VOLUME & INVESTORS 2024*

1.7

BN

BN DKK 26% 7.1

BN DKK 13% OTHER ZEALAND

BN DKK 13% OTHER ZEALAND

1.8

BN DKK 1% AALBORG 15.0

BN DKK 28%

1.7 BN

BN

Source: ReData

1.7

BN

BN DKK 26% 7.1

BN DKK 13% OTHER ZEALAND

BN DKK 13% OTHER ZEALAND

1.8

BN DKK 1% AALBORG 15.0

BN DKK 28%

1.7 BN

BN

Source: ReData

Dear reader,

Welcome to ”RED Danish Investment Atlas 2025”.

After a long period with market instability impacted by increasing interest rates and yield requirements, as well as uncertainties about the future, the past year brought several positive turning points. Although the high financing costs continued to limit the investment activity in 2024, the commercial real estate market also experienced a gradual stabilisation, where several interest rate cuts, greater investor demand, a smaller gap between in the price expectations, as well as strong underlying occupier markets, became a reality.

Therefore, it will be interesting to see what 2025 brings for the commercial real estate market in Denmark. Expectations of additional interest rate cuts, coupled with solid underlying market conditions, are expected to contribute to an increased liquidity in the market and a gradual recovery of the market during the year.

On the following pages, you can get a detailed insight into the Danish commercial real estate market in the past year, as well as RED’s forecast on how we expect the market to develop in the coming year.

The report is structured as an easily accessible reference work, where you can either get a quick overview of a single segment or immerse yourself in all the tendencies segment by segment.

The data for this year’s report is made in collaboration with ReData, which collects and validates data on every single transaction on the Danish real estate market.

Enjoy the report.

Nicholas Thurø, Managing Partner Cushman & Wakefield | RED

In some ways, the commercial real estate market in Denmark was completely stagnant in 2024, but in others, much was happening. In the following, we will summarize some of the trends that defined the market in the past year.

”In the past year, we had to acknowledge that when the significant interest rate hikes hit the market, the commercial real estate market took the elevator down, and from then, it has slowly climbed back up the stairs. Consequently, 2024 also became a year where we had hoped and believed to see a higher activity than we did. Fortunately, there were also several bright spots throughout the year where the buyers and the sellers aligned more closely. Now, as we enter 2025 with expectations of further interest rate cuts, there is strong optimism in the market. While I do not believe that we will see activity levels comparable to those from 2022, I do believe that we will see an increasing investment activity in 2025. We always try to make predictions, yet we are still often surprised, but my cautious estimate is that we will see a transaction volume that is 20-30% higher in 2025 than in 2024.”

Nicholas Thurø, Managing Partner, Capital Markets

“In recent years, light industrial assets have proven to be highly liquid, and unlike many other property segments, the yields have actually been decreasing. Foreign value-add capital has, in particular, been competitive in acquiring these assets. Therefore, foreign investors have successfully built significant portfolios. The business plan is simple: in the areas servicing the growing metropolises, industrial areas are removed in favour of residential development, resulting in an increasing imbalance between the supply and demand, which continues to drive up the rent levels. The big question remains whether there is enough capital to absorb all of the assets when these business plans are to be executed, and large portfolios of light industrial properties are targeted the core market (e.g., pension funds), which typically do not want broad exposure to this exact asset class.”

Kim Søberg Petersen, Partner, Capital Markets

“We have been seing a very narrow market on the high streets of Copenhagen in recent years, as the tenant interest was primarily coming from luxury retailers targeting Amagertorv. However, in 2024, we saw a much broader market, where low-end and mid-market brands were also active in the search for retail leases and where the interest was, therefore, also directed towards the other high streets. Although it has taken several years for the high streets of Copenhagen to recover after challenges such as rising e-commerce, covid-19, and the interest rate hikes, it finally seems like we are getting there, and thankfully, we are also looking ahead to 2025 with positive expectations for the occupier market.”

Kristian Vinggaard Partner, Retail

“When one challenge after another hit the retail industry, uncertainties about the future led to a slowdown in both the occupier and investment markets. Fortunately, the high streets of Copenhagen have made a very strong comeback in recent years, and a consensus now seems to have emerged about the rent levels for the different areas on the high streets. At the same time, many of the key investors began turning their interest back toward this segment in 2024. As a result, we believe to see an increasing investor activity in 2025 as investors gain confidence in both the rent levels and the yields.”

Lior Koren, Partner & Head of Capital Markets

“Year after year, we see newly built residential properties at the top of the investors’ shopping lists, and looking at the Copenhagen market, there has been good reason for it. Both the rent levels and the owner-occupied housing prices have risen year after year – no matter the challenges facing the market. However, we residents’ cannot continue to pay a larger share of their incomes, so there must be a limit to how high the housing burden can be. The question is just where that limit lies. Judging by the investors’ insatiable appetite for this segment, we have not reached that limit yet, and it is unlikely that they believe that we will hit it any time soon.”

Kjeld Pedersen Partner, Capital Markets

“Looking back at 2024, the office occupier market tells both positive and negative stories. What we saw was a market that split in two. If tenants wanted a modern, larger office located centrally in Copenhagen in a newly constructed multi-tenant property with attractive shared facilities, they had to bring out both a magnifying glass and their wallet. On the other hand, those seeking smaller offices in older buildings had more options, and the landlords were willing to offer quite attractive lease terms to attract the tenants. As we head into 2025, all signs indicate that this polarisation of the office market will continue.”

53.5 BN DKK

The transaction volume increased in 2024, although the interest rate levels continued to influence the investment activity.

Although Danish capital accounted for twothirds of the volume in 2024, the Danish investors sold more than they acquired.

The residential segment maintained its position as the investors’ preferred property segment (accounting for 40% of the volume).

While the volume was equally divided, the number of asset deals was almost 20 times as high as the number of share deals.

While the competition between the logistics and office segment was close in 2023, the logistics segment clearly secured the second place in 2024.

Positive market trends and expectations of further interest rate cuts fostered a renewed optimism in the investment market towards the end of the year. The transaction volume was calculated on January 15th , 2025, and it is customary for significant volumes to be recorded retroactively. For instance, the total transaction volume for 2023 on the same date last year was 22% lower than the currently known volume for 2023.

New investors were hesitant to enter the market. Consequently, nine of the ten largest investors in 2024 (all except Velkomn) were well-established investors.

In 2024, the investors sought less risk diversification than in 2023, resulting in a higher volume of large transactions and fewer small ones.

The acquisition of Denmark’s largest logistics centre in Horsens marked the largest stand-alone transaction ever recorded in Denmark.

A lack of transactions with prime properties in Copenhagen and a pursuit of higher yields became defining factors for the geographic distribution of the volume.

For several years, the Danish real estate market has been characterised by a high demand from foreign investors, which has benefited from the low interest rates and the associated leverage effect in commercial real estate. But what has the recent higher interest rate environment meant for the foreign investors’ acquisitions?

2017-2022

2023-2024

Source: ReData

In the period from 2017-2022, foreign investors accounted for between 42% and 50% of the annual investment volume in the Danish real estate market, where particularly large transactions were dominated by foreign capital. However, in the past few years, the foreign share has dropped significantly (in 2024, foreign investors accounted for about 32% of the invested capital), and at the same time, we have seen more foreign investors selling off their properties.

For a long period of time, the combination of low interest rates and the possibility of high leverage (higher gearing) made residential investments very attractive. As a result, foreign investors allocated 53% of their capital to the residential segment in the period from 2017 to 2022 ( Figure 6).

The higher interest rates seen in recent years have made it nearly impossible for leveraged investors to generate satisfactory returns

on their equity, which has also affected their investment activity. Foreign investors went from investing an average of DKK 21 bn annually in Danish residential properties in the period 2017-2022, to investing an average of around DKK 6 bn in the past two years. Simultaneously, the share of their capital allocated to residential properties has dropped from 53% to 36%.

In the past two years, foreign investors have increasingly turned towards the logistics segment (including light industrial properties). Consequently, the segment’s share of capital invested increased from 14% in 20172022 to 39% in 2023-2024. This shift in capital allocation is likely due to a combination of the investors’ expectation that a strong tenant demand in the logistics sector will result in positive rent growth and the fact that the higher yields in logistics properties (compared to residential properties) still allow investors to achieve a leverage effect on their equity through debt financing.

Between 2017-2022, foreign investors’ divestments only accounted for 34% of their acquisitions, meaning that a significantly higher number of Danish properties ended up in foreign hands ( Figure 7). However, in the past two years, foreign investors have sold off for DKK 26.9 bn but only invested DKK 31.7 bn – equivalent to a divestment share of 85% relative to their investment volume. Thus, the foreign investors have not only been buying less – they have also been more active sellers.

However, foreign investors have not divested all property types equally (Figure 8). The office and retail segments are the two segments where investors have been selling off the most. In contrast, foreign investors have held on to their residential and logistics properties.

Timing is everything in real estate investments, and it can be difficult to know when the market has bottomed out and it is time to buy. However, many signs suggest that we have reached a point where investors across segments need to start paying attention if they want to get in early and be a part of the turnaround.

The real estate market always follows a cycle – and where a segment is in the cycle at any given time depends on a range of underlying factors such as economic indicators (macroeconomic conditions, financing terms, and political stability), the investor confidence (expectations for development in rents and yields), as well as the historical conditions (market liquidity).

Since the real estate market turned in 2022, we have generally moved from being in a downward market to being in a cautious market, which was still characterised by significant uncertainties and adjustments, to now having reached a turning point where trends are becoming more positive (stable prices, higher demand, better economic conditions) – and the next phase will be the early growth phase.

Source: Cushman & Wakefield Research

However, when diving into the individual segments, there are significant differences in how far each segment has progressed ( Figure 9). In Denmark, the largest segments can be ranked as follows:

The segment is always in high demand, and we expect to see both increasing rent levels and yield compression in 2025. It can actually be argued that the segment is already on the verge of entering the early growth phase.

We continue to see a strong investor demand in the logistics segment, but the tenant demand has slightly decreased, and we expect to see a stable to slightly positive development in both rent and yield levels in the segment in 2025.

The retail segment can be difficult to place, as there has been a lack of trans actions involving prime assets in recent years. Nevertheless, ongoing processes and dialogues indicate that the liquidity is returning to the market, and we have also seen a strong occupier market that has created security regarding rent levels. However, we do not expect the market to enter the growth phase immediately, as increased liquidity is still needed.

The liquidity remains limited in the office segment, and the development of rent levels will vary greatly from area to area. We also do not expect any general yield compression in the near future. Therefore, the segment remains at the boundary between the cautious phase and the turning point.

Of course, it is not enough that the market is moving in the right direction if the asset values do not align with the associated risks. The figure on the left side shows that, on a European level, all of the major segments are assessed to be underpriced according to Cushman & Wakefield’s index.

When looking at the Danish market, it took quite a long time before we saw an adjustment in the prices, which is why the Danish assets were overpriced for a long period of time. However, it now seems that the timing is right, with prices having been adjusted, interest rates having fallen slightly, risk premiums has increased, and positive expectations for the rent development in several of the segments.

This implies that Cushman & Wakefield also currently asses all of the four major segments to be underpriced when looking at the Danish market. Given the current expectations, investors should, thus, be able to generate attractive risk-adjusted returns if they reenter the market now.

It should be noted that there are also differences between asset types within the asset classes. For example, we do not believe that secondary office properties located outside Denmark’s largest cities have yet reached their bottom, as liquidity is low, vacancy rates are increasing, and rent levels are expected to be under pressure in the near future. Therefore, despite the many positive trends indicating that investors can generate reasonable returns in the coming years, they should still remain cautious when considering their business plans. This

is one of the reasons why we expect that the investors will, to some extent, continue to wait for more clarity before reentering the market.

As the commercial real estate market in Denmark has become highly internationalised during the past decade, it is no longer sufficient to assess the conditions in the Danish market alone, as a significant share of the investors are active across borders and compare conditions between countries. Therefore, it is important to note that there are both reasons for and against investors placing their capital in the Danish real estate.

In this regard, it is noteworthy that we have seen smaller price adjustments in Denmark compared to many other countries in the past couple of years. As a result, prices are also expected to increase to a smaller extent when they begin to increase again. Furthermore, property owners in Denmark have not, in the same way, been forced to sell, which is why some sellers will remain reluctant to divest until the prices better match their price expectations.

Although the investment activity remained limited in 2024, the year was characterised by an increased stabilisation and a smaller gap between the buyers’ and sellers’ price expectations. With expectations of improving financing conditions, growing investor optimism, and strong underlying occupier markets, we anticipate an increased activity in 2025, where foreign investors will once again increase their presence on the Danish investment market.

Although 2024 did not turn out to be the comeback year that we had hoped for, we saw several positive trends in the transaction market, where the buyers and the sellers were increasingly aligned in their price expectations and where several new benchmarks materialised. With expectations of additional interest rate cuts in 2025 and a growing optimism in the market, we anticipate that the buyers’ and the sellers’ price expectations will align even more, leading to a higher investment activity in 2025.

The expectation of a higher investment activity in 2025 is supported by our investor survey from early 2025, which shows that the share of investors expecting to acquire more than they will divest has increased to 71%, while only 6% anticipate divesting more than acquiring ( Figure 10).

However, the development in the interest rates will be crucial for the investor appetite and the overall market trends. With continued high interest rates at the beginning of the year, the transaction volume is not expected to reach the same high levels as seen in the years prior to the interest rate hikes. Instead, we anticipate a gradual market recovery, with

Danish and foreign investors expected to start increasing their investment activity.

Both the office, retail, and logistics segments were generally characterised by an increasing stabilisation in the occupier market in 2024. Conversely, the residential segment experienced shorter offering periods for rental housing nationwide and increasing rental levels in both Copenhagen and Greater Copenhagen. At the same time, the owner-occupied market proved resilient, maintaining consistently high condominium prices.

In 2025, residential properties are, therefore, expected to be in high demand. The investors’ confidence in the residential segment is reflected in our investor survey, where almost 80% of the investors consider residential properties to be the segment with the best potential to perform well in the coming six months ( Figure 11). Consequently, Danish residential assets are anticipated to remain a key target for investors in 2025.

In the pursuit of higher returns, we have observed an increasing demand for value-add properties across the segments. For instance, investors in the residential segment

are increasingly pursuing sell-off cases and forward deals, while in the logistics segment, investors have increasingly focused on well-located industrial properties with rent potential. With a significant share of the capital raised by property funds in recent years being allocated to value-add and opportunistic investments, we anticipate seeing a continued strong demand for assets with this risk profile in 2025 ( Figure 12). However, if our expectations of further interest rate cuts materialise in 2025, we also expect to see a higher investment activity with core assets.

Alongside the investor focus on residential assets and value-add properties, we expect sustainability to become an increasing priority for both tenants and investors in 2025. This expectation is supported by our investor survey from Q1 2025, which shows that more than 80% of the investors have an ESG strategy in place. While most of the investors believe that the initiatives implemented through ESG strategies enhance the value of their properties (lower yield requirements) and ensure long-term success of their organisations, 40% of the investors expect the initiatives to secure a higher tenant demand.

Continued on next page

With expectations of additional interest rate cuts in 2025 and a growing optimism in the market, we anticipate that the buyers’ and the sellers’ price expectations will align even more, leading to a higher investment activity in 2025.”

Nicholas Thurø Managing Partner, Capital Markets, RED

Figure 11: Investor Confidence Index – Segment with best potential

Continued from previous page

After a long period of macroeconomic fluctuations and a frozen investment market, we saw a greater consensus on market prices at the end of 2024. Looking ahead, we expect that the prospects of further interest rate cuts, coupled with strong underlying occupier markets, will result in an increased investor demand. While the yield requirements for most assets in the Danish market are expected to remain stable, we anticipate that the yield curve for the most attractive and sought-after assets across segments will turn, leading to a downward pressure on yield requirements – particularly within the residential segment.

This expectation is supported by our investor survey, showing that the majority of the investors (68%) anticipate their portfolio value to increase over the next six months,

while only 1% expect a decline in their portfolio value ( Figure 13). Most of the investors anticipate that yield requirements will be the main factor driving the changes in their portfolio values. However, developments in rent levels and financing conditions are also expected to have an important impact.

When it comes to expectations for future financing conditions, the investors have become significantly more optimistic than previously ( Figure 14). While 93% of the investors expect improved or unchanged financing conditions during the next six months, only 7% anticipate worsening financing conditions.

Therefore, after a long period with macroeconomic fluctuations, it now seems that

Figure 13: Investor Confidence Index – Portfolio value

How do you see the value of your portfolio developing during the coming six months?

there is light at the end of the tunnel, with optimistic expectations for the investors’ financing conditions, an increased investor demand, and a higher transaction activity.

The development in the interest rates will, however, continue to be a key factor in shaping the investment market in 2025. In the following, Danske Bank’s Chief Economist, Las Olsen, will provide his insights into how interest rates are expected to evolve in 2025 and how they will impact the real estate market.

The index monitors 147 of the most active investors’ expectations for the Danish commercial real estate market during the coming six months. The broad coverage ensures that the findings are representative reflections of the investors’ confidence in the Danish market. By conducting the survey on a biannual basis, we are also able to track changes in the confidence.

Figure 14: Investor Confidence Index – Financing conditions

What is the future outlook for your financing compared with your current financing? (In terms of the financing of new acquisitions or the refinancing of your existing properties)

LAS OLSEN

Las Olsen is Chief Economist at Danske Bank. Las Olsen has been with Danske Bank since 2007 and has a master’s degree in Economics from the University of Copenhagen.

Danske Bank is a Nordic bank headquartered in Denmark. The bank, which is the largest in Denmark, advises both private and business customers as well as institutional customers.

How do you expect the short- and longterm interest rates to develop in 2025?

We expect that the European Central Bank, and thus Danmarks National Bank, will continue to lower the interest rates. The current interest rate is so high that it is dampening the economy, and we do not believe that this will remain necessary. On the contrary, it would make good sense to lower the interest rate significantly to avoid the risk of the inflation once again being stuck well below two percent, as it was before the corona crisis. The long-term interest rates have risen recently, which is largely driven by the development in the US, but we believe that the development in Europe suggests they (RED: the interest rates) will move downward again, and we expect the 3.5% loan to become the benchmark.

How do you expect the developments in financial markets will affect the real estate market?

The financial markets mainly influence the real estate market through the development in the bond yields and their effect on the yield requirements at which investment and commercial properties are traded. While mortgage bonds are traded on a relatively liquid market, where the price adjusts relatively quickly, there is a significantly more inertia when it comes to the price setting on the market for investment and commercial properties. The commercial real estate market is, in many ways, like an oil tanker. It only reacts to a few factors, and it adjusts relatively slowly. The adjustment to the higher interest rates has been underway for the past two years, resulting in a significant upward pressure on the yield requirements, especially for the properties where the yield requirements had dropped to very

low levels before the interest rate hikes. However, as we enter 2025, the adjustment in yields is almost complete, and therefore, we do not believe that there will be a need for further increases in the yield requirements unless the mortgage bond yields begin to rise once again – which we do not expect.

Do you expect the ESG profile of companies and properties to affect the investors’ financing conditions in the coming year? And if so, how?

Yes, it will over time play an increasingly important role, alongside the many other factors that are already considered. It is an ongoing process that is only moving in one direction, so it is a good idea to prepare and ensure that the properties are ready for this shift. Not only for the sake of the bank but also because the real estate market will increasingly favour a strong ESG profile.

Volume & Investors

Transactions & Key Figures 24 26 27 28 30 32 36

Geographical Distribution

Key Figures for Asset Types

Highlight: Is the Sell-off Strategy a Temporary Trend?

Highlight: Rental Housing in High Demand

Expectations for 2025

21.2 BN DKK

The volume increased with 11% from 2023 to 2024 (before transactions registered retroactively).

The residential segment remains the largest property segment in Denmark (40% of the total volume).

The year ended strongly, with more than 40% of the annual volume being invested in the last quarter of the year.

An increase in both the number and the volume of larger transactions drove the average transaction size up by 23%.

Danish capital accounted for three-quarters of the investments made in the residential segment.

NREP was particularly active in acquiring residential rental properties with the purpose of selling the units on the owner-occupied market.

The transaction volume was calculated on January 15th , 2025, and it is customary for significant volumes to be recorded retroactively. For instance, the total residential transaction volume for 2023 on the same date last year was 12% lower than the currently known volume for 2023.

Source: ReData

COPENHAGEN

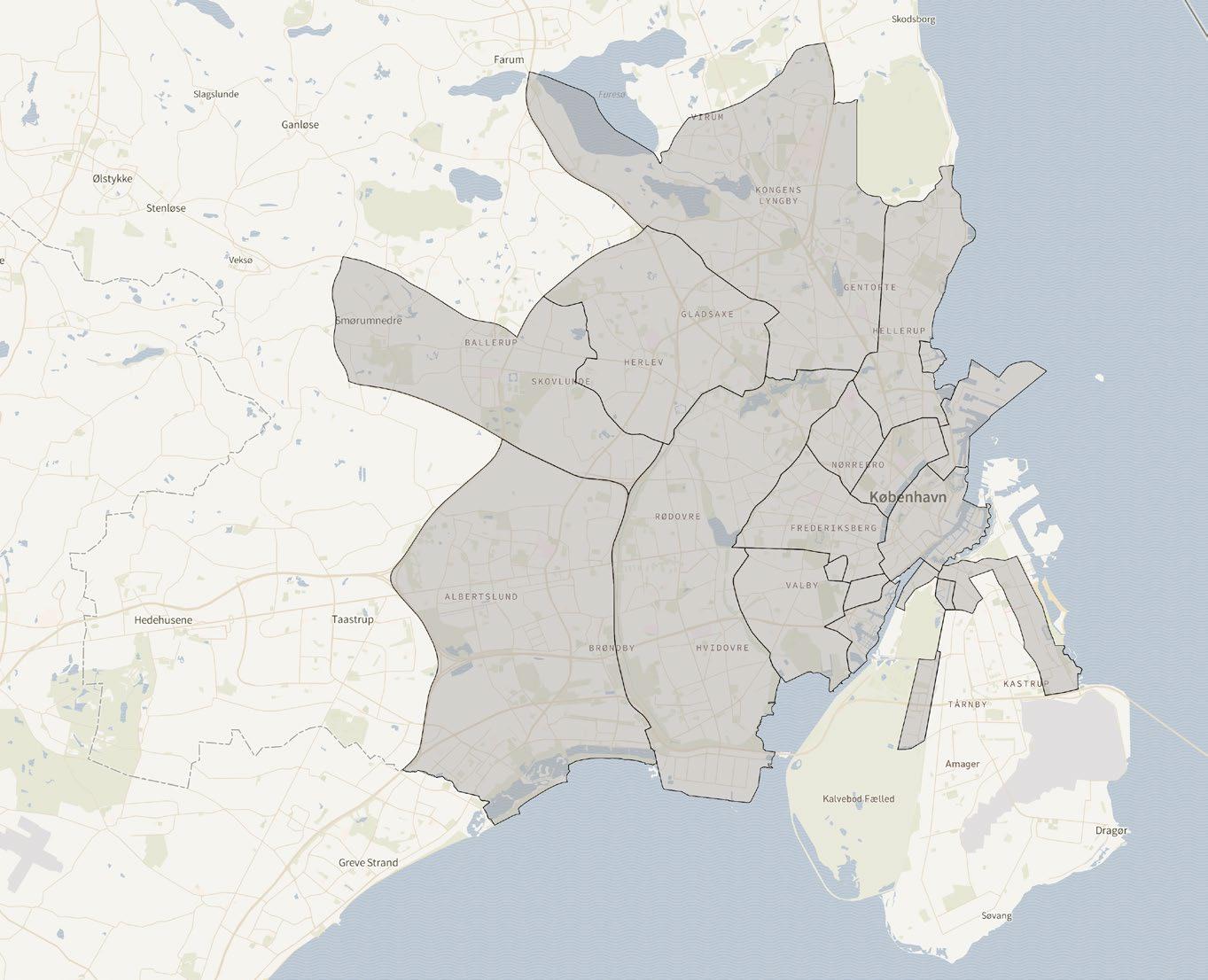

For the first time ever, more capital was invested in Greater Copenhagen than in Copenhagen.

In search of higher yields, foreign investors (in particular) sought opportunities in the surrounding municipalities.

While the average prices per square meter increased in the largest cities, the prices decreased in the provinces.

* Other residential properties include student housing properties, senior housing, properties with less than seven units (“småhuse” in Danish), etc. ** The properties are characterised by very different characteristics, which is why the price per m² and the change herein is not shown.

Higher interest rates have impacted the commercial real estate market in Denmark significantly, resulting in both a decline in the volumes and higher yield requirements. However, the owner-occupied homes in Copenhagen have shown resilience, maintaining surprisingly strong price levels. Therefore, sell-off cases involving rental apartments being sold individually on the owner-occupied market have become an increasingly attractive exit strategy for many property owners. The question now is whether this strategy will receive greater attention from investors going forward or if the trend is temporary?

For many years, the residential segment has been the investors’ preferred property segment, with centrally located residential properties consistently topping the investors’ wish lists. This strong demand was largely driven by the fact that before the significant interest rate hikes, investors could achieve highly attractive returns on their equity, benefiting from stable cash flows, low interest rates, increasing market rents, and high loan-to-value ratios.

Investors were, therefore, willing to accept historically low yields. However, when the interest rates increased, the sellers’ yield requirements (and consequently their price expectations) did not adjust to the same extent ( Figure 19).

With the current interest rates, core residential rental properties can no longer generate the same returns from the running cash flows alone. Therefore, investors must turn to alternative strategies to achieve a satisfactory return on their investments. Consequently, most of the capital raised by property funds in 2024 was allocated to value-add and opportunistic investments.

For newly built residential rental properties, the value can typically not be increased by investing in improving the property’s quality, conversion to alternative uses or similar strategies, as seen in other segments. However, one solution for creating value could be for the investors to adjust their exit strategy.

While the higher interest rates have resulted in an upward pressure on the yield requirements (and thus lower square meter prices) for residential rental properties, the square meter prices for owner-occupied apartments have (despite the interest rate hikes) remained surprisingly high ( Figure 20). Thus, investors can ensure higher returns on their investments by actively working with the rental properties and selling off the units on the owner-occupied market as they become vacant.

In 2024, we have seen an increasing number of players (e.g. NREP & Heimstaden) adjusting their strategies in the pursuit of returns, where sell-off cases have become increasingly interesting.

Sell-off cases may appear to be an obvious strategy in the current market. However, investors should carefully weigh the potential drawbacks, as this approach may not be suitable for all value-add capital. Given the involvement of multiple different buyers, selling residential apartments individually requires significant asset management resources. Furthermore, there is always uncertainty associated with the churn rate, which implies a risk of the strategy extending beyond the planned investment horizon. Therefore, if the investor wants to avoid being left with a portfolio containing the unsold condominium units (to which the investor pool is somewhat smaller), the strategy is particularly attractive to investors without closed-ended funds.

Going forward, the question is whether we will see more sell-off cases or whether this strategy is merely temporary?

Looking at the underlying factors on the owner-occupied market, the housing burden seems fragile (and at the same level as just before the financial crisis), indicating that a correction will likely have to take

place – either through lower prices for owner- occupied condominiums or through decreasing interest rates. More over, history shows that it must be economically beneficial for residents searching for a home to take on the additional risk of investing in their own home rather than renting a home. Thus, history indicates that the current market conditions are “abnormal”.

If the condominium prices decrease, it will (all else being equal) reduce the returns for the investors utilising sell-off strategies. Conversely, if the interest rates continue to decrease (as is currently expected), it will likely increase the investor appetite for residential rental properties. Yields have already been adjusted in the current market, and

decreasing interest rates can result in investors being able to meet their IRR requirements through stable cash flows (at least on some assets), which would also bring more core capital back into the market.

In the coming period, we expect that more investors will continue to sell-off vacant rental units as condominiums on the private market rather than re-letting them. However, as the market normalises, investors will likely return to the stable cash flows with a more ‘clear’ exit.

This expectation should, among other things, be viewed in the light of the fact that the current “gap” between the value of

Source: Cushman & Wakefield | RED and Finans Danmark

* Figures up to and including Q3 2024.

Source: Realkredit Danmark, Finans Danmark and Statistics Denmark

residential rental properties with free rent determination and the owner-occupied market is expected to be reduced in the coming years – either through a correction of the owner-occupied market or an increase in the sales prices (lower net initial yield) for residential rental properties. Moreover, the selloff case is not always an attractive strategy, as the square meter prices for residential rental properties in large parts of the country (including parts of Greater Copenhagen) are on par with the condominium prices.

The sell-off trend is, therefore, considered temporary and is more likely to reflect a current “gap” that provides investors an opportunity to achieve attractive returns in the current interest rate environment.

Since the rapid and substantial increase in the interest rates, the combination of increased financing costs and continued high condominium prices has pushed residents towards the rental market.

However, whether the increasing demand for rental housing also pushed the rent levels upwards in 2024 depends on where we are in the country.

The housing market is a cost game, and historically, it has been more economically advantageous for residents to invest in an owner-occupied apartment rather than renting an apartment ( Figure 21). However, the combination of higher interest rates and continued high condominium prices have resulted in a very high housing burden on the owner-occupied market in Copenhagen. As a result, the total monthly costs of owning a condominium have increased significantly more than the monthly rent for a comparable rental apartment, making renting a more cost-effective option than owning in the current market.

OFFERING PERIODS

As a consequence of the economic benefits in recent years shifting towards the rental market, we have seen an increasing demand for rental properties in Denmark. In 2024, the average offering periods decreased across all parts of Denmark and across all unit sizes (p. 37). While the average offering period was shortest for residential properties located in the country’s largest cities, Copenhagen and Aarhus, the longest offering periods were observed in “Other Jutland and Funen”.

The rental market in Copenhagen has, in particular, performed well, where a high demand and a limited supply of rental apartments have pushed the rent levels upwards and shortened the average offering periods.”

Nicholas Thurø Managing Partner, Cushman & Wakefield

|

RED

Along with the high housing burden on the owner-occupied market, the high tenant demand for rental housing in Copenhagen has also been driven by a large influx of citizens towards the capital area, combined with a continued undersupply of rental apartments in the city.

The imbalance between the supply and demand for rental properties in Copenhagen has led to an upward pressure on the rental levels, and in 2024, the average asking rent in Copenhagen increased by 6% to DKK 2,160 per square meter. In Greater Copenhagen, the development in the rent level was more stable, with an average increase in the asking rent of 3% and at the same time, the average offering period was longer.

In recent years, many headlines have focused on the construction boom in Aarhus, highlighting how the completion of a large number of apartment buildings in the city led to increased vacancy periods that were expected to put a downward pressure on the rental levels. However, in 2024,

we saw a decrease in the average offering period and an increase in the asking rent of 2% in Aarhus, indicating that the demand for rental housing has largely absorbed the increased supply.

In contrast to Aarhus and the capital area, we did not observe a positive rental development for rental housing in the rest of Jutland, Zealand, and Funen. In fact, the average asking rents decreased slightly from 2023 to 2024 despite the average offering periods being lower than the previous year in these areas. However, the tenant demand in the provinces highly depends on the individual project and its location.

Thus, residential rental properties have generally been in high demand in 2024, with decreasing offering periods across the country and increasing rent levels in the capital region and Aarhus. The rental market in Copenhagen has, in particular, performed well, where a high demand and a limited supply of rental apartments have pushed the rent levels upwards and shortened the average offering periods.

Source: Realkredit Danmark and Cushman & Wakefield | RED

The residential segment and the investment market, in general, have been challenged by rising interest rates in recent years, which have led to higher yield requirements and a lower investment activity in the investors’ preferred property segment. However, in 2025, the increased optimism in the market, continued high condominium prices, a strong underlying rental market, and expectations of further interest rate cuts are expected to turn the yield curve for residential properties and increase the investment activity in the segment.

EXPECTATIONS OF A MORE NORMALISED OWNER-OCCUPIED MARKET

For several years, there has been a strong demand for rental housing in the country’s largest cities. High interest rates combined with continued high condominium prices have created a significant housing burden in the owner-occupied market, pushing residents towards the rental market, where the monthly costs are lower.

Despite seeing interest rate cuts over the past year, the housing burden on the owner-occupied market remains high, which can be explained by the fact that the condominium prices in Copenhagen have also risen. However, there is broad consensus among economists that the central banks are likely to implement further interest rate cuts in 2025, which may result in more residents returning to the owner- occupied market. Despite this, we expect rental housing to continue to be more economically attractive when comparing the costs of owning versus renting in 2025.

Copenhagen continues to experience a shortage of rental housing, and the development opportunities in the city are limited. These conditions, combined with the demographic trends where more people want to live in the city, are expected to create a continued upward pressure on the market rent for residential rental properties in Copenhagen – even if the housing burden on the owner-occupied market should normalise in the near future. However, the increase in the rent level in Copenhagen is expected to be more moderate than that of recent years, as there is a natural limit to how much of their income residents are willing (and able) to pay in rent.

In the surrounding municipalities, we expect that the increases in the market rent for rental housing will be more limited (similar to 2024). With significant construction activity in Greater Copenhagen in recent years, the supply has been better able to meet the growing demand.

Our expectations of a strong rental housing market in Copenhagen are supported by our investor survey, which shows that the majority of the investors in Q1 2025 expect to see increasing rental levels in Copen hagen ( Figure 22).

With the increasing urbanisation, there has historically been a shortage of rental housing in Aarhus. However, over the past decade, substantial new residential buildings have been added to the housing stock in the city, resulting in higher vacancy rates and a more moderate increase in the market rent in Aarhus.

Although inflation eased throughout 2024, the increases in the construction costs in recent years, combined with the current interest rate levels, continues to challenge the developers’ business plans. This has led to a significant slowdown in the construction activity and, consequently, in the market supply.

Copenhagen continues to experience a shortage of rental housing, and the development opportunities in the city are limited. These conditions, combined with the demographic trends (...), are expected to create a continued upward pressure on the market rent for residential properties in Copenhagen.”

Kjeld Pedersen Partner, Capital Markets, RED

With continued population growth in Aarhus and a better balance between the supply and the demand, we expect to see a positive development in the rental market in 2025, characterised by modest rent increases in the area. Our investor survey shows that the investors have recognised that the demand

is increasingly able to keep up with the supply, as most investors expect stable rental levels in Aarhus throughout 2025. Likewise, most of the investors expect the rental levels to remain stable in the provinces.

During the coming six months, the market rent for residential units will:

COPENHAGEN

Continued on next page

The Cushman & Wakefield | RED Investor Confidence Index

The index monitors 147 of the most active investors’ expectations for the Danish commercial real estate market during the coming six months. The broad coverage ensures that the findings are representative reflections of the investors’ confidence in the Danish market. By conducting the survey on a biannual basis, we are also able to track changes in the confidence.

Continued from previous page

23: Investor Confidence Index – Residential yields

Several investors have initiated sell-off strategies in the pursuit of higher returns, involving rental apartments being sold individually on the owner-occupied market. However, in 2025, we expect to see more transactions with core residential properties, as decreasing yield requirements will increase the owners’ motivation to sell.”

Kim Søberg Petersen Partner, Capital Markets, RED

Expectations of stable growth in both the rental levels and prices have meant that investors, for many years, wanted to increase their allocations in Danish residential assets. However, the increasing financing costs and the gap between the buyer’s and the seller’s price expectations have challenged the market and limited the investment activity in the past few years.

During 2024, the gap between the buyers’ and the sellers’ price expectations narrowed, and therefore, we expect to see more transactions and a higher investment activity in the residential segment. Furthermore, we expect that the recent decreases in the interest rates, expectations of further interest rate cuts in 2025, and the continued strong outlook for the rental market will put a downward pressure on the investors’ yield requirements in the residential segment.

Both Danish and international investors maintain strong confidence in the housing market in Copenhagen. While the owner- occupied market has proven resilient during uncertain times, the investors expect to see increases in the market rent for Copenhagen properties.

Recently, we have seen an increasing appetite from value-add capital, where the investors are actively seeking investment opportunities where they can create value in order to meet their IRR requirements. Although core buyers have continued to be active in the market, property owners have been reluctant to meet the higher yield requirements from the buyers. As a result, several investors have initiated sell-off strategies in the pursuit of higher returns, involving rental apartments being sold individually on the owner-occupied market. However, in 2025, we expect to see more transactions with core residential properties, as decreasing yield requirements will increase the owners’ motivation to sell. Therefore, we expect to see a broader market with both value-add and core investors showing investment appetite for residential properties in Copenhagen and the surrounding municipalities.

An increasing optimism in the residential segment and our expectations of decreasing yield requirements in 2025 are supported by our investor survey showing that the majority of the investors expect to see a downward pressure on the yield requirements in 2025, while only 9% expect to see increasing yield requirements ( Figure 23).

While the investment appetite for properties with free rent determination is high, the investment appetite for rent-controlled properties is expected to remain subdued in 2025. The introduction of the waiting period for rent-controlled properties, coupled with the financial institutions’ high requirements for the investors’ equity, narrows the pool to long-term investors with a high share of equity. Rent-controlled properties will, however, still be marketable in today’s market, if the location is attractive. The new taxation rules for generational succession of companies may also contribute to an increasing demand for these properties, which are typically well-located and considered low-risk assets.

The tables below show statistics on the offering rent and the offering period for residential leases based on 119,500 observations from 2023 and 2024. Moreover, the expected prime yield for Q1 2025 is stated.

* The average offering rent is based on 64,763 observations from 2024, and is stated in DKK per m² per year (rounded).

** The figure indicates the change in the average offering rent (in %) and in the offering period (in days) from 2023 to 2024.

*** The average offering period is the number of days, in which the lease was offered on the market.

**** The prime yield within Copenhagen differs significantly from the most (North Harbour & City Centre) to the least attractive areas (Ørestad & South Harbour).

Volume & Investors

Transactions & Key Figures 40 42 44 48 50 52

Geographical Distribution

Highlight: Is Sustainability as Important as We Think?

Highlight: A Cool Down on The Logistics Market

Expectations for 2025

When the logistics segment is mentioned in this publication, the term ’logistics’ not only includes logistics properties but also industrial and warehouse properties.

13.4 BN DKK

The logistics segment was the segment with the highest growth in the investment activity from 2023 to 2024.

The high investment activity was driven by transactions involving both core and value-add properties across the country.

Logistics properties accounted for 25% of the total volume, thus manifesting its position as the second-largest segment.

Unlike all of the other segments, foreign investors were behind the majority of the volume in the logistics segment.

Transactions involving assets valued at +DKK 250mn more than doubled, which was primarily driven by the foreign investors.

With combined investments totalling DKK 5.6bn, Catena, Blackstone, and Brunswick accounted for more than 40% of the logistics volume.

The transaction volume was calculated on January 15th , 2025, and it is customary for significant volumes to be recorded retroactively. For instance, the total logistics transaction volume for 2023 on the same date last year was 13% lower than the currently known volume for 2023.

Figure 24: Logistics – Breakdown in price range 2023 & 2024

COPENHAGEN

0.1 BN DKK 1%

LOGISTICS VOLUME IN TOTAL

Danish 96% Foreign 4%

0.1

BN DKK 1%

Source: ReData

0.1

BN DKK 1%

COPENHAGEN

Danish 96% Foreign 4%

GREATER COPENHAGEN Danish

4.3

BN DKK 32%

4.3

BN DKK 32%

GREATER COPENHAGEN

Danish 27% Foreign 73%

COPENHAGEN

0.1

BN DKK 1%

1.8

1.8

BN DKK 13%

0.3

BN DKK 2%

OTHER ZEALAND

OTHER ZEALAND

BN DKK 13%

4.3

BN DKK 32%

0.3

BN DKK 2%

1.8

BN DKK 13%

7.0

7.0

BN DKK 52%

Danish 62% Foreign 38%

GREATER COPENHAGEN

AARHUS

AARHUS

Danish 100% Foreign 0%

OTHER ZEALAND

OTHER JUTLAND AND FUNEN

BN DKK 52%

0.3

BN DKK 2%

4.4

4.4

BN DKK 33%

OTHER JUTLAND AND FUNEN Danish 45% Foreign 55%

BN DKK 33%

7.0

BN DKK 52%

4.4

BN DKK 33%

13.4

13.4 BN DKK LOGISTICS VOLUME IN TOTAL

BN DKK

Danish 45% Foreign 55% 100%

AARHUS

COPENHAGEN AND GREATER COPENHAGEN

Danish 28% Foreign 72%

COPENHAGEN AND GREATER COPENHAGEN Danish 28% Foreign 72%

JUTLAND AND FUNEN

COPENHAGEN AND GREATER COPENHAGEN

Danish 28% Foreign 72%

4.3 BN DKK 32%

GREATER COPENHAGEN

Danish 27% Foreign 73%

Danish 43% Foreign 57%

OTHER ZEALAND

1.8 BN DKK 13%

13.4 BN DKK LOGISTICS VOLUME IN TOTAL

Danish 62% Foreign 38%

0.3 BN DKK 2% AARHUS

Danish 100% Foreign 0%

OTHER JUTLAND AND FUNEN

7.0

BN DKK 52%

0.1 BN DKK 1%

4.4 BN DKK 33%

4.3 BN DKK 32%

1.8 BN DKK 13%

0.3

COPENHAGEN

Danish 45% Foreign 55%

COPENHAGEN AND GREATER COPENHAGEN

Danish 28% Foreign 72%

13.4

VOLUME GREATER COPENHAGEN Danish 96% Foreign 4% Danish 27% Foreign 73%

Danish 62% Foreign 38%

Danish 100% Foreign 0% 100%

LOGISTICS

More than 50% of the volume was invested in “Other Jutland & Funen” –largely driven by Catena’s acquisition of DSV’s logistics centre in Horsens.

The relatively low activity in Greater Copenhagen was not due to a lack of demand but rather a limited supply.

The average prices per m² were influenced by several portfolio sales involving light industrial properties and a lack of transactions with prime properties.

The number of properties with industrial use in Aarhus mainly consists of properties with a secondary use as storage.

Sustainability is playing an increasingly pivotal role in the daily operations on the real estate market. However, despite the wide spread focus on the subject, it can be challenging to keep up as existing requirements evolve and new ones emerge at the speed of light. At the same time, sustainability can be viewed from countless angles, and in many ways, we (unfortunately) are still fumbling in the dark when it comes to understanding the economic consequences of sustainable investments.

In this article, we shed light on some of the evidence available based on a study of more than 1,500 transactions involving logistics properties. However, we also try to address some of the challenges that arise when attempting to quantify the financial impact of sustainability.

This article could be very brief if its sole purpose was to answer the question: Is sustainability truly as essential to include in the investors’ business plans as we all believe? The answer is unequivocally yes. The investors face demands about sustainability from all their stakeholders, including developers, tenants, (potential) underlying investors, financial institutions, competitors, the media, and more. Therefore, a lack of focus on sustainability can be disastrous for real estate investors.

Thus, it might seem obvious to assume that there is a “green premium” (a higher price) for sustainable buildings. However, we lean more towards the conclusion that the price difference is to be seen as a “brown discount” (a lower price) for non-sustainable buildings. The rationale behind this is that tenants and investors no longer view sustainability as just an attractive add-on feature of a building but rather as a nonnegotiable requirement where a certain standard is expected as a baseline.

Non-sustainable properties are, therefore, at higher risk of becoming stranded assets, as the tenants consider them less attractive. This will result in higher vacancy rates and lower rental levels. At the same time, the number of potential buyers at a future sale will be lower, and the expected exit yields will likely be higher. In addition, financial institutions increasingly differentiate their financing terms based on whether the buildings are sustainable or not.

Consequently, it is no surprise that many investors today focus on energy labels and the various certifications used for commercial real estate. The advantage of using energy labels and certifications is that they provide a set of common global standards that allow us to assess and compare sustainability across buildings. As a result, the majority of newly constructed buildings are now being certified.

A study by Cushman & Wakefield also shows that these certifications come with substantial economic benefits ( Figure 28). Based

All locations

Non superprime locations

Avg. all locations

Ang. non superprime locations

on more than 1,500 transactions involving warehouse and logistics properties in the UK and the Netherlands, the study found that, between 2019 and 2023, properties with high certifications were sold at an average price premium of 19% compared to properties with low or no certifications.

Now that we finally have evidence of price differences, we should be happy, right? The problem is that sustainability itself is incredibly complex, and as the requirements continue to evolve, we do not have any (or only very few) comparable properties that differ in terms of sustainability but are equally attractive in other tenant-related criteria (e.g., clearing height, load capacity, technical installations, etc.). Consequently, it can be difficult (if not impossible) to isolate the effects from each other.

The complexity also implies that something that is assessed to be sustainable in one

Continued on next page

Continued from previous page

context may not be in another. Thus, older, non-certified buildings can (in some cases) be more sustainable than newly constructed buildings.

An example from the logistics industry is a newly constructed distribution centre that meets the latest sustainability standards but is located farther from suppliers and customers. From a broader perspective, this building may be less sustainable than an older property optimally located near suppliers and customers. This can be explained by the fact that the building itself typically accounts for a smaller share of logistics companies’ overall carbon footprint compared to the emissions from in- and outbound transportation of goods.

The premium also depends on general market conditions. This is supported by the study from Cushman & Wakefield, which shows significant differences in price premiums depending on the location of the properties and the year. This can partly be explained by the recent trend of “flight to quality,” where tenants and investors have sought the most attractive properties to an increasing degree, .

In areas characterised by an undersupply relative to the tenant and investor demand, the differences in the rent and price levels will generally be more limited – regardless of whether the properties are sustainable or not. Conversely, in areas with greater competition for tenants and a narrower field of investors, it becomes more critical to ensure that the properties meet the sustainability

standards to avoid the properties becoming stranded assets.

In the Greater Copenhagen area, there are still relatively many opportunities for developing new sustainable properties in attractive locations along the Southern Corridor. However, even though tenant demand is strong, speculative construction has historically been (and remains) minimal. Therefore, in these areas, the investors have the opportunity to make relatively secure investments in newly constructed certified logistics properties, attracting the core capital in today’s market.

In contrast, the most attractive locations closest to Copenhagen (e.g., Avedøre Holme) primarily consist of older buildings, and the development opportunities in these areas are almost fully utilised, making

new construction more or less impossible. However, the shorter distance to Copenhagen implies that both the economic and the sustainability related transportation costs for the tenants are lower, which keeps the vacancy rates in these areas low. Finally, the investors often have the opportunity to improve the sustainability characteristics for the older properties through a “brown to green” strategy. This approach has become increasingly attractive among investors in today’s market – especially given the high share of value-add capital being raised.

Thus, we see that in today’s market, there is capital available for (almost) all types of warehouse and logistics properties in Greater Copenhagen and that the investments can be sustainable in different ways. However, due to the many differences across the properties and the investment

strategies, we still lack evidence to quantify the price premium in Denmark. But generally, both the tenant and investor demand exceeds the supply, suggesting that the price premium in Denmark is smaller than in other more challenged markets.

While much has (and is still) been done in the logistics industry regarding sustainability in recent years, we are still far from reaching the goal. Nonetheless, the foundation and the willingness to act are in place, so we are moving in the right direction. Hopefully, in the coming years, we will get some tools that make it easier to quantify the economic impact and evaluate sustainability from a broader perspective. One thing is certain: All stakeholders in the real estate industry must focus on sustainability to some extent.

After several years with an insatiable demand for logistics leases, we saw a strong but more subdued market in 2024, where both the rents, the construction activity, and the vacancy rates showed signs of stabilisation. The trends seen in 2024 indicate that a better balance has emerged between the supply and the tenant demand in the logistics segment.

For many years, we have seen a significant tenant demand for warehouse and logistics properties, which was, among others, driven by increasing e-commerce, nearshoring trends, a higher focus on avoiding supply chain issues, and a strong economic activity. Due to the strong demand, a substantial number of new warehouse and logistics buildings were constructed from 2020 and onwards. Therefore, despite many older industrial buildings being either demolished or converted to other uses (especially in areas near the country’s largest cities), the building stock increased significantly from 2020 to today ( Figure 29).

However, the construction activity was insufficient to keep up with the demand, and consequently, the vacancy rates for warehouse and logistics properties fell steadily from 2015 until the end of 2022, where the national vacancy rate reached a historically low (and unsustainable) level of 2.3%.

In 2024, the tenant demand remained strong but more restrained, as corporate and

economic uncertainties lead to longer decision-making and negotiation processes than usual. As a result, the vacancy rate in the segment increased and reached 3.6% in Q4 2024. However, this is still a low level in both a historical and an international context (the European average across 10 different markets is 5.60%, according to data from Cushman & Wakefield).

As tenants had (slightly) more lease options in 2024, we saw a clear trend where tenants prioritised efficiency when deciding between leases – either in terms of location or quality. This led to the most sought-after properties being the best-located lastmile properties located near the country’s largest cities (e.g., properties in Avedøre Holme) and newly constructed properties in the logistics hubs (e.g., in Greve, Køge, and the Triangle Region). Consequently, the older and more outdated properties – that were neither located in prime locations (further from major cities and highway networks) nor meeting the tenants’ sustainability requirements – were often disregarded. The vacancy rates, therefore, increased the most for these types of leases.

In recent years, the construction activity has slowed, which has been driven by a more subdued tenant demand, reduced land availability (in attractive locations), higher construction costs, worsened financing conditions, etc. Additionally, the Danish market (even during times with significant undersupply) is characterised by a low share of speculative construction, and there is no indication that the construction activity in this segment will change significantly in the near future.

Despite the fact that the vacancy rates were increasing in 2023 and 2024, the prime rents also increased in the country’s most attractive logistics areas, albeit at a slower growth rate than in the previous years. In other areas, rents were generally stable or only increased slightly. This continued positive development in the rental levels indicates that the logistics occupier market is not in any form of crisis but has instead stabilised at a healthy level with a better balance between the supply and the demand.

Source: Ejendomstorvet

The market for warehouse and logistics properties has experienced somewhat of a rollercoaster ride in recent years. However, in 2025, we expect the market to be characterised by an increased stability, where global megatrends such as e-commerce, supply chain security, and sustainability, are expected to result in a sustained strong demand for modern logistics facilities. However, the pursuit of returns remains highly relevant, which is also expected to be reflected in the investment activity.

POSITIVE OUTLOOK FOR BUSINESSES

Economic uncertainties influenced the businesses and their decision-making processes in 2024, resulting in a logistics market which was characterised by a continued strong but more subdued tenant demand compared to previous years. However, in 2025, market participants are looking towards a more positive future, with private consumption expected to increase, interest rates expected to decrease, and unemployment anticipated to remain low. Along with a continued growth in e-commerce and an increasing focus on supply chain management, these factors are expected to positively influence the tenant demand for warehouse and logistics leases.

MARKET BALANCE

After several years of high construction activity, the developers are currently more cautious about initiating new projects. This is due to challenges posed by the persistently high construction costs, the investors’ higher yield requirements, and a more

restrained tenant demand. As a result, there will be very limited speculative construction initiated in the near future.

Overall, we expect the logistics market to remain stable in 2025, with a balance between the supply and the demand, with vacancy rates being more or less unchanged. This expectation is supported by our investor survey, which shows that the investors’ expectations for the logistics occupier market have remained more or less the same in the past couple of years, with the majority of investors still expecting improved or unchanged tenant demand ( Figure 30).

In 2025, we expect the “flight to quality” trend among tenants to continue. This implies that we no longer expect that the choice of lease will solely be a question of square meters and bricks but also about technological specifications, efficiency, and sustainability. Consequently, we expect to

see a greater spread in the rent levels from top to bottom. While the rent levels are expected to increase slightly for prime properties (though not at the same pace as in recent years), the rent levels for the less attractive properties are expected to remain more or less stable.

In recent years, we have seen a strong tenant demand for warehouse and logistics leases across the country’s logistics hubs. However, in the longer term, we expect the opening of the Fehmarn Belt connection to shift the tenant preferences toward the logistics hubs in Zealand rather than those in Funen and Jutland. As the tunnel will not open until 2029, we do not expect any significant changes in the tenant demand for logistics properties already in 2025. However, the Fehmarn connection will attract attention from both the tenants and the investors.

That the yields for prime logistics properties are not expected to compress significantly, despite multiple interest rate cuts in 2024 (and expectations of further cuts in 2025), can be attributed to the fact that in recent years, we have not seen the same yield adjustments for Danish logistics properties as in the rest of the Nordic region.”

Lior Koren Partner, Capital Markets, RED

In 2025, we expect the strong underlying market conditions to result in a continued high investor appetite for Danish warehouse and logistics properties, with foreign investors remaining the most aggressive in their pricing.

For the most attractive properties, we expect that the investors’ yield requirements will once again fall below 5.00% in 2025. This is partly due to the strong interest from foreign investors and partly due to the continued influx of new investors looking to invest in Danish logistics properties. However, for the majority of logistics properties, we expect the investors’ yield requirements to remain stable in the near future. This expectation is supported by our latest investor survey, where 78% of respondents answered that they anticipate that the yield

requirements for logistics properties will remain stable during the first half of 2025 ( Figure 31).

That the yields for prime logistics properties are not expected to compress significantly, despite multiple interest rate cuts in 2024 (and expectations of further cuts in 2025), can be attributed to the fact that in recent years, we have not seen the same yield adjustments for Danish logistics properties as in the rest of the Nordic region. This implies that the premium (that characterised the Danish market for many years) has disappeared, and in today’s market, prime yields in Denmark are actually lower than in the rest of the Nordics.

Despite our expectations of additional interest rate cuts and continued high levels of

Figure 30: Investor Confidence Index – Logistics occupier demand

During the coming six months, the demand on the logistics occupier market will:

capital allocated to value-add properties in 2025, we do not expect to see any significant decrease in the investors’ yield requirements for light industrial properties.

A potential risk in the light industrial property market is that, in recent years, significantly more value-add than core capital has been raised. Much of this capital has been placed by closed-end funds, which will need to sell the properties to core investors once their value-add strategies have been executed. Going forward, we expect investors to increasingly consider whether there are enough core investors in the market to absorb the supply when the properties are to be resold. If not, investors will be forced to accept higher exit yields, which will impact their IRRs negatively.

31: Investor Confidence Index – Logistics yields

During the coming six

market yields for logistics properties will:

The Cushman & Wakefield | RED Investor Confidence Index

The index monitors 147 of the most active investors’ expectations for the Danish commercial real estate market during the coming six months. The broad coverage ensures that the findings are representative reflections of the investors’ confidence in the Danish market. By conducting the survey on a biannual basis, we are also able to track changes in the confidence.

LOGISTICS – PRIME RENT AND YIELD LEVELS Q1 2025

1 Copenhagen (Avedøre Holme & Amager)

2 Taastrup

3 Køge & Greve

4 The Triangle Area (Fredericia, Kolding & Vejle)

5

6 Aarhus

* DKK per m² per year excl. service charges

Source: Cushman & Wakefield | RED

5.00 - 5.75%

Volume & Investors

Transactions & Key Figures 56 58 62 64 68 70

Geographical Distribution

Highlight: Outlook for Another Year with Limited Returns

Highlight: The Office Market is No Longer Just One Uniform Market

Expectations for 2025

The transaction volume in the office segment was the lowest recorded in 10 years.

With a 15% share of the total volume, the segment has definitively lost its historical position as the second-largest property segment.

The foreign investors remained hesitant. Consequently, Danish capital accounted for nearly 80% of the investments in the segment.

The foreign investors remained hesitant. Consequently, Danish capital accounted for nearly 80% of the investments in the segment.

While the transaction activity was previously driven by prime properties, the activity in 2024 was primarily driven by value-add and user properties.

Public institutions were highly active with office investments in 2024, thereby replacing pension funds, which dominated the segment in 2023.

The transaction volume was calculated on January 15th , 2025, and it is customary for significant volumes to be recorded retroactively. For instance, the total office transaction volume for 2023 on the same date last year was 14% lower than the currently known volume for 2023.

Source: ReData

3.3

BN DKK 41%

Source: ReData

3.3

COPENHAGEN

Danish 76% Foreign 24%

8.0 BN DKK OFFICE VOLUME IN TOTAL GREATER COPENHAGEN

GREATER COPENHAGEN

1.1

BN DKK 14%

0.8

BN DKK 10%

1.1 BN DKK 14%

COPENHAGEN

8.0

79% Foreign 21% Danish 85% Foreign 15%

8.0

Danish 88% Foreign 12%

0.5

DKK 7%

Danish 100% Foreign 0%

3.3

2.2

2.2

BN DKK 27% OTHER JUTLAND AND FUNEN Danish 70% Foreign 30%

0.5

2.2

Fewer transactions with core properties resulted in decreasing prices per square meter across the country.

Office properties in Copenhagen accounted for more than 40% of the total volume in the segment.

The occupiers’ and investors’ preferences for Copenhagen offices are reflected in significantly lower prices outside the capital.

When investors in the commercial real estate market assess investment opportunities, the choice largely depends on the expected total return over a given investment period. Looking at the total returns in the office segment in recent years, the stagnation in the investment activity in the segment makes a lot of sense. The question now is whether we will see appealing total returns again, resulting in a higher investment activity in the office segment in the coming period?

* The prime yields are calculated as average yields across Copenhagen’s subareas at the end of the year. For example, in 2024, the yields range from 4.50% in CBD and Nordhavn to 5.00% in Ørestad and Nordvest, resulting in an average yield of 4.69%.

** The vacancy rent is based on the average vacancy rate for office leases in Copenhagen in the given year.

*** The calculation is based on estimated costs of DKK 5,000 per m² in 2022 prices, which are adjusted annually with the inflation.

The total return on commercial real estate depends on both the operating yield, how the market rent develops, and whether there are fluctuations in the yield requirements from investors – as we, for example, saw when the significant interest rate increases hit the market in 2022. In this analysis, we will look back at how the office market in Copenhagen has developed during the past ten years and how these different components have contributed to the development of total returns in the segment.

The first step in the analysis is to calculate the annual operating yield. A property acquired at a 5% net initial yield would, in a perfect world without vacancy, generate an annual operating yield of 5% before the indexation of the rent (i.e., a real yield).

As shown in the table ( Figure 36), the prime yields for office properties located in Copenhagen have ranged between

3.9%-5.6% in the period from 2015 to 2024. These yields are, thus, the operating yields investors would have realised in the perfect world without vacancy.

However, very few property owners are fortunate enough to experience no vacancy in the properties. For most assets, investors will experience some vacancy during their investment period, leading to rental income losses during the vacancy periods and refurbishment costs to prepare the leases for new tenants.

During the past ten years, vacancy rates for office leases in Copenhagen have ranged from almost 10% in 2016 to a low point of 5.9% in 2023. As a result, missing rental income reduced the ongoing operating yield by as much as 0.6%-points in 2016, whereas it only reduced the operating yield by 0.2%-points in 2023.

In addition, the refurbishment costs that owners incur due to vacancies also take a significant share of the operating yields during years with high vacancy rates. While as much as 2.0%-points in 2016 went to refurbishment costs, resulting in a total operating yield of 2.7%, the lower vacancy in 2023 implied that only 0.7%-points of the yield went to refurbishment costs, resulting in a total operating yield of 3.3%.

Despite the fact that prime yields were 100 basis points higher in 2016 than in 2023 (5.3% vs. 4.3%), the higher vacancy in 2016 resulted in operating yields being 60 basis points lower in 2016 than in 2023 (2.7% vs. 3.3%).

As also shown in the table, the average operating yield for office properties in the period 2015-2024 was 2.9%, and although this is considered a real yield (i.e., before

Continued on next page

Continued from previous page

inflation), it is not impressive. Therefore, it is also interesting to understand how much the development in market rents has contributed to the total returns.

The market rent is the rent that can be achieved for a lease in the market at a given time between two independent parties, which depends on the supply and the demand. Thus, when we refer to market rent development below, it may not be confused with the annual rent indexation.

While the office rent levels in Copen hagen were more or less stable for many years (with an average increase of about 0.5% p.a. from 2004-2015), we have seen a positive development in market rents in the last ten

years (with an average increase of 3.3% p.a. from 2015-2024).

This significant increase in market rents has, on average, contributed with a return of 3.6% over the past ten years. The difference of 0.3%-points between the market rent growth and the return is due to the fact that property owners, in addition to the market rent growth, can benefit from rents increasing faster than the owner-paid costs (which in the calculation are adjusted with the inflation).

SAVED THE INVESTORS

The final component in the calculation of the total returns is the yield that are generated through changes in the investors’ (net initial) yield requirements. For example, for many

years, we saw how decreasing interest rates led investors to accept lower and lower yields on their property investments, as it became cheaper to finance the acquisitions – and we also saw how the opposite happened when the interest rates skyrocketed. However, it is not only interest rates that affect the yield requirements – access to capital (willingness to lend) and the investors’ expectations for the market rent development (supply and demand) are two other important parameters.

From 2015 to 2022, we saw a significant yield compression, which led investors to increase their property values solely due to the yield compression. Conversely, in 2023 and 2024, the significant increases in the yield requirements for office properties resulted in the

investors having to write down their property values by 9.9% and 8.0%, respectively.

However, the many years of yield compression have offset the recent write-downs. As a result, investors have, on average, been able to generate a return from value appreciation of 2.3% p.a. over the past ten years.

Based on the different components, it can be concluded that office properties in Copenhagen delivered very high total returns from 2015-2022 (an average of over 11% p.a.). However, the picture has been very different in the last two years, where the total returns have been -2.3% and -1.0%, respectively. These negative total returns have primarily been driven by write-downs, as operating yields were, in fact, the highest in the entire 10-year period, and market rents have increased.

One thing is the historical total returns, but particularly interesting is how the

total return will develop in the near future ( Figure 37).