The future has arrived with TANK Ai, an intelligent suite of technologies introduced by EnTrans to provide visibility and operational efficiency. Using onboard sensors, cloud-based communication, and active monitoring, TANK Ai funnels all data through one device to increase efficiency and reduce the paperwork and staffing needed to track trailer information. This advanced system increases driver accountability and record accuracy, and enhances fleet safety and uptime with proactive maintenance features. When it comes to load security, fleet managers and operators can check the loading and unloading of their trailers no matter where they are on their route.

EnTrans is ready to take you into the future with TANK Ai. Learn how at https://entransinternational.com/.

Tank4Swap delivers digital solutions for liquid logistics

Founder outlines platform’s features and benefits for ISO tank shippers

BulkTransporter.com/55241158

Expert shares strategies tank truck carriers can use to optimize transport BulkTransporter.com/55252413

Bulk Transporter

VP/Market Leader

Commercial Vehicle Group – Dyanna Hurley dhurley@endeavorb2b.com

Editorial Director – Kevin Jones kjones@endeavorb2b.com

Editor – Jason McDaniel

jmcdaniel@endeavorb2b.com

Associate Editor – Alex Keenan akeenan@endeavorb2b.com

Marketing/Advertising – Dan Elm delm@endeavorb2b.com

Art Director – Eric Van Egeren evanegeren@endeavorb2b.com

Production Manager – Patricia Brown pbrown@endeavorb2b.com

Directories/Listings – Maria Singletary msingletary@endeavorb2b.com

Audience Development Manager –Jaime DeArman, jdearman@endeavorb2b.com

Endeavor Business Media, LLC

CEO Chris Ferrell

COO Patrick Rains

CRO Paul Andrews

CDO Jacquie Niemiec

CALO Tracy Kane

CMO Amanda Landsaw

EVP/Transportation Kylie Hirko

Bulk Transporter Volume 122, Issue 1, is published six times per year by Endeavor Business Media, LLC, 201 N Main St, 5th Floor, Fort Atkinson WI 53538. Postmaster: Send address changes to Bulk Transporter, PO Box 3257, Northbrook, IL 60065-3257. Send inquiries to Bulk Transporter, PO Box 3257, Northbrook, IL 600653257. Customer service can be reached toll-free at 877-382-9187 or at bulktransporter@omeda.com for magazine assistance or questions.

Printed in the USA. Copyright 2025 Endeavor Business Media, LLC. All rights reserved. No part of this publication may be reproduced or transmitted in any form or by any means, electronic or mechanical, including photocopies, recordings, or any information storage or retrieval system without permission from the publisher. Endeavor Business Media, LLC does not assume and hereby disclaims any liability to any person or company for any loss or damage caused by errors or omissions in the material herein, regardless of whether such errors result from negligence, accident, or any other cause whatsoever. The views and opinions in the articles herein are not to be taken as official expressions of the publishers, unless so stated. The publishers do not warrant either expressly or by implication, the factual accuracy of the articles herein, nor do they so warrant any views or opinions by the authors of said articles.

Corporate Office: Endeavor Business Media, LLC, 30 Burton Hills Blvd, Ste. 185, Nashville, TN 37215 USA; 800-547-7377

Jason McDaniel Editor

Follow us at:

@bulktransporter

linkedin.com/in/ jason-mcdaniel-BT

facebook.com/bulktrans

After participating in the process for the first time, I fully appreciate the position, and the program’s prestige

I have interviewed and profiled every National Tank Truck Carriers Professional Driver of the Year since becoming Bulk Transporter editor in 2020. I even wrote about all eight Champion Finalists my first year, when NTTC suspended the program due to Covid-19, and the candidates waited an extra year to see who won. So I know these are all elite tank truck drivers—and even more impressive people.

Still, I didn’t fully comprehend the difficulty of selecting a winner until now.

This year’s field of William A. Usher Sr. trophy finalists, which a panel of American Trucking Associations staff whittled to eight well-deserving individuals, featured Darrin Guillory, Custom Commodities Transport; Ed Heard, Highway Transport; Bruce Jones, G&D Trucking/Hoffman Transportation; Michael Key, Kenan Advantage Group; Travis King, ADM Trucking; Jwill Kosier, SWTO; Heath Leitzke, Groendyke Transport; and Mark Schroyer, Grammer Logistics. Together, they boast over 17 million career miles.

Heard and Schroyer are repeat finalists, so I knew a little about them. Heard worked in law enforcement for 26 years before switching careers and Schroyer is a past president of the American Truck Historical Society (ATHS). But before traveling to Arlington, Virginia, to participate in the judging process for the first time, I didn’t know Heard’s son, Jazton Heard, is the assistant chief of police for the Missouri City Police Department, or that ATHS’s scholarship is named for Schroyer’s dad, George Schroyer.

In other words, these are high-character folks from first-class families.

While celebrating at the Chart House, and conferring in a boardroom at the Westin Arlington Gateway hotel, I also learned Guillory lost three fingers intervening in a domestic violence incident; Jones is a former Marine who has endured unimaginable family tragedy; Key, the youngest in the bunch at 40, already operates a five-truck fleet; King is a pastor who drives a pink truck in honor of his wife’s breast cancer battle; Kosier decided to pursue his life-long passion for driving trucks in his 50s after beating cancer; and the always-helpful Leitzke, whose son also is a trucker, trains first responders.

With so much quality, how do you crown only one? It’s a quandary. Fortunately, I wasn’t alone in this worthy endeavor.

The 2024-25 Driver of the Year panel included Rebecca Brewster, American Transportation Research Institute president and COO, and Dan Horvath, ATA senior vice president of regulatory affairs and safety policy, two people I’m more accustomed to seeing on stage than across the table; and America’s Road Team Captains Pete Palczynski and Anthony Tirone, two impressive Walmart Transportation drivers who previously pulled tanks. We asked each Champion Finalist 1-2 questions, then listened to each one explain why they’re a good candidate, how safety is a core value, and why tank trucks are their passion in a speech that was supposed to last 3 minutes.

Spoiler alert: They all went over, so time wasn’t the determining factor.

Confession: Tirone and I also queried candidates on their barbeque preferences. One correctly stated the best brisket is in Texas, so I considered elevating him to No. 1 in my top three for that reason alone.

I didn’t. But I thought about it.

Upon further reflection, I have also gained a much deeper appreciation for the first 10 NTTC Drivers of the Year, starting with Groendyke’s James Starr in 2013-14, and the judges annually tasked with grading their greatness.

Now I’m eager to sit with this year’s winner—after the big reveal. BT

Kenan Advantage Group recently acquired XBL Holdings, which includes subsidiaries Xcel Bulk Logistics and XBL Industrial Materials, from private-equity firm Lilium Group.

XBL—a $65 million operation as of early 2023—is a diversified dry bulk transporter that provides transportation, storage, and logistics services to industrial and construction customers. The company, headquartered in Weatherford, TX, operates the largest dry bulk fleet in the Carolinas, with significant capacity throughout the Gulf Coast and the Midwest.

Terms of the transaction were not disclosed.

The deal comes on the heels of KAG acquiring another dry bulk hauler, PRM Trucking, based in White Pigeon, Michigan. KAG secured its “definitive entrance” into dry bulk transportation with the acquisition of Northern Dry Bulk earlier this year.

“The transaction with XBL uniquely positions KAG to materially expand our dry bulk transportation platform in the future,” Grant Mitchell, KAG president and chief operating officer, said in a news re-

lease. “With their impressive market position and a diverse group of tenured, blue-chip customers, we’ve solidified our entrance into a very niche marketplace. What better way to expand our geographic footprint and service offerings than by partnering with one of the best in the industry?”

As part of the transaction, KAG will add 162 drivers and 53 operations staff to its team, along with 186 tractors, 356 trailers, 10 mobile storage silos, 11 terminal and satellite locations, and three maintenance facilities.

“It was important to our leadership team to find a partner who operates with the same principles and ambitious standards that we hold ourselves to every day—building trust through execution and creating value and long-term stability for our employees and our custom-

The Kenan Advantage Group recently acquired PRM Trucking.

The White Pigeon, Michigan-based company specializes in the transportation, transloading, and storage of lime, sand, and other dry bulk products for manufacturing and foundry companies throughout the Midwest.

Terms of the transaction were not disclosed.

“The further expansion of our dry bulk transportation services will be supported with the latest addition of PRM, allowing us to capitalize on our growing Midwest presence,” John Rakoczy, KAG Specialty

Products executive vice president, said in a news release. “We are also fortunate to benefit from the ongoing leadership of the PRM team, which will continue its successful journey with KAG.”

The acquisition includes 39 tractors, 91 trailers, a terminal, and a maintenance facility, along with approximately 3,000 ft. of rail for transloading operations.

KAG also is adding 33 drivers and 12 operational employees to its specialized team.

“We are pleased to provide our expertise and knowledge to KAG in the dry bulk space,” said Shari and Tom Morris, PRM’s

Photo: XBL

ers,” said Richard Hoyle, XBL cofounder and president.

“We look forward to providing our expertise as a leading provider in dry bulk services to help KAG elevate this segment of their business to the next level.”

The acquisition does not include Florida-based FlowTrans, the liquid food-grade hauler in Lilium’s portfolio.

“We are tremendously proud to have supported Rick and his team in developing XBL into such a strong logistics provider for critical industry,” said Peterson Hawkins, Lilium partner. “This transaction is a great outcome for shareholders and a wonderful opportunity for XBL and its customers to benefit from KAG’s leading platform.

“We look forward to watching what this powerful combination will achieve.”

owners. “It’s exciting to be a part of a new platform where our employees can further grow their careers and provide valuable insight into what we feel is a bright future for everyone involved in this transaction.”

No one was busier in 2024 than Bob Heniff.

The Heniff Transportation Systems founder and CEO in November welcomed Weinrich Truck Line to the Heniff group only a few hours after his growing family of companies revealed the acquisition of the Hagen Johnson Group. Heniff also expanded transload and depot services in the ports of Charleston and New Orleans, and went international with the purchase of TechnoPort in The Netherlands—all in a five-month span.

Weinrich is an Iowa-based food-grade fleet with a two-bay kosher tank wash, which Heniff plans to incorporate into its foodgrade network.

Terms of the transaction were not disclosed.

“We’re very pleased to welcome our new teammates from Weinrich,” Bob Heniff said in a news release. “Our growing foodgrade operation and its many customers will benefit greatly from this complementary addition to our service network. We’ll also benefit greatly from the many years of industry experience that Donna Weinrich and her family offer the Heniff family of companies.”

Weinrich traces its roots to 1919, when Sam Weinrich operated

Trimac Transportation recently acquired Watt & Stewart, a specialized carrier serving Canada and the United States, in a strategic move that strengthens Trimac’s position as a North American leader in bulk transportation.

The addition of Watt & Stewart, which includes a large flatbed fleet, expands Trimac’s service offerings in the mining, forestry, and heavy-equipment transportation sectors. By combining their expertise, the companies will deliver “enhanced operational efficiencies, service offerings, and broader market coverage,” Trimac said.

a drayage service. Weinrich Truck Line started in 1960 and moved to its current Hinton location in 1980, when the company began hauling food-grade bulk products.

The company has 35 power units, according to an FMCSA notice.

“Our team is pleased to join forces with an industry leader like Heniff,” said Brenda Dittmer, Weinrich vice president. “Heniff’s organization shares the same fundamental commitment to safety and service that our company was built upon over 60 years ago by my parents. Our two companies share the same values when it comes to our professional drivers and our customers. We look forward to working with the Heniff team as we continue to build upon the Weinrich legacy.”

Founded by Neil Watt and John Stewart in 1987, Watt & Stewart has grown from a small operation to running 124 tractors and 205 trailers. And with locations in Claresholm, Alberta, Canada, and Lexington, South Carolina, the firm is positioned to serve key mining and manufacturing hubs.

“Watt & Stewart is a remarkable company with a proud history, and we are honored to carry forward their legacy while working together to achieve new heights,”

Matt Faure, Trimac president and CEO, said in a news release. “Both organizations share core values of ‘Live Safety, Do the

Bulk Specialty Inc. (BSI) recently completed a $3.5 million expansion of its transloading terminal in Langley, British Columbia, Canada, aimed at increasing operational capacity, enhancing safety, and improving service for customers.

Key features of the fully operational upgrade include:

■ A 20% increase in railcar spots, expanding capacity to handle higher volumes.

■ Two brand-new, high-speed loading racks powered by an advanced 1,640-ft. header supply system. Ability to load 15,850 gallons in 30 minutes, reducing driver time at rack.

■ Dual loading arms.

■ Blending ability for dye.

■ A state-of-the-art spill containment system to ensure environmental and operational safety.

our customers and drive growth across North America.”

Watt & Stewart will retain its name and branding, and operate as part of Trimac’s family of companies, ensuring continuity for employees and customers, Trimac said.

As part of this transformative project, additional safety features were incorporated across the terminal, ensuring the well-being of employees, carriers, and the surrounding community, the company added.

Further advancements include a new transportation management system (TMS) designed to eliminate bill-of-lading errors, reduce loading times, provide advanced reporting, and streamline logistics operations. Looking ahead, carriers soon will have the capability to self-load directly from the racks, offering greater efficiency and flexibility.

“These enhancements reflect our unwavering commitment to customer satisfaction, safety, and continuous improvement,” John Badgley, BSI director of strategy and operations, said in a news release.

A SUBSIDIARY OF HENDRICKS HOLDING

• 3-A SANITARY

• DOT-407 CHEMICAL

• FOOD GRADE

• ASME

• DOUBLE CONICAL

PREMIUM QUALITY. EXPERT DESIGN. TRUSTED FOR OVER 50 YEARS.

REALLY FT. MANUFAC TURING TRAILER

...AND, NOW, A PURPOSE-BUILT, REALLY COOL, 400,000+ SQ. FT. AUTOMATED MANUFACTURING FACILITY AND INDOOR TRAILER SHOWROOM.

WE WOULD LOVE TO SHOW YOU WHAT WE DO! CONTACT US TODAY!

CONTAC T

Heniff Transportation Systems recently expanded its international presence after fortifying its U.S.-based food-grade fleet in November.

The rapidly growing tank truck carrier’s latest addition is a deal to acquire the Netherlands-headquartered Combo Group, which provides transport and logistics, food-grade tank cleaning, and maintenance and repair services for European customers.

Terms of the transaction were not disclosed.

“We’re very pleased to welcome our new teammates from the Combo Group,” Bob Heniff, Heniff Transportation founder and CEO, said in a news release. “Combo shares our customer-focused approach and brings immediate scale to our growing bulk services operations in Europe.”

The acquisition was Heniff’s second deal in the European bulk transportation market in 2024, following the addition of Technoport, an ISO tank services provider based in Moerdijk, Netherlands, over the

summer in its first foray overseas. Combo is strategically situated in the southern region of the country, near the Belgian and German borders, which is one of the busiest transport connections in Europe, Heniff reported.

The company also operates a state-of-the-art maintenance facility in nearby Geleen, Netherlands, and an additional office in Straelen, Germany.

“Teaming up with Heniff marks a significant milestone for Combo,” said Jan Van Erp, Combo founder and owner. “Heniff is an inspiring organization that shares our cultural values and strong commitment to service and safety. By joining forces, we continue to provide our customers, professional workforce, and other key stakeholders with a solid foundation to consistently deliver high-quality solutions.”

Based in Born, Netherlands, Combo

A Tres Energy affiliate recently agreed to acquire Adams Resources & Energy for approximately $138.9 million in an all-cash transaction.

Adams Resources companies include Houston-based tank truck carrier Service Transport Company—a recent National Tank Truck Carriers North American safety champion—Firebird Bulk Carriers, and Gulfmark Energy.

The transaction was expected to close in early 2025, the companies reported.

Upon completion, the company’s shares will no longer trade on the NYSE American stock exchange, and Adams will become a private company.

“We are thrilled to be a part of [the Tres Energy] team,” Adams CEO Kevin Roycraft said in a news release. “This new chapter will empower us to innovate more freely and focus on our long-term vision without the pressures of being a public company. We believe this partnership will enhance our ability to deliver exceptional value to our

is comprised of three operating entities. Founded in 1998 by Van Erp, the family-owned and -operated business started in the intermodal repair space and then expanded into other bulk services in response to customer demand. Today, Combo is recognized for transporting bulk beer and intermodal movements that require each of its service offerings through a one-stop-shop approach.

customers and employees, and we look forward to embarking on this exciting journey together.”

Under the terms of the agreement, Adams stockholders will receive $38 per share in cash for each share of Adams common stock owned as of the closing of the transaction. The per-share purchase price represents a 39% premium to the company’s closing share price of $27.32 on Nov. 11, the last full trading date prior to the announcement of the transaction, and a 53% premium to the company’s threemonth, volume-weighted average per-share price for the period ended Nov. 11, according to the release.

“This transaction marks the successful completion of a profitable journey for our shareholders and fulfills our strategic goal to restructure the company, unlocking more value from our assets and operations,” said Townes G. Pressler, chairman of the Adams board of directors. “By returning to our roots as a private company in partnership with [the] buyer, we will gain efficiencies and create new entrepreneurial opportunities for both the company and our employees.”

All Chemical Transport is expanding to the Houston area with a new terminal in Channelview, Texas.

The new chemical logistics hub will be the fourth location for the Lakewood, New Jersey-headquartered bulk hauler, which also boasts operations in Delaware and North Carolina.

“When I started All Chemical in 1978, it was me and my truck,” Steve Quadrel, All Chemical founder and owner, said in a blog post. “Over 45 years later, we have terminals in four states and employ over 130 drivers.

“It’s an exciting time to expand our services in Texas.”

With business booming for All Chemical in the Northeast corridor, and “growing numbers of satisfied customers in the Houston area and beyond,” the carrier said it was time to establish a local foundation

with a Texas terminal. Previously, the company served customers “from the outside in,” sending drivers into Texas to complete their in-state hauls before heading back out to work in other states.

The new terminal will open “a whole new landscape of possibilities,” All Chemical said. Services will include transportation, storage, on-site dispatch support, and a dedicated team of vetted local drivers using locally domiciled equipment to preload and stage hauls. The new terminal is expected to “come to fruition” as construction unfolds over the coming months, the company added.

The new operation includes immediate access to a local shop for fleet testing, repairs, and preventative maintenance, improving service for customers and drivers; and the carrier plans to add steaming capability.

Palmdale Oil continues to expand.

The Florida-based fuels and lubricants provider—which last year absorbed Maassen Oil Company—recently acquired Combs Oil Company, a Naples, Florida-based distributor of diesel fuel, gasoline, lubricants, and related products.

Terms of the transaction were not disclosed.

“Combs Oil Company has built an exceptional reputation for high-quality fuel distribution services for customers across Southwest Florida,” Palmdale CEO Lachlan Cheatham said in a news release. “This partnership will expand our presence in a target market and allows us to better serve our collective customers in the region.

“As we continue to focus on thoughtfully growing our footprint, we are excited to expand our service offerings to the Combs customer base and want to thank [Comb Oil president] Dennis [Combs] and his team for all of their hard work building Combs into the business it is today.”

Established in 1967, Combs Oil boasts a nearly 60-year track record of high-quality distribution of gasoline and diesel fuel related products to customers throughout Southwest Florida, Palmdale reported. With the addition of Combs Oil, Palmdale continues to expand its geographical footprint and strategic bulk plant storage infrastructure in the region.

“We are thrilled to join forces with Palmdale—a family-founded and operated business that shares our dedication to excellence and personalized customer service,” Combs said. “This partnership marks the beginning of an exciting new chapter for Combs as part of an organization equally committed to going above and beyond for its customers.

“We look forward to bringing an enhanced offering to our customers alongside the Palmdale family.”

All Chemical Transport’s new chemical logistics hub is based in Channelview, Texas, which is in the Greater Houston area.

“The expansion is exciting,” All Chemical COO Anthony Coruccini said.

“We have a budding reputation in the area. A number of our existing relationships also have large-scale operations in the Houston area, so it was organic in growing an operation out of that area. Being able to partner with a long-standing and reputable repair shop also makes the transition that much easier.”

Gemini Motor Transport, the private fuel-hauling fleet for Love’s Travel Stops, recently implemented Gravitate’s AI-powered supply and dispatch software.

Gemini—National Tank Truck Carriers’ first back-to-back North American safety champion in 24 years—delivers millions of gallons of fuel to Love’s stores and other locations annually, and the Gravitate solution is expected to help the company manage supply, optimize fuel supply decisions, dispatch 1,300 trucks, and provide new freight and quoting functionality, the company’s reported.

“Love’s transportation business has grown and evolved over the last 20 years, and we are excited to utilize the power of Gravitate Supply and Dispatch to help us further enhance our strategic approach to order generation, dispatch automation, supply optimization, and driver support across the nation,” Brent Bergevin, Love’s executive vice president of transportation, said in a news release.

The Gravitate Supply and Dispatch system is designed to enhance dispatch productivity and truck utilization. Through automated order creation and route optimization, it provides the power to increase dispatchers’ productivity. And, by leveraging an advanced supply optimization technology, Love’s expects to drive more intelligent fuel supply decisions and minimize laid-in costs of fuel across its network.

“It has been a real pleasure working with Love’s,” said Tom Hunt, Gravitate vice president of sales.

“I think we have learned as much from them as they have from us. Love’s runs a tight ship, and we are excited to incorporate their ideas in our solution to continue to drive value for the industry.”

D.G. Coleman, a bulk hauler with 150 trucks and trailers based in Commerce City, Colorado, recently implemented BeyondTrucks’ cloud-based transportation management system (TMS) in an effort to modernize and automate dispatch, billing, and payroll operations.

The partnership is expected to enhance the D.G. Coleman’s customer service capabilities and meet the evolving needs of its drivers, the companies said.

“Given the complexity of bulk operation, our dispatch, billing and payroll were highly manual processes before we started implementing BeyondTrucks,” Jimmy Coleman, a third-generation D.G. Coleman team member, said in a news release. “Today, we can already see how BeyondTrucks improves our dispatch decisions, replaces trip sheets in the delivery process, and automates payroll and billing processes.

“The seamless process we have with the BeyondTrucks TMS will help us provide even better service to our customers and support our dedicated team of drivers.”

Key features of BeyondTrucks’ solution, which is tailored to the unique demands of liquid and dry bulk transportation, include:

■ Configurable driver workflows: Provides customizable workflows for different commodities and stops, ensuring digital data collection for invoicing and payroll purposes, and

compliance and safety across all operations.

■ Load, equipment, and driver compatibility checks: Automates the matching process by considering driver availability, qualifications, and preferences, as well as equipment status and suitability, avoiding costly errors caused by matching the wrong equipment or driver with a load.

■ Sequence vs. scheduled load dispatch: Enhances dispatch planning by managing complex orders and load assignments unique to bulk loads with a digital planning board.

Mobile fueling company EzFill Holdings recently agreed to purchase 78 trucks from the Shell Retail and Convenience Operations fleet in a deal that allows it to immediately begin delivering fuel in the Phoenix, San Antonio, Austin, Dallas, and Houston markets.

“[This] announcement marks a transformative milestone for EzFill,” EzFill CEO Yehuda Levy said in a news release. “More than doubling our fleet immediately enhances our operational capacity and fuel delivery capabilities, [and] EzFill will now service customers in five new markets. This agreement positions us to scale efficiently, reduce costs, and continue delivering exceptional service to our customers nationwide.

“We jumped at the opportunity to purchase these trucks to enable EzFill to service the fleet of a large retailer and other customers in these markets.”

The addition of Shell’s trucks will increase EzFill’s fleet to 144 and expand its geographic reach in five new Arizona and Texas

■ Mobile off-line mode: Supports data storage and transmission in areas with poor cell reception, ensuring continuous operation regardless of connectivity.

“Fleets like D.G. Coleman’s with unique operations need to stay at the forefront of technology to deliver unique capabilities in specific customer segments,” BeyondTrucks CEO Hans Galland added. “We’re proud to support D.G Coleman with our platform so they can continue to gain a competitive advantage and build on the foundation Dan and Kathy Coleman laid at the company’s creation in 1972.”

markets, along with Miami, Orlando, Jacksonville, Tampa, Los Angeles, San Francisco, Detroit, and Nashville.

This agreement follows EzFill’s recent national expansion efforts, including the acquisition of Yoshi Mobility’s fuel division.

Houston-based tank truck carrier charts market-savvy path forward by Jason McDaniel

HOUSTON, Texas—Joe Pulido was busy when the call came in. And since the Pulido Transport owner didn’t recognize the number, he only partially listened to the exasperated voice on the other end—who he assumed was probably selling something—before saying he wasn’t interested and hanging up.

“I said, ‘Oh, I think I got that call already,” he chuckled.

Suescun ended up accepting the

A few days later, Alex Suescun, chief financial officer for the growing tank truck carrier based in Northeast Houston, told Joe to expect a call from Laura Murillo, president and CEO of the Houston Hispanic Chamber of Commerce, informing him he was named the organization’s 2019 Male Entrepreneur of the Year.

honor on Joe’s behalf. Joe was appreciative, but award ceremonies are outside his comfort zone, and the truck driver-turned-minority business owner prefers to focus his energy on expanding Pulido’s fleet, diversifying its services— and enjoying his prized 1969 Plymouth Road Runner whenever possible. And while Joe’s proud of his heritage, and Pulido’s Houston Minority Supplier Development Council certification, he’s determined to prevail based on the depth of Pulido’s services by leveraging his

team’s unique product knowledge and market perspective.

“You can use your background as a tool, and it can be a differentiator, but at the end of the day, are we servicing our customers and adding real value?” he said. “That’s our main goal. And then, are we treating employees well?

“They play such an important role in our success.”

Joe and his three brothers grew up in trucking. Older brother Carlos taught him to drive a truck when he turned 18, and he went to work at their dad’s company pulling end-dump trailers with sand and gravel. He transitioned to owner-operator after another older brother, Pete, helped him buy his first truck in 1985; and he founded Pulido Trucking, Inc. in 1995, when he had the opportunity to purchase additional trucks and trailers and join Traylor Bros. on a fouryear construction project to expand U.S. Highway 59.

The life-long trucker continued hauling sand and gravel, and waste in rolloff containers and vacuum trucks, until 2013. Then he connected with Lubrizol through a new employee and acquired his first tank trailer for lubricants. That led to spot loads with ExxonMobil, which invited Pulido to become a contract carrier in September 2014. So Joe and Suescun—a friend from church who previously worked at JP Morgan and joined the growing operation that year to help manage its finances—decided to sell off their environmental equipment, exit the more event-driven waste business, and pivot to steadier activity hauling refined products, now as Pulido Transport, exclusively in tankers, which is appropriate since Pulido translates to “finely polished.”

“We’re babies in this industry compared to the big guys, and it’s definitely more challenging to service customers,” Joe said. “But there’s just more opportunity for growth, and more consistency, especially with the customers we’re dealing with now, who we can depend on for steady load volumes.”

Pulido now is up to 30 trucks and 60 tank trailers, along with 30 drivers, 40 total employees, and two locations—the 3-acre headquarters on U.S. Highway 90, and a five-truck satellite operation in Beaumont. The for-hire carrier hauls lubricants, fuel additives, wax, and chemicals, including plasticizers and water treatment chemicals, for clients who value safety, on-time delivery, full transparency, and industry expertise.

“We’re not the most expensive option, but we’re not the cheapest either,” Suescun said.

“So the rates we’re able to charge are predicated by our value proposition. We must deliver value for our customers.”

Peniel Lim is Pulido’s most valuable secret weapon.

The new vice president spent 14 years with Exxon in various roles, including supply chain management, before joining Pulido in 2022, so he brings a shipper’s perspective to the business; and with a doctorate in chemistry, he knows the materials better than most. “He is a great asset to our operation,” Joe said. “Occasionally, we’ll get a product we’re not familiar with, so we go to Peniel, and he breaks it down for us.”

Lim’s arrival preceded Pulido’s big push into chemicals in a profit-protecting portfolio diversification. “When I

joined, one blue-chip customer supplied 34% of our revenue mix, and another provided 35%,” he said. “Now, chemicals account for more than 50% of revenue, and our two largest customers combine for less than 20%.” Under his direction, Pulido chases higher-margin specialized chemicals, like stabilizing agents for the oil industry. “Growth in lubes and wax is in the single-digit CAGR range,” he said. “Chemicals are growing much faster.”

To secure the best loads, they need to deliver the best service, which starts with relentless reliability. “One energy producer recently showed us the average on-time delivery and pickup percentages for all their carriers, and it’s 91%,” Lim relayed. “We’re at 95% on pickups—and 98% on deliveries.” And that performance is turning Pulido into a carrier of choice. “What we hear from customers is, for the strategic loads—the ones that really have to be picked up and dropped off on time—they call us,” Suescun said. Bulk shippers also appreciate load visibility, and Pulido delivers with its transportation management system (TMS), as well as its Samsara cameras, electronic-logging devices, and GPS tracking. Using their Houston-based TMS provider’s comprehensive, web-based software, managers, dispatchers, and

drivers—via an app on their phone—can double-click on a load for all relevant information, including vehicle identifiers, maintenance history, location, and delivery instructions. Pulido also shares Samsara tracking links with customers for real-time visibility. “They love it,” Suescun said.

“They tell us, ‘We know other carriers use Samsara, but they never send the links.’”

Pulido further distinguishes itself through its thoroughly audited commitment to safety. The carrier is a certified American Chemistry Council Responsible Care Partner, and in the rare event of a service issue, conducting a full root-cause analysis—and then sharing it with customers—is part of the company’s culture.

“We deliver a higher level of accountability—for our customers and ourselves,” Joe said.

Reliability on the road starts in the classroom.

Referrals still are the best way to find drivers, Suescun said, but Pulido also uses Tenstreet’s platform to find and recruit prospects, and order pre-employment screening reports, motor vehicle

records, and background checks. The carrier prefers at least two years of commercial vehicle driving experience and one year of tanker experience. Promising candidates have phone interviews with operations manager Matt McFerren and safety and compliance manager Melissa Wyatt. If they’re satisfied, in-person meetings with every department, including Suescun and Lim, come next.

“Every driver sits down with every member of our team,” Suescun explained. “I want them to understand why the paperwork they submit is so critical, so they sit with payroll. I want them to know why invoices are important, so they sit with invoicing. Then they’re going to meet with me to learn what I communicate with customers, so they understand what we’re selling. And they’re also going to sit down with safety and compliance, operations, and the dispatch manager [Christie Vandiver].”

Managers also want to make sure new drivers fit in culturally, and understand the nature of the products they’re hauling. “We tell our drivers they’re extremely important, because that plasticizer could be in your kid’s favorite toy they love to play with,” Lim said. “Quality is essential. What we do here every day affects everyone.”

Onboarding, which includes Infinit-I online safety training, typically takes 3-4 days. Then new drivers head out with a driver trainer for at least a week. “We don’t put pressure on drivers,” Joe said. “We tell them, it takes how long it takes. We want to make sure when they get in their own truck, they’re not thinking ‘Uh oh, I don’t know what I’m doing’ when they’re halfway to North Dakota.”

To ensure employee satisfaction, Pulido provides above-market pay with matching 401K contributions up to 3% for company drivers, and flexible scheduling for owner-operators. It also shuns inward-facing cameras and speed limiters, and only buys distinctively styled Peterbilt trucks. “I’ve always loved Peterbilt, and the way I see things, if you’re going to have a fleet of trucks, it’s better to run one make,” Joe said. Pulido recently expanded its fleet with 10 Peterbilt 579 sleepers, all sourced from Rush Truck Centers. To maximize value, the carrier only purchases latemodel used trucks, which Joe says are significantly more affordable now than at their post-pandemic high. “We’ve been fortunate lately,” he said. “We’ve tapped into a leasing program Rush offers, and when those trucks come off their lease, they’re usually turned in at around 300,000 miles, which is pretty low for a used truck. And with the agreement we have with Rush, they’ll put new tires on and fix whatever we want them to fix.”

Advantage Truck and Trailer Repair, a third-party shop on site, is charged with keeping trucks running at least another 600,000 miles. “A good maintenance program makes all the difference,” Joe said. Pulido also tracks maintenance costs per mile to ensure it stays within industry standards.

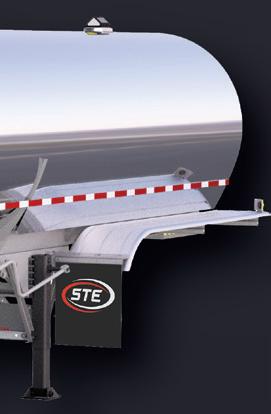

The trailing fleet includes both leased and owned DOT 407 stainless-steel tank trailers from Tremcar and STE. Pulido runs insulated 7,000-gallon rear and center unloaders with ground-level vapor recovery and air-ride suspensions. It also has three four-compartment aluminum Polar Tank Trailers. “With some

of our newer customers, we’re seeing a lot of the same products, so we can top load those units, which is making our dispatchers far more efficient with trailer utilization,” Suescun said.

Efficiency is essential—because Pulido isn’t done expanding.

The carrier plans to add more 10 trucks this year, including three in the first quarter, to take advantage of what it sees as improving market conditions under the Trump administration, which includes new EPA administrator Lee Zeldin. “But it’s hard to predict the future,” Lim said. “So we’ll react to what the data tells us.” Pulido also is considering new locations with input from Uber Freight, a valued partner that delivers occasional loads, and invaluable

insights. “Their feedback gives us a good indication of where the freight market is going, and we can search there for new customers,” Suescun said.

Lim sees Uber Freight’s system playing an expanding role in trucking. He also believes the company’s ride-share technology eventually will work for bulk liquid transportation, along with electric and even autonomous trucks. “We need to be adaptive to technology, and quick to respond when the industry evolves,” he insisted.

That’s why Joe, who’s now 66 years old, sees his savvy leadership team as the future of Pulido Transport. “We want to be very smart about how we grow,” Joe said. “I don’t want to lose focus on servicing our customers or hiring the right drivers—and we have to add value for customers.” BT

Premier Builder of Tank Trailer Equipment Since 1952

With over 70 years in the industry, we understand tough conditions. That’s why we put our stainless hydraulic pump to the test—extreme temperatures, harsh cleaning agents like sodium hypochlorite, and over 1,000 pressure cycles. The result? Zero wear, flawless performance.

Contact your local Girard distributor for price and availability

Part Number: GZ50000

Contact Us at gsales@girardequip.com or 908-862-6300

• Stainless sight gauge for easy fluid monitoring

• Tamper-evident seal tab on fill plug for security

• Durable all-stainless construction built for the chemical transport industry

• Easy retrofitting with industry-standard mounting

• Versatile—optimized for hydraulic fluid but can handle other liquids

Fueled by its 2022 acquisition, American PetroLog expands multimodal bulk solutions

by Jason McDaniel

American PetroLog’s founder said the time was right when he sold the third-party bulk logistics company in 2022. Bailey Bobbitt, American PetroLog vice president, now is certain Kenan Advantage Group was the right place, too. “KAG Logistics was the best fit for us culturally,” he said. “They already did a lot of the same things we’d been doing for 10 years, just more on the fuels side, and we did something totally different as far as verticals, with transloading, private-fleet reliability, and specialized services like grease transport.

“That’s really what brought us together.” The American PetroLog (APL) acquisition also helped KAG advance its rail expertise, and APL secured access to new technology, name-brand backing, a vast tank truck fleet, and KAG Logistics’ expansive carrier network. Now, their combination is giving bulk shippers access to elite rail-to-truck services, including new and expanded transload facilities in California, Nevada, Texas, and Florida—and holistic supply chain solutions. “When we execute an acquisition, we don’t go in and say, ‘Our ideas are right,’ and push them on a company that’s been successful,” said Mark Lloyd, KAG Logistics executive vice president.

“We share best practices, look for efficiencies, figure out what they do better—and then decide together which route to take.”

The KAG Logistics/APL advantage APL was founded in 2015 with the goal of providing safe and dependable

capacity to the petrochemical industry. Initial customers included producers of wastewater treatment chemicals and biofuels; and the U.S. military, which hired APL to coordinate deliveries of jet fuel. Bobbitt joined APL in 2016, and the asset-light company established its first transload facility in late 2017 in Venus, Texas, outside the Dallas-Fort Worth Metroplex. Harry Coyne, who now serves as vice president of transload operations for KAG Logistics and APL, entered in 2018; and Bobbitt and Coyne—who previously worked together at another bulk carrier—established a safety program that began attracting big energy producers in 2019.

That’s the same year APL secured its first major transloading contract. “That is when Harry and I really realized we could hang our hats on developing custom-fit transloading operations,” Bobbitt recalled.

At the time of its sale to KAG Logistics, the growing company had 15 employees, six transload locations, an office in Lafayette, Louisiana, and a run rate of $82 million. APL now boasts 17 locations—and is on pace to reach $100 million this year. “You can’t pigeonhole the APL guys,” Lloyd said. “They’re an aggressive group.

“They have the tag line, ‘We get to yes,’ and they’re very solutions oriented.”

Kevin Spencer started KAG’s logistics operation in 2005. Lloyd succeeded him as EVP when Spencer retired last year. KAG Logistics, one of six divisions within North America’s largest tank truck transporter, primarily moved fuels early on, transitioned to handling all bulk liquids in 2018, and then diversified into other transportation segments—it’s a big player in dry van and flatbed now, too—and multimodal bulk services, including transloading, rail management, and cross-docking, with help from APL and Connectrans, also added in 2022. KAG Logistics grew at a rate of 16.7% from 2015 to 2023, Lloyd shared. It now manages $500 million in freight and boasts 10,000-plus carriers, including 1,500 liquid, dry bulk, and drayage specialists.

Together, American PetroLog and KAG Logistics entered 2025 with synergistic momentum.

APL’s contribution includes helping KAG Logistics optimize lanes and services with its transloading equipment and expertise, which brings in more multi-touch truck cargo; its extensive network of railcar operators, which allows clients to outsource the time-consuming task of securing tank cars with the appropriate liners; and its exhaustive safety program that supports carriers’ efforts to meet chemical and energy producers’ lofty compliance, safety, accountability (CSA) thresholds.

KAG, in turn, is injecting its transformative transportation management system (TMS) and risk management information system software technology into APL’s operation, delivering audit-easing insurance levels and shipper familiarity.

“We’ve been able to bring a ton of business into the asset side, through our relationships with shared customers, and the transloading sites we set up, and they have unlocked more business for us,” Bobbitt said. “It’s a win-win for both sides of the table.”

Their deepening partnership is a slam dunk for multimodal bulk operators, too.

The newly unified KAG-APL Logistics network features new and brownfield sites, previously underutilized rail connections at existing KAG terminals, and expanding cross-dock and warehouse services. The newest transload operations are in West Texas, just outside Odessa, where APL began developing a facility last year; and a location west of Reno, Nevada, where APL is working with a new ISO tank depot partner.

The 40-acre West Texas site, which is anchored by a blending facility, boasts water access, and a rail siding served by Union Pacific, by way of short-line railroad operator Watco, that’s long enough to simultaneously load multiple tank cars.

“We have aspirations to build that into a larger, multi-customer blending facility for specialty chemicals,” Coyne said. “We can hold 100-plus cars on site, we have yard equipment—soon we’ll have our own rail-car pusher—we’ll be toting and packaging there, and we’ll have opportunities to expand with a laydown yard or other operations.”

Bobbitt plans to accelerate marketing efforts for the facility when the blending operation is fully functional, sometime in the first quarter, he said. “We couldn’t have gotten this far as just American PetroLog, the startup company,” Bobbitt said. “We needed KAG behind us to get this operation off the ground.

“KAG is the engine that’s fueling our growth.”

APL already managed tank container fleets for the Department of Defense in Hawaii and Puerto Rico, so the Nevada facility—which has 30 rail-car spots and a booming fuels business—extends the service to meet growing demand in the contiguous United Sates. “It seems like everybody wants ISO tanks these days, and they want them in strange location that are hard to support,” Coyne confirmed.

The South Gate facility near downtown Los Angeles is served by KAG drayage trucks and features APLmanaged warehousing and cross-docking services for growing export markets in Korea, Japan, and South America. KAG’s preexisting Eagle Lake terminal, east of Tampa, Florida, serves lumber, steel, and petroleum manufacturers supplying one of the fastest-growing areas of the country. “We’re really looking to increase our position there,” Coyne revealed. “We have approximately 10 rail car spots I could easily fill today, and the ability to expand— with the right commitments—in the next six months.”

KAG Logistics’ initial transloading operations primarily facilitated ethanol delivery. With APL’s diverse contribution of bulk commodities, it’s now transferring everything from plastic pellets and dry cement to waxes, lubricants, and even grease—a niche transportation service APL’s team developed.

“A customer needed additional grease capacity, especially into Canada, so we did some research and learned only one company in North America makes piston trailers,” Bobbitt relayed. But that manufacturer wanted to lease the trailers

to APL, so he and Coyne designed their own instead. “It took nearly two years to put it all together, with engineering, testing and logistics, and getting the price where we needed it,” Coyne explained. “They would have been manufactured largely in China and then assembled in Australia and shipped to Mexico.”

However, the Covid-19 pandemic disrupted those plans—and doubled the price point.

Forced to pivot under pressure, APL quickly sourced a new U.S. supplier— just in time to beat a drop-dead delivery deadline. “We weren’t 100% sure they’d work,” Bobbitt recalled. “We had to pivot fast, and it was minus-6 in Gary, Indiana, the day of the first delivery.” The trailers did work, so APL now runs 10 highly customized piston tanks designed for all weather conditions. “Our trailers are insulated, with heat tracing and steam capability, and they operate efficiently, so our first customer loved them, and we built more. Now we’re hauling grease for five customers, and a lot goes into Canada.”

One shipment recently crossed the famous Ice Road on its way to Fort McMurray.

“Next we’re looking to wrap or paint those trailers, with attention-grabbing logos, with help from KAG Logistics,” Bobbitt said.

Expansive

As a newly assembled unit, they’re anticipating further transload-fueled growth.

“It’s a key component, because I believe rail is going to be a bigger and bigger part of peoples’ supply chains,” Lloyd said. “And we’ll continue to go upstream with our customers, whether it’s building a transload facility or helping them manage railcars. We have big growth plans for Bailey and his team.”

With built-to-spec, rail-to-truck transfers as the lynchpin, Bobbitt aims to double annual load counts over the next several years. Transloading currently makes up only 25% of APL’s overall bulk business, and 10% of KAG Logistics revenue, but KAG’s relationships are unlocking new opportunities for multimodal

growth as shippers attempt to reduce carbon counts and navigate the ongoing driver shortage. “Before, customers might have seen us as just a broker, or dedicated operation, mostly for trucking,” Coyne said.

“Now, with KAG’s name behind us, the sky’s the limit on what we can do.”

They’re also well-positioned to take advantage of improving conditions. “The big oil-and-gas customers we work with have been holding back investments for the last four or five years,” Bobbitt said.

“Now that the money’s there, it will be actively invested in growing business.”

And oil-rich regions like the Permian Basin in Texas are expected to benefit from ongoing changes in Washington.

“We’ll be able to service a wide array of customers, and really plant our flag in West Texas, which we expect to see a resurgence in the next couple years, with exploration and other oilfield activities,” Lloyd said.

Technology is the latest KAG-enabled advantage in APL’s business-boosting arsenal. With “game-changing” new TMS software, which is in the final stages of implementation, APL will be able to manage entire books of business,

into the thousands of loads, with fully integrated rail management, carrier protection and compliance software, supply-chain tracking, and a client-facing load board. “The big challenge with transloading is forecasting,” Lloyd said. “If it’s on rail today, how long do I need to hold onto the inventory, when will it show up, and can I keep my operations running effectively?

“We’re making strides in that department, which allows customers to utilize transloading to a higher degree.”

The APL and KAG Logistics teams also continue to improve their cooperative efforts to sell transload services, leading APL’s leaders to scout locations for future facilities in places like Las Vegas, Phoenix, and Sacramento, while dreaming of a day when their collective efforts create a new division—KAG Transloading. “We want to grow into a standalone vertical,” Bobbitt said. “That’s the ultimate goal.”

Lloyd’s expectations are equally lofty. But, for him, the only measure is success.

“If it makes sense, we’ll do that,” he said. “But I’m not worried about who reports to who. I just want to put the right people and solutions in place.” BT

by Jason McDaniel

New facilities, growing aluminum business energize Canadian manufacturer’s U.S. expansion

STRASBURG, Ohio—Tremcar has worked hard to solidify its reputation as a manufacturer of premium stainless-steel chemical and food-grade tankers and highly customized multi-axle trailers since Jacques Tremblay purchased the Canadian company from the Tougas brothers 36 years ago. But recent and upcoming expansions are quickly transforming Tremcar into an elite supplier of aluminum equipment, too.

The manufacturer last year produced 28% more aluminum tankers—primarily for fuel transportation—than in 2023 at its upgraded Tremcar USA facility in Strasburg, Ohio, which now features a dedicated building for barrel construction, two additional service bays, and a

parts warehouse; and it plans to open a new plant this summer in Québec, Canada, that will produce aluminum trailers and truck-mounted tanks.

“People know us for making the best stainless-steel tanks on the market,” said Daniel Tremblay, Tremcar president, and

Tremcar’s $4 million production facility expansion

the son of Jacques, who retired in 2017. “That’s what we aim for, and we never cut corners—we always give more to our customers—so they’re still our top seller.

“But more and more, with our Strasburg plant and growing fuels business, people are seeing we make very good aluminum tanks.”

With help from its growing aluminum segment, Tremcar also increased total tank trailer output year-overyear, to nearly 1,300 units, in 2024; and expanding production capacity has the company poised for further growth under President Trump, Daniel said, arguing the administration’s

pro-business, pro-energy policies far outweigh the threat of tariffs for commercial vehicle manufacturers. “People are excited,” agreed Melanie Dufresne, Tremcar director of marketing and communications.

“It’s positive for the economy—and when the economy’s good, people buy more tankers.”

Aldé and Léo Tougas founded A&L Tougas in 1962 in Sabrevois, Québec, as a milk tank manufacturer. Jacques, who spent most of his career in the concrete industry, purchased the company in 1989 and renamed it Tremcar. Daniel entered the family business in 1992 and quickly gravitated to the tanker operation, which grew exponentially under his leadership. So Jacques opted to sell his concrete operations and join Daniel at Tremcar in 1995. “He saw my passion, and how involved I was in the business, and decided to come work here with me,

Tremcar’s Strasburg, Ohio, facility produced 172 aluminum tank trailers last year in the first full year inside a new 20,000-sq.-ft. production facility.

so we could build something together,” Daniel recalled.

Tremcar established its first U.S. plant in 1998 in Champlain, New York, then relocated the operation in 2004 to the old International Tank Trailer facility in Ohio. Today, the company is one of the largest tank trailer manufacturers in North America, with over 700 employees and production plants in Strasburg; Haverhill, Massachusetts (home of Boston Steel, a Tremcar USA division); Saint-Jean-sur-Richelieu— where Tremcar has two facilities—and Saint-Césaire, Quebec; and London, Ontario. Tremcar specializes in innovative dairy transports, like a farm

pickup tanker with automated metering and sampling introduced in 2020; heavy-duty tank trailers with up to eight axles; and A- and B-train combinations.

“Tremcar stands out for being a premier custom tank shop,” said Kevin Vogel, Strasburg quality control manager.

“We build the trailers people need.”

Now Tremcar aims to build more tank trailers, and boosting its U.S. market share—which accounted for 35% of total revenues last year—is a top priority. That’s why the company invested more than $5 million in the Strasburg expansion, and last year tripled its U.S. sales staff and added 35 skilled U.S. workers.

“Customers drive our growth,” Daniel said. “They’re asking for more from Tremcar, and it breaks my heart when someone buys from a competitor because I can’t meet their demand.”

Strasburg production

The 7-acre Strasburg location, which Tremcar has expanded five times, produced 134 DOT 406 aluminum tankers in 2023, and 172 tankers last year in the first full year inside a new 20,000-sq.-ft. building with three versatile barrel lines. “We went from 2.5 trailers per week, if we were lucky, to 3-4, and now we’re looking to add a fourth line and go to 5-6 trailers per week,” said Dave Brooks, Strasburg plant manager.

The $4 million facility is set up for lean-manufacturing efficiency and line flexibility, with three portable barrel rotators that enable quick changeovers. Tremcar was building B-trains with tridem leads and tandem pups for Alaska and Canada on Line 1; standard 53-ft. units for the U.S., South America, and the Caribbean on Line 2; and sixaxle trailers for Michigan on Line 3 when Bulk Transporter visited.

“We’re shipping them out to dealers as fast as we can build them,” Brooks said.

The original horseshoe-shaped, 11,000-sq.-ft. building now is dedicated to tanker fabrication, finishing, and final inspections. Tremcar makes most parts

The original Strasburg production facility now is reserved for fabrication and finishing.

and components, from custom cabinets and hose trays to ladders, fenders, and frames, in house using new tools and fixtures, a Kodiak plasma cutter, and Ermaksan press brake. End caps from Tremcar’s Saint-Césaire plant are shaped using a Blue Valley flanger.

Strasburg is up to 75 production workers, and 100 total employees—and it’s still growing.

“We have a solid team there, and it’s easy to invest when people are doing their jobs,” Daniel explained. “They’re serious about the work, so I want to support their efforts, and help them make things happen.

“Our goal is to keep moving forward. We’re not at full capacity yet.”

A $1.5 million investment in the adjacent tank maintenance and repair shop added two bays and 5,000 sq. ft. in late 2023. The building now boasts 19,200 sq. ft. and 10 bays, including a dedicated fabrication space with a shear and press brake for speedier repairs and replacement parts. But, with five tank service facilities in a 180-mile radius, it’s the shop’s nine long-tenured, highly skilled employees—including 44-year industry veteran Ed Dugan—who make Strasburg stand out. “We have 215 years of combined experience in the service center here,” said Jim Everett, Strasburg

service manager. “They’re well-rounded, they’re knowledgeable—and they’ve seen it all.”

The result is a persistent backlog. Even with the additional bays, customers wait 2-4 weeks for annual inspections, and 4-8 weeks for bigger projects, and every bay was full when Bulk Transporter arrived. The shop maintains, repairs, and inspects all tanker makes, models, and years. Regular jobs include modifications, accessory installations, frame repairs, and jacket replacements. They even fix vacuum-collapsed barrels. “It’s amazing how you can blow them out,” Everett said. “We cut off the rings in the damaged areas, fill them full of water,

repressurize them, and they bounce right back.”

All trailers are metered for safety before they enter the shop.

“First and foremost, every trailer that comes in must have a cleaning slip,” Everett said. “If it’s missing, we’ll contact the company and have them send the slip or take the trailer back to have it cleaned. Then I want the SDS sheet, because even if it was cleaned, I want to know what we’re diving into.”

Improvements are ongoing across the growing company. In Strasburg, Brooks is developing new confined-space entry

training for employees and first responders, introducing ergonomic carts for parts movement and staging, and emphasizing good “housekeeping.”

The location also is increasing inventory, improving the utilization of raw materials, and modernizing its management system to digitize paperwork and track tanks throughout the manufacturing process.

The state-of-the-art, 125,000-sq.-ft. Granby facility will feature “4.0 automation” powered by artificial intelligence and robotic welding cells—at a cost of $30 million—when it opens in July after two years of planning.

“We’re always looking for opportunities to upgrade operations,” Dufresne said. Now is the right time, too—despite Trump’s threat of 25% tariffs on Canadian goods, Daniel maintained. Expanding U.S. production minimizes Tremcar’s risk, and the company already sources most of its materials and components from the U.S., but the owner and president also believes any tariffs imposed will be applied in “very precise places” to help protect complex U.S.-Canada parts supply chains.

“I really don’t believe the tanker industry will be impacted at all,” he said. “It’s not something that I’m losing sleep over, yet anyway.” BT

By Jason McDaniel

The Covid-19 pandemic prevented National Tank Truck Carriers from celebrating its diamond jubilee in person, so leaders are determined to ensure this year’s 80th birthday bash is an occasion worth remembering.

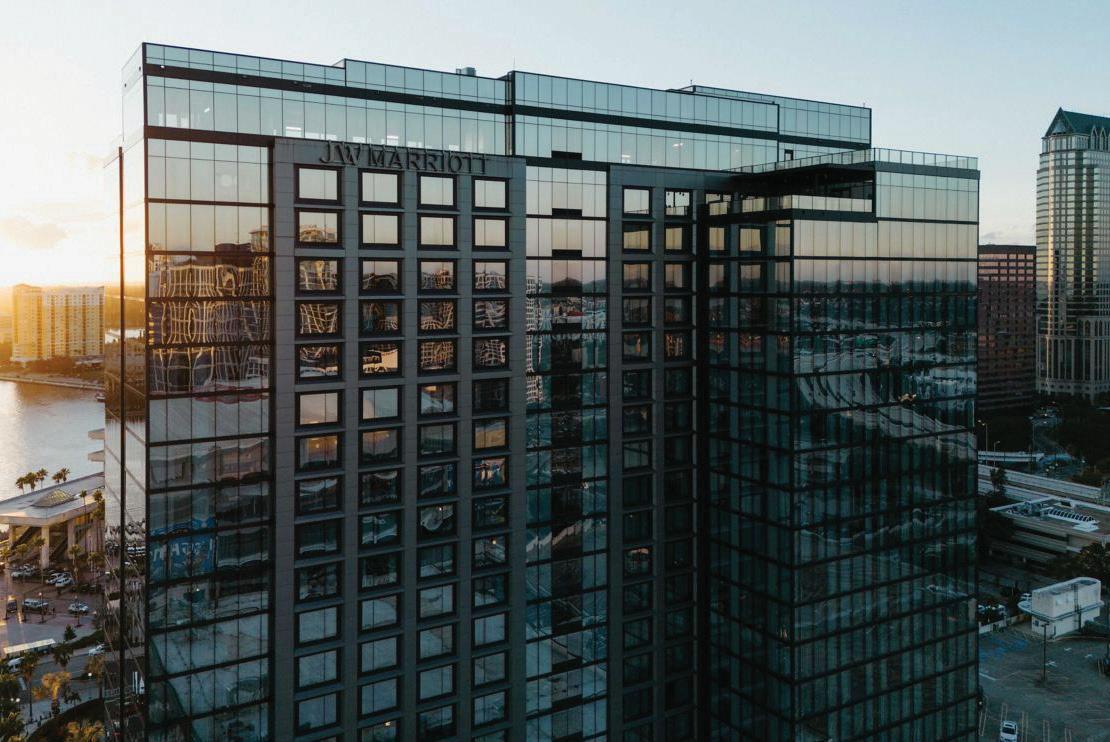

The trade association’s “oak” anniversary is the overarching theme for the 2025 NTTC Annual Conference & Exhibits, which is set for April 21-25 at the JW Marriott Tampa Water Street hotel in Tampa, Florida, where industry stakeholders will gather to recognize the safest tank truck companies and drivers, advance industry initiatives, share best practices—and reflect on NTTC’s 80-year legacy.

“It’s humbling to think about,” said Ryan Streblow, who’s only the fifth president and CEO in the association’s history. “It speaks to our deep roots as an association, and the character of the

individuals in the tank truck industry. These aren’t fly-by-night operations. Many of them are family-driven companies

“So it’s in their blood—and they’re here for life.”

This year’s annual meeting also comes on the heels of the first 100 days under the Trump Administration, which started with a flurry of executive orders, including ambitious plans to roll back climate change regulations and promote fossil fuel production. Those moves, combined with the appointments of Republicans Sean Duffy as U.S. transportation secretary and Lee Zeldin as U.S. EPA administrator, bode well for NTTC in its battle against unreasonable zero-emission vehicle adoption times. But Streblow says emissions regulations will remain a top-tier priority for

the association, which recently approved a record $204,000 in Political Action Committee disbursements for 2025.

“There are so many freshmen members of Congress who we need to spend time with to help educate; and then, with a Republican-dominated House, a Republican administration, and a small margin in the Senate, we have two years, maybe four, to get some of our association’s major priorities pushed across,” Streblow explained. Those priorities still include lobbying for electronic shipping papers in hazmat transportation and the dry bulk axle variance. They do not include streamlining duplicative security credentialing after NTTC helped push that issue across the finish line last year with the signing of the TSA Security Screening Modernization Act—giving members another reason to celebrate. Washington now has until June 2027 to implement the new legislation, Streblow said.

“That may seem like a long time, but it’s lightning speed in government years,” he said.

NTTC was founded in 1945, just after World War II ended, to advocate for tank truck industry causes, provide a valuable resource, and champion safety in the tanker community. Eighty years later, it’s better equipped than ever to fulfill that mission, Streblow contended, with improved financial status, enhanced deliverables, determined industry leaders, and swelling membership, all of which will be on display in Tampa.

“There was a lot to be excited about over the last five years,” said Streblow, who succeeded Dan Furth as president in 2020. “It certainly took a lot of hard work by our association staff and members— with everybody committed to pushing us in the right direction.”

In addition to sharing updates on key initiatives, like NTTC’s industry branding campaign and apprenticeship program, the conference will feature expert presentations, the 2025 rollouts of NTTC’s “Tank Truck Market Analysis” and Cottingham & Butler’s “Trucking Benchmark Compensation & Benefits Survey,” a PAC event at Top Golf, and an 80th anniversary celebration sponsored by ACT 1.

“It’s a great venue for this year’s activities,” Streblow said.

As always, the conference highlights are the Professional Tank Truck Driver of the Year award ceremony, which includes a keynote address by NFL Hall of Fame Coach Jimmy Johnson—who led the Dallas Cowboys to two Super Bowl championships—and the North American Safety Award luncheon.

The champion finalists for the title of 2024-25 NTTC Driver of the Year— and the coveted Usher trophy—are Darrin Guillory, Custom Commodities Transport; Ed Heard, Highway Transport; Bruce Jones, G&D Trucking/ Hoffman Transportation; Michael Key, Kenan Advantage Group; Travis King, ADM Trucking; Jwill Kozier, SWTO; Heath Leitzke, Groendyke Transport; and Mark Schroyer, Grammer Logistics. The presentation is on April 23. “I say it every year: I don’t understand how we

could have such an amazing selection of drivers, and continue to one-up it year after year,” Streblow said. Previous winners of the NTTC Driver of the Year award include:

• 2013-14: James Starr, Groendyke Transport

• 2014-15: Bobby Weller, Hahn Transportation

• 2015-16: Darryl Nowell, Eagle Transport

• 2016-17: Todd Stine, Carbon Express

• 2017-18: Paul Emerson, Foodliner

• 2018-19: Barbara Herman, K-Limited Carrier

• 2019-20: Program suspended due to pandemic

• 2020-21: Ron Baird, G&D Trucking/Hoffman Transportation

• 2021-22: Thomas Frain, Highway Transport

• 2022-23: Kenneth Tolliver, G&D Trucking/Hoffman Transportation

• 2023-24: Dave Powell, Usher Transport

Finally, NTTC will present its prestigious Heil trophies to two for-hire carriers and a private fleet during a conference-concluding ceremony April 24. Groendyke Transport is the reigning and nine-time champion in the Harvison division, for carriers who traveled more than 15 million miles in 2024; G&D Trucking/Hoffman Transportation is the reigning and three-time winner in the Sutherland division, for carriers with less than 15 million miles; and Gemini Motor Transport, another three-time champ, won the first two private-fleet titles.

“Gemini has an elite safety program,” Streblow said. “But everyone is beatable. Every day, someone is trying to improve their operations.” BT

Younger Brothers, Houston, Texas

1986 Ruan Transport, Des Moines, Iowa

1987 Manfredi Motor Transit Company, Newbury, Ohio

1988 Boncosky Transportation, Algonquin, Ill.

1989 Enterprise Transportation, Houston, Texas

1990 Groendyke Transport, Enid, Okla.

1991 Groendyke Transport, Enid, Okla.

1992 Manfredi Motor Transit Company, Newbury, Ohio

1993 Manfredi Motor Transit Company, Newbury, Ohio

1994 Roeder Cartage, Lima, Ohio

A&R

Joliet, Ill.

Distribution Technologies (formerly Manfredi), Newbury, Ohio

Miller Transporters, Jackson, Miss.

Trimac Transportation, Calgary, and Houston, Texas

Jack B. Kelley, Amarillo, Texas

Andrews Logistics, Irving, Texas

A&R Transport, Joliet, Ill.

Florida Rock & Tank Lines, Jacksonville, Fla.

Usher Transport, Louisville, Kentucky

Superior Carriers, Oak Brook, Ill.

Tidewater Transit, Harvison; Wynne Transport, Sutherland 1995 Manfredi Motor Transit Company, Newbury, Ohio

Miller Transporters, Harvison; Carbon Express, Sutherland 1996 Matlack, Wilmington, Del.

Manfredi Motor Transit Company, Newbury, Ohio

1998 Transport Service Company, Hinsdale, Ill.

Groendyke Transport, Harvison; GLS Transport, Sutherland

Harvison; G&D Trucking/Hoffman Transportation,

Groendyke Transport, Harvison; Tandet Logistics, Sutherland 1999 Groendyke Transport, Enid, Okla.

Trimac Transportation, Harvison; G&D Trucking/Hoffman Transportation, Sutherland 2000 Groendyke Transport, Enid, Okla.

Usher Transport, Louisville, Kentucky

Trimac Transportation, Calgary, Alberta, Canada

Suttles Truck Leasing, Harvison; LSP Transport, Sutherland

Service Transport Company, Harvison; Lacy’s Express, Sutherland

Tandet Logistics, Harvison; Harmac Transportation, Sutherland; Gemini Motor Transport, private 2003 Mission Petroleum Carriers, Houston, Texas

Groendyke Transport, Harvison; G&D Trucking/Hoffman Transportation, Sutherland; Gemini Motor Transport, private

No matter if you need bottom-loading, gravity-unloading, standard or air-actuated product returns, single-, dual- or triple-bank manifolds, get exactly what you need, built to your specifications, with Betts-engineered proven modular design.

• Up to 10 compartments

• 11-inch or larger on-center distance

• Standard or air-actuated product returns

• Methanol/ethanol-resistant sight glass

• Multiple seal options available, including fluorosilicone, FKM BLT and FKM “GFLT-S” Visit BettsInd.com/AirManifold and use our SmartSpec™ Custom Air Manifold Configurator to easily generate a custom product number for your specific application.

ABC vice president leads association through an ‘interesting’ 2024-25 tenure

by Jason McDaniel

Ward Best was ready for a change. He and wife Shannon had recently welcomed their first son, Camden, so she wanted to move closer to home, and he wanted a new career. Fortunately for them, providing solutions is a life-long passion for Shannon’s dad, Gary Short, the 82-year-old CEO of Atlantic Bulk Carrier (ABC), which Short founded in 1971 in Providence Forge, Virginia. “Gary and I met, and we agreed he would hire me, and we could try it out,” Best recalled. “And if it didn’t work, we’d part ways without any hard feelings.

“We’re still waiting to see how that turns out.”

Best’s signature quips aside, it was the best decision ABC could have made.

The carrier ran only 32 trucks when he joined the family business in 1996. Today, he’s the vice president of a leading bulk hauler that has 200 tractors, 750 trailers, and 200 employees, including Camden, now 29. And the guy who jokingly insists he couldn’t spell “tank truck” when he started also now serves as National Tank Truck Carriers’ 77th chairman—one of the industry’s most prominent positions.

“It’s been an absolute honor to have him,” said Ryan Streblow, NTTC president and CEO.

“Ward not only is well-connected politically, he has a leadership mindset when it comes to advocacy. So, in a time when we were shifting from a focus on the economy, and trying to right the ship, to a workforce-focused effort—along with it being an election year—Ward helped steer the association in the right direction by focusing on the advocacy side, and make sure we’re considering every angle.”

Best began his ABC career as a mechanic, changing tires and greasing tanker

chassis. But he progressed quickly and rose to president of Atlantic Tank Lines in 2003, when ABC separated its hazardous and non-hazardous services for liability purposes. Four years later, he rejoined ABC as VP after leaders decided the savings didn’t justify the inefficiencies. “I thoroughly enjoyed doing that, and we had success, but we felt we could be more successful by reintegrating the two companies,” Best explained.

The wholly owned operation now hauls liquid and dry bulk products, including plastic pellets, aggregates, and water treatment chemicals, across the United States, with a focus on shippers in the Southeast. “Growth, for us, has never been a straight line,” Best said. “When I came on board, we had a much tighter footprint. Then as we expanded operations, we opened terminals farther and farther outside that footprint. Some of those we’ve grown, but others subsequently closed. So it hasn’t all been straight-line, continuous growth, but we’ve maintained an upward trajectory, increasing steadily in size and scope.

“It’s still an open question as to how much farther we want to venture out of the Southeast, but we’re fortunate this region is one of the fastest growing in the nation, and that includes population and manufacturing activity.”

While helping grow the third-generation family business—which includes brother-in-law Mark Short, ABC president; and sister-in-law Jeniffer Zaun, who oversees payroll and benefits—Best has been actively involved with NTTC since the late 1990s, when he became a registered hazmat cargo tank inspector through the association’s Tank Truck University while still working under longtime ABC shop foreman Jerry Oliver. Best also was appointed chairman of the Virginia Trucking Association in 2019.

“These associations bring untold value to our industry,” Best said. “More carriers need to recognize that—and participate.”

Best’s participation will continue long after his 2024-25 chairmanship ends, and he hands the reins to David Price, United Petroleum Transports vice chairman. But before moving on to the next opportunity, Best visited with Bulk

Transporter for our annual “State of the Industry” address, covering everything from ABC’s growth and market expectations to ongoing challenges and the Trump administration’s impact. Questions and answers are edited for space and clarity.

Bulk Transporter: What sets ABC apart from other tank truck carriers?

Ward Best: “We’re family-owned and family-run, and we find that many drivers are looking for that family feeling when they’re searching for a home. Tank truck drivers and technicians are highly skilled and sought after, so any advantage we have benefits us. And our employees benefit because they have unrestricted access to the folks who own and run the company. Gary Short still comes into work regularly.”

BT: How did ABC fair in 2024?

WB: “As with many tank truck carriers, the past few years have been challenging. Economic conditions have made it a struggle and the workforce has undergone a radical change since the Covid pandemic. Luckily, I believe tankers have fared better than the general freight market. I’m still very active in the Virginia Trucking Association, so I talk with folks from different sectors of the industry on a regular basis. And I’m hopeful and more optimistic about this year, so we are actively working to position ourselves for improved conditions.”

BT: Is there a segment where you see the most potential for growth?

WB: “Different opportunities present themselves at different times, and in different areas. So we try to stay openminded and look for those opportunities and position ourselves to be able to take advantage of them. And we’ve diversified our operations to do that. We run both liquid and dry hazardous and non-hazardous products. Now, we don’t do food-grade. That’s a different world. And unlike a lot of NTTC members, we don’t haul any fuel. But that still leaves a broad swath of the market that is moving liquid and dry bulk materials we can

handle, which gives us opportunities others may not have.”

BT: With uncertainty in the energy sector, many carriers have pursued growth in chemicals in recent years. Do you see that continuing?

WB: “When I started, many years ago, there was a whole lot of chemicals coming out of the Northeast. And I very specifically remember picking up loads in the Philadelphia and New England markets and bringing them back to the South. A lot of that has moved. It’s either going on rail or into holding and transload sites closer to the final delivery point in the Southeast. So that modification has already occurred, and those types of things will continue to happen as the labor market, economy, and population shift. So it’s incumbent upon us, and anyone else out there, to be familiar

with those changes, and be able to react to them accordingly. The only constant in trucking is change.”

BT: Speaking of changes, we saw a big one in January. I think most tank truck carriers are optimistic about how Trumpadministration policies will impact their operations, especially regarding zero-emission vehicle adoption timelines. What do you think?

WB: “We’re certainly at an inflection point. Most people I’ve spoken with in the industry at large have a positive outlook about the administration change, so they’re hopeful, but we must continue to stay on top of our iniatives. With the electrification of trucks, we’re not opposed to the advancement of technology. As a matter of fact, we’re the biggest cheerleaders for that. What we oppose is the impractical headlong rush to push

this technology out before it’s ready, before we have any infrastructure on the ground, and without any commonsense guidelines in place.

“So we’re asking for a reevaluation. We want folks to look at this issue very critically and come up with a good-faith assessment of how and when this should happen. Electrification might not be the best path forward. It might be alternative fuels, like renewable diesel, or maybe hydrogen, or any number of different things. We should not be forcing a single solution on very disparate organizations and industries.”

BT: Can you at least breathe a sigh of relief on emissions regulations?