Lake Forest Community High School

A Closer Look at District 115 School Finance

Lake Forest Community High School

Transparency and fiscal responsibility are top priorities for our community—and priorities we share with you.

In the following pages, you’ll find an overview of how our school finances are managed and how our fiscal decisions directly support student learning. For a more detailed look, we invite you to visit our website. We hope this summary offers a clear, accessible snapshot of how we’re working for our students—and for you.

In District 67 and District 115, we remain focused on academic excellence and our Portrait of a Learner competencies. The bottom line is that strong fiscal stewardship leads to stronger schools. Thank you for your continued investment in our students and the future of our community.

As Chief Operating Officer, I oversee budget planning and support our Boards of Education in ensuring that every dollar spent aligns with student needs and our shared strategic goals.

Budgeting in our districts is a thoughtful, yearround process that involves long-range planning, careful oversight, and ongoing evaluation. We undergo regular independent audits—and we’re proud to consistently receive clean audit reports, reflecting the integrity and precision of our financial practices.

We are proud to deliver exceptional education with the lowest school tax rates in Lake County thanks to sound financial management, transparent reporting, and a shared commitment with our community to responsibly steward the resources that support our students.

Sincerely, Superintendent

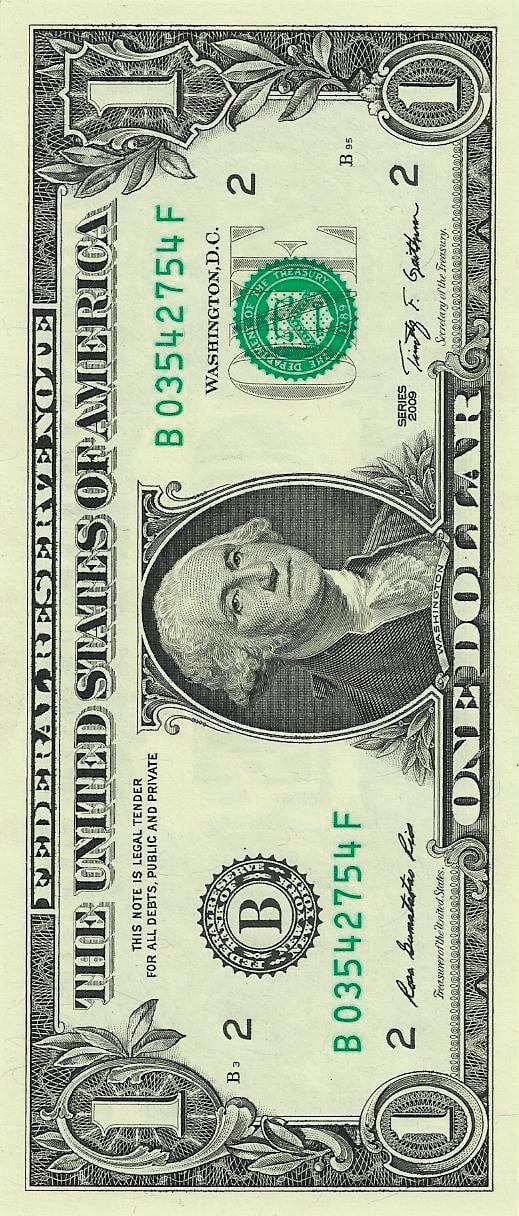

LFHS has the Lowest Tax Rate in Lake County among high school districts

Source: 2023 ISBE General State Aid data

Sincerely,

Chief Operating Officer, CSBO

Source: Lake County Collector tax bill for 2023 tax year

College of Lake County 532

County of Lake

College of Lake County 532

County of Lake

Lake Forest School D67

LFHS Earns Highest Bond Rating for 22nd Consecutive Year A A A

The AAA long-term rating from Standard & Poor’s (S&P) Global Ratings is the highest possible credit designation, allowing the District to borrow at a more favorable rate for taxpayers.

$1,227,619 $51,336,371

Local property taxes are collected in two installments (June and September) and makes up 81.4% of the district’s local operating funds. Other local revenue consists of investment earnings, Little Scouts tuition, food service, facility rentals, and other student-based revenue such as parking, participation, and transportation fees.

Due to the state’s funding formula which takes into account the relative property value within the district’s boundaries, state revenue has been and will remain a very small percentage of both districts’ overall funding.

Source: District 115 Operating Funds Based on the 2023-2024 Budget

$620,458

Federal revenue is minimal and primarily consists of categorical payments, with a significant portion coming from IDEA funds. These federal revenues have restricted uses based on the specific grants they originate from.

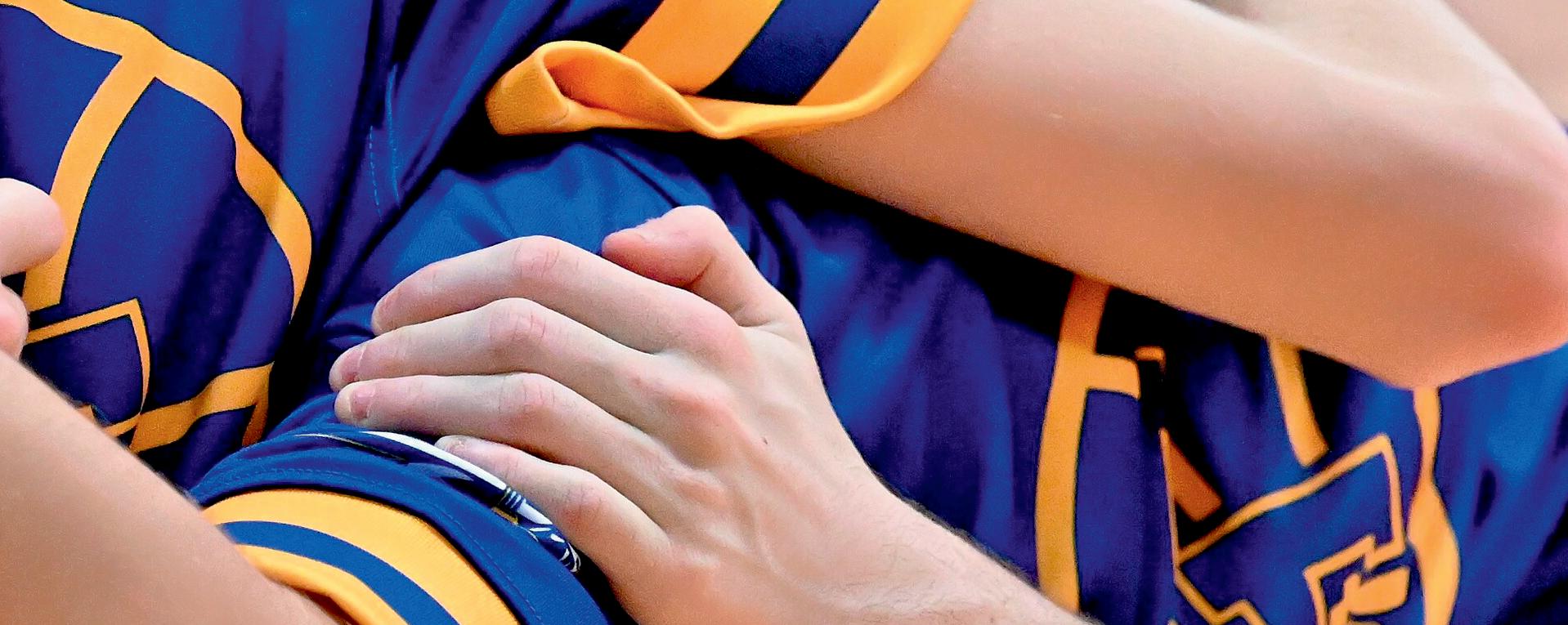

“I always feel supported at LFHS. Teachers are always willing to help me, and this year, parent groups like PALS, Applause, and the APT have offered support, too. Because of them, our Choir, Bel Cantos singing group, One Acts play, the Talent Show, and the musical were all big successes and really fun to be part of.”

BLAKE S., CLASS OF 2028

LFHS

The Illinois school funding model relies heavily on local tax dollars, and District 115 is no exception. 96.5% of the district’s budget comes from local revenue, primarily property taxes, which directly sustain high-quality education, small class sizes, and student programs.

Only 2.3% of the district's funding comes from the state. This reflects the Illinois state funding formula, which assumes communities like ours can primarily support their schools locally. Federal funding (1.2%) is limited, tied to student needs, and restricted to specific programs like special education.

Our ability to deliver strong student outcomes for Lake Forest High School students depends, in part, on local investment. The benefit of this model is that the LFHS community and Board of Education set the standard for the quality of education provided. This is evident in the District 115 Board Priorities, Strategic Plan, and metrics.

District 115 is fortunate to have a community that believes in its schools and invests in students through philanthropy. Parentled organizations like Boosters, PALS, Applause, and the LFHS Foundation provide financial and volunteer support for student experiences beyond what public dollars provide in academics, athletics, and extracurriculars.

The LFHS Association of Parents and Teachers (APT) fosters a strong partnership among parents, teachers, and staff by providing volunteer-driven support for teachers, student enrichment, and parent involvement opportunities. This shared commitment ensures District 115 continues to offer exceptional learning opportunities and a thriving school community.

“

The generosity of our community partners allows us to offer students unique experiences that extend beyond the classroom. Their support enriches our programs, enhances our facilities, and helps us continue our tradition of excellence.”

DR. ERIN LENART, ASSISTANT SUPERINTENDENT

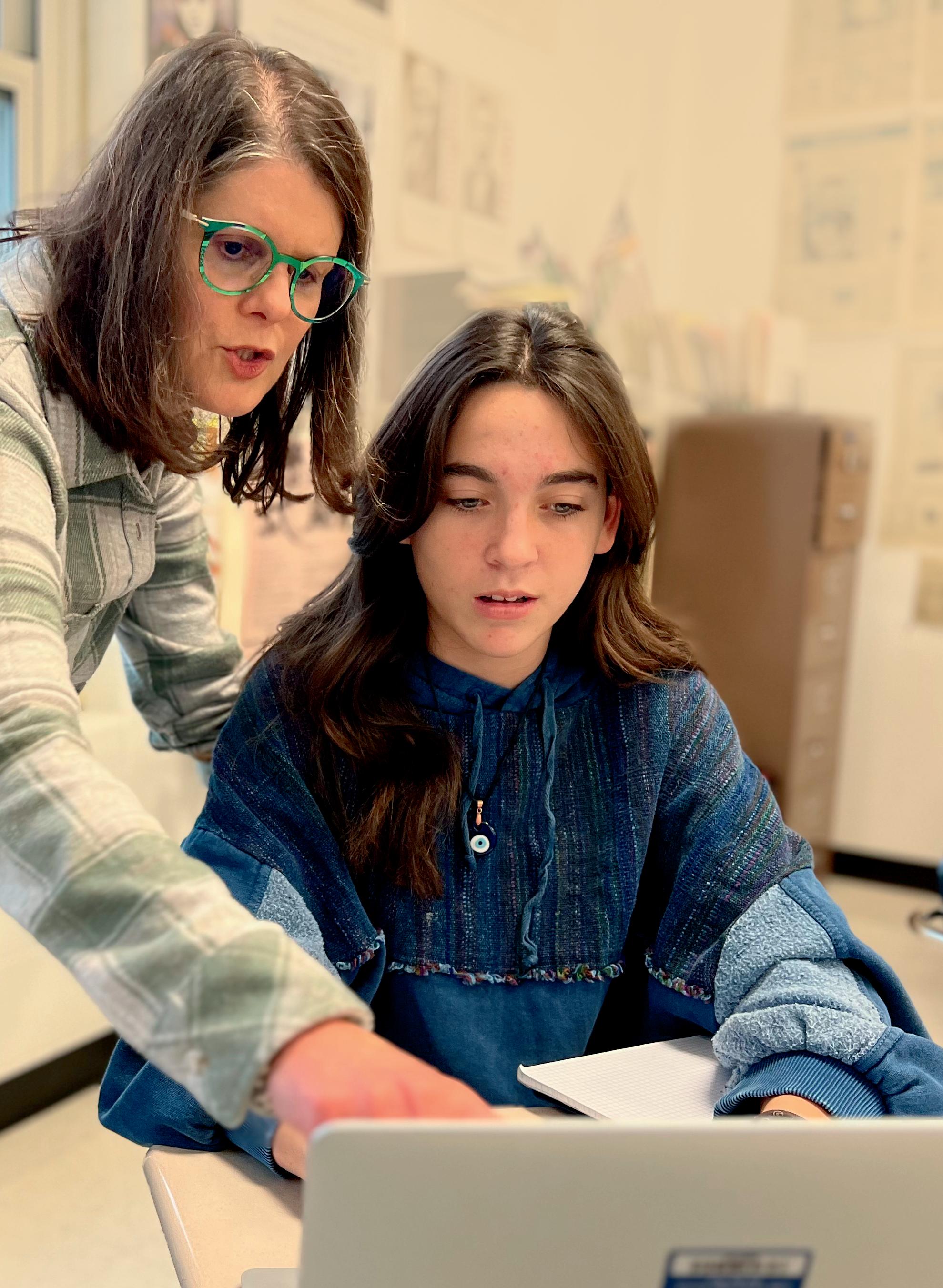

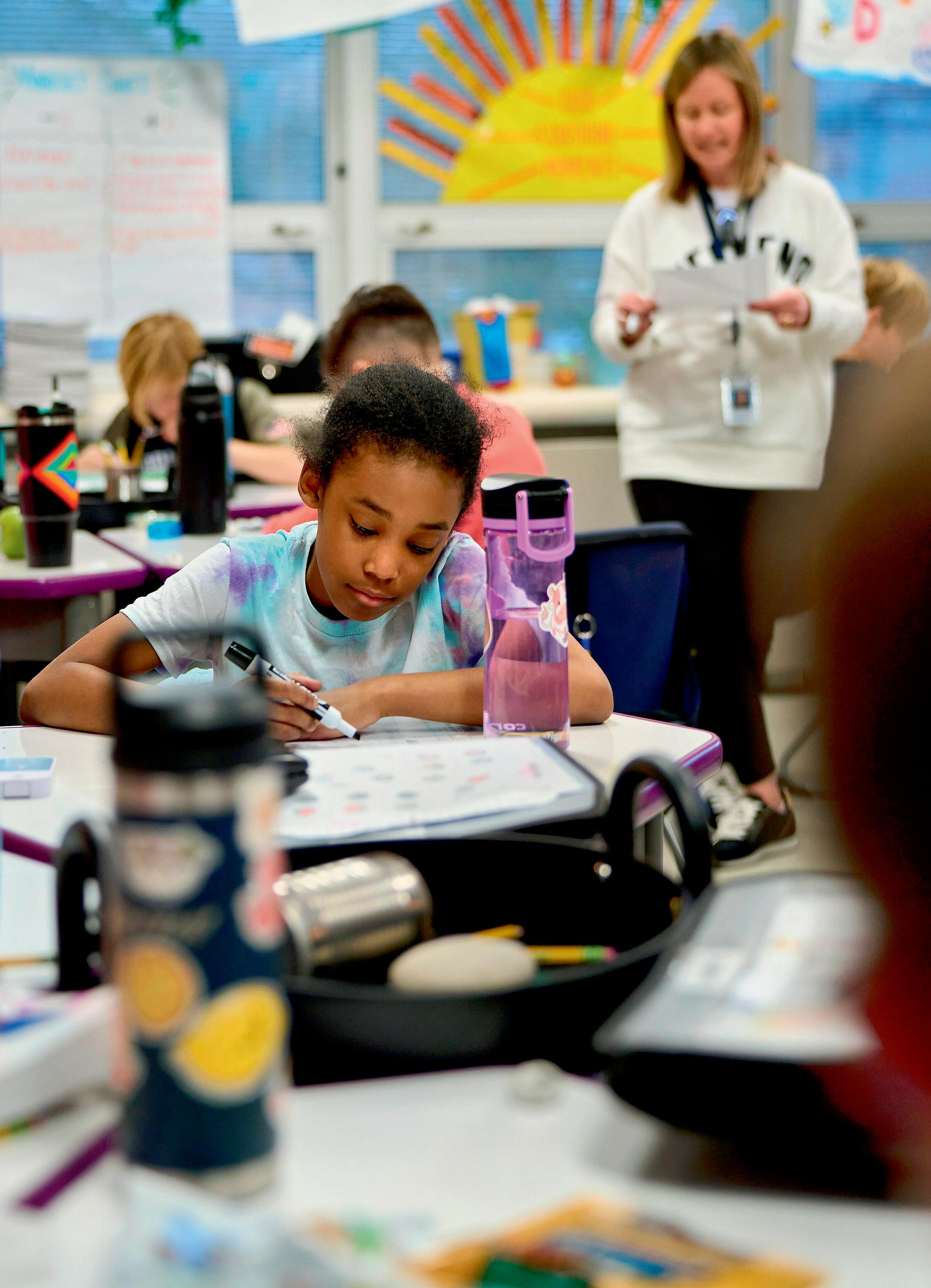

Academic excellence starts with our educators and the support students receive throughout their journey at LFHS. We prioritize attracting and retaining highly qualified teachers and support staff who facilitate exceptional learning experiences.

Our staff and the services that support them and our students make up most of the district’s expenditures in the Salaries & Benefits and Purchased Services categories. These two

expenditures total about 85% of the district’s spending.

Beyond classroom instruction, a dedicated team of psychologists, librarians, teaching assistants, educational service professionals, and administrators provides a safe, engaging, and efficient learning environment that empowers best practices, student needs, and student-centered preparation for college and career.

top 1 % of non-selective Illinois high school districts for academic achievement, as measured by average SAT scores and Science Assessment

91 % of students scored 3+ on Advanced Placement exams

Guided by our community-driven Portrait of a Learner, Strategic Plan, and District 115 Board of Education priorities, LFHS is deeply committed to delivering an exceptional education for every student. Our expert staff use evidence-based practices, data insights, and innovative strategies to create meaningful, highimpact learning experiences.

Source: Data from 2023-2024 school year

99.4%

graduation rate, the highest among all Illinois schools

90% of students participate in Student Activities and/or Athletics

98th

percentile student attendance among Illinois unit and high school districts

LFHS achieves these results with the lowest school district tax rate in Lake County! Did you know?

Referendum Update: On Time and On Budget

In April 2023, the Lake Forest, Lake Bluff, and Knollwood communities approved a $105.7 million referendum to improve Lake Forest Community High School, built in 1935. Transparency and accountability are essential to the district’s project management.

The district’s online dashboard tracks progress and spending in real-time. The dashboard is organized by project phase and includes detailed information on construction and finances.

Phase 1 construction began on March 21. This construction phase is expected to take two years and address major renovations and improvements, including:

• Classrooms for English, Science, Social Studies, World Language, and Special Education

• Robotics and CAD Labs

• Little Theater & Auditorium Lighting

• Bathrooms – All Floors

• HVAC Systems

• LED Lighting

• Fire Sprinkler Expansion

• Roofing and Other Electrical Updates

The project is on time and on budget to provide a safe, warm, and engaging learning environment that prepares our students for their futures.

ENABLING PHASE: JUNE 2023–AUGUST 2024 On Time and Under Budget

Completed During Enabling Phase:

Instructional Spaces

• Relocation of the Arts Department

• Remodel of Five Flexible-Use Classrooms (Lower Level/2nd Floor)

ONGOING

Increased Safety

• Upgraded Entrance Vestibule

• Replacement of Exterior Fieldhouse Door

Accessibility

Three

Furnishings, Security Improvements, and Technology / Mechanical Equipment Upgrades

Referendum Dollars Are Separate from Daily Operations

Referendum funding is dedicated to long-term facility projects, such as upgrades, major renovations, and new construction that enhance learning environments and address infrastructure needs. Referendum funding refers to voter-approved bonds, which are separate from the district's day-to-day operating budget.

We Are Here

PHASE 1: MARCH 2025–AUGUST 2027 Main Construction

NEW DISTRICT 115 REFERENDUM DASHBOARD Track projects, timelines, budgets, and more!

1

PHASE 2: JUNE 2027+ Construction Closeout

2

To further strengthen fiscal oversight, the Finance and Operations Committee, which includes board members and community representatives with expertise in finance and operations, provides guidance and independent review. Their insights help ensure every dollar is spent responsibly and with fidelity to the board’s goals and the community’s expectations.

The Annual Budget Cycle

Financial oversight in Districts 67 and 115 is a multi-layered process designed to ensure transparency, accountability, and strategic resource allocation. The elected Board of Education is the final authority on all financial decisions, receiving and reviewing detailed budget reports monthly. Both districts operate on a fiscal year from July 1 to June 30, mirroring the school year.

• Staffing needs are assessed and evaluated.

• Department and building-level budgets are submitted to the Business Office.

• Business Office and Administration conduct review and analysis of alignment to goals. Adjustments are made.

• Finance and Operations Committee reviews tentative budgets.

• Public display of the tentative budget lasts at least 30 days.

• Board of Education reviews the budget and votes on final board approval.

• Budget is posted online and incorporated into the 5-Year Forecast.

DEC.–FEB. Year-End Projections

District Funds Explained NOV.–DEC. Tax Levy Audit Review SEP.–NOV. 5-Year Projection

CAPITAL PROJECTS FUND Funds facility improvements to maintain safe and modern schools, including:

• Life safety upgrades FINANCIAL INFORMATION Access reports, budgets and more.

• Capital projects

District 67 and District 115 manage finances through funds, each serving a specific purpose to support students and schools. This system ensures resources are appropriately allocated to keep schools running, maintain facilities, and support student programs.

DEBT SERVICE FUND Used exclusively for managing financial obligations, such as:

• Bond principal payments

• Interest on long-term debt

OPERATING FUNDS

Covers daily expenses to keep schools running, including:

• Education

• Food service

• Transportation

• Operations and maintenance

• Community programs

Updates to the DPM cafeteria from the District 67 Capital Improvement Plan will be completed this summer. The renovation is funded through Debt Service Extension Base (DSEB) working cash bonds and generous support from the Spirit of 67 Foundation. The summer renovations are the next step in transforming the cafeteria into a more functional, student-friendly space with updated seating, expanded serving areas, and modernized design.

New grab-and-go counters on both sides of the cafeteria to improve efficiency.

$2,094,880

$271,471 in furniture donated by the Spirit of 67 Foundation funded by working cash bonds utilizing the district’s Debt Service Extension Base (DSEB).

Flexible seating options already provided by the Spirit of 67 Foundation and in use create a more comfortable and collaborative dining experience.

The DPM Hub will be created from a former office and teacher space and converted into a studentfriendly area with a serving station, flexible seating, and a nanowall that opens into the cafeteria.

District 67 maintains safe, efficient, and future-ready schools. Through strategic capital planning, the district ensures that every facility improvement aligns with student needs, educational priorities, and long-term fiscal responsibility. Recent projects focus on safety, infrastructure updates, and learning space enhancements to support academic growth.

WHERE CAPITAL FUNDS ARE ALLOCATED

Safety & Security Upgrades

Camera systems, PA system upgrades, visitor management system, staff RFID badges, public safety radio improvements

Health & Life Safety Projects

Building inspections, classroom compliance upgrades, ADA accessibility, HVAC improvements

Facility Maintenance & Modernization

Roof replacements, flooring repairs, drainage improvements, wayfinding signage

“I like the projects we can do in the new science lab. It was fun when we made paper airplanes and experimented with pushes and pulls. I also like the flexible seating in the library and the desks in my classroom that move around and have space for our materials.”

EMILY H., CHEROKEE, 3RD GRADE

Anchored in the Portrait of a Learner, Strategic Plan, and District 67 Board of Education goals, District 67 ensures academic growth, early literacy development, and high school readiness. Educators create learning experiences that prepare every student for long-term success through rigorous curriculum, data-driven instruction, and targeted support.

93rd

percentile in ELA among non-selective Illinois districts

percentile in Math

96th Did you know?

percentile in Math among non-selective Illinois districts

Did you know?

D67 achieves these results with the lowest elementary school district tax rate in Lake County!

18

average class size

Our investment in high-quality educators and support staff is key to student success. With about 85% of our budget dedicated to salaries and benefits and the purchased services that support staff and students, District 67 is fully focused on efficiently and effectively improving student outcomes.

Smaller class sizes allow for greater individualized attention, helping to close achievement gaps and implement data-driven strategies that support every learner.

Our staffing model enables teachers to deliver rigorous curricula and best practices with the support of instructional coaches, intervention specialists, and student service professionals.

Without our dedicated educators, progress wouldn’t be possible. Their expertise, commitment, and care create a safe, engaging environment where every child is supported academically, socially, and emotionally.

WHERE DOES THE MONEY COME FROM?

$42,058,828

Local property taxes are collected in two installments (June and September) and makes up 88.1% of the district’s local operating funds. Other local revenue consists of investment earnings, food service, facility rentals, and other studentbased revenue such as registration and transportation fees.

$787,325 $1,202,832

Due to the state’s funding formula which takes into account the relative property values within the district’s boundaries, state revenue has been and will remain a very small percentage of both districts’ overall funding.

Source: District 67 Operating Funds Based on the 2023-2024 Budget

Federal revenue is minimal and primarily consists of categorical payments, with a significant portion coming from IDEA funds. These federal revenues have restricted uses based on the specific grants they originate from.

Local Revenue Powers D67

Illinois’ school funding model is designed to be locally driven, and District 67 depends on community investment to maintain the high-quality education families expect. 95.5% of the district’s budget comes from local revenue, primarily property taxes.

State funding accounts for just 2.7% of the district’s revenue, reflecting Illinois' funding formula, which assumes that communities like ours can sustain their schools primarily through local funding. At 1.8%, federal funding is limited and designated for specific student needs, such as special education.

District 67’s ability to deliver exceptional early learning experiences and foundational skills directly results from local support. This funding model allows the Board of Education and community to determine educational priorities that best serve students, ensuring resources are used to strengthen academic progress, classroom innovation, and student well-being.

The District 67 community, through its generous philanthropy and parent support, enhances student learning beyond what tax dollars can provide. We are grateful to the Spirit of 67 Foundation, which funds classroom grants and innovative programs directly impacting student success.

In addition, APT groups at each building foster engagement and school spirit, organizing events and strengthening connections between families and schools.

“Our partnerships with the community provide invaluable resources that help meet the diverse needs of our students. Whether through classroom grants, facilities upgrades, or innovative programs, their contributions directly impact student growth and achievement.”

DR. RENEE FITZSIMMONS, ASSISTANT SUPERINTENDENT OF TEACHING, LEARNING, AND ACCOUNTABILITY

A A A

Source: Lake County Collector tax bill for 2023 tax year College of Lake County 532

District 67 Retains Highest Possible Bond Rating

For the 14th consecutive year, District 67 has been awarded a prestigious recognition as a creditworthy school district. The Aaa bond rating was awarded by Moody’s Investors Services, one of three agencies that assess school districts.

Our financial planning is guided by the District 67 Strategic Plan and Board of Education goals. These goals are academic progress, positive climate and culture, and financial and resource management.

Every financial decision is made to provide our students with a strong foundation for lifelong learning. District 67 is nearing completion of a renewed 10-year Health and Life Safety Plan conducted by Perkins&Will, the district’s architect of record. This plan will identify through building assessments urgent, required, and recommended projects related to building systems, materials and finishes, and accessibility.

The bottom line: Every dollar supports safe, high-quality learning environments that reflect our shared priorities and long-term vision for student success.

As Chief Operating Officer, I partner with the Boards of Education to ensure financial decisions align with district goals and support student learning. Fiscal responsibility is a year-round effort that prioritizes efficiency while maintaining the lowest tax rates in Lake County.

With an updated Capital Improvement Plan nearing completion, District 67 will continue using a strategic, three-tiered approach to facility improvements. By leveraging bonds and the intentional use of Fund Balance, the district can fund critical projects without a referendum or significant impact on operating dollars.

This responsible approach allows for major improvements while preserving classroom resources. The continued success of our schools is made possible through this careful stewardship and the strong partnership we share with our community.

Sincerely,

Sincerely, Superintendent

Dr. Jennifer Hermes Chief Operating Officer, CSBO

D67 has the Lowest Tax Rate in Lake County among elementary school districts

Source: 2023 ISBE General State Aid data