A comprehensive guide to

A comprehensive guide to

Charitable giving options that can help you achieve your personal, financial, and philanthropic goals TOGETHER WE GIVE. TOGETHER THEY THRIVE.

An ongoing show of financial support with regular, annual gifts

A significant show of support with a sizable monetary gift

The process of making a significant charitable gift during a donor’s life or at death as part of your financial or estate plan

A combination of a major and a planned gift

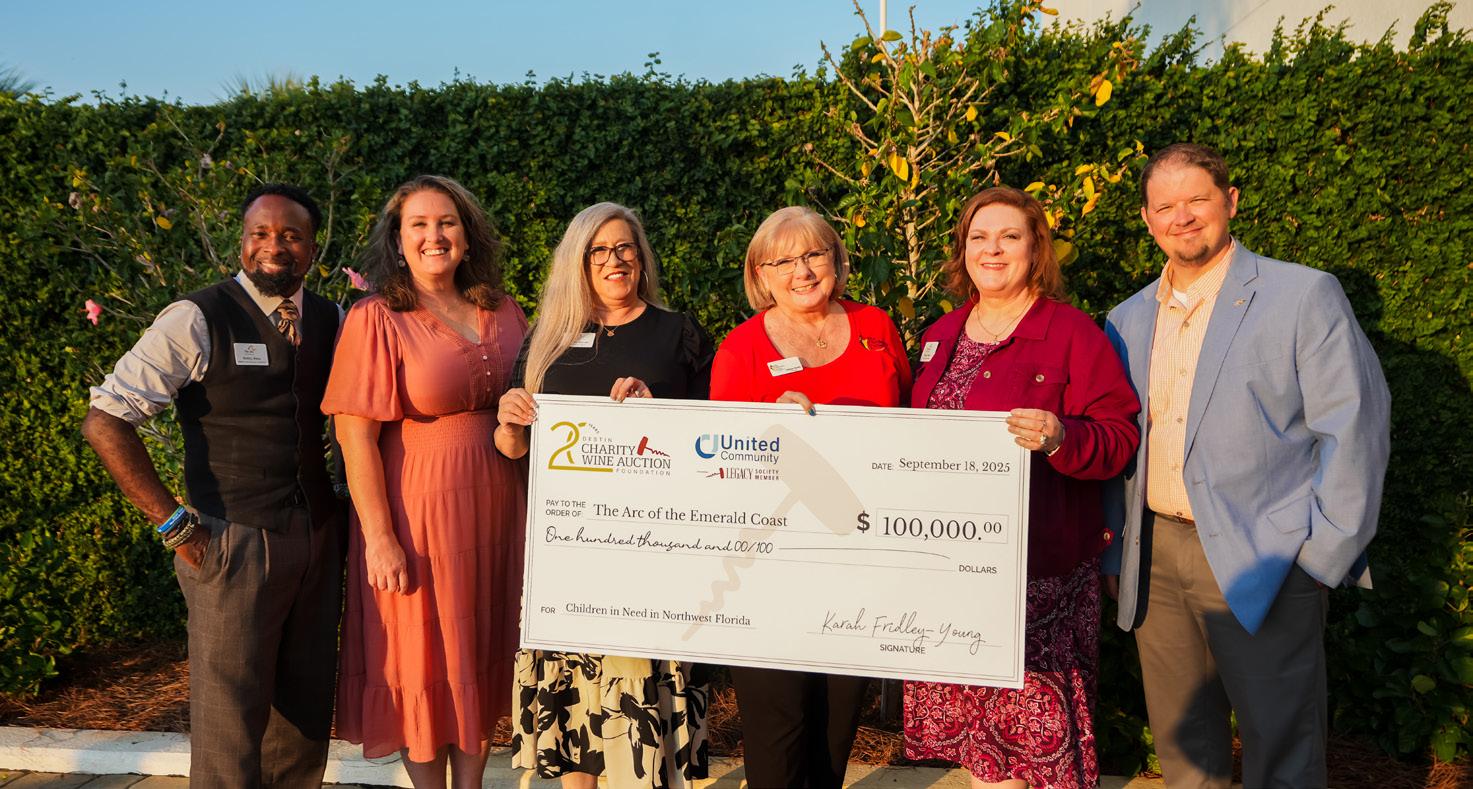

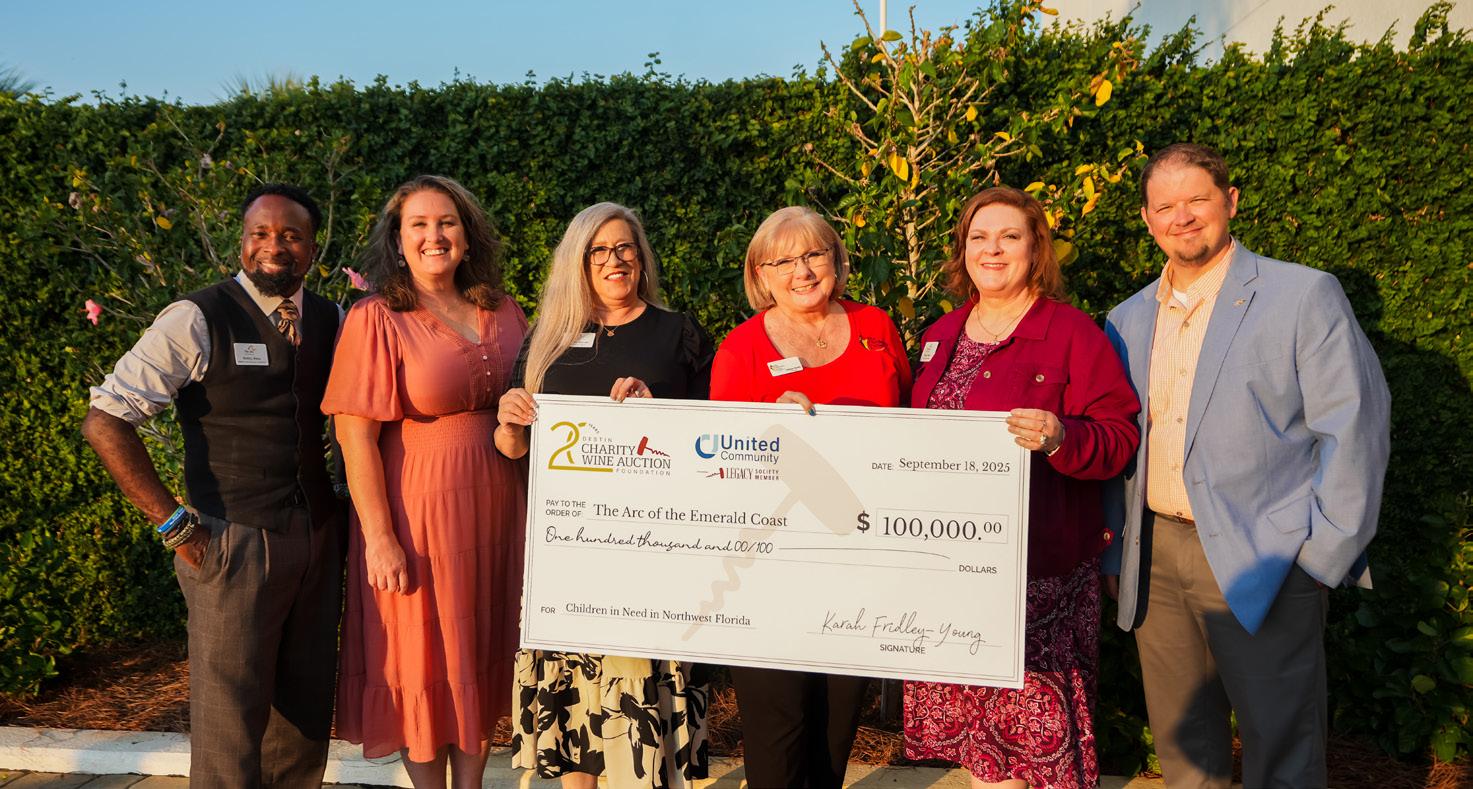

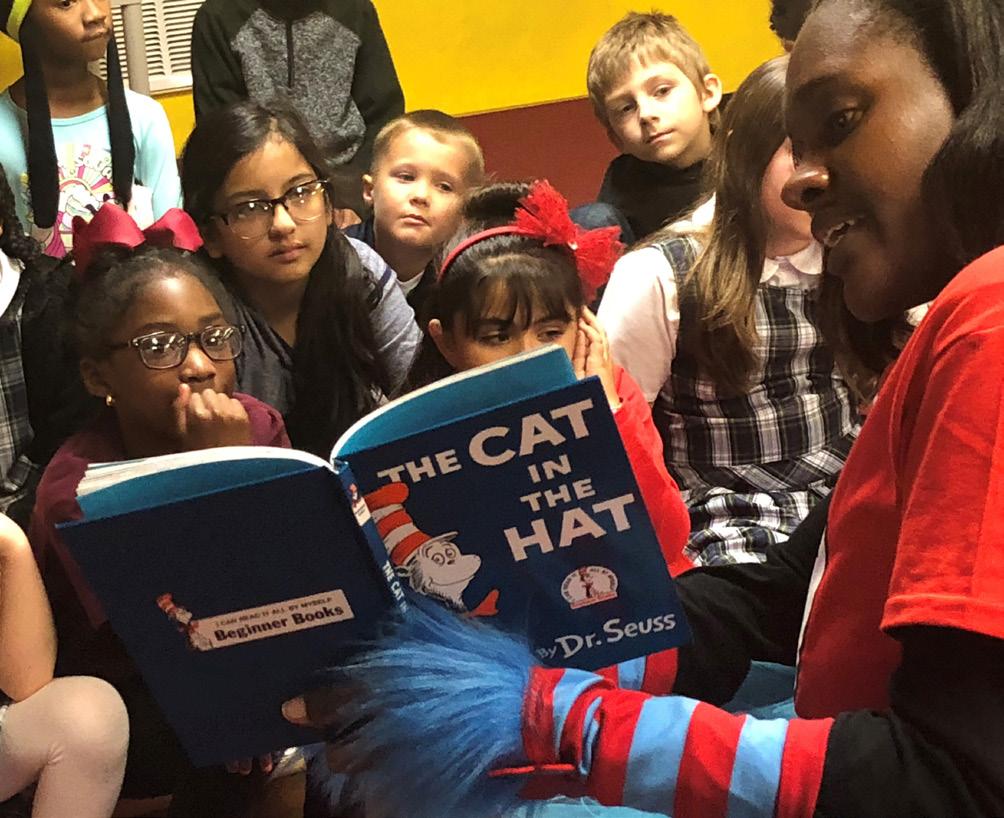

Thank you for your interest in supporting Destin Charity Wine Auction Foundation’s sustainability, ensuring we can positively impact the lives of children in need in Northwest Florida for generations to come. As our community continues to grow, the challenges vulnerable children face are growing too. At Destin Charity Wine Auction Foundation, every dollar fuels proven, high-impact solutions, lifting children beyond limitations.

Before making a planned gift, we recommend seeking the advice of your legal, tax, estate planning, or financial advisor to ensure any gift you are considering best fits your personal needs. If you or your advisor have questions, our staff is available to assist you. Destin Charity Wine Auction Foundation also has relationships with multiple, highly accredited advisors that are happy to consult or provide a second opinion should you wish.

Making a gift, pledge, or planned gift to DCWAF’s endowment ensures our continued operations and ability to support future generations of children in need in Northwest Florida. Help us protect and preserve DCWAF’s history of impact. The suggested minimum gift to the endowment is $10,000.

We hope you’ll join us in building permanent solutions for children in need in Northwest Florida.

A charitable gift annuity (CGA) is a contract between a donor and DCWAF. In exchange for a gift of cash, DCWAF agrees to make fixed payments to you, or you and a loved one, for the remainder of your life.

Someone who desires fixed payments for life. Beneficial if you have cash or appreciated property that produces little or no income.

You give cash to DCWAF. We make fixed payments for the lifetime(s) of one or two individuals.

Payments are based on the age of the annuitant(s). We use rates recommended by the American Council on Gift Annuities (ACGA).

A portion of most gift annuity payments is tax free. The remainder of the income is taxed as ordinary rates and possibly capital gains rates.

A gift annuity contract can begin making payments immediately (current gift annuity) or defer payments for at least one year (deferred gift annuity).

You want to make a gift to DCWAF and receive fixed payments for the future. You may be looking for current income tax savings.

You enter into a charitable gift annuity agreement with us.

• Fixed payments for life

• Tax-free payments (a portion of each payment may be tax-free)

• Rates determined by age

• Tax reduction

A charitable remainder trust (CRT) is funded with cash or appreciated property. It makes payments for a lifetime or a specified term of years to people you select, then distributes the remainder to DCWAF. A CRT is a tax-exempt trust that can sell property without paying capital gains tax and can invest the proceeds to pay income.

IDEAL FOR:

Someone with cash or appreciated property of at least $100,000 in value who desires income and tax savings.

Payments from the trust can last for the lifetime of one or more beneficiaries or for a specified term of years.

A charitable remainder annuity trust (CRAT) pays out a fixed amount each year. A charitable remainder unitrust (CRUT) pays out a percentage of the trust value each year.

Most CRT payout are taxed to the beneficiary as ordinary income and/or capital gains.

After all of the income payments have been made, the trust assets are transferred to us to support DCWAF.

You desire to change appreciated property that produces little to no income into an income stream without paying capital gains tax on the sale of the property.

You contribute appreciated property to a charitable remainder trust that will sell the property tax-free and make payments for the beneficiaries’ lifetime or a specified term of years.

You can use your retirement assets to support DCWAF. An IRA rollover gift will support DCWAF today. The bequest of an IRA will ensure you leave a lasting legacy. If you are looking to include DCWAF in your estate plan but are not sure how to do that, consider a bequest of all or part of your IRA or other retirement assets.

Someone who wants to make an impact now with an IRA rollover gift, or who wants to avoid leaving family a taxable gift by making a testamentary gift of retirement assets.

Individuals aged 73 or older must take the Required Minimum Distribution (RMD) from their IRA. This is taxable, and it can push the recipients into a higher tax bracket. If you are 70 ½ or older and do not need the extra income, or want to lower your taxes, you can give up to $108,000 directly from your IRA in 2025 to support our work, and the gift may count against your RMD. If you are interested in making an IRA rollover gift, we will provide you with information you can share with your IRA custodian so you can complete your gift.

Benefits of Retirement Assets Are:

You continue to control your retirement assets and take distributions to meet your needs.

To make a gift, simply contact your IRA custodian and ask for a beneficiary designation form.

Bequests left to charity are not subject to estate taxes and provide an estate tax deduction.

Leaving retirement asset to DCWAF in your estate plan is an excellent way to support us. You can use a “beneficiary designation” to name DCWAF as a beneficiary of your retirement account. Retirement assets can also be used to fund a charitable trust to provide for loved ones. The trust can pay income to your loved ones for the period of time you designate, after which the trust balance will be distributed to use. This strategy also produces estate tax benefits.

Someone who wants to see the impact of giving today while also enjoying significant tax savings.

An outright gift of cash qualifies for a full charitable deduction for most donors who itemize on their federal income tax returns. Donors who make a gift in this way recognize the importance of their annual support and enjoy seeing the immediate results of their generosity.

Making a gift of appreciated securities is a popular alternative to a cash gift, because it saves taxes twice. If you’ve held the securities for more than one year, you can receive an income tax deduction for its full fair market value while also avoiding capital gains tax on the appreciation. You may also realize substantial estate and gift tax savings as well if you use appreciated securities to fund a charitable trust, gift annuity, or other gift plan directed to DCWAF.

You may claim an income tax charitable deduction of up to 30% of your annual adjusted gross income for gifts of securities held for more than a year. As with gifts of cash, any deduction you cannot use in the year of your gift may be carried over and used for up to five additional years.

Someone who owns a life insurance policy purchased long ago that is no longer needed to provide necessary protection for loved ones.

Policies Sole or partial beneficiary

Life insurance affords numerous charitable giving options. DCWAF can be named as the sole beneficiary of a life insurance policy. We can also be named as a partial beneficiary, allowing you to share your policy amount between multiple beneficiaries.

A policy that is paid up can earn the donor an income tax deduction when the ownership is transferred to DCWAF. If a policy is still in effect, the donor will receive additional deductions for any premium payments made.

A charitable bequest is a gift left to a charitable organization when someone passes away. A bequest is one of the easiest ways to leave a legacy and support Destin Charity Wine Auction Foundation. You can leave a bequest by making a promise in your will, living trust, or codicil. Certain assets, such as an insurance policy, retirement account, or bank account can be left by way of a beneficiary designation.

Someone

You want to make a gift to DCWAF, but are looking for a way to give that provides you with flexibility if your needs change.

Bequests are flexible. You can leave a bequest of a specific dollar amount, a percentage of your estate or even a specific asset, such as a retirement account.

Bequests can be strategic. Bequests can help you establish priorities. You can name a primary beneficiary, but if that person is no longer living, your estate plan can leave the asset to Destin Charity Wine Auction Foundation as a contingent beneficiary.

Bequests are empowering. With a bequest, you retain full ownership and control of your assets during life—you can use your assets as you see fit and can even sell the asset if you need to.

Bequests may save on taxes. If your estate will be subject to estate taxes, a charitable bequest will reduce the amount of tax due by generating a charitable estate tax reduction.

The right solution could be a charitable bequest. You can establish a gift in your estate plan today while preserving your savings for tomorrow.

With a bequest, you can support the causes you care about while saving on potential estate taxes and retaining assets to meet your future needs.

Outright Bequest:

An unrestricted gift in which you give Destin Charity Wine Auction Foundation a specified dollar amount or specified assets, such as securities, real estate, or tangible personal property.

Residual Bequest:

A gift in which you give Destin Charity Wine Auction Foundation all or a percentage of the remainder of your estate after specific amounts designated for other beneficiaries are distributed and estate-related expenses are paid.

Contingent Bequest:

A gift that provides for Destin Charity Wine Auction Foundation upon the occurrence of a certain event if, for example, your primary beneficiary does not survive you.

“I give, devise, and bequeath to Destin Charity Wine Auction Foundation, or its successor (insert dollar amount) dollars* to be used for its general purpose.”

“I give, devise, and bequeath to Destin Charity Wine Auction Foundation, or its successor (insert percent amount) percent of the residue of my estate to be used for its general purpose.”

“In the event that (insert name) predeceases me, I give, devise, and bequeath his/her bequest or share to Destin Charity Wine Auction Foundation to be used for its general purpose.”

Beneficiary-designated property (e.g., retirement plans and insurance) does not pass through your will or trust. Therefore, naming Destin Charity Wine Auction Foundation as beneficiary of a retirement plan or an insurance policy requires that you change your beneficiary designation form with your plan sponsor or insurance provider.

Name: Destin Charity Wine Auction Foundation, or its successor

Address: Destin Charity Wine Auction Foundation 600 Grand Boulevard, Suite 206 Miramar Beach, FL 32550 Federal Tax Identification Number: 20-4475403 (use in place of a social security number)

Relationship: Non-profit organization

*Instead of a dollar amount, you can also indicate a percentage of your total estate or specifically describe property to be given. Bequest provisions designated for a specific program or activity require additional language. Please contact us for more information if you have a specific purpose in mind for your gift.

A blended gift combines a current gift and a planned gift. It’s a way for you to support DCWAF and make your giving go further. A current gift creates the opportunity for you to see the impact of your giving today. Adding a planned gift to your current gift makes it possible for your giving to make a difference in the future. The most popular planned gift remains the charitable bequest. So, it should not be a surprise that the most common blended gift is a combination of a current gift (often a major gift) and a charitable bequest. Below are the 12 most common blended gifts:

If you make annual gifts, please also consider continuing your giving by leaving a bequest in your estate plan.

are a flexible way to give. If your circumstances change, you can change your estate plan.