The Defender is on break…and bringing you tips and advice to get your

At the Defender, this is a special week. One, we are focused on you, our Readers, and empowering you with information that will help during the hard economic times when Make America Great Folks are focused on the economic demise of Black People. And two, the Defender understands the importance of the “Rest Revolution” to take time to rejuvenate in order to continue the battle. I believe that building a strong, effective workforce requires more than just talent and hustle—it requires intention, balance and rest. That’s why every July, we do something radical in today’s nonstop grind culture: we pause. We shut down the newsroom, give our team a well-deserved mental health break and use that time to bring you a special edition—one that we

hope informs, empowers and inspires you.

Last year, we focused on mental health and this year, we’re focused on financial health. Because we know that for many in our community, money matters are a major source of stress. From rising costs to systemic barriers to dwindling paychecks, far too many Black families are forced to navigate a financial landscape stacked against them.

We also know the power of information. Financial freedom starts with financial knowledge.

Did you know that the average Black household holds just about one-eighth of the wealth of the average white household? Or that only 34% of Black Americans say they feel financially secure, compared to 54% of white Americans?

These aren’t just numbers from Pew Research—they’re warning signs. And they’re a call to action.

That’s why this special Finance Edition is all about helping you make Money Moves that matter. Whether you’re trying to crush debt, build generational wealth, buy a home, or start a business—we’ve got something for you. Inside this issue, you’ll find practical advice, smart strategies and real stories from people in our community making it work and making it count.

We have put a full court press with this newspaper and online, so visit DefenderNetwork.com to dig even deeper—budgeting hacks, investing tips, small business spotlights and more. You can find a full list of digital stories and explore even more online.

This annual break is a reminder that taking care of yourself isn’t selfish—it’s essential. And financial health, just like mental health, deserves your attention and action.

Check out some of the stories at DefenderNetwork Online:

• How Black couples are Redefining Finances in relationships

• Housing Down payment hurdlesassistance programs

• Habits and lingo that grow financially literate Black youth

• Ways to finance your community organization

• How can parents, students finance a college education in 2025?

• Financial First Dates: Navigating Money Talk in New Relationships

• Intentional Spending and ValueDriven Purchases Among Young Black Houstonian

• And more

By Aswad Walker

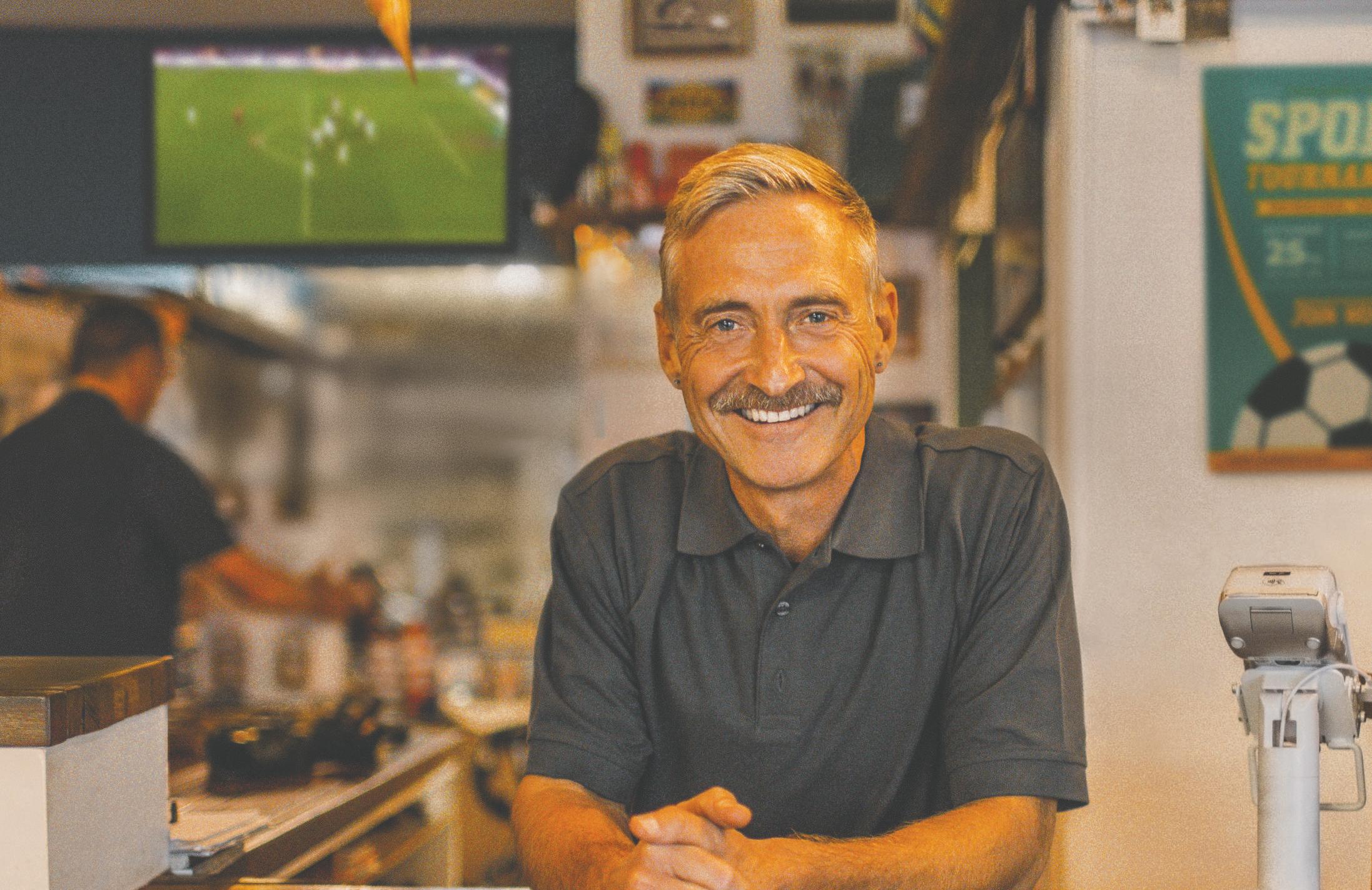

John Hope Bryant is a brother who knows a thing or two about money. Entrepreneur, author, philanthropist and prominent thought leader on fnancial inclusion, economic empowerment and fnancial dignity, Bryant is dedicated to educating anyone who will listen about steps to becoming more fnancially savvy and solvent.

Te Defender asked Bryant, who Delta Air Lines CEO Ed Bastian described as the “conscience of capitalism,” to ofer advice on money moves to avoid.

Without hesitation, Bryant ofered his first suggestion regarding moves to stop making that damage your fnances.

“Stop hanging around with broke people, frst of all. If you hang around nine broke people, you’ll be the tenth,” Bryant said. “I don’t mean like some class-based, bougie thing. I mean, people who have broke mentalities, poverty mentalities.”

Bryant said aside from “sustenance poverty” (i.e., lacking food, shelter and healthcare), all other forms of poverty are a mindset.

“Tere’s a diference between being broke and being poor. Being broke is economic. Being poor is a disabling frame of mind, a depressed condition of your spirit,” he said. “And you must vow never, ever, ever to be poor again.”

Bryant said many people possess poor spirits and poor mindsets that keep them forever focusing on “the cash, the bag, the dollar, the short-term whatever.”

“And you forget that you make money

READERS SPEAK

By Aswad Walker

With troubling economic times upon us and fnancial analysts predicting more storms to come, now is as good a time as any to get your fnancial game plan in order, and that includes money moves you need to avoid.

during the day. You build wealth in your sleep. Tat’s why our ‘get up and go’ has got up and went,” said Bryant, chairman and CEO of Bryant Group Ventures and founder and principal of Te Promise Homes Company, the largest minority-controlled owner of single-family rental homes in the country.

“We’ve got ‘too much month at the end of our money.’ We’re looking for love in all the wrong places. So, avoid the noise, avoid the toxicity, avoid people with a negative ‘glasshalf-empty mentality. Because whether you

both traditional and payday, as moves that negatively impacted their fnances.

“Loans seemed like a temporary fx, but ended up being more fnancial trouble than they were worth,” said Rankins.

“Tose payday loans are such a rip-of,” said Jean. “Tey just put you deeper in debt.

“As soon as you get your frst loan, you are trapped unless you know you will have the 300 extra dollars in the next two weeks,” said Lisa Engelkins, a single mother making less than $8 an hour.

Engelkins paid $1,254 in fees to renew a payday loan 35 times. Lisa thought she was getting “new money” each time, when in fact she was simply borrowing back the $300 she just repaid. She paid renewal fees every two weeks for 17 months to foat a $300 loan, without paying down the loan.

believe you can or whether you believe you can’t, you’re absolutely right.”

Bryant’s second suggestion: Stop focusing on Washington, D.C.

“I don’t care about DEI. I mean, we’re ffh on the list,” said Bryant, who is the founder and CEO of Operation HOPE, Inc., the largest non-proft, best-in-class provider of fnancial literacy and economic empowerment services in the U.S. “We have become the poster child

For the past 12 years, Vannessa Wade has grown the company she founded and leads as CEO, Connect the Dots Public Relations Firm.

But in the early days of her business, the journey wasn’t always smooth.

“Not planning for slow business months when I first started my business,” said Wade, was a fnancial move she said had negative impacts.

Abayomi Allen listed getting a credit card at age 18 as a move he wishes he could undo.

“Getting those ‘free’ credit cards in college was bad news,” said Allen. Chase.com states that though most

for diversity, equity and inclusion. That’s exactly what some people want; for us to be the poster child because then it triggers other biases.

“Te reality is the biggest DEI, the biggest afrmative action, the biggest subsidy in this country goes to white farmers. White women are at the top of the list, [followed by] Hispanics, military personnel and those with disabilities. So, we need to stop obsessing with Washington altogether.”

Bryant suggested focusing that “federal government policy-watching” energy elsewhere.

“Get on with getting our credit score up. Tat’s worth $750 billion over the next 20 years,” said Bryant. “Becoming homeowners, that’s worth $800 billion over the next 20 years. Artifcial intelligence is worth a trillion dollars. And buying businesses of these baby boomers that are retiring in the next 10 years is worth a trillion dollars.

“Take any part of that $3.5 trillion that I just mentioned. None of that requires the government. Not one dime of it.”

Bryant’s message is resonating with people of all races across the country. His free podcast, “Money and Wealth,” is in the Top 100 in the country for business and Top 40 for entrepreneurship.

Derrick Morrow, general manager of the Hyatt Regency Atlanta, views Bryant as a fnancial transformer.

“John Hope Bryant embodies the ethos of empowerment through economics,” said Morrow. “His tireless eforts to eradicate poverty and spread hope inspire us all.”

college students will have no or very limited credit history, there are a few different types of credit cards to consider. These include getting a student credit card, becoming an authorized user on an existing credit card (usually a parent) or getting someone to co-sign their credit card application.

But a teenager with a credit card comes with the temptation to spend, which can lead to a wrecked credit score. Debit cards, pre-paid cards and secured cards are alternatives that can help young adults remain fscally solvent.

By ReShonda Tate

For many, damaged credit can feel like a scarlet letter. Whether it’s from a job loss, divorce, unexpected medical bills or student loans that never seem to shrink, millions of Americans—especially Black and Brown folks—know the weight of fnancial setbacks.

But bad credit isn’t a life sentence. It’s a chapter, not your whole story. And with the right tools, support and mindset, you can rewrite it.

“Tis shame narrative around bad credit is what keeps people stuck,” said Carla S. Morrison, fnancial coach and founder of Smart Credit Divas. “We need to talk about it more, without judgment, so people can take their power back.”

Why credit matters more than you think

Credit isn’t just about buying a car or getting a fancy rewards card. It afects nearly every aspect of your life—from renting an apartment to landing a job to the interest you will pay on loans to your eligibility for

Credit: Getty Images

utilities. A low credit score can cost you thousands of dollars over time.

Your credit score, typically ranging from 300 to 850, is calculated based on fve main factors: payment history, credit utilization, length of credit history, new credit and your credit mix. Even one missed payment or a maxed-out card can cause a noticeable dip.

Te good news? Every positive step you take now can start turning things around.

Face the

“Te frst thing I tell my clients is: stop running from your credit report,” Morrison said. “Pull it. Read it. Know what’s on there.

You can’t fx what you won’t face.”

Federal law allows you to check your credit report for free once a year from each of the three major credit bureaus—Equifax, Experian and TransUnion. Check for unfamiliar accounts, late payments, collections or outdated information. If you see something that’s inaccurate, dispute it. Credit bureaus are legally required to investigate.

Adrienne Taylor, founder of Tailored WealthSaver, warns against using credit repair companies that promise quick fxes.

“I encourage everybody—please, please, please—and I’m not trying to knock anyone’s hustle: do not go through credit repair,” Taylor said. “Tere is a whole entire law that people don’t realize. It’s called the Credit Repair Organizations Act, and it tells credit repair companies what they can and cannot do.”

Taylor said many people don’t understand that credit repair companies can’t do anything you can’t do yourself. “Tat’s one thing I make clear—we don’t do credit repair, but we do teach people how to build their credit,” she said.

The foundation of credit health is built on three habits, according to Taylor: making payments on time, understanding your credit limits and keeping your credit utilization low.

“An easy way to destroy your credit is not paying your bills on time,” Taylor said. “Another way is not understanding your utilization. If you have a $1,000 credit limit and you go above $300, now you’re over 30% of your limit—and your score will decrease over time.”

Taylor said that staying under 30% of your credit limit and paying your bills consistently are two of the most important things people can do to raise their scores.

Other tools to consider include secured credit cards, credit builder loans from local fnancial institutions and fnancial apps that help report on-time payments to the credit bureaus.

By Laura Onyeneho

Whether you’re newly engaged, fresh off the honeymoon, or a decade deep into “for better or worse,” one conversation many couples dread is the one about fnances.

Who pays what? Should we split everything 50/50? Is a joint bank account a sign of trust or trouble? Tese are uncomfortable but necessary questions that every serious relationship must eventually face.

And it’s not just theory, research shows that fnancial confict is one of the leading causes of divorce. So if you and your partner are tiptoeing around money issues, it may

be time to stop dodging the hard talks and start building fnancial intimacy before the tension builds a wedge between you.

On a casual date night over a decade ago, Vincent and Ebony Powell did something most couples don’t do until they’re kneedeep in marriage—or never at all.

“We printed out our credit reports and went through them line by line,” Vincent recalled with a chuckle. “It was like, ‘If we’re going to do this, let’s be clear on what we’re getting into.’”

That candid moment laid the groundwork for a financial partnership rooted in honesty,

teamwork and long-term vision— an approach shaped by personal histories and generational examples. Ebony, who had been briefy married before, said she came into the relationship determined to put every card on the table—literally and fnancially.

“I just didn’t want to enter another relationship without full transparency,” she said. “And luckily, we both grew up with parents who modeled fnancial openness. Tat made it easier for us to emulate the same in our marriage.”

Today, afer 12 years together, Ebony and Vincent’s philosophy involves joint effort and joint accounts.

“We always side-eye couples who split everything down the middle—his rent, her rent. Tat’s not us,” Ebony said. “We’re all in on everything.”

Te Powells maintain a shared bank account for major household expenses, while allowing themselves individual accounts—primarily for gif-giving or surprise purchases. But there’s no hoarding, hidden funds, or fnancial secrecy.

“I just opened my frst personal account in 10 years this February,” Vincent said. “And that was only so I could buy Ebony a birthday gif without her getting an alert from our shared Amazon account.”

Each can access the other’s passwords, accounts, and schedules.

“If something happens to me while traveling, I need to know Ebony has access to everything,” Vincent added. “It’s not about control, it’s about partnership.”

At one point, their financial unity was tested when Vincent got accepted into a competitive film program at the University of Southern California. With a demanding schedule that lef no room for part-time work, Ebony, then a high school English teacher,

shouldered the family’s income.

“It was a lot,” she said. “But we had the conversation upfront and agreed on the sacrifce. Tere was never a moment of resentment.”

After Vincent graduated, the couple returned to Houston. Tis time, Ebony took a break from the workforce. Te roles reversed, but the commitment remained.

“We always reassess,” Ebony said. “We ask each other: What season are we in? Who needs to lead right now? Who needs to rest?”

By Tannistha Sinha

As grocery prices climb, rent surges and inflation chips away at every dollar, many Houstonians may be struggling to make ends meet. Some may even be asking: How can I make my paycheck go further?

Experts say the answer lies in being intentional, resourceful and realistic.

Build a detailed, realistic budget

“Most people, when they say, ‘I have a budget,’ write down their list of bills,” said Desmond Johnson, financial advisor at Edward Jones. “Where most people fail in creating their budget is to actually do something specific and detailed that they can actually follow.”

Johnson urges Houstonians to track not just fixed expenses like utilities, but also daily indulgences that quietly drain funds.

Thinking something is “just $5” several times a week might add up to hundreds of dollars at the end of the month.

“There can be a big hole in what you think you’re spending versus what you’re actually spending,” he said.

Instead, Johnson recommends using one’s net income, the money you actually take home after taxes and deductions, as the foundation of your financial planning.

Use free community resources

Some suggest tapping into the wealth of Houston’s local support available in Houston.

“A lot of nonprofits offer support, whether it is with groceries like the Houston Food Bank or Wesley Community Center’s savings clubs and United Way’s 2-1-1 helpline,” said Sabrina Lewis, Houston Money Week’s chair and executive director. “These free resources can help you remove some costs so that it doesn’t impact you as heavily.”

To manage debt without hurting your credit score, Lewis advises against payday loans and apps that give early access to paychecks with hidden fees.

For those juggling multiple debts, Lewis suggests the “snowball method, or paying off the smallest debts first while making minimum payments on the rest, which can provide motivation and progress. On the flip side, one can choose to look at his debt and check which one has the highest interest rate and work on paying that one off first to reduce the overall debt.

Save first, even if it’s just $10

Even with a tight paycheck, both Lewis and Johnson agree that saving even a little is non-negotiable.

“Your finances are a zero-sum game,” Johnson said. “Let’s say you do not earn more. You have to find that money somewhere within what you’re already spending.”

Also, make sure you are rewarding yourself before pushing yourself to achieve the next goal. “Don’t throw yourself a $100 celebration party…maybe buy yourself a $10 Slurpee,” he added.

Spend only on what you can’t live without

Dr. Ethiopia Keleta, a professor of Economics at Texas Southern University, stresses the importance of building an emergency fund, especially for underserved communities. She urged them to do a cost-benefit analysis of their expenses, focus on necessities like food, shelter and medicine. She also encourages reducing non-essential spending like eating out, brand-name products, or beauty items.

Keleta suggested keeping a three-month spending log to pinpoint where cuts can be made, especially during an inflationary period.

She assured that economies do not always become persistently inflationary.

“Over time, it’s going to change because people’s behavior is going to change. We are going to drive fewer miles, look for alternatives like carpooling, or grow our own vegetables,” she said. “Businesses are going to notice this because they’re going to lose customers. Eventually, this inflationary pressure will change.”

When the conversation turns to freedom, it often stops at civil rights and voting power. However, true freedom includes financial liberation — the ability to make choices without being burdened by debt, paycheck-to-paycheck cycles or generational disadvantage.

By ReShonda Tate

For Black families, the wealth gap remains a significant barrier. According to Pew Research, the median wealth of Black households is $27,100, compared with $250,400 for white households.

Tat story does not have to be the fnal chapter.

Financial freedom is not about luck. It is about intention, strategy and education. Whether you’re starting from scratch or looking to advance, here are 10 steps to take control of your money, reclaim your power and build lasting wealth.

1

Know your numbers

You cannot change what you do not measure. Start by listing your income, monthly expenses, debts and savings. Use tools like Mint, YNAB (You Need a Budget) or an Excel sheet to get the full picture. Do not be afraid of what you fnd — clarity is power. “When I fnally wrote everything down, I realized I was not broke — I was just unorganized,” said Houston entrepreneur Tifany Jackson.

2

Create a budget that respects your life Budgeting does not mean deprivation — it means direction. Set a

monthly budget that includes necessities, savings, debt repayment and joy. Te 50/30/20 rule (50% needs, 30% wants, 20% savings/debt) is a good start, but customize it for your situation.

3

Build an emergency fund

Life happens. A blown tire, medical bill, or job loss should not wipe you out. Aim to save three to six months of expenses, starting with a goal of $500 and building from there. Automate your savings so you do not have to think about it.

4

Eliminate high-interest debt

Credit card debt is a wealth killer. Use the snowball method (pay of smallest debts frst) or the avalanche method (tackle highest interest rates frst). Whichever you choose, be consistent. Every dollar you pay of is a dollar you reclaim.

5

Protect your credit score

Your credit score afects everything from home loans to insurance rates. Pay bills on time, keep credit utilization under 30% and do not open too many new accounts. Apps like Credit Karma or Experian Boost can help you monitor your progress.

In today’s fast-moving world, credit can be your financial best friend—or your worst enemy.

For many in Houston’s Black community, credit has often been associated with stress, rejection or predatory traps. But financial experts say it’s time to shift that narrative. Used wisely, credit can open doors to homeownership, education, business expansion and long-term wealth.

6

Learn to invest (Yes, You Can)

Black families have historically been lef out of investment opportunities. It is time to change that. Start with a Roth IRA, 401(k), or index funds. You do not need to be rich to invest—just consistent. Compound interest is the real beneft.

7

Buy (or Keep) property if you can Homeownership is still a major wealth builder, especially when property values increase. Programs like NACA, FHA loans and local grants can help frsttime buyers. However, ownership also includes protecting inherited property and avoiding land loss.

“Too many Black families lose the home grandma worked for because the paperwork was not right,” said real estate attorney Marcus Brooks. “Make sure the deed is clear and the heirs understand the value.”

8

Teach the next generation Financial literacy is not just for adults. Talk to your children and teenagers about saving, budgeting and ownership. Open custodial savings accounts, introduce them to investing early and model the habits you want them to repeat.

9

Find a Financial Accountability Partner

You do not have to go it alone. Whether it is a trusted friend, family member or fnancial coach, share your goals and check in monthly. Black wealth is community wealth — do not be afraid to lean on your village.

10

Leave a Legacy, Not Just Money

Wealth is more than a dollar amount. It is insurance. It is estate planning. It is a will that protects your children. Meet with a Black estate attorney or planner and ensure your assets are clearly designated. Do not let probate courts decide your family’s future.

Financial freedom is not a destination — it is a practice. Start where you are. Build as you go. And remember: We are not just consumers. We are creators, builders and owners.”Black wealth is a revolutionary act,” said fnancial educator Dominique Broadway. “And it is one we can achieve — one step at a time.”

Small steps make a diference, whether you’re just starting or trying to bounce back.

READ MORE ABOUT BUILDING LASTING WEALTH AT DEFENDERNETWORK.COM

“Credit is not just about borrowing; it’s about building,” says Danielle Joseph, a Houston-based financial coach who helps clients rebuild their credit profiles. “It’s a tool that, when managed correctly, can completely change your financial trajectory.”

Understanding credit: beyond the score

Your credit score isn’t just a number—it’s a snapshot of how you manage financial responsibility.

Lenders, landlords and even some employers look at this score when making decisions. But credit is about more than approval; it’s about the cost of your approval.

“With strong credit, you’re not just more likely to be approved for loans or credit cards—you get

them at better interest rates,” says Joseph. “That can mean thousands saved over a lifetime.”

For example, someone with excellent credit might get a car loan at 4%, while someone with poor credit could be offered the same loan at 18%. Over time, that difference adds up dramatically.

How to use credit as a financial tool

Experts recommend five core strategies to use credit wisely:

• Pay on time, every time. Late payments are one of the fastest ways to damage your credit.

• Keep balances low. Aim to use less than 30% of your available credit. If your credit card has a $1,000 limit, keep the balance below $300.

• Don’t close old accounts. Length of credit history matters.

• Limit new credit applications

Too many hard inquiries can drag down your score.

• Monitor your credit report. You’re entitled to a free credit report annually at AnnualCreditReport.com.

hit hard. But recovery is possible.

Start by prioritizing high-interest debts, negotiating payment plans if needed, and committing to a realistic budget. Avoid quickfix credit repair scams that promise to “erase” bad credit overnight. True credit repair takes time and consistent effort.

“Think of credit like a relationship,” Joseph adds. “Nurture it. Check in on it regularly. Don’t ghost it for years and then be surprised when it’s no longer working in your favor.”

Repairing damaged credit

If you’ve faced financial setbacks, you’re not alone. Life events like job loss, medical bills, or divorce can

Building credit in our communities

Access to credit has long been a racial equity issue. Black Americans have historically been denied fair access to credit, mortgages and capital, contributing to the racial wealth gap. Financial advocates urge the community to embrace financial education and empowerment.

“We can’t let historical barriers stop us from building the future we deserve,” says Joseph. “Learning how to make credit work for you, instead of against you, is one of the smartest moves you can make for yourself and your family.”

Take action today

Small steps make a difference, whether you’re just starting or trying to bounce back. Set up autopay on bills, reduce unnecessary spending, and seek advice from trusted financial professionals or community workshops. Credit is not your enemy. It’s a powerful tool—if you learn to use it right.

By Laura Onyeneho

Homeownership has been portrayed as the cornerstone of the American dream, a gateway to financial freedom, stability and generational wealth.

But for many young Black people, that dream remains out of reach. Despite being touted as the primary engine of wealth-building, homeownership hasn’t delivered equally across racial lines.

Structural racism, hidden costs, economic volatility, student loan crisis and stagnant wages continue to rob Black people of the opportunity to build equity and stability.

But real estate experts say it is possible and, if approached wisely, can be one of the smartest wealth-building decisions a person can make.

“Homeownership is one of the only assets that can generate longterm returns for everyday people,” said Five Woods Realty Principal Laolu Davies-Yemitan. “It’s a gateway to financial stability and generational wealth — especially for our community.”

Davies-Yemitan knows this firsthand. He bought his first home at just 23 years old and, over the years, helped lead developments across Texas, delivering over 850 affordable housing units.

He broke down his strategy for preparing financially for a home, what he calls the “Three

Cs”: cash, credit and career.

The Three Cs Credit is where it all starts.

“Your credit history is your financial character,” he said. “It begins as soon as you get a cell phone plan or your first credit card. You don’t have to wait until you’re ready to buy a house to build credit.”

Davies-Yemitan recommends tools like Credit Karma and NerdWallet to track and improve your score. Ideally, you want a credit score of 660 or higher to qualify for favorable loan options.

“It doesn’t matter if you’re a restaurant server or an engineer — what matters is how you build your career over time,” he said. “Your income influences how much house you can afford and how comfortable you’ll be paying that mortgage.”

And then there’s cash — the money you’ll need for a down payment and closing costs.

Bid Notice

REQUEST FOR QUALIFICATIONS FOR CONSULTANT FOR COOL & CONNECTED CORRIDORS 2025/2026 IMPLEMENTATION FOR THE HOUSTON DOWNTOWN MANAGEMENT DISTRICT

The Houston Downtown Management District (the “Downtown District”) will receive Statements of Qualifications (SOQ) for the preparation and issuance of construction and bidding documents for capital improvements to be constructed in Downtown Houston, Texas. Statements of Qualifications will be received until 2:00 P.M. CDT, on Wednesday, July 23, 2025, by Cassie Hoeprich, Director of Planning & Economic Development, at cassie.hoeprich@downtownhouston.org per instructions outlined in this project’s RFQ document. Qualifications received after this time will not be accepted.

Beginning Thursday, June 26, 2025, this project’s Request for Qualifications (RFQ) may be reviewed and downloaded from the Organization’s website: https://downtownhouston.org/do-business/procurement-RFQ

Only queries or requests for information submitted via email will be addressed by the Downtown District. Please submit written queries or requests for information directly to the Director of Planning & Economic Development Cassie Hoeprich at cassie.hoeprich@downtownhouston.org on or before 2:00 P.M. CDT, Tuesday, July 15, 2025. Please note that telephone or mail queries or requests for information will not be addressed by the Downtown District.

Additionally, a mandatory proposal pre-submittal conference via Zoom is scheduled for 2:00 P.M. CDT, Monday, July 07, 2025. The link to the conference will be available on the Organization’s website: https://downtownhouston.org/do-business/procurement-RFQ

Based on the Proposals submitted, an evaluation and selection committee will identify up to three qualifying consultants for a second-stage interview to be held in early-August. The Downtown District will award the contract to the selected consultant based on the qualifications and interview performance.

According to the National Association of Realtors, the Black homeownership rate in the U.S. is just 44.1%, compared to 74.5% for white households.

Credit: Getty Images

While the traditional 20% down payment might seem out of reach, Davies-Yemitan points out that some mortgage programs allow you to put down as little as 3%. Additionally, down payment assistance programs from local banks or nonprofits can help bridge the gap.

According to the National Association of Realtors, the Black homeownership rate in the U.S. is just 44.1%, compared to 74.5% for white households. Closing that gap means empowering people with the right information and reminding them that homeownership is within reach.

Houston real estate investor Onaje Barnes says the pathway to homeownership brought his family generational wealth he didn’t have growing up. He grew up in the Third Ward and graduated valedictorian from Jack Yates

High School. He accomplished many things academically that he felt statistically he wasn’t supposed to achieve.

“I did everything society said was the ‘right’ path — good grades, college, corporate job,” said Barnes, “But a company merger laid off 25,000 people, including me.

“I was at an age where people ahead of me told us to stay loyal to one company, retire with a pension, and you’re set. But that’s not our world anymore. I realized real stability would only come if I had more control over my income and that meant ownership.”

Understand that your home is an investment

For many first-time buyers, especially those raised in renting households, homeownership is easy to view as simply securing a roof over one’s head. But Barnes challenges us to go deeper.

“Whether you want it to be or not, your home is an investment. It’s likely the largest purchase you’ll ever make, so treat it that way,” he said. “Equity is a powerful tool and one that too many of us don’t understand because we haven’t experienced it firsthand.”

HCTRA is doing more for mobility in our region - from toll roads to a new Ship Channel Bridge.

By Tannistha Sinha

First-time homebuyers making the leap from renting often discover an expensive truth: the price tag on a home is only part of the actual cost.

Beyond the usual down payment and monthly mortgage bills, buyers face “hidden costs” that are not always advertised in the same font as the pros of homeownership. For Black homebuyers already navigating systemic barriers to homeownership, these costs can be a serious setback.

“When you see all these advertisements of getting a home with zero down, buying a house when broke, or closing on properties and getting money back, all of [that] could be true, to an extent. However, there are out-of-pocket expenditures that are non-negotiable when you’re purchasing a home,” said LaKendra Coffman-Harper, a broker and real estate mentor at the Five Star Team in Houston with 18 years of industry experience.

Among the first expenses are earnest money and option fees.

Earnest money, while not a requirement, is a good-faith deposit a buyer puts down to demonstrate seriousness about buying a home. Ranging from 1% to 10% of the home’s purchase price, it is paid when signing the purchase agreement or the sales contract and can be part of the offer. If the sale takes place, the earnest money is applied to the down payment or closing costs. But if the sale fails, the amount is refunded.

Meanwhile, an option fee is a payment made by a buyer for the unrestricted right to terminate a real estate contract within a specified period, also called the “option period.” If the contract is terminated during the option period, the option fee, if not claimed, is sent to the sellers.

“The inspection is for you, not for the sellers of the home. This is to equip you with the knowledge of what potential issues may or may not be occurring with that property,” Coffman-Harper explained, adding they range between $400 and $600 depending on the home’s size and features.

Next comes the appraisal, which determines the market value of a home and how much a lender is willing to lend. A lender typically orders an appraisal, and the results

can be used by a buyer or a seller to ensure both are getting a fair deal. The appraisal ranges from $600 to $700.

Closing costs include the following:

Lender and loan-related fees

Prepaid and escrow items

(subtotal: $3,000 - $6,000)

• Escrow funds (taxes, insurance, etc.)

“A lot of those things can catch you by surprise,” said LaQuana Davis, a real estate professional at the Brooks & Davis Real Estate and the lead of LaQuana Davis Realty Group. She warned buyers against paying for an appraisal during the option period, especially amidst ongoing negotiations and repairs.

First-time home buyers often do not accurately gauge the total closing costs. Some may not even know there are ways to reduce the payment, which depends on the loan type and where the home is located.

It is a cost paid upon closing on a mortgage, covering fees for services like a home appraisal and searches on a home’s title. They typically range between 3% and 6% of the loan amount.

(subtotal: $1,500 - $4,000)

• Application fee

• Credit reporting fee

• Discount points

• Loan origination fee

• Rate lock fee

• Private mortgage insurance (PMI)

Title and legal costs

(subtotal: $2,000 - $4,500)

• Attorney fees

• Closing fee

• Lender’s title insurance

• Owner’s title insurance

• Title search fees

• Transfer tax

• Recording fee

Property-related inspections and certifications

(subtotal: $700 - $1,500)

• Appraisal

• Pest inspection fee

• Lead-based paint inspection

• Survey fee

• Flood certification

• Property taxes

• Homeowners’ insurance

• Tax monitoring and tax status research fees

Other costs (subtotal: $300 - $800)

• Courier fee

• Homeowners association (HOA) transfer fee

Closing costs do not include the down payment but can be negotiated, depending on whether you are in a buyer’s or seller’s market. While sellers can contribute to these costs and you can shop around for lenders, such costs must be negotiated upfront.

Even when you get the keys in hand, the bills do not stop.

According to Alverna Austin, a real estate agent at Keller Williams Houston Central, new homeowners also have to prepare for utilities, flood insurance, yard maintenance and unexpected repairs, even in new builds.

By Raquel Rogers

On social media, the “soft life” sparkles: silk robes, spontaneous travel, designer bags and captioned affirmations about rest, femininity and abundance. For many Black women—especially millennials and Gen Z—this aesthetic is more than a trend. It’s a declaration. A much-needed rebuttal to the “strong Black woman” script that glorified grind and minimized burnout.

But behind the glow of luxury candles and champagne brunches lies a quieter, more sobering truth: many are financing this life with credit card debt, BNPL (Buy Now, Pay Later) plans and loans. The price of aspirational living is often long-term financial instability—and for some, deep emotional exhaustion.

The allure of luxury

The “soft life” movement exploded during and after the pandemic. At its heart, it’s a cultural shift: a desire to reclaim rest, indulgence and joy after generations of hustle with little payoff. For Black women, it’s also a form of resistance—choosing pleasure in a world that so often denies it.

“The soft life felt like freedom,” said Maya Williams, a 28-year-old communications professional in Houston. “No more overworking to prove my worth. I was buying flowers for myself, booking staycations, treating every weekend like a celebration. But it came at a cost.”

That cost: nearly $12,000 in credit card debt, much of it tied to beauty appointments, luxury skincare and travel she couldn’t truly afford.

The pressure to perform wealth

Social media doesn’t just promote lifestyle—it demands it. Instagram and TikTok are overflowing with curated versions of “Black luxury,” where success must also look successful. Designer shoes. Perfect makeup. Brunch with bottomless mimosas at five-star hotels.

Dr. Joy Harden Bradford, psychologist and host of Therapy for Black Girls, says this visibility creates pressure that goes deeper than aesthetics.

“There’s a double bind,” she explains. “Black women are expected to outperform to be taken seriously—and when they do, they’re expected to show it. That performance of success becomes a way to assert worth in a world that often questions it.”

Bradford says that in some cases, luxury spending can mask deeper emotional needs:

loneliness, imposter syndrome, or a sense of inadequacy.

“Buying gives us a dopamine hit. It says, ‘I’m doing okay.’ But that’s not the same as healing.”

The financial fallout

The numbers tell a sobering story:

• Black women carry more student loan debt than any other group—averaging over $37,000, accord ing to the Education Data Initiative.

• Credit card debt is rising fastest among millennials and Gen Z, especially those using BNPL platforms like Klarna or Afterpay.

• Only 23% of Black women have three months’ worth of emergency savings, per a 2022 TIAA report.

“We’re often the breadwinners in our families, yet we’re

also the ones most targeted by aspirational marketing,” said financial educator Tiffany

“The Budgetnista” Aliche. “It creates a cycle where we’re spending to ‘feel’ secure instead of

still says broke. That’s not wealth. That’s a trap.”

A new definition of luxury

For Houston-based financial coach Renee Taylor, the shift came after a breakdown. “I looked amazing on Instagram, but I had $18 in my checking account,” she recalled. “That’s when I decided peace is the new luxury.”

Taylor now helps Black women redefine wealth as freedom, not flexing. Her clients work on budgeting, building emergency funds and exploring what actually brings them joy—often finding that it’s time, health,

Aliche agrees. “Luxury doesn’t have to mean labels. It can be not stressing when your car breaks down. It’s sleeping at night without money anxiety.”

Even some social media influencers are shifting course. Kayla Simone, who once posted daily OOTDs featuring luxury brands, now documents her journey to financial recovery and intentional living.

“I was scared to be honest,” she said. “But the response was incredible. So many women messaged me saying, ‘Thank you. I felt alone

for thriving without debt

If you’re ready to live well and build wealth, here’s where to start:

• Create a realistic budget: Use tools like Mint, YNAB, or even a good old spreadsheet. Track everything.

• Build an emergency fund: Start small—$500, then $1,000. Aim for 3–6 months of expenses.

• Pause before you purchase: Ask: is this an emotional buy? Will it matter in a week?

• Prioritize longterm goals: Retirement, investing, paying off high-interest debt.

• Unfollow or mute: If luxury content makes you feel less-than, detox your feed.

• Talk to a therapist or coach: Money is emotional. You don’t have to sort it alone.

By Terrance Harris

Te date June 21, 2021 will perhaps live in college athletics infamy.

Afer decades of college athletes pouring their blood, sweat and tears into their sports for nothing more than a college scholarship, on that date, a landmark decision allowed student athletes to begin profting of their name, image and likeness, aka NIL.

Tat has meant substantial riches for some who’ve played the game of going to the highest bidder for their athletic riches, with a few deals exceeding $10 million for a college student. It’s been life-changing money for some.

NIL money has also been life-changing in ways 17, 18 and 19-year-olds never considered. Suddenly, they are now balancing life as college students while being the breadwinners for their families, having access to luxury cars, homes and other trappings of rich people. They also come under Uncle Sam’s purview in the form of taxes.

“Tere is a thing about living in these United States where we are all governed by a term called tax laws,” University of Houston men’s basketball coach Kelvin Sampson said to the Defender. “So if I said I’m going to give you $100 in NIL money to come here, you do understand that that’s going to be taxed? So don’t look at me six months later saying, `Nobody told me about that.’ Nobody told you we are in the United States and all money is subject to tax laws, whether it’s W-2s or 1099s?

“But we have to educate them on that. Tat wasn’t part of the deal fve years ago. But it is now.”

Without question, student-athletes deserve to proft of name, image and likeness in the billion-dollar college athletics landscape that has flourished on their backs. But experts warn that student-athletes and their families must be aware of the responsibilities that come with making thousands, hundreds of thousands and in some cases millions of dollars.

The money sometimes sounds good until you have to deal with it.

“It can be hard to get young people to think about that, think like they are a business. Some of them embrace it, create

an LLC and know about their taxes,” said Houston native and Texas Southern alumnus Tony Wylie, who is the chief executive ofcer of marketing agency Te Collective Engine. “Some of them are pretty impressive, that they are young and they understand the business side of it. But the majority of them don’t know, so you have to really manage expectations. Te media really doesn’t report the accuracy of some of these things, and it’s not like there is a collective bargaining agreement where everyone knows what everyone is making. So it breeds a false sense of reality and expectations.

“I think if they do things where they can learn fnancial literacy and know what to do once they get the money, I think that would be good.”

Some schools and coaches, like Sampson, have tried to get ahead of the chaos by working with student athletes on fnancial literacy. In addition to talking to his players about how to handle their money,

he also conducts a Zoom call with the parents every year about the money their sons are coming into. He has been surprised at how many don’t understand dollars and cents and how they apply to the American economy.

“I’ve had discussions … some of these kids are going to be making more money than they will at any job for the rest of their lives,” Sampson said. “Te positive is when they do leave here and they go on to the next phase of their lives, they will have already been educated and able to make decisions, whether it’s federal tax or state tax or whatever it is, it’s things that kids would never have thought of. You have to think of those things for them.

“But every school does this. It’s part of being a coach now. Before, you coached this and you coached that like all coaches do, but now we’ve been doing that for three years.”

Wylie, whose primary role is to fnd student-athletes’ NIL deals, says some schools

do help their student-athletes with fnancial literacy, but because it’s still a relatively new frontier, many don’t provide any formal preparation on how to deal with the newfound riches.

“I haven’t seen it. I think some do, but I think it’s on a case-by-case basis,” Wylie said. “Some schools are just trying to get a grasp of this whole NIL thing. Tis thing is only a couple of years old.

“I think eventually, it will evolve into that. But for right now, it’s a whole new lane for everyone. It’s a moving target. It’s changing all of the time now.”

What’s also changing is the awareness of student-athletes and their families that these universities and deep-pocket boosters are willing to pay top dollars. Tis has created a culture of athletes going to the highest bidder and not hesitating to jump into the transfer portal when they see opportunities for better NIL ofers.

Tis past spring we saw University of Tennessee quarterback Nico Iamaleava reach out to the Vols’ NIL collective, Sprye Sports Group, to increase his NIL deal from $2 million a year to $4 million. While Iamaleava and his father negotiated his deal, the starting quarterback refused to participate in spring practices. In the world where the head coach still has the fnal say so, Iamaleava was kicked of the Volunteers’ team.

Iamaleava eventually landed at UCLA, but for less than the $2 million he was making at Tennessee.

“At one point, I was like this is going good, it’s going where it needs to go,” said marketing agent Ishmael Lawrence, who is the founder and CEO of In Real Life Talent Group. “But the athletes have taken it too far.

“I love that they are taking back their intellectual property. They know their worth. Tey are getting an education. Tey are getting compensated for these billion-dollar media rights deals. And I hate this because it’s always the dads or the uncles. If they just snif the money, they take it to extremes. It’s hurting these kids.”

But despite the few troubling instances we’ve seen and heard about, Wylie says that, for the most part, student athletes are handling their money the right way.

“Some have and some are really smart,” he said. “Tat goes to you having the right kid that’s pretty grounded where the money won’t make them go crazy.

“Te ones I’ve seen who are grounded are handling it pretty well.”