INSIGHTS

CYPRUS RESIDENTIAL MARKET OVERVIEW

Data provided by Cyprus’ Department of Lands and Surveys; data processing and analysis carried out by WiRE (Wire Services Ltd, Wire Wind Ltd and Wire Valuations LLC, collectively WiRE). Cyprus Sotheby’s International Realty and WiRE make no representations or warranties of any kind with respect to the presentation or the content contained on the presentation and disclaims all such representations and warranties as to the condition, quality, accuracy, suitability, fitness for purpose or completeness. Nothing in this presentation shall be regarded as providing financial advice and you acknowledge that the content on this presentation is not suitable for this purpose. Neither Cyprus Sotheby’s International Realty or WiRE nor any of their directors, employees or other representatives will be liable for damages arising out of or in connection with the use of this presentation. This is a comprehensive limitation of liability that applies to all damages of any kind, including (without limitation) compensatory, direct, indirect or consequential damages, loss of data, income or profit, loss of or damage to property and claims of third parties. All material in this presentation is information of a general nature and does not address the circumstances of any particular individual or entity. Nothing in this presentation constitutes professional and/or financial advice nor does any information in this presentation constitute a comprehensive or complete statement of the matters discussed or the law relating thereto. Information in this presentation may not be accurate or current. In particular (but without limitation) information may be rendered inaccurate by changes in applicable laws and other regulations. No action should be taken or omitted to be taken in reliance upon information in this presentation.

LOCAL EXPERTISE WITH A GLOBAL PERSPECTIVE

It is with great pleasure that I share with you our first market report, bringing the latest perspectives on Cyprus real estate.

The Cyprus economy and housing market are poised to accelerate into the remainder of the year. As the real estate market expands, we’ll continue to combine analytical approach and global viewpoint with the local expertise of our real estate professionals to advise our clients with timely and relevant knowledge.

Our global network keeps opening doors to life-changing opportunities. 1000 offices in 81 countries affiliated with Sotheby’s International Realty form one of the strongest and most respected real estate networks in the world.

We are proud to represent the number 1 luxury real estate brand in Cyprus and be the beacon of luxury, knowledge, innovation and trust in the local market.

With gratitude,

Anastasia Yianni Chief Executive Officer

Cyprus Sotheby’s International Realty

Anastasia Yianni Chief Executive Officer

Cyprus Sotheby’s International Realty

Transaction data are provided by Cyprus’ Department of Lands and Surveys, which records all transfers of ownership and registered contracts of sale (including property description, purchase price, date, etc). The data is processed in order to classify each transaction (as some properties are under construction, their description is not exact, or they form part of bigger projects) and are categorised by property type.

The analysis covers the entire area controlled by the Republic of Cyprus, excludes properties sold at auction (foreclosure), and references property values based on the amount declared by the purchaser at the time of the transaction (which excludes any VAT, transfer fees, or other duties levied).

THE REAL ESTATE MARKET

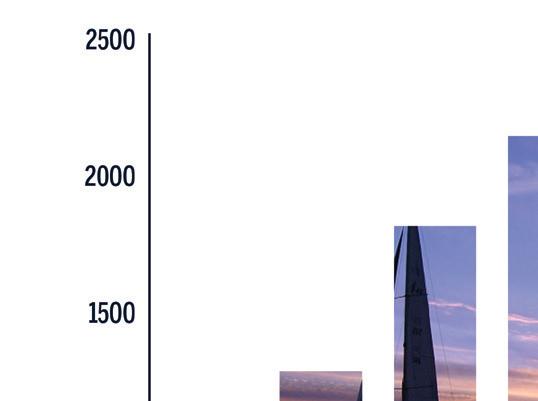

TRANSACTION VOLUME

• Across Cyprus, quarter-on-quarter (Q1 2022 – Q2 2022) transaction volume of houses increased by 9% (to 1.6k) and by 23% (to 2.9k) for apartments. Year-on-year (Q2 2021 – Q2 2022) transaction volume of houses increased by 83% and by 95% for apartments.

• Quarter-on-quarter transaction volume of premium houses (>€500k) increased by 6% (to 171) and by 28% (to 776) for premium apartments (>€200k). Year-on-year (Q2 2021 – Q2 2022) transaction volume of premium houses increased by 159% and by 163% for premium apartments.

• Limassol’s year-on-year transaction volume of houses increased by 270% (to 333) and by 330% (to 305) for apartments.

• Paphos’ quarter-on-quarter transaction volume for apartments increased by almost 50%, to 524. Larnaca was next in line with a 30% and 37% increase in house and apartment transactions, respectively.

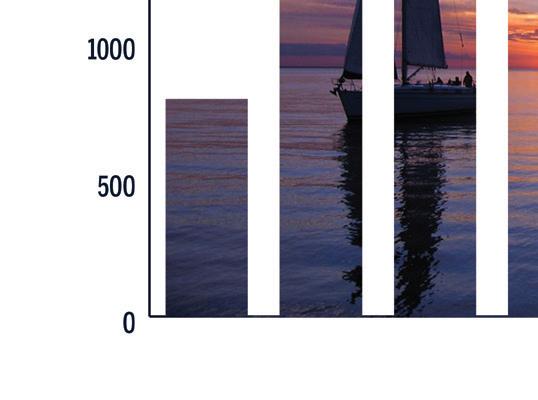

PRICES

• Across Cyprus, median prices of both houses and apartments slightly decreased in Q2 2022, compared to Q1 2022, at €245k for houses and €140k for apartments. However, year-on-year (Q2 2021 – Q2 2022) median prices of houses increased by 3%, while for apartments by 2%.

• Quarter-on-quarter median prices of premium houses (>€500k) decreased by 6% (to €750k) and by 3% (to €291k) for premium apartments (>€200k). Year-on-year (Q2 2021 – Q2 2022) median prices increased by 5% for both premium houses and apartments.

RESIDENTIAL PROPERTY OUTLOOK

• Current position and expectation on whether the trend is up/down in the short and medium term.

• For outlook mention key developments in the economy that might affect future supply/demand over the foreseeable future.

LIMASSOL

CONTINUING GROWTH

Limassol is the business capital of Cyprus and a city of skyscrapers. Relocated international companies are the driving force behind the constant real estate growth in the city.

SINCE Q1 2016

• There have been 19,074 transactions, 6,407 of houses and 12,667 of apartments. Of these, 457 (38%) were at the premium end of the market.

• Total transaction value for residential properties stood at €7.481bn of which €5.425bn (73%) was for the premium end of the market.

• The overall breakdown of residential transactions across the market was 84% of houses under €500k and 51% of apartments under €200k. This apportionment has remained broadly stable throughout, indicating the attractiveness of the premium segment of the market (particularly for apartments).

Residential transactions totalled 1,228 in Q2 2022, of which 45% (558 properties) were of the premium segment of the market.

Premium residential properties are of particularly high demand in Limassol, indicated by the high percentage of houses (67 properties, 39% of the total for Cyprus) and apartments (491 properties, 63% of the total for Cyprus) transacted over the past quarter.

During the first two quarters of 2022, transaction value of residential properties totalled €922m, of which €652m (71%) was for the premium end of the market. It is worth noting that €580m related to apartments, as this is the main premium product of the district.

The median transaction price for premium houses was €913k and €328k for apartments in Q2 2022. Compared to Q2 2021, median prices of houses increased by 15%, and by 25% for apartments.

INCREASING VOLUME AND MEDIAN

TRANSACTIONS’ PRICE DISTRIBUTION

PAFOS

Residential transactions totalled 984 in Q2 2022, of which 13% (130 properties) were of the premium segment of the market.

Premium residential properties are of particularly high demand in Paphos, indicated by the high percentage of houses (54 properties, 32% of the total for Cyprus) and apartments (76 properties, 10% of the total for Cyprus) transacted over the past quarter.

During the first two quarters of 2022, transaction volume of residential properties totalled €403m, of which €156m (39%) was for the premium end of the market. Its worth noting that €116m related to houses, as this in the main premium product of the district.

SINCE Q1 2016

• There have been 14,416 transactions, 7,002 of houses and 7,414 of apartments. Of these, 2,271 (16%) were at the premium end of the market showing the district’s appeal as a destination for more affluent buyers.

Pafos is the cultural capital of the island, a city of villas and low-rise buildings, It has traditionally been popular with foreign buyers. PRICE INCREASE BY 13.1% TRANSACTIONS’ PRICE DISTRIBUTION

The median transaction price for premium houses was €773k and €263k for apartments. Compared to Q2 2021, median prices of houses increased by 1%, and by 13% for apartments. KEY INDICATORS

• Total transaction value for residential properties stood at €3.915bn of which €2.098bn (54%) was for the premium end of the market.

• The overall breakdown of residential transactions across the market was 82% of houses under €500k and 86% of apartments under €200k. This apportionment has remained broadly stable throughout, indicating the attractiveness of the premium segment of the market (particularly for houses).

INCREASING VOLUME AND MEDIAN PRICES

REMAINED STABLE OVER PAST QUARTERS Q1 & Q2 2022

NICOSIA

THE CAPITAL APPRECIATION

Nicosia. the capital of Cyprus, is an amazing and attractive place to be. Commercial and long term rental properties drive the market here.

SINCE Q1 2016

• There have been 15,996 transactions, 4,335 of houses and 11,661 of apartments. Of these, 1,875 (12%) were at the premium end of the market.

• Total transaction value for residential properties stood at €2.736bn of which €0.780bn (29%) was for the premium end of the market.

• The overall breakdown of residential transactions across the market was 94% of houses under €500k and 86% of apartments under €200k. This apportionment has remained broadly stable throughout, indicating the attractiveness of the premium end of the market (particularly for apartments).

Residential transactions totalled 1,179 in Q2 2022, of which 13% (148 properties) were of the premium segment of the market.

Premium residential properties are of particularly medium demand in Nicosia, indicated by the percentage of houses (19 properties, 11% of the total for Cyprus) and apartments (129 properties, 17% of the total for Cyprus) transacted over the past quarter.

During the first two quarters of 2022, transaction value of residential properties totalled €403m, of which €114m (28%) was for the premium end of the market. It is worth noting that €238m related to apartments, as this is the main premium product of the district.

The median transaction price for premium houses was €740k and €239k for apartments in Q2 2022. Compared to Q2 2021, median prices of houses increased by 2%, and by 3% for apartments. KEY INDICATORS 2022 TRANSACTIONS’ PRICE DISTRIBUTION 2016 - 2021

& Q2 2022

LARNACA

HOUSE PRICES 6% UP

Larnaca is one of the oldest cities in Cyprus with lots of history and class, yet the recent years’ development gave it a modern sparkle, and the best is yet to come.

SINCE Q1 2016

• There have been 11,767 transactions, 3,822 of houses and 7,945 of apartments. Of these, 1,904 (9%) were at the premium end of the market.

• Total transaction value for residential properties stood at €1.883bn of which €0.543m (29%) were for the premium end of the market.

• The overall breakdown of residential transactions across the market was 94% of houses under €500k and 89% of apartments under €200k. This apportionment has remained broadly stable throughout, indicating the attractiveness of the premium segment of the market (particularly for high-end apartments).

Residential transactions totalled 921 in Q2 2022, of which 10% (92 properties) were of the premium segment of the market.

Premium residential properties are of medium demand in Larnaca, indicated by the percentage of houses (18 properties, 11% of the total for Cyprus) and apartments (74 properties, 10% of the total for Cyprus) transacted over the past quarter.

During the first two quarters of 2022, transaction value of residential properties totalled €255m, of which €56m (22%) was for the premium segment of the market. It is worth noting that €143m related to apartments, as this is the main premium product of the district.

The median transaction price for premium houses was €610k and for apartments €300k, in Q2 2022. Compared to Q2 2021, median prices of houses decreased by 9%, while for apartments increased by 5%.

INCREASING VOLUME AND MEDIAN PRICES OF

TRANSACTIONS’ PRICE DISTRIBUTION

- 2021

REMAINED STABLE OVER PAST QUARTERS Q1 & Q2 2022

FAMAGUSTA

+ 25% FOR HOUSES

The Eastern part of Cyprus is a famous tourist destination. With the vibrant Ayia Napa and quiet Protaras, this area offers mostly holiday oriented properties.

SINCE Q1 2016

• There have been 4,212 transactions, 2,019 of houses and 2,193 of apartments. Of these, 457 (11%) were at the premium end of the market.

• Total transaction value for residential properties stood at €1.053bn of which €0.461m (44%) was for the premium end of the market.

• The overall breakdown of residential transactions across the market was 86% of houses under €500k and 92% of apartments under €200k. This apportionment has remained broadly stable throughout, indicating the attractiveness of the premium segment of the market (particularly for high-end apartments).

Residential transactions totalled 237 in Q2 2022, of which 8% (19 properties) were of the premium segment of the market.

Premium residential properties are of particularly low demand in Famagusta, indicated by the low percentage of houses (13 properties, only 8% of the total for Cyprus) and apartments (six properties, only 1% of the total for Cyprus) transacted over the past quarter.

During the first two quarters of 2022, transaction value of residential properties totalled €102m, of which €37m (36%) was for the premium end of the market. It is worth noting that €77m related to houses, as this is the main premium product of the district.

The median transaction price for premium houses was €790k and €275k for apartments in Q2 2022. Compared to Q2 2021, median prices of houses decreased by 16%, while for apartments increased by 2%.

INCREASING VOLUME AND MEDIAN PRICES

Fully Licensed Real Estate Advisors

Experts in Real Estate Transactions

Complete Range of Services

Property Portfolio Management

International Rules and Standards

Advantages of the Sotheby’s Brand