CYPRUS REAL ESTATE MARKET: ENTERING A NEW PHASE

We are pleased to present the latest Insights report on Cyprus’s residential real estate market for the third quarter of this year, a publication we prepare for you every quarter.

What are the key trends worth highlighting? First and foremost, the market continues to grow, and the fgures for Q3 2025 confrm its resilience and maturity.

Year-on-year (Q3 2024 – Q3 2025), the number of transactions across the country has increased: house sales are up by 7%, and apartment sales by 6%

The main growth driver remains new construction — modern quality, well-designed infrastructure, and a limited supply of good resale properties make new developments the primary choice for buyers.

The mid- and high-end segments (apartments priced from €200,000 and houses from €500,000) are showing the most active growth. In this category, the number of house transactions has risen by 26%, and apartment transactions by 10%, indicating a shift in buyer preferences toward more thoughtfully designed, high-quality properties.

Across the country, median prices have increased by 5% for houses and 1% for apartments. Even with slight corrections in certain cities, the market remains dynamic, showing real growth in regions where new housing construction is most active.

Pafos and Larnaca are leading in terms of activity, with a growing number of transactions and strong investor interest.

Pafos remains particularly popular among buyers from Europe and the UK, while Larnaca continues to gain momentum thanks to its proximity to the airport and more afordable prices.

Nicosia maintains steady demand, attracting those who value stability and long-term prospects, while Limassol, despite a slight correction, retains its leadership in transaction volume and investment activity.

Key Trends of Q3 2025

• New developments continue to drive the market. Active construction and a shortage of quality resale properties make new projects the main source of supply.

• The premium segment is expanding. Buyers are increasingly choosing mid- and high-end homes and apartments, prioritizing quality and infrastructure over price per square meter.

• The market is stabilizing. After several years of rapid growth, it is entering a phase of steady, more balanced development, with demand gradually shifting toward regions that still have growth potential.

Stay connected,

Anastasia Yianni Chief Executive Ofcer Cyprus Sotheby’s International Realty

*Mid- and high-range residential segments - apartments priced from €200,000 and houses from €500.000

ABOUT INSIGHTS:

Transaction data are provided by Cyprus’ Department of Lands and Surveys, which records all transfers of ownership and registered contracts of sale (including property description, purchase price, date, etc). The data is processed in order to classify each transaction (as some properties are under construction, their description is not exact, or they form part of bigger projects) and are categorised by property type.

The analysis covers the entire area controlled by the Republic of Cyprus, excludes properties sold at auction (foreclosure), and references property values based on the amount declared by the purchaser at the time of the transaction (which excludes any VAT, transfer fees, or other duties levied).

MARKET INSIGHTS Q3 2025

CYPRUS REAL ESTATE MARKET: Q3 2025 OVERVIEW

After several years of rapid price growth, the Cyprus real estate market appears to be entering a more stable and mature phase. However, it’s too early to speak of a slowdown. The latest data for Q3 2025 show that the market is stabilizing, demand remains strong, and buyers are increasingly focused on quality and well-conceptualized developments.

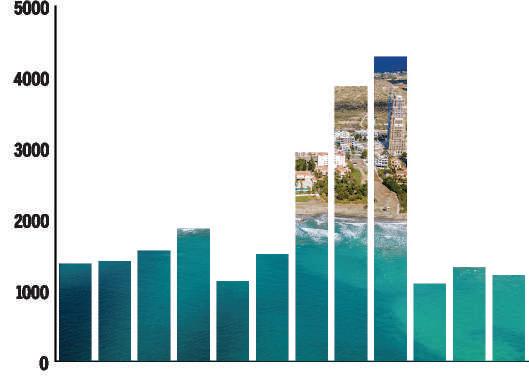

According to Cyprus Sotheby’s International Realty, the total number of transactions across the country rose by approximately 6% year-on-year (Q3 2024 – Q3 2025), confrming the sustained interest of both local buyers and international investors who continue to view Cyprus as a safe and attractive destination.

Limassol remains the market leader in terms of volume, recording 987 transactions in Q3 2025. In the premium segment, a slight price correction has been observed, yet demand remains high. Pafos follows closely with 961 transactions during the same period. Coastal development activity remains strong, and foreign buyer interest continues to grow. The median apartment price increased by 1%, while house prices decreased by 3%, but the region remains highly sought after due to its balance between premium quality and more moderate pricing compared to Limassol.

Larnaca continues to afrm its status as the rising star of the market, registering 907 transactions in Q3 with stable prices. The city is undergoing active transformation — new projects around the port and marina are turning Larnaca into a modern coastal hub with attractive prices for new-build properties.

In Nicosia, demand is growing for contemporary homes and apartments in business districts. House median prices in the region increased by 11% year-on-year. Famagusta shows moderate growth, driven mainly by new developments and second-home purchases.

The key takeaway from the third quarter of 2025 is not just the increase in transaction volume but the maturation of the market. Buyers are becoming more discerning, focusing on high-quality

new developments, efficient layouts, and reliable developers. Projects at advanced stages of construction with well-planned infrastructure continue to attract both investors and end users. Overall, Cyprus remains resilient. Growth has become steadier, but confidence is as strong as ever. From the glass towers of Limassol to Larnaca’s emerging seafront, the island continues to evolve — shaping a market where what truly matters is not only the sea view, but also real value, comfort, and quality of life.

RESIDENTIAL PROPERTY SALES DISTRIBUTION PER REGION IN Q3 2025

*Mid- and high-end segments are defined as apartments priced from €200,000 and houses from €500,000.

LIMASSOL

Limassol is Cyprus’s premier real estate hub A cosmopolitan business city where sustained demand for mid- and high-end properties continues to shape a mature, premium-driven market.

In Q3 2025, 987 residential transactions were registered in Limassol, of which 69% (678 properties) belonged to the high & mid-range segments of the market.

Demand for high- and mid-range residential properties remains particularly strong. Limassol accounted for 26% of all house sales in Cyprus (50 properties) and 48% of all apartment sales (628 properties) during the quarter.

Since Q1 2024, the total transaction value of residential properties reached €2.7 billion, of which €2.3 billion (84%) corresponded to the high & mid-range segment.

In Q3 2025, the median transaction price was €707,000 for houses and €250,000 for apartments. Compared to Q3 2024, the median price decreased by 21% for houses and by 5% for apartments.

KEY INDICATORS

VOLUME AND MEDIAN PRICES

PAFOS

Pafos emerges as Cyprus’s new lifestyle hotspot

With strong demand for premium villas and scenic living, the region is rapidly evolving into a key destination for highend buyers.

In Q3 2025, 961 residential transactions were recorded, with 33% (320 properties) in the high & mid-range segment of the market.

High & mid-range houses were in particularly high demand, accounting for 60% of all such house transactions in Cyprus (115 properties). Apartment transactions totaled 205 units, representing 16% of the national fgure.

Since Q1 2024, the total transaction value of residential properties reached €1.7 billion, of which €951 million (55%) was attributed to the high & mid-range segment.

In Q3 2025, the median transaction price for high & mid-range houses was €730,000, and €307,000 for apartments. Compared to Q3 2024, median prices decreased by 3% for houses but increased by 1% for apartments.

KEY INDICATORS

NICOSIA

Nicosia — the capital city with stable demand driven by international companies, embassies, and government institutions.

In Q3 2025, 852 residential transactions were recorded, of which 22% (186 properties) belonged to the high & mid-range segment.

This segment included 178 apartments (13% of the total for Cyprus) and 8 houses.

Since Q1 2024, the total transaction value reached €1.0 billion, with €404 million (40%) attributed to the high & mid-range segment.

In Q3 2025, the median transaction price was €707,000 for houses and €250,000 for apartments. Compared to Q3 2024, median prices increased by 11% for houses and by 3% for apartments. KEY INDICATORS

VOLUME AND MEDIAN PRICES

LARNACA

Larnaca — a dynamic coastal city with growing residential demand driven by its strategic location and expanding infrastructure.

In Q3 2025, 907 residential transactions were completed, of which 25% (226 properties) were in the high & midrange segments.

High & mid-range properties included 201 apartments (15% of the total for Cyprus) and 25 houses (13% of the total for Cyprus).

Since Q1 2024, the total transaction value for residential properties reached €1.1 billion, with €448 million (41%) attributed to the high & mid-range segment.

In Q3 2025, the median transaction price for high & mid-range houses was €618,000, and €239,000 for apartments. Compared to Q3 2024, median prices decreased by 2% for houses and remained unchanged for apartments.

INDICATORS

FAMAGUSTA

Famagusta — a niche coastal market focused on high-end leisure properties.

In Q3 2025, 263 residential transactions were recorded, with 25% (65 properties) in the high & mid-range segments.

Within this segment, 37 apartment sales were registered (3% of all apartment transactions in Cyprus), indicating that the segment remains relatively small. In contrast, house sales reached 28 units, representing 15% of all houses sold.

Since Q1 2024, the total transaction value for residential properties reached €364 million, of which €138 million (38%) belonged to the high & mid-range segment.

In Q3 2025, the median transaction price was €605,000 for houses and €250,000 for apartments. Compared to Q3 2024, median prices increased by 6% for houses but decreased by 5% for apartments.

During this period, Famagusta experienced a release of deferred demand from the frst and second quarters, aligning with overall market trends. Growth was primarily driven by new developments.

KEY INDICATORS

Pafos Vasileos Konstantinou, 1, office 302, 8020

Limassol Olympic Residence A15 353, 28th October, 3107

Larnaca Unit 3, Giannou Kranidioti 2, 6045

Registration No.: 1013 | License No.: 517/E.

© 2025 Cyprus Sotheby’s International Realty. All rights reserved. Cyprus Sotheby’s International Realty® and the Sotheby s International Realty ogo are service marks licensed to Sotheby s International Realty Afliates C and used with permission. ONE Sotheby’s International Realty fully supports the principles of the Fair Housing Act and the Equal Opportunity Act. Each franchise is independently owned and operated. Any services or products provided by independently owned and operated franchisees are not provided by, afliated with or related to Sotheby s International Realty Afliates C nor any of its afliated companies. The information contained herein is deemed accurate but not guaranteed.

Data provided by the Cyprus Department of Lands and Surveys. All data analysis, processing, and insights have been prepared exclusively by Cyprus Sotheby’s International Realty. Cyprus Sotheby’s International Realty makes no representations or warranties regarding the content of this report and disclaims all such representations and warranties, including but not limited to those related to condition, quality, accuracy, suitability, ftness for purpose, or completeness. This report should not be considered fnancial advice, and you acknowledge that its content is not intended for that purpose.

Cyprus Sotheby’s International Realty, its directors, employees, or other representatives shall not be held liable for any damages arising from or in connection with the use of this report. This is a comprehensive limitation of liability that applies to all types of damages, including (without limitation) compensatory, direct, indirect, or consequential damages, loss of data, income or proft, loss of or damage to property, and third-party claims. All material in this report is provided for general informational purposes only and does not consider the specifc circumstances of any individual or entity. Nothing in this report constitutes professional and or fnancial advice, nor does it ofer a comprehensive or complete statement of the matters discussed or the laws applicable thereto. The information may be inaccurate or outdated due to changes in applicable laws and regulations. No action should be taken or omitted to be taken based solely on this report.