Publisher & Editor

Glenn L. Vo, DDS CEO, Dental Lifestyles Publishing

Managing Editor

Ethan Webb

Project Manager

Hanna Garcia

Art Director

Jess Beltran

Editorial Board

Dr. Adam Vega

Dr. Brittany Vo Nick Pavlidis

Kyle Summerford

Contributors

Dr. Glenn Vo

Elijah Desmond

Justin Withrow

Tim McNeely

Advertising Inquiries info@dentallifestyles.com

Send Any Correspondence to:

Dental Lifestyles Publishing 2450 Lakeside Pkwy Suite 150-107 Flower Mound, Texas 75022

Dental Lifestyles is published quarterly by Dental Lifestyles Publishing Group. Advertisers may sponsor some articles and/or content. Opinions expressed in articles or advertisements do not necessarily reflect the publisher’s opinion. Dental Lifestyles is not responsible for omissions or information misrepresented to the magazine. Advertisers and their agencies assume all liability for advertising content. No part of this publication may be reproduced or transmitted without written permission from the publisher.

Publisher’s Note

Happiness = Reality – Expectations: A Chairside Lesson in Letting Go..........................................

Marketing Life

Why Dental Conferences Are Failing: The Uncomfortable Truth Nobody Wants to Discuss..........

Business Life

Building Championship Teams: Gabriel Hofmann’s Playbook for Dental Practice Success..............

Mindset Life

How to Drop PPOs: A Practical Guide for Dentists......................

Legal Life

Break Glass in Case of Emergency: A Dental Defense Attorney’s Guide to Legal Preparedness..

Finance Life

Is It Time to Stress Test Your Financial Plan?.......................

Business Life The Leadership Triangle: Taking Care of Your Team So They Take Care of Your Practice.............

Conference Life

It started like any normal day at the practice... The schedule was full, production looked solid, and I had a plan in my head to knock out a few key goals before lunch. But by 9:15 a.m., things had already gone off the rails.

At first, a new patient didn’t show. Then, a long-time patient called with a last-minute toothache. And just when I thought I had room to breathe, my assistant let me know that the crown for our next patient came in… and it had an open margin.

That familiar frustration started creeping in. I caught myself thinking, “This isn’t how today was supposed to go.” I had pictured a productive, smooth-running day. But instead, I was in the middle of a mess.

Then a line from a book I had read the night before came to mind. It said:

It was from Solve for Happy by Mo Gawdat. I remembered that I had written a quick note in the margin: “Try this at the office.” And here I was, being given the perfect opportunity to do just that.

If you’ve been in dentistry for any amount of time, you’ve probably told yourself, “I’ll feel better once I hit this goal” or “I’ll be happier when my team runs more smoothly.” The truth is, we build these expectations in our heads of how our workday should go, how our patients should act, how our team should perform.

But reality rarely matches those mental blueprints. And that’s where the stress comes in—not from what actually happens, but from the difference between what we expected and what we got.

This equation helped me realize that the bigger the gap between reality and expectation, the more unhappy or frustrated I feel. But when I close that gap— either by adjusting how I see the situation or what I expect from it—things get better.

Here’s a quick process I use when things don’t go as planned. It helps keep me grounded and keeps small issues from ruining the whole day.

1. Pause and take a breath.

Before reacting, I stop and ask, “What actually happened?” I focus on just the facts. No judgment, no assumptions. Just the truth.

2. Ask yourself what you expected.

I ask, “What did I think was going to happen?”

Maybe I thought the lab would nail the crown.

Maybe I expected everyone to be on time.

Most of the time, my frustration came from holding on to some version of the day that never really existed.

3. Reframe the story.

Next, I ask myself what I can learn or do differently. Maybe we need to double-check cases when they arrive. Maybe it’s time to improve how we confirm appointments. It turns the problem into a learning moment.

4. Choose how to respond.

Now that I’ve cleared my head, I pick the next best step. Whether it’s calling the lab, adjusting the schedule, or just letting go of something small, I move forward with intention instead of frustration.

To be clear, this doesn’t mean accepting sloppy work or tolerating chaos. It just means letting go of the unrealistic belief that everything has to go perfectly for us to feel okay. We can still hold high standards for care and leadership without expecting perfection every step of the way.

This mindset shift shows up in all areas of the practice.

When a team member asks for a raise and you feel caught off guard, take a moment to think: are you upset about the request, or about your own assumption that loyalty means silence? Look at the data and have the conversation.

When a patient doesn’t accept treatment, it can be frustrating. But is it really about the “no,” or about the expectation that every patient should say yes right away? Instead, focus on building trust and educating, not controlling outcomes.

When the numbers dip, don’t jump to blame. Sometimes it’s just the season, or a slow stretch. Adjust your plans and move forward.

When you come back from CE and want to change everything overnight, but the team isn’t moving as fast as you’d hoped, that’s another expectation creeping in. Focus on one change at a time and build from there.

This equation has even made its way into our team conversations. After a tough morning, I’ll say something like, “Okay, let’s look at what happened and what we expected.” It creates space for honest reflection without finger-pointing.

One time, my assistant said, “Reality: the lab messed up. Expectation: we were going to seat eight crowns today. New plan: seat seven and personally call Mrs. Lee.” Just like that, the problem was addressed and the mood shifted.

In dentistry, ignoring clinical reality leads to failure. The same is true for our mindset. When we ignore the gap between what is and what we expected, we open the door to unnecessary stress and burnout.

This equation from Solve for Happy is more than just a good quote. It’s a tool that helps us respond better to the curveballs of everyday life in and out of the practice.

For the past decade, I’ve lived and breathed dental conferences. I’ve brought anywhere from 200 to 1,000 attendees to my events, created unique experiences like Smiles at Sea and The Dental Festival, and literally wrote the book on turning conferences into fun, high-energy events. I’ve been a DJ, speaker, emcee, and sponsor at events worldwide.

So when I tell you that most dental conferences are failing, I’m not speaking from the sidelines—I’m speaking from the center of the action. And it’s time someone had the courage to expose what’s really happening.

The pandemic didn’t create this problem; it simply accelerated it. When COVID-19 forced conferences to shut down for two years, companies that traditionally spent $50,000 to millions annually on conference marketing suddenly discovered they could grow without them. They got creative, found new channels, and kept their momentum going.

When conferences returned, the landscape had fundamentally changed. I’ll never forget walking onto the Hinman Dental

By Elijah Desmond, Founder of Smiles at Sea, The Dental Festival, and Author of Hype

2. They let sponsors provide speakers—turning educational sessions into thinly-veiled sales pitches.

3. They charge speakers to speak—yes, you read that correctly. Some conferences now charge $10,000 for speaking slots. And who’s going to pay that kind of money to speak? You guessed it: sponsors.

Their dentists don’t need external conferences anymore.

Not all conferences are dying. The winners share specific characteristics that set them apart from the failing masses.

Conference floor and seeing what felt like 1,500-2,500 attendees where thousands once stood. Massive exhibition halls with elaborate displays hanging from the ceiling had shrunk to small rooms with basic 10x10 booths. The vendor count had plummeted from what appeared to be 500 to maybe 50.

The truth is, the entire conference ecosystem has been turned upside down by a fundamental shift in who pays whom.

Pre-pandemic, vendors would pour hundreds of thousands— sometimes millions—into conferences. This money funded top-tier speakers commanding $5,000 to $15,000 honorariums who delivered exceptional clinical and business content. Attendees got value, vendors got exposure, and conferences thrived.

Now? The money has dried up. Without vendor dollars, conferences can’t afford quality speakers. So what do they do? They get creative in ways that ultimately hurt everyone:

1. They book speakers who don’t charge honorariums often less experienced or lower-quality presenters.

This creates a death spiral that’s destroying the industry from within.

Attendees suffer through mediocre content and constant sales pitches, leading them to stop attending conferences altogether and turn to online CE platforms instead. With fewer attendees, vendors see less value and reduce their spending even further. This leaves conferences with even less money, causing the quality to deteriorate more dramatically. The result? State conferences that once drew 20,000 attendees now struggle to attract 8,000.

Meanwhile, online platforms like DentalFlix, CE Zoom, and others are booming. Why? Because top speakers can deliver five webinars in one day, wearing their pajamas in the comfort of their own home, earning money without airport hassles or health risks.

Meanwhile, the rise of DSOs is cannibalizing traditional conferences. With 30% of practices already consolidated (heading to 85% within 5-10 years), these large organizations create their own internal education programs. Heartland Dental, with 2,000 practices, can attract top-level speakers and afford to pay them well.

DYKEMA targets DSOs specifically and attracts millions in sponsorship dollars because they serve a focused niche with deep pockets. Florida Dental Association and Rocky Mountain Dental Conference thrive by investing in the complete attendee journey, creating experiences that go far beyond just educational sessions. Thrive Live and events run by industry influencers succeed by leveraging their built-in audiences and existing communities. My own Smiles at Sea combines education with cruise experiences, offering something you simply can’t get from a hotel conference room.

The formula is simpler than you’d think: deliver extraordinary value through unique experiences, serve specific niches, or leverage existing relationships. Generic state meetings offering mediocre speakers in convention centers? They’re toast.

Want to help? Show up. The more attendees who return to quality conferences, the more vendors will follow. More vendors mean better speakers and experiences. It’s that simple.

For conference organizers: Bring back speaker application portals. Stop treating your stage like a billboard for sale. Invest in quality over quantity.

For speakers: Consider teaching at DSO events or building your online presence. The traditional speaking circuit has fundamentally changed.

For attendees: Vote with your feet. Support conferences that prioritize education over sponsor pitches.

The dental conference industry stands at a crossroads. We can either continue down this path of decline, or we can collectively choose to rebuild something better. As someone who’s dedicated their career to creating exceptional conference experiences, I’m not ready to give up.

The question is: Are you?

For more insights on creating exceptional conferences, check out my book Hype on Amazon. If you’re an aspiring speaker, come to The Dental Festival where real meeting planners scout real talent. At our last festival, over 20 meeting planners were actively in attendance looking for emerging talent.

SCAN TO LEARN MORE

DON’T JUST TAKE OUR WORD FOR IT:

“Must read if you love hosting events. Great, valuable pointer information on how to organize a talk-of-the-town event. Easy read but need lots of time to digest and execute one step at a time when we’re actively in attendance looking for emerging talent.”

— Danh Thai

“Elijah Desmond is one of the authentic, generous humans in this space. He invests in humans… listen and learn from the master!!!”

— Dr. Beckford

When Gabriel Hofmann mentioned he regularly helps practices save hundreds of thousands to millions of dollars annually, I had to know more— those are serious numbers! But what really intrigued me about the “Dental Efficiency Guy” wasn’t just the financial results; it was his approach to making dentistry fun again.

Yeah, you read that right: fun. In an industry where burnout is basically an epidemic and talented hygienists are jumping ship faster than we can hire them, Gabriel has cracked the code on boosting profits while helping teams actually enjoy coming to work.

Gabriel brings something most consultants don’t: he’s actually been in the trenches. Twenty-plus years in operations leadership, from massive DSOs to co-founding a six-location multi-specialty group. Real estate negotiations at 2 AM? Been there. Creating SOPs that actually work? He’s written hundreds.

“I realized the level of inefficiency and the consistent challenges that plague practices, no matter their size,” Gabriel

By Dr. Glenn Vo, Editor-in-Chief of Dental Lifestyles Magazine

told me. “These challenges had become accepted as just the way of doing business, leading to a loss of joy—unhappy doctors, unhappy teams, and high turnover.”

Let’s be real, this isn’t some guy with an MBA who read about dentistry in a textbook. Gabriel has felt that 3 AM anxiety when your best hygienist threatens to quit. And it’s his passion for solving these problems that eventually led him from “operator” to “optimizer.”

“They don’t have one top star,” he explained. “On any given night, eight or nine players can score in double figures because they’re focused on making each other better rather than individual glory.”

So, what does that have to do with dentistry? “The best teams take new talent and develop them into all-stars. Why focus only on recruiting the cream of the crop when we might have unicorns already on our team? We just haven’t invested in developing them yet.”

Gabriel noted. I know exactly what he means—how many dentists do you know who pull in $2 million but take home as if they’re running a $500K practice?

Gabriel digs deep into P&Ls, often finding hundreds of thousands in recoverable costs. “We implement cost-saving strategies that go directly to the bottom line without putting more on anyone’s plate. Actually, we make their lives easier.”

After years of quietly helping colleagues, mentors recently pushed him to think bigger.

“My intrinsic motivation isn’t just about helping owners love what they do—it’s about energizing and engaging entire teams.”

Now, I love a good sports analogy, and Gabriel delivered one that made me completely rethink how we build dental teams. A die-hard Yankees fan (fun fact: his relative actually played for the team for 13 years!), he pointed to the Indiana Pacers (his city’s NBA team) as the perfect example.

Think about it. How many of us are constantly hunting for that “unicorn” hygienist while we’ve got future stars riding our bench? It’s like having a diamond in the rough that just needs some polishing, but we’re too busy shopping for pre-cut gems to notice.

Three Pillars That Actually Work

Gabriel’s system rests on three pillars, and trust me, after seeing how most practices operate (including my own at times), we could all use this framework:

1) Financial Optimization: “Many practices are doing well from a revenue standpoint, but the bottom line isn’t there,”

Did you catch that? Easier. Not another system to manage. In a world where many “solutions” end up creating even more work, that’s music to my ears.

2) Strategic Automation: “The only way practices achieve 30-plus percent EBITDA today is through finding the right partners, implementing smart automation, and closing the back door on inefficiencies,” Gabriel explained.

30-plus percent EBITDA… Let that sink in. Most practices I know throw a party when they hit 20%.

Gabriel’s not pushing tech for tech’s sake. He’s thinking about where you’ll be in 3-5 years.

Will you have associates? Multiple locations? He helps practices make investments that actually make sense. (We even geeked out about those Yomi implant robots—seriously, robots doing implants... We’re living in Star Wars times, folks!)

3) Leadership Development: This might be my favorite because it hits so close to home. “Are we developing our assistants to become office managers? Our office managers to become practice administrators?” Gabriel challenged.

I thought about my own morning huddles. How many times have I been that person, talking AT my team instead of developing leaders? Total gut check moment.

Gabriel transforms team members into “creators” with an ownership mentality. When your team starts thinking like owners instead of clock-punchers, that’s when magic happens.

Beyond the Bank Account

Sure, Gabriel’s clients see massive financial improvements—”hundreds of thousands to millions annually.” But here’s what really matters: “Happy people are productive people,” he said. “When we create solid cultures where results are sustainable, teams begin taking a leadership approach to the business.”

I’ve seen this in our Nifty Thrifty community. The practices that focus solely on numbers? They’re constantly dealing with drama. The ones building culture alongside profitability? Those are where people actually want to work.

We’ve all seen practices that grew fast and became unrecognizable—and not in a good way. Gabriel knows why: “When we grow quickly and hire at a rapid rate, culture gets diluted. You can’t train people and ingrain them in your culture fast enough.” Having built a multi-location group himself, he’s lived through the chaos. His advice? Get your foundation rock-solid first. It’s like building a house—nobody cares how fast you framed it if the foundation cracks.

Speaking of houses, Gabriel has a greenhouse in his basement, where he keeps his citrus trees during the chilly Indiana winters. “My kids say I like plants more than people,” he joked. “When I’m stressed, I work on my citrus trees.”

Ironically, growing fruit in an unlikely environment is precisely what he does with dental practices. Just as those trees require the right conditions

(temperature, humidity, and nutrients), your practice needs the right systems to thrive.

For practitioners feeling trapped, Gabriel gets it. “I hear it all the time—practitioners who feel like slaves to their practice. By getting time back for them and their teams, we help redirect that energy toward building sustainable results.”

Gabriel offers free 15-30 minute consultations—no high-pressure tactics, just a conversation about where you are and where you want to be. As he says, “Where you invest your time is ultimately where you’re going to grow.”

After our conversation, I’m convinced that investing some time with Gabriel might be one of the smartest moves you make this year.

Ready to build your championship team? Connect with Gabriel Hofmann, the “Dental Efficiency Guy,” for a no-pressure consultation. Whether you’re dealing with urgent challenges or ready to unlock your practice’s potential, Gabriel and his network can help create a practice that’s both profitable AND genuinely enjoyable to run. Reach out at gabriel@ thedentalefficiencyguy.com and discover why practices nationwide are rediscovering their joy in dentistry.

In-network dentistry often comes with limitations: lower profitability, administrative overload, and less time to focus on patient care. Transitioning to a fee-for-service (FFS) model isn't about losing patients, it's about gaining control, autonomy, and the ability to deliver high-quality care on your terms. This guide outlines a smart, strategic, and sustainable approach.

Total Estimated Time: 6–24 months

Best Approach:

Phased withdrawal from low-value PPOs first

By Cassie Tallon, Fractional COO of The Fractional Match LLC

Step 1: Evaluate & Prioritize (Month 0–3)

What to do:

- Run a payer mix analysis: percentage revenue by plan, reimbursement rate vs. UCR, time per procedure

- Identify the lowest-performing PPOs—these are your first targets

- Assess patient loyalty and potential attrition risk

Pro Tips:

- Work with a financial analyst or consultant to model the impact

- Segment your patients by PPO to prepare communications

Step 2: Build Your Communication Plan (Month 1–4)

What to do:

- Train your team on how to talk about the shift

- Prepare emails, front desk scripts, and in-office signage

- Focus messaging on patient care and improved experience

Communication Plan:

1. Team Meeting: Host an internal meeting to educate your team on why the practice is transitioning away from PPOs

and how to confidently and empathetically explain the change to patients.

2. Written Scripts: Develop scripts for phone calls, in-person conversations, and email communication to ensure a consistent message.

3. Patient Letters: Send a formal letter to accepted patients 90–120 days in advance explaining the change, their options, and the benefits of staying with the practice.

4. Office Signage: Place friendly, professional signage in the office reinforcing the message and offering support.

5. Website and Social Media: Update your online presence to reflect your value-based care model and reinforce your patient-first philosophy.

Key Phrases:

- “We’re choosing to step away from insurance contracts so we can focus 100 percent on your care.”

- “We will still help you file claims for reimbursement, you’re not alone in this.”

Step 3: Begin the Drop Process (Month 3–12)

What to do:

- Start with one or two PPOs— send formal resignation letters to each carrier

- Notify patients 90–120 days in advance

- Offer options: out-of-network benefits, in-house membership plans, flexible payment plans

Important:

- Keep clear records of all communication with insurers

- Confirm termination effective dates in writing

Step 4: Shift Patient Experience (Month 3–18)

What to do:

- Enhance every touchpoint of your patient experience

- Train your team on presenting treatment plans with confidence and empathy

- Add value: comfort amenities, longer appointments, technology, and continuity of care

System Focus:

- Fine-tune scheduling, billing, and collections for an FFS model

- Consider adding or expanding hygiene-based programs and elective services

Step 5: Full Transition & Stabilization (Month 12–24)

What to do:

- Evaluate how the first PPO exits impacted retention and revenue

- Use data to decide on next contracts to terminate

- Reinforce culture, service standards, and leadership to retain staff and patients

KPI Monitoring:

- New patient acquisition

- Case acceptance

- Monthly collections per provider

- Hygiene reappointment rates

- Net patient attrition

Bonus Tips for Success

- Start slow, be strategic: This is a marathon, not a sprint

- Empower your team: The transition lives or dies with their confidence

- Introduce a Membership Plan: Helps bridge the affordability gap

- Use marketing wisely: Promote value-driven care, personalized service, and results, not “no insurance needed”

Final Reminder

Dropping PPOs isn’t just a financial decision, it’s an act of leadership and it’s not right for everyone. You’re choosing autonomy, sustainability, and excellence over volume, red tape, and burnout. Your future practice, and your peace of mind are worth it.

By Dr. Glenn Vo, Editor-in-Chief of Dental Lifestyles Magazine

In the world of dentistry, we’re trained to spot problems before they become painful. We look for the subtle signs—a tiny shadow on an X-ray, a hairline fracture, the earliest stages of decay. But when it comes to our practice’s financial health, many of us are operating blind, missing critical warning signs until they’ve developed into full-blown emergencies.

That’s why, for this edition’s cover feature, I sat down with Harsh Patel, CEO of HMP Consultants, the winner of our 2024 “Favorite Dental CPA” Nifty Award, and someone who approaches financial health with the same diagnostic precision we bring to clinical care.

As someone who has been in Harsh’s client chair myself, I’m one of his biggest fans. Filing your taxes or balancing your books may be Harsh’s “bread and butter,” but—more importantly—he also understands the unique challenges we face as dental professionals when it comes to building thriving, sustainable practices.

Harsh’s journey into dental-specific accounting wasn’t planned; instead, it evolved organically from recognizing an unmet need. When he first launched his firm, HMP Consultants served clients across all industries. But something special happened when he began working with dental practices.

“When I first started my firm, I served all industries. I had some dental clients, and I quickly realized that I enjoy working with dentists,” Harsh shared during our conversation. “There are many aspects to the business. They don’t educate students in the business side of dentistry in dental school. Therefore, owners often need assistance understanding that aspect when it comes to practice ownership.”

He couldn’t be more right. We spend years mastering the clinical skills needed to provide exceptional patient care, but graduate with minimal preparation for the business realities of running a practice.

What started as a handful of dental clients soon became a transformation of his entire practice. “I had a batch of dental practice clients as I was serving other industries,” Harsh explained. “I not only enjoyed the professionalism of the clients, but being able to offer more services and consulting within dentistry was what kickstarted the transformation.”

But, for Harsh, it wasn’t just a matter of business opportunity; there was something deeper that drew him to our profession. “There are a lot of things to focus on. I realized this was something I am passionate about. Being able to specialize in one industry allows us to provide better service to our clients, and it allows us to grow at the same time.”

This specialization has paid dividends for both Harsh and his clients. By focusing exclusively on dental practices, HMP Consultants has developed an intimate understanding of our industry’s unique financial challenges—from managing high equipment costs and staffing complexities to navigating insurance reimbursements and planning for practice transitions.

During our conversation, I asked Harsh to share a recent example that illustrates why dentists need specialized financial guidance. His response painted a picture that’s all too familiar in our industry.

“There was a new practice owner who contacted us. I had an initial consultation, and during that consultation, I learned that they had a family member doing the books,” Harsh recounted. “The bookkeeping was incorrect—not caught up— and their business structure was incorrect as well. After they began working with me, their production doubled within a few months.”

The implications were staggering. Here was a practice experiencing tremendous growth— production doubling in just months—but the owner was flying blind. “With this sticky situation, they did not know how to make business decisions with hiring additional hygienists, etc.,” Harsh explained.

This scenario represents more than just poor bookkeeping. It’s a practice at a critical inflection point, unable to capitalize on its success because the owner lacks the financial visibility needed to make informed decisions. Should they hire more staff? Invest in new equipment?

Expand their space? Without accurate, timely financial data, these become guesses rather than strategic decisions.

But perhaps the most common—and costly—mistake Harsh sees involves business structure. “The most common error that many owners tend to make is with their business structure—Sole Proprietor versus S-Corporation,” he revealed. “They don’t seek professional advice, or they may have gotten incorrect advice. This results in them having to overpay taxes.”

The solution? “One of the first things we do is assess the business structure of our new clients. If required, we switch it to the correct structure with calculations to prove the savings.”

These aren’t abstract concepts—they translate directly to your bottom line. The wrong business structure can cost a practice tens of thousands of dollars annually in unnecessary taxes. That’s money that could be invested in new technology, staff bonuses, or your retirement fund.

One of the most striking differences in Harsh’s approach is his emphasis on frequent, regular communication with clients. While many CPAs may meet

with clients once a year (usually just before tax season), Harsh insists on holding monthly or quarterly meetings.

“It is important for us, as accountants, to know what is happening within the business and personal side of our clients,” he explained. “Likewise, they need to know what is happening on the accounting and tax side.”

This regular cadence serves multiple purposes. “With frequent meetings, the clients know where they stand with their taxes. They are also aware of any changes in laws or regulations. As a team, we can collaborate and come up with action items to plan for the remainder of the year, make important business decisions, set goals, and save more in taxes.”

It’s not so different from how we approach patient care. We don’t see patients once and then hope for the best—we schedule regular check-ups, monitor progress, and adjust treatment plans as needed. Harsh applies this same philosophy to financial health.

The dental industry is experiencing rapid change. DSOs are reshaping practice ownership models, group practices are becoming more common, and technology investments are

accelerating. I asked Harsh how he helps practices navigate these shifts from a financial perspective.

“We help clients with vendor changes to save more,” he responded. “In addition, we advise on using the latest technology to help their practice be as efficient as possible. With any large investment, we help break down the cost-benefit analysis and determine if the investment is worthwhile. After that, we analyze the tax side and see the tax impact of the investment.”

This comprehensive approach to financial decision-making is a must in today’s environment. Whether you’re considering a CEREC machine, exploring laser dentistry, or evaluating practice management software, these investments require rigorous financial analysis.

Looking ahead to 2025, Harsh highlighted several pending changes that practice owners should monitor: “There are a lot of proposals that are pending final approval. 100% bonus depreciation, no tax on overtime, and changes in the State and Local Tax deduction are a few to keep an eye on.”

When I asked Harsh about lesser-known tax strategies that could benefit dental practices, he didn’t disappoint. Beyond the commonly discussed Augusta Rule and vehicle deductions, he highlighted opportunities many practices miss.

“We advise on the Work Opportunity Tax Credit, which is a tax credit if your practice hires employees from certain targeted groups, such as veterans or individuals receiving government assistance,” he explained.

These are the kinds of opportunities that general CPAs often overlook because they’re not immersed in the specific needs and opportunities of dental practices. It’s like the difference between a generalist who sees teeth and a specialist who understands the intricacies of endodontic therapy.

For dentists still using their parents’ CPA or a general practitioner, Harsh offered specific questions to assess whether they’re getting appropriate support: “Is their CPA implementing KPIs, goals, projections, tracking new patient counts, monitoring production, A/R balance? If they aren’t doing those at the minimum, they should request them to do so.”

One of HMP Consultants’ strengths is its ability to support practices at every stage of growth. I was curious how their approach differs between a solo practitioner and someone managing multiple locations.

“We provide different layers of reporting and metrics,” Harsh explained. “With a solo practitioner, we focus a lot on education and helping our clients grow their business acumen. This involves understanding key financial metrics, staying on top of overhead, and focusing on growing the practice.”

But as practices expand, the complexity multiplies exponentially. “With multi-practice, there are more complexities. It is our job to provide as much financial insight and metrics on each practice and at a consolidated level. At times, we must restructure everything and utilize tax credits. This requires more frequent meetings and advanced tax planning.” He emphasized a crucial point: “Small changes result in massive savings. We have to make sure the owners do not over-leverage themselves.”

This scalable approach to financial management ensures that whether you’re running a single operatory practice or building a multi-location empire, you have the financial intelligence needed to make informed decisions.

Benchmarking—comparing your practice’s performance against industry standards and regional competitors—plays a pivotal role in HMP’s process. Harsh makes certain that his clients don’t view it as abstract numbers on a spreadsheet.

“It is important for owners to know their overhead and how it stands against industry standards,” Harsh emphasized. “Rising costs and employment issues can significantly impact overhead. If a specific metric is off by a large amount, it is important for the client to know.”

The key is translating data into action. “Being able to build out the metrics and reports on an ongoing basis allows us to present this to our clients. A minor change can result in tremendous savings.”

Perhaps the most powerful moment in our conversation came when I asked Harsh to share a story where financial guidance directly impacted patient care.

“There was a client that had a massive cash flow issue,” he told me. “The practice was not profitable for 18 months. They were 6 months out from selling the practice if things did not turn around.” The situation was dire—huge accounts receivable balance, toxic office manager, poor front office, bad reviews, and an owner who had lost grip of the practice.

“This caused a lot of mental strain on the owner. The patient experience fell apart. The doctor lost some confidence with these issues and stopped doing larger cases.”

Through careful analysis of management reports and financials, Harsh identified the specific issues and worked with the client to address them. “After fixing overhead, staff, and office protocols, things slowly turned around. After 6 hard-working months, the office was coming back. The production and new patient counts improved. The patient experience was improved as a result of all this.”

Many dentists don’t realize it, but financial stress doesn’t just affect the bottom line—it affects every aspect of patient care. When practice owners are worried about making payroll or keeping the lights on, it’s impossible to provide the level of care our patients deserve.

When I asked Harsh about the most rewarding part of working with dental professionals, his answer reflected the same service-oriented mindset that draws many of us to dentistry.

“Being able to educate clients on the financial side of things is a great experience. Seeing the practice grow and evolve after all this makes it all worthwhile,” he shared. “Practice ownership is not easy. Being able to help owners grow brings a lot of gratitude.”

This educational component is central to Harsh’s philosophy.

He’s not interested in simply handling the books—he wants his clients to understand their finances well enough to make confident, informed decisions about their practice’s future.

As we look ahead to the next 5-10 years, Harsh sees technology as a major disruptor in dental finance. “Utilization of technology and AI is growing. Older practices that don’t implement newer systems and processes may need to start making changes in the near future so they are competing with the newer ones.”

While he remained tight-lipped about specific new services HMP Consultants is developing (“There are a few things I am working on. At the moment, I don’t want to release the news”), he assured me that “the new tools will definitely bring a new and improved experience to our clientele.”

As our conversation drew to a close, I asked Harsh what he would say to dentists who have been putting off getting their finances in order.

“Staying ahead of your finances and numbers will advance your career. Small changes can bring significant improvements. There is no harm in getting a second look at how you are doing things. It is better to regret now than regret 10 years from now.”

For those ready to take that first step, HMP Consultants offers a free tax and accounting analysis session. “The consultation is a discovery call where we go through the structure. In addition, we address any pain points you may have with the current services you are receiving,” Harsh explained. “This small consultation addresses errors, structural changes, and potential tax savings opportunities.”

After my conversation with Harsh, I’m more convinced than ever that specialized financial guidance isn’t a luxury for dental practices—it’s a necessity. Just as our patients trust us with their oral health because of our specialized knowledge and training, we need financial partners who understand the unique challenges and opportunities of dental practice ownership.

Harsh and his team at HMP Consultants represent a new breed of financial professionals—those who see beyond the numbers to understand the human side of practice ownership. They recognize that behind every P&L statement is a dentist trying to provide excellent patient care while building a sustainable business. Behind every tax return is a practice owner juggling clinical responsibilities with business demands.

In our Nifty Thrifty Dentists community, we’re always looking for partners who share our values of education, collaboration, and mutual support. Harsh embodies these principles, which is why I’m not just featuring him in this magazine—I’m proud to call him my CPA.

If you’re ready to take control of your practice’s financial health, I encourage you to reach out to Harsh and his team.

Whether you’re a new graduate opening your first practice or an established owner looking to optimize your operations, they have the expertise and dedication to help you succeed. Remember, in dentistry, we don’t wait for problems to become painful before addressing them. The same principle should apply to your practice’s financial health. Take action today—your future self (and your patients) will thank you.

To learn more about HMP Consultants or to schedule your free tax and accounting analysis session, visit https:// www.hmpconsultants.com/ or reach out directly to Harsh and his team.

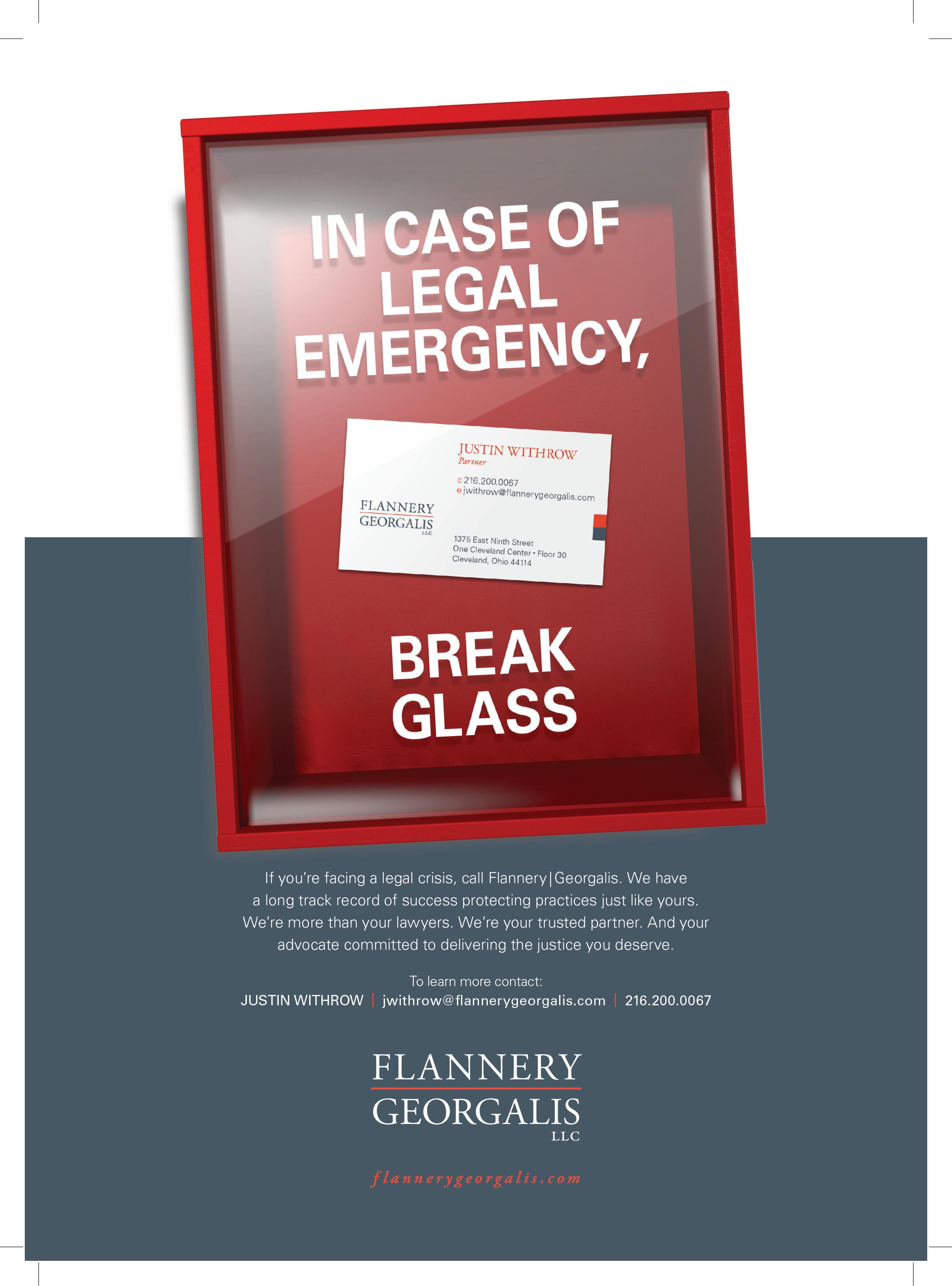

By Justin Withrow, Partner at Flannery Georgalis, LLC

The content in this article is for informational purposes only and does not constitute legal advice. Consult with a qualified attorney for guidance specific to your situation.

As a Partner at Flannery | Georgalis focusing my practice on complex criminal, regulatory, and civil matters, I've seen firsthand how quickly a routine day can turn into a legal nightmare for dental professionals. Whether it's an unexpected FBI search warrant at 7 AM on a busy patient day or a seemingly innocent insurance audit that escalates into a quarter-million-dollar demand, dental professionals face unique legal challenges that require specialized expertise.

I like to describe myself as the "break glass in case of emergency" attorney—that red phone you hope you'll never need but are grateful to have when crisis strikes. Unlike lawyers who primarily handle employment contracts or practice sales, I focus my practice on enforcement matters across federal, state, and local levels: criminal investigations, regulatory subpoenas, licensing board complaints, insurance audits, and complex business litigation. I've developed a nationwide practice representing dentists and other medical professionals in these sensitive matters.

Over the past decade, I've represented dentists facing everything from minor licensing board inquiries to federal criminal investigations involving millions of dollars in alleged improper billings. In one memorable case, we successfully defended a client against $4.5 million in alleged fraudulent charges, resulting in no incarceration and preservation of their license. Today, that client operates a thriving general dentistry practice.. In another, our advocacy resulted in the Department of Justice closing a criminal investigation where the government initially believed millions had been improperly billed—only to discover through our

defense investigation that services were properly documented and billed.

The reality is that 99.9% of dental professionals will face some form of legal challenge during their careers. These situations don't exist in a vacuum—they impact marriages, families, staff retention, patient relationships, and financial stability. That's why I take what I call a "quarterback" approach, coordinating with other professionals when needed, whether that's tax specialists, family law attorneys, financial advisors, and other specialized professionals.

Here's what I've learned through years of representing dentists in regulatory matters: the earlier we get involved, the better the outcome. Too often, I receive calls only after practices have tried to handle audits themselves, submitted records without proper review, or responded to board complaints or subpoenas without understanding the potential consequences.

I've been hired on countless occasions where the initial bad news—a proposed license suspension, a demand for hundreds of thousands in audit repayments, or a criminal subpoena—could have been prevented or minimized with proper early representation. While we can absolutely help in these later-stage situations, the sooner we're involved, the greater our ability to influence the outcome.

While you can never completely prevent legal challenges, you can significantly minimize your risk. I'm a huge proponent of regular internal compliance reviews—what I call "practice flossing." Just as you preach daily flossing to your patients for

preventative care, you need to regularly examine your own practice's documentation, coding, and record-keeping practices.

If you give any auditor enough time to review practice records, they'll find something that could be improved. The key is finding and fixing these issues before they become problems. Consider hiring external professionals to conduct random chart reviews or compliance assessments. This investment in prevention can save you exponentially more in potential audit repayments or legal fees down the road.

Every practice should have a "break glass in case of emergency" list of professionals for different situations. The moment you receive a subpoena, audit notice, or licensing board complaint, you should know exactly who to call. You shouldn't be searching for legal representation when you're already under stress and facing tight deadlines.

When clients call my direct number—which is both my personal and business line—we'll have an immediate conversation about what's needed and how quickly. With experience across multiple states, I'm positioned to handle matters wherever they arise and can mobilize rapidly to protect your interests. When you hire me, you not only receive the benefits of my expertise, but you get the entire Flannery Georgalis team – home to several former federal and state prosecutors and federal special agents.

There are far more good people who make bad decisions than truly bad people.

Most dental professionals I represent are ethical practitioners who found themselves in difficult situations through misunderstanding, poor documentation, or simply being in the wrong place at the wrong time.

I regularly take calls from dental consultants or practitioners with questions, even when it doesn’t result in paid representation. It’s about being a resource and ensuring people get accurate information rather than relying on potentially harmful advice that could lead them down the wrong path.

My philosophy is simple: if I’m not the right solution for your problem, I’ll connect you with someone who is. This commitment to finding the best outcome for clients, rather than simply securing business, has been the foundation of my practice throughout my career at Flannery | Georgalis and previously working with other highly regarded criminal defense attorneys. Beyond dental practice defense,

I also assist licensed professionals seeking to seal or expunge criminal convictions that could jeopardize professional licenses, security clearances, employment opportunities, or international travel.

for the Unexpected

The dental professionals I work with often say, “I like talking to you, but I hope I don’t have to talk to you again.” I completely understand that sentiment. But having that relationship established—knowing you have someone to call who understands the unique challenges of dental practice—provides invaluable peace of mind. Whether you’re facing an immediate crisis or simply want to establish that emergency contact for the future, I encourage every dental professional to think proactively about legal preparedness. Because when legal trouble strikes, you want to focus on resolving the issue, not scrambling to find qualified representation.

In my experience, the practitioners who fare best in legal challenges are those who recognize early that they need specialized help and aren’t afraid to ask for it. Don’t let pride or the hope that “it will blow over” turn a manageable situation into a career-threatening crisis.

Justin Withrow is a Partner at Flannery | Georgalis, where he leads the firm’s dental practice group. His practice focuses on complex criminal, regulatory and civil matters at federal,

state, and local levels. He has developed a nationwide practice representing dentists and other medical professionals in sensitive matters including regulatory investigations, billing audits, professional licensing matters, and complex business litigation. Justin is licensed to practice in Michigan, Ohio, multiple federal district courts, the U.S. Court of Appeals for the Sixth Circuit, and the U.S. Supreme Court. He can be reached directly for emergency consultations.

M

y journey into wealth management for dental professionals began where many great stories do—when I fell in love.

As a financial advisor, I had all the credentials and book knowledge you’d expect. I understood portfolios, asset allocation, and investment strategies. But when I met and fell in love with a beautiful dentist who would later become my wife, I discovered something humbling: I couldn’t actually help her solve the most pressing financial challenges she faced in her practice.

I couldn’t effectively address her cash flow issues, couldn’t properly value her dental business, and had no clear path to build a comprehensive wealth plan that acknowledged the unique realities of dental entrepreneurship. I found myself miserable because I wasn’t making a meaningful difference. I was just an ordinary advisor who thought my job was to manage a mutual fund portfolio.

I faced a pivotal choice: find another career or commit to solving these problems—first for my wife and eventually for other dental professionals. I chose the latter, and without realizing it at the time, I began building what I would later learn was called a “family office”—a team of elite professionals that typically helps ultra-wealthy individuals manage their complex financial affairs.

My wife Dana and I assembled the right specialists, and soon, we were back to enjoying our

By Tim McNeely, CFP®, CIMA®, CEPA®

date nights and discussing our hopes and dreams rather than financial stressors. But life had another test in store.

Dana began experiencing problems with her hands—a potentially career-ending development for a dentist. Suddenly, we had to put our own financial plan through a rigorous evaluation. This process revealed that an earlier advisor had sold her a disability policy that, while valuable, was set up incorrectly. The benefits would have been fully taxable, significantly reducing their value when she needed them most.

I’ll never forget sitting in that specialist’s office under harsh fluorescent lighting, waiting for a doctor with zero bedside manner to tell the person I loved most whether she had a future in her chosen career. But what I remember most clearly is that, regardless of what the doctor would say, we knew we would be financially okay. We had run the numbers, we had done the planning, and we had corrected the errors in our protection strategy.

That experience crystallized my passion for helping dental entrepreneurs navigate their unique financial challenges—so they could focus on caring for their patients without financial anxiety clouding their judgment or compromising their decisions.

The self-made “Super Rich” (those with a net worth of $500 million or more) consistently employ a strategy that most dental entrepreneurs overlook: stress testing their financial plans. This process—questioning the underlying assumptions in your planning—helps

identify costly errors and missed opportunities before they become problems.

Think about it: You may have started your career working with a financial advisor you met on the golf course or a CPA who was a buddy from school. These relationships served you well in the beginning, but as your practice and wealth have grown, there’s a good chance you’ve outgrown these advisors. The people who got you where you are now aren’t necessarily the ones who will get you where you want to go.

This is where stress testing becomes invaluable. As President Reagan famously said: “Trust, but verify.”

When it comes to stress testing your wealth planning, there are numerous areas to evaluate. However, three areas tend to be of particular interest to successful dental entrepreneurs:

1. Exit Planning

Research shows that only about one in ten successful entrepreneurs has acted to “freeze” the value of their business for estate tax purposes. If you’re considering the eventual sale of your practice, skillfully executed stress testing can identify ways to walk away with more wealth from the sale—money that can go to your family instead of to the government.

2. Asset Protection Planning

More than 85% of successful business owners are concerned about being involved in unjust lawsuits. But how many have comprehensive protection in place? Ask yourself:

• Is the indemnification language in your corporate documents as strong as you

want it to be?

• Is your commercial insurance coverage adequate?

• Do you have the right structure for your business interests?

3. Retirement Planning

Nearly three out of five successful business owners have qualified retirement plans. But are these the right plans for their specific goals? Some dental practice owners want to use retirement plans primarily to attract and retain top talent. Others are focused on minimizing taxes. The right approach depends on your intended outcomes.

I often explain my role as being the general contractor for your financial house. Most dental practice owners try hiring all the subcontractors (CPA, attorney, insurance agent, investment advisor) themselves, with no one overseeing the entire strategy—and that’s why they end up with subpar results.

What the wealthy know is that generational wealth doesn’t come primarily from investment returns. For dental entrepreneurs, it comes from equity ownership in your practice. You create wealth by building an excellent dental practice. Investments become crucial

when you’re ready to take money off the table and diversify away from your business.

Having a strong wealth management plan isn’t selfish—it’s what I call “enlightened self-interest.” Like the airplane safety briefing instructs, you need to put on your own oxygen mask first before helping others. When your financial house is in order, you can treat patients out of the goodness of your heart without worrying about meeting monthly production

quotas or cutting corners.

Financial peace of mind translates directly to better patient care.

If you haven’t stress-tested your financial plan recently (or ever), I encourage you to take action:

1. Ask your current advisors to conduct a formal stress test of your financial plan

2. Request that they question all the underlying assumptions in your planning

3. If they seem confused by the request or unwilling to do this work, consider seeking a second opinion

Remember, it doesn’t require a nine-figure net worth to benefit from the financial strategies used by the Super Rich. Technology and regulatory changes have made sophisticated planning accessible to dental entrepreneurs at all levels.

Whether you work with me or someone else, make sure your wealth management plan receives the same care and attention you provide to your patients. Your financial health deserves nothing less.

Tim McNeely, CFP®, CIMA®, CEPA®, is know for helping dental entrepreneurs turn their

success into significance. He helps practice owners protect what they’ve built, unlock advanced planning opportunities, and care for the people and causes that matter most. You can reach him at tim@timmcneely.com or 818-534-4949

By Dr. Glenn Vo, Editor-in-Chief of Dental Lifestyles Magazine

As a dentist and practice owner myself, I know firsthand that our success doesn’t just depend on clinical excellence—it hinges on how well we lead our teams. That’s why I was particularly excited to sit down with Greg Essenmacher for this edition of Dental Lifestyles Magazine.

With 18 years in the dental industry, Greg helped launch the Neodent brand into the US market (which now commands an impressive 50% market share in fixed full-arch treatments). Today, he’s dedicated his career to helping practitioners like you and me transform our practices through expert team development.

You might be wondering what an NBA coach has to do with running your dental practice. Well, hang with me here—this connection was one of my favorite insights from my conversation with Greg.

Greg’s eyes lit up when he started talking about Phil Jackson, the legendary basketball coach with 11 championship rings. “I love Phil Jackson’s perspective on leadership,” he told

me enthusiastically. “He proved that raw talent alone can’t win you anything—it’s about creating a cohesive system where each team member plays their specific role.”

What made Jackson’s approach revolutionary was his famous “triangle offense”—a system that required even superstars like Michael Jordan and Kobe Bryant to adapt their individual brilliance to benefit the team. Greg has brilliantly adapted this philosophy into what he calls the “triangle of success” for dental practices.

As someone who runs both a clinical practice and multiple businesses, I couldn’t agree more. I’ve experienced how easy it is for dentists (myself included!) to fall into the trap of thinking we need to be experts at everything.

“Most practice owners who’ve gotten into full-arch cases are already successful entrepreneurs with thriving general practices,” Greg explained. “But to excel in specialized treatments like full-arch, you need what Phil Jackson calls ‘benching the ego’—empowering each team member to specialize in what they’re truly great at.”

Here’s the key insight: benching your ego doesn’t mean surrendering your authority as the practice leader. It means recognizing that your team members bring unique strengths to the table. Your job isn’t to be the best at everything—it’s to create a system where everyone’s talents amplify each other.

As Greg put it, “It’s not one plus one equals two. It’s one plus one equals eleven when you have a team functioning at its highest level.” Now that’s the kind of math I can get behind!

I think we all know the feeling—you’re excellent chairside, but maybe QuickBooks makes your head spin. Or perhaps you’re a wizard with treatment planning but struggle with managing team conflicts. That’s why I was particularly struck by a distinction Greg made when we discussed team development.

“It’s not about supplementing areas where the clinician or owner is weak—it’s about complementing certain areas,” he told me. This subtle shift in perspective—from a scarcity

to an abundance mindset—can completely change how we approach building our teams.

I loved Greg’s choice of words here. Rather than talking about “weaknesses,” he refers to these as “areas of opportunity”— highlighting the growth mindset that’s essential for leading a thriving practice. As practice owners, the first step is honest self-awareness—understanding both our superpowers and our kryptonite.

“Each individual has certain strengths and certain areas of opportunity,” Greg explained. “With that self-awareness, you can find individuals in your organization who complement those areas so you can focus on aspects you’re really good at.”

This doesn’t mean abdicating your role as leader. You maintain authority while learning to trust team members with specialized responsibilities. Information still reaches you, but as Greg puts it, it gets “condensed and boiled up” to leadership at a high level. This keeps everyone aligned while maximizing efficiency—something I know we could all use more of in our practices!

ting

Let me share something from my own practice—implementing a consistent morning huddle was one of the simplest yet most transformative changes we ever made. So I was nodding ith a big smile on my face when Greg mentioned this as a cornerstone of effective leadership.

While many practices have abandoned this tradition due to busy schedules (and trust me, I get it!), Greg sees tremendous value in starting each day as a unified team: “There’s nothing like getting the team together and setting things on a good path,” he told me. “You can do a check-in and see if individuals are in the right frame of mind for the day.”

In my practice, an effective huddle balances two key elements:

1. Financial metrics: Where are we relative to our goals? What opportunities exist in today’s schedule?

2. Cultural elements: What wins (beyond financial ones) should we celebrate? How is everyone feeling today?

This second part is where the magic happens. The morning huddle creates space for empathy, allowing team members to be authentic about their current state while feeling supported. Greg put it beautifully: “Being able to show empathy, whether it’s you or that person who’s most empathic on your team... there’s going to be so much runway with that particular employee because they know on their worst day, you supported them.”

I’ve seen this play out countless times. When a team member is going through a tough time— whether it’s a sick child or a car breakdown—acknowledging it rather than ignoring it creates loyalty that money simply cannot buy.

One quote that Greg shared has been replaying in my mind since our conversation. It’s from Maya Angelou: “People will forget what you say. They’ll forget what you’ve done for them, but they’ll never forget the way you made them feel.”

As dentists, we often focus on the technical aspects of our work—the perfect margin, the ideal occlusion. But when I reflect on my own practice journey, I realize that team conflicts and successes almost always trace back to feelings, not facts.

Greg’s leadership philosophy centers on this wisdom. It doesn’t mean being overly emotional or running your practice like a group therapy session. Rather, it means “responding, not reacting” to situations and team members.

I appreciated Greg’s candor when he admitted, “Reacting is something I struggle with. But responding—that’s something that can be learned. That’s really the self-awareness and self-growth that individuals can go on a path and journey on.”

I’ll be the first to admit that in the stress of a busy clinical day, my first impulse isn’t always my best one. Greg’s distinction between reacting and responding has given me a new framework for those challenging moments we all face as practice leaders.

Another profound insight Greg shared came from Richard Branson: “Train people to where they have the ability to leave but treat them so they don’t want to.”

This encapsulates the delicate balance leaders must strike— investing in team development while creating a culture people don’t want to leave. “Will you lose a few people? Yeah,” Greg acknowledged. “But what happens if you don’t train them and they stay? That’s scariest of all.”

This is especially critical in specialized areas like full-arch treatment, where cases can run $20,000-$60,000. The risk vs. reward ratio demands highly skilled team members who feel valued and empowered.

When hiring, Greg looks beyond technical skills to find people who are coachable and align with the practice’s culture and values. “If you find those individuals, maybe in the beginning they’re not so much plug-andplay, but you can certainly teach them your ways,” he explained.

This cultural alignment has become increasingly important as younger generations scrutinize potential employers more thoroughly than ever before. “They’re going to scout you,” Greg noted. “They’re going to look at your social media. They’re going to check you out. They’re going to find: does that practice look like what I’m looking for?”

Greg likens team building to dating or bringing new members into a family. Each addition changes the dynamic, for better or worse. “Any time you add a team member, it’s like bringing another family member in, changing the dynamic. Good, bad, or indifferent—don’t have to judge it, it just does.”

Greg emphasized that skill without passion isn’t sustainable. “Eventually, if they’re in a role and doing tasks they may be really good at but don’t have passion around, it drains their energy bucket. It’s not going to be a fruitful opportunity long term.”

Great leaders recognize when team members have talents that aren’t being utilized or passions that aren’t being fulfilled. By realigning roles with passions, you can dramatically improve both satisfaction and performance.

The Foundation of Practice Success

Greg articulated the connection between leadership and practice success with remarkable clarity: “Case acceptance is driven by patient experience. Patient experience is powered by team development. And all of that is absolutely influenced significantly by leadership.”

In other words, your leadership doesn’t just affect your team—it cascades through every aspect of your practice, ultimately determining your financial success and patient outcomes.

By investing in leadership development and creating a culture where team members feel valued, empowered, and passionate about their roles, you build the foundation for exceptional patient experiences and practice growth.

Your leadership triangle—connecting team development, patient experience, and practice success—may be the most important factor determining your long-term prosperity.

Greg Essenmacher helps transform single-office practitioners into successful implant practices through team development and operational excellence. For a complimentary Strategy Call, visit www.dentalconsult4u.com, mention this article, and receive an additional 3 free call analyses to pinpoint where you can improve your conversion rates (a $499 value), or find free content by searching GnA Consult on social media platforms..

As we look ahead to 2026, the dental industry across North America continues to evolve with groundbreaking technologies, innovative treatments, and constantly changing best practices. For dental professionals who want to stay at the forefront of their field, attending conferences is an essential way to connect, learn, and grow.

To support your planning, we've put together a curated list of some of the most anticipated dental conferences happening across North America in 2026. Each event offers unique opportunities for professional development, networking, and gaining valuable insights into the future of dentistry.

ADEA ANNUAL SESSION & EXHIBITION 2026

DATE: MARCH 21–24, 2026

LOCATION: MONTRÉAL, QC, CANADA

Hosted by the American Dental Education Association, this four-day event focuses on the future of dental education. Programming includes keynote addresses, interactive sessions, leadership forums, and a robust exhibit hall, all held at the Palais des congrès de Montréal.

CHICAGO DENTAL SOCIETY MIDWINTER MEETING 2026

DATE: FEBRUARY 19–21, 2026

LOCATION: CHICAGO, IL

Held at McCormick Place West, the 161st Midwinter Meeting will feature hundreds of exhibitors, nationally recognized speakers, CE courses, and networking opportunities for dental professionals from around the country.

AACD CONFERENCE 2026

DATE: APRIL 16–18, 2026

LOCATION: AVENTURA, FL

The American Academy of Cosmetic Dentistry’s annual event will focus on hands-on aesthetic techniques, materials, and practice management. Attendees can expect workshops, CE opportunities, and networking specific to cosmetic dentistry.

AAE ANNUAL MEETING 2026

DATE: APRIL 15–18, 2026

LOCATION: SALT LAKE CITY, UT

The American Association of Endodontists will gather at the Salt Palace Convention Center for lectures, workshops, scientific poster presentations, and hands-on training focused on the latest in endodontic care and technology.

THOMAS P. HINMAN DENTAL MEETING 2026

DATE: MARCH 11–13, 2026

LOCATION: ATLANTA, GA

Taking place at the Georgia World Congress Center, this longstanding meeting offers high-quality CE, interactive exhibits, and a reputation for hospitality. It remains one of the most well-attended dental events in the Southeast.

IADR/AADOCR/CADR GENERAL SESSION & EXHIBITION 2026

DATE: MARCH 25–28, 2026

LOCATION: SAN DIEGO, CA

This collaborative research-focused conference will bring together global leaders in dental, oral, and craniofacial science. The event will include symposia, poster sessions, oral presentations, and scientific networking.

AAO ANNUAL SESSION 2026

DATE: MAY 1–3, 2026

LOCATION: ORLANDO, FL

The American Association of Orthodontists will hold its annual meeting at the Orange County Convention Center. It will include lectures, product demonstrations, and CE courses designed specifically for orthodontists and their staff.