BROUGHT TO YOU BY THE VIRGINIA SOCIETY OF CPAs I SEPTEMBER/OCTOBER 2016 I VOL. 29 NO. 5 I VSCPA.COM DISCLOSURES.VSCPA.COM Educator roundtable Social media marketing Divorce taxation Kanban for accounting firms page 14 KEEP IT SIMPLE

November 9–11, 2016 Intelligent Tax Planning to Combat Increasing Federal and State Taxes 62 nd Annual WILLIAM & MARY TAX CONFERENCE presented by Estimated 21 hours CPE (50-minute hours). Registration forms available at law.wm.edu/taxconference or by email at wmtax@wm.edu. Introducing

INSIDE this issue NOV. 10–11, 2016 THE HYATT REGENCY RESTON, VA Introducing KnowledgeNOW Featured Speakers Jared Weiner Senior Policy Fellow at Rutgers University, Lecturer at Princeton University Richard Keevey Former U.S. Comptroller David Walker Executive Vice President and Chief Strategy Officer at The Future Hunters CPA, CISA, CGFM, Former DCAA Director, Former U.S. Army Auditor General Patrick Fitzgerald

COVER STORY >>

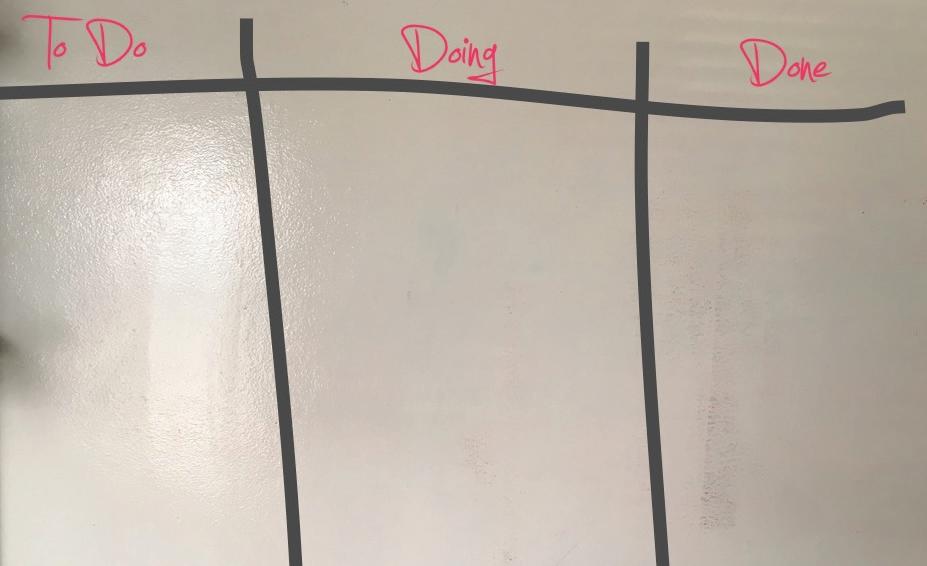

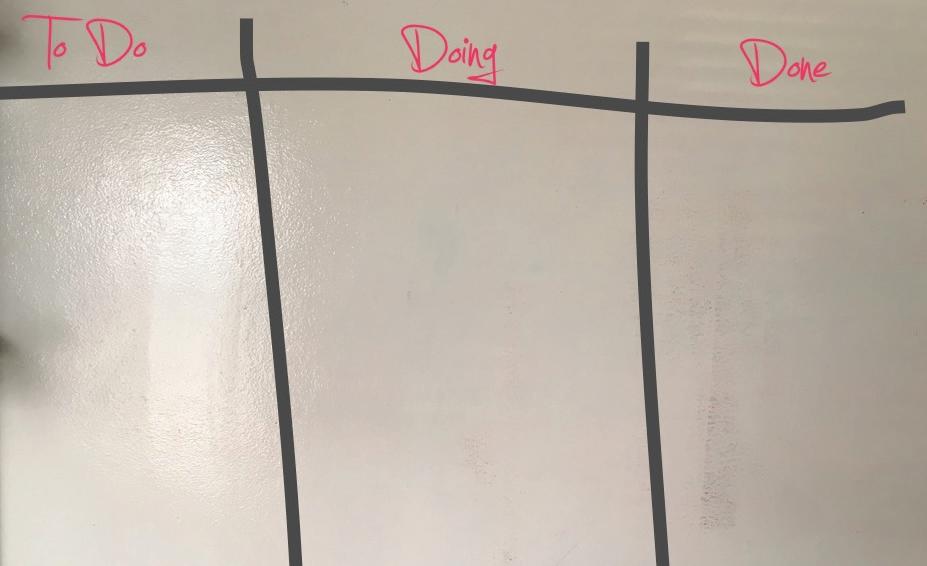

A Kanban board in its simplest form is a visual representation of a ‘to-do’ list that has three columns: to-do, doing and done. Learn how you can use the principles of Kanban to help your office run more smoothly.

FEATURES

KANBAN FOR ACCOUNTING FIRMS 14

Through a simple process, Kanban can increase efficiency, reduce mistakes, identify and correct bottlenecks and communicate progress.

UPS AND DOWNS:

DIVORCE TAXATION 20

When clients get divorced, they are on a roller coaster ride of legal and tax issues. CPAs can play a significant role in helping clients navigate the challenges.

TEACHER TALK: EDUCATOR ROUNDTABLE 24

How are educators around Virginia preparing their accounting students for their careers? Teachers discuss technology, the CPA Exam and more.

ARTICLES

DEVELOPMENT

Volunteering for a chapter

MARKETING MATTERS 12 Social media marketing CPE 13

Navigate your CPE busy season

SECTIONS

PERSPECTIVE

AD INDEX

Aon 17 CAMICO 29 Beth A. Berk, CPA 19 Digital Benefit Advisors 23 Keiter 40 Nationwide 11 Poe Group Advisors 39 William & Mary Law School 2

disclosures

is published bimonthly for members of the Virginia Society of CPAs.

ITEMS

DRAFT

NEWS

AM THE VSCPA

mission is to enhance the success of CPAs.

BACKTALK 5 PRESIDENT’S

6 LINE

7 DATA

9 VSCPA

30 CLASSIFIEDS 37 I

38

Our

10

CONTENTS 4 DISCLOSURES • SEPTEMBER/OCTOBER 2016 • DISCLOSURES.VSCPA.COM

VIRGINIA SOCIETY OF CPAs 4309 Cox Road

Glen Allen, VA 23060 (800) 733-8272

Fax: (804) 273-1741 vscpa.com

disclosures

disclosures.vscpa.com

EDITORIAL STAFF

Jill Edmonds

Managing Editor disclosures@vscpa.com

Chip Knighton

Contributing Editor

cknighton@vscpa.com

David Bass

Public Relations & Communications Director dbass@vscpa.com

EDITORIAL TASK FORCE

Olaf Barthelmai, CPA

Adam Chaikin, CPA

Cheri David, CPA

Jennifer Eversole, CPA

Keith Gray, CPA

Genevieve Hancock

Alesia Lewis, CPA

Harold Martin Jr., CPA

David Peters, CPA

Mark Plostock, CPA

Barbara Sukramani, CPA

DEADLINES

Articles and advertising for future issues are due by 5 p.m. on the following dates:

Nov./Dec. 2015 Sept. 1, 2016

Jan./Feb. 2017 Nov. 1, 2016

March/April 2017 Jan. 2, 2017

May/June 2017 March 1, 2017

July/Aug. 2017 May 1, 2017

Sept./Oct. 2017 July 5, 2017

Statements of fact and opinion are made by the authors alone and do not imply an opinion on the part of the officers, members or editorial staff.

VSCPA ENDORSED PARTNERS

From Facebook

BACKTALK you said it

This is one of the best programs I’ve been to and I even got a mentor!!! Thank you all so much. — On the Leaders’ Institute

ELIZABETH OWUSUWAA Norfolk

VIA FACEBOOK >>

Good work! Miss those days. — On the VSCPA Board of Directors’ strategic retreat in June

COLETTE WILSON, CPA Fairfax

VIA INSTAGRAM >>

From the TWITTERSPHERE >>

What does DHG Manager @RobCherryCRE think is the future of #accounting? Flexibility. Read more via @VSCPANews: http:// ow.ly/3qrs302o4AN. — @RWHITE13908

@VSCPANews, you did an excellent job w/ the recap PDFs of the Business & Industry Conference and Educators’ Symposium. Thanks for sharing! — @PROFMITCHELL

Definitely agree with this list — @TEDTalks that will inspire CPAs http://ow.ly/i1Y0301G7be. — @EKIMOFFCPA

Congratulations to the winners of the VA CFO awards! — @OVERHOLTLORI

We love #VACFOMonth! Our CFO Laura is always bringing her A+ game. — @MINNIELAND_VA

#TBT to last year’s @VirginiaBiz #VACFOAWARDS. Excited to celebrate this year’s nominees tonight @JeffersonHotel! — @VERO_GARABELLI

VSCPA student member Courtney Armistead (VCU 2016) joined us at the CPA Center for the Renewal Phonathon this year.

CONNECT: connect.vscpa.com

TWITTER: @VSCPANews, @FinancialFit

LINKEDIN: tinyurl.com/VSCPALinkedInGroup FACEBOOK: facebook.com/VSCPA INSTAGRAM: instagram.com/VSCPA

Get in touch At the Virginia Society of CPAs, we love to hear from you. Whether it’s a quick email to a staff member, chat on the phone, Disclosures letter to the editor, tweet, blog comment or something different altogether, let us know what you’re talking about, how you feel about different issues affecting CPAs and how we can help.

tweet or something different altogether, let us know what you’re talking about, how you feel about different issues affecting CPAs and how we can help.

PRESIDENT’S perspective

Testing what matters: The new CPA Exam

One of the VSCPA’s top priorities is to ensure the vitality of the CPA pipeline in Virginia and elsewhere. That’s why we provide scholarships to Virginia’s top accounting students, work closely with educators to make sure they’ve got the tools needed to prepare those students and provide resources and discounts for young accountants preparing for the CPA Exam.

For the youngest of those accountants and the students who will follow them into the profession, Exam prep — as well as that of the professors tasked with getting them ready — is about to change. Next April, the American Institute of CPAs (AICPA) will roll out the updated version of the CPA Exam.

Changes to the Exam obviously have profound effects on the future of the profession, and the VSCPA is at the forefront of making sure all affected members are prepared. The new Exam was the subject of the main session at the 2015 and 2016 VSCPA Educators’ Symposiums, held each June to help accounting professors keep abreast of changes in the profession. And in the November/December issue of Disclosures, VSCPA members Gabriele Lingenfelter, CPA, and Phil Umansky, CPA, will write on how educators can teach to the new Exam more effectively.

Many things won’t change on the new Exam, including the basic level of competence assumed of the prospective CPA. As on previous incarnations of the Exam, the AICPA holds that a newly licensed CPA should have the knowledge and skills typically possessed by an accountant with two years of experience.

What’s different is the way that knowledge, and those skills, are assessed. Previous versions of the Exam were criticized for being too memorization-based. That’s a point that AICPA experts have hammered home over the last two years of the Educators’ Symposium.

In 2015, presenter Richard Gallagher, CPA, of the AICPA

Examinations Team, said “People want people to know more than a whole bunch of facts and how to regurgitate them.”

This June, AICPA Technical Manager

Jessica Gray, CPA, said “You can’t test an analysis and evaluation with a multiple-choice question.”

So the AICPA has ramped up its use of task-based simulations, adding 12 of them across the four sections of the Exam. The increased use of simulations is intended to aid assessment of higher-order skills and tasks.

The AICPA’s analysis of the old Exam and its development of the new one was based largely on Bloom’s taxonomy, a set of hierarchical models used to organize educational learning objectives. Learning objectives for the Exam were slotted into four categories of ascending difficulty:

>> Remembering and understanding: Perception and comprehension of knowledge

>> Application: Demonstration of knowledge

>> Analysis: Identification of relationships to determine causes and evidence supporting inferences

>> Evaluation: Examination and use of judgment to draw conclusions

The AICPA sought out help from subject matter experts in crafting and revamping questions, with the goal of getting input from people who use CPA skills to perform their

day-to-day jobs. After all, there’s a vested public interest in an accounting education preparing students to be effective stewards and watchdogs of the business community and the government.

The CPA Exam is the next step in that process. The CPA credential shows that an accountant has gotten the proper education and been deemed worthy of entry into the profession. The accounting industry is a largely selfregulating community that can’t operate effectively without the trust of the people it’s charged with protecting. Maintaining a challenging, but fair, CPA Exam is a crucial part of that regulatory process. When new CPAs are better equipped to do the vital job they’re tasked with, the credential becomes that much stronger, and everyone who takes pride in it benefits. n

STEPHANIE PETERS, CAE, has served as president and CEO of the Virginia Society of CPAs since 2007. speters@vscpa.com connect.vscpa.com/StephaniePeters @StephPeters

6 DISCLOSURES • SEPTEMBER/OCTOBER 2016 • DISCLOSURES.VSCPA.COM

IT’S HURRICANE SEASON >>

Prepare your clients

Even though a disaster can strike at any time, Virginians often find themselves in the path of hurricanes during the fall. Financial readiness is an important part of planning, just like an evacuation plan. Last year, the American Institute of CPAs (AICPA), American Red Cross and National Endowment for Financial Education released a new guide, “Disasters and Financial Planning: A Guide for Preparedness and Recovery,” to help Americans craft plans that protect their property, income, assets and records.

It’s easy to share this free resource with your clients. Visit tinyurl.com/DisasterPrepGuide. n

EXCELLENT EXCEL >>

LINE items

Add chart element: Trendline

As auditors and accountants, we like information to be timely so that it is relevant. It’s hard to make decisions on old information. Recently a colleague provided me a table of dates for when certain information is issued annually. While all the dates were in an Excel table, it was difficult for me determine if there was a trend within the release dates. As a visual person, I wanted to see if I could graph the release dates, and with a few formulas and Excel’s charting tools, I came up with the following chart:

COSO PROPOSES ERM FRAMEWORK UPDATES

If you want to provide the Committee of Sponsoring Organizations of the Treadway Commission (COSO) with comments on its updated enterprise risk management (ERM) framework, now is the time. Back in October 2014, COSO announced a project to review and update the ERM — Integrated Framework. Companies’ managers and boards of directors use the framework to enhance their organizations’ abilities to manage uncertainty.

The revised framework, Enterprise Risk Management — Aligning Risk with Strategy and Performance, updates the core definitions of risk and ERM, as well as the components of ERM. It also introduces principles that reflect the evolution of ERM thinking and practices.

You can read the draft and its FAQ and provide comment by Sept. 30, 2016, at coso.org.

These are the steps that I took, should you want to develop your own similar visual analysis. To chart the release dates, I calculated the number of dates between the start of each calendar year and related release date using the ‘DAYS’ function. For example, if the release date of 6/9/2005 was in cell B2, I would enter 1/1/2005 in cell C2 with the formula DAYS(B2,C2) in cell D2 to calculate that the 2005 information was released 159 days into the calendar year. With the years in one column and the ‘number days into the calendar year the information is released’ in another column, I was able to highlight the data and “insert” a line chart. As you can see by the dotted line, my analysis did not end there. Under the Design ribbon, I clicked on the Add Chart Element button and selected Trendline followed by Linear Forecast. It is the Linear Forecast that allows the user to know that while the timeliness of the information is not consistent, it is trending in the right direction. n

GEORGE D. STRUDGEON, CPA, CGFM, is an audit director at the Virginia Auditor of Public Accounts in Richmond. Email him if you have Excel topics you want him to cover.

george.strudgeon@gmail.com connect.vscpa.com/GeorgeStrudgeon

DISCLOSURES • SEPTEMBER/OCTOBER 2016 • DISCLOSURES.VSCPA.COM 7

IRS INVESTIGATORS AT WORK >>

ID theft tax scheme halted in Richmond

One of the top 10 national cases of identity theft and tax fraud was prosecuted in Richmond, according to the Internal Revenue Service (IRS) Criminal Investigation division. In August 2015, Eddie Blanchard of Miami was sentenced to 204 months in prison with three years of supervised release and ordered to pay $568,625 in restitution for his role in a stolen identity tax refund fraud scheme.

In the early part of 2012, Blanchard repeatedly traveled to Richmond with other criminals and used stolen personal identifying information to file hundreds of fraudulent tax returns through online tax preparation programs. The men claimed significant refunds on the fraudulent returns and requested the refunds be placed on pre-paid debit cards, which were later mailed to Richmond addresses selected by the conspirators. The scheme began to unravel when a Virginia police

WHAT WE’VE BEEN DOING

The VSCPA’s annual State of the VSCPA report is now online! The report details the activities of the VSCPA, the VSCPA Educational Foundation and the VSCPA Political Action Committee (VSCPA PAC) as we work toward our mission of supporting Virginia CPAs.

Visit vscpa.com/StateOfTheVSCPA to view the report as well as the VSCPA’s audited financial statements. n

officer encountered one of the men removing a box containing stolen identity information from a storage unit.

The case is an example of the major crackdown by the IRS on identity theft. In fiscal year 2015, the IRS initiated 776 identity theft-related investigations, resulting in 774 sentencings through Criminal Investigation enforcement efforts. n

FEDERALLY SPEAKING

Top news from the Capitol and other national happenings…

IRS RELEASES DEFERRED COMP PROPOSAL

After a nine-year wait, the U.S. Internal Revenue Service (IRS) issued proposed regulations on deferred compensation plans of state and local governments and tax-exempt entities, with section 457(f) plans as a key focus. Find out more at irs.gov.

"PROTECT YOUR CLIENTS; PROTECT YOURSELF" CAMPAIGN

The IRS has launched a new campaign called "Protect Your Clients; Protect Yourself" to encourage tax preparers to implement safeguards to protect clients from data theft. The program is an expansion of the Security Summit's 2015 "Taxes. Security. Together." campaign, which sought to increase public awareness of identity theft. Fact Sheet 2016-23 summarizes the critical steps necessary to protect taxpayer information and refers preparers to IRS Publication 4557 (Safeguarding Taxpayer Data). Find the fact sheet at irs.gov/pub/irs-news/fs-16-23.pdf.

SUMMERTIME TAX SCAMS

The scammers were out in full force all summer long, duping taxpayers by using aggressive scare tactics, spoofing caller ID, using phish email and through many other ways. Scams cost victims more than $38 MILLION. Educate your clients on the tactics of scammers, and visit irs.gov for more details. n

POTENTIAL EMPLOYER MANDATE PENALTIES FOR HEALTH CARE

In an Information Letter, the IRS indicated that an employer mandate penalty under IRC Sec. 4980H could apply to an employer that develops a new policy restricting part-time and seasonal employees to no more than 29 hours per week and the employee works more than 29 hours of service in a week. The amount of the employer's potential liability is based on the number of employees who average 30 or more hours of service per week in a given month. Check out Information Letter 2016-0030 at irs.gov for more. n

8 DISCLOSURES • SEPTEMBER/OCTOBER 2016 • DISCLOSURES.VSCPA.COM

LINE items

The CPA brand by the numbers

CPAs inspire confidence and remain the most highly regarded and trusted business professionals among business decision-makers and investors — and there are stats to back it up.

In 2015, the American Institute of CPAs (AICPA) commissioned its multi-constituency biennial research study to understand perceptions of the CPA brand, update insights from the 2013 brand study, measure progress against key brand metrics and guide strategy and plans. Here are some highlights:

>> Among finance and business professionals, CPAs are ranked NO. 1 for high regard by business decision-makers and investors. Among all professionals, they are second only to physicians. This rank increased by 12 PERCENT over 2013 results.

>> Business decision-makers’ satisfaction (very satisfied and somewhat satisfied) ranks very high among both internal (93 PERCENT) and external CPAs (90 PERCENT). Investors who work with CPAs are 97 PERCENT satisfied with their performance.

>> Integrity and competency continue to be rated the top two CPA attributes by business decision-makers and investors.

Learn more about the research study in an AICPA blog post at tinyurl.com/CPABrandBlogPost. n

CANCELLED

Commit the spelling of “cancelled” to memory because Virginians have problems spelling it, according to search research released by Google to determine the most-misspelled words in each state. Hey, it could be worse: “diarrhea” tops the list in more than one state. Other troublesome culprits around the country? Desert, leprechaun, tongue and cousin, to name a few. n

CONSTRUCTING THE COMMONWEALTH

Virginia ranked NO. 9 nationally in 2015 for development for office, industrial, warehouse and retail real estate, according to NAIOP, the commercial real estate development association. Fast facts about Virginia’s real estate development:

>> New development supported 13,281 JOBS

>> Development overall supported 34,482 JOBS

>> Development contributed $2.5 BILLION to Virginia’s economy

Find the full study, with several appendices detailing development stats by state, at naiop.org. n

Affordable colleges in Virginia

According to the Forbes list of this year’s 300 Best Value universities, the Commonwealth is chock full of affordable educational opportunities. Eleven universities made the list of 300, and five made the top 50.

The Virginia universities among the top 50 were the University of Virginia (No. 19), the College of William and Mary (No. 22), Virginia Tech (No. 29), Washington and Lee University (No. 32) and Virginia Military Institute (No. 44). The other Virginia-based schools on the list were James Madison University (No. 99), the University of Richmond (No. 127), George Mason University (No. 180), the University of Mary Washington (No. 185), Hampden-Sydney College (No. 201) and Sweet Briar College (No. 298).

The No. 1 most-affordable school was the University of California, Berkeley. n

DATA draft DISCLOSURES • SEPTEMBER/OCTOBER 2016 • DISCLOSURES.VSCPA.COM 9

PROFESSIONAL development

Why you should serve your CPA society: A chapter volunteer’s perspective

BY KEITH GRAY, CPA

I would be lying if I said it was not a combination of eagerness and angst I felt as I sat across from a slightly intimidating partner gauging my interest in the opening for Roanoke Chapter vice president, which drove my decision to serve. I have never liked letting people down, and I was not about to start just a few months after moving to the Roanoke area.

In my defense, however, I possessed at least a sliver of a foundation on which to make this decision. I had always been intrigued with the state society in Alabama and was a member of its Huntsville Chapter until moving to Virginia three years ago, and moving a few states away only had the effect of adding one more publication (Disclosures) to my morning reading ritual. Even still, the day the partner presented me with the opportunity, I admittedly would have struggled to expound on the mission of state societies and their local counterparts. Further, what I could say on the matter would not have come out with much conviction.

But now, after two enjoyable years serving with the VSCPA’s Roanoke Chapter, I can provide some food for thought as to why you should get involved.

During my time as both president and vice president of the Chapter, I witnessed the Society’s impact on the profession at the local level. Last year, we sponsored 20 hours of affordable CPE for our members through several chapter meetings and our 14th annual CPE event. Not only were these events reasonably priced, but they provided a communal atmosphere for CPAs from all corners of the profession and with a variety of experience levels to converse on the latest issues affecting our profession, interact with trusted local professionals who teach our seminars or simply catch up on happenings since the last meeting, all while satisfying their CPE requirements.

During Student Night, the second of our Chapter’s annual events, we educated students through a speaker panel of experienced local practitioners and awarded $3,000 in scholarships to select students from colleges and universities located in the Chapter’s footprint — undoubtedly the most rewarding experience of the year. We hope to build on the momentum of the past year after recently installing three new officers, all of whom are capable of making this a reality.

Members routinely express their gratitude for a trusted source of informative CPE close to home and for the Chapter’s continual investment in young professionals as they face key decisions surrounding entrance into the profession, including which city or state

they will call home. Over the course of the last two years, this gratitude shed light on what it means to “serve the profession” and rejuvenated my appreciation for the role local chapters play in the lives of CPAs.

I would be remiss in failing to mention the professional benefits I received as an officer of the Roanoke Chapter. Most notably, I matured in my leadership ability. Local CPA chapters provide a chance for the young CPA to lead early in his or her career — an opening that can seem elusive at times, especially to those in large organizations. This experience, combined with unavoidable exposure to key individuals, sets chapter officers apart in the CPA community and in their respective organizations. From an employer’s perspective, an organization looking to develop leaders while reinforcing their support for the profession would be hard-pressed to find a more tailored opportunity for one of their team members.

In addition to leadership experience, serving inevitably brings with it direct access to many of the CPAs in the local community. However, I quickly discovered this network’s reach extends well beyond a single group sharing a certification or even the confines of a city. Chapter leaders are exposed to a statewide network that includes fellow CPAs, as well as professionals outside the CPA community. Whether through interaction with a financial professional from across the state looking to geographically expand his or her reach by speaking to the chapter, or collaborating with leaders from other local chapters at the VSCPA Leaders’ Summit, serving as a chapter officer will set in motion conversations, friendships and opportunities that would not have existed otherwise.

Officers are tasked with setting in motion these same opportunities for the chapter members they serve. As CPAs in the modern era, we can seemingly accomplish everything necessary to become a competent professional while comfortably seated in our office chairs. Assisting a local chapter to provide alternatives to this approach benefits both the officer as well as chapter members. CPAs can choose to lean on the aforementioned conveniences or we can unchain ourselves from the desk for reasons other than grabbing pages off the printer. Chapters are a refuge for the sedentary, as officers facilitate an environment that encourages any of the following actions during the course of a lunch hour: Meet an influencer or an up-and-coming member of the profession, gain insight into a practitioner’s niche, uncover other civic endeavors that value the skills of a CPA or establish yourself as an expert by teaching a seminar.

Of course, all of these benefits are accessible to members who choose

10 DISCLOSURES • SEPTEMBER/OCTOBER 2016 • DISCLOSURES.VSCPA.COM

to volunteer beyond their local chapters with the VSCPA itself, which offers countless opportunities to impact the profession on a broader scale. If you like to write, help plan the latest CPE seminars, educate the public or help determine the VSCPA’s position on legislative issues, there are places for you. You can find out more by logging into the website at vscpa.com/Volunteer.

Though lost on me at the time, I now realize that receiving a college scholarship from the Alabama Society of CPAs sparked an interest in that society that ultimately played a part in the actions I’ve taken over the past two years in Roanoke. Further, when I look back over my career, I’m certain I will attribute serving as a local chapter officer to my success as a CPA and advisor to my clients. I hope that, as a chapter, we have sparked this same interest in college students and members alike, setting in motion a series of thoughts, decisions and actions that will ultimately lead to crafting better professionals and enhancing our

profession as a whole. Similarly, I hope that’s what I’m accomplishing by writing this article — setting in motion the next wave of chapter officers. n

KEITH GRAY, CPA, is a tax consultant with Arlington Family Offices in Birmingham, Ala. He is former president and vice president of the VSCPA Roanoke Chapter and sits on the Disclosures Editorial Task Force. kgray@myafotax.com connect.vscpa.com/KeithGray

PROFESSIONAL development DISCLOSURES • SEPTEMBER/OCTOBER 2016 • DISCLOSURES.VSCPA.COM 11

Because Virginia Society of Certifi ed Public Accountants has partnered with Nationwide, you can save with exclusive discounts on Nationwide auto insurance. Add Accident Forgiveness and/or Vanishing Deductible, and you can save even more. Nationwide may make a fi nancial contribution to this organization in return for the opportunity to market products and services to its members or customers. Products Underwritten by Nationwide Mutual Insurance Company and A liated Companies. Nationwide Lloyds and Nationwide Property & Casualty Companies (in TX). Home O ce: Columbus, OH 43215. Subject to underwriting guidelines, review, and approval. *Vanishing Deductible is an optional feature. Annual credits subject to eligibility requirements. Max. credit: $500. Details and availability vary by state. Products and discounts not available to all persons in all states. Nationwide, Nationwide Insurance, the Nationwide framemark, On Your Side and Vanishing Deductible are service marks of Nationwide Mutual Insurance Company. © 2016 Nationwide Mutual Insurance Company AFO-0915AO (03/16) Ronnie Shriner shriner@nationwide.com 2571 Homeview Dr Richmond VA 23294 Ronnie Shriner Insurance Agency Inc Phone: (877) 683-3364 Experience benefits that reward you Contact me today to see how I can save you money on your insurance.

Serving inevitably brings direct access to many CPAs in the local community.

matters

Social media marketing: Worth it?

BY DAVID R. PETERS, CPA

I read a blog post recently where the author said social media platforms like Facebook and Twitter had become nothing more than another place for companies to shamelessly plug their products. While I am not yet willing to condemn these websites for abandoning their morals, I have to admit that my LinkedIn account looks more like a billboard for products and services now than it used to.

Social media has seemingly crossed a threshold in recent years from a place to interact with friends, family and colleagues to a more legitimate marketing channel. Companies have started hiring social media specialists, tweeting regularly and creating YouTube channels. With more than 27 percent of total U.S. internet time being spent on social networking sites, according to Hubspot.com, it is clear that social media represents a tremendous opportunity to interact with clients. However, the social media space is crowded and your clients’ attention spans are limited. Can social media be a viable part of your marketing mix?

In contrast to many marketing experts, I don’t prescribe social media as a cure for every business need. The numbers indicate that the effectiveness of any social media program depends on your target market, approach and timing.

NOT EVERYONE USES SOCIAL MEDIA EQUALLY

A 2013 study by the Pew Research Institute found that 74 percent of people in the United States use social networking sites, which is high. But before jumping on the bandwagon, you need to dig into the details. This percentage is pulled upward by younger users. Use among older age segments has grown, but it is still only 65 percent for ages 50 to 64, and then 49 percent for those 65 or older. If your client base is more concentrated in older age segments, such as retirement planning clients, for example, the advantages of using social media become much less clear. If your social media efforts only reach about half your clients, you need to consider whether this is worth your time and marketing dollars.

NOT ALL SOCIAL MEDIA IS THE SAME

We tend to group social media together into one large category, yet Twitter, YouTube and Facebook are certainly not the same thing.

According to the 2016 Global Social Media Research Summary, people access Facebook around eight times per day; the Pew Research Center found the Facebook usage amount among adults is 71 percent. Compare this to 28 percent usage of LinkedIn and 23 percent usage of Twitter, and it is clear that Facebook rules the social landscape.

In spite of these overwhelming numbers, some experts have said that YouTube provides a better connection with clients. However, a recent

research study in Information & Management found that people generally learn more when they are actively engaged with the presenter in the video. In other words, the level of active interaction by the viewer makes video interaction higher quality, not necessarily the medium itself. Therefore, the effectiveness of video media is not guaranteed to be better. The bottom line in all of this is that companies need to consider which social media platforms their customers naturally use, as well as which platforms would be most appropriate for their message.

TIMING IS EVERYTHING

A recent study reported on the Forbes website suggests that posting to social media during commuting times (late afternoon) and dinner time will result in a higher chance of your post being read. Again, these findings highlight the importance of knowing your target client base. If you are targeting working people, posting in the middle of a weekday will be less effective than posting during the drive home. Have you ever been in a crowded elevator or bus during rush hour, and seen everyone looking at their Facebook page on their phones?

These considerations only touch the surface, but the overarching message is clear: Go to where your clients are! If your clients don’t use social media, you shouldn’t either. Success in social media is more a matter of figuring out which platforms your current and potential clients use and when they are most likely to be looking at them. It is less about being technically proficient, and more about simply knowing your client base. n

DAVID PETERS, CPA, is the strategic relationship manager and financial advisor for Carroll Financial Inc., in Charlotte, N.C. He is also an adjunct professor in accounting, insurance and ethics, a doctoral student in financial planning and sits on the Disclosures Editorial Task Force. dpeters@carrollfinancial.com connect.vscpa.com/DavidPeters carrollfinancial.com

The information discussed herein is general in nature and provided for informational purposes only. There is no guarantee as to its accuracy or completeness. Nothing in this article constitutes an offer to sell or a solicitation of any offer to buy any type of securities. Registered Representative of and securities offered through Cetera Advisors Network, LLC, Member SIPC/FINRA. Advisory services offered through Carroll Financial Associates, Inc., a Registered Investment Advisor. Carroll Financial and Cetera Advisors Network, LLC are not affiliated.

12 DISCLOSURES • SEPTEMBER/OCTOBER 2016 • DISCLOSURES.VSCPA.COM

MARKETING

Navigate CPE busy season with ease

>> Yellow Book: 80 hours every two years (24 hours in government subjects), with at least 20 hours per year

That’s what you need to take. But in which state do you need to take it? The VSCPA and the VBOA sent a joint letter last year to all state boards of accountancy and state CPA societies explaining the issue of CPE reciprocity among substantially equivalent jurisdictions. The letter reads, in part:

“Virginia has a longstanding practice of CPE reciprocity for dual and multi-state licensees. The VBOA applies the following practices related to CPE reciprocity:

>> If the licensee’s principal place of business is Virginia, then the licensee must comply with Virginia’s CPE requirements.

VSCPA learning: Attendees listen to a presenter at the VSCPA Business & Industry Conference in May.

Children are back in school, the leaves are starting to turn and there’s just a hint of chill in the evening. It’s fall in Virginia, but just as importantly for your career development, it’s CPE season at the VSCPA.

The vast majority of the VSCPA’s CPE opportunities come in our own “busy season” from September through December. That’s mostly to best align with you and your fellow members’ busy professional schedules, but it’s also because you’ve got until the end of the year to fulfill your CPE requirements for 2016, and we’re here to serve all of you — even the procrastinators.

As a reminder, here are the requirements every CPA with an active Virginia license must fulfill, with the exception of those CPAs who have requested and obtained Active — CPE Exempt status from the Virginia Board of Accountancy (VBOA).

>> All CPAs: 120 hours in the past three years, with at least 20 hours per year, including the 2-hour Virginia-specific Ethics course

>> CPAs in public practice who release or authorize the release of reports on attest & compilation services: 8 hours annually related to attest services or compilation services

>> If the licensee’s principal place of business is in a substantially equivalent jurisdiction and the licensee holds a license of such substantially equivalent jurisdiction, then the licensee may claim a ‘Home State Exemption’ through the CPE Tracking System for Virginia CPE compliance. The licensee must have an ‘active’ CPA license in good standing in their principal place of business to qualify for the Home State Exemption.”

The Virginia-specific Ethics requirement follows similar guidelines, as detailed in VBOA regulation 18VAC5-22-90: “If the person holds the license of another state and Virginia is not the principal place of business in which he provides services to the public using the CPA title, the ethics course taken to comply with this subsection either shall conform with the requirements prescribed by the board or shall be an ethics course acceptable to the board of accountancy of another state in which the person holds a license.”

There’s an easy place to find all the CPE you need — the VSCPA. Visit vscpa.com/CPE to search our online course catalog. n

Ever wonder how the VSCPA’s conferences go from idea to event? We spoke with the chairs of the planning committees for the VSCPA’s five major conferences to talk about their work. Read more at vscpa.com/ConferenceCommitteeChairs.

CPE

DISCLOSURES • SEPTEMBER/OCTOBER 2016 • DISCLOSURES.VSCPA.COM 13

PRACTICE management

KANBAN FOR ACCOUNTING FIRMS:

Keep it visual to get things done

BY JENNIFER EVERSOLE, CPA

There is little doubt that the rules of business have changed. Because of technology and social media, clients drive business behavior more than ever before in history.

Client satisfaction isn’t good enough anymore — client loyalty has become the holy grail of leading indicators to predict future financial performance.

14 DISCLOSURES • SEPTEMBER/OCTOBER 2016 • DISCLOSURES.VSCPA.COM

PRACTICE management

And, inefficient and ineffective processes directly affect those client loyalty scores. Clients demand that the job be done completely, on time and correctly the first time, and they can often defect with the click of a mouse if they don’t perceive value in the services provided to them.

Businesses can gain distinct competitive advantages by finding better ways of doing things. Over time, processes can become overly complex to the point that people get lost in their own workflows causing some level of paralysis and inability to move forward. Even firms that have processes that work reasonably well can have a difficult time managing their processes in a way that keeps up with client demands. One way to eliminate most of these organizational problems is to implement a lean methodology called Kanban to increase efficiency, reduce mistakes, identify and correct bottlenecks and communicate progress.

WHAT IS KANBAN?

In the late 1940s, Taiichi Ohno, an industrial engineer at Toyota, took notice of the way supermarkets managed their inventory. Store clerks restocked shelves based on the store’s inventory, rather than the vendor’s supply. It’s not until supply was running low on the shelves that more inventory was added. Using this just-in-time approach, Ohno developed the Kanban system to match inventory with demand and provide an all-around higher level of quality. Kanban is the Japanese word for “visual card.” At Toyota, workers use Kanban cards to mark steps in their process. When the supply of work is low at one step in the process, a signal is sent to the ‘supplier’ of that process (the preceding step in the workflow) and more work is pulled to ensure just-in-time delivery of components.

Imagine that you work in an office that is always running out of coffee pods before the supply is replenished. Perhaps it is because nobody is notified that the supply is low, or because some people hoard the coffee at their

FIGURE 1: SIMPLE KANBAN BOARD

desks. Now, imagine that, in an effort to never be without caffeine again, you implement a system where the available boxes of coffee pods are stacked up in a central location in the break room, and everyone is instructed that they can only take as many coffee pods as they can consume that day. There is a post-it note stuck to the last box of coffee pods instructing whomever opened that box to take the note to the office manager who then re-orders and stocks the kitchen shelves. You’ve just experienced a simplistic example of a Kanban system.

But Kanban’s applications in the world of knowledge work extend far beyond the break room. Most of us don’t work in silos anymore. Workflows and processes that consist of many people and many steps are woven throughout our workdays. At any given time, an individual may be working on 20 tasks that span many projects. Likewise, a project may have hundreds of tasks assigned to 20 different people. With so many moving parts, it’s no wonder that keeping up with what’s going on with spreadsheets or email isn’t efficient. A Kanban board helps to distribute and prioritize work, communicate to the team

and uncover workflow and process problems so that you can continuously improve your processes.

HOW DOES KANBAN WORK?

A Kanban board in its simplest form is a visual representation of a ‘to-do’ list that has three columns: to-do, doing and done. You can make a Kanban board for you and/or your team using markers and sticky notes (see Figure 1).

Of course, there are also many electronic versions available where you drag and drop “cards” as steps in the workflow are completed. Kanban boards can range from simple to complex, depending on your business needs. You may choose to have high-level boards that give a big picture of what’s going on across the entire company and additional boards for projects or teams.

As a matter of fact, one of the most enticing features of Kanban is that it is doesn’t impose pre-set workflows or processes onto your business. Take, for example, a CPA firm auditing the internal controls of u

DISCLOSURES • SEPTEMBER/OCTOBER 2016 • DISCLOSURES.VSCPA.COM 15

Respond to email

Write a blog

Research new software

Financial projections Complete coding course

Turn

in billable hours

New

client proposal

Setup

Twitter account

Project

wrap-up meeting

PRACTICE management

service organizations. The audit team consists of partners, managers and staff accountants. The firm can take their existing workflow and create a Kanban workflow template for each of its projects. When used in a team environment, cards can be assigned to individuals at each step of the way to create accountability for both the audit team and the client. Many virtual Kanban boards will also allow you to attach files to cards so that all of the information and documentation pertaining to the card is in one place and can be retrieved with just a click.

David Anderson, a thought leader in managing effective technology development, is credited with the first implementation of a Kanban process for software development. He identified six general practices and four principles of a successful Kanban implementation.

GENERAL PRACTICES OF KANBAN

VISUALIZE THE WORKFLOW

Marketers typically embrace visual content because 90 percent of information transmitted to the human brain is visual. Not only that, the brain processes visual information 60,000 times faster than text. Kanban takes full advantage of the brain’s visual nature by creating a “picture” of your work. It also helps you see the flow of work as it moves through the Kanban system. Bottlenecks become impossible to ignore because you can actually the see the cards stacking up in one column of the board. For example, tax return preparation is a process that consists of many steps with many people. When a client requests that a firm prepare their taxes, the workflow may look something like this:

FIGURE 2: SAMPLE KANBAN BOARD

Figure 2 is a sample board showing of the first few steps of the process. A quick glance at the board lets you know immediately that returns are piling up waiting for partner review, causing a bottleneck in the process. Armed with that knowledge, the workflow can immediately be improved, perhaps by replacing the first partner review with a peer review.

WORK-IN-PROGRESS LIMITS

Multitasking kills productivity. Many studies have proven that the more people switch tasks, the less effective and more error-prone they are when completing work. Kanban helps eliminate these context-shifting penalties by limiting work-in-progress. Work is pulled through the system by available capacity, not pushed through based on supply. In other words, people finish what they are working on before starting something new. Increasing efficiency will ultimately reduce the time it takes for an item to travel through the Kanban system.

MANAGE FLOW

It’s all about continuous improvement. Kanban

systems provide data that allows you to analyze what is flowing through the system.

Virtual Kanban tools actually capture data points automatically as cards move through the workflow. Days to complete a task, lead time, wait time, rework time and throughput time all give you valuable information about what incremental changes are needed to improve the flow of work. This data is also predictive in nature, allowing you to forecast future performance.

MAKE PROCESS POLICIES EXPLICIT

People working together on a team often incorrectly assume that they have the same ideas about things like project methodology, priorities and communication. And, they often find out about their differences the hard way after losing momentum and cohesiveness in the team.

The purpose of explicitly stating process policies is to be sure that everyone knows the “rules of the game.” Once everyone really understands how things work, the team can make decisions that move them in the right direction.

16 DISCLOSURES • SEPTEMBER/OCTOBER 2016 • DISCLOSURES.VSCPA.COM

Scan documents Prepare returns Partner review Return revisions Partner review Assemble returns Partner signature Client billing Request client authorization and E-signature File returns

SOC 1 DBS SOFTWARE � � � � ? CONTROL OBJECTIVES IN DOCUMENTATION NEW CONTROLS IN REVIEW READY FOR REVIEW READY FOR APPROVAL READY FOR DOCUMENTATION CONTROL ACTIVITIES IT.02 IT Logical Access SJonesIT 453 IT.01 Transmission of Business Data SJonesIT 444 IT.01.02 Secure File Transfer LScottIT 453 IT.02.02 Allow-any Rules LScottIT 487 DEV.01.07 Development Unit Testing JSmithDEV 501 DEV.01.01 Release Notes JSmithDEV 503 DEV.01 Program Change Management JSmithDEV 455 OPS.01 New Client Onboarding RKempOPS 447 OPS.01.01 Service Agreement RKempOPS 496 OPS.01.04 New Client Record RKempOPS 475 CONTROL PLANNING CONTROL DOCCONTROL REVIEW+ BACKLOG

IMPLEMENT FEEDBACK LOOPS

Feedback loops improve productivity. Using feedback loops, you can compare actual outcomes to expected outcomes in order to understand what happened. Feedback should be obtained from the process itself (metrics like cycle time), participants in the process (employees) and customers of the process (clients). Then you can use that information to make iterative improvements to the process.

IMPROVE COLLABORATIVELY

Kaizen is a word that is often associated with Kanban. Kaizen is another Japanese word that generally means “improvement.” In business, Kaizen is often used to describe a system of

continuous improvement, which is a core tenet of Kanban. Further, the Kanban method encourages the use of a scientific approach to implement continuous, incremental and evolutionary changes. For example, you may decide on a new workflow, set an acceptance criteria and define a test period. Then, you try the new workflow during the test period, after which you evaluate the outcome. Finally, you decide to keep or modify the new workflow.

WHAT ARE THE PRINCIPLES OF KANBAN?

The properties of Kanban describe what you need to do to implement Kanban. There are also four principles to help describe how to think about Kanban.

PRACTICE management

1. Start with what you know: Implementing Kanban doesn’t require massive changes to your current processes. The point is to start with your current process and then introduce changes based on feedback about the process. Because of the continuous improvement nature of Kanban, the longer you use it, the better your process becomes.

2. Agree to pursue incremental, evolutionary change: Like everything else that we do in business, change is more effective if everyone on the team is on board. Create a culture of continuous improvement by selling team members on the importance of improving u

liability insurance include coverage for

DISCLOSURES • SEPTEMBER/OCTOBER 2016 • DISCLOSURES.VSCPA.COM 17

*CPA NetProtect® is offered for an additional fee as part of the AICPA Professional Liability Insurance Program. Aon Insurance Services is the brand name for the brokerage and program administration operations of Affinity Insurance Services, Inc. (TX 13695), (AR 100106022); in CA & MN, AIS Affinity Insurance Agency, Inc. (CA 0795465); in OK, AIS Affinity Insurance Services, Inc.; in CA, Aon Affinity Insurance Services, Inc. (CA 0G94493), Aon Direct Insurance Administrators and Berkely Insurance Agency; and in NY, AIS Affinity Insurance Agency. One or more of the CNA companies provide the products and/or services described. The information is intended to present a general overview for illustrative purposes only. It is not intended to constitute a binding contract. Please remember that only the relevant insurance policy can provide the actual terms, coverages, amounts, conditions and exclusions for an insured. All products and services may not be available in all states and may be subject to change without notice. The statements, analyses and opinions expressed in this publication are those of the respective authors and may not necessarily reflect those of any third parties including the CNA companies. “CNA” is a service mark registered by CNA Financial Corporation with the United States Patent and Trademark Office. Certain CNA Financial Corporation subsidiaries use the “CNA” service mark in connection with insurance underwriting and claims activities. Copyright © 2016 CNA. All rights reserved. E-11347-916 VA Administered by:Underwritten by:Endorsed by: To learn more about the AICPA Professional Liability Insurance Program or CPA NetProtect® , please contact Rich Bacher at Aon Insurance Services at 1-800-221-3023 or visit www.cpai.com/cyberad Does your professional

a CYBER ATTACK ? GET CPA NETPROTECT® The AICPA Professional Liability Insurance Program includes cyber liability coverage for litigation resulting from damage to a third party’s network. Add the CPA NetProtect® endorsement to your policy and you also get first-party privacy event expense coverage for client notification costs, credit monitoring, and more.*

PRACTICE management

the processes. This can be done by showing the team the correlation between better service delivery, customer loyalty and ultimately business success.

3. Respect the current process, roles, responsibilities and job titles: Kanban recognizes that it is likely that there is value in the way things are currently done that should be preserved, so it does not prescribe sweeping changes, which often elicit fear in team members. Explicitly stating that the current processes, roles, responsibilities and job titles are respected will help alleviate fear that often accompanies change and will make team members more comfortable to participate in the smaller improvements along the way. Incremental, rather than sweeping, changes also allow the team to tie results to the change that preceded them which facilitates better decision making.

4. Encourage acts of leadership at all levels of the organization: Team members at all levels need to feel safe to introduce change into the process. There is tremendous value in the perspectives of individuals throughout the organization. Everyone involved, regardless of their pay grade, should feel empowered to show leadership.

Kanban’s usefulness has been recognized in industries like supermarkets, manufacturing and software development, just to name a few. Given the right attitude and culture, a Kanban approach can also help accounting firms.

A Kanban system can help track work being done by providing a visual representation of what has been done, what is being worked on and what still needs to be done. It can also help with the distribution of work.

On a Kanban board, work that needs to be done is kept in a backlog column and can be prioritized. Swim lanes can also be added in order to categorize work (e.g. individual vs. business returns) within a single board. When an accountant is done with what they

are working on, they can go to the backlog column and pull the next highest priority task that fits within their skill set. Kanban can also help a firm track the resources spent on each client.

Most importantly, Kanban will facilitate continuous process improvement so that firms can give their clients an amazing experience that will keep them coming back for more. n

1. Anderson, David J. “The Principles & General Practices of the Kanban Method.” Lean Kanban Services. Dec. 10, 2010. services.leankanban. com/principles-general-practices-kanbanmethod

2. Wester, Julia. “What is Kanban?” Everyday Kanban. everydaykanban.com/what-is-kanban/

JENNIFER EVERSOLE, CPA, is co-founder and partner at Management Stack, LLC, a CPA firm and digital consultancy in Roanoke. She is a member of the VSCPA Board of Directors and serves on the Disclosures Editorial Task Force. jeversole@managementstack.com connect.vscpa.com/JenniferEversole @JennEversoleCPA linkedin.com/in/jenniferduffcpa managementstack.com

Keep CPA Businesses Thriving

When you contribute to the Virginia Society of CPAs Political Action Committee (VSCPA PAC), your voice joins thousands of Virginia CPAs, ensuring that you are heard at the Virginia General Assembly.

Contribute to the VSCPA PAC today, and help keep CPA concerns in front of Virginia state and local officials.

Society of

Visit vscpa.com/PAC or (800) 733-8272.

18 DISCLOSURES • SEPTEMBER/OCTOBER 2016 • DISCLOSURES.VSCPA.COM

Virginia

Certified Public Accountants Political Action Committee

Attention CPAs:

Whether A Decision Maker Looking To Upgrade Your Talent, Or A CPA Looking to Upgrade Your self/Your Skills, Ask Yourself:

Who really chose who in joining your company?

Are you/your professional staff really at the right level where you should be/you need them to be?

Are you/your staff in a position that truly suits your/their personality, values, and professional and personal needs?

Why leave your future to chance?

If you’re seriously interested in making the “right” move for your next hire, I can help you I am an actively licensed CPA in Maryland and Virginia with over 20 years of experience including public accounting (E&Y) and consulting (KPMG), financial accounting (American Cancer Society), internal audit (Moneyline Tele rate), and recruiting (Acsys, formerly Don Richards). As a networker who truly enjoys helping others and sharing my career experiences to guide fellow professionals, here is how I can help you:

Decision Makers:

Ask you questions, and most likely ask many more questions than other recruiters about your company, duties involved, skills required, corporate culture and more

Work with you on finding the “right” professional that is the “right fit”

Provide you with valuable information about the professionals I work with, the marketplace, what your competitors pay, and more

Career Seekers:

Guide you on career paths available in public accounting and industry

Enable you to capitalize on your strengths

Coach you on how to put your best foot forwa rd to find the “right fit”

Advise you when to stay in your current position if that is the right move

If you’re interested in working with a recruiter who understand s your background, skills, and is genuinely interested in helping you find the “right fit

then I welcome meeting you!

BETH A. BERK, CPA , CGMA Independent Recruiter

Specializing in CPA Firm, Accounting & Finance Positions in Metropolitan DC &

Suburbs/B

Connecting You To Your Next Hire TM Contingency & Retained Staffing Solutions matching skills, experience & values with needs

Recruiter

” ,

Nearby

altimore/Richmond/Tidewater

Serving clients and professionals as an Independent

since March 2005 Phone: 301-767-0670 Email: BethABerk@msn.com

TAXATION

UPS AND DOWNS

Help your clients navigate the roller coaster of divorce taxation

BY CHERI G. DAVID, CPA, CVA

BY CHERI G. DAVID, CPA, CVA

Divorce can be like a stomach-turning roller-coaster ride. For me, it started in the Hanover Circuit Court, headed up to the Virginia Appellate Court and then all the way to the top — the Virginia Supreme Court — with an explosive win. And then, I came all the way back down the court chain again with a grand finale of more than $250,000 in legal bills (just for my side). David v. David 287

VA. 231 (2014) was most certainly not my favorite roller-coaster ride, but one that has shaped my perspective on what clients may be experiencing during separation and divorce. While most clients’ divorce journeys will not land them in front of the Supreme Court, it is important to recognize how we as CPAs can play significant roles in helping our clients and their families survive the ride.

20 DISCLOSURES • SEPTEMBER/OCTOBER 2016 • DISCLOSURES.VSCPA.COM

TAXATION

THE INITIAL PHASE

CLIENT CONTACT

Amicable or not, the first very important stage of any divorce is a separation agreement. Hopefully your clients will, at minimum, consider this less litigious agreement, collaborative law or mediation first. However, sometimes emotionally charged divorcing couples will skip these steps completely and head straight to divorce court by way of filing a divorce complaint with full-blown litigation to follow. CPAs will often find that their clients only show them a separation agreement or divorce decree after it has been signed, agreed upon and approved by the judge. Moreover, these final agreements may or may not leave room for the CPA to provide the most tax advantageous scenario to the formerly happy, now not-so-happy, couple. In effect, the CPA is left with the daunting task of working through tax situations “after the fact.”

But CPAs can take a proactive role in assisting their clients before the agreements are drafted, signed and approved by helping them (and their lawyers) include very important elements in the final, legally binding documents.

CLIENT REPRESENTATION

CPA firms that prepare joint tax returns for separated parties often find themselves in a precarious situation. Considering whether to retain both clients, one client or none after the separation should meet the state professional codes of conduct. To retain both clients, the separating spouses should be amicable and the firm must disclose to the clients that a conflict of interest could exist if the parties do not agree on their tax matters. Be sure to have two separate engagement letters, each containing a reference to the potential conflict of interest, if preparing both parties’ tax returns. Anything less will open your firm up to significant risks of malpractice, as well as distrust and the potential loss of both clients.

If the clients are anything less than amicable,

immediately disengage from working with at least one of the parties or maybe both. From that point forward, it’s advisable that all future communications regarding agreements between the parties be made in writing and preferably ask the disembarking client if it is okay to communicate with their new CPA directly. Remember, divorce is a roller-coaster ride. One day everything is fine between the parties and the next it is not! Don’t jeopardize your firm’s professionalism by trying to keep both clients in this tentative type of situation.

THE SEPARATION PHASE

Understanding the separation agreement as well as referencing the guidance in U.S. Internal Revenue Service (IRS) Publication 504, Divorced or Separated Individuals, will help in the tax preparation and planning for the divorcing couples. Depending on the each of the party’s individual circumstances, the tax return may be very simple or somewhat complex. Collect the facts and be proactive. Ask a lot of questions, such as:

1. What are the living arrangements?

2. How are the children’s expenses paid?

3. Who pays the household living expenses?

4. Did either party move out?

5. What are your plans for the marital residence (keep or sell)?

6. What are your plans for handling the division of your assets?

7. Have you retained or are you thinking about retaining a lawyer?

Early intervention in the drafting of the agreements is critical — the separation agreement is essentially the beginning framework for a final decree. Think of a separation agreement like a trial-run agreement as to how the couples are able to follow the terms of the agreement in their new paradigm, as co-parents or as independent

living members of society. If the separation agreement is missing certain elements of tax law clarification, the parties will hopefully be afforded another opportunity to make modifications before the final court-ordered decree. Parties are often in a flurry of emotional trauma, and are not thinking about how dependents will be claimed or how the Affordable Care Act (ACA) will affect their taxes. A CPA who is able to work with attorneys and clients during this first phase can clear up potential tax-related pitfalls in those written agreements between the parties.

FILING STATUS

Marital status is decided as of the last day of the year — Dec. 31. For those parting couples who can be somewhat agreeable, married filing jointly (MFJ) will likely yield the best tax result (though it is not a slam dunk filing status in all cases). For example, if the parties have split homes and there are children involved, a Head of Household (HOH) status should be considered. The HOH rules indicate that if, in the last six months of the year, the taxpayers maintained separate households with a qualifying child, HOH status may be available and will almost always yield the best tax advantage for both parties.

In high-conflict divorces, parties often will ask to file their returns separately. Sometimes, it really doesn’t matter that the tax result will be better under a MFJ status. These types of couples may not only despise the air the other party breathes, but the thought of having their name listed with their soon-tobe-ex is incomprehensible. In some cases, it’s absolutely necessary to prepare a married filing separate (MFS) return if there are past tax liabilities, debts or late tax filing issues to consider by either spouse.

Keep in mind that preparing MFS returns has some twists. The MFS filing status claimed must be the same for both parties’ returns. Additionally, the spouse who files first gets to pick whether they want to itemize or claim a standard deduction. The spouse who files u

DISCLOSURES • SEPTEMBER/OCTOBER 2016 • DISCLOSURES.VSCPA.COM 21

TAXATION

last is stuck with having to file in the same fashion, including using the same itemized or standard deduction as the first spouse. Let your client know the MFS filing ramifications before filing season, and that mix-andmatching in the MFS returns will earn them unwanted IRS attention.

LIVING UNDER THE SAME ROOF

More than ever before, divorcing couples are living together while their divorces are pending — and even sometimes during high-conflict litigation. Be extra careful when couples are in this situation. Support agreements may indicate spousal support, child support and other directives. However, if the couple is still living together, the normal exemptions, deductions, child tax credits, dependent care credit and income allocation rules are modified and may not apply. For example, the dependent care credit is not available for MFS returns.

WHO GETS TO CLAIM THE KIDS?

There used to be an old saying: “He who files first gets to claim the kids.” Although to some degree that remains true, if both parties claim the same kids, the IRS will eventually review both parties’ returns and send letters to your clients asking who has the right to claim the children. Several examples are itemized in IRS Publication 504. However, it simply boils down to this: Whichever parent provides more than half the support is entitled to the deduction. If both parents provide equal support, then the exemption goes to the parent with the higher Adjusted Gross Income. If the non-custodial parent provides more than half the support, then the custodial parent needs to release the exemption by completing IRS Form 8332, Release of Claim to Exemption for Child by Custody Parent, and file it with the return.

Have a directive as to who will be signing the Form 8332 and for which years included in the parties’ agreements and decree. The IRS can disallow the deduction to the noncustodial parent without this form attached

to the return — regardless of what the court order states about exemptions.

There are a few exceptions when neither parent can claim the children. This mostly happens if the child is being supported by another provider, grandparent, foster care or family member. Sometimes the parents are receiving significant aide from public sources, such as Social Security or government aid. Thorough client inquiry and communications will help in the accurate tax preparation and proper dependency exemptions reporting.

ALIMONY OR SPOUSAL SUPPORT

Transfers of marital property between spouses as a result of divorce or separation are generally not taxable. However, payments required by a legally binding separation agreement or decree to spouses for maintenance can be considered alimony. Unlike alimony, which is taxable income to the receiving spouse and a deduction to the paying spouse, child support is not alimony and not taxable or deductible. Parties can also agree in their agreement or decree that support or certain payments (i.e. auto expense, insurance, utilities) will not be designated as alimony. If the parties wish to exclude support payments from their tax return, a legal binding document (separation agreement or decree) must be filed and attached to their returns to qualify for the exclusion.

Parting spouses — even if living in the same home in separate bedrooms and with a legal separation agreement or decree — cannot claim support payments as alimony unless one of the spouses leaves no later than one month after the date of the payment. In other words, it’s not enough to just have an agreement that includes a party’s requirement to pay expenses for the other spouse. The couples must live in separate residences to claim this tax deductible obligation.

Be careful of alimony recapture rules. It’s often difficult for couples to fathom writing checks to their soon-to-be ex. While the courts,

bound by state laws, may require mandatory payments under certain circumstances, a crafty lawyer may draft spousal support agreements that include a reduction of those payments when the kids turn 18. Even though this fact may not be identifiable in the agreement, the mere dropping of payments in the future should raise caution flags for potential recapture. Specifically, if the alimony/spousal support decreases by more than $15,000 or decreases significantly in years two and three from the first, the parties likely may have to recapture that alimony.

AFFORDABLE CARE ACT (ACA) PROVISIONS

The ACA is now adding additional layers of complication for divorcing couples. The ACA provisions consider that households with incomes from 100 percent to 400 percent of the poverty level are eligible for the advanced premium tax credits (PTC) for payment toward their health insurance premiums. This means there are incentives to how couples divide children dependency exemptions and allocate income. If a higher-income spouse makes alimony payments to the lower-income spouse, then essentially there is a shift of income to the lower-income spouse. In some states, like Virginia, a minimum household income in 2016 of $11,880 is required to be eligible for the PTC. Therefore, in some circumstances alimony and/or spousal support that meet a minimum income threshold for ACA purposes may increase the couple’s chances to save significant tax dollars, combined with correctly reporting the PTC between the returns.

The PTC is essentially a subsidy tied to the taxpayer and their dependents. The parent who claims the child gets claim the credit if within the eligible income limits. The parent who doesn’t claim the child but receives the subsidy (PTC), may have to pay a portion or the entire subsidy back. This subsidy is reconciled between the parties’ returns and hopefully it is referenced in the parties’ legally binding agreements. If the unhappily divorcing couple does not communicate

22 DISCLOSURES • SEPTEMBER/OCTOBER 2016 • DISCLOSURES.VSCPA.COM

TAXATION

with one another about who is claiming the dependent exemptions and who will be carrying the health insurance policy, but one or the other holds the policy, the parties may be out of luck in being able to claim the credit — or worse, they may have to pay it back. This is due to another mismatch between the party’s returns, one claiming the dependency exemptions and the other receiving the PTC subsidy. Further guidance of the PTC and the interplay between divorcing couples’ tax return filing statuses, as well as dependency exemptions, can be found in IRS Instructions for Form 8962, Premium Tax Credit

THE FINAL DECREE

For divorcing couples, a final divorce decree is the pathway to the future. Divorce decrees

come in all shapes and sizes. Hopefully, the clients have worked with their CPAs during the process and the final decree clearly identifies directives based upon the couple’s mutual agreements or the finality by a highly litigated court decision. The decree should include concise and specific directives of how the marital and separate assets are divided or sold, how IRAs are to be transferred, who makes which payments and for how long, child support, alimony and various other support requirements.

Divorcing couples are often battle-worn by the time they get to the final decree stage. They will find themselves in a “just get through it” attitude. It’s okay to assert your knowledge and help them from “just” signing off on a legally binding document that does not

include necessary tax planning objectives. Fundamentally, once a court order of final decree is entered, it can take a tremendous amount of time and financial resources to have it changed later.

A NEW CHAPTER

A CPA is often the most trusted and neutral advisor between divorcing couples. Whether you helped your client navigate through the process of preparing taxes or provided them with just an empathetic ear, a proactive approach can save your client much agony and dispute through the divorce process. CPAs are in a unique position to supply sound advice in the early stages from the separation agreement all the way through to the final decree.

While it sounds contrarian, divorcing couples who can work together are far better off — not just as it relates to their tax savings, but for their kids and their future economic statuses as well. CPAs who add value by helping their clients stomach the rollercoaster ride will land sincere loyalty and a long-trusting relationship for years to follow. n

CHERI G. DAVID, CPA, CVA, has nearly 20 years of experience in tax, financial and small business consulting. She is an owner and managing partner at Clarkson David, CPA, and is also a partner at Valuation One, LLC, a firm specializing in expert witness testimony and divorce litigation matters. She is a member of the Disclosures Editorial Task Force. cheri@clarksondavid.com linkedin.com/in/cheridavidcpa

@clarksondavidcpa connect.vscpa.com/CheriDavid

DISCLOSURES • SEPTEMBER/OCTOBER 2016 • DISCLOSURES.VSCPA.COM 23

We just broke the mold in the benefits industry. We’re offering the single most critical benefit for you and your clients — advice. Sound, actionable advice. This changes everything. Game Change. Game On? Endorsed by the VSPCA P age g ordon , S enior B enefit C on S ultant C all : 877.998.7272 email : pgordon@vscpainsurance.com vi S it : www.digitalbenefitadvisors.com/vspca

TEACHER TALK: EDUCATOR ROUNDTABLE online learning case studies

technology

Exam critical thinking

24 DISCLOSURES • SEPTEMBER/OCTOBER 2016 • DISCLOSURES.VSCPA.COM EDUCATION

As the school year kicks off, the VSCPA likes to take the pulse of the world of accounting education in Virginia’s colleges and universities. In the past, we’ve spoken with students about their accounting experiences, but this year, we wanted to talk to the professors about incorporating everadvancing technology, keeping up with changes to the CPA Exam and more.

We spoke to some students, too, and you can read their responses at vscpa.com/StudentRoundtable. But here’s what our educators had to say about their experiences in the accounting classroom in 2016. We spoke with:

HOW HAS NEW TECHNOLOGY CHANGED THE WAY YOU TEACH YOUR CLASSES?

HOLLY CALDWELL: Technology has allowed me to better connect with my students. Through the use of online learning centers provided by publishers to using Moodle to post documents for students to access, I have been able to use class time in a more efficient manner. Many students are using multiple technology tools in high school, so I think it is important for college professors to keep to the technology level that they have been accustomed to.

CINDY EASTERWOOD: New technology has primarily allowed me to have more resources available for students online. Students have access to my PowerPoint slides and sample problems with solutions. I can assign more homework because the homework is completed online and automatically graded. Students also have access to videos that explain the course material.

JILL MITCHELL: New technology allows me to be more flexible in teaching and use my time more efficiently. For example, publishers’ online learning systems, like

McGraw-Hill’s Connect or WileyPLUS, grade students’ homework and provides resources to help them when they are working on an assignment. They receive detailed, customized feedback immediately. With over 200 students, I am not able to provide that kind of feedback on every assignment. Now when I do meet one-on-one or in the classroom, we can zero in on the areas or topics on which students need additional guidance or support. We spend the precious class time we have together to focus on problems that involve higher-level thinking. u

DISCLOSURES • SEPTEMBER/OCTOBER 2016 • DISCLOSURES.VSCPA.COM 25 EDUCATION

(PICTURED ABOVE, LEFT TO RIGHT)

HOLLY CALDWELL, CPA Bridgewater College, Bridgewater

BOB COCHRAN, CPA Longwood University, Farmville

CINDY EASTERWOOD, CPA Virginia Tech, Blacksburg

GABRIELE LINGENFELTER, CPA Christopher Newport University (CNU), Newport News

JILL MITCHELL

Northern Virginia Community College (NVCC), Annandale

WHAT CAN COLLEGES AND UNIVERSITIES DO TO ENCOURAGE STUDENTS TO BECOME CPAs?

BOB COCHRAN: The faculty needs to constantly stress the importance of the credential. I do this in a variety of ways. I begin in the principles classes by stressing the variety of career opportunities available to accounting majors, especially those who get the CPA. In upper level classes where all the students are declared accounting majors, I require membership in the VSCPA and the AICPA. I set aside at least one class day each semester to introduce students to a variety of websites available to assist in preparing for and passing the CPA Exam.

It is important for the faculty to live the CPA culture by being CPAs. The dean of the College of Business and Economics is a CPA. We have three full-time faculty. Two are CPAs and the third is in the process of obtaining the CPA. All of our adjunct faculty are CPAs.

GABRIELE LINGENFELTER: I believe that having an accounting faculty that is active in the profession is important. Faculty members need to maintain their CPA license and need to be involved with professional organizations at either the local, state or national level. Additionally, inviting various CPA organizations, such as the VSCPA and the Virginia Board of Accountancy (VBOA), and CPAs from industry, public practice and government to speak to the Accounting Club or in accounting classes helps promote the profession. Universities can also put the spotlight on successful accounting alumni who are CPAs, whether on the department’s website or featured in promotional material.

JM: The key to encouraging students to become CPAs is to share with students the many career paths that the CPA license can

associations

provide them. Students come to accounting classes with the misconception that accounting is all about math. Colleges and universities need to change that mindset by exposing students to CPAs who have experience in all industries. If a student is interested in working in sports, for example, he or she can enter that industry as a CPA. Students need to be made aware of these opportunities.

HOW ARE YOU CHANGING YOUR COURSES TO HELP STUDENTS BETTER PREPARE FOR THE NEW CPA EXAM?

BC: I have always stressed critical thinking in my classes. I constantly relate the details to the big picture. I ask students to explain and interpret material, not just master debit/credit fundamentals.

GL: The new CPA Exam will test higher-level skills and will place more emphasis on critical thinking, problem solving and professional skepticism.

In order to better prepare my students for the revised Exam, I am developing a new course. Likely, the best way to improve these higher level skills is through case studies. The new course will use case studies and be the mandatory capstone course for the accounting majors. Students will be required to analyze some of the cases individually, others in teams. The learning objectives and related questions will ask students to analyze and evaluate and apply their accounting knowledge from previous accounting classes.

HOW HAVE THE AICPA’S FUTURE OF LEARNING RECOMMENDATIONS PLAYED INTO YOUR TEACHING AND PLANNING?

CE: I try to incorporate new technology into my teaching in order to address student’s different learning styles and increase student engagement. I make the textbook videos available to students in case they need extra help. I have also used iClicker response systems in the classroom to increase student involvement. This is especially helpful in very large classes where students are not comfortable speaking up. I am also trying to increase student engagement and make the classes more personal by incorporating examples that students can relate to.