5 minute read

LINE ITEMS

IT’S HURRICANE SEASON >>

Prepare your clients

Advertisement

Even though a disaster can strike at any time, Virginians often find themselves in the path of hurricanes during the fall. Financial readiness is an important part of planning, just like an evacuation plan. Last year, the American Institute of CPAs (AICPA), American Red Cross and National Endowment for Financial Education released a new guide, “Disasters and Financial Planning: A Guide for Preparedness and Recovery,” to help Americans craft plans that protect their property, income, assets and records.

It’s easy to share this free resource with your clients. Visit tinyurl.com/DisasterPrepGuide. n

COSO PROPOSES ERM FRAMEWORK UPDATES

If you want to provide the Committee of Sponsoring Organizations of the Treadway Commission (COSO) with comments on its updated enterprise risk management (ERM) framework, now is the time. Back in October 2014, COSO announced a project to review and update the ERM — Integrated Framework. Companies’ managers and boards of directors use the framework to enhance their organizations’ abilities to manage uncertainty.

The revised framework, Enterprise Risk Management — Aligning Risk with Strategy and Performance, updates the core definitions of risk and ERM, as well as the components of ERM. It also introduces principles that reflect the evolution of ERM thinking and practices.

You can read the draft and its FAQ and provide comment by Sept. 30, 2016, at coso.org.

LINE items

EXCELLENT EXCEL >>

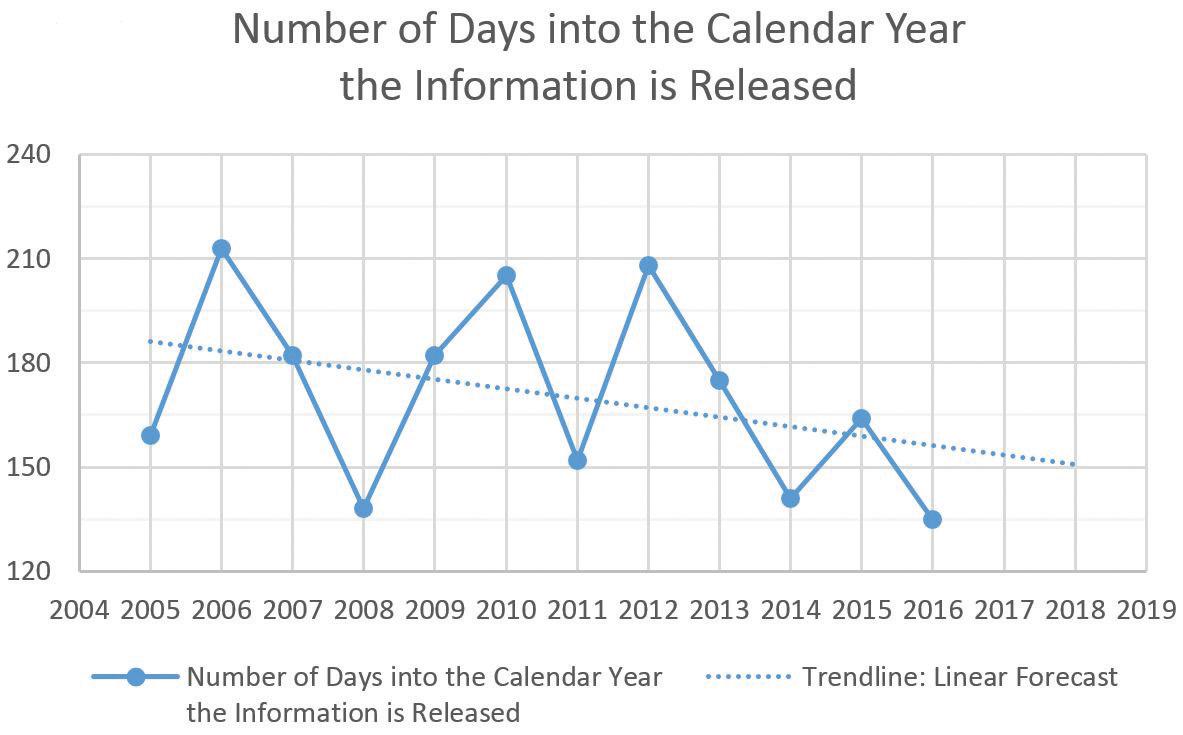

Add chart element: Trendline

As auditors and accountants, we like

information to be timely so that it is relevant. It’s hard to make decisions on old information. Recently a colleague provided me a table of dates for when certain information is issued annually. While all the dates were in an Excel table, it was difficult for me determine if there was a trend within the release dates. As a visual person, I wanted to see if I could graph the release dates, and with a few formulas and Excel’s charting tools, I came up with the following chart:

These are the steps that I took, should you want to develop your own similar visual analysis. To chart the release dates, I calculated the number of dates between the start of each calendar year and related release date using the ‘DAYS’ function. For example, if the release date of 6/9/2005 was in cell B2, I would enter 1/1/2005 in cell C2 with the formula DAYS(B2,C2) in cell D2 to calculate that the 2005 information was released 159 days into the calendar year. With the years in one column and the ‘number days into the calendar year the information is released’ in another column, I was able to highlight the data and “insert” a line chart. As you can see by the dotted line, my analysis did not end there. Under the Design ribbon, I clicked on the Add Chart Element button and selected Trendline followed by Linear Forecast. It is the Linear Forecast that allows the user to know that while the timeliness of the information is not consistent, it is trending in the right direction. n

GEORGE D. STRUDGEON, CPA, CGFM, is

an audit director at the Virginia Auditor of Public Accounts in Richmond. Email him if you have Excel topics you want him to cover.

george.strudgeon@gmail.com connect.vscpa.com/GeorgeStrudgeon

LINE items

IRS INVESTIGATORS AT WORK >>

ID theft tax scheme halted in Richmond

One of the top 10 national cases of identity theft and tax fraud was prosecuted in Richmond, according to the Internal Revenue Service (IRS) Criminal Investigation division. In August 2015, Eddie Blanchard of Miami was sentenced to 204 months in prison with three years of supervised release and ordered to pay $568,625 in restitution for his role in a stolen identity tax refund fraud scheme.

In the early part of 2012, Blanchard repeatedly traveled to Richmond with other criminals and used stolen personal identifying information to file hundreds of fraudulent tax returns through online tax preparation programs. The men claimed significant refunds on the fraudulent returns and requested the refunds be placed on pre-paid debit cards, which were later mailed to Richmond addresses selected by the conspirators. The scheme began to unravel when a Virginia police officer encountered one of the men removing a box containing stolen identity information from a storage unit.

The case is an example of the major crackdown by the IRS on identity theft. In fiscal year 2015, the IRS initiated 776 identity theft-related investigations, resulting in 774 sentencings through Criminal Investigation enforcement efforts. n

WHAT WE’VE BEEN DOING

The VSCPA’s annual State of the VSCPA report is now online! The report details the activities of the VSCPA, the VSCPA Educational Foundation and the VSCPA Political Action Committee (VSCPA PAC) as we work toward our mission of supporting Virginia CPAs.

Visit vscpa.com/StateOfTheVSCPA to view the report as well as the VSCPA’s audited financial statements. n

SUMMERTIME TAX SCAMS

The scammers were out in full force all summer long, duping taxpayers by using aggressive scare tactics, spoofing caller ID, using phish email and through many other ways. Scams cost victims more than $38 MILLION. Educate your clients on the tactics of scammers, and visit irs.gov for more details. n

FEDERALLY SPEAKING

Top news from the Capitol and other national happenings…

IRS RELEASES DEFERRED COMP PROPOSAL

After a nine-year wait, the U.S. Internal Revenue Service (IRS) issued proposed regulations on deferred compensation plans of state and local governments and tax-exempt entities, with section 457(f) plans as a key focus. Find out more at irs.gov.

"PROTECT YOUR CLIENTS; PROTECT YOURSELF" CAMPAIGN

The IRS has launched a new campaign called "Protect Your Clients; Protect Yourself" to encourage tax preparers to implement safeguards to protect clients from data theft. The program is an expansion of the Security Summit's 2015 "Taxes. Security. Together." campaign, which sought to increase public awareness of identity theft. Fact Sheet 2016-23 summarizes the critical steps necessary to protect taxpayer information and refers preparers to IRS Publication 4557 (Safeguarding Taxpayer Data). Find the fact sheet at irs.gov/pub/irs-news/fs-16-23.pdf.

POTENTIAL EMPLOYER MANDATE PENALTIES FOR HEALTH CARE

In an Information Letter, the IRS indicated that an employer mandate penalty under IRC Sec. 4980H could apply to an employer that develops a new policy restricting part-time and seasonal employees to no more than 29 hours per week and the employee works more than 29 hours of service in a week. The amount of the employer's potential liability is based on the number of employees who average 30 or more hours of service per week in a given month. Check out Information Letter 2016-0030 at irs.gov for more. n