With the launch of the Delaware State Chamber Foundation, we are taking facts found in this book and digging deeper into the issues that matter most to our members and all Delawareans. Our foundation, a 501(c) (3) organization, will conduct nonpartisan research and elevate the data points discovered within these pages by turning them into actionable policy initiatives.

As part of this effort, we are planning to develop an interactive competitiveness dashboard on our website that will incorporate this data and additional indicators over time. This tool will allow policymakers, businesses, and the public to easily explore trends and better understand the forces shaping Delaware’s future.

You can scan the QR code on this page to learn more about the Foundation and access the dashboard when it launches. It is our hope that policymakers at every level of government will view this work as an opportunity to reshape our state in ways that set us apart from other states and lead to a brighter future.

Our changing demographics necessitate that we take on these challenges and right-size services and programs that have been delivered the same way for decades. With their exit into retirement, the largest generation in the history of the world, the Baby Boomers, are followed by successively smaller generations. That means personal income tax revenues the state collects to fund public services will decline as fewer and fewer people are part of the workforce. If we want to avoid structural deficits for years to come, we need to promptly reconsider the programs of old and reconfigure our spending priorities. The tax base is shrinking, period.

Another example of “right-sizing” our spending would be the consolidation of public school buildings. 20% of our public school buildings are operating at less than 65% of their capacity, and several schools are not even half full. The collective cost to operate and maintain more than 200 buildings is over a quarter of a billion dollars per year. We need to reduce our inventory where it makes sense, refurbish buildings that need repairs, and build new facilities in geographies with populations that are growing.

This book is about uplifting all the good we do and highlighting the challenges before us. The Delaware State Chamber of Commerce stands ready to be a thoughtful partner in this journey. Onward.

Michael J. Quaranta President, Delaware State Chamber of Commerce

Cover photographs courtesy of: Dover Motor Speedway; MDavis & Sons; and Delaware Division of Historical and Cultural Affairs, New Castle Court House Museum

Non-Agricultural

year) (Aug. 2015 – Aug. 2025) Source: U.S. Bureau of Labor Statistics

(Q1 2024 – Q4 2024)

Lincoln Institute of Land Policy/Minnesota Center for Fiscal Excellence

(2nd Quarter 2025)

1 Raleigh-Cary, NC Metro Area

2 Austin-Round Rock-San Marcos, TX Metro Area

Denver-Aurora-Centennial, CO Metro Area 4 Portland-Vancouver-Hillsboro, OR-WA Metro Area

5 Washington-Arlington-Alexandria, DC-VA-MD-WV Metro Area 6 Tampa-St. Petersburg-Clearwater, FL Metro Area

7 Charlotte-Concord-Gastonia, NC-SC Metro Area

8 San Francisco-Oakland-Fremont, CA Metro Area 9 Atlanta-Sandy Springs-Roswell, GA Metro Area

Seattle-Tacoma-Bellevue, WA Metro Area

Phoenix-Mesa-Chandler, AZ Metro Area

Minneapolis-St. Paul-Bloomington, MN-WI Metro Area 13 Jacksonville, FL Metro Area

Columbus, OH Metro Area

15 Orlando-Kissimmee-Sanford, FL Metro Area

16 Nashville-Davidson--Murfreesboro--Franklin, TN Metro Area

17 Sacramento-Roseville-Folsom, CA Metro Area

18 Salt Lake City-Murray, UT Metro Area

19 Boston-Cambridge-Newton, MA-NH Metro Area

20 San Diego-Chula Vista-Carlsbad, CA Metro Area 21 Richmond, VA Metro Area

22 Pittsburgh, PA Metro Area 23 Dallas-Fort Worth-Arlington, TX Metro Area 24 Philadelphia-Camden-Wilmington, PA-NJ-DE-MD Metro Area

25 Baltimore-Columbia-Towson, MD Metro Area

26 Los Angeles-Long Beach-Anaheim, CA Metro Area 27 Chicago-Naperville-Elgin, IL-IN Metro Area 28 Kansas City, MO-KS Metro Area

29 San Jose-Sunnyvale-Santa Clara, CA Metro Area

30 Miami-Fort Lauderdale-West Palm Beach, FL Metro Area

31 Hartford-West Hartford-East Hartford, CT Metro Area

32 Indianapolis-Carmel-Greenwood, IN Metro Area

33 Cleveland, OH Metro Area

34 San Antonio-New Braunfels, TX Metro Area

35 St. Louis, MO-IL Metro Area

36 Milwaukee-Waukesha, WI Metro Area

37 New York-Newark-Jersey City, NY-NJ Metro Area

38 Cincinnati, OH-KY-IN Metro Area

39 Detroit-Warren-Dearborn, MI Metro Area

40 Louisville/Jefferson County, KY-IN Metro Area

41 Houston-Pasadena-The Woodlands, TX Metro Area

42 Las Vegas-Henderson-North Las Vegas, NV Metro Area

43 Grand Rapids-Wyoming-Kentwood, MI Metro Area

44 Virginia Beach-Chesapeake-Norfolk, VA-NC Metro Area

45 Providence-Warwick, RI-MA Metro Area

46 Riverside-San Bernardino-Ontario, CA Metro Area

47 Birmingham, AL Metro Area

48 Oklahoma City, OK Metro Area

49 Memphis, TN-MS-AR Metro Area

50 Fresno, CA Metro Area

Remote work in the Philadelphia-Camden-Wilmington metropolitan area has continued to fall, ranking 24th in 2024 at 13 4%, compared with 16 9% in 2023 (19th) and 23 6% in 2021 (13rd) Pre-pandemic remote work in 2019 was 5 9% (23rd)

U.S. Department of Commerce: Bureau of Economic Analysis

(2nd Quarter 2020 – 2nd Quarter 2025)

2024-2025 School Year

2024-2025 School Year

Source: Delaware Department of Education, FY24 State Capacity Report

2024-2025 School Year

Source: EL Calculations based on Lightcast 2025.4

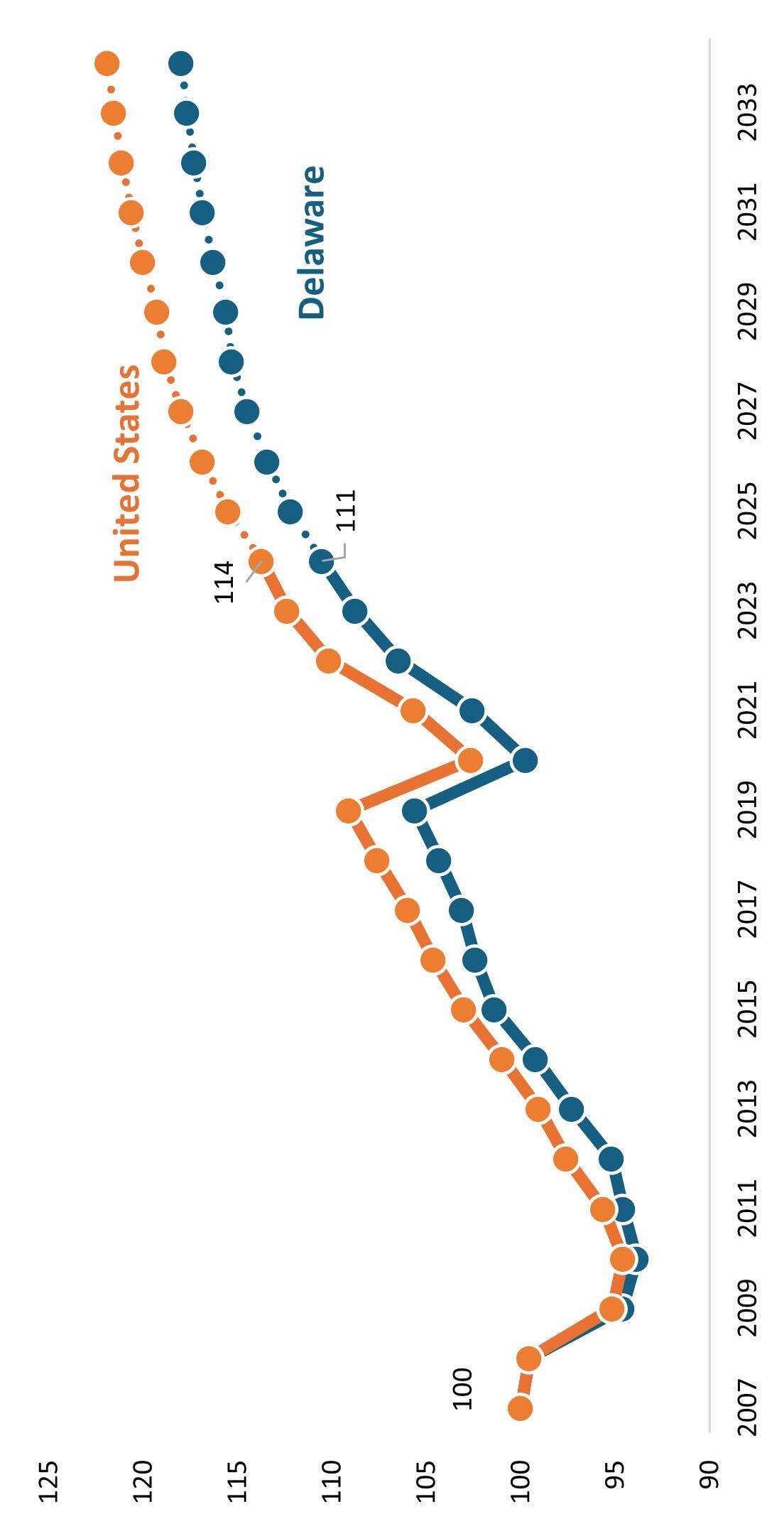

100 = 2007 Employment Levels

Source: EL Calculations based on Lightcast 2025.4

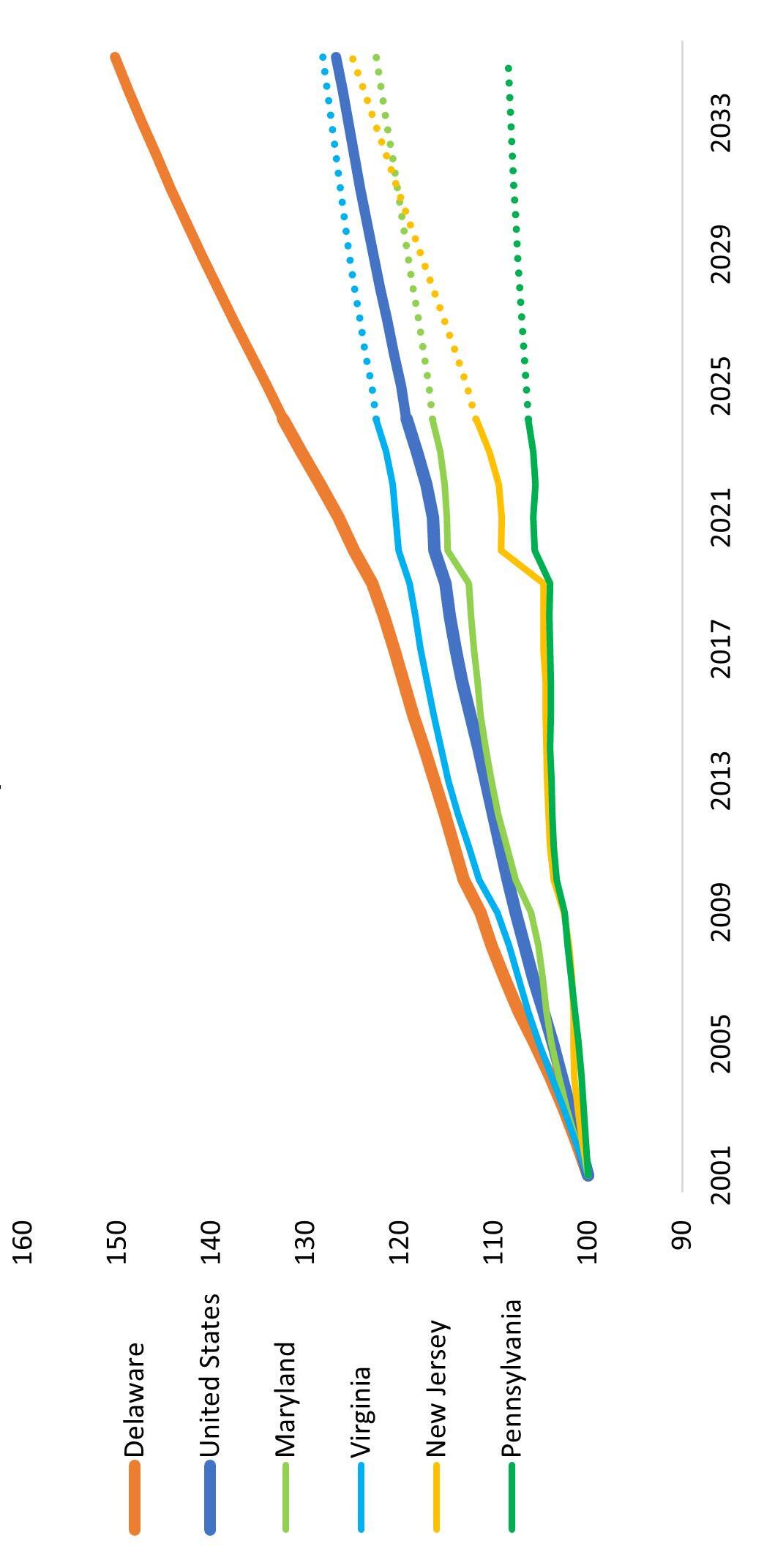

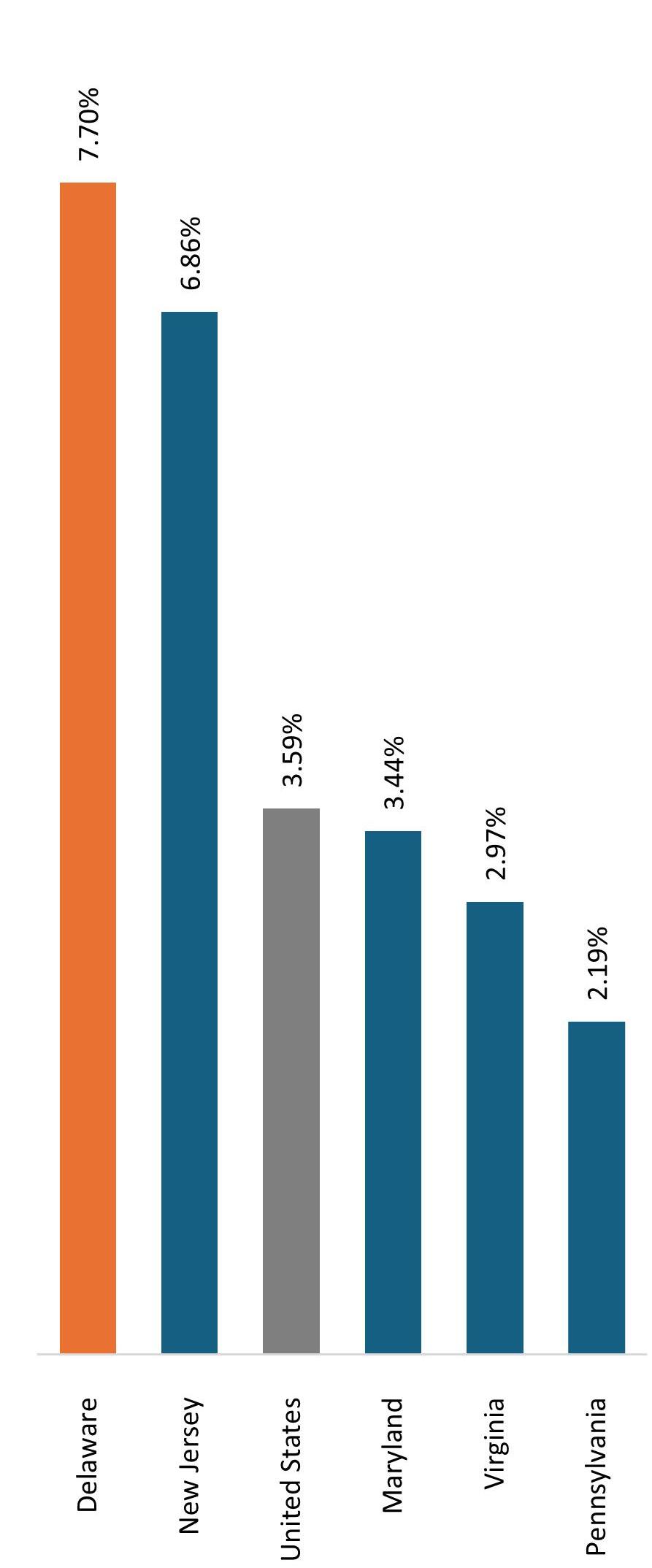

100 = 2001 Population Levels

Source: EL Calculations based on Lightcast 2025.4

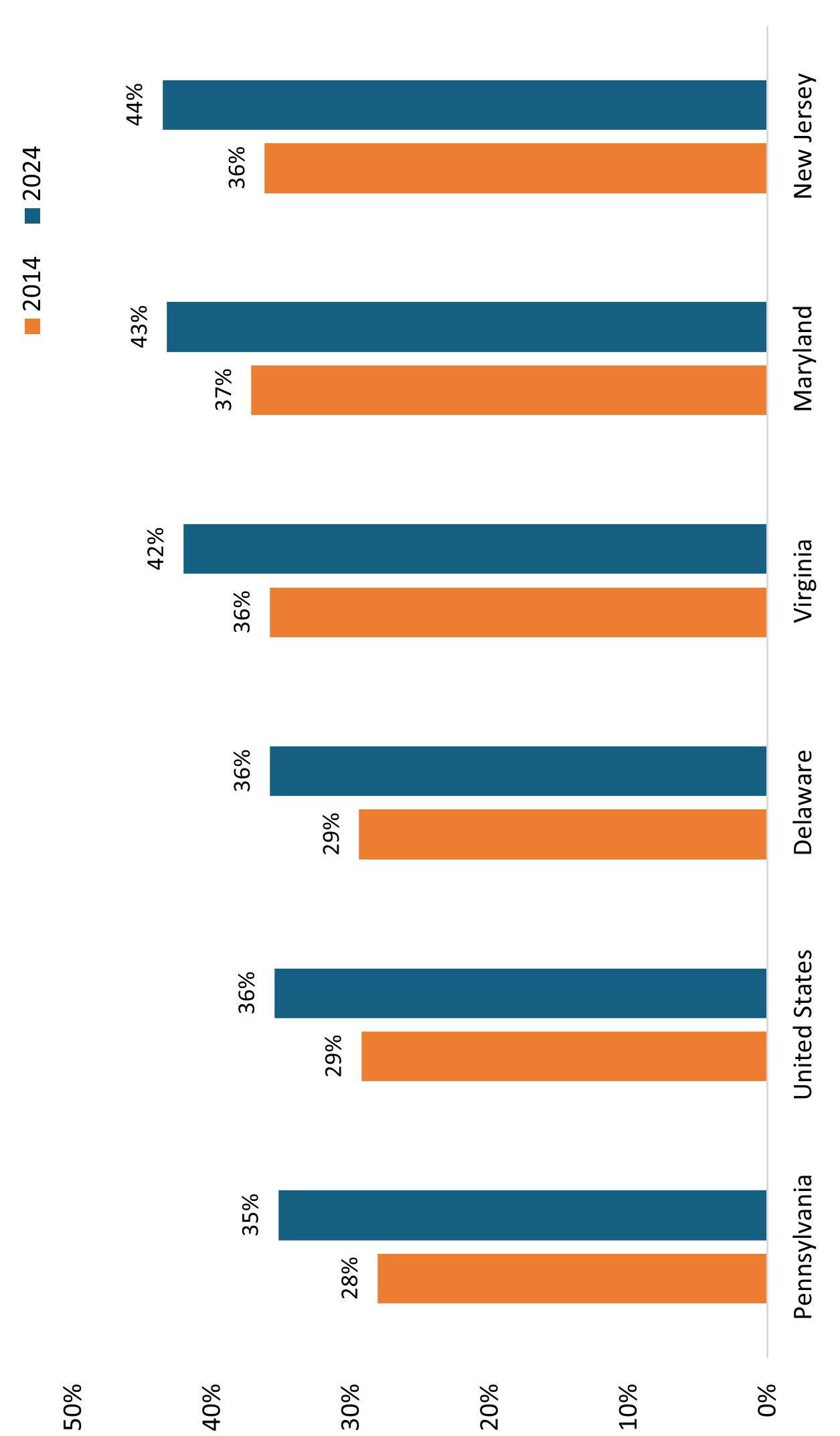

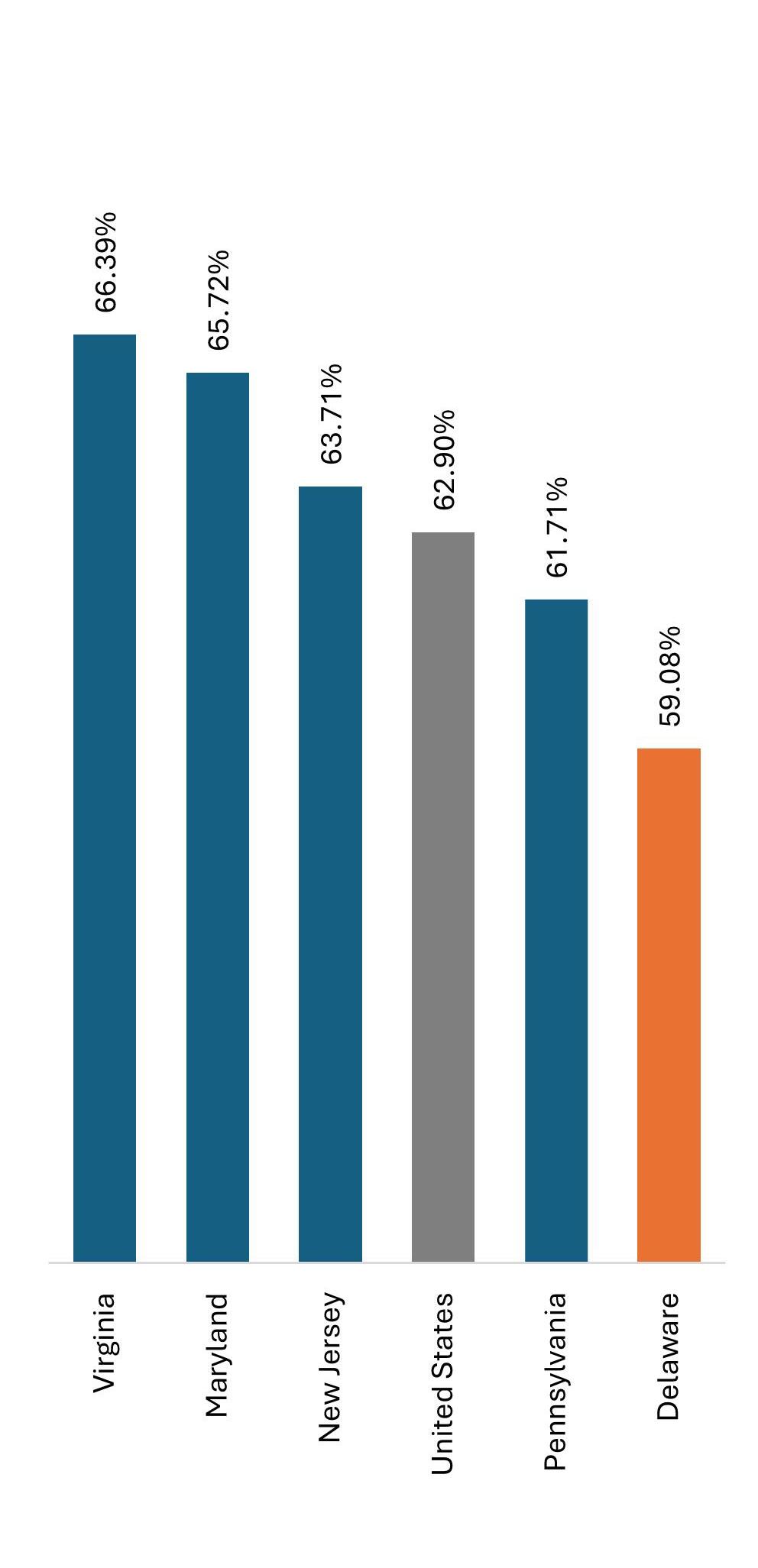

Percentage of Population with a Bachelors Degree or Higher