste Streams

s food and beverage processors look for ways to enhance their sustainability efforts, more of them are turning toward their production waste streams to find hidden value. Scott Cole, senior director, strategic growth for food & beverage, for Envita Solutions, discusses some of the initiatives and innovations processors can look into that can help them both save on costs and also protect the environment around them.

Food Processing: How can data and analytics help food and beverage companies identify hidden value in their waste streams?

Scott Cole: Food and beverage companies spend millions of dollars every year just throwing things away, and what they don't realize is that a lot of these waste streams could potentially be a source of profit for them. With the right data and analytics, we can help uncover the hidden values in what they once thought was just trash. To determine this, we have four themes to help educate and identify this hidden value. The first theme is having insight into your waste. A lot of manufacturers just don't know what's in their waste. We go on site with the customer to analyze waste streams and see what's there. One of the big things we see are production inefficiencies, whether it's in production itself or at the end of the line where they're just throwing things away. From there, you can get some clarity into your costs. Once you have the data, you can start breaking down your disposal costs plant by plant, product or waste stream. Suddenly, you can see where

you're losing money. After you have the insight and cost clarity, you can turn that trash into value. Some of these byproducts can be sold, and data helps show if there's enough supply, volume (which is critical) and consistency to make it a viable revenue-generating stream. Finally, predictive analytics can help stop the waste before it happens, looking at things like expiration dates and how to increase efficiency or align raw materials with demand more accurately.

FP: What are some of the more innovative or sustainable outlets emerging for various waste types?

SC: As I mentioned before, a lot of people view trash as just trash, but really the scraps and organic byproducts are more than that. Organic byproducts are things like fruit, spent grains, vegetable trimmings, coffee husks, etc. — a lot of which can be used as animal feed, soil amendments, essential oils, natural dyes or even bioactive compounds in nutraceuticals. Then you have companies turning food processing waste

into bioenergy, essentially taking organic material waste and turning it into a biogas, which then in turn can power facilities. And the residual solid waste that comes out of that can be used as a compost or soil conditioner. Next, you have the packaging materials. We know packaging waste, plastics, styrofoams, multilayer materials have always been a huge headache, but there are some solutions popping up: compostable packaging material that's made from plant fibers, for example, or recycled and upcycled packaging that can be repackaged or repurposed. There are also improvements to the design of the upcycled packaging allowing the materials to be recycled or reused several times over. Beyond that, wastewater is another big one, with a hidden value that not a lot of manufacturers really think about. You can capture and recover nutrients such as nitrogen and phosphorus to make fertilizer. Finally, one of the things that intrigues me is the use of off-cuts from fruits and vegetables for food ingredients like purees, sauces and upcycled snacks.

FP: How do you help companies measure the true cost of waste beyond just hauling and disposal fees?

SC: There are several layers to setting up the most efficient systems and programs. As I mentioned, we do on-site visits, walk with the team, and look at every single point of production. We look at how material comes into the building, how is it unpackaged, sorted, separated and then used throughout production. Do we have waste? Are there places where we could capture that waste? If so, how can we take that and create efficiencies internally? Then we have a nationwide network of suppliers to receive these materials; we're not beholden to one large corporate entity. This allows us to have the supply chain and logistics capabilities to get various streams from point A to point B. This also gives us the ability to provide accurate diversion data for material-specific tracking and reporting through a proprietary, customizable system. Second, we work continuously to meet zero-waste goals. We have an operational team dedicated

Food For Thought

Hear the conversation by tuning in to Food Processing’s Food For Thought podcast.

to customer satisfaction, as well as ways to continuously look for optimization opportunities for the waste and recycling program. We are a “one-stop shop” for waste and recycling in the food and beverage industry. We want to pull as much out of the waste stream as possible and convert it into a revenue generating stream if possible. We have sustainability and compliance documentation that can help with carbon footprint calculations and sustainability reporting. We can also provide any certification they may need.

FP: For companies just starting out here, what would you advise as the first step they can take to start finding value in their waste stream?

SC: First, reach out and ask questions. Then, be open to change and have a different view of what waste really is and its potential, whether it's recycling, animal feed or other outlets. We’ve witnessed this fundamental shift: Waste had always been a backof-the-house necessity, but now it's become a strategic business function. Companies want their waste to contribute to the bottom line. We take a three-pronged approach; it's not exactly a linear vision. You have to consider what the operational leaders, procurement leaders and sustainability leaders all need. When you put together this comprehensive program, it really helps you achieve your waste and recycling goals. As a true partner, that’s what we try to do.

Ikhsansaputra

The 2022 merger of Wayne Farms and Sanderson Farms combined complementary processors into a poultry powerhouse that just completed an outstanding financial year.

Written by Dave Fusaro

EDITOR IN CHIEF

When we created our Top 100 list back in August, it was apparent most poultry companies enjoyed a profitable 2024. By contrast, beef was at historically high prices, driven by the smallest cattle inventory since 1951. Pork also experienced large price increases. Chicken prices rose only modestly, causing many consumers to make poultry their animal protein of choice.

Even among the poultry processors, one company stood out. Wayne-Sanderson Farms increased sales by $1.3 billion, nearly 18%, to $8.7 billion. Was it a fluke?

“There has been a long-term trend – going back 50 years – where chicken

has been gaining ground over the other proteins,” says T.J. Wolfe, CFO of Wayne-Sanderson. “If you look in the short term, consumers are looking for more protein in their diets. What’s especially helped us in the past year is the affordability of chicken versus the other proteins.” He also notes the surge in popularity of chicken products at quick-service restaurants over the past two years.

All of which conspired to make for a great year, the best so far, for the threeyear-old integrated poultry company based in Oakwood, Ga. Wayne-Sanderson Farms as our 21st Processor of the Year? That’s money in the bank.

Photo: David Tadevosian / Shutterstock.com

PROCESSOR OF THE YEAR

A recent history

Since 1965 there had been a Wayne Farms, a vertically integrated poultry company based in Oakwood, Ga., that was probably the fifth- or sixth-largest vertically integrated poultry processor in the country. Since 1947, there had been a Sanderson Farms in Laurel, Miss., a distant No. 3 on the chicken-company list.

In an era when scale, especially in the meat & poultry industry, has become critical, the two merged in 2022 to form Wayne-Sanderson Farms, solidly the country’s third-largest poultry supplier and increasingly a maker of further-processed and value-added chicken products.

Wayne Farms actually traces its history to an 1895 feed mill in Fort Wayne, Ind. – hence the name. Wayne Feeds came to be owned by Allied Mills, which spun off Wayne Farms in 1965. That same year Continental Grain Co. (ContiGroup) purchased a majority interest in Allied/Wayne Farms and ultimately became sole owner of Wayne Farms.

Wayne Farms was more focused on business-to-business relationships with major restaurant brands and operating as a big-bird/small bird commodity supplier, especially to foodservice and grocers, and strongest in Alabama, Georgia and North Carolina. Sanderson had a retail tray-pack operation with branded products, and most of its operations were in the more central South, from Mississippi to Texas.

In addition to many primary processing plants, Wayne had two prepared foods plants, both fully cooked and par-fried products, both in Decatur, Ala. Sanderson had one prepared foods plant, only for par-fried products, in Flowood, Miss.

“Both [companies] were very good at what they did,” says Kevin McDaniel, current president/ CEO of Wayne-Sanderson. To a large extent, what one did, the other didn’t do, making them complementary in products and geography.

“The chairman of ContiGroup always admired what Joe

Sanderson had built at Sanderson Farms, and there had been an ongoing dialogue for several years,” says McDaniel. “For the 10 years prior to the merger, Sanderson had been the fastest-growing poultry company in the U.S. and had built more plants than anybody at the time; really good facilities, good assets.”

Sanderson Farms remained owned by the Sanderson family until its public stock listing in 1987, with members of the Sanderson family retaining a significant stake. At the height of the Covid pandemic, ContiGroup, with the participation of Cargill, made an offer to buy Sanderson for $4.53 billion.

“Cargill had been out of the poultry business for a while and wanted to get back in, and they weren’t going to start small,” says

CEO Kevin McDaniel

CFO T.J. Wolfe

McDaniel, “so they and Conti put this deal together.” Although the Justice Dept. held up the acquisition for nearly a year, Sanderson was able to essentially merge with Wayne Farms in July of 2022, 11 months after the deal had been announced.

Clint Rivers, who was CEO of Wayne Farms, became CEO of the combined company, headquartered in Oakwood. McDaniel, who was COO at the time, replaced Rivers when the latter retired this April.

McDaniel’s earlier career experience includes executive positions with Pilgrim’s Pride and OK Foods prior to joining Wayne Farms as senior director of Wayne Farms fresh operations. He left the company in 2014 to serve as president of Aviagen North America and rejoined Wayne Farms in 2019 as VP/GM of the fresh business unit.

Business units

Wayne-Sanderson is on an April 1 fiscal year, so that $8.7 billion in sales was for the 2025 fiscal year

ending March 31, 2025. Although he couldn’t provide numbers for the midpoint of this FY2026, Wolfe says sales are “in line with last year.”

“The positive trends [for chicken] are continuing, there is broadbased, strong demand,” the CFO says. “Inflation is moderating. Feed costs have been relatively stable. Retail tray packs, that was a capability of Sanderson, have been very strong. At least for the first six months of this year, foodservice in general has been good.”

Exports account for about 5-7% of sales and in the past have consisted of dark meat and paws (feet). But there has been a shift in domestic consumption lately, with American consumers buying a little more of dark meat, particularly deboned thigh meat.

Wayne-Sanderson is vertically integrated, meaning it starts with purchasing breeders and pullets and operating its own feed mills, processing facilities and further-processing facilities. It has three business units: fresh, representing 61% of sales; retail (mostly tray packs) accounting

for 30%; and prepared foods, making up the final 9%.

“We over-index the other poultry companies in fresh and tray packs but we under-index them in prepared foods,” says Wolfe. While he acknowledges that Tyson and Pilgrim’s Pride have invested heavily in facilities and brand-building in prepared foods, Wolfe sees that category as a priority and growth opportunity for Wayne-Sanderson.

“I see us continuing to put investment back into our business to make that happen, increasing both capacity and capability.” While he doesn’t see a new, greenfield plant in the immediate future, Wolfe says there will be investments in those three prepared foods plants to increase value-added foods and further processing.

A step in that direction was the July acquisition of Harrison Poultry, best known for its Golden Goodness brand of traditional, international and halal poultry

PROCESSOR OF THE YEAR

Wayne-Sanderson developed Kosmic Krunch, a batter-breading platform that retains its signature crunchiness over longer hold times.

our business. We’re getting more efficient, getting better every day from the live production side to the rearing of the bird to the processing. We’re making a better, a more wholesome, a higher-quality product.”

“Automated deboning in the plants, for example, is relatively new,” adds Wolfe. “With AI, these new machines can learn, get better over time. That’s real interesting.”

Being a private company, as opposed to some of its larger competitors, has its advantages. “The difference is, our owners have a long-term view over investments and growth, and Kevin and I can make investments and decisions for the longer-term versus thinking quarter to quarter,” says the CFO.

Processors of the Year

2024: Keurig Dr Pepper

2023: JBS USA

2022: Hershey

2021: Mondelez

2020: Perdue Farms

2019: Hearthside Food Solutions

2018: Smithfield Foods

2017: Pinnacle Foods

2016: General Mills

2015: PepsiCo

2014: WhiteWave Foods

2013: ConAgra

2012: Chobani Inc.

products. “They’re much more into retail and foodservice,” says McDaniel. Harrison also brings Wayne-Sanderson medium-sized birds for a different category of foodservice customers.

Has the company changed much since Wayne and Sanderson were independent companies?

“Because we are a larger company, we can scale up investments more efficiently,” says Wolfe. “For example, right now we are making a significant amount of technology investments, replacing our ERP system, deploying new technologies not just across the plants but also at the farm level, at the hatcheries, everywhere.”

The chicken business also has changed in the past three years. “Where we are now, compared to even three years ago, there’s a lot more automation in the processing plants than ever before,” says McDaniel. “We don’t always think about it, but there’s some AI [artificial intelligence] coming into

“We believe this chicken industry is going to continue to grow, so we plan to make significant investments to grow as fast or faster as the industry is growing,” Wolfe continues. “We’d like to leverage our strengths, which are around our fresh business unit, our customer service and our company culture, but also to diversify into the areas where consumer demand is going. We need to not only make more chicken but to provide it in a way that consumers want, at a price point they need and give people all the choices they want in the future.”

Diversification within chicken, yes, but not into other proteins, at least not at this time, says Wolfe. “The reason is our ownership group. Cargill does have beef operations. We envision our future as a pure-play chicken company.”

Wayne-Sanderson has 27,000 employees over 24 complexes across seven states, in addition to 2,000 family farmers they work with.

2011: H.J. Heinz Co.

2010: TreeHouse Foods

2009: Nestle USA

2008: Hormel Foods

2007: Mars Snackfood

2006: Kellogg Co.

2005: Tyson Foods

It’s a very local, people-oriented, very rural business where the Wayne-Sanderson plant is a key part of the community, giving back, especially during tough times.

McDaniel sums, “We pride ourselves on being the supplier of choice, but at the same time, we strive to be the employer of choice. We put a lot of emphasis on retention, on employee welfare, we want this to be the place people want to work, from Texas all the way to North Carolina.”

PROCESSOR OF THE YEAR

CONNECTING CULTURE AND CUSTOMERS

Wayne-Sanderson Farms’ product development efforts flow from its Customer Innovation Center (CIC) and its location adjacent to its prepared foods plant, with the company capabilities and culture in plain sight.

Written by Andy Hanacek

SENIOR EDITOR

hen Wayne Farms and Sanderson Farms joined forces in 2022 to create Wayne-Sanderson Farms, many people were impressed by the companies’ natural fit together in the chicken marketplace with minimal overlap. Wayne W

sold its products mostly to foodservice customers, while Sanderson leaned more heavily toward the retail chicken channel.

Lesser known, however, was the ease at which interlocking the two companies’ R&D efforts would be.

“It was a pretty seamless transition, I’d say,” explains Matt Masters, director of research & development. “Sanderson had capabilities that Wayne didn’t, and vice versa.”

Beau Batchelor, corporate research chef –product development, and his team serve up a wide range of products at WayneSanderson's Customer Innovation Center.

PROCESSOR OF THE YEAR

Beau Batchelor, corporate research chef – product development, adds, “One was focused on B2B [business to business] and the other on B2C [business to consumer], but at the end of the day, the customer’s the customer, and we’re going to take care of that customer no matter their focus.”

Wayne Farms entered the marriage with its Customer Innovation Center (CIC), a standalone R&D center located on the same property as the company’s prepared foods plant in Decatur, Ala. The CIC is a 15,000-sq.-ft. facility built in 2018, with a test kitchen, presentation areas, R&D workspaces and a USDA-inspected pilot plant that mirrors the processes at the plant across the parking lot.

“This facility was designed to go from meetings to cuttings to small-scale production all in one place — you can take an idea from benchtop to commercialized product,” Masters says. “What you see here is pretty much identical to what’s in the plant — on a much smaller scale — from an equipment standpoint.”

The company wanted a space that was welcoming and delivered a pleasant experience for customers, as many R&D showcase facilities attempt to achieve. But, one thing that stands out about the CIC, says Batchelor, is its location.

“Usually, you’ll find a facility like this at a corporate location, but here, when we bring customers in, we can show them the path from idea to full production,” he explains. “They get a full picture of not only our processes, but our people, culture and everything else that makes us a great partner.”

The CIC’s location also benefits Wayne-Sanderson when it comes

to working with the operations and quality assurance (QA) teams. If adjustments to a product or process are necessary, the R&D team can react right away.

“Not doing these things over video conference or the phone, or waiting on someone to travel to the site, allows us to lend the support operations needs to win,” Batchelor adds. “We see things in real time, which makes for a more seamless process and faster reaction time, which I believe our customers also appreciate.”

In the best-case scenario, Masters says a product can go from concept to commercialization in four to six weeks. And because of the company’s due diligence process on new projects, the CIC’s commercialization success rate last year averaged slightly better than 80%.

“We ask the right questions, we dissect it and go through it as a total team — including sales,

category management, R&D, operations and QA,” he says. “It does the company no good if we develop a product that the operations team cannot run efficiently.”

The people playbook

A major selling point for Wayne-Sanderson to customers, the team notes, is that visitors to the CIC get a firsthand look — during both the product-development process and through operations — at the company’s culture of teamwork and how it puts the customer first. Alexander Brown, director of operations – prepared foods, says Wayne-Sanderson creates a truly unique experience for each customer.

“We’re in the business of chicken, but first and foremost, we’re in the business of people and relationships,” he says. “We’re

Wayne-Sanderson Farms developed Kosmic Krunch, a batter-breading platform that retains its signature crunchiness over longer hold times, looking to help its customers meet that demand for consumers.

Having the CIC match up with the prepared foods production lines certainly helps customers “put two trying to create an experience that is memorable for them, without inundating them with industry jargon they’re going to hear almost everywhere else; they’re not just

looking for process capability, machines and things of that nature.”

and two together” to make the leap from concept to commercialization, Masters adds. But it also empowers the operations team to be involved in that process as well, and Brown says customers notice that from the moment they arrive.

“We had a key customer [visit the CIC], and he said in his 30 years he had never come into this type of visit where the company talked about its culture from the gate,” he explains. “He would generally have to ask about it, and that really impressed him about us, because he was looking for that culture to be invested in his product.”

On the production floor in Decatur, if employees identify something that seems out of the ordinary, they’re comfortable approaching members of the R&D team like Masters and Batchelor, among others, rather than having to file something up through the chain of command and wait for what could be a simple answer.

“Their feedback and ideas have made us very successful, because they’re the experts who see our product the very last time before it goes to the customer,” Brown says. “So, they have a big influence on how competitive and successful we are long-term as a company — and they are empowered by that.”

Building out the CIC

Wayne-Sanderson has continued to invest in the CIC, bringing in new equipment to match what the prepared foods plant uses, as well as testing other machinery and processes for the plant and its customers.

“We have to provide the operations and QA teams with as good of a starting point as we can,” Masters says. “We’re constantly adapting,

Bulk Material Handling • Industrial Vacuum Cleaning

PROCESSOR OF THE YEAR

than ever for the R&D team, and that he’d like to have more space and more time to work on even more projects. With the company continuing to succeed as 2025 rolls along, keeping things simple, yet rooted in the teamwork culture Wayne-Sanderson has cultivated, may be the best approach.

The CIC has expanded its staffing levels in the past year, and Masters says the facility has been working more on retail-focused projects in recent times as well. For him, it has been a busier time and when we write a specification, we want to be able to hand that to an operator with every bit of information they need in order to run that product even without any prior experience on it.”

“I tell our customers, let us be the chicken experts, and we will work together to get you the product that you need,” Masters says. “We’re here to get the customer the end product they want at the efficiencies the operations team needs, so we can grow our business and our customer’s business together.”

FOOD PROCESSING MAINTENANCE SOLUTIONS

The Customer Innovation Center is located on the same property as Wayne-Sanderson’s Decatur prepared foods plant.

PROCESSOR OF THE YEAR

PROCESSING PARTNER OF CHOICE

Wayne-Sanderson Farms’ operations team embraces the customer-centric approach, with an engaged workforce and a strong company culture that pushes the envelope to the benefit of all.

Written by Andy Hanacek

SENIOR EDITOR

For any food or beverage processor, having a long-tenured roster of customers is a feather in the cap — and at the least can help stave off significant downturns in times of trouble. Earning the loyalty of a foodservice or retail customer can be achieved in numerous ways, and our 2025 Processor of the Year, Wayne-Sanderson Farms, relies on its customer focus and company culture to meet that challenge.

“We want to be able to produce what’s needed for our customers, and we marry that with the culture and leadership that we have in operations,” says Alexander Brown, director of operations – prepared foods.

“That’s how we become a partner of choice.”

With 23 different processing facilities across the South and Southeast U.S. — many of them vertically integrated complexes from hatchery to processing plant — the challenge

may sound daunting. But Wayne-Sanderson wears its culture on its sleeves and makes it the star of the show for customers.

In fact, the company points out the importance of culture, which has existed since the merger of Wayne Farms with Sanderson Farms in 2022. Both sides brought good, strong cultural traits to the new organization.

One of those cultures embedded in each separate company was process efficiency, which meant the new company could lean on positive culture and efficient operations to address most day-to-day hurdles that arose due to the geographically wider and more diverse plants and workforces.

Now, any time a business partner visits Wayne-Sanderson, they’re treated to a deep dive into the company’s culture along with its capabilities (see “Connecting Culture and Customers” on p28). And if they dig deeper into how the chicken processor treats its employees and runs its plants, they quickly realize that Wayne-Sanderson backs up its claims of also being an employer of choice.

PROCESSOR OF THE YEAR

Assembling the puzzle

After the merger that created Wayne-Sanderson, the operations side was divided up based on product output, resulting in processing lines and facilities dedicated to fresh (big bird/small bird), retail (medium bird) and prepared foods products. However, the operations and sales teams interact daily, the company says, to stay out of operational silos and also to serve all its customers holistically.

The Decatur, Ala., prepared foods facility has a great example of that cooperative spirit in the form of a production line that creates a valuable product out of what was a low-value byproduct of fresh processing.

Wayne-Sanderson is able to convert some of its various trim from fresh operations and portioning lines into safe, ground product for its chopped and

formed products — a segment of the market where the company is looking to expand its business. The line stands out in the prepared foods plant compared to the rest of the further-processing lines around it, but it is helping Wayne-Sanderson’s different divisions work together to meet customer demands more efficiently.

As the company has grown, creating redundancy within each operational division has become a bit easier to achieve, says Brown. And the company has embraced automation where it has made the most sense to improve efficiency.

“Redundancy is always in the back of our minds, so we can meet customer needs on time,” he explains. “As lines are getting faster and larger, we need to make sure we can stay competitive, and we’re looking to expand into more automation.”

Breaded chicken products travel along a conveyor to be packed for a customer at Wayne-Sanderson Farms’ Decatur, Ala., prepared foods plant.

Wayne-Sanderson has installed robotics in the pack-off area of its wing line at the prepared foods plant in Decatur, moving employees out of repetitive-motion jobs like this into better roles.

A constant flow of chicken wings makes its way down the wing line at the Decatur prepared foods plant.

Automation

as an assistant

The poultry industry, at least, has reached a level beyond the early days when any mention of automation and robotics in plants led to hand-wringing over potential layoffs on the plant floor. In particular, the chicken industry has embraced cutting-edge technology that has taken the most difficult, repetitive and hard-to-fill jobs out of the hands of manual labor.

Wayne-Sanderson has been able to reap the benefits of automation particularly on the fresh chicken processing side, where turnover is an industry-wide issue. Automated evisceration, deboning and cut-up lines have taken over for the old, manual cone lines, where dozens of employees manned stations along the chicken “disassembly” line. But automation isn’t reserved for first processing and fresh operations.

“One of the biggest expansions we completed was implementing a high-speed wing line, and we installed robotics at the packaging end of it as well,” Brown says. “We’ve got forward-thinking plans to incorporate robotics not only to save on labor costs but also to help us keep up with the needs of the customers.”

All that automation hasn’t cost employees their jobs; in fact, Wayne-Sanderson employees have seen upgrades to their roles and a safer work environment.

“The other selling point to the employees was that it would help them not have to work as many days per week, because we get to our intended production targets sooner,” Brown explains. “They understood it would be a huge benefit to get back some of their weekends to spend with their families.”

The worker safety benefits mesh nicely with the company culture at Wayne-Sanderson, which prioritizes being an employer of choice. Employee engagement on safety is critical, Brown explains, and the company has instituted weekly plant walkthroughs where employees from all over the facility bring a fresh set of eyes to the production floor and potential safety issues. Any questionable points are categorized by priority, and the company follows up and gauges its progress on each. Safety is also on the minds of “The Link,” a roundtable group that connects the ideas and concerns of the production floor directly to the senior leadership, helping drive the initiatives and safety strategies in both directions. The Link comprises members of maintenance, quality

assurance, shipping & receiving and production at each complex. They keep the facility workers engaged in the process, which results in those employees feeling empowered to take care of the products going out the door.

That, in turn, bolsters the culture Wayne-Sanderson has done well to create in just three years of combined existence. And that culture is evident to the company’s partners up and down the chain.

“People come here and they feel really good about us producing their products, because we’re selling the whole team and experience, not just our equipment and capabilities,” Brown concludes. “Customers feel really good knowing that we are going to show up every time for them and their products.”