Delta Capita, the Financial Services division of Prytek, is a leading Consulting, Managed Services and Technology provider with a unique combination of FS experience and tech innovation capability.

Consulting: We provide a proven advisory and transformation execution capability, which can accelerate the delivery of change programmes from inception through to benefits realisation.

Services: We provide solutions ranging from Resource Augmentation through to fully tech-enabled, Mutualised Managed Services. We currently provide services in Client Lifecycle Management, Post Trade, Structured Products, Pricing & Risk and Market Infrastructure.

Mutualised Managed Services: Our vision is to reinvent the Financial Services Value Chain. We leverage our industry expertise, proprietary technology & investment capital, and work with our clients to:

► Replace high-cost, non-differentiating in-house platforms with our Mutualised Managed Services to reduce costs and improve efficiency.

► Identify valuable technology assets, supporting non-differentiating functions, which can be commercialised in a joint venture.

Trusted partner for a more efficient, effective and secure Financial Services value chain.

65+ Customers Globally Tier 1 & 2 Service Top Financial Institutions

1000+ Expert practitioners and consultants globally

Recognised by the Financial Times as a Leading Management Consultant for 2023

We support our broad Capital Markets client base on a wealth of industry challenges, from evolving regulatory landscapes, advancing technology risks, cyber security threats, sustainability and the ongoing impact of global geopolitical tension.

We help our clients optimise operational efficiency, implement innovative technologies and navigate complex regulatory mandates so they can thrive in a dynamic financial environment. By leveraging advanced analytics, we also focus on helping provide data driven insights to ensure informed decision making.

We help Asset Managers as they navigate the challenges of emerging and disruptive technologies, understand the opportunities as well as the risks, and to execute strategies that will get the most from AI, data and blockchain advances.

We also provide solutions to scale processes like client onboarding and transaction processing and reporting, as well as the increased demands from investors and regulators from ESG investment criteria.

We work with our clients to helping them to enhance their performance and ensure compliance with regulatory requirements. We can provide real support for a Commercial Bank with a key focus on bringing our expertise to a number of key areas:

► Strategic Planning: Developing & Implementing plans aligned with your business needs

► Model Risk Management: Using our technical expertise, we can assist in validating existing model management functions or improving your existing model management

► Technology & Innovation: Leveraging our new technologies to improve efficiency

► Digital Transformation: Tailored strategies to optimise digital transformation

We help retail banks navigate the ongoing pace of innovation, competitive landscape and increased regulation to create customer centric propositions and deliver against their strategy.

DC support across strategy and target operating model definition through to delivery expertise and capacity. We combine this with experts in data, regulation and process design plus experience in reinventing customer journeys, sustainable business models, operations and underlying technology and deep expertise in loan operations.

We support our clients across the wealth management value chain to navigate evolving client expectations and demographic changes, increasing competition from new technology-enabled solutions and increasing regulation.

DC support across strategy and target operating model definition through to delivery expertise and capacity. We combine this with expertise in data, regulation and process design plus experience in reinventing client experience, sustainable business models, operations and underlying technology.

We work with our clients to create sustainable, customer-centric business models driven by the proactive use of data and innovative technologies.

We support our clients across the breadth of the insurance industry. From strategy and target operating model definition through to delivery expertise and capacity. We combine this with experts in data, regulation and process design plus deep expertise in Delegated Authority, Underwriting, Claims Handling, Due Diligence and Bordereaux Analysis.

► Managed Services. Full KYC managed service covering the full end to end CLM lifecycle and ongoing monitoring, powered by Karbon.

► Managed teams and staff augmentation. KYC remediation and uplift projects via a with domain expertise across multiple jurisdictions and entity types.

► Policy review. Policy review and guidance to ensure compliance with the latest regulatory updates.

► CLM advisory. Target operating model, processes and procedures reviews optimise the clients CLM capability.

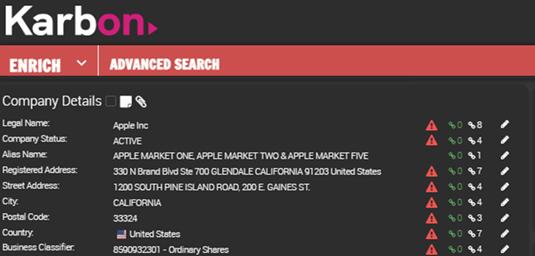

► We have developed Karbon Data that provides comprehensive data sourcing across 500 primary data sources covering 120 countries.

► DC continually its ‘Market Manual’ which provides live feedback on data source integrity & accuracy gained across multiple clients.

► Karbon Outreach provides a digital customer outreach capability, alongside biometrics, liveness testing, dynamic OCR and individual authentication.

► Our CLM team combines extensive experience with domain expertise in delivering KYC services across multiple organisations.

► 500+ dedicated KYC permanent employees with global footprint.

► Comprehensive KYC/AML training programme.

► 30+ global client base ranging from Tier 1 banks to Hedge funds to Brokers

► Active pipeline of clients and dedicated CLM sales team.

► Industry move to a managed service offering for non-differentiating services.

► Significant industry demand (Tier 1 – 3 banks) for credible KYC data source source providence.

Led by experienced industry practioners

Global Operations across US, EMEA & APAC

30+

Global client base ranging from Tier 1 banks to Hedge funds to Brokers

~500 Dedicated KYC permanent employees

CLM Technology. Delta Capita have a suite of innovative technology solutions to enhance CLM. These are underpinned by Karbon a proprietary CLM platform that provides data sourcing, data integration, workflow and client outreach.

Managed Services. We provide full end to end KYC managed services, powered by Karbon covering the collection and verification of data, UBO unwrapping, risk scoring, screening, quality assurance, escalation and ongoing monitoring.

Managed Teams and Staff Augmentation. Provide full KYC remediation and uplift projects via a choice of onshore/ nearshore KYC teams with domain expertise across multiple jurisdictions and entity types.

Continuous KYC. Advise Clients on transitioning to a continuous KYC model, leveraging our SMEs experience combined with the latest technology solutions. The result is a cost-efficient operating model that allows clients to effectively manage their AML risk.

Controls & Policy. Our Policy and Controls SMEs provide advisory services for clients on AML polices to ensure compliance with the latest regulatory updates, and conduct documentation, processes and procedures reviews.

Financial Market Infrastructures (FMIs) allow the clearing, settlement, and recording of financial transactions. They continue to adapt & develop to meet the evolving demands of global financial markets.

The Market Infrastructure Landscape is made up of the following types of participants:

The bodies that govern the financial markets

Infrastructure Providers

The core operating foundations of the financial markets

i.e. Exchanges, CCPs, Trade Repositories, Trade/Data Service Providers, Trade Execution Services

Technology Vendors & Utilities

Supporting the FMI providers with innovative solutions

i.e. Client Solutions, Document Solutions, Workflow Tools & Data Tooling

Delta Capita’s Market Infrastructure offering is underpinned by two main areas of focus:

► Helping the FMI community with the positioning of their services to gain greater reach (and trust) amongst competition on a greater scale and provide maximum value for users (most likely data driven benefit)

► Supporting the end users to connect, integrate to and evolve adoption of FMI capabilities to achieve greater efficiencies and effectiveness of their day-to-day operations

Our Post Trade business is focused on helping delivery processing efficiencies to our clients against a backdrop of rising costs, legacy infrastructures, risk and compliance measures and regulatory challenges

Operations Support

Origination Support

Risk Support Tax Operations

Credit Events & Novations

Substitutions & Rebalancing

Loan Operations Event & Lifecycle Management Cash & Securities Processing Query Management

Middle Office Treasury Operations Nostro Management

Structured Trade Processing

Trade Capture Validation & Matching

MCA Drafting & Negotiation

Trade Confirmations

Derivatives Documentation

Portfolio Reconciliations Novations

Collateral Management

TriParty Optimisation

Remediation & Reconciliation

Margin Call & Dispute Management

We work DC Post Trade Services partners with our clients to provide solutions across Operations, Technology and Market Infrastructure.

Delta Capita’s Post Trade Services offering has longstanding credibility supporting financial institutions by providing subject matter expertise across multiple asset classes: We help our clients to:

Simplify Operations

Innovate Business Models and Technologies

Improve Process Efficiency

Comply With Regulatory Obligations

► Our aim is to offer all the necessary infrastructure tools to run a trading business within a financial institution.

► Our expertise spans multiple asset classes, products and models.

► We can support the implementation of regulatory capital changes as well as develop and validate pricing and risk models.

► We can review the pricing and risk architecture and operating model and introduce or upgrade the trading and risk system as required.

Risk Apettite Frameworks Valuations

► Calibrated data Competencies Independent Model Validation

Vendor System

Decommissioning

S1. Trading and Risk Analytics Solutions

► Trading Risk Management systems [front-end systems].

► Pricing libraries & XVA analytics

► Risk Data infrastructure for 2LOD

S2. Model Validation as a service

► Model benchmarking

► Model input data support

► Model documentation & reporting

S3. Market Data Analytics as a service

► Derived data

Pre-trade Trade Inception Trade Verification

Model Development Product Approval and Definition

Pre-Trade Analytics Model Testing

Key:

Pricing & Risk

Deal/Trade Capture Trade Booking Checks

Real-Time Profit & Loss Trade Confirmations

Real-Time Pricing & Risk Calculations

Trade Blotter / Position Manager

EoD & Life-cycle Trade Termination

Processing of Fixings, Cash Flow Schedules

Trade Termination

Event Management

Event Mgmt & Processing of Corporate Actions Trade Settlements

PnL, Valuations, Margin & Market Risk

XVA, PnL Explain, Limit Measurement

Counterparty Credit Risk Analytics

Collateral Optimization Utility

► Delta Capita aims to offer services across the Trade lifecycle

► Pricing and Risking of trades requires multiple processes to run pre- and post-trade. Some of these other process such as lifecycle events, settlements etc. are well understood in the Post-trade and SRP businesses of Delta Capita.

Pricing and Risk Activities

Process

Intra-day Trade Pricing & Risk, Position Management

Margining

IT / DevOps / Devs / Ops

EOD PnL, Valuations, XVA and Risk

Quantitative Analysis

Risk Data & Reporting

Model Testing Benchmarking

Technology

Risk Types

People Regulation

Quantitative Analysts

Core Trading Platform, Trade Capture Market Risk

FRTB SA

PruVal / IPV

Core Risk Systems

2nd LOD Risk Operations SA - CCR Trades,

Counterparty Credit Risk

Finance Valuations

Proprietary Applications

Model Risk

Senior industry professionals bringing industry insights and best practices to inform your transformation agenda

A team of 100+ Structured Products specialists supporting global Tier-1 issuers throughout the product lifecycle

Specialist technology, inspire, designed for Structured Products issuers andsupported by Structured Products SMEs

Workflow orchestration from deal capture to post-trade lifecycle management with control and transparency

A product documentation service combining a stateof-the-art automation solution with manual drafting services

Product Approval, Testing and Target Market administration, oversight support and monitoring, using our powerful rules engine for Pre and Post Trade controls

Complete solution for Structured Product distributor due diligence covering KYD, Distribution Agreement drafting, KYC and market research services

Managed solution to simplify the setup and maintenance of inbound/outbound connectivity to clients, external service providers and market infrastructure operators

SME support to establish frameworks, configure and run applications, deliver continuous automation and resolve exceptions

Delta Capita Structured Products & Derivatives business provides a unique range of tools through its inSPire platform to support structured products manufacturers through the issuance process, platform management, product governance and full lifecycle support.

Our team of experts and specialist technology is used by many of the leading structured product issuers to reduce the strain on their resources and benefit from industry standards and mutualisation.

100+ STRUCTURED PRODUCTS SMEs +120k DOCUMENTS AUTOMATED

12 GLOBAL ISSUERS

700+ DISTRIBUTOR QUESTIONNAIRES

3.5m MESSAGES DELIVERED

99.9% SERVICE AVAILABILITY Internal use only – not for external use

Our Cyber practice leverages our Financial Services and technical expertise and combines this with partnerships from the Prytek Cyber division. We create unique propositions to meet client demand working with top-tier banks, other financial institutions and market infrastructure providers.

What do we do for clients in Cyber?

► We work with clients on everything from board level, setting cyber risk appetite, advisory, incident simulation, education and benign phishing attacks, Security Operations Centre of Excellence creation and support, SME support, provision of diverse trained cyber resources globally, cyber controls, cyber gap analysis and remediation.

Who are our target clients?

► CISOs (Chief Information Security Officers) and CIOs (Chief Information Officers) at top-tier banks, other financial institutions and market infrastructure providers.

Is there a regulatory impact to our work?

► We can help clients comply with industry regulations such as:

If you’re a Cyber enthusiast, then click here to find out more.

Educate the Boards of Banks, Financial Institutions and Market Infrastructure Providers in understanding their cyber risks and run simulations to enable them to practice their response to cyber-attacks.

We provide courses for the general population, IT generalists, Risk, and IT Security. These courses are backed up by benign phishing attacks that reinforce the learning.

Assisting clients on cyber controls and establishing Security Operations Centres (SOCs). Management of cyber remediation and DevSecOps best practice.

We leverage our knowledge of trends in the cyber world across multiple clients, to provide the benefits of a mutualised managed service, lowering operational risk and providing the service at a very competitive price point.

We work with our clients to fill the significant global skills shortage in skilled cyber staff at all levels.

The inSPire platform provides multiple service access options. Data ingestion and validation is controlled by business configurable rulesets while data can be translated to provider specific formats. Process and data models are decoupled from vendor specific details facilitating live switching and easy transition from one provider to another if required. Users benefit from a single consistent environment, consolidated MI, and access to superior control tooling.

Raising requests or integrating into front end systems for new onboarding and periodic refresh cycles

Workflow – easily configured to meet your processes

Risk assessment

Rules engine and policy enforcement – configure to your policy / polices

Data gathering and enrichment – using data robotics, from external and internal data sources

Digital client outreach

MI and reporting

Screening – integrate to your screening provider

Client configurable Internal use only – not for external use

► Browser-based end-client portal with your corporate branding.

► Consolidated end client outreach task List with individual task submission.

► Secure multi-factor authenticated end-user access

► Fully configurable online forms and questionnaires

► Simple document upload submissions and recertification

► View and downloadable informative documents and one-way letter provision.

► Customisable dashboards & metrics

► Configurable MI widgets

► Standalone browser-based analyst portal for client entity, case and workflow creation and management

► Full API for automated integration with internal or Delta Capita onboarding case management systems

► Multiple outreach workflows and task sets to support your various legal, regulatory and onboarding requirements.

► Conditional logic to select the relevant tasks for the client based on relationship, product, and service types.

► On portal secure messaging between your end clients and your analysts

► Private comment capability between multiple end users

► Mobile identifies document scanning and OCR

► Mobile liveness checks & biometric identity verification

► Task submission notifications

► Upload and online form review, feedback and approval

► Task cancellation, case suspension or approval

The most important asset of the financial institution or any other entity is the customer, making a customer-centric approach vital, even after the onboarding process is complete. Your organization needs to manage the identity of the customer throughout their lifecycle in the organization, managing customers’ lists and data seamlessly and without error.

Delta Capita’s Karbon IDnV platform is a state-of-the-art tool providing identity management across business units and service channels, both at scale and in real time.

Seamless Integration: Effortlessly integrate workflows and case management.

Digital File Mastery: Generate comprehensive digital files and ingest all data effortlessly.

All-Round Biometrics: Capture facial, fingerprint, and iris data for complete identity assurance.

Continuous Identity Care: Consistently verify and refresh biometric samples, ensuring updated identity verification.

Stay Updated: Promptly check and update essentials like phone ID and address.

Always-On Verification: Execute identity verification across all scenarios, keeping you ahead.

Background Vigilance: Run ongoing background checks on every identity in the system.

Custom List Management: Handle biometric lists, from VIPs to fraud watch, tailored to your needs.

Step into the future of ID management with Karbon IDnV. Engage with precision.

Delta Capita believes Distributed Ledger Technology will revolutionise Capital Markets. Our MACH product suite helps clients to enhance efficiency and transparency with global integration.

Key benefits we deliver to our clients:

To find out more about MACH click here.

Delta Capita’s MACH Distributed Ledger product suite is comprised of six subproducts. Each solution allows Financial Institutions to unlock the power of innovative technology across valuable opportunities for efficiencies, cost savings, improved regulatory compliance and enhanced security.

Settlement

Digital issuance and custody solution allowing the issuance, transfer and safekeeping of digital assets.

optimisation solution enabling bilateral and multilateral transaction netting.

Tokenisation solution allowing minting, transferring, locking and burning of tokens.

Pass

Digital passports solution for the creation and storage of digital records.

Bridge

Interoperability solution facilitating seamless data sharing, faster transactions, and expanded market access.

Multi-ledger books and records solution processing thousands of transactions per seconds.

Internal use only – not for external use

QMA streamlines communications with features that allow users to reply to and resolve client enquiries faster and collaborate as a team more efficiently.

Not only does QMA improve client experience and reduce operational risk, but it ultimately improves the lives of our users by offering peace of mind.

Multiple Channels

Users need to monitor various channels of communication like email, chat, and more.

All in One Place

Single integrated platform to handle various modes of communication without needing to toggle between different channels.

High Volumes

High email and chat volumes in post-trade activities and other financial operations teams.

Time spent

Over 50% of users’ time is spent on communication.*

Lack of Transparency

Limited data analytics on group inboxes and client response times.

Prioritised Inbox View

Users can view and action the most important enquiries.

Rapid Response to Clients

100+ features to reduce duplicative work across teams and resolve enquireies faster.

Real-time insights to help teams enhance processes and improve client services.

► Tailored assessment and advice based on Agile maturity and organizational goals

► Different levels: Team | Team of Teams | Strategy & Portfolio | Organisation

Agile Transformation

► Teams | ARTs | Value Streams

► Structure | Roles | Governance

► Ways of Working | Culture

► Lean Portfolio Management

► Agile Metrics Our Business Offering

► Product Owner | Scrum Master | Agile Coach

► Executive Coaching | Agile Leadership

► Scrum | Kanban | DevSecOps | Lean

► Design Thinking | System Thinking

► Agile Transformation Lead | Agile Trainer | Agile Coach

► Agile Project/Programme Manager | Agile PMO | Agile BA

► Product Owner | Scrum Master

We have a toolkit of methods, technology and experience to support us in benchmarking, voice customer insights through to implementation.

Our approach:

Our approach to a voice of the customer piece of work is driven by the objectives and current state customer research and strategy. We therefore design a tailored approach bringing in relevant parts subject to the specific goals and work done to date.

Understand the vision: First is to understand the vision, problem statement, goals of any voice of research, and the brand values etc.

Validate the current information:

► Customer insights: any insights previously gathered are essential to consider unless the data is to time period or retired products / services. This is essential to prevent duplication and ensure not frustrate customers by asking the same questions twice.

► Benchmarking: we track the market and can provide market insights around positioning as well research into points of differentiation linked to your market positioning strategy. This is essential it’s important to understand the alternative options available to customers.

► Data Insights: gathering meaningful data insights whether from operations or customer data and

Example group: Determine the segments, personas or characteristics of your desired example group. capability to reach out to every single customer to ask for feedback it is essential that a representative or target customers is profiled in order to gather diverse and impactful feedback. Even if a customer then an engaged sample set is still required for depth interviews and as a user testing group.

Playback and Prototype: Depending on the scale of the project we would then playback the findings different target groups. Once validated we can either present recommendations or we can support working to create design mock ups, screen prototypes etc, the concept is to get simple wireframes hands of customers to gather feedback prior to investing in making any of the changes. The next ensure there is sufficient critical mass in feedback and then begin to implement.

of the customer, state of the parts of the toolkit of the customer is redundant due ensure that you do well as bespoke essential to bring in as and any previous work conducted. group. Unless there is a representative group of either existing customer wide survey is launched findings into core themes across support in realising the change wireframes and hi-fi prototypes into the next step would be again to listen,

One-on-one session to undertand the individual

Expose an issue by pitting opposing choices against the other

Enable the customer to log their own behaviour

Brief but rapid feedback from a broad panel of people

Observe the behaviour to establish patterns

Use existing research to build up a bank of insights

Mining existing online conversations for insights

Harness latest tools to passively collect behavioural data

PRODUCT USE

Not using product

Natural use

Scripted use

Enables people to interact with each other and debate issues together

The Attitudinal vs Behavioural Dimension contrasting “what people say” versus “what people do”

Direct methods are much better suited for answering questions about why or how to fix a problem, whereas indirect methods do better job answering how many and how much types of questions.

► Natural use of product – goal is to minimise interference from the study in order to understand behaviour of attitudes as close to reality as possible – greater validity but less control over what topics you learn about

► Scripted use of product – focus the insights on specific usage aspects

► Not using product during the study –examine issues that are broader than usage and usability, such as a study of the brand of larger cultural behaviours

► Map and digitise end-to-end processes for automation, streamlining and omni-channel access

► Utilise low-code development to rapidly update digitised processes

► Analyse data, identify high-cost trends, optimise workforce and renegotiate vendor contracts

► Reduce costs across headcount, vendors, processes, technology and assets through a data driven approach

► Redesigned value streams

► Implemented new technologies

► Continuously improve CEX by enhancing products, services and delivery through engagement, empowerment and tools & training (e.g. Lean Six Sigma)

► Standardised Operating Model

► Enhanced visibility with KPIs

► Clarify process ownership and governance to sustain change and ROI

Case Studies (Tier 1 Bank)

► Redesigned the banks change processes to Scaled Agile methods

► Increased business agility

► 15% cost saving achieved

► Use data to measure progress on KPIs and identify improvement areas and ensure sustainability over time

Case Studies (International Insurer)

► Implemented Agile & Change Management

► $5M in annual cost savings achieved

Client

► Reduction of cycle times across core processes

► Align changes to strategic goals

► Continuously monitor rollout progress

► Reduced time to market for new products and services

► Improved processes helped improve staff retention

Key Benefits:

► Effective strategy delivery focusing on the root causes & requirements

► Metrics and data driven outcomes

► Develop digitisation roadmap, manage change via training, stakeholder buy-in and benefit tracking

► Engage stakeholders with optimal communication.

► Identify impediments and capture root requirements.

► Achieved 300 % faster time to market for new products and services

► Regulatory analysis of EMIR 3.0

► Identifying and collaborating with Stakeholders through interactive workshops

► Analyse and prioritise needs.

► Determine optimal solutions to meet requirements.

► Gathered requirements from documents and SME’s

► Map processes, analyse metrics, find improvement areas and root causes

► Redesign processes for future state, validate changes, achieve buy-in, train and rollout

► Process analysis, modeling & mapping to BPMN standards

► Tracked progress continuously

► Collect data continuously, review performance and implement incremental improvements

► Reduced costs, improved service levels & optimised processes

► Move to a process-led culture

► Iterative delivery

► Comprehensive Process Documentation produced

► Verify functionality, align with business requirements and identify defects early

► Defined overall test strategy and process

► Ensure end-to-end integration testing and test case coverage

► Execute functional and non-functional test cases

► Executed SIT & UAT testing. Identified defects for resolution. Implemented new test tool (Xray)

use only – not for external

We leverage our unique position at the heart of the Financial Services Ecosystem to deliver expertise, extensive client experience, in-house technology solutions and select partnerships

Data Analytics

► Data Analysis

► Data Visualisation

► Business Intelligence

► Data Quality

We boast capabilities to support your organisation across

Data Management and Governance

► Data Management and Engineering

► Database Architecture

► Data Lakes

► Data Controls and Governance

Data Architecture

► Data Operational Model

► Data Virtualisation

► Data Migration

► API Mapping

► Data Lineage

Automated ETL: ingest and transform multiple large data sets to create desired output

MI/BI dashboarding: fully automate MI with advanced and customisable tooling

Privacy-preserving synthetic data: populate enterprise warehouses with GDPR-compliant datasets

Data policy frameworks: get your organisation and external audit comfortable with data governance

Data-driven culture: empower business users with access to meaningful data on demand

Cloud migration: support from SMEs along each stage of your journey

Our team has deep tooling proficiency across the data and automation lifecycle.

deliver a holistic approach across our Data practice by combining cross-domain partnerships to drive transformation within your organisation.

Performance Optimisation and Automation across the entire data value chain

► Data Automation

► Robotic Process Automation

► Document Intelligence

Data Science (incl. AI & ML)

► Artificial Intelligence

► Machine Learning & LLMs

► Behavioural Science

► Data Modelling

Help our clients to establish a datadriven organisation through improved understanding, management, and governance of data

Robotic process automation: 24/7 digital workforce to manage repetitive manual tasks

Unstructured data ingestion: eliminate need for human input

Risk modelling: allocate risk metrics to predict risk fluctuation

Transaction monitoring: predict malicious activity using ML and be proactive prior to incident

Utilise data insights to drive business decisions, optimise processes, and deliver increased value from data assets

Build and deploy solutions to decouple data from legacy architecture and optimise data in motion across the organisation

only – not for external use

Shaping a new digital future requires interdependent transformation of connected organisational capabilities and departments. Delta Capita brings our relevant specialist practice areas together to deliver a bespoke solution to each client problem/ambition

Digital Strategy

► Vision Setting

► Unmet needs / market analysis

► Business case creation

► Review of current strategy and roadmap

Proposition Design

► Products & Services review

► Product roadmap: harmonisation & focus

► New differentiated and tailored propositions

Customer Journey Review / Design

► Optimised and differentiated customer journey

► Omni-channel servicing

► Journey prioritisation / scorecards

Delivery

► E2E process design

► Assignment of tasks & responsibilities

► Operational Excellence

► Automation opportunities / implementation

► Op model modelling and visualisation (DC Modus)

► Impact analysis across dimensions of change

► Workforce skill gaps

Technology

► Solution architecture

► Legacy & Cloud migration

► Build v Buy & Integrate

► Data definitions, lineage & quality assurance

► Data Science, Insights & analytics

► Data Protection, consumer duty and Risk and Regulation

People & Culture

► Design/embed new way of working

► Cultural transformation

► Organisational / leadership buy in

Created in 2020, the Payments practice is one of the newest and fastest growing domains at Delta Capita having been driven by unique propositions to meet client demand and deep industry expertise working with top-tier banks, SWIFT and other payment infrastructures.

How we work?

► We collaborate with our clients by co-creating propositions that meet our clients’ requirements. This includes working on everything from business and technology advisory, impact assessments, voice of the customer, centre of excellence creation, SME support, payment controls, gap analysis, through to project and program delivery.

► We also collectively work with banks, fintech’s and central banks on a number of emerging payments and market infrastructure developments covering digital assets, distributed ledger technology (DLT) and tokenisation.

Our expertise

► We bring together specialist consultants with years of payments and banking industry experience, as well as in-depth knowledge of the latest technologies. Our Payments team is led by subject matter experts with over four decades of industry experience across market infrastructures, financial institutions and technology.

► We are seen as thought leaders with practical experience in the ever-changing Payments transformation space. From advising top-tier banks on their current technology and commercial strategy to working with existing and new market Infrastructures initiatives and their early adopter communities.

► We have the capability and resource availability to provide fit for purpose teams and individuals at various levels of seniority and expertise, ranging from entry level doers to business analysts, project managers and senior subject matter directors.

Assisting Payment Infrastructure providers with Standards, internal product development, market infrastructure adoption, communications and client outreach to the community.

Assisting clients with their ISO 20022 migration starting in Nov 22 and ending after the coexistence period Nov 2025.

Assisting clients on modernizing legacy technology and establishing the requisite workflow, controls and optimal operations to minimize the risk of erroneous payments leaving the organization.

Assist clients with advisory and discovery work, impact assessments and new target operating models.

Work with clients on new market infrastructure initiatives including (but limited to) digital assets, distributed ledger technology (DLT) and tokenisation in the payments and settlements space. Internal use only – not for external use

► Qualified and experienced PMs managing complex, multi-disciplined projects and programmes across Financial Services

► Project and Programme delivery from workstream to macro-level

► Proven F2B delivery from discovery to benefits analysis and realisation

► Extensive stakeholder management expertise, across all business areas and value streams

► Failing project recovery and assurance

► PRINCE2

► AgilePM / SAFe

► Scrum / Kanban / Scrumban

► Lean / Six Sigma transformation

► Education of Agile methodology with project team, stakeholders and BAU resources

► Agile accredited PMs

► Culture of learning & collaboration

► Multiple Agile disciplines e.g., SAFe, Scrum

► We have experience in supporting our clients to deliver their Agile vision and business strategy

► Internal accredited trainers

► Flexibility to adapt to various levels of Agile adoption

► Experience across a mix of leading Agile Frameworks including, (but not limited) to SAFe, Scrum, Kanban, etc.

► Guidance on implementation of Agile across programmes / institutions

Programme Communications

Development of project and programme communication strategy

Multiple communication streams utilised, leveraging tools, templates and client infrastructure

Case Studies

► Work with clients on strategic planning, identifying trends & opportunities and securing stakeholder buy-in through effective communication

Programme Communication management across multi-year non-financial risk transformation programme, Ensuring consistency of programme communication and stakeholder engagement, direction and delivery across all projects

► Enterprise-wide change assessments

► Communication strategy

► Embedding change culturally

► Vendor Selection processes

► Business case development

► Checkpoint reports

► Facilitating RFP processes and third-party vendor management

► Developing Target Operating Model design across businesses and value streams

► Lessons learned reviews

► Understand, plan, implement, communicate change strategies

► Agile delivery methodologies (e.g., retrospectives)

Project status report

► Governance structure optimization

► Project planning to appropriate horizons (strategic, initiative, delivery)

► Timebox/sprint run rates

practice / PMO set-up

Studies

Provision of PMO resources to set up best practice and governance

structures

Individual PMO support for PMs

► Delivery of Programme level PMO support to establish, track and monitor cross-functional workstreams aimed at delivering organisational strategy

► Transforming operating model, processes and tools in response to regulatory requirements e.g., MiFID II

Delta Capita partners with clients to navigate competing global regulatory priorities, identify deliver regulatory change programmes and ensure clients are best equipped to demonstrate

Competencies Across The Regulatory Compliance Lifecycle Client

identify impact to client businesses, design and demonstrate and maintain cross jurisdictional compliance.

5. Control framework definition

8. Resource augmentation & managed service 6. Remediation

7. Supervisory audit prep and response

There are 4 core services that we provide to help our clients set clear business objectives and effect change in complex operating environments. These services can be deployed at various stages of a client’s transformation agenda to align the organisation towards shared goals and measurable business results.

► Functional impact assessment on existing operating model

► Identification of underlying mis-performance

► Response planning and prioritisation

► Vision and Strategy development and articulation

► Current state assessment

► Model design, roadmap, and business case creation

Operating

► Implement strategic change to support operating model transformation

Business

► Business case articulation and organisational alignment

► Opportunity sizing and measurement

Expertise Seasoned Institutional post trade infrastructure infrastructure. Run the Bank (CTB) business managing and design

Expertise

Seasoned professionals with Institutional knowledge of banks trade operations & technology infrastructure and market infrastructure. Experience in both the Bank (RTB) & Change the (CTB) around cost / benefit & business case analysis, building and managing a change book of work, design of operating models.

Business Strategy

Our teams partner with our clients to determine levels of support required, across multi-phased change agendas. We understand and can position the required change in the context of the broader organisational design and change book of work.

Business aspirations and guidelines to guide current and future thinking. Specific outcomes that demonstrate realization of the Vision Business Structure

framework through which the business will operate

Business Infrastructure and Operations

fundamental activities and operating environment Implementation

We have extensive experience of strategic reviews and target operating model design with over 100 engagements across many different business domains. We have developed a repeatable agile methodology that accelerates the review process and the level of detail available to support investment decisions.

4. Business Standards Parameters and values that will influence the design and execution (legal entity structure, core values, culture etc.)

DC were engaged by a leading clearing house to assist with aligning, communicating and developing their strategy. Findings and recommendations were provided to help enhance their strategy formulation process and inform business model changes

DC were engaged to help the client develop a target operating model that would enable them to meet ambitious growth targets against a backdrop of historic underinvestment and ongoing regulatory scrutiny

DC were engaged by a prominent market infrastructure provider to perform an external ‘voice of customer’ exercise to help focus, refine and validate their business strategy, business case and roadmap

Delta Capita has the skills and expertise to support our clients with their sustainability programme. sustainability ambitions vary and can provide expert advisory services through to implementation, compliance or competitive advantage.

Sustainability embedded in strategy enabling credibility and longevity of sustainability framework

► Double Materiality Assessment – Robust view of the relative materiality of ESG and impact issues and clear recommendations on next steps

► Disclosure – Gap analysis for relevant ‘optional’ frameworks including TCFD, TNFD, SASB, transition planning frameworks

► Metrics and KPI’s – Execute ESG metrics and KPI’s tailored to our sustainability streams to quantitatively indicate improvement

► Commitments – SBTI and CDP reporting for Carbon Emissions, UNGC to report on bi-annual progress

Sustainability imperatives to ensure your organisation is meeting its compliance obligations

► Compliance – Ensure full compliance with current reporting and legislation requirements

► Reporting – Proactively prepare for upcoming reporting obligations and legislation

► Governance and Accountability Framework – gap analysis, proposed pathways & accountabilities, implementation

► Net Zero Roadmap – recommended approach to measurement and target setting aligned to best practices

► Due Diligence – understanding exposure to ESG risks from clients and suppliers

programme. Delta Capita understands that implementation, whether your institution is seeking

differentiation from peers

► Brand Differentiation – More effectively embed sustainability into core strategy, brand and “DNA” to support long-term value enhancement

► Agile Model – Build a dynamic business model to meet evolving market demands and customer needs, delivering positive impact beyond profits

► Proposition development – Build on existing product / service portfolio building out “green” credentials to deliver positive impact and differentiation

► Pledges – Develop and publish a Sustainability Impact Report including, for example, public commitments to specific SDGs as part of the UN Global Compact

Advisory services leveraging our in-house SMEs and partners; benchmarking, strategy setting, impact & gap assessment obligations implementation roadmap

practices (Including approach to financed emissions)

Front to back delivery of your sustainability programme; project management, mobilisation & planning, operating model solution & design

Resource augmentation leveraging our experienced consultants to supplement your sustainability programme; PM/PMO, BA, Data & Technology experts

Financial Services firms are re-aligning their strategy to rationalise systems, embrace new technology and move to the cloud in a measured manner. As organisations become digitally native, security and security risk awareness is critical.

Vision: To be the trusted go-to partner who empowers clients with strategic technology solutions, driving their growth, innovation, and competitive advantage.

► Cloud strategy and advisory, assessments, recommendations, TOM build and roadmaps

► Cloud infrastructure application and data migration (deployment Models: IaaS, PaaS, SaaS)

► Cloud and Cyber Security and Resilience

► Tool Implementation (with other Consulting competencies – core BA/PM activity and including Testing)

► Integration Management

► Establishment of Technology Centres of Excellence

► DLT (Blockchain)and Smart Contracts

► Digital Assets

► Data Warehouses & Stores

► AI, Machine Learning and Language Model Solutions

► Application Lifecycle Management / Development

► System and Tool Implementation

► Integration and Connections API Design, Development

► Quality Assurance and End-to-End Testing

► Solution Architecture, Strategy and Technology Advisory, TCO analysis

► Modelling, documentation and explanation or training

► Solution Design, System and Tool Selection

► Design (UI/CX)

► Security Assessments

► Vendor Value Stories and Market Positioning

► Vendor Prof Services Implementation

► Vendor Product Roadmaps

Chief Operating Office

Finance

Human Resources

Legal & Governance

Risk and Compliance

Sales and Marketing

Sustainability

Technology

Development of tech solutions, infrastructure and security to support our services and consulting as well as IT support for the DC team

Drives our global commitment to ESG which is integral to the DC business

Provides guidance and support across the global business to deliver against our strategic initiatives

Assesses the control framework of business including operational risk and compliance and maintains Delta Capita’s compliance policies and procedures

Directs our People agenda through the full employee lifecycle

Monitors business performance and ensures financial discipline

Supports our business contractual commitments and maintains a robust corporate governance structure

Identifies new and expands existing client opportunities, as well as driving our brand and communications